Financial Resource Management and Decisions: A Detailed Report

VerifiedAdded on 2020/01/23

Resources and

Decisions

Paraphrase This Document

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1................................................................................................................................................1

1.2................................................................................................................................................2

1.3................................................................................................................................................3

2.1................................................................................................................................................4

2.2................................................................................................................................................4

2.3................................................................................................................................................5

2.4................................................................................................................................................6

3.1................................................................................................................................................6

3.2................................................................................................................................................7

3.3................................................................................................................................................8

TASK 2............................................................................................................................................9

4.1................................................................................................................................................9

4.2..............................................................................................................................................10

4.3..............................................................................................................................................10

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................12

Table 1: Pros and Cons of Carious sources of finance....................................................................2

Table 2: Cash budget analysis ( in £)...............................................................................................8

Table 3: Sales Budget......................................................................................................................8

Table 4: Calculation of Unit Cost....................................................................................................9

Table 5: Net Present Value..............................................................................................................9

Table 6: IRR...................................................................................................................................10

Table 7: Payback Period................................................................................................................11

Table 8: Ratio Analysis of Sainsburry...........................................................................................12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial management is concerned with the concept of managing and arranging funds to

carry out the different activities of new business concern. It assist in effective allocation of

money to all the sectors of the company. The present research report is about a new business

entity facing issues to adapt the best and the most appropriate sources of finance to start-up the

operations (Booker, 2006). Main aim of this study is to present readers with an insight of where

and how to access sources of finance for the enterprise and also the skills needed to utilize the

information for making various decisions. Learners will be able to identify the sources of funds

and their pros and cons. Based on this the appropriate source shall be chosen by the entrepreneur

and along with that the cost of the sources of finance shall also be identified. Furthermore, in the

report, cash budget, Unit cost of product and ratio analysis of another company has also been

presented. On this basis various decisions are made by the entrepreneur that assist in expanding

its business activities (Broadbent and Cullen, 2012).

TASK 1

1.1

The first and foremost task involved in starting up a new business unit is identification of

various sources of finance. An organization requires finance to purchase, stock, and assets as

well as for several other activities. Therefore, enlisted below are few sources of finance which

the entrepreneur feels that can be adapted by it: Crowd funding: In this type of finance, an owner of the company can raise funds through

various social networking sites such as Facebook and twitter. Hereby, the entrepreneur

aims to provide best services, goods and equity to people in return for the money

generated through these sites. It is the best method where the owner wants to build the

goodwill of the company before starting up its business activities. Business Angels: These are the institutes which invest in new projects or businesses by

providing funds for development or either by giving contacts and skills that may be

beneficial of the entrepreneur (Bull, 2007). Australian business angels and Angels pvt Ltd

are the examples of such institutes. They take risk by investing in it and also involve

themselves in the business either as a mentor or as a financier. Venture capital: It is a kind of source in which the new businesses receives various types

of knowledge regarding the operations along with the initial investment of fund. They

1

Paraphrase This Document

made in the development, expansion and later stages of business life cycle. Government programmes: Herein, the government of UK arranges programmes to

provide loan to a new business venture. Funds are being provided to the needed

enterprise who are having low investment in regard to this and it demands certain

documents that can be kept as guarantee (Komissarov, 2014). Loans: Banks loans are the most effective means of source of finance wherein they

provide the respective amount to the person in need on the basis of certain guarantee kept

in form of collateral money with the bank owners.

Family and Relatives: The entrepreneur can undertake loans from the person that are

close to them. They can provide the loans on the basis of some security or interest

provided by the owner.

1.2

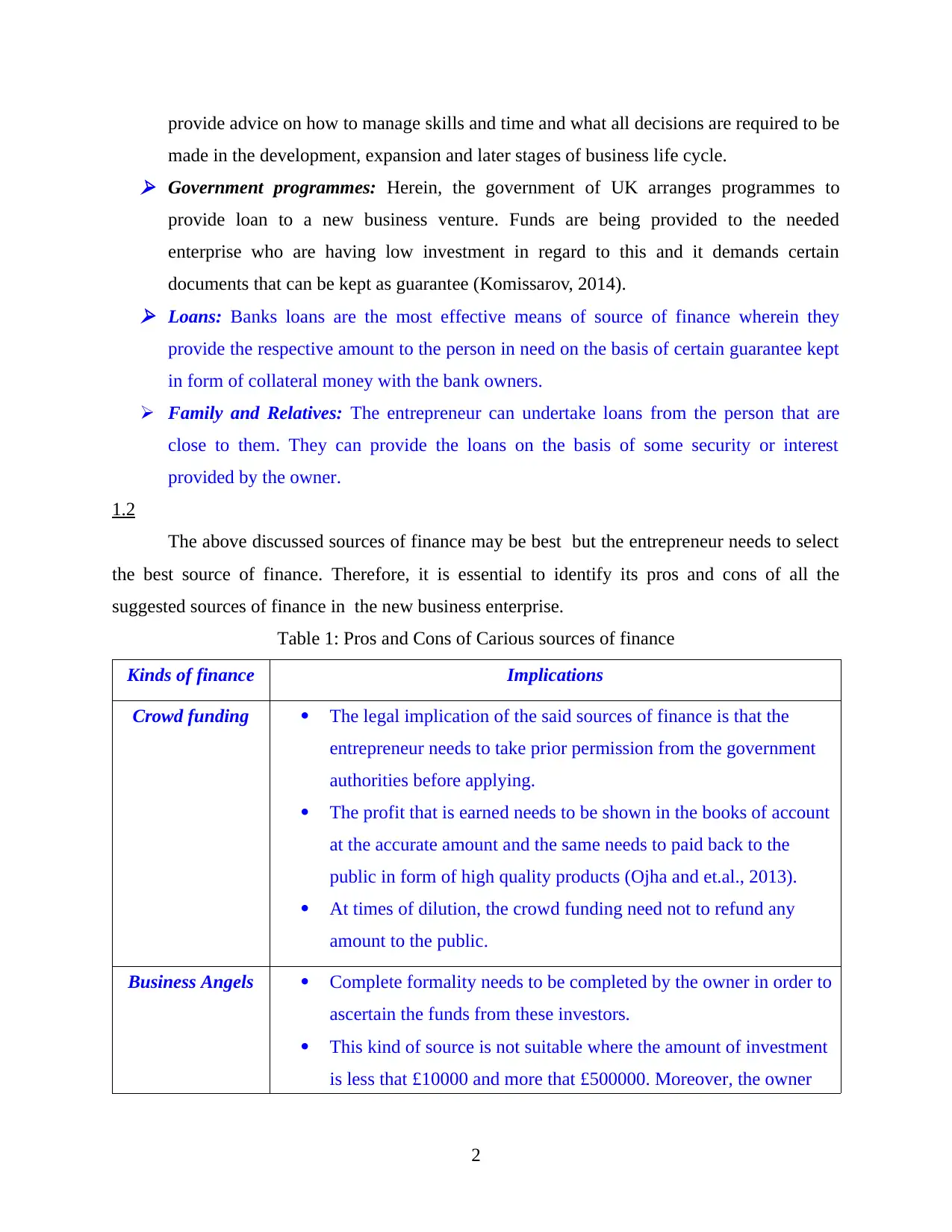

The above discussed sources of finance may be best but the entrepreneur needs to select

the best source of finance. Therefore, it is essential to identify its pros and cons of all the

suggested sources of finance in the new business enterprise.

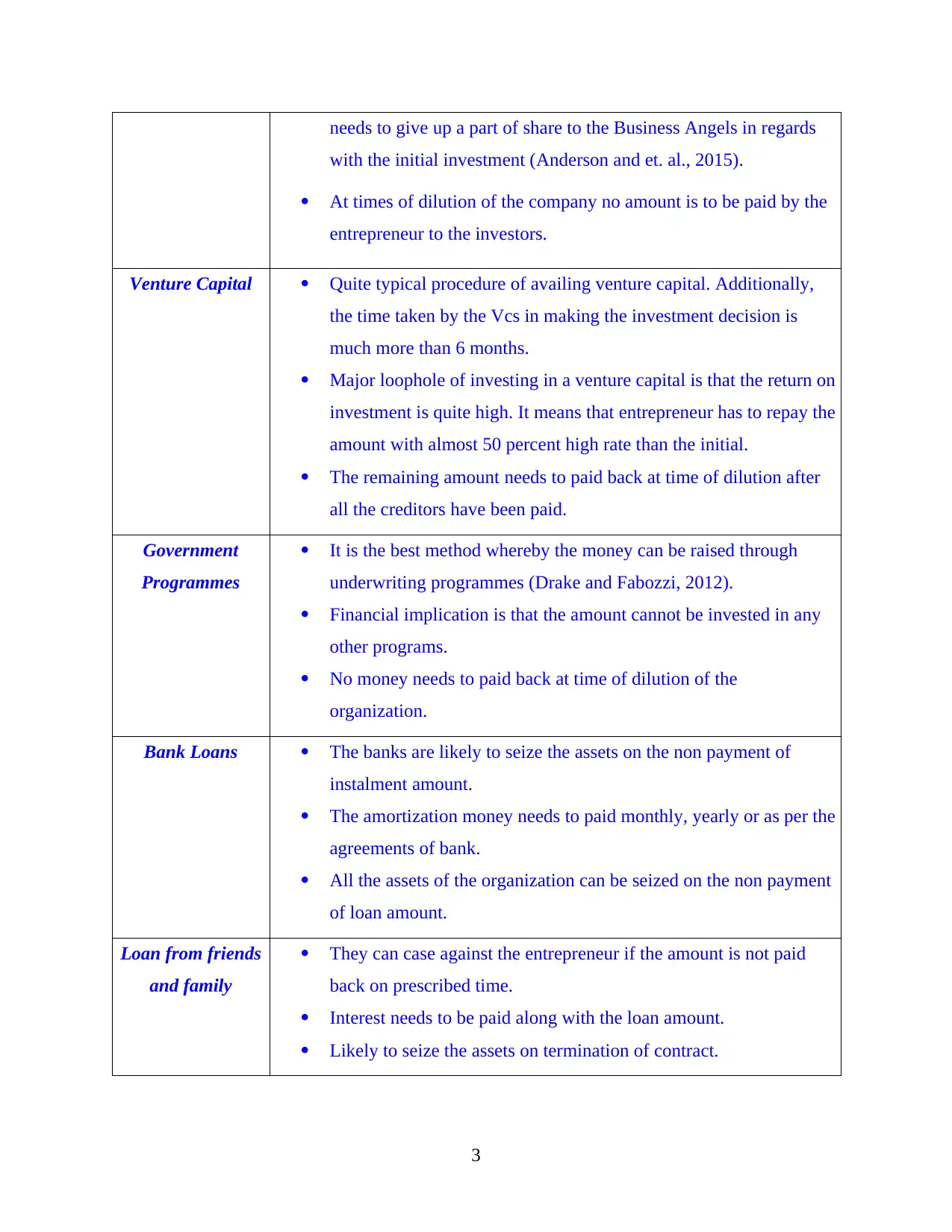

Table 1: Pros and Cons of Carious sources of finance

Kinds of finance Implications

Crowd funding The legal implication of the said sources of finance is that the

entrepreneur needs to take prior permission from the government

authorities before applying.

The profit that is earned needs to be shown in the books of account

at the accurate amount and the same needs to paid back to the

public in form of high quality products (Ojha and et.al., 2013).

At times of dilution, the crowd funding need not to refund any

amount to the public.

Business Angels Complete formality needs to be completed by the owner in order to

ascertain the funds from these investors.

This kind of source is not suitable where the amount of investment

is less that £10000 and more that £500000. Moreover, the owner

2

with the initial investment (Anderson and et. al., 2015).

At times of dilution of the company no amount is to be paid by the

entrepreneur to the investors.

Venture Capital Quite typical procedure of availing venture capital. Additionally,

the time taken by the Vcs in making the investment decision is

much more than 6 months.

Major loophole of investing in a venture capital is that the return on

investment is quite high. It means that entrepreneur has to repay the

amount with almost 50 percent high rate than the initial.

The remaining amount needs to paid back at time of dilution after

all the creditors have been paid.

Government

Programmes

It is the best method whereby the money can be raised through

underwriting programmes (Drake and Fabozzi, 2012).

Financial implication is that the amount cannot be invested in any

other programs.

No money needs to paid back at time of dilution of the

organization.

Bank Loans The banks are likely to seize the assets on the non payment of

instalment amount.

The amortization money needs to paid monthly, yearly or as per the

agreements of bank.

All the assets of the organization can be seized on the non payment

of loan amount.

Loan from friends

and family

They can case against the entrepreneur if the amount is not paid

back on prescribed time.

Interest needs to be paid along with the loan amount.

Likely to seize the assets on termination of contract.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The entrepreneur has various choices available with it in order to cater finance for its

business. It can arrange funds from venture capital, Business angels, crowdfunding, government

programmes, etc. All these sources are best and efficient in own place but the owner needs to

evaluate the cost effective and reasonable source which best suits the enterprise. Currently, the

entrepreneur has £20000 of personal money that it can invest in the firm and additionally it

requires £280000 to start-up its business (Griffin, 2013). For this purpose, the venture capital and

Business angel is appropriate for the enterprise because no amount of interest is to be repaid to

both the investors. Additionally, the cost of implementing this tool is quite low as compared to

the government programmes because the amount of interest they take is quite high which

overtakes the cost of investment.

Contrary, arrangement of funds through crowdfunding requires huge risk in terms of

losing the business confidential information if it has not been secured with the patent or

copyright. Apart from, it is necessary to evaluate and select the one best method from the

Business angels and Venture capital for the company (Avlonitis and Indounas, 2005). It has been

recommended that the entrepreneur shall opt for angel financing because it is the most cost

efficient and effective source of finance as compared to the venture capital. This is due to the

high rate of return charged by the Vcs for the amount of investment.

2.1

Before making any decisions regarding selection of one of the best source it is essential

to evaluate the actual cost of implementing the same. The same have been highlighted below: Cost of Crowdfunding: Although, it is the most efficient method of raising funds from

the public but the amount of fees required to be paid for the campaign constitutes of 3 to

5% of total amount generated from these sites which is quite high amount to be repaid. In

order to avail the respective source of fund the entrepreneur needs to incur the

opportunity cost of losing the other sources. This can be termed as the amount of

dissatisfaction ascertained from losing the equally important things in order to get the one

which is best meets the requirements of the owner (Driouchi and Bennett, 2012). Cost of Business angels: The cost of investing in the Business angel is quite low as it

does not require interest amount to be paid. Moreover, the company need not to keep any

assets as collateral with the investor. The only cost involve herein is that the entrepreneur

4

Paraphrase This Document

brokers in order to avail the funds. Cost of venture Capital: Alike the angel financiers, venture capitalist also demands some

share in the company in the form of becoming part of management. Although the

expected rate of return on the investment is quite high that nearly constitutes 50 percent

return. Cost of government Programmes: Lastly, the cost involved in taking loan from

government results in high rate of interest. Likewise the SBA loans, the government

funding programmes involves the high amount of risk in terms of collateral kept as

securities (Magni, 2010).

Loan from relatives and banks: The cost incurred in availing one amongst the two can

be the amount of interest that needs to be paid in each of the cases. Thereafter, as

discussed above, only the best source can be selected by the entrepreneur and this means

sacrificing the other. Therefore, opportunity cost of relatives loans also needs to be

ascertained to avail the bank loan.

2.2

For each business enterprise to be successful, it requires proper financial plan which will

assist in giving directions to the managers in proper utilization of available funds. Some of the

benefits of financial planning have been enlisted herein:

It is essential to ensure that adequate amount of funds are available by the company.

Financial planning assist in ensuring timely investment of funds by the investors in the

business which will further aids in continuity of the enterprise (Polasky and et. al., 2011).

Likewise, with effective financial plan an entrepreneur can ensure that funds are being

allocated to all the departments and it does not hampers the productivity of the

organization.

Furthermore, it assist in managing the uncertain events that are likely to occur in the

organization and enables a business to grow and attain its long term and short term

objectives (Baker and Powell, 2009).

With the proper financial plan an entrepreneur knows where to invest and where not to. It

aids in knowing the current position of the firm and also helps in to manage and

incorporate changes according to the current market trends.

5

the most efficient manner that renders best result for the company. Currently, the entrepreneur is

facing issues regarding the best source of finance to be incorporated. This issue can be easily

solved through effective financial plan. Moreover, the entrepreneur must hire a finance manager

in order to look after the funds of business entity (Bennouna and et.al., 2010).

2.3

The financial information produced by the company are used by all its stakeholders.

These data's are used for the purpose of decision making process and analysing the current

position of the business enterprise in the market. The list of different users of financial

information of the concerned organization have been highlighted below:

Internal Users: Entrepreneur: They need to asses to these information for the purpose of assessing the

profitability and viability of the enterprise. Based on it further decisions are made for

expansion and investment. Management: The managers of the company require data's to determine the present

position of the company in the market and based on it decisions are made to improve and

enhance the performance of the enterprise. They also require data's regarding the current

liquidity position of the firm so as to manage its operations accordingly. If the firm assets

are quite liquid then they need to make investment in varied other activities (Brigham and

Ehrhardt, 2013). Workers: The financial information and stability of the firm has a direct and consequent

impact on the employees remuneration and job security. They periodically assess these

information to check the future impact of it on their compensation.

External Users: Regulatory authorities: Their main purpose of reviewing the the information of the

company is to analyse that the data's provided to its stakeholders are in compliant with

the rules and regulations of the company. This will provide an understanding of the

current revenue generated in the particular period and then determining the amount of

taxes that the entrepreneur needs to pay. Creditors and Investors: These comprises of the suppliers, bands and investors of the

company. They determine and assess the credit worthiness of the firm and on the basis of

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2008).

Tax authorities: They need various informations for the company to determine whether

the said firm is in the position to pay the taxes to the government. The profitability and

liquidity of the firm will become a basis for determination of taxes need to be paid by the

owner.

2.4

Financial statement of a company constitutes of the profit and loss account, balance

sheet, income statement and cash flow statement. The various source identified by the

entrepreneur has an equal and consequent impact on the financial statement. All of the illustrated

sources of funds increased the owners capital, therefore it can be said that the business angel,

crowd funding, venture capital and government programme funds will be shown in the liability

side of balance sheet (Habib and et.al., 2013).

Likewise the entrepreneur needs to pay in return the interest, shares or definite amount of

money for the same. In case of crowd funding the owner needs to pay a certain amount of its

profit or revenue generated through the social networking sites. Therefore, it will affect the

liability side of the balance sheet. Likewise, in case of the government programmes, the

company is obliged to pay the interest along with the initial amount. Therefore, the it will be

shown in the liability side of under secured loans and the profit and loss will be affected by the

amount of interest (Mishra and et.al., 2009). Similarly, the angel financing and the venture

capital have a similar impact on the balance sheet as investment. And the same amount shall be

credited in the share capital account as the owners allow the investors to take part in management

by providing some amount of shares in the company. Along with that, the loans taken by the

owner shall have a consequent impact on the income statement of the firm as more amount of

investment result in increase operations and sales thereby causing a similar impact on the said

statements.

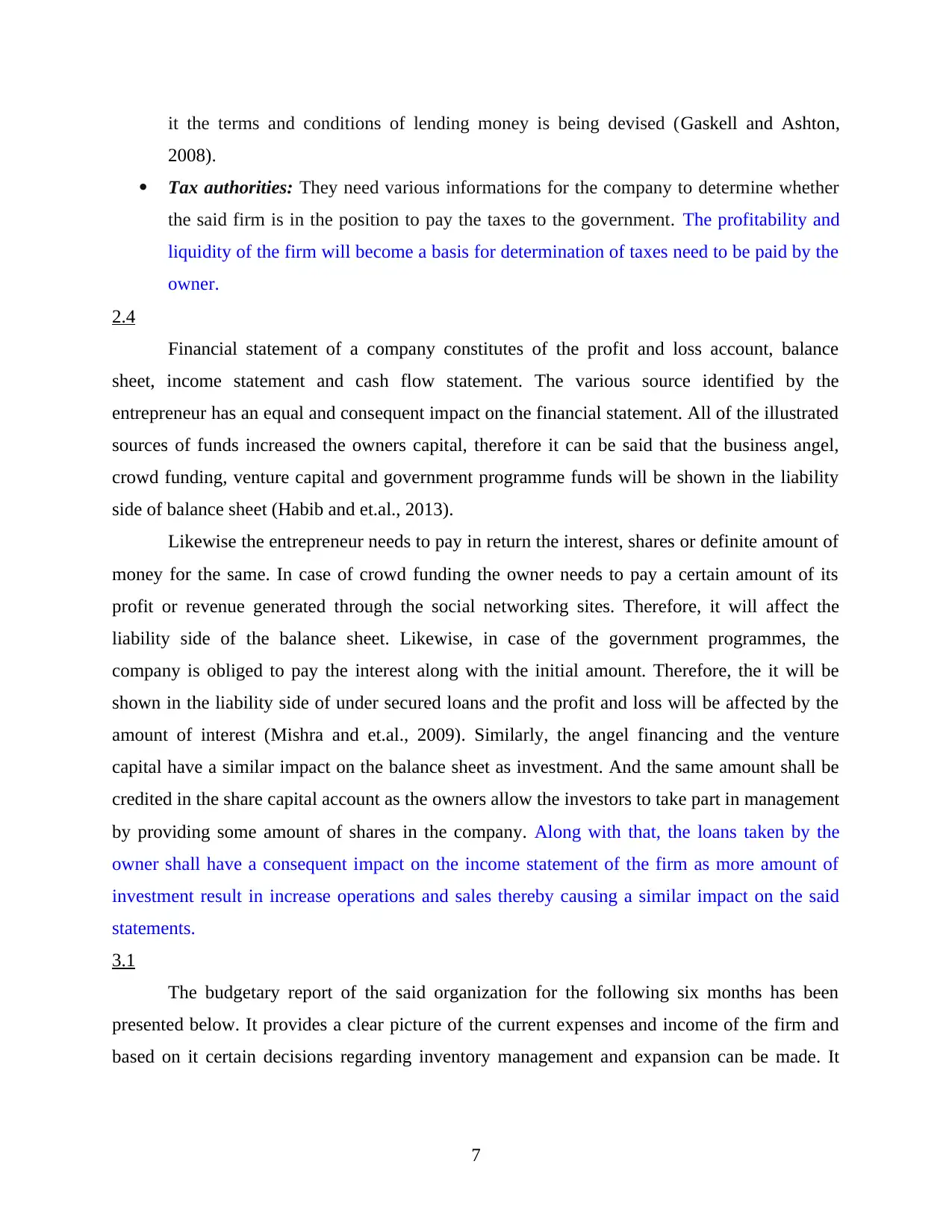

3.1

The budgetary report of the said organization for the following six months has been

presented below. It provides a clear picture of the current expenses and income of the firm and

based on it certain decisions regarding inventory management and expansion can be made. It

7

Paraphrase This Document

same for future course of action.

Table 2: Cash budget analysis ( in £)

January February March April May June

Opening Balance £20000 £24300 £38600 £43850 £51950 £55100

Incomes

Sales 15000 24000 15750 20500 16750 19200

Total Income 35000 48300 54350 64350 68700 74300

Expenditures

Purchase 5000 4000 3500 5000 7000 2500

Salary 3000 3000 3000 3000 3000 3000

Expenses 1500 1200 1000 2500 2000 1800

Creditors 1200 1500 3000 1900 1600 1100

Total Expenditure 10700 9700 10500 12400 13600 8400

Closing Balance 24300 38600 43850 51950 55100 65900

Table 3: Sales Budget

Particulars January February March April May June

Units 1200 1500 1600 1800 2000 2200

Selling price 10 10 10 10 10 10

Total sales 12000 15000 16000 18000 20000 22000

(-)discounts 0 2500 5300 4700 5800 6600

Net sales 12000 12500 10700 13300 14200 15400

From the above analysis of the cash and sales budget it is clear that the company is

continuously making an average rate of growth in its sales and thereby raising the overall

profitability of the firm. In order to make the higher returns the company needs to focus on

reducing the overall expenses of it (Peslak, 2006). The revenue can be raised by decreasing the

8

discounts to increase its net sales. The finance manager of the said organization can keep aside

certain amount of funds to raise the amount of stock which will lead to more earnings of the

company.

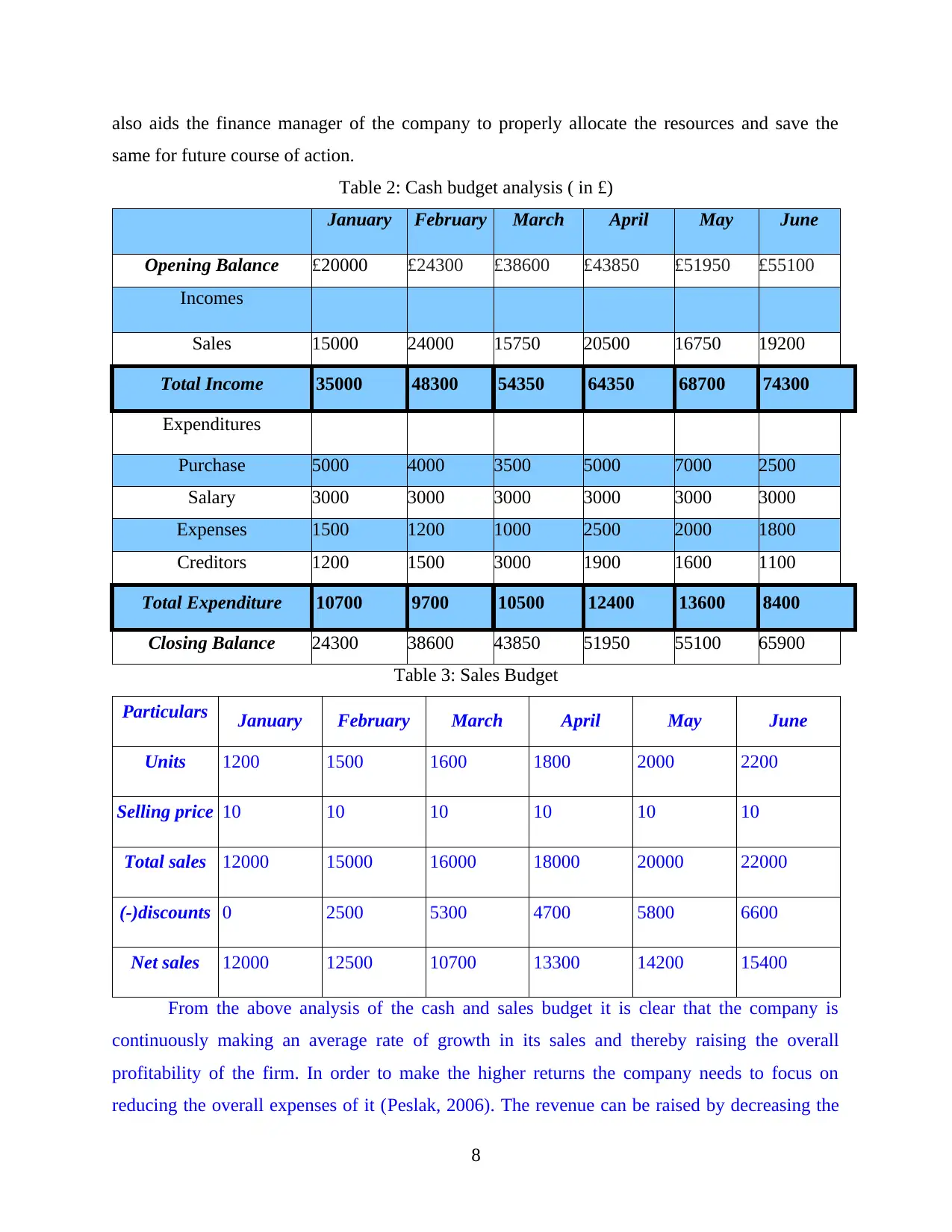

3.2

Cost of the product plays a crucial role in making various pricing decisions for the firm.

It also affects the overall profitability of the company therefore the entrepreneur ask to prepare a

unit cost analysis of the firm (Rasid, 2014). The same has been highlighted below:

Table 4: Calculation of Unit Cost

Unit cost Amount in £

Total cost 70000

Unit manufactured 350

Variable Cost 45000

Fixed cost 25000

Total amount 70000

Formula for unit cost Total cost divided by

unit manufactured

Cost per Unit 200

Margin on cost 25%

Selling Price of Product 250

From the above analysis of unit cost of each unit it can be said that the firm needs to

focus on the total cost and unit produced by the firm. It can increase its funds and start producing

more which will result in raising the overall productivity of the company. Moreover, the

company shall maintain its variable cost by reducing the amount of wastage caused in production

process (Sivakumar, 2011). This will increase the number of overall units and produced and

leading to decrease in cost per unit. The said enterprise can also increase its profit margin leading

to rise in the selling price of the product.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

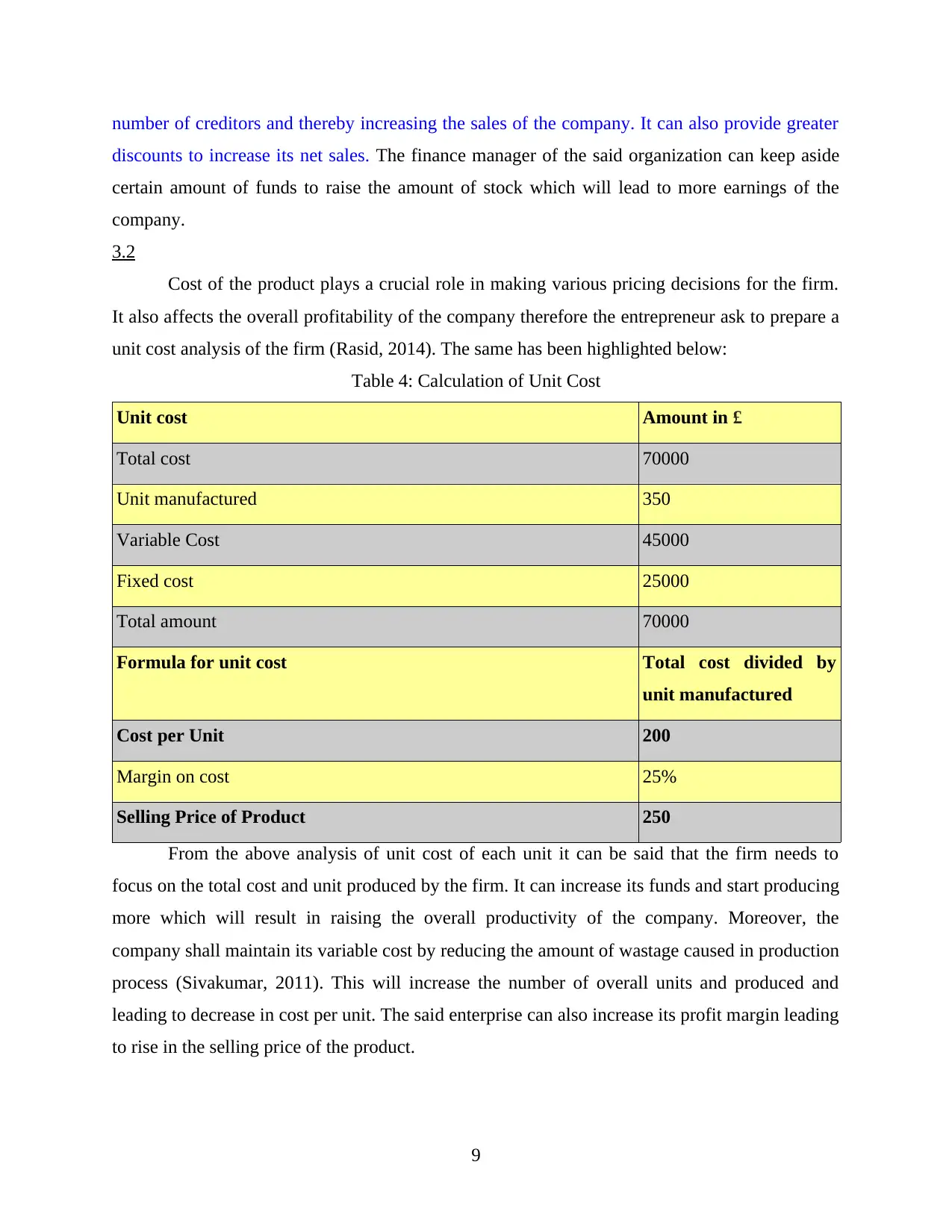

It is essential to assess the viability and profitability of a project in which the

entrepreneur is thinking to invest. There are various methods such as Pay Back period and Net

Present Value Method to know about the average return on a particular project (Wang and et.al.,

2011). For this purpose the entrepreneur feels the NPV is the best and the most viable technique

that can be used. The same has been illustrated below:

Table 5: Net Present Value

Year Cash Inflow(£000) PV Factor @ 8% Present Value of Cash Flow @

8%

First 400 0.9433962264 377.35

Second 450 0.88999644 400.49

Third 500 0.839619283 419.80

Fourth 550 0.7920936632 435.65

Present Value of Cash Inflow (1) 1633.29

Present Value of Cash Outflow (2) 1100

Net Present Value (1-2) 533.29

So, it can be said that the entrepreneur can effectively invest in the new project as the

positive value determines that the project is profitable. Contrastingly, if the result would have

been negative than it is suggested not to invest in the particular project as it will lead to negative

returns. In the initial stages of the development, the organization will earn a slow revenue and at

the end of the period it can earn high yield on investment (Basic investment appraisal

techniques. 2012).

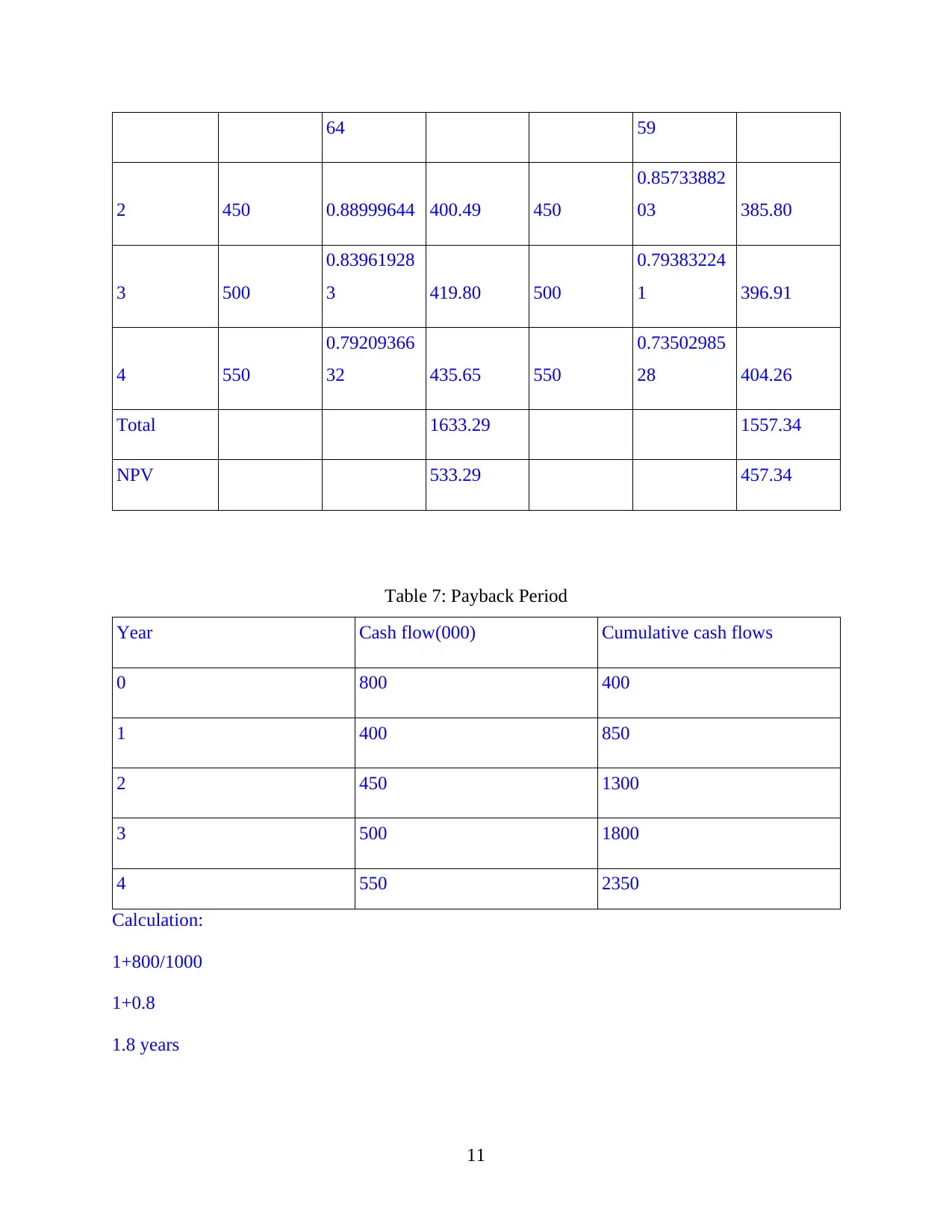

Table 6: IRR

Year cash flow PV @6%

Present

value Cash flow Pv @ 8%

Present

value

1 400 0.94339622 377.35 400 0.92592592 370.37

10

Paraphrase This Document

2 450 0.88999644 400.49 450

0.85733882

03 385.80

3 500

0.83961928

3 419.80 500

0.79383224

1 396.91

4 550

0.79209366

32 435.65 550

0.73502985

28 404.26

Total 1633.29 1557.34

NPV 533.29 457.34

Table 7: Payback Period

Year Cash flow(000) Cumulative cash flows

0 800 400

1 400 850

2 450 1300

3 500 1800

4 550 2350

Calculation:

1+800/1000

1+0.8

1.8 years

11

will receive the reasonable return on investment after approximately 1.8 years of time.

TASK 2

4.1

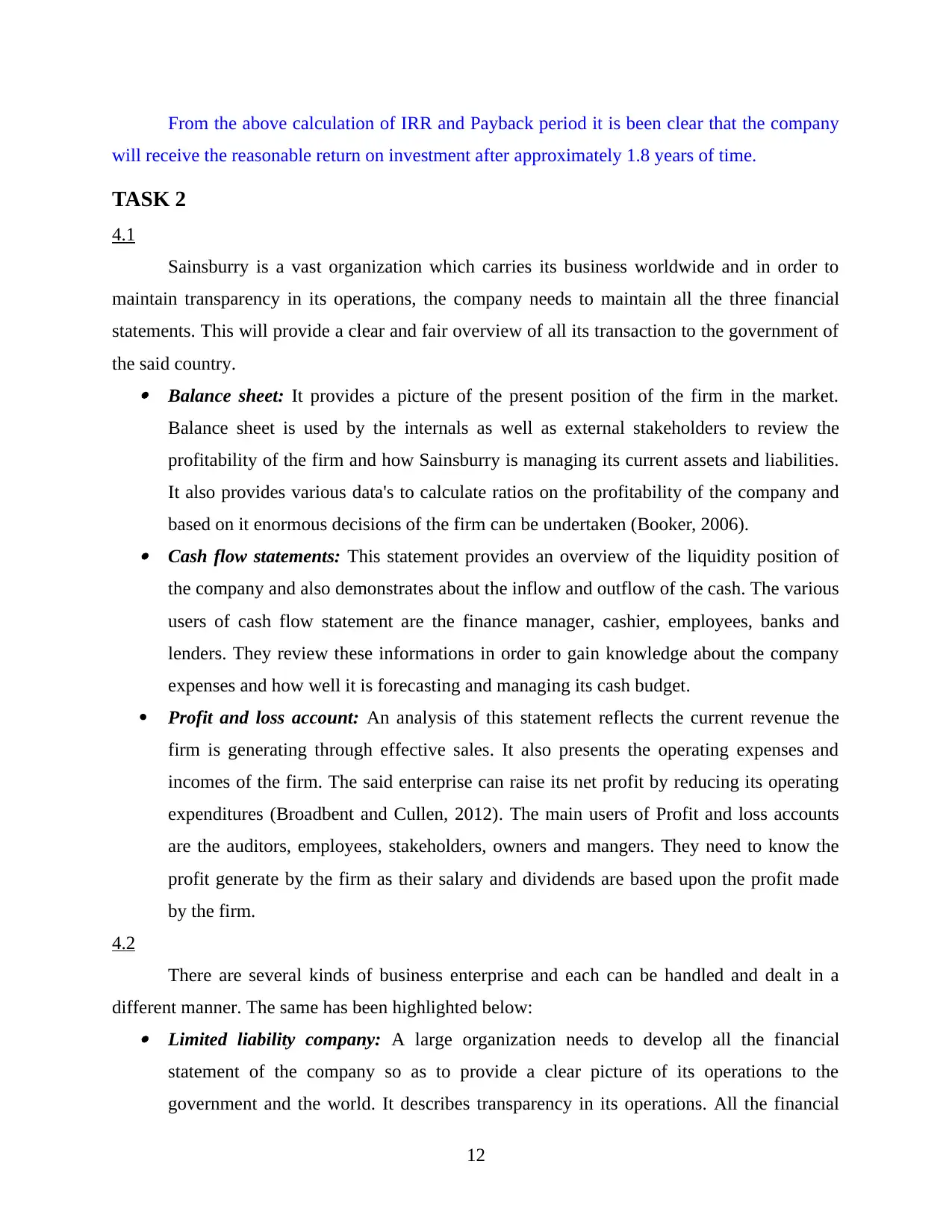

Sainsburry is a vast organization which carries its business worldwide and in order to

maintain transparency in its operations, the company needs to maintain all the three financial

statements. This will provide a clear and fair overview of all its transaction to the government of

the said country. Balance sheet: It provides a picture of the present position of the firm in the market.

Balance sheet is used by the internals as well as external stakeholders to review the

profitability of the firm and how Sainsburry is managing its current assets and liabilities.

It also provides various data's to calculate ratios on the profitability of the company and

based on it enormous decisions of the firm can be undertaken (Booker, 2006). Cash flow statements: This statement provides an overview of the liquidity position of

the company and also demonstrates about the inflow and outflow of the cash. The various

users of cash flow statement are the finance manager, cashier, employees, banks and

lenders. They review these informations in order to gain knowledge about the company

expenses and how well it is forecasting and managing its cash budget.

Profit and loss account: An analysis of this statement reflects the current revenue the

firm is generating through effective sales. It also presents the operating expenses and

incomes of the firm. The said enterprise can raise its net profit by reducing its operating

expenditures (Broadbent and Cullen, 2012). The main users of Profit and loss accounts

are the auditors, employees, stakeholders, owners and mangers. They need to know the

profit generate by the firm as their salary and dividends are based upon the profit made

by the firm.

4.2

There are several kinds of business enterprise and each can be handled and dealt in a

different manner. The same has been highlighted below: Limited liability company: A large organization needs to develop all the financial

statement of the company so as to provide a clear picture of its operations to the

government and the world. It describes transparency in its operations. All the financial

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

profit it has made will present the amount of dividend that shall be paid to its

shareholders (Bull, 2007). Partnership: In this kind of organization. The management needs to prepare the balance

sheet and profit and loss account of the company so as to present the equal distribution of

the same to both the partners. It also provides a clear overview of the amount of

investment that needs to be made by each partner. Profits are also distributed on the basis

of the Profit and loss account of the firm (Komissarov, 2014).

Sole trader: In this kind of business, the owner is the whole and sole of the business.

Therefore, the need for preparing all the financial statements does not arise. It just need to

make the profit and loss account of the company to ascertain the amount of revenue

generated in the particular period.

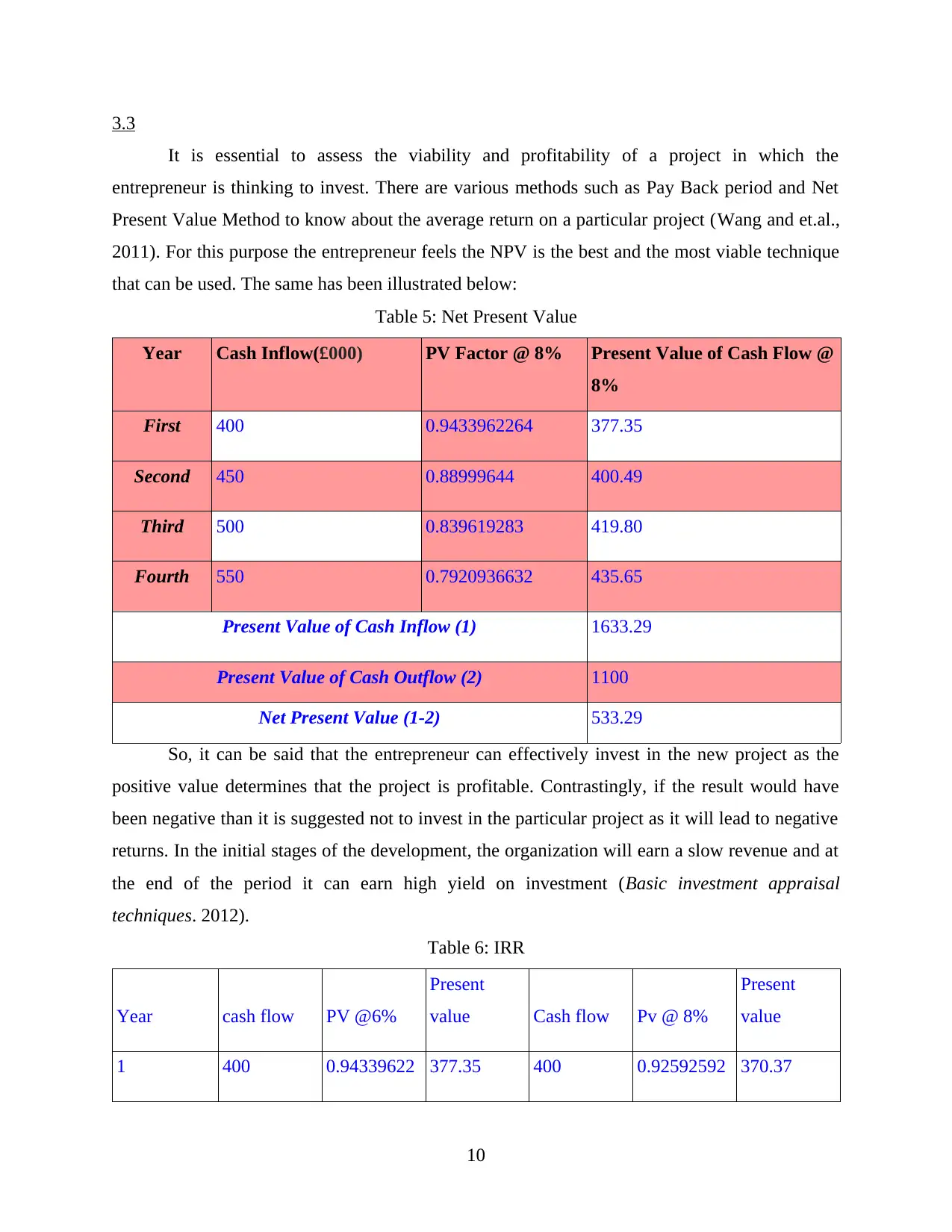

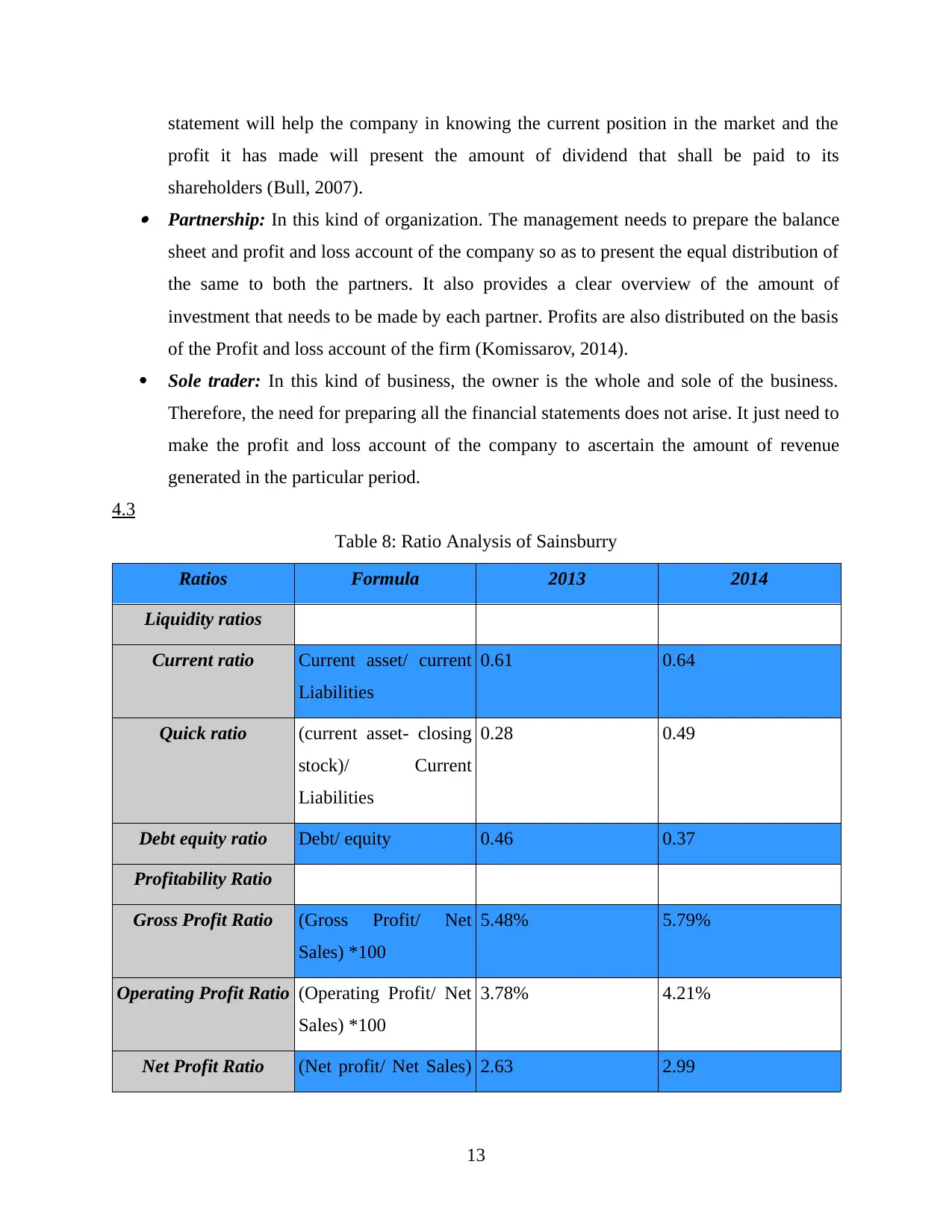

4.3

Table 8: Ratio Analysis of Sainsburry

Ratios Formula 2013 2014

Liquidity ratios

Current ratio Current asset/ current

Liabilities

0.61 0.64

Quick ratio (current asset- closing

stock)/ Current

Liabilities

0.28 0.49

Debt equity ratio Debt/ equity 0.46 0.37

Profitability Ratio

Gross Profit Ratio (Gross Profit/ Net

Sales) *100

5.48% 5.79%

Operating Profit Ratio (Operating Profit/ Net

Sales) *100

3.78% 4.21%

Net Profit Ratio (Net profit/ Net Sales) 2.63 2.99

13

Paraphrase This Document

Efficiency Ratio

Asset turnover ratio Net Sales/total assets 1.86 1.64

Inventory turnover

ratio

COGS/ Inventory 22.88 22.65

The above illustrated table demonstrates the profitability the firm has made in the year

2013 and 2014. from the liquidity ratio of current asset it can be ascertained that the company

has made investment in its current asset therefore it has increased by the year 2014. Likewise the

profitability ratio demonstrates the Sainsburry gross, net and operating profit has gradually

increased by the year 2014. Additionally, it can be concluded that the company's operating profit

is increasing day by day causing a consequent effect on the firms profitability. In addition to the

above, the ratios can also be compared with those of its competitors such as ASDA, marks and

Spencer and other rivalry firm. It has been determined that the other firms are nowhere in

comparison to the current organization as it profitability for the current period is quite high.

Moreover, the liquidity of ASDA is quite more which means that it has huge expenditure for the

said period (Ojha and et.al., 2013).

CONCLUSION

The above report depicts the importance of various sources of finance and its

implications in the company. The entrepreneur has many choices available in terms of the

selecting the funds but the most appropriate source found was business angels. The implication

of the same in the business enterprise and its cost has been evaluated in this study. Furthermore,

various ratios and cost budget prepared, presents an insight about the funds spent in different

activities. All these becomes the basis of decision making for the firm (Anderson and et. al.,

2015).

14

Books and journals

Anderson, D. and et. al., 2015. An introduction to management science: quantitative approaches

to decision making. Cengage Learning.

Avlonitis, G. and Indounas, K., 2005. Pricing objectives and pricing methods in the services

sector. Journal of Services Marketing. 19(1). pp.47–57.

Baker, K. H. and Powell, G., 2009. Understanding Financial Management: A Practical Guide.

John Wiley & Sons

Bennouna, K., and et.al., 2010. Improved capital budgeting decision making: evidence from

Canada. Management Decision. 48(2). pp.225–247.

Booker, J., 2006. Financial Planning Fundamentals. CCH Canadian Limited.

Brigham, E. and Ehrhardt, M., 2013. Financial Management: Theory & Practice. 14th ed.

Cengage Learning.

Broadbent, M. and Cullen, J., 2012. Managing Financial Resources. 3rd ed. Routledge.

Bull, R., 2007. Financial Ratios: How to use financial ratios to maximise value and success for

your business. Elsevier.

Drake, P. and Fabozzi, F., 2012. Analysis of Financial Statements. 3rd ed. John Wiley & Sons.

Driouchi, T. and Bennett, D. J., 2012. Real Options in Management and Organizational Strategy:

A Review of Decision‐making and Performance Implications. International journal of

management reviews. 14(1). pp. 39-62.

Gaskell, J. and Ashton, J., 2008. Developing a financial services planning profession in the UK:

An examination of past and present developments. Journal of Financial Regulation and

Compliance. 16(2). pp.159–172.

Griffin, R., 2013. Fundamentals of management. Cengage Learning.

Habib, A. and et.al., 2013. Financial distress, earnings management and market pricing of

accruals during the global financial crisis. Managerial Finance. 39(2). pp.155–180.

Komissarov, S., 2014. Financial reporting and economic implications of statements of financial

standards No. 132(R) and No. 158. Review of Accounting and Finance. 13(1) pp.88–103.

Magni, C. A., 2010. Average internal rate of return and investment decisions: a new perspective.

The Engineering Economist. 55(2).pp. 150-180.

Mishra, A. and et.al., 2009. Factors affecting financial performance of new and beginning

farmers. Agricultural Finance Review. 69(2). pp.160–179.

Ojha, D. and et.al., 2013. Impact of logistical business continuity planning on operational

capabilities and financial performance. International Journal of Logistics Management.

24(2). pp.180–209.

Peslak, R. A., 2006. Enterprise resource planning success: An exploratory study of the financial

executive perspective. Industrial Management & Data Systems. 106(9). pp.1288-1303.

Polasky, S. and et. al., 2011. Decision-making under great uncertainty: environmental

management in an era of global change. Trends in ecology & evolution. 26(8). pp. 398-

404.

Rasid, A. J. S., 2014. Management accounting systems, enterprise risk management and

organizational performance in financial institutions. Asian Review of Accounting. 22(2).

pp.128–144.

Sivakumar, N., 2011. Management of financial market scandals – regulatory and values based

approaches. Humanomics. 27(3). pp.153–165.

15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Review of Accounting. 19(1). pp.5-30.

Online

Basic investment appraisal techniques. 2012. [Online]. Available through:

<http://kfknowledgebank.kaplan.co.uk/KFKB/Wiki%20Pages/Basic%20investment

%20appraisal%20techniques.aspx?mode=none>. [Accessed on 30th September 2016].

16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.