Statistics for Managerial Decisions Assignment Solution Week 10

VerifiedAdded on 2022/11/13

|10

|974

|397

Homework Assignment

AI Summary

This assignment solution provides detailed answers to questions related to statistics for managerial decisions. It includes analysis of stock prices using stem and leaf plots, histograms, and frequency polygons, along with a bar chart depicting market capitalization of healthcare firms. The solution also compares stock investment options based on risk and return. Further, it summarizes weekly rents for 1-bedroom apartments in Australia and analyzes Airbnb listings. It calculates probabilities using Poisson and normal distributions and interprets normal probability plots for variables like resting blood pressure and serum cholesterol to determine the suitability of normal distribution. Confidence intervals are computed and used to assess the variables' effectiveness in segregating patients with and without heart disease. Desklib offers a wide range of solved assignments and past papers to support students in their academic journey.

STATISTICS FOR MANAGERIAL DECISIONS

STUDENT ID:

[Pick the date]

STUDENT ID:

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

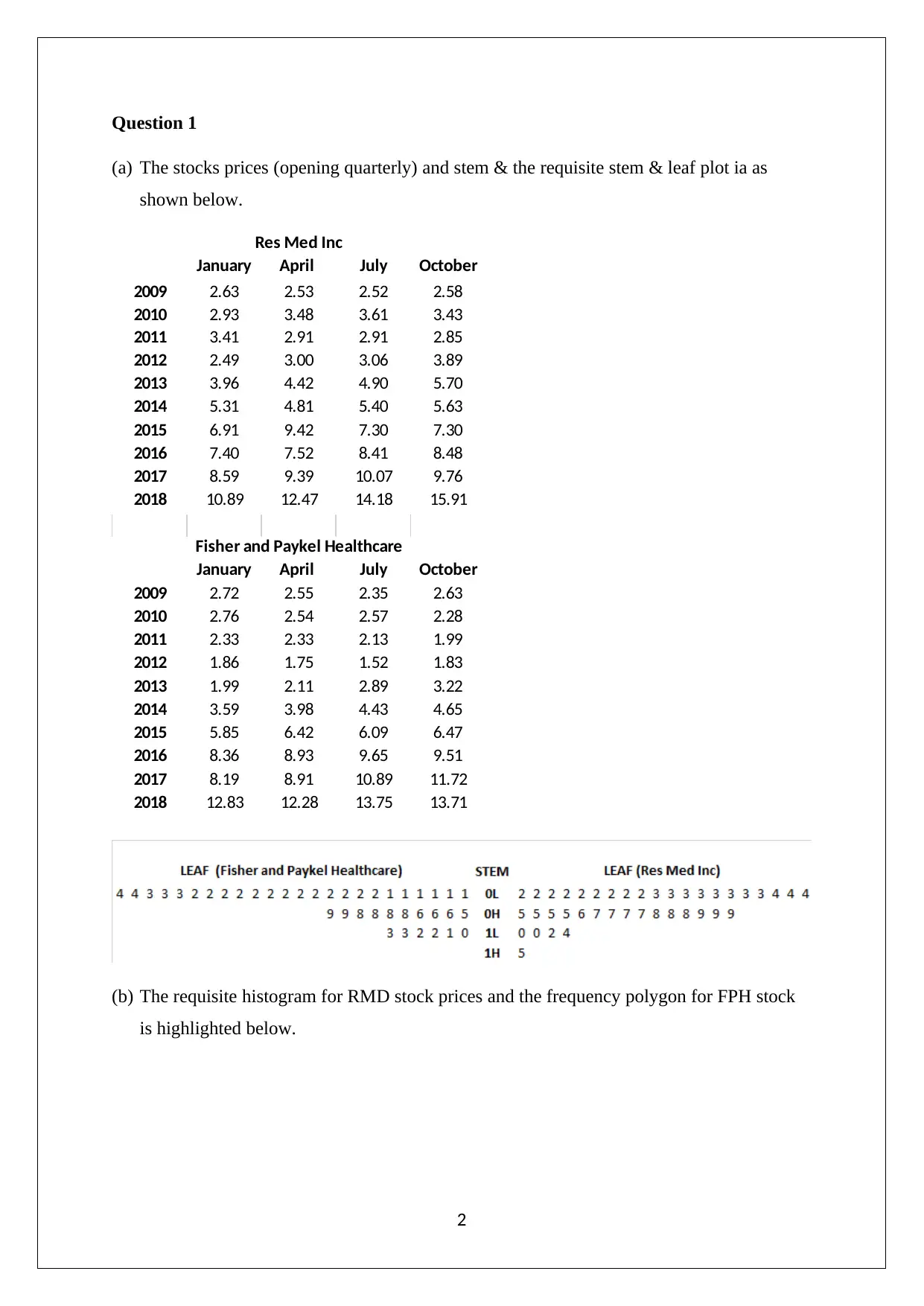

(a) The stocks prices (opening quarterly) and stem & the requisite stem & leaf plot ia as

shown below.

January April July October

2009 2.63 2.53 2.52 2.58

2010 2.93 3.48 3.61 3.43

2011 3.41 2.91 2.91 2.85

2012 2.49 3.00 3.06 3.89

2013 3.96 4.42 4.90 5.70

2014 5.31 4.81 5.40 5.63

2015 6.91 9.42 7.30 7.30

2016 7.40 7.52 8.41 8.48

2017 8.59 9.39 10.07 9.76

2018 10.89 12.47 14.18 15.91

January April July October

2009 2.72 2.55 2.35 2.63

2010 2.76 2.54 2.57 2.28

2011 2.33 2.33 2.13 1.99

2012 1.86 1.75 1.52 1.83

2013 1.99 2.11 2.89 3.22

2014 3.59 3.98 4.43 4.65

2015 5.85 6.42 6.09 6.47

2016 8.36 8.93 9.65 9.51

2017 8.19 8.91 10.89 11.72

2018 12.83 12.28 13.75 13.71

Res Med Inc

Fisher and Paykel Healthcare

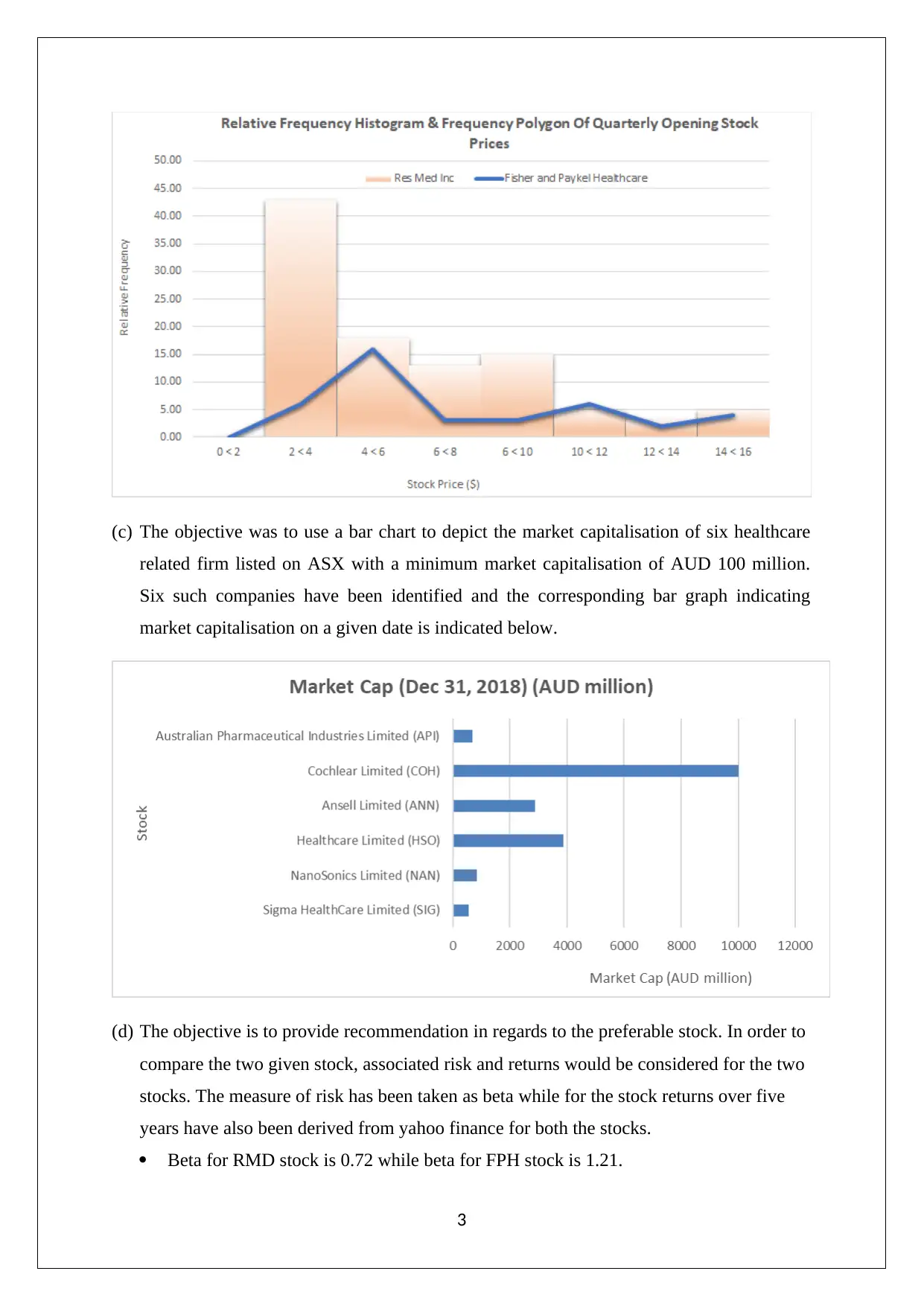

(b) The requisite histogram for RMD stock prices and the frequency polygon for FPH stock

is highlighted below.

2

(a) The stocks prices (opening quarterly) and stem & the requisite stem & leaf plot ia as

shown below.

January April July October

2009 2.63 2.53 2.52 2.58

2010 2.93 3.48 3.61 3.43

2011 3.41 2.91 2.91 2.85

2012 2.49 3.00 3.06 3.89

2013 3.96 4.42 4.90 5.70

2014 5.31 4.81 5.40 5.63

2015 6.91 9.42 7.30 7.30

2016 7.40 7.52 8.41 8.48

2017 8.59 9.39 10.07 9.76

2018 10.89 12.47 14.18 15.91

January April July October

2009 2.72 2.55 2.35 2.63

2010 2.76 2.54 2.57 2.28

2011 2.33 2.33 2.13 1.99

2012 1.86 1.75 1.52 1.83

2013 1.99 2.11 2.89 3.22

2014 3.59 3.98 4.43 4.65

2015 5.85 6.42 6.09 6.47

2016 8.36 8.93 9.65 9.51

2017 8.19 8.91 10.89 11.72

2018 12.83 12.28 13.75 13.71

Res Med Inc

Fisher and Paykel Healthcare

(b) The requisite histogram for RMD stock prices and the frequency polygon for FPH stock

is highlighted below.

2

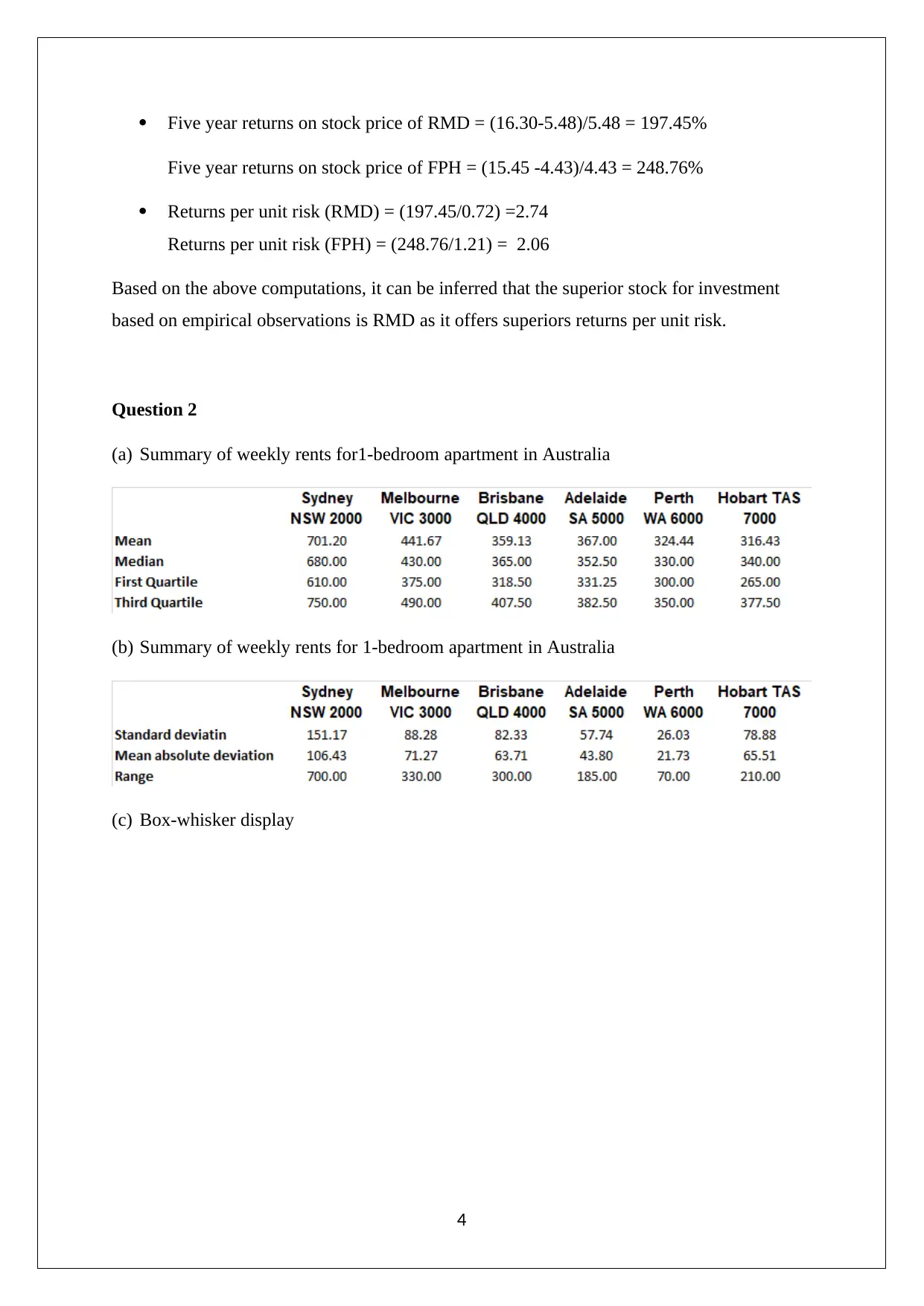

(c) The objective was to use a bar chart to depict the market capitalisation of six healthcare

related firm listed on ASX with a minimum market capitalisation of AUD 100 million.

Six such companies have been identified and the corresponding bar graph indicating

market capitalisation on a given date is indicated below.

(d) The objective is to provide recommendation in regards to the preferable stock. In order to

compare the two given stock, associated risk and returns would be considered for the two

stocks. The measure of risk has been taken as beta while for the stock returns over five

years have also been derived from yahoo finance for both the stocks.

Beta for RMD stock is 0.72 while beta for FPH stock is 1.21.

3

related firm listed on ASX with a minimum market capitalisation of AUD 100 million.

Six such companies have been identified and the corresponding bar graph indicating

market capitalisation on a given date is indicated below.

(d) The objective is to provide recommendation in regards to the preferable stock. In order to

compare the two given stock, associated risk and returns would be considered for the two

stocks. The measure of risk has been taken as beta while for the stock returns over five

years have also been derived from yahoo finance for both the stocks.

Beta for RMD stock is 0.72 while beta for FPH stock is 1.21.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Five year returns on stock price of RMD = (16.30-5.48)/5.48 = 197.45%

Five year returns on stock price of FPH = (15.45 -4.43)/4.43 = 248.76%

Returns per unit risk (RMD) = (197.45/0.72) =2.74

Returns per unit risk (FPH) = (248.76/1.21) = 2.06

Based on the above computations, it can be inferred that the superior stock for investment

based on empirical observations is RMD as it offers superiors returns per unit risk.

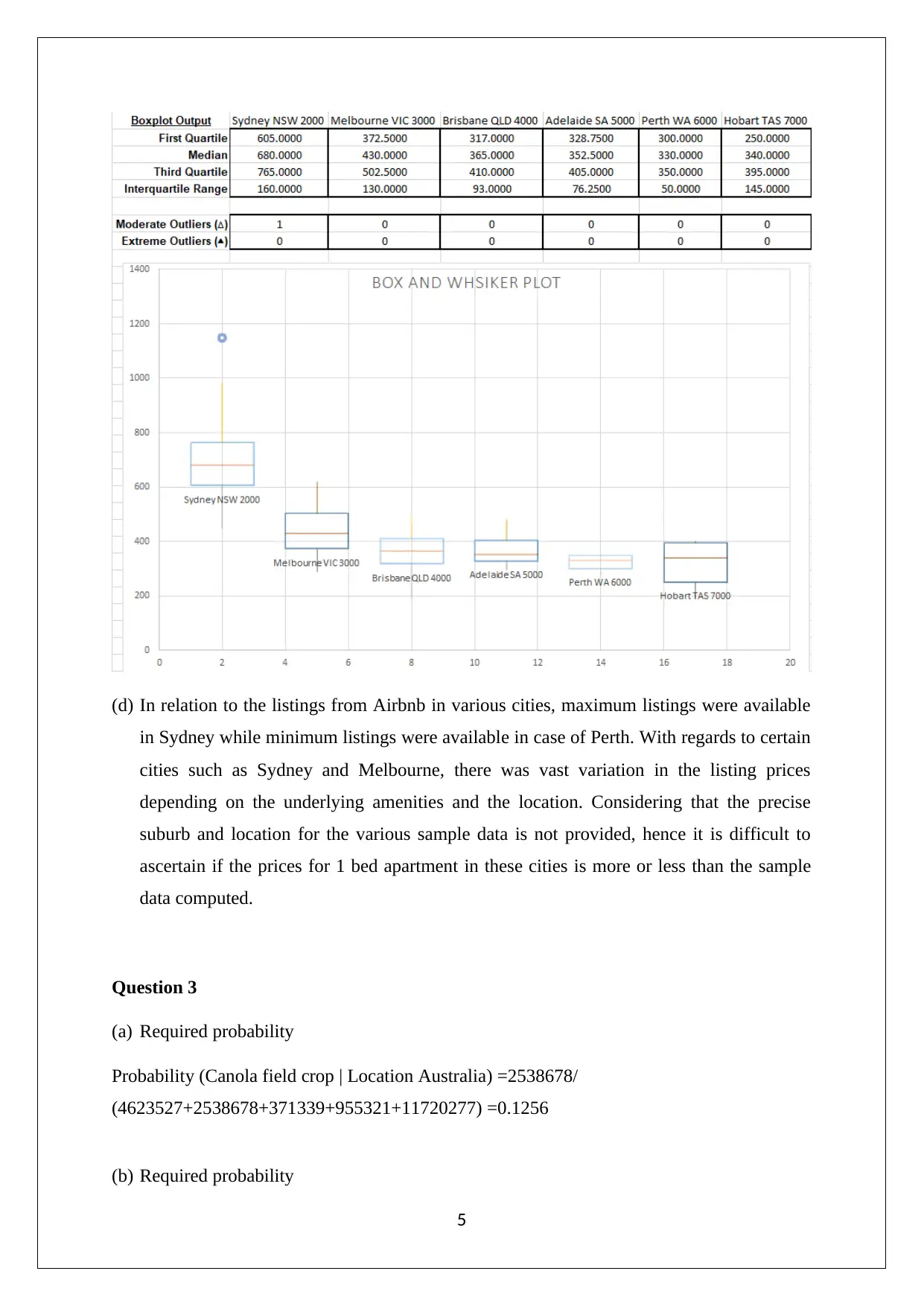

Question 2

(a) Summary of weekly rents for1-bedroom apartment in Australia

(b) Summary of weekly rents for 1-bedroom apartment in Australia

(c) Box-whisker display

4

Five year returns on stock price of FPH = (15.45 -4.43)/4.43 = 248.76%

Returns per unit risk (RMD) = (197.45/0.72) =2.74

Returns per unit risk (FPH) = (248.76/1.21) = 2.06

Based on the above computations, it can be inferred that the superior stock for investment

based on empirical observations is RMD as it offers superiors returns per unit risk.

Question 2

(a) Summary of weekly rents for1-bedroom apartment in Australia

(b) Summary of weekly rents for 1-bedroom apartment in Australia

(c) Box-whisker display

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(d) In relation to the listings from Airbnb in various cities, maximum listings were available

in Sydney while minimum listings were available in case of Perth. With regards to certain

cities such as Sydney and Melbourne, there was vast variation in the listing prices

depending on the underlying amenities and the location. Considering that the precise

suburb and location for the various sample data is not provided, hence it is difficult to

ascertain if the prices for 1 bed apartment in these cities is more or less than the sample

data computed.

Question 3

(a) Required probability

Probability (Canola field crop | Location Australia) =2538678/

(4623527+2538678+371339+955321+11720277) =0.1256

(b) Required probability

5

in Sydney while minimum listings were available in case of Perth. With regards to certain

cities such as Sydney and Melbourne, there was vast variation in the listing prices

depending on the underlying amenities and the location. Considering that the precise

suburb and location for the various sample data is not provided, hence it is difficult to

ascertain if the prices for 1 bed apartment in these cities is more or less than the sample

data computed.

Question 3

(a) Required probability

Probability (Canola field crop | Location Australia) =2538678/

(4623527+2538678+371339+955321+11720277) =0.1256

(b) Required probability

5

P (Wheat field crop | Location NSW) = 9556517/

((2755310+1201045+403121+483081+9556517)) =0.6637 or 66.37%

(c) Required probability

P = Yield of SA / (Yield of NSW + Yield of VIC + Yield of QID + Yield of SA)

P = 2.974 / (2.733 + 3.49 + 2.909 + 2.974) = 0.25 or 25%

Yield = Production/Area

(d) The relevant crop is grain sorghum while the underlying state is South Australia. In the

given data, the relative standard error observed is more than 50% and hence this estimate

is classified as unreliable.

Question 4

(a) Poisson distribution

(i) “Probability of no rainfall in week”

Days of rainfall = 170 and Mean λ = 170

52 = 3.3077

P(X = 0 | λ= 3.3077) = 3.30770 × e−3.30779

0! = 0.0366

(ii) “Probability of rainfall happened for 3 or more days in one week”

(b) Normal distribution

(i) “Probabilityrainfall between 10 mm and 50 mm”

𝜇 = 83.75 𝑚𝑚 , 𝜎= 152.74 , 𝑆.𝐸= 152.74

𝑠𝑞𝑟𝑡ሺ52ሻ= 21.18

6

((2755310+1201045+403121+483081+9556517)) =0.6637 or 66.37%

(c) Required probability

P = Yield of SA / (Yield of NSW + Yield of VIC + Yield of QID + Yield of SA)

P = 2.974 / (2.733 + 3.49 + 2.909 + 2.974) = 0.25 or 25%

Yield = Production/Area

(d) The relevant crop is grain sorghum while the underlying state is South Australia. In the

given data, the relative standard error observed is more than 50% and hence this estimate

is classified as unreliable.

Question 4

(a) Poisson distribution

(i) “Probability of no rainfall in week”

Days of rainfall = 170 and Mean λ = 170

52 = 3.3077

P(X = 0 | λ= 3.3077) = 3.30770 × e−3.30779

0! = 0.0366

(ii) “Probability of rainfall happened for 3 or more days in one week”

(b) Normal distribution

(i) “Probabilityrainfall between 10 mm and 50 mm”

𝜇 = 83.75 𝑚𝑚 , 𝜎= 152.74 , 𝑆.𝐸= 152.74

𝑠𝑞𝑟𝑡ሺ52ሻ= 21.18

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(ii) Rainfall amount = X (mm)

Probability (Rainfall amount greater than X) = 12%

Z value for this probability = -1.17499

Now, -1.17499 = (X-83.75)/21.18 and hence, X = 58.86 mm

Question 5

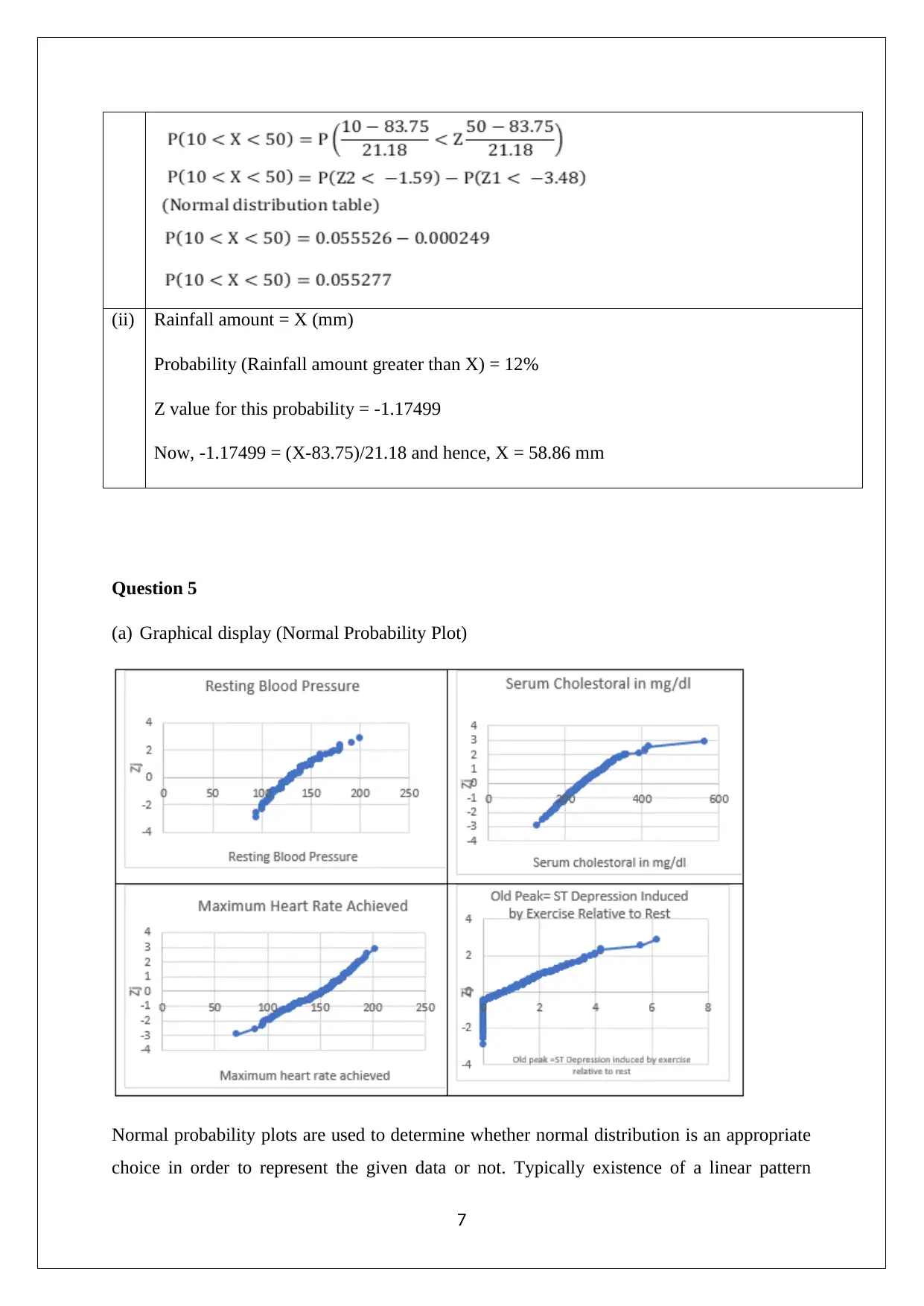

(a) Graphical display (Normal Probability Plot)

Normal probability plots are used to determine whether normal distribution is an appropriate

choice in order to represent the given data or not. Typically existence of a linear pattern

7

Probability (Rainfall amount greater than X) = 12%

Z value for this probability = -1.17499

Now, -1.17499 = (X-83.75)/21.18 and hence, X = 58.86 mm

Question 5

(a) Graphical display (Normal Probability Plot)

Normal probability plots are used to determine whether normal distribution is an appropriate

choice in order to represent the given data or not. Typically existence of a linear pattern

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

would imply that normal distribution should be a suitable choice for underlying variable

representation. In wake of the above understanding, the normal probability plots for the

various variables are interpreted below.

1) Resting blood pressure – Leaving aside couple of points on the higher end, the other

values can be fit in a broad linear trend owing to which it can be concluded that

normal distribution would be a suitable choice for this variable representation.

2) Serum Cholesterol - Leaving aside one point on the higher end (which is outlier), the

other values can be fit in a broad linear trend owing to which it can be concluded that

normal distribution would be a suitable choice for this variable representation.

3) Maximum heart rate - Leaving aside one point on the lower end (which is outlier), the

other values can be fit in a broad linear trend owing to which it can be concluded that

normal distribution would be a suitable choice for this variable representation.

4) Old Peak – There are multiple outliers both on the lower end and also on the upper

end which form sizable portion of the overall values. As a result, it does not seem that

normal distribution is an appropriate choice for representing the given variable.

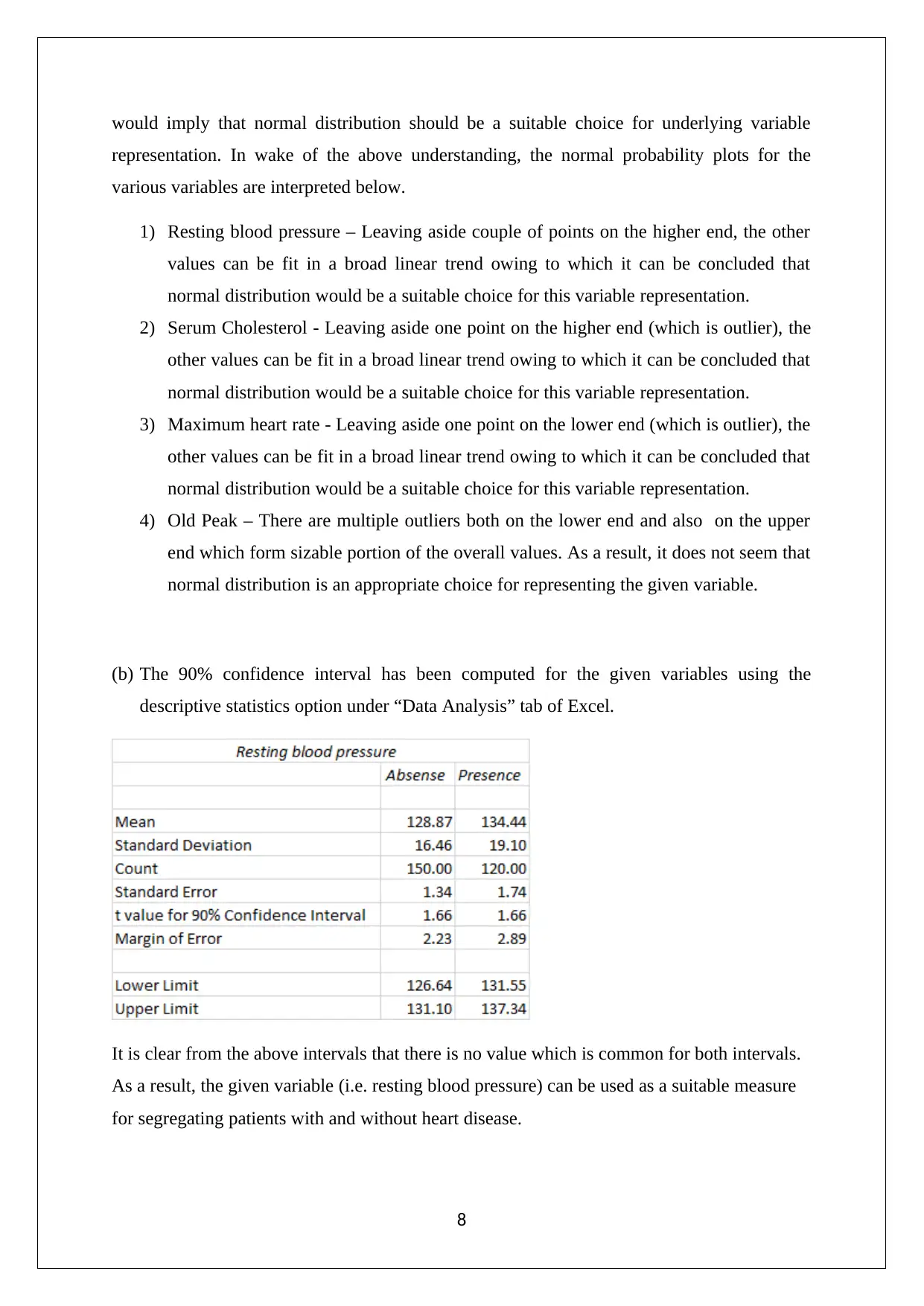

(b) The 90% confidence interval has been computed for the given variables using the

descriptive statistics option under “Data Analysis” tab of Excel.

It is clear from the above intervals that there is no value which is common for both intervals.

As a result, the given variable (i.e. resting blood pressure) can be used as a suitable measure

for segregating patients with and without heart disease.

8

representation. In wake of the above understanding, the normal probability plots for the

various variables are interpreted below.

1) Resting blood pressure – Leaving aside couple of points on the higher end, the other

values can be fit in a broad linear trend owing to which it can be concluded that

normal distribution would be a suitable choice for this variable representation.

2) Serum Cholesterol - Leaving aside one point on the higher end (which is outlier), the

other values can be fit in a broad linear trend owing to which it can be concluded that

normal distribution would be a suitable choice for this variable representation.

3) Maximum heart rate - Leaving aside one point on the lower end (which is outlier), the

other values can be fit in a broad linear trend owing to which it can be concluded that

normal distribution would be a suitable choice for this variable representation.

4) Old Peak – There are multiple outliers both on the lower end and also on the upper

end which form sizable portion of the overall values. As a result, it does not seem that

normal distribution is an appropriate choice for representing the given variable.

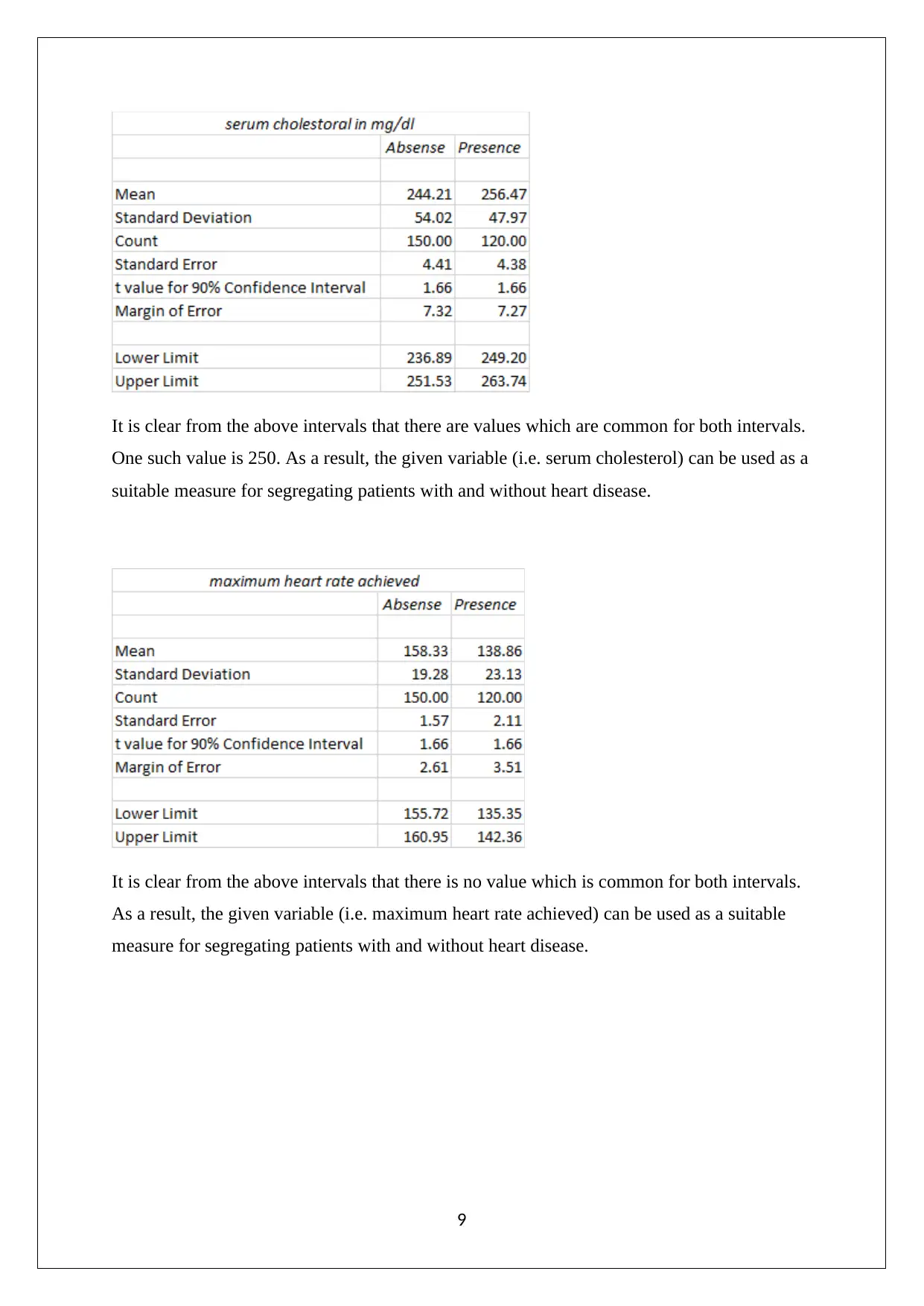

(b) The 90% confidence interval has been computed for the given variables using the

descriptive statistics option under “Data Analysis” tab of Excel.

It is clear from the above intervals that there is no value which is common for both intervals.

As a result, the given variable (i.e. resting blood pressure) can be used as a suitable measure

for segregating patients with and without heart disease.

8

It is clear from the above intervals that there are values which are common for both intervals.

One such value is 250. As a result, the given variable (i.e. serum cholesterol) can be used as a

suitable measure for segregating patients with and without heart disease.

It is clear from the above intervals that there is no value which is common for both intervals.

As a result, the given variable (i.e. maximum heart rate achieved) can be used as a suitable

measure for segregating patients with and without heart disease.

9

One such value is 250. As a result, the given variable (i.e. serum cholesterol) can be used as a

suitable measure for segregating patients with and without heart disease.

It is clear from the above intervals that there is no value which is common for both intervals.

As a result, the given variable (i.e. maximum heart rate achieved) can be used as a suitable

measure for segregating patients with and without heart disease.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

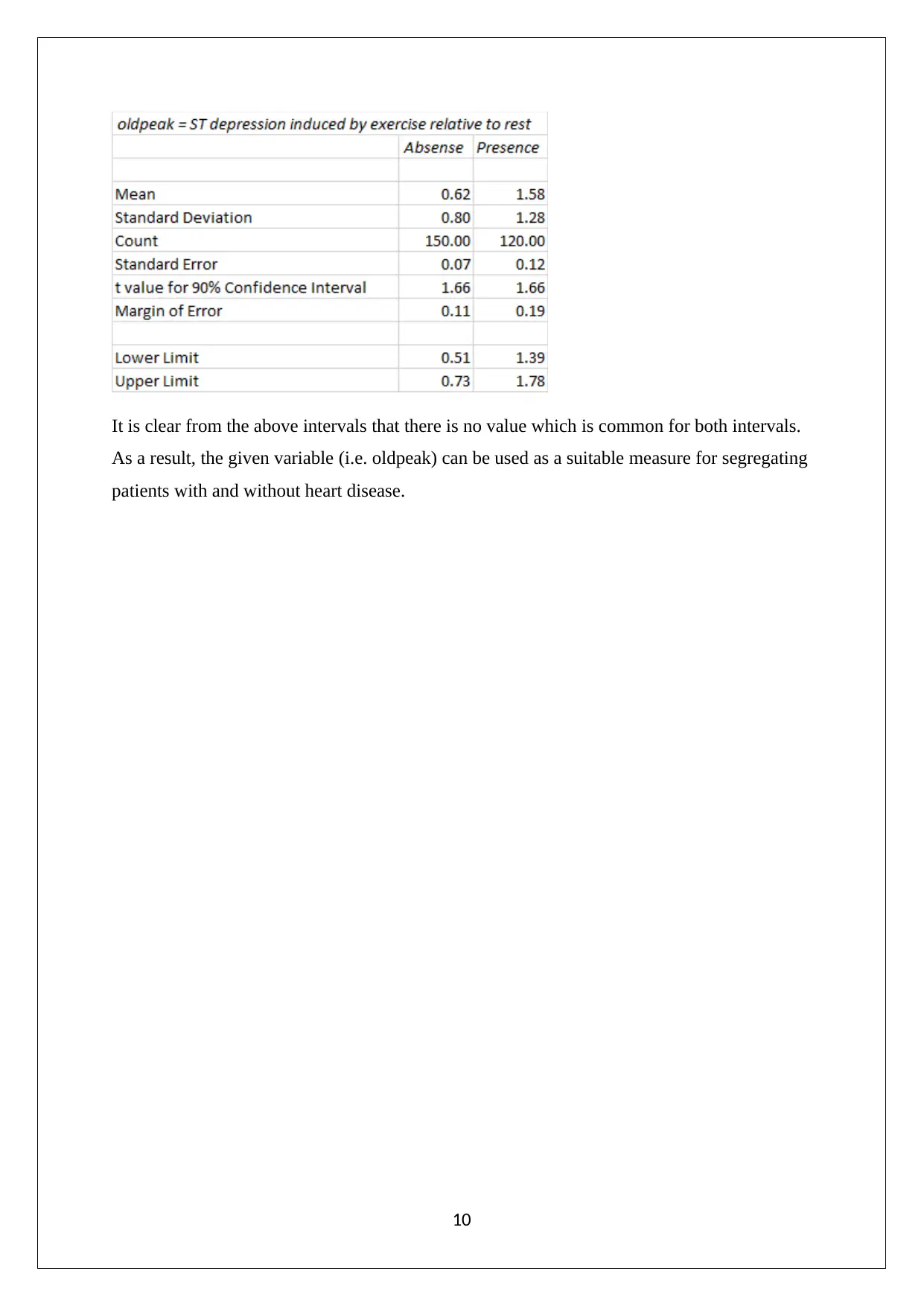

It is clear from the above intervals that there is no value which is common for both intervals.

As a result, the given variable (i.e. oldpeak) can be used as a suitable measure for segregating

patients with and without heart disease.

10

As a result, the given variable (i.e. oldpeak) can be used as a suitable measure for segregating

patients with and without heart disease.

10

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.