Statistics Assignment: Statistical Analysis of Market Data and Report

VerifiedAdded on 2021/01/03

|21

|4859

|41

Homework Assignment

AI Summary

This statistics assignment presents a comprehensive analysis of market data using various statistical tools and techniques. The assignment begins with analyzing data for CSR Ltd and SFR Ltd, including stem-and-leaf diagrams, relative frequency histograms, and frequency polygons. It then moves on to a bar chart analysis of six listed companies in the material sector. Furthermore, the assignment delves into recommendations for investment based on fundamental analysis and expert advice. The second part of the assignment focuses on calculating descriptive statistics, such as mean, median, quartiles, standard deviation, and range, for apartment prices in different Australian cities, along with box and whisker plots. Probability calculations are also performed based on provided data. The assignment concludes with a discussion of recent trends in apartment prices and recommendations for investment based on the analysis.

STATISTICS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

QUESTION 1...................................................................................................................................1

(a) Data for CSR Ltd and SFR Ltd along with stem-and-leaf diagram using Excel..............1

(b) Construction of Relative frequency for CSR Ltd and frequency polygon for SFR Ltd:. .4

(c) Bar Chart for six listed companies in Material Sector according to market capital.........6

(d) Recommendations to invest in CSR Ltd or SFR Ltd. based on fundamental analysis and

expert advice...........................................................................................................................7

QUESTION 2...................................................................................................................................8

(a) Calculation of Mean, Median, first quartile, and third quartile of sold prices for each city

using excel..............................................................................................................................8

(b) Calculation of standard deviation, mean absolute deviation and range for each city using

excel........................................................................................................................................8

c) Box and Whisker Plot for the sold prices of each city.......................................................9

d) Recent trends in apartment prices in Australia..................................................................9

QUESTION 3.................................................................................................................................10

a) Calculation of probability that an employee in Australia.................................................11

b) Probability of male sale worker employed in Australia...................................................11

c) Probability of female employee working in part time of clerical and administrative workers

..............................................................................................................................................11

d) Ratio for total persons in 2013 between Owner managers of incorporated enterprises to

Owner managers of unincorporated enterprises...................................................................12

b) Professional......................................................................................................................14

QUESTION 4.................................................................................................................................14

b)...........................................................................................................................................14

QUESTION 5...................................................................................................................................1

CONCLUSION................................................................................................................................2

REFERENCES................................................................................................................................3

APPENDIX......................................................................................................................................4

QUESTION 1...................................................................................................................................1

(a) Data for CSR Ltd and SFR Ltd along with stem-and-leaf diagram using Excel..............1

(b) Construction of Relative frequency for CSR Ltd and frequency polygon for SFR Ltd:. .4

(c) Bar Chart for six listed companies in Material Sector according to market capital.........6

(d) Recommendations to invest in CSR Ltd or SFR Ltd. based on fundamental analysis and

expert advice...........................................................................................................................7

QUESTION 2...................................................................................................................................8

(a) Calculation of Mean, Median, first quartile, and third quartile of sold prices for each city

using excel..............................................................................................................................8

(b) Calculation of standard deviation, mean absolute deviation and range for each city using

excel........................................................................................................................................8

c) Box and Whisker Plot for the sold prices of each city.......................................................9

d) Recent trends in apartment prices in Australia..................................................................9

QUESTION 3.................................................................................................................................10

a) Calculation of probability that an employee in Australia.................................................11

b) Probability of male sale worker employed in Australia...................................................11

c) Probability of female employee working in part time of clerical and administrative workers

..............................................................................................................................................11

d) Ratio for total persons in 2013 between Owner managers of incorporated enterprises to

Owner managers of unincorporated enterprises...................................................................12

b) Professional......................................................................................................................14

QUESTION 4.................................................................................................................................14

b)...........................................................................................................................................14

QUESTION 5...................................................................................................................................1

CONCLUSION................................................................................................................................2

REFERENCES................................................................................................................................3

APPENDIX......................................................................................................................................4

QUESTION 1

(a) Data for CSR Ltd and SFR Ltd along with stem-and-leaf diagram using Excel

The sample data for two ASX listed companies viz. CSR Limited and SFR Limited have

been provided below along with their unadjusted opening prices for the time period January 2008

to December 2017. (Price and research of SFR Limited, 2019)

Date Opening Prices (Unadjusted)

2008 CSR LTD. (in $ AUD) SFR LTD. (in $ AUD)

January 8.21 0.34

April 8.45 0.3

July 6.59 0.27

October 6.78 0.17

2009

January 5.19 0.08

April 3.53 0.08

July 4.93 1

October 5.54 3.4

2010

January 5.4 3.7

April 5.31 3.62

October 5.4 6.91

2011

January 5.07 8.11

April 3.28 6.81

July 2.93 7.11

October 2.26 5.88

1

(a) Data for CSR Ltd and SFR Ltd along with stem-and-leaf diagram using Excel

The sample data for two ASX listed companies viz. CSR Limited and SFR Limited have

been provided below along with their unadjusted opening prices for the time period January 2008

to December 2017. (Price and research of SFR Limited, 2019)

Date Opening Prices (Unadjusted)

2008 CSR LTD. (in $ AUD) SFR LTD. (in $ AUD)

January 8.21 0.34

April 8.45 0.3

July 6.59 0.27

October 6.78 0.17

2009

January 5.19 0.08

April 3.53 0.08

July 4.93 1

October 5.54 3.4

2010

January 5.4 3.7

April 5.31 3.62

October 5.4 6.91

2011

January 5.07 8.11

April 3.28 6.81

July 2.93 7.11

October 2.26 5.88

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2012

January 1.96 6.58

April 1.81 8.04

July 1.42 7.27

October 1.55 8.36

2013

January 1.96 8.63

April 2.06 6.02

July 2.22 5.13

October 2.44 6.43

2014

January 2.65 6.46

April 3.5 5.85

July 3.5 6.18

October 3.3 5.77

2015

January 3.9 4.55

April 4.03 4.37

July 3.59 5.71

October 2.88 5.65

2016

January 2.89 5.63

April 3.25 5.67

July 3.68 5.25

2

January 1.96 6.58

April 1.81 8.04

July 1.42 7.27

October 1.55 8.36

2013

January 1.96 8.63

April 2.06 6.02

July 2.22 5.13

October 2.44 6.43

2014

January 2.65 6.46

April 3.5 5.85

July 3.5 6.18

October 3.3 5.77

2015

January 3.9 4.55

April 4.03 4.37

July 3.59 5.71

October 2.88 5.65

2016

January 2.89 5.63

April 3.25 5.67

July 3.68 5.25

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

October 3.65 5.08

2017

January 4.62 5.64

April 4.5 6.37

July 4.22 5.62

October 4.72 5.76

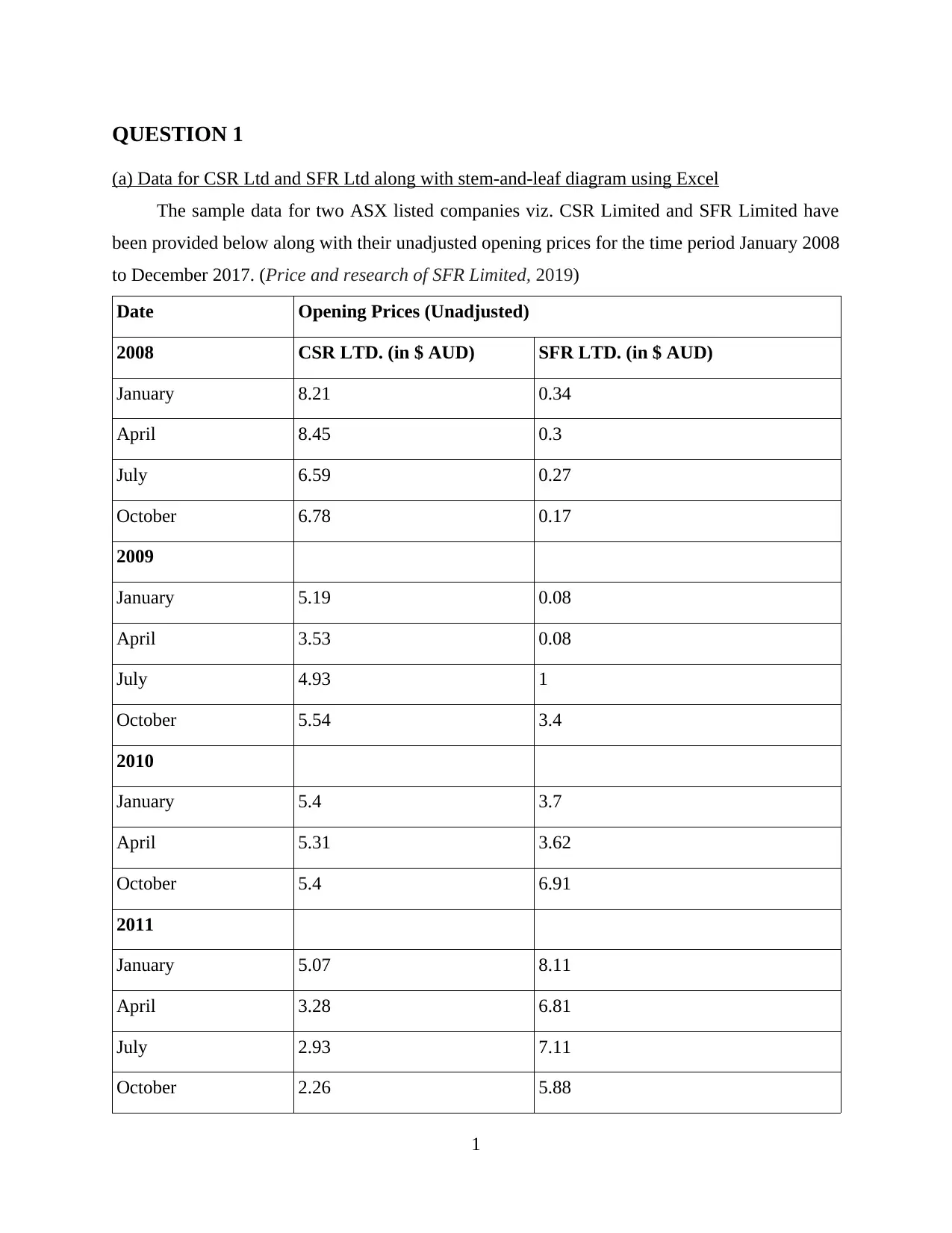

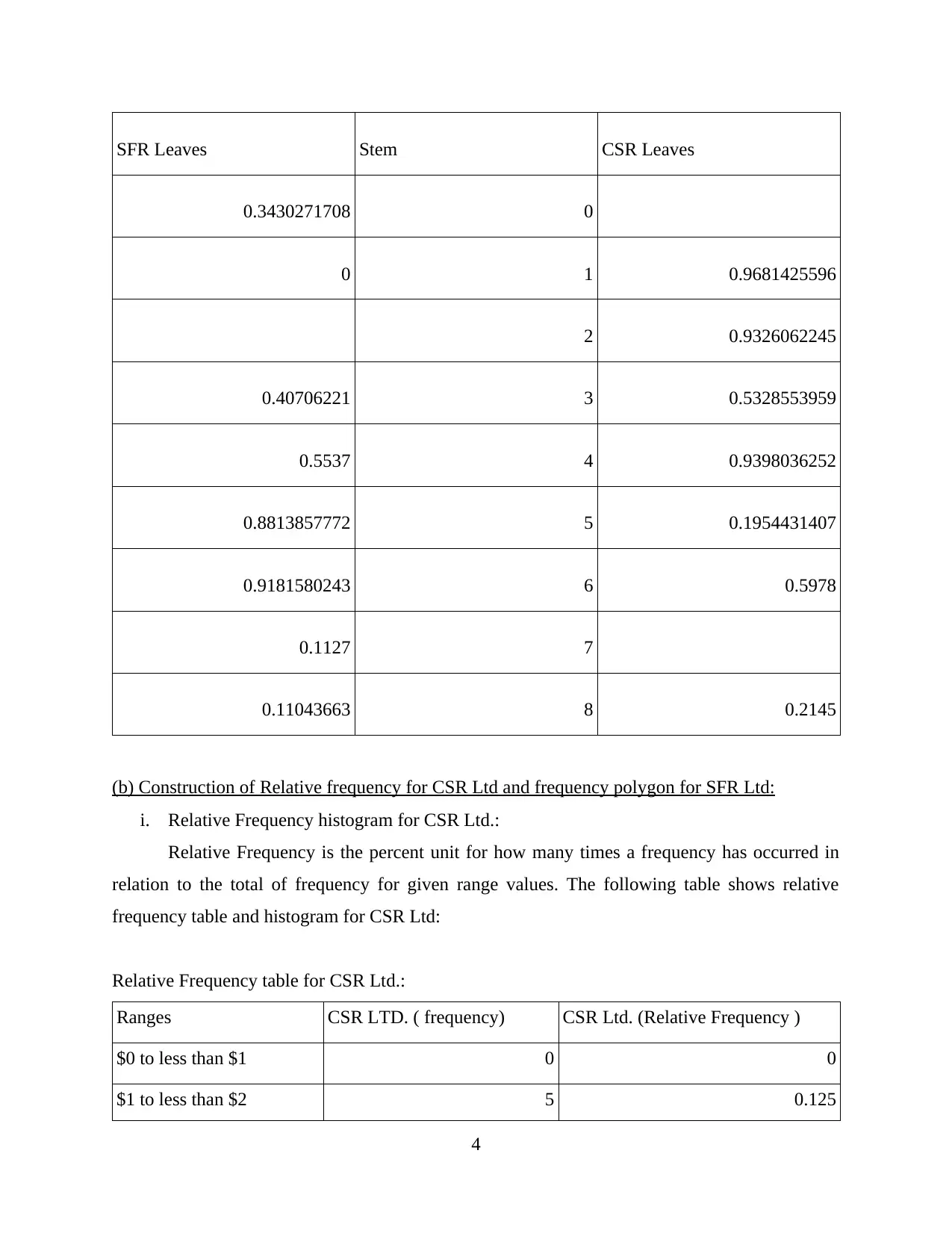

Stem-and-leaf Display:

As the name suggests, stem and leaf diagram is a table produced by Excel that splits the

given data into stems and leaves. It is an analytical tool that helps in bifurcation of given data

into more legible and easier manner for the analysts to make sense of the collected data (Al-

Omari, 2016).

Given below is an output of values in stem and leaf pattern which shows stem values

ranging between 0 to 8 and includes CSR and SFR values on the right side and left side

respectively (Armstrong and Taylor, 2014). Here, the data values are broken down into stems

and just like the stem holds the leaves of a plant, the leaves values originate from these given

stem values. For instance, Stem Value 0 produces an SFR leaf depicting the value for unadjusted

opening prices for January 2008 0.34 in decimal values. Since, CSR prices have no value with a

zero in it, the CSR leaves for stem value 0 has been left empty. For Stem Value 1, SFR Leaves

produces a value zero since there is only one opening price for SFR in the above data that

touches $1 for July 2009. Therefore, SFR leaf shows zero in front of Stem-value 1 since zero

plus one would render a value of one (Boehm and Thomas, 2013).

The value 0.3430271708 for Stem-value 0 can be read as the prices $0.34, $0.30, $0.27,

$0.17 and $0.08. This is applicable for both SFR and CSR Leaves. It is easier to see through this

plot the ranges of opening prices at which the Company stocks have been frequent. For instance,

SFR Share price has not touched price $2 at all, it has either touched $5 and $6 as its highest

opening prices and $0.08 as its lowest opening price between January 2008 and December 2017

(Price and research of CSR Limited, 2019).

3

2017

January 4.62 5.64

April 4.5 6.37

July 4.22 5.62

October 4.72 5.76

Stem-and-leaf Display:

As the name suggests, stem and leaf diagram is a table produced by Excel that splits the

given data into stems and leaves. It is an analytical tool that helps in bifurcation of given data

into more legible and easier manner for the analysts to make sense of the collected data (Al-

Omari, 2016).

Given below is an output of values in stem and leaf pattern which shows stem values

ranging between 0 to 8 and includes CSR and SFR values on the right side and left side

respectively (Armstrong and Taylor, 2014). Here, the data values are broken down into stems

and just like the stem holds the leaves of a plant, the leaves values originate from these given

stem values. For instance, Stem Value 0 produces an SFR leaf depicting the value for unadjusted

opening prices for January 2008 0.34 in decimal values. Since, CSR prices have no value with a

zero in it, the CSR leaves for stem value 0 has been left empty. For Stem Value 1, SFR Leaves

produces a value zero since there is only one opening price for SFR in the above data that

touches $1 for July 2009. Therefore, SFR leaf shows zero in front of Stem-value 1 since zero

plus one would render a value of one (Boehm and Thomas, 2013).

The value 0.3430271708 for Stem-value 0 can be read as the prices $0.34, $0.30, $0.27,

$0.17 and $0.08. This is applicable for both SFR and CSR Leaves. It is easier to see through this

plot the ranges of opening prices at which the Company stocks have been frequent. For instance,

SFR Share price has not touched price $2 at all, it has either touched $5 and $6 as its highest

opening prices and $0.08 as its lowest opening price between January 2008 and December 2017

(Price and research of CSR Limited, 2019).

3

SFR Leaves Stem CSR Leaves

0.3430271708 0

0 1 0.9681425596

2 0.9326062245

0.40706221 3 0.5328553959

0.5537 4 0.9398036252

0.8813857772 5 0.1954431407

0.9181580243 6 0.5978

0.1127 7

0.11043663 8 0.2145

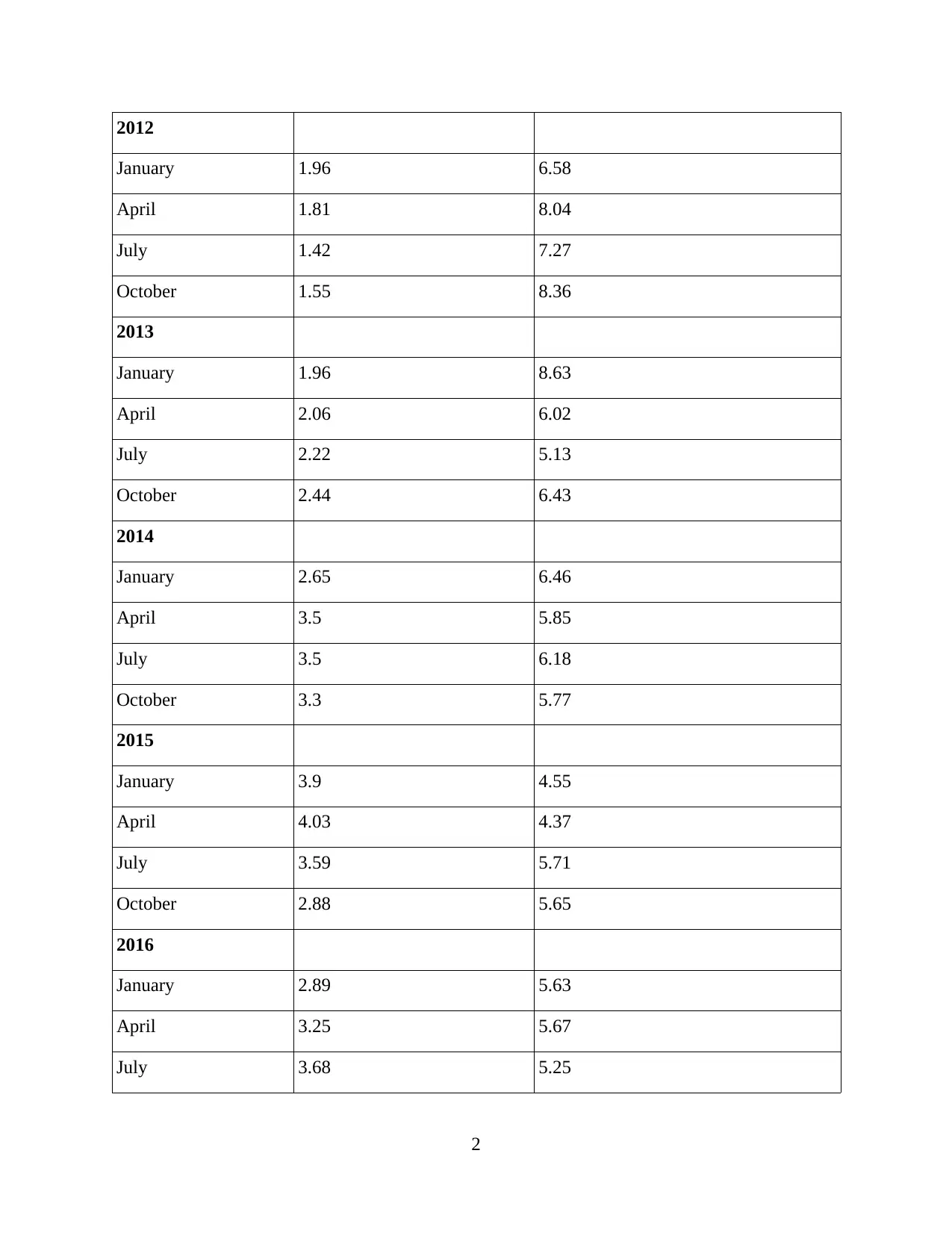

(b) Construction of Relative frequency for CSR Ltd and frequency polygon for SFR Ltd:

i. Relative Frequency histogram for CSR Ltd.:

Relative Frequency is the percent unit for how many times a frequency has occurred in

relation to the total of frequency for given range values. The following table shows relative

frequency table and histogram for CSR Ltd:

Relative Frequency table for CSR Ltd.:

Ranges CSR LTD. ( frequency) CSR Ltd. (Relative Frequency )

$0 to less than $1 0 0

$1 to less than $2 5 0.125

4

0.3430271708 0

0 1 0.9681425596

2 0.9326062245

0.40706221 3 0.5328553959

0.5537 4 0.9398036252

0.8813857772 5 0.1954431407

0.9181580243 6 0.5978

0.1127 7

0.11043663 8 0.2145

(b) Construction of Relative frequency for CSR Ltd and frequency polygon for SFR Ltd:

i. Relative Frequency histogram for CSR Ltd.:

Relative Frequency is the percent unit for how many times a frequency has occurred in

relation to the total of frequency for given range values. The following table shows relative

frequency table and histogram for CSR Ltd:

Relative Frequency table for CSR Ltd.:

Ranges CSR LTD. ( frequency) CSR Ltd. (Relative Frequency )

$0 to less than $1 0 0

$1 to less than $2 5 0.125

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

$2 to less than $3 8 0.2

$3 to less than $4 10 1

$4 to less than $5 7 0.175

$5 to less than $6 6 0.15

$6 to less than $7 2 2

$7 to less than $8 0 0

$8 to less than $9 2 0.05

Total 40

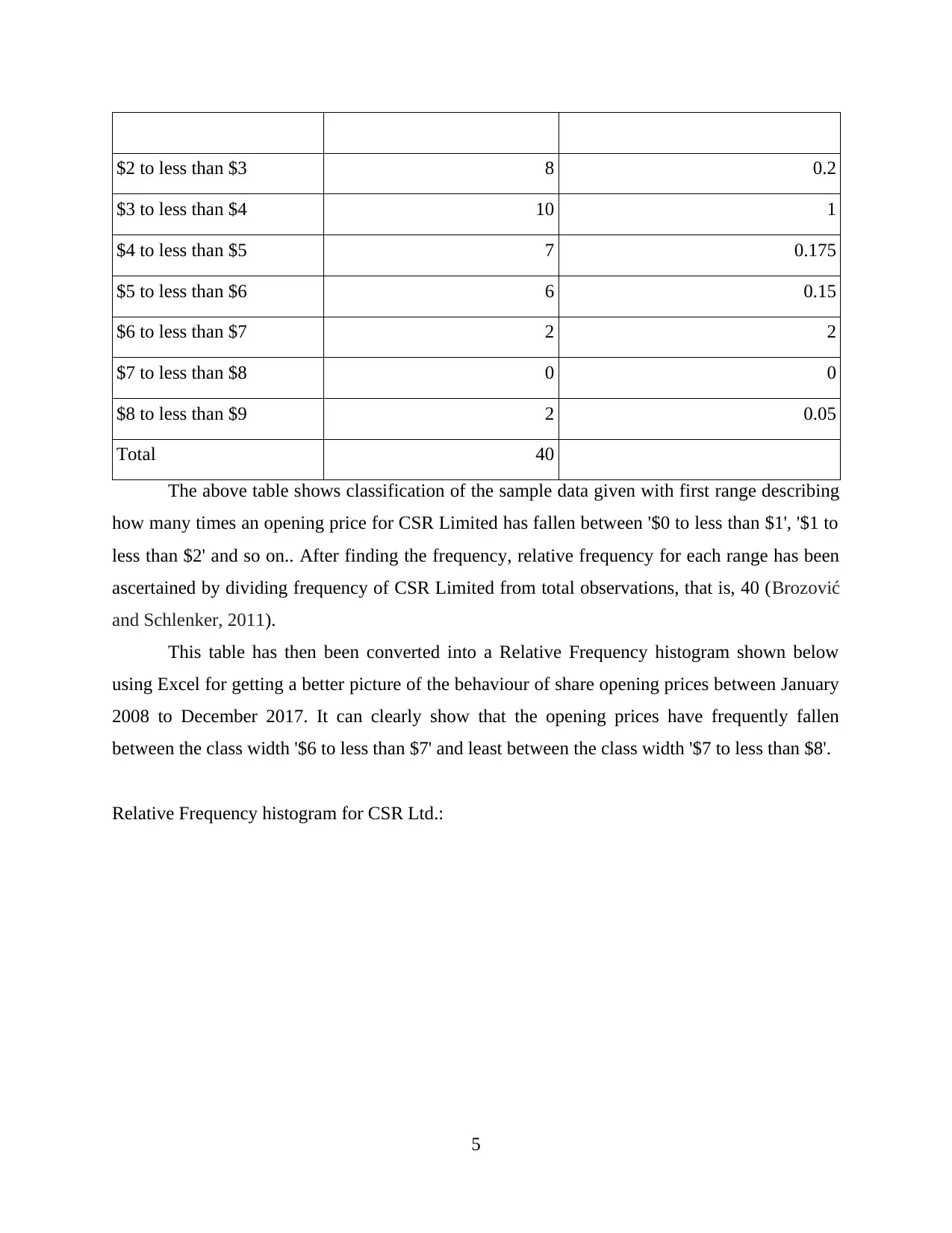

The above table shows classification of the sample data given with first range describing

how many times an opening price for CSR Limited has fallen between '$0 to less than $1', '$1 to

less than $2' and so on.. After finding the frequency, relative frequency for each range has been

ascertained by dividing frequency of CSR Limited from total observations, that is, 40 (Brozović

and Schlenker, 2011).

This table has then been converted into a Relative Frequency histogram shown below

using Excel for getting a better picture of the behaviour of share opening prices between January

2008 to December 2017. It can clearly show that the opening prices have frequently fallen

between the class width '$6 to less than $7' and least between the class width '$7 to less than $8'.

Relative Frequency histogram for CSR Ltd.:

5

$3 to less than $4 10 1

$4 to less than $5 7 0.175

$5 to less than $6 6 0.15

$6 to less than $7 2 2

$7 to less than $8 0 0

$8 to less than $9 2 0.05

Total 40

The above table shows classification of the sample data given with first range describing

how many times an opening price for CSR Limited has fallen between '$0 to less than $1', '$1 to

less than $2' and so on.. After finding the frequency, relative frequency for each range has been

ascertained by dividing frequency of CSR Limited from total observations, that is, 40 (Brozović

and Schlenker, 2011).

This table has then been converted into a Relative Frequency histogram shown below

using Excel for getting a better picture of the behaviour of share opening prices between January

2008 to December 2017. It can clearly show that the opening prices have frequently fallen

between the class width '$6 to less than $7' and least between the class width '$7 to less than $8'.

Relative Frequency histogram for CSR Ltd.:

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CSR Ltd. (Relative Frequency )

0

0.5

1

1.5

2

2.5

0 0.125 0.2

1

0.175 0.15

2

0.05

$0 to less than $1

$1 to less than $2

$2 to less than $3

$3 to less than $4

$4 to less than $5

$5 to less than $6

$6 to less than $7

$7 to less than $8

$8 to less than $9

ii. Frequency polygon for SFR Ltd.:

Frequency polygon refers to the graphical representation of frequency of a given sample

data with equal class widths (Embrechts and Hofert, 2014). The following table shows frequency

table and polygon for SFR Ltd:

Frequency table for SFR Ltd.:

Ranges Frequency (f)

$0 to less than $1 6

$1 to less than $2 1

$2 to less than $3 0

$3 to less than $4 4

$4 to less than $5 2

$5 to less than $6 13

$6 to less than $7 8

$7 to less than $8 2

$8 to less than $9 3

6

0

0.5

1

1.5

2

2.5

0 0.125 0.2

1

0.175 0.15

2

0.05

$0 to less than $1

$1 to less than $2

$2 to less than $3

$3 to less than $4

$4 to less than $5

$5 to less than $6

$6 to less than $7

$7 to less than $8

$8 to less than $9

ii. Frequency polygon for SFR Ltd.:

Frequency polygon refers to the graphical representation of frequency of a given sample

data with equal class widths (Embrechts and Hofert, 2014). The following table shows frequency

table and polygon for SFR Ltd:

Frequency table for SFR Ltd.:

Ranges Frequency (f)

$0 to less than $1 6

$1 to less than $2 1

$2 to less than $3 0

$3 to less than $4 4

$4 to less than $5 2

$5 to less than $6 13

$6 to less than $7 8

$7 to less than $8 2

$8 to less than $9 3

6

Total 39

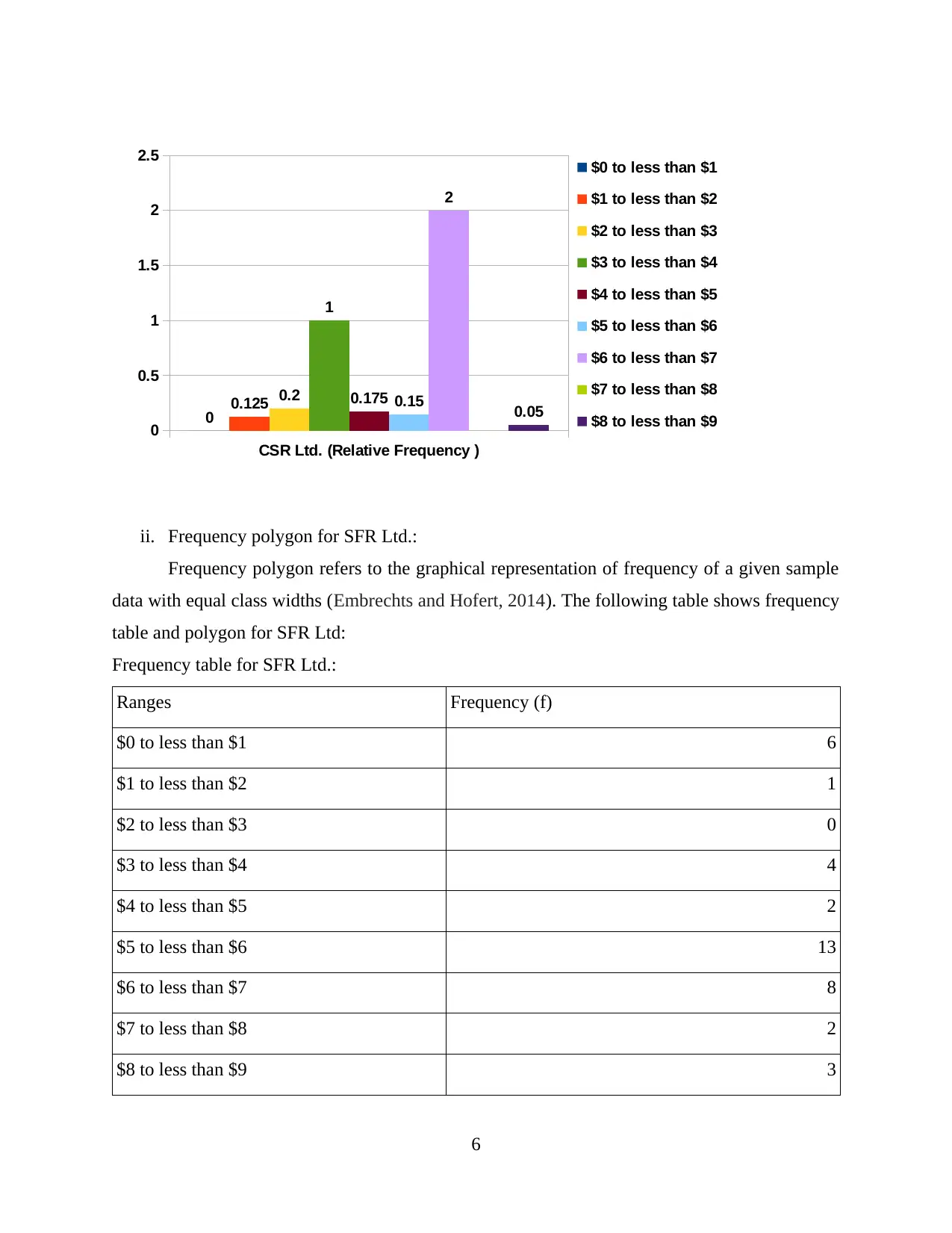

The above table shows classification of the sample data given with first range describing

how many times an opening price for SFR Limited has fallen between class widths '$0 to less

than $1', '$1 to less than $2' and so on.

This table has then been converted into a Frequency polygon shown below using Excel

for getting a better picture of the behaviour of share opening prices between January 2008 to

December 2017. It can clearly show that the opening prices have frequently fallen, 13 times,

between the class width '$5 to less than $6' and least,1 time, between the class width '$2 to less

than $3' (Haimes, 2015).

$0 to less ...

$1 to less ...

$2 to less ...

$3 to less ...

$4 to less ...

$5 to less ...

$6 to less ...

$7 to less ...

$8 to less ...

0

2

4

6

8

10

12

14

6

1 0

4

2

13

8

2 3

SFR LTD.

(frequency)

Ranges

Frequency (f)

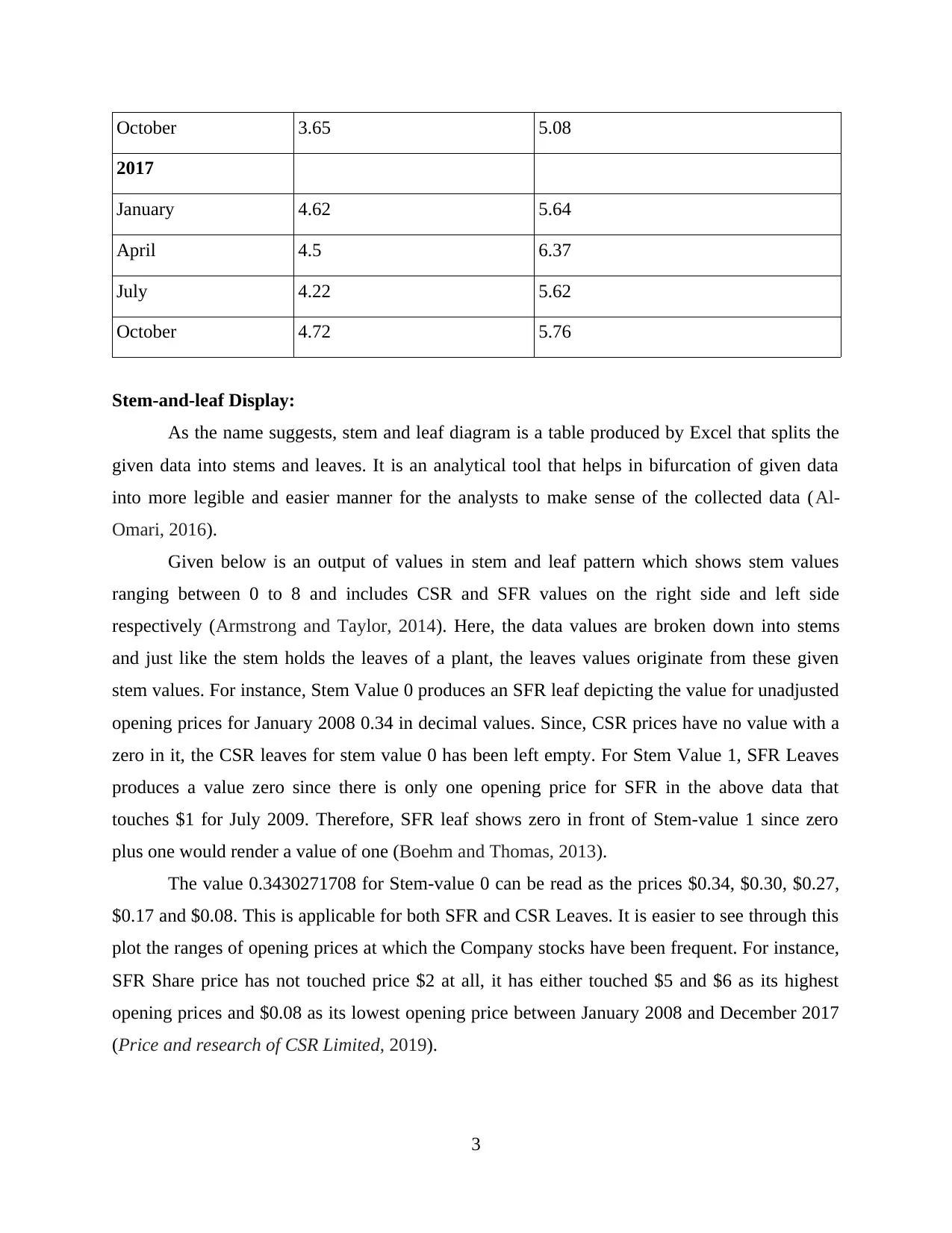

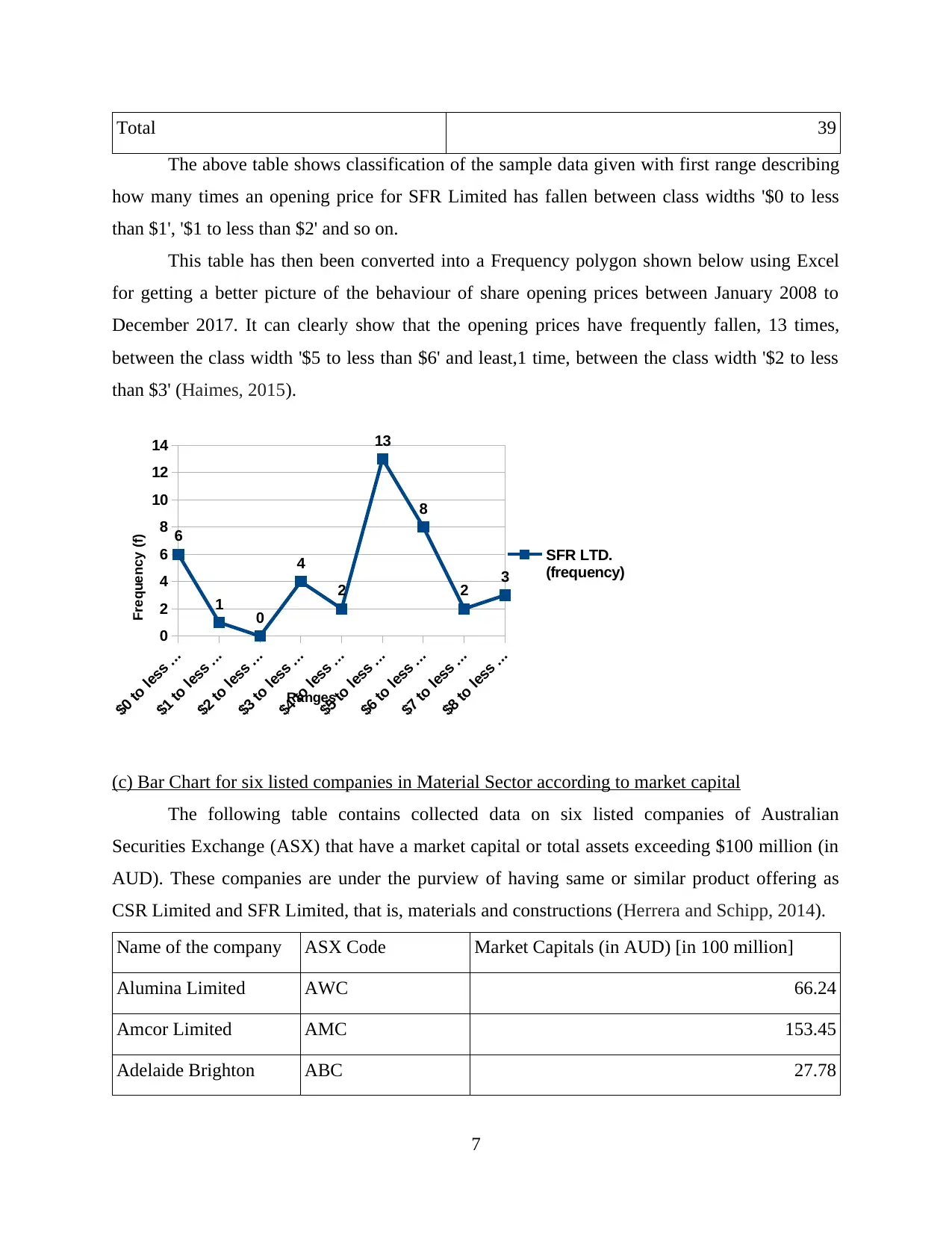

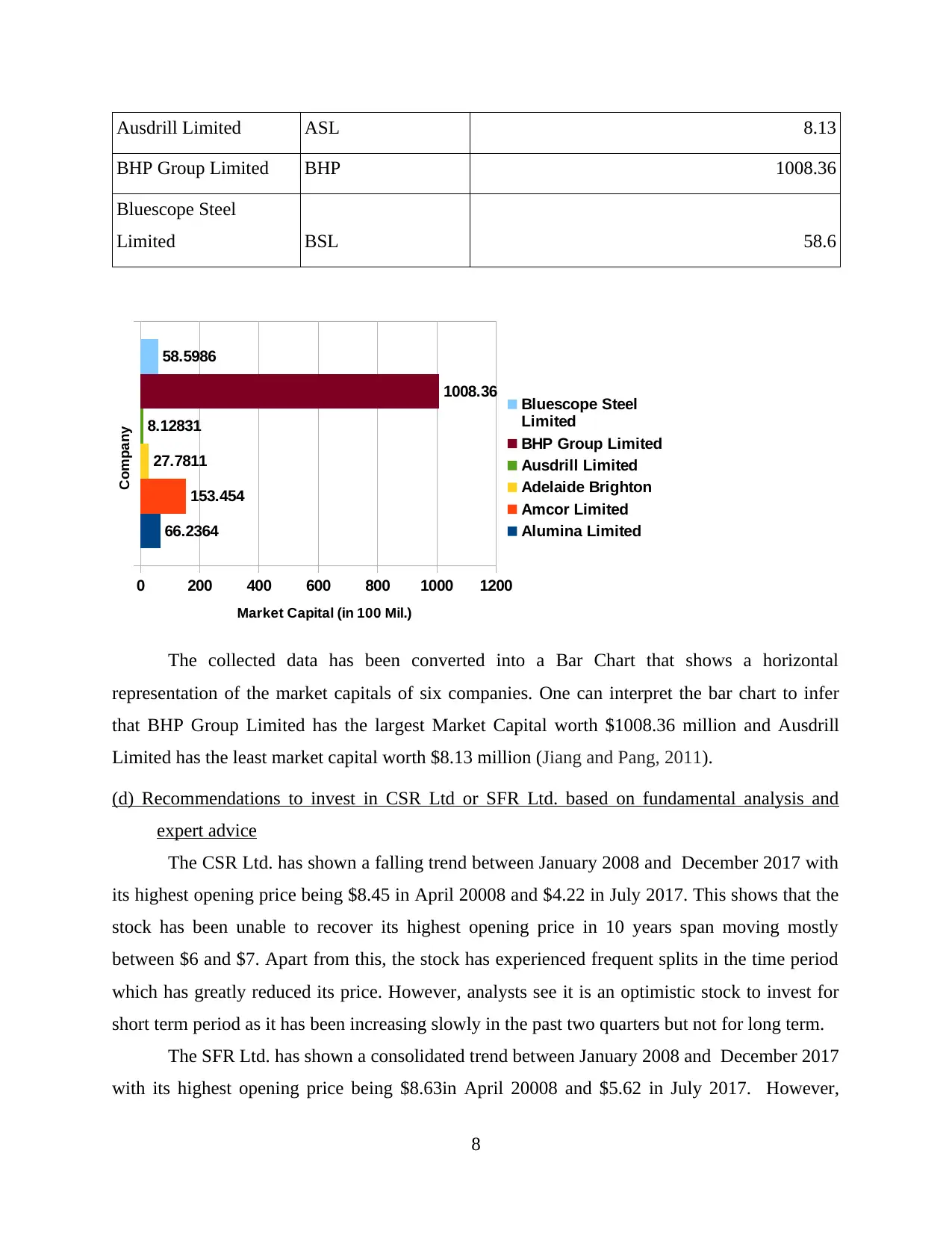

(c) Bar Chart for six listed companies in Material Sector according to market capital

The following table contains collected data on six listed companies of Australian

Securities Exchange (ASX) that have a market capital or total assets exceeding $100 million (in

AUD). These companies are under the purview of having same or similar product offering as

CSR Limited and SFR Limited, that is, materials and constructions (Herrera and Schipp, 2014).

Name of the company ASX Code Market Capitals (in AUD) [in 100 million]

Alumina Limited AWC 66.24

Amcor Limited AMC 153.45

Adelaide Brighton ABC 27.78

7

The above table shows classification of the sample data given with first range describing

how many times an opening price for SFR Limited has fallen between class widths '$0 to less

than $1', '$1 to less than $2' and so on.

This table has then been converted into a Frequency polygon shown below using Excel

for getting a better picture of the behaviour of share opening prices between January 2008 to

December 2017. It can clearly show that the opening prices have frequently fallen, 13 times,

between the class width '$5 to less than $6' and least,1 time, between the class width '$2 to less

than $3' (Haimes, 2015).

$0 to less ...

$1 to less ...

$2 to less ...

$3 to less ...

$4 to less ...

$5 to less ...

$6 to less ...

$7 to less ...

$8 to less ...

0

2

4

6

8

10

12

14

6

1 0

4

2

13

8

2 3

SFR LTD.

(frequency)

Ranges

Frequency (f)

(c) Bar Chart for six listed companies in Material Sector according to market capital

The following table contains collected data on six listed companies of Australian

Securities Exchange (ASX) that have a market capital or total assets exceeding $100 million (in

AUD). These companies are under the purview of having same or similar product offering as

CSR Limited and SFR Limited, that is, materials and constructions (Herrera and Schipp, 2014).

Name of the company ASX Code Market Capitals (in AUD) [in 100 million]

Alumina Limited AWC 66.24

Amcor Limited AMC 153.45

Adelaide Brighton ABC 27.78

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Ausdrill Limited ASL 8.13

BHP Group Limited BHP 1008.36

Bluescope Steel

Limited BSL 58.6

0 200 400 600 800 1000 1200

66.2364

153.454

27.7811

8.12831

1008.36

58.5986

Bluescope Steel

Limited

BHP Group Limited

Ausdrill Limited

Adelaide Brighton

Amcor Limited

Alumina Limited

Market Capital (in 100 Mil.)

Company

The collected data has been converted into a Bar Chart that shows a horizontal

representation of the market capitals of six companies. One can interpret the bar chart to infer

that BHP Group Limited has the largest Market Capital worth $1008.36 million and Ausdrill

Limited has the least market capital worth $8.13 million (Jiang and Pang, 2011).

(d) Recommendations to invest in CSR Ltd or SFR Ltd. based on fundamental analysis and

expert advice

The CSR Ltd. has shown a falling trend between January 2008 and December 2017 with

its highest opening price being $8.45 in April 20008 and $4.22 in July 2017. This shows that the

stock has been unable to recover its highest opening price in 10 years span moving mostly

between $6 and $7. Apart from this, the stock has experienced frequent splits in the time period

which has greatly reduced its price. However, analysts see it is an optimistic stock to invest for

short term period as it has been increasing slowly in the past two quarters but not for long term.

The SFR Ltd. has shown a consolidated trend between January 2008 and December 2017

with its highest opening price being $8.63in April 20008 and $5.62 in July 2017. However,

8

BHP Group Limited BHP 1008.36

Bluescope Steel

Limited BSL 58.6

0 200 400 600 800 1000 1200

66.2364

153.454

27.7811

8.12831

1008.36

58.5986

Bluescope Steel

Limited

BHP Group Limited

Ausdrill Limited

Adelaide Brighton

Amcor Limited

Alumina Limited

Market Capital (in 100 Mil.)

Company

The collected data has been converted into a Bar Chart that shows a horizontal

representation of the market capitals of six companies. One can interpret the bar chart to infer

that BHP Group Limited has the largest Market Capital worth $1008.36 million and Ausdrill

Limited has the least market capital worth $8.13 million (Jiang and Pang, 2011).

(d) Recommendations to invest in CSR Ltd or SFR Ltd. based on fundamental analysis and

expert advice

The CSR Ltd. has shown a falling trend between January 2008 and December 2017 with

its highest opening price being $8.45 in April 20008 and $4.22 in July 2017. This shows that the

stock has been unable to recover its highest opening price in 10 years span moving mostly

between $6 and $7. Apart from this, the stock has experienced frequent splits in the time period

which has greatly reduced its price. However, analysts see it is an optimistic stock to invest for

short term period as it has been increasing slowly in the past two quarters but not for long term.

The SFR Ltd. has shown a consolidated trend between January 2008 and December 2017

with its highest opening price being $8.63in April 20008 and $5.62 in July 2017. However,

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

analysts see it is not an optimistic stock to invest since it has been a consolidated phase for a very

long period (Kyriakarakos and et. al., 2013).

QUESTION 2

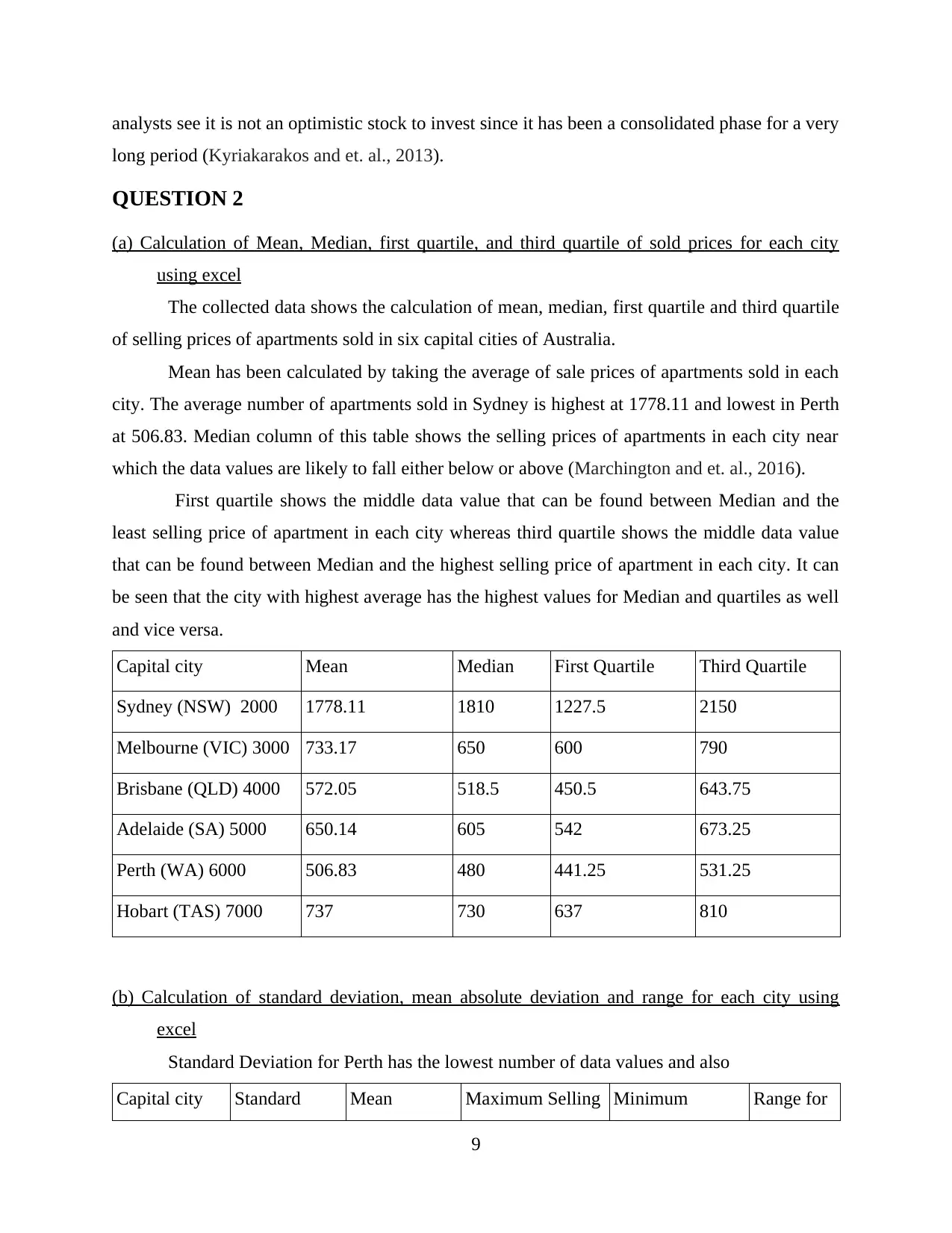

(a) Calculation of Mean, Median, first quartile, and third quartile of sold prices for each city

using excel

The collected data shows the calculation of mean, median, first quartile and third quartile

of selling prices of apartments sold in six capital cities of Australia.

Mean has been calculated by taking the average of sale prices of apartments sold in each

city. The average number of apartments sold in Sydney is highest at 1778.11 and lowest in Perth

at 506.83. Median column of this table shows the selling prices of apartments in each city near

which the data values are likely to fall either below or above (Marchington and et. al., 2016).

First quartile shows the middle data value that can be found between Median and the

least selling price of apartment in each city whereas third quartile shows the middle data value

that can be found between Median and the highest selling price of apartment in each city. It can

be seen that the city with highest average has the highest values for Median and quartiles as well

and vice versa.

Capital city Mean Median First Quartile Third Quartile

Sydney (NSW) 2000 1778.11 1810 1227.5 2150

Melbourne (VIC) 3000 733.17 650 600 790

Brisbane (QLD) 4000 572.05 518.5 450.5 643.75

Adelaide (SA) 5000 650.14 605 542 673.25

Perth (WA) 6000 506.83 480 441.25 531.25

Hobart (TAS) 7000 737 730 637 810

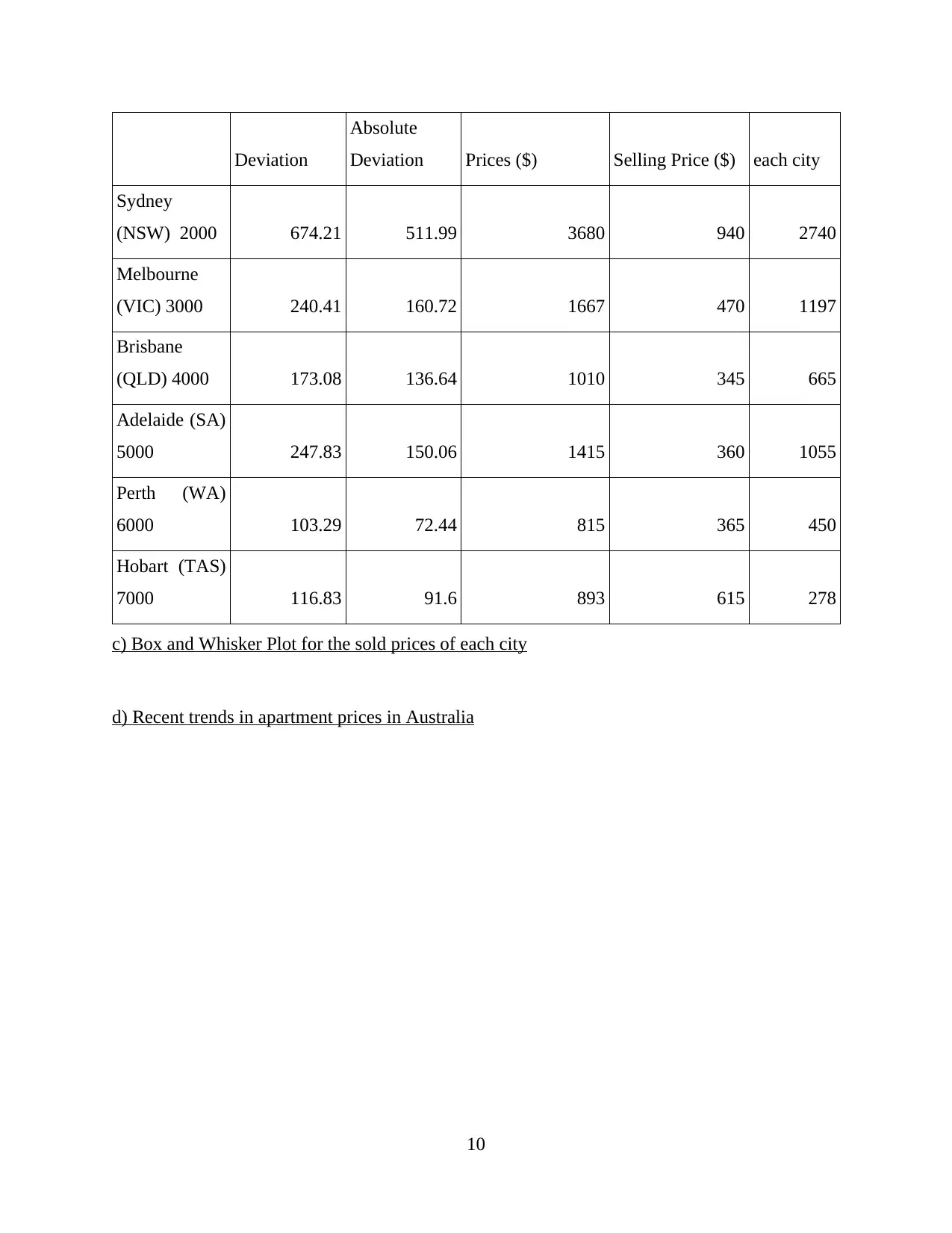

(b) Calculation of standard deviation, mean absolute deviation and range for each city using

excel

Standard Deviation for Perth has the lowest number of data values and also

Capital city Standard Mean Maximum Selling Minimum Range for

9

long period (Kyriakarakos and et. al., 2013).

QUESTION 2

(a) Calculation of Mean, Median, first quartile, and third quartile of sold prices for each city

using excel

The collected data shows the calculation of mean, median, first quartile and third quartile

of selling prices of apartments sold in six capital cities of Australia.

Mean has been calculated by taking the average of sale prices of apartments sold in each

city. The average number of apartments sold in Sydney is highest at 1778.11 and lowest in Perth

at 506.83. Median column of this table shows the selling prices of apartments in each city near

which the data values are likely to fall either below or above (Marchington and et. al., 2016).

First quartile shows the middle data value that can be found between Median and the

least selling price of apartment in each city whereas third quartile shows the middle data value

that can be found between Median and the highest selling price of apartment in each city. It can

be seen that the city with highest average has the highest values for Median and quartiles as well

and vice versa.

Capital city Mean Median First Quartile Third Quartile

Sydney (NSW) 2000 1778.11 1810 1227.5 2150

Melbourne (VIC) 3000 733.17 650 600 790

Brisbane (QLD) 4000 572.05 518.5 450.5 643.75

Adelaide (SA) 5000 650.14 605 542 673.25

Perth (WA) 6000 506.83 480 441.25 531.25

Hobart (TAS) 7000 737 730 637 810

(b) Calculation of standard deviation, mean absolute deviation and range for each city using

excel

Standard Deviation for Perth has the lowest number of data values and also

Capital city Standard Mean Maximum Selling Minimum Range for

9

Deviation

Absolute

Deviation Prices ($) Selling Price ($) each city

Sydney

(NSW) 2000 674.21 511.99 3680 940 2740

Melbourne

(VIC) 3000 240.41 160.72 1667 470 1197

Brisbane

(QLD) 4000 173.08 136.64 1010 345 665

Adelaide (SA)

5000 247.83 150.06 1415 360 1055

Perth (WA)

6000 103.29 72.44 815 365 450

Hobart (TAS)

7000 116.83 91.6 893 615 278

c) Box and Whisker Plot for the sold prices of each city

d) Recent trends in apartment prices in Australia

10

Absolute

Deviation Prices ($) Selling Price ($) each city

Sydney

(NSW) 2000 674.21 511.99 3680 940 2740

Melbourne

(VIC) 3000 240.41 160.72 1667 470 1197

Brisbane

(QLD) 4000 173.08 136.64 1010 345 665

Adelaide (SA)

5000 247.83 150.06 1415 360 1055

Perth (WA)

6000 103.29 72.44 815 365 450

Hobart (TAS)

7000 116.83 91.6 893 615 278

c) Box and Whisker Plot for the sold prices of each city

d) Recent trends in apartment prices in Australia

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.