Capital Budgeting Techniques: A Comprehensive Analysis

VerifiedAdded on 2020/04/21

|18

|4135

|106

AI Summary

The provided text examines various aspects of capital budgeting techniques, specifically focusing on Net Present Value (NPV), Internal Rate of Return (IRR), and Dividend Discount Model (DDM). The discussion highlights the relevance and application of NPV as a critical tool for decision-making in investments, emphasizing its superiority over other methods due to its direct linkage with value maximization. IRR is also discussed as an important metric but is noted for its limitations compared to NPV. Additionally, the text touches upon the Dividend Discount Model (DDM), used primarily for valuing companies based on expected dividends, and its application in the context of stock valuation at exchanges like the Nairobi Stock Exchange. The sources cited provide a broad view from various studies conducted over different periods, offering insights into how these techniques have evolved and been applied across industries and regions. This comprehensive analysis aims to equip finance professionals with a nuanced understanding of capital budgeting decisions, ensuring they are well-informed about the strengths and limitations of each method.

Running Head: Stock Valuation and Capital Budgeting Techniques

Financial Studies

Financial Studies

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Stock Valuation and Capital Budgeting Techniques 1

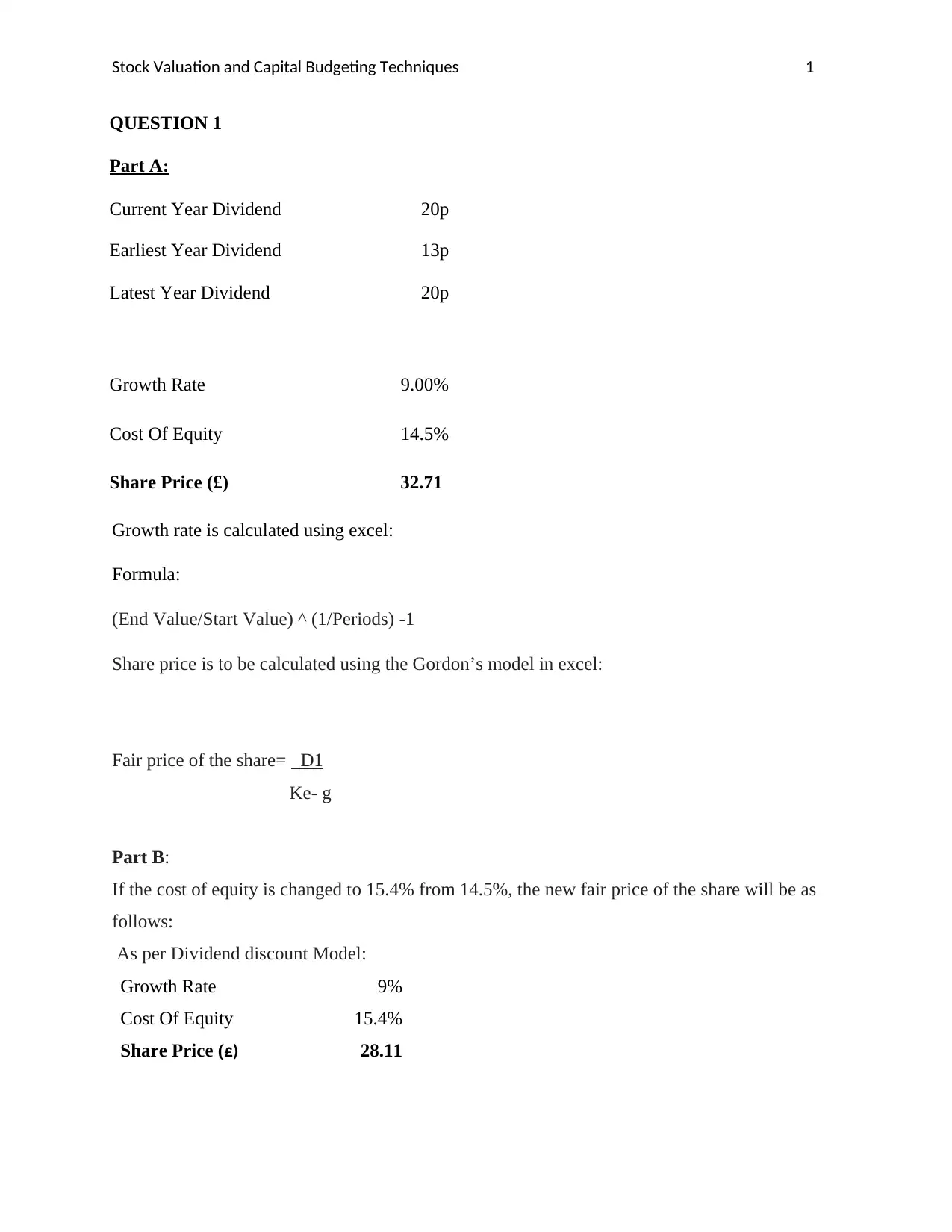

QUESTION 1

Part A:

Current Year Dividend 20p

Earliest Year Dividend 13p

Latest Year Dividend 20p

Growth Rate 9.00%

Cost Of Equity 14.5%

Share Price (£) 32.71

Growth rate is calculated using excel:

Formula:

(End Value/Start Value) ^ (1/Periods) -1

Share price is to be calculated using the Gordon’s model in excel:

Fair price of the share= D1

Ke- g

Part B:

If the cost of equity is changed to 15.4% from 14.5%, the new fair price of the share will be as

follows:

As per Dividend discount Model:

Growth Rate 9%

Cost Of Equity 15.4%

Share Price (£) 28.11

QUESTION 1

Part A:

Current Year Dividend 20p

Earliest Year Dividend 13p

Latest Year Dividend 20p

Growth Rate 9.00%

Cost Of Equity 14.5%

Share Price (£) 32.71

Growth rate is calculated using excel:

Formula:

(End Value/Start Value) ^ (1/Periods) -1

Share price is to be calculated using the Gordon’s model in excel:

Fair price of the share= D1

Ke- g

Part B:

If the cost of equity is changed to 15.4% from 14.5%, the new fair price of the share will be as

follows:

As per Dividend discount Model:

Growth Rate 9%

Cost Of Equity 15.4%

Share Price (£) 28.11

Stock Valuation and Capital Budgeting Techniques 2

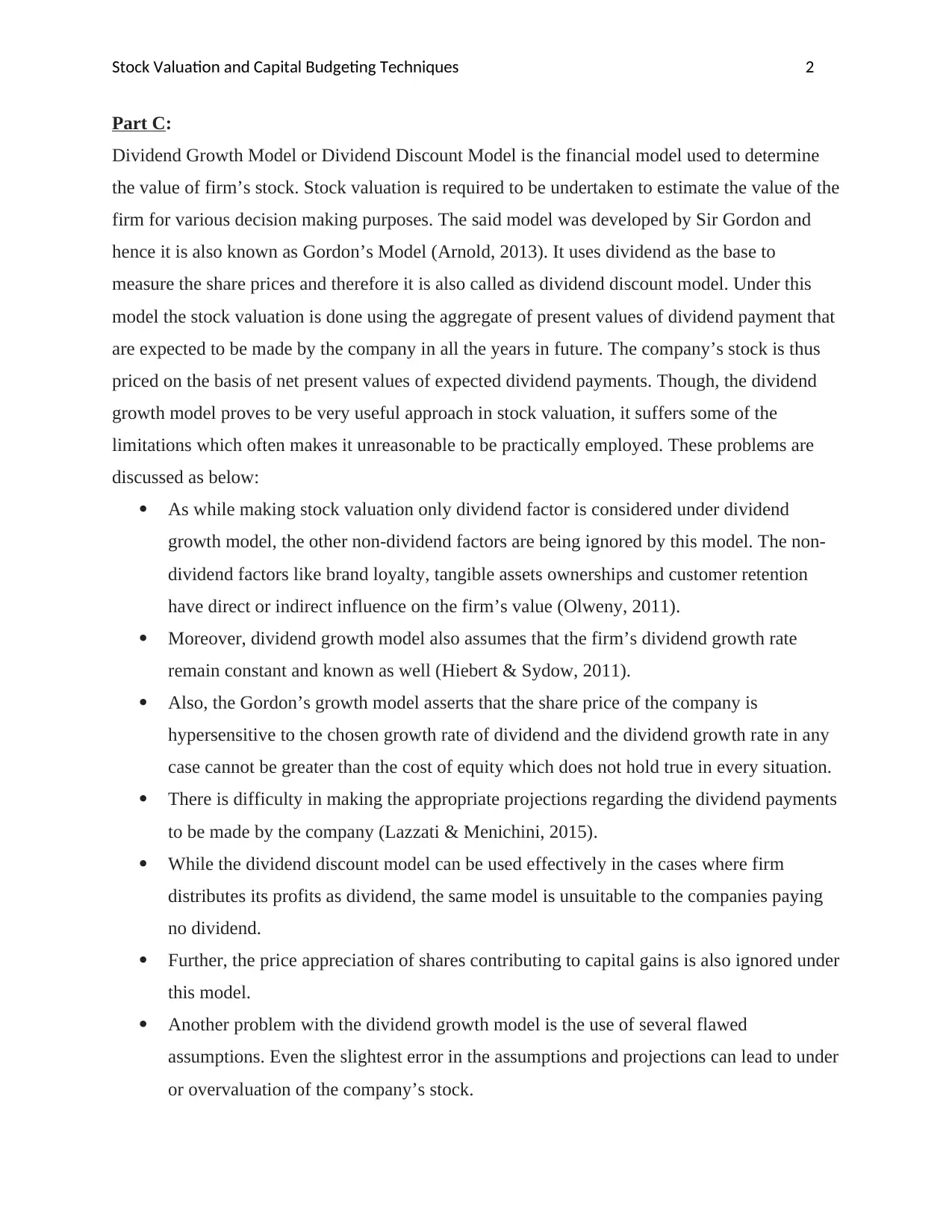

Part C:

Dividend Growth Model or Dividend Discount Model is the financial model used to determine

the value of firm’s stock. Stock valuation is required to be undertaken to estimate the value of the

firm for various decision making purposes. The said model was developed by Sir Gordon and

hence it is also known as Gordon’s Model (Arnold, 2013). It uses dividend as the base to

measure the share prices and therefore it is also called as dividend discount model. Under this

model the stock valuation is done using the aggregate of present values of dividend payment that

are expected to be made by the company in all the years in future. The company’s stock is thus

priced on the basis of net present values of expected dividend payments. Though, the dividend

growth model proves to be very useful approach in stock valuation, it suffers some of the

limitations which often makes it unreasonable to be practically employed. These problems are

discussed as below:

As while making stock valuation only dividend factor is considered under dividend

growth model, the other non-dividend factors are being ignored by this model. The non-

dividend factors like brand loyalty, tangible assets ownerships and customer retention

have direct or indirect influence on the firm’s value (Olweny, 2011).

Moreover, dividend growth model also assumes that the firm’s dividend growth rate

remain constant and known as well (Hiebert & Sydow, 2011).

Also, the Gordon’s growth model asserts that the share price of the company is

hypersensitive to the chosen growth rate of dividend and the dividend growth rate in any

case cannot be greater than the cost of equity which does not hold true in every situation.

There is difficulty in making the appropriate projections regarding the dividend payments

to be made by the company (Lazzati & Menichini, 2015).

While the dividend discount model can be used effectively in the cases where firm

distributes its profits as dividend, the same model is unsuitable to the companies paying

no dividend.

Further, the price appreciation of shares contributing to capital gains is also ignored under

this model.

Another problem with the dividend growth model is the use of several flawed

assumptions. Even the slightest error in the assumptions and projections can lead to under

or overvaluation of the company’s stock.

Part C:

Dividend Growth Model or Dividend Discount Model is the financial model used to determine

the value of firm’s stock. Stock valuation is required to be undertaken to estimate the value of the

firm for various decision making purposes. The said model was developed by Sir Gordon and

hence it is also known as Gordon’s Model (Arnold, 2013). It uses dividend as the base to

measure the share prices and therefore it is also called as dividend discount model. Under this

model the stock valuation is done using the aggregate of present values of dividend payment that

are expected to be made by the company in all the years in future. The company’s stock is thus

priced on the basis of net present values of expected dividend payments. Though, the dividend

growth model proves to be very useful approach in stock valuation, it suffers some of the

limitations which often makes it unreasonable to be practically employed. These problems are

discussed as below:

As while making stock valuation only dividend factor is considered under dividend

growth model, the other non-dividend factors are being ignored by this model. The non-

dividend factors like brand loyalty, tangible assets ownerships and customer retention

have direct or indirect influence on the firm’s value (Olweny, 2011).

Moreover, dividend growth model also assumes that the firm’s dividend growth rate

remain constant and known as well (Hiebert & Sydow, 2011).

Also, the Gordon’s growth model asserts that the share price of the company is

hypersensitive to the chosen growth rate of dividend and the dividend growth rate in any

case cannot be greater than the cost of equity which does not hold true in every situation.

There is difficulty in making the appropriate projections regarding the dividend payments

to be made by the company (Lazzati & Menichini, 2015).

While the dividend discount model can be used effectively in the cases where firm

distributes its profits as dividend, the same model is unsuitable to the companies paying

no dividend.

Further, the price appreciation of shares contributing to capital gains is also ignored under

this model.

Another problem with the dividend growth model is the use of several flawed

assumptions. Even the slightest error in the assumptions and projections can lead to under

or overvaluation of the company’s stock.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Stock Valuation and Capital Budgeting Techniques 3

It is also argued that the dividend growth rate model also ignores the stock buyback

effects whereas these effects can bring vast differences in the stock valuation. This

indicates that the model is being over conservative in its approach of estimation of stock

prices.

Therefore, it can be concluded that even when dividend growth model proves to be a reliable

method, there are some problems that are generally faced in its practical implementation.

QUESTION 3

Part 1:

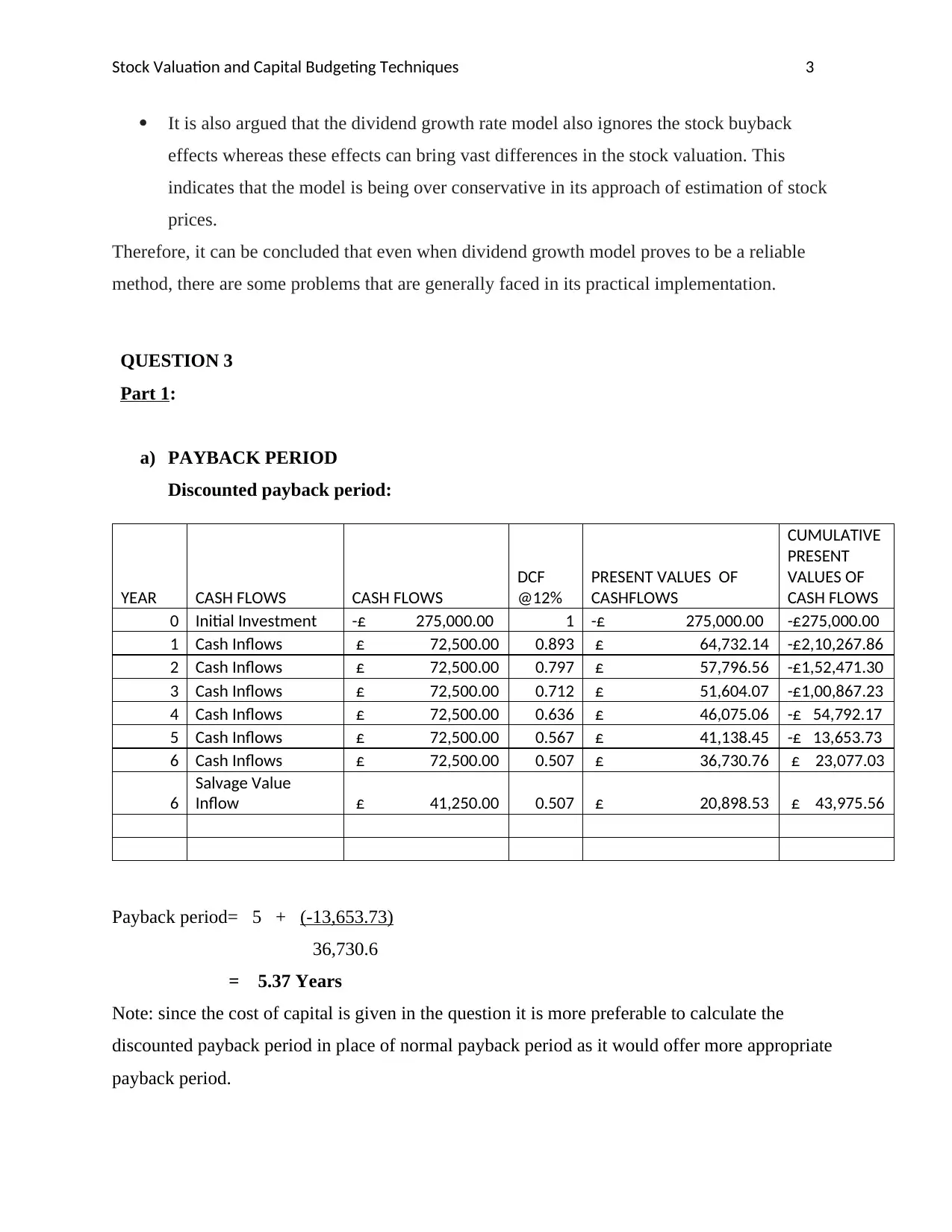

a) PAYBACK PERIOD

Discounted payback period:

YEAR CASH FLOWS CASH FLOWS

DCF

@12%

PRESENT VALUES OF

CASHFLOWS

CUMULATIVE

PRESENT

VALUES OF

CASH FLOWS

0 Initial Investment -£ 275,000.00 1 -£ 275,000.00 -£275,000.00

1 Cash Inflows £ 72,500.00 0.893 £ 64,732.14 -£2,10,267.86

2 Cash Inflows £ 72,500.00 0.797 £ 57,796.56 -£1,52,471.30

3 Cash Inflows £ 72,500.00 0.712 £ 51,604.07 -£1,00,867.23

4 Cash Inflows £ 72,500.00 0.636 £ 46,075.06 -£ 54,792.17

5 Cash Inflows £ 72,500.00 0.567 £ 41,138.45 -£ 13,653.73

6 Cash Inflows £ 72,500.00 0.507 £ 36,730.76 £ 23,077.03

6

Salvage Value

Inflow £ 41,250.00 0.507 £ 20,898.53 £ 43,975.56

Payback period= 5 + (-13,653.73)

36,730.6

= 5.37 Years

Note: since the cost of capital is given in the question it is more preferable to calculate the

discounted payback period in place of normal payback period as it would offer more appropriate

payback period.

It is also argued that the dividend growth rate model also ignores the stock buyback

effects whereas these effects can bring vast differences in the stock valuation. This

indicates that the model is being over conservative in its approach of estimation of stock

prices.

Therefore, it can be concluded that even when dividend growth model proves to be a reliable

method, there are some problems that are generally faced in its practical implementation.

QUESTION 3

Part 1:

a) PAYBACK PERIOD

Discounted payback period:

YEAR CASH FLOWS CASH FLOWS

DCF

@12%

PRESENT VALUES OF

CASHFLOWS

CUMULATIVE

PRESENT

VALUES OF

CASH FLOWS

0 Initial Investment -£ 275,000.00 1 -£ 275,000.00 -£275,000.00

1 Cash Inflows £ 72,500.00 0.893 £ 64,732.14 -£2,10,267.86

2 Cash Inflows £ 72,500.00 0.797 £ 57,796.56 -£1,52,471.30

3 Cash Inflows £ 72,500.00 0.712 £ 51,604.07 -£1,00,867.23

4 Cash Inflows £ 72,500.00 0.636 £ 46,075.06 -£ 54,792.17

5 Cash Inflows £ 72,500.00 0.567 £ 41,138.45 -£ 13,653.73

6 Cash Inflows £ 72,500.00 0.507 £ 36,730.76 £ 23,077.03

6

Salvage Value

Inflow £ 41,250.00 0.507 £ 20,898.53 £ 43,975.56

Payback period= 5 + (-13,653.73)

36,730.6

= 5.37 Years

Note: since the cost of capital is given in the question it is more preferable to calculate the

discounted payback period in place of normal payback period as it would offer more appropriate

payback period.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Stock Valuation and Capital Budgeting Techniques 4

Analysis: The payback period of 5.37 years is quite large and it indicates that the project will

take maximum time to cover its cost and only thereafter it will start to generate returns. So the

company must not consider the option of investing in the new machinery.

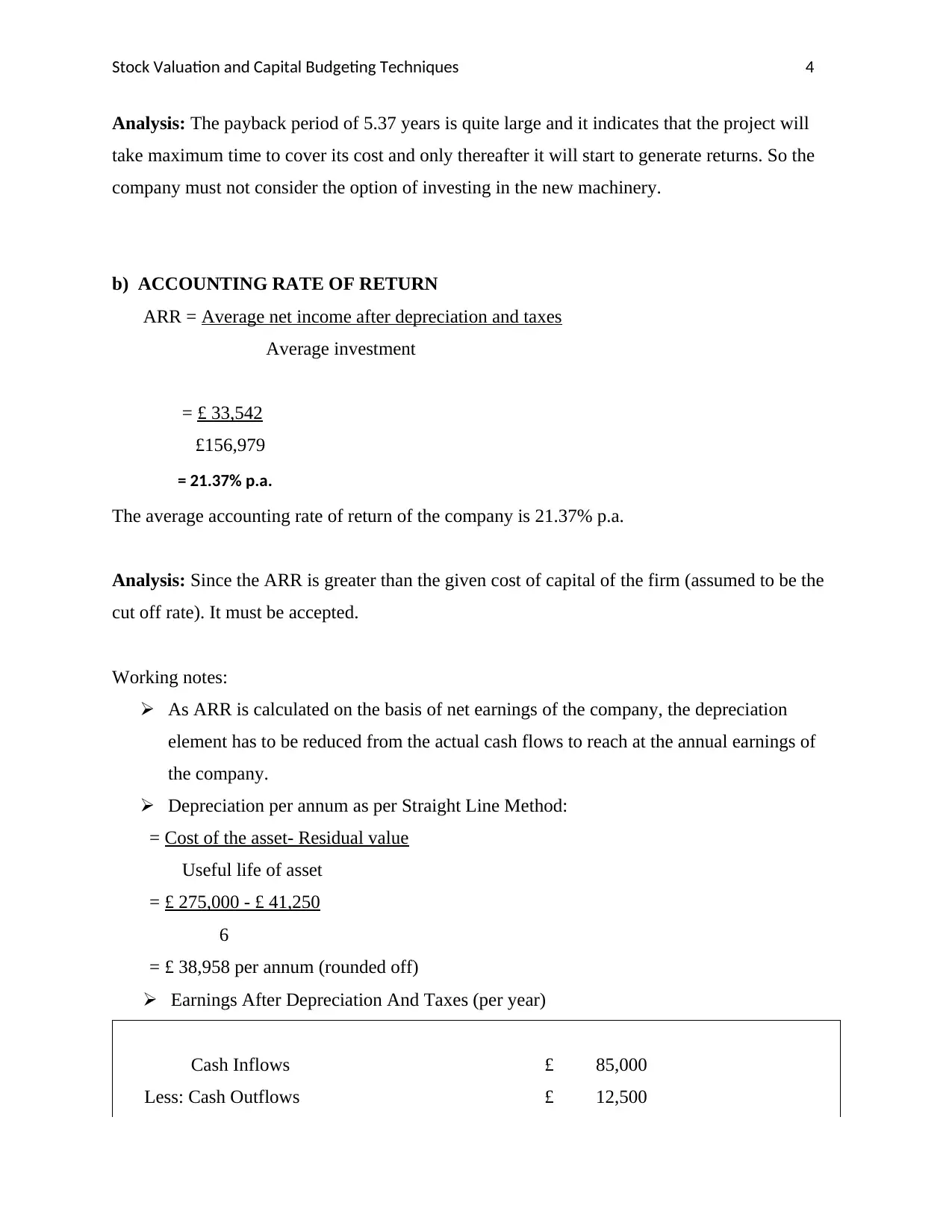

b) ACCOUNTING RATE OF RETURN

ARR = Average net income after depreciation and taxes

Average investment

= £ 33,542

£156,979

= 21.37% p.a.

The average accounting rate of return of the company is 21.37% p.a.

Analysis: Since the ARR is greater than the given cost of capital of the firm (assumed to be the

cut off rate). It must be accepted.

Working notes:

As ARR is calculated on the basis of net earnings of the company, the depreciation

element has to be reduced from the actual cash flows to reach at the annual earnings of

the company.

Depreciation per annum as per Straight Line Method:

= Cost of the asset- Residual value

Useful life of asset

= £ 275,000 - £ 41,250

6

= £ 38,958 per annum (rounded off)

Earnings After Depreciation And Taxes (per year)

Cash Inflows £ 85,000

Less: Cash Outflows £ 12,500

Analysis: The payback period of 5.37 years is quite large and it indicates that the project will

take maximum time to cover its cost and only thereafter it will start to generate returns. So the

company must not consider the option of investing in the new machinery.

b) ACCOUNTING RATE OF RETURN

ARR = Average net income after depreciation and taxes

Average investment

= £ 33,542

£156,979

= 21.37% p.a.

The average accounting rate of return of the company is 21.37% p.a.

Analysis: Since the ARR is greater than the given cost of capital of the firm (assumed to be the

cut off rate). It must be accepted.

Working notes:

As ARR is calculated on the basis of net earnings of the company, the depreciation

element has to be reduced from the actual cash flows to reach at the annual earnings of

the company.

Depreciation per annum as per Straight Line Method:

= Cost of the asset- Residual value

Useful life of asset

= £ 275,000 - £ 41,250

6

= £ 38,958 per annum (rounded off)

Earnings After Depreciation And Taxes (per year)

Cash Inflows £ 85,000

Less: Cash Outflows £ 12,500

Stock Valuation and Capital Budgeting Techniques 5

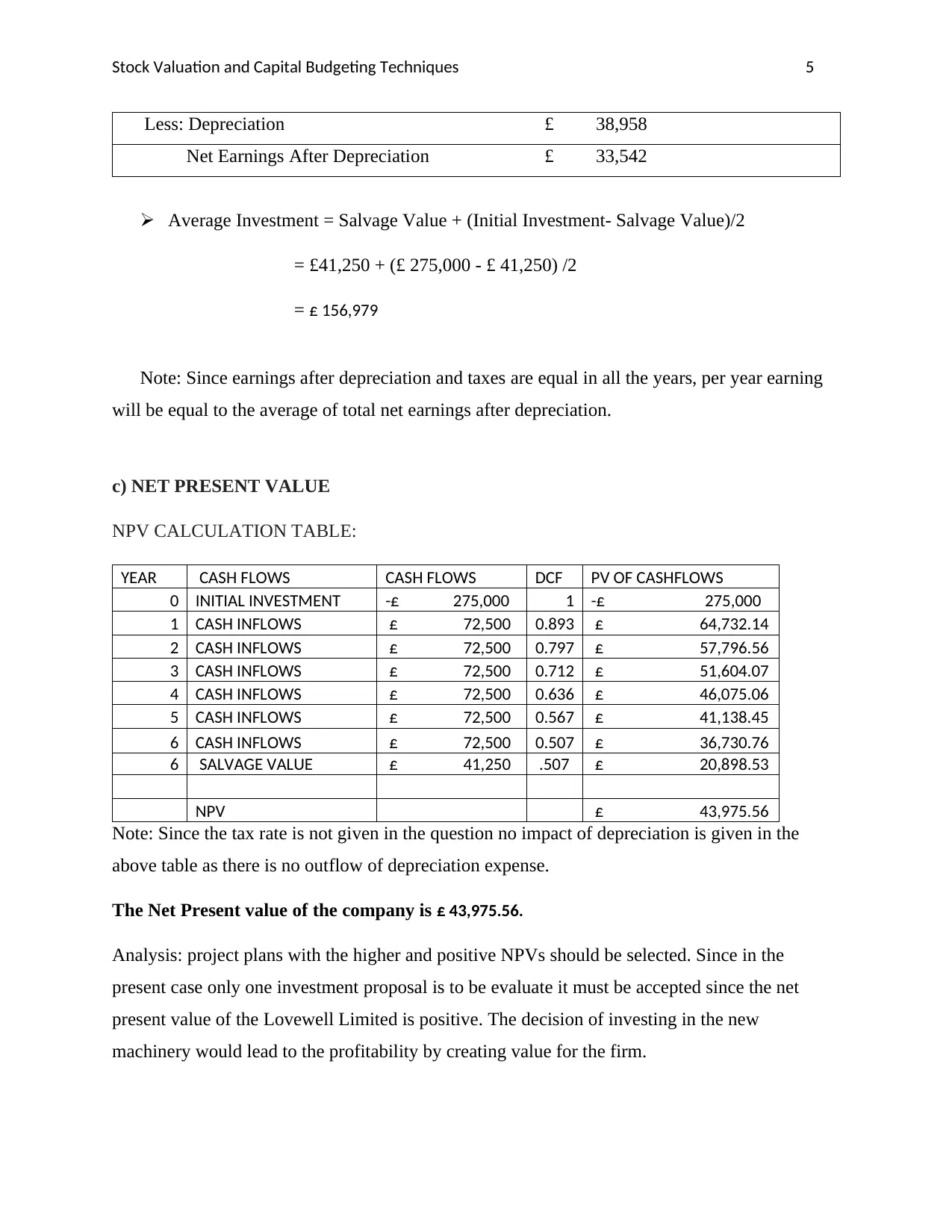

Less: Depreciation £ 38,958

Net Earnings After Depreciation £ 33,542

Average Investment = Salvage Value + (Initial Investment- Salvage Value)/2

= £41,250 + (£ 275,000 - £ 41,250) /2

= £ 156,979

Note: Since earnings after depreciation and taxes are equal in all the years, per year earning

will be equal to the average of total net earnings after depreciation.

c) NET PRESENT VALUE

NPV CALCULATION TABLE:

YEAR CASH FLOWS CASH FLOWS DCF PV OF CASHFLOWS

0 INITIAL INVESTMENT -£ 275,000 1 -£ 275,000

1 CASH INFLOWS £ 72,500 0.893 £ 64,732.14

2 CASH INFLOWS £ 72,500 0.797 £ 57,796.56

3 CASH INFLOWS £ 72,500 0.712 £ 51,604.07

4 CASH INFLOWS £ 72,500 0.636 £ 46,075.06

5 CASH INFLOWS £ 72,500 0.567 £ 41,138.45

6 CASH INFLOWS £ 72,500 0.507 £ 36,730.76

6 SALVAGE VALUE £ 41,250 .507 £ 20,898.53

NPV £ 43,975.56

Note: Since the tax rate is not given in the question no impact of depreciation is given in the

above table as there is no outflow of depreciation expense.

The Net Present value of the company is £ 43,975.56.

Analysis: project plans with the higher and positive NPVs should be selected. Since in the

present case only one investment proposal is to be evaluate it must be accepted since the net

present value of the Lovewell Limited is positive. The decision of investing in the new

machinery would lead to the profitability by creating value for the firm.

Less: Depreciation £ 38,958

Net Earnings After Depreciation £ 33,542

Average Investment = Salvage Value + (Initial Investment- Salvage Value)/2

= £41,250 + (£ 275,000 - £ 41,250) /2

= £ 156,979

Note: Since earnings after depreciation and taxes are equal in all the years, per year earning

will be equal to the average of total net earnings after depreciation.

c) NET PRESENT VALUE

NPV CALCULATION TABLE:

YEAR CASH FLOWS CASH FLOWS DCF PV OF CASHFLOWS

0 INITIAL INVESTMENT -£ 275,000 1 -£ 275,000

1 CASH INFLOWS £ 72,500 0.893 £ 64,732.14

2 CASH INFLOWS £ 72,500 0.797 £ 57,796.56

3 CASH INFLOWS £ 72,500 0.712 £ 51,604.07

4 CASH INFLOWS £ 72,500 0.636 £ 46,075.06

5 CASH INFLOWS £ 72,500 0.567 £ 41,138.45

6 CASH INFLOWS £ 72,500 0.507 £ 36,730.76

6 SALVAGE VALUE £ 41,250 .507 £ 20,898.53

NPV £ 43,975.56

Note: Since the tax rate is not given in the question no impact of depreciation is given in the

above table as there is no outflow of depreciation expense.

The Net Present value of the company is £ 43,975.56.

Analysis: project plans with the higher and positive NPVs should be selected. Since in the

present case only one investment proposal is to be evaluate it must be accepted since the net

present value of the Lovewell Limited is positive. The decision of investing in the new

machinery would lead to the profitability by creating value for the firm.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Stock Valuation and Capital Budgeting Techniques 6

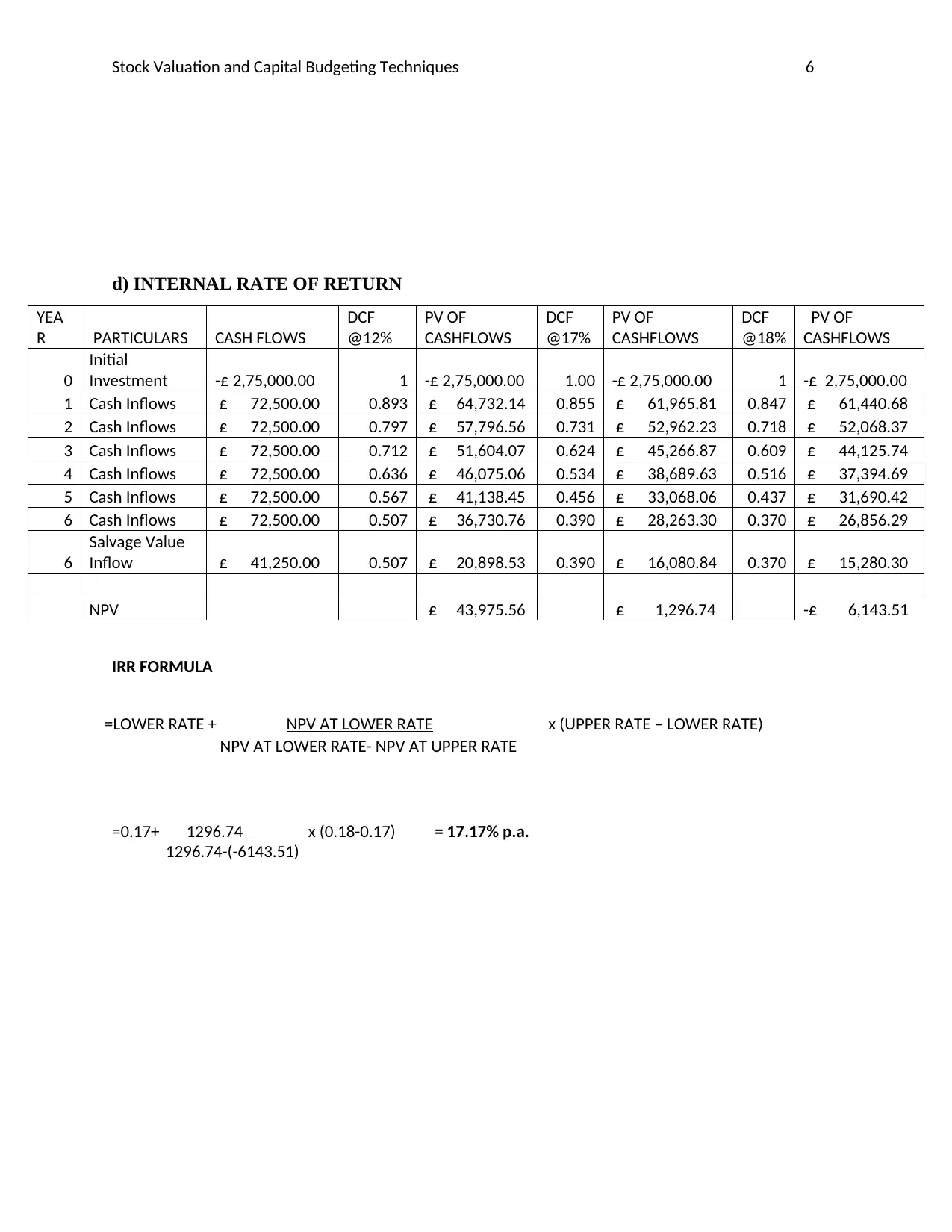

d) INTERNAL RATE OF RETURN

YEA

R PARTICULARS CASH FLOWS

DCF

@12%

PV OF

CASHFLOWS

DCF

@17%

PV OF

CASHFLOWS

DCF

@18%

PV OF

CASHFLOWS

0

Initial

Investment -£ 2,75,000.00 1 -£ 2,75,000.00 1.00 -£ 2,75,000.00 1 -£ 2,75,000.00

1 Cash Inflows £ 72,500.00 0.893 £ 64,732.14 0.855 £ 61,965.81 0.847 £ 61,440.68

2 Cash Inflows £ 72,500.00 0.797 £ 57,796.56 0.731 £ 52,962.23 0.718 £ 52,068.37

3 Cash Inflows £ 72,500.00 0.712 £ 51,604.07 0.624 £ 45,266.87 0.609 £ 44,125.74

4 Cash Inflows £ 72,500.00 0.636 £ 46,075.06 0.534 £ 38,689.63 0.516 £ 37,394.69

5 Cash Inflows £ 72,500.00 0.567 £ 41,138.45 0.456 £ 33,068.06 0.437 £ 31,690.42

6 Cash Inflows £ 72,500.00 0.507 £ 36,730.76 0.390 £ 28,263.30 0.370 £ 26,856.29

6

Salvage Value

Inflow £ 41,250.00 0.507 £ 20,898.53 0.390 £ 16,080.84 0.370 £ 15,280.30

NPV £ 43,975.56 £ 1,296.74 -£ 6,143.51

IRR FORMULA

=0.17+ 1296.74 x (0.18-0.17) = 17.17% p.a.

1296.74-(-6143.51)

=LOWER RATE + NPV AT LOWER RATE x (UPPER RATE – LOWER RATE)

NPV AT LOWER RATE- NPV AT UPPER RATE

d) INTERNAL RATE OF RETURN

YEA

R PARTICULARS CASH FLOWS

DCF

@12%

PV OF

CASHFLOWS

DCF

@17%

PV OF

CASHFLOWS

DCF

@18%

PV OF

CASHFLOWS

0

Initial

Investment -£ 2,75,000.00 1 -£ 2,75,000.00 1.00 -£ 2,75,000.00 1 -£ 2,75,000.00

1 Cash Inflows £ 72,500.00 0.893 £ 64,732.14 0.855 £ 61,965.81 0.847 £ 61,440.68

2 Cash Inflows £ 72,500.00 0.797 £ 57,796.56 0.731 £ 52,962.23 0.718 £ 52,068.37

3 Cash Inflows £ 72,500.00 0.712 £ 51,604.07 0.624 £ 45,266.87 0.609 £ 44,125.74

4 Cash Inflows £ 72,500.00 0.636 £ 46,075.06 0.534 £ 38,689.63 0.516 £ 37,394.69

5 Cash Inflows £ 72,500.00 0.567 £ 41,138.45 0.456 £ 33,068.06 0.437 £ 31,690.42

6 Cash Inflows £ 72,500.00 0.507 £ 36,730.76 0.390 £ 28,263.30 0.370 £ 26,856.29

6

Salvage Value

Inflow £ 41,250.00 0.507 £ 20,898.53 0.390 £ 16,080.84 0.370 £ 15,280.30

NPV £ 43,975.56 £ 1,296.74 -£ 6,143.51

IRR FORMULA

=0.17+ 1296.74 x (0.18-0.17) = 17.17% p.a.

1296.74-(-6143.51)

=LOWER RATE + NPV AT LOWER RATE x (UPPER RATE – LOWER RATE)

NPV AT LOWER RATE- NPV AT UPPER RATE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Stock Valuation and Capital Budgeting Techniques 7

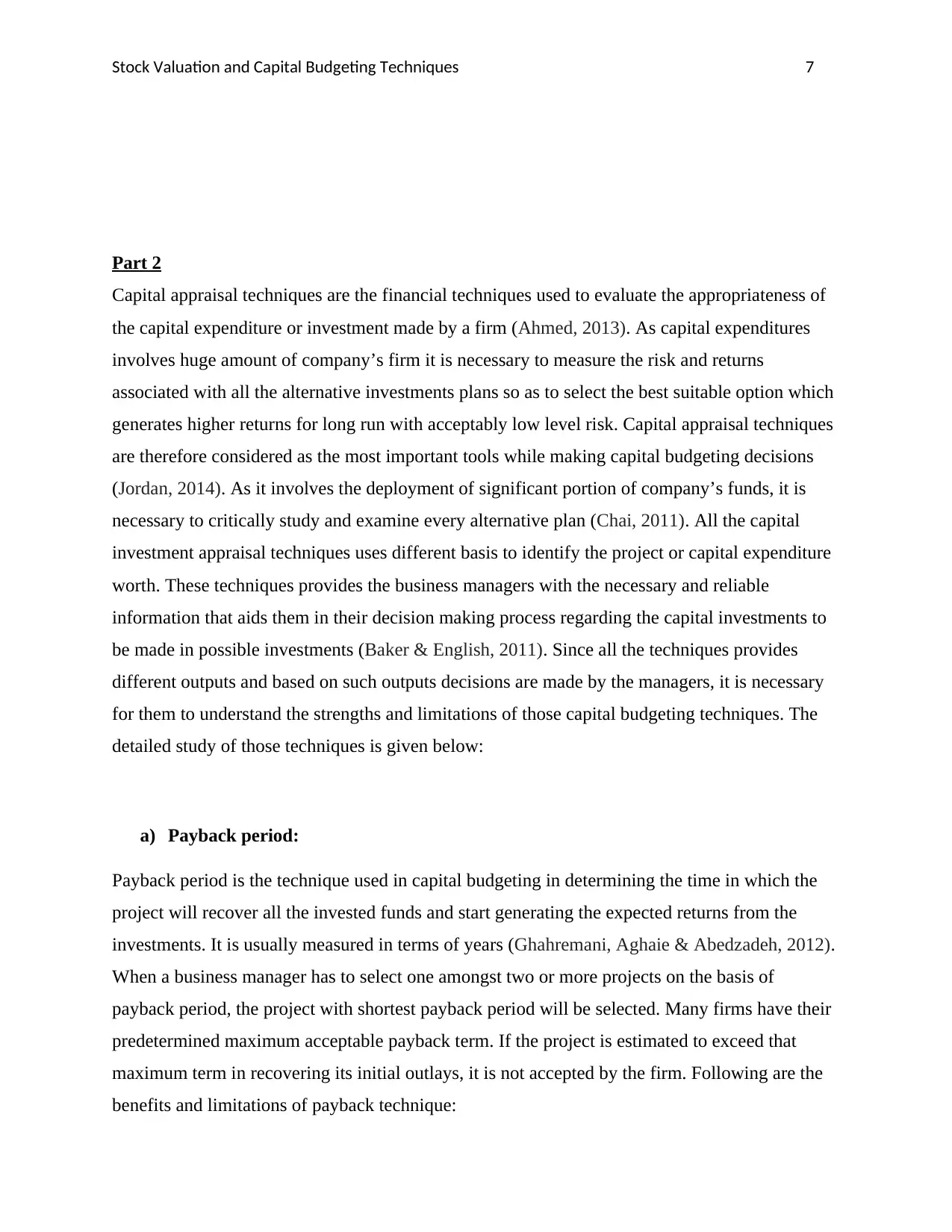

Part 2

Capital appraisal techniques are the financial techniques used to evaluate the appropriateness of

the capital expenditure or investment made by a firm (Ahmed, 2013). As capital expenditures

involves huge amount of company’s firm it is necessary to measure the risk and returns

associated with all the alternative investments plans so as to select the best suitable option which

generates higher returns for long run with acceptably low level risk. Capital appraisal techniques

are therefore considered as the most important tools while making capital budgeting decisions

(Jordan, 2014). As it involves the deployment of significant portion of company’s funds, it is

necessary to critically study and examine every alternative plan (Chai, 2011). All the capital

investment appraisal techniques uses different basis to identify the project or capital expenditure

worth. These techniques provides the business managers with the necessary and reliable

information that aids them in their decision making process regarding the capital investments to

be made in possible investments (Baker & English, 2011). Since all the techniques provides

different outputs and based on such outputs decisions are made by the managers, it is necessary

for them to understand the strengths and limitations of those capital budgeting techniques. The

detailed study of those techniques is given below:

a) Payback period:

Payback period is the technique used in capital budgeting in determining the time in which the

project will recover all the invested funds and start generating the expected returns from the

investments. It is usually measured in terms of years (Ghahremani, Aghaie & Abedzadeh, 2012).

When a business manager has to select one amongst two or more projects on the basis of

payback period, the project with shortest payback period will be selected. Many firms have their

predetermined maximum acceptable payback term. If the project is estimated to exceed that

maximum term in recovering its initial outlays, it is not accepted by the firm. Following are the

benefits and limitations of payback technique:

Part 2

Capital appraisal techniques are the financial techniques used to evaluate the appropriateness of

the capital expenditure or investment made by a firm (Ahmed, 2013). As capital expenditures

involves huge amount of company’s firm it is necessary to measure the risk and returns

associated with all the alternative investments plans so as to select the best suitable option which

generates higher returns for long run with acceptably low level risk. Capital appraisal techniques

are therefore considered as the most important tools while making capital budgeting decisions

(Jordan, 2014). As it involves the deployment of significant portion of company’s funds, it is

necessary to critically study and examine every alternative plan (Chai, 2011). All the capital

investment appraisal techniques uses different basis to identify the project or capital expenditure

worth. These techniques provides the business managers with the necessary and reliable

information that aids them in their decision making process regarding the capital investments to

be made in possible investments (Baker & English, 2011). Since all the techniques provides

different outputs and based on such outputs decisions are made by the managers, it is necessary

for them to understand the strengths and limitations of those capital budgeting techniques. The

detailed study of those techniques is given below:

a) Payback period:

Payback period is the technique used in capital budgeting in determining the time in which the

project will recover all the invested funds and start generating the expected returns from the

investments. It is usually measured in terms of years (Ghahremani, Aghaie & Abedzadeh, 2012).

When a business manager has to select one amongst two or more projects on the basis of

payback period, the project with shortest payback period will be selected. Many firms have their

predetermined maximum acceptable payback term. If the project is estimated to exceed that

maximum term in recovering its initial outlays, it is not accepted by the firm. Following are the

benefits and limitations of payback technique:

Stock Valuation and Capital Budgeting Techniques 8

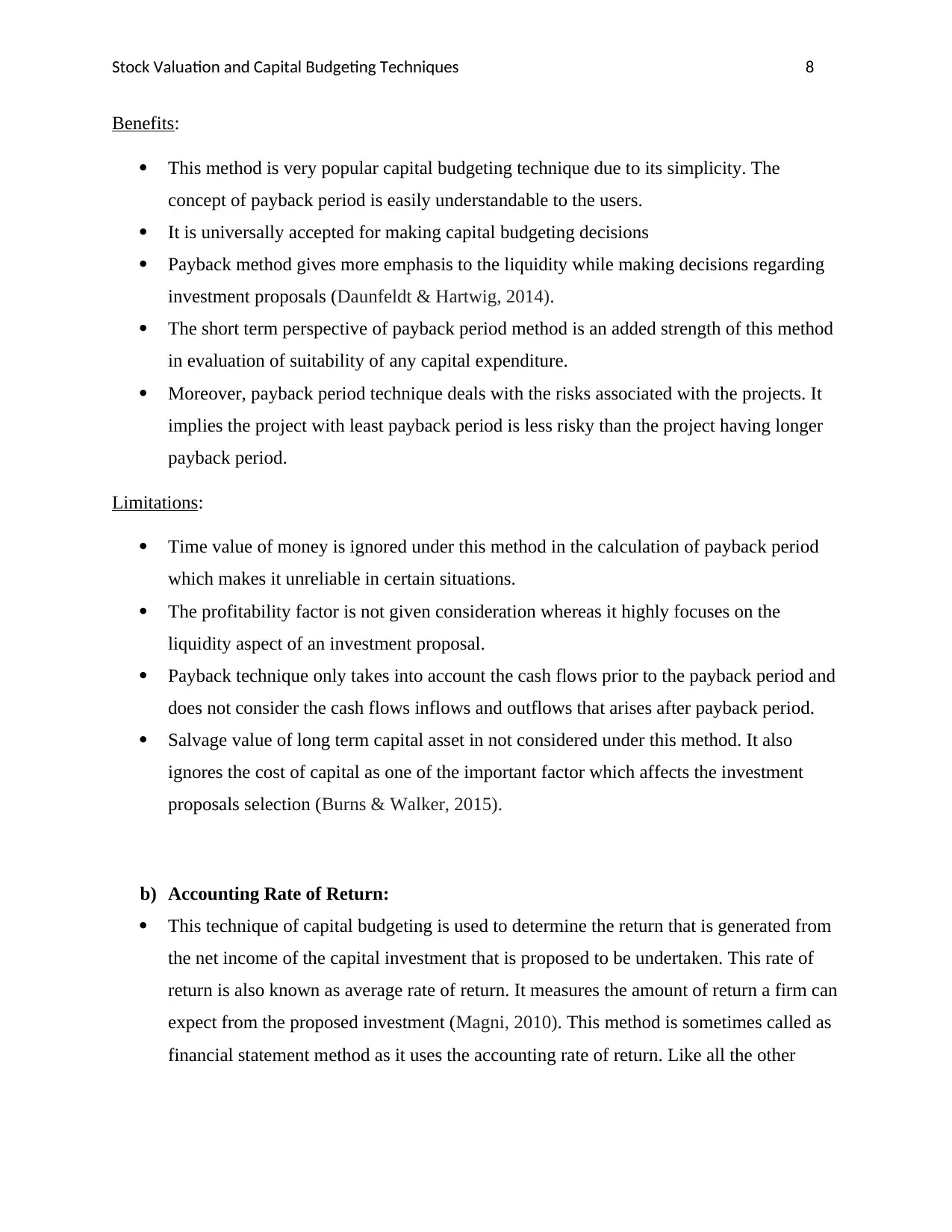

Benefits:

This method is very popular capital budgeting technique due to its simplicity. The

concept of payback period is easily understandable to the users.

It is universally accepted for making capital budgeting decisions

Payback method gives more emphasis to the liquidity while making decisions regarding

investment proposals (Daunfeldt & Hartwig, 2014).

The short term perspective of payback period method is an added strength of this method

in evaluation of suitability of any capital expenditure.

Moreover, payback period technique deals with the risks associated with the projects. It

implies the project with least payback period is less risky than the project having longer

payback period.

Limitations:

Time value of money is ignored under this method in the calculation of payback period

which makes it unreliable in certain situations.

The profitability factor is not given consideration whereas it highly focuses on the

liquidity aspect of an investment proposal.

Payback technique only takes into account the cash flows prior to the payback period and

does not consider the cash flows inflows and outflows that arises after payback period.

Salvage value of long term capital asset in not considered under this method. It also

ignores the cost of capital as one of the important factor which affects the investment

proposals selection (Burns & Walker, 2015).

b) Accounting Rate of Return:

This technique of capital budgeting is used to determine the return that is generated from

the net income of the capital investment that is proposed to be undertaken. This rate of

return is also known as average rate of return. It measures the amount of return a firm can

expect from the proposed investment (Magni, 2010). This method is sometimes called as

financial statement method as it uses the accounting rate of return. Like all the other

Benefits:

This method is very popular capital budgeting technique due to its simplicity. The

concept of payback period is easily understandable to the users.

It is universally accepted for making capital budgeting decisions

Payback method gives more emphasis to the liquidity while making decisions regarding

investment proposals (Daunfeldt & Hartwig, 2014).

The short term perspective of payback period method is an added strength of this method

in evaluation of suitability of any capital expenditure.

Moreover, payback period technique deals with the risks associated with the projects. It

implies the project with least payback period is less risky than the project having longer

payback period.

Limitations:

Time value of money is ignored under this method in the calculation of payback period

which makes it unreliable in certain situations.

The profitability factor is not given consideration whereas it highly focuses on the

liquidity aspect of an investment proposal.

Payback technique only takes into account the cash flows prior to the payback period and

does not consider the cash flows inflows and outflows that arises after payback period.

Salvage value of long term capital asset in not considered under this method. It also

ignores the cost of capital as one of the important factor which affects the investment

proposals selection (Burns & Walker, 2015).

b) Accounting Rate of Return:

This technique of capital budgeting is used to determine the return that is generated from

the net income of the capital investment that is proposed to be undertaken. This rate of

return is also known as average rate of return. It measures the amount of return a firm can

expect from the proposed investment (Magni, 2010). This method is sometimes called as

financial statement method as it uses the accounting rate of return. Like all the other

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Stock Valuation and Capital Budgeting Techniques 9

capital investment appraisal techniques accounting rate of return method also has its own

strengths and limitations which are described as below:

Benefits:

This technique considers the earnings from the project investment over its entire life.

ARR method is also easily understandable and also it is quite simplified to be followed

by the project managers (DeFusco et al., N.D.).

As accounting rate of return is based on the accounting information, this method does not

require the use of special reports to determine ARR.

As this technique is highly focused on the accounting profit, it helps the business

managers to measure the project profitability.

Limitations:

This method also proves to be unreasonable in certain situations due to the ignorance of

time value of money under it.

As ARR method uses the earnings to determine the rate of return, it does not take into

consideration the cash flows of any particular project.

It is also criticized because it does not consider the project’s terminal value.

Also, this technique cannot be used in the situations where a portion of capital investment

is to be made after the commencement of project.

It also ignores the shrinkage of the original investment as it charges depreciation against

the project’s earnings (Maroyi & Poll, 2012).

c) Net present value

Net present value is the method used in identifying the appropriateness of the investment

decision. It takes into account all the possible cash outflows and inflows to determine the net

amount of cash flows of the company (Arshad, 2012). Once the possible cash flows are

estimated, the present values of those cash flows is calculated using the discounting rate

(Hanafizadeh & Latif, 2011). All the present values of net cash flows are then aggregated to

measure the net present value of any project. Following are the benefits and limitations of Net

Present Value Method:

Benefits:

capital investment appraisal techniques accounting rate of return method also has its own

strengths and limitations which are described as below:

Benefits:

This technique considers the earnings from the project investment over its entire life.

ARR method is also easily understandable and also it is quite simplified to be followed

by the project managers (DeFusco et al., N.D.).

As accounting rate of return is based on the accounting information, this method does not

require the use of special reports to determine ARR.

As this technique is highly focused on the accounting profit, it helps the business

managers to measure the project profitability.

Limitations:

This method also proves to be unreasonable in certain situations due to the ignorance of

time value of money under it.

As ARR method uses the earnings to determine the rate of return, it does not take into

consideration the cash flows of any particular project.

It is also criticized because it does not consider the project’s terminal value.

Also, this technique cannot be used in the situations where a portion of capital investment

is to be made after the commencement of project.

It also ignores the shrinkage of the original investment as it charges depreciation against

the project’s earnings (Maroyi & Poll, 2012).

c) Net present value

Net present value is the method used in identifying the appropriateness of the investment

decision. It takes into account all the possible cash outflows and inflows to determine the net

amount of cash flows of the company (Arshad, 2012). Once the possible cash flows are

estimated, the present values of those cash flows is calculated using the discounting rate

(Hanafizadeh & Latif, 2011). All the present values of net cash flows are then aggregated to

measure the net present value of any project. Following are the benefits and limitations of Net

Present Value Method:

Benefits:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Stock Valuation and Capital Budgeting Techniques 10

The most obvious benefit of net present value method is that it gives effect to the basic

concept of time value of money i.e. the value of a dollar in future will be less than it’s

worth today (Schutt et al., 2012).

This method helps the investors to identify whether the investment in a particular plan

will create will value or not, for the firm along with the quantum of such value creation.

Therefore it helps the managers in maximizing the value of a firm over a period of time

(Holopainen et al., 2010).

Another strength of net present value method is that it duly considers the project’s cost of

capital and also the inherent risk associated with the making of future projections

(Pasqual, Padilla & Jadotte, 2013).

This technique gives highest preference to the consideration of profitability and risk

factor of any investment plan in making the project selection.

Limitations:

The practical implementation of net present value method is difficult as it involves

calculation of appropriate cost of capital of investment to ascertain the present values of

the cash inflows and outflows of a firm (Shinoda, 2010).

It does not provide the accurate decision in the cases of unequal amounts invested in the

mutually exclusive projects.

Even when the projects have different project life, this method proves to be inefficient in

providing the correct decision making information to the business managers for the

selection of one best suited project plan (Galperin, Fishman & Gibiansky, 2012).

d) Internal rate of return:

This technique is commonly used while making the decisions regarding capital

investments. It determines the profitability of the proposed investment. IRR is the rate

that equates the present values of cash inflows with that of cash outflows (Bierman &

Smidt, 2012). This is therefore the rate at which the net present value of the particular

project is zero. This technique also carries some benefits and limitations which are

mentioned below:

Benefits:

The most obvious benefit of net present value method is that it gives effect to the basic

concept of time value of money i.e. the value of a dollar in future will be less than it’s

worth today (Schutt et al., 2012).

This method helps the investors to identify whether the investment in a particular plan

will create will value or not, for the firm along with the quantum of such value creation.

Therefore it helps the managers in maximizing the value of a firm over a period of time

(Holopainen et al., 2010).

Another strength of net present value method is that it duly considers the project’s cost of

capital and also the inherent risk associated with the making of future projections

(Pasqual, Padilla & Jadotte, 2013).

This technique gives highest preference to the consideration of profitability and risk

factor of any investment plan in making the project selection.

Limitations:

The practical implementation of net present value method is difficult as it involves

calculation of appropriate cost of capital of investment to ascertain the present values of

the cash inflows and outflows of a firm (Shinoda, 2010).

It does not provide the accurate decision in the cases of unequal amounts invested in the

mutually exclusive projects.

Even when the projects have different project life, this method proves to be inefficient in

providing the correct decision making information to the business managers for the

selection of one best suited project plan (Galperin, Fishman & Gibiansky, 2012).

d) Internal rate of return:

This technique is commonly used while making the decisions regarding capital

investments. It determines the profitability of the proposed investment. IRR is the rate

that equates the present values of cash inflows with that of cash outflows (Bierman &

Smidt, 2012). This is therefore the rate at which the net present value of the particular

project is zero. This technique also carries some benefits and limitations which are

mentioned below:

Benefits:

Stock Valuation and Capital Budgeting Techniques 11

This technique considers the time value of money and hence it can be relied upon under

various situations.

It also considers the profitability of the investment proposal over its economic life.

This technique helps the business managers to meet the objective of maximizing their

welfare.

IRR technique provides the sophisticated and reliable method to evaluate the capital

investment proposals (Wiesemann, Kuhn & Rustem, 2010).

This method is considered as most effective method as it offers uniform ranking. Along

with the ranking IRR also provides for quick comparisons of the relative efficiency of the

potential projects.

Limitations:

The discounting of the cash flows using the cost of capital and other rates is quite

difficult to be undertaken as it involves complex calculations.

The internal rate of return can be negative or sometimes one or multiple rates are also

offered under this method when the project has a series of changes in the signs of cash

flows. This feature makes it difficult to interpret the results.

IRR method relies on the assumption that the project incomes are compounded

(reinvested) over the entire economic life of the project at the rate of return earned on the

investments. However, this assumption does not hold true in every situation. Rather, the

appropriateness of this assumption can only be illustrated in the situation when IRR is

close enough to the average rate of return generated on the total investments. In the cases

where IRR departs from the company’s typical rate of earnings, the results delivered by

the IRR technique would be misleading (Bennouna, Meredith & Marchant, 2010).

Apart from the above discussed capital appraisal techniques there are various other techniques

also that are commonly used in capital budgeting desion making. Those techniques are

profitability index method, modified internal rate of return, adjusted present value, equivalent

annuity discounted pay-back period method etc. But, from the above analysis it can be concluded

that each of the capital appraisal techniques has its own pros and cons. Though, the capital

budgeting techniques are useful enough in the decision making regarding the capital investments

to be made by the company to achieve higher returns, each of them suffers from some or the

This technique considers the time value of money and hence it can be relied upon under

various situations.

It also considers the profitability of the investment proposal over its economic life.

This technique helps the business managers to meet the objective of maximizing their

welfare.

IRR technique provides the sophisticated and reliable method to evaluate the capital

investment proposals (Wiesemann, Kuhn & Rustem, 2010).

This method is considered as most effective method as it offers uniform ranking. Along

with the ranking IRR also provides for quick comparisons of the relative efficiency of the

potential projects.

Limitations:

The discounting of the cash flows using the cost of capital and other rates is quite

difficult to be undertaken as it involves complex calculations.

The internal rate of return can be negative or sometimes one or multiple rates are also

offered under this method when the project has a series of changes in the signs of cash

flows. This feature makes it difficult to interpret the results.

IRR method relies on the assumption that the project incomes are compounded

(reinvested) over the entire economic life of the project at the rate of return earned on the

investments. However, this assumption does not hold true in every situation. Rather, the

appropriateness of this assumption can only be illustrated in the situation when IRR is

close enough to the average rate of return generated on the total investments. In the cases

where IRR departs from the company’s typical rate of earnings, the results delivered by

the IRR technique would be misleading (Bennouna, Meredith & Marchant, 2010).

Apart from the above discussed capital appraisal techniques there are various other techniques

also that are commonly used in capital budgeting desion making. Those techniques are

profitability index method, modified internal rate of return, adjusted present value, equivalent

annuity discounted pay-back period method etc. But, from the above analysis it can be concluded

that each of the capital appraisal techniques has its own pros and cons. Though, the capital

budgeting techniques are useful enough in the decision making regarding the capital investments

to be made by the company to achieve higher returns, each of them suffers from some or the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.