Financial Analysis: Stock Valuation of JB Hi-Fi & Harvey Norman Ltd

VerifiedAdded on 2023/06/03

|5

|673

|304

Report

AI Summary

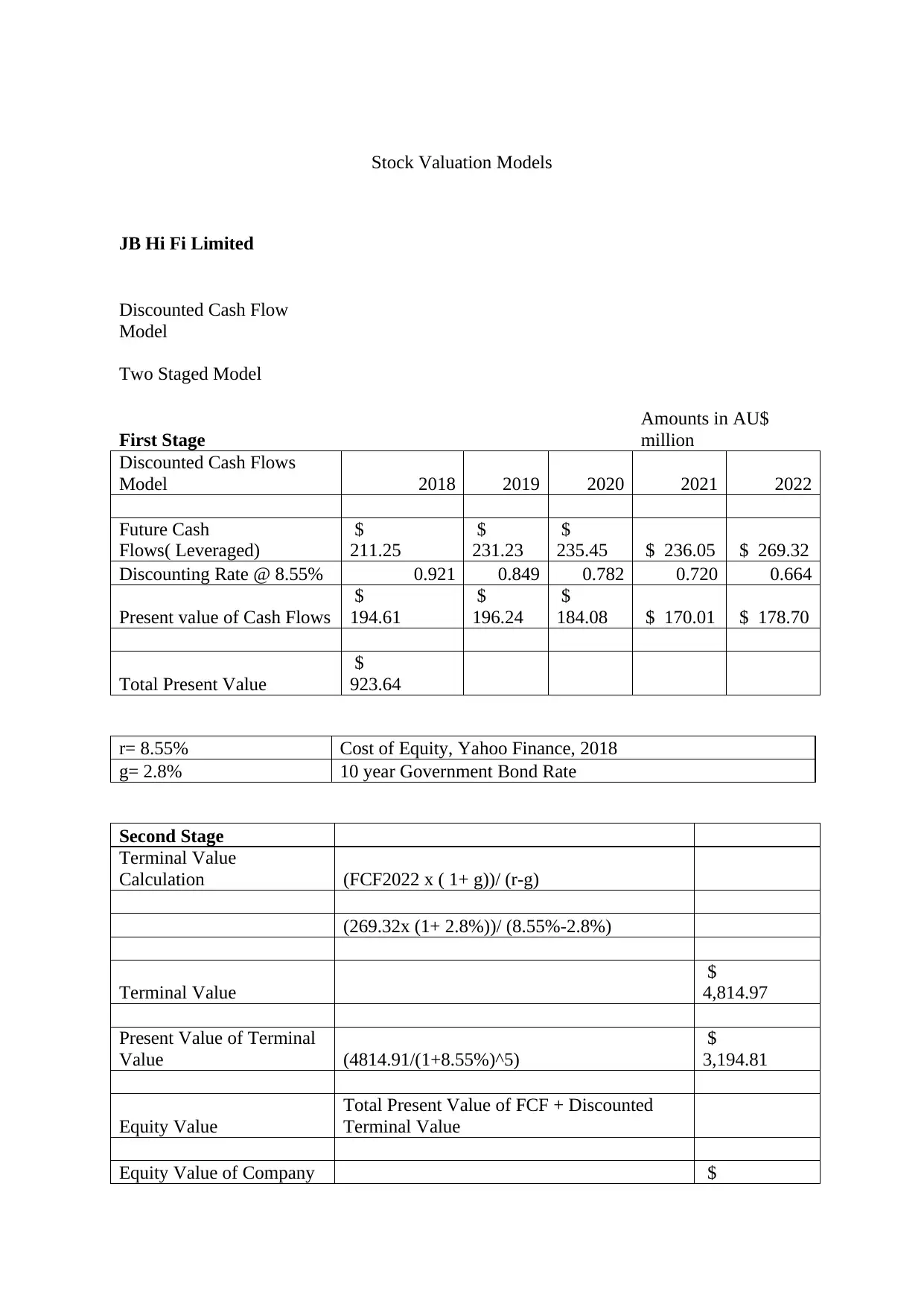

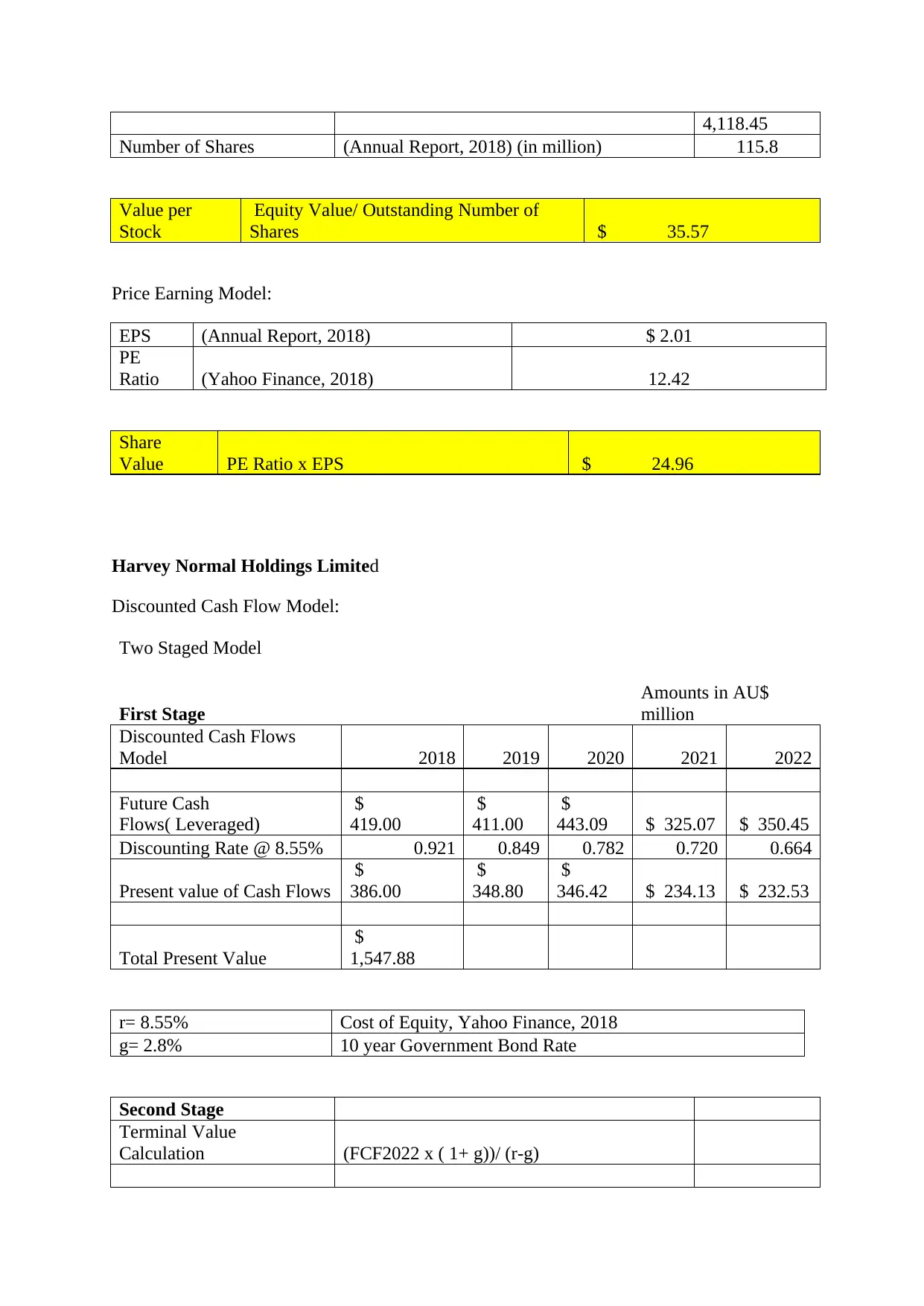

This report presents a stock valuation analysis of JB Hi-Fi Limited and Harvey Norman Holdings Limited using the Discounted Cash Flow (DCF) model. A two-staged DCF model is employed, incorporating future cash flows and a terminal value calculation to determine the equity value of each company. For JB Hi-Fi, the analysis projects future cash flows for 2018-2022, discounts them at a rate of 8.55%, and calculates a terminal value, resulting in an equity value per stock of $35.57, also using a price earning model the share value is $24.96. Similarly, for Harvey Norman, future cash flows are projected and discounted, leading to an equity value per stock of $5.12 and share value using price earning model is $3.40. The report references annual reports and financial data from sources like Yahoo Finance and Simplywall.st to support the valuation process.

1 out of 5

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)