Stakeholder Theory and Carbon Emissions: An Analysis of USA Companies

VerifiedAdded on 2023/06/05

|25

|6070

|415

AI Summary

This research paper analyzes the impact of stakeholder theory on carbon emissions by USA companies. It evaluates the changes in carbon emissions by companies providing incentives to management and those that do not. The paper includes a conceptual model, hypotheses, and descriptive data analysis.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

MGT723 Research Project

Semester X 20XX

Assessment Task 3: Report

Student Name: XXXXX

Title: XXXXX

Submission Date: XXXXX

(Note that the submission is due by 5:00pm via SafeAssign)

Acknowledgement:

I certify that I have carefully reviewed the university’s academic misconduct policy. I understand

that the source of ideas must be referenced and that quotation marks and a reference are required

when directly quoting anyone else’s words.

Semester X 20XX

Assessment Task 3: Report

Student Name: XXXXX

Title: XXXXX

Submission Date: XXXXX

(Note that the submission is due by 5:00pm via SafeAssign)

Acknowledgement:

I certify that I have carefully reviewed the university’s academic misconduct policy. I understand

that the source of ideas must be referenced and that quotation marks and a reference are required

when directly quoting anyone else’s words.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Introduction: (Not assessed)

Carbon emissions are one of the major problems in the environment today globally.

Emissions of carbon have been affecting the industries greatly. In this research, the stakeholder

theory will be discussed with effect to the carbon emissions. There are certain theoretical as well

as practical motivations to this concept of carbon emissions in accordance with the stakeholder

theory. The research is mainly aimed at evaluating the changes in the emissions of carbon by the

companies.

Literature Review: (Not assessed)

In view of dependence on carbon-based utilities, our atmosphere is changing quickly and

it's a remediable issue of the present corporate world. Organizations convey and discharge a huge

measure of carbon in the earth in perspective of their radiation of taking care of plant abuse in

pointless aggregate and a section of the ruinous fabricated blends utilized as a bit of storing up of

the thing. Nowadays the organizations also end up being extremely aware of the need to make a

move on environmental change.

The Stakeholder got a huge influence on the organization. According to Donaldsom and

Preston (1995), “Stakeholder theory has been used to describe (a) the nature of the firm (Brenner

and Cochran, 1991), (b) the way managers think about managing (Brenner and Molander, 1977),

(c) how board members think about the interests of corporate con stridencies (Wang and

Dewhirst, 1992), and (d) how some corporations are actually managed (Clarkson, 1995; Halal,

1990; Kreiner and Bhambri, 1991)”. There is not much disagreement on what kind of entity can

be a stakeholder. Persons, groups, neighborhoods, organizations, institutions, societies, and even

the natural environment are generally thought to qualify as actual or potential stakeholders

(Mitchell and Agle, 1997). One investor's advantage is to expand the benefits and lessen the

useless exercises from the business in here and now, yet the primary focus of association ought

to be to deal with the prerequisites and meet the desires for Stakeholder (George, 2003). The

primary individuals who ring a bell while considering who holds the stakes at an association are

the Shareholder and the government. Other than the undeniable, Stakeholder consolidates each

Carbon emissions are one of the major problems in the environment today globally.

Emissions of carbon have been affecting the industries greatly. In this research, the stakeholder

theory will be discussed with effect to the carbon emissions. There are certain theoretical as well

as practical motivations to this concept of carbon emissions in accordance with the stakeholder

theory. The research is mainly aimed at evaluating the changes in the emissions of carbon by the

companies.

Literature Review: (Not assessed)

In view of dependence on carbon-based utilities, our atmosphere is changing quickly and

it's a remediable issue of the present corporate world. Organizations convey and discharge a huge

measure of carbon in the earth in perspective of their radiation of taking care of plant abuse in

pointless aggregate and a section of the ruinous fabricated blends utilized as a bit of storing up of

the thing. Nowadays the organizations also end up being extremely aware of the need to make a

move on environmental change.

The Stakeholder got a huge influence on the organization. According to Donaldsom and

Preston (1995), “Stakeholder theory has been used to describe (a) the nature of the firm (Brenner

and Cochran, 1991), (b) the way managers think about managing (Brenner and Molander, 1977),

(c) how board members think about the interests of corporate con stridencies (Wang and

Dewhirst, 1992), and (d) how some corporations are actually managed (Clarkson, 1995; Halal,

1990; Kreiner and Bhambri, 1991)”. There is not much disagreement on what kind of entity can

be a stakeholder. Persons, groups, neighborhoods, organizations, institutions, societies, and even

the natural environment are generally thought to qualify as actual or potential stakeholders

(Mitchell and Agle, 1997). One investor's advantage is to expand the benefits and lessen the

useless exercises from the business in here and now, yet the primary focus of association ought

to be to deal with the prerequisites and meet the desires for Stakeholder (George, 2003). The

primary individuals who ring a bell while considering who holds the stakes at an association are

the Shareholder and the government. Other than the undeniable, Stakeholder consolidates each

one of those exercises and responsibilities affects association execution, like laborers, customers,

and business accomplices (Bridoux and Stoelhorst, 2014).

Analyses have also shown that the associations in the USA transmit a massive proportion

of carbon into the air. 23 – 24 % of the carbon Dioxide transmitted by the corporate firms

wherever all through the world start with the USA associations. The USA uses oil-based goods

to make essentialness and subsequently, the surge of carbon in the atmosphere by the USA firms

are high (Jones and Wicks, 1999). This examination paper is thusly away to work up the

capabilities in the rate changes in the arrival of carbon by the relationship in the context of USA

as for the presentation of jolts that a few affiliations accommodate the association and some

others don't. The adjustments in the arrival of carbon dioxidehave been assessed in a rating scale

from the year 2012 to 2013. The choice of the relationship in the spread of carbon dioxide is all

things considered in the context of the impact the accessories play on the affiliations.

Considering the choice of the accessories, the affiliations will pick whether to give influencing

forces to the association or not.

Conceptual Model: (Not Assessed)

IndependentvariableUSAcompaniesprovidingincentivestControlveribleLocationofthecompany(UDependentveriablePercentagechangesincarbon

and business accomplices (Bridoux and Stoelhorst, 2014).

Analyses have also shown that the associations in the USA transmit a massive proportion

of carbon into the air. 23 – 24 % of the carbon Dioxide transmitted by the corporate firms

wherever all through the world start with the USA associations. The USA uses oil-based goods

to make essentialness and subsequently, the surge of carbon in the atmosphere by the USA firms

are high (Jones and Wicks, 1999). This examination paper is thusly away to work up the

capabilities in the rate changes in the arrival of carbon by the relationship in the context of USA

as for the presentation of jolts that a few affiliations accommodate the association and some

others don't. The adjustments in the arrival of carbon dioxidehave been assessed in a rating scale

from the year 2012 to 2013. The choice of the relationship in the spread of carbon dioxide is all

things considered in the context of the impact the accessories play on the affiliations.

Considering the choice of the accessories, the affiliations will pick whether to give influencing

forces to the association or not.

Conceptual Model: (Not Assessed)

IndependentvariableUSAcompaniesprovidingincentivestControlveribleLocationofthecompany(UDependentveriablePercentagechangesincarbon

Hypotheses: (Not assessed)

1) H01: No significant difference exists between the company provide incentive in 2012

with the companies do not provide incentive in 2012 on percentage changes in carbon

emissions.(Null)

H11: There is statistically significant difference that exists between the companies who

provide incentive in 2012 and the companies who do not provide incentive in 2012 on

percentage changes in carbon emissions. (Alternative)

2) H02: No significant difference exists between the company provide incentive in 2013

with the companies do not provide incentive in 2013 on percentage changes in carbon

emissions. (Null)

H12: There is statistically significant difference that exists between the companies who

provide incentive in 2013 and the companies who do not provide incentive in 2013 on

percentage changes in carbon emissions. (Alternative)

3) H03: No significant difference exists between the company provide incentive in 2012

and the companies who provide incentive in 2013 on percentage changes in carbon

emissions. (Null)

H13: There is statistically significant difference that exists between the companies who

provide incentive in 2012 and the companies who provide incentive in 2013 on

percentage changes in carbon emissions. (Alternative)

4) H04: No significant difference exists between the company who do not provide

incentive in 2013 and the companies who do not provide incentive in 2013 on percentage

changes in carbon emissions. (Null)

H14: There is statistically significant difference that exists between the companies who

do not provide incentive in 2013 and the companies who do not provide incentive in 2013

on percentage changes in carbon emissions. (Alternative)

1) H01: No significant difference exists between the company provide incentive in 2012

with the companies do not provide incentive in 2012 on percentage changes in carbon

emissions.(Null)

H11: There is statistically significant difference that exists between the companies who

provide incentive in 2012 and the companies who do not provide incentive in 2012 on

percentage changes in carbon emissions. (Alternative)

2) H02: No significant difference exists between the company provide incentive in 2013

with the companies do not provide incentive in 2013 on percentage changes in carbon

emissions. (Null)

H12: There is statistically significant difference that exists between the companies who

provide incentive in 2013 and the companies who do not provide incentive in 2013 on

percentage changes in carbon emissions. (Alternative)

3) H03: No significant difference exists between the company provide incentive in 2012

and the companies who provide incentive in 2013 on percentage changes in carbon

emissions. (Null)

H13: There is statistically significant difference that exists between the companies who

provide incentive in 2012 and the companies who provide incentive in 2013 on

percentage changes in carbon emissions. (Alternative)

4) H04: No significant difference exists between the company who do not provide

incentive in 2013 and the companies who do not provide incentive in 2013 on percentage

changes in carbon emissions. (Null)

H14: There is statistically significant difference that exists between the companies who

do not provide incentive in 2013 and the companies who do not provide incentive in 2013

on percentage changes in carbon emissions. (Alternative)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

5) H05: No significant difference exists between the company provide incentive in 2012

and the companies who do not provide incentive in 2013 on percentage changes in carbon

emissions. (Null)

H15: There is statistically significant difference that exists between the companies who

provide incentive in 2012 and the companies who do not provide incentive in 2013 on

percentage changes in carbon emissions. (Alternative)

6) H06: No significant difference exists between the company who do not provide

incentive in 2012 and the companies who do not provide incentive in 2013 on percentage

changes in carbon emissions. (Null)

H16: There is statistically significant difference that exists between the companies who

do not provide incentive in 2012 and the companies who do not provide incentive in 2013

on percentage changes in carbon emissions. (Alternative)

Data Analysis – Descriptive (Not assessed)

Trend Analysis

-600

-500

-400

-300

-200

-100

0

100

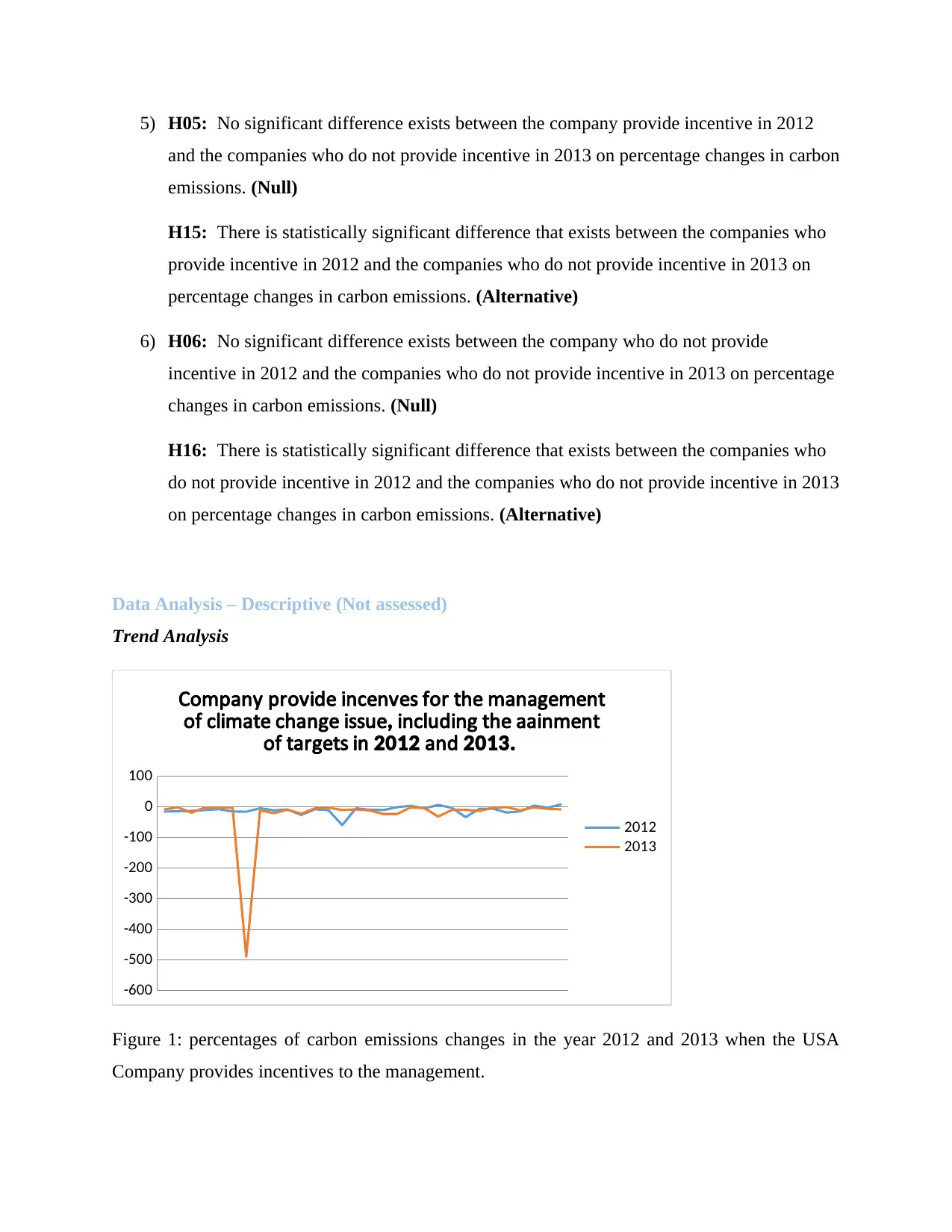

Company provide incentives for the management

of climate change issue including the attainment,

of targets in and2012 2013.

2012

2013

Figure 1: percentages of carbon emissions changes in the year 2012 and 2013 when the USA

Company provides incentives to the management.

and the companies who do not provide incentive in 2013 on percentage changes in carbon

emissions. (Null)

H15: There is statistically significant difference that exists between the companies who

provide incentive in 2012 and the companies who do not provide incentive in 2013 on

percentage changes in carbon emissions. (Alternative)

6) H06: No significant difference exists between the company who do not provide

incentive in 2012 and the companies who do not provide incentive in 2013 on percentage

changes in carbon emissions. (Null)

H16: There is statistically significant difference that exists between the companies who

do not provide incentive in 2012 and the companies who do not provide incentive in 2013

on percentage changes in carbon emissions. (Alternative)

Data Analysis – Descriptive (Not assessed)

Trend Analysis

-600

-500

-400

-300

-200

-100

0

100

Company provide incentives for the management

of climate change issue including the attainment,

of targets in and2012 2013.

2012

2013

Figure 1: percentages of carbon emissions changes in the year 2012 and 2013 when the USA

Company provides incentives to the management.

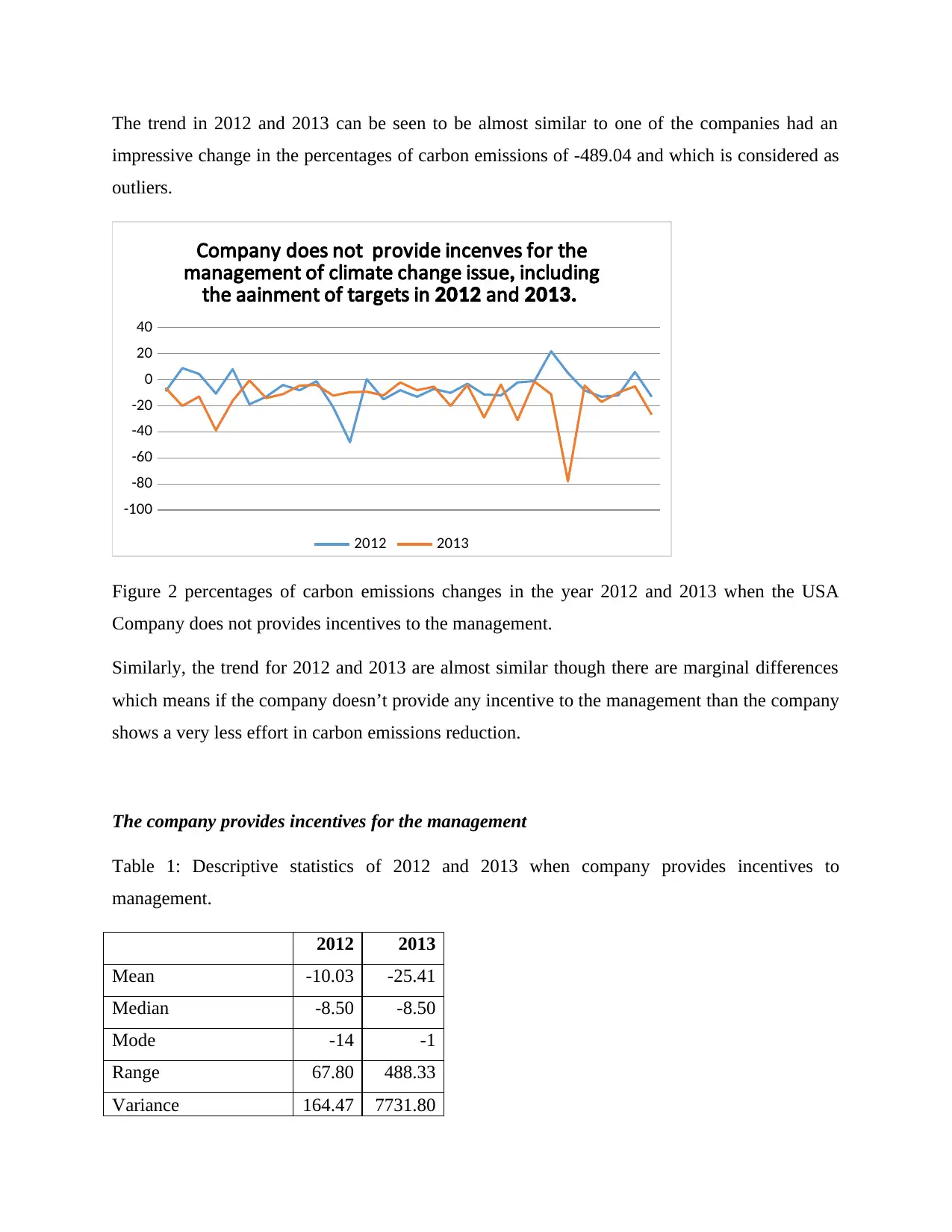

The trend in 2012 and 2013 can be seen to be almost similar to one of the companies had an

impressive change in the percentages of carbon emissions of -489.04 and which is considered as

outliers.

-100

-80

-60

-40

-20

0

20

40

Company does not provide incentives for the

management of climate change issue including,

the attainment of targets in and2012 2013.

2012 2013

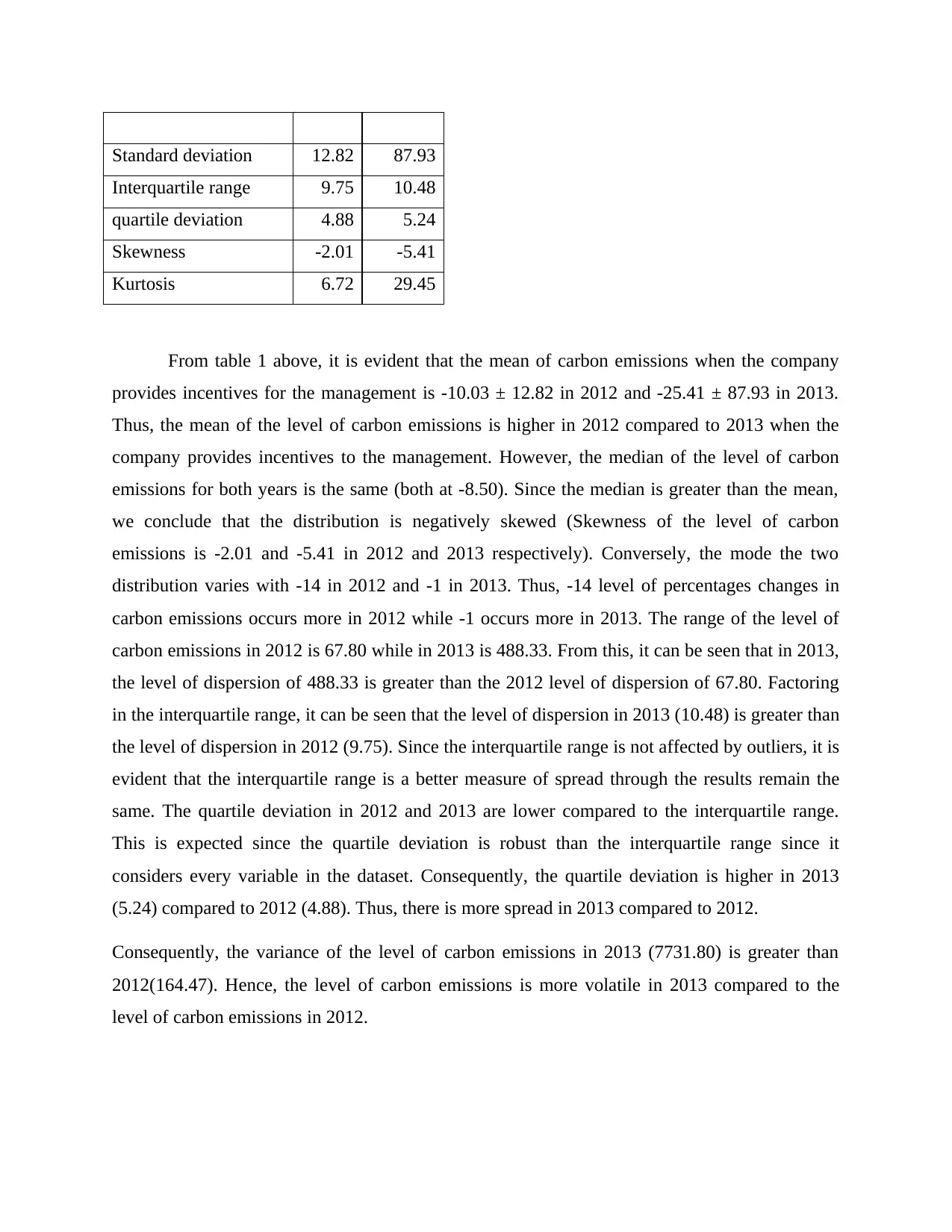

Figure 2 percentages of carbon emissions changes in the year 2012 and 2013 when the USA

Company does not provides incentives to the management.

Similarly, the trend for 2012 and 2013 are almost similar though there are marginal differences

which means if the company doesn’t provide any incentive to the management than the company

shows a very less effort in carbon emissions reduction.

The company provides incentives for the management

Table 1: Descriptive statistics of 2012 and 2013 when company provides incentives to

management.

2012 2013

Mean -10.03 -25.41

Median -8.50 -8.50

Mode -14 -1

Range 67.80 488.33

Variance 164.47 7731.80

impressive change in the percentages of carbon emissions of -489.04 and which is considered as

outliers.

-100

-80

-60

-40

-20

0

20

40

Company does not provide incentives for the

management of climate change issue including,

the attainment of targets in and2012 2013.

2012 2013

Figure 2 percentages of carbon emissions changes in the year 2012 and 2013 when the USA

Company does not provides incentives to the management.

Similarly, the trend for 2012 and 2013 are almost similar though there are marginal differences

which means if the company doesn’t provide any incentive to the management than the company

shows a very less effort in carbon emissions reduction.

The company provides incentives for the management

Table 1: Descriptive statistics of 2012 and 2013 when company provides incentives to

management.

2012 2013

Mean -10.03 -25.41

Median -8.50 -8.50

Mode -14 -1

Range 67.80 488.33

Variance 164.47 7731.80

Standard deviation 12.82 87.93

Interquartile range 9.75 10.48

quartile deviation 4.88 5.24

Skewness -2.01 -5.41

Kurtosis 6.72 29.45

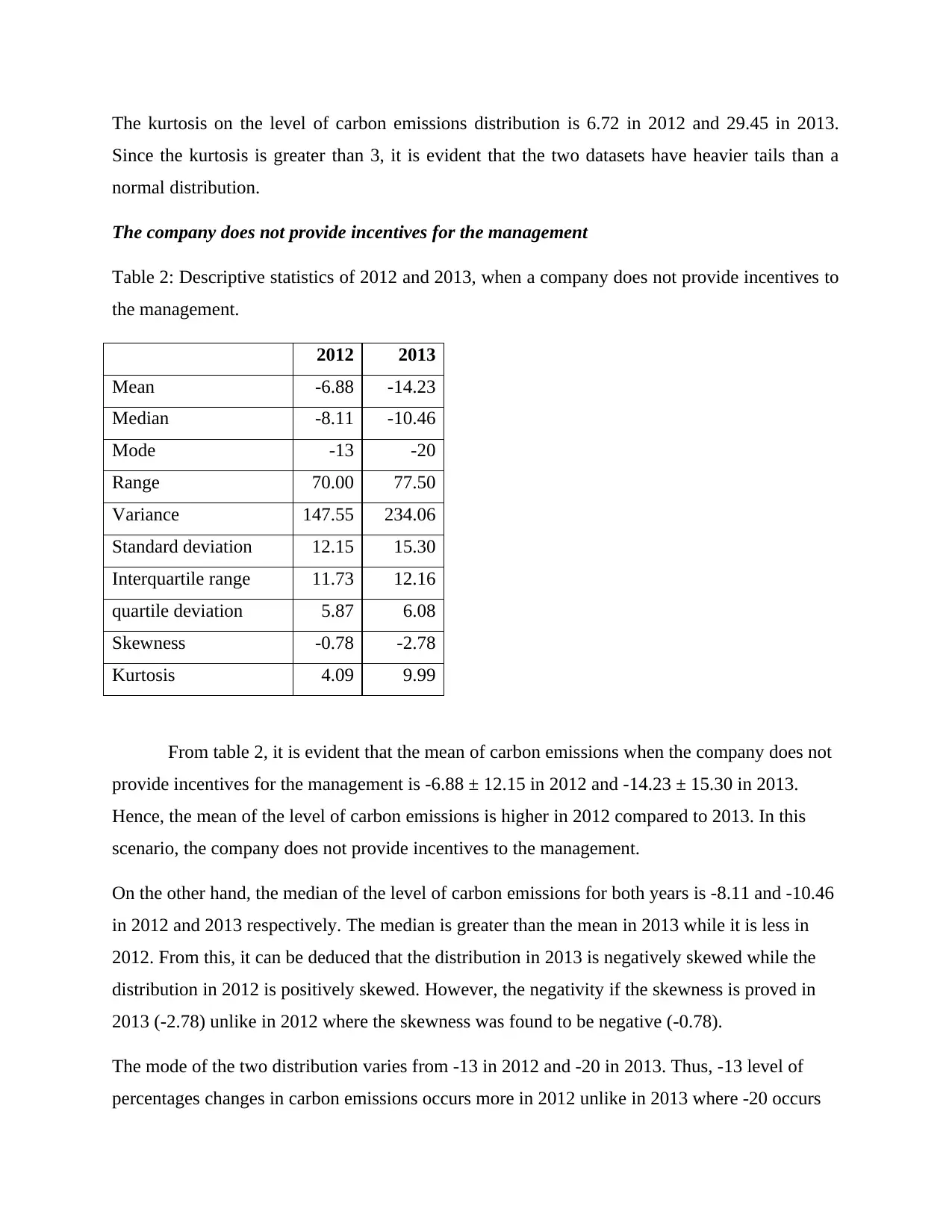

From table 1 above, it is evident that the mean of carbon emissions when the company

provides incentives for the management is -10.03 ± 12.82 in 2012 and -25.41 ± 87.93 in 2013.

Thus, the mean of the level of carbon emissions is higher in 2012 compared to 2013 when the

company provides incentives to the management. However, the median of the level of carbon

emissions for both years is the same (both at -8.50). Since the median is greater than the mean,

we conclude that the distribution is negatively skewed (Skewness of the level of carbon

emissions is -2.01 and -5.41 in 2012 and 2013 respectively). Conversely, the mode the two

distribution varies with -14 in 2012 and -1 in 2013. Thus, -14 level of percentages changes in

carbon emissions occurs more in 2012 while -1 occurs more in 2013. The range of the level of

carbon emissions in 2012 is 67.80 while in 2013 is 488.33. From this, it can be seen that in 2013,

the level of dispersion of 488.33 is greater than the 2012 level of dispersion of 67.80. Factoring

in the interquartile range, it can be seen that the level of dispersion in 2013 (10.48) is greater than

the level of dispersion in 2012 (9.75). Since the interquartile range is not affected by outliers, it is

evident that the interquartile range is a better measure of spread through the results remain the

same. The quartile deviation in 2012 and 2013 are lower compared to the interquartile range.

This is expected since the quartile deviation is robust than the interquartile range since it

considers every variable in the dataset. Consequently, the quartile deviation is higher in 2013

(5.24) compared to 2012 (4.88). Thus, there is more spread in 2013 compared to 2012.

Consequently, the variance of the level of carbon emissions in 2013 (7731.80) is greater than

2012(164.47). Hence, the level of carbon emissions is more volatile in 2013 compared to the

level of carbon emissions in 2012.

Interquartile range 9.75 10.48

quartile deviation 4.88 5.24

Skewness -2.01 -5.41

Kurtosis 6.72 29.45

From table 1 above, it is evident that the mean of carbon emissions when the company

provides incentives for the management is -10.03 ± 12.82 in 2012 and -25.41 ± 87.93 in 2013.

Thus, the mean of the level of carbon emissions is higher in 2012 compared to 2013 when the

company provides incentives to the management. However, the median of the level of carbon

emissions for both years is the same (both at -8.50). Since the median is greater than the mean,

we conclude that the distribution is negatively skewed (Skewness of the level of carbon

emissions is -2.01 and -5.41 in 2012 and 2013 respectively). Conversely, the mode the two

distribution varies with -14 in 2012 and -1 in 2013. Thus, -14 level of percentages changes in

carbon emissions occurs more in 2012 while -1 occurs more in 2013. The range of the level of

carbon emissions in 2012 is 67.80 while in 2013 is 488.33. From this, it can be seen that in 2013,

the level of dispersion of 488.33 is greater than the 2012 level of dispersion of 67.80. Factoring

in the interquartile range, it can be seen that the level of dispersion in 2013 (10.48) is greater than

the level of dispersion in 2012 (9.75). Since the interquartile range is not affected by outliers, it is

evident that the interquartile range is a better measure of spread through the results remain the

same. The quartile deviation in 2012 and 2013 are lower compared to the interquartile range.

This is expected since the quartile deviation is robust than the interquartile range since it

considers every variable in the dataset. Consequently, the quartile deviation is higher in 2013

(5.24) compared to 2012 (4.88). Thus, there is more spread in 2013 compared to 2012.

Consequently, the variance of the level of carbon emissions in 2013 (7731.80) is greater than

2012(164.47). Hence, the level of carbon emissions is more volatile in 2013 compared to the

level of carbon emissions in 2012.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The kurtosis on the level of carbon emissions distribution is 6.72 in 2012 and 29.45 in 2013.

Since the kurtosis is greater than 3, it is evident that the two datasets have heavier tails than a

normal distribution.

The company does not provide incentives for the management

Table 2: Descriptive statistics of 2012 and 2013, when a company does not provide incentives to

the management.

2012 2013

Mean -6.88 -14.23

Median -8.11 -10.46

Mode -13 -20

Range 70.00 77.50

Variance 147.55 234.06

Standard deviation 12.15 15.30

Interquartile range 11.73 12.16

quartile deviation 5.87 6.08

Skewness -0.78 -2.78

Kurtosis 4.09 9.99

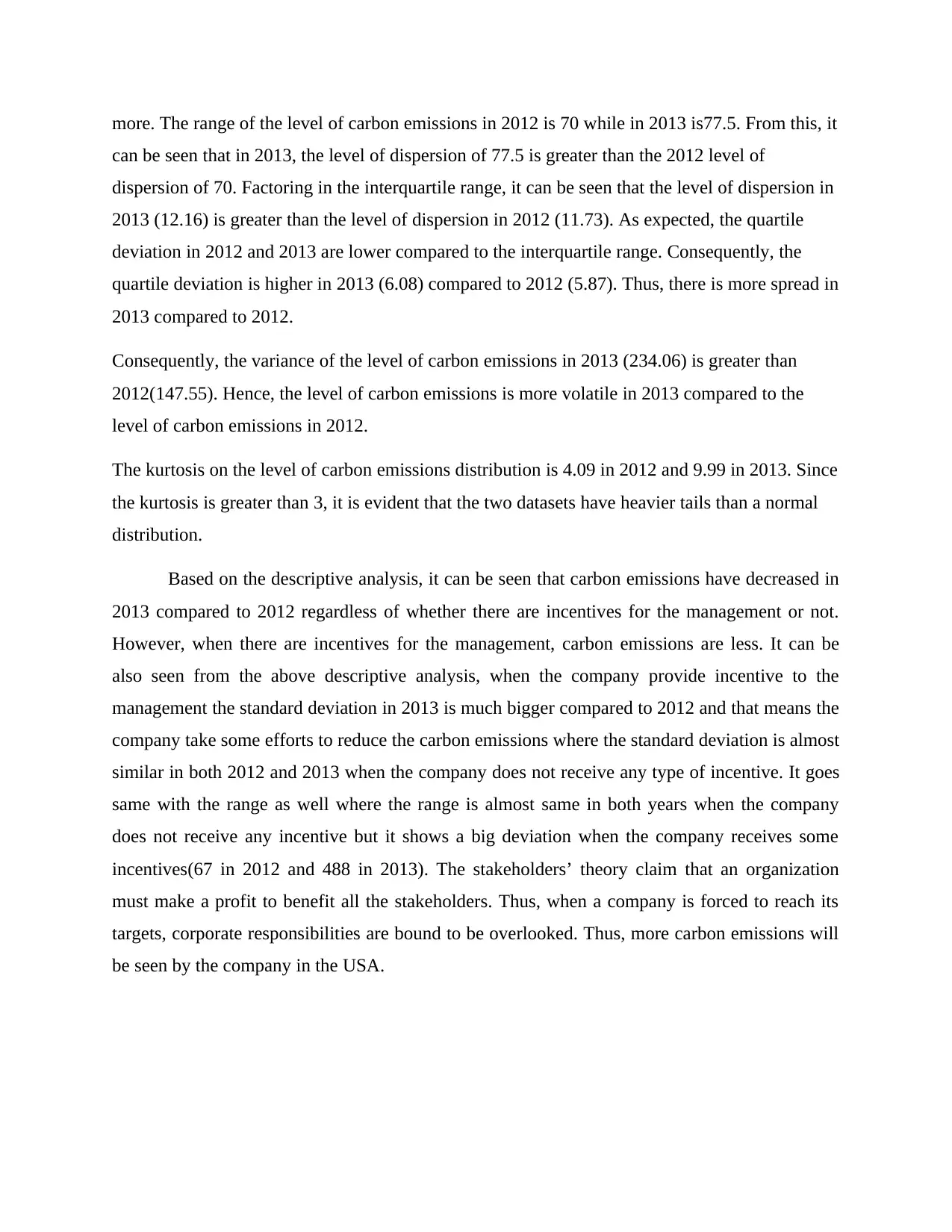

From table 2, it is evident that the mean of carbon emissions when the company does not

provide incentives for the management is -6.88 ± 12.15 in 2012 and -14.23 ± 15.30 in 2013.

Hence, the mean of the level of carbon emissions is higher in 2012 compared to 2013. In this

scenario, the company does not provide incentives to the management.

On the other hand, the median of the level of carbon emissions for both years is -8.11 and -10.46

in 2012 and 2013 respectively. The median is greater than the mean in 2013 while it is less in

2012. From this, it can be deduced that the distribution in 2013 is negatively skewed while the

distribution in 2012 is positively skewed. However, the negativity if the skewness is proved in

2013 (-2.78) unlike in 2012 where the skewness was found to be negative (-0.78).

The mode of the two distribution varies from -13 in 2012 and -20 in 2013. Thus, -13 level of

percentages changes in carbon emissions occurs more in 2012 unlike in 2013 where -20 occurs

Since the kurtosis is greater than 3, it is evident that the two datasets have heavier tails than a

normal distribution.

The company does not provide incentives for the management

Table 2: Descriptive statistics of 2012 and 2013, when a company does not provide incentives to

the management.

2012 2013

Mean -6.88 -14.23

Median -8.11 -10.46

Mode -13 -20

Range 70.00 77.50

Variance 147.55 234.06

Standard deviation 12.15 15.30

Interquartile range 11.73 12.16

quartile deviation 5.87 6.08

Skewness -0.78 -2.78

Kurtosis 4.09 9.99

From table 2, it is evident that the mean of carbon emissions when the company does not

provide incentives for the management is -6.88 ± 12.15 in 2012 and -14.23 ± 15.30 in 2013.

Hence, the mean of the level of carbon emissions is higher in 2012 compared to 2013. In this

scenario, the company does not provide incentives to the management.

On the other hand, the median of the level of carbon emissions for both years is -8.11 and -10.46

in 2012 and 2013 respectively. The median is greater than the mean in 2013 while it is less in

2012. From this, it can be deduced that the distribution in 2013 is negatively skewed while the

distribution in 2012 is positively skewed. However, the negativity if the skewness is proved in

2013 (-2.78) unlike in 2012 where the skewness was found to be negative (-0.78).

The mode of the two distribution varies from -13 in 2012 and -20 in 2013. Thus, -13 level of

percentages changes in carbon emissions occurs more in 2012 unlike in 2013 where -20 occurs

more. The range of the level of carbon emissions in 2012 is 70 while in 2013 is77.5. From this, it

can be seen that in 2013, the level of dispersion of 77.5 is greater than the 2012 level of

dispersion of 70. Factoring in the interquartile range, it can be seen that the level of dispersion in

2013 (12.16) is greater than the level of dispersion in 2012 (11.73). As expected, the quartile

deviation in 2012 and 2013 are lower compared to the interquartile range. Consequently, the

quartile deviation is higher in 2013 (6.08) compared to 2012 (5.87). Thus, there is more spread in

2013 compared to 2012.

Consequently, the variance of the level of carbon emissions in 2013 (234.06) is greater than

2012(147.55). Hence, the level of carbon emissions is more volatile in 2013 compared to the

level of carbon emissions in 2012.

The kurtosis on the level of carbon emissions distribution is 4.09 in 2012 and 9.99 in 2013. Since

the kurtosis is greater than 3, it is evident that the two datasets have heavier tails than a normal

distribution.

Based on the descriptive analysis, it can be seen that carbon emissions have decreased in

2013 compared to 2012 regardless of whether there are incentives for the management or not.

However, when there are incentives for the management, carbon emissions are less. It can be

also seen from the above descriptive analysis, when the company provide incentive to the

management the standard deviation in 2013 is much bigger compared to 2012 and that means the

company take some efforts to reduce the carbon emissions where the standard deviation is almost

similar in both 2012 and 2013 when the company does not receive any type of incentive. It goes

same with the range as well where the range is almost same in both years when the company

does not receive any incentive but it shows a big deviation when the company receives some

incentives(67 in 2012 and 488 in 2013). The stakeholders’ theory claim that an organization

must make a profit to benefit all the stakeholders. Thus, when a company is forced to reach its

targets, corporate responsibilities are bound to be overlooked. Thus, more carbon emissions will

be seen by the company in the USA.

can be seen that in 2013, the level of dispersion of 77.5 is greater than the 2012 level of

dispersion of 70. Factoring in the interquartile range, it can be seen that the level of dispersion in

2013 (12.16) is greater than the level of dispersion in 2012 (11.73). As expected, the quartile

deviation in 2012 and 2013 are lower compared to the interquartile range. Consequently, the

quartile deviation is higher in 2013 (6.08) compared to 2012 (5.87). Thus, there is more spread in

2013 compared to 2012.

Consequently, the variance of the level of carbon emissions in 2013 (234.06) is greater than

2012(147.55). Hence, the level of carbon emissions is more volatile in 2013 compared to the

level of carbon emissions in 2012.

The kurtosis on the level of carbon emissions distribution is 4.09 in 2012 and 9.99 in 2013. Since

the kurtosis is greater than 3, it is evident that the two datasets have heavier tails than a normal

distribution.

Based on the descriptive analysis, it can be seen that carbon emissions have decreased in

2013 compared to 2012 regardless of whether there are incentives for the management or not.

However, when there are incentives for the management, carbon emissions are less. It can be

also seen from the above descriptive analysis, when the company provide incentive to the

management the standard deviation in 2013 is much bigger compared to 2012 and that means the

company take some efforts to reduce the carbon emissions where the standard deviation is almost

similar in both 2012 and 2013 when the company does not receive any type of incentive. It goes

same with the range as well where the range is almost same in both years when the company

does not receive any incentive but it shows a big deviation when the company receives some

incentives(67 in 2012 and 488 in 2013). The stakeholders’ theory claim that an organization

must make a profit to benefit all the stakeholders. Thus, when a company is forced to reach its

targets, corporate responsibilities are bound to be overlooked. Thus, more carbon emissions will

be seen by the company in the USA.

Data Analysis – Inferential (ASSESSED)(20%)

The results of the descriptive statistical analysis only provides an exploratory idea about

the impact of incentives being included into the company business strategy and offered to the

management to influence the company to reduce its carbon emissions. Although the descriptive

analysis reveals a general decrease in carbon emissions from 2012 to 2013 among the sample,

regardless of the fact that a company has such an incentive plan in place or not, it cannot be

asserted to be true for the population of companies that exist or not. The statistical validity of the

conjecture that inclusion of such incentives to influence a core stakeholder group, that is the

management, could go on to significantly impact and hence reduce the emission levels is hence

still not established on the sole of the descriptive measures. In order to come to an evidence

based conclusion regarding the impact of incentives, inferential analysis is then employed to

approach the problem.

Inferential statistics is a tool that allows for the researcher to arrive at conclusions about

the whole population on the basis of the given representative sample, with some degree of

controlled error. The two errors associated with the methodology are type I error or the

probability that the true null hypothesis is rejected. This is also equivalent to the level of

significance of the test. Type II error or the probability that the false alternative will be accepted.

Then naturally, decreasing one error would imply the increase in the other. The following

methodology set the type I error as 0.05 and the type II error was minimized to arrive at the

conclusion. This means that the null is rejected whenever the p-value is found to be less than

0.05, at 5% level of significance. The difference in the percentage change of the companies who

give incentives between 2012 and 2013 was then tested for using the paired t-tests. The

difference between the two groups of companies, namely, those who give incentives and those

who do not, in terms of percentage emission in 2012 and in 2013 was tested for using two

independent sample t-tests. The same was employed for the difference between the companies

who offered incentives in 2012 and those which did not offer incentives in 2013 and those which

did not offer incentives in 2012 and those which did offer incentives in 2013.

The first assumption for both paired t-tests and independent sample t-tests is that the data

is free from outliers. This is primarily due to the fact that the test statistics are based on the mean

The results of the descriptive statistical analysis only provides an exploratory idea about

the impact of incentives being included into the company business strategy and offered to the

management to influence the company to reduce its carbon emissions. Although the descriptive

analysis reveals a general decrease in carbon emissions from 2012 to 2013 among the sample,

regardless of the fact that a company has such an incentive plan in place or not, it cannot be

asserted to be true for the population of companies that exist or not. The statistical validity of the

conjecture that inclusion of such incentives to influence a core stakeholder group, that is the

management, could go on to significantly impact and hence reduce the emission levels is hence

still not established on the sole of the descriptive measures. In order to come to an evidence

based conclusion regarding the impact of incentives, inferential analysis is then employed to

approach the problem.

Inferential statistics is a tool that allows for the researcher to arrive at conclusions about

the whole population on the basis of the given representative sample, with some degree of

controlled error. The two errors associated with the methodology are type I error or the

probability that the true null hypothesis is rejected. This is also equivalent to the level of

significance of the test. Type II error or the probability that the false alternative will be accepted.

Then naturally, decreasing one error would imply the increase in the other. The following

methodology set the type I error as 0.05 and the type II error was minimized to arrive at the

conclusion. This means that the null is rejected whenever the p-value is found to be less than

0.05, at 5% level of significance. The difference in the percentage change of the companies who

give incentives between 2012 and 2013 was then tested for using the paired t-tests. The

difference between the two groups of companies, namely, those who give incentives and those

who do not, in terms of percentage emission in 2012 and in 2013 was tested for using two

independent sample t-tests. The same was employed for the difference between the companies

who offered incentives in 2012 and those which did not offer incentives in 2013 and those which

did not offer incentives in 2012 and those which did offer incentives in 2013.

The first assumption for both paired t-tests and independent sample t-tests is that the data

is free from outliers. This is primarily due to the fact that the test statistics are based on the mean

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

which is highly susceptible to presence of outliers. Thus presence of extreme values in the data

could potentially lead to erroneous results.The two sets of data to be compared for the paired t-

tests must be on the same attribute but dependent on each other, such that they may be from the

same individual or object in different time or scenarios, that is, should be observations on the

same variable at different scenarios but related to the same unit. The assumption for independent

t-tests however is that the data samples are on the same variable but drawn independently from

each other. Again, another assumption is that the data samples are underlined by some normal

distribution.

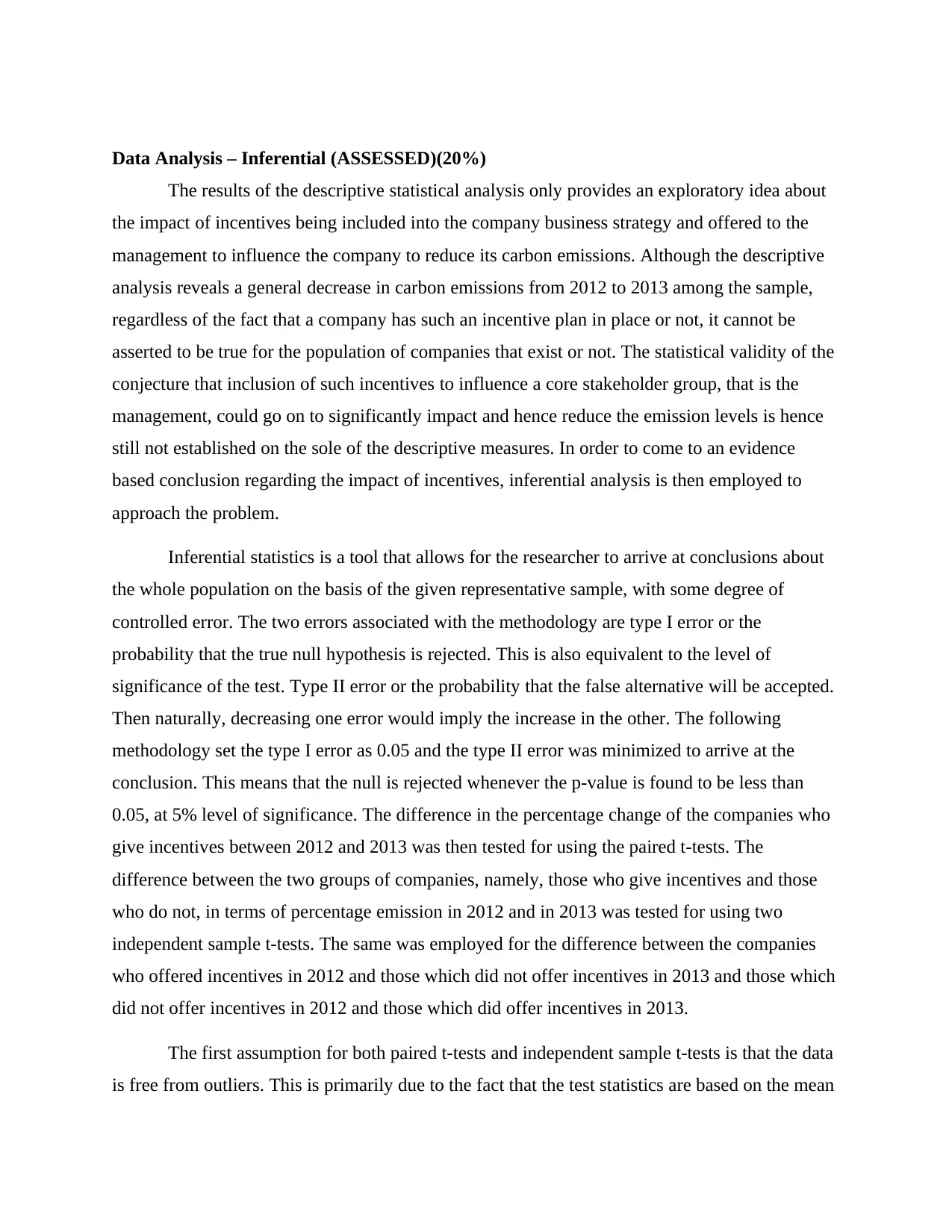

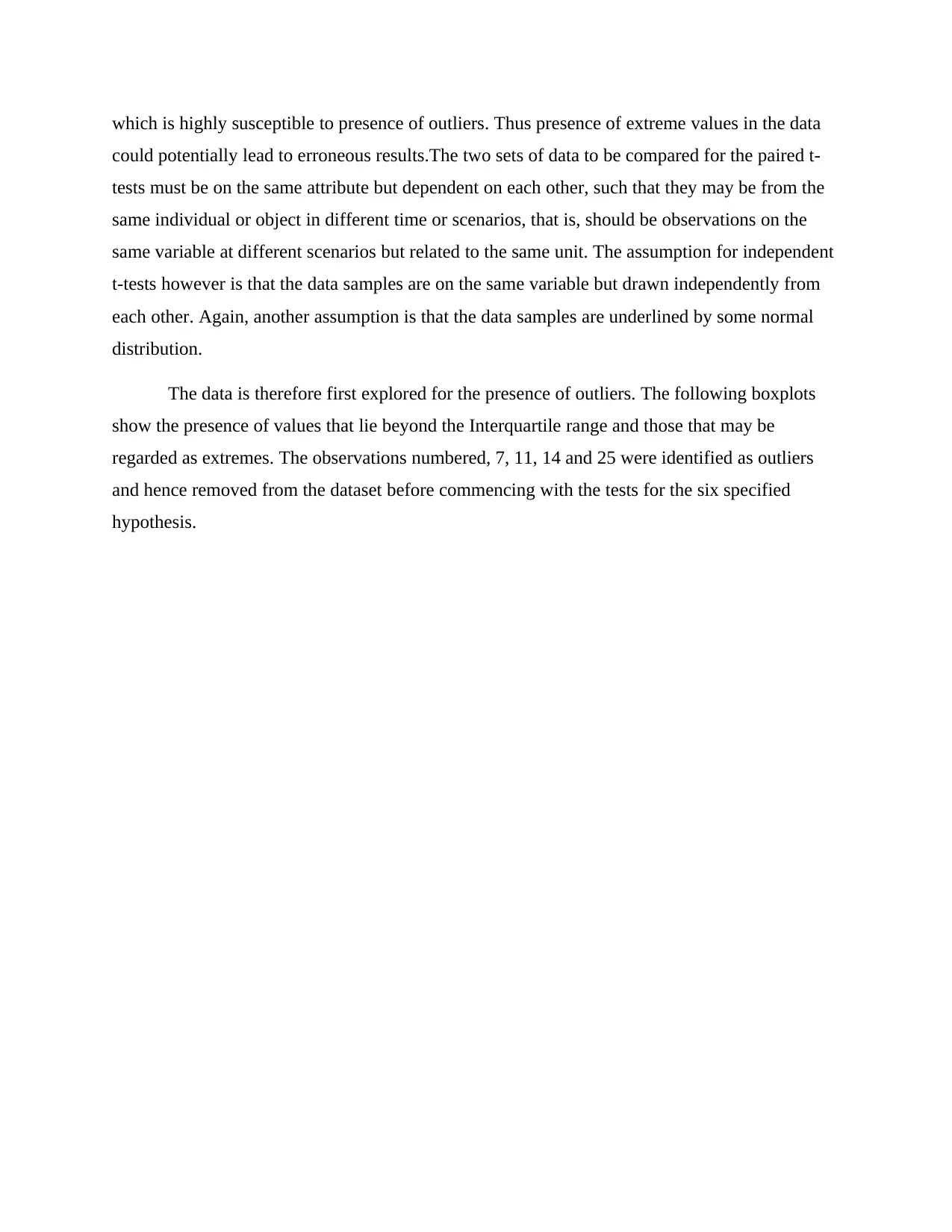

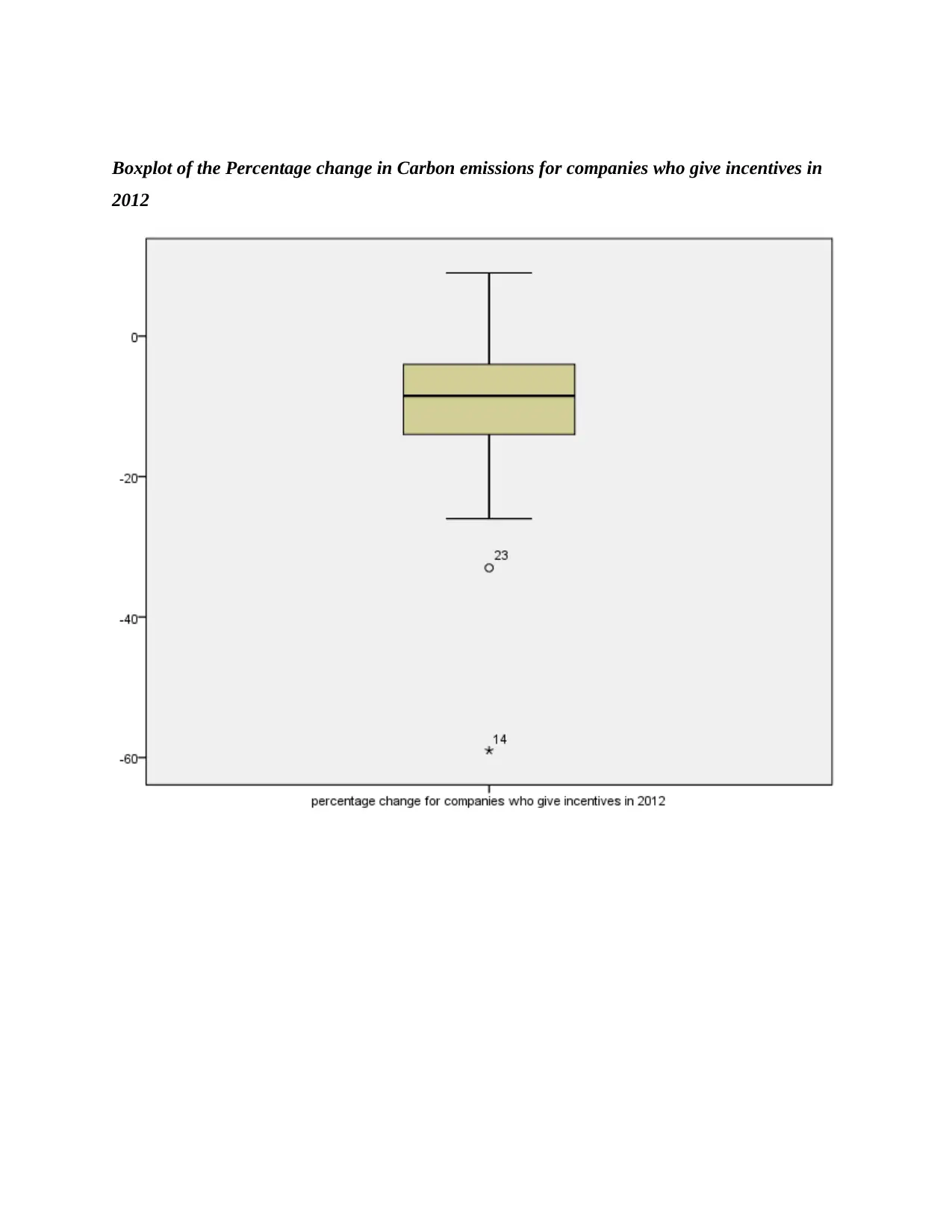

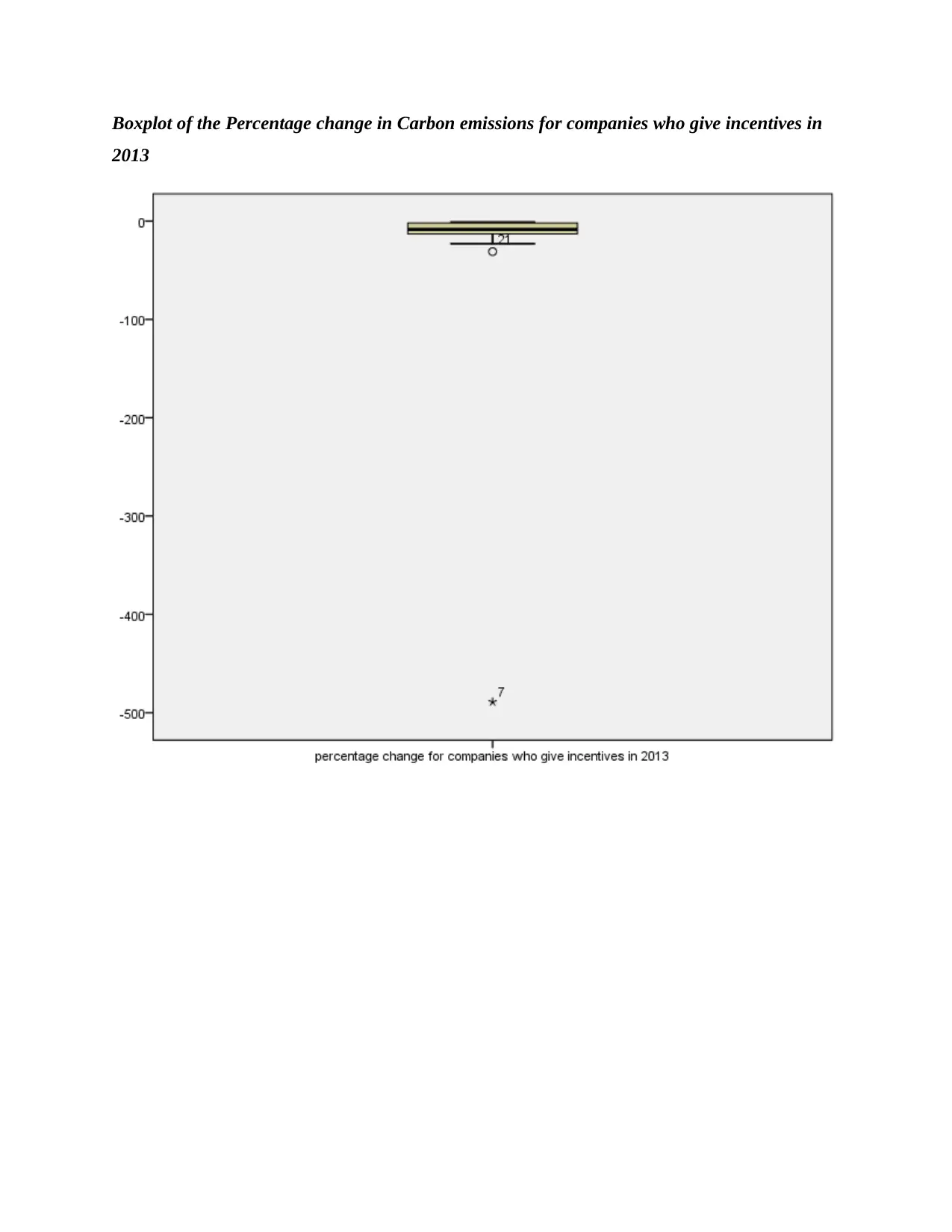

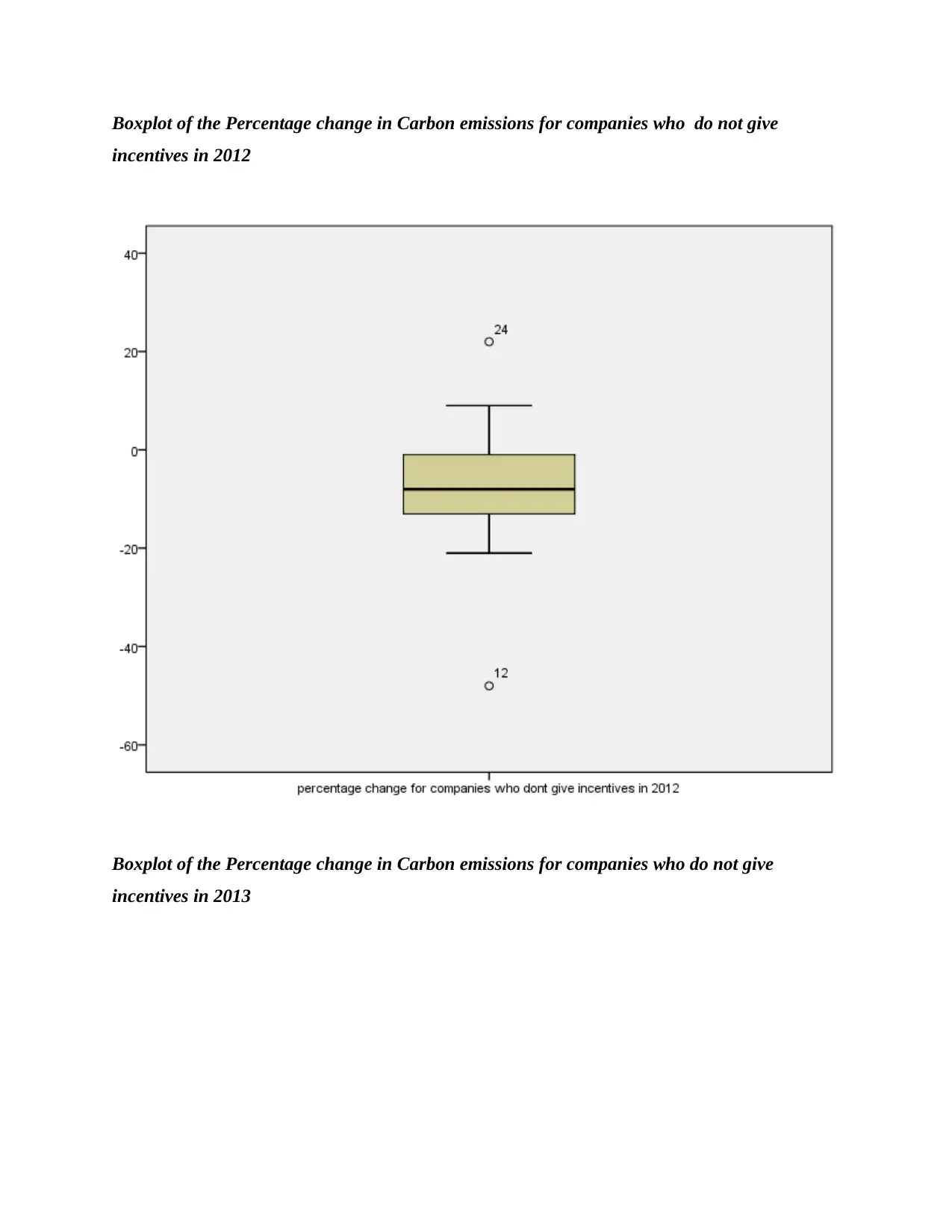

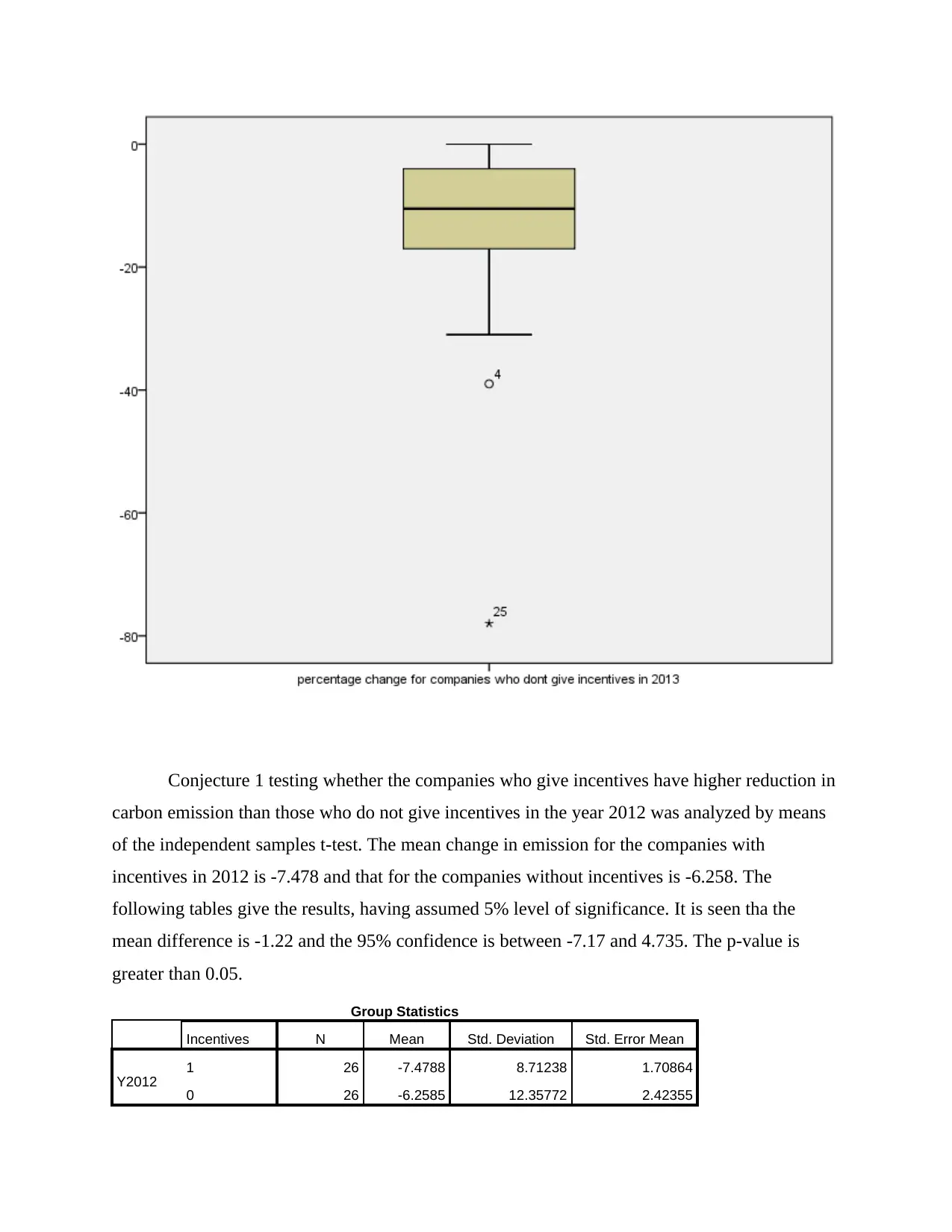

The data is therefore first explored for the presence of outliers. The following boxplots

show the presence of values that lie beyond the Interquartile range and those that may be

regarded as extremes. The observations numbered, 7, 11, 14 and 25 were identified as outliers

and hence removed from the dataset before commencing with the tests for the six specified

hypothesis.

could potentially lead to erroneous results.The two sets of data to be compared for the paired t-

tests must be on the same attribute but dependent on each other, such that they may be from the

same individual or object in different time or scenarios, that is, should be observations on the

same variable at different scenarios but related to the same unit. The assumption for independent

t-tests however is that the data samples are on the same variable but drawn independently from

each other. Again, another assumption is that the data samples are underlined by some normal

distribution.

The data is therefore first explored for the presence of outliers. The following boxplots

show the presence of values that lie beyond the Interquartile range and those that may be

regarded as extremes. The observations numbered, 7, 11, 14 and 25 were identified as outliers

and hence removed from the dataset before commencing with the tests for the six specified

hypothesis.

Boxplot of the Percentage change in Carbon emissions for companies who give incentives in

2012

2012

Boxplot of the Percentage change in Carbon emissions for companies who give incentives in

2013

2013

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Boxplot of the Percentage change in Carbon emissions for companies who do not give

incentives in 2012

Boxplot of the Percentage change in Carbon emissions for companies who do not give

incentives in 2013

incentives in 2012

Boxplot of the Percentage change in Carbon emissions for companies who do not give

incentives in 2013

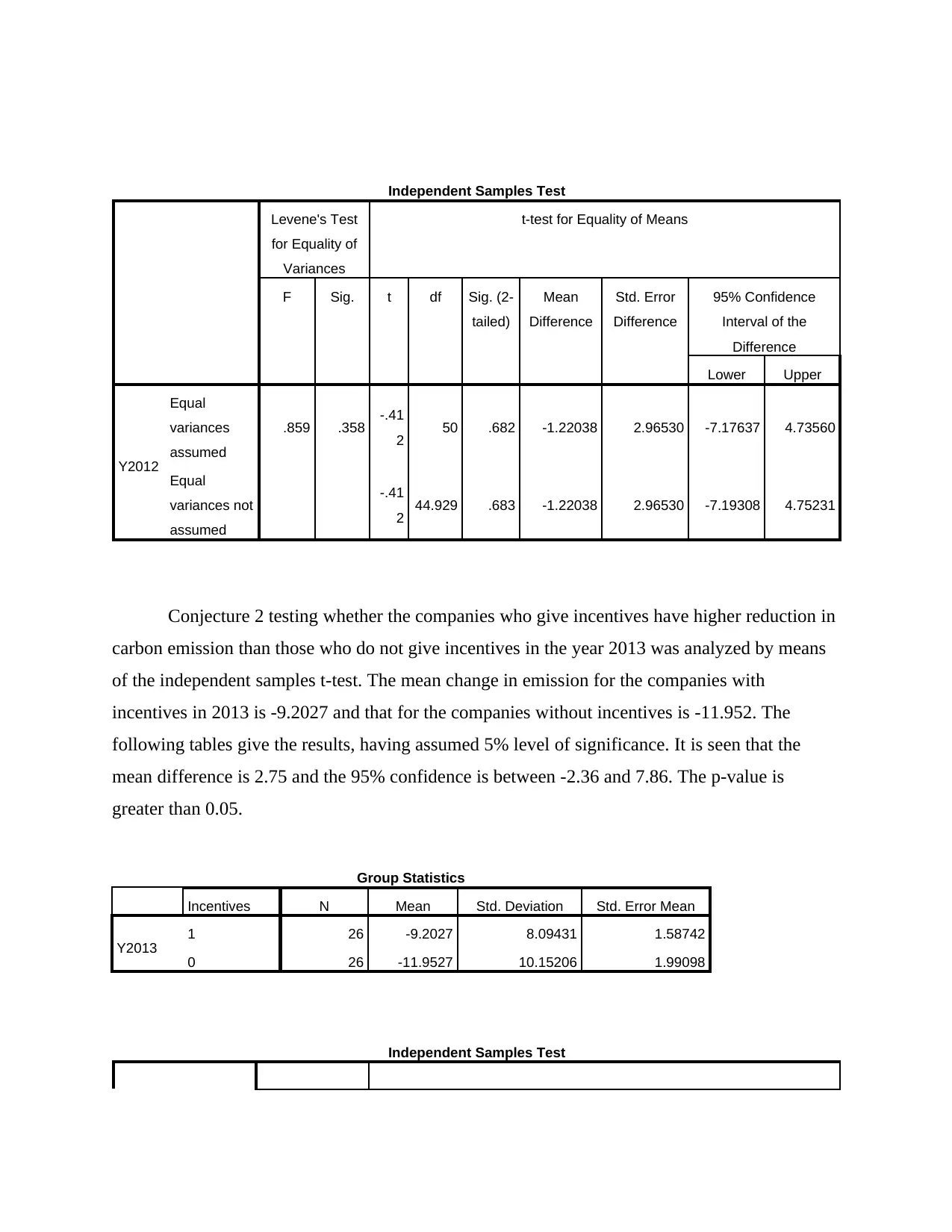

Conjecture 1 testing whether the companies who give incentives have higher reduction in

carbon emission than those who do not give incentives in the year 2012 was analyzed by means

of the independent samples t-test. The mean change in emission for the companies with

incentives in 2012 is -7.478 and that for the companies without incentives is -6.258. The

following tables give the results, having assumed 5% level of significance. It is seen tha the

mean difference is -1.22 and the 95% confidence is between -7.17 and 4.735. The p-value is

greater than 0.05.

Group Statistics

Incentives N Mean Std. Deviation Std. Error Mean

Y2012 1 26 -7.4788 8.71238 1.70864

0 26 -6.2585 12.35772 2.42355

carbon emission than those who do not give incentives in the year 2012 was analyzed by means

of the independent samples t-test. The mean change in emission for the companies with

incentives in 2012 is -7.478 and that for the companies without incentives is -6.258. The

following tables give the results, having assumed 5% level of significance. It is seen tha the

mean difference is -1.22 and the 95% confidence is between -7.17 and 4.735. The p-value is

greater than 0.05.

Group Statistics

Incentives N Mean Std. Deviation Std. Error Mean

Y2012 1 26 -7.4788 8.71238 1.70864

0 26 -6.2585 12.35772 2.42355

Independent Samples Test

Levene's Test

for Equality of

Variances

t-test for Equality of Means

F Sig. t df Sig. (2-

tailed)

Mean

Difference

Std. Error

Difference

95% Confidence

Interval of the

Difference

Lower Upper

Y2012

Equal

variances

assumed

.859 .358 -.41

2 50 .682 -1.22038 2.96530 -7.17637 4.73560

Equal

variances not

assumed

-.41

2 44.929 .683 -1.22038 2.96530 -7.19308 4.75231

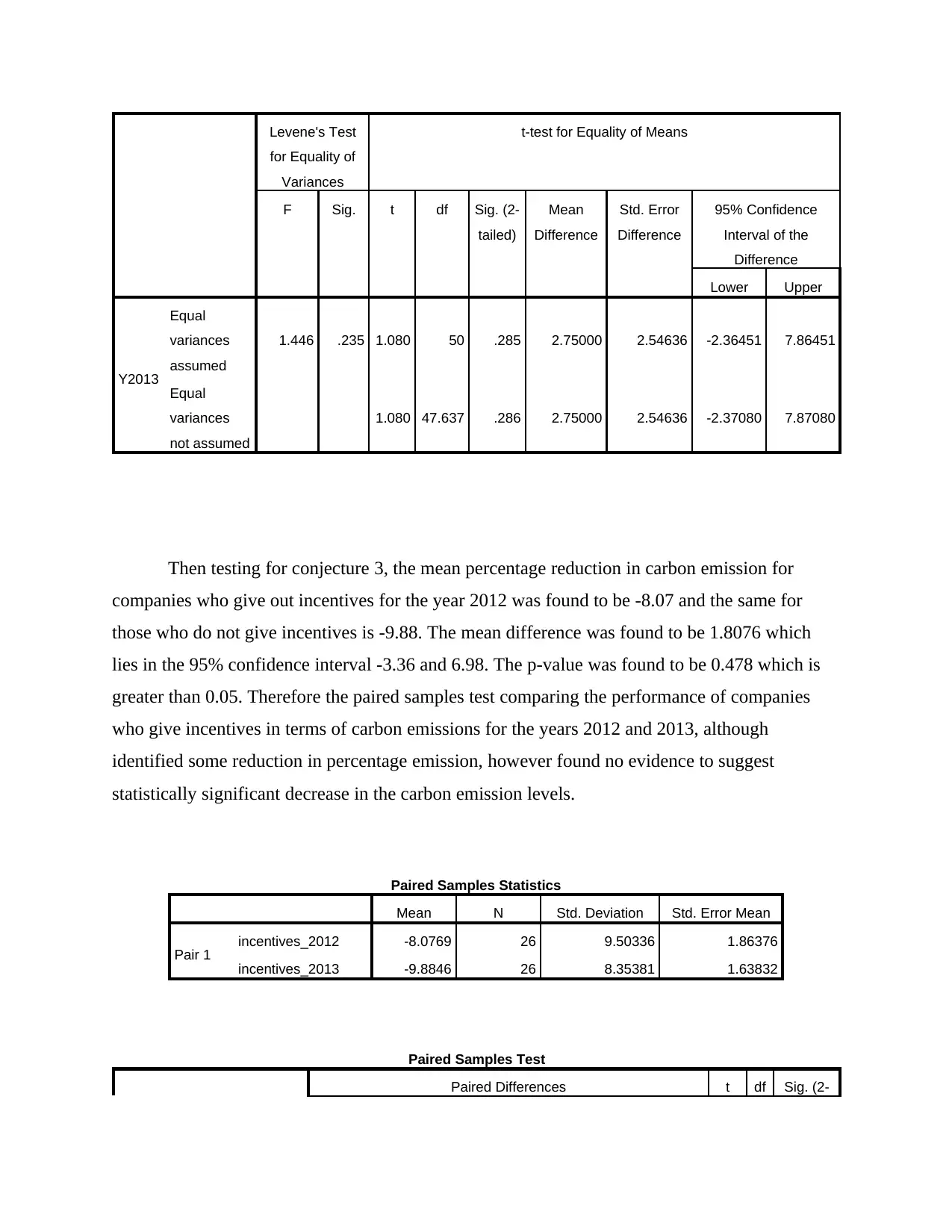

Conjecture 2 testing whether the companies who give incentives have higher reduction in

carbon emission than those who do not give incentives in the year 2013 was analyzed by means

of the independent samples t-test. The mean change in emission for the companies with

incentives in 2013 is -9.2027 and that for the companies without incentives is -11.952. The

following tables give the results, having assumed 5% level of significance. It is seen that the

mean difference is 2.75 and the 95% confidence is between -2.36 and 7.86. The p-value is

greater than 0.05.

Group Statistics

Incentives N Mean Std. Deviation Std. Error Mean

Y2013 1 26 -9.2027 8.09431 1.58742

0 26 -11.9527 10.15206 1.99098

Independent Samples Test

Levene's Test

for Equality of

Variances

t-test for Equality of Means

F Sig. t df Sig. (2-

tailed)

Mean

Difference

Std. Error

Difference

95% Confidence

Interval of the

Difference

Lower Upper

Y2012

Equal

variances

assumed

.859 .358 -.41

2 50 .682 -1.22038 2.96530 -7.17637 4.73560

Equal

variances not

assumed

-.41

2 44.929 .683 -1.22038 2.96530 -7.19308 4.75231

Conjecture 2 testing whether the companies who give incentives have higher reduction in

carbon emission than those who do not give incentives in the year 2013 was analyzed by means

of the independent samples t-test. The mean change in emission for the companies with

incentives in 2013 is -9.2027 and that for the companies without incentives is -11.952. The

following tables give the results, having assumed 5% level of significance. It is seen that the

mean difference is 2.75 and the 95% confidence is between -2.36 and 7.86. The p-value is

greater than 0.05.

Group Statistics

Incentives N Mean Std. Deviation Std. Error Mean

Y2013 1 26 -9.2027 8.09431 1.58742

0 26 -11.9527 10.15206 1.99098

Independent Samples Test

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Levene's Test

for Equality of

Variances

t-test for Equality of Means

F Sig. t df Sig. (2-

tailed)

Mean

Difference

Std. Error

Difference

95% Confidence

Interval of the

Difference

Lower Upper

Y2013

Equal

variances

assumed

1.446 .235 1.080 50 .285 2.75000 2.54636 -2.36451 7.86451

Equal

variances

not assumed

1.080 47.637 .286 2.75000 2.54636 -2.37080 7.87080

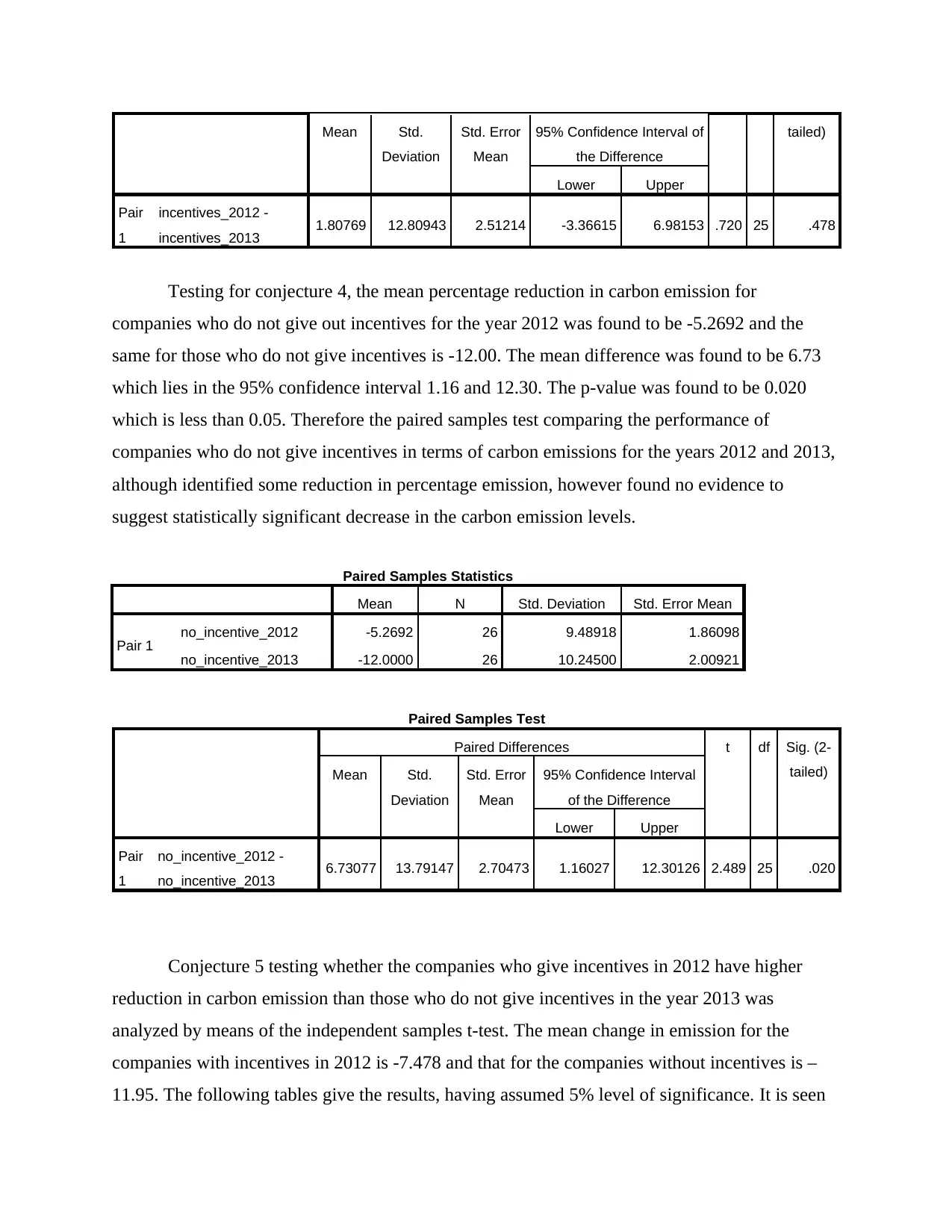

Then testing for conjecture 3, the mean percentage reduction in carbon emission for

companies who give out incentives for the year 2012 was found to be -8.07 and the same for

those who do not give incentives is -9.88. The mean difference was found to be 1.8076 which

lies in the 95% confidence interval -3.36 and 6.98. The p-value was found to be 0.478 which is

greater than 0.05. Therefore the paired samples test comparing the performance of companies

who give incentives in terms of carbon emissions for the years 2012 and 2013, although

identified some reduction in percentage emission, however found no evidence to suggest

statistically significant decrease in the carbon emission levels.

Paired Samples Statistics

Mean N Std. Deviation Std. Error Mean

Pair 1 incentives_2012 -8.0769 26 9.50336 1.86376

incentives_2013 -9.8846 26 8.35381 1.63832

Paired Samples Test

Paired Differences t df Sig. (2-

for Equality of

Variances

t-test for Equality of Means

F Sig. t df Sig. (2-

tailed)

Mean

Difference

Std. Error

Difference

95% Confidence

Interval of the

Difference

Lower Upper

Y2013

Equal

variances

assumed

1.446 .235 1.080 50 .285 2.75000 2.54636 -2.36451 7.86451

Equal

variances

not assumed

1.080 47.637 .286 2.75000 2.54636 -2.37080 7.87080

Then testing for conjecture 3, the mean percentage reduction in carbon emission for

companies who give out incentives for the year 2012 was found to be -8.07 and the same for

those who do not give incentives is -9.88. The mean difference was found to be 1.8076 which

lies in the 95% confidence interval -3.36 and 6.98. The p-value was found to be 0.478 which is

greater than 0.05. Therefore the paired samples test comparing the performance of companies

who give incentives in terms of carbon emissions for the years 2012 and 2013, although

identified some reduction in percentage emission, however found no evidence to suggest

statistically significant decrease in the carbon emission levels.

Paired Samples Statistics

Mean N Std. Deviation Std. Error Mean

Pair 1 incentives_2012 -8.0769 26 9.50336 1.86376

incentives_2013 -9.8846 26 8.35381 1.63832

Paired Samples Test

Paired Differences t df Sig. (2-

tailed)Mean Std.

Deviation

Std. Error

Mean

95% Confidence Interval of

the Difference

Lower Upper

Pair

1

incentives_2012 -

incentives_2013 1.80769 12.80943 2.51214 -3.36615 6.98153 .720 25 .478

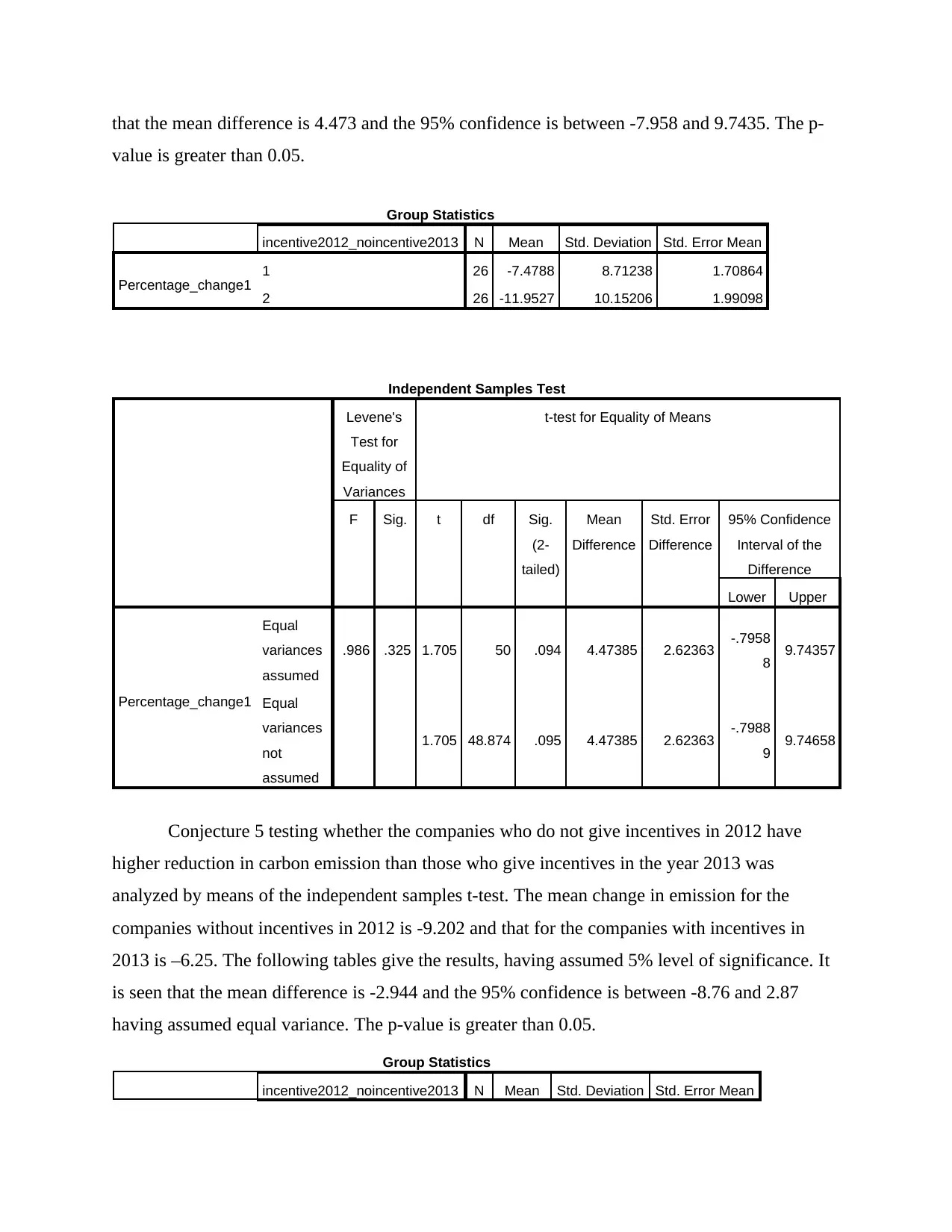

Testing for conjecture 4, the mean percentage reduction in carbon emission for

companies who do not give out incentives for the year 2012 was found to be -5.2692 and the

same for those who do not give incentives is -12.00. The mean difference was found to be 6.73

which lies in the 95% confidence interval 1.16 and 12.30. The p-value was found to be 0.020

which is less than 0.05. Therefore the paired samples test comparing the performance of

companies who do not give incentives in terms of carbon emissions for the years 2012 and 2013,

although identified some reduction in percentage emission, however found no evidence to

suggest statistically significant decrease in the carbon emission levels.

Paired Samples Statistics

Mean N Std. Deviation Std. Error Mean

Pair 1 no_incentive_2012 -5.2692 26 9.48918 1.86098

no_incentive_2013 -12.0000 26 10.24500 2.00921

Paired Samples Test

Paired Differences t df Sig. (2-

tailed)Mean Std.

Deviation

Std. Error

Mean

95% Confidence Interval

of the Difference

Lower Upper

Pair

1

no_incentive_2012 -

no_incentive_2013 6.73077 13.79147 2.70473 1.16027 12.30126 2.489 25 .020

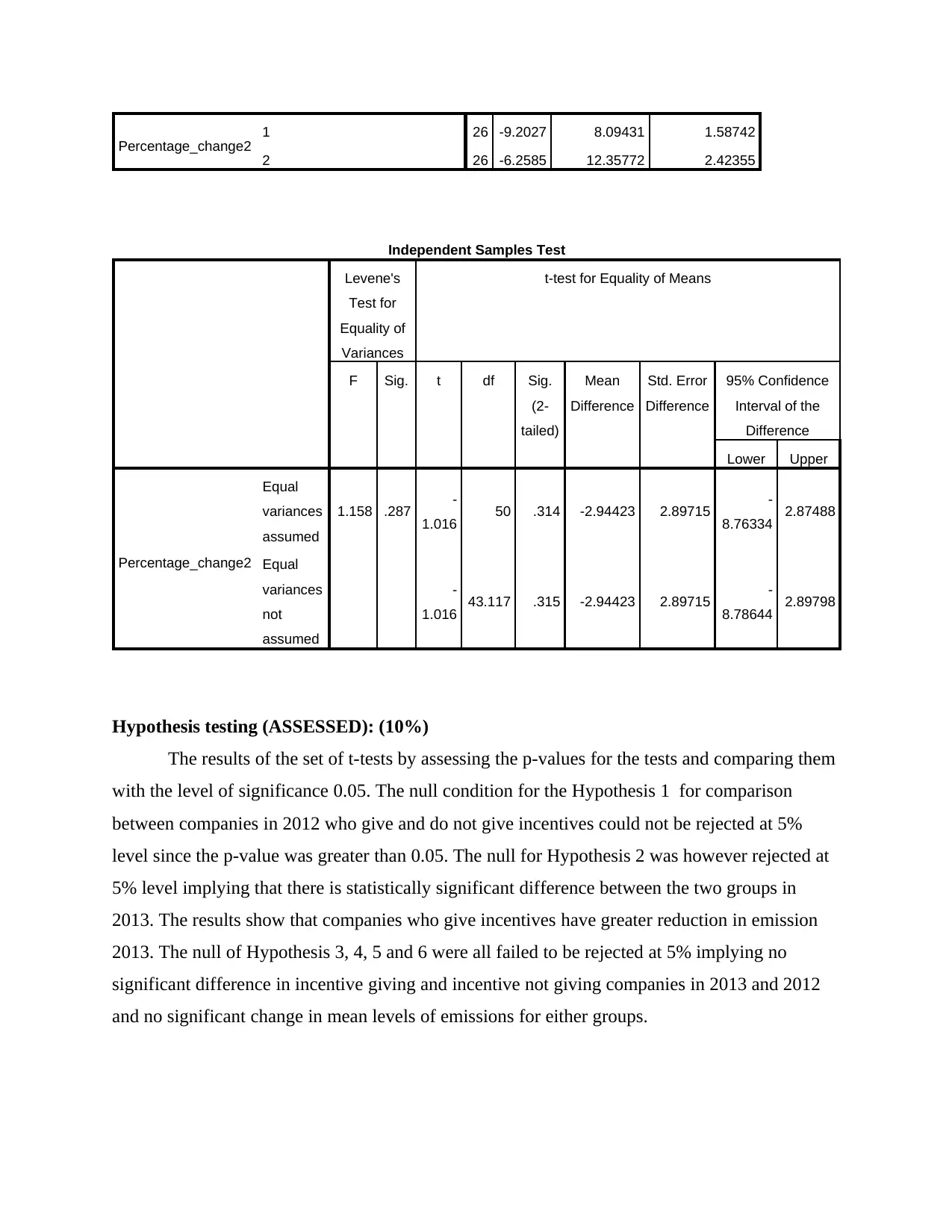

Conjecture 5 testing whether the companies who give incentives in 2012 have higher

reduction in carbon emission than those who do not give incentives in the year 2013 was

analyzed by means of the independent samples t-test. The mean change in emission for the

companies with incentives in 2012 is -7.478 and that for the companies without incentives is –

11.95. The following tables give the results, having assumed 5% level of significance. It is seen

Deviation

Std. Error

Mean

95% Confidence Interval of

the Difference

Lower Upper

Pair

1

incentives_2012 -

incentives_2013 1.80769 12.80943 2.51214 -3.36615 6.98153 .720 25 .478

Testing for conjecture 4, the mean percentage reduction in carbon emission for

companies who do not give out incentives for the year 2012 was found to be -5.2692 and the

same for those who do not give incentives is -12.00. The mean difference was found to be 6.73

which lies in the 95% confidence interval 1.16 and 12.30. The p-value was found to be 0.020

which is less than 0.05. Therefore the paired samples test comparing the performance of

companies who do not give incentives in terms of carbon emissions for the years 2012 and 2013,

although identified some reduction in percentage emission, however found no evidence to

suggest statistically significant decrease in the carbon emission levels.

Paired Samples Statistics

Mean N Std. Deviation Std. Error Mean

Pair 1 no_incentive_2012 -5.2692 26 9.48918 1.86098

no_incentive_2013 -12.0000 26 10.24500 2.00921

Paired Samples Test

Paired Differences t df Sig. (2-

tailed)Mean Std.

Deviation

Std. Error

Mean

95% Confidence Interval

of the Difference

Lower Upper

Pair

1

no_incentive_2012 -

no_incentive_2013 6.73077 13.79147 2.70473 1.16027 12.30126 2.489 25 .020

Conjecture 5 testing whether the companies who give incentives in 2012 have higher

reduction in carbon emission than those who do not give incentives in the year 2013 was

analyzed by means of the independent samples t-test. The mean change in emission for the

companies with incentives in 2012 is -7.478 and that for the companies without incentives is –

11.95. The following tables give the results, having assumed 5% level of significance. It is seen

that the mean difference is 4.473 and the 95% confidence is between -7.958 and 9.7435. The p-

value is greater than 0.05.

Group Statistics

incentive2012_noincentive2013 N Mean Std. Deviation Std. Error Mean

Percentage_change1 1 26 -7.4788 8.71238 1.70864

2 26 -11.9527 10.15206 1.99098

Independent Samples Test

Levene's

Test for

Equality of

Variances

t-test for Equality of Means

F Sig. t df Sig.

(2-

tailed)

Mean

Difference

Std. Error

Difference

95% Confidence

Interval of the

Difference

Lower Upper

Percentage_change1

Equal

variances

assumed

.986 .325 1.705 50 .094 4.47385 2.62363 -.7958

8 9.74357

Equal

variances

not

assumed

1.705 48.874 .095 4.47385 2.62363 -.7988

9 9.74658

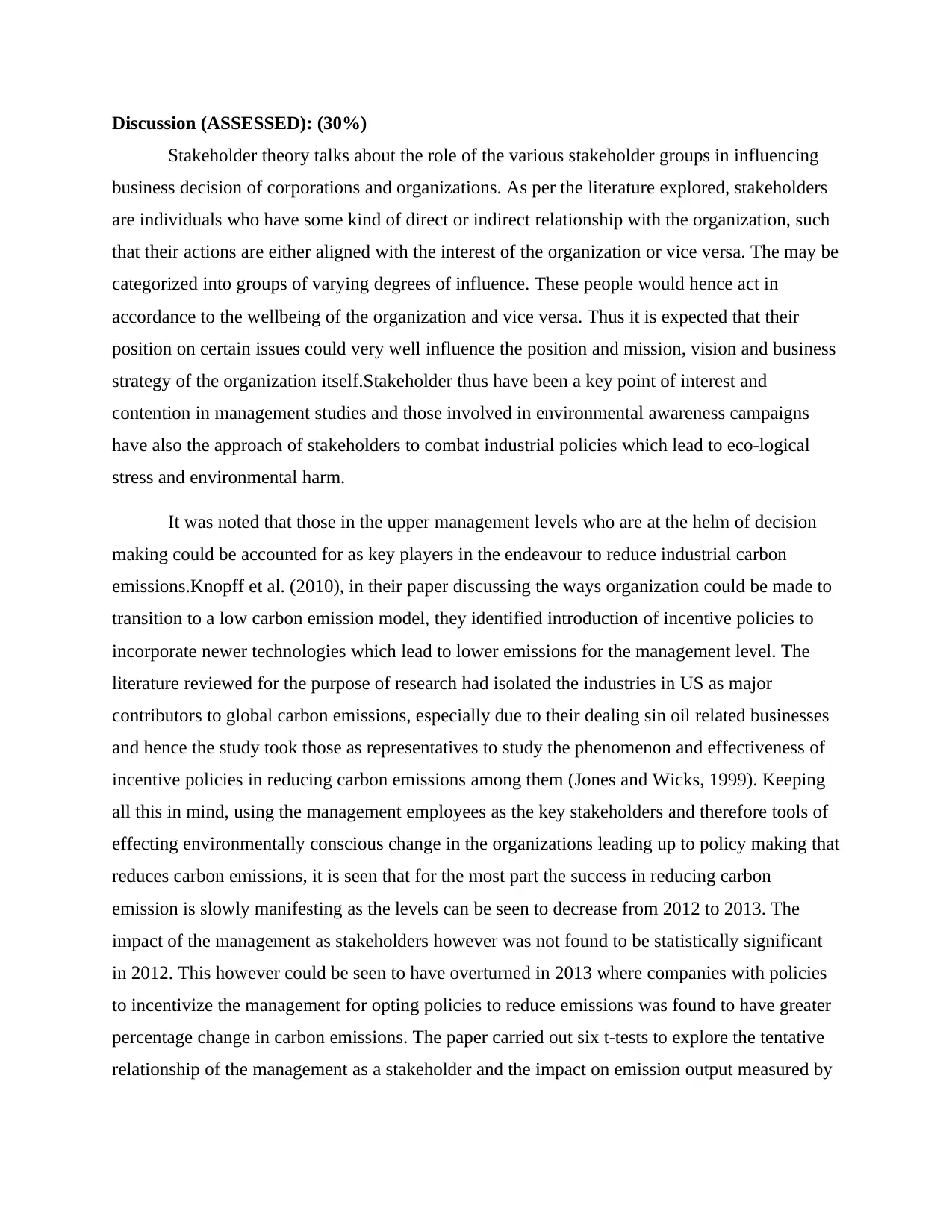

Conjecture 5 testing whether the companies who do not give incentives in 2012 have

higher reduction in carbon emission than those who give incentives in the year 2013 was

analyzed by means of the independent samples t-test. The mean change in emission for the

companies without incentives in 2012 is -9.202 and that for the companies with incentives in

2013 is –6.25. The following tables give the results, having assumed 5% level of significance. It

is seen that the mean difference is -2.944 and the 95% confidence is between -8.76 and 2.87

having assumed equal variance. The p-value is greater than 0.05.

Group Statistics

incentive2012_noincentive2013 N Mean Std. Deviation Std. Error Mean

value is greater than 0.05.

Group Statistics

incentive2012_noincentive2013 N Mean Std. Deviation Std. Error Mean

Percentage_change1 1 26 -7.4788 8.71238 1.70864

2 26 -11.9527 10.15206 1.99098

Independent Samples Test

Levene's

Test for

Equality of

Variances

t-test for Equality of Means

F Sig. t df Sig.

(2-

tailed)

Mean

Difference

Std. Error

Difference

95% Confidence

Interval of the

Difference

Lower Upper

Percentage_change1

Equal

variances

assumed

.986 .325 1.705 50 .094 4.47385 2.62363 -.7958

8 9.74357

Equal

variances

not

assumed

1.705 48.874 .095 4.47385 2.62363 -.7988

9 9.74658

Conjecture 5 testing whether the companies who do not give incentives in 2012 have

higher reduction in carbon emission than those who give incentives in the year 2013 was

analyzed by means of the independent samples t-test. The mean change in emission for the

companies without incentives in 2012 is -9.202 and that for the companies with incentives in

2013 is –6.25. The following tables give the results, having assumed 5% level of significance. It

is seen that the mean difference is -2.944 and the 95% confidence is between -8.76 and 2.87

having assumed equal variance. The p-value is greater than 0.05.

Group Statistics

incentive2012_noincentive2013 N Mean Std. Deviation Std. Error Mean

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Percentage_change2 1 26 -9.2027 8.09431 1.58742

2 26 -6.2585 12.35772 2.42355

Independent Samples Test

Levene's

Test for

Equality of

Variances

t-test for Equality of Means

F Sig. t df Sig.

(2-

tailed)

Mean

Difference

Std. Error

Difference

95% Confidence

Interval of the

Difference

Lower Upper

Percentage_change2

Equal

variances

assumed

1.158 .287 -

1.016 50 .314 -2.94423 2.89715 -

8.76334 2.87488

Equal

variances

not

assumed

-

1.016 43.117 .315 -2.94423 2.89715 -

8.78644 2.89798

Hypothesis testing (ASSESSED): (10%)

The results of the set of t-tests by assessing the p-values for the tests and comparing them

with the level of significance 0.05. The null condition for the Hypothesis 1 for comparison

between companies in 2012 who give and do not give incentives could not be rejected at 5%

level since the p-value was greater than 0.05. The null for Hypothesis 2 was however rejected at

5% level implying that there is statistically significant difference between the two groups in

2013. The results show that companies who give incentives have greater reduction in emission

2013. The null of Hypothesis 3, 4, 5 and 6 were all failed to be rejected at 5% implying no

significant difference in incentive giving and incentive not giving companies in 2013 and 2012

and no significant change in mean levels of emissions for either groups.

2 26 -6.2585 12.35772 2.42355

Independent Samples Test

Levene's

Test for

Equality of

Variances

t-test for Equality of Means

F Sig. t df Sig.

(2-

tailed)

Mean

Difference

Std. Error

Difference

95% Confidence

Interval of the

Difference

Lower Upper

Percentage_change2

Equal

variances

assumed

1.158 .287 -

1.016 50 .314 -2.94423 2.89715 -

8.76334 2.87488

Equal

variances

not

assumed

-

1.016 43.117 .315 -2.94423 2.89715 -

8.78644 2.89798

Hypothesis testing (ASSESSED): (10%)

The results of the set of t-tests by assessing the p-values for the tests and comparing them

with the level of significance 0.05. The null condition for the Hypothesis 1 for comparison

between companies in 2012 who give and do not give incentives could not be rejected at 5%

level since the p-value was greater than 0.05. The null for Hypothesis 2 was however rejected at

5% level implying that there is statistically significant difference between the two groups in

2013. The results show that companies who give incentives have greater reduction in emission

2013. The null of Hypothesis 3, 4, 5 and 6 were all failed to be rejected at 5% implying no

significant difference in incentive giving and incentive not giving companies in 2013 and 2012

and no significant change in mean levels of emissions for either groups.

Discussion (ASSESSED): (30%)

Stakeholder theory talks about the role of the various stakeholder groups in influencing

business decision of corporations and organizations. As per the literature explored, stakeholders

are individuals who have some kind of direct or indirect relationship with the organization, such

that their actions are either aligned with the interest of the organization or vice versa. The may be

categorized into groups of varying degrees of influence. These people would hence act in

accordance to the wellbeing of the organization and vice versa. Thus it is expected that their

position on certain issues could very well influence the position and mission, vision and business

strategy of the organization itself.Stakeholder thus have been a key point of interest and

contention in management studies and those involved in environmental awareness campaigns

have also the approach of stakeholders to combat industrial policies which lead to eco-logical

stress and environmental harm.

It was noted that those in the upper management levels who are at the helm of decision

making could be accounted for as key players in the endeavour to reduce industrial carbon

emissions.Knopff et al. (2010), in their paper discussing the ways organization could be made to

transition to a low carbon emission model, they identified introduction of incentive policies to

incorporate newer technologies which lead to lower emissions for the management level. The

literature reviewed for the purpose of research had isolated the industries in US as major

contributors to global carbon emissions, especially due to their dealing sin oil related businesses

and hence the study took those as representatives to study the phenomenon and effectiveness of

incentive policies in reducing carbon emissions among them (Jones and Wicks, 1999). Keeping

all this in mind, using the management employees as the key stakeholders and therefore tools of

effecting environmentally conscious change in the organizations leading up to policy making that

reduces carbon emissions, it is seen that for the most part the success in reducing carbon

emission is slowly manifesting as the levels can be seen to decrease from 2012 to 2013. The

impact of the management as stakeholders however was not found to be statistically significant

in 2012. This however could be seen to have overturned in 2013 where companies with policies

to incentivize the management for opting policies to reduce emissions was found to have greater

percentage change in carbon emissions. The paper carried out six t-tests to explore the tentative

relationship of the management as a stakeholder and the impact on emission output measured by

Stakeholder theory talks about the role of the various stakeholder groups in influencing

business decision of corporations and organizations. As per the literature explored, stakeholders

are individuals who have some kind of direct or indirect relationship with the organization, such

that their actions are either aligned with the interest of the organization or vice versa. The may be

categorized into groups of varying degrees of influence. These people would hence act in

accordance to the wellbeing of the organization and vice versa. Thus it is expected that their

position on certain issues could very well influence the position and mission, vision and business

strategy of the organization itself.Stakeholder thus have been a key point of interest and

contention in management studies and those involved in environmental awareness campaigns

have also the approach of stakeholders to combat industrial policies which lead to eco-logical

stress and environmental harm.

It was noted that those in the upper management levels who are at the helm of decision

making could be accounted for as key players in the endeavour to reduce industrial carbon

emissions.Knopff et al. (2010), in their paper discussing the ways organization could be made to

transition to a low carbon emission model, they identified introduction of incentive policies to

incorporate newer technologies which lead to lower emissions for the management level. The

literature reviewed for the purpose of research had isolated the industries in US as major

contributors to global carbon emissions, especially due to their dealing sin oil related businesses

and hence the study took those as representatives to study the phenomenon and effectiveness of

incentive policies in reducing carbon emissions among them (Jones and Wicks, 1999). Keeping

all this in mind, using the management employees as the key stakeholders and therefore tools of

effecting environmentally conscious change in the organizations leading up to policy making that

reduces carbon emissions, it is seen that for the most part the success in reducing carbon

emission is slowly manifesting as the levels can be seen to decrease from 2012 to 2013. The

impact of the management as stakeholders however was not found to be statistically significant

in 2012. This however could be seen to have overturned in 2013 where companies with policies

to incentivize the management for opting policies to reduce emissions was found to have greater

percentage change in carbon emissions. The paper carried out six t-tests to explore the tentative

relationship of the management as a stakeholder and the impact on emission output measured by

percentage change in emissions.Even though the difference could not be found to be significant

for the same group in subsequent years, it is seen that some impact can be identified.

Consequently the study finds that incentive policies have for the most part not been as

successful so as to usher in drastic change in policy within the companies who have adopted

them and even so have not been able to effect immediate significant change between 2012 and

2013. It is not clear whether the policies would have significant impact on a long term basis.

However in 2013 some marginal change in the positive direction as far as reduction in emission

is concerned indicates that some positive impact may be a possibility. However further in depth

and persistent inquiry shall be required to come to any decisive conclusion regarding the

effectiveness of incentivizing the stakeholder group of management level employees to curb

carbon based emissions in the United States at least.

Limitations (ASSESSED): (10%)

The sample used for the study is less than size 50. The sample again had outliers which

led to the usable sample size to be 26. This is too small to amount to any robust result for the

inferential test. The minimum sample size to ensure 95% confidence and 0.05 level of margin of

error is about 250 to 300 which is much higher than the size considered. The t-test also has the

assumption of normality which is never verified given the small size of the sample. The study

therefore is limited in representation. The data also considered only 2 consecutive years to

explore any significant change exists or not. Naturally it is not practical to assume that a

company would be willing to effect such drastic change in policy, endangering its business

process at one go. Thus the scope of the study ought to be more diversified both in terms of

sample size as well as the time. Another limitation is that the study only focussed on companies

which are based in the United States. However many multinational companies of significant

impact in terms of carbon emissions are from outside the US. In fact Asia and South Asia is a

significant player when it comes to carbon emissions, indicating that companies relating to and

based in the regions should also be considered.

for the same group in subsequent years, it is seen that some impact can be identified.

Consequently the study finds that incentive policies have for the most part not been as

successful so as to usher in drastic change in policy within the companies who have adopted

them and even so have not been able to effect immediate significant change between 2012 and

2013. It is not clear whether the policies would have significant impact on a long term basis.

However in 2013 some marginal change in the positive direction as far as reduction in emission

is concerned indicates that some positive impact may be a possibility. However further in depth

and persistent inquiry shall be required to come to any decisive conclusion regarding the

effectiveness of incentivizing the stakeholder group of management level employees to curb

carbon based emissions in the United States at least.

Limitations (ASSESSED): (10%)

The sample used for the study is less than size 50. The sample again had outliers which

led to the usable sample size to be 26. This is too small to amount to any robust result for the

inferential test. The minimum sample size to ensure 95% confidence and 0.05 level of margin of

error is about 250 to 300 which is much higher than the size considered. The t-test also has the

assumption of normality which is never verified given the small size of the sample. The study

therefore is limited in representation. The data also considered only 2 consecutive years to

explore any significant change exists or not. Naturally it is not practical to assume that a

company would be willing to effect such drastic change in policy, endangering its business

process at one go. Thus the scope of the study ought to be more diversified both in terms of

sample size as well as the time. Another limitation is that the study only focussed on companies

which are based in the United States. However many multinational companies of significant

impact in terms of carbon emissions are from outside the US. In fact Asia and South Asia is a

significant player when it comes to carbon emissions, indicating that companies relating to and

based in the regions should also be considered.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Further Research (ASSESSED): (10%)

The study first of all should aim to increase more companies spread out across various

sectors over a longer period of time. The data would then take the structure of a longitudinal

data. The study could include more stakeholders such as the customers as well as the

governments and their policies in their area of operations in addition to the management. The

study would then be required to expand its scope to primary data analysis by collecting opinions

via interviews and surveys of the various stakeholders. The study should also aim to take at least

5 years’ worth of readings and at least 300 companies and even greater number of observations

from the consumers. The study should take companies which are not just limited to the USA but

also from other locations, especially from industrially developing and active regions such as

China and India.

The study first of all should aim to increase more companies spread out across various

sectors over a longer period of time. The data would then take the structure of a longitudinal

data. The study could include more stakeholders such as the customers as well as the

governments and their policies in their area of operations in addition to the management. The

study would then be required to expand its scope to primary data analysis by collecting opinions

via interviews and surveys of the various stakeholders. The study should also aim to take at least

5 years’ worth of readings and at least 300 companies and even greater number of observations

from the consumers. The study should take companies which are not just limited to the USA but

also from other locations, especially from industrially developing and active regions such as

China and India.

Reference for tast 1 and task 2 and task 3

Knopf, B., Edenhofer, O., Flachsland, C., Kok, M.T., Lotze-Campen, H., Luderer, G., Popp, A.

and Van Vuuren, D.P., 2010. Managing the low-carbon transition–from model results to

policies. The Energy Journal, pp.223-245.

Brenner, S.N. andMolander, E.A., 1977. Is ethics of business changing. Harvard Business

Review, 55(1), pp.57-71.

Bridoux, F. and Stoelhorst, J.W., 2014. Microfoundations for stakeholder theory: Managing

stakeholders with heterogeneous motives. Strategic Management Journal, 35(1), pp.107-125.

Clarkson, M.E., 1995. A stakeholder framework for analyzing and evaluating corporate social

performance. Academy of management review, 20(1), pp.92-117.

Donaldson, T., and Preston, L. E. (1995). The stakeholder theory of the corporation: Concepts,

evidence, and implications. Academy of management Review, 20(1), 65-91.

George, B., 2003. Managing stakeholders vs. responding to shareholders. Strategy and

Leadership, 31(6), pp.36-40.

Halal, W.E., 1990. The new management: Business and social institutions in the information

age. Business in the Contemporary World, 2(2), pp.41-54.

Jones, T.M. and Wicks, A.C., 1999. Convergent stakeholder theory. Academy of management

review, 24(2), pp.206-221.

Kreiner, P., A. Bhambri. 1991. Influence and information in organization-stakeholder

relationships. J. E. Post (Ed.) Research in Corporate Social performance and Policy, 12, pp.3-

36.

Wang, J. and Dewhirst, H.D., 1992. Boards of directors and stakeholder orientation. Journal of

business ethics, 11(2), pp.115-123.

Brenner, S.N. and Cochran, P., 1991, July. The stakeholder theory of the firm: Implications for

business and society theory and research. In Proceedings of the international association for

business and society (Vol. 2, pp. 897-933).

Knopf, B., Edenhofer, O., Flachsland, C., Kok, M.T., Lotze-Campen, H., Luderer, G., Popp, A.

and Van Vuuren, D.P., 2010. Managing the low-carbon transition–from model results to

policies. The Energy Journal, pp.223-245.

Brenner, S.N. andMolander, E.A., 1977. Is ethics of business changing. Harvard Business

Review, 55(1), pp.57-71.

Bridoux, F. and Stoelhorst, J.W., 2014. Microfoundations for stakeholder theory: Managing

stakeholders with heterogeneous motives. Strategic Management Journal, 35(1), pp.107-125.

Clarkson, M.E., 1995. A stakeholder framework for analyzing and evaluating corporate social

performance. Academy of management review, 20(1), pp.92-117.

Donaldson, T., and Preston, L. E. (1995). The stakeholder theory of the corporation: Concepts,

evidence, and implications. Academy of management Review, 20(1), 65-91.

George, B., 2003. Managing stakeholders vs. responding to shareholders. Strategy and

Leadership, 31(6), pp.36-40.

Halal, W.E., 1990. The new management: Business and social institutions in the information

age. Business in the Contemporary World, 2(2), pp.41-54.

Jones, T.M. and Wicks, A.C., 1999. Convergent stakeholder theory. Academy of management

review, 24(2), pp.206-221.

Kreiner, P., A. Bhambri. 1991. Influence and information in organization-stakeholder

relationships. J. E. Post (Ed.) Research in Corporate Social performance and Policy, 12, pp.3-

36.

Wang, J. and Dewhirst, H.D., 1992. Boards of directors and stakeholder orientation. Journal of

business ethics, 11(2), pp.115-123.

Brenner, S.N. and Cochran, P., 1991, July. The stakeholder theory of the firm: Implications for

business and society theory and research. In Proceedings of the international association for

business and society (Vol. 2, pp. 897-933).

Mitchell, R.K. and Agle, B.R., 1997, July. Stakeholder identification and salience: Dialogue and

operationalization. In Proceedings of the International Association for Business and

Society (Vol. 8, pp. 717-727).

Norušis, M.J., 2006. SPSS 14.0 guide to data analysis. Upper Saddle River, NJ: Prentice Hall.

operationalization. In Proceedings of the International Association for Business and

Society (Vol. 8, pp. 717-727).

Norušis, M.J., 2006. SPSS 14.0 guide to data analysis. Upper Saddle River, NJ: Prentice Hall.

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.