Strategic Position and Choices: US Airlines Industry Analysis

VerifiedAdded on 2023/01/17

|13

|3895

|94

Report

AI Summary

This report presents a strategic analysis of the US airlines industry, examining its position and potential strategic choices. It begins with an executive summary and table of contents, followed by an introduction outlining the industry's competitive landscape since deregulation. The report then delves into theoretical frameworks, including PESTLE analysis to assess the external environment (political, economic, social, technological, legal, and environmental factors) and Porter's Five Forces to evaluate industry attractiveness. The analysis section applies these frameworks to the US airlines industry, identifying key drivers of change, opportunities, and threats. The report discusses the implications of the strategic analysis, culminating in recommendations for strategic choices that could improve the profitability and market position of US airlines. The report concludes with a list of references.

Running Head: STRATEGIC ANALYSIS OF US AIRLINES

STRATEGIC ANALYSIS OF US AIRLINES

Name of the Student

Name of the University

Author note

STRATEGIC ANALYSIS OF US AIRLINES

Name of the Student

Name of the University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

iSTRATEGIC ANALYSIS OF US AIRLINES

Executive Summary

The report dealt with strategic analysis of US airlines industry. It was designed in a way to

give holistic exposure of the industry, that after deregulation how US airlines would manage

its losses. The study was carried through some analysis such as PESTLE analysis for external

environment and the famous managerial tool Porter’s five forces model to frame strategic

analysis. Basically the aim was to find out the Strategic position and strategic choices for

achieving future goals. Finally, the report carries a clear understanding of the inferences of

strategic concepts followed by the formulated recommendations for company profitability.

Executive Summary

The report dealt with strategic analysis of US airlines industry. It was designed in a way to

give holistic exposure of the industry, that after deregulation how US airlines would manage

its losses. The study was carried through some analysis such as PESTLE analysis for external

environment and the famous managerial tool Porter’s five forces model to frame strategic

analysis. Basically the aim was to find out the Strategic position and strategic choices for

achieving future goals. Finally, the report carries a clear understanding of the inferences of

strategic concepts followed by the formulated recommendations for company profitability.

iiSTRATEGIC ANALYSIS OF US AIRLINES

Table of Contents

Executive Summary....................................................................................................................i

Introduction................................................................................................................................1

Historical Overview...................................................................................................................1

Theory........................................................................................................................................2

PESTLE analysis....................................................................................................................2

Porter’s Five Forces Theory...................................................................................................2

Strategic Choice Concepts.....................................................................................................3

Analysis......................................................................................................................................3

PESTLE analysis....................................................................................................................3

Political Factors..................................................................................................................3

Economic Factors...............................................................................................................3

Social Factors.....................................................................................................................3

Technological Factors........................................................................................................4

Legal Factors......................................................................................................................4

Environmental Factors.......................................................................................................4

Michael Porter’s Five Forces Analysis..................................................................................4

Supplier Power...................................................................................................................5

Buyer Power.......................................................................................................................5

Threat of new Entrants.......................................................................................................5

Threat of Substitutes..........................................................................................................5

Competitive Rivalry...........................................................................................................5

Discussion..................................................................................................................................6

Conclusion..................................................................................................................................8

Recommendations......................................................................................................................8

References..................................................................................................................................9

Table of Contents

Executive Summary....................................................................................................................i

Introduction................................................................................................................................1

Historical Overview...................................................................................................................1

Theory........................................................................................................................................2

PESTLE analysis....................................................................................................................2

Porter’s Five Forces Theory...................................................................................................2

Strategic Choice Concepts.....................................................................................................3

Analysis......................................................................................................................................3

PESTLE analysis....................................................................................................................3

Political Factors..................................................................................................................3

Economic Factors...............................................................................................................3

Social Factors.....................................................................................................................3

Technological Factors........................................................................................................4

Legal Factors......................................................................................................................4

Environmental Factors.......................................................................................................4

Michael Porter’s Five Forces Analysis..................................................................................4

Supplier Power...................................................................................................................5

Buyer Power.......................................................................................................................5

Threat of new Entrants.......................................................................................................5

Threat of Substitutes..........................................................................................................5

Competitive Rivalry...........................................................................................................5

Discussion..................................................................................................................................6

Conclusion..................................................................................................................................8

Recommendations......................................................................................................................8

References..................................................................................................................................9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1STRATEGIC ANALYSIS OF US AIRLINES

Introduction

This report is based on the analysis of Strategic Position and strategic choices of US

Airlines Industry which is the most favoured airlines brand over the world. The domiciliary

US airline has an intense competitive past since it got deregulated in 1978. Labour unions got

powerful and thus workers at major imperative carriers got overpaid. Consequently, after the

deregulation effect those obligatory carriers felt the utmost pressure, and many ways opened

for new agile carriers with relatively low cost stratas for cut throat competition with the

prolong entrenched airlines (Pickrell 2017). There were extensive insolvencies followed by

the best carriers available and the rest being acquired or going out of business. The

deregulation effect, fluctuation rates of fuel price and increasing vulnerability of terrorism, is

continuing and airline industry is struggling to meet these challenges. It is important to

analyse this problem in the report as US Airlines is oppressed with hefty labour costs, for a

balance sheet that is not so strong, and continuous trade union issues (Williams 2017).

American Airlines never entered into unethical ways to achieve cost reductions to meet the

losses. The aim of this report is to provide the strategic analysis in order to show the current

market position of US airlines through PESTLE theory and Porter’s five competitive forces

with recommendations of strategic choices to improve its position in the market. The report

follows ahead detailed analysis of how the US airlines is struggling with other emerging

competitors and what competitive edge it can provide to become the market leader.

Historical Overview

US Airline industry by nature has an oligopoly market structure. The historical view

with respect to economic performance of the US airlines will be discussed in terms of

competition, pricing strategies and collaboration in the local market of America. Further,

merger-acquisition of the airlines industry and deregulations impact will be analyzed in the

economic performances (Bachwich and Wittman 2017).

Previously, in the past US airlines industry faced tough times due to the recession

period of 1930’s and eventually the price rates established jointly by airlines and IATA

(International Air Transport Association). As per estimations IATA evidenced a severe loss

of US$9 billion in 2009 due to recession. The economic situation facing competition among

carriers of the high and low cost which was majorly a downfall for the whole airline industry

of US. It has been grown tremendously since the deregulation act of 1978 due oligopoly

market structure that removes price and entry rules. This has adversely effected the economic

Introduction

This report is based on the analysis of Strategic Position and strategic choices of US

Airlines Industry which is the most favoured airlines brand over the world. The domiciliary

US airline has an intense competitive past since it got deregulated in 1978. Labour unions got

powerful and thus workers at major imperative carriers got overpaid. Consequently, after the

deregulation effect those obligatory carriers felt the utmost pressure, and many ways opened

for new agile carriers with relatively low cost stratas for cut throat competition with the

prolong entrenched airlines (Pickrell 2017). There were extensive insolvencies followed by

the best carriers available and the rest being acquired or going out of business. The

deregulation effect, fluctuation rates of fuel price and increasing vulnerability of terrorism, is

continuing and airline industry is struggling to meet these challenges. It is important to

analyse this problem in the report as US Airlines is oppressed with hefty labour costs, for a

balance sheet that is not so strong, and continuous trade union issues (Williams 2017).

American Airlines never entered into unethical ways to achieve cost reductions to meet the

losses. The aim of this report is to provide the strategic analysis in order to show the current

market position of US airlines through PESTLE theory and Porter’s five competitive forces

with recommendations of strategic choices to improve its position in the market. The report

follows ahead detailed analysis of how the US airlines is struggling with other emerging

competitors and what competitive edge it can provide to become the market leader.

Historical Overview

US Airline industry by nature has an oligopoly market structure. The historical view

with respect to economic performance of the US airlines will be discussed in terms of

competition, pricing strategies and collaboration in the local market of America. Further,

merger-acquisition of the airlines industry and deregulations impact will be analyzed in the

economic performances (Bachwich and Wittman 2017).

Previously, in the past US airlines industry faced tough times due to the recession

period of 1930’s and eventually the price rates established jointly by airlines and IATA

(International Air Transport Association). As per estimations IATA evidenced a severe loss

of US$9 billion in 2009 due to recession. The economic situation facing competition among

carriers of the high and low cost which was majorly a downfall for the whole airline industry

of US. It has been grown tremendously since the deregulation act of 1978 due oligopoly

market structure that removes price and entry rules. This has adversely effected the economic

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2STRATEGIC ANALYSIS OF US AIRLINES

performance of airline industry of US because during this time many other airline industries

were set up with their own strategies in market. This brought the heterogeneity in terms of

services provided to the passengers and fares taken. As a result passengers rejoicing the

variations from one airline to the other ultimately the US airlines facing the financial crunch.

In 2010, United Airlines merged with continental airlines and US Airways merged with

American Airlines in 2013 to save US Airlines from bankruptcy. This financial crisis has

affected the GDP growth of the US economy (Pearce 2015). According to the National Air

Traffic Controllers Association the airlines industry has contributed $150.5 billion dollar in

the GDP of America and a contribution of $44.6 billion dollar from airport operations.

Therefore 4.9-5.2% share of GDP is from US airlines industry (Helleloid et al. 2015).

Theory

Theories are the best source to plan and strategize work formats. In this report mainly

two theories have been used for the strategic analysis of US Airlines industry, PESTLE

analysis and Michael Porter’s competitive five forces analysis. Strategic Positioning is the

process that is used in most of the companies to recognize itself in the market as a leader and

to identify the core competitive advantage as a whole to differentiate with the other

competitors to cater to demand and supply. The next relevant aspect is the strategic choice

which is the most selective strategy/s to achieve future goals. Hence strategic choice depends

on few steps of strategy selection to choose the best out of the alternative strategies (Chen

and Pawlikowski 2015). Company’s performance mostly depends on the choice of proper

strategies from corporate levels.

PESTLE analysis

PESTLE is the abbreviation of Political, Economic, Social, Technological, Legal and

Environmental. PESTLE analysis is a famous concept used for analysing the external

environment. This is a tool used by the companies to operate in external environment or to

introduce a new product, service or scheme in market. It is an effective method to study the

external environment and forces. Advantage is the thorough study externally and

disadvantage include, sometimes study becomes prolonged, resulting in high cost and much

time invested.

Porter’s Five Forces Theory

It is the most reliable model to understand the business environment. The five forces

include, Competitive rivalry, Supplier power, Buyer power, Threat of substitution, Threat of

performance of airline industry of US because during this time many other airline industries

were set up with their own strategies in market. This brought the heterogeneity in terms of

services provided to the passengers and fares taken. As a result passengers rejoicing the

variations from one airline to the other ultimately the US airlines facing the financial crunch.

In 2010, United Airlines merged with continental airlines and US Airways merged with

American Airlines in 2013 to save US Airlines from bankruptcy. This financial crisis has

affected the GDP growth of the US economy (Pearce 2015). According to the National Air

Traffic Controllers Association the airlines industry has contributed $150.5 billion dollar in

the GDP of America and a contribution of $44.6 billion dollar from airport operations.

Therefore 4.9-5.2% share of GDP is from US airlines industry (Helleloid et al. 2015).

Theory

Theories are the best source to plan and strategize work formats. In this report mainly

two theories have been used for the strategic analysis of US Airlines industry, PESTLE

analysis and Michael Porter’s competitive five forces analysis. Strategic Positioning is the

process that is used in most of the companies to recognize itself in the market as a leader and

to identify the core competitive advantage as a whole to differentiate with the other

competitors to cater to demand and supply. The next relevant aspect is the strategic choice

which is the most selective strategy/s to achieve future goals. Hence strategic choice depends

on few steps of strategy selection to choose the best out of the alternative strategies (Chen

and Pawlikowski 2015). Company’s performance mostly depends on the choice of proper

strategies from corporate levels.

PESTLE analysis

PESTLE is the abbreviation of Political, Economic, Social, Technological, Legal and

Environmental. PESTLE analysis is a famous concept used for analysing the external

environment. This is a tool used by the companies to operate in external environment or to

introduce a new product, service or scheme in market. It is an effective method to study the

external environment and forces. Advantage is the thorough study externally and

disadvantage include, sometimes study becomes prolonged, resulting in high cost and much

time invested.

Porter’s Five Forces Theory

It is the most reliable model to understand the business environment. The five forces

include, Competitive rivalry, Supplier power, Buyer power, Threat of substitution, Threat of

3STRATEGIC ANALYSIS OF US AIRLINES

new entrants. It helps in understanding every aspect before starting with the business. This

model is very relevant for new business starters. Disadvantage may be that this analytical

study can be costly for small business models.

Strategic Choice Concepts

The strategic choice concepts help selecting the best strategic concept out of the

alternative strategies available. It helps in achieving overall favourable outcomes for an

industry. The available options are evaluated first and then at the end selection process

arrives. The strategic concepts is very effective in making strategic decisions. There is also an

option for feedback. It has few approaches, like, planned approach, enforced choice

approach, experience based approach and command approach. These concepts together

contributes in the selection of the best strategy required for the industry.

Analysis

PESTLE analysis

The initiative to learn better about the US airlines industry is the PESTLE analysis,

the most preferred study than all other business analysis tools.

Political Factors

There are certain existing political factors which variedly affects the US airlines

industry. Since after the 9/11 terror attack, the country has increased the security reasons for

safety of the citizens, this resulting in decreased number of people travelling to other

countries. It is adversely affecting the country’s airlines business as it could not make much

profit annually, therefore, it is deviating to some other proposals as investing on new airports

and improving the existing ones to attract more travellers across the nation.

Economic Factors

The increased fuel prices is the first major concern for the airlines industry and

secondly is the demand in the market for low budget airlines. These factors seem to be

challenging for the US airlines because it never compromised with its quality served to the

passengers (Iatrou and Oretti 2016). The trend of low cost airlines resulted in rise of many

new competitors of the similar field and as a result the existing players have to cut down their

costs to be competitive enough to stay in market.

new entrants. It helps in understanding every aspect before starting with the business. This

model is very relevant for new business starters. Disadvantage may be that this analytical

study can be costly for small business models.

Strategic Choice Concepts

The strategic choice concepts help selecting the best strategic concept out of the

alternative strategies available. It helps in achieving overall favourable outcomes for an

industry. The available options are evaluated first and then at the end selection process

arrives. The strategic concepts is very effective in making strategic decisions. There is also an

option for feedback. It has few approaches, like, planned approach, enforced choice

approach, experience based approach and command approach. These concepts together

contributes in the selection of the best strategy required for the industry.

Analysis

PESTLE analysis

The initiative to learn better about the US airlines industry is the PESTLE analysis,

the most preferred study than all other business analysis tools.

Political Factors

There are certain existing political factors which variedly affects the US airlines

industry. Since after the 9/11 terror attack, the country has increased the security reasons for

safety of the citizens, this resulting in decreased number of people travelling to other

countries. It is adversely affecting the country’s airlines business as it could not make much

profit annually, therefore, it is deviating to some other proposals as investing on new airports

and improving the existing ones to attract more travellers across the nation.

Economic Factors

The increased fuel prices is the first major concern for the airlines industry and

secondly is the demand in the market for low budget airlines. These factors seem to be

challenging for the US airlines because it never compromised with its quality served to the

passengers (Iatrou and Oretti 2016). The trend of low cost airlines resulted in rise of many

new competitors of the similar field and as a result the existing players have to cut down their

costs to be competitive enough to stay in market.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4STRATEGIC ANALYSIS OF US AIRLINES

Social Factors

The trend of tourism and holiday packages are increasing at a global rate. People are

inclined for social gatherings and therefore find short distance travelling to fulfil their holiday

desires. Even if they go for long tours they find better solutions over internet sources in low

budget airlines as per their requirement. The demand of perfection within low cost structure

has made it all for the US airlines to down grade gradually (Rothaermel 2015).

Technological Factors

The airlines are greatly affected by the technological factors. People are now

becoming more active on internet and they find it quite accessible to check for all kinds of

airfare tickets, discounts and offers by the emergent of same field. They get more options to

choose from the low cost airlines to travel (Hitt, Ireland and Hoskisson 2016). They book

tickets online and as the competitors are always active to beat others so most of them now

have airlines ticket booking app to make bookings easy and faster. The aero planes is the

most fuel efficient and thus provide the benefit of low cost travelling.

Legal Factors

The legal factors related to the airlines industry is getting stronger day by day. Many

law suits are charged for unsafe travelling and many countries have introduced their

guidelines to run airlines industry which has increased the costs of air tickets. As per the

guidelines under certain rules and regulations the industries have to maintain the basic

services and standards during travelling (Iatrou and Oretti 2016). Thus it is tough for the

airlines to sustain longer in the market without innovations as the law has become strict than

before for airlines industry.

Environmental Factors

The environmental concerns are alarming among the people. Every second person in

the world today is concern and aware of their environment and related health issues. The

awareness reached at a point where there is a demand for eco-friendly aeroplanes that

consume less diesel and runs on bio fuel, which also contributes to cost reduction and safe

travelling (Lawton 2017). The emissions of chemicals through airlines is anticipated around

15% globally which needs to be checked before it rises high. This new demand made existing

airlines to change from the older versions to newer ones accordingly to remain in the market.

Social Factors

The trend of tourism and holiday packages are increasing at a global rate. People are

inclined for social gatherings and therefore find short distance travelling to fulfil their holiday

desires. Even if they go for long tours they find better solutions over internet sources in low

budget airlines as per their requirement. The demand of perfection within low cost structure

has made it all for the US airlines to down grade gradually (Rothaermel 2015).

Technological Factors

The airlines are greatly affected by the technological factors. People are now

becoming more active on internet and they find it quite accessible to check for all kinds of

airfare tickets, discounts and offers by the emergent of same field. They get more options to

choose from the low cost airlines to travel (Hitt, Ireland and Hoskisson 2016). They book

tickets online and as the competitors are always active to beat others so most of them now

have airlines ticket booking app to make bookings easy and faster. The aero planes is the

most fuel efficient and thus provide the benefit of low cost travelling.

Legal Factors

The legal factors related to the airlines industry is getting stronger day by day. Many

law suits are charged for unsafe travelling and many countries have introduced their

guidelines to run airlines industry which has increased the costs of air tickets. As per the

guidelines under certain rules and regulations the industries have to maintain the basic

services and standards during travelling (Iatrou and Oretti 2016). Thus it is tough for the

airlines to sustain longer in the market without innovations as the law has become strict than

before for airlines industry.

Environmental Factors

The environmental concerns are alarming among the people. Every second person in

the world today is concern and aware of their environment and related health issues. The

awareness reached at a point where there is a demand for eco-friendly aeroplanes that

consume less diesel and runs on bio fuel, which also contributes to cost reduction and safe

travelling (Lawton 2017). The emissions of chemicals through airlines is anticipated around

15% globally which needs to be checked before it rises high. This new demand made existing

airlines to change from the older versions to newer ones accordingly to remain in the market.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5STRATEGIC ANALYSIS OF US AIRLINES

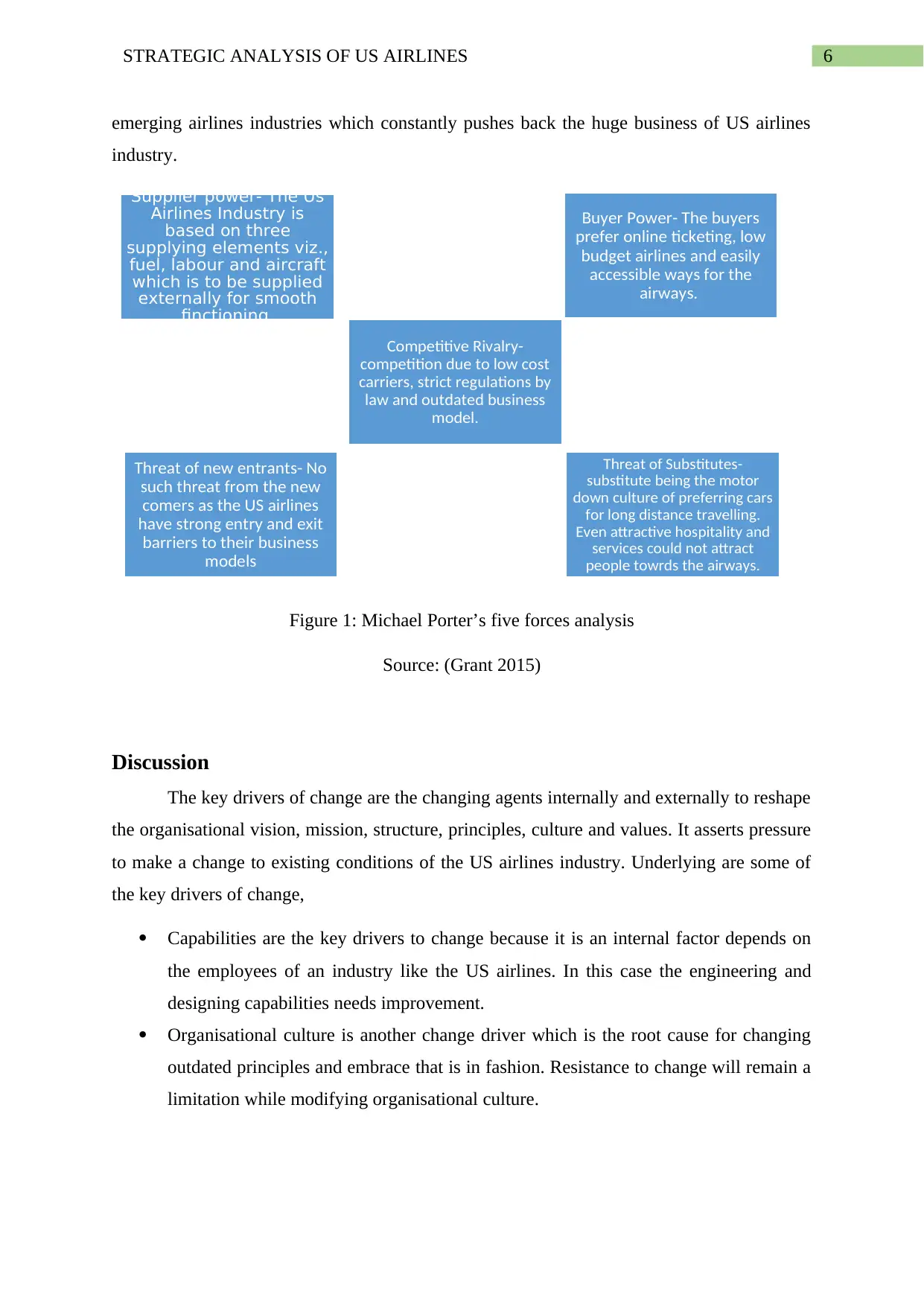

Michael Porter’s Five Forces Analysis

The reason behind implementing five forces analysis is that it is the most appropriate

tool to analyse the external forces in the environment (Hannigan, Hamilton and Mudambi

2015). By this methodology, companies prepare strategies keeping in mind the futuristic

goals. This analysis helps an industry to review the overall phenomena going on including the

Buyer’s Power, the Supplier’s Power, Competitive rivalry, Threat of substitution and threat

of new entrants.

Supplier Power

The supplier power is fully external. The US airlines industry is depended on three

major elements like, labour, aircraft and fuel. These three has outwardly production and

external supply from respective suppliers. Therefore, according to Porter’s five forces

analysis this has a huge impact and one of the most important forces of competitive analysis.

Buyer Power

Factors like demand regulation crisis, price wars, competitiveness yields power to the

passengers and thus retaining the buyer’s power medium to high according to the Porter’s

competitive five forces analysis (Mallikarjun 2015).

Threat of new Entrants

This is subjected to the entry and exit barriers for new comers in business line. This is

quite important to know before setting up a business. The US airlines industry is pretty high

in this aspect as the rules and regulations for entry to an industry like airlines is no less then a

tough job irrespective of one is expertise in the same field(Lelieur 2017). Similar is the case

for exiting from business. Nobody can either enter or exit freely from the business industries

in US.

Threat of Substitutes

The emerging threat to the US Airlines industry which has been identified is the

American culture of motor down. Practice of using cars for long journey seems more

relishing than travelling to airways. This stands out the major cause of threat to the airlines

business.

Competitive Rivalry

The US airlines has always been the target area for the competitors. The reason why it

has many competitive rivalries is due to its outdated business model (Tan 2016). The trend of

low cost carriers, government intervention and strict regulations resulted into many other

Michael Porter’s Five Forces Analysis

The reason behind implementing five forces analysis is that it is the most appropriate

tool to analyse the external forces in the environment (Hannigan, Hamilton and Mudambi

2015). By this methodology, companies prepare strategies keeping in mind the futuristic

goals. This analysis helps an industry to review the overall phenomena going on including the

Buyer’s Power, the Supplier’s Power, Competitive rivalry, Threat of substitution and threat

of new entrants.

Supplier Power

The supplier power is fully external. The US airlines industry is depended on three

major elements like, labour, aircraft and fuel. These three has outwardly production and

external supply from respective suppliers. Therefore, according to Porter’s five forces

analysis this has a huge impact and one of the most important forces of competitive analysis.

Buyer Power

Factors like demand regulation crisis, price wars, competitiveness yields power to the

passengers and thus retaining the buyer’s power medium to high according to the Porter’s

competitive five forces analysis (Mallikarjun 2015).

Threat of new Entrants

This is subjected to the entry and exit barriers for new comers in business line. This is

quite important to know before setting up a business. The US airlines industry is pretty high

in this aspect as the rules and regulations for entry to an industry like airlines is no less then a

tough job irrespective of one is expertise in the same field(Lelieur 2017). Similar is the case

for exiting from business. Nobody can either enter or exit freely from the business industries

in US.

Threat of Substitutes

The emerging threat to the US Airlines industry which has been identified is the

American culture of motor down. Practice of using cars for long journey seems more

relishing than travelling to airways. This stands out the major cause of threat to the airlines

business.

Competitive Rivalry

The US airlines has always been the target area for the competitors. The reason why it

has many competitive rivalries is due to its outdated business model (Tan 2016). The trend of

low cost carriers, government intervention and strict regulations resulted into many other

6STRATEGIC ANALYSIS OF US AIRLINES

emerging airlines industries which constantly pushes back the huge business of US airlines

industry.

Figure 1: Michael Porter’s five forces analysis

Source: (Grant 2015)

Discussion

The key drivers of change are the changing agents internally and externally to reshape

the organisational vision, mission, structure, principles, culture and values. It asserts pressure

to make a change to existing conditions of the US airlines industry. Underlying are some of

the key drivers of change,

Capabilities are the key drivers to change because it is an internal factor depends on

the employees of an industry like the US airlines. In this case the engineering and

designing capabilities needs improvement.

Organisational culture is another change driver which is the root cause for changing

outdated principles and embrace that is in fashion. Resistance to change will remain a

limitation while modifying organisational culture.

Supplier power- The Us

Airlines Industry is

based on three

supplying elements viz.,

fuel, labour and aircraft

which is to be supplied

externally for smooth

finctioning.

Competitive Rivalry-

competition due to low cost

carriers, strict regulations by

law and outdated business

model.

Buyer Power- The buyers

prefer online ticketing, low

budget airlines and easily

accessible ways for the

airways.

Threat of new entrants- No

such threat from the new

comers as the US airlines

have strong entry and exit

barriers to their business

models

Threat of Substitutes-

substitute being the motor

down culture of preferring cars

for long distance travelling.

Even attractive hospitality and

services could not attract

people towrds the airways.

emerging airlines industries which constantly pushes back the huge business of US airlines

industry.

Figure 1: Michael Porter’s five forces analysis

Source: (Grant 2015)

Discussion

The key drivers of change are the changing agents internally and externally to reshape

the organisational vision, mission, structure, principles, culture and values. It asserts pressure

to make a change to existing conditions of the US airlines industry. Underlying are some of

the key drivers of change,

Capabilities are the key drivers to change because it is an internal factor depends on

the employees of an industry like the US airlines. In this case the engineering and

designing capabilities needs improvement.

Organisational culture is another change driver which is the root cause for changing

outdated principles and embrace that is in fashion. Resistance to change will remain a

limitation while modifying organisational culture.

Supplier power- The Us

Airlines Industry is

based on three

supplying elements viz.,

fuel, labour and aircraft

which is to be supplied

externally for smooth

finctioning.

Competitive Rivalry-

competition due to low cost

carriers, strict regulations by

law and outdated business

model.

Buyer Power- The buyers

prefer online ticketing, low

budget airlines and easily

accessible ways for the

airways.

Threat of new entrants- No

such threat from the new

comers as the US airlines

have strong entry and exit

barriers to their business

models

Threat of Substitutes-

substitute being the motor

down culture of preferring cars

for long distance travelling.

Even attractive hospitality and

services could not attract

people towrds the airways.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7STRATEGIC ANALYSIS OF US AIRLINES

Technology is the most powerful external change drivers that forces to update

regularly. An organisation is forced to change the technology to sustain in the market

(Birim Anitsal and Anitsal 2016).

Customer needs and preferences is the most addressed external force that acts as a key

driver for the industry. Customer needs can vary with demographical change and

customer preferences is the shift from one change to another for time being.

The industry attractiveness can be better outlined by Michael Porter’s five forces analysis as

it is designed in a way that gives an entire analysis of the external and internal environment.

This model can be used by both the new entrants to understand the current market scenario.

This is equally important for a company that is in declining stage and wants to win back the

growing stage (Holloway 2017). The potential opportunities can be explained with respect to

the PEST analysis. It studies the external environment and reaches to the findings that which

area of the environment best suits for business settlement and also a portion where effort

needed to alter things accordingly. The possible threat for the US airlines is the competitors

with strong command on modern technology, cost reduction with environment friendly

products and services matching to the customer demands.

The importance of applying strategic choice concepts for profitability includes

decision taken strategically (Grant 2015). The following strategic choice concepts can

contribute to the profitability factor of the US airlines industry:

Planned approach: This is a planned approach towards the strategic choice concepts.

It is based on ranking measures to select the best strategy out of the available

alternative strategic options.

Enforced choice approach: The dominant company stakeholders who has prolonged

years of stake in the company is liable to enforced choice approach.

Experience based approach: Here the experience of the managers is being weighed

before involving the strategy formulation. Past experience curve is needed for those

mangers to implement the strategic choice.

Command approach: Here the strategic choice depends on the command and direction

of the corporate level. In an organization it follows as top down approach.

Technology is the most powerful external change drivers that forces to update

regularly. An organisation is forced to change the technology to sustain in the market

(Birim Anitsal and Anitsal 2016).

Customer needs and preferences is the most addressed external force that acts as a key

driver for the industry. Customer needs can vary with demographical change and

customer preferences is the shift from one change to another for time being.

The industry attractiveness can be better outlined by Michael Porter’s five forces analysis as

it is designed in a way that gives an entire analysis of the external and internal environment.

This model can be used by both the new entrants to understand the current market scenario.

This is equally important for a company that is in declining stage and wants to win back the

growing stage (Holloway 2017). The potential opportunities can be explained with respect to

the PEST analysis. It studies the external environment and reaches to the findings that which

area of the environment best suits for business settlement and also a portion where effort

needed to alter things accordingly. The possible threat for the US airlines is the competitors

with strong command on modern technology, cost reduction with environment friendly

products and services matching to the customer demands.

The importance of applying strategic choice concepts for profitability includes

decision taken strategically (Grant 2015). The following strategic choice concepts can

contribute to the profitability factor of the US airlines industry:

Planned approach: This is a planned approach towards the strategic choice concepts.

It is based on ranking measures to select the best strategy out of the available

alternative strategic options.

Enforced choice approach: The dominant company stakeholders who has prolonged

years of stake in the company is liable to enforced choice approach.

Experience based approach: Here the experience of the managers is being weighed

before involving the strategy formulation. Past experience curve is needed for those

mangers to implement the strategic choice.

Command approach: Here the strategic choice depends on the command and direction

of the corporate level. In an organization it follows as top down approach.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8STRATEGIC ANALYSIS OF US AIRLINES

Conclusion

Therefore, to conclude, the report carries essence of the strategic analysis for the US

airlines industry. This would help the company to strategize in order to take proactive

measures to stay above the competitors. Strategizing is the key element for any business to

set up or to sustain its position in market. This report provides complete background and

theory of the US airlines, its downfall after deregulation and its present condition to sink

down due to non-adaptive of innovations and newness in services. It is incapable to cope with

the external forces and therefore seems lacking in maintaining standards. Suggestion is to

follow the underlying recommendations and renovate strategies by eradicating former

practices for a successful airlines journey.

Recommendations

Following are few of the recommendations after going through a thorough analysis of

the US airlines industry.

The industry should be updated with the latest technological changes.

The industry should diversify to environment friendly flights so as to match with the

modern sentiments.

The best way to face competitors is to improve core competitive advantage.

The industry should go for BCG and SWOT analysis for deeper understanding of

service positioning.

The industry should implement offers and discounts to attract passengers.

The industry should initiate applying bio fuel instead of diesel to lower down

environmental risks.

Should find ways of cost reduction by introducing low budget airlines facility.

The industry can outsource maintenance and servicing to retain the set standards.

Conclusion

Therefore, to conclude, the report carries essence of the strategic analysis for the US

airlines industry. This would help the company to strategize in order to take proactive

measures to stay above the competitors. Strategizing is the key element for any business to

set up or to sustain its position in market. This report provides complete background and

theory of the US airlines, its downfall after deregulation and its present condition to sink

down due to non-adaptive of innovations and newness in services. It is incapable to cope with

the external forces and therefore seems lacking in maintaining standards. Suggestion is to

follow the underlying recommendations and renovate strategies by eradicating former

practices for a successful airlines journey.

Recommendations

Following are few of the recommendations after going through a thorough analysis of

the US airlines industry.

The industry should be updated with the latest technological changes.

The industry should diversify to environment friendly flights so as to match with the

modern sentiments.

The best way to face competitors is to improve core competitive advantage.

The industry should go for BCG and SWOT analysis for deeper understanding of

service positioning.

The industry should implement offers and discounts to attract passengers.

The industry should initiate applying bio fuel instead of diesel to lower down

environmental risks.

Should find ways of cost reduction by introducing low budget airlines facility.

The industry can outsource maintenance and servicing to retain the set standards.

9STRATEGIC ANALYSIS OF US AIRLINES

References

Mallikarjun, S., 2015. Efficiency of US airlines: a strategic operating model. Journal of Air

Transport Management, 43, pp.46-56.

Hannigan, T.J., Hamilton III, R.D. and Mudambi, R., 2015. Competition and competitiveness

in the US airline industry. Competitiveness Review, 25(2), pp.134-155.

Pickrell, D., 2017. The regulation and deregulation of US airlines. In Airline

Deregulation (pp. 5-47). Routledge.

Williams, G., 2017. The airline industry and the impact of deregulation. Routledge.

Bachwich, A.R. and Wittman, M.D., 2017. The emergence and effects of the ultra-low cost

carrier (ULCC) business model in the US airline industry. Journal of Air Transport

Management, 62, pp.155-164.

Pearce, B., 2015. Economic performance of the airline industry. Retrieved March, 1, p.2016.

Helleloid, D., Nam, S.H., Schultz, P. and Vitton, J., 2015. The US airline industry in

2015. Journal of the International Academy for Case Studies, 21(5), p.113.

Tan, K.M., 2016. Incumbent Response to Entry by Low‐Cost Carriers in the US Airline

Industry. Southern Economic Journal, 82(3), pp.874-892.

Birim, S., Anitsal, M.M. and Anitsal, İ., 2016. A Model of Business Performance in The US

Airline Industry: How Customer Complaints Predict The Performance?. Business Studies

Journal, 8(2).

Rothaermel, F.T., 2015. Strategic management. McGraw-Hill Education.

Grant, R.M., 2015. Five Forces of Competition. Wiley Encyclopedia of Management, pp.1-4.

Helleloid, D., Nam, S.H., Schultz, P. and Vitton, J., 2015. THE US AIRLINE INDUSTRY

IN 2015: INSTRUCTORS'NOTES. Journal of the International Academy for Case

Studies, 21(6), p.145.

Moreno, L., Ramon, A. and Pedreño, A., 2015. The Development of Low-cost Airlines and

Tourism as a Competitiveness Complementor: Effects, Evolution and Strategies. Journal of

Spatial and Organizational Dynamics, 3(4), pp.262-274.

References

Mallikarjun, S., 2015. Efficiency of US airlines: a strategic operating model. Journal of Air

Transport Management, 43, pp.46-56.

Hannigan, T.J., Hamilton III, R.D. and Mudambi, R., 2015. Competition and competitiveness

in the US airline industry. Competitiveness Review, 25(2), pp.134-155.

Pickrell, D., 2017. The regulation and deregulation of US airlines. In Airline

Deregulation (pp. 5-47). Routledge.

Williams, G., 2017. The airline industry and the impact of deregulation. Routledge.

Bachwich, A.R. and Wittman, M.D., 2017. The emergence and effects of the ultra-low cost

carrier (ULCC) business model in the US airline industry. Journal of Air Transport

Management, 62, pp.155-164.

Pearce, B., 2015. Economic performance of the airline industry. Retrieved March, 1, p.2016.

Helleloid, D., Nam, S.H., Schultz, P. and Vitton, J., 2015. The US airline industry in

2015. Journal of the International Academy for Case Studies, 21(5), p.113.

Tan, K.M., 2016. Incumbent Response to Entry by Low‐Cost Carriers in the US Airline

Industry. Southern Economic Journal, 82(3), pp.874-892.

Birim, S., Anitsal, M.M. and Anitsal, İ., 2016. A Model of Business Performance in The US

Airline Industry: How Customer Complaints Predict The Performance?. Business Studies

Journal, 8(2).

Rothaermel, F.T., 2015. Strategic management. McGraw-Hill Education.

Grant, R.M., 2015. Five Forces of Competition. Wiley Encyclopedia of Management, pp.1-4.

Helleloid, D., Nam, S.H., Schultz, P. and Vitton, J., 2015. THE US AIRLINE INDUSTRY

IN 2015: INSTRUCTORS'NOTES. Journal of the International Academy for Case

Studies, 21(6), p.145.

Moreno, L., Ramon, A. and Pedreño, A., 2015. The Development of Low-cost Airlines and

Tourism as a Competitiveness Complementor: Effects, Evolution and Strategies. Journal of

Spatial and Organizational Dynamics, 3(4), pp.262-274.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.