Consolidation Accounting Solutions

VerifiedAdded on 2020/02/18

|9

|1422

|53

Practical Assignment

AI Summary

This document presents solutions to three different consolidation accounting problems. Solution 1 details the steps involved in accounting for an 80% stake acquisition in a subsidiary, including acquisition analysis, goodwill calculation, business combination valuation entries, pre-acquisition and non-controlling interest entries, and inter-company transaction eliminations. Solution 2 focuses on accounting for investments in associates, covering acquisition analysis, goodwill computation, and journal entries related to revaluation gains, depreciation, profit sharing, and dividend receipts. Solution 3 addresses foreign exchange transactions, demonstrating journal entries for inventory and plant & equipment purchases, and accounting for unrealized forex gains and losses. The solutions provide detailed journal entries and explanations for each step, making them a valuable resource for students learning about consolidation accounting.

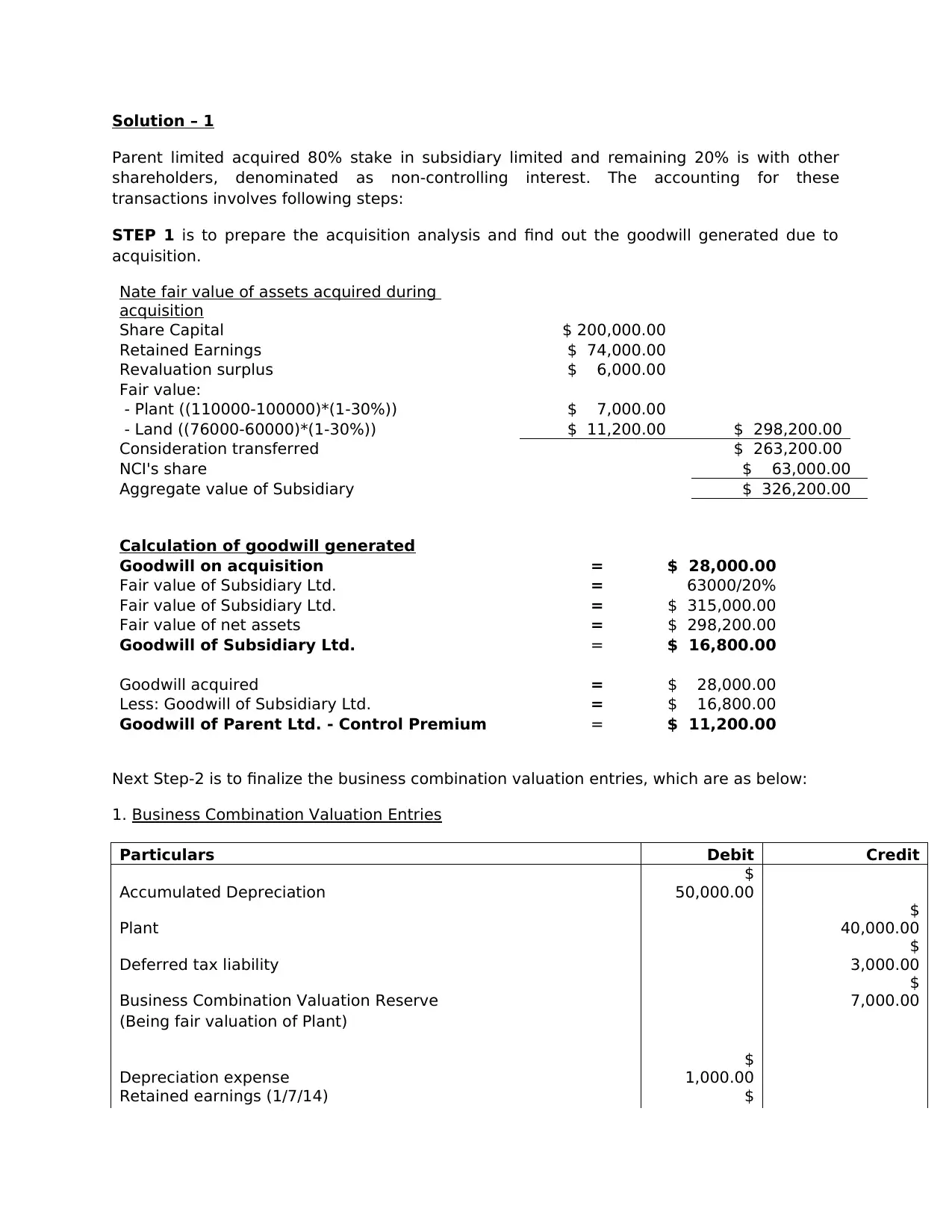

Solution – 1

Parent limited acquired 80% stake in subsidiary limited and remaining 20% is with other

shareholders, denominated as non-controlling interest. The accounting for these

transactions involves following steps:

STEP 1 is to prepare the acquisition analysis and find out the goodwill generated due to

acquisition.

Nate fair value of assets acquired during

acquisition

Share Capital $ 200,000.00

Retained Earnings $ 74,000.00

Revaluation surplus $ 6,000.00

Fair value:

- Plant ((110000-100000)*(1-30%)) $ 7,000.00

- Land ((76000-60000)*(1-30%)) $ 11,200.00 $ 298,200.00

Consideration transferred $ 263,200.00

NCI's share $ 63,000.00

Aggregate value of Subsidiary $ 326,200.00

Calculation of goodwill generated

Goodwill on acquisition = $ 28,000.00

Fair value of Subsidiary Ltd. = 63000/20%

Fair value of Subsidiary Ltd. = $ 315,000.00

Fair value of net assets = $ 298,200.00

Goodwill of Subsidiary Ltd. = $ 16,800.00

Goodwill acquired = $ 28,000.00

Less: Goodwill of Subsidiary Ltd. = $ 16,800.00

Goodwill of Parent Ltd. - Control Premium = $ 11,200.00

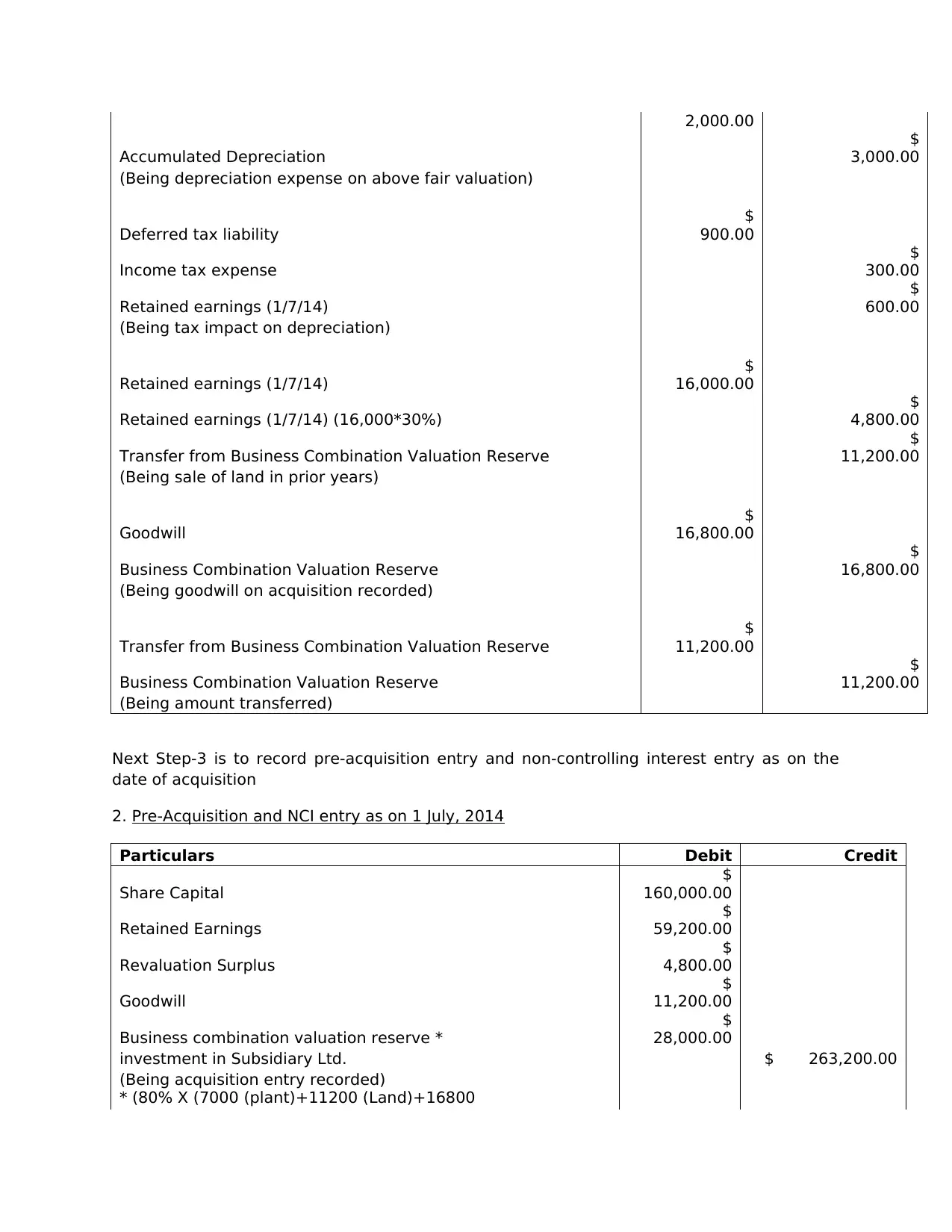

Next Step-2 is to finalize the business combination valuation entries, which are as below:

1. Business Combination Valuation Entries

Particulars Debit Credit

Accumulated Depreciation

$

50,000.00

Plant

$

40,000.00

Deferred tax liability

$

3,000.00

Business Combination Valuation Reserve

$

7,000.00

(Being fair valuation of Plant)

Depreciation expense

$

1,000.00

Retained earnings (1/7/14) $

Parent limited acquired 80% stake in subsidiary limited and remaining 20% is with other

shareholders, denominated as non-controlling interest. The accounting for these

transactions involves following steps:

STEP 1 is to prepare the acquisition analysis and find out the goodwill generated due to

acquisition.

Nate fair value of assets acquired during

acquisition

Share Capital $ 200,000.00

Retained Earnings $ 74,000.00

Revaluation surplus $ 6,000.00

Fair value:

- Plant ((110000-100000)*(1-30%)) $ 7,000.00

- Land ((76000-60000)*(1-30%)) $ 11,200.00 $ 298,200.00

Consideration transferred $ 263,200.00

NCI's share $ 63,000.00

Aggregate value of Subsidiary $ 326,200.00

Calculation of goodwill generated

Goodwill on acquisition = $ 28,000.00

Fair value of Subsidiary Ltd. = 63000/20%

Fair value of Subsidiary Ltd. = $ 315,000.00

Fair value of net assets = $ 298,200.00

Goodwill of Subsidiary Ltd. = $ 16,800.00

Goodwill acquired = $ 28,000.00

Less: Goodwill of Subsidiary Ltd. = $ 16,800.00

Goodwill of Parent Ltd. - Control Premium = $ 11,200.00

Next Step-2 is to finalize the business combination valuation entries, which are as below:

1. Business Combination Valuation Entries

Particulars Debit Credit

Accumulated Depreciation

$

50,000.00

Plant

$

40,000.00

Deferred tax liability

$

3,000.00

Business Combination Valuation Reserve

$

7,000.00

(Being fair valuation of Plant)

Depreciation expense

$

1,000.00

Retained earnings (1/7/14) $

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2,000.00

Accumulated Depreciation

$

3,000.00

(Being depreciation expense on above fair valuation)

Deferred tax liability

$

900.00

Income tax expense

$

300.00

Retained earnings (1/7/14)

$

600.00

(Being tax impact on depreciation)

Retained earnings (1/7/14)

$

16,000.00

Retained earnings (1/7/14) (16,000*30%)

$

4,800.00

Transfer from Business Combination Valuation Reserve

$

11,200.00

(Being sale of land in prior years)

Goodwill

$

16,800.00

Business Combination Valuation Reserve

$

16,800.00

(Being goodwill on acquisition recorded)

Transfer from Business Combination Valuation Reserve

$

11,200.00

Business Combination Valuation Reserve

$

11,200.00

(Being amount transferred)

Next Step-3 is to record pre-acquisition entry and non-controlling interest entry as on the

date of acquisition

2. Pre-Acquisition and NCI entry as on 1 July, 2014

Particulars Debit Credit

Share Capital

$

160,000.00

Retained Earnings

$

59,200.00

Revaluation Surplus

$

4,800.00

Goodwill

$

11,200.00

Business combination valuation reserve *

$

28,000.00

investment in Subsidiary Ltd. $ 263,200.00

(Being acquisition entry recorded)

* (80% X (7000 (plant)+11200 (Land)+16800

Accumulated Depreciation

$

3,000.00

(Being depreciation expense on above fair valuation)

Deferred tax liability

$

900.00

Income tax expense

$

300.00

Retained earnings (1/7/14)

$

600.00

(Being tax impact on depreciation)

Retained earnings (1/7/14)

$

16,000.00

Retained earnings (1/7/14) (16,000*30%)

$

4,800.00

Transfer from Business Combination Valuation Reserve

$

11,200.00

(Being sale of land in prior years)

Goodwill

$

16,800.00

Business Combination Valuation Reserve

$

16,800.00

(Being goodwill on acquisition recorded)

Transfer from Business Combination Valuation Reserve

$

11,200.00

Business Combination Valuation Reserve

$

11,200.00

(Being amount transferred)

Next Step-3 is to record pre-acquisition entry and non-controlling interest entry as on the

date of acquisition

2. Pre-Acquisition and NCI entry as on 1 July, 2014

Particulars Debit Credit

Share Capital

$

160,000.00

Retained Earnings

$

59,200.00

Revaluation Surplus

$

4,800.00

Goodwill

$

11,200.00

Business combination valuation reserve *

$

28,000.00

investment in Subsidiary Ltd. $ 263,200.00

(Being acquisition entry recorded)

* (80% X (7000 (plant)+11200 (Land)+16800

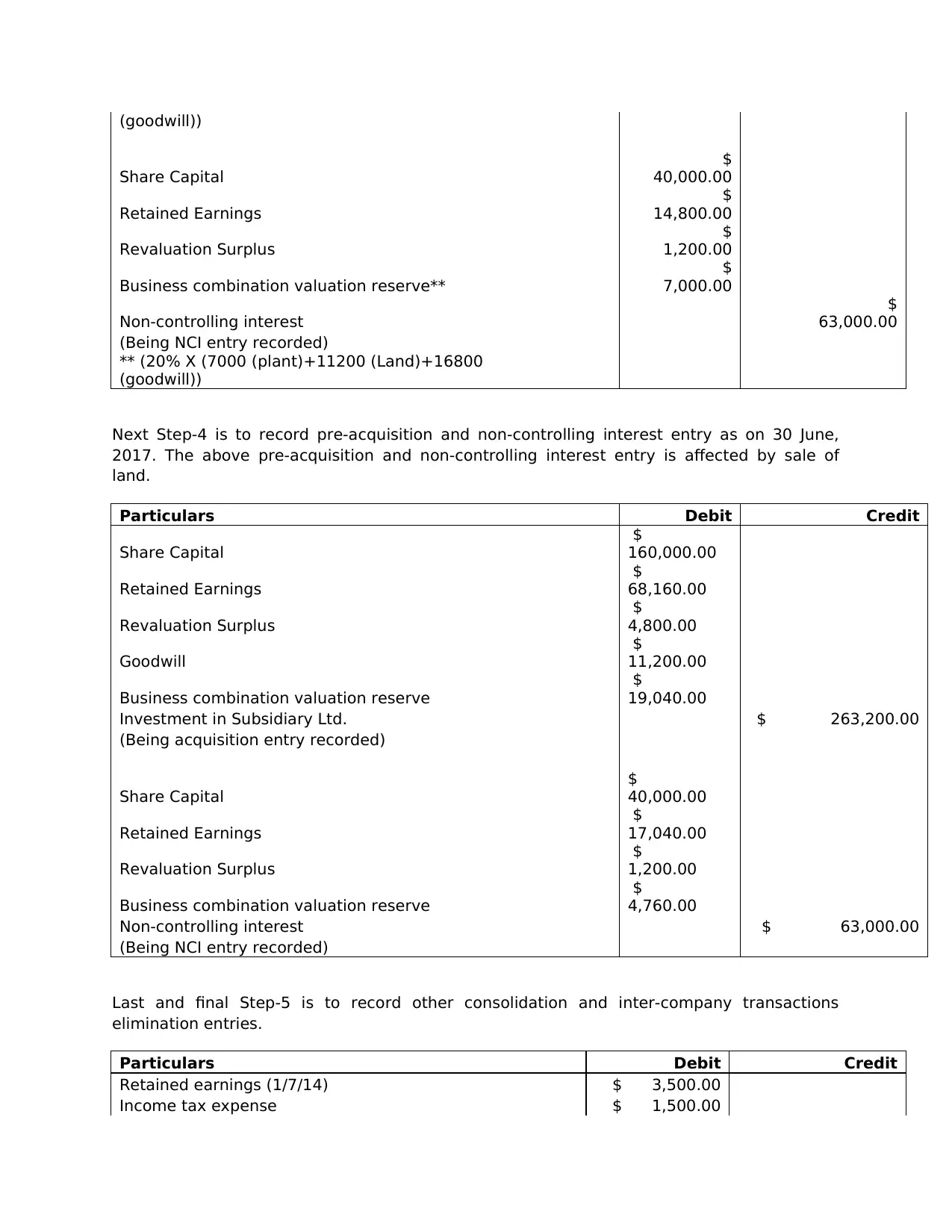

(goodwill))

Share Capital

$

40,000.00

Retained Earnings

$

14,800.00

Revaluation Surplus

$

1,200.00

Business combination valuation reserve**

$

7,000.00

Non-controlling interest

$

63,000.00

(Being NCI entry recorded)

** (20% X (7000 (plant)+11200 (Land)+16800

(goodwill))

Next Step-4 is to record pre-acquisition and non-controlling interest entry as on 30 June,

2017. The above pre-acquisition and non-controlling interest entry is affected by sale of

land.

Particulars Debit Credit

Share Capital

$

160,000.00

Retained Earnings

$

68,160.00

Revaluation Surplus

$

4,800.00

Goodwill

$

11,200.00

Business combination valuation reserve

$

19,040.00

Investment in Subsidiary Ltd. $ 263,200.00

(Being acquisition entry recorded)

Share Capital

$

40,000.00

Retained Earnings

$

17,040.00

Revaluation Surplus

$

1,200.00

Business combination valuation reserve

$

4,760.00

Non-controlling interest $ 63,000.00

(Being NCI entry recorded)

Last and final Step-5 is to record other consolidation and inter-company transactions

elimination entries.

Particulars Debit Credit

Retained earnings (1/7/14) $ 3,500.00

Income tax expense $ 1,500.00

Share Capital

$

40,000.00

Retained Earnings

$

14,800.00

Revaluation Surplus

$

1,200.00

Business combination valuation reserve**

$

7,000.00

Non-controlling interest

$

63,000.00

(Being NCI entry recorded)

** (20% X (7000 (plant)+11200 (Land)+16800

(goodwill))

Next Step-4 is to record pre-acquisition and non-controlling interest entry as on 30 June,

2017. The above pre-acquisition and non-controlling interest entry is affected by sale of

land.

Particulars Debit Credit

Share Capital

$

160,000.00

Retained Earnings

$

68,160.00

Revaluation Surplus

$

4,800.00

Goodwill

$

11,200.00

Business combination valuation reserve

$

19,040.00

Investment in Subsidiary Ltd. $ 263,200.00

(Being acquisition entry recorded)

Share Capital

$

40,000.00

Retained Earnings

$

17,040.00

Revaluation Surplus

$

1,200.00

Business combination valuation reserve

$

4,760.00

Non-controlling interest $ 63,000.00

(Being NCI entry recorded)

Last and final Step-5 is to record other consolidation and inter-company transactions

elimination entries.

Particulars Debit Credit

Retained earnings (1/7/14) $ 3,500.00

Income tax expense $ 1,500.00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

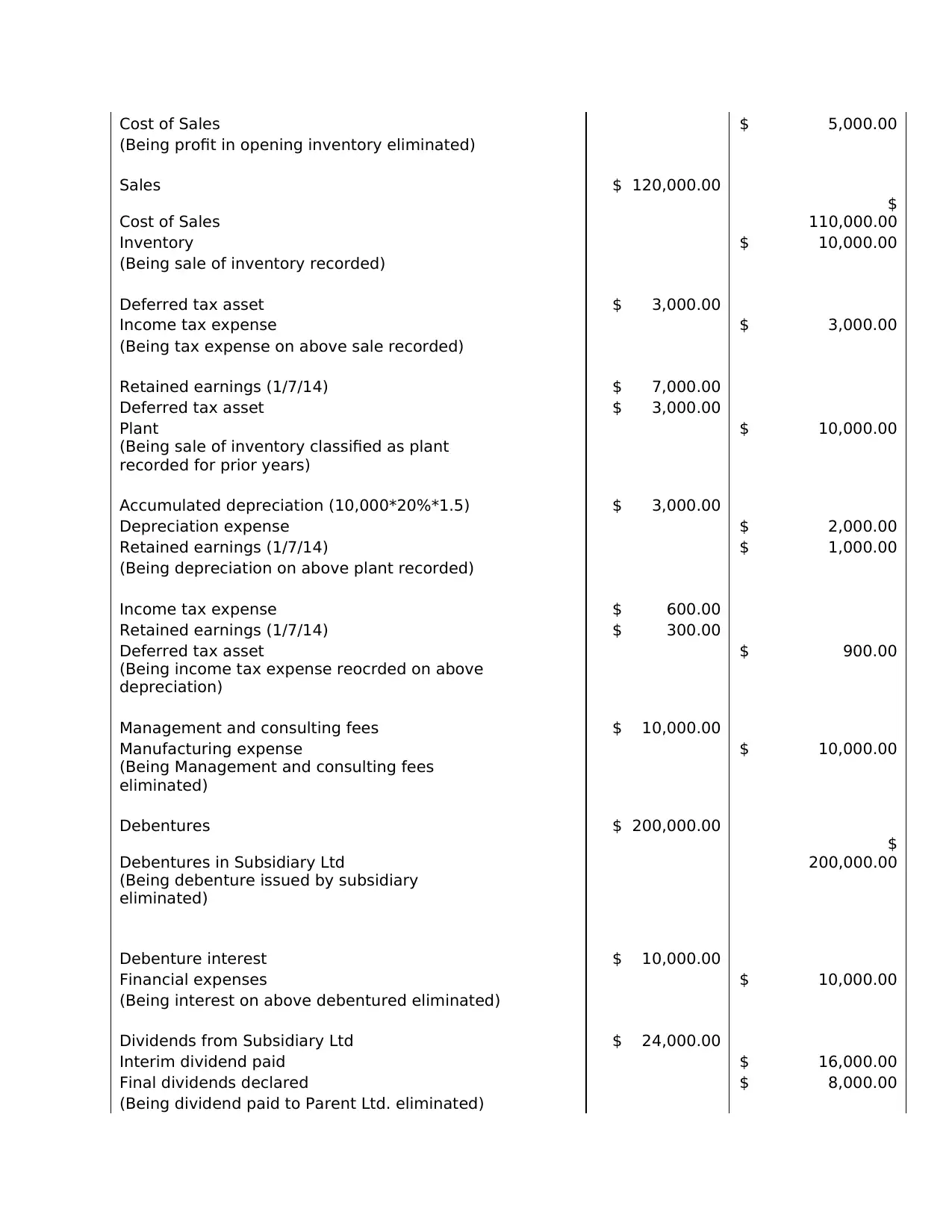

Cost of Sales $ 5,000.00

(Being profit in opening inventory eliminated)

Sales $ 120,000.00

Cost of Sales

$

110,000.00

Inventory $ 10,000.00

(Being sale of inventory recorded)

Deferred tax asset $ 3,000.00

Income tax expense $ 3,000.00

(Being tax expense on above sale recorded)

Retained earnings (1/7/14) $ 7,000.00

Deferred tax asset $ 3,000.00

Plant $ 10,000.00

(Being sale of inventory classified as plant

recorded for prior years)

Accumulated depreciation (10,000*20%*1.5) $ 3,000.00

Depreciation expense $ 2,000.00

Retained earnings (1/7/14) $ 1,000.00

(Being depreciation on above plant recorded)

Income tax expense $ 600.00

Retained earnings (1/7/14) $ 300.00

Deferred tax asset $ 900.00

(Being income tax expense reocrded on above

depreciation)

Management and consulting fees $ 10,000.00

Manufacturing expense $ 10,000.00

(Being Management and consulting fees

eliminated)

Debentures $ 200,000.00

Debentures in Subsidiary Ltd

$

200,000.00

(Being debenture issued by subsidiary

eliminated)

Debenture interest $ 10,000.00

Financial expenses $ 10,000.00

(Being interest on above debentured eliminated)

Dividends from Subsidiary Ltd $ 24,000.00

Interim dividend paid $ 16,000.00

Final dividends declared $ 8,000.00

(Being dividend paid to Parent Ltd. eliminated)

(Being profit in opening inventory eliminated)

Sales $ 120,000.00

Cost of Sales

$

110,000.00

Inventory $ 10,000.00

(Being sale of inventory recorded)

Deferred tax asset $ 3,000.00

Income tax expense $ 3,000.00

(Being tax expense on above sale recorded)

Retained earnings (1/7/14) $ 7,000.00

Deferred tax asset $ 3,000.00

Plant $ 10,000.00

(Being sale of inventory classified as plant

recorded for prior years)

Accumulated depreciation (10,000*20%*1.5) $ 3,000.00

Depreciation expense $ 2,000.00

Retained earnings (1/7/14) $ 1,000.00

(Being depreciation on above plant recorded)

Income tax expense $ 600.00

Retained earnings (1/7/14) $ 300.00

Deferred tax asset $ 900.00

(Being income tax expense reocrded on above

depreciation)

Management and consulting fees $ 10,000.00

Manufacturing expense $ 10,000.00

(Being Management and consulting fees

eliminated)

Debentures $ 200,000.00

Debentures in Subsidiary Ltd

$

200,000.00

(Being debenture issued by subsidiary

eliminated)

Debenture interest $ 10,000.00

Financial expenses $ 10,000.00

(Being interest on above debentured eliminated)

Dividends from Subsidiary Ltd $ 24,000.00

Interim dividend paid $ 16,000.00

Final dividends declared $ 8,000.00

(Being dividend paid to Parent Ltd. eliminated)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

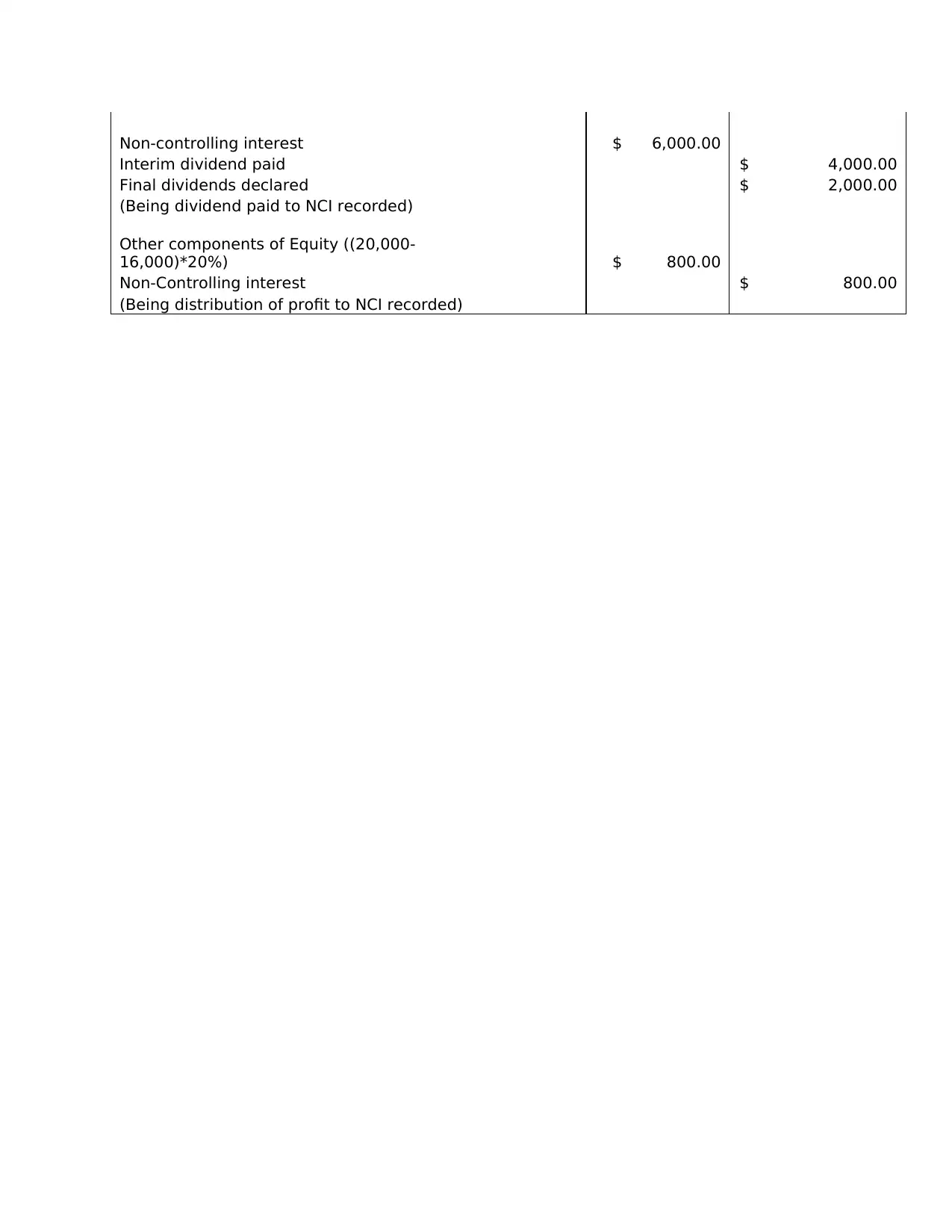

Non-controlling interest $ 6,000.00

Interim dividend paid $ 4,000.00

Final dividends declared $ 2,000.00

(Being dividend paid to NCI recorded)

Other components of Equity ((20,000-

16,000)*20%) $ 800.00

Non-Controlling interest $ 800.00

(Being distribution of profit to NCI recorded)

Interim dividend paid $ 4,000.00

Final dividends declared $ 2,000.00

(Being dividend paid to NCI recorded)

Other components of Equity ((20,000-

16,000)*20%) $ 800.00

Non-Controlling interest $ 800.00

(Being distribution of profit to NCI recorded)

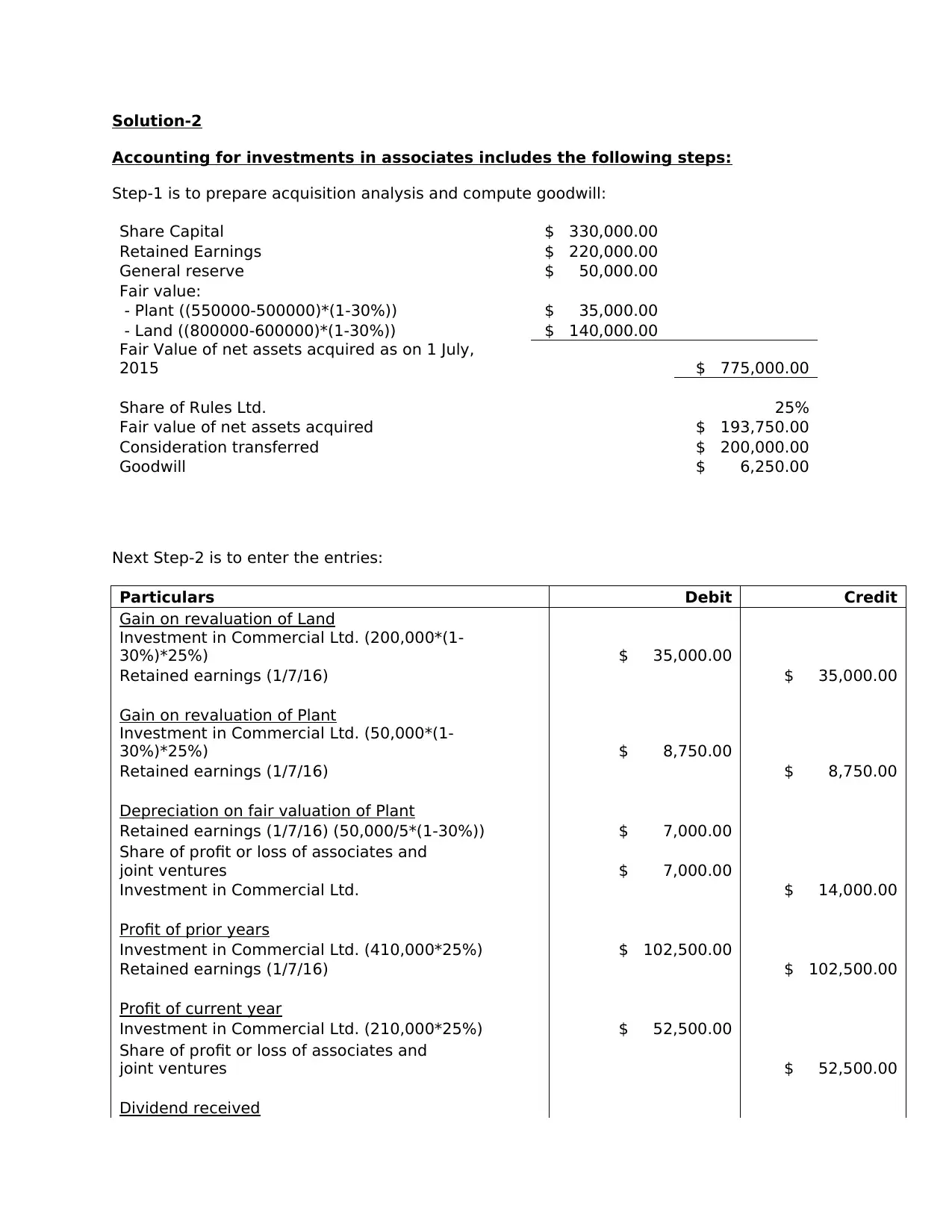

Solution-2

Accounting for investments in associates includes the following steps:

Step-1 is to prepare acquisition analysis and compute goodwill:

Share Capital $ 330,000.00

Retained Earnings $ 220,000.00

General reserve $ 50,000.00

Fair value:

- Plant ((550000-500000)*(1-30%)) $ 35,000.00

- Land ((800000-600000)*(1-30%)) $ 140,000.00

Fair Value of net assets acquired as on 1 July,

2015 $ 775,000.00

Share of Rules Ltd. 25%

Fair value of net assets acquired $ 193,750.00

Consideration transferred $ 200,000.00

Goodwill $ 6,250.00

Next Step-2 is to enter the entries:

Particulars Debit Credit

Gain on revaluation of Land

Investment in Commercial Ltd. (200,000*(1-

30%)*25%) $ 35,000.00

Retained earnings (1/7/16) $ 35,000.00

Gain on revaluation of Plant

Investment in Commercial Ltd. (50,000*(1-

30%)*25%) $ 8,750.00

Retained earnings (1/7/16) $ 8,750.00

Depreciation on fair valuation of Plant

Retained earnings (1/7/16) (50,000/5*(1-30%)) $ 7,000.00

Share of profit or loss of associates and

joint ventures $ 7,000.00

Investment in Commercial Ltd. $ 14,000.00

Profit of prior years

Investment in Commercial Ltd. (410,000*25%) $ 102,500.00

Retained earnings (1/7/16) $ 102,500.00

Profit of current year

Investment in Commercial Ltd. (210,000*25%) $ 52,500.00

Share of profit or loss of associates and

joint ventures $ 52,500.00

Dividend received

Accounting for investments in associates includes the following steps:

Step-1 is to prepare acquisition analysis and compute goodwill:

Share Capital $ 330,000.00

Retained Earnings $ 220,000.00

General reserve $ 50,000.00

Fair value:

- Plant ((550000-500000)*(1-30%)) $ 35,000.00

- Land ((800000-600000)*(1-30%)) $ 140,000.00

Fair Value of net assets acquired as on 1 July,

2015 $ 775,000.00

Share of Rules Ltd. 25%

Fair value of net assets acquired $ 193,750.00

Consideration transferred $ 200,000.00

Goodwill $ 6,250.00

Next Step-2 is to enter the entries:

Particulars Debit Credit

Gain on revaluation of Land

Investment in Commercial Ltd. (200,000*(1-

30%)*25%) $ 35,000.00

Retained earnings (1/7/16) $ 35,000.00

Gain on revaluation of Plant

Investment in Commercial Ltd. (50,000*(1-

30%)*25%) $ 8,750.00

Retained earnings (1/7/16) $ 8,750.00

Depreciation on fair valuation of Plant

Retained earnings (1/7/16) (50,000/5*(1-30%)) $ 7,000.00

Share of profit or loss of associates and

joint ventures $ 7,000.00

Investment in Commercial Ltd. $ 14,000.00

Profit of prior years

Investment in Commercial Ltd. (410,000*25%) $ 102,500.00

Retained earnings (1/7/16) $ 102,500.00

Profit of current year

Investment in Commercial Ltd. (210,000*25%) $ 52,500.00

Share of profit or loss of associates and

joint ventures $ 52,500.00

Dividend received

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

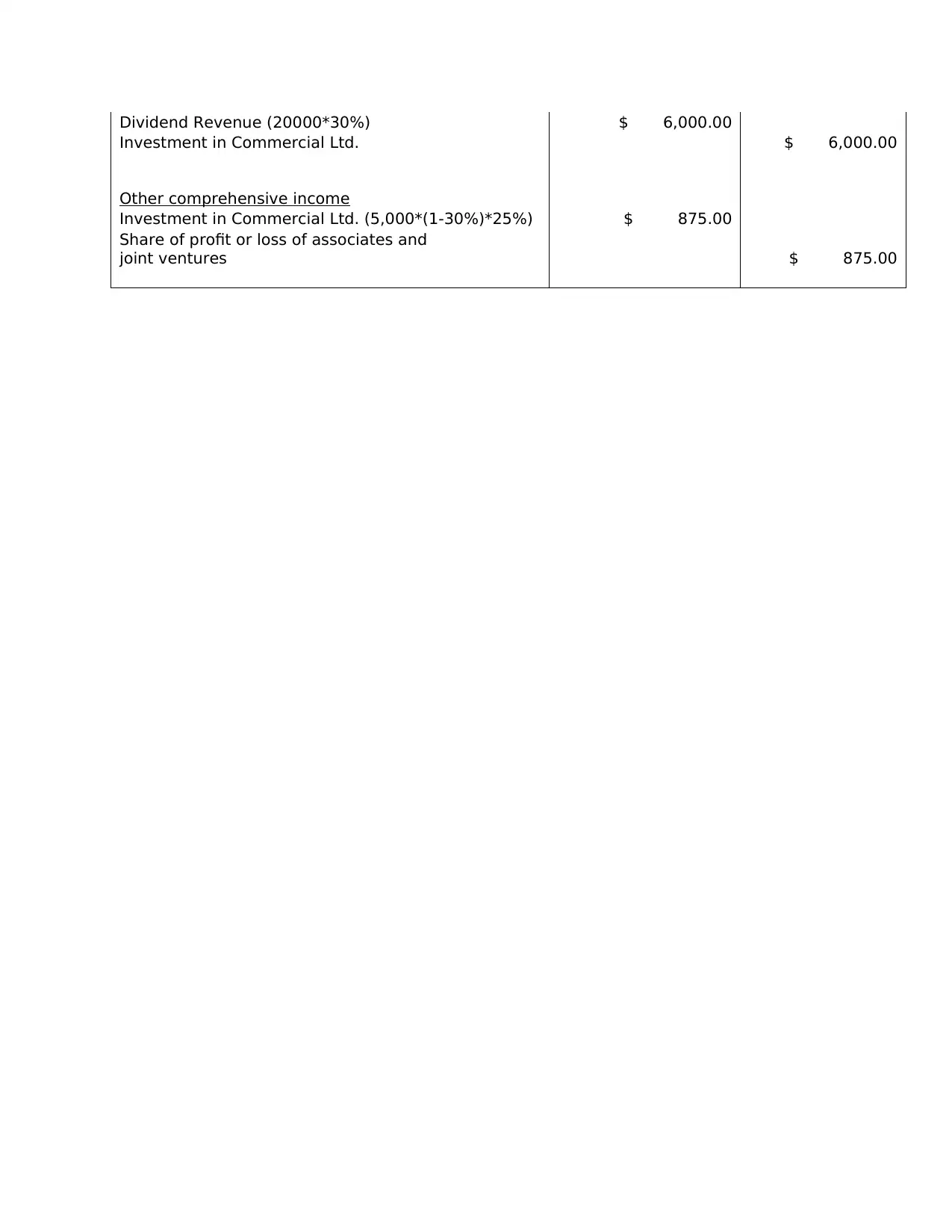

Dividend Revenue (20000*30%) $ 6,000.00

Investment in Commercial Ltd. $ 6,000.00

Other comprehensive income

Investment in Commercial Ltd. (5,000*(1-30%)*25%) $ 875.00

Share of profit or loss of associates and

joint ventures $ 875.00

Investment in Commercial Ltd. $ 6,000.00

Other comprehensive income

Investment in Commercial Ltd. (5,000*(1-30%)*25%) $ 875.00

Share of profit or loss of associates and

joint ventures $ 875.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

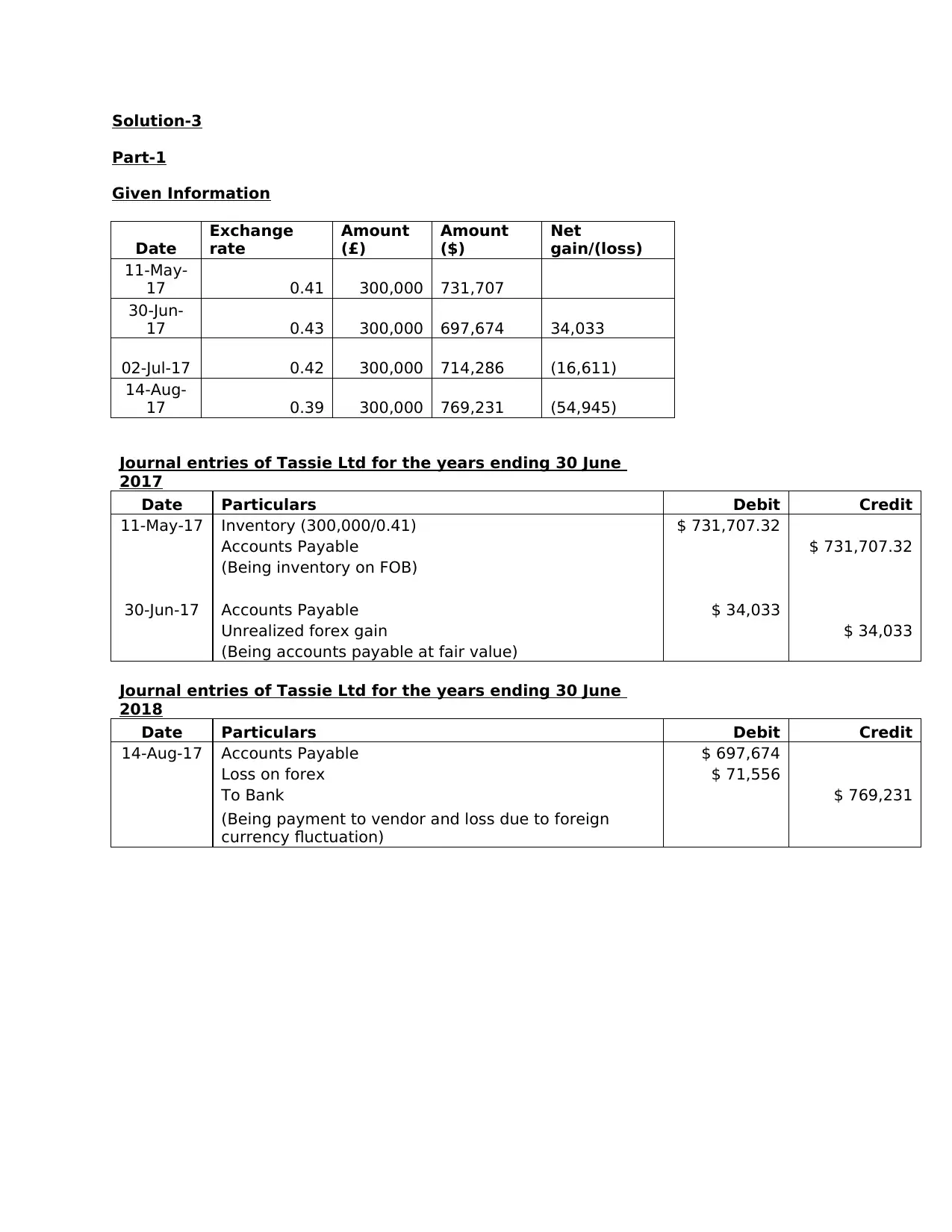

Solution-3

Part-1

Given Information

Date

Exchange

rate

Amount

(£)

Amount

($)

Net

gain/(loss)

11-May-

17 0.41 300,000 731,707

30-Jun-

17 0.43 300,000 697,674 34,033

02-Jul-17 0.42 300,000 714,286 (16,611)

14-Aug-

17 0.39 300,000 769,231 (54,945)

Journal entries of Tassie Ltd for the years ending 30 June

2017

Date Particulars Debit Credit

11-May-17 Inventory (300,000/0.41) $ 731,707.32

Accounts Payable $ 731,707.32

(Being inventory on FOB)

30-Jun-17 Accounts Payable $ 34,033

Unrealized forex gain $ 34,033

(Being accounts payable at fair value)

Journal entries of Tassie Ltd for the years ending 30 June

2018

Date Particulars Debit Credit

14-Aug-17 Accounts Payable $ 697,674

Loss on forex $ 71,556

To Bank $ 769,231

(Being payment to vendor and loss due to foreign

currency fluctuation)

Part-1

Given Information

Date

Exchange

rate

Amount

(£)

Amount

($)

Net

gain/(loss)

11-May-

17 0.41 300,000 731,707

30-Jun-

17 0.43 300,000 697,674 34,033

02-Jul-17 0.42 300,000 714,286 (16,611)

14-Aug-

17 0.39 300,000 769,231 (54,945)

Journal entries of Tassie Ltd for the years ending 30 June

2017

Date Particulars Debit Credit

11-May-17 Inventory (300,000/0.41) $ 731,707.32

Accounts Payable $ 731,707.32

(Being inventory on FOB)

30-Jun-17 Accounts Payable $ 34,033

Unrealized forex gain $ 34,033

(Being accounts payable at fair value)

Journal entries of Tassie Ltd for the years ending 30 June

2018

Date Particulars Debit Credit

14-Aug-17 Accounts Payable $ 697,674

Loss on forex $ 71,556

To Bank $ 769,231

(Being payment to vendor and loss due to foreign

currency fluctuation)

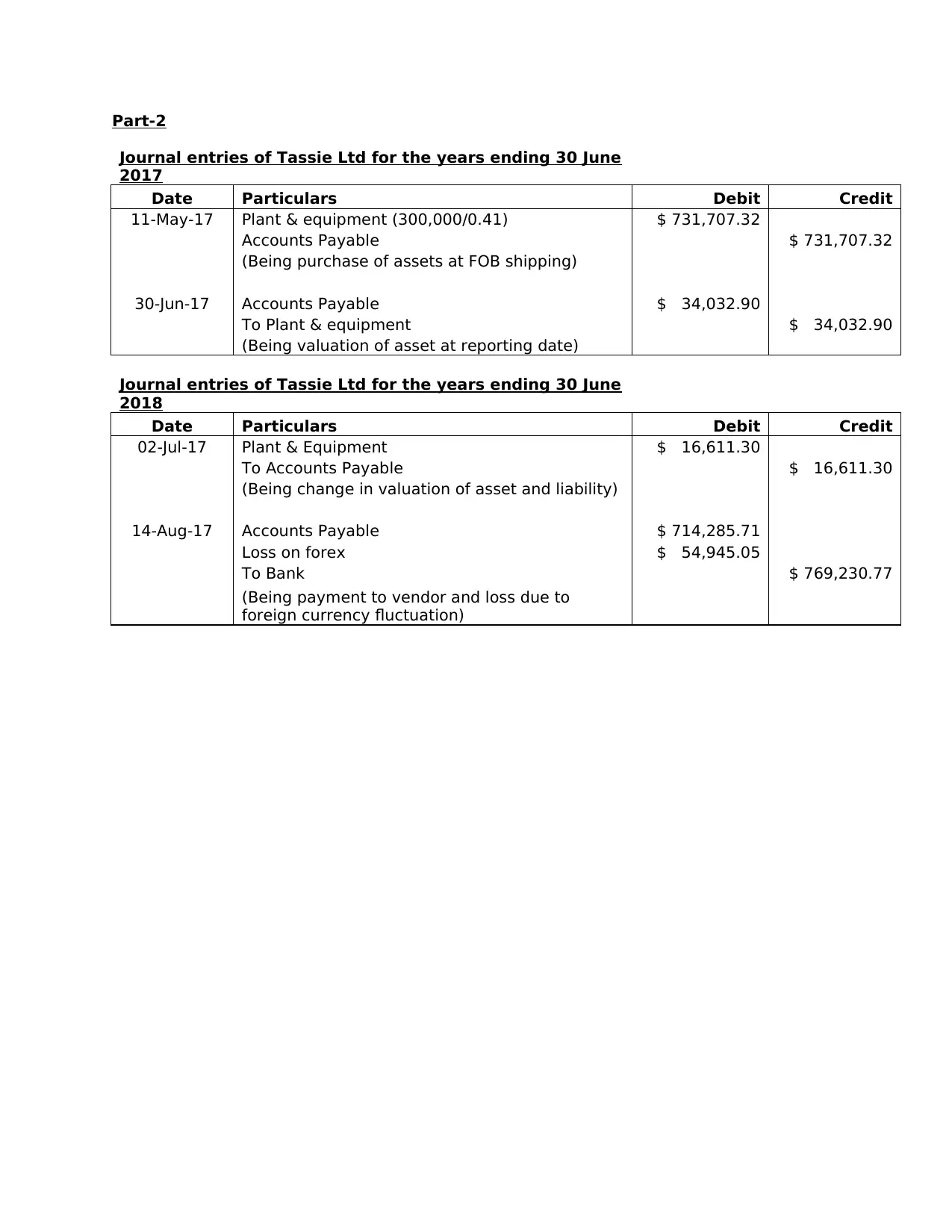

Part-2

Journal entries of Tassie Ltd for the years ending 30 June

2017

Date Particulars Debit Credit

11-May-17 Plant & equipment (300,000/0.41) $ 731,707.32

Accounts Payable $ 731,707.32

(Being purchase of assets at FOB shipping)

30-Jun-17 Accounts Payable $ 34,032.90

To Plant & equipment $ 34,032.90

(Being valuation of asset at reporting date)

Journal entries of Tassie Ltd for the years ending 30 June

2018

Date Particulars Debit Credit

02-Jul-17 Plant & Equipment $ 16,611.30

To Accounts Payable $ 16,611.30

(Being change in valuation of asset and liability)

14-Aug-17 Accounts Payable $ 714,285.71

Loss on forex $ 54,945.05

To Bank $ 769,230.77

(Being payment to vendor and loss due to

foreign currency fluctuation)

Journal entries of Tassie Ltd for the years ending 30 June

2017

Date Particulars Debit Credit

11-May-17 Plant & equipment (300,000/0.41) $ 731,707.32

Accounts Payable $ 731,707.32

(Being purchase of assets at FOB shipping)

30-Jun-17 Accounts Payable $ 34,032.90

To Plant & equipment $ 34,032.90

(Being valuation of asset at reporting date)

Journal entries of Tassie Ltd for the years ending 30 June

2018

Date Particulars Debit Credit

02-Jul-17 Plant & Equipment $ 16,611.30

To Accounts Payable $ 16,611.30

(Being change in valuation of asset and liability)

14-Aug-17 Accounts Payable $ 714,285.71

Loss on forex $ 54,945.05

To Bank $ 769,230.77

(Being payment to vendor and loss due to

foreign currency fluctuation)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.