HI6007 Statistics for Business Decisions Group Assignment T3 2019

VerifiedAdded on 2022/08/20

|15

|1895

|11

Homework Assignment

AI Summary

This document presents a group assignment solution for the HI6007 Statistics for Business Decisions course. The assignment includes three main answers. The first answer involves the comparison of Australian Food and Fibre Exports between 2010 and 2015 using bar graphs, analyzing export values in both millions of dollars and percentages across different states and regions. The second answer focuses on a frequency distribution analysis of weekly sales data, including the creation of frequency tables, relative frequency histograms, and ogives, along with calculations of cumulative frequencies and proportions. The third answer explores the relationship between the rate of inflation and the All-Ordinaries Index in Australia, using scatter plots, descriptive statistics, correlation analysis, and a simple linear regression model. The analysis includes the calculation of the correlation coefficient, hypothesis testing, and interpretation of the regression output, including R-squared and standard error, to determine the impact of inflation on the stock market index.

Running head: STATISTICS FOR BUSINESS DECISIONS

Statistics for Business

Name of the Student:

Name of the University:

Author note:

Statistics for Business

Name of the Student:

Name of the University:

Author note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1STATISTICS FOR BUSINESS DECISIONS

Table of Contents

Answer 1..........................................................................................................................................2

Answer 2..........................................................................................................................................4

Answer 3..........................................................................................................................................6

References......................................................................................................................................13

Table of Contents

Answer 1..........................................................................................................................................2

Answer 2..........................................................................................................................................4

Answer 3..........................................................................................................................................6

References......................................................................................................................................13

2STATISTICS FOR BUSINESS DECISIONS

Answer 1

a)

Victoria

Queensland

NSW

WA

SA

Tasmania

Others

0 2,000 4,000 6,000 8,000 10,000 12,000 14,000

7,344

4,872

4,959

4,219

3,391

907

973

11,656

8,179

6,979

6,350

5,255

736

4,278

Australian food and fibre exports by state ($million),

2010 and 2015

Exports ($million) 2015 Exports ($million) 2010

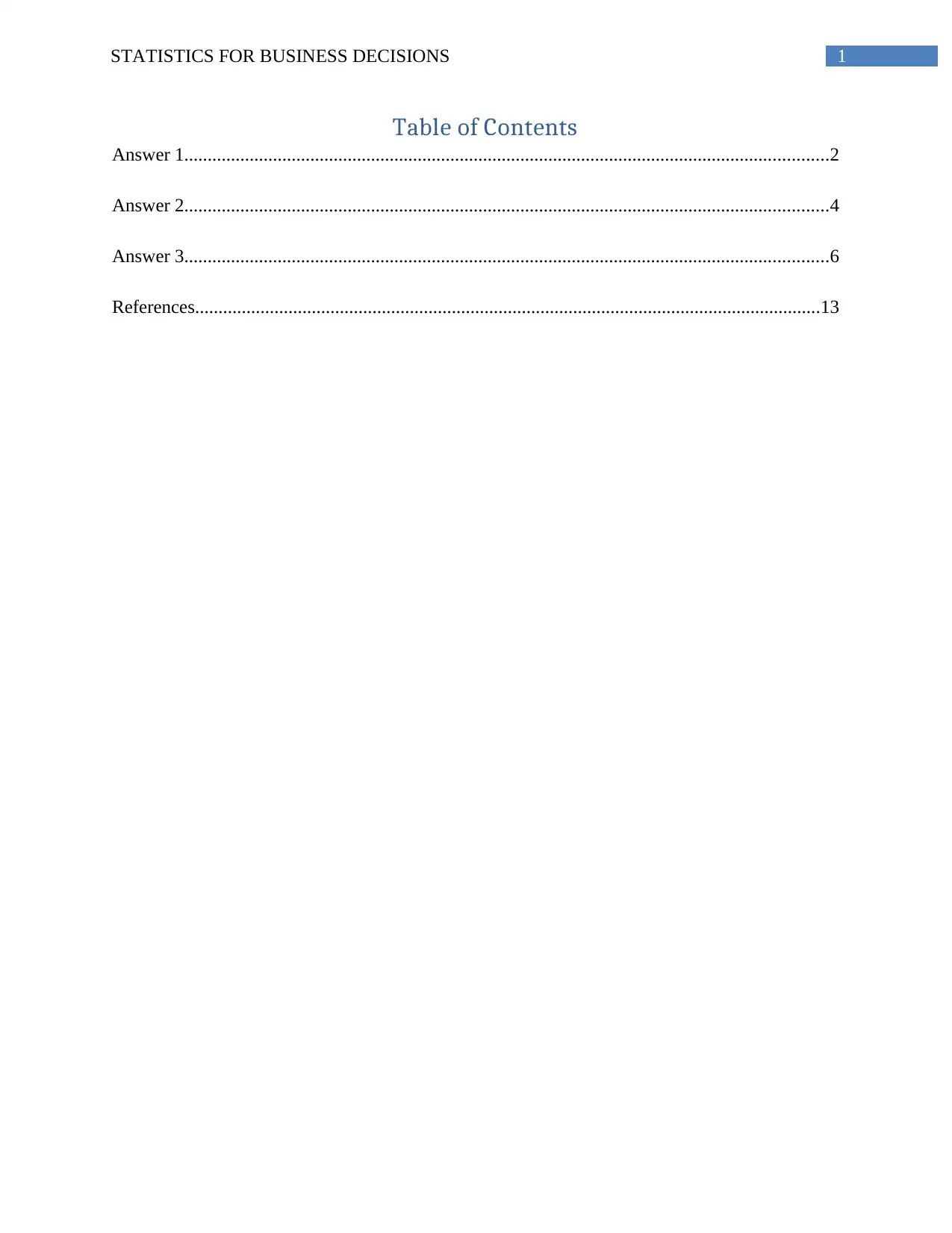

Figure 1: Australian Food and Fibre Exports ($million), 2010, 2015

b)

Victoria

Queensland

NSW

WA

SA

Tasmania

Others

0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00%

27.54%

18.27%

18.60%

15.82%

12.72%

3.40%

3.65%

26.84%

18.83%

16.07%

14.62%

12.10%

1.69%

9.85%

Australia Food and fibre exports (%), 2010 and 2015

Export ($million, %), 2015 Export ($million, %), 2010

Answer 1

a)

Victoria

Queensland

NSW

WA

SA

Tasmania

Others

0 2,000 4,000 6,000 8,000 10,000 12,000 14,000

7,344

4,872

4,959

4,219

3,391

907

973

11,656

8,179

6,979

6,350

5,255

736

4,278

Australian food and fibre exports by state ($million),

2010 and 2015

Exports ($million) 2015 Exports ($million) 2010

Figure 1: Australian Food and Fibre Exports ($million), 2010, 2015

b)

Victoria

Queensland

NSW

WA

SA

Tasmania

Others

0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00%

27.54%

18.27%

18.60%

15.82%

12.72%

3.40%

3.65%

26.84%

18.83%

16.07%

14.62%

12.10%

1.69%

9.85%

Australia Food and fibre exports (%), 2010 and 2015

Export ($million, %), 2015 Export ($million, %), 2010

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3STATISTICS FOR BUSINESS DECISIONS

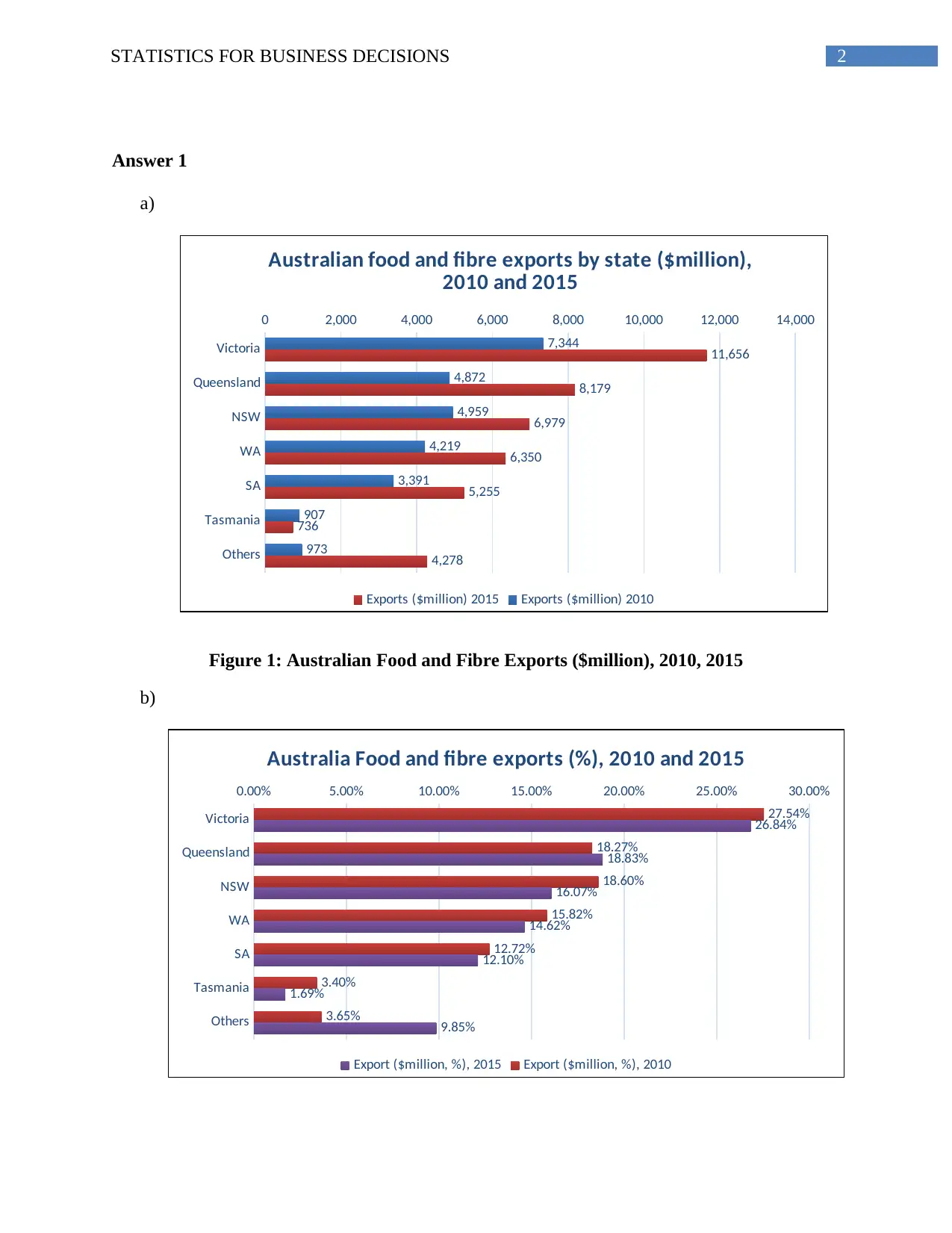

Figure 2: Australian Food and Fibre Exports ($million, %), 2010, 2015

c) Figure 1 and 2 compares the total export value of the Australian Food and Fibre in

$million and in percentage values for 2010 and 2015 for each state of Australia and other

regions of Australia. Both bar graphs display that among all the Australian states,

Victoria has provided the maximum in the total export value in $million and in

percentage values as well. It is found from the Figure 1 that the total export value of food

and fibre for each of the states has increased substantially in 2015 than in 2010. The

growth in the value of export in $million has been consistent for all the Australian states

for both the years. All the states show export growth from 2010 to 2015. The regions

under ‘Others’ category have contributed higher than Tasmania.

Figure 2 displays shows the percentage contribution of all the Australian states in

the food and fibre exports for 2010 and 2015. In 2015, the total value of export was much

higher for all the states from that in 2010 and that has influenced the percentage value of

the contribution made by the states in the food and fibre exports. The bar graph displays

that, the percentage contribution of all the states was higher in 2010 than in 2015. As the

total export value has increased quite significantly in 2015, the proportion of the

contribution of the states has changed too. The percentage contribution of the states were

higher in 2010 than in 2015 except for Queensland due to the difference in total value.

Figure 2: Australian Food and Fibre Exports ($million, %), 2010, 2015

c) Figure 1 and 2 compares the total export value of the Australian Food and Fibre in

$million and in percentage values for 2010 and 2015 for each state of Australia and other

regions of Australia. Both bar graphs display that among all the Australian states,

Victoria has provided the maximum in the total export value in $million and in

percentage values as well. It is found from the Figure 1 that the total export value of food

and fibre for each of the states has increased substantially in 2015 than in 2010. The

growth in the value of export in $million has been consistent for all the Australian states

for both the years. All the states show export growth from 2010 to 2015. The regions

under ‘Others’ category have contributed higher than Tasmania.

Figure 2 displays shows the percentage contribution of all the Australian states in

the food and fibre exports for 2010 and 2015. In 2015, the total value of export was much

higher for all the states from that in 2010 and that has influenced the percentage value of

the contribution made by the states in the food and fibre exports. The bar graph displays

that, the percentage contribution of all the states was higher in 2010 than in 2015. As the

total export value has increased quite significantly in 2015, the proportion of the

contribution of the states has changed too. The percentage contribution of the states were

higher in 2010 than in 2015 except for Queensland due to the difference in total value.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4STATISTICS FOR BUSINESS DECISIONS

Answer 2

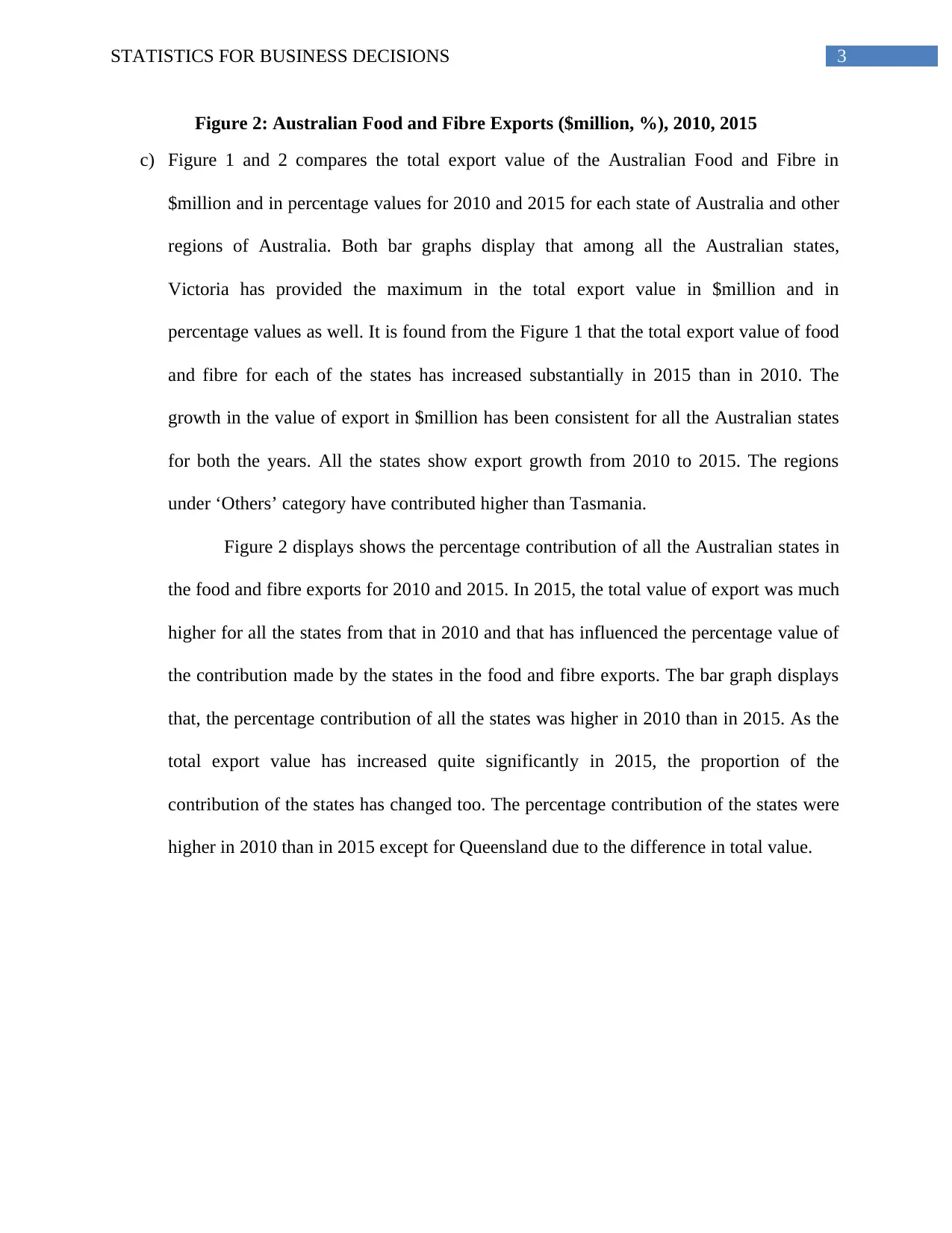

(a) and (b)

Classes Frequency Relative

Frequency

Cumulative

Frequency

Cumulative

Relative

Frequency

0 - 4 4 0.1 4 0.100

5 - 9 9 0.225 13 0.325

10 - 14 7 0.175 20 0.500

15 - 19 11 0.275 31 0.775

20 - 24 2 0.05 33 0.825

25 - 29 5 0.125 38 0.950

30 - 34 2 0.05 40 1.000

Total 40 1 40 1

Table 1: Weekly Sales Data: Frequency and class distribution

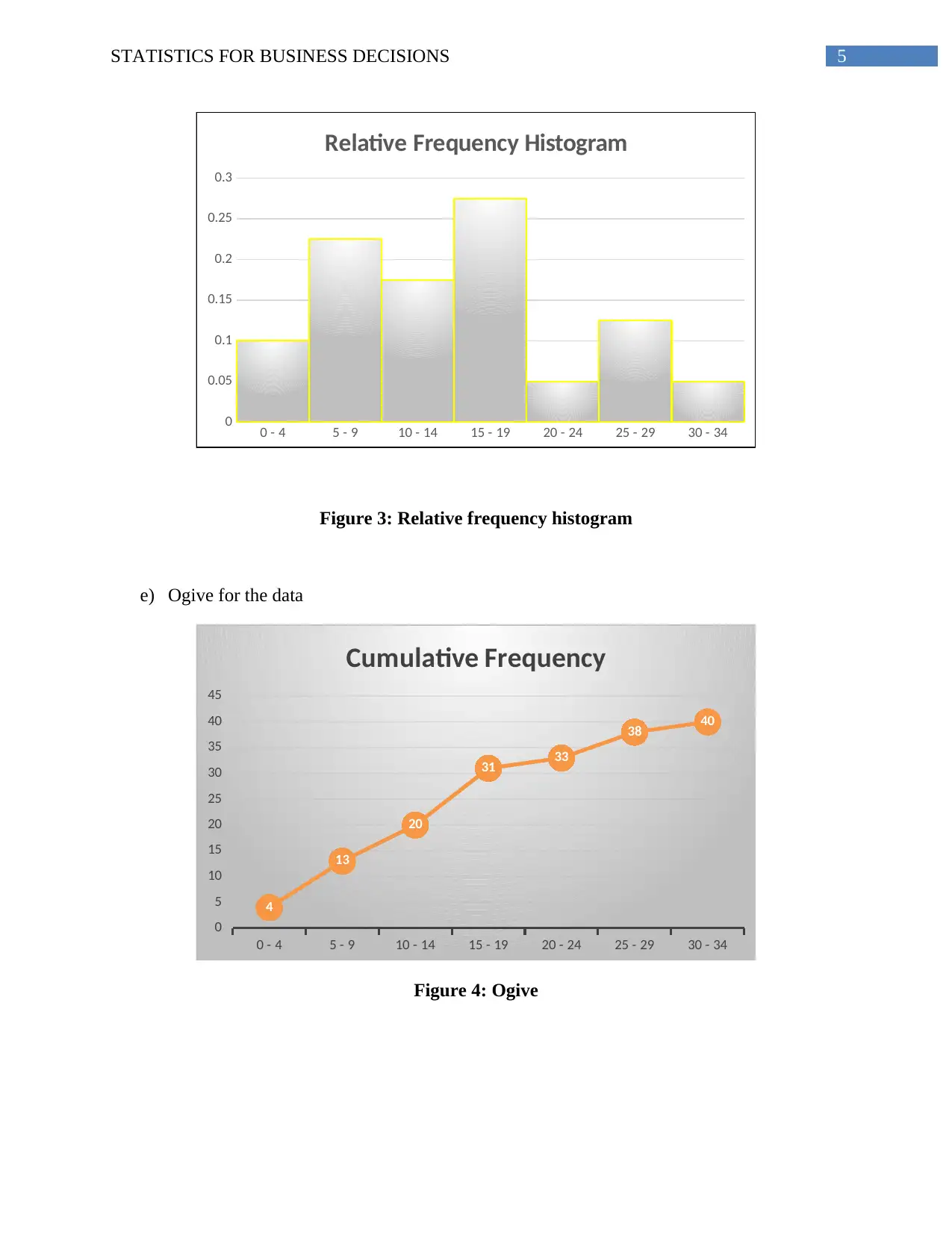

d) Relative frequency histogram

Answer 2

(a) and (b)

Classes Frequency Relative

Frequency

Cumulative

Frequency

Cumulative

Relative

Frequency

0 - 4 4 0.1 4 0.100

5 - 9 9 0.225 13 0.325

10 - 14 7 0.175 20 0.500

15 - 19 11 0.275 31 0.775

20 - 24 2 0.05 33 0.825

25 - 29 5 0.125 38 0.950

30 - 34 2 0.05 40 1.000

Total 40 1 40 1

Table 1: Weekly Sales Data: Frequency and class distribution

d) Relative frequency histogram

5STATISTICS FOR BUSINESS DECISIONS

0 - 4 5 - 9 10 - 14 15 - 19 20 - 24 25 - 29 30 - 34

0

0.05

0.1

0.15

0.2

0.25

0.3

Relative Frequency Histogram

Figure 3: Relative frequency histogram

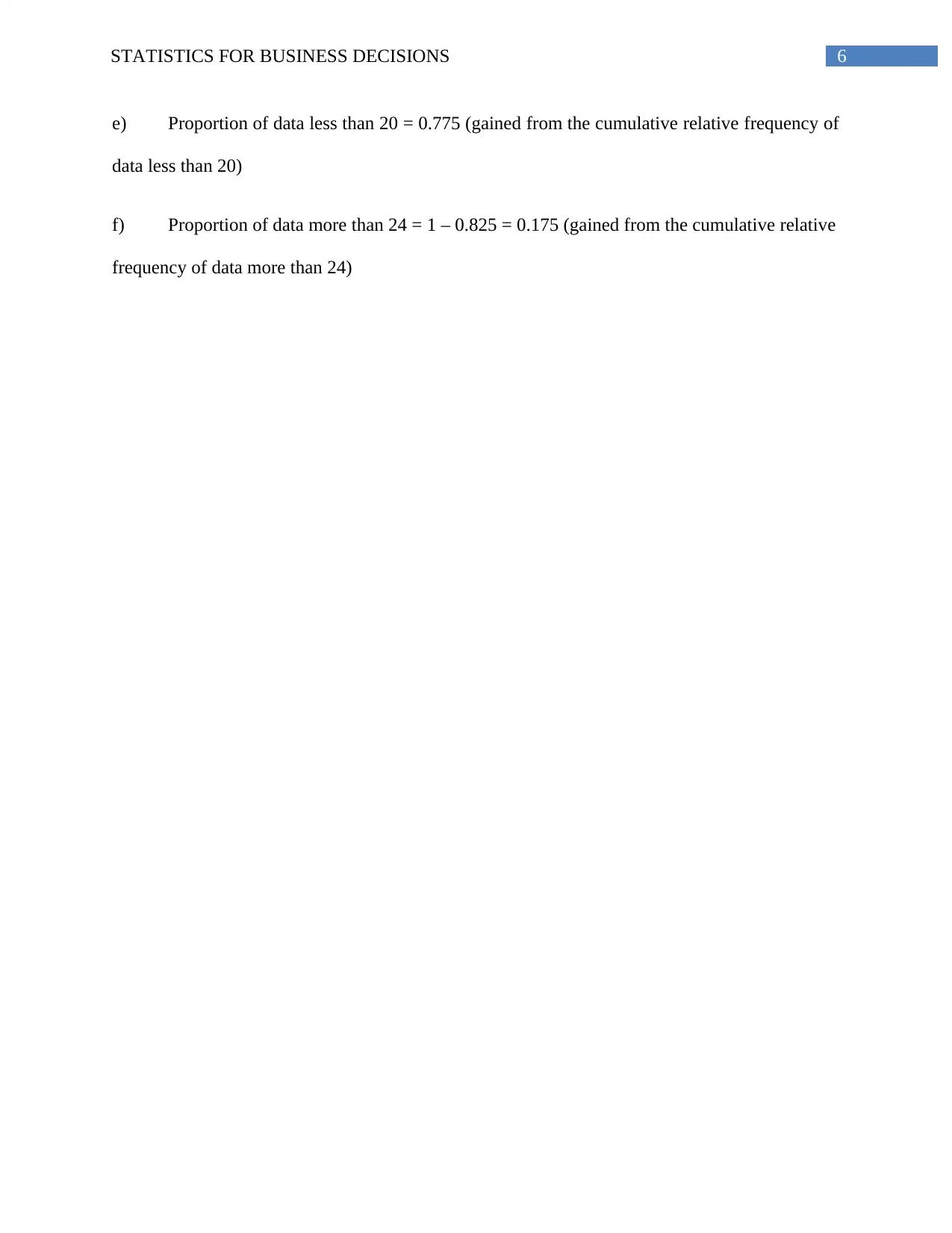

e) Ogive for the data

0 - 4 5 - 9 10 - 14 15 - 19 20 - 24 25 - 29 30 - 34

0

5

10

15

20

25

30

35

40

45

4

13

20

31 33

38 40

Cumulative Frequency

Figure 4: Ogive

0 - 4 5 - 9 10 - 14 15 - 19 20 - 24 25 - 29 30 - 34

0

0.05

0.1

0.15

0.2

0.25

0.3

Relative Frequency Histogram

Figure 3: Relative frequency histogram

e) Ogive for the data

0 - 4 5 - 9 10 - 14 15 - 19 20 - 24 25 - 29 30 - 34

0

5

10

15

20

25

30

35

40

45

4

13

20

31 33

38 40

Cumulative Frequency

Figure 4: Ogive

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6STATISTICS FOR BUSINESS DECISIONS

e) Proportion of data less than 20 = 0.775 (gained from the cumulative relative frequency of

data less than 20)

f) Proportion of data more than 24 = 1 – 0.825 = 0.175 (gained from the cumulative relative

frequency of data more than 24)

e) Proportion of data less than 20 = 0.775 (gained from the cumulative relative frequency of

data less than 20)

f) Proportion of data more than 24 = 1 – 0.825 = 0.175 (gained from the cumulative relative

frequency of data more than 24)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7STATISTICS FOR BUSINESS DECISIONS

Answer 3

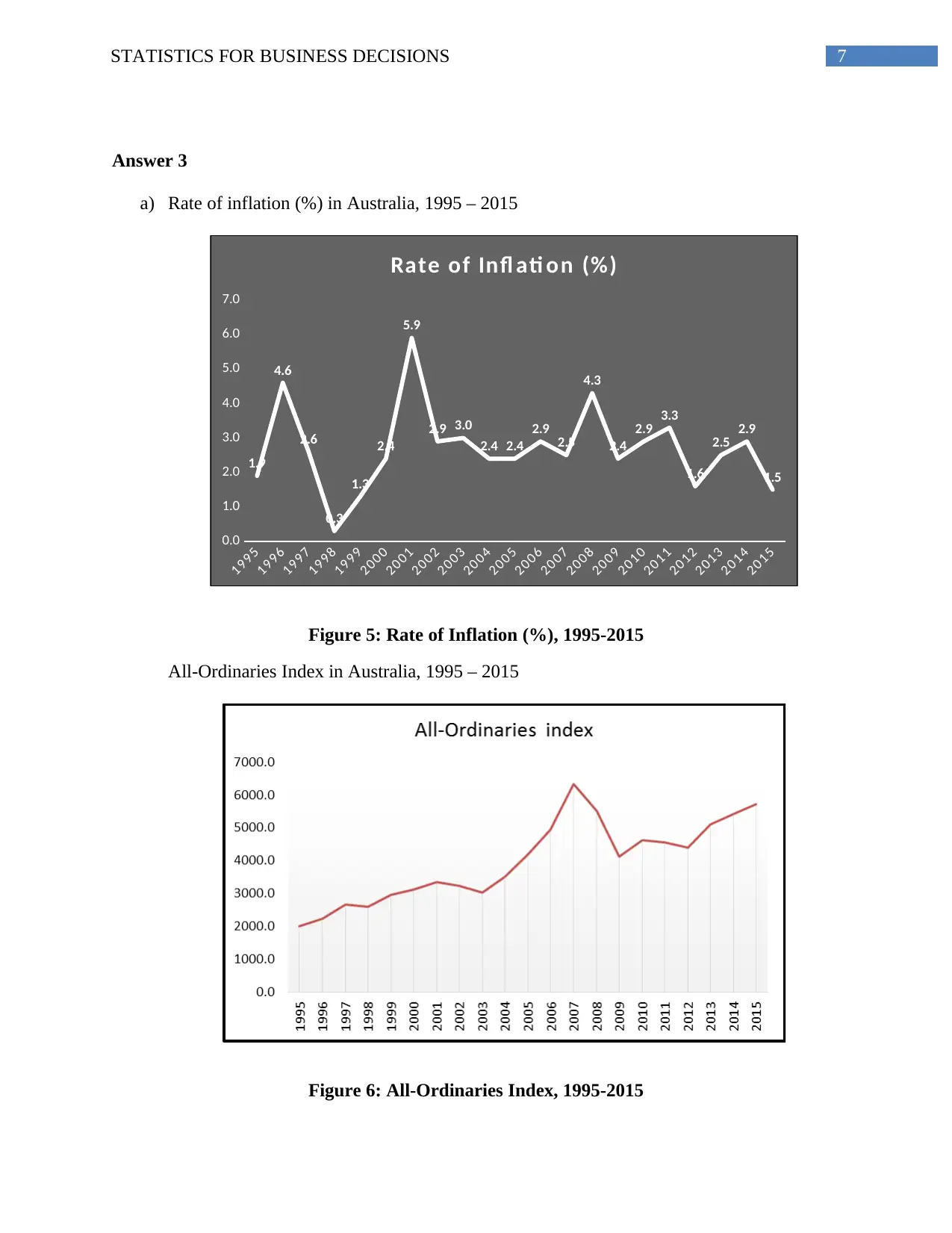

a) Rate of inflation (%) in Australia, 1995 – 2015

199 5

199 6

199 7

199 8

199 9

200 0

200 1

200 2

200 3

200 4

200 5

200 6

200 7

200 8

200 9

201 0

201 1

201 2

201 3

201 4

201 5

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

1.9

4.6

2.6

0.3

1.3

2.4

5.9

2.9 3.0

2.4 2.4

2.9 2.5

4.3

2.4

2.9 3.3

1.6

2.5 2.9

1.5

Rate of Infl ati on (%)

Figure 5: Rate of Inflation (%), 1995-2015

All-Ordinaries Index in Australia, 1995 – 2015

Figure 6: All-Ordinaries Index, 1995-2015

Answer 3

a) Rate of inflation (%) in Australia, 1995 – 2015

199 5

199 6

199 7

199 8

199 9

200 0

200 1

200 2

200 3

200 4

200 5

200 6

200 7

200 8

200 9

201 0

201 1

201 2

201 3

201 4

201 5

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

1.9

4.6

2.6

0.3

1.3

2.4

5.9

2.9 3.0

2.4 2.4

2.9 2.5

4.3

2.4

2.9 3.3

1.6

2.5 2.9

1.5

Rate of Infl ati on (%)

Figure 5: Rate of Inflation (%), 1995-2015

All-Ordinaries Index in Australia, 1995 – 2015

Figure 6: All-Ordinaries Index, 1995-2015

8STATISTICS FOR BUSINESS DECISIONS

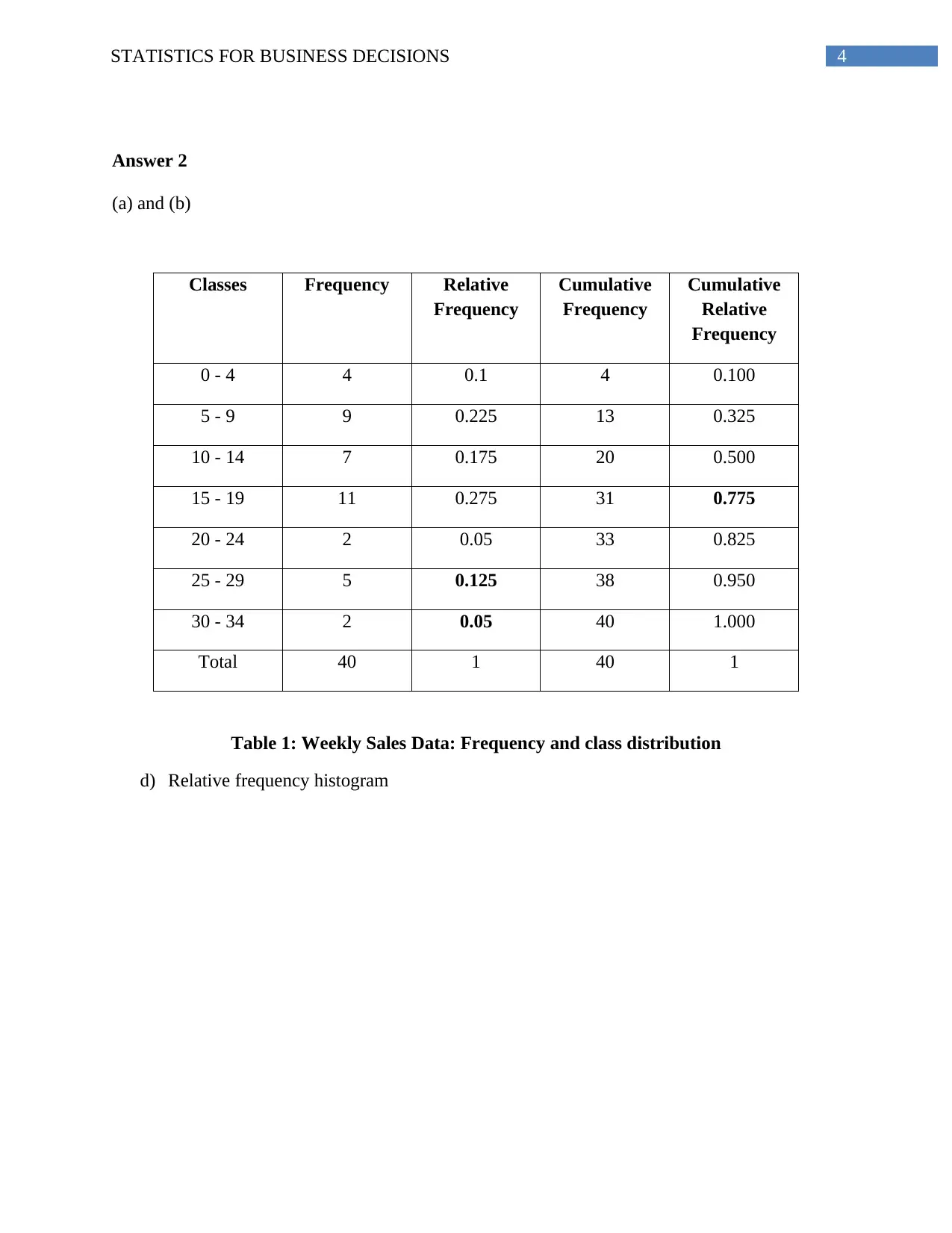

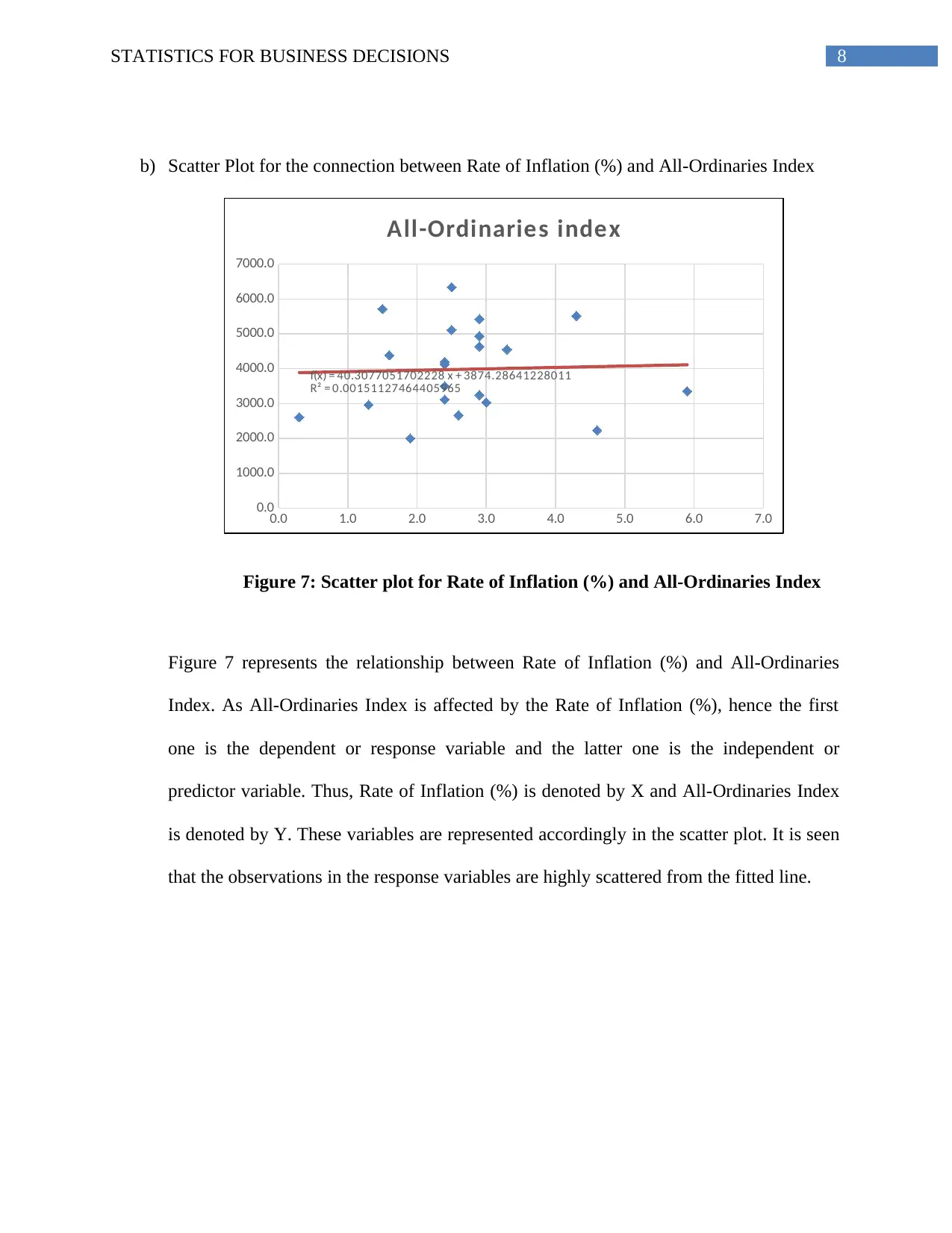

b) Scatter Plot for the connection between Rate of Inflation (%) and All-Ordinaries Index

0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0

0.0

1000.0

2000.0

3000.0

4000.0

5000.0

6000.0

7000.0

f(x) = 40.3077051702228 x + 3874.28641228011

R² = 0.00151127464405965

All-Ordinaries index

Figure 7: Scatter plot for Rate of Inflation (%) and All-Ordinaries Index

Figure 7 represents the relationship between Rate of Inflation (%) and All-Ordinaries

Index. As All-Ordinaries Index is affected by the Rate of Inflation (%), hence the first

one is the dependent or response variable and the latter one is the independent or

predictor variable. Thus, Rate of Inflation (%) is denoted by X and All-Ordinaries Index

is denoted by Y. These variables are represented accordingly in the scatter plot. It is seen

that the observations in the response variables are highly scattered from the fitted line.

b) Scatter Plot for the connection between Rate of Inflation (%) and All-Ordinaries Index

0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0

0.0

1000.0

2000.0

3000.0

4000.0

5000.0

6000.0

7000.0

f(x) = 40.3077051702228 x + 3874.28641228011

R² = 0.00151127464405965

All-Ordinaries index

Figure 7: Scatter plot for Rate of Inflation (%) and All-Ordinaries Index

Figure 7 represents the relationship between Rate of Inflation (%) and All-Ordinaries

Index. As All-Ordinaries Index is affected by the Rate of Inflation (%), hence the first

one is the dependent or response variable and the latter one is the independent or

predictor variable. Thus, Rate of Inflation (%) is denoted by X and All-Ordinaries Index

is denoted by Y. These variables are represented accordingly in the scatter plot. It is seen

that the observations in the response variables are highly scattered from the fitted line.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9STATISTICS FOR BUSINESS DECISIONS

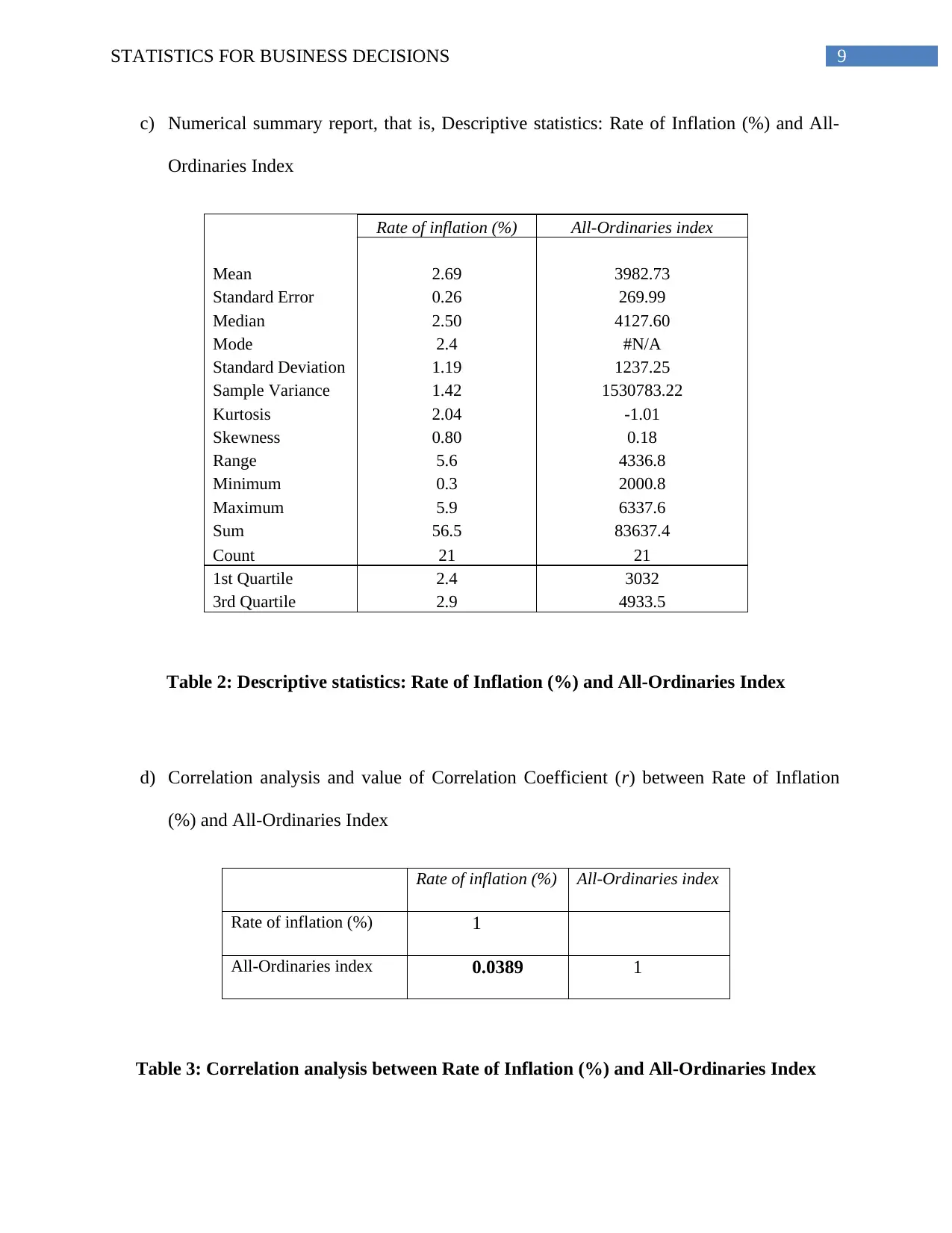

c) Numerical summary report, that is, Descriptive statistics: Rate of Inflation (%) and All-

Ordinaries Index

Rate of inflation (%) All-Ordinaries index

Mean 2.69 3982.73

Standard Error 0.26 269.99

Median 2.50 4127.60

Mode 2.4 #N/A

Standard Deviation 1.19 1237.25

Sample Variance 1.42 1530783.22

Kurtosis 2.04 -1.01

Skewness 0.80 0.18

Range 5.6 4336.8

Minimum 0.3 2000.8

Maximum 5.9 6337.6

Sum 56.5 83637.4

Count 21 21

1st Quartile 2.4 3032

3rd Quartile 2.9 4933.5

Table 2: Descriptive statistics: Rate of Inflation (%) and All-Ordinaries Index

d) Correlation analysis and value of Correlation Coefficient (r) between Rate of Inflation

(%) and All-Ordinaries Index

Rate of inflation (%) All-Ordinaries index

Rate of inflation (%) 1

All-Ordinaries index 0.0389 1

Table 3: Correlation analysis between Rate of Inflation (%) and All-Ordinaries Index

c) Numerical summary report, that is, Descriptive statistics: Rate of Inflation (%) and All-

Ordinaries Index

Rate of inflation (%) All-Ordinaries index

Mean 2.69 3982.73

Standard Error 0.26 269.99

Median 2.50 4127.60

Mode 2.4 #N/A

Standard Deviation 1.19 1237.25

Sample Variance 1.42 1530783.22

Kurtosis 2.04 -1.01

Skewness 0.80 0.18

Range 5.6 4336.8

Minimum 0.3 2000.8

Maximum 5.9 6337.6

Sum 56.5 83637.4

Count 21 21

1st Quartile 2.4 3032

3rd Quartile 2.9 4933.5

Table 2: Descriptive statistics: Rate of Inflation (%) and All-Ordinaries Index

d) Correlation analysis and value of Correlation Coefficient (r) between Rate of Inflation

(%) and All-Ordinaries Index

Rate of inflation (%) All-Ordinaries index

Rate of inflation (%) 1

All-Ordinaries index 0.0389 1

Table 3: Correlation analysis between Rate of Inflation (%) and All-Ordinaries Index

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10STATISTICS FOR BUSINESS DECISIONS

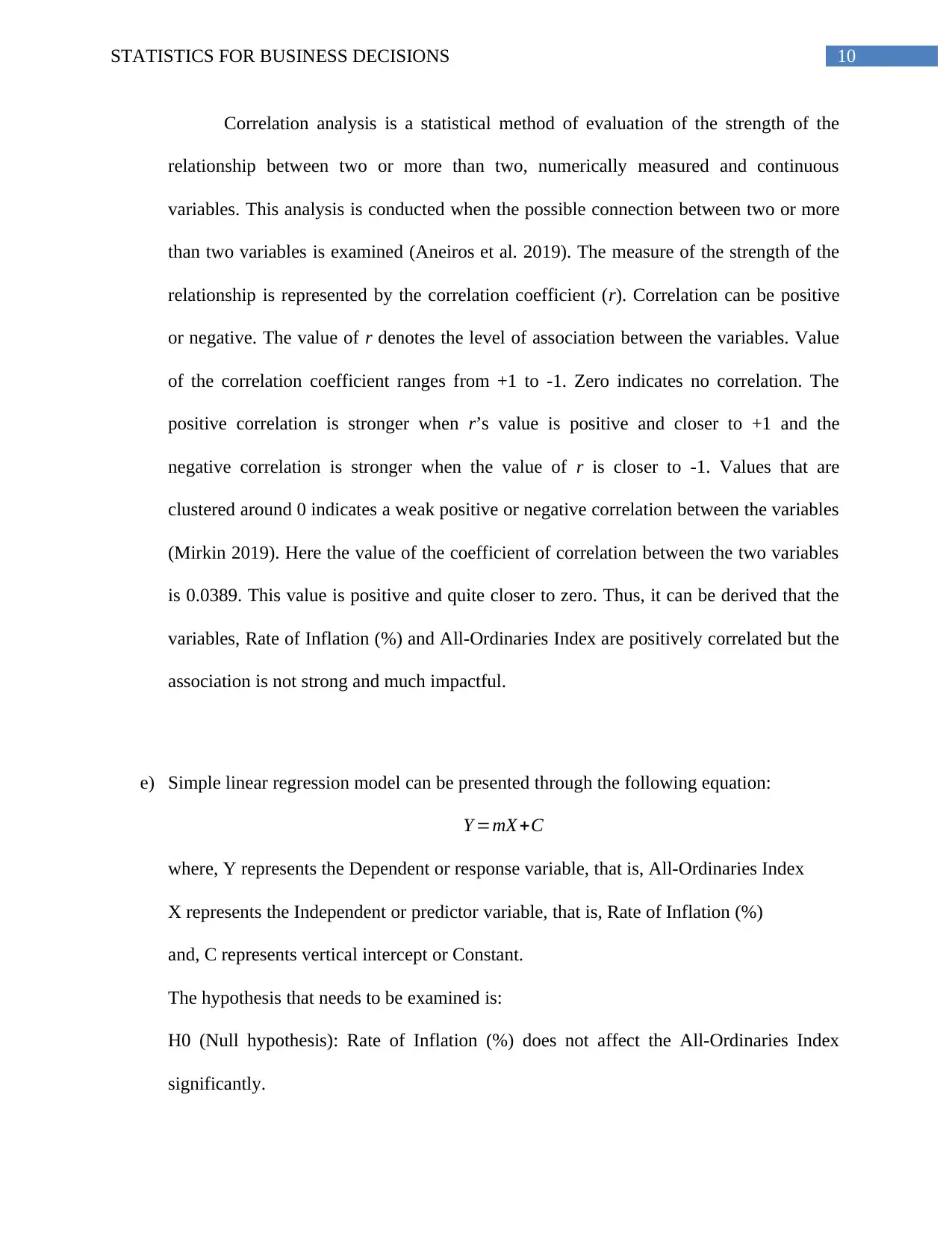

Correlation analysis is a statistical method of evaluation of the strength of the

relationship between two or more than two, numerically measured and continuous

variables. This analysis is conducted when the possible connection between two or more

than two variables is examined (Aneiros et al. 2019). The measure of the strength of the

relationship is represented by the correlation coefficient (r). Correlation can be positive

or negative. The value of r denotes the level of association between the variables. Value

of the correlation coefficient ranges from +1 to -1. Zero indicates no correlation. The

positive correlation is stronger when r’s value is positive and closer to +1 and the

negative correlation is stronger when the value of r is closer to -1. Values that are

clustered around 0 indicates a weak positive or negative correlation between the variables

(Mirkin 2019). Here the value of the coefficient of correlation between the two variables

is 0.0389. This value is positive and quite closer to zero. Thus, it can be derived that the

variables, Rate of Inflation (%) and All-Ordinaries Index are positively correlated but the

association is not strong and much impactful.

e) Simple linear regression model can be presented through the following equation:

Y =mX +C

where, Y represents the Dependent or response variable, that is, All-Ordinaries Index

X represents the Independent or predictor variable, that is, Rate of Inflation (%)

and, C represents vertical intercept or Constant.

The hypothesis that needs to be examined is:

H0 (Null hypothesis): Rate of Inflation (%) does not affect the All-Ordinaries Index

significantly.

Correlation analysis is a statistical method of evaluation of the strength of the

relationship between two or more than two, numerically measured and continuous

variables. This analysis is conducted when the possible connection between two or more

than two variables is examined (Aneiros et al. 2019). The measure of the strength of the

relationship is represented by the correlation coefficient (r). Correlation can be positive

or negative. The value of r denotes the level of association between the variables. Value

of the correlation coefficient ranges from +1 to -1. Zero indicates no correlation. The

positive correlation is stronger when r’s value is positive and closer to +1 and the

negative correlation is stronger when the value of r is closer to -1. Values that are

clustered around 0 indicates a weak positive or negative correlation between the variables

(Mirkin 2019). Here the value of the coefficient of correlation between the two variables

is 0.0389. This value is positive and quite closer to zero. Thus, it can be derived that the

variables, Rate of Inflation (%) and All-Ordinaries Index are positively correlated but the

association is not strong and much impactful.

e) Simple linear regression model can be presented through the following equation:

Y =mX +C

where, Y represents the Dependent or response variable, that is, All-Ordinaries Index

X represents the Independent or predictor variable, that is, Rate of Inflation (%)

and, C represents vertical intercept or Constant.

The hypothesis that needs to be examined is:

H0 (Null hypothesis): Rate of Inflation (%) does not affect the All-Ordinaries Index

significantly.

11STATISTICS FOR BUSINESS DECISIONS

H1 (Alternate hypothesis): Rate of Inflation (%) affects All-Ordinaries Index

significantly.

Regression outcome:

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.0389

R Square 0.0015

Adjusted R Square -0.0510

Standard Error 1268.4304

Observations 21

ANOVA

df SS MS F

Significance

F

Regression 1 46268.68 46268.68 0.029 0.867

Residual 19 30569395.73 1608915.56

Total 20 30615664.41

Coefficient

s

Standard

Error t Stat P-value

Intercept 3874.29 696.83 5.560 0.000

Rate of inflation (%) 40.31 237.69 0.170 0.867

Table 4: Simple linear regression model

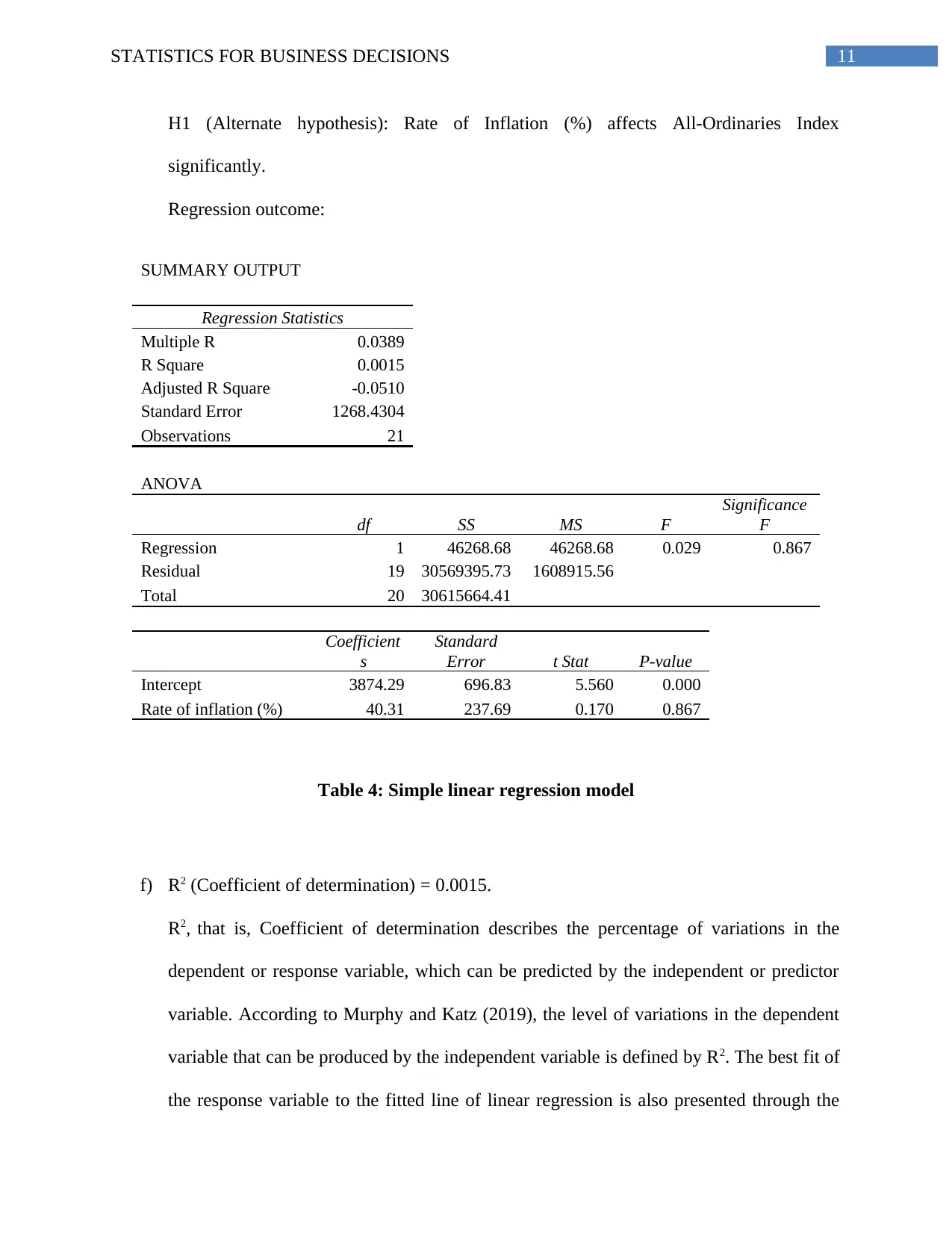

f) R2 (Coefficient of determination) = 0.0015.

R2, that is, Coefficient of determination describes the percentage of variations in the

dependent or response variable, which can be predicted by the independent or predictor

variable. According to Murphy and Katz (2019), the level of variations in the dependent

variable that can be produced by the independent variable is defined by R2. The best fit of

the response variable to the fitted line of linear regression is also presented through the

H1 (Alternate hypothesis): Rate of Inflation (%) affects All-Ordinaries Index

significantly.

Regression outcome:

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.0389

R Square 0.0015

Adjusted R Square -0.0510

Standard Error 1268.4304

Observations 21

ANOVA

df SS MS F

Significance

F

Regression 1 46268.68 46268.68 0.029 0.867

Residual 19 30569395.73 1608915.56

Total 20 30615664.41

Coefficient

s

Standard

Error t Stat P-value

Intercept 3874.29 696.83 5.560 0.000

Rate of inflation (%) 40.31 237.69 0.170 0.867

Table 4: Simple linear regression model

f) R2 (Coefficient of determination) = 0.0015.

R2, that is, Coefficient of determination describes the percentage of variations in the

dependent or response variable, which can be predicted by the independent or predictor

variable. According to Murphy and Katz (2019), the level of variations in the dependent

variable that can be produced by the independent variable is defined by R2. The best fit of

the response variable to the fitted line of linear regression is also presented through the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.