Starting a Business and Financial Accounting: Desklib Study Material

VerifiedAdded on 2023/06/13

|10

|1367

|295

AI Summary

This study material from Desklib covers the steps to start a business, the role of financial accounting in decision making, and includes examples of journal entries and income statements. The report also compares the profitability of two companies.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Business Transaction

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION ..........................................................................................................................3

TASK...............................................................................................................................................3

1.Describe the steps in starting a business..................................................................................3

2.Explain the role of financial accounting and whom is responsible for decision making.........3

Part B...............................................................................................................................................4

1. Journal entries for F Polk.............................................................................................................4

2. (a) Post the Journal entries into the General Ledger Accounts...............................................5

2. (b) Make the trail balance on 31st August, 2021....................................................................7

PART C............................................................................................................................................7

(a) Make the income Statement of B Moore for the year ending on 30th September, 2021......7

CONCLUSION ...............................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION ..........................................................................................................................3

TASK...............................................................................................................................................3

1.Describe the steps in starting a business..................................................................................3

2.Explain the role of financial accounting and whom is responsible for decision making.........3

Part B...............................................................................................................................................4

1. Journal entries for F Polk.............................................................................................................4

2. (a) Post the Journal entries into the General Ledger Accounts...............................................5

2. (b) Make the trail balance on 31st August, 2021....................................................................7

PART C............................................................................................................................................7

(a) Make the income Statement of B Moore for the year ending on 30th September, 2021......7

CONCLUSION ...............................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

A business transaction is an accounting event which is recorded in accounting system of

an organisation. Business transaction includes exchange of goods services for some

consideration (Kaiser, 2018). Every transactions are classified as business transaction then it is

recorded in the journal. Then these transaction are posted to the ledger and after that trail balance

is prepared to check whether the balance of the accounts match or not. Mark and Spencer is

taken as the reference company.

TASK

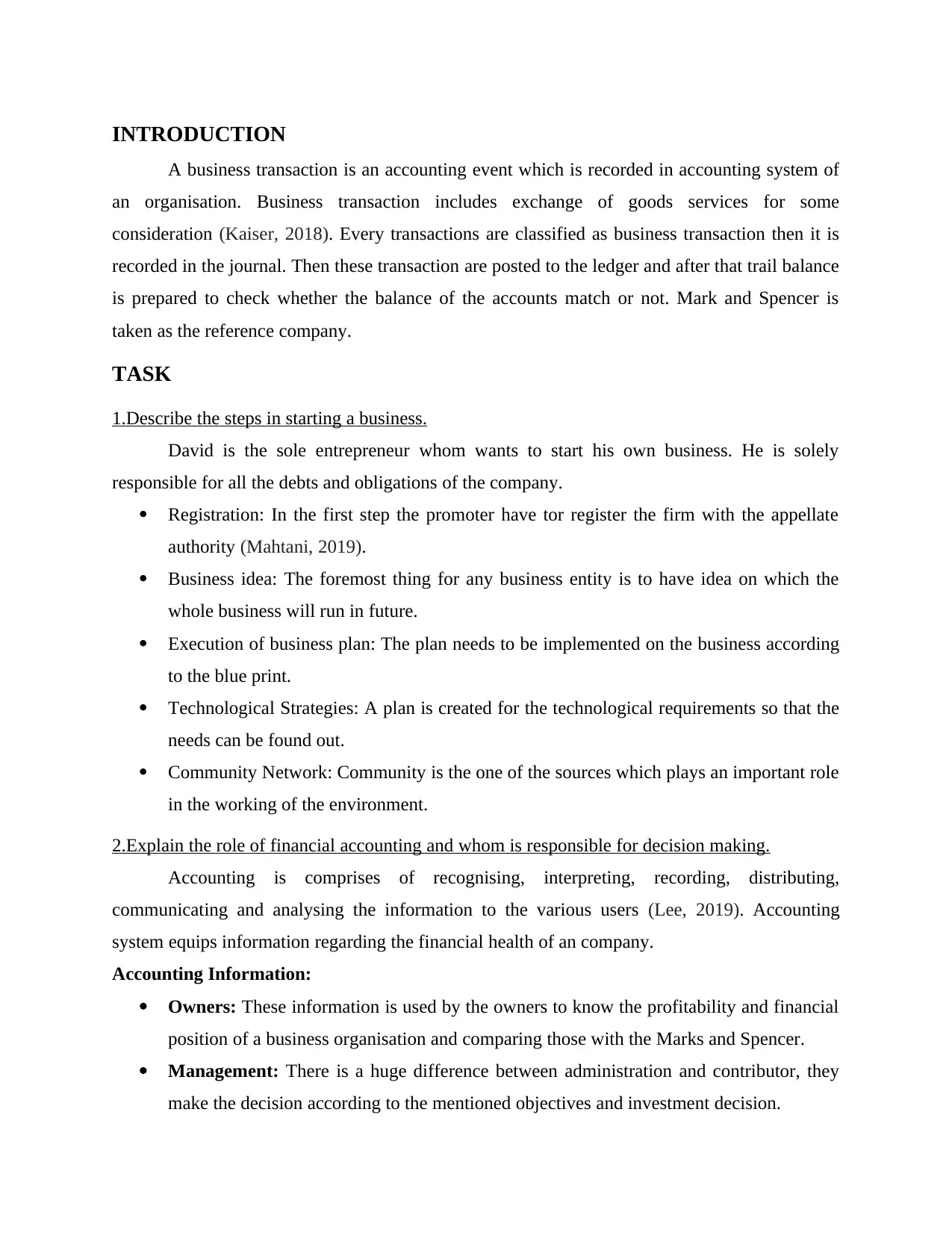

1.Describe the steps in starting a business.

David is the sole entrepreneur whom wants to start his own business. He is solely

responsible for all the debts and obligations of the company.

Registration: In the first step the promoter have tor register the firm with the appellate

authority (Mahtani, 2019).

Business idea: The foremost thing for any business entity is to have idea on which the

whole business will run in future.

Execution of business plan: The plan needs to be implemented on the business according

to the blue print.

Technological Strategies: A plan is created for the technological requirements so that the

needs can be found out.

Community Network: Community is the one of the sources which plays an important role

in the working of the environment.

2.Explain the role of financial accounting and whom is responsible for decision making.

Accounting is comprises of recognising, interpreting, recording, distributing,

communicating and analysing the information to the various users (Lee, 2019). Accounting

system equips information regarding the financial health of an company.

Accounting Information:

Owners: These information is used by the owners to know the profitability and financial

position of a business organisation and comparing those with the Marks and Spencer.

Management: There is a huge difference between administration and contributor, they

make the decision according to the mentioned objectives and investment decision.

A business transaction is an accounting event which is recorded in accounting system of

an organisation. Business transaction includes exchange of goods services for some

consideration (Kaiser, 2018). Every transactions are classified as business transaction then it is

recorded in the journal. Then these transaction are posted to the ledger and after that trail balance

is prepared to check whether the balance of the accounts match or not. Mark and Spencer is

taken as the reference company.

TASK

1.Describe the steps in starting a business.

David is the sole entrepreneur whom wants to start his own business. He is solely

responsible for all the debts and obligations of the company.

Registration: In the first step the promoter have tor register the firm with the appellate

authority (Mahtani, 2019).

Business idea: The foremost thing for any business entity is to have idea on which the

whole business will run in future.

Execution of business plan: The plan needs to be implemented on the business according

to the blue print.

Technological Strategies: A plan is created for the technological requirements so that the

needs can be found out.

Community Network: Community is the one of the sources which plays an important role

in the working of the environment.

2.Explain the role of financial accounting and whom is responsible for decision making.

Accounting is comprises of recognising, interpreting, recording, distributing,

communicating and analysing the information to the various users (Lee, 2019). Accounting

system equips information regarding the financial health of an company.

Accounting Information:

Owners: These information is used by the owners to know the profitability and financial

position of a business organisation and comparing those with the Marks and Spencer.

Management: There is a huge difference between administration and contributor, they

make the decision according to the mentioned objectives and investment decision.

Investors: These are the one whom carry research and analyse those results to know the

financial position of the business. Marks and Spencer, the basic requirement for any

investor is the final accounts of any organisation which is used for the purpose of

investing in a concern.

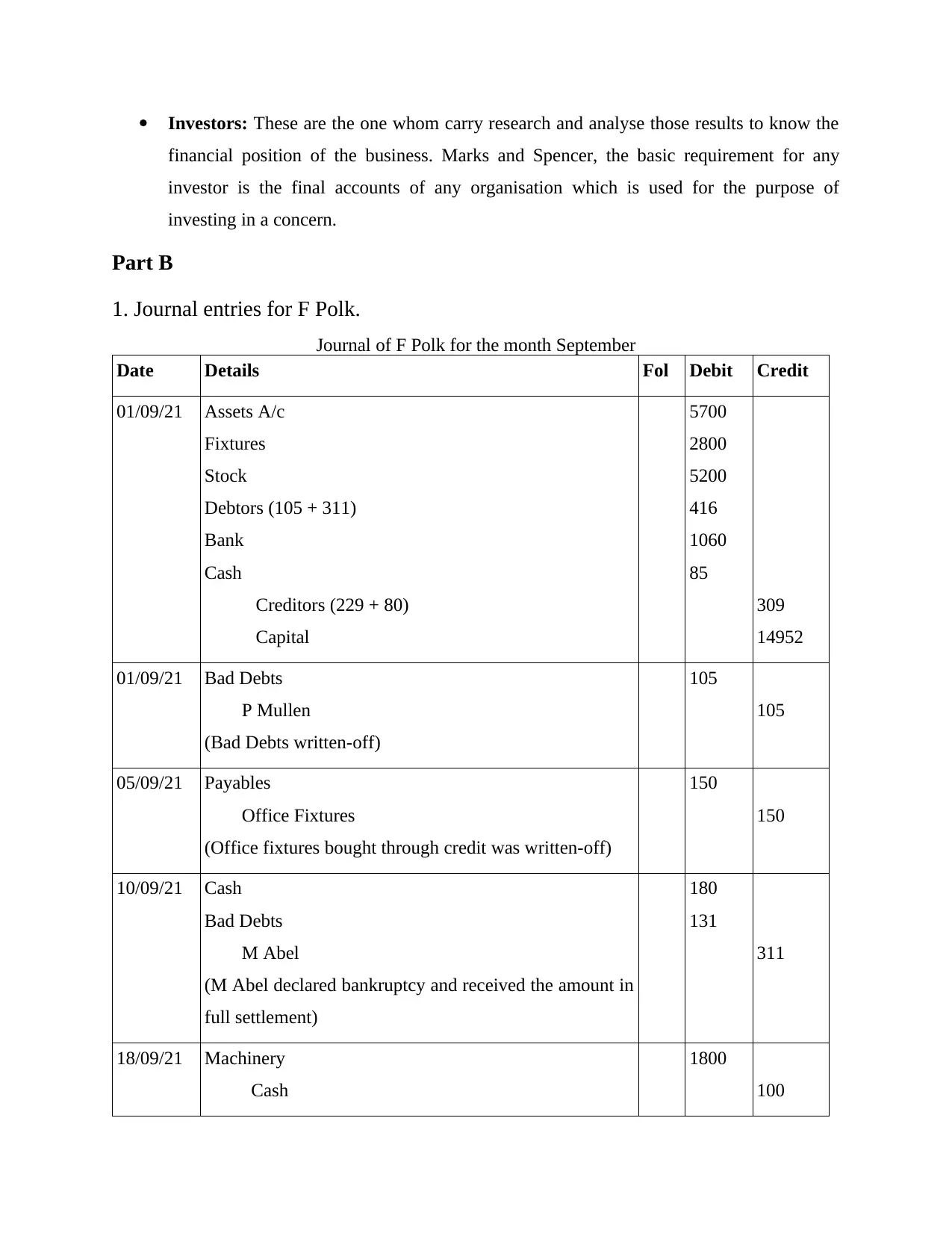

Part B

1. Journal entries for F Polk.

Journal of F Polk for the month September

Date Details Fol Debit Credit

01/09/21 Assets A/c

Fixtures

Stock

Debtors (105 + 311)

Bank

Cash

Creditors (229 + 80)

Capital

5700

2800

5200

416

1060

85

309

14952

01/09/21 Bad Debts

P Mullen

(Bad Debts written-off)

105

105

05/09/21 Payables

Office Fixtures

(Office fixtures bought through credit was written-off)

150

150

10/09/21 Cash

Bad Debts

M Abel

(M Abel declared bankruptcy and received the amount in

full settlement)

180

131

311

18/09/21 Machinery

Cash

1800

100

financial position of the business. Marks and Spencer, the basic requirement for any

investor is the final accounts of any organisation which is used for the purpose of

investing in a concern.

Part B

1. Journal entries for F Polk.

Journal of F Polk for the month September

Date Details Fol Debit Credit

01/09/21 Assets A/c

Fixtures

Stock

Debtors (105 + 311)

Bank

Cash

Creditors (229 + 80)

Capital

5700

2800

5200

416

1060

85

309

14952

01/09/21 Bad Debts

P Mullen

(Bad Debts written-off)

105

105

05/09/21 Payables

Office Fixtures

(Office fixtures bought through credit was written-off)

150

150

10/09/21 Cash

Bad Debts

M Abel

(M Abel declared bankruptcy and received the amount in

full settlement)

180

131

311

18/09/21 Machinery

Cash

1800

100

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

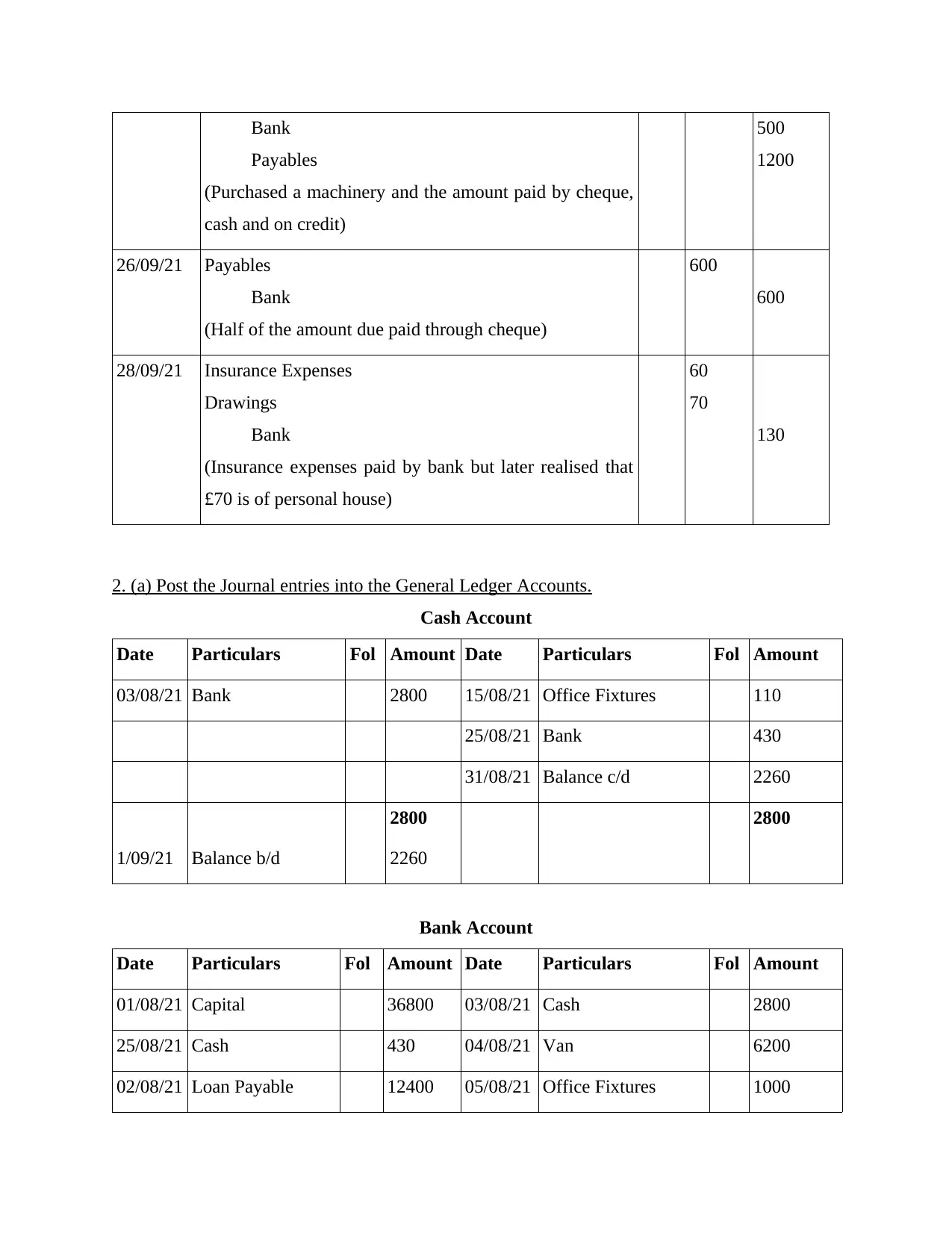

Bank

Payables

(Purchased a machinery and the amount paid by cheque,

cash and on credit)

500

1200

26/09/21 Payables

Bank

(Half of the amount due paid through cheque)

600

600

28/09/21 Insurance Expenses

Drawings

Bank

(Insurance expenses paid by bank but later realised that

£70 is of personal house)

60

70

130

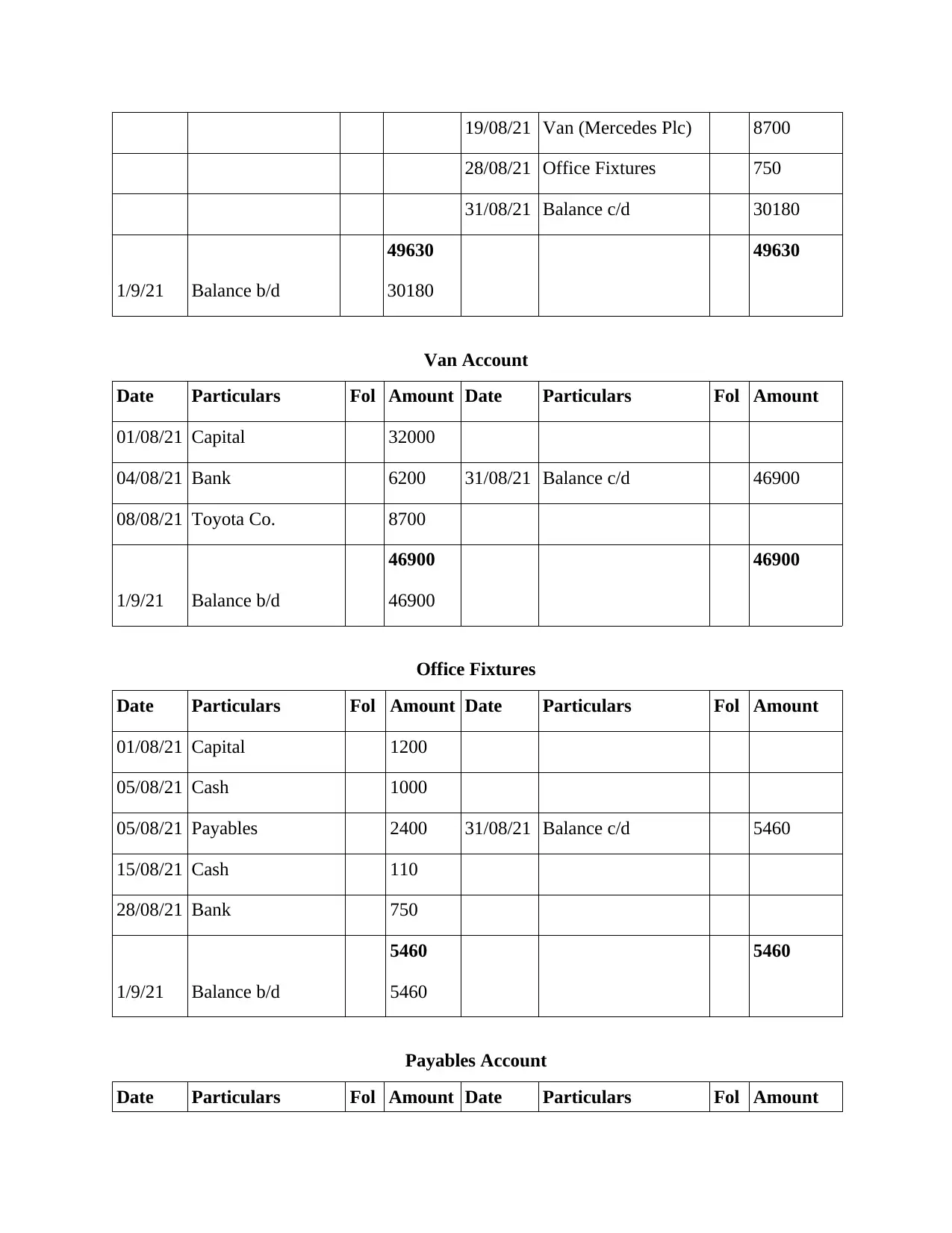

2. (a) Post the Journal entries into the General Ledger Accounts.

Cash Account

Date Particulars Fol Amount Date Particulars Fol Amount

03/08/21 Bank 2800 15/08/21 Office Fixtures 110

25/08/21 Bank 430

31/08/21 Balance c/d 2260

2800 2800

1/09/21 Balance b/d 2260

Bank Account

Date Particulars Fol Amount Date Particulars Fol Amount

01/08/21 Capital 36800 03/08/21 Cash 2800

25/08/21 Cash 430 04/08/21 Van 6200

02/08/21 Loan Payable 12400 05/08/21 Office Fixtures 1000

Payables

(Purchased a machinery and the amount paid by cheque,

cash and on credit)

500

1200

26/09/21 Payables

Bank

(Half of the amount due paid through cheque)

600

600

28/09/21 Insurance Expenses

Drawings

Bank

(Insurance expenses paid by bank but later realised that

£70 is of personal house)

60

70

130

2. (a) Post the Journal entries into the General Ledger Accounts.

Cash Account

Date Particulars Fol Amount Date Particulars Fol Amount

03/08/21 Bank 2800 15/08/21 Office Fixtures 110

25/08/21 Bank 430

31/08/21 Balance c/d 2260

2800 2800

1/09/21 Balance b/d 2260

Bank Account

Date Particulars Fol Amount Date Particulars Fol Amount

01/08/21 Capital 36800 03/08/21 Cash 2800

25/08/21 Cash 430 04/08/21 Van 6200

02/08/21 Loan Payable 12400 05/08/21 Office Fixtures 1000

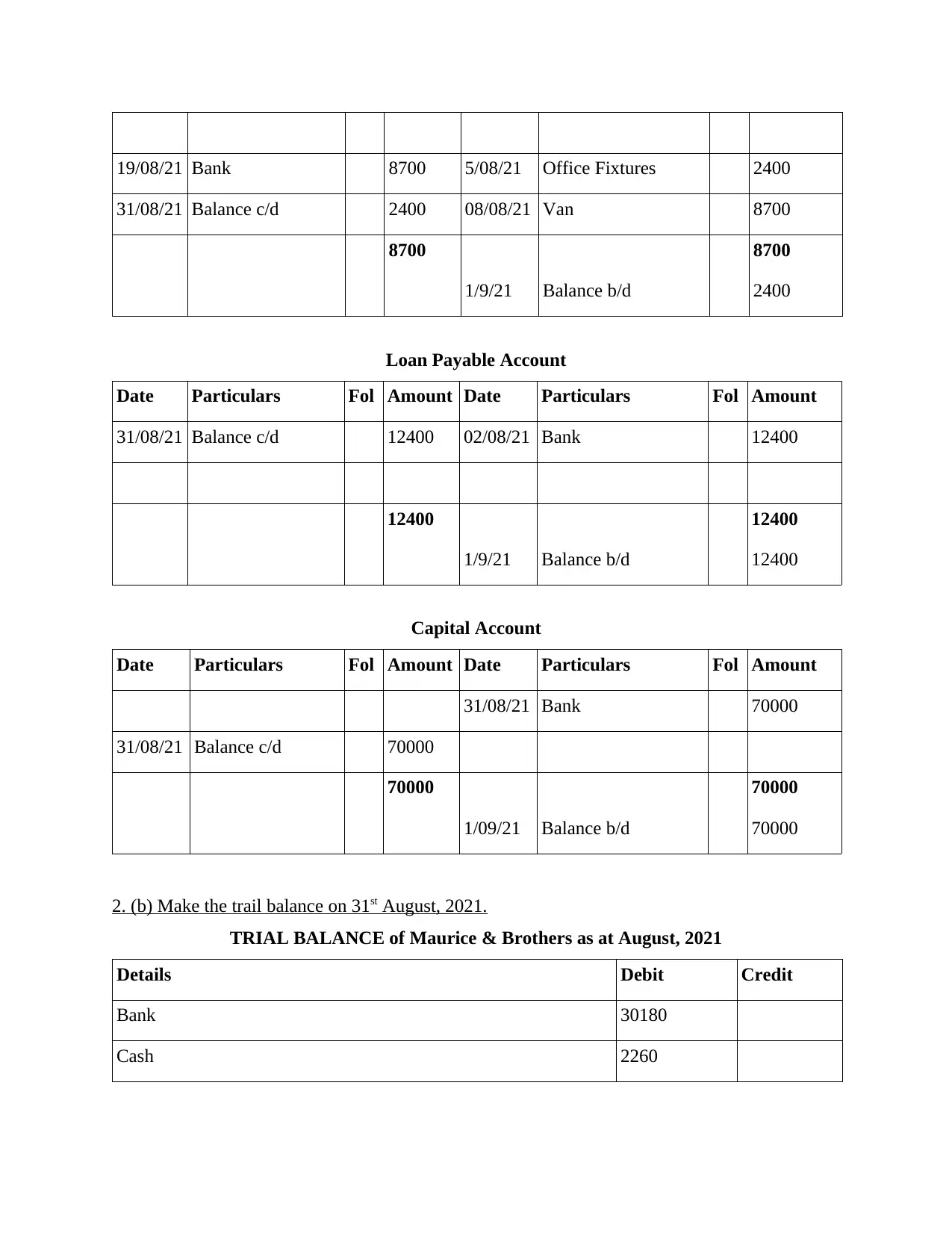

19/08/21 Van (Mercedes Plc) 8700

28/08/21 Office Fixtures 750

31/08/21 Balance c/d 30180

49630 49630

1/9/21 Balance b/d 30180

Van Account

Date Particulars Fol Amount Date Particulars Fol Amount

01/08/21 Capital 32000

04/08/21 Bank 6200 31/08/21 Balance c/d 46900

08/08/21 Toyota Co. 8700

46900 46900

1/9/21 Balance b/d 46900

Office Fixtures

Date Particulars Fol Amount Date Particulars Fol Amount

01/08/21 Capital 1200

05/08/21 Cash 1000

05/08/21 Payables 2400 31/08/21 Balance c/d 5460

15/08/21 Cash 110

28/08/21 Bank 750

5460 5460

1/9/21 Balance b/d 5460

Payables Account

Date Particulars Fol Amount Date Particulars Fol Amount

28/08/21 Office Fixtures 750

31/08/21 Balance c/d 30180

49630 49630

1/9/21 Balance b/d 30180

Van Account

Date Particulars Fol Amount Date Particulars Fol Amount

01/08/21 Capital 32000

04/08/21 Bank 6200 31/08/21 Balance c/d 46900

08/08/21 Toyota Co. 8700

46900 46900

1/9/21 Balance b/d 46900

Office Fixtures

Date Particulars Fol Amount Date Particulars Fol Amount

01/08/21 Capital 1200

05/08/21 Cash 1000

05/08/21 Payables 2400 31/08/21 Balance c/d 5460

15/08/21 Cash 110

28/08/21 Bank 750

5460 5460

1/9/21 Balance b/d 5460

Payables Account

Date Particulars Fol Amount Date Particulars Fol Amount

19/08/21 Bank 8700 5/08/21 Office Fixtures 2400

31/08/21 Balance c/d 2400 08/08/21 Van 8700

8700 8700

1/9/21 Balance b/d 2400

Loan Payable Account

Date Particulars Fol Amount Date Particulars Fol Amount

31/08/21 Balance c/d 12400 02/08/21 Bank 12400

12400 12400

1/9/21 Balance b/d 12400

Capital Account

Date Particulars Fol Amount Date Particulars Fol Amount

31/08/21 Bank 70000

31/08/21 Balance c/d 70000

70000 70000

1/09/21 Balance b/d 70000

2. (b) Make the trail balance on 31st August, 2021.

TRIAL BALANCE of Maurice & Brothers as at August, 2021

Details Debit Credit

Bank 30180

Cash 2260

31/08/21 Balance c/d 2400 08/08/21 Van 8700

8700 8700

1/9/21 Balance b/d 2400

Loan Payable Account

Date Particulars Fol Amount Date Particulars Fol Amount

31/08/21 Balance c/d 12400 02/08/21 Bank 12400

12400 12400

1/9/21 Balance b/d 12400

Capital Account

Date Particulars Fol Amount Date Particulars Fol Amount

31/08/21 Bank 70000

31/08/21 Balance c/d 70000

70000 70000

1/09/21 Balance b/d 70000

2. (b) Make the trail balance on 31st August, 2021.

TRIAL BALANCE of Maurice & Brothers as at August, 2021

Details Debit Credit

Bank 30180

Cash 2260

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

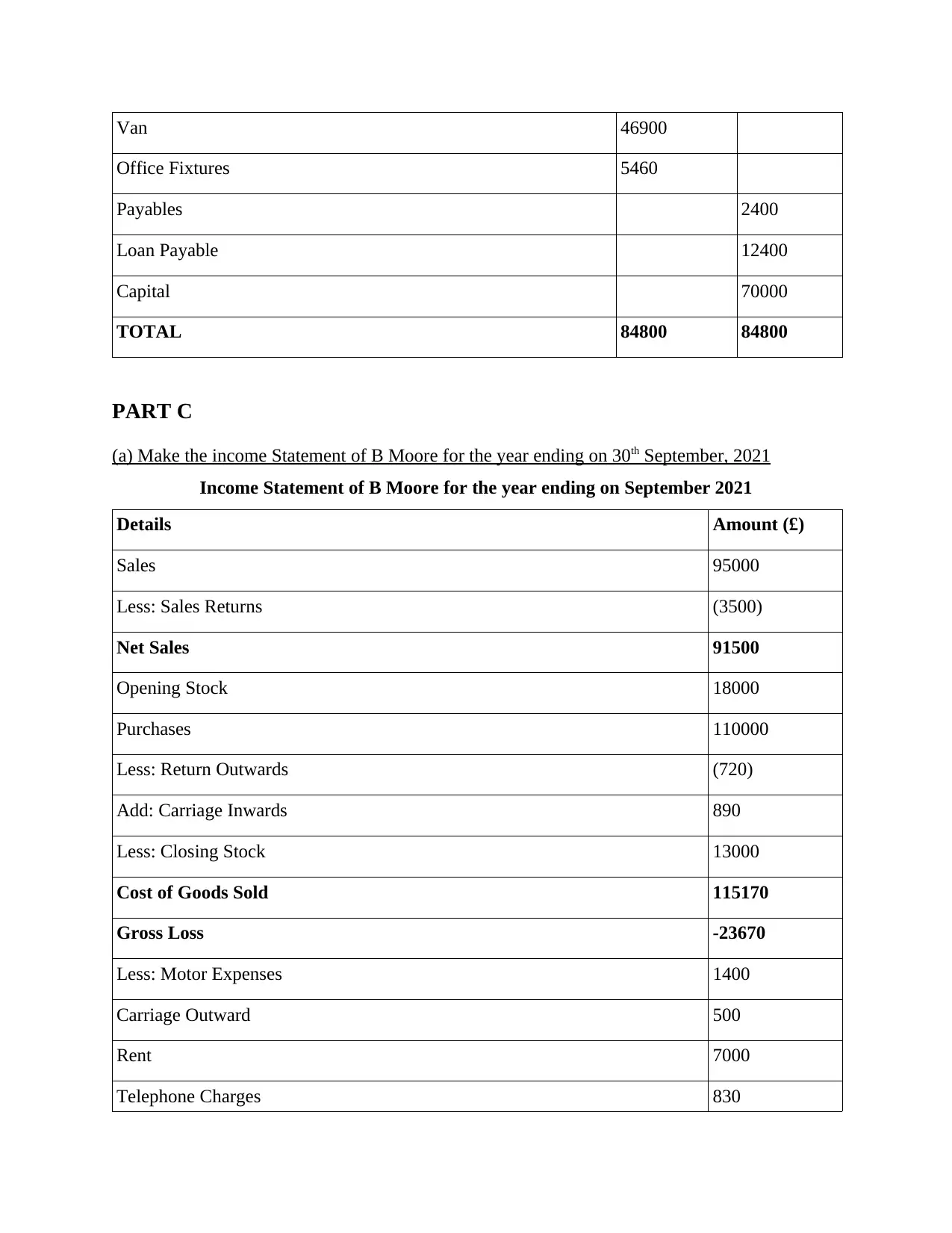

Van 46900

Office Fixtures 5460

Payables 2400

Loan Payable 12400

Capital 70000

TOTAL 84800 84800

PART C

(a) Make the income Statement of B Moore for the year ending on 30th September, 2021

Income Statement of B Moore for the year ending on September 2021

Details Amount (£)

Sales 95000

Less: Sales Returns (3500)

Net Sales 91500

Opening Stock 18000

Purchases 110000

Less: Return Outwards (720)

Add: Carriage Inwards 890

Less: Closing Stock 13000

Cost of Goods Sold 115170

Gross Loss -23670

Less: Motor Expenses 1400

Carriage Outward 500

Rent 7000

Telephone Charges 830

Office Fixtures 5460

Payables 2400

Loan Payable 12400

Capital 70000

TOTAL 84800 84800

PART C

(a) Make the income Statement of B Moore for the year ending on 30th September, 2021

Income Statement of B Moore for the year ending on September 2021

Details Amount (£)

Sales 95000

Less: Sales Returns (3500)

Net Sales 91500

Opening Stock 18000

Purchases 110000

Less: Return Outwards (720)

Add: Carriage Inwards 890

Less: Closing Stock 13000

Cost of Goods Sold 115170

Gross Loss -23670

Less: Motor Expenses 1400

Carriage Outward 500

Rent 7000

Telephone Charges 830

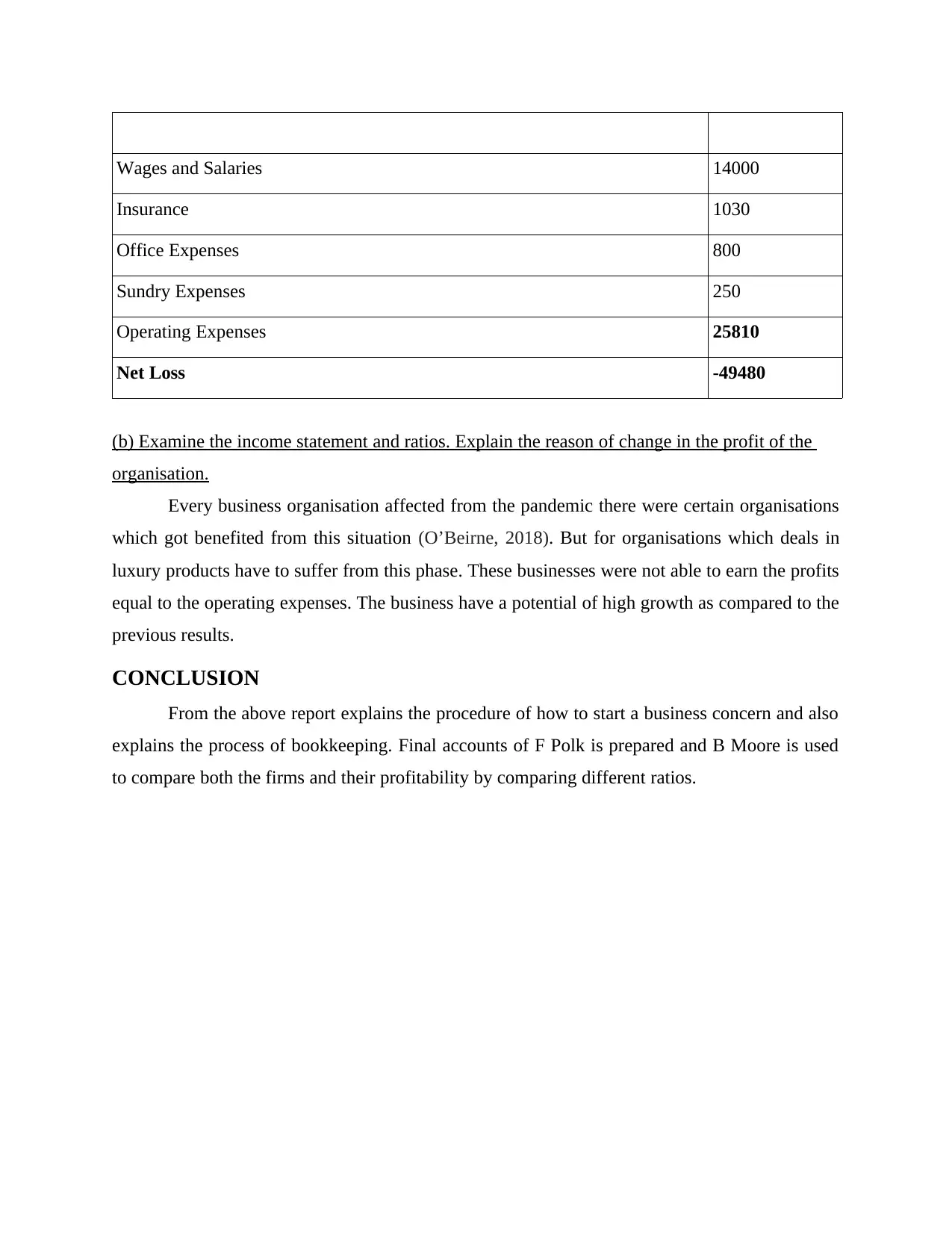

Wages and Salaries 14000

Insurance 1030

Office Expenses 800

Sundry Expenses 250

Operating Expenses 25810

Net Loss -49480

(b) Examine the income statement and ratios. Explain the reason of change in the profit of the

organisation.

Every business organisation affected from the pandemic there were certain organisations

which got benefited from this situation (O’Beirne, 2018). But for organisations which deals in

luxury products have to suffer from this phase. These businesses were not able to earn the profits

equal to the operating expenses. The business have a potential of high growth as compared to the

previous results.

CONCLUSION

From the above report explains the procedure of how to start a business concern and also

explains the process of bookkeeping. Final accounts of F Polk is prepared and B Moore is used

to compare both the firms and their profitability by comparing different ratios.

Insurance 1030

Office Expenses 800

Sundry Expenses 250

Operating Expenses 25810

Net Loss -49480

(b) Examine the income statement and ratios. Explain the reason of change in the profit of the

organisation.

Every business organisation affected from the pandemic there were certain organisations

which got benefited from this situation (O’Beirne, 2018). But for organisations which deals in

luxury products have to suffer from this phase. These businesses were not able to earn the profits

equal to the operating expenses. The business have a potential of high growth as compared to the

previous results.

CONCLUSION

From the above report explains the procedure of how to start a business concern and also

explains the process of bookkeeping. Final accounts of F Polk is prepared and B Moore is used

to compare both the firms and their profitability by comparing different ratios.

REFERENCES

Books and Journals

Jia, P., 2018. Book review: David Banks, The Birth of the Academic Article: Le Journal des

Sçavans and the Philosophical Transactions 1665–1700.

Kaiser, C., 2018. Privacy and Identity Issues in Financial Transactions: The proportionality of

the European anti-money laundering legislation (Doctoral dissertation, University of

Groningen).

Lee, I., 2019. The Internet of Things for enterprises: An ecosystem, architecture, and IoT service

business model. Internet of Things. 7. p.100078.

Mahtani, U.S., 2019. Related party transactions in India and their impact on reported

earnings. The Journal of Developing Areas. 53(1).

O’Beirne, C., 2018. Information and communications technology and its use in sport business.

In Managing Sport Business (pp. 502-514). Routledge.

Books and Journals

Jia, P., 2018. Book review: David Banks, The Birth of the Academic Article: Le Journal des

Sçavans and the Philosophical Transactions 1665–1700.

Kaiser, C., 2018. Privacy and Identity Issues in Financial Transactions: The proportionality of

the European anti-money laundering legislation (Doctoral dissertation, University of

Groningen).

Lee, I., 2019. The Internet of Things for enterprises: An ecosystem, architecture, and IoT service

business model. Internet of Things. 7. p.100078.

Mahtani, U.S., 2019. Related party transactions in India and their impact on reported

earnings. The Journal of Developing Areas. 53(1).

O’Beirne, C., 2018. Information and communications technology and its use in sport business.

In Managing Sport Business (pp. 502-514). Routledge.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.