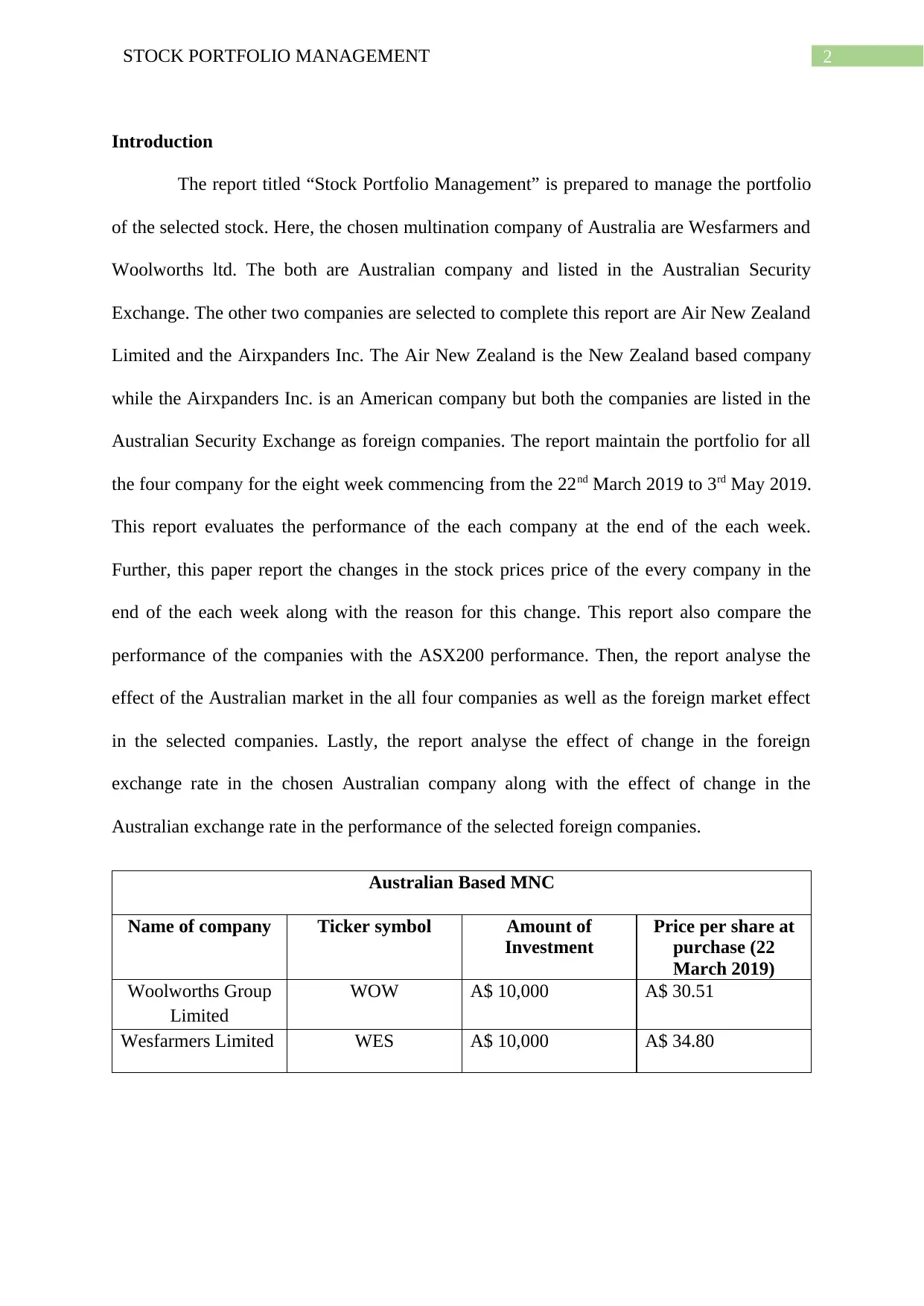

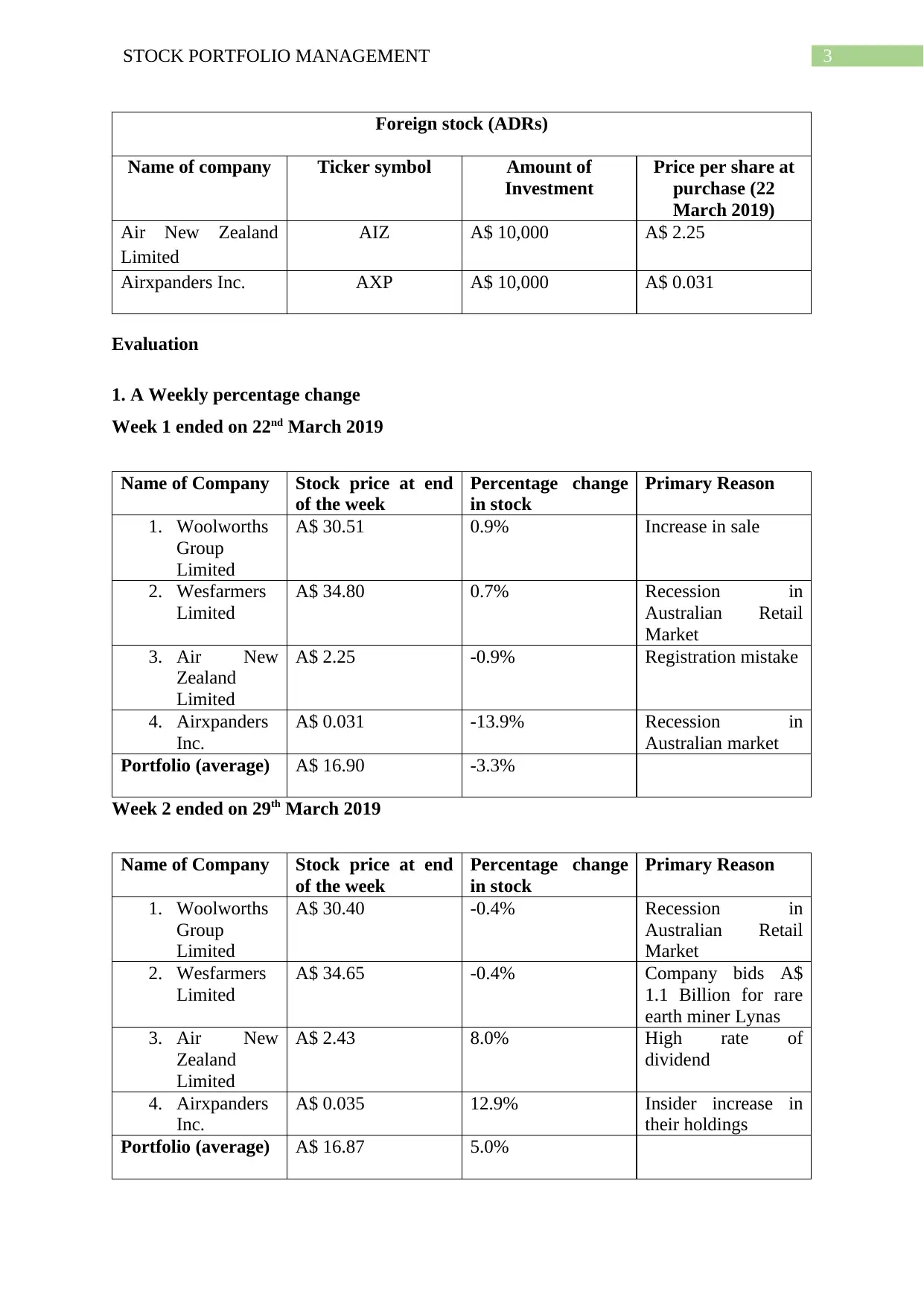

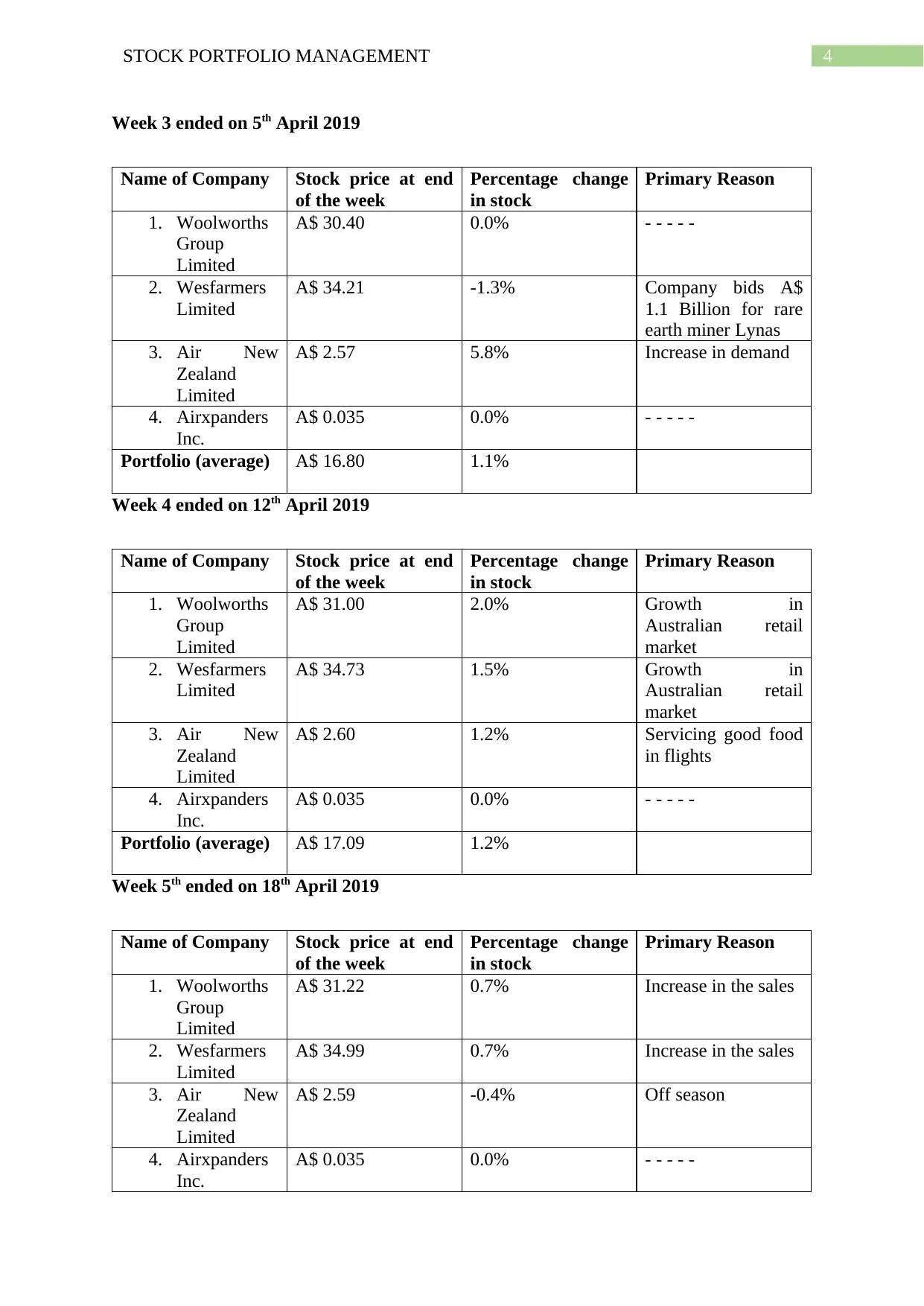

The report titled “Stock Portfolio Management” is prepared to manage the portfolio of the selected stock. Here, the chosen multination company of Australia are Wesfarmers and Woolworths ltd. The both are Australian company and listed in the Australian Security Exchange. The other two companies are selected to complete this report are Air New Zealand Limited and the Airxpanders Inc. The Air New Zealand is the New Zealand based company while the Airxpanders Inc. is an American company but both the companies are listed in the Australian Security Exchange as foreign companies. The report maintain the portfolio for all the four company for the eight week commencing from the 22 nd March 2019 to 3rd May 2019. This report evaluates the performance of the each company at the end of the each week. Further, this paper report the changes in the stock prices price of the every company in the end of the each week along with the reason for this change. This report also compare the performance of the companies with the ASX200 performance. Then, the report analyse the effect of the Australian market in the all four companies as well as the foreign market effect in the selected companies. Lastly, the report analyse the effect of change in the foreign exchange rate in the chosen Australian company along with the effect of change in the Australian exchange rate in the performance of the selected foreign companies.

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)