Report: Statistics for Financial Decision Making Analysis

VerifiedAdded on 2021/01/02

|12

|2652

|122

Report

AI Summary

This report delves into the application of statistical tools, particularly regression analysis, in financial decision-making. It begins with an introduction to statistics and its importance in business, followed by an examination of a regression model involving market price as the dependent variable and several independent variables, including Sydney price index, annual percentage change, total number of square meters, and age of the house. The report presents the full model, the least squares regression equation, and interprets the coefficients, discussing their significance. The coefficient of determination is evaluated to assess the model's goodness of fit. Confidence intervals for each parameter are stated, and hypothesis testing is conducted to determine the significance of each independent variable. Finally, the original and re-estimated models are compared, and the market price of a house with 400 square meters is predicted. The report concludes by summarizing the findings and providing references.

STATISTICS FOR FINANCIAL

DECISION

DECISION

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

TASK 2............................................................................................................................................2

TASK 3............................................................................................................................................4

Presenting full model..................................................................................................................4

TASK 4............................................................................................................................................5

Least squares regression equation and interpreting the equation................................................5

TASK 5............................................................................................................................................5

Interpreting estimated coefficients of regression model with discussion of significance values

.....................................................................................................................................................5

TASK 6............................................................................................................................................7

Value of coefficient of determination for relationship among dependent and independent

variables......................................................................................................................................7

TASK 7............................................................................................................................................7

Stating 95% confidence interval for every parameter.................................................................7

TASK 8............................................................................................................................................8

TASK 9............................................................................................................................................8

Comparing original and re-estimated model...............................................................................8

TASK 10..........................................................................................................................................9

Predicting market price of house with 400 square meters..........................................................9

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

TASK 2............................................................................................................................................2

TASK 3............................................................................................................................................4

Presenting full model..................................................................................................................4

TASK 4............................................................................................................................................5

Least squares regression equation and interpreting the equation................................................5

TASK 5............................................................................................................................................5

Interpreting estimated coefficients of regression model with discussion of significance values

.....................................................................................................................................................5

TASK 6............................................................................................................................................7

Value of coefficient of determination for relationship among dependent and independent

variables......................................................................................................................................7

TASK 7............................................................................................................................................7

Stating 95% confidence interval for every parameter.................................................................7

TASK 8............................................................................................................................................8

TASK 9............................................................................................................................................8

Comparing original and re-estimated model...............................................................................8

TASK 10..........................................................................................................................................9

Predicting market price of house with 400 square meters..........................................................9

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION

The term statistics is concerned with the process of numerical and data analysis of the

given data set values. By making correct and proper analysis, interpretation of the given data set,

sound and effective business and financial decision can be made for the betterment of business

operations. The present report is based on regression analysis, which is considered as one of the

most important statistical business tool. With the help of this statistical tool, relationship between

two variables can be studied. Influence of one or more independent variables on a dependent

variable can be examined. The report will contain plotting of dependent variable against

independent variable by using scatter plot or dot function and relationship from this plotting. It

will disclose concept of the least square regression equation along with interpretation. At last,

comparison and evaluation of goodness of fit between the original model and re estimated model

will be made.

TASK 1

Rationale and details of Regression Model – The term regression is considered as one of

the most important statistical tool which helps the company in examining the relationship

between two or more independent variable on a dependent variable (Bun and Harrison, 2018). In

the above table the Sample Size calculated is 18. Also, for the question the dependent variable is

Market Price ($000) and independent variables are Sydney price Index, Annual % change, Total

number of square meters and Age of house (years).

Regression Statistics

Multiple R 0.8999

R Square 0.8098

Adjusted R Square 0.7512

Standard Error 45.0011

Observations 18

Coefficie

nts

Standard

Error t Stat P-value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 531.463 80.386 6.611 0.000 357.801 705.126 357.801 705.126

1

The term statistics is concerned with the process of numerical and data analysis of the

given data set values. By making correct and proper analysis, interpretation of the given data set,

sound and effective business and financial decision can be made for the betterment of business

operations. The present report is based on regression analysis, which is considered as one of the

most important statistical business tool. With the help of this statistical tool, relationship between

two variables can be studied. Influence of one or more independent variables on a dependent

variable can be examined. The report will contain plotting of dependent variable against

independent variable by using scatter plot or dot function and relationship from this plotting. It

will disclose concept of the least square regression equation along with interpretation. At last,

comparison and evaluation of goodness of fit between the original model and re estimated model

will be made.

TASK 1

Rationale and details of Regression Model – The term regression is considered as one of

the most important statistical tool which helps the company in examining the relationship

between two or more independent variable on a dependent variable (Bun and Harrison, 2018). In

the above table the Sample Size calculated is 18. Also, for the question the dependent variable is

Market Price ($000) and independent variables are Sydney price Index, Annual % change, Total

number of square meters and Age of house (years).

Regression Statistics

Multiple R 0.8999

R Square 0.8098

Adjusted R Square 0.7512

Standard Error 45.0011

Observations 18

Coefficie

nts

Standard

Error t Stat P-value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 531.463 80.386 6.611 0.000 357.801 705.126 357.801 705.126

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Sydney

price

Index 2.264 0.560 4.043 0.001 1.054 3.473 1.054 3.473

Annual %

change -6.310 3.060 -2.062 0.060 -12.919 0.300 -12.919 0.300

Total

number of

square

meters 0.507 0.315 1.607 0.132 -0.174 1.187 -0.174 1.187

Age of

house

(years) -2.637 1.146 -2.301 0.039 -5.113 -0.161 -5.113 -0.161

TASK 2

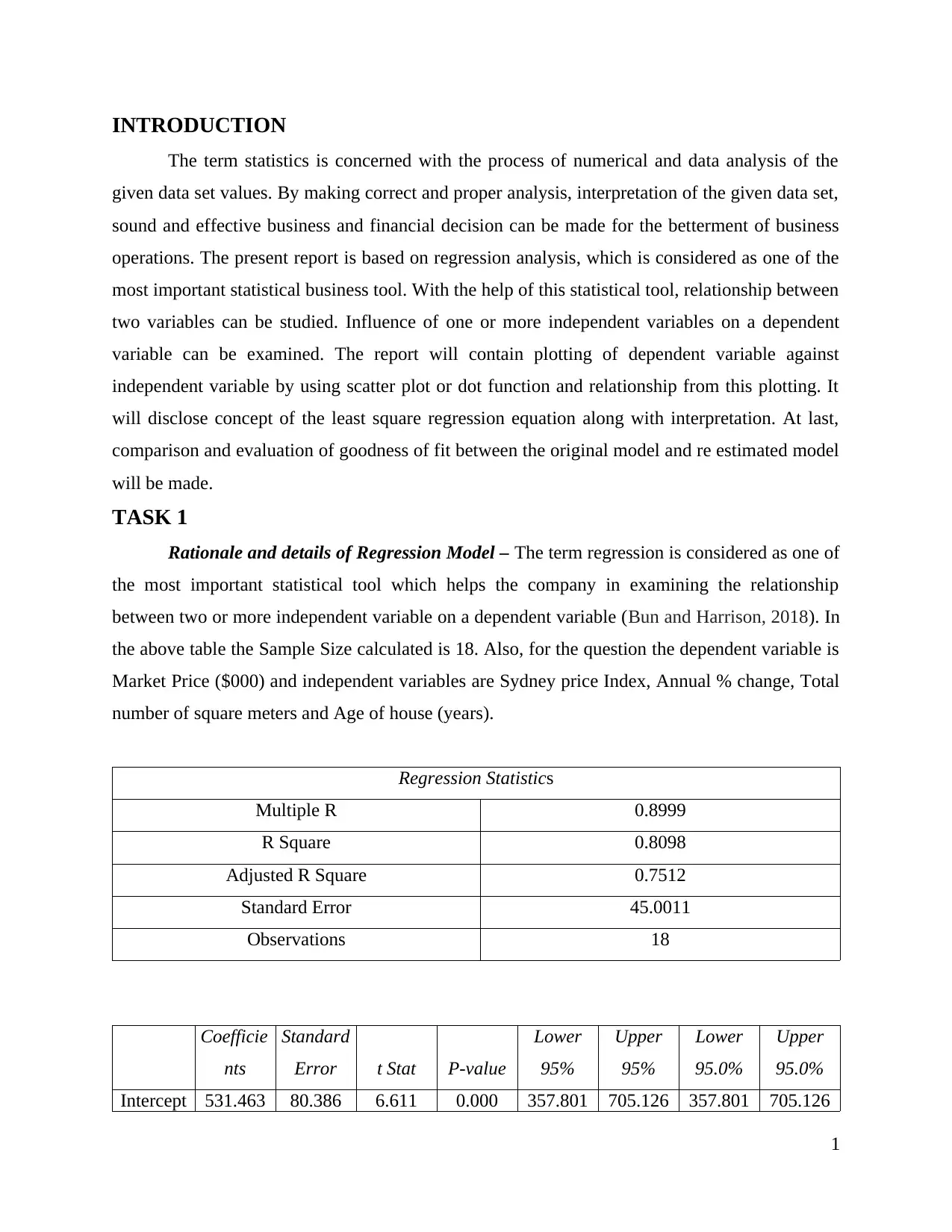

Sydney Price Index

60 80 100 120 140 160 180 200

-100

-50

0

50

100

Sydney price Index Residual Plot

Sydney price Index

Residuals

Interpretation: The above graph is reflecting scatter plot of market price and Sydney

Price index which shows no correlation due to spread out which signifies absence of trend to

correlation.

2

price

Index 2.264 0.560 4.043 0.001 1.054 3.473 1.054 3.473

Annual %

change -6.310 3.060 -2.062 0.060 -12.919 0.300 -12.919 0.300

Total

number of

square

meters 0.507 0.315 1.607 0.132 -0.174 1.187 -0.174 1.187

Age of

house

(years) -2.637 1.146 -2.301 0.039 -5.113 -0.161 -5.113 -0.161

TASK 2

Sydney Price Index

60 80 100 120 140 160 180 200

-100

-50

0

50

100

Sydney price Index Residual Plot

Sydney price Index

Residuals

Interpretation: The above graph is reflecting scatter plot of market price and Sydney

Price index which shows no correlation due to spread out which signifies absence of trend to

correlation.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Regression Statistics

Multiple R 0.8277

R Square 0.6851

Adjusted R Square 0.6654

Standard Error 52.1937

Observations 18

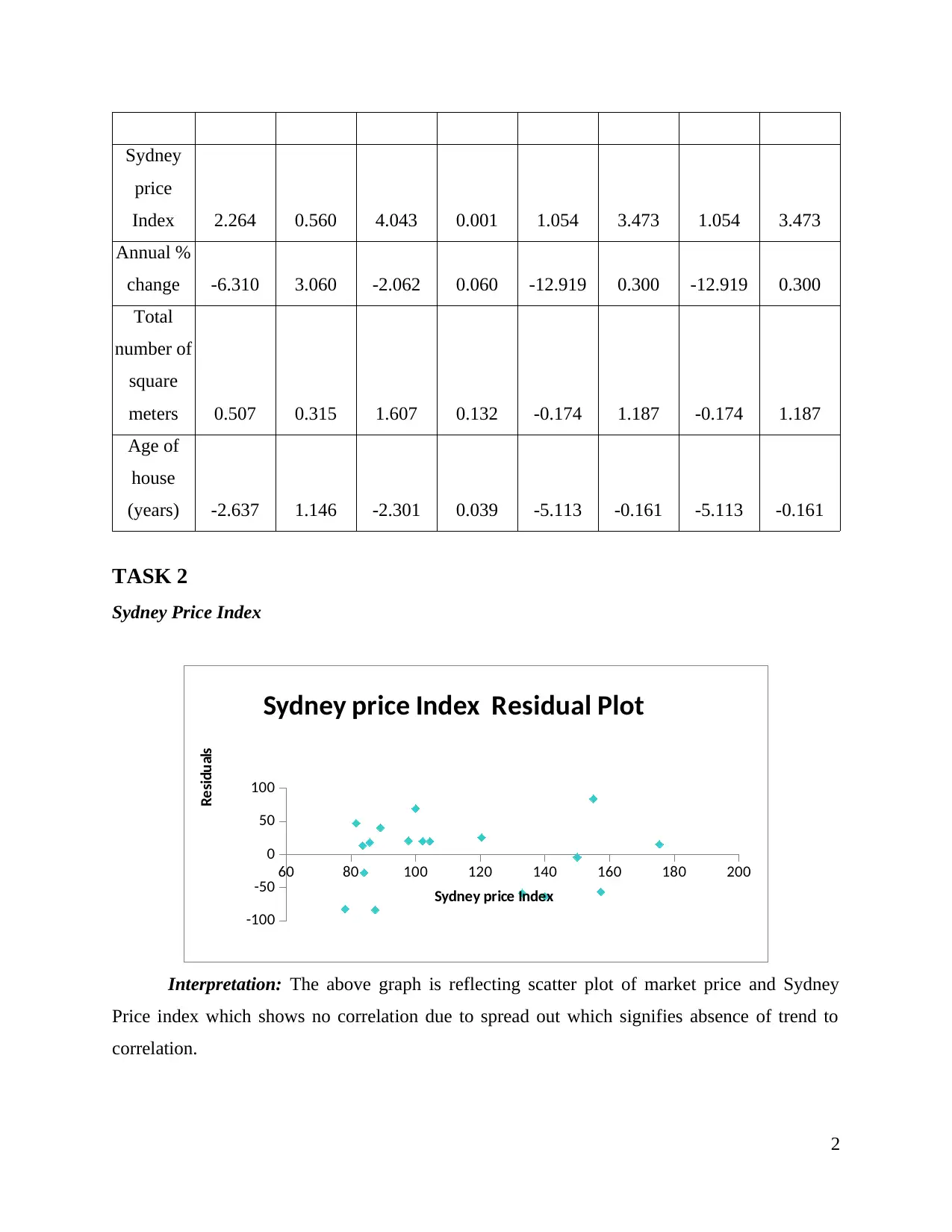

Annual percentage change

0 2 4 6 8 10 12 14 16 18

-200

-100

0

100

200

Annual % change Residual Plot

Annual % change

Residuals

Interpretation: The above table is stating scatter plot of market price and annual %

change which shows no correlation due to spread out which reflects absence of trend to

correlation.

Total number of square meter

140 160 180 200 220 240 260 280 300 320

-200

-100

0

100

200

300

Total number of square meters

Residual Plot

Total number of square meters

Residuals

3

Multiple R 0.8277

R Square 0.6851

Adjusted R Square 0.6654

Standard Error 52.1937

Observations 18

Annual percentage change

0 2 4 6 8 10 12 14 16 18

-200

-100

0

100

200

Annual % change Residual Plot

Annual % change

Residuals

Interpretation: The above table is stating scatter plot of market price and annual %

change which shows no correlation due to spread out which reflects absence of trend to

correlation.

Total number of square meter

140 160 180 200 220 240 260 280 300 320

-200

-100

0

100

200

300

Total number of square meters

Residual Plot

Total number of square meters

Residuals

3

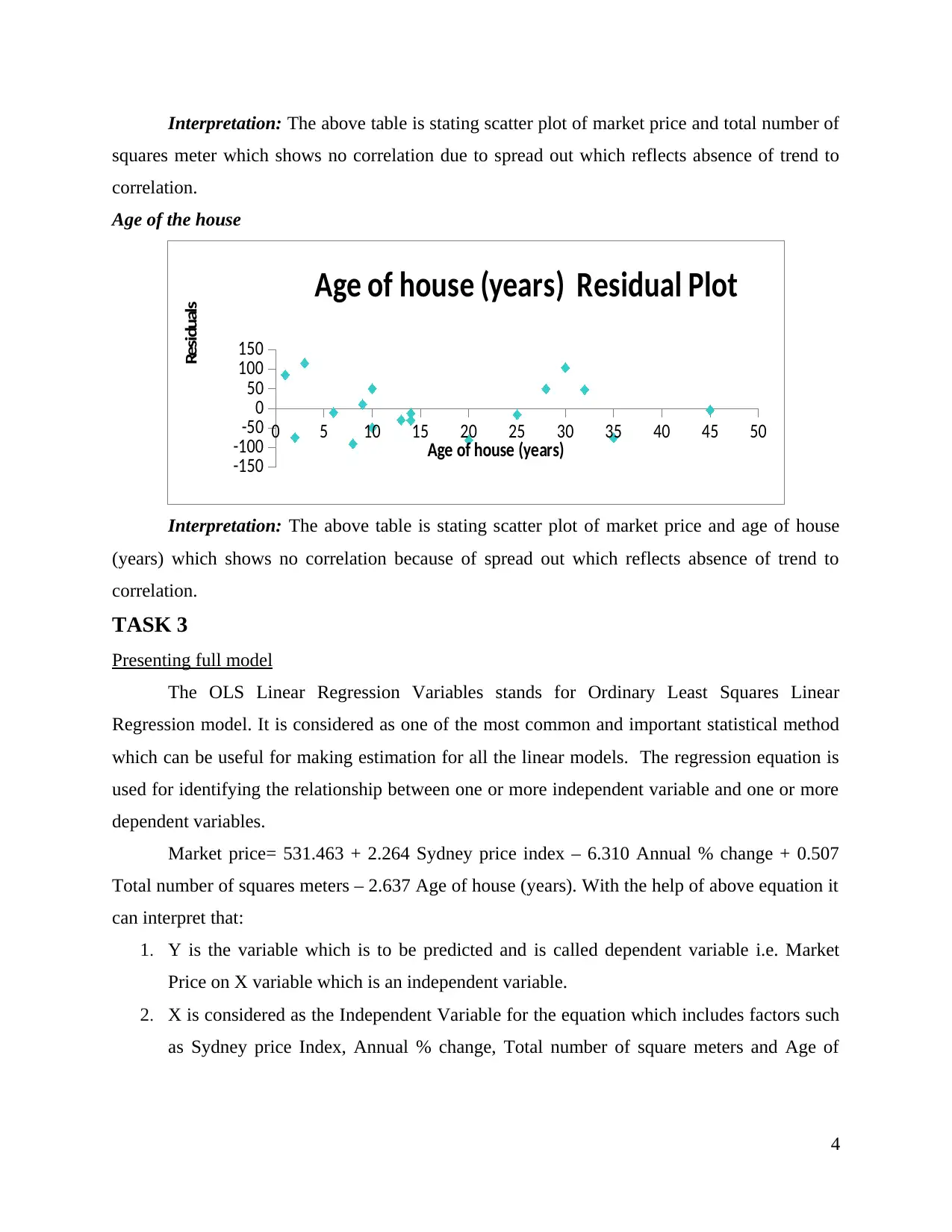

Interpretation: The above table is stating scatter plot of market price and total number of

squares meter which shows no correlation due to spread out which reflects absence of trend to

correlation.

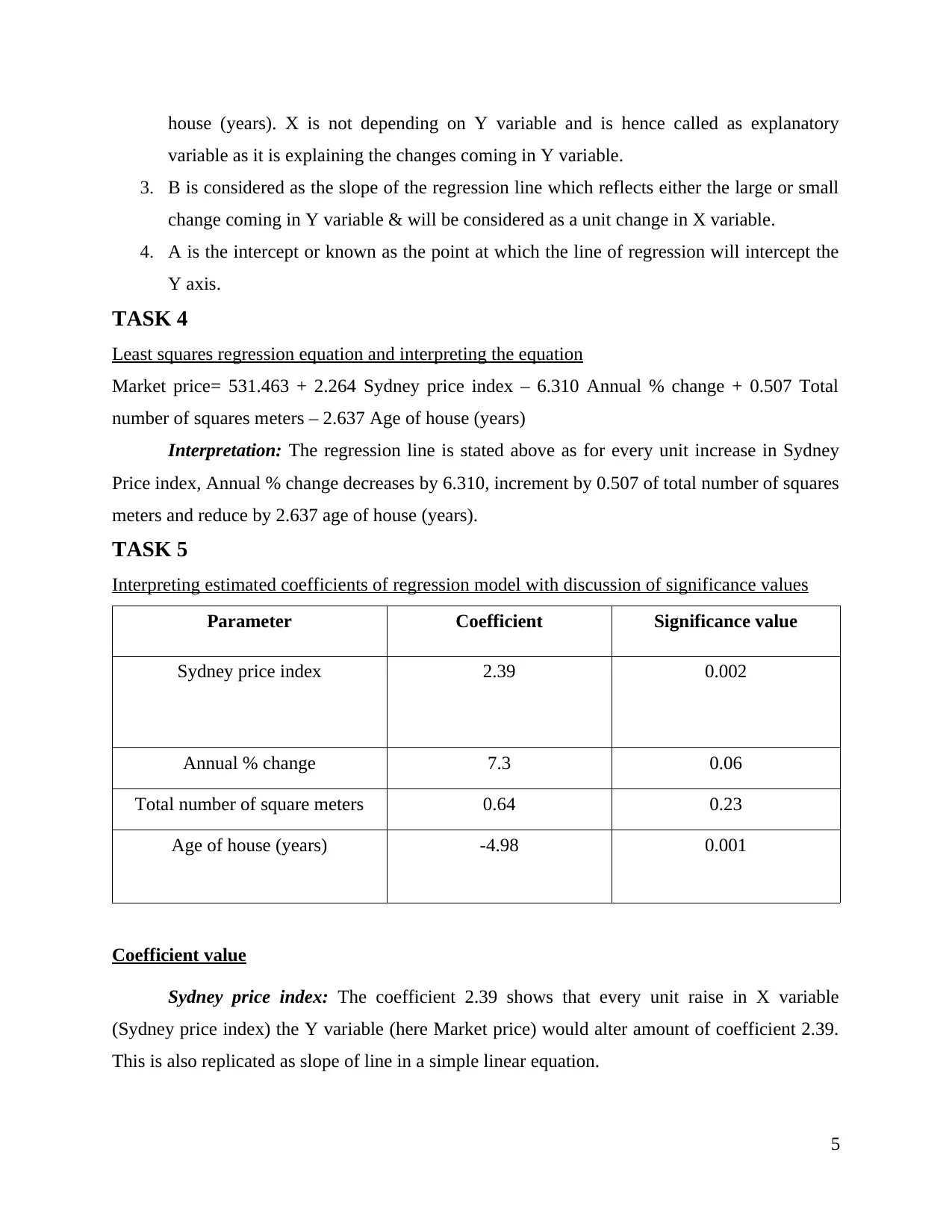

Age of the house

0 5 10 15 20 25 30 35 40 45 50

-150

-100

-50

0

50

100

150

Age of house (years) Residual Plot

Age of house (years)

Residuals

Interpretation: The above table is stating scatter plot of market price and age of house

(years) which shows no correlation because of spread out which reflects absence of trend to

correlation.

TASK 3

Presenting full model

The OLS Linear Regression Variables stands for Ordinary Least Squares Linear

Regression model. It is considered as one of the most common and important statistical method

which can be useful for making estimation for all the linear models. The regression equation is

used for identifying the relationship between one or more independent variable and one or more

dependent variables.

Market price= 531.463 + 2.264 Sydney price index – 6.310 Annual % change + 0.507

Total number of squares meters – 2.637 Age of house (years). With the help of above equation it

can interpret that:

1. Y is the variable which is to be predicted and is called dependent variable i.e. Market

Price on X variable which is an independent variable.

2. X is considered as the Independent Variable for the equation which includes factors such

as Sydney price Index, Annual % change, Total number of square meters and Age of

4

squares meter which shows no correlation due to spread out which reflects absence of trend to

correlation.

Age of the house

0 5 10 15 20 25 30 35 40 45 50

-150

-100

-50

0

50

100

150

Age of house (years) Residual Plot

Age of house (years)

Residuals

Interpretation: The above table is stating scatter plot of market price and age of house

(years) which shows no correlation because of spread out which reflects absence of trend to

correlation.

TASK 3

Presenting full model

The OLS Linear Regression Variables stands for Ordinary Least Squares Linear

Regression model. It is considered as one of the most common and important statistical method

which can be useful for making estimation for all the linear models. The regression equation is

used for identifying the relationship between one or more independent variable and one or more

dependent variables.

Market price= 531.463 + 2.264 Sydney price index – 6.310 Annual % change + 0.507

Total number of squares meters – 2.637 Age of house (years). With the help of above equation it

can interpret that:

1. Y is the variable which is to be predicted and is called dependent variable i.e. Market

Price on X variable which is an independent variable.

2. X is considered as the Independent Variable for the equation which includes factors such

as Sydney price Index, Annual % change, Total number of square meters and Age of

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

house (years). X is not depending on Y variable and is hence called as explanatory

variable as it is explaining the changes coming in Y variable.

3. B is considered as the slope of the regression line which reflects either the large or small

change coming in Y variable & will be considered as a unit change in X variable.

4. A is the intercept or known as the point at which the line of regression will intercept the

Y axis.

TASK 4

Least squares regression equation and interpreting the equation

Market price= 531.463 + 2.264 Sydney price index – 6.310 Annual % change + 0.507 Total

number of squares meters – 2.637 Age of house (years)

Interpretation: The regression line is stated above as for every unit increase in Sydney

Price index, Annual % change decreases by 6.310, increment by 0.507 of total number of squares

meters and reduce by 2.637 age of house (years).

TASK 5

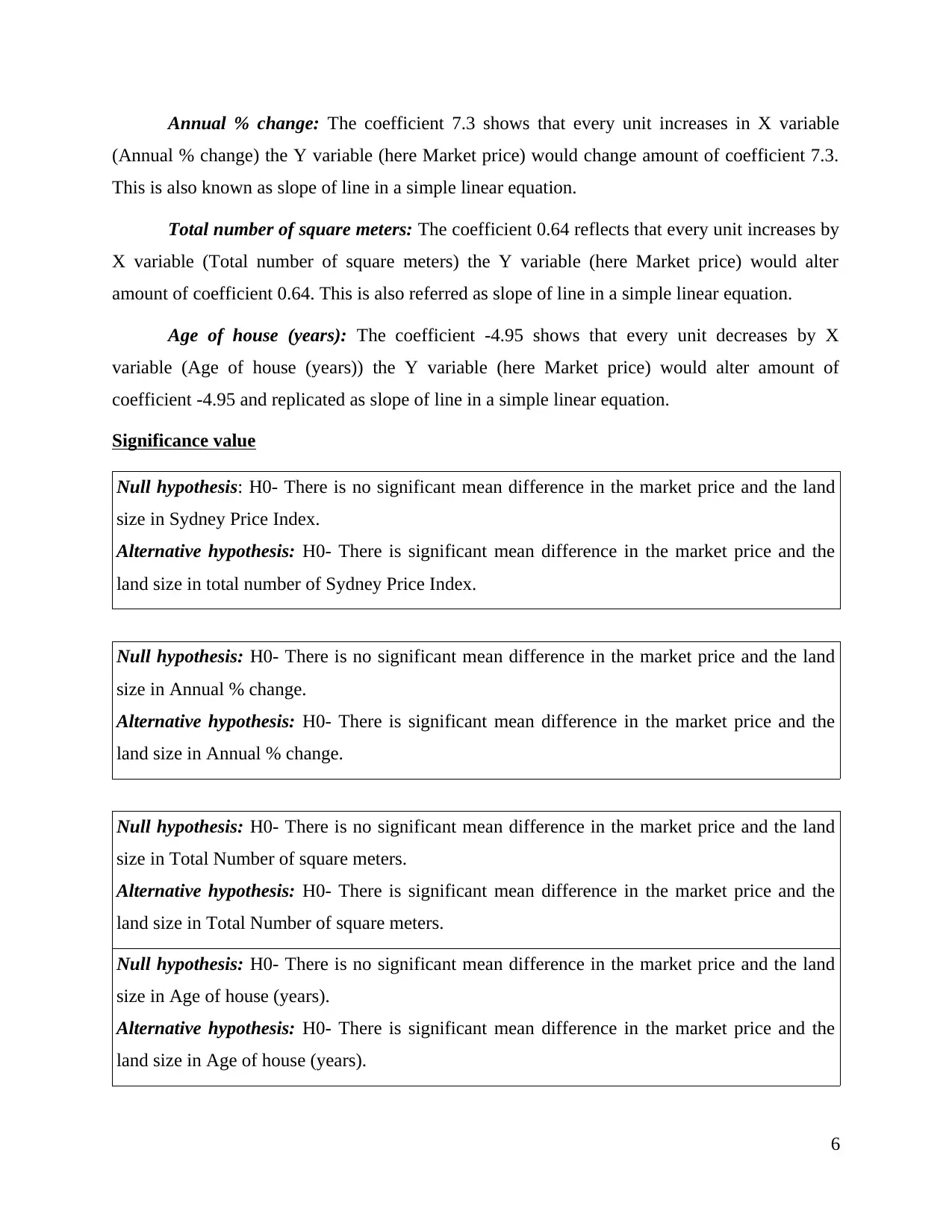

Interpreting estimated coefficients of regression model with discussion of significance values

Parameter Coefficient Significance value

Sydney price index 2.39 0.002

Annual % change 7.3 0.06

Total number of square meters 0.64 0.23

Age of house (years) -4.98 0.001

Coefficient value

Sydney price index: The coefficient 2.39 shows that every unit raise in X variable

(Sydney price index) the Y variable (here Market price) would alter amount of coefficient 2.39.

This is also replicated as slope of line in a simple linear equation.

5

variable as it is explaining the changes coming in Y variable.

3. B is considered as the slope of the regression line which reflects either the large or small

change coming in Y variable & will be considered as a unit change in X variable.

4. A is the intercept or known as the point at which the line of regression will intercept the

Y axis.

TASK 4

Least squares regression equation and interpreting the equation

Market price= 531.463 + 2.264 Sydney price index – 6.310 Annual % change + 0.507 Total

number of squares meters – 2.637 Age of house (years)

Interpretation: The regression line is stated above as for every unit increase in Sydney

Price index, Annual % change decreases by 6.310, increment by 0.507 of total number of squares

meters and reduce by 2.637 age of house (years).

TASK 5

Interpreting estimated coefficients of regression model with discussion of significance values

Parameter Coefficient Significance value

Sydney price index 2.39 0.002

Annual % change 7.3 0.06

Total number of square meters 0.64 0.23

Age of house (years) -4.98 0.001

Coefficient value

Sydney price index: The coefficient 2.39 shows that every unit raise in X variable

(Sydney price index) the Y variable (here Market price) would alter amount of coefficient 2.39.

This is also replicated as slope of line in a simple linear equation.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Annual % change: The coefficient 7.3 shows that every unit increases in X variable

(Annual % change) the Y variable (here Market price) would change amount of coefficient 7.3.

This is also known as slope of line in a simple linear equation.

Total number of square meters: The coefficient 0.64 reflects that every unit increases by

X variable (Total number of square meters) the Y variable (here Market price) would alter

amount of coefficient 0.64. This is also referred as slope of line in a simple linear equation.

Age of house (years): The coefficient -4.95 shows that every unit decreases by X

variable (Age of house (years)) the Y variable (here Market price) would alter amount of

coefficient -4.95 and replicated as slope of line in a simple linear equation.

Significance value

Null hypothesis: H0- There is no significant mean difference in the market price and the land

size in Sydney Price Index.

Alternative hypothesis: H0- There is significant mean difference in the market price and the

land size in total number of Sydney Price Index.

Null hypothesis: H0- There is no significant mean difference in the market price and the land

size in Annual % change.

Alternative hypothesis: H0- There is significant mean difference in the market price and the

land size in Annual % change.

Null hypothesis: H0- There is no significant mean difference in the market price and the land

size in Total Number of square meters.

Alternative hypothesis: H0- There is significant mean difference in the market price and the

land size in Total Number of square meters.

Null hypothesis: H0- There is no significant mean difference in the market price and the land

size in Age of house (years).

Alternative hypothesis: H0- There is significant mean difference in the market price and the

land size in Age of house (years).

6

(Annual % change) the Y variable (here Market price) would change amount of coefficient 7.3.

This is also known as slope of line in a simple linear equation.

Total number of square meters: The coefficient 0.64 reflects that every unit increases by

X variable (Total number of square meters) the Y variable (here Market price) would alter

amount of coefficient 0.64. This is also referred as slope of line in a simple linear equation.

Age of house (years): The coefficient -4.95 shows that every unit decreases by X

variable (Age of house (years)) the Y variable (here Market price) would alter amount of

coefficient -4.95 and replicated as slope of line in a simple linear equation.

Significance value

Null hypothesis: H0- There is no significant mean difference in the market price and the land

size in Sydney Price Index.

Alternative hypothesis: H0- There is significant mean difference in the market price and the

land size in total number of Sydney Price Index.

Null hypothesis: H0- There is no significant mean difference in the market price and the land

size in Annual % change.

Alternative hypothesis: H0- There is significant mean difference in the market price and the

land size in Annual % change.

Null hypothesis: H0- There is no significant mean difference in the market price and the land

size in Total Number of square meters.

Alternative hypothesis: H0- There is significant mean difference in the market price and the

land size in Total Number of square meters.

Null hypothesis: H0- There is no significant mean difference in the market price and the land

size in Age of house (years).

Alternative hypothesis: H0- There is significant mean difference in the market price and the

land size in Age of house (years).

6

The significance value helps in understanding significance F as probability that

regression model is in appropriate and has requirement to be discarded. It reflects the probability

that model is wrong as per significance or probability of being incorrect with possibilities. In our

data age of house and Sydney price index's significance value is less than 0.05 which shows that

acceptance then null hypothesis is rejected. It could be elaborated that there is significant mean

difference in the market price and the land size in Age of house (years) and Sydney price index.

However, significance value of total number of squares meters and annual % change

value is more than 0.05 as it could be elaborated about acceptance of alternative hypothesis. It

could be explained statistically that there is no significant mean difference in the total number of

squares meters and annual % change (Dinov, 2018).

TASK 6

Value of coefficient of determination for relationship among dependent and independent

variables

The coefficient of determination is replicated as measure implied in statistical analysis

which assess that how model explain and forecast the future outcomes. This is highly indicative

of level of elaborated variability in data set and is commonly known as R squared as measure of

accuracy of the model. In this relationship R square as goodness of fit is 0.8098 which is positive

signal as 80% of the variation of Market price is elaborated through all independent variables

(Sydney price index, Annual % change, Total number of meter and years). Thus, closer to 1,

better regression line fits the particular data.

TASK 7

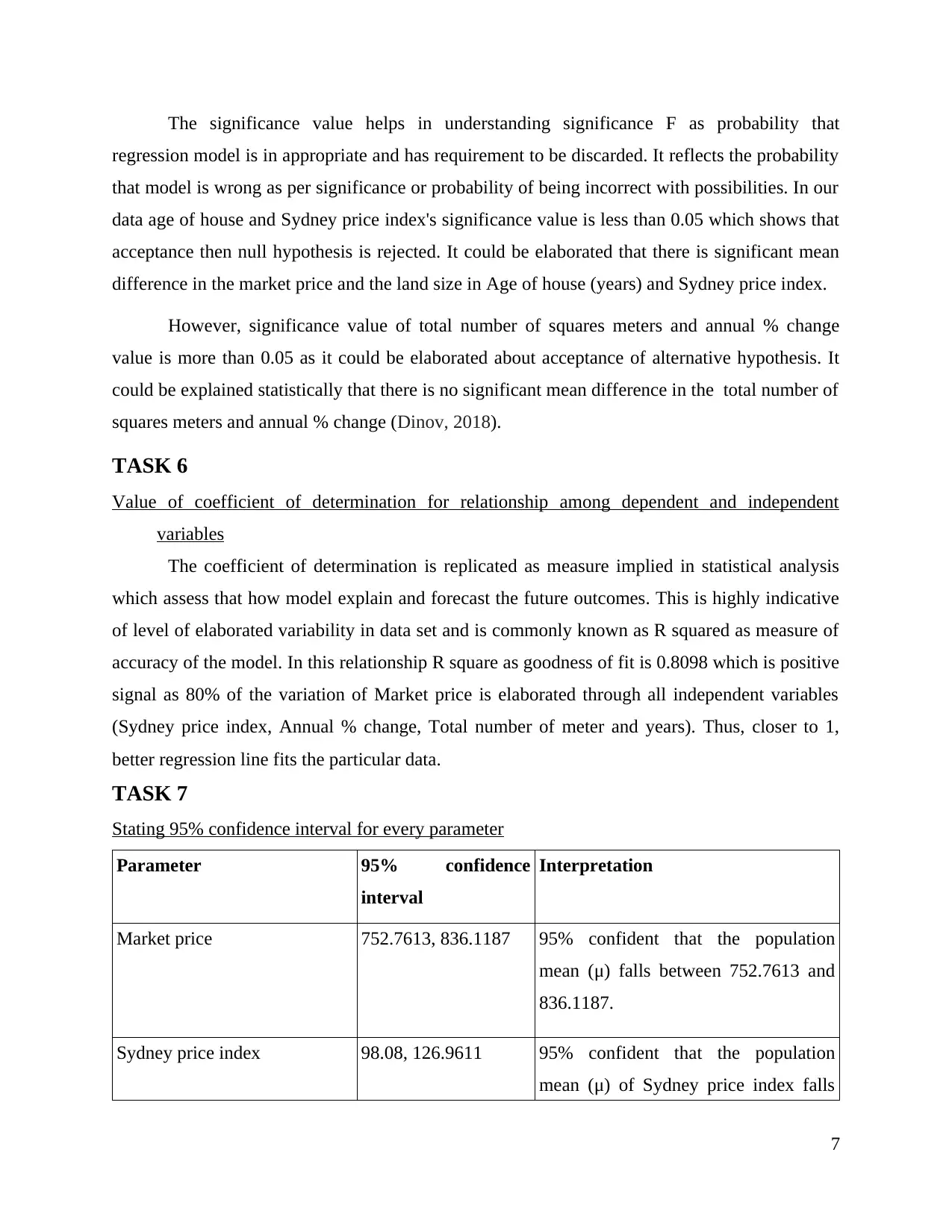

Stating 95% confidence interval for every parameter

Parameter 95% confidence

interval

Interpretation

Market price 752.7613, 836.1187 95% confident that the population

mean (μ) falls between 752.7613 and

836.1187.

Sydney price index 98.08, 126.9611 95% confident that the population

mean (μ) of Sydney price index falls

7

regression model is in appropriate and has requirement to be discarded. It reflects the probability

that model is wrong as per significance or probability of being incorrect with possibilities. In our

data age of house and Sydney price index's significance value is less than 0.05 which shows that

acceptance then null hypothesis is rejected. It could be elaborated that there is significant mean

difference in the market price and the land size in Age of house (years) and Sydney price index.

However, significance value of total number of squares meters and annual % change

value is more than 0.05 as it could be elaborated about acceptance of alternative hypothesis. It

could be explained statistically that there is no significant mean difference in the total number of

squares meters and annual % change (Dinov, 2018).

TASK 6

Value of coefficient of determination for relationship among dependent and independent

variables

The coefficient of determination is replicated as measure implied in statistical analysis

which assess that how model explain and forecast the future outcomes. This is highly indicative

of level of elaborated variability in data set and is commonly known as R squared as measure of

accuracy of the model. In this relationship R square as goodness of fit is 0.8098 which is positive

signal as 80% of the variation of Market price is elaborated through all independent variables

(Sydney price index, Annual % change, Total number of meter and years). Thus, closer to 1,

better regression line fits the particular data.

TASK 7

Stating 95% confidence interval for every parameter

Parameter 95% confidence

interval

Interpretation

Market price 752.7613, 836.1187 95% confident that the population

mean (μ) falls between 752.7613 and

836.1187.

Sydney price index 98.08, 126.9611 95% confident that the population

mean (μ) of Sydney price index falls

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

between 98.0789 and 126.9611.

Annual % change 5.9492, 11.0308 95% confident that the population

mean (μ) falls between 5.9492 and

11.0308.

Total number of square meters 191.15, 229.5879 95% confident that the population

mean (μ) falls between 191.1521 and

229.5879.

Age of house (years) 11.0453, 22.8347 95% confident that the population

mean (μ) falls between 11.0453 and

22.8347

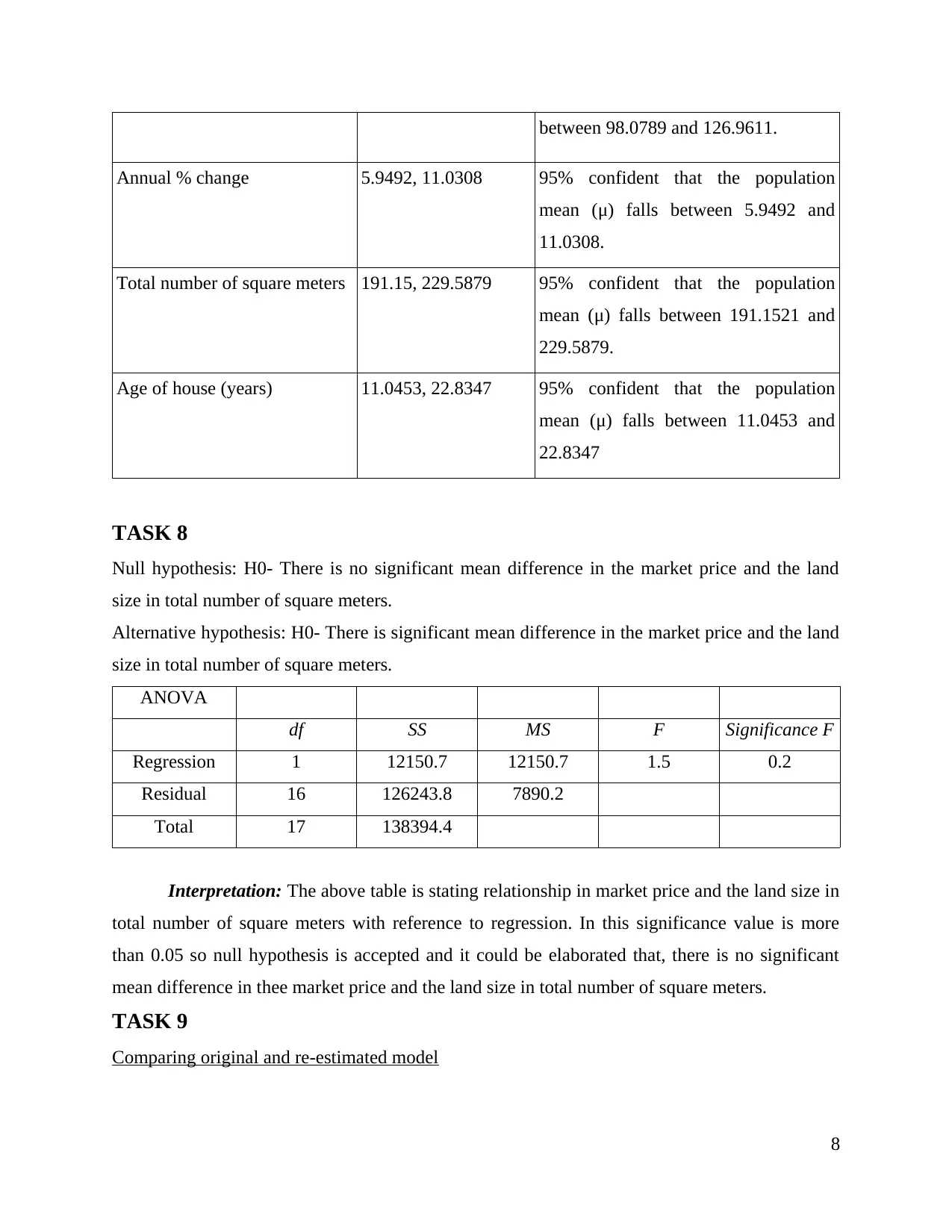

TASK 8

Null hypothesis: H0- There is no significant mean difference in the market price and the land

size in total number of square meters.

Alternative hypothesis: H0- There is significant mean difference in the market price and the land

size in total number of square meters.

ANOVA

df SS MS F Significance F

Regression 1 12150.7 12150.7 1.5 0.2

Residual 16 126243.8 7890.2

Total 17 138394.4

Interpretation: The above table is stating relationship in market price and the land size in

total number of square meters with reference to regression. In this significance value is more

than 0.05 so null hypothesis is accepted and it could be elaborated that, there is no significant

mean difference in thee market price and the land size in total number of square meters.

TASK 9

Comparing original and re-estimated model

8

Annual % change 5.9492, 11.0308 95% confident that the population

mean (μ) falls between 5.9492 and

11.0308.

Total number of square meters 191.15, 229.5879 95% confident that the population

mean (μ) falls between 191.1521 and

229.5879.

Age of house (years) 11.0453, 22.8347 95% confident that the population

mean (μ) falls between 11.0453 and

22.8347

TASK 8

Null hypothesis: H0- There is no significant mean difference in the market price and the land

size in total number of square meters.

Alternative hypothesis: H0- There is significant mean difference in the market price and the land

size in total number of square meters.

ANOVA

df SS MS F Significance F

Regression 1 12150.7 12150.7 1.5 0.2

Residual 16 126243.8 7890.2

Total 17 138394.4

Interpretation: The above table is stating relationship in market price and the land size in

total number of square meters with reference to regression. In this significance value is more

than 0.05 so null hypothesis is accepted and it could be elaborated that, there is no significant

mean difference in thee market price and the land size in total number of square meters.

TASK 9

Comparing original and re-estimated model

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

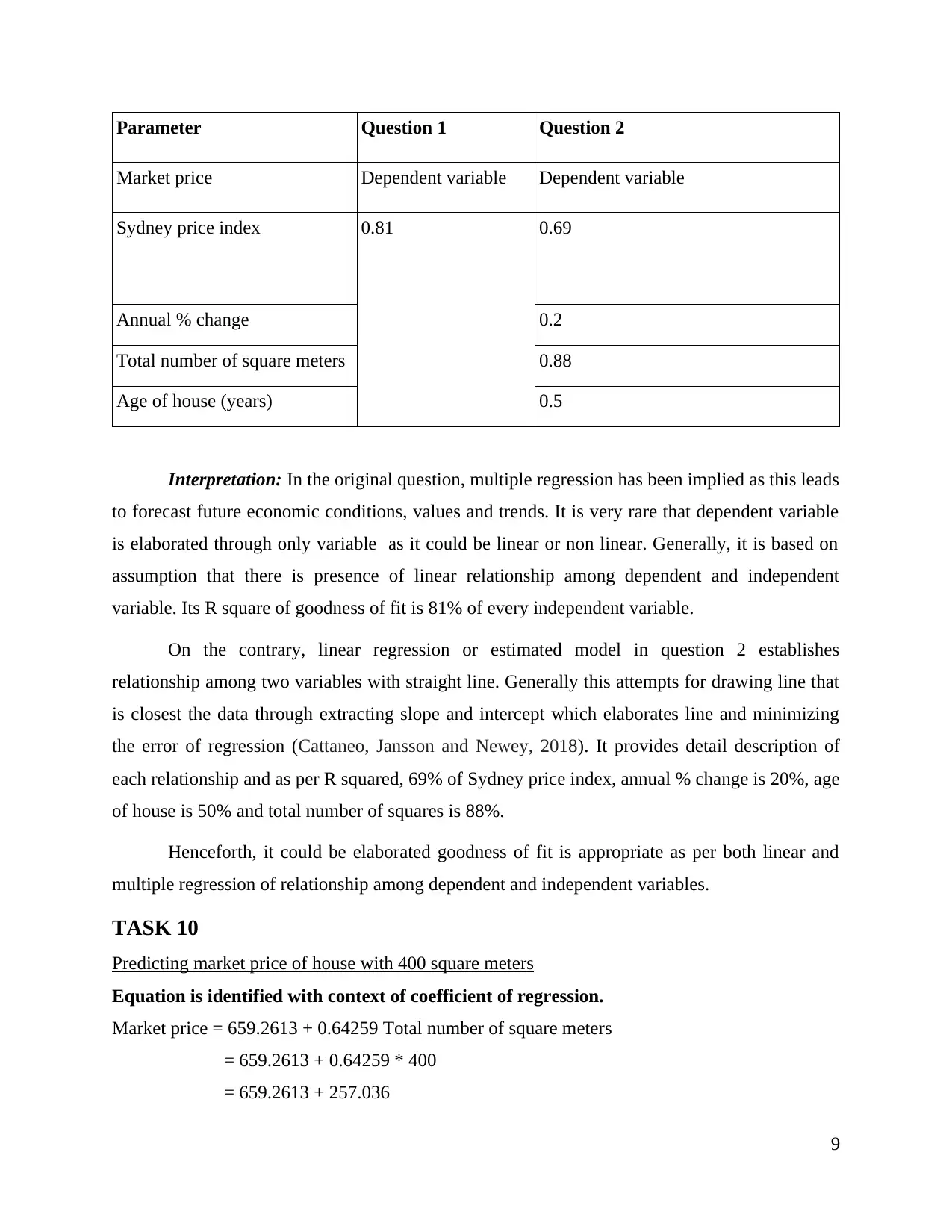

Parameter Question 1 Question 2

Market price Dependent variable Dependent variable

Sydney price index 0.81 0.69

Annual % change 0.2

Total number of square meters 0.88

Age of house (years) 0.5

Interpretation: In the original question, multiple regression has been implied as this leads

to forecast future economic conditions, values and trends. It is very rare that dependent variable

is elaborated through only variable as it could be linear or non linear. Generally, it is based on

assumption that there is presence of linear relationship among dependent and independent

variable. Its R square of goodness of fit is 81% of every independent variable.

On the contrary, linear regression or estimated model in question 2 establishes

relationship among two variables with straight line. Generally this attempts for drawing line that

is closest the data through extracting slope and intercept which elaborates line and minimizing

the error of regression (Cattaneo, Jansson and Newey, 2018). It provides detail description of

each relationship and as per R squared, 69% of Sydney price index, annual % change is 20%, age

of house is 50% and total number of squares is 88%.

Henceforth, it could be elaborated goodness of fit is appropriate as per both linear and

multiple regression of relationship among dependent and independent variables.

TASK 10

Predicting market price of house with 400 square meters

Equation is identified with context of coefficient of regression.

Market price = 659.2613 + 0.64259 Total number of square meters

= 659.2613 + 0.64259 * 400

= 659.2613 + 257.036

9

Market price Dependent variable Dependent variable

Sydney price index 0.81 0.69

Annual % change 0.2

Total number of square meters 0.88

Age of house (years) 0.5

Interpretation: In the original question, multiple regression has been implied as this leads

to forecast future economic conditions, values and trends. It is very rare that dependent variable

is elaborated through only variable as it could be linear or non linear. Generally, it is based on

assumption that there is presence of linear relationship among dependent and independent

variable. Its R square of goodness of fit is 81% of every independent variable.

On the contrary, linear regression or estimated model in question 2 establishes

relationship among two variables with straight line. Generally this attempts for drawing line that

is closest the data through extracting slope and intercept which elaborates line and minimizing

the error of regression (Cattaneo, Jansson and Newey, 2018). It provides detail description of

each relationship and as per R squared, 69% of Sydney price index, annual % change is 20%, age

of house is 50% and total number of squares is 88%.

Henceforth, it could be elaborated goodness of fit is appropriate as per both linear and

multiple regression of relationship among dependent and independent variables.

TASK 10

Predicting market price of house with 400 square meters

Equation is identified with context of coefficient of regression.

Market price = 659.2613 + 0.64259 Total number of square meters

= 659.2613 + 0.64259 * 400

= 659.2613 + 257.036

9

= $916.2973

CONCLUSION

On basis of above report it could be concluded that regression helps in extracting

relationship among dependent and independent variable. It has shown importance of confidence

interval with 95% within 18 sample of House price Index (a) (b); Brisbane, Sydney and

Melbourne, 2002 – 03 to 2016 – 17 with context to significance value.

10

CONCLUSION

On basis of above report it could be concluded that regression helps in extracting

relationship among dependent and independent variable. It has shown importance of confidence

interval with 95% within 18 sample of House price Index (a) (b); Brisbane, Sydney and

Melbourne, 2002 – 03 to 2016 – 17 with context to significance value.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.