Strategic Analysis of ASDA

VerifiedAdded on 2024/04/09

|16

|4080

|424

AI Summary

This strategic analysis delves into the detailed examination of ASDA, a prominent retail company in the UK. The analysis covers various aspects including PESTEL analysis, SWOT analysis, Porter's Generic Analysis, competitive strategies, and recommendations for the company's future growth and sustainability.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Strategic Analysis

Of

ASDA

Of

ASDA

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

Introduction:.......................................................................................................................................... 1

PESTEL Analysis of Asda:....................................................................................................................1

Political factors..................................................................................................................................1

Economic factors...............................................................................................................................2

Social factors.....................................................................................................................................3

Technological factors.........................................................................................................................3

Environmental factors:......................................................................................................................4

Legal factors:.....................................................................................................................................4

SWOT Analysis of Asda:.......................................................................................................................6

Strength:............................................................................................................................................ 6

Weaknesses........................................................................................................................................ 6

Opportunities..................................................................................................................................... 6

Threats............................................................................................................................................... 7

Porter’s Generic Analysis of Asda:........................................................................................................8

Competitive Strategy for Asda:..........................................................................................................8

Porter’s Five Forces Analysis:...............................................................................................................9

Bargaining power of buyers:..............................................................................................................9

Bargaining power of suppliers:..........................................................................................................9

Industry Rivalry:................................................................................................................................9

Threat of New Entrant:....................................................................................................................10

Threat of Substitute Products:..........................................................................................................10

Recommendation:................................................................................................................................ 11

Conclusion:.......................................................................................................................................... 12

References........................................................................................................................................... 13

Figure 1: The UK Retail industry outlook for quarter 2 in 2016............................................................2

Figure 2: Retailer investment plan in 2014............................................................................................4

Figure 3: Estimated amount of legal spending by retailers....................................................................5

Figure 4: UK retail industry market share............................................................................................10

Figure 5: Product-wise cheapest supermarkets....................................................................................11

Introduction:.......................................................................................................................................... 1

PESTEL Analysis of Asda:....................................................................................................................1

Political factors..................................................................................................................................1

Economic factors...............................................................................................................................2

Social factors.....................................................................................................................................3

Technological factors.........................................................................................................................3

Environmental factors:......................................................................................................................4

Legal factors:.....................................................................................................................................4

SWOT Analysis of Asda:.......................................................................................................................6

Strength:............................................................................................................................................ 6

Weaknesses........................................................................................................................................ 6

Opportunities..................................................................................................................................... 6

Threats............................................................................................................................................... 7

Porter’s Generic Analysis of Asda:........................................................................................................8

Competitive Strategy for Asda:..........................................................................................................8

Porter’s Five Forces Analysis:...............................................................................................................9

Bargaining power of buyers:..............................................................................................................9

Bargaining power of suppliers:..........................................................................................................9

Industry Rivalry:................................................................................................................................9

Threat of New Entrant:....................................................................................................................10

Threat of Substitute Products:..........................................................................................................10

Recommendation:................................................................................................................................ 11

Conclusion:.......................................................................................................................................... 12

References........................................................................................................................................... 13

Figure 1: The UK Retail industry outlook for quarter 2 in 2016............................................................2

Figure 2: Retailer investment plan in 2014............................................................................................4

Figure 3: Estimated amount of legal spending by retailers....................................................................5

Figure 4: UK retail industry market share............................................................................................10

Figure 5: Product-wise cheapest supermarkets....................................................................................11

Introduction:

ASDA was built by a group of farmers of Yorkshire in 1965 and sold only grocery products. However

in 1999, after coming along a long path, ASDA was taken over by Wal-Mart. After this takeover,

ASDA entered into other retail sectors like- electronic products, insurances, home appliances etc

(Saunders, 2011). At present ASDA is the third largest retailing company in The UK and sells more

than 35000 products to its customers. Apart from selling core retailing products, Asda provides

financial and telecommunication services as well. Even after being a subsidiary of Wal-Mart Asda has

retained its British structure and management group since the takeover.

PESTEL Analysis of Asda:

Political factors

The political environment in the UK is much stable and has ensured the sustainability of the retailers.

The retail industry employs over more than 10% of the UK workforce, amounts for more than 5%

value generated each year and contributes almost 17.5 billion pound taxes ("UK Retail Industry:

International Action Plan by GOV.UK", 2016). The recent policies about increased taxes, especially

on alcohol, is about to bring some changes in the industry. To keep the fierce competition in control

the government have many regulations which prevent harming the industry or consumers.

Economic factors

ASDA was built by a group of farmers of Yorkshire in 1965 and sold only grocery products. However

in 1999, after coming along a long path, ASDA was taken over by Wal-Mart. After this takeover,

ASDA entered into other retail sectors like- electronic products, insurances, home appliances etc

(Saunders, 2011). At present ASDA is the third largest retailing company in The UK and sells more

than 35000 products to its customers. Apart from selling core retailing products, Asda provides

financial and telecommunication services as well. Even after being a subsidiary of Wal-Mart Asda has

retained its British structure and management group since the takeover.

PESTEL Analysis of Asda:

Political factors

The political environment in the UK is much stable and has ensured the sustainability of the retailers.

The retail industry employs over more than 10% of the UK workforce, amounts for more than 5%

value generated each year and contributes almost 17.5 billion pound taxes ("UK Retail Industry:

International Action Plan by GOV.UK", 2016). The recent policies about increased taxes, especially

on alcohol, is about to bring some changes in the industry. To keep the fierce competition in control

the government have many regulations which prevent harming the industry or consumers.

Economic factors

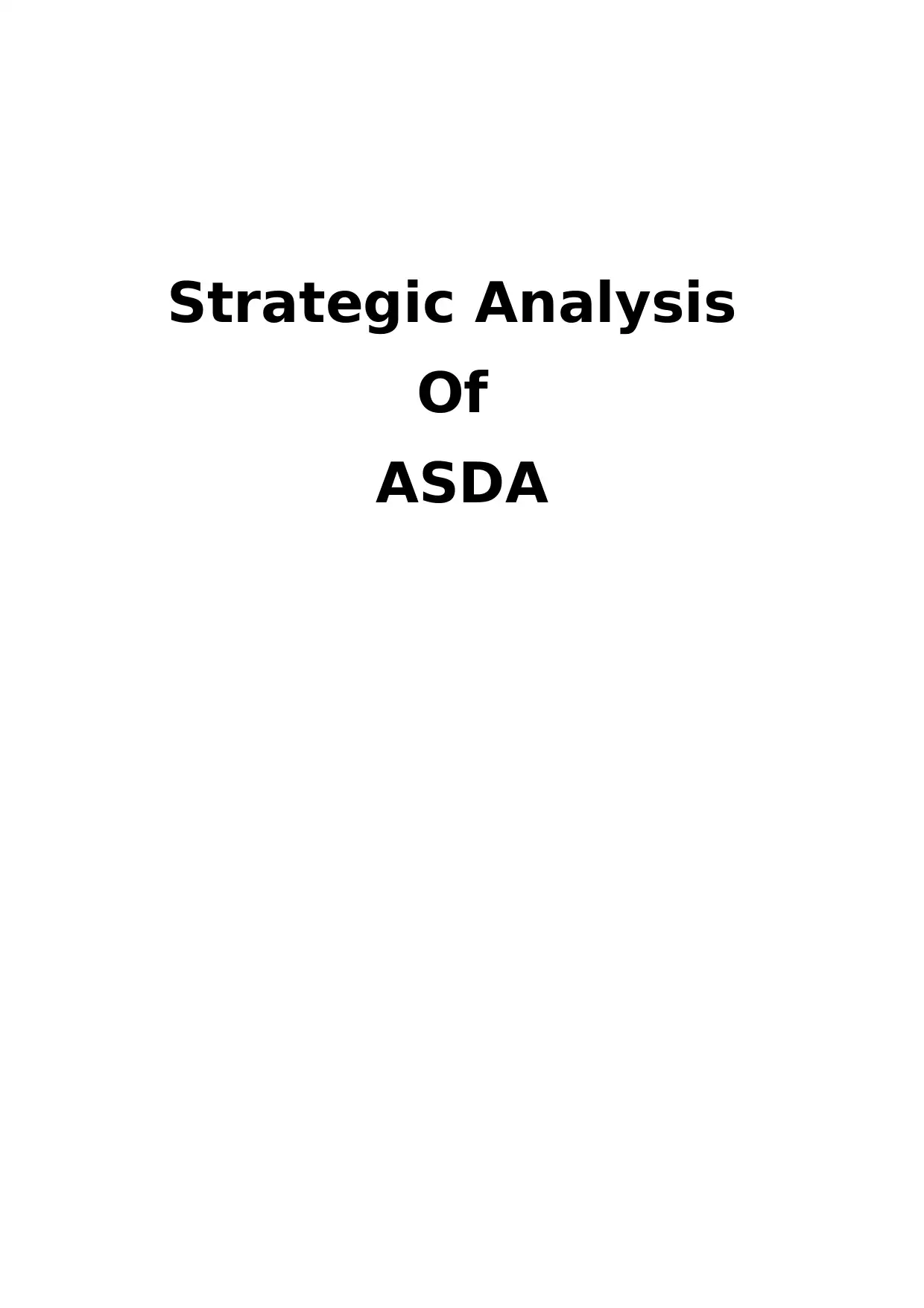

The volatility of the political conditions global economy has faced some deep changes in the early 20th

century. Economic growth was high in the 2000s and then sharply declined after 9/11 in America

(Colin Grahame Bamford, 2002). But this volatility has hardly touched UK economy as it remained

comparatively stable. UK turned into an lucrative market to investors for many reasons – lower tax in

EU, infrastructure development, low labour cost etc.

After the Brexit and because of UK leaving the EU things are about to change a little. The short-term

outlook for The UK and the global economy both have weakened (Retail Economics, 2016). The

consumer spending hasn’t decreased yet after Brexit (the Guardian) but it is expected to fall by 1.3%

in 2016 and 2017 (Retail Research, 2016). The UK economy was weakening even before the Brexit

vote, so Brexit cannot be held liable for everything. The GDP is expected to fall by .5% by the end of

this year and levelling up of inflation and unemployment will influence retail spending and other

decisions.

Figure 1: The UK Retail industry outlook for quarter 2 in 2016

Source: Retail Economics, 2016

Situation after publishing new policies is uncertain which is making the retail industry unstable.

Retailers have to discount prices to prevent sales decline which ultimately causing them losses. In

recessions, consumer will be warier of spending cutting down extra expenditures which will make

them switch from brands to low-cost products. In such situation value for money, strategy becomes

successful which can help Asda to retain its sales and market shares.

Social factors

century. Economic growth was high in the 2000s and then sharply declined after 9/11 in America

(Colin Grahame Bamford, 2002). But this volatility has hardly touched UK economy as it remained

comparatively stable. UK turned into an lucrative market to investors for many reasons – lower tax in

EU, infrastructure development, low labour cost etc.

After the Brexit and because of UK leaving the EU things are about to change a little. The short-term

outlook for The UK and the global economy both have weakened (Retail Economics, 2016). The

consumer spending hasn’t decreased yet after Brexit (the Guardian) but it is expected to fall by 1.3%

in 2016 and 2017 (Retail Research, 2016). The UK economy was weakening even before the Brexit

vote, so Brexit cannot be held liable for everything. The GDP is expected to fall by .5% by the end of

this year and levelling up of inflation and unemployment will influence retail spending and other

decisions.

Figure 1: The UK Retail industry outlook for quarter 2 in 2016

Source: Retail Economics, 2016

Situation after publishing new policies is uncertain which is making the retail industry unstable.

Retailers have to discount prices to prevent sales decline which ultimately causing them losses. In

recessions, consumer will be warier of spending cutting down extra expenditures which will make

them switch from brands to low-cost products. In such situation value for money, strategy becomes

successful which can help Asda to retain its sales and market shares.

Social factors

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Even after being taken over by Wal-Mart Asda has maintained its British management structure and

retained its management team. Social trend changes the demand for products significantly. Some

recent social issues are rising in the retail industry. First one is cutting off employees. Asda cut off 750

employees in March as a part of their renewal program. The other top retailers also have been cutting

down employees in last few years to cope up with the rising cost of business rates and labour maintain

the discounted price. Tesco chief executive officer Dave Lewis stated that the jobs in the retail

industry are at risk because of rising cost. British Retail Consortium also confirmed this statement by

stating “there could be 900,000 fewer jobs in the retail industry by 2025” (the Guardian, 2016).

Another social issue aroused in the retailing industry is the low amount of pension fund. Recent

reports, published by Sir Philip Green, states that the biggest companies in the UK pay five times

more dividends than they pay on pensions. The report claimed that top 100 companies paid only

£13.3bn towards pension scheme whereas they paid £71.8bn as dividends (Ruddick, 2016). Social

issues like these need to be addressed by the retail industry.

Technological factors

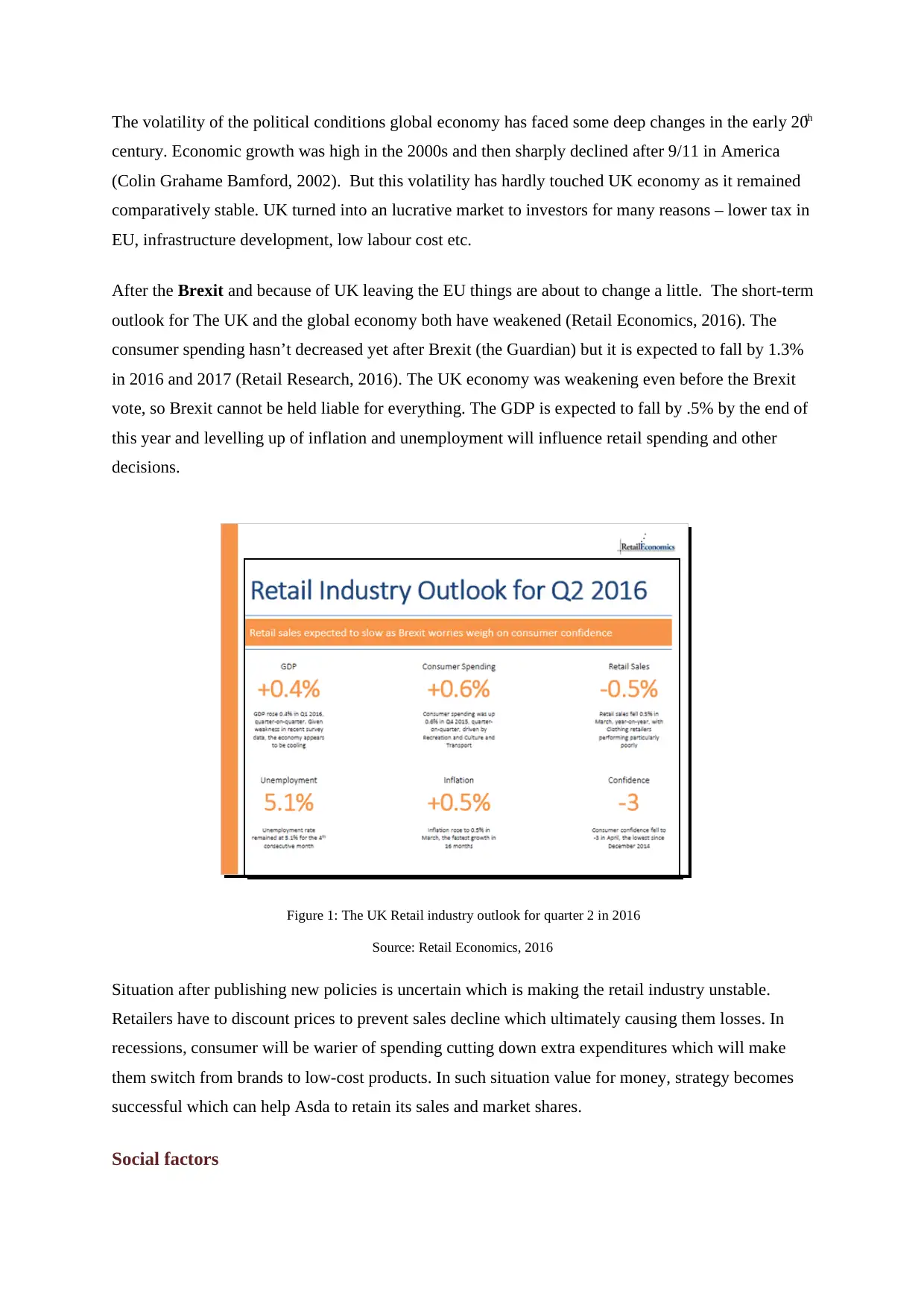

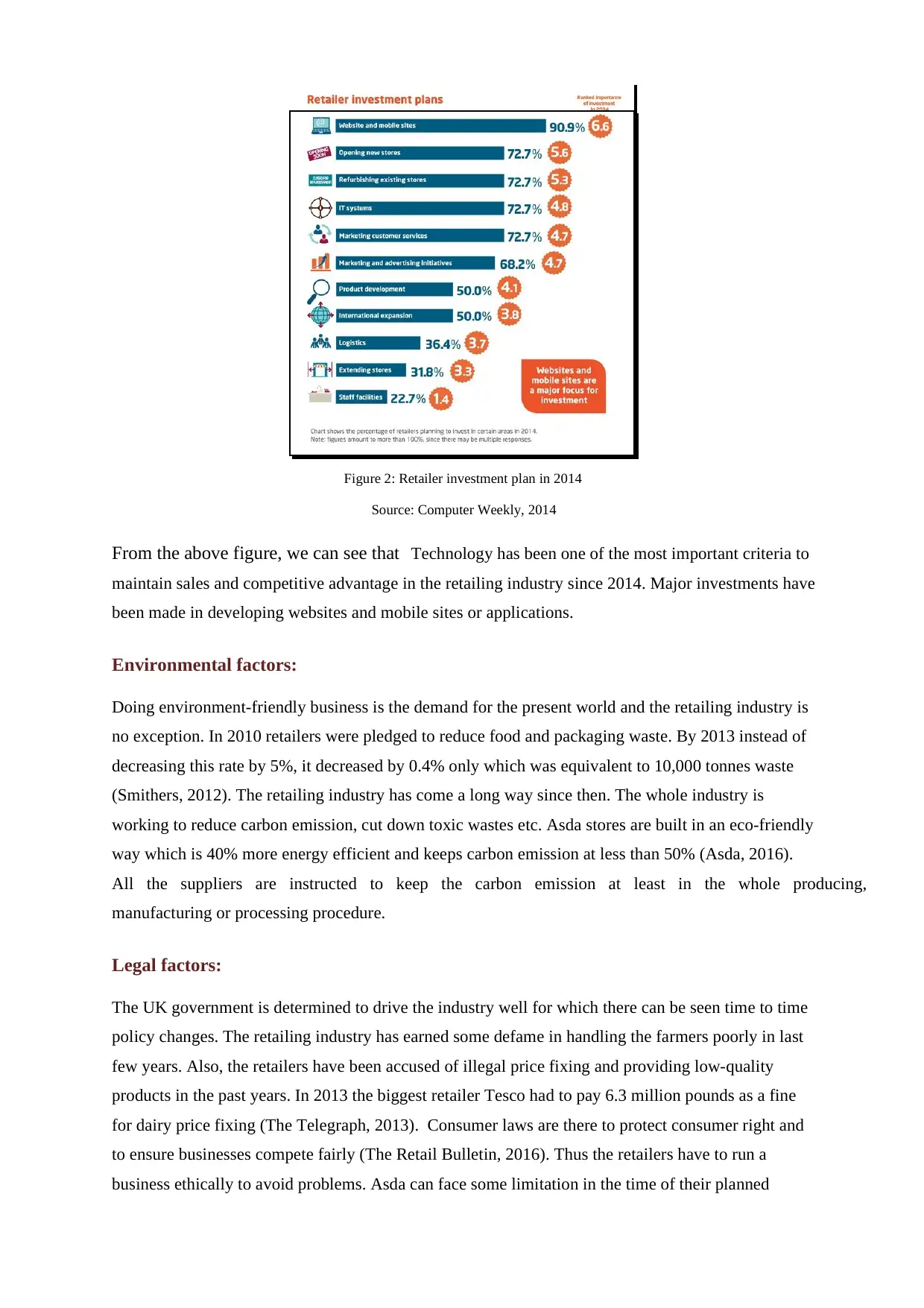

A new technology promises new products and processing systems. Asda’s success can be attributed to

online shopping and computer-based systems to a large percentage. Asda has shown efficiency in

building hardcore competence in information technology so that it can support its business operations

well. Asda is constantly introducing new technology to maintain its performance and remain one step

ahead of the competitors. It launched “to you” system in January to strengthen its supply system and

to ensure better order collection and return service to customers (Retail Technology, 2016). 32% of

the UK retailers plan to install technology which enables customers to order products from one branch

to another where it’s available (Internetretailing, 2016).

retained its management team. Social trend changes the demand for products significantly. Some

recent social issues are rising in the retail industry. First one is cutting off employees. Asda cut off 750

employees in March as a part of their renewal program. The other top retailers also have been cutting

down employees in last few years to cope up with the rising cost of business rates and labour maintain

the discounted price. Tesco chief executive officer Dave Lewis stated that the jobs in the retail

industry are at risk because of rising cost. British Retail Consortium also confirmed this statement by

stating “there could be 900,000 fewer jobs in the retail industry by 2025” (the Guardian, 2016).

Another social issue aroused in the retailing industry is the low amount of pension fund. Recent

reports, published by Sir Philip Green, states that the biggest companies in the UK pay five times

more dividends than they pay on pensions. The report claimed that top 100 companies paid only

£13.3bn towards pension scheme whereas they paid £71.8bn as dividends (Ruddick, 2016). Social

issues like these need to be addressed by the retail industry.

Technological factors

A new technology promises new products and processing systems. Asda’s success can be attributed to

online shopping and computer-based systems to a large percentage. Asda has shown efficiency in

building hardcore competence in information technology so that it can support its business operations

well. Asda is constantly introducing new technology to maintain its performance and remain one step

ahead of the competitors. It launched “to you” system in January to strengthen its supply system and

to ensure better order collection and return service to customers (Retail Technology, 2016). 32% of

the UK retailers plan to install technology which enables customers to order products from one branch

to another where it’s available (Internetretailing, 2016).

Figure 2: Retailer investment plan in 2014

Source: Computer Weekly, 2014

From the above figure, we can see that Technology has been one of the most important criteria to

maintain sales and competitive advantage in the retailing industry since 2014. Major investments have

been made in developing websites and mobile sites or applications.

Environmental factors:

Doing environment-friendly business is the demand for the present world and the retailing industry is

no exception. In 2010 retailers were pledged to reduce food and packaging waste. By 2013 instead of

decreasing this rate by 5%, it decreased by 0.4% only which was equivalent to 10,000 tonnes waste

(Smithers, 2012). The retailing industry has come a long way since then. The whole industry is

working to reduce carbon emission, cut down toxic wastes etc. Asda stores are built in an eco-friendly

way which is 40% more energy efficient and keeps carbon emission at less than 50% (Asda, 2016).

All the suppliers are instructed to keep the carbon emission at least in the whole producing,

manufacturing or processing procedure.

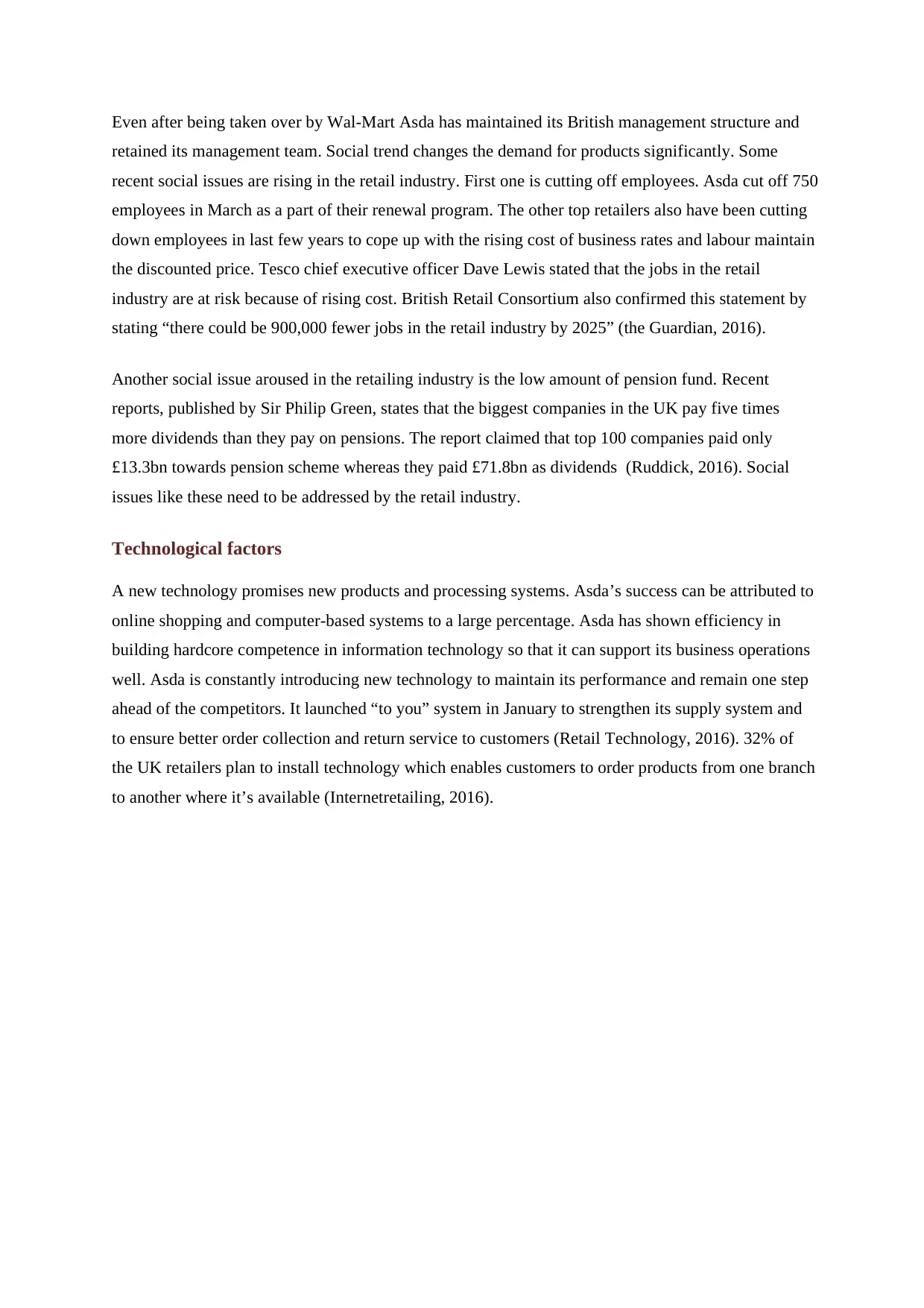

Legal factors:

The UK government is determined to drive the industry well for which there can be seen time to time

policy changes. The retailing industry has earned some defame in handling the farmers poorly in last

few years. Also, the retailers have been accused of illegal price fixing and providing low-quality

products in the past years. In 2013 the biggest retailer Tesco had to pay 6.3 million pounds as a fine

for dairy price fixing (The Telegraph, 2013). Consumer laws are there to protect consumer right and

to ensure businesses compete fairly (The Retail Bulletin, 2016). Thus the retailers have to run a

business ethically to avoid problems. Asda can face some limitation in the time of their planned

Source: Computer Weekly, 2014

From the above figure, we can see that Technology has been one of the most important criteria to

maintain sales and competitive advantage in the retailing industry since 2014. Major investments have

been made in developing websites and mobile sites or applications.

Environmental factors:

Doing environment-friendly business is the demand for the present world and the retailing industry is

no exception. In 2010 retailers were pledged to reduce food and packaging waste. By 2013 instead of

decreasing this rate by 5%, it decreased by 0.4% only which was equivalent to 10,000 tonnes waste

(Smithers, 2012). The retailing industry has come a long way since then. The whole industry is

working to reduce carbon emission, cut down toxic wastes etc. Asda stores are built in an eco-friendly

way which is 40% more energy efficient and keeps carbon emission at less than 50% (Asda, 2016).

All the suppliers are instructed to keep the carbon emission at least in the whole producing,

manufacturing or processing procedure.

Legal factors:

The UK government is determined to drive the industry well for which there can be seen time to time

policy changes. The retailing industry has earned some defame in handling the farmers poorly in last

few years. Also, the retailers have been accused of illegal price fixing and providing low-quality

products in the past years. In 2013 the biggest retailer Tesco had to pay 6.3 million pounds as a fine

for dairy price fixing (The Telegraph, 2013). Consumer laws are there to protect consumer right and

to ensure businesses compete fairly (The Retail Bulletin, 2016). Thus the retailers have to run a

business ethically to avoid problems. Asda can face some limitation in the time of their planned

expansion which may not be approved by the authority. Also, illegal price wars introduced by Asda

are creating rage in the industry.

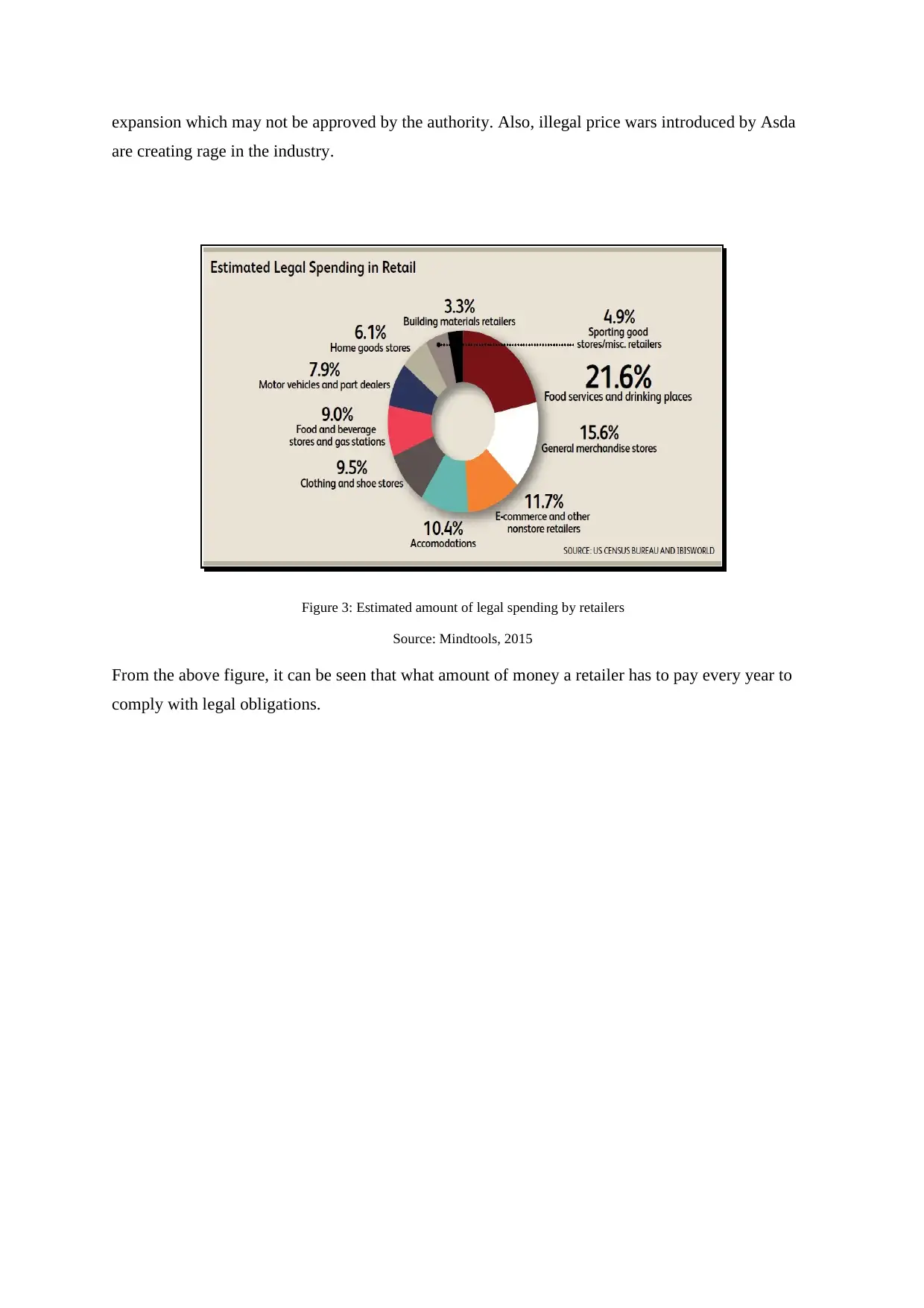

Figure 3: Estimated amount of legal spending by retailers

Source: Mindtools, 2015

From the above figure, it can be seen that what amount of money a retailer has to pay every year to

comply with legal obligations.

are creating rage in the industry.

Figure 3: Estimated amount of legal spending by retailers

Source: Mindtools, 2015

From the above figure, it can be seen that what amount of money a retailer has to pay every year to

comply with legal obligations.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

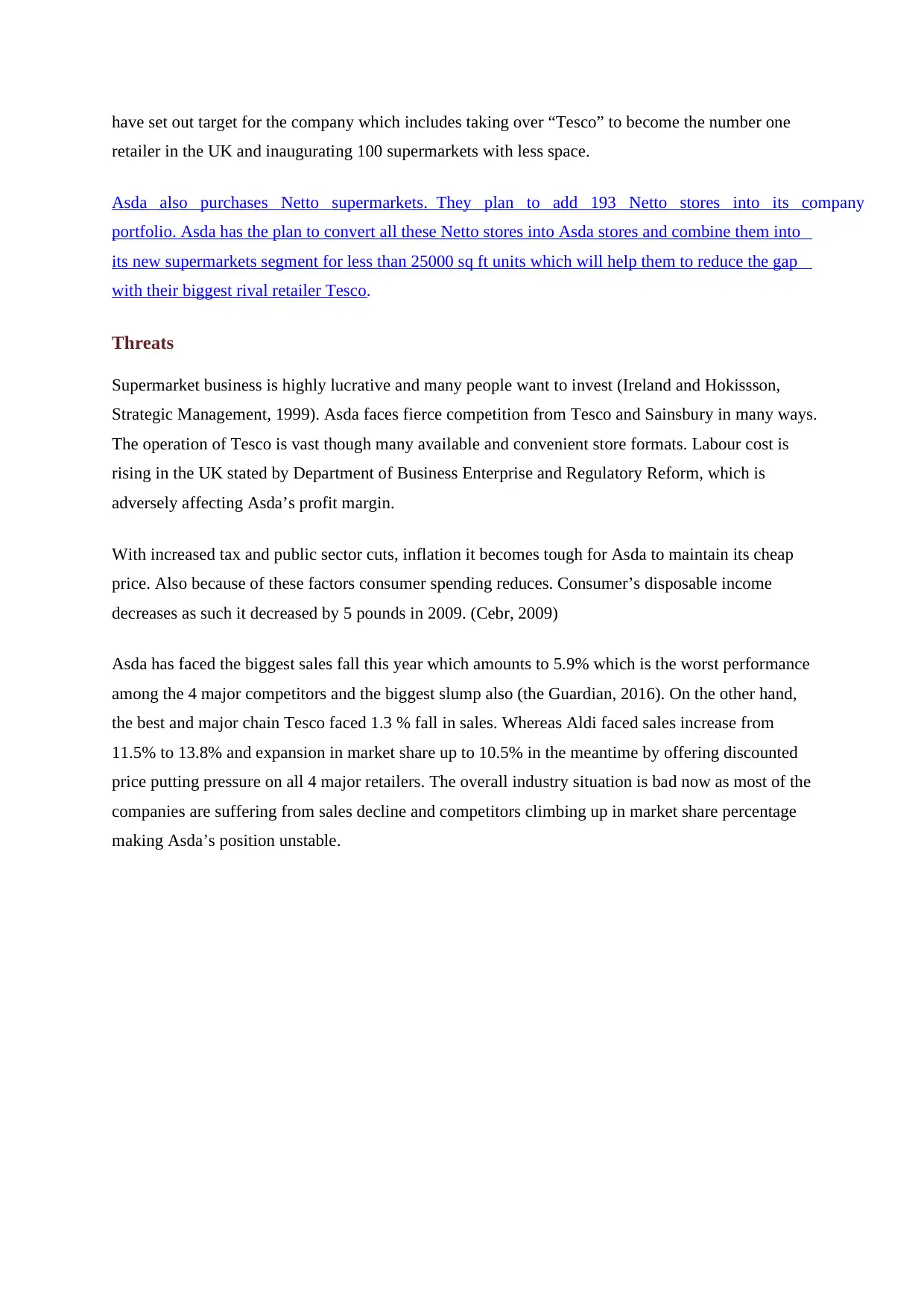

SWOT Analysis of Asda:

Strength:

Asda is one of the oldest and reputed retail brands in the UK. It has earned reputation by proving the

fact by providing value for money, offering handiness and an extremely wide range of products all in

one place. Asda’s focus like its parent company Wal-Mart is also to save money and keep the price

low. The company has demonstrated skill in its use of information technology to execute its

operational activities. As such- by their technology they can watch each product’s performance in

every store at a glance. IT helps Asda in human resource management also. They understand

employees are important to run their business thus they invest in them in the form of training,

motivating and developing them.

Asda spread out in the non-food sectors after being taken over by Wal-Mart. The company now offers

a non-food item in more than 12000 product line. Asda can recognise the prospect of growth in the

UK and so has derived some expertise from Wal-Mart. Over the years they have introduced new

products, gone on combined business trips, and sourced worldwide and shared category management

skill on how to manage the stores well.

Weaknesses

As Asda’s objective is to sell cheap products sometimes they have to maintain this strategy even by

providing inferior goods. Another weakness is its huge and inconvenient stores. Britain, like many

other European countries such as France and Germany, has imposed strict restrictions on the building

of "big box" stores in country sides. Asda stores mostly fall into this category though other

competitors like Tesco’s almost 70% stores are small or medium sized. Even if now they are doing

well but with this structure, it might be difficult for them to expand (Matlack, 2005)

Being a subsidiary of Wal-Mart Asda has to also sell products in a broad range which deprive them of

focusing on a specific sector more.

Opportunities

Being part of the world's largest retailer, Asda has gained Wal-Mart's massive buying power,

particularly on general goods. So, Asda has been able to procure materials like Denim at such a

universal level that they have been able to reduce the cost of a pair of jeans from £14 to £4 over last

years. Food contributes the most in Asda’s turnover and this is because their low-cost strategy.

Being financially strong Asda has the opportunity to take over or merge with or form alliances with

other internationally renowned retailers to boost its growth in food and non-food market. Chairmen

Strength:

Asda is one of the oldest and reputed retail brands in the UK. It has earned reputation by proving the

fact by providing value for money, offering handiness and an extremely wide range of products all in

one place. Asda’s focus like its parent company Wal-Mart is also to save money and keep the price

low. The company has demonstrated skill in its use of information technology to execute its

operational activities. As such- by their technology they can watch each product’s performance in

every store at a glance. IT helps Asda in human resource management also. They understand

employees are important to run their business thus they invest in them in the form of training,

motivating and developing them.

Asda spread out in the non-food sectors after being taken over by Wal-Mart. The company now offers

a non-food item in more than 12000 product line. Asda can recognise the prospect of growth in the

UK and so has derived some expertise from Wal-Mart. Over the years they have introduced new

products, gone on combined business trips, and sourced worldwide and shared category management

skill on how to manage the stores well.

Weaknesses

As Asda’s objective is to sell cheap products sometimes they have to maintain this strategy even by

providing inferior goods. Another weakness is its huge and inconvenient stores. Britain, like many

other European countries such as France and Germany, has imposed strict restrictions on the building

of "big box" stores in country sides. Asda stores mostly fall into this category though other

competitors like Tesco’s almost 70% stores are small or medium sized. Even if now they are doing

well but with this structure, it might be difficult for them to expand (Matlack, 2005)

Being a subsidiary of Wal-Mart Asda has to also sell products in a broad range which deprive them of

focusing on a specific sector more.

Opportunities

Being part of the world's largest retailer, Asda has gained Wal-Mart's massive buying power,

particularly on general goods. So, Asda has been able to procure materials like Denim at such a

universal level that they have been able to reduce the cost of a pair of jeans from £14 to £4 over last

years. Food contributes the most in Asda’s turnover and this is because their low-cost strategy.

Being financially strong Asda has the opportunity to take over or merge with or form alliances with

other internationally renowned retailers to boost its growth in food and non-food market. Chairmen

have set out target for the company which includes taking over “Tesco” to become the number one

retailer in the UK and inaugurating 100 supermarkets with less space.

Asda also purchases Netto supermarkets. They plan to add 193 Netto stores into its company

portfolio. Asda has the plan to convert all these Netto stores into Asda stores and combine them into

its new supermarkets segment for less than 25000 sq ft units which will help them to reduce the gap

with their biggest rival retailer Tesco.

Threats

Supermarket business is highly lucrative and many people want to invest (Ireland and Hokissson,

Strategic Management, 1999). Asda faces fierce competition from Tesco and Sainsbury in many ways.

The operation of Tesco is vast though many available and convenient store formats. Labour cost is

rising in the UK stated by Department of Business Enterprise and Regulatory Reform, which is

adversely affecting Asda’s profit margin.

With increased tax and public sector cuts, inflation it becomes tough for Asda to maintain its cheap

price. Also because of these factors consumer spending reduces. Consumer’s disposable income

decreases as such it decreased by 5 pounds in 2009. (Cebr, 2009)

Asda has faced the biggest sales fall this year which amounts to 5.9% which is the worst performance

among the 4 major competitors and the biggest slump also (the Guardian, 2016). On the other hand,

the best and major chain Tesco faced 1.3 % fall in sales. Whereas Aldi faced sales increase from

11.5% to 13.8% and expansion in market share up to 10.5% in the meantime by offering discounted

price putting pressure on all 4 major retailers. The overall industry situation is bad now as most of the

companies are suffering from sales decline and competitors climbing up in market share percentage

making Asda’s position unstable.

retailer in the UK and inaugurating 100 supermarkets with less space.

Asda also purchases Netto supermarkets. They plan to add 193 Netto stores into its company

portfolio. Asda has the plan to convert all these Netto stores into Asda stores and combine them into

its new supermarkets segment for less than 25000 sq ft units which will help them to reduce the gap

with their biggest rival retailer Tesco.

Threats

Supermarket business is highly lucrative and many people want to invest (Ireland and Hokissson,

Strategic Management, 1999). Asda faces fierce competition from Tesco and Sainsbury in many ways.

The operation of Tesco is vast though many available and convenient store formats. Labour cost is

rising in the UK stated by Department of Business Enterprise and Regulatory Reform, which is

adversely affecting Asda’s profit margin.

With increased tax and public sector cuts, inflation it becomes tough for Asda to maintain its cheap

price. Also because of these factors consumer spending reduces. Consumer’s disposable income

decreases as such it decreased by 5 pounds in 2009. (Cebr, 2009)

Asda has faced the biggest sales fall this year which amounts to 5.9% which is the worst performance

among the 4 major competitors and the biggest slump also (the Guardian, 2016). On the other hand,

the best and major chain Tesco faced 1.3 % fall in sales. Whereas Aldi faced sales increase from

11.5% to 13.8% and expansion in market share up to 10.5% in the meantime by offering discounted

price putting pressure on all 4 major retailers. The overall industry situation is bad now as most of the

companies are suffering from sales decline and competitors climbing up in market share percentage

making Asda’s position unstable.

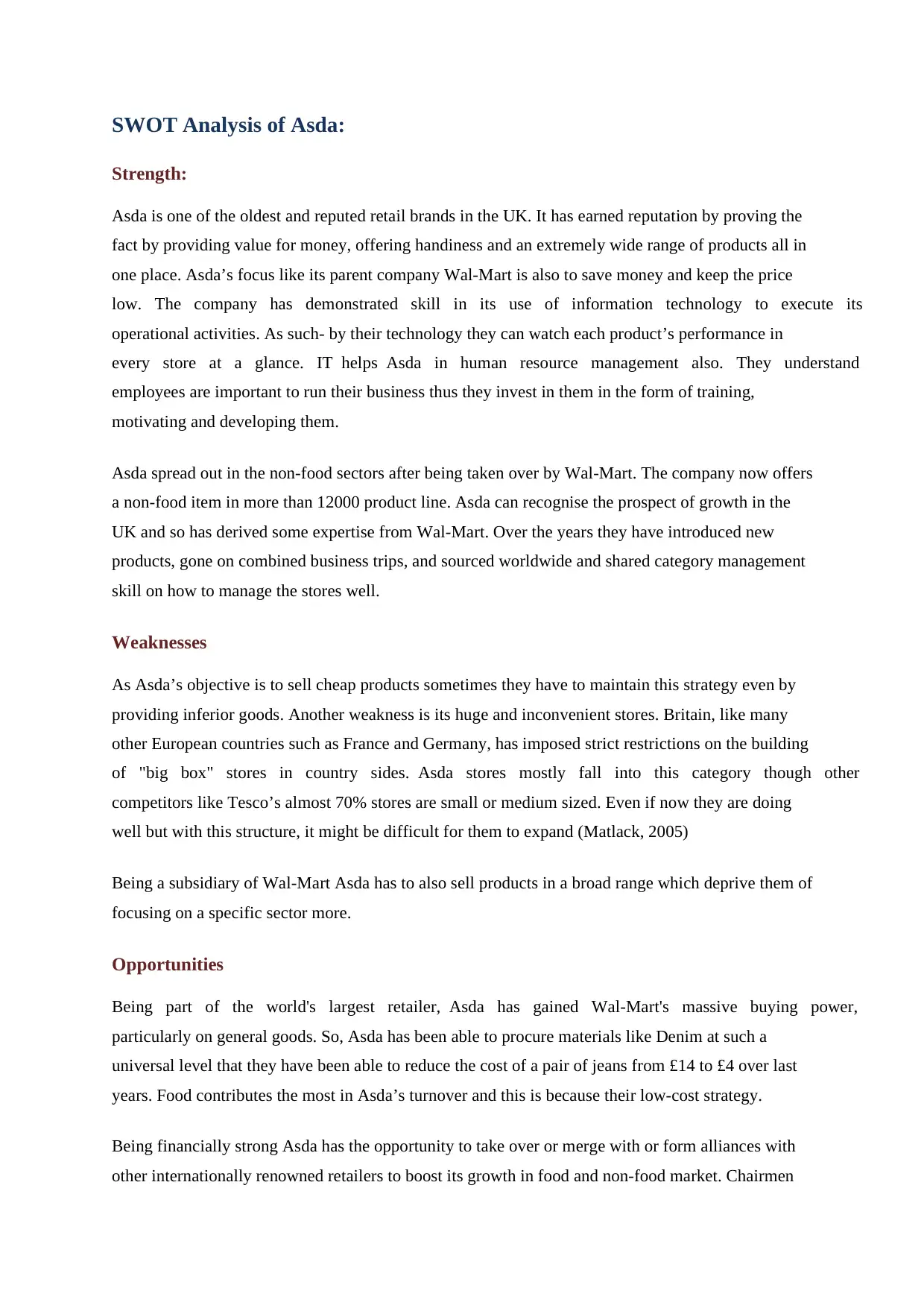

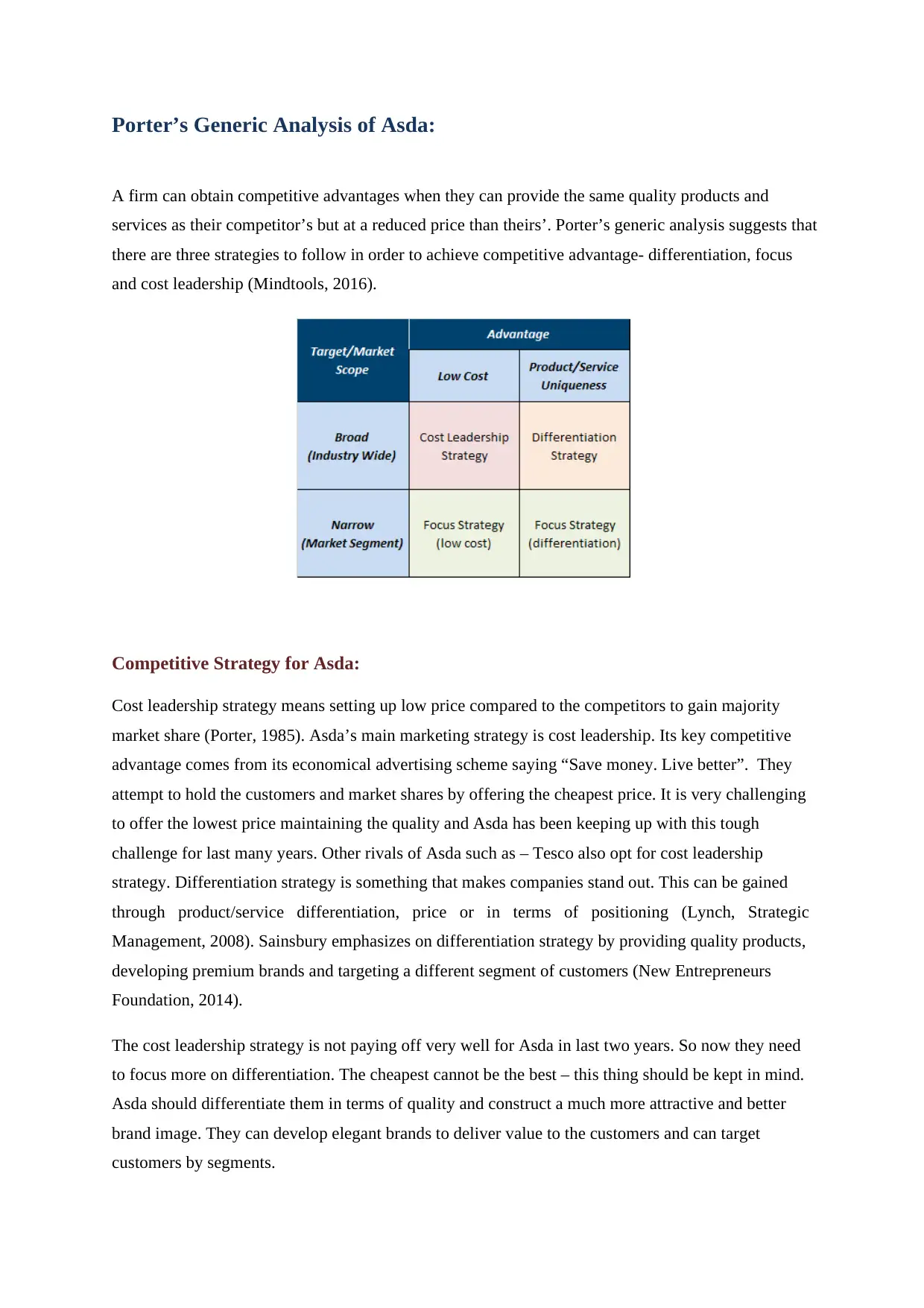

Porter’s Generic Analysis of Asda:

A firm can obtain competitive advantages when they can provide the same quality products and

services as their competitor’s but at a reduced price than theirs’. Porter’s generic analysis suggests that

there are three strategies to follow in order to achieve competitive advantage- differentiation, focus

and cost leadership (Mindtools, 2016).

Competitive Strategy for Asda:

Cost leadership strategy means setting up low price compared to the competitors to gain majority

market share (Porter, 1985). Asda’s main marketing strategy is cost leadership. Its key competitive

advantage comes from its economical advertising scheme saying “Save money. Live better”. They

attempt to hold the customers and market shares by offering the cheapest price. It is very challenging

to offer the lowest price maintaining the quality and Asda has been keeping up with this tough

challenge for last many years. Other rivals of Asda such as – Tesco also opt for cost leadership

strategy. Differentiation strategy is something that makes companies stand out. This can be gained

through product/service differentiation, price or in terms of positioning (Lynch, Strategic

Management, 2008). Sainsbury emphasizes on differentiation strategy by providing quality products,

developing premium brands and targeting a different segment of customers (New Entrepreneurs

Foundation, 2014).

The cost leadership strategy is not paying off very well for Asda in last two years. So now they need

to focus more on differentiation. The cheapest cannot be the best – this thing should be kept in mind.

Asda should differentiate them in terms of quality and construct a much more attractive and better

brand image. They can develop elegant brands to deliver value to the customers and can target

customers by segments.

A firm can obtain competitive advantages when they can provide the same quality products and

services as their competitor’s but at a reduced price than theirs’. Porter’s generic analysis suggests that

there are three strategies to follow in order to achieve competitive advantage- differentiation, focus

and cost leadership (Mindtools, 2016).

Competitive Strategy for Asda:

Cost leadership strategy means setting up low price compared to the competitors to gain majority

market share (Porter, 1985). Asda’s main marketing strategy is cost leadership. Its key competitive

advantage comes from its economical advertising scheme saying “Save money. Live better”. They

attempt to hold the customers and market shares by offering the cheapest price. It is very challenging

to offer the lowest price maintaining the quality and Asda has been keeping up with this tough

challenge for last many years. Other rivals of Asda such as – Tesco also opt for cost leadership

strategy. Differentiation strategy is something that makes companies stand out. This can be gained

through product/service differentiation, price or in terms of positioning (Lynch, Strategic

Management, 2008). Sainsbury emphasizes on differentiation strategy by providing quality products,

developing premium brands and targeting a different segment of customers (New Entrepreneurs

Foundation, 2014).

The cost leadership strategy is not paying off very well for Asda in last two years. So now they need

to focus more on differentiation. The cheapest cannot be the best – this thing should be kept in mind.

Asda should differentiate them in terms of quality and construct a much more attractive and better

brand image. They can develop elegant brands to deliver value to the customers and can target

customers by segments.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Porter’s Five Forces Analysis:

Bargaining power of buyers:

Buyers bargaining power is high. Customers have many other supermarkets to shop from. So when

they purchase products they consider all the factors like –low price, supreme quality, satisfaction,

customer service etc. They can shop from any retailer as per their choice. Asda tries to preserve its

customers by offering the lowest prize with quality products and services.

Bargaining power of suppliers:

Suppliers bargaining power is low. Generally, supply terms are contractual which can’t be changed

afterwards. Asda has more than 500 suppliers. They opt to keep a good relationship with them with

the intention of obtaining quality products so that they can beat the competition and survive.

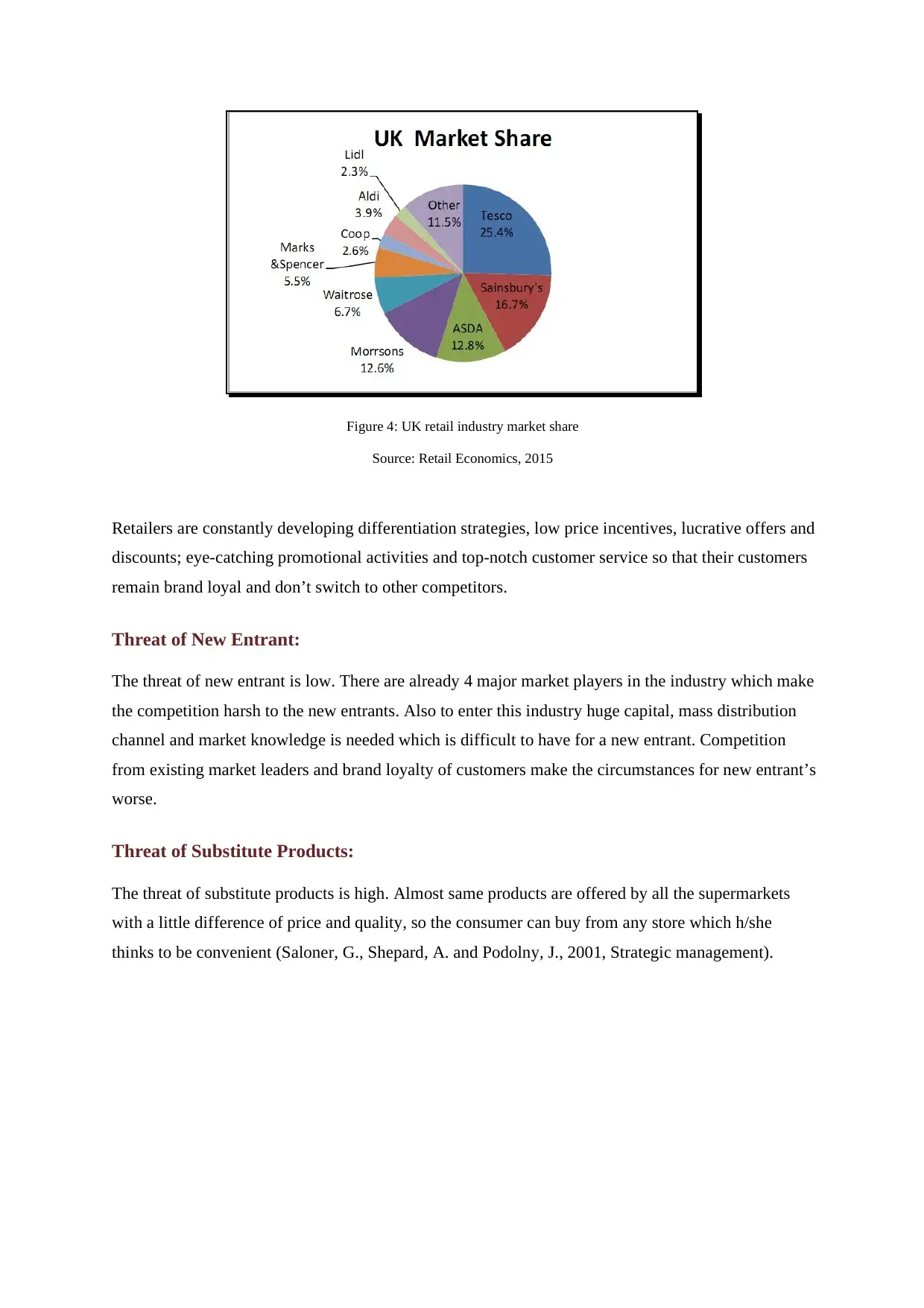

Industry Rivalry:

Rivalry among the competitors is high. Asda’s biggest competitions are Tesco, Sainsbury, and

Morrison etc. Each of these companies is trying their utmost to become the market leader and capture

the largest portion of market shares.

Bargaining power of buyers:

Buyers bargaining power is high. Customers have many other supermarkets to shop from. So when

they purchase products they consider all the factors like –low price, supreme quality, satisfaction,

customer service etc. They can shop from any retailer as per their choice. Asda tries to preserve its

customers by offering the lowest prize with quality products and services.

Bargaining power of suppliers:

Suppliers bargaining power is low. Generally, supply terms are contractual which can’t be changed

afterwards. Asda has more than 500 suppliers. They opt to keep a good relationship with them with

the intention of obtaining quality products so that they can beat the competition and survive.

Industry Rivalry:

Rivalry among the competitors is high. Asda’s biggest competitions are Tesco, Sainsbury, and

Morrison etc. Each of these companies is trying their utmost to become the market leader and capture

the largest portion of market shares.

Figure 4: UK retail industry market share

Source: Retail Economics, 2015

Retailers are constantly developing differentiation strategies, low price incentives, lucrative offers and

discounts; eye-catching promotional activities and top-notch customer service so that their customers

remain brand loyal and don’t switch to other competitors.

Threat of New Entrant:

The threat of new entrant is low. There are already 4 major market players in the industry which make

the competition harsh to the new entrants. Also to enter this industry huge capital, mass distribution

channel and market knowledge is needed which is difficult to have for a new entrant. Competition

from existing market leaders and brand loyalty of customers make the circumstances for new entrant’s

worse.

Threat of Substitute Products:

The threat of substitute products is high. Almost same products are offered by all the supermarkets

with a little difference of price and quality, so the consumer can buy from any store which h/she

thinks to be convenient (Saloner, G., Shepard, A. and Podolny, J., 2001, Strategic management).

Source: Retail Economics, 2015

Retailers are constantly developing differentiation strategies, low price incentives, lucrative offers and

discounts; eye-catching promotional activities and top-notch customer service so that their customers

remain brand loyal and don’t switch to other competitors.

Threat of New Entrant:

The threat of new entrant is low. There are already 4 major market players in the industry which make

the competition harsh to the new entrants. Also to enter this industry huge capital, mass distribution

channel and market knowledge is needed which is difficult to have for a new entrant. Competition

from existing market leaders and brand loyalty of customers make the circumstances for new entrant’s

worse.

Threat of Substitute Products:

The threat of substitute products is high. Almost same products are offered by all the supermarkets

with a little difference of price and quality, so the consumer can buy from any store which h/she

thinks to be convenient (Saloner, G., Shepard, A. and Podolny, J., 2001, Strategic management).

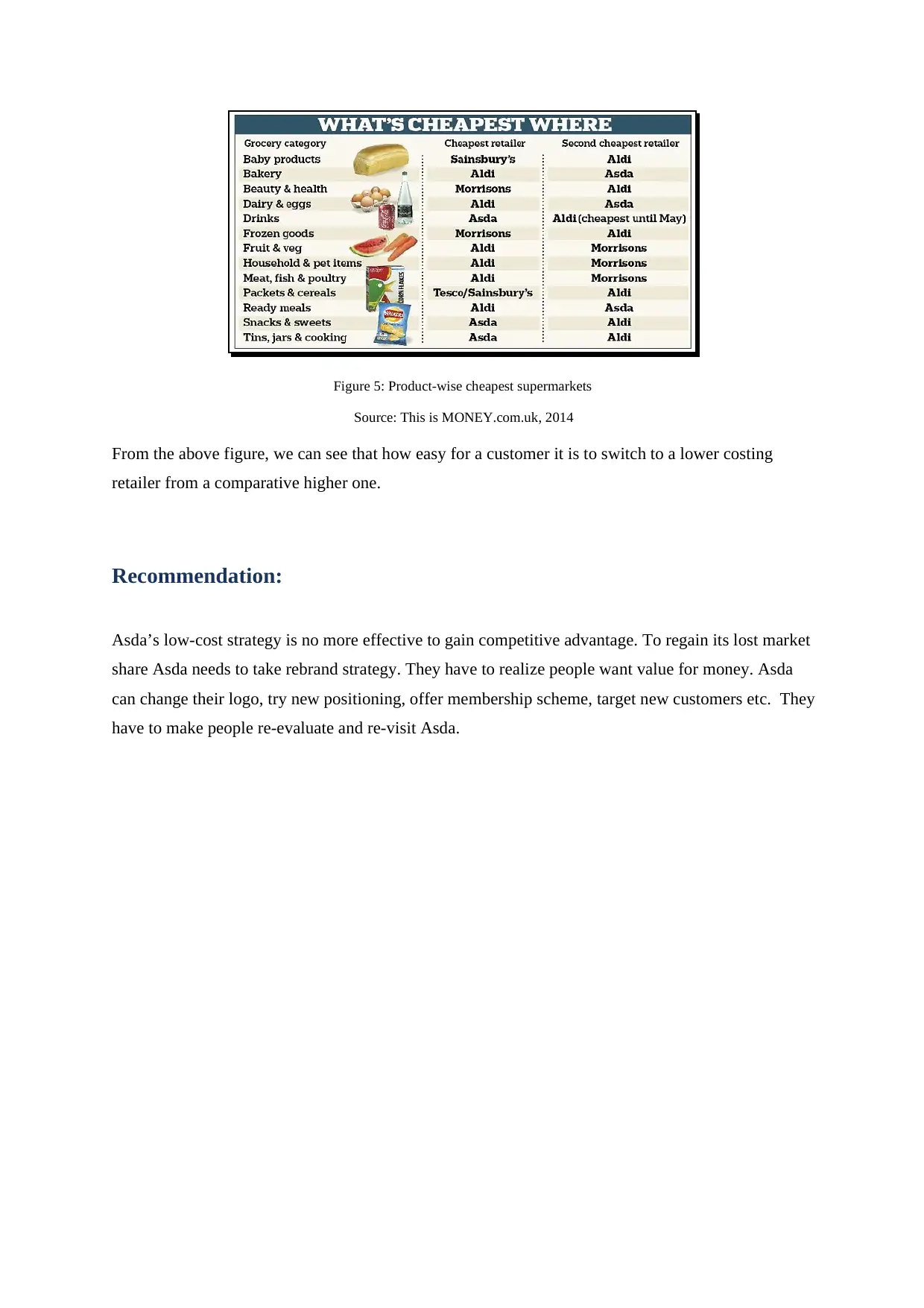

Figure 5: Product-wise cheapest supermarkets

Source: This is MONEY.com.uk, 2014

From the above figure, we can see that how easy for a customer it is to switch to a lower costing

retailer from a comparative higher one.

Recommendation:

Asda’s low-cost strategy is no more effective to gain competitive advantage. To regain its lost market

share Asda needs to take rebrand strategy. They have to realize people want value for money. Asda

can change their logo, try new positioning, offer membership scheme, target new customers etc. They

have to make people re-evaluate and re-visit Asda.

Source: This is MONEY.com.uk, 2014

From the above figure, we can see that how easy for a customer it is to switch to a lower costing

retailer from a comparative higher one.

Recommendation:

Asda’s low-cost strategy is no more effective to gain competitive advantage. To regain its lost market

share Asda needs to take rebrand strategy. They have to realize people want value for money. Asda

can change their logo, try new positioning, offer membership scheme, target new customers etc. They

have to make people re-evaluate and re-visit Asda.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Conclusion:

Asda seems to lose its ‘low-price” crown to competitors like Aldi & Lidl. To regain the ground they

have given a hint of price wars which has already brought the industry in retreat through the decline

of Tesco and Sainsbury’s market share (UK Equities, 2016). But offering the cheapest price hasn’t

served them well in the last two years. They have lost market shares to Aldi and Lidl. After Brexit, the

pound value has decreased and the entire pressure of changing economy has to be swallowed by the

retailers without affecting the buyers to retain their price and sales. 40% of foods and groceries are

imported which is now huge cost because of the devaluing of pound.

Cheap prices are not working for Asda. They need to re-create their image and come out of the shell

of being a retailer for middle class budgeted families. Asda needs a message to communicate to its

customers rather than low price to drive the sales. They have got an image problem not a price trouble

to tackle. Declaring a price war will only deteriorate their present situation. Asda’s nuclear price war

will not only damage it but also will impair its other 3 major market leaders – Tesco, Sainsbury, and

Morrison.

Apparently Asda boss Andy Clarke says that they would endure some short term loss for long term

benefits and they have proper strategies which will be triggered at the right time but even if situation

doesn’t improve after all these then it is wise for Asda to start investing in developing markets like-

India and China and try to capture market shares there. The UK market is saturated so investing in

those countries which have immense prospect will give them the advantage of being the first mover

and thus will be proven beneficial for their future financial performance.

Asda seems to lose its ‘low-price” crown to competitors like Aldi & Lidl. To regain the ground they

have given a hint of price wars which has already brought the industry in retreat through the decline

of Tesco and Sainsbury’s market share (UK Equities, 2016). But offering the cheapest price hasn’t

served them well in the last two years. They have lost market shares to Aldi and Lidl. After Brexit, the

pound value has decreased and the entire pressure of changing economy has to be swallowed by the

retailers without affecting the buyers to retain their price and sales. 40% of foods and groceries are

imported which is now huge cost because of the devaluing of pound.

Cheap prices are not working for Asda. They need to re-create their image and come out of the shell

of being a retailer for middle class budgeted families. Asda needs a message to communicate to its

customers rather than low price to drive the sales. They have got an image problem not a price trouble

to tackle. Declaring a price war will only deteriorate their present situation. Asda’s nuclear price war

will not only damage it but also will impair its other 3 major market leaders – Tesco, Sainsbury, and

Morrison.

Apparently Asda boss Andy Clarke says that they would endure some short term loss for long term

benefits and they have proper strategies which will be triggered at the right time but even if situation

doesn’t improve after all these then it is wise for Asda to start investing in developing markets like-

India and China and try to capture market shares there. The UK market is saturated so investing in

those countries which have immense prospect will give them the advantage of being the first mover

and thus will be proven beneficial for their future financial performance.

References

BBC News. (2016). Asda sales slump continues amid 'fierce competition' - BBC News. [online]

Available at: http://www.bbc.com/news/business-36333861 [Accessed 9 Aug. 2016].

Bulletin, R. (2016). New consumer laws and their impact on retailers | The Retail Bulletin, Retail

News. [online] Theretailbulletin.com. Available at:

http://www.theretailbulletin.com/news/new_consumer_laws_and_their_impact_on_retailers_23-06-

14/ [Accessed 1 Aug. 2016].

Butler, S. (2016). Asda to cut up to 750 jobs. [online] the Guardian. Available at:

https://www.theguardian.com/business/2016/mar/16/asda-to-cut-up-to-750-jobs [Accessed 19 Jul.

2016].

Butler, S. (2016). UK's major supermarkets decline for first time this year. [online] the Guardian.

Available at: https://www.theguardian.com/business/2016/jun/28/aldi-lidl-asda-supermarket-sector

[Accessed 1 Aug. 2016].

Financial Times. (2016). Supermarkets in retreat on Asda war signal - FT.com. [online] Available at:

http://www.ft.com/cms/s/0/f6d24b9e-29a9-11e6-8ba3-cdd781d02d89.html#axzz4HVgPVSZd

[Accessed 3 Aug. 2016].

Gov.uk. (2016). UK retail industry: international action plan - GOV.UK. [online] Available at:

https://www.gov.uk/government/publications/uk-retail-industry-international-action-plan/uk-retail-

industry-international-action-plan [Accessed 12 Aug. 2016].

Hitt, M., Ireland, R. and Hoskisson, R. (1999). Strategic management. Cincinnati: South-Western

College Pub.

InternetRetailing. (2016). 32% of ‘major’ UK retailers will install tech to meet growing demand for

omni-channel, Jaeger and New Look lead the way - InternetRetailing. [online] Available at:

http://internetretailing.net/2016/06/32-major-uk-retailers-will-install-tech-meet-growing-demand-

omni-channel-jeager-leads-way/ [Accessed 9 Aug. 2016].

Lynch, R. and Lynch, R. (2008). Strategic management. Harlow: Financial Times Prentice Hall.

Mindtools.com. (2016). Porter's Generic Strategies: Choosing Your Route to Success. [online]

Available at: https://www.mindtools.com/pages/article/newSTR_82.htm [Accessed 6 Aug. 2016].

BBC News. (2016). Asda sales slump continues amid 'fierce competition' - BBC News. [online]

Available at: http://www.bbc.com/news/business-36333861 [Accessed 9 Aug. 2016].

Bulletin, R. (2016). New consumer laws and their impact on retailers | The Retail Bulletin, Retail

News. [online] Theretailbulletin.com. Available at:

http://www.theretailbulletin.com/news/new_consumer_laws_and_their_impact_on_retailers_23-06-

14/ [Accessed 1 Aug. 2016].

Butler, S. (2016). Asda to cut up to 750 jobs. [online] the Guardian. Available at:

https://www.theguardian.com/business/2016/mar/16/asda-to-cut-up-to-750-jobs [Accessed 19 Jul.

2016].

Butler, S. (2016). UK's major supermarkets decline for first time this year. [online] the Guardian.

Available at: https://www.theguardian.com/business/2016/jun/28/aldi-lidl-asda-supermarket-sector

[Accessed 1 Aug. 2016].

Financial Times. (2016). Supermarkets in retreat on Asda war signal - FT.com. [online] Available at:

http://www.ft.com/cms/s/0/f6d24b9e-29a9-11e6-8ba3-cdd781d02d89.html#axzz4HVgPVSZd

[Accessed 3 Aug. 2016].

Gov.uk. (2016). UK retail industry: international action plan - GOV.UK. [online] Available at:

https://www.gov.uk/government/publications/uk-retail-industry-international-action-plan/uk-retail-

industry-international-action-plan [Accessed 12 Aug. 2016].

Hitt, M., Ireland, R. and Hoskisson, R. (1999). Strategic management. Cincinnati: South-Western

College Pub.

InternetRetailing. (2016). 32% of ‘major’ UK retailers will install tech to meet growing demand for

omni-channel, Jaeger and New Look lead the way - InternetRetailing. [online] Available at:

http://internetretailing.net/2016/06/32-major-uk-retailers-will-install-tech-meet-growing-demand-

omni-channel-jeager-leads-way/ [Accessed 9 Aug. 2016].

Lynch, R. and Lynch, R. (2008). Strategic management. Harlow: Financial Times Prentice Hall.

Mindtools.com. (2016). Porter's Generic Strategies: Choosing Your Route to Success. [online]

Available at: https://www.mindtools.com/pages/article/newSTR_82.htm [Accessed 6 Aug. 2016].

New Entrepreneurs Foundation. (2014). You can’t be the cheapest and the best – Porter’s Generic

Strategies - New Entrepreneurs Foundation. [online] Available at:

http://newentrepreneursfoundation.com/you-cant-be-the-cheapest-and-the-best-porters-generic-

strategies/ [Accessed 10 Aug. 2016].

Retaileconomics.co.uk. (2016). What does Brexit mean for the economy and the UK retail industry? |

Retail Economics. [online] Available at: http://www.retaileconomics.co.uk/brexit/what-does-brexit-

mean-for-UK-retail [Accessed 7 Aug. 2016].

Retailresearch.org. (2016). UK Retail after Brexit - Centre for Retail Research, Nottingham UK.

[online] Available at: http://www.retailresearch.org/brexit.php [Accessed 3 Aug. 2016].

Retailtechnology.co.uk. (2016). Asdas launches new fulfilment and returns toyou | News | Retail

Technology. [online] Available at: http://www.retailtechnology.co.uk/news/5896/asdas-launches-new-

fulfilment-and-returns-toyou/ [Accessed 7 Aug. 2016].

Ruddick, G. (2016). Top UK firms paid five times more in dividends than into pensions. [online] the

Guardian. Available at: https://www.theguardian.com/money/2016/aug/16/top-uk-firms-paid-five-

times-more-in-dividends-than-into-pensions [Accessed 5 Aug. 2016].

Saloner, G., Shepard, A. and Podolny, J. (2001). Strategic management. New York: John Wiley.

Smithers, R. (2012). UK retailers fail to meet food and packaging waste pledges. [online] the

Guardian. Available at: https://www.theguardian.com/environment/2012/jan/31/retailers-supply-chain-

food-waste [Accessed 24 Jul. 2016].

Telegraph.co.uk. (2016). Tesco to pay £6.5m fine in dairy price fixing settlement. [online] Available

at: http://www.telegraph.co.uk/finance/newsbysector/retailandconsumer/9895895/Tesco-to-pay-6.5m-

fine-in-dairy-price-fixing-settlement.html [Accessed 12 Jul. 2016].

Strategies - New Entrepreneurs Foundation. [online] Available at:

http://newentrepreneursfoundation.com/you-cant-be-the-cheapest-and-the-best-porters-generic-

strategies/ [Accessed 10 Aug. 2016].

Retaileconomics.co.uk. (2016). What does Brexit mean for the economy and the UK retail industry? |

Retail Economics. [online] Available at: http://www.retaileconomics.co.uk/brexit/what-does-brexit-

mean-for-UK-retail [Accessed 7 Aug. 2016].

Retailresearch.org. (2016). UK Retail after Brexit - Centre for Retail Research, Nottingham UK.

[online] Available at: http://www.retailresearch.org/brexit.php [Accessed 3 Aug. 2016].

Retailtechnology.co.uk. (2016). Asdas launches new fulfilment and returns toyou | News | Retail

Technology. [online] Available at: http://www.retailtechnology.co.uk/news/5896/asdas-launches-new-

fulfilment-and-returns-toyou/ [Accessed 7 Aug. 2016].

Ruddick, G. (2016). Top UK firms paid five times more in dividends than into pensions. [online] the

Guardian. Available at: https://www.theguardian.com/money/2016/aug/16/top-uk-firms-paid-five-

times-more-in-dividends-than-into-pensions [Accessed 5 Aug. 2016].

Saloner, G., Shepard, A. and Podolny, J. (2001). Strategic management. New York: John Wiley.

Smithers, R. (2012). UK retailers fail to meet food and packaging waste pledges. [online] the

Guardian. Available at: https://www.theguardian.com/environment/2012/jan/31/retailers-supply-chain-

food-waste [Accessed 24 Jul. 2016].

Telegraph.co.uk. (2016). Tesco to pay £6.5m fine in dairy price fixing settlement. [online] Available

at: http://www.telegraph.co.uk/finance/newsbysector/retailandconsumer/9895895/Tesco-to-pay-6.5m-

fine-in-dairy-price-fixing-settlement.html [Accessed 12 Jul. 2016].

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.