Statistics for Business Decision Making: Regression and ANOVA

VerifiedAdded on 2023/06/06

|7

|985

|83

Homework Assignment

AI Summary

This assignment provides solutions to statistical problems relevant to business decision-making. It includes the creation and interpretation of a frequency distribution table for examination scores, followed by a histogram analysis to determine the skewness of the data. Regression analysis is performed to assess the relationship between unit price and product supply, including the calculation of the coefficient of determination and correlation. Furthermore, an ANOVA test is conducted to evaluate the differences in production across four different programs, identifying the program with the highest average productivity. Finally, a regression equation is estimated to analyze the impact of price and advertising on sales, with a subsequent refinement of the model by removing insignificant variables to improve its predictive capability. Desklib offers a wide range of solved assignments and past papers for students.

Running Head: STATISTICS FOR BUSINESS DECISION MAKING

Statistics for Business Decision Making

Name of the Student

Name of the University

Student ID

Statistics for Business Decision Making

Name of the Student

Name of the University

Student ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1STATISTICS FOR BUSINESS DECISION MAKING

Table of Contents

Answer 1....................................................................................................................................2

Answer 2....................................................................................................................................3

Answer 3....................................................................................................................................3

Answer 4....................................................................................................................................4

Table of Contents

Answer 1....................................................................................................................................2

Answer 2....................................................................................................................................3

Answer 3....................................................................................................................................3

Answer 4....................................................................................................................................4

2STATISTICS FOR BUSINESS DECISION MAKING

Answer 1

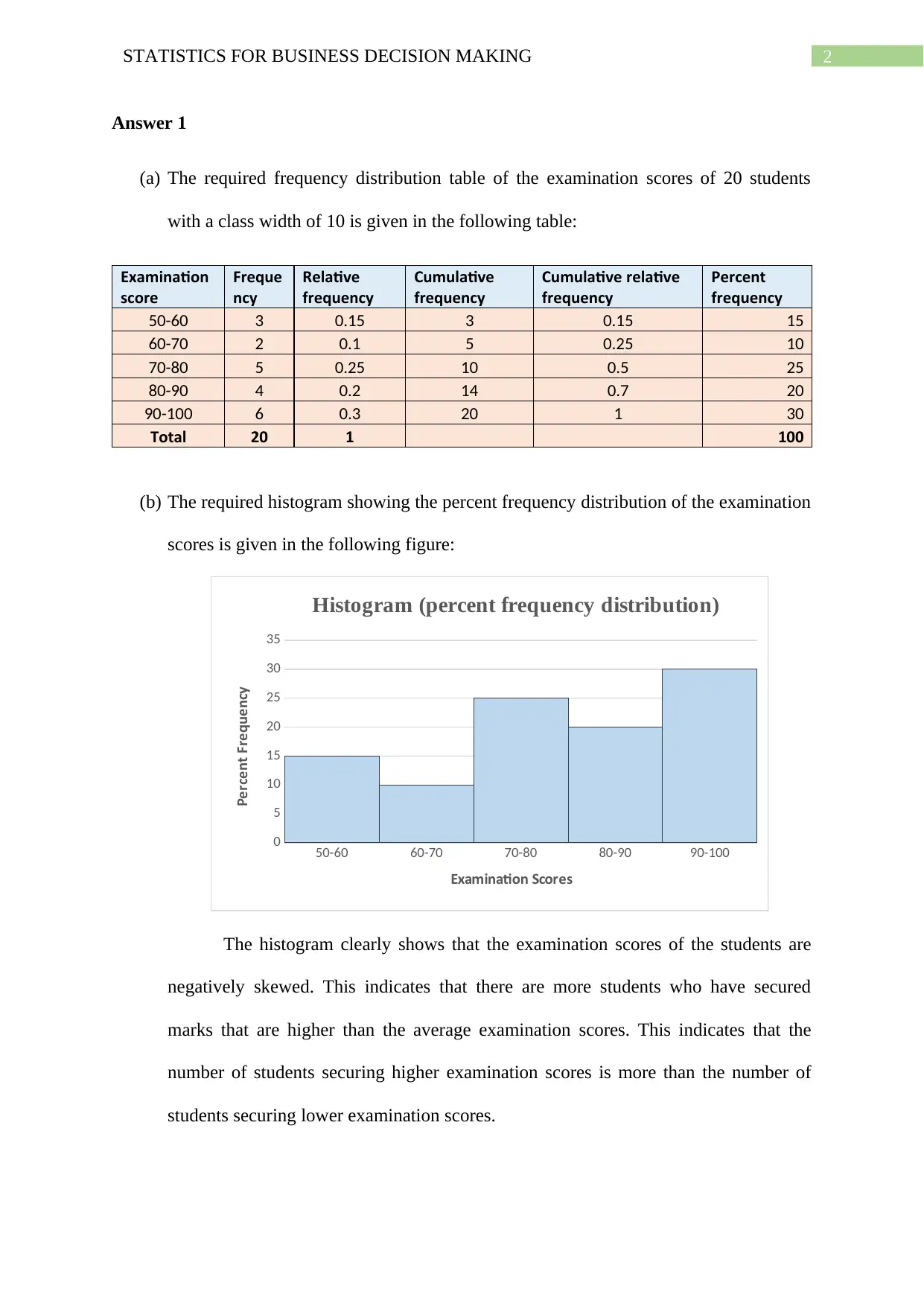

(a) The required frequency distribution table of the examination scores of 20 students

with a class width of 10 is given in the following table:

Examination

score

Freque

ncy

Relative

frequency

Cumulative

frequency

Cumulative relative

frequency

Percent

frequency

50-60 3 0.15 3 0.15 15

60-70 2 0.1 5 0.25 10

70-80 5 0.25 10 0.5 25

80-90 4 0.2 14 0.7 20

90-100 6 0.3 20 1 30

Total 20 1 100

(b) The required histogram showing the percent frequency distribution of the examination

scores is given in the following figure:

50-60 60-70 70-80 80-90 90-100

0

5

10

15

20

25

30

35

Histogram (percent frequency distribution)

Examination Scores

Percent Frequency

The histogram clearly shows that the examination scores of the students are

negatively skewed. This indicates that there are more students who have secured

marks that are higher than the average examination scores. This indicates that the

number of students securing higher examination scores is more than the number of

students securing lower examination scores.

Answer 1

(a) The required frequency distribution table of the examination scores of 20 students

with a class width of 10 is given in the following table:

Examination

score

Freque

ncy

Relative

frequency

Cumulative

frequency

Cumulative relative

frequency

Percent

frequency

50-60 3 0.15 3 0.15 15

60-70 2 0.1 5 0.25 10

70-80 5 0.25 10 0.5 25

80-90 4 0.2 14 0.7 20

90-100 6 0.3 20 1 30

Total 20 1 100

(b) The required histogram showing the percent frequency distribution of the examination

scores is given in the following figure:

50-60 60-70 70-80 80-90 90-100

0

5

10

15

20

25

30

35

Histogram (percent frequency distribution)

Examination Scores

Percent Frequency

The histogram clearly shows that the examination scores of the students are

negatively skewed. This indicates that there are more students who have secured

marks that are higher than the average examination scores. This indicates that the

number of students securing higher examination scores is more than the number of

students securing lower examination scores.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3STATISTICS FOR BUSINESS DECISION MAKING

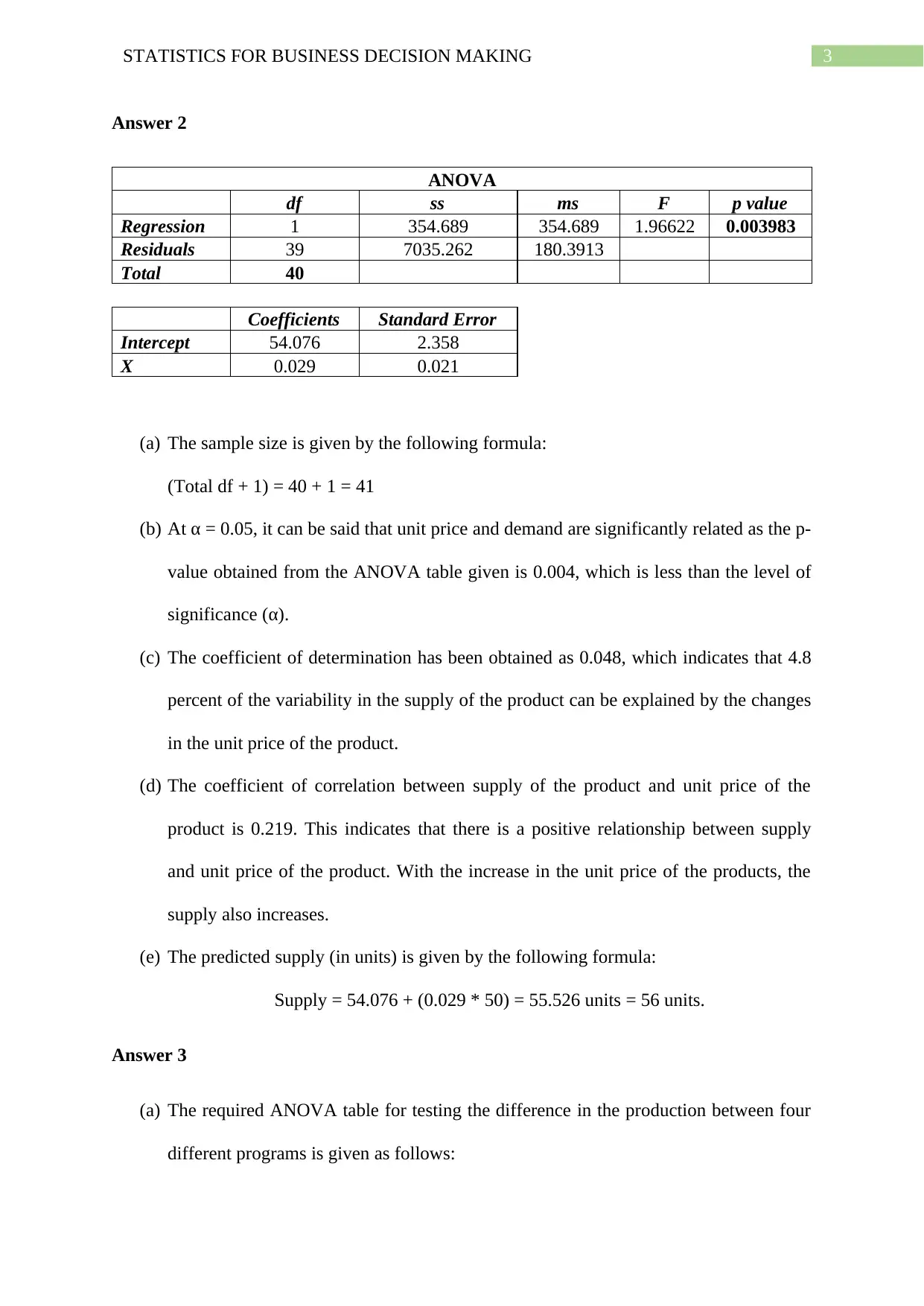

Answer 2

ANOVA

df ss ms F p value

Regression 1 354.689 354.689 1.96622 0.003983

Residuals 39 7035.262 180.3913

Total 40

Coefficients Standard Error

Intercept 54.076 2.358

X 0.029 0.021

(a) The sample size is given by the following formula:

(Total df + 1) = 40 + 1 = 41

(b) At α = 0.05, it can be said that unit price and demand are significantly related as the p-

value obtained from the ANOVA table given is 0.004, which is less than the level of

significance (α).

(c) The coefficient of determination has been obtained as 0.048, which indicates that 4.8

percent of the variability in the supply of the product can be explained by the changes

in the unit price of the product.

(d) The coefficient of correlation between supply of the product and unit price of the

product is 0.219. This indicates that there is a positive relationship between supply

and unit price of the product. With the increase in the unit price of the products, the

supply also increases.

(e) The predicted supply (in units) is given by the following formula:

Supply = 54.076 + (0.029 * 50) = 55.526 units = 56 units.

Answer 3

(a) The required ANOVA table for testing the difference in the production between four

different programs is given as follows:

Answer 2

ANOVA

df ss ms F p value

Regression 1 354.689 354.689 1.96622 0.003983

Residuals 39 7035.262 180.3913

Total 40

Coefficients Standard Error

Intercept 54.076 2.358

X 0.029 0.021

(a) The sample size is given by the following formula:

(Total df + 1) = 40 + 1 = 41

(b) At α = 0.05, it can be said that unit price and demand are significantly related as the p-

value obtained from the ANOVA table given is 0.004, which is less than the level of

significance (α).

(c) The coefficient of determination has been obtained as 0.048, which indicates that 4.8

percent of the variability in the supply of the product can be explained by the changes

in the unit price of the product.

(d) The coefficient of correlation between supply of the product and unit price of the

product is 0.219. This indicates that there is a positive relationship between supply

and unit price of the product. With the increase in the unit price of the products, the

supply also increases.

(e) The predicted supply (in units) is given by the following formula:

Supply = 54.076 + (0.029 * 50) = 55.526 units = 56 units.

Answer 3

(a) The required ANOVA table for testing the difference in the production between four

different programs is given as follows:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

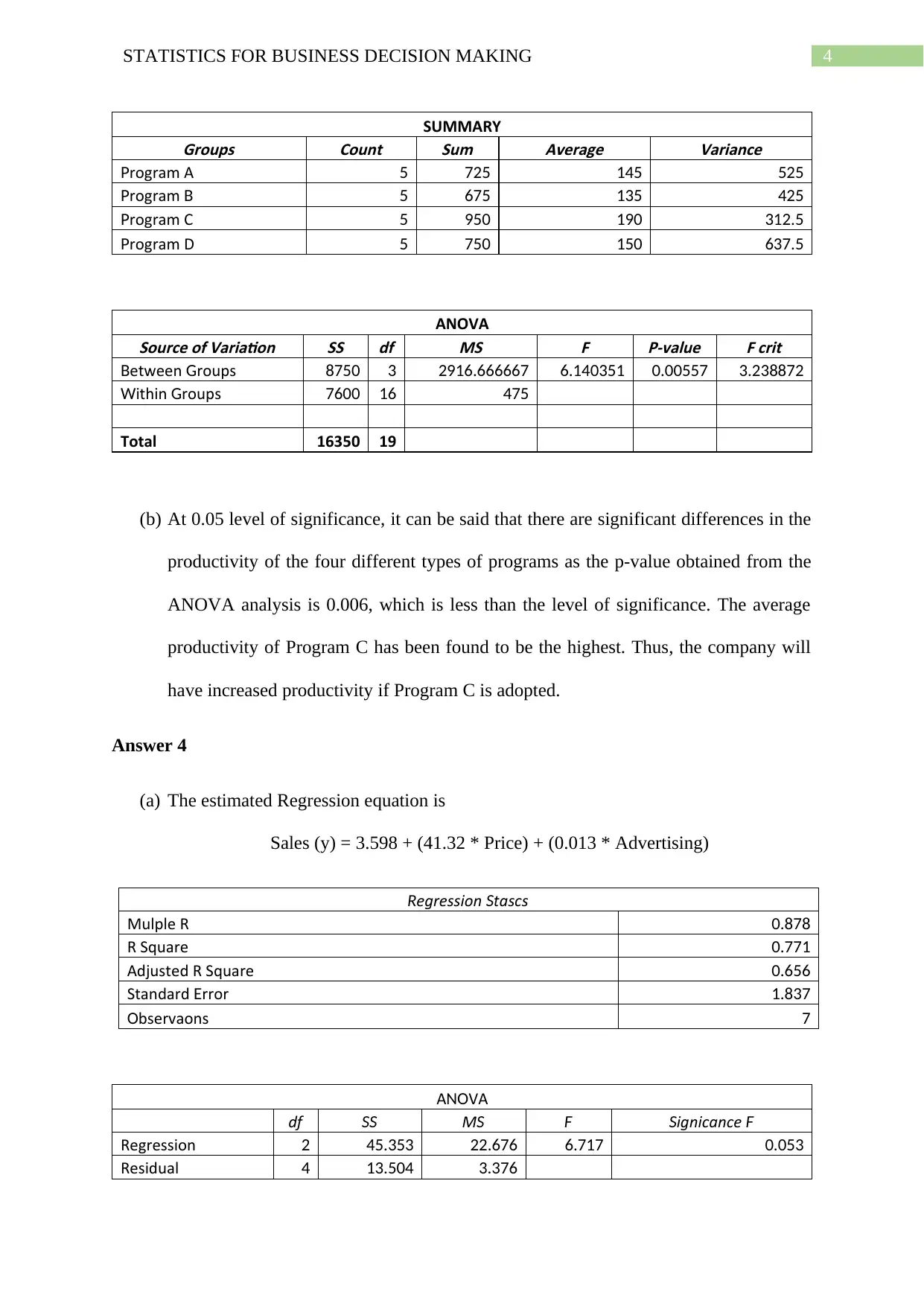

4STATISTICS FOR BUSINESS DECISION MAKING

SUMMARY

Groups

Count Sum

Average

Variance

rogram AP 5 725 145 525

rogramP B 5 675 135 425

rogram CP 5 950 190 312.5

rogram DP 5 750 150 637.5

ANOVA

Source of Variation SS df MS

F P-value F crit

etween roupsB G 8750 3 2916.666667 6.140351 0.00557 3.238872

ithin roupsW G 7600 16 475

Total 16350 19

(b) At 0.05 level of significance, it can be said that there are significant differences in the

productivity of the four different types of programs as the p-value obtained from the

ANOVA analysis is 0.006, which is less than the level of significance. The average

productivity of Program C has been found to be the highest. Thus, the company will

have increased productivity if Program C is adopted.

Answer 4

(a) The estimated Regression equation is

Sales (y) = 3.598 + (41.32 * Price) + (0.013 * Advertising)

egression tatisticsR S

Multiple R 0.878

R Square 0.771

Adjusted R Square 0.656

Standard rrorE 1.837

bservationsO 7

A VANO

df SS MS F ignificanceS F

Regression 2 45.353 22.676 6.717 0.053

Residual 4 13.504 3.376

SUMMARY

Groups

Count Sum

Average

Variance

rogram AP 5 725 145 525

rogramP B 5 675 135 425

rogram CP 5 950 190 312.5

rogram DP 5 750 150 637.5

ANOVA

Source of Variation SS df MS

F P-value F crit

etween roupsB G 8750 3 2916.666667 6.140351 0.00557 3.238872

ithin roupsW G 7600 16 475

Total 16350 19

(b) At 0.05 level of significance, it can be said that there are significant differences in the

productivity of the four different types of programs as the p-value obtained from the

ANOVA analysis is 0.006, which is less than the level of significance. The average

productivity of Program C has been found to be the highest. Thus, the company will

have increased productivity if Program C is adopted.

Answer 4

(a) The estimated Regression equation is

Sales (y) = 3.598 + (41.32 * Price) + (0.013 * Advertising)

egression tatisticsR S

Multiple R 0.878

R Square 0.771

Adjusted R Square 0.656

Standard rrorE 1.837

bservationsO 7

A VANO

df SS MS F ignificanceS F

Regression 2 45.353 22.676 6.717 0.053

Residual 4 13.504 3.376

5STATISTICS FOR BUSINESS DECISION MAKING

otalT 6 58.857

Coefficients

tandarS

d Error t tatS P value-

o erL w

95%

pperU

95%

o erL w

90.0%

pperU

90.0%

nterceptI 3.598 4.052 0.888 0.425 -7.653 14.848 -5.041 12.236

riceP 41.320 13.337 3.098 0.036 4.290 78.350 12.887 69.753

Advertising 0.013 0.328 0.040 0.970 -0.896 0.923 -0.685 0.712

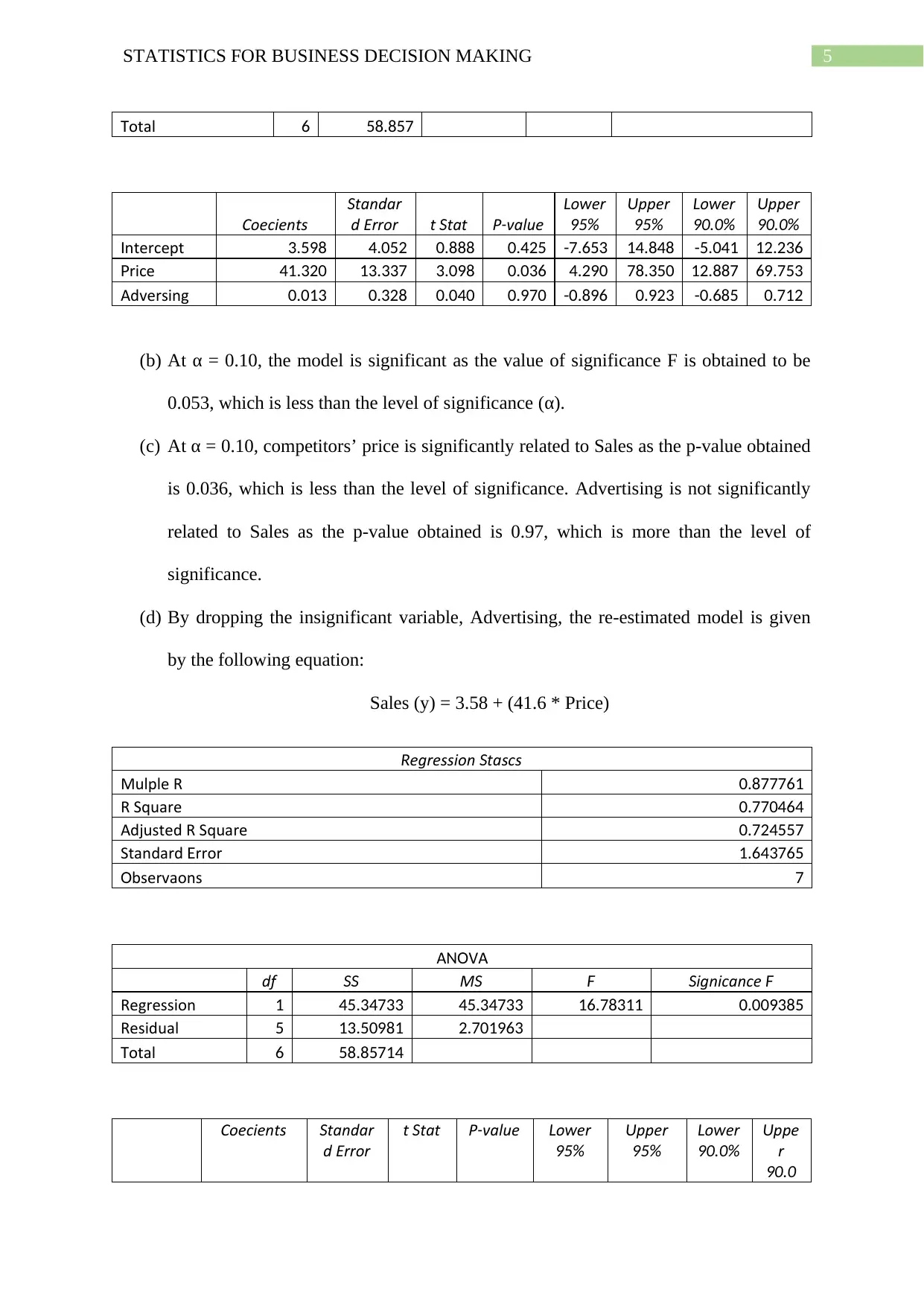

(b) At α = 0.10, the model is significant as the value of significance F is obtained to be

0.053, which is less than the level of significance (α).

(c) At α = 0.10, competitors’ price is significantly related to Sales as the p-value obtained

is 0.036, which is less than the level of significance. Advertising is not significantly

related to Sales as the p-value obtained is 0.97, which is more than the level of

significance.

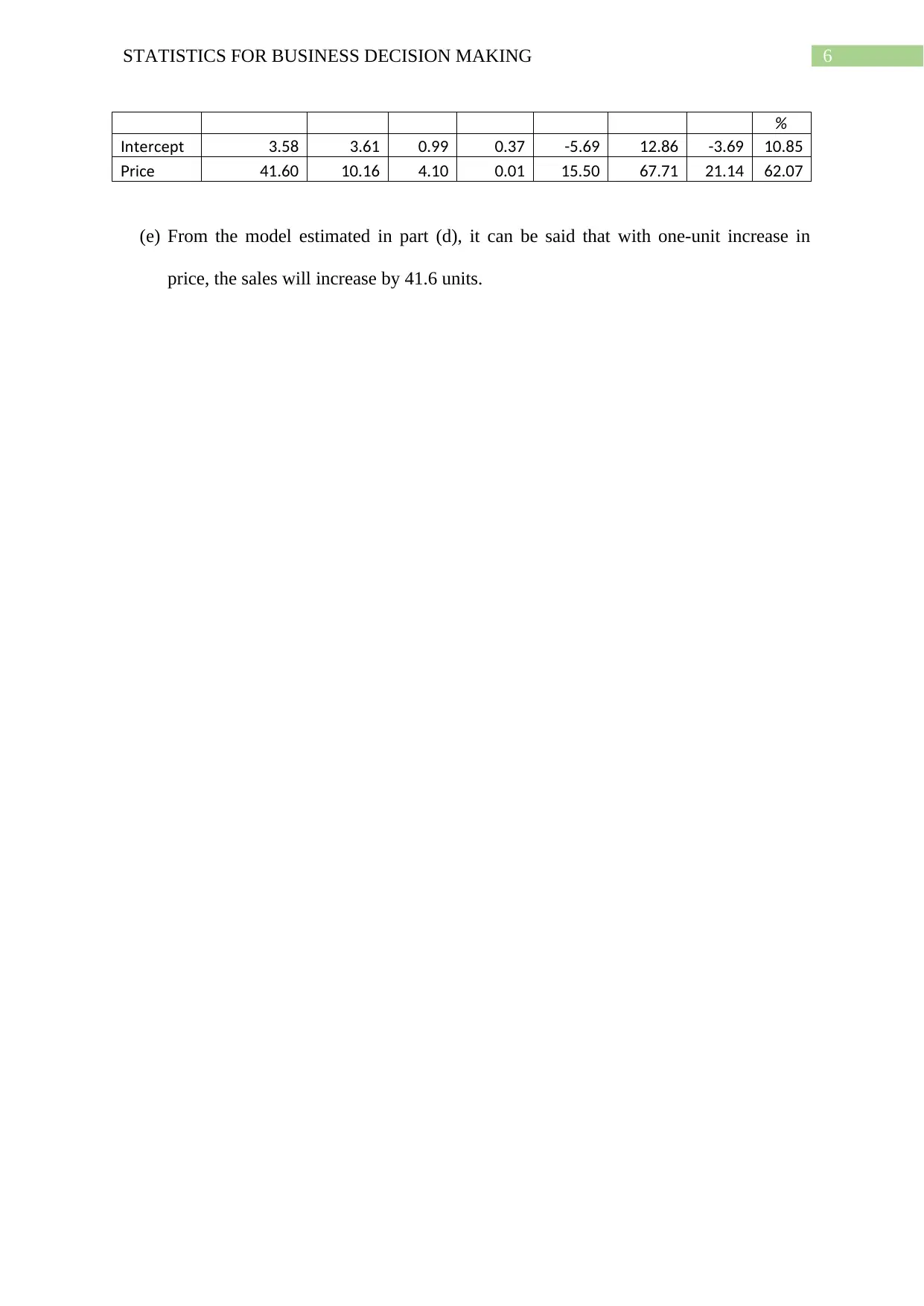

(d) By dropping the insignificant variable, Advertising, the re-estimated model is given

by the following equation:

Sales (y) = 3.58 + (41.6 * Price)

egression tatisticsR S

Multiple R 0.877761

R Square 0.770464

Adjusted R Square 0.724557

Standard rrorE 1.643765

bservationsO 7

A VANO

df SS MS F ignificanceS F

Regression 1 45.34733 45.34733 16.78311 0.009385

Residual 5 13.50981 2.701963

otalT 6 58.85714

Coefficients tandarS

d Error

t tatS P value- o erL w

95%

pperU

95%

o erL w

90.0%

ppeU

r

90.0

otalT 6 58.857

Coefficients

tandarS

d Error t tatS P value-

o erL w

95%

pperU

95%

o erL w

90.0%

pperU

90.0%

nterceptI 3.598 4.052 0.888 0.425 -7.653 14.848 -5.041 12.236

riceP 41.320 13.337 3.098 0.036 4.290 78.350 12.887 69.753

Advertising 0.013 0.328 0.040 0.970 -0.896 0.923 -0.685 0.712

(b) At α = 0.10, the model is significant as the value of significance F is obtained to be

0.053, which is less than the level of significance (α).

(c) At α = 0.10, competitors’ price is significantly related to Sales as the p-value obtained

is 0.036, which is less than the level of significance. Advertising is not significantly

related to Sales as the p-value obtained is 0.97, which is more than the level of

significance.

(d) By dropping the insignificant variable, Advertising, the re-estimated model is given

by the following equation:

Sales (y) = 3.58 + (41.6 * Price)

egression tatisticsR S

Multiple R 0.877761

R Square 0.770464

Adjusted R Square 0.724557

Standard rrorE 1.643765

bservationsO 7

A VANO

df SS MS F ignificanceS F

Regression 1 45.34733 45.34733 16.78311 0.009385

Residual 5 13.50981 2.701963

otalT 6 58.85714

Coefficients tandarS

d Error

t tatS P value- o erL w

95%

pperU

95%

o erL w

90.0%

ppeU

r

90.0

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6STATISTICS FOR BUSINESS DECISION MAKING

%

nterceptI 3.58 3.61 0.99 0.37 -5.69 12.86 -3.69 10.85

riceP 41.60 10.16 4.10 0.01 15.50 67.71 21.14 62.07

(e) From the model estimated in part (d), it can be said that with one-unit increase in

price, the sales will increase by 41.6 units.

%

nterceptI 3.58 3.61 0.99 0.37 -5.69 12.86 -3.69 10.85

riceP 41.60 10.16 4.10 0.01 15.50 67.71 21.14 62.07

(e) From the model estimated in part (d), it can be said that with one-unit increase in

price, the sales will increase by 41.6 units.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.