BUECO5903 Macroeconomics Assignment: Economic Indicators Analysis

VerifiedAdded on 2023/03/30

|9

|1554

|178

Homework Assignment

AI Summary

This assignment solution delves into macroeconomics, focusing on GDP calculation using both income and expenditure methods. It analyzes Gross National Expenditure (GNE), Net Domestic Product (NDP), Gross National Product (GNP), and Net National Product (NNP). The solution also covers current account balance, gross national savings, and the impact of marginal propensity to consume on domestic consumption. Furthermore, it examines the effects of changes in net exports, investment, and government expenditure on GDP, incorporating the multiplier effect. The assignment also addresses the classification of goods, the inclusion of unsold goods in GDP, and the impact of cost-push and demand-pull inflation. Finally, it explores the relationship between money supply and interest rates, along with the balance of payments and its components. Desklib provides this solution and many other resources like past papers and solved assignments for students.

Solution 1:

a) GDP using income method = Returns to labor + Firm profits + other factor rentals

= 2651 + 1687 + 482 = 4820

b) GDP using expenditure method at market prices = Consumption + Investment + Government

Expenditure + (Export - Import)

= Household Consumption Expenditure +Government Consumption Expenditure + Consumption

in fixed capital +Gross private fixed capital formation + Government investment expenditure +

(Export of goods and services - Import of goods and services)

= 3115 + 585 + 320 +785 + 210 + (690-565) = 5140

c) Gross National Expenditure (GNE) = GDP - (Export -Import)

= 5140 - ( 690 - 565) = 5140 - 125 = 5015

d) NDP = GDP - Depreciation = GDP - consumption in fixed capital = 5140 - 320 = 4820

e) In NDP the country is able to replace the loss of capital stock through depreciation. Therefore,

NDP is a better measure of economic performance than GDP.

(f) To calcualte GNP : Y = C + I + G + X + Z. where

Y means GNP = Consumption + Investment + Government + X (net exports, or imports minus

exports) + Z (net income earned by domestic residents from overseas investments - net income

earned by foreign residents from domestic investments.)

C = Consumption of fixed capital+ Household consumption expenditure

a) GDP using income method = Returns to labor + Firm profits + other factor rentals

= 2651 + 1687 + 482 = 4820

b) GDP using expenditure method at market prices = Consumption + Investment + Government

Expenditure + (Export - Import)

= Household Consumption Expenditure +Government Consumption Expenditure + Consumption

in fixed capital +Gross private fixed capital formation + Government investment expenditure +

(Export of goods and services - Import of goods and services)

= 3115 + 585 + 320 +785 + 210 + (690-565) = 5140

c) Gross National Expenditure (GNE) = GDP - (Export -Import)

= 5140 - ( 690 - 565) = 5140 - 125 = 5015

d) NDP = GDP - Depreciation = GDP - consumption in fixed capital = 5140 - 320 = 4820

e) In NDP the country is able to replace the loss of capital stock through depreciation. Therefore,

NDP is a better measure of economic performance than GDP.

(f) To calcualte GNP : Y = C + I + G + X + Z. where

Y means GNP = Consumption + Investment + Government + X (net exports, or imports minus

exports) + Z (net income earned by domestic residents from overseas investments - net income

earned by foreign residents from domestic investments.)

C = Consumption of fixed capital+ Household consumption expenditure

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

C = 3435

I = 210

G = 585

X = 125

Z = - 34

GNP = 3435 + 210 + 585 + 125 -34 = 4321

(g) NNP = GNP - Depreciation

here we do not any depreciation given, so NNP is same as GNP.

(h) Current Account Balance = (X-M) + NI + NT

X means the export of goods and M means the import of goods = 125

NI means net income = 34

NT means net current transfers

Current account Balance = 125 + 34 = 159

(i) GNS = Gross national disposable income - final consumption expenditure

National disposable income = National income (4321)+ Net indirect taxes(0) + Net current

transfers from rest of the world(-34)

= 4321 - 34 = 4287

final consumption expenditure = Government consumption expenditure + Household

consumption expenditure

I = 210

G = 585

X = 125

Z = - 34

GNP = 3435 + 210 + 585 + 125 -34 = 4321

(g) NNP = GNP - Depreciation

here we do not any depreciation given, so NNP is same as GNP.

(h) Current Account Balance = (X-M) + NI + NT

X means the export of goods and M means the import of goods = 125

NI means net income = 34

NT means net current transfers

Current account Balance = 125 + 34 = 159

(i) GNS = Gross national disposable income - final consumption expenditure

National disposable income = National income (4321)+ Net indirect taxes(0) + Net current

transfers from rest of the world(-34)

= 4321 - 34 = 4287

final consumption expenditure = Government consumption expenditure + Household

consumption expenditure

= 3700

GNS = 4287 - 3700 = 587

j) National income or GDP has two sides following the way it is calculated. These are income

method and expenditure method. Income method measures GDP by adding the income heads,

expenditure method calculates GDP by adding the expenditure heads. First we calculate the total

income generated using the income method.

Income = returns to labour + firm profits + other factor rentals = 4820

Next we calculate total expenditure by adding the heads of expenditure. And they are broadly

categorised as

i. Private Consumption expenditure (by the household) = 3115

ii. Private Investment expenditure = gross fixed capital formation = 785

iii. Government expenditure (consumption + investment) = 585 + 210 = 795

iv. Export – imports = 690 – 565 = 125

S = I + (G – T) + (X – M) = 785 + (795 – 17) + 125 = 1688.

Therefore, the value of national savings is $ 1688 billion.

k) I presume that MPCd refers to the domestic marginal propensity to consume. Marginal

propensity to consume measure how much consumption increases if income increase by $1. Here

income increases by $(4873 – 4820) = $53 billion. Hence, given that MPCd is 0.63, the increase

in consumption will be by an amount of 0.63 × $53 = $33.39 billion. The new level of domestic

consumption will be 3115 + 33.39 = $3148.39 billion

GNS = 4287 - 3700 = 587

j) National income or GDP has two sides following the way it is calculated. These are income

method and expenditure method. Income method measures GDP by adding the income heads,

expenditure method calculates GDP by adding the expenditure heads. First we calculate the total

income generated using the income method.

Income = returns to labour + firm profits + other factor rentals = 4820

Next we calculate total expenditure by adding the heads of expenditure. And they are broadly

categorised as

i. Private Consumption expenditure (by the household) = 3115

ii. Private Investment expenditure = gross fixed capital formation = 785

iii. Government expenditure (consumption + investment) = 585 + 210 = 795

iv. Export – imports = 690 – 565 = 125

S = I + (G – T) + (X – M) = 785 + (795 – 17) + 125 = 1688.

Therefore, the value of national savings is $ 1688 billion.

k) I presume that MPCd refers to the domestic marginal propensity to consume. Marginal

propensity to consume measure how much consumption increases if income increase by $1. Here

income increases by $(4873 – 4820) = $53 billion. Hence, given that MPCd is 0.63, the increase

in consumption will be by an amount of 0.63 × $53 = $33.39 billion. The new level of domestic

consumption will be 3115 + 33.39 = $3148.39 billion

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

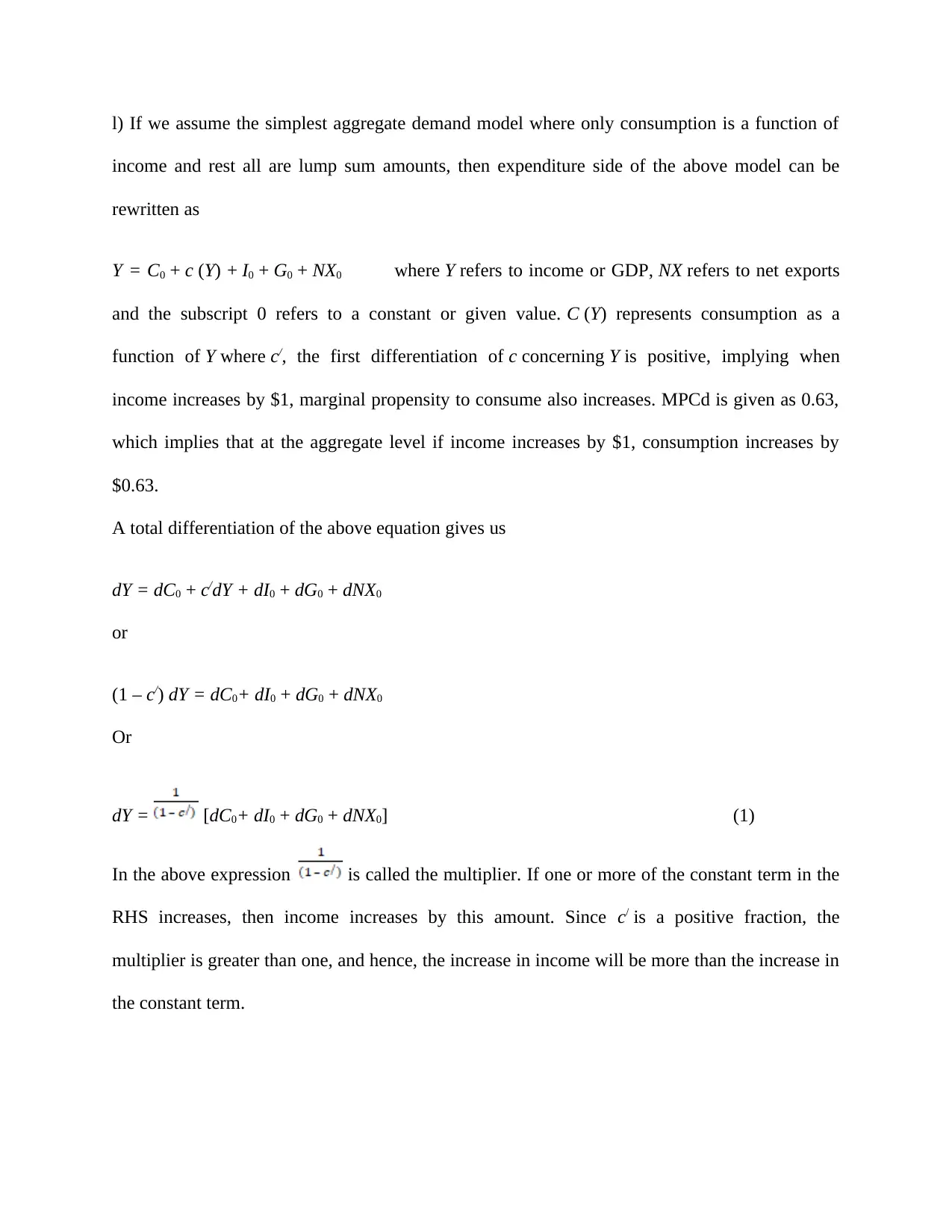

l) If we assume the simplest aggregate demand model where only consumption is a function of

income and rest all are lump sum amounts, then expenditure side of the above model can be

rewritten as

Y = C0 + c (Y) + I0 + G0 + NX0 where Y refers to income or GDP, NX refers to net exports

and the subscript 0 refers to a constant or given value. C (Y) represents consumption as a

function of Y where c/, the first differentiation of c concerning Y is positive, implying when

income increases by $1, marginal propensity to consume also increases. MPCd is given as 0.63,

which implies that at the aggregate level if income increases by $1, consumption increases by

$0.63.

A total differentiation of the above equation gives us

dY = dC0 + c/dY + dI0 + dG0 + dNX0

or

(1 – c/) dY = dC0+ dI0 + dG0 + dNX0

Or

dY = [dC0+ dI0 + dG0 + dNX0] (1)

In the above expression is called the multiplier. If one or more of the constant term in the

RHS increases, then income increases by this amount. Since c/ is a positive fraction, the

multiplier is greater than one, and hence, the increase in income will be more than the increase in

the constant term.

income and rest all are lump sum amounts, then expenditure side of the above model can be

rewritten as

Y = C0 + c (Y) + I0 + G0 + NX0 where Y refers to income or GDP, NX refers to net exports

and the subscript 0 refers to a constant or given value. C (Y) represents consumption as a

function of Y where c/, the first differentiation of c concerning Y is positive, implying when

income increases by $1, marginal propensity to consume also increases. MPCd is given as 0.63,

which implies that at the aggregate level if income increases by $1, consumption increases by

$0.63.

A total differentiation of the above equation gives us

dY = dC0 + c/dY + dI0 + dG0 + dNX0

or

(1 – c/) dY = dC0+ dI0 + dG0 + dNX0

Or

dY = [dC0+ dI0 + dG0 + dNX0] (1)

In the above expression is called the multiplier. If one or more of the constant term in the

RHS increases, then income increases by this amount. Since c/ is a positive fraction, the

multiplier is greater than one, and hence, the increase in income will be more than the increase in

the constant term.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

In the given problem, following changes are mentioned: dNX0 = 4 billion, dI0 = - 3 billion, net

change in government expenditure is $1 billion, therefore, dG0 = 1 billion and there is no change

in the basic consumption expenditure or dC0 = 0.

Therefore, in equation the term in the parenthesis = 4 – 3 + 1 = 2.

The multiplier value for c/ = 0.63 is 2.70 (approximately).

Therefore, change in GDP or dY = 2 × 2.70 = 5.40.

Hence, the new value of GDP will be $(4820 + 5.40) = $ 4825.4 billion.

change in government expenditure is $1 billion, therefore, dG0 = 1 billion and there is no change

in the basic consumption expenditure or dC0 = 0.

Therefore, in equation the term in the parenthesis = 4 – 3 + 1 = 2.

The multiplier value for c/ = 0.63 is 2.70 (approximately).

Therefore, change in GDP or dY = 2 × 2.70 = 5.40.

Hence, the new value of GDP will be $(4820 + 5.40) = $ 4825.4 billion.

Solution 2:

a)

A windscreen purchased by a motor vehicle spare parts supplier : final goods and

services as it is being purchased by the supplier to be sold to the final consumer of the

goods which are vehicle owners.

A new bulldozer to be used by a construction company : final goods and

services because it has been purchased by the construction company for the capital

formation or investment.

A household cleaning service purchased by a family from a domestic cleaning service

company : final goods and services as the family is the final consumer of the services.

Coking coal : intermediate goods and services because it is used for producing final

goods like electricity.

b) Gross domestic product (GDP) is the total value of the final goods and services that have

been produced and sold in a country during a year. So, it does not include the value of the

goods that have been produced but not sold. So, in the present case, the nation’s GDP

will be $750 billion.

c) Goods that are purchased by firms as part of capital formation or investment are included

as final goods irrespective of their use. So, even though the new truck sold for use by a transport

company is being used for transporting the final goods, its value should be included while

calculating the GDP.

a)

A windscreen purchased by a motor vehicle spare parts supplier : final goods and

services as it is being purchased by the supplier to be sold to the final consumer of the

goods which are vehicle owners.

A new bulldozer to be used by a construction company : final goods and

services because it has been purchased by the construction company for the capital

formation or investment.

A household cleaning service purchased by a family from a domestic cleaning service

company : final goods and services as the family is the final consumer of the services.

Coking coal : intermediate goods and services because it is used for producing final

goods like electricity.

b) Gross domestic product (GDP) is the total value of the final goods and services that have

been produced and sold in a country during a year. So, it does not include the value of the

goods that have been produced but not sold. So, in the present case, the nation’s GDP

will be $750 billion.

c) Goods that are purchased by firms as part of capital formation or investment are included

as final goods irrespective of their use. So, even though the new truck sold for use by a transport

company is being used for transporting the final goods, its value should be included while

calculating the GDP.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Solution 3:

In figure 1, AS and AD are initial Aggregate supply and Aggregate demand, respectively. Now

an increase in the cost of production shifts short run Aggregate supply to SRASo. As result

prices rise from p to p1. Since it happens due to cost increase this type of inflation is known as

cost-push inflation

Demand-pull inflation is shown in figure 2.Here prices rise from po to p1 because Aggregate

demand rises from AD to AD1.

Cost push inflation occurs due to an increase in taxes or an increase in prices of some inputs like

crude oil

Demand-pull inflation occurs due to higher wages of labour which thus demand more goods and

services, increase in Govt expenditure

In figure 1, AS and AD are initial Aggregate supply and Aggregate demand, respectively. Now

an increase in the cost of production shifts short run Aggregate supply to SRASo. As result

prices rise from p to p1. Since it happens due to cost increase this type of inflation is known as

cost-push inflation

Demand-pull inflation is shown in figure 2.Here prices rise from po to p1 because Aggregate

demand rises from AD to AD1.

Cost push inflation occurs due to an increase in taxes or an increase in prices of some inputs like

crude oil

Demand-pull inflation occurs due to higher wages of labour which thus demand more goods and

services, increase in Govt expenditure

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Solution 7:

a)Won't increase. The selling of government securities to banks would not increase, rather

decrease the money supply, as the money circulating in the economy through the bank would

decrease.

b)Increase. A fall in interest rates would increase the money supply as the consumers' incentive

to store the money with the bank decrease due to lower interest rates, and they will try to keep

money more liquid.

c)No change in money supply, as the government is spending the money it is borrowing from the

bank, it is being circulated in the economy.

d)Increases. The money supply increases in this case as the government injects money into the

economy by purchasing securities from the bank.

e)Reduces. To reduce the rate of inflation, the interest rate should rise, thus reducing money

supply in the economy.

a)Won't increase. The selling of government securities to banks would not increase, rather

decrease the money supply, as the money circulating in the economy through the bank would

decrease.

b)Increase. A fall in interest rates would increase the money supply as the consumers' incentive

to store the money with the bank decrease due to lower interest rates, and they will try to keep

money more liquid.

c)No change in money supply, as the government is spending the money it is borrowing from the

bank, it is being circulated in the economy.

d)Increases. The money supply increases in this case as the government injects money into the

economy by purchasing securities from the bank.

e)Reduces. To reduce the rate of inflation, the interest rate should rise, thus reducing money

supply in the economy.

Soln 8:

(a)DVD recorders imported into the nation from Japan – Import of goods

(b) Insurance cover purchased in the nation by overseas residents – Exports of services

(c) The nation gives overseas aid to a developing country – Other income outflows

(d) A US car company sets up a factory in the nation - Capital transfers to the nation from

overseas

(e) Some of the nation’s residents take a holiday in Bali - Other income outflows

(f) Interest earned by the nation’s residents on overseas assets - The nation’s investments

overseas

(g) Running down the stock of foreign exchange in the Central Bank of the nation - Drawing on

reserves

(h) Migrants to the nation transferring property to the nation - Other income inflows

(i) New deposits made in banks in the nation by overseas residents - Short-term financial inflows

(j) The nation’s palm oil is sold in the United Kingdom - Exports of goods

(a)DVD recorders imported into the nation from Japan – Import of goods

(b) Insurance cover purchased in the nation by overseas residents – Exports of services

(c) The nation gives overseas aid to a developing country – Other income outflows

(d) A US car company sets up a factory in the nation - Capital transfers to the nation from

overseas

(e) Some of the nation’s residents take a holiday in Bali - Other income outflows

(f) Interest earned by the nation’s residents on overseas assets - The nation’s investments

overseas

(g) Running down the stock of foreign exchange in the Central Bank of the nation - Drawing on

reserves

(h) Migrants to the nation transferring property to the nation - Other income inflows

(i) New deposits made in banks in the nation by overseas residents - Short-term financial inflows

(j) The nation’s palm oil is sold in the United Kingdom - Exports of goods

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.