Financial Accounting: Standards Application & Analysis Assignment

VerifiedAdded on 2023/06/10

|15

|2129

|437

Homework Assignment

AI Summary

This assignment solution covers various aspects of financial accounting, including the application of accounting standards and financial analysis. Part A addresses questions related to company control, expense recognition, and tax liabilities. Part B delves into practical applications, including journal entries for share calls, forfeiture, and reissue, along with the conceptual framework behind equity measurement. It further explores deferred tax calculations, temporary differences, and journal entries for tax expenses. The assignment also includes detailed calculations for cost of acquisition, net assets, and goodwill in business combinations, along with journal entries for foreign currency transactions under AASB 121. Finally, it covers consolidation entries, impairment loss accounting, and the preparation of a consolidated statement, offering a comprehensive overview of key financial accounting principles and practices. Desklib provides access to more solved assignments and study resources.

8 Questions

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Part A...............................................................................................................................................3

Question 1....................................................................................................................................3

Question 2....................................................................................................................................3

Question 3....................................................................................................................................3

Part B...............................................................................................................................................3

Question 1....................................................................................................................................3

Question 2....................................................................................................................................4

Question 3....................................................................................................................................6

Question 4....................................................................................................................................8

Question 5..................................................................................................................................10

Part A...............................................................................................................................................3

Question 1....................................................................................................................................3

Question 2....................................................................................................................................3

Question 3....................................................................................................................................3

Part B...............................................................................................................................................3

Question 1....................................................................................................................................3

Question 2....................................................................................................................................4

Question 3....................................................................................................................................6

Question 4....................................................................................................................................8

Question 5..................................................................................................................................10

Part A

Question 1

a) Yes, Maggie Ltd controls Luna-Kitty Ltd. Luna-kitty ltd is wholly controlled by Buppie

Ltd whose majority of board of directors are the directors of Maggie Ltd.

b) Yes, Luna-kitty Ltd is directly controlled by Buppie Ltd. Buppie ltd is directly controlled

by Maggie and Cleocat Ltd.

c) Yes, Maggie Ltd. have an interest in Cleocat Ltd. The type of interest that Maggie Ltd.

have in Cleocat Ltd. is non-controlling. The interest is because of the fact that Cleocat

Ltd have stake in Buppie Ltd in which Maggie ltd also have a stake of 75%.

Question 2

The expenses will be more in the initial years firstly because of the interest amount that will be

higher in early years and secondly because of the depreciation amount which will also be higher

during early years and both will be debited to the income statement.

Question 3

The reason for no tax liability for Keperra Ltd for the profits generated as per the income

statement of the company for year will be that the tax assets of the company be equivalent or

higher to its tax liabilities or the profit generated is lesser than the taxable income.

Part B

Question 1

A

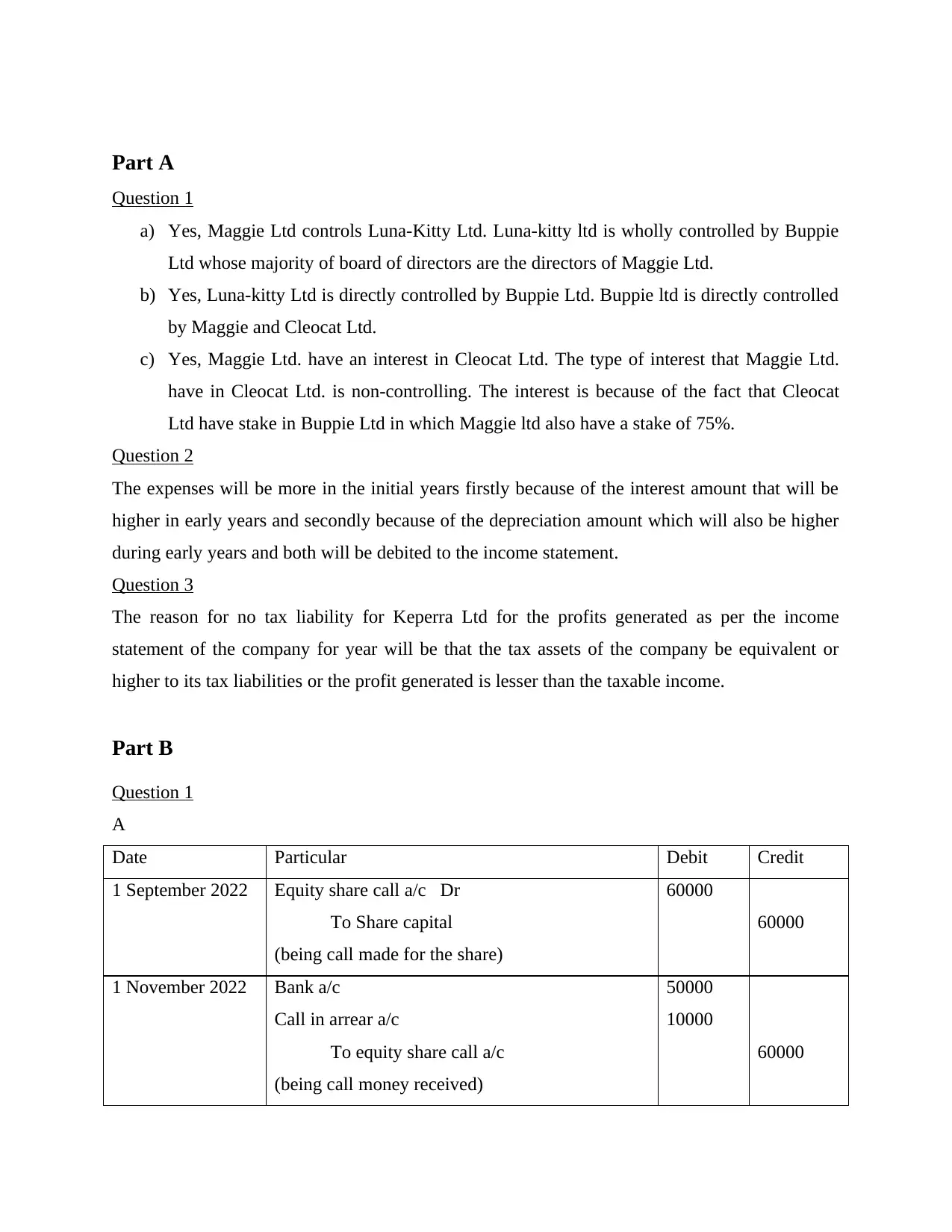

Date Particular Debit Credit

1 September 2022 Equity share call a/c Dr

To Share capital

(being call made for the share)

60000

60000

1 November 2022 Bank a/c

Call in arrear a/c

To equity share call a/c

(being call money received)

50000

10000

60000

Question 1

a) Yes, Maggie Ltd controls Luna-Kitty Ltd. Luna-kitty ltd is wholly controlled by Buppie

Ltd whose majority of board of directors are the directors of Maggie Ltd.

b) Yes, Luna-kitty Ltd is directly controlled by Buppie Ltd. Buppie ltd is directly controlled

by Maggie and Cleocat Ltd.

c) Yes, Maggie Ltd. have an interest in Cleocat Ltd. The type of interest that Maggie Ltd.

have in Cleocat Ltd. is non-controlling. The interest is because of the fact that Cleocat

Ltd have stake in Buppie Ltd in which Maggie ltd also have a stake of 75%.

Question 2

The expenses will be more in the initial years firstly because of the interest amount that will be

higher in early years and secondly because of the depreciation amount which will also be higher

during early years and both will be debited to the income statement.

Question 3

The reason for no tax liability for Keperra Ltd for the profits generated as per the income

statement of the company for year will be that the tax assets of the company be equivalent or

higher to its tax liabilities or the profit generated is lesser than the taxable income.

Part B

Question 1

A

Date Particular Debit Credit

1 September 2022 Equity share call a/c Dr

To Share capital

(being call made for the share)

60000

60000

1 November 2022 Bank a/c

Call in arrear a/c

To equity share call a/c

(being call money received)

50000

10000

60000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

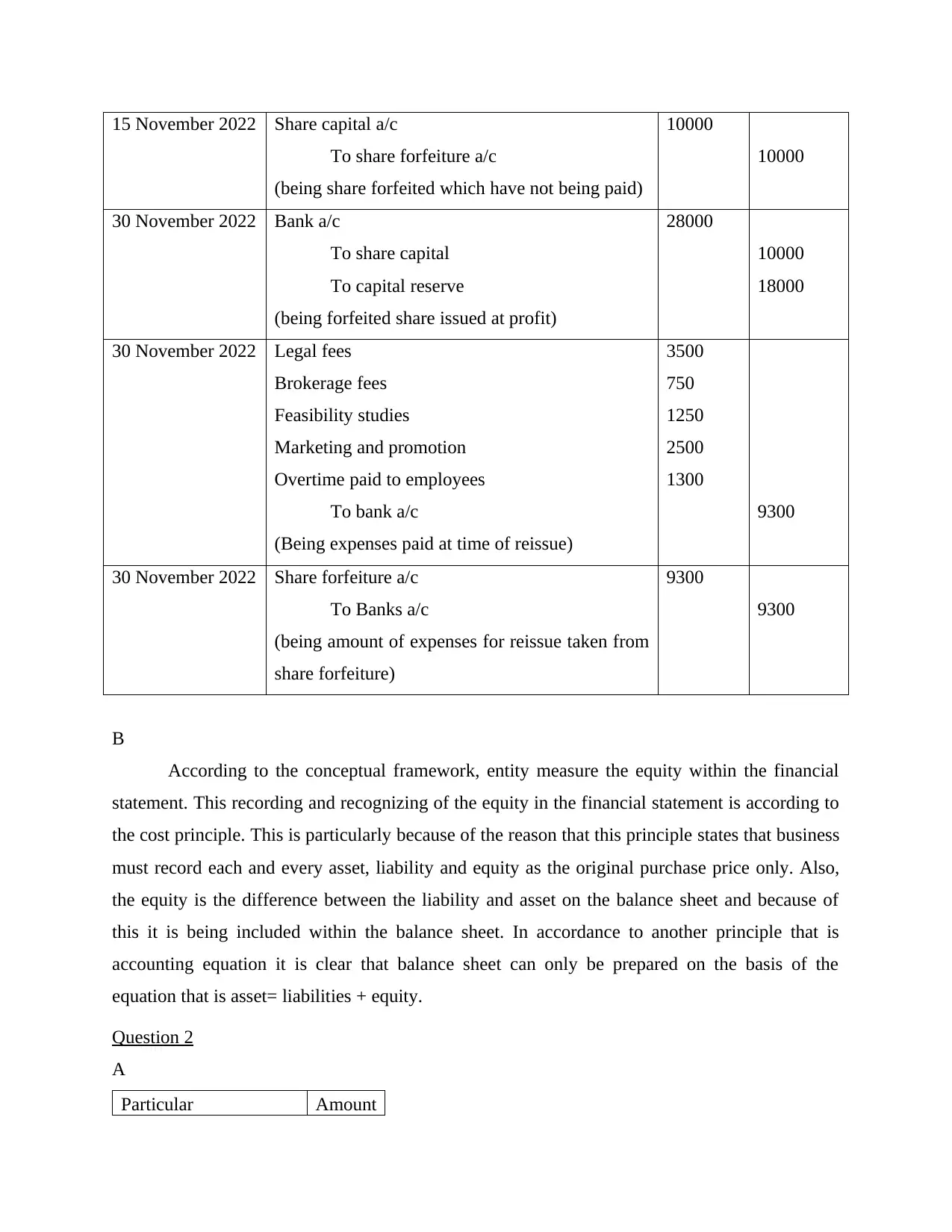

15 November 2022 Share capital a/c

To share forfeiture a/c

(being share forfeited which have not being paid)

10000

10000

30 November 2022 Bank a/c

To share capital

To capital reserve

(being forfeited share issued at profit)

28000

10000

18000

30 November 2022 Legal fees

Brokerage fees

Feasibility studies

Marketing and promotion

Overtime paid to employees

To bank a/c

(Being expenses paid at time of reissue)

3500

750

1250

2500

1300

9300

30 November 2022 Share forfeiture a/c

To Banks a/c

(being amount of expenses for reissue taken from

share forfeiture)

9300

9300

B

According to the conceptual framework, entity measure the equity within the financial

statement. This recording and recognizing of the equity in the financial statement is according to

the cost principle. This is particularly because of the reason that this principle states that business

must record each and every asset, liability and equity as the original purchase price only. Also,

the equity is the difference between the liability and asset on the balance sheet and because of

this it is being included within the balance sheet. In accordance to another principle that is

accounting equation it is clear that balance sheet can only be prepared on the basis of the

equation that is asset= liabilities + equity.

Question 2

A

Particular Amount

To share forfeiture a/c

(being share forfeited which have not being paid)

10000

10000

30 November 2022 Bank a/c

To share capital

To capital reserve

(being forfeited share issued at profit)

28000

10000

18000

30 November 2022 Legal fees

Brokerage fees

Feasibility studies

Marketing and promotion

Overtime paid to employees

To bank a/c

(Being expenses paid at time of reissue)

3500

750

1250

2500

1300

9300

30 November 2022 Share forfeiture a/c

To Banks a/c

(being amount of expenses for reissue taken from

share forfeiture)

9300

9300

B

According to the conceptual framework, entity measure the equity within the financial

statement. This recording and recognizing of the equity in the financial statement is according to

the cost principle. This is particularly because of the reason that this principle states that business

must record each and every asset, liability and equity as the original purchase price only. Also,

the equity is the difference between the liability and asset on the balance sheet and because of

this it is being included within the balance sheet. In accordance to another principle that is

accounting equation it is clear that balance sheet can only be prepared on the basis of the

equation that is asset= liabilities + equity.

Question 2

A

Particular Amount

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

profit before income

tax 235000

Adjustment

add: annual leave

balance 25000

Add: warranty payment 31000

Less: prepaid insurance 13000

profit before tax 278000

B

The deferred tax is the one which arises because of the difference between the taxable

profit and the accounting profit. In the present case of ABC Ltd the accounting profit was

@235000. But after making all the adjustment which were not included the taxable profit came

to $278000. With this it can be seen that there is a difference of $40000 in the actual profit which

company has earned that it current actual profit is 40000 more as compared to earlier. So that

deferred tax is being calculated as following-

Tax in case of accounting profit

Particular Amount

profit before tax 235000

Tax @ 30% 70500

Net profit after tax 164500

Tax in case of taxable profit

Particular Amount

Profit before tax 278000

tax @ 30 % 83400

Net profit 194600

With the above deferred tax, it is clear that in case of accounting profit the net profit is

less as compared to the net profit in case of taxable profits. Further the tax amount in more in

case of taxable profit that is 83400. But in case of accounting profit the tax value is less that is

70500.

C

tax 235000

Adjustment

add: annual leave

balance 25000

Add: warranty payment 31000

Less: prepaid insurance 13000

profit before tax 278000

B

The deferred tax is the one which arises because of the difference between the taxable

profit and the accounting profit. In the present case of ABC Ltd the accounting profit was

@235000. But after making all the adjustment which were not included the taxable profit came

to $278000. With this it can be seen that there is a difference of $40000 in the actual profit which

company has earned that it current actual profit is 40000 more as compared to earlier. So that

deferred tax is being calculated as following-

Tax in case of accounting profit

Particular Amount

profit before tax 235000

Tax @ 30% 70500

Net profit after tax 164500

Tax in case of taxable profit

Particular Amount

Profit before tax 278000

tax @ 30 % 83400

Net profit 194600

With the above deferred tax, it is clear that in case of accounting profit the net profit is

less as compared to the net profit in case of taxable profits. Further the tax amount in more in

case of taxable profit that is 83400. But in case of accounting profit the tax value is less that is

70500.

C

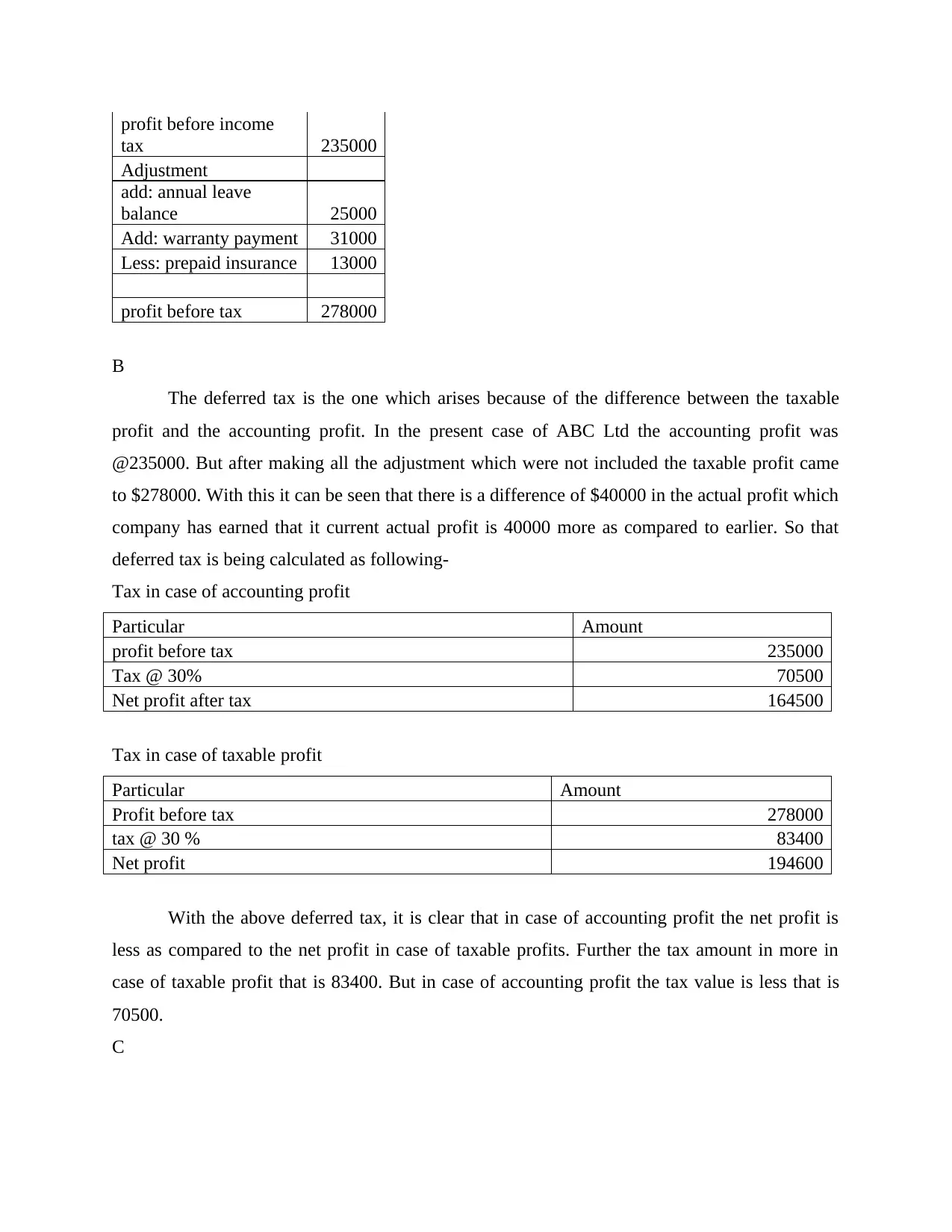

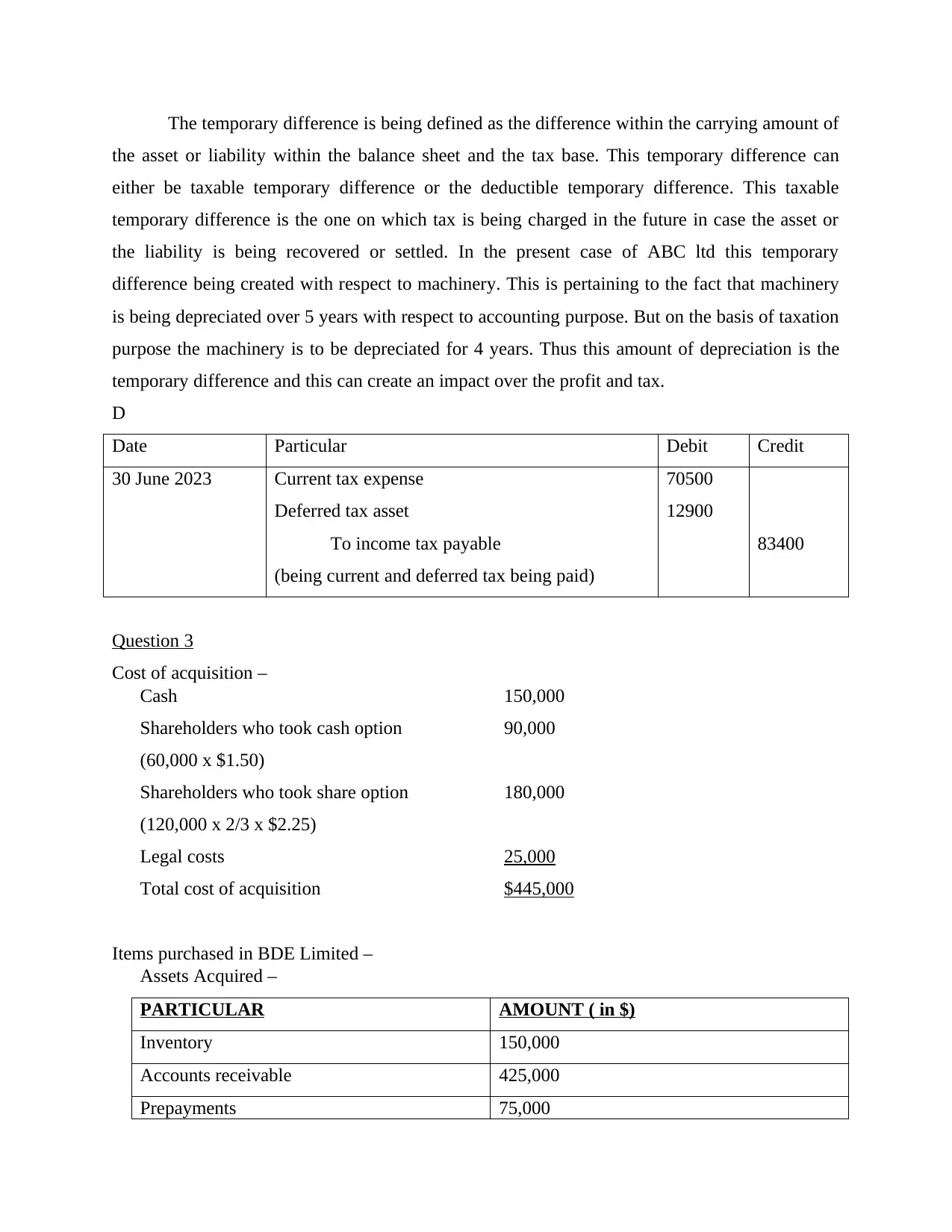

The temporary difference is being defined as the difference within the carrying amount of

the asset or liability within the balance sheet and the tax base. This temporary difference can

either be taxable temporary difference or the deductible temporary difference. This taxable

temporary difference is the one on which tax is being charged in the future in case the asset or

the liability is being recovered or settled. In the present case of ABC ltd this temporary

difference being created with respect to machinery. This is pertaining to the fact that machinery

is being depreciated over 5 years with respect to accounting purpose. But on the basis of taxation

purpose the machinery is to be depreciated for 4 years. Thus this amount of depreciation is the

temporary difference and this can create an impact over the profit and tax.

D

Date Particular Debit Credit

30 June 2023 Current tax expense

Deferred tax asset

To income tax payable

(being current and deferred tax being paid)

70500

12900

83400

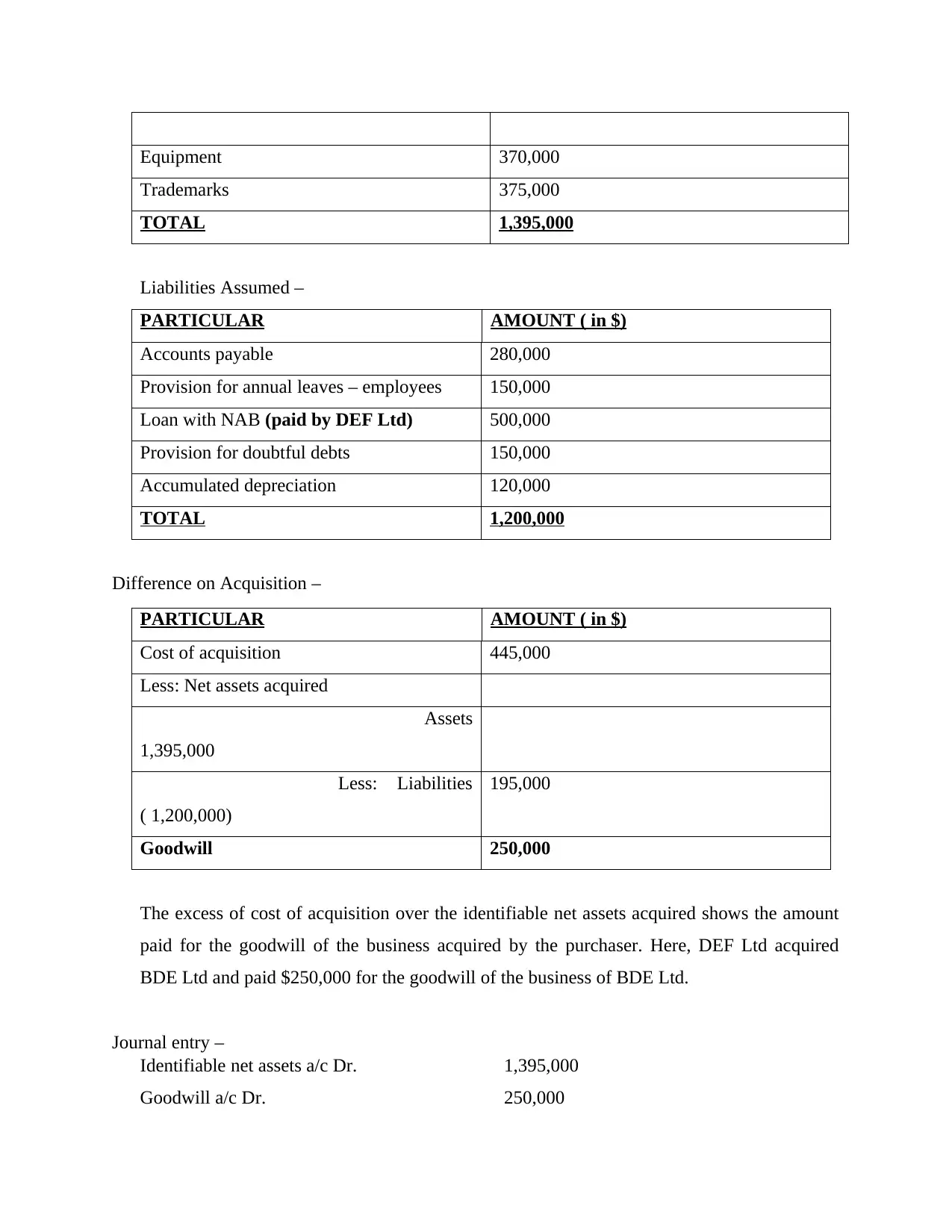

Question 3

Cost of acquisition –

Cash 150,000

Shareholders who took cash option 90,000

(60,000 x $1.50)

Shareholders who took share option 180,000

(120,000 x 2/3 x $2.25)

Legal costs 25,000

Total cost of acquisition $445,000

Items purchased in BDE Limited –

Assets Acquired –

PARTICULAR AMOUNT ( in $)

Inventory 150,000

Accounts receivable 425,000

Prepayments 75,000

the asset or liability within the balance sheet and the tax base. This temporary difference can

either be taxable temporary difference or the deductible temporary difference. This taxable

temporary difference is the one on which tax is being charged in the future in case the asset or

the liability is being recovered or settled. In the present case of ABC ltd this temporary

difference being created with respect to machinery. This is pertaining to the fact that machinery

is being depreciated over 5 years with respect to accounting purpose. But on the basis of taxation

purpose the machinery is to be depreciated for 4 years. Thus this amount of depreciation is the

temporary difference and this can create an impact over the profit and tax.

D

Date Particular Debit Credit

30 June 2023 Current tax expense

Deferred tax asset

To income tax payable

(being current and deferred tax being paid)

70500

12900

83400

Question 3

Cost of acquisition –

Cash 150,000

Shareholders who took cash option 90,000

(60,000 x $1.50)

Shareholders who took share option 180,000

(120,000 x 2/3 x $2.25)

Legal costs 25,000

Total cost of acquisition $445,000

Items purchased in BDE Limited –

Assets Acquired –

PARTICULAR AMOUNT ( in $)

Inventory 150,000

Accounts receivable 425,000

Prepayments 75,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Equipment 370,000

Trademarks 375,000

TOTAL 1,395,000

Liabilities Assumed –

PARTICULAR AMOUNT ( in $)

Accounts payable 280,000

Provision for annual leaves – employees 150,000

Loan with NAB (paid by DEF Ltd) 500,000

Provision for doubtful debts 150,000

Accumulated depreciation 120,000

TOTAL 1,200,000

Difference on Acquisition –

PARTICULAR AMOUNT ( in $)

Cost of acquisition 445,000

Less: Net assets acquired

Assets

1,395,000

Less: Liabilities

( 1,200,000)

195,000

Goodwill 250,000

The excess of cost of acquisition over the identifiable net assets acquired shows the amount

paid for the goodwill of the business acquired by the purchaser. Here, DEF Ltd acquired

BDE Ltd and paid $250,000 for the goodwill of the business of BDE Ltd.

Journal entry –

Identifiable net assets a/c Dr. 1,395,000

Goodwill a/c Dr. 250,000

Trademarks 375,000

TOTAL 1,395,000

Liabilities Assumed –

PARTICULAR AMOUNT ( in $)

Accounts payable 280,000

Provision for annual leaves – employees 150,000

Loan with NAB (paid by DEF Ltd) 500,000

Provision for doubtful debts 150,000

Accumulated depreciation 120,000

TOTAL 1,200,000

Difference on Acquisition –

PARTICULAR AMOUNT ( in $)

Cost of acquisition 445,000

Less: Net assets acquired

Assets

1,395,000

Less: Liabilities

( 1,200,000)

195,000

Goodwill 250,000

The excess of cost of acquisition over the identifiable net assets acquired shows the amount

paid for the goodwill of the business acquired by the purchaser. Here, DEF Ltd acquired

BDE Ltd and paid $250,000 for the goodwill of the business of BDE Ltd.

Journal entry –

Identifiable net assets a/c Dr. 1,395,000

Goodwill a/c Dr. 250,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

To Liabilities a/c 1,200,000

To cash a/c 265,000

To Equity share capital a/c 80,000

To share security premium 100,000

Liabilities (loan with NAB) 500,000

To cash 500,000

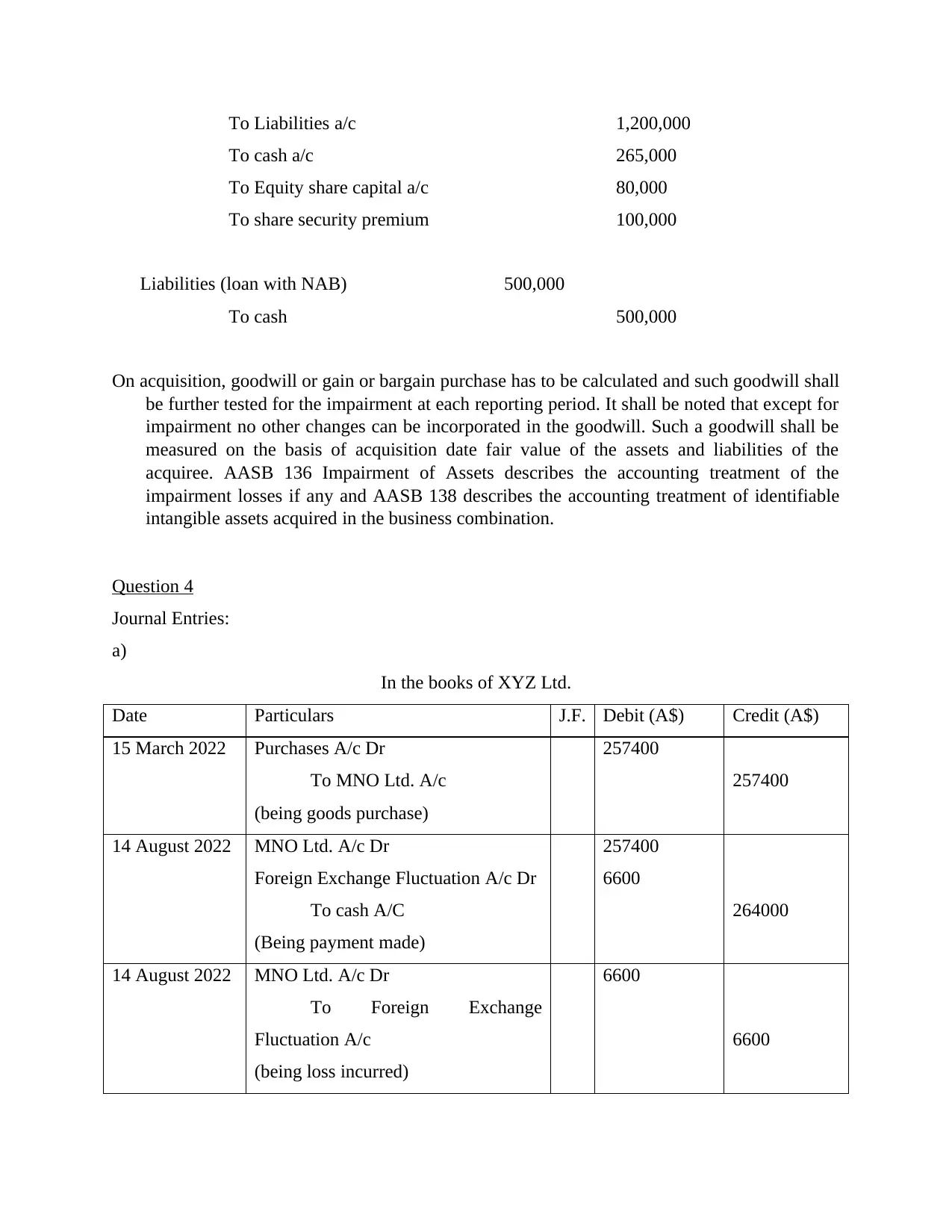

On acquisition, goodwill or gain or bargain purchase has to be calculated and such goodwill shall

be further tested for the impairment at each reporting period. It shall be noted that except for

impairment no other changes can be incorporated in the goodwill. Such a goodwill shall be

measured on the basis of acquisition date fair value of the assets and liabilities of the

acquiree. AASB 136 Impairment of Assets describes the accounting treatment of the

impairment losses if any and AASB 138 describes the accounting treatment of identifiable

intangible assets acquired in the business combination.

Question 4

Journal Entries:

a)

In the books of XYZ Ltd.

Date Particulars J.F. Debit (A$) Credit (A$)

15 March 2022 Purchases A/c Dr

To MNO Ltd. A/c

(being goods purchase)

257400

257400

14 August 2022 MNO Ltd. A/c Dr

Foreign Exchange Fluctuation A/c Dr

To cash A/C

(Being payment made)

257400

6600

264000

14 August 2022 MNO Ltd. A/c Dr

To Foreign Exchange

Fluctuation A/c

(being loss incurred)

6600

6600

To cash a/c 265,000

To Equity share capital a/c 80,000

To share security premium 100,000

Liabilities (loan with NAB) 500,000

To cash 500,000

On acquisition, goodwill or gain or bargain purchase has to be calculated and such goodwill shall

be further tested for the impairment at each reporting period. It shall be noted that except for

impairment no other changes can be incorporated in the goodwill. Such a goodwill shall be

measured on the basis of acquisition date fair value of the assets and liabilities of the

acquiree. AASB 136 Impairment of Assets describes the accounting treatment of the

impairment losses if any and AASB 138 describes the accounting treatment of identifiable

intangible assets acquired in the business combination.

Question 4

Journal Entries:

a)

In the books of XYZ Ltd.

Date Particulars J.F. Debit (A$) Credit (A$)

15 March 2022 Purchases A/c Dr

To MNO Ltd. A/c

(being goods purchase)

257400

257400

14 August 2022 MNO Ltd. A/c Dr

Foreign Exchange Fluctuation A/c Dr

To cash A/C

(Being payment made)

257400

6600

264000

14 August 2022 MNO Ltd. A/c Dr

To Foreign Exchange

Fluctuation A/c

(being loss incurred)

6600

6600

30 June 2023 Profit & Loss A/C Dr

To MNO Ltd. A/c

(being loss incurred adjusted)

13200

13200

In the books of MNO Ltd.

Date Particulars J.F. Debit (US$) Credit (US$)

02 July 2022 XYZ Ltd. A/c Dr

To Export Sales A/C

(being goods sold)

273900

273900

14 August 2022 Bank A/C Dr

Foreign Exchange Fluctuation A/c Dr

To XYZ Ltd. A/c

(being payment received)

264000

9900

273900

Year end XYZ Ltd. A/c Dr

To Foreign Exchange

Fluctuation A/c

(being loss incurred adjusted)

9900

9900

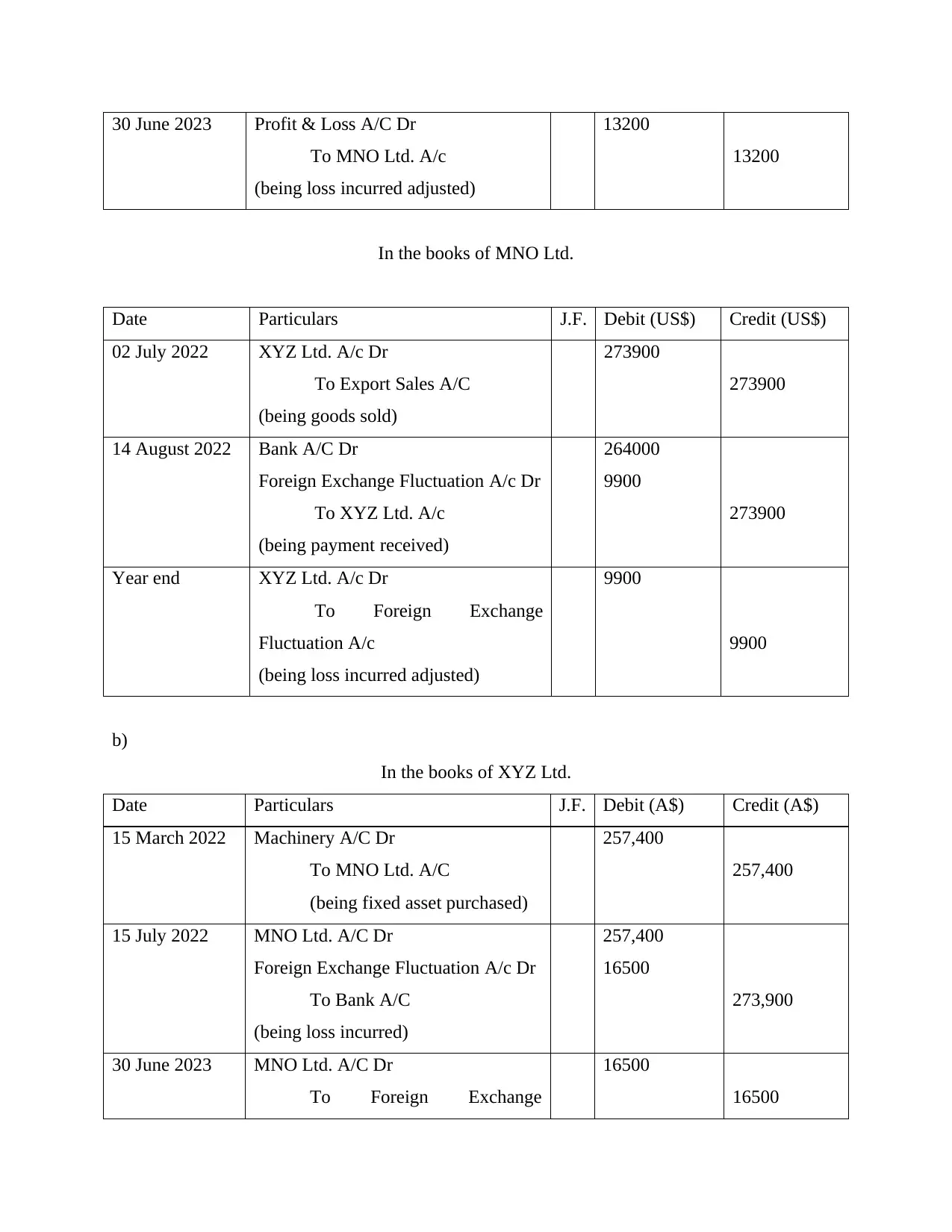

b)

In the books of XYZ Ltd.

Date Particulars J.F. Debit (A$) Credit (A$)

15 March 2022 Machinery A/C Dr

To MNO Ltd. A/C

(being fixed asset purchased)

257,400

257,400

15 July 2022 MNO Ltd. A/C Dr

Foreign Exchange Fluctuation A/c Dr

To Bank A/C

(being loss incurred)

257,400

16500

273,900

30 June 2023 MNO Ltd. A/C Dr

To Foreign Exchange

16500

16500

To MNO Ltd. A/c

(being loss incurred adjusted)

13200

13200

In the books of MNO Ltd.

Date Particulars J.F. Debit (US$) Credit (US$)

02 July 2022 XYZ Ltd. A/c Dr

To Export Sales A/C

(being goods sold)

273900

273900

14 August 2022 Bank A/C Dr

Foreign Exchange Fluctuation A/c Dr

To XYZ Ltd. A/c

(being payment received)

264000

9900

273900

Year end XYZ Ltd. A/c Dr

To Foreign Exchange

Fluctuation A/c

(being loss incurred adjusted)

9900

9900

b)

In the books of XYZ Ltd.

Date Particulars J.F. Debit (A$) Credit (A$)

15 March 2022 Machinery A/C Dr

To MNO Ltd. A/C

(being fixed asset purchased)

257,400

257,400

15 July 2022 MNO Ltd. A/C Dr

Foreign Exchange Fluctuation A/c Dr

To Bank A/C

(being loss incurred)

257,400

16500

273,900

30 June 2023 MNO Ltd. A/C Dr

To Foreign Exchange

16500

16500

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

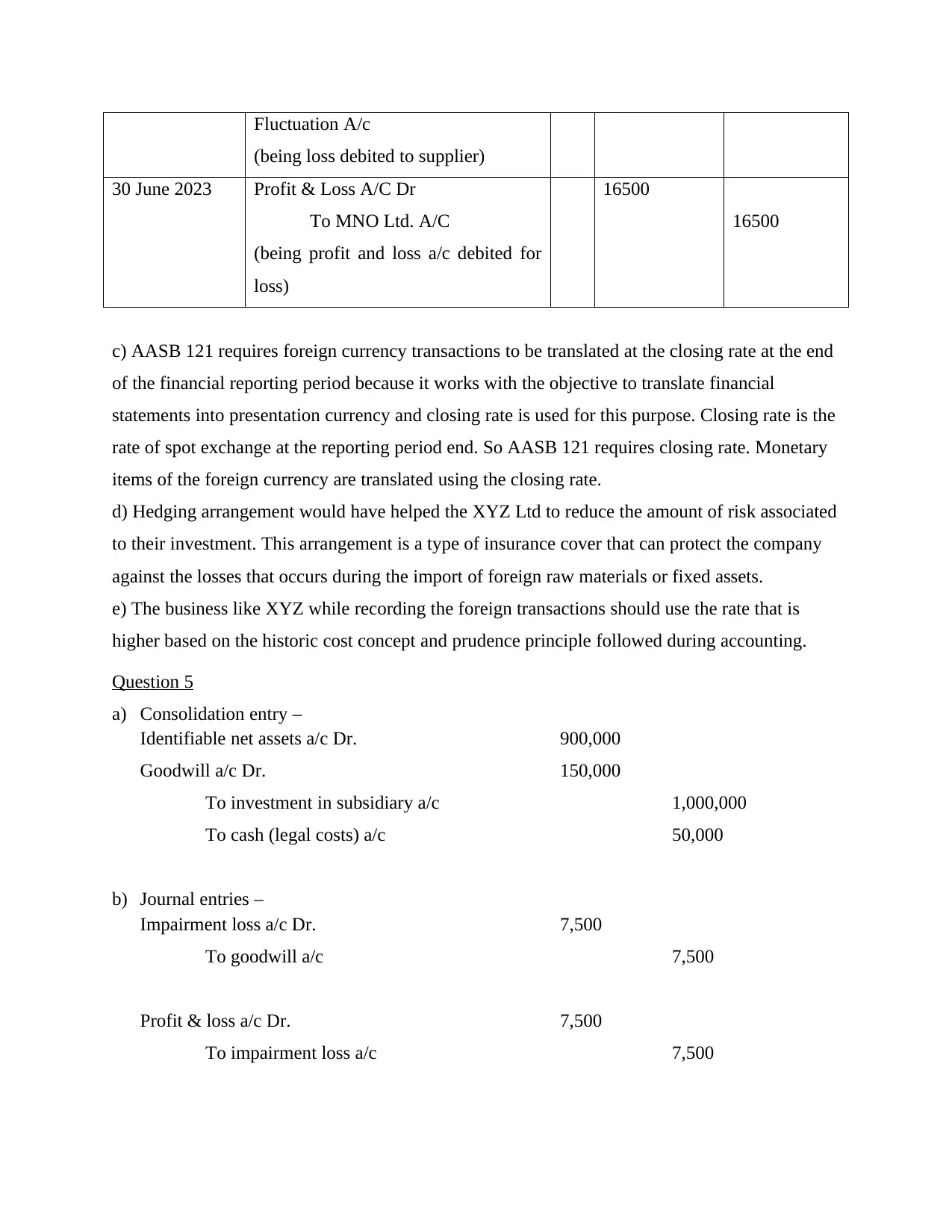

Fluctuation A/c

(being loss debited to supplier)

30 June 2023 Profit & Loss A/C Dr

To MNO Ltd. A/C

(being profit and loss a/c debited for

loss)

16500

16500

c) AASB 121 requires foreign currency transactions to be translated at the closing rate at the end

of the financial reporting period because it works with the objective to translate financial

statements into presentation currency and closing rate is used for this purpose. Closing rate is the

rate of spot exchange at the reporting period end. So AASB 121 requires closing rate. Monetary

items of the foreign currency are translated using the closing rate.

d) Hedging arrangement would have helped the XYZ Ltd to reduce the amount of risk associated

to their investment. This arrangement is a type of insurance cover that can protect the company

against the losses that occurs during the import of foreign raw materials or fixed assets.

e) The business like XYZ while recording the foreign transactions should use the rate that is

higher based on the historic cost concept and prudence principle followed during accounting.

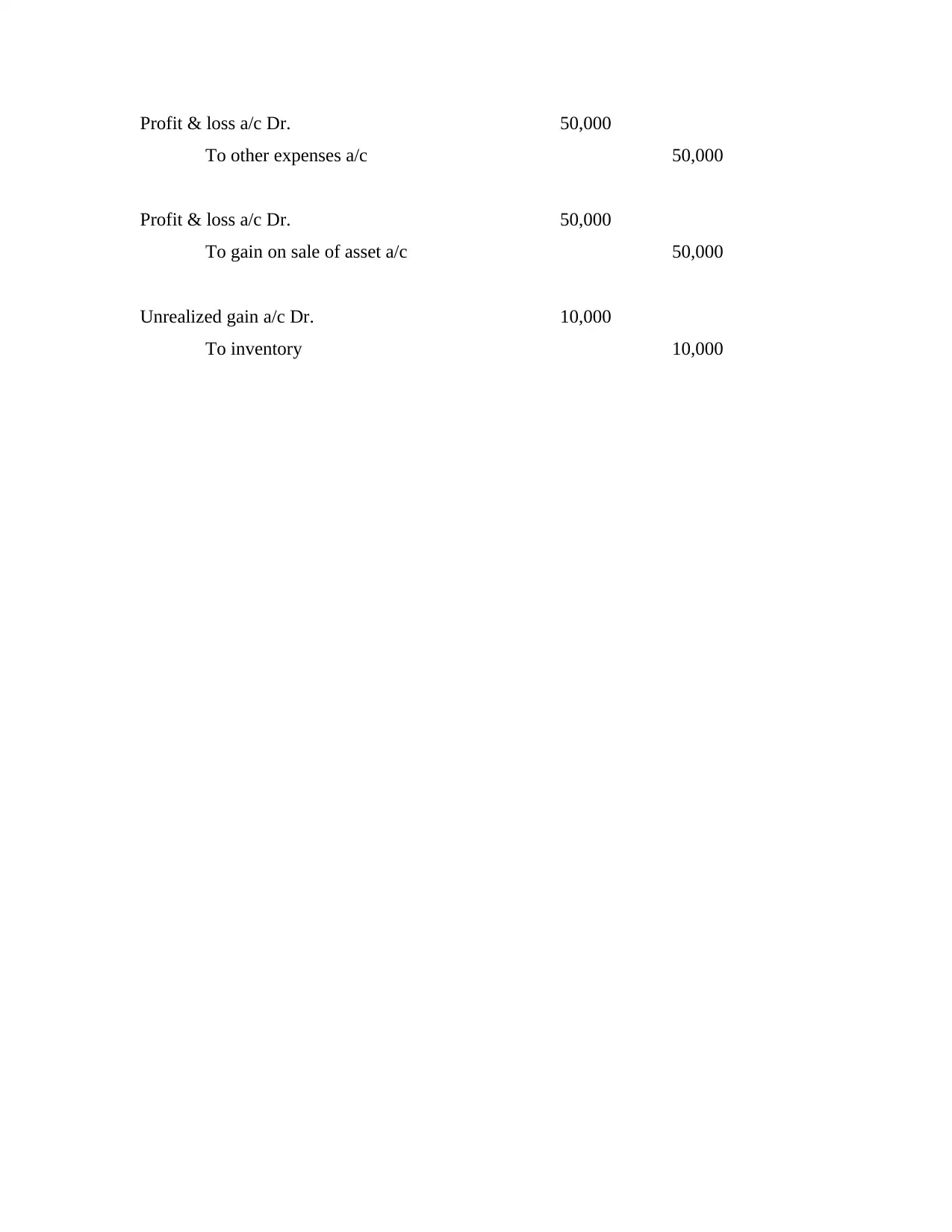

Question 5

a) Consolidation entry –

Identifiable net assets a/c Dr. 900,000

Goodwill a/c Dr. 150,000

To investment in subsidiary a/c 1,000,000

To cash (legal costs) a/c 50,000

b) Journal entries –

Impairment loss a/c Dr. 7,500

To goodwill a/c 7,500

Profit & loss a/c Dr. 7,500

To impairment loss a/c 7,500

(being loss debited to supplier)

30 June 2023 Profit & Loss A/C Dr

To MNO Ltd. A/C

(being profit and loss a/c debited for

loss)

16500

16500

c) AASB 121 requires foreign currency transactions to be translated at the closing rate at the end

of the financial reporting period because it works with the objective to translate financial

statements into presentation currency and closing rate is used for this purpose. Closing rate is the

rate of spot exchange at the reporting period end. So AASB 121 requires closing rate. Monetary

items of the foreign currency are translated using the closing rate.

d) Hedging arrangement would have helped the XYZ Ltd to reduce the amount of risk associated

to their investment. This arrangement is a type of insurance cover that can protect the company

against the losses that occurs during the import of foreign raw materials or fixed assets.

e) The business like XYZ while recording the foreign transactions should use the rate that is

higher based on the historic cost concept and prudence principle followed during accounting.

Question 5

a) Consolidation entry –

Identifiable net assets a/c Dr. 900,000

Goodwill a/c Dr. 150,000

To investment in subsidiary a/c 1,000,000

To cash (legal costs) a/c 50,000

b) Journal entries –

Impairment loss a/c Dr. 7,500

To goodwill a/c 7,500

Profit & loss a/c Dr. 7,500

To impairment loss a/c 7,500

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Profit & loss a/c Dr. 50,000

To other expenses a/c 50,000

Profit & loss a/c Dr. 50,000

To gain on sale of asset a/c 50,000

Unrealized gain a/c Dr. 10,000

To inventory 10,000

To other expenses a/c 50,000

Profit & loss a/c Dr. 50,000

To gain on sale of asset a/c 50,000

Unrealized gain a/c Dr. 10,000

To inventory 10,000

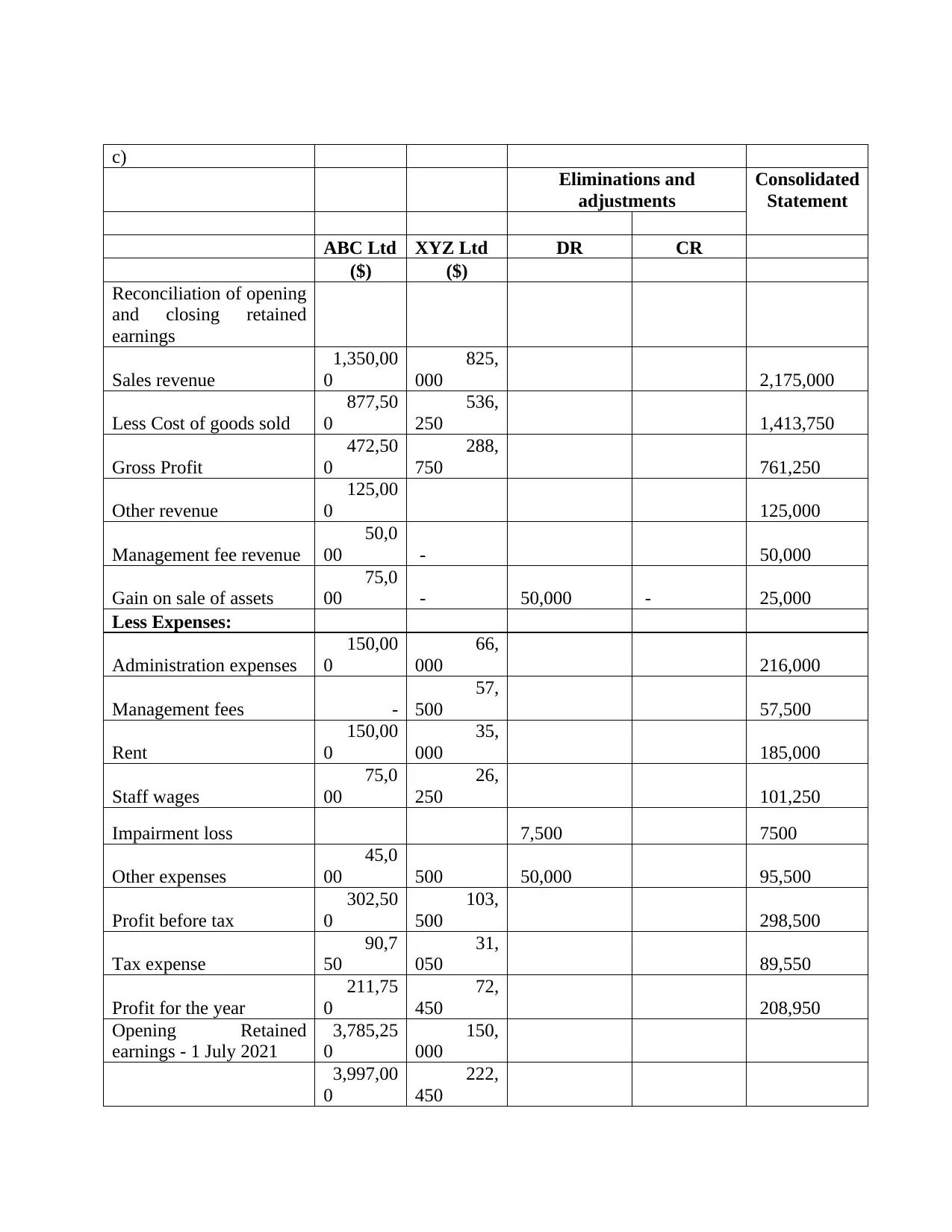

c)

Eliminations and

adjustments

Consolidated

Statement

ABC Ltd XYZ Ltd DR CR

($) ($)

Reconciliation of opening

and closing retained

earnings

Sales revenue

1,350,00

0

825,

000 2,175,000

Less Cost of goods sold

877,50

0

536,

250 1,413,750

Gross Profit

472,50

0

288,

750 761,250

Other revenue

125,00

0 125,000

Management fee revenue

50,0

00 - 50,000

Gain on sale of assets

75,0

00 - 50,000 - 25,000

Less Expenses:

Administration expenses

150,00

0

66,

000 216,000

Management fees -

57,

500 57,500

Rent

150,00

0

35,

000 185,000

Staff wages

75,0

00

26,

250 101,250

Impairment loss 7,500 7500

Other expenses

45,0

00 500 50,000 95,500

Profit before tax

302,50

0

103,

500 298,500

Tax expense

90,7

50

31,

050 89,550

Profit for the year

211,75

0

72,

450 208,950

Opening Retained

earnings - 1 July 2021

3,785,25

0

150,

000

3,997,00

0

222,

450

Eliminations and

adjustments

Consolidated

Statement

ABC Ltd XYZ Ltd DR CR

($) ($)

Reconciliation of opening

and closing retained

earnings

Sales revenue

1,350,00

0

825,

000 2,175,000

Less Cost of goods sold

877,50

0

536,

250 1,413,750

Gross Profit

472,50

0

288,

750 761,250

Other revenue

125,00

0 125,000

Management fee revenue

50,0

00 - 50,000

Gain on sale of assets

75,0

00 - 50,000 - 25,000

Less Expenses:

Administration expenses

150,00

0

66,

000 216,000

Management fees -

57,

500 57,500

Rent

150,00

0

35,

000 185,000

Staff wages

75,0

00

26,

250 101,250

Impairment loss 7,500 7500

Other expenses

45,0

00 500 50,000 95,500

Profit before tax

302,50

0

103,

500 298,500

Tax expense

90,7

50

31,

050 89,550

Profit for the year

211,75

0

72,

450 208,950

Opening Retained

earnings - 1 July 2021

3,785,25

0

150,

000

3,997,00

0

222,

450

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.