University Study: Analyzing Tax Return Lodgment Methods and Trends

VerifiedAdded on 2020/05/16

|11

|1604

|109

Report

AI Summary

This report presents a statistical analysis of tax return lodgment methods in Australia, examining the preferences of taxpayers regarding the use of tax agents versus self-lodgment. The study utilizes two datasets, one secondary and one primary, to investigate the relationship between lodgment methods, age groups, and income levels. The analysis includes graphical displays, confidence intervals, and a chi-square test to determine the association between age and lodgment method. The findings reveal that a majority of the population prefers using tax agents, though international students show a different trend. Furthermore, a positive linear relationship exists between total income and deduction amounts. The report concludes with recommendations for future research, suggesting a focus on diverse samples and larger sample sizes to collect more varied perspectives. The report highlights the importance of understanding taxpayer behavior for effective tax administration and policy making.

Statistics and data analysis

Student Name:

University

23rd January 2018

Student Name:

University

23rd January 2018

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Section 1: Introduction....................................................................................................................4

Brief introduction.........................................................................................................................4

Dataset 1.......................................................................................................................................4

Dataset 2.......................................................................................................................................4

Section 2: Lodgment Method – Dataset 1.......................................................................................5

95% confidence intervals.............................................................................................................5

Section 3: Lodgment Method – Dataset 2.......................................................................................6

Graphical Display........................................................................................................................6

95% confidence interval...............................................................................................................7

Section 4: Lodgment Method and Age Group.................................................................................7

Test of association........................................................................................................................8

Section 5: Lodgment Method and Total Income Amount...............................................................9

Section 6: Total Income Amount and Deduction Amount............................................................10

Section 7: Conclusion....................................................................................................................10

Section 1: Introduction....................................................................................................................4

Brief introduction.........................................................................................................................4

Dataset 1.......................................................................................................................................4

Dataset 2.......................................................................................................................................4

Section 2: Lodgment Method – Dataset 1.......................................................................................5

95% confidence intervals.............................................................................................................5

Section 3: Lodgment Method – Dataset 2.......................................................................................6

Graphical Display........................................................................................................................6

95% confidence interval...............................................................................................................7

Section 4: Lodgment Method and Age Group.................................................................................7

Test of association........................................................................................................................8

Section 5: Lodgment Method and Total Income Amount...............................................................9

Section 6: Total Income Amount and Deduction Amount............................................................10

Section 7: Conclusion....................................................................................................................10

List of tables

Table 1: List of five cases of the dataset..........................................................................................4

Table 2: Comparison of lodgment method versus age group..........................................................8

Table 3: Chi-Square Tests...............................................................................................................8

List of figures

Figure 1: Pie chart on lodgment method..........................................................................................5

Figure 2: Pie chart on whether participants would want to use tax agents......................................6

Figure 4: Comparative bar chart of tax lodgment method versus age group...................................7

Figure 5: Average total income amount based on lodgment method..............................................9

Figure 6: A scatter plot of total income amount versus deduction amount...................................10

Table 1: List of five cases of the dataset..........................................................................................4

Table 2: Comparison of lodgment method versus age group..........................................................8

Table 3: Chi-Square Tests...............................................................................................................8

List of figures

Figure 1: Pie chart on lodgment method..........................................................................................5

Figure 2: Pie chart on whether participants would want to use tax agents......................................6

Figure 4: Comparative bar chart of tax lodgment method versus age group...................................7

Figure 5: Average total income amount based on lodgment method..............................................9

Figure 6: A scatter plot of total income amount versus deduction amount...................................10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Section 1: Introduction

Introduction

This study sought to investigate and understand the current behavior of the Australian population

in relation to the tax returns lodgment methods. The citizens can file their tax returns on their

own or they can involve the services of tax agents. So essentially we sought to investigate the

proportion of those who want to engage the tax agents and how much income they have.

Dataset 1

Dataset is a secondary dataset that has five variables in total. The variables are lodgment method,

age group, gender, total deducted amount and lastly total income amount. Tax lodgment method

and gender are nominal variables. Age group on the other hand is an ordinal variable while total

deducted amount and the total income amount are numerical variables

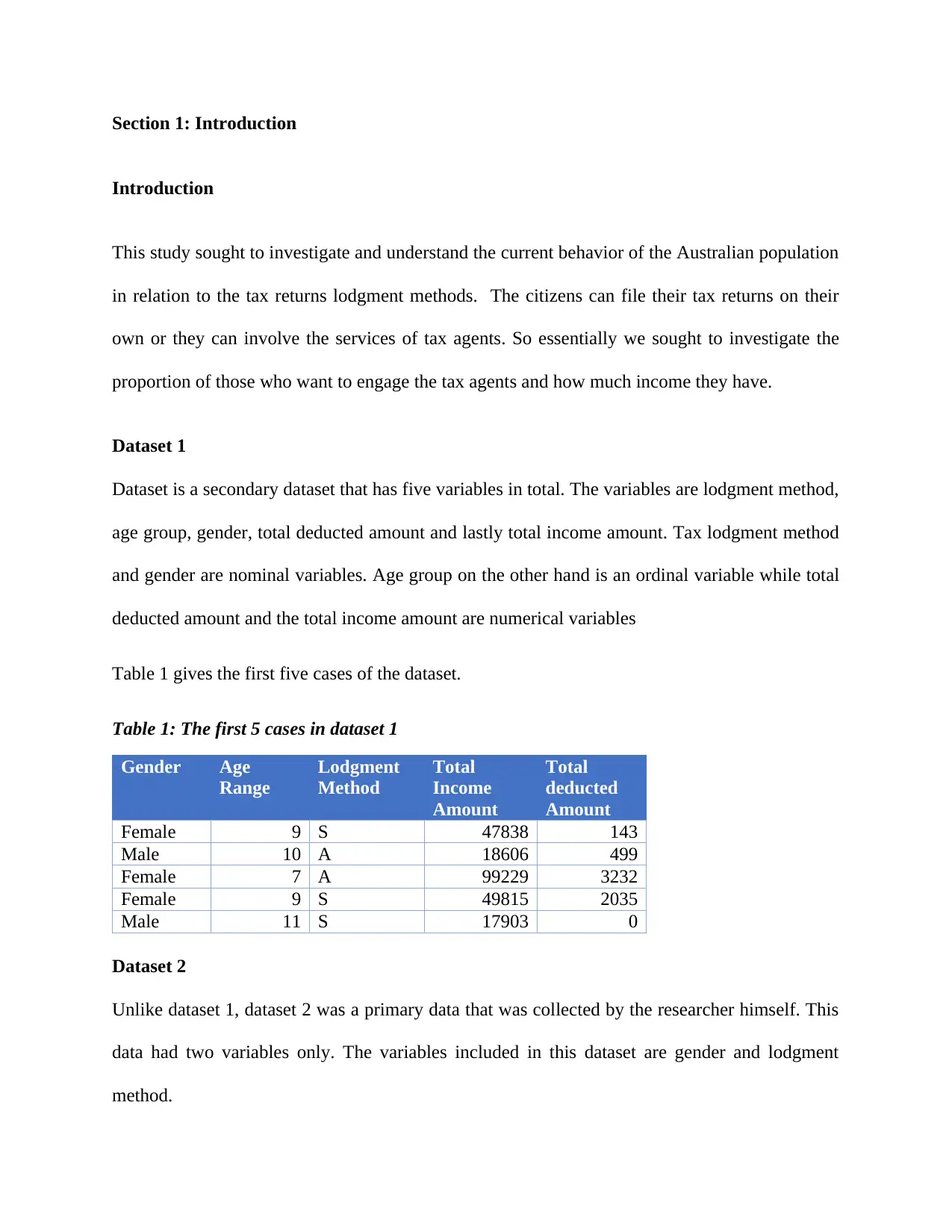

Table 1 gives the first five cases of the dataset.

Table 1: The first 5 cases in dataset 1

Gender Age

Range

Lodgment

Method

Total

Income

Amount

Total

deducted

Amount

Female 9 S 47838 143

Male 10 A 18606 499

Female 7 A 99229 3232

Female 9 S 49815 2035

Male 11 S 17903 0

Dataset 2

Unlike dataset 1, dataset 2 was a primary data that was collected by the researcher himself. This

data had two variables only. The variables included in this dataset are gender and lodgment

method.

Introduction

This study sought to investigate and understand the current behavior of the Australian population

in relation to the tax returns lodgment methods. The citizens can file their tax returns on their

own or they can involve the services of tax agents. So essentially we sought to investigate the

proportion of those who want to engage the tax agents and how much income they have.

Dataset 1

Dataset is a secondary dataset that has five variables in total. The variables are lodgment method,

age group, gender, total deducted amount and lastly total income amount. Tax lodgment method

and gender are nominal variables. Age group on the other hand is an ordinal variable while total

deducted amount and the total income amount are numerical variables

Table 1 gives the first five cases of the dataset.

Table 1: The first 5 cases in dataset 1

Gender Age

Range

Lodgment

Method

Total

Income

Amount

Total

deducted

Amount

Female 9 S 47838 143

Male 10 A 18606 499

Female 7 A 99229 3232

Female 9 S 49815 2035

Male 11 S 17903 0

Dataset 2

Unlike dataset 1, dataset 2 was a primary data that was collected by the researcher himself. This

data had two variables only. The variables included in this dataset are gender and lodgment

method.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Section 2: Lodgment Method – Dataset 1

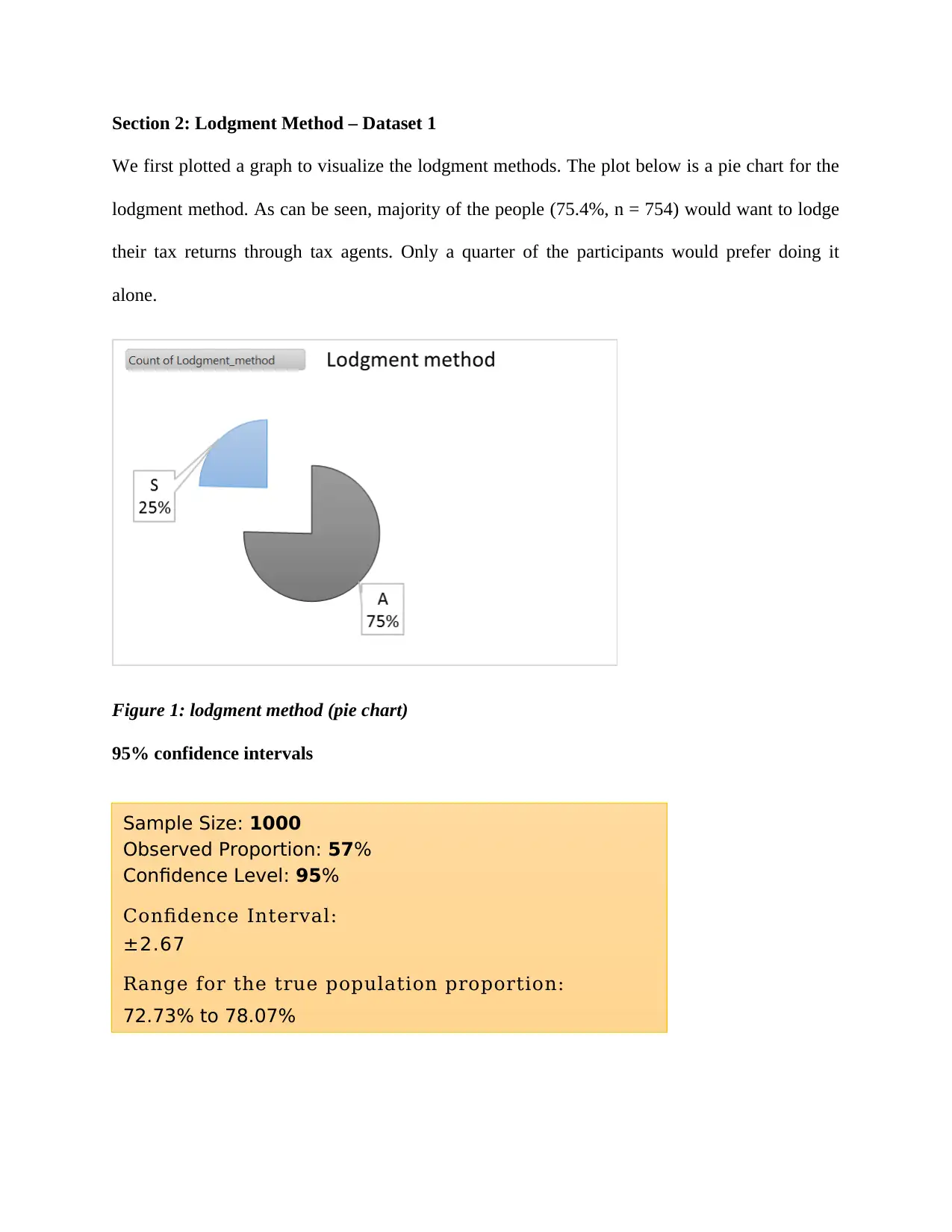

We first plotted a graph to visualize the lodgment methods. The plot below is a pie chart for the

lodgment method. As can be seen, majority of the people (75.4%, n = 754) would want to lodge

their tax returns through tax agents. Only a quarter of the participants would prefer doing it

alone.

Figure 1: lodgment method (pie chart)

95% confidence intervals

Sample Size: 1000

Observed Proportion: 57%

Confidence Level: 95%

Confidence Interval:

±2.67

Range for the true population proportion:

72.73% to 78.07%

We first plotted a graph to visualize the lodgment methods. The plot below is a pie chart for the

lodgment method. As can be seen, majority of the people (75.4%, n = 754) would want to lodge

their tax returns through tax agents. Only a quarter of the participants would prefer doing it

alone.

Figure 1: lodgment method (pie chart)

95% confidence intervals

Sample Size: 1000

Observed Proportion: 57%

Confidence Level: 95%

Confidence Interval:

±2.67

Range for the true population proportion:

72.73% to 78.07%

The above results shows that we 95% confident that the sample proportion is between72.73%

and 78.07% for the persons who would use the tax agents in lodging tax returns.

Section 3: Lodgment Method – Dataset 2

Graphical Display

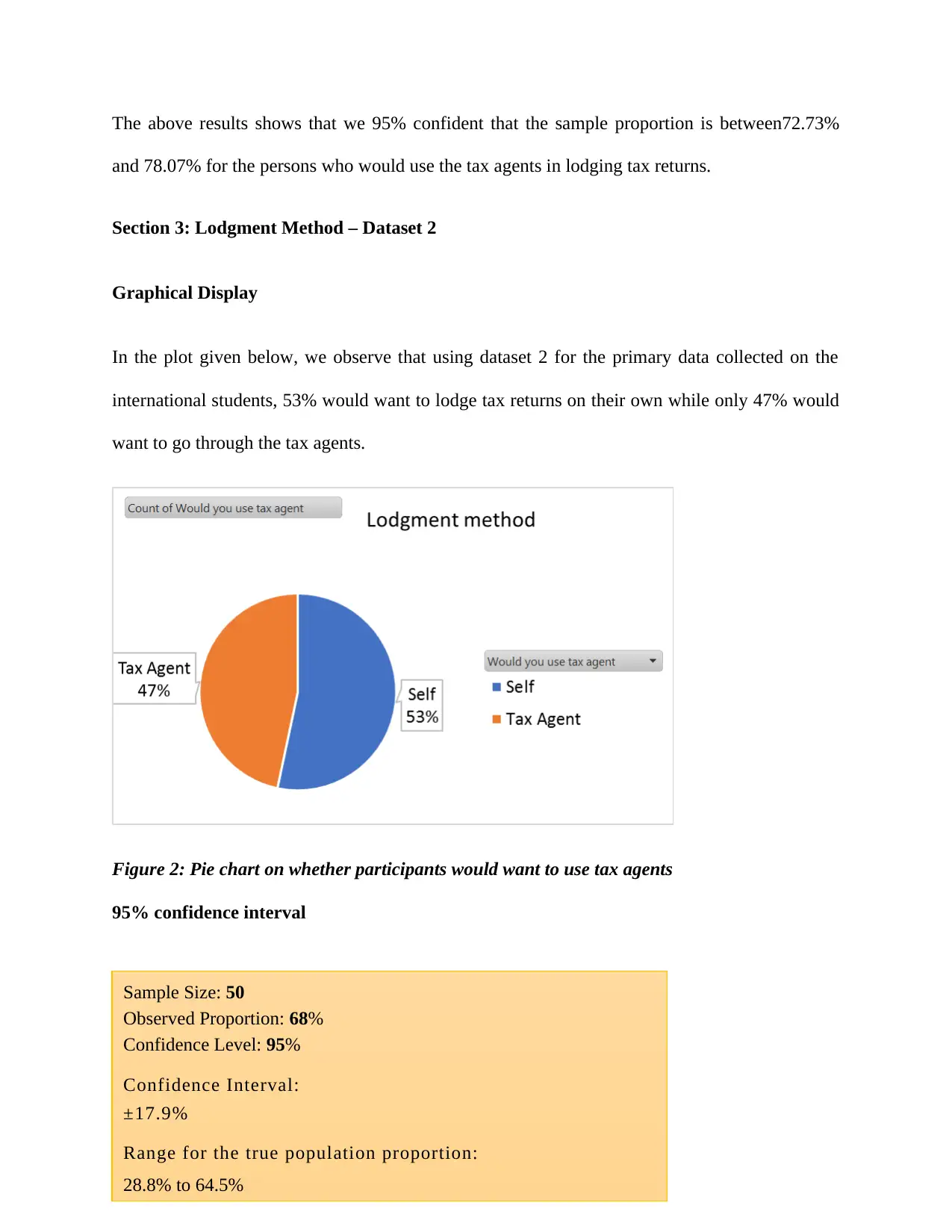

In the plot given below, we observe that using dataset 2 for the primary data collected on the

international students, 53% would want to lodge tax returns on their own while only 47% would

want to go through the tax agents.

Figure 2: Pie chart on whether participants would want to use tax agents

95% confidence interval

Sample Size: 50

Observed Proportion: 68%

Confidence Level: 95%

Confidence Interval:

±17.9%

Range for the true population proportion:

28.8% to 64.5%

and 78.07% for the persons who would use the tax agents in lodging tax returns.

Section 3: Lodgment Method – Dataset 2

Graphical Display

In the plot given below, we observe that using dataset 2 for the primary data collected on the

international students, 53% would want to lodge tax returns on their own while only 47% would

want to go through the tax agents.

Figure 2: Pie chart on whether participants would want to use tax agents

95% confidence interval

Sample Size: 50

Observed Proportion: 68%

Confidence Level: 95%

Confidence Interval:

±17.9%

Range for the true population proportion:

28.8% to 64.5%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

From the above results, we are 95% confident that the sample proportion is between 28.8% and

64.5% for the international students who want to use the tax agents to lodge tax returns.

In comparison with dataset 1, we observe that a much lower percent of people are willing to

lodge tax returns by going through the tax agents in dataset 2 as compared to dataset 1.

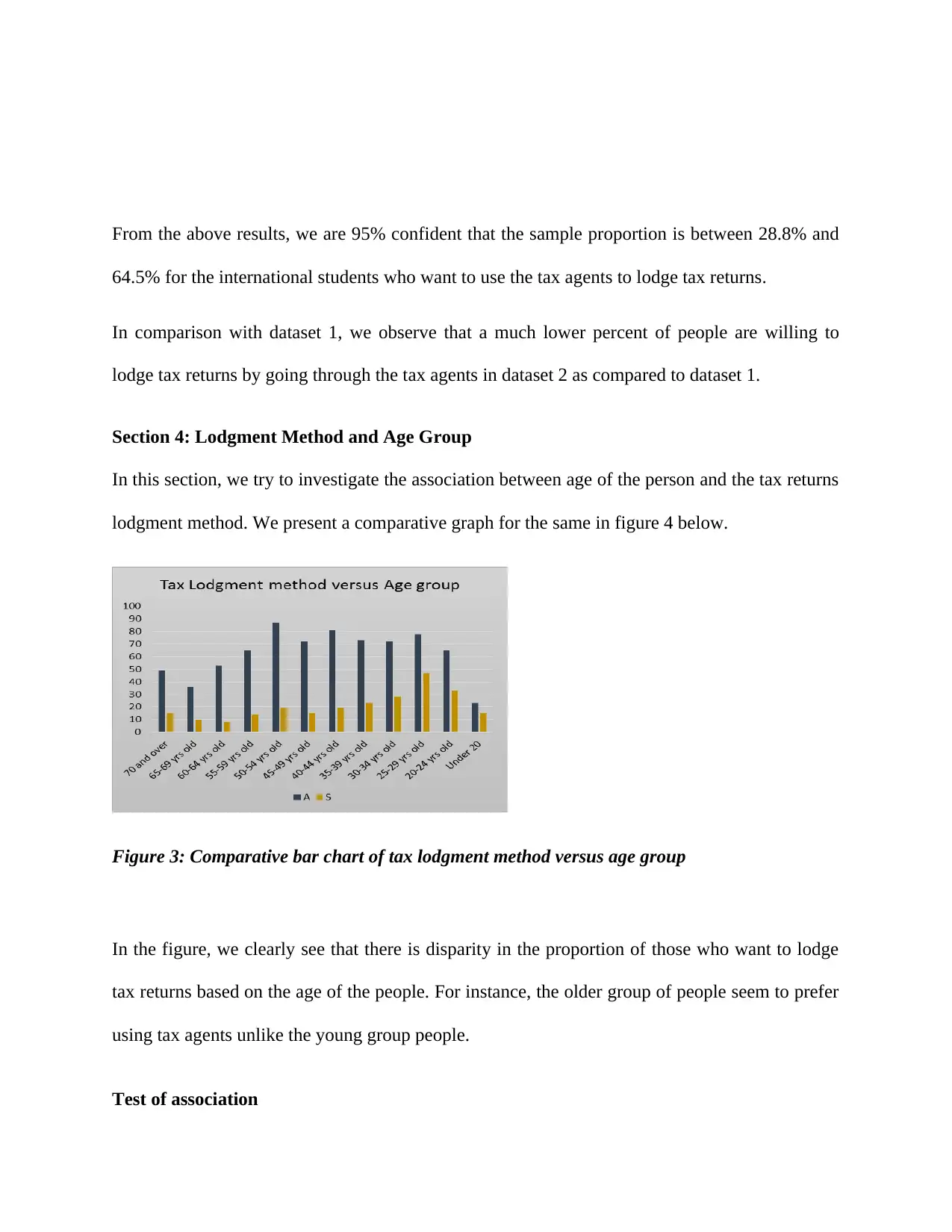

Section 4: Lodgment Method and Age Group

In this section, we try to investigate the association between age of the person and the tax returns

lodgment method. We present a comparative graph for the same in figure 4 below.

Figure 3: Comparative bar chart of tax lodgment method versus age group

In the figure, we clearly see that there is disparity in the proportion of those who want to lodge

tax returns based on the age of the people. For instance, the older group of people seem to prefer

using tax agents unlike the young group people.

Test of association

64.5% for the international students who want to use the tax agents to lodge tax returns.

In comparison with dataset 1, we observe that a much lower percent of people are willing to

lodge tax returns by going through the tax agents in dataset 2 as compared to dataset 1.

Section 4: Lodgment Method and Age Group

In this section, we try to investigate the association between age of the person and the tax returns

lodgment method. We present a comparative graph for the same in figure 4 below.

Figure 3: Comparative bar chart of tax lodgment method versus age group

In the figure, we clearly see that there is disparity in the proportion of those who want to lodge

tax returns based on the age of the people. For instance, the older group of people seem to prefer

using tax agents unlike the young group people.

Test of association

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

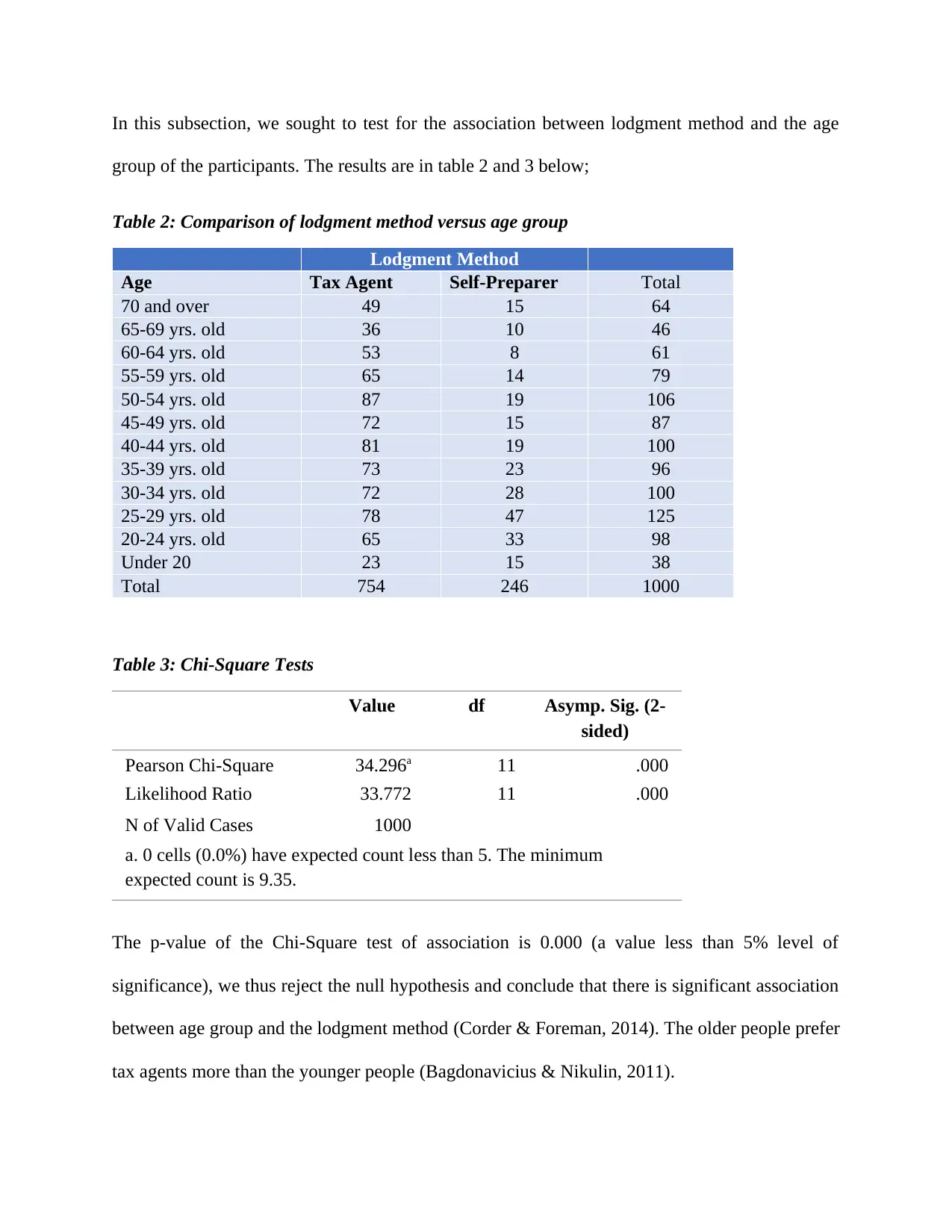

In this subsection, we sought to test for the association between lodgment method and the age

group of the participants. The results are in table 2 and 3 below;

Table 2: Comparison of lodgment method versus age group

Lodgment Method

Age Tax Agent Self-Preparer Total

70 and over 49 15 64

65-69 yrs. old 36 10 46

60-64 yrs. old 53 8 61

55-59 yrs. old 65 14 79

50-54 yrs. old 87 19 106

45-49 yrs. old 72 15 87

40-44 yrs. old 81 19 100

35-39 yrs. old 73 23 96

30-34 yrs. old 72 28 100

25-29 yrs. old 78 47 125

20-24 yrs. old 65 33 98

Under 20 23 15 38

Total 754 246 1000

Table 3: Chi-Square Tests

Value df Asymp. Sig. (2-

sided)

Pearson Chi-Square 34.296a 11 .000

Likelihood Ratio 33.772 11 .000

N of Valid Cases 1000

a. 0 cells (0.0%) have expected count less than 5. The minimum

expected count is 9.35.

The p-value of the Chi-Square test of association is 0.000 (a value less than 5% level of

significance), we thus reject the null hypothesis and conclude that there is significant association

between age group and the lodgment method (Corder & Foreman, 2014). The older people prefer

tax agents more than the younger people (Bagdonavicius & Nikulin, 2011).

group of the participants. The results are in table 2 and 3 below;

Table 2: Comparison of lodgment method versus age group

Lodgment Method

Age Tax Agent Self-Preparer Total

70 and over 49 15 64

65-69 yrs. old 36 10 46

60-64 yrs. old 53 8 61

55-59 yrs. old 65 14 79

50-54 yrs. old 87 19 106

45-49 yrs. old 72 15 87

40-44 yrs. old 81 19 100

35-39 yrs. old 73 23 96

30-34 yrs. old 72 28 100

25-29 yrs. old 78 47 125

20-24 yrs. old 65 33 98

Under 20 23 15 38

Total 754 246 1000

Table 3: Chi-Square Tests

Value df Asymp. Sig. (2-

sided)

Pearson Chi-Square 34.296a 11 .000

Likelihood Ratio 33.772 11 .000

N of Valid Cases 1000

a. 0 cells (0.0%) have expected count less than 5. The minimum

expected count is 9.35.

The p-value of the Chi-Square test of association is 0.000 (a value less than 5% level of

significance), we thus reject the null hypothesis and conclude that there is significant association

between age group and the lodgment method (Corder & Foreman, 2014). The older people prefer

tax agents more than the younger people (Bagdonavicius & Nikulin, 2011).

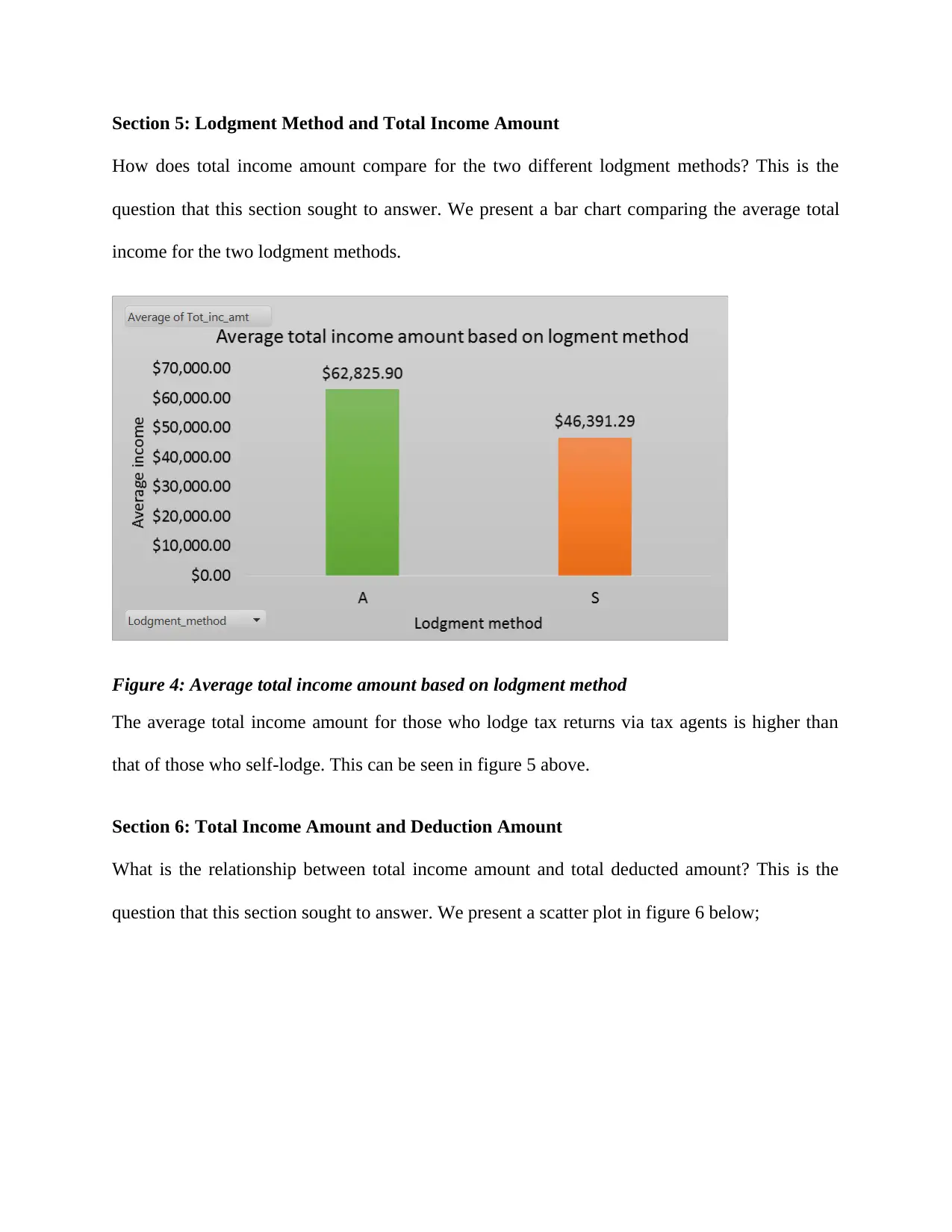

Section 5: Lodgment Method and Total Income Amount

How does total income amount compare for the two different lodgment methods? This is the

question that this section sought to answer. We present a bar chart comparing the average total

income for the two lodgment methods.

Figure 4: Average total income amount based on lodgment method

The average total income amount for those who lodge tax returns via tax agents is higher than

that of those who self-lodge. This can be seen in figure 5 above.

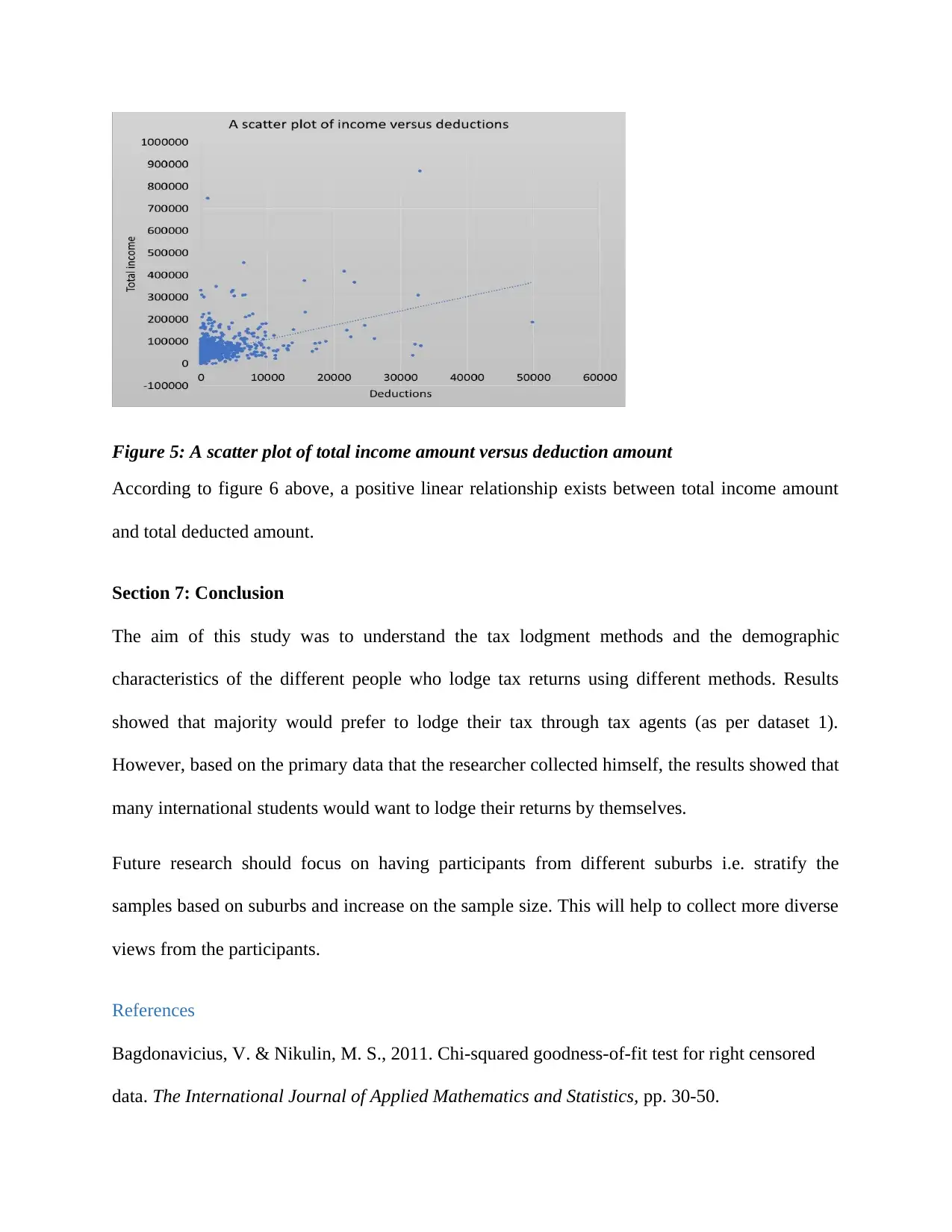

Section 6: Total Income Amount and Deduction Amount

What is the relationship between total income amount and total deducted amount? This is the

question that this section sought to answer. We present a scatter plot in figure 6 below;

How does total income amount compare for the two different lodgment methods? This is the

question that this section sought to answer. We present a bar chart comparing the average total

income for the two lodgment methods.

Figure 4: Average total income amount based on lodgment method

The average total income amount for those who lodge tax returns via tax agents is higher than

that of those who self-lodge. This can be seen in figure 5 above.

Section 6: Total Income Amount and Deduction Amount

What is the relationship between total income amount and total deducted amount? This is the

question that this section sought to answer. We present a scatter plot in figure 6 below;

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Figure 5: A scatter plot of total income amount versus deduction amount

According to figure 6 above, a positive linear relationship exists between total income amount

and total deducted amount.

Section 7: Conclusion

The aim of this study was to understand the tax lodgment methods and the demographic

characteristics of the different people who lodge tax returns using different methods. Results

showed that majority would prefer to lodge their tax through tax agents (as per dataset 1).

However, based on the primary data that the researcher collected himself, the results showed that

many international students would want to lodge their returns by themselves.

Future research should focus on having participants from different suburbs i.e. stratify the

samples based on suburbs and increase on the sample size. This will help to collect more diverse

views from the participants.

References

Bagdonavicius, V. & Nikulin, M. S., 2011. Chi-squared goodness-of-fit test for right censored

data. The International Journal of Applied Mathematics and Statistics, pp. 30-50.

According to figure 6 above, a positive linear relationship exists between total income amount

and total deducted amount.

Section 7: Conclusion

The aim of this study was to understand the tax lodgment methods and the demographic

characteristics of the different people who lodge tax returns using different methods. Results

showed that majority would prefer to lodge their tax through tax agents (as per dataset 1).

However, based on the primary data that the researcher collected himself, the results showed that

many international students would want to lodge their returns by themselves.

Future research should focus on having participants from different suburbs i.e. stratify the

samples based on suburbs and increase on the sample size. This will help to collect more diverse

views from the participants.

References

Bagdonavicius, V. & Nikulin, M. S., 2011. Chi-squared goodness-of-fit test for right censored

data. The International Journal of Applied Mathematics and Statistics, pp. 30-50.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Burdett, J. & Crossman, J., 2012. Engaging international students: An analysis of the Australian

Universities Quality Agency (AUQA) reports. Quality Assurance in Education. 20(3), pp. 207-

222..

Corder, G. W. & Foreman, D. I., 2014. Nonparametric Statistics: A Step-by-Step Approach.

Corti, L. & Bishop, L., 2005. Strategies in Teaching Secondary Analysis of Qualitative Data.

Harmer, J., Piggott, J., Ridout, H. & Smith, G., 2009. Australia's Future Tax System: Report to

the Treasurer.

Universities Quality Agency (AUQA) reports. Quality Assurance in Education. 20(3), pp. 207-

222..

Corder, G. W. & Foreman, D. I., 2014. Nonparametric Statistics: A Step-by-Step Approach.

Corti, L. & Bishop, L., 2005. Strategies in Teaching Secondary Analysis of Qualitative Data.

Harmer, J., Piggott, J., Ridout, H. & Smith, G., 2009. Australia's Future Tax System: Report to

the Treasurer.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.