Comprehensive Report: South Africa's Economic Analysis and Outlook

VerifiedAdded on 2023/06/10

|10

|1883

|165

Report

AI Summary

This report provides a comprehensive analysis of the South African economy, examining key economic indicators and trends. It begins by assessing the country's real GDP growth rate, which averaged 3.27% annually from the onset of democratic rule through 2012, and details the fluctuations in South Africa's national debt as a percentage of GDP. The report compares South Africa's debt to global standards and other African nations. It further explores gross fixed capital formation, government spending, and revenue, offering insights into the impact of public debt and the potential for economic crisis. The analysis includes graphical representations of debt trends and capital formation. The report concludes with potential solutions for mitigating debt and fostering economic development, such as government transparency, investing in local currency debt markets, and tax collection.

An Analysis of South Africa Economy 1

AN ANALYSIS OF SOUTH AFRICA ECONOMY

Name

University

Unit

Unit Code

City/State

Date

AN ANALYSIS OF SOUTH AFRICA ECONOMY

Name

University

Unit

Unit Code

City/State

Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

An Analysis of South Africa Economy 2

An Analysis of South Africa Economy

Q1

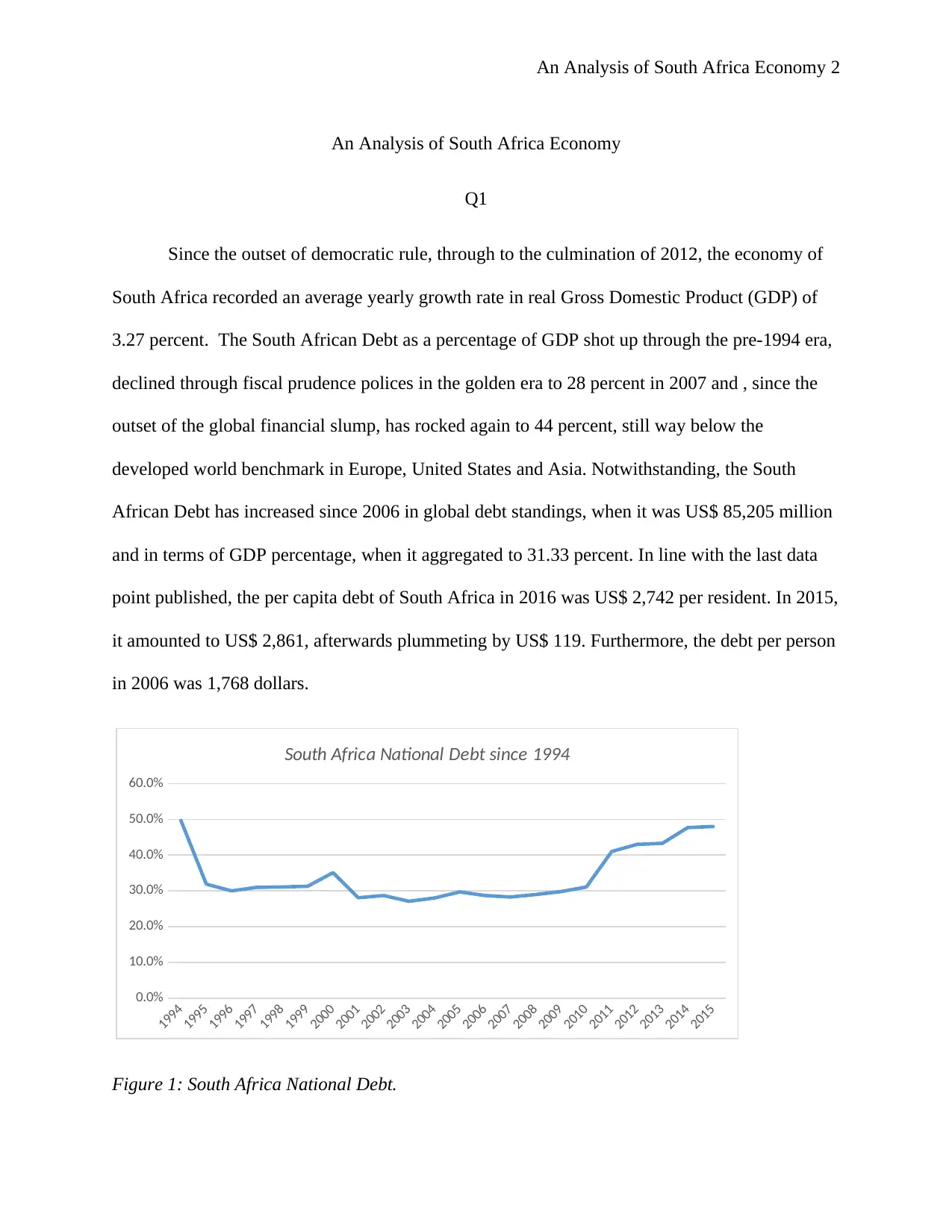

Since the outset of democratic rule, through to the culmination of 2012, the economy of

South Africa recorded an average yearly growth rate in real Gross Domestic Product (GDP) of

3.27 percent. The South African Debt as a percentage of GDP shot up through the pre-1994 era,

declined through fiscal prudence polices in the golden era to 28 percent in 2007 and , since the

outset of the global financial slump, has rocked again to 44 percent, still way below the

developed world benchmark in Europe, United States and Asia. Notwithstanding, the South

African Debt has increased since 2006 in global debt standings, when it was US$ 85,205 million

and in terms of GDP percentage, when it aggregated to 31.33 percent. In line with the last data

point published, the per capita debt of South Africa in 2016 was US$ 2,742 per resident. In 2015,

it amounted to US$ 2,861, afterwards plummeting by US$ 119. Furthermore, the debt per person

in 2006 was 1,768 dollars.

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

South Africa National Debt since 1994

Figure 1: South Africa National Debt.

An Analysis of South Africa Economy

Q1

Since the outset of democratic rule, through to the culmination of 2012, the economy of

South Africa recorded an average yearly growth rate in real Gross Domestic Product (GDP) of

3.27 percent. The South African Debt as a percentage of GDP shot up through the pre-1994 era,

declined through fiscal prudence polices in the golden era to 28 percent in 2007 and , since the

outset of the global financial slump, has rocked again to 44 percent, still way below the

developed world benchmark in Europe, United States and Asia. Notwithstanding, the South

African Debt has increased since 2006 in global debt standings, when it was US$ 85,205 million

and in terms of GDP percentage, when it aggregated to 31.33 percent. In line with the last data

point published, the per capita debt of South Africa in 2016 was US$ 2,742 per resident. In 2015,

it amounted to US$ 2,861, afterwards plummeting by US$ 119. Furthermore, the debt per person

in 2006 was 1,768 dollars.

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

South Africa National Debt since 1994

Figure 1: South Africa National Debt.

An Analysis of South Africa Economy 3

Figure 1 represents the evolution of South Africa debt. In 2016, the national debt of

South Africa was 152,508 millions of dollars, (51.57percent debt-to-GDP ratio) and its public

debt per capita is US$ 2,742 dollars per inhabitant, 4,142 million shy of 2015 debt

(Data.worldbank.org, 2018). This amount implies that the debt in 2016 stretched to 51.57 percent

of South Africa GDP, a 2.26 percent-point increase from 2015, when it was 49.32 percent of

GDP (Data.worldbank.org, 2018). The figure below summarizes the history of South Africa

National Debt. The downturn, in spite of being short-lived has had substantial labor market

impacts which the economy of South Africa is still trying to recover from. Essentially however,

the period prior to the slump signifies perhaps the longest period of continuous positive

economic growth in the modern history of South Africa.

Q2

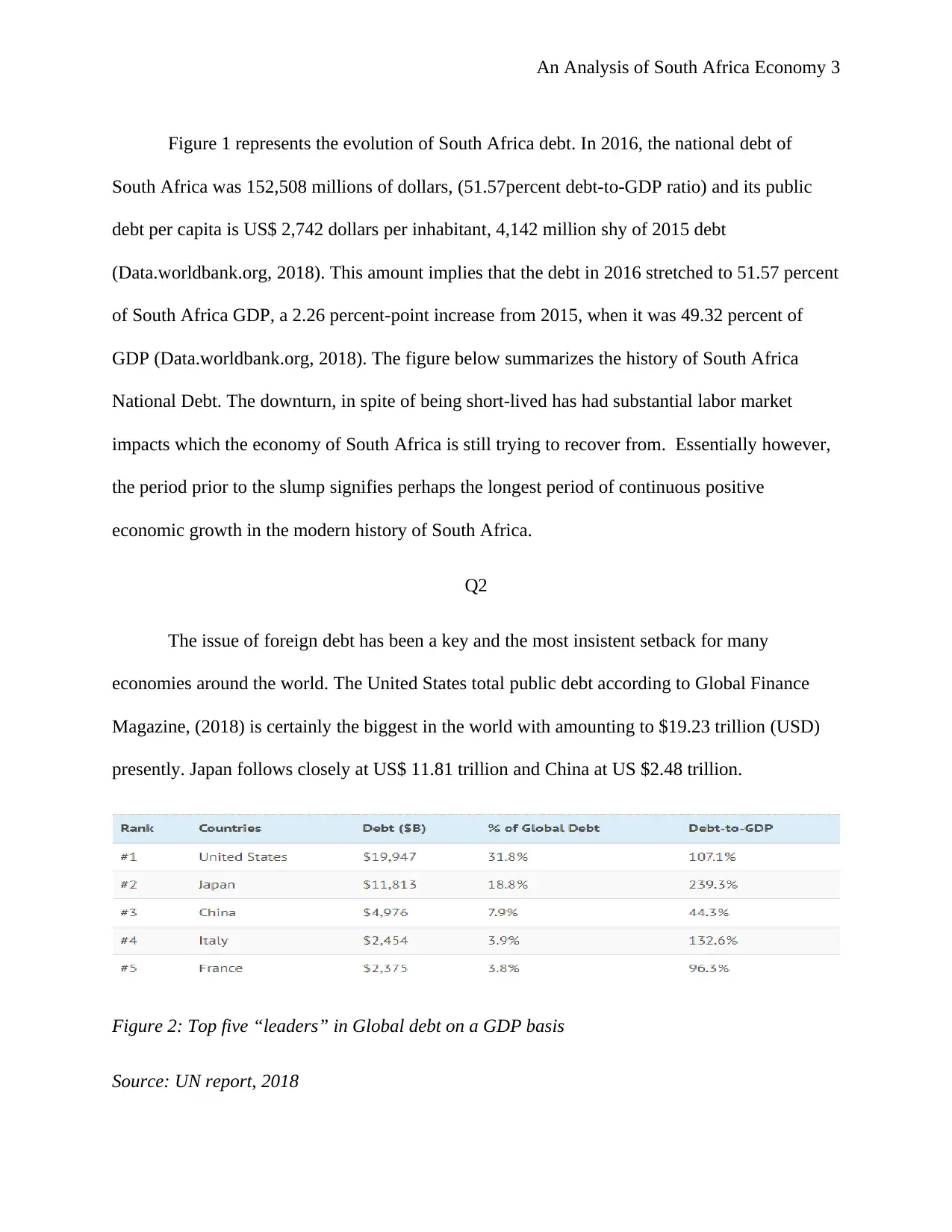

The issue of foreign debt has been a key and the most insistent setback for many

economies around the world. The United States total public debt according to Global Finance

Magazine, (2018) is certainly the biggest in the world with amounting to $19.23 trillion (USD)

presently. Japan follows closely at US$ 11.81 trillion and China at US $2.48 trillion.

Figure 2: Top five “leaders” in Global debt on a GDP basis

Source: UN report, 2018

Figure 1 represents the evolution of South Africa debt. In 2016, the national debt of

South Africa was 152,508 millions of dollars, (51.57percent debt-to-GDP ratio) and its public

debt per capita is US$ 2,742 dollars per inhabitant, 4,142 million shy of 2015 debt

(Data.worldbank.org, 2018). This amount implies that the debt in 2016 stretched to 51.57 percent

of South Africa GDP, a 2.26 percent-point increase from 2015, when it was 49.32 percent of

GDP (Data.worldbank.org, 2018). The figure below summarizes the history of South Africa

National Debt. The downturn, in spite of being short-lived has had substantial labor market

impacts which the economy of South Africa is still trying to recover from. Essentially however,

the period prior to the slump signifies perhaps the longest period of continuous positive

economic growth in the modern history of South Africa.

Q2

The issue of foreign debt has been a key and the most insistent setback for many

economies around the world. The United States total public debt according to Global Finance

Magazine, (2018) is certainly the biggest in the world with amounting to $19.23 trillion (USD)

presently. Japan follows closely at US$ 11.81 trillion and China at US $2.48 trillion.

Figure 2: Top five “leaders” in Global debt on a GDP basis

Source: UN report, 2018

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

An Analysis of South Africa Economy 4

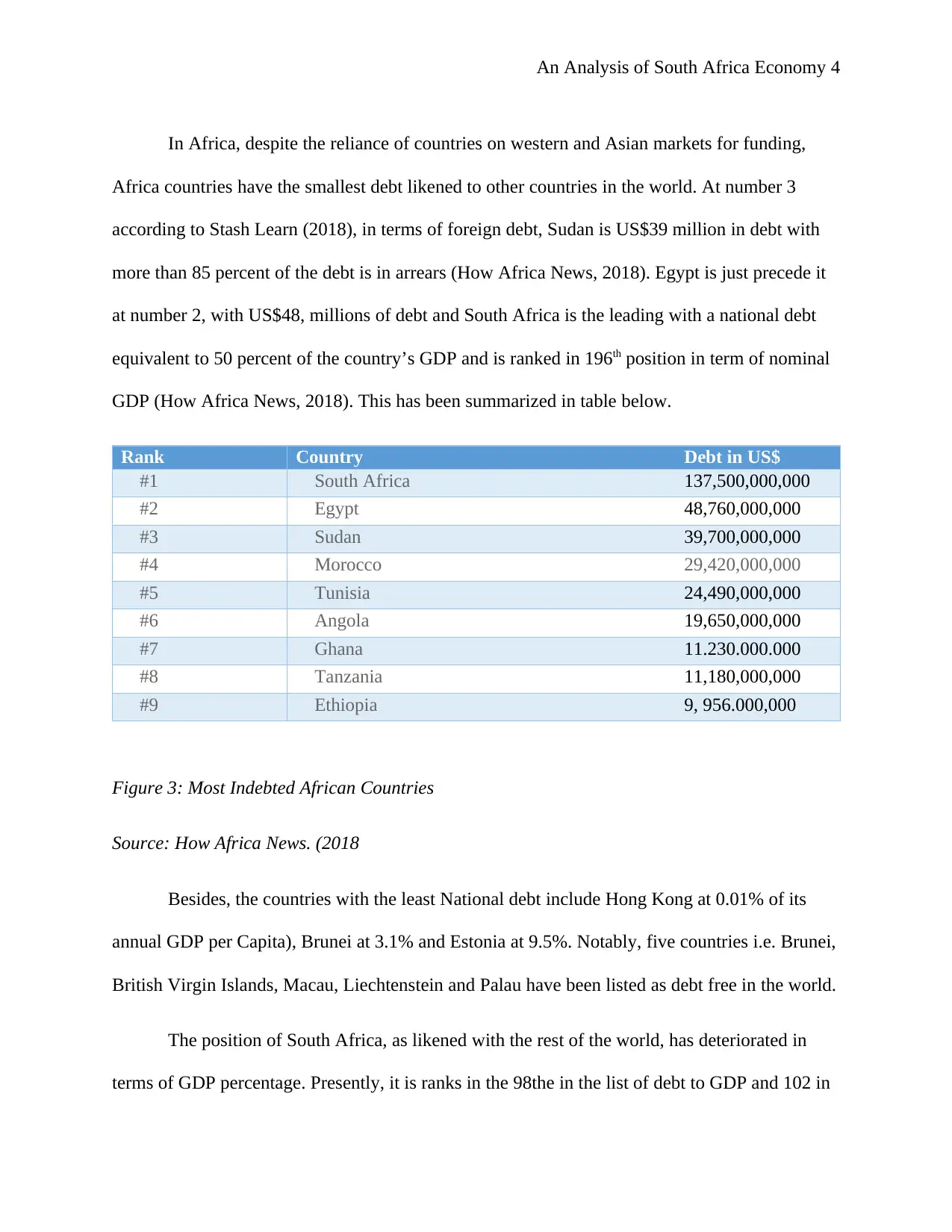

In Africa, despite the reliance of countries on western and Asian markets for funding,

Africa countries have the smallest debt likened to other countries in the world. At number 3

according to Stash Learn (2018), in terms of foreign debt, Sudan is US$39 million in debt with

more than 85 percent of the debt is in arrears (How Africa News, 2018). Egypt is just precede it

at number 2, with US$48, millions of debt and South Africa is the leading with a national debt

equivalent to 50 percent of the country’s GDP and is ranked in 196th position in term of nominal

GDP (How Africa News, 2018). This has been summarized in table below.

Rank Country Debt in US$

#1 South Africa 137,500,000,000

#2 Egypt 48,760,000,000

#3 Sudan 39,700,000,000

#4 Morocco 29,420,000,000

#5 Tunisia 24,490,000,000

#6 Angola 19,650,000,000

#7 Ghana 11.230.000.000

#8 Tanzania 11,180,000,000

#9 Ethiopia 9, 956.000,000

Figure 3: Most Indebted African Countries

Source: How Africa News. (2018

Besides, the countries with the least National debt include Hong Kong at 0.01% of its

annual GDP per Capita), Brunei at 3.1% and Estonia at 9.5%. Notably, five countries i.e. Brunei,

British Virgin Islands, Macau, Liechtenstein and Palau have been listed as debt free in the world.

The position of South Africa, as likened with the rest of the world, has deteriorated in

terms of GDP percentage. Presently, it is ranks in the 98the in the list of debt to GDP and 102 in

In Africa, despite the reliance of countries on western and Asian markets for funding,

Africa countries have the smallest debt likened to other countries in the world. At number 3

according to Stash Learn (2018), in terms of foreign debt, Sudan is US$39 million in debt with

more than 85 percent of the debt is in arrears (How Africa News, 2018). Egypt is just precede it

at number 2, with US$48, millions of debt and South Africa is the leading with a national debt

equivalent to 50 percent of the country’s GDP and is ranked in 196th position in term of nominal

GDP (How Africa News, 2018). This has been summarized in table below.

Rank Country Debt in US$

#1 South Africa 137,500,000,000

#2 Egypt 48,760,000,000

#3 Sudan 39,700,000,000

#4 Morocco 29,420,000,000

#5 Tunisia 24,490,000,000

#6 Angola 19,650,000,000

#7 Ghana 11.230.000.000

#8 Tanzania 11,180,000,000

#9 Ethiopia 9, 956.000,000

Figure 3: Most Indebted African Countries

Source: How Africa News. (2018

Besides, the countries with the least National debt include Hong Kong at 0.01% of its

annual GDP per Capita), Brunei at 3.1% and Estonia at 9.5%. Notably, five countries i.e. Brunei,

British Virgin Islands, Macau, Liechtenstein and Palau have been listed as debt free in the world.

The position of South Africa, as likened with the rest of the world, has deteriorated in

terms of GDP percentage. Presently, it is ranks in the 98the in the list of debt to GDP and 102 in

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

An Analysis of South Africa Economy 5

debt per capita, out of the 185 that are usually published by countryeconomy.com. Nonetheless,

Nigeria and Algeria have the least national debt in Africa at 18 and 21 percent respectively of

their GDP per capital

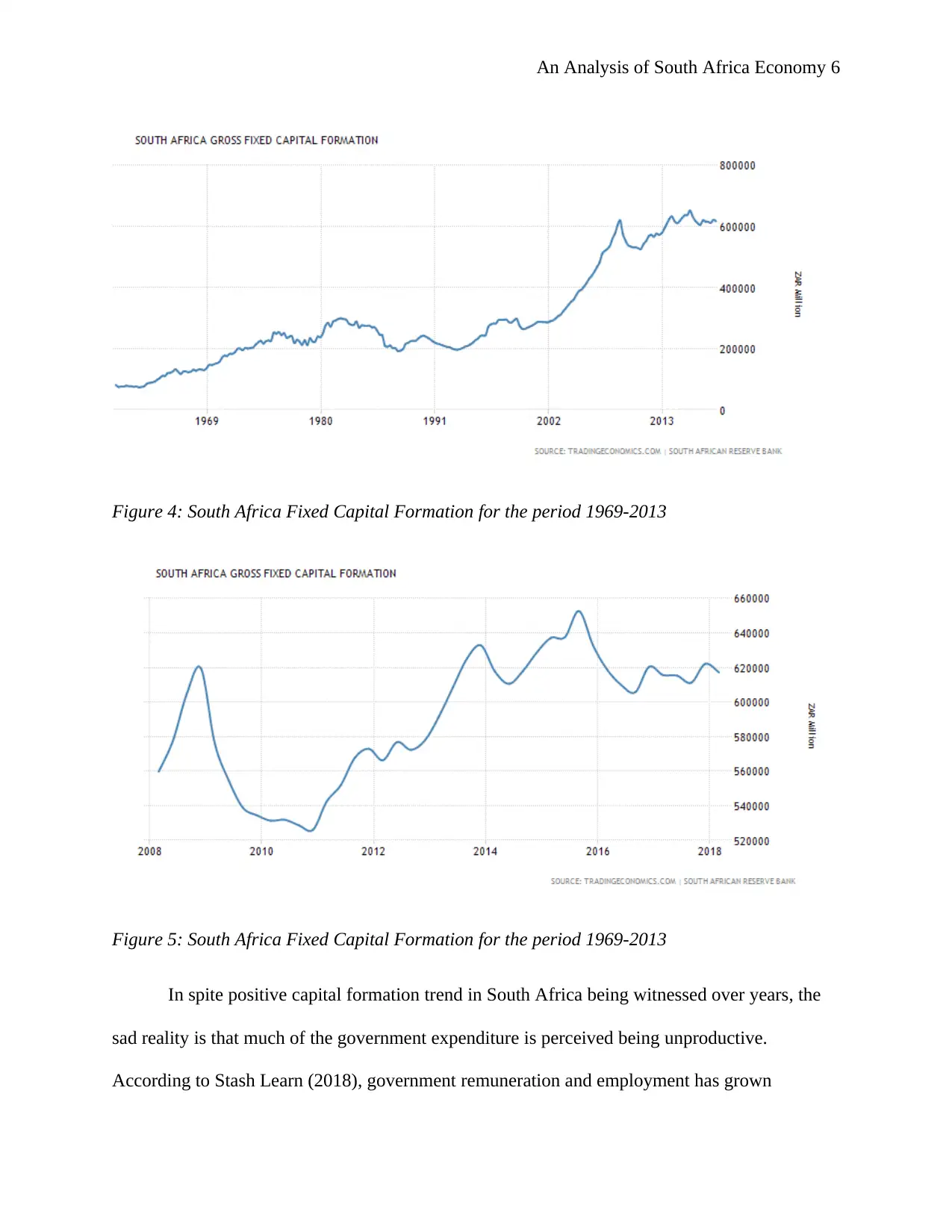

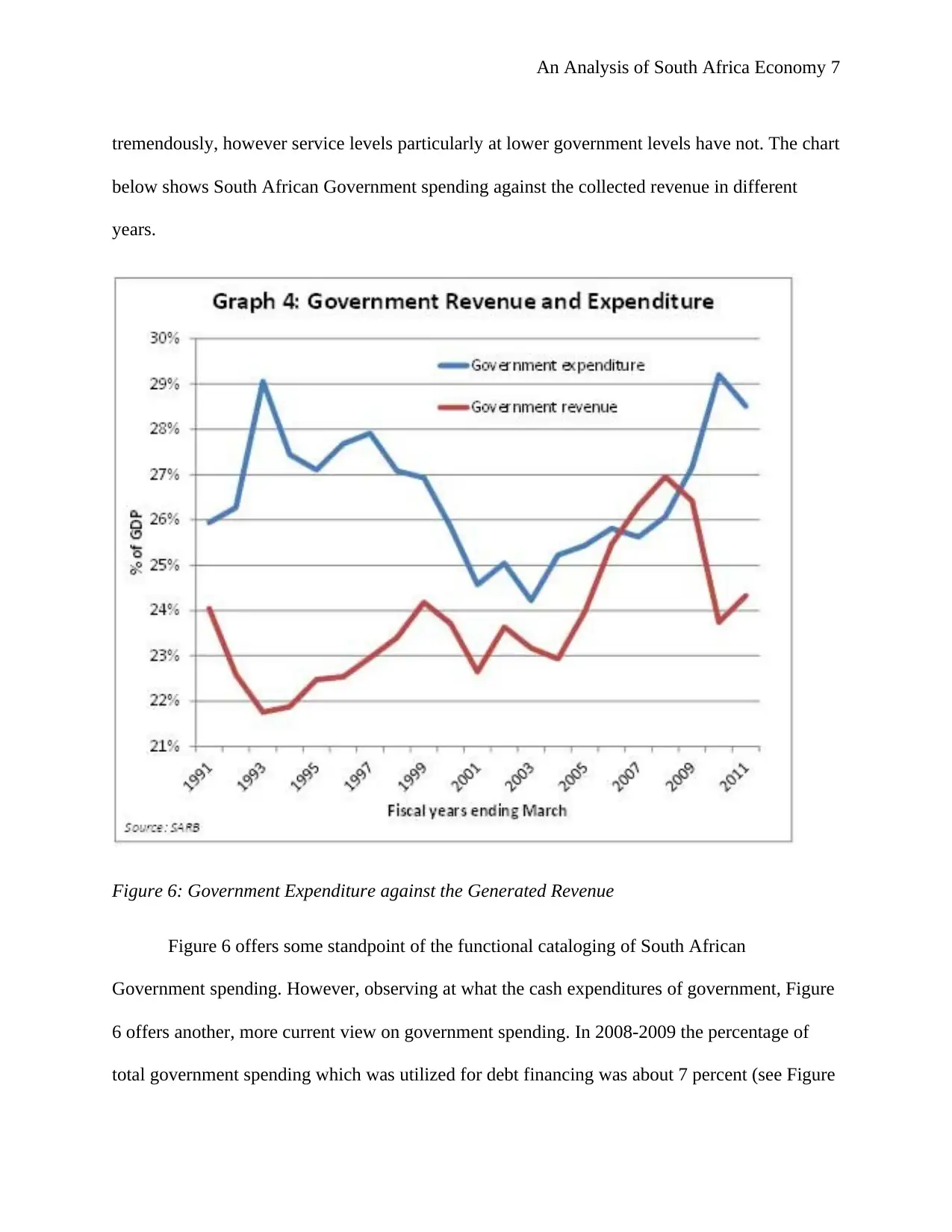

Q3

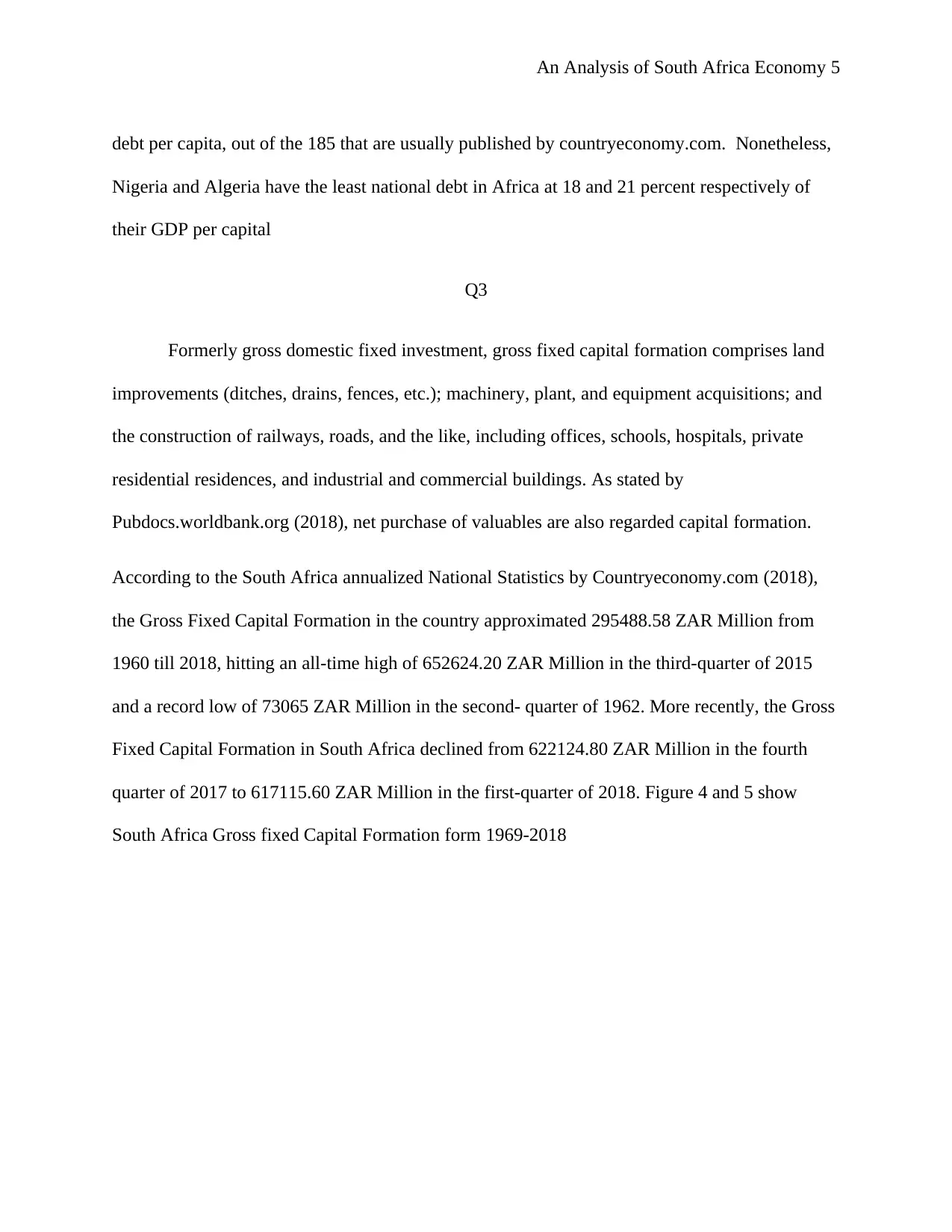

Formerly gross domestic fixed investment, gross fixed capital formation comprises land

improvements (ditches, drains, fences, etc.); machinery, plant, and equipment acquisitions; and

the construction of railways, roads, and the like, including offices, schools, hospitals, private

residential residences, and industrial and commercial buildings. As stated by

Pubdocs.worldbank.org (2018), net purchase of valuables are also regarded capital formation.

According to the South Africa annualized National Statistics by Countryeconomy.com (2018),

the Gross Fixed Capital Formation in the country approximated 295488.58 ZAR Million from

1960 till 2018, hitting an all-time high of 652624.20 ZAR Million in the third-quarter of 2015

and a record low of 73065 ZAR Million in the second- quarter of 1962. More recently, the Gross

Fixed Capital Formation in South Africa declined from 622124.80 ZAR Million in the fourth

quarter of 2017 to 617115.60 ZAR Million in the first-quarter of 2018. Figure 4 and 5 show

South Africa Gross fixed Capital Formation form 1969-2018

debt per capita, out of the 185 that are usually published by countryeconomy.com. Nonetheless,

Nigeria and Algeria have the least national debt in Africa at 18 and 21 percent respectively of

their GDP per capital

Q3

Formerly gross domestic fixed investment, gross fixed capital formation comprises land

improvements (ditches, drains, fences, etc.); machinery, plant, and equipment acquisitions; and

the construction of railways, roads, and the like, including offices, schools, hospitals, private

residential residences, and industrial and commercial buildings. As stated by

Pubdocs.worldbank.org (2018), net purchase of valuables are also regarded capital formation.

According to the South Africa annualized National Statistics by Countryeconomy.com (2018),

the Gross Fixed Capital Formation in the country approximated 295488.58 ZAR Million from

1960 till 2018, hitting an all-time high of 652624.20 ZAR Million in the third-quarter of 2015

and a record low of 73065 ZAR Million in the second- quarter of 1962. More recently, the Gross

Fixed Capital Formation in South Africa declined from 622124.80 ZAR Million in the fourth

quarter of 2017 to 617115.60 ZAR Million in the first-quarter of 2018. Figure 4 and 5 show

South Africa Gross fixed Capital Formation form 1969-2018

An Analysis of South Africa Economy 6

Figure 4: South Africa Fixed Capital Formation for the period 1969-2013

Figure 5: South Africa Fixed Capital Formation for the period 1969-2013

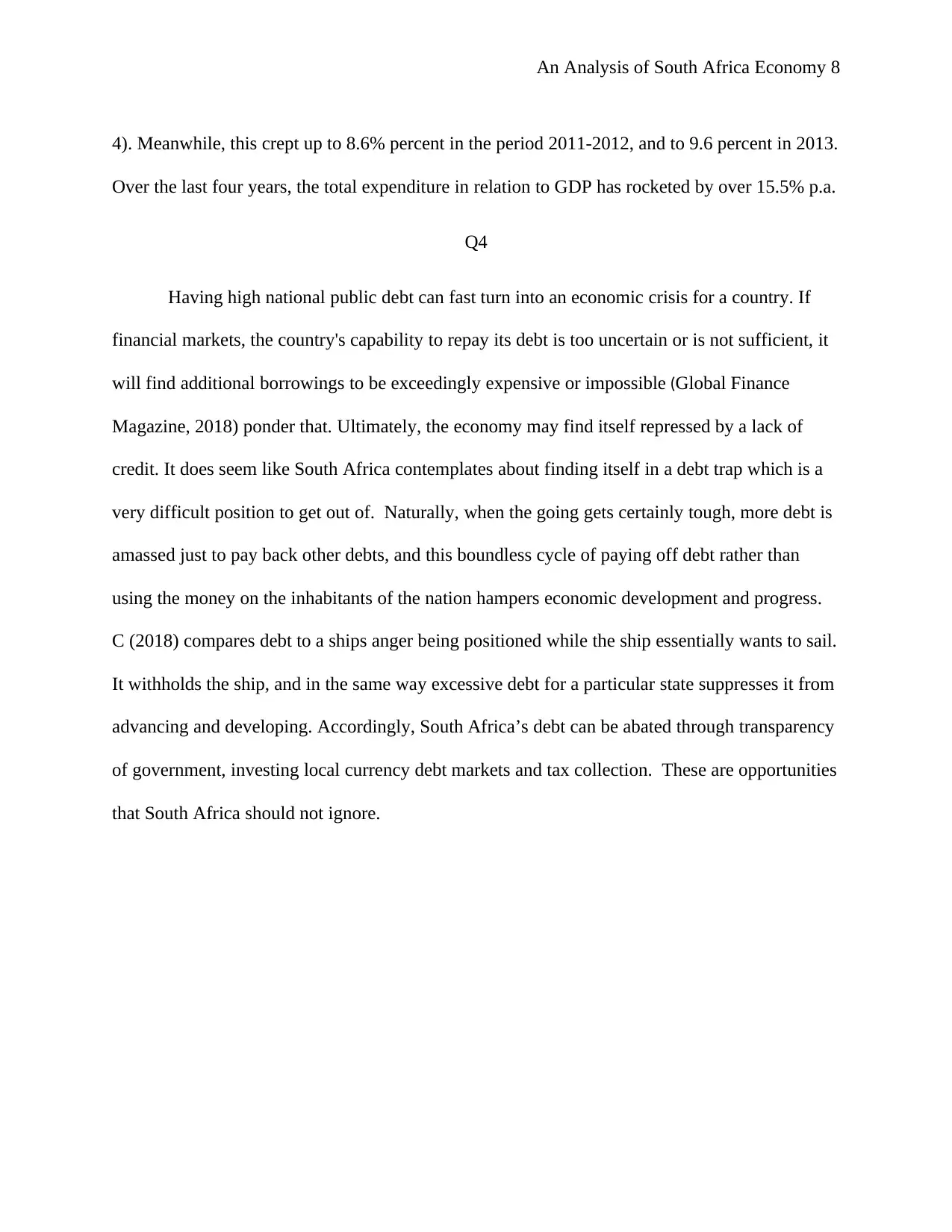

In spite positive capital formation trend in South Africa being witnessed over years, the

sad reality is that much of the government expenditure is perceived being unproductive.

According to Stash Learn (2018), government remuneration and employment has grown

Figure 4: South Africa Fixed Capital Formation for the period 1969-2013

Figure 5: South Africa Fixed Capital Formation for the period 1969-2013

In spite positive capital formation trend in South Africa being witnessed over years, the

sad reality is that much of the government expenditure is perceived being unproductive.

According to Stash Learn (2018), government remuneration and employment has grown

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

An Analysis of South Africa Economy 7

tremendously, however service levels particularly at lower government levels have not. The chart

below shows South African Government spending against the collected revenue in different

years.

Figure 6: Government Expenditure against the Generated Revenue

Figure 6 offers some standpoint of the functional cataloging of South African

Government spending. However, observing at what the cash expenditures of government, Figure

6 offers another, more current view on government spending. In 2008-2009 the percentage of

total government spending which was utilized for debt financing was about 7 percent (see Figure

tremendously, however service levels particularly at lower government levels have not. The chart

below shows South African Government spending against the collected revenue in different

years.

Figure 6: Government Expenditure against the Generated Revenue

Figure 6 offers some standpoint of the functional cataloging of South African

Government spending. However, observing at what the cash expenditures of government, Figure

6 offers another, more current view on government spending. In 2008-2009 the percentage of

total government spending which was utilized for debt financing was about 7 percent (see Figure

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

An Analysis of South Africa Economy 8

4). Meanwhile, this crept up to 8.6% percent in the period 2011-2012, and to 9.6 percent in 2013.

Over the last four years, the total expenditure in relation to GDP has rocketed by over 15.5% p.a.

Q4

Having high national public debt can fast turn into an economic crisis for a country. If

financial markets, the country's capability to repay its debt is too uncertain or is not sufficient, it

will find additional borrowings to be exceedingly expensive or impossible (Global Finance

Magazine, 2018) ponder that. Ultimately, the economy may find itself repressed by a lack of

credit. It does seem like South Africa contemplates about finding itself in a debt trap which is a

very difficult position to get out of. Naturally, when the going gets certainly tough, more debt is

amassed just to pay back other debts, and this boundless cycle of paying off debt rather than

using the money on the inhabitants of the nation hampers economic development and progress.

C (2018) compares debt to a ships anger being positioned while the ship essentially wants to sail.

It withholds the ship, and in the same way excessive debt for a particular state suppresses it from

advancing and developing. Accordingly, South Africa’s debt can be abated through transparency

of government, investing local currency debt markets and tax collection. These are opportunities

that South Africa should not ignore.

4). Meanwhile, this crept up to 8.6% percent in the period 2011-2012, and to 9.6 percent in 2013.

Over the last four years, the total expenditure in relation to GDP has rocketed by over 15.5% p.a.

Q4

Having high national public debt can fast turn into an economic crisis for a country. If

financial markets, the country's capability to repay its debt is too uncertain or is not sufficient, it

will find additional borrowings to be exceedingly expensive or impossible (Global Finance

Magazine, 2018) ponder that. Ultimately, the economy may find itself repressed by a lack of

credit. It does seem like South Africa contemplates about finding itself in a debt trap which is a

very difficult position to get out of. Naturally, when the going gets certainly tough, more debt is

amassed just to pay back other debts, and this boundless cycle of paying off debt rather than

using the money on the inhabitants of the nation hampers economic development and progress.

C (2018) compares debt to a ships anger being positioned while the ship essentially wants to sail.

It withholds the ship, and in the same way excessive debt for a particular state suppresses it from

advancing and developing. Accordingly, South Africa’s debt can be abated through transparency

of government, investing local currency debt markets and tax collection. These are opportunities

that South Africa should not ignore.

An Analysis of South Africa Economy 9

References List

C, L. (2018). South Africa's growing public debt. [online] Financialmarketsjournal.co.za.

Available at: http://financialmarketsjournal.co.za/oldsite/15thedition/printed%20articles/

publicdebt.htm [Accessed 8 Aug. 2018].

countryeconomy.com. (2018). General government gross debt 2017. [online] Available at:

https://countryeconomy.com/national-debt [Accessed 7 Aug. 2018].

countryeconomy.com. (2018). South Africa National Debt 2016. [online] Available at:

https://countryeconomy.com/national-debt/south-africa [Accessed 7 Aug. 2018].

Data.worldbank.org. (2018). South Africa | Data. [online] Available at:

https://data.worldbank.org/country/south-africa [Accessed 7 Aug. 2018

Global Finance Magazine. (2018). Global Finance Magazine - Countries With The Most

External Debt in 2017. [online] Available at: https://www.gfmag.com/global-data/economic-

data/xtegh9-external-debt-in-countries-around-the-world [Accessed 8 Aug. 2018].

Heritage.org. (2018). South Africa Economy: Population, GDP, Inflation, Business, Trade, FDI,

Corruption. [online] Available at: https://www.heritage.org/index/country/southafrica [Accessed

7 Aug. 2018].

How Africa News. (2018). Africa’s Top 10 Most Indebted Countries According to World Bank

Revealed – Is your country among?. [online] Available at: https://howafrica.com/africas-top-10-

most-indebted-countries-according-to-world-bank-revealed-is-your-country-among/ [Accessed 8

Aug. 2018].

References List

C, L. (2018). South Africa's growing public debt. [online] Financialmarketsjournal.co.za.

Available at: http://financialmarketsjournal.co.za/oldsite/15thedition/printed%20articles/

publicdebt.htm [Accessed 8 Aug. 2018].

countryeconomy.com. (2018). General government gross debt 2017. [online] Available at:

https://countryeconomy.com/national-debt [Accessed 7 Aug. 2018].

countryeconomy.com. (2018). South Africa National Debt 2016. [online] Available at:

https://countryeconomy.com/national-debt/south-africa [Accessed 7 Aug. 2018].

Data.worldbank.org. (2018). South Africa | Data. [online] Available at:

https://data.worldbank.org/country/south-africa [Accessed 7 Aug. 2018

Global Finance Magazine. (2018). Global Finance Magazine - Countries With The Most

External Debt in 2017. [online] Available at: https://www.gfmag.com/global-data/economic-

data/xtegh9-external-debt-in-countries-around-the-world [Accessed 8 Aug. 2018].

Heritage.org. (2018). South Africa Economy: Population, GDP, Inflation, Business, Trade, FDI,

Corruption. [online] Available at: https://www.heritage.org/index/country/southafrica [Accessed

7 Aug. 2018].

How Africa News. (2018). Africa’s Top 10 Most Indebted Countries According to World Bank

Revealed – Is your country among?. [online] Available at: https://howafrica.com/africas-top-10-

most-indebted-countries-according-to-world-bank-revealed-is-your-country-among/ [Accessed 8

Aug. 2018].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

An Analysis of South Africa Economy 10

Maumela, P. (2018). SARB - Economic and Financial data for SA. [online]

Wwwrs.resbank.co.za. Available at:

http://wwwrs.resbank.co.za/webindicators/econfindataforsa.aspx [Accessed 7 Aug. 2018].

Pubdocs.worldbank.org. (2018). [online] Available at:

http://pubdocs.worldbank.org/en/485501510083255459/webinar-

changesintheinvestorbaseforemergingmarketpublicdebt-presentation-countrycaseofsouthafrica-

thembimda-2014.pdf [Accessed 7 Aug. 2018].

Stash Learn. (2018). Top 10 Countries with Largest National Debt-to-GDP in 2018 - Stash

Learn. [online] Available at: https://learn.stashinvest.com/10-countries-with-largest-national-

debt-to-gdp [Accessed 8 Aug. 2018].

Maumela, P. (2018). SARB - Economic and Financial data for SA. [online]

Wwwrs.resbank.co.za. Available at:

http://wwwrs.resbank.co.za/webindicators/econfindataforsa.aspx [Accessed 7 Aug. 2018].

Pubdocs.worldbank.org. (2018). [online] Available at:

http://pubdocs.worldbank.org/en/485501510083255459/webinar-

changesintheinvestorbaseforemergingmarketpublicdebt-presentation-countrycaseofsouthafrica-

thembimda-2014.pdf [Accessed 7 Aug. 2018].

Stash Learn. (2018). Top 10 Countries with Largest National Debt-to-GDP in 2018 - Stash

Learn. [online] Available at: https://learn.stashinvest.com/10-countries-with-largest-national-

debt-to-gdp [Accessed 8 Aug. 2018].

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.