Strategic Analysis of Marks and Spencer: A Comprehensive Study

VerifiedAdded on 2024/05/20

|37

|8022

|302

AI Summary

This comprehensive study delves into the strategic landscape of Marks and Spencer, a renowned British multinational retailer. It analyzes the impact of the macro environment on the organization, assesses its internal capabilities, and evaluates its competitive position using Porter's Five Forces model. The study further explores various strategic directions available to M&S, including generic strategies, growth strategies, and the implementation of a related diversification strategy. It concludes with a strategic plan outlining SMART objectives, strategies, tactics, and evaluation and control mechanisms for M&S to achieve sustainable growth and competitive advantage.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

BUSINESS STRATEGY

1

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

INTRODUCTION................................................................................................................................3

LO1...................................................................................................................................................4

ANALYSE THE IMPACT AND INFLUENCE WHICH THE MACRO ENVIRONMENT HAS ON AN

ORGANISATION............................................................................................................................4

LO2 ASSESS AN ORGANISATION’S INTERNAL ENVIRONMENT AND CAPABILITIES.........................9

LO3 EVALUATE AND APPLY THE OUTCOMES OF AN ANALYSIS USING PORTER’S FIVE FORCES

MODEL TO A GIVEN MARKET SECTOR...........................................................................................14

LO4 APPLY MODELS, THEORIES AND CONCEPTS TO ASSIST WITH THE UNDERSTANDING AND

INTERPRETATION OF STRATEGIC DIRECTIONS AVAILABLE TO AN ORGANISATION......................17

GENERIC STRATEGIES.................................................................................................................17

GROWTH STRATEGIES FOR M&S...............................................................................................19

STRATEGIC PLAN........................................................................................................................25

CONCLUSION.................................................................................................................................27

REFERENCES...................................................................................................................................28

2

INTRODUCTION................................................................................................................................3

LO1...................................................................................................................................................4

ANALYSE THE IMPACT AND INFLUENCE WHICH THE MACRO ENVIRONMENT HAS ON AN

ORGANISATION............................................................................................................................4

LO2 ASSESS AN ORGANISATION’S INTERNAL ENVIRONMENT AND CAPABILITIES.........................9

LO3 EVALUATE AND APPLY THE OUTCOMES OF AN ANALYSIS USING PORTER’S FIVE FORCES

MODEL TO A GIVEN MARKET SECTOR...........................................................................................14

LO4 APPLY MODELS, THEORIES AND CONCEPTS TO ASSIST WITH THE UNDERSTANDING AND

INTERPRETATION OF STRATEGIC DIRECTIONS AVAILABLE TO AN ORGANISATION......................17

GENERIC STRATEGIES.................................................................................................................17

GROWTH STRATEGIES FOR M&S...............................................................................................19

STRATEGIC PLAN........................................................................................................................25

CONCLUSION.................................................................................................................................27

REFERENCES...................................................................................................................................28

2

INTRODUCTION

A strategy is the term which provides direction and scope to the working structure of any

organisation. In this word, the advantages and configuration of the resources within a

challenging environment can meet the needs of the markets. It can further fulfil the

expectation of the stakeholders of the organisation (Favaro, 2015). There are a number of tools

which can assist in the strategic analysis of the external factors that influence the strength and

positioning of the organisation.

Marks and Spencer is a well-known British multinational retailing organisation. It specialises in

the selling of clothes, luxurious food products and home products. M&S was founded in 1884

by Thomas Spencer and Michael Marks in Leeds. The company is listed on London Stock

Exchange ranking on FTSE100 index (Gamble and Thompson, 2014). The business mission

statement is based on the M&S outlined clothing and food business with its core financial

objectives to maximise the preference of their shareholder.

M&S has currently 1483 stores around the globe, among which 615 only sell a food product.

Back in the early 20th century, the establishment of selling British made goods and policies were

entered into a long-term treaty with raise of pay for Supermarine Spitfire fighter aircraft. The

organisation followed those policies and treaty to set competitive advantage to the market. The

company consists 914 stores in the UK and beyond them, 222 are owned and 348 are franchises

stores which provide them with a platform to encounter with more than seven million

registered users across the global market.

3

A strategy is the term which provides direction and scope to the working structure of any

organisation. In this word, the advantages and configuration of the resources within a

challenging environment can meet the needs of the markets. It can further fulfil the

expectation of the stakeholders of the organisation (Favaro, 2015). There are a number of tools

which can assist in the strategic analysis of the external factors that influence the strength and

positioning of the organisation.

Marks and Spencer is a well-known British multinational retailing organisation. It specialises in

the selling of clothes, luxurious food products and home products. M&S was founded in 1884

by Thomas Spencer and Michael Marks in Leeds. The company is listed on London Stock

Exchange ranking on FTSE100 index (Gamble and Thompson, 2014). The business mission

statement is based on the M&S outlined clothing and food business with its core financial

objectives to maximise the preference of their shareholder.

M&S has currently 1483 stores around the globe, among which 615 only sell a food product.

Back in the early 20th century, the establishment of selling British made goods and policies were

entered into a long-term treaty with raise of pay for Supermarine Spitfire fighter aircraft. The

organisation followed those policies and treaty to set competitive advantage to the market. The

company consists 914 stores in the UK and beyond them, 222 are owned and 348 are franchises

stores which provide them with a platform to encounter with more than seven million

registered users across the global market.

3

LO1

ANALYSE THE IMPACT AND INFLUENCE WHICH THE MACRO ENVIRONMENT

HAS ON AN ORGANISATION

M&S has expanded their business through establishing a best practice of retail in society. It is

western managerial giant through which the corporate objectives of business can be

determined as “Making aspirational quality and innovation which are accessible to all”. Marks

and Spencer can foreplay generic strategies through which strong tradition and corporate

responsibilities are integrated with all other operations at each level (Zhu and Chertow, 2017).

Multinational companies and firms who are establishing as subsidiaries and entities in foreign

countries or are depending on integration process of the subsidiary are generally originated

through Origin Company.

Macro-environment factors, as well as the influence of the economic factors, can set the

dimension to correlate with the dimension of research which is interlinked with intercultural

dimension and integration process. A macro environment factor involves the influence of

economic factors of the business through examining the inbound logistics, marketing, outbound

logistics and sales and services.

The company has established their entire business through Middle East, Asia and Europe

through spans of 59 territories and generate revenue of £1.2 billion in their last financial year

(Drucker, 2014). The company has suffered financial crisis from the past years but has

continued to be strong brand as they had maintained their premium pricing, backing and

continuous investment in advertising. The improvement in their sales and share prices has

reversed their grip and had outreach to the competitive retailers. They have also helped the

retailer to build a strong brand positioning through sustaining waste reduction and sourcing

and providing community care.

MISSION OF THE MARKS AND SPENCER

4

ANALYSE THE IMPACT AND INFLUENCE WHICH THE MACRO ENVIRONMENT

HAS ON AN ORGANISATION

M&S has expanded their business through establishing a best practice of retail in society. It is

western managerial giant through which the corporate objectives of business can be

determined as “Making aspirational quality and innovation which are accessible to all”. Marks

and Spencer can foreplay generic strategies through which strong tradition and corporate

responsibilities are integrated with all other operations at each level (Zhu and Chertow, 2017).

Multinational companies and firms who are establishing as subsidiaries and entities in foreign

countries or are depending on integration process of the subsidiary are generally originated

through Origin Company.

Macro-environment factors, as well as the influence of the economic factors, can set the

dimension to correlate with the dimension of research which is interlinked with intercultural

dimension and integration process. A macro environment factor involves the influence of

economic factors of the business through examining the inbound logistics, marketing, outbound

logistics and sales and services.

The company has established their entire business through Middle East, Asia and Europe

through spans of 59 territories and generate revenue of £1.2 billion in their last financial year

(Drucker, 2014). The company has suffered financial crisis from the past years but has

continued to be strong brand as they had maintained their premium pricing, backing and

continuous investment in advertising. The improvement in their sales and share prices has

reversed their grip and had outreach to the competitive retailers. They have also helped the

retailer to build a strong brand positioning through sustaining waste reduction and sourcing

and providing community care.

MISSION OF THE MARKS AND SPENCER

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

The mission of the organisation is to be standard organisation against others in providing the

accessible quality goods to their customer. Further, their mission is to maintain the business on

strong values, innovation, Integrity and Inspiration (Goetsch and Davis, 2014).

VISION OF THE ORGANISATION

The vision of the marks and Spencer is to investigate the economic, social and global

environment which is reliable for them. In order to explore the significance of international

trade and the European dimension for the UK business building, a sustainable future is

essential. By being a business that enables the customer to have a positive impact on well-being

and on communities.

GOAL AND OBJECTIVES

The strategic intent of the organisation is to expand their customer base through sustainability

plan. They will support to 1000 communities and 10 million people to live happier and healthier

lives through Zero Waste Business (Rothaermel, 2015). The objectives of the Marks and Spencer

majorly focus on-

To build its brand

To sustain customer interest in their food stores

To introduce unique design and create unique clothing style

CORE COMPETENCIES

M&S core competencies result in the development of quality products and influencing as a

strong brand and good customer services. The reliability to generate the strong leadership

position to the firm with the development of core product is considered as the core

competency of the organisation (Rothaermel, 2015). It can be foreseen that the customer

benefits can imitate the competitors easily. Thus, leveraging on products and markets helps in

developing an attribute towards outperformance of the competitors and implementing

strategies accordingly.

IMPACT OF MACRO ENVIRONMENT FACTORS IN MARKS AND SPENCER

5

accessible quality goods to their customer. Further, their mission is to maintain the business on

strong values, innovation, Integrity and Inspiration (Goetsch and Davis, 2014).

VISION OF THE ORGANISATION

The vision of the marks and Spencer is to investigate the economic, social and global

environment which is reliable for them. In order to explore the significance of international

trade and the European dimension for the UK business building, a sustainable future is

essential. By being a business that enables the customer to have a positive impact on well-being

and on communities.

GOAL AND OBJECTIVES

The strategic intent of the organisation is to expand their customer base through sustainability

plan. They will support to 1000 communities and 10 million people to live happier and healthier

lives through Zero Waste Business (Rothaermel, 2015). The objectives of the Marks and Spencer

majorly focus on-

To build its brand

To sustain customer interest in their food stores

To introduce unique design and create unique clothing style

CORE COMPETENCIES

M&S core competencies result in the development of quality products and influencing as a

strong brand and good customer services. The reliability to generate the strong leadership

position to the firm with the development of core product is considered as the core

competency of the organisation (Rothaermel, 2015). It can be foreseen that the customer

benefits can imitate the competitors easily. Thus, leveraging on products and markets helps in

developing an attribute towards outperformance of the competitors and implementing

strategies accordingly.

IMPACT OF MACRO ENVIRONMENT FACTORS IN MARKS AND SPENCER

5

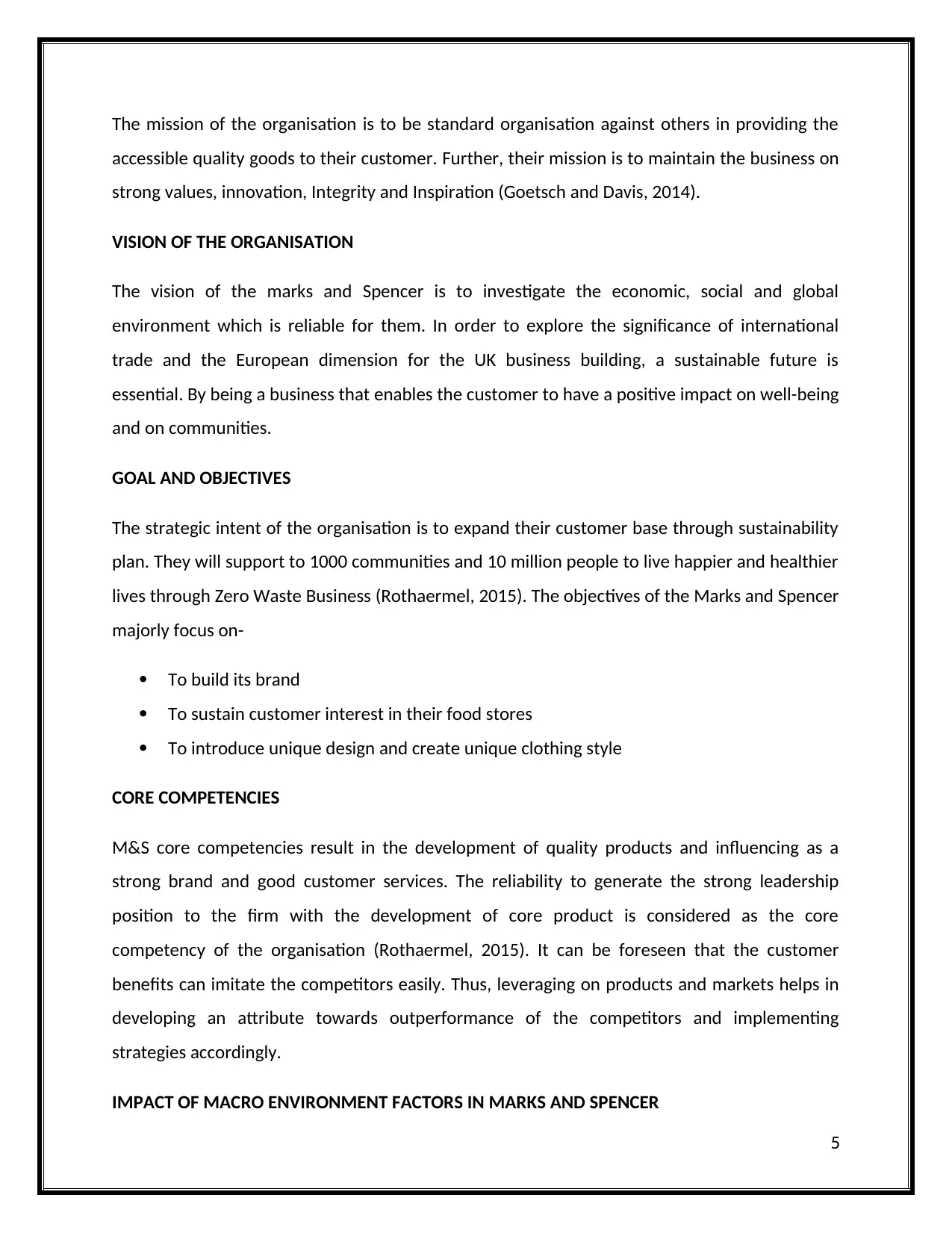

The strategic business analysis of Marks and Spencer can be recorded through performing

PESTEL analysis in order to understand the impact of macro factors in the organisation. A

PESTEL analysis provides an extensive framework to investigate a non-controllable factor by

potential means in order to affect its operations (Morelli, 2018). These measures are likely to

minimise the upcoming risks factors and implications. They can be explained as:

POLITICAL FACTORS

M&S has been favourable in terms of product imports and export under the treaty with the

European Commission’s Free trade agreements. The company has, however; decrease their

cost of outsourcing their products. The working prospects of the business have been affected

after the British EU referendum on 23rd June 2016. It has resulted in a dip in the company's sales

and has increased their cost structure (Anton, 2015). Due to this, the company has to suffer

huge market share loss. The stalled growth in their international business has certainly

decreased profitability and has also affected their overseas operations. The business has

enormously suffered decline due to geopolitical instability and fluctuations in their local

currency. It has resulted in a decrease in consumer demand. The company has eponymously

intestate on their ethical “Plan A” which is based on the green strategy. This has set them into

dealing with the sustainable measures (Paul, et al. 2014). This flagship energy efficiency scheme

has resulted in providing them with a clarity in their business prospects. Initially it has affected

the company's effort but later on, it has outset their business behaviour.

ECONOMIC FACTORS

During the financial crisis in the year 2008, the company has suffered heavy loss in their

customer base as the competitors like Tesco, ALDI and other has offered them discounted

prices product. M&S has an emphasis on providing higher quality products and better customer

satisfaction. This has also however led to decrease in the sale for short-term and increase in

consumer confidence for the long term. The strategy has helped the business to maintain their

market share and achieving their targeted sales in the business (Rauch, et al. 2015). The impact

of Brexit has propounded on the sudden drop of the consumer confidence and fluctuations in

6

PESTEL analysis in order to understand the impact of macro factors in the organisation. A

PESTEL analysis provides an extensive framework to investigate a non-controllable factor by

potential means in order to affect its operations (Morelli, 2018). These measures are likely to

minimise the upcoming risks factors and implications. They can be explained as:

POLITICAL FACTORS

M&S has been favourable in terms of product imports and export under the treaty with the

European Commission’s Free trade agreements. The company has, however; decrease their

cost of outsourcing their products. The working prospects of the business have been affected

after the British EU referendum on 23rd June 2016. It has resulted in a dip in the company's sales

and has increased their cost structure (Anton, 2015). Due to this, the company has to suffer

huge market share loss. The stalled growth in their international business has certainly

decreased profitability and has also affected their overseas operations. The business has

enormously suffered decline due to geopolitical instability and fluctuations in their local

currency. It has resulted in a decrease in consumer demand. The company has eponymously

intestate on their ethical “Plan A” which is based on the green strategy. This has set them into

dealing with the sustainable measures (Paul, et al. 2014). This flagship energy efficiency scheme

has resulted in providing them with a clarity in their business prospects. Initially it has affected

the company's effort but later on, it has outset their business behaviour.

ECONOMIC FACTORS

During the financial crisis in the year 2008, the company has suffered heavy loss in their

customer base as the competitors like Tesco, ALDI and other has offered them discounted

prices product. M&S has an emphasis on providing higher quality products and better customer

satisfaction. This has also however led to decrease in the sale for short-term and increase in

consumer confidence for the long term. The strategy has helped the business to maintain their

market share and achieving their targeted sales in the business (Rauch, et al. 2015). The impact

of Brexit has propounded on the sudden drop of the consumer confidence and fluctuations in

6

the commodities prices. Further, it has negatively impacted on the performance of the stores in

the Middle East.

SOCIO-CULTURAL FACTORS

The factor that has affected the change in the value of population and producing high-quality

products has been affected. With the considerable development in the different generations,

customer preference such as Baby Boomer generation retiring and Generation X and the

Millennial has heavily shifted towards consumer behaviour and their shopping trends along

with channels and technology (Paul, et al. 2014). The two trends that are considered are green

consumerism and customers ethical concerns that contribute to the sustainable development

of the organisation. The introduction to the Plan A has helped the organisation to build

relationships with customers and suppliers. It has also added the organisation to operate with

redistribution partners effectively by organising community shop programme. Further, M&S has

also started a campaign through 1000 employees those who are indulging in community work

and charity action days. The programme named as “Spark Something Good”.

TECHNOLOGICAL FACTORS

M&S is in good strategic position after the proliferation of enjoying benefits by rising mobile

wave. This has increased their business trends and has also increased in speed of

transportation. People associated have seamlessly integrated online behaviour experiences and

physical experiences through setting a platform for the organisation (Goetsch and Davis, 2014).

M&S has launched their own web platform through which they provide services and products

to the people by serving them with deliverables. A predictive analysis of the replenishment and

adaptation of digital strategy result in first mobile approach and resolving the dis-comfortless

with the help of technology. The latest trends to access answer to their customer and meet the

needs of consumers can forefront to the technological development of the company.

7

the Middle East.

SOCIO-CULTURAL FACTORS

The factor that has affected the change in the value of population and producing high-quality

products has been affected. With the considerable development in the different generations,

customer preference such as Baby Boomer generation retiring and Generation X and the

Millennial has heavily shifted towards consumer behaviour and their shopping trends along

with channels and technology (Paul, et al. 2014). The two trends that are considered are green

consumerism and customers ethical concerns that contribute to the sustainable development

of the organisation. The introduction to the Plan A has helped the organisation to build

relationships with customers and suppliers. It has also added the organisation to operate with

redistribution partners effectively by organising community shop programme. Further, M&S has

also started a campaign through 1000 employees those who are indulging in community work

and charity action days. The programme named as “Spark Something Good”.

TECHNOLOGICAL FACTORS

M&S is in good strategic position after the proliferation of enjoying benefits by rising mobile

wave. This has increased their business trends and has also increased in speed of

transportation. People associated have seamlessly integrated online behaviour experiences and

physical experiences through setting a platform for the organisation (Goetsch and Davis, 2014).

M&S has launched their own web platform through which they provide services and products

to the people by serving them with deliverables. A predictive analysis of the replenishment and

adaptation of digital strategy result in first mobile approach and resolving the dis-comfortless

with the help of technology. The latest trends to access answer to their customer and meet the

needs of consumers can forefront to the technological development of the company.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Figure 1: PESTLE Analysis

Source: (Anton, 2015)

ENVIRONMENTAL FACTORS

The formulation of the Plan A has resulted in the environmental and ethical practices

concerning towards the consumer pressure in the business. It has cradled on to grave their

suppliers and disposes on the strategic and tactical practices of the environment (Anton, 2015).

M&S has outset their business curve on reducing the waste and helping stakeholder's

communities. For this plan of action, M&S has been sourced from silver and gold sustainability

standard producers. The charitable activities have been continuously performed by the

organisation to set a transparent supply chain. The company has gained its rank ahead from

their competitors by increasing the development of sustainable products and services through

the implementation of the lucrative strategy.

LEGAL FACTORS

Following the impact of the Brexit on the company, it is likely to face major legal issues

regarding the supply chains, IP rights and international contracts and more (Gamble and

Thompson, 2014). Under the Health and safety regulations, consumer rights and other legal

factors organisation have set an initiative called "Behind the Barcode" through which different

8

Source: (Anton, 2015)

ENVIRONMENTAL FACTORS

The formulation of the Plan A has resulted in the environmental and ethical practices

concerning towards the consumer pressure in the business. It has cradled on to grave their

suppliers and disposes on the strategic and tactical practices of the environment (Anton, 2015).

M&S has outset their business curve on reducing the waste and helping stakeholder's

communities. For this plan of action, M&S has been sourced from silver and gold sustainability

standard producers. The charitable activities have been continuously performed by the

organisation to set a transparent supply chain. The company has gained its rank ahead from

their competitors by increasing the development of sustainable products and services through

the implementation of the lucrative strategy.

LEGAL FACTORS

Following the impact of the Brexit on the company, it is likely to face major legal issues

regarding the supply chains, IP rights and international contracts and more (Gamble and

Thompson, 2014). Under the Health and safety regulations, consumer rights and other legal

factors organisation have set an initiative called "Behind the Barcode" through which different

8

standards such as VAT rules, Online Home delivery services and in-store collection through

scanning a product has been published. The legal environmental practices of the organisation

are paramount on the expansion of ‘Simply Food' by the organisation. M&S has set a

framework to improve their remuneration work and provide greater transparency to their

stakeholders. For this, the company requires put a strategic plan in order to reduce the tariffs

and buying the power of the stakeholders in the market.

9

scanning a product has been published. The legal environmental practices of the organisation

are paramount on the expansion of ‘Simply Food' by the organisation. M&S has set a

framework to improve their remuneration work and provide greater transparency to their

stakeholders. For this, the company requires put a strategic plan in order to reduce the tariffs

and buying the power of the stakeholders in the market.

9

LO2 ASSESS AN ORGANISATION’S INTERNAL ENVIRONMENT AND

CAPABILITIES

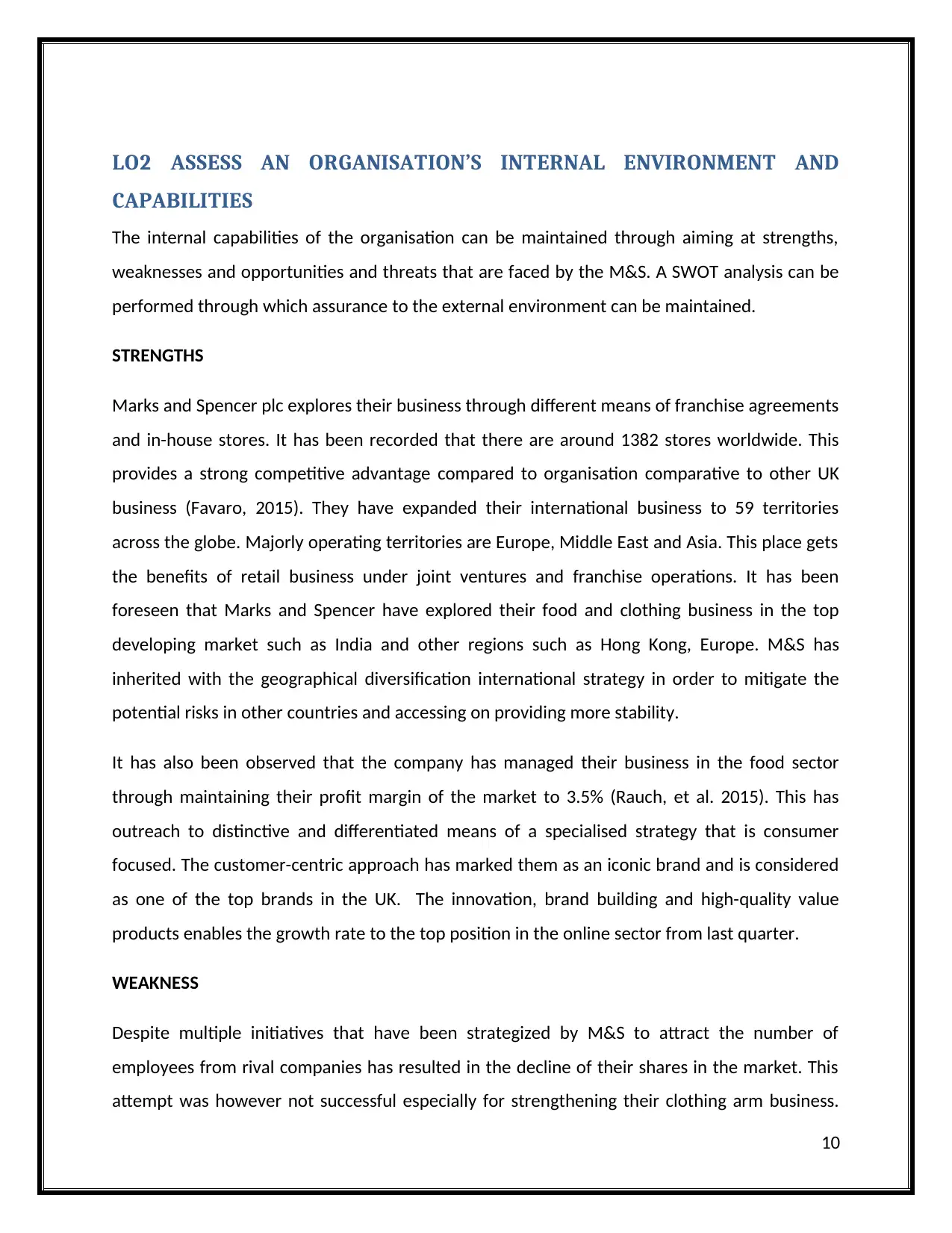

The internal capabilities of the organisation can be maintained through aiming at strengths,

weaknesses and opportunities and threats that are faced by the M&S. A SWOT analysis can be

performed through which assurance to the external environment can be maintained.

STRENGTHS

Marks and Spencer plc explores their business through different means of franchise agreements

and in-house stores. It has been recorded that there are around 1382 stores worldwide. This

provides a strong competitive advantage compared to organisation comparative to other UK

business (Favaro, 2015). They have expanded their international business to 59 territories

across the globe. Majorly operating territories are Europe, Middle East and Asia. This place gets

the benefits of retail business under joint ventures and franchise operations. It has been

foreseen that Marks and Spencer have explored their food and clothing business in the top

developing market such as India and other regions such as Hong Kong, Europe. M&S has

inherited with the geographical diversification international strategy in order to mitigate the

potential risks in other countries and accessing on providing more stability.

It has also been observed that the company has managed their business in the food sector

through maintaining their profit margin of the market to 3.5% (Rauch, et al. 2015). This has

outreach to distinctive and differentiated means of a specialised strategy that is consumer

focused. The customer-centric approach has marked them as an iconic brand and is considered

as one of the top brands in the UK. The innovation, brand building and high-quality value

products enables the growth rate to the top position in the online sector from last quarter.

WEAKNESS

Despite multiple initiatives that have been strategized by M&S to attract the number of

employees from rival companies has resulted in the decline of their shares in the market. This

attempt was however not successful especially for strengthening their clothing arm business.

10

CAPABILITIES

The internal capabilities of the organisation can be maintained through aiming at strengths,

weaknesses and opportunities and threats that are faced by the M&S. A SWOT analysis can be

performed through which assurance to the external environment can be maintained.

STRENGTHS

Marks and Spencer plc explores their business through different means of franchise agreements

and in-house stores. It has been recorded that there are around 1382 stores worldwide. This

provides a strong competitive advantage compared to organisation comparative to other UK

business (Favaro, 2015). They have expanded their international business to 59 territories

across the globe. Majorly operating territories are Europe, Middle East and Asia. This place gets

the benefits of retail business under joint ventures and franchise operations. It has been

foreseen that Marks and Spencer have explored their food and clothing business in the top

developing market such as India and other regions such as Hong Kong, Europe. M&S has

inherited with the geographical diversification international strategy in order to mitigate the

potential risks in other countries and accessing on providing more stability.

It has also been observed that the company has managed their business in the food sector

through maintaining their profit margin of the market to 3.5% (Rauch, et al. 2015). This has

outreach to distinctive and differentiated means of a specialised strategy that is consumer

focused. The customer-centric approach has marked them as an iconic brand and is considered

as one of the top brands in the UK. The innovation, brand building and high-quality value

products enables the growth rate to the top position in the online sector from last quarter.

WEAKNESS

Despite multiple initiatives that have been strategized by M&S to attract the number of

employees from rival companies has resulted in the decline of their shares in the market. This

attempt was however not successful especially for strengthening their clothing arm business.

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

The business has faced steep fall in their upcoming year since 2005 (Rauch, et al. 2015). After

the second quarter of 2016, the company has however grasped the level of stability in their

business. The decline in sales has also resulted in the loss of many key employees leaving the

job and joining to their key competitors.

The company has to face a battle while hiring the new recruits as the expenditure has raised

the bars of the organisation. The investment in the recruitment, hiring, training and

development of the new employees has however resulted in facing risk through potential

contracts and business (Goetsch and Davis, 2014). The new employees were becoming readily

available for the competitors. They have also decided to implement a digital transformation

strategy through which the company can set their own web platform which has also

experienced technical difficulties and privacy breaches. This turns out to be a great loss in their

schemes related to the introduction of their members. It has temporary set a shutdown to the

website.

OPPORTUNITIES

The growth rate in the food business of M&S has outreach to highest peak comparative to their

other services. The sale of the food business has also utilised the trend of expanding its network

through Simply Food, convenience stores and planning the fastest food through the opening

programme. The current prospects of the business to engage their customers were done

through high street stores and online shopping. M&S has also launched number of clubs

through associating members in groups and called it as Sparks. They have also introduced

personalise shopping experience and loyalty schemes (Jayaram, et al. 2014). Some of the

launched initiatives are no monthly fee and £100 gift cards facility. This has also present

opportunities for the company.

THREATS

Once the biggest clothing giant M&S has faced a big slump in sales that has dropped them to

the third position after Primark and Asda. Due to this reason, there has been a phase in which

recession and other macro-environmental factors were weakened (Rothaermel, 2015). It has

11

the second quarter of 2016, the company has however grasped the level of stability in their

business. The decline in sales has also resulted in the loss of many key employees leaving the

job and joining to their key competitors.

The company has to face a battle while hiring the new recruits as the expenditure has raised

the bars of the organisation. The investment in the recruitment, hiring, training and

development of the new employees has however resulted in facing risk through potential

contracts and business (Goetsch and Davis, 2014). The new employees were becoming readily

available for the competitors. They have also decided to implement a digital transformation

strategy through which the company can set their own web platform which has also

experienced technical difficulties and privacy breaches. This turns out to be a great loss in their

schemes related to the introduction of their members. It has temporary set a shutdown to the

website.

OPPORTUNITIES

The growth rate in the food business of M&S has outreach to highest peak comparative to their

other services. The sale of the food business has also utilised the trend of expanding its network

through Simply Food, convenience stores and planning the fastest food through the opening

programme. The current prospects of the business to engage their customers were done

through high street stores and online shopping. M&S has also launched number of clubs

through associating members in groups and called it as Sparks. They have also introduced

personalise shopping experience and loyalty schemes (Jayaram, et al. 2014). Some of the

launched initiatives are no monthly fee and £100 gift cards facility. This has also present

opportunities for the company.

THREATS

Once the biggest clothing giant M&S has faced a big slump in sales that has dropped them to

the third position after Primark and Asda. Due to this reason, there has been a phase in which

recession and other macro-environmental factors were weakened (Rothaermel, 2015). It has

11

been experienced that M&S is still facing challenges in the Middle East. The instability in

political and economic conditions has an upraised threat to operations in Ukraine, Russia and

Middle East areas of franchise operations.

Figure 2: SWOT Analysis

Source: Hill, et al. 2014

Increase in the terror attacks in Europe has also impacted the targeted sales of their stores. It

has been also measured that safety measure has not been focused by the organisation which in

turn result in destroying of large stores (Rothaermel, 2015). The economic uncertainty has

resulted in restructuring their supply chains and also comprise of loss of 8 percent of the

workforce in UK's stores of M&S.

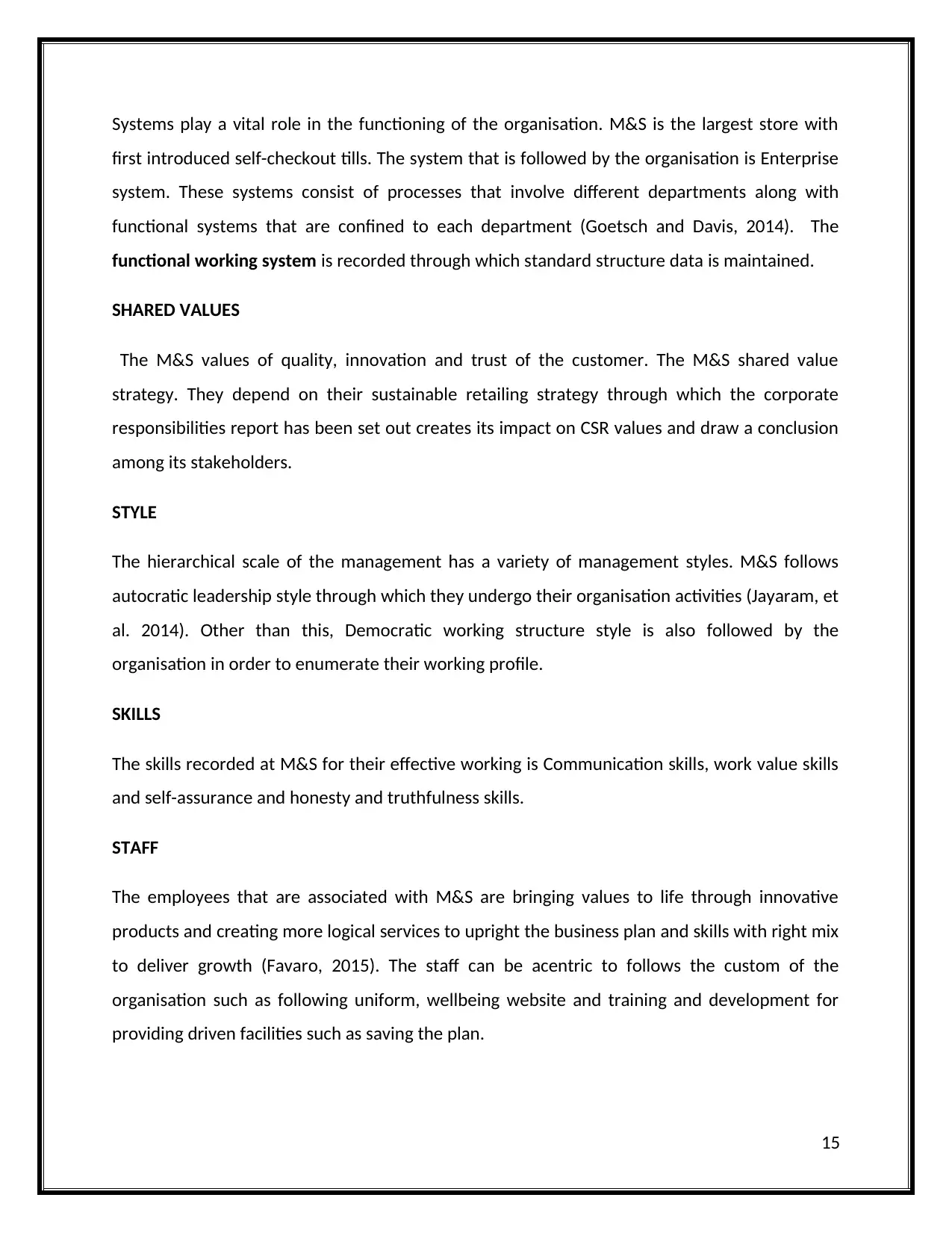

USE OF MCKINSEY FRAMEWORK TO ENLIGHTEN STRENGTHS AND WEAKNESS OF M&S

The use of the McKinsey 7-S framework model can be used in order to align the situations that

are enduring the strengths and weakness of the organisation. The McKinsey 7-S framework

applied to M&S helps in accessing their internal capabilities, strengths and weakness of the

12

political and economic conditions has an upraised threat to operations in Ukraine, Russia and

Middle East areas of franchise operations.

Figure 2: SWOT Analysis

Source: Hill, et al. 2014

Increase in the terror attacks in Europe has also impacted the targeted sales of their stores. It

has been also measured that safety measure has not been focused by the organisation which in

turn result in destroying of large stores (Rothaermel, 2015). The economic uncertainty has

resulted in restructuring their supply chains and also comprise of loss of 8 percent of the

workforce in UK's stores of M&S.

USE OF MCKINSEY FRAMEWORK TO ENLIGHTEN STRENGTHS AND WEAKNESS OF M&S

The use of the McKinsey 7-S framework model can be used in order to align the situations that

are enduring the strengths and weakness of the organisation. The McKinsey 7-S framework

applied to M&S helps in accessing their internal capabilities, strengths and weakness of the

12

organisation. It has been experienced that effective change in future capabilities and alignment

to departmental processes can be merged through this framework (Mitchell, et al. 2015). It

consists of seven elements through which organisation practices can be encountered. They are

classified as Hard and Soft Element.

Hard Elements Soft Elements

Strategy Shared Values

Structure Style

Systems Skills

Staff

Table 1: Hard and Soft Elements of Model

Source: Mitchell, et al. 2015

The elements can be explained as:

STRATEGY

M&S follows competitive pricing strategy through which marketing mix and product portfolio

have been developed. The Marks & Spencer has provided premium quality product through

which they offer a discount on products to get more customers. The dynamic strategy helps in

setting old stock input for sale at a lesser price. The other strategy they promote is a seasonal

sale to loyal customers by offering special discounts under their program named Sparks. Even

they get rewards points on each purchase (Tizroo, et al. 2017). They emphasize on diversity in

each outlet to promote women employees by bringing more female-friendly policies.

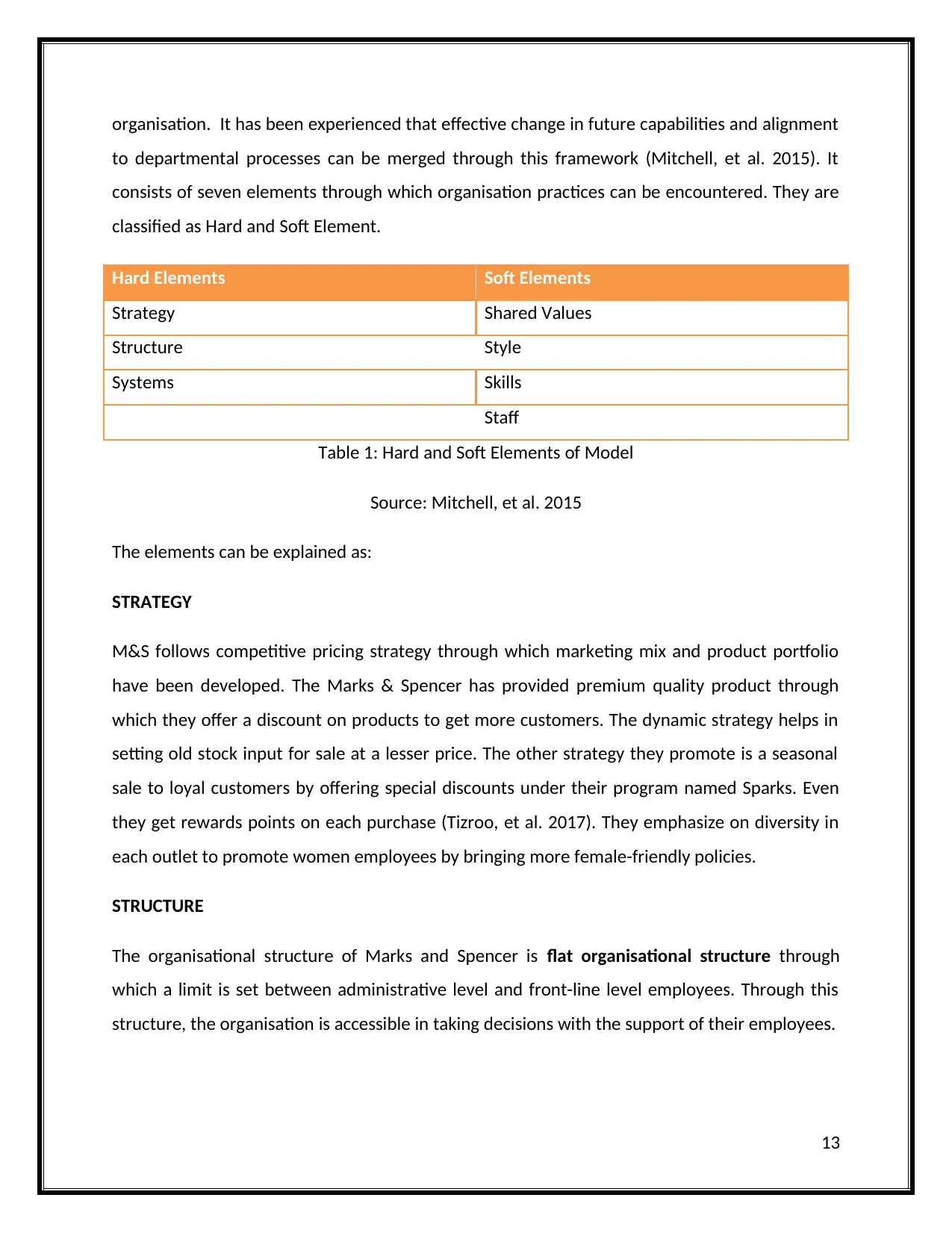

STRUCTURE

The organisational structure of Marks and Spencer is flat organisational structure through

which a limit is set between administrative level and front-line level employees. Through this

structure, the organisation is accessible in taking decisions with the support of their employees.

13

to departmental processes can be merged through this framework (Mitchell, et al. 2015). It

consists of seven elements through which organisation practices can be encountered. They are

classified as Hard and Soft Element.

Hard Elements Soft Elements

Strategy Shared Values

Structure Style

Systems Skills

Staff

Table 1: Hard and Soft Elements of Model

Source: Mitchell, et al. 2015

The elements can be explained as:

STRATEGY

M&S follows competitive pricing strategy through which marketing mix and product portfolio

have been developed. The Marks & Spencer has provided premium quality product through

which they offer a discount on products to get more customers. The dynamic strategy helps in

setting old stock input for sale at a lesser price. The other strategy they promote is a seasonal

sale to loyal customers by offering special discounts under their program named Sparks. Even

they get rewards points on each purchase (Tizroo, et al. 2017). They emphasize on diversity in

each outlet to promote women employees by bringing more female-friendly policies.

STRUCTURE

The organisational structure of Marks and Spencer is flat organisational structure through

which a limit is set between administrative level and front-line level employees. Through this

structure, the organisation is accessible in taking decisions with the support of their employees.

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Figure 3: Flat organisational Structure

Source: Tizroo, et al. 2017

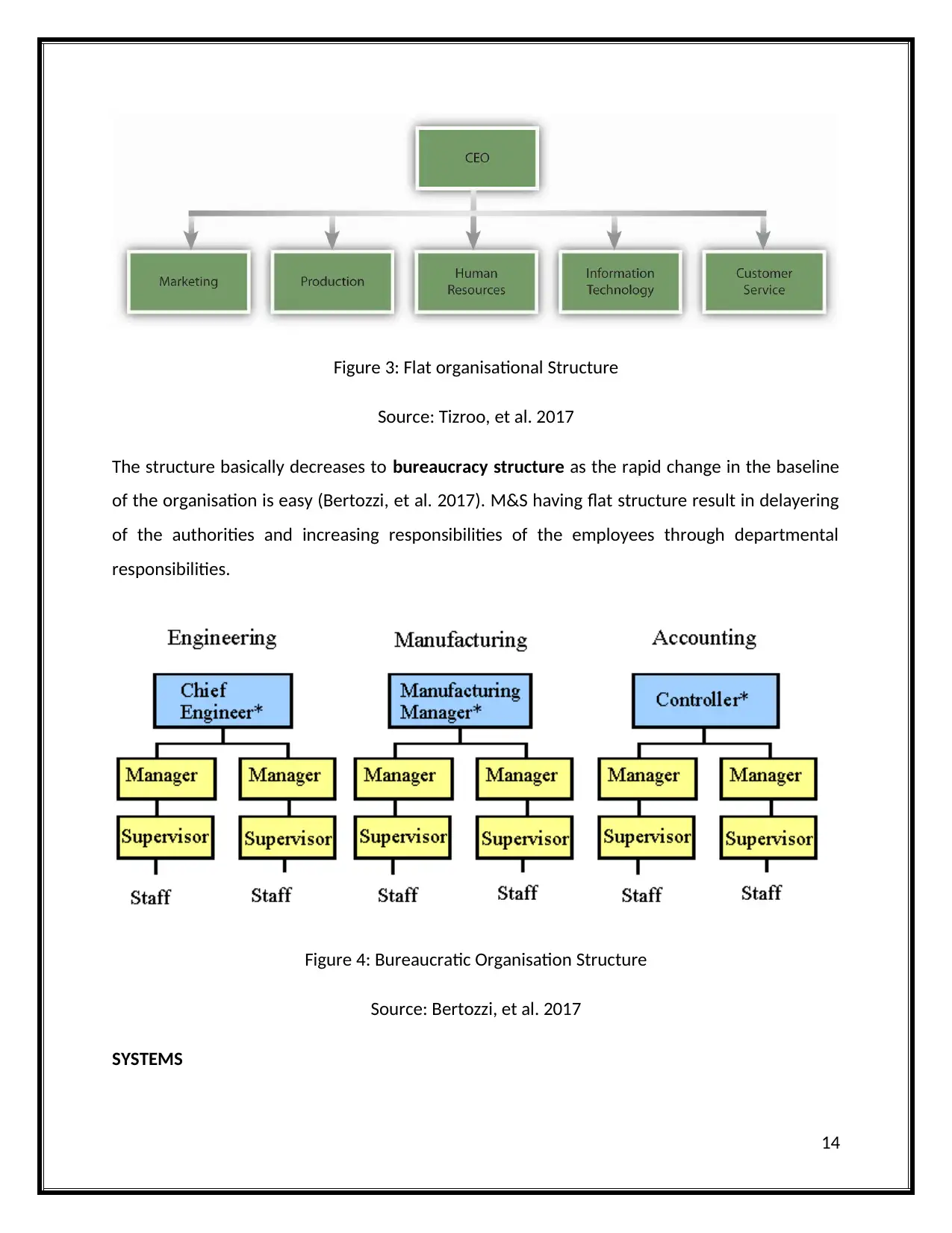

The structure basically decreases to bureaucracy structure as the rapid change in the baseline

of the organisation is easy (Bertozzi, et al. 2017). M&S having flat structure result in delayering

of the authorities and increasing responsibilities of the employees through departmental

responsibilities.

Figure 4: Bureaucratic Organisation Structure

Source: Bertozzi, et al. 2017

SYSTEMS

14

Source: Tizroo, et al. 2017

The structure basically decreases to bureaucracy structure as the rapid change in the baseline

of the organisation is easy (Bertozzi, et al. 2017). M&S having flat structure result in delayering

of the authorities and increasing responsibilities of the employees through departmental

responsibilities.

Figure 4: Bureaucratic Organisation Structure

Source: Bertozzi, et al. 2017

SYSTEMS

14

Systems play a vital role in the functioning of the organisation. M&S is the largest store with

first introduced self-checkout tills. The system that is followed by the organisation is Enterprise

system. These systems consist of processes that involve different departments along with

functional systems that are confined to each department (Goetsch and Davis, 2014). The

functional working system is recorded through which standard structure data is maintained.

SHARED VALUES

The M&S values of quality, innovation and trust of the customer. The M&S shared value

strategy. They depend on their sustainable retailing strategy through which the corporate

responsibilities report has been set out creates its impact on CSR values and draw a conclusion

among its stakeholders.

STYLE

The hierarchical scale of the management has a variety of management styles. M&S follows

autocratic leadership style through which they undergo their organisation activities (Jayaram, et

al. 2014). Other than this, Democratic working structure style is also followed by the

organisation in order to enumerate their working profile.

SKILLS

The skills recorded at M&S for their effective working is Communication skills, work value skills

and self-assurance and honesty and truthfulness skills.

STAFF

The employees that are associated with M&S are bringing values to life through innovative

products and creating more logical services to upright the business plan and skills with right mix

to deliver growth (Favaro, 2015). The staff can be acentric to follows the custom of the

organisation such as following uniform, wellbeing website and training and development for

providing driven facilities such as saving the plan.

15

first introduced self-checkout tills. The system that is followed by the organisation is Enterprise

system. These systems consist of processes that involve different departments along with

functional systems that are confined to each department (Goetsch and Davis, 2014). The

functional working system is recorded through which standard structure data is maintained.

SHARED VALUES

The M&S values of quality, innovation and trust of the customer. The M&S shared value

strategy. They depend on their sustainable retailing strategy through which the corporate

responsibilities report has been set out creates its impact on CSR values and draw a conclusion

among its stakeholders.

STYLE

The hierarchical scale of the management has a variety of management styles. M&S follows

autocratic leadership style through which they undergo their organisation activities (Jayaram, et

al. 2014). Other than this, Democratic working structure style is also followed by the

organisation in order to enumerate their working profile.

SKILLS

The skills recorded at M&S for their effective working is Communication skills, work value skills

and self-assurance and honesty and truthfulness skills.

STAFF

The employees that are associated with M&S are bringing values to life through innovative

products and creating more logical services to upright the business plan and skills with right mix

to deliver growth (Favaro, 2015). The staff can be acentric to follows the custom of the

organisation such as following uniform, wellbeing website and training and development for

providing driven facilities such as saving the plan.

15

Figure 4: Mckinsey Model 7S

Source: Favaro, 2015

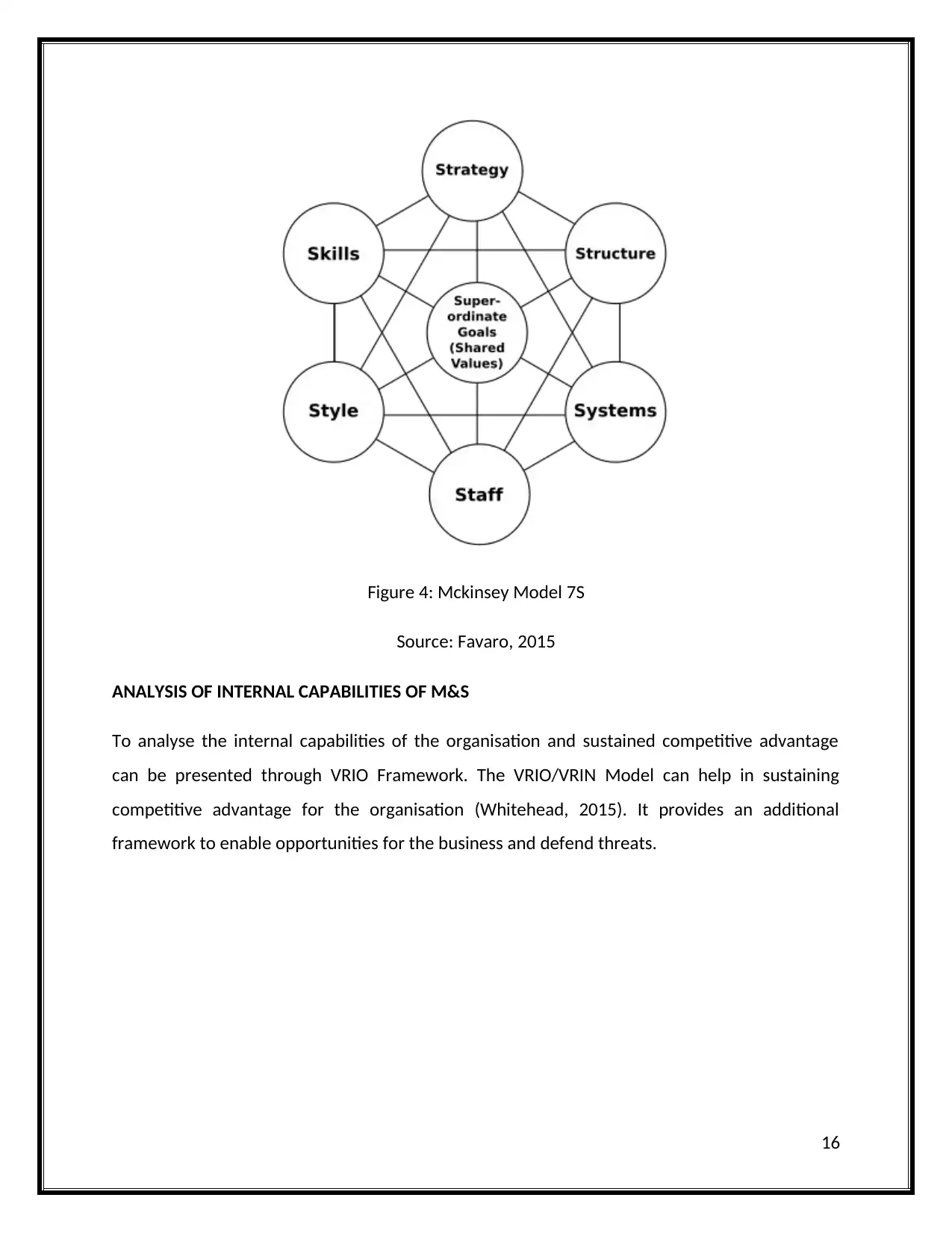

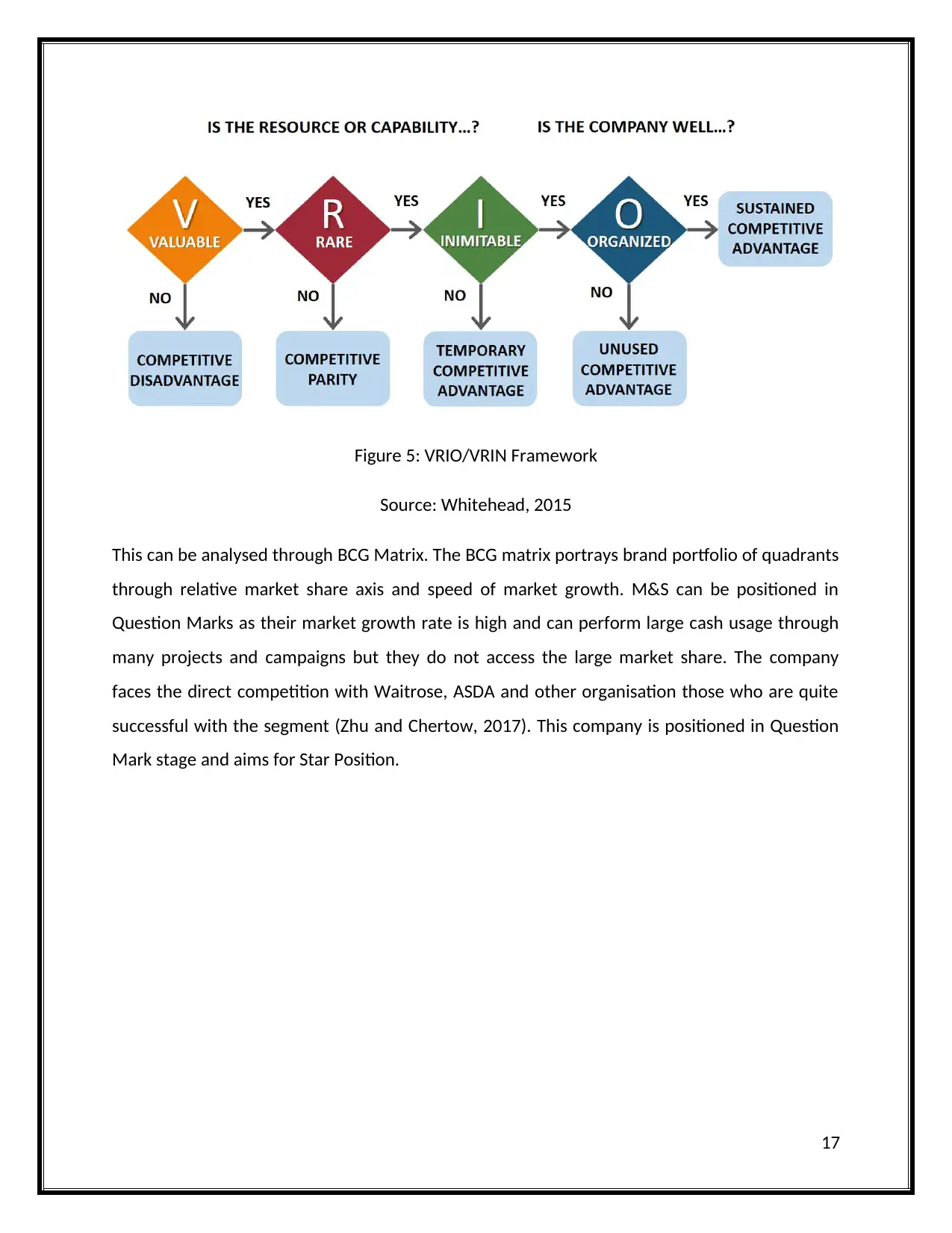

ANALYSIS OF INTERNAL CAPABILITIES OF M&S

To analyse the internal capabilities of the organisation and sustained competitive advantage

can be presented through VRIO Framework. The VRIO/VRIN Model can help in sustaining

competitive advantage for the organisation (Whitehead, 2015). It provides an additional

framework to enable opportunities for the business and defend threats.

16

Source: Favaro, 2015

ANALYSIS OF INTERNAL CAPABILITIES OF M&S

To analyse the internal capabilities of the organisation and sustained competitive advantage

can be presented through VRIO Framework. The VRIO/VRIN Model can help in sustaining

competitive advantage for the organisation (Whitehead, 2015). It provides an additional

framework to enable opportunities for the business and defend threats.

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Figure 5: VRIO/VRIN Framework

Source: Whitehead, 2015

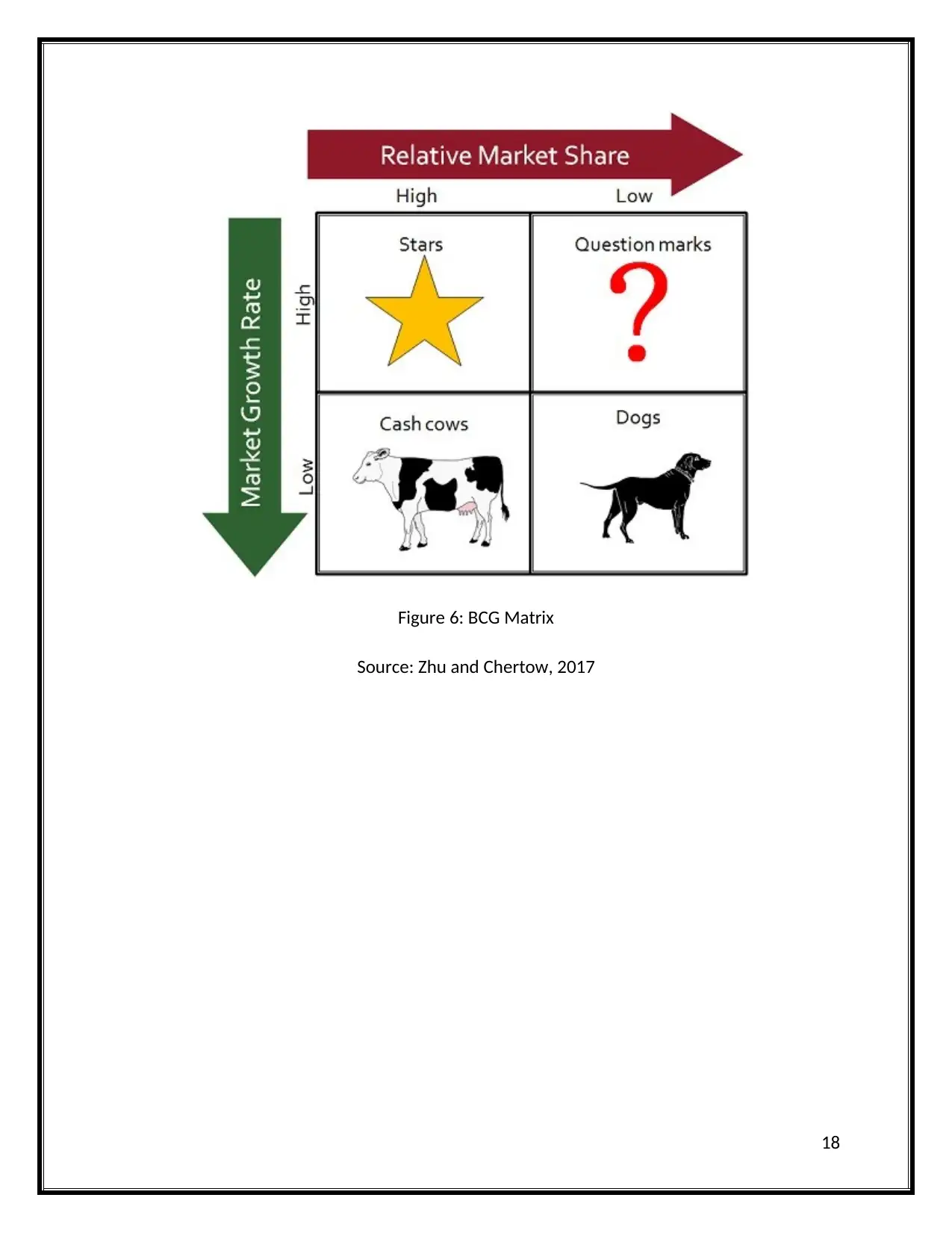

This can be analysed through BCG Matrix. The BCG matrix portrays brand portfolio of quadrants

through relative market share axis and speed of market growth. M&S can be positioned in

Question Marks as their market growth rate is high and can perform large cash usage through

many projects and campaigns but they do not access the large market share. The company

faces the direct competition with Waitrose, ASDA and other organisation those who are quite

successful with the segment (Zhu and Chertow, 2017). This company is positioned in Question

Mark stage and aims for Star Position.

17

Source: Whitehead, 2015

This can be analysed through BCG Matrix. The BCG matrix portrays brand portfolio of quadrants

through relative market share axis and speed of market growth. M&S can be positioned in

Question Marks as their market growth rate is high and can perform large cash usage through

many projects and campaigns but they do not access the large market share. The company

faces the direct competition with Waitrose, ASDA and other organisation those who are quite

successful with the segment (Zhu and Chertow, 2017). This company is positioned in Question

Mark stage and aims for Star Position.

17

Figure 6: BCG Matrix

Source: Zhu and Chertow, 2017

18

Source: Zhu and Chertow, 2017

18

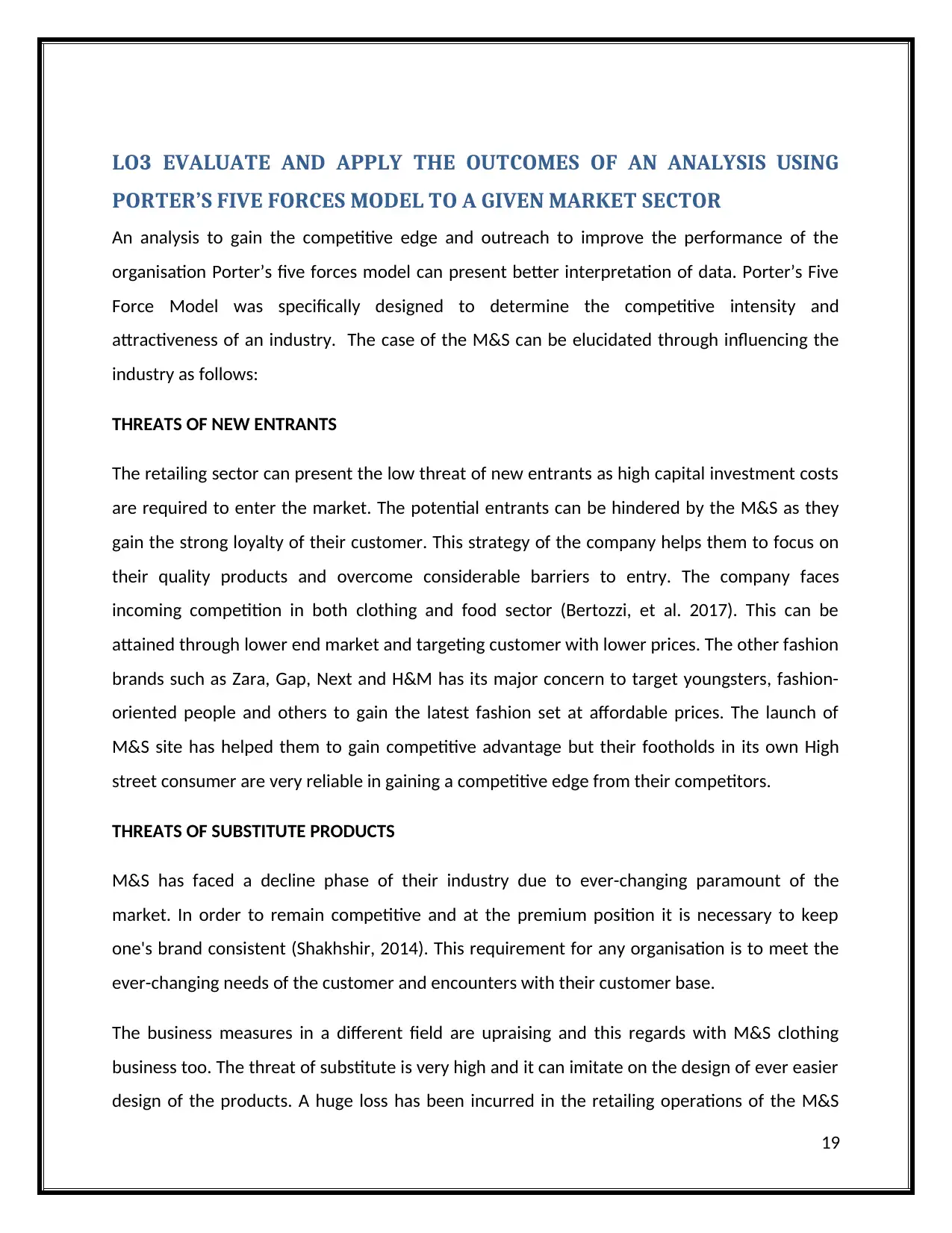

LO3 EVALUATE AND APPLY THE OUTCOMES OF AN ANALYSIS USING

PORTER’S FIVE FORCES MODEL TO A GIVEN MARKET SECTOR

An analysis to gain the competitive edge and outreach to improve the performance of the

organisation Porter’s five forces model can present better interpretation of data. Porter’s Five

Force Model was specifically designed to determine the competitive intensity and

attractiveness of an industry. The case of the M&S can be elucidated through influencing the

industry as follows:

THREATS OF NEW ENTRANTS

The retailing sector can present the low threat of new entrants as high capital investment costs

are required to enter the market. The potential entrants can be hindered by the M&S as they

gain the strong loyalty of their customer. This strategy of the company helps them to focus on

their quality products and overcome considerable barriers to entry. The company faces

incoming competition in both clothing and food sector (Bertozzi, et al. 2017). This can be

attained through lower end market and targeting customer with lower prices. The other fashion

brands such as Zara, Gap, Next and H&M has its major concern to target youngsters, fashion-

oriented people and others to gain the latest fashion set at affordable prices. The launch of

M&S site has helped them to gain competitive advantage but their footholds in its own High

street consumer are very reliable in gaining a competitive edge from their competitors.

THREATS OF SUBSTITUTE PRODUCTS

M&S has faced a decline phase of their industry due to ever-changing paramount of the

market. In order to remain competitive and at the premium position it is necessary to keep

one's brand consistent (Shakhshir, 2014). This requirement for any organisation is to meet the

ever-changing needs of the customer and encounters with their customer base.

The business measures in a different field are upraising and this regards with M&S clothing

business too. The threat of substitute is very high and it can imitate on the design of ever easier

design of the products. A huge loss has been incurred in the retailing operations of the M&S

19

PORTER’S FIVE FORCES MODEL TO A GIVEN MARKET SECTOR

An analysis to gain the competitive edge and outreach to improve the performance of the

organisation Porter’s five forces model can present better interpretation of data. Porter’s Five

Force Model was specifically designed to determine the competitive intensity and

attractiveness of an industry. The case of the M&S can be elucidated through influencing the

industry as follows:

THREATS OF NEW ENTRANTS

The retailing sector can present the low threat of new entrants as high capital investment costs

are required to enter the market. The potential entrants can be hindered by the M&S as they

gain the strong loyalty of their customer. This strategy of the company helps them to focus on

their quality products and overcome considerable barriers to entry. The company faces

incoming competition in both clothing and food sector (Bertozzi, et al. 2017). This can be

attained through lower end market and targeting customer with lower prices. The other fashion

brands such as Zara, Gap, Next and H&M has its major concern to target youngsters, fashion-

oriented people and others to gain the latest fashion set at affordable prices. The launch of

M&S site has helped them to gain competitive advantage but their footholds in its own High

street consumer are very reliable in gaining a competitive edge from their competitors.

THREATS OF SUBSTITUTE PRODUCTS

M&S has faced a decline phase of their industry due to ever-changing paramount of the

market. In order to remain competitive and at the premium position it is necessary to keep

one's brand consistent (Shakhshir, 2014). This requirement for any organisation is to meet the

ever-changing needs of the customer and encounters with their customer base.

The business measures in a different field are upraising and this regards with M&S clothing

business too. The threat of substitute is very high and it can imitate on the design of ever easier

design of the products. A huge loss has been incurred in the retailing operations of the M&S

19

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

post-1990s which relate to the foreign imports. This has taken a threatening shift in the

customer preferences regarding the brand label and other measures were obtained. The

potential shift of the shop for a label or look for similar quality products can be offered through

maintaining better price. As regards, different company’s food stores business has also

developed a high range of quality foods and abandons the traditional market of M&S

(Mathooko and Ogutu, 2015).

BARGAINING POWER OF BUYERS

In the retailing sector in which the M&S industry operates rely on the bargaining power of the

customer. Therefore, it is consistent to say that bargaining power is high. It has also resulted in

pricing as the customer seeks for the fashionable designed items which instinct with a shift in

the consumer market. It has been experienced that disloyalty of UK consumers to British

products has affected retailers in heavily. The primary product-oriented strategy of the

company has placed a strong emphasis on its brand and are employing their customer through

customer-oriented approach (Mathooko and Ogutu, 2015). This helps in building strong

consumer relationships through which weaker consumer confidence can be approached. The

impact of Brexit has resulted in a decrease in growth of sales. However, cutting of the

employees (recession) and prices upshot to provide customer satisfactory results.

BARGAINING POWER OF SUPPLIERS

The M&S organisation was priory dependent on British suppliers due to which they had

experienced high bargaining power. Later on post-1990s, there was a sudden decline in sales as

the suppliers overseas have offered more competitive prices in order to outsource their

product globally. The company’s accounts significant competitive advantage through which

they enhance the bargaining power of its suppliers which is currently low (Paul, et al. 2014). It is

necessary to provide a considerable result to the British Suppliers as to overcome the declining

stage of the bargaining power of industry in terms of bargaining power of its suppliers.

INTENSITY OF COMPETITIVE RIVALRY

20

customer preferences regarding the brand label and other measures were obtained. The

potential shift of the shop for a label or look for similar quality products can be offered through

maintaining better price. As regards, different company’s food stores business has also

developed a high range of quality foods and abandons the traditional market of M&S

(Mathooko and Ogutu, 2015).

BARGAINING POWER OF BUYERS

In the retailing sector in which the M&S industry operates rely on the bargaining power of the

customer. Therefore, it is consistent to say that bargaining power is high. It has also resulted in

pricing as the customer seeks for the fashionable designed items which instinct with a shift in

the consumer market. It has been experienced that disloyalty of UK consumers to British

products has affected retailers in heavily. The primary product-oriented strategy of the

company has placed a strong emphasis on its brand and are employing their customer through

customer-oriented approach (Mathooko and Ogutu, 2015). This helps in building strong

consumer relationships through which weaker consumer confidence can be approached. The

impact of Brexit has resulted in a decrease in growth of sales. However, cutting of the

employees (recession) and prices upshot to provide customer satisfactory results.

BARGAINING POWER OF SUPPLIERS

The M&S organisation was priory dependent on British suppliers due to which they had

experienced high bargaining power. Later on post-1990s, there was a sudden decline in sales as

the suppliers overseas have offered more competitive prices in order to outsource their

product globally. The company’s accounts significant competitive advantage through which

they enhance the bargaining power of its suppliers which is currently low (Paul, et al. 2014). It is

necessary to provide a considerable result to the British Suppliers as to overcome the declining

stage of the bargaining power of industry in terms of bargaining power of its suppliers.

INTENSITY OF COMPETITIVE RIVALRY

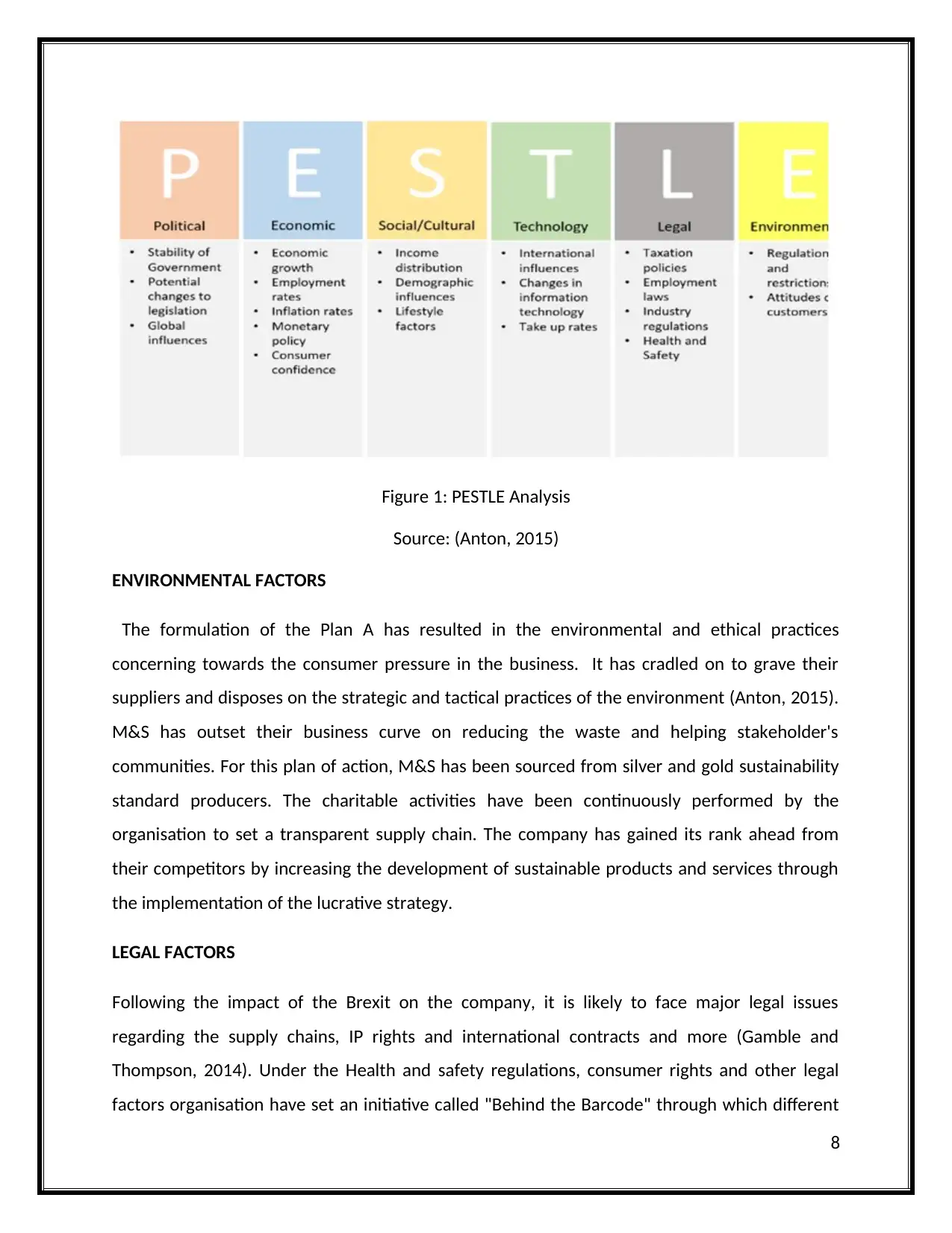

20

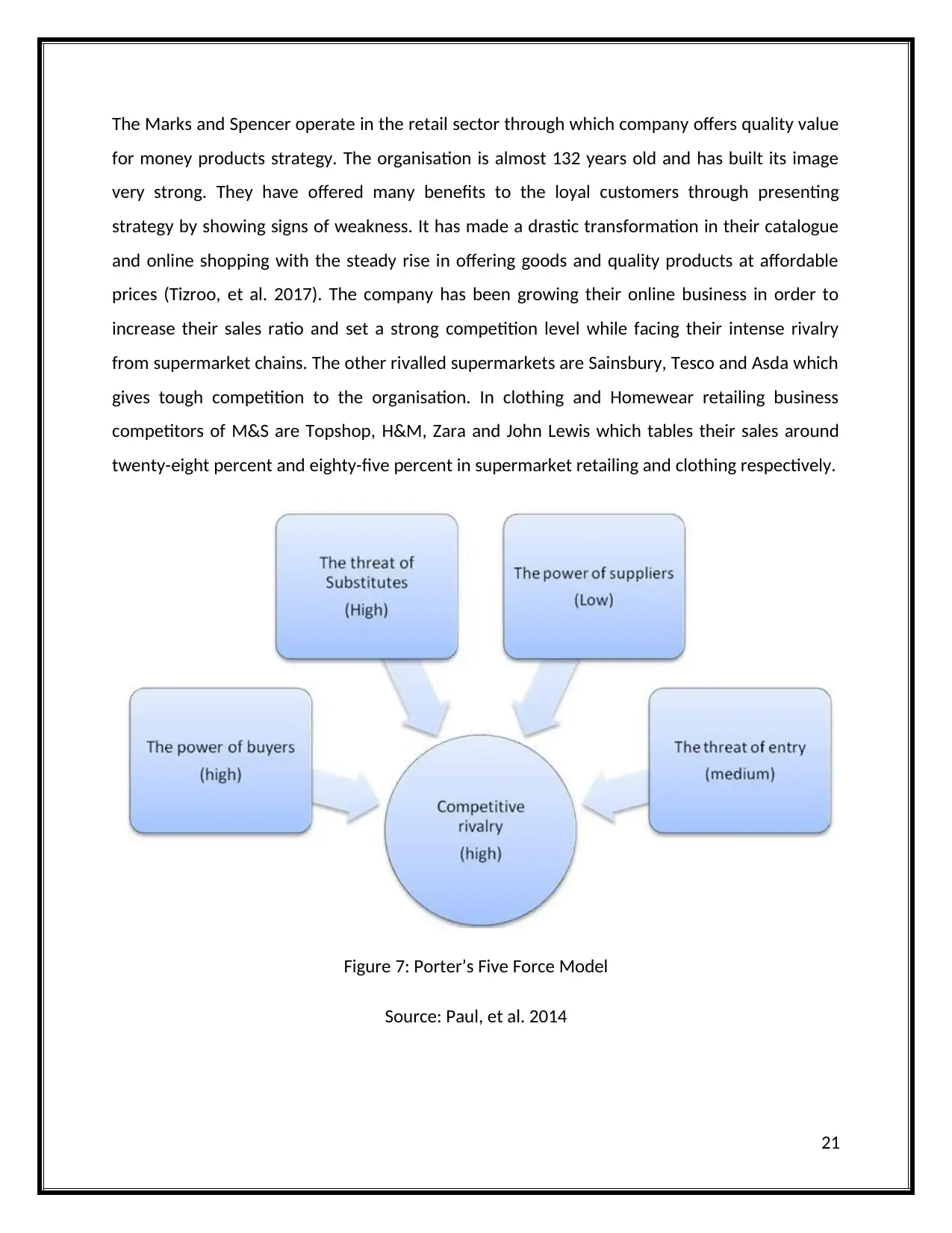

The Marks and Spencer operate in the retail sector through which company offers quality value

for money products strategy. The organisation is almost 132 years old and has built its image

very strong. They have offered many benefits to the loyal customers through presenting

strategy by showing signs of weakness. It has made a drastic transformation in their catalogue

and online shopping with the steady rise in offering goods and quality products at affordable

prices (Tizroo, et al. 2017). The company has been growing their online business in order to

increase their sales ratio and set a strong competition level while facing their intense rivalry

from supermarket chains. The other rivalled supermarkets are Sainsbury, Tesco and Asda which

gives tough competition to the organisation. In clothing and Homewear retailing business

competitors of M&S are Topshop, H&M, Zara and John Lewis which tables their sales around

twenty-eight percent and eighty-five percent in supermarket retailing and clothing respectively.

Figure 7: Porter’s Five Force Model

Source: Paul, et al. 2014

21

for money products strategy. The organisation is almost 132 years old and has built its image

very strong. They have offered many benefits to the loyal customers through presenting

strategy by showing signs of weakness. It has made a drastic transformation in their catalogue

and online shopping with the steady rise in offering goods and quality products at affordable

prices (Tizroo, et al. 2017). The company has been growing their online business in order to

increase their sales ratio and set a strong competition level while facing their intense rivalry

from supermarket chains. The other rivalled supermarkets are Sainsbury, Tesco and Asda which

gives tough competition to the organisation. In clothing and Homewear retailing business

competitors of M&S are Topshop, H&M, Zara and John Lewis which tables their sales around

twenty-eight percent and eighty-five percent in supermarket retailing and clothing respectively.

Figure 7: Porter’s Five Force Model

Source: Paul, et al. 2014

21

22

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

LO4 APPLY MODELS, THEORIES AND CONCEPTS TO ASSIST WITH THE

UNDERSTANDING AND INTERPRETATION OF STRATEGIC DIRECTIONS

AVAILABLE TO AN ORGANISATION

A strategic plan of M&S can be developed in order to achieve different business objectives. For

the development of an effective plan, it is crucial to focus on the different types of strategic

direction available to the M&S.

GENERIC STRATEGIES

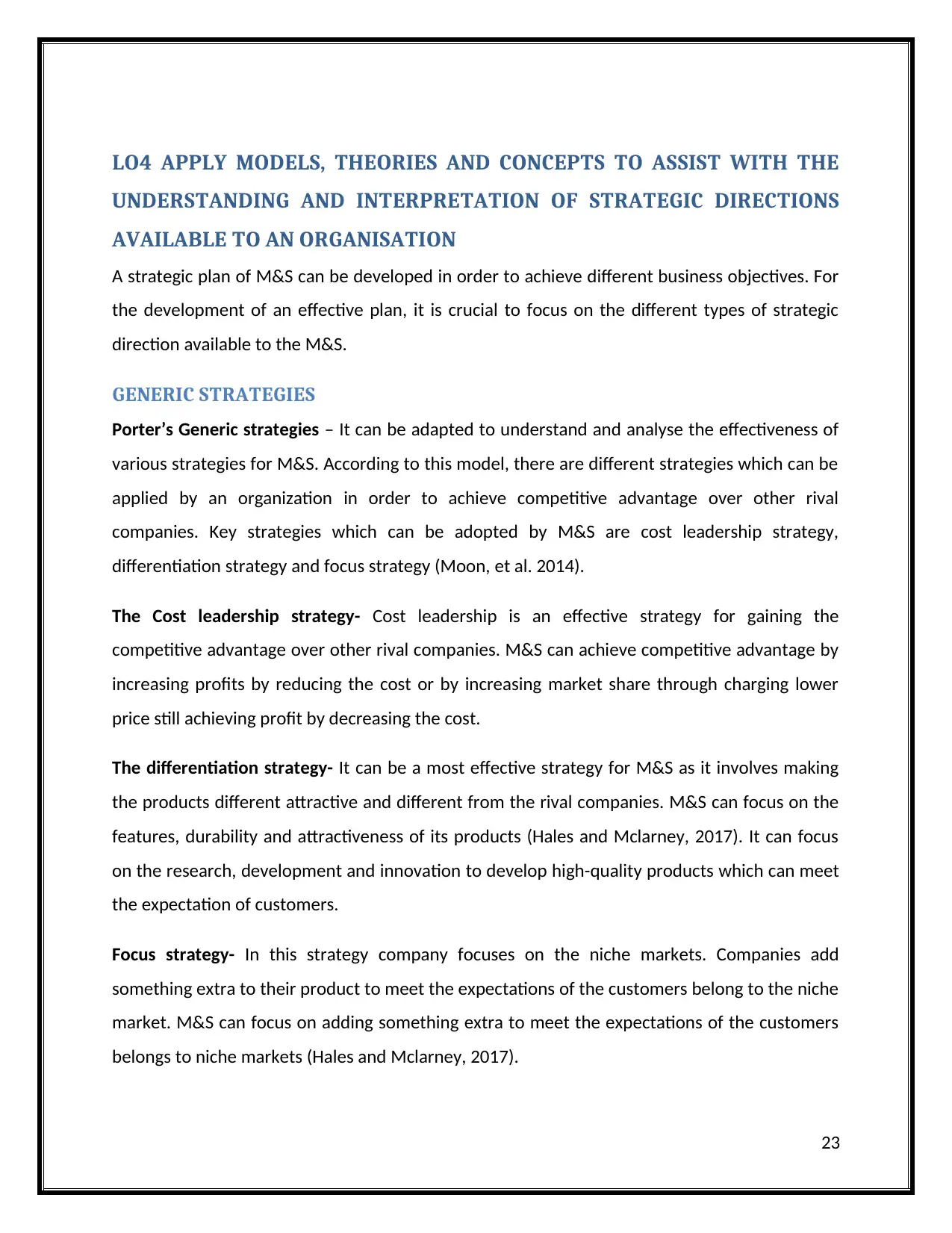

Porter’s Generic strategies – It can be adapted to understand and analyse the effectiveness of

various strategies for M&S. According to this model, there are different strategies which can be

applied by an organization in order to achieve competitive advantage over other rival

companies. Key strategies which can be adopted by M&S are cost leadership strategy,

differentiation strategy and focus strategy (Moon, et al. 2014).

The Cost leadership strategy- Cost leadership is an effective strategy for gaining the

competitive advantage over other rival companies. M&S can achieve competitive advantage by

increasing profits by reducing the cost or by increasing market share through charging lower

price still achieving profit by decreasing the cost.

The differentiation strategy- It can be a most effective strategy for M&S as it involves making

the products different attractive and different from the rival companies. M&S can focus on the

features, durability and attractiveness of its products (Hales and Mclarney, 2017). It can focus

on the research, development and innovation to develop high-quality products which can meet

the expectation of customers.

Focus strategy- In this strategy company focuses on the niche markets. Companies add

something extra to their product to meet the expectations of the customers belong to the niche

market. M&S can focus on adding something extra to meet the expectations of the customers

belongs to niche markets (Hales and Mclarney, 2017).

23

UNDERSTANDING AND INTERPRETATION OF STRATEGIC DIRECTIONS

AVAILABLE TO AN ORGANISATION

A strategic plan of M&S can be developed in order to achieve different business objectives. For

the development of an effective plan, it is crucial to focus on the different types of strategic

direction available to the M&S.

GENERIC STRATEGIES

Porter’s Generic strategies – It can be adapted to understand and analyse the effectiveness of

various strategies for M&S. According to this model, there are different strategies which can be

applied by an organization in order to achieve competitive advantage over other rival

companies. Key strategies which can be adopted by M&S are cost leadership strategy,

differentiation strategy and focus strategy (Moon, et al. 2014).

The Cost leadership strategy- Cost leadership is an effective strategy for gaining the

competitive advantage over other rival companies. M&S can achieve competitive advantage by

increasing profits by reducing the cost or by increasing market share through charging lower

price still achieving profit by decreasing the cost.

The differentiation strategy- It can be a most effective strategy for M&S as it involves making

the products different attractive and different from the rival companies. M&S can focus on the

features, durability and attractiveness of its products (Hales and Mclarney, 2017). It can focus

on the research, development and innovation to develop high-quality products which can meet

the expectation of customers.

Focus strategy- In this strategy company focuses on the niche markets. Companies add

something extra to their product to meet the expectations of the customers belong to the niche

market. M&S can focus on adding something extra to meet the expectations of the customers

belongs to niche markets (Hales and Mclarney, 2017).

23

Figure 8: Porter’s Five Strategies

Source: Shakhshir, 2014

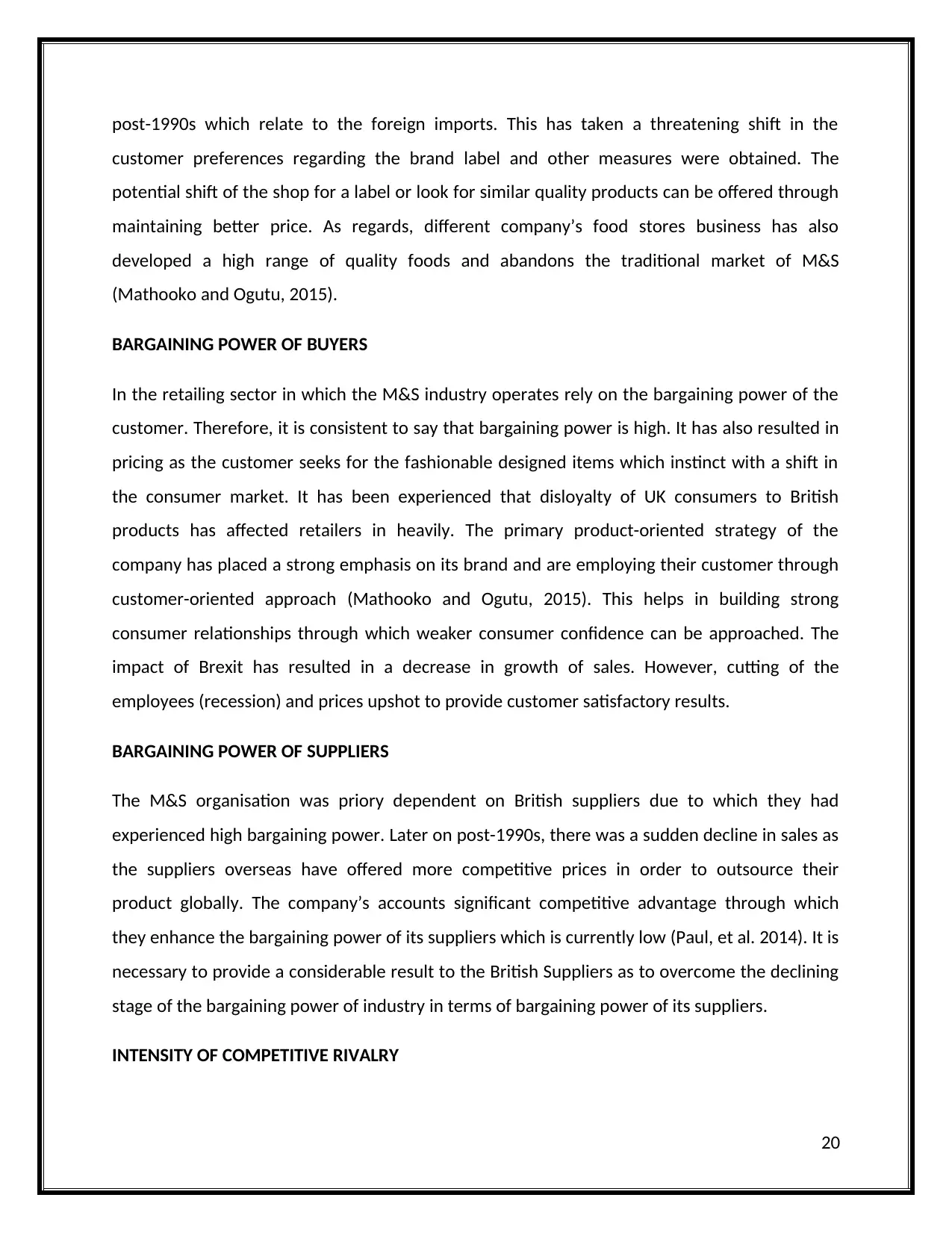

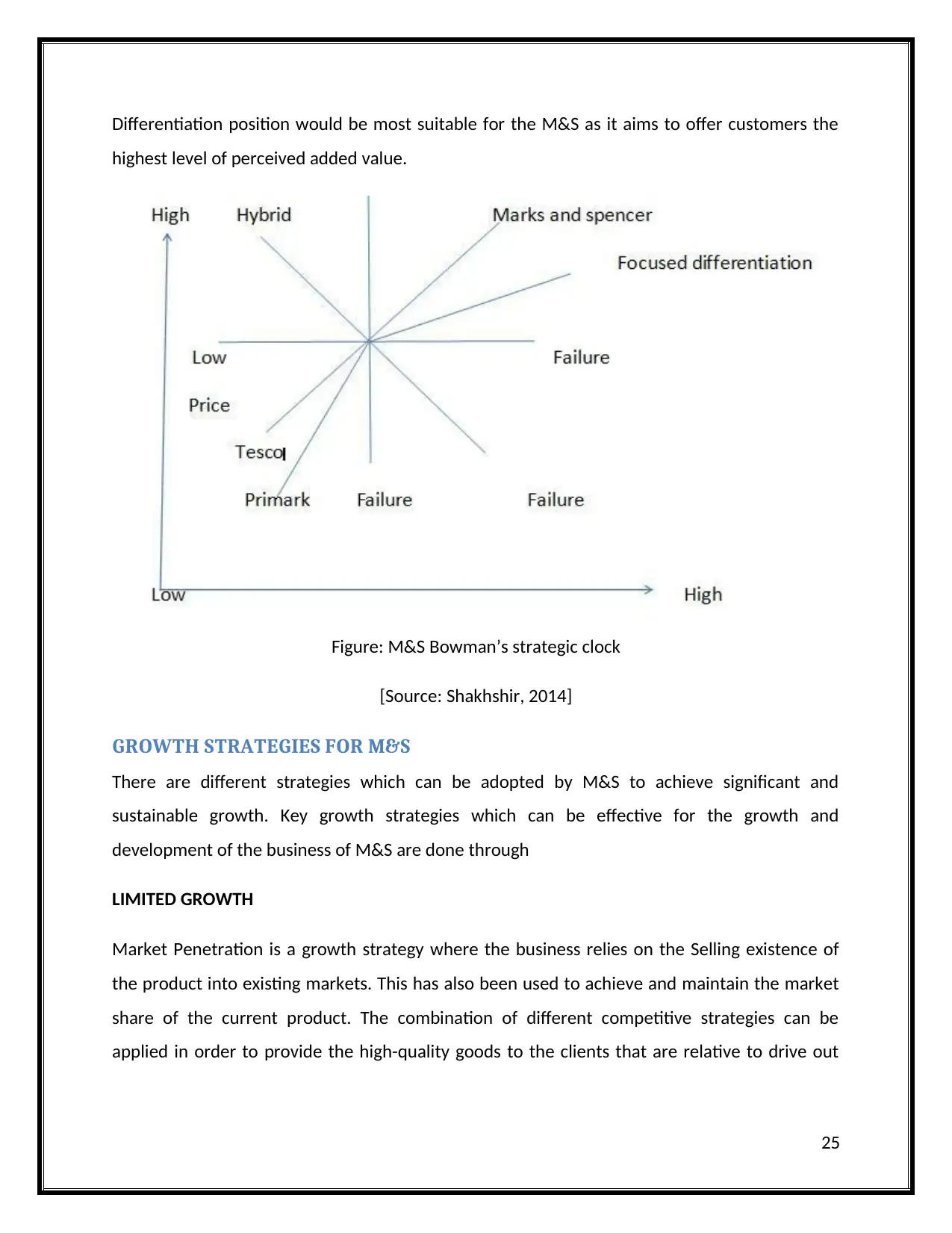

BOWMAN’S STRATEGIC CLOCK MODEL

Bowman’s strategic clock is another important model that can be adopted by a company to

position its product or service to achieve the most competitive position in the market. It helps

a company to positions its product on the basis of two dimensions that are price and perceived

value. This model describes eight different positions which can be considered by a company to

gain the competitive advantage (Shakhshir, 2014). These positions are low price and low added

value, low price, hybrid, differentiation, focused differentiation, risky high margins, monopoly

pricing and loss of market share. M&S can focus on the hybrid, differentiation and focused

differentiation position to achieve the competitive advantage over its rival companies.

24

Source: Shakhshir, 2014

BOWMAN’S STRATEGIC CLOCK MODEL

Bowman’s strategic clock is another important model that can be adopted by a company to

position its product or service to achieve the most competitive position in the market. It helps

a company to positions its product on the basis of two dimensions that are price and perceived

value. This model describes eight different positions which can be considered by a company to

gain the competitive advantage (Shakhshir, 2014). These positions are low price and low added

value, low price, hybrid, differentiation, focused differentiation, risky high margins, monopoly

pricing and loss of market share. M&S can focus on the hybrid, differentiation and focused

differentiation position to achieve the competitive advantage over its rival companies.

24

Differentiation position would be most suitable for the M&S as it aims to offer customers the

highest level of perceived added value.

Figure: M&S Bowman’s strategic clock

[Source: Shakhshir, 2014]

GROWTH STRATEGIES FOR M&S

There are different strategies which can be adopted by M&S to achieve significant and

sustainable growth. Key growth strategies which can be effective for the growth and

development of the business of M&S are done through

LIMITED GROWTH

Market Penetration is a growth strategy where the business relies on the Selling existence of

the product into existing markets. This has also been used to achieve and maintain the market

share of the current product. The combination of different competitive strategies can be

applied in order to provide the high-quality goods to the clients that are relative to drive out

25

highest level of perceived added value.

Figure: M&S Bowman’s strategic clock

[Source: Shakhshir, 2014]

GROWTH STRATEGIES FOR M&S

There are different strategies which can be adopted by M&S to achieve significant and

sustainable growth. Key growth strategies which can be effective for the growth and

development of the business of M&S are done through

LIMITED GROWTH

Market Penetration is a growth strategy where the business relies on the Selling existence of

the product into existing markets. This has also been used to achieve and maintain the market

share of the current product. The combination of different competitive strategies can be

applied in order to provide the high-quality goods to the clients that are relative to drive out

25

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the competitor in the market (Weiss, 2016). For example- The discounted coupons are offered

to their customers under the launch of the loyalty schemes.

Market development is another strategy for the business which seeks the existence of the

business in the new market. For example- Marks and Spencer shift their growth for the business

in different cities of China. The aspects of new geographical areas and other possible entrants

approaching the working structure of the organisation can be explored. Marks and Spencer can

presently focus on their new store launched in Shanghai as to develop the market.

Product Development is the business which aims to introduce a new product into existing

market (Ward, 2016). This strategy helps in developing modified products and services through

financial service and banking such as new product development

SUBSTANTIVE GROWTH

Substantive growth strategies can be adopted by M&S to achieve the competitive edge over

other rival companies and to make a significant and sustainable growth and development. M&S

can focus on the different strategies like horizontal integration, related diversification, vertical

integration and unrelated diversification.

Horizontal integration- In this strategy, a company merge with the direct or indirect

competitors in order to enhance its market share. M&S can focus on merging with its

competitors to expand its business in new markets.

Vertical integration- A company can also link with another company in the same supply

chain. M&S can link with the other companies in the same supply chain.

Related diversification- Related diversification is moving into an area where either

technology or marketing issues are similar. M&S can also move into such areas through

acquisition, merger or strategic alliance.

Unrelated diversification- Unrelated diversification is one of the risk-based strategies as

its launching of new products with new technology in a new market.

It is important to consider the different factors for the selection of the appropriate and effective

business strategies. Key factors which can be considered for the selection of appropriate

26

to their customers under the launch of the loyalty schemes.

Market development is another strategy for the business which seeks the existence of the

business in the new market. For example- Marks and Spencer shift their growth for the business

in different cities of China. The aspects of new geographical areas and other possible entrants

approaching the working structure of the organisation can be explored. Marks and Spencer can

presently focus on their new store launched in Shanghai as to develop the market.

Product Development is the business which aims to introduce a new product into existing

market (Ward, 2016). This strategy helps in developing modified products and services through

financial service and banking such as new product development

SUBSTANTIVE GROWTH

Substantive growth strategies can be adopted by M&S to achieve the competitive edge over

other rival companies and to make a significant and sustainable growth and development. M&S

can focus on the different strategies like horizontal integration, related diversification, vertical

integration and unrelated diversification.

Horizontal integration- In this strategy, a company merge with the direct or indirect

competitors in order to enhance its market share. M&S can focus on merging with its

competitors to expand its business in new markets.

Vertical integration- A company can also link with another company in the same supply

chain. M&S can link with the other companies in the same supply chain.

Related diversification- Related diversification is moving into an area where either

technology or marketing issues are similar. M&S can also move into such areas through

acquisition, merger or strategic alliance.

Unrelated diversification- Unrelated diversification is one of the risk-based strategies as

its launching of new products with new technology in a new market.

It is important to consider the different factors for the selection of the appropriate and effective

business strategies. Key factors which can be considered for the selection of appropriate

26

techniques are strength, weakness, opportunities, threats, organizational objectives, the

capability of organization etc.

RETRENCHMENT

There is a number of problems that are associated with the entrants in the Chinese market. This

has also centralised the trading policies of M&S. Through this strategy, the elevating

substantive means of the organisation hinder the country's economy. The Chinese market

certainly disapproves the foreign brands in the market as this can rapidly indulge the consumer

on the others (Tomczak, et al. 2018). Therefore, it is very difficult for M&S to maintain their

status in this market as they undergo rapid movements in grocery and clothing and other

sectors.

Turnaround- This specifically initialise with the strategies to outset the profitable

amount of performance

Liquidation- This stage helps in analysing the assets of the organisation in terms of sales

Divestment- The shared bond with the other company portrays the divestment of

company details. In other words, it relates to the selling of the business to other

company.

M&S is struggling with many stores to serve the customers. The different changes in the

business environment have influenced the business of the company. By considering different

factors and analysing the current situation of the company, the related diversification strategy

can be effective for the company (Rong and Xiao, 2017). The horizontal integration strategy can

help the company in enhancing its market share through merger, acquisition and strategic

alliance.

CASE FOR M&S

Marks and Spencer is one of the leading brands in terms of retailing. They can expand their

business through setting a merger alliance with the other organisation to set a treaty and enter

the Chinese market. The franchise operations to fulfil the needs of the organisation such as

inbound logistics, suppliers, operations and store designing and other stocks are all well aware

27

capability of organization etc.

RETRENCHMENT

There is a number of problems that are associated with the entrants in the Chinese market. This

has also centralised the trading policies of M&S. Through this strategy, the elevating

substantive means of the organisation hinder the country's economy. The Chinese market

certainly disapproves the foreign brands in the market as this can rapidly indulge the consumer

on the others (Tomczak, et al. 2018). Therefore, it is very difficult for M&S to maintain their

status in this market as they undergo rapid movements in grocery and clothing and other

sectors.

Turnaround- This specifically initialise with the strategies to outset the profitable

amount of performance

Liquidation- This stage helps in analysing the assets of the organisation in terms of sales

Divestment- The shared bond with the other company portrays the divestment of

company details. In other words, it relates to the selling of the business to other

company.

M&S is struggling with many stores to serve the customers. The different changes in the

business environment have influenced the business of the company. By considering different

factors and analysing the current situation of the company, the related diversification strategy

can be effective for the company (Rong and Xiao, 2017). The horizontal integration strategy can

help the company in enhancing its market share through merger, acquisition and strategic

alliance.

CASE FOR M&S

Marks and Spencer is one of the leading brands in terms of retailing. They can expand their

business through setting a merger alliance with the other organisation to set a treaty and enter

the Chinese market. The franchise operations to fulfil the needs of the organisation such as

inbound logistics, suppliers, operations and store designing and other stocks are all well aware

27

and productive measure which can be planned by the organisation. This can account for

providing the customer product at less price (Moon, et al. 2014). Thus, the marks and spencer

business can depend on the diversification strategy through which maintenance to the global

scenario has acknowledged the customers by latest technologies in the business sector.

IMPLEMENTATION OF THE RELATED DIVERSIFICATION STRATEGY

Related diversification is a strategy of the acquisition of additional business activities that are at

the similar level in the context of values chain in similar or different industries. The company

can focus on the M&S can focus on the related diversification in order to enhance its market

share. It can merge with its companies like Aldi, Asda and Tesco to enhance the sales. M&S can

also merge with the NEXT to reach to online buyers. Related diversification can help M&S in

achieving several advantages such as economies of scale, reduction in cost, and increasing

market power (Weiss, 2016). They can also set a merger with the Chinese supermarket stores

and outset on the services and implement them.

BALANCED SCORECARD SYSTEM

This system can help in communicating different strategies through which strategic plans and

other measurement systems can be managed (Moon, et al. 2014). The role of BSC relates on:

Communicating with another merger in order to accomplish the desired objectives

Aligning update on a daily basis

Prioritizing the project through maintaining product and services

Proper monitoring and progress of the project is marked towards strategic targets

28

providing the customer product at less price (Moon, et al. 2014). Thus, the marks and spencer

business can depend on the diversification strategy through which maintenance to the global

scenario has acknowledged the customers by latest technologies in the business sector.

IMPLEMENTATION OF THE RELATED DIVERSIFICATION STRATEGY