Acquisition of LinkedIn by Microsoft: A Strategic Finance Analysis

VerifiedAdded on 2023/04/17

|26

|954

|268

Presentation

AI Summary

This presentation provides a strategic finance analysis of the acquisition of LinkedIn by Microsoft, including the purpose of the acquisition, parties involved, initial and subsequent offers, potential results, reaction of the target management, and the role of the Takeover Panel. It also includes an analysis of the stock performance before and after the announcement of the acquisition.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Strategic finance for

managers

TASK 1 (PART B)

managers

TASK 1 (PART B)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Microsoft Corporation is a multinational technology

company, listed on NASDAQ and headquartered in

Redmond, Washington.

Product portfolio:

1. Computer software

2. Personal computers

3. Consumer electronics

4. Other products and devices.

Microsoft Corporation (MSFT)

company, listed on NASDAQ and headquartered in

Redmond, Washington.

Product portfolio:

1. Computer software

2. Personal computers

3. Consumer electronics

4. Other products and devices.

Microsoft Corporation (MSFT)

LinkedIn is a social networking sites traded on NYSE

and operates worldwide.

Company renders professional networking services

especially to the recruiters and sales professionals to

create their profiles to interact with each other via

social networking.

LinkedIn

and operates worldwide.

Company renders professional networking services

especially to the recruiters and sales professionals to

create their profiles to interact with each other via

social networking.

Acquisition of LI by MSFT

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

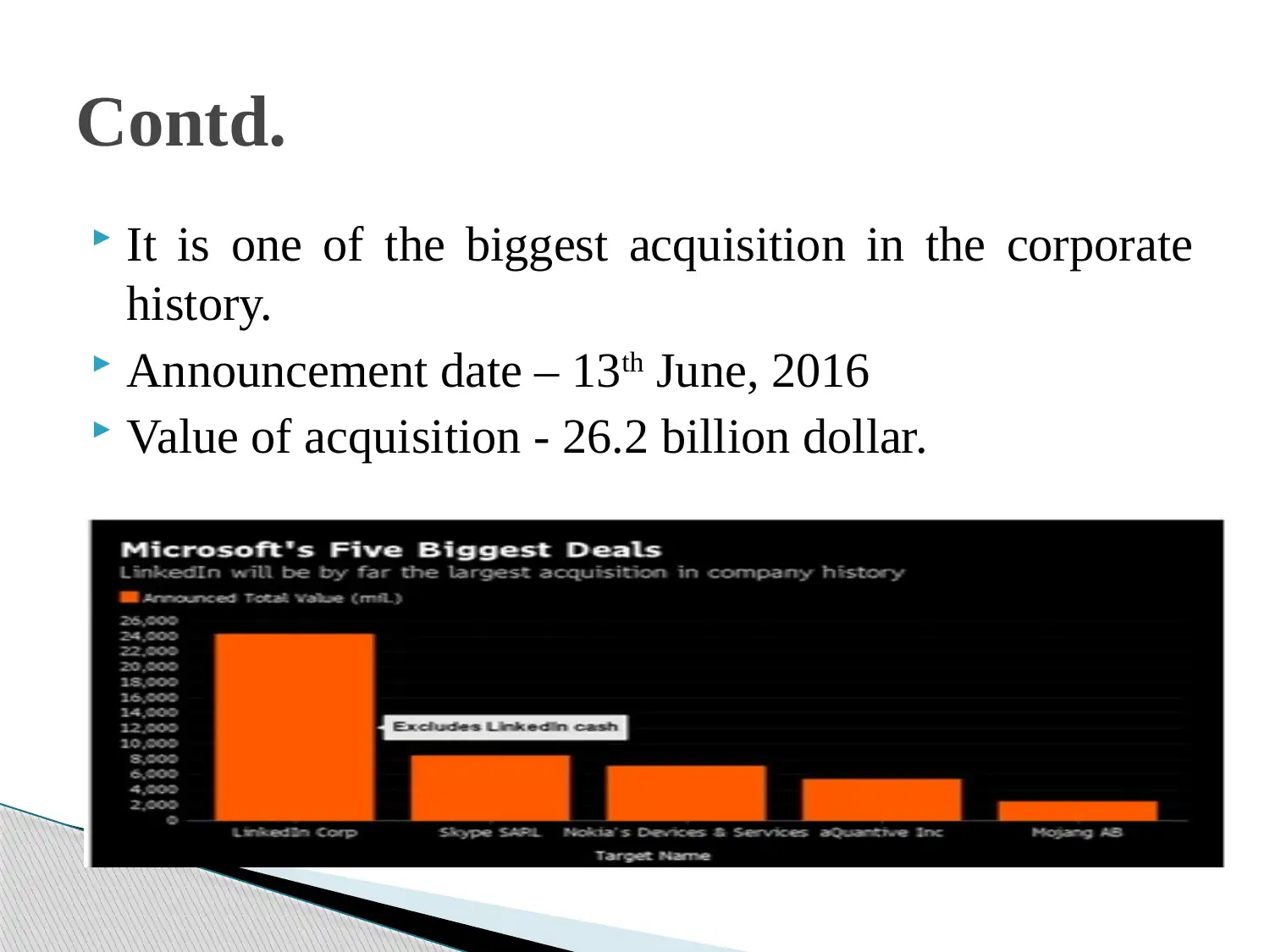

It is one of the biggest acquisition in the corporate

history.

Announcement date – 13th June, 2016

Value of acquisition - 26.2 billion dollar.

Contd.

history.

Announcement date – 13th June, 2016

Value of acquisition - 26.2 billion dollar.

Contd.

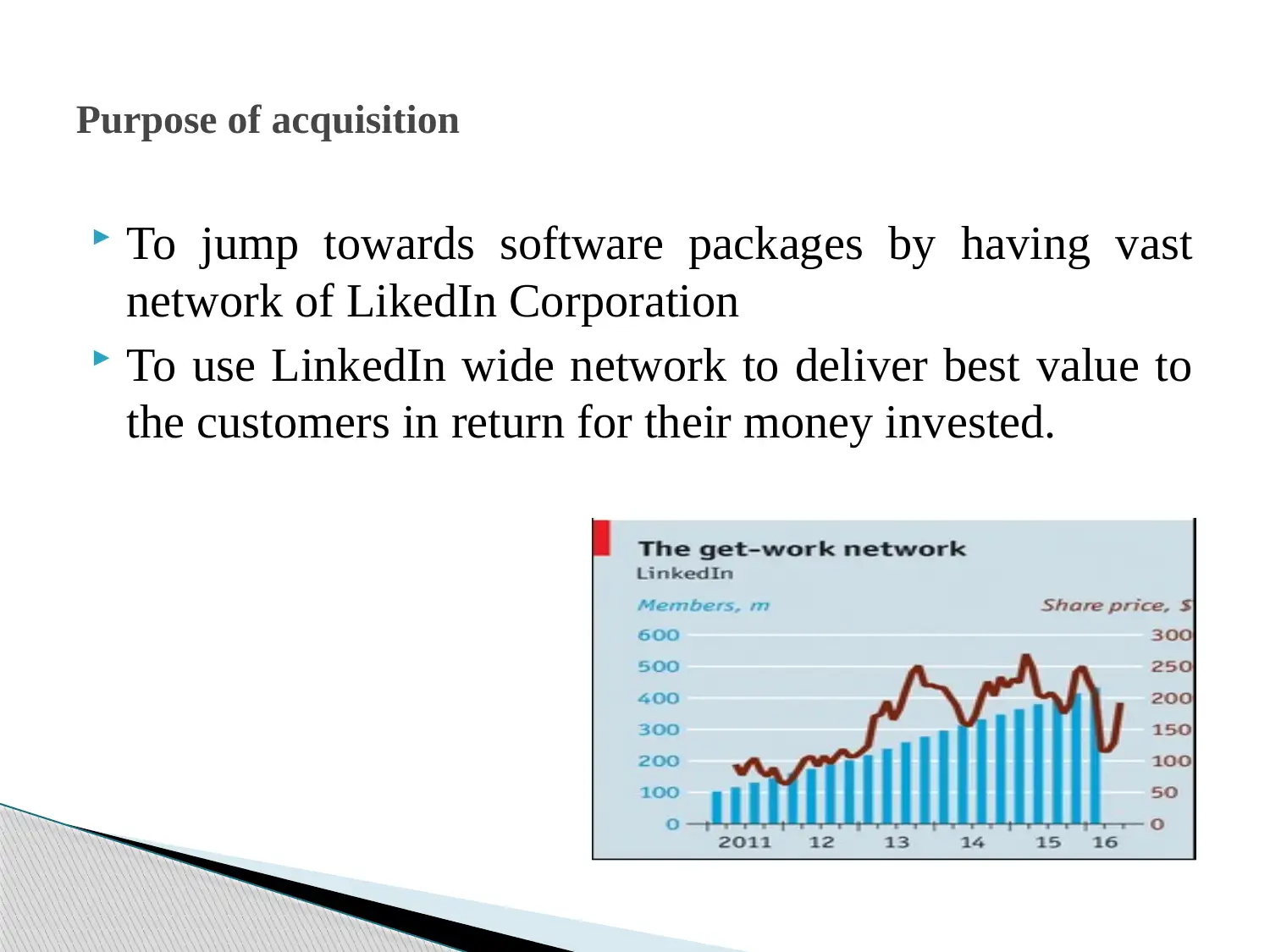

To jump towards software packages by having vast

network of LikedIn Corporation

To use LinkedIn wide network to deliver best value to

the customers in return for their money invested.

Purpose of acquisition

network of LikedIn Corporation

To use LinkedIn wide network to deliver best value to

the customers in return for their money invested.

Purpose of acquisition

MSFT’s CEO – Satya Nadella

LI’s Ceo – Jeff Weiner

MSFT’s CFO – Amy Hood

MSFT’s CLO – Brad Smith

MSFT’s Co-Founder – Bill Gates

MSFT’s financial advisor – Morgan Stanley

MSFT’s legal advisor – Simpson Thacher

LI’s Legal advisor – Wilson Sonsini, Goodrich & Rosati

LI’s Qatalyst partner – Allen and company

Parties involved in the M&A

LI’s Ceo – Jeff Weiner

MSFT’s CFO – Amy Hood

MSFT’s CLO – Brad Smith

MSFT’s Co-Founder – Bill Gates

MSFT’s financial advisor – Morgan Stanley

MSFT’s legal advisor – Simpson Thacher

LI’s Legal advisor – Wilson Sonsini, Goodrich & Rosati

LI’s Qatalyst partner – Allen and company

Parties involved in the M&A

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Initially, MSFT announced to takeover LinkedIn at

lower price, but due to bidding from sales force, it

pushed deal prices by 22% or roughly by $5 billion

dollar.

In the terms of value, it increased acquisition price per

share to $196.

Initial offer and subsequent offer

lower price, but due to bidding from sales force, it

pushed deal prices by 22% or roughly by $5 billion

dollar.

In the terms of value, it increased acquisition price per

share to $196.

Initial offer and subsequent offer

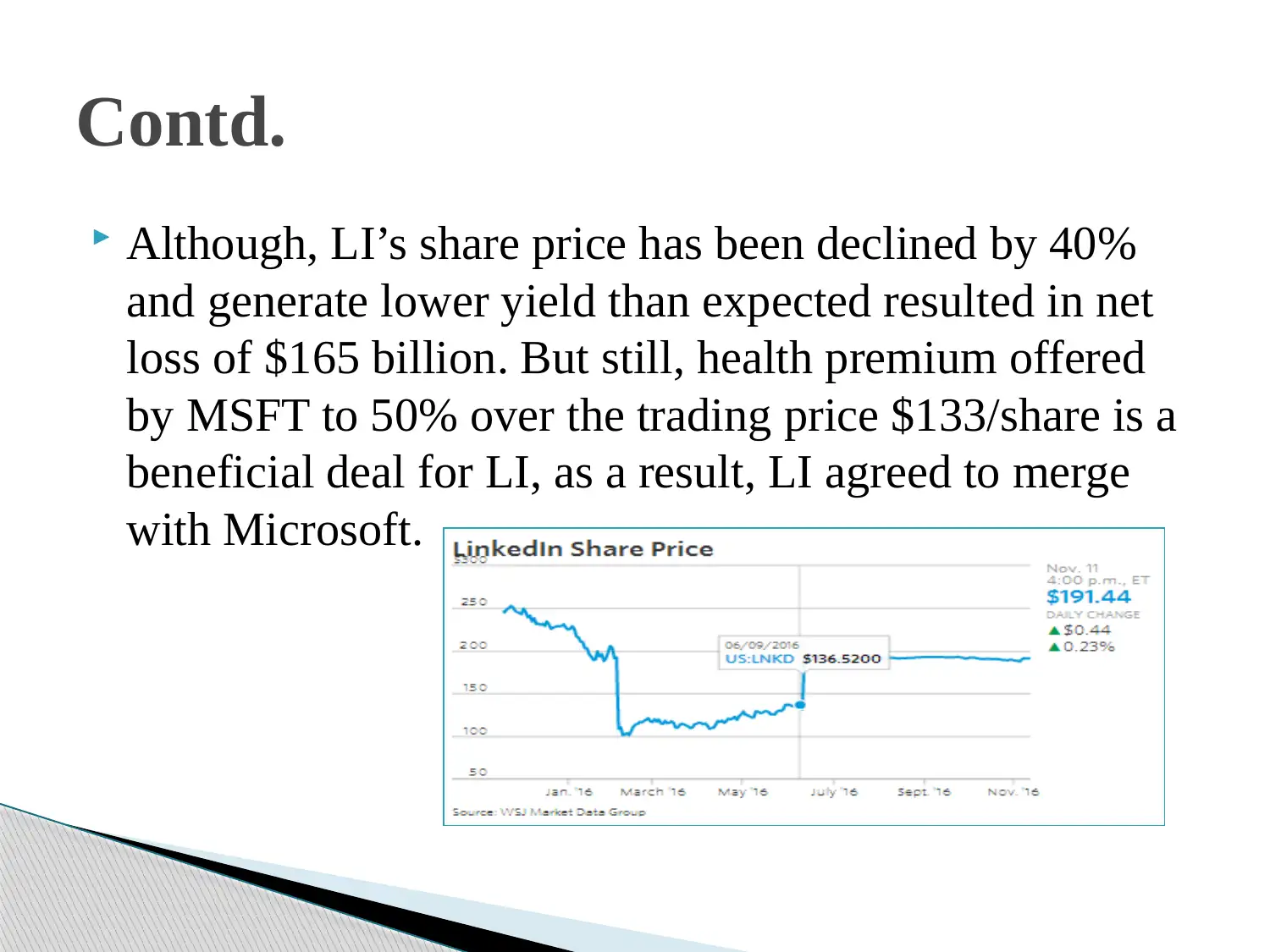

Although, LI’s share price has been declined by 40%

and generate lower yield than expected resulted in net

loss of $165 billion. But still, health premium offered

by MSFT to 50% over the trading price $133/share is a

beneficial deal for LI, as a result, LI agreed to merge

with Microsoft.

Contd.

and generate lower yield than expected resulted in net

loss of $165 billion. But still, health premium offered

by MSFT to 50% over the trading price $133/share is a

beneficial deal for LI, as a result, LI agreed to merge

with Microsoft.

Contd.

Offer value worth 26.2 billion dollar is approximately

91 times of LI’s EBITDA (Earnings before interest,

taxes, depreciation and amortization).

Excluding cash, it is about 84 times to EBITDA.

Venture capitalists finalized at 250 million dollar.

Offer value

91 times of LI’s EBITDA (Earnings before interest,

taxes, depreciation and amortization).

Excluding cash, it is about 84 times to EBITDA.

Venture capitalists finalized at 250 million dollar.

Offer value

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

19% year by year (YOY) growth by having more than

433 million across world.

9% YOY growth by having more than 105 million

members each month.

49% YOY by increasing mobile usage to 60%.

34% growth YOY by increasing member page views to

45 billion

101% growth by having more than 7 million active job

listing

M&A offer’s potential results

433 million across world.

9% YOY growth by having more than 105 million

members each month.

49% YOY by increasing mobile usage to 60%.

34% growth YOY by increasing member page views to

45 billion

101% growth by having more than 7 million active job

listing

M&A offer’s potential results

With the planned M&A, both MSFT and LI’s CEO Satya

Nadella and Jeff Weinger were excited and tell their staff

member about the deal.

They assumed that this deal will bring together world’s

largest professional cloud company and leading

professional networking company.

It will bring fantastic and excellent network by having

more than 433 million professionals. Moreover, potential

increase in number of commercial and dynamic offices to

365 will assist business to reinvent its productivity and

operational processes.

Reaction of the target by management

Nadella and Jeff Weinger were excited and tell their staff

member about the deal.

They assumed that this deal will bring together world’s

largest professional cloud company and leading

professional networking company.

It will bring fantastic and excellent network by having

more than 433 million professionals. Moreover, potential

increase in number of commercial and dynamic offices to

365 will assist business to reinvent its productivity and

operational processes.

Reaction of the target by management

Takeover panel is a regulatory body situated

in London, England. The body is responsible

and accountable to regulate and monitor

takeovers and mergers undertaken by the

company.

Takeover panel

in London, England. The body is responsible

and accountable to regulate and monitor

takeovers and mergers undertaken by the

company.

Takeover panel

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It plays an essential role to make sure that all the

shareholders are treated equally and well during the period

of takeover bids.

PTM has wider authority and power to declare such

circumstances that are unacceptable.

Moreover, it also plays an inevitable role in mitigating

issues and resolve complexities associated with the

acquisition of LinkedIn with Microsoft Corporation.

Both the MSFT and LikedIn are liable to follow PTM’s

rules, regulations and principles to have successful merger

plan.

Role of PTM

shareholders are treated equally and well during the period

of takeover bids.

PTM has wider authority and power to declare such

circumstances that are unacceptable.

Moreover, it also plays an inevitable role in mitigating

issues and resolve complexities associated with the

acquisition of LinkedIn with Microsoft Corporation.

Both the MSFT and LikedIn are liable to follow PTM’s

rules, regulations and principles to have successful merger

plan.

Role of PTM

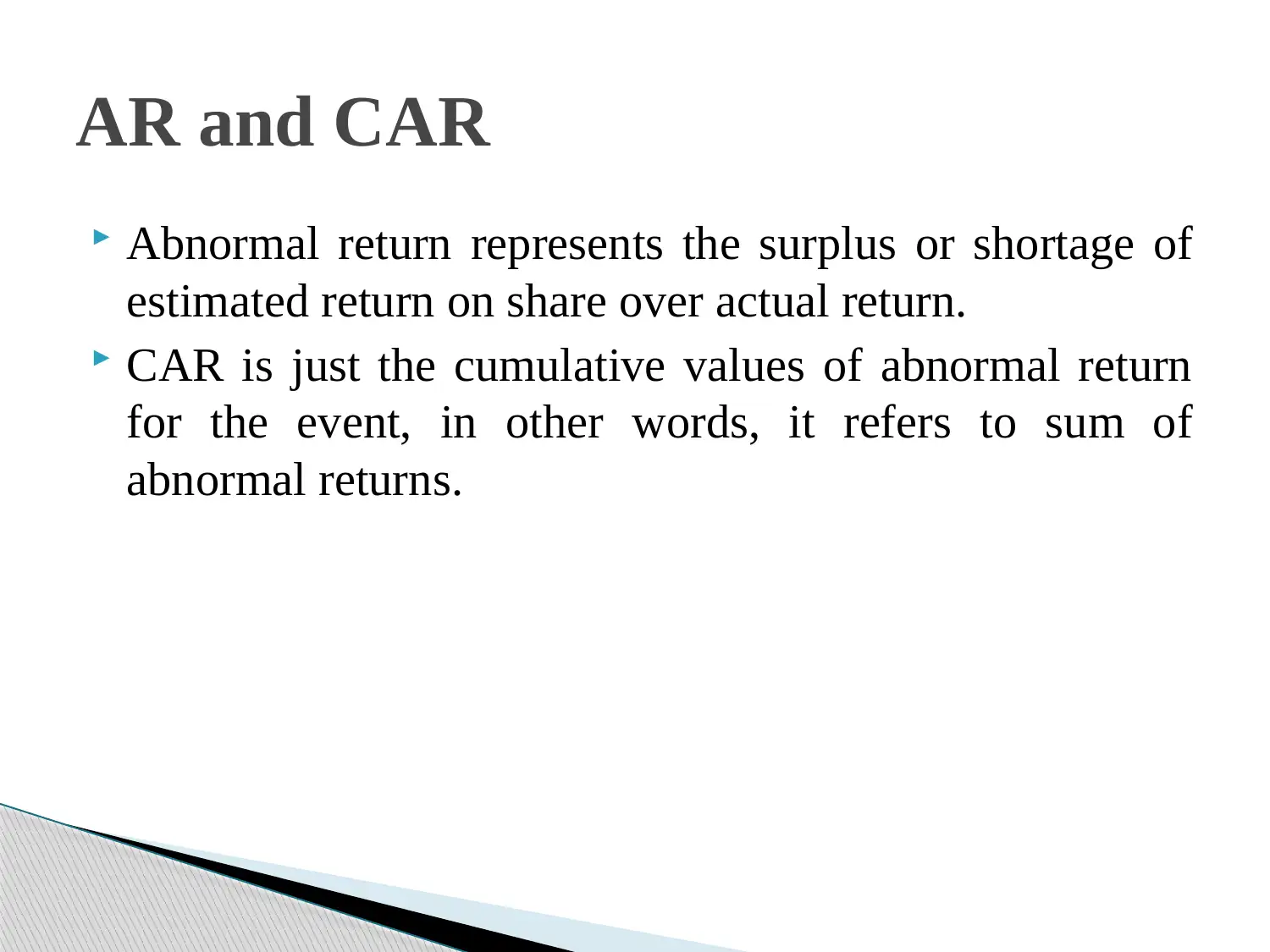

Abnormal return represents the surplus or shortage of

estimated return on share over actual return.

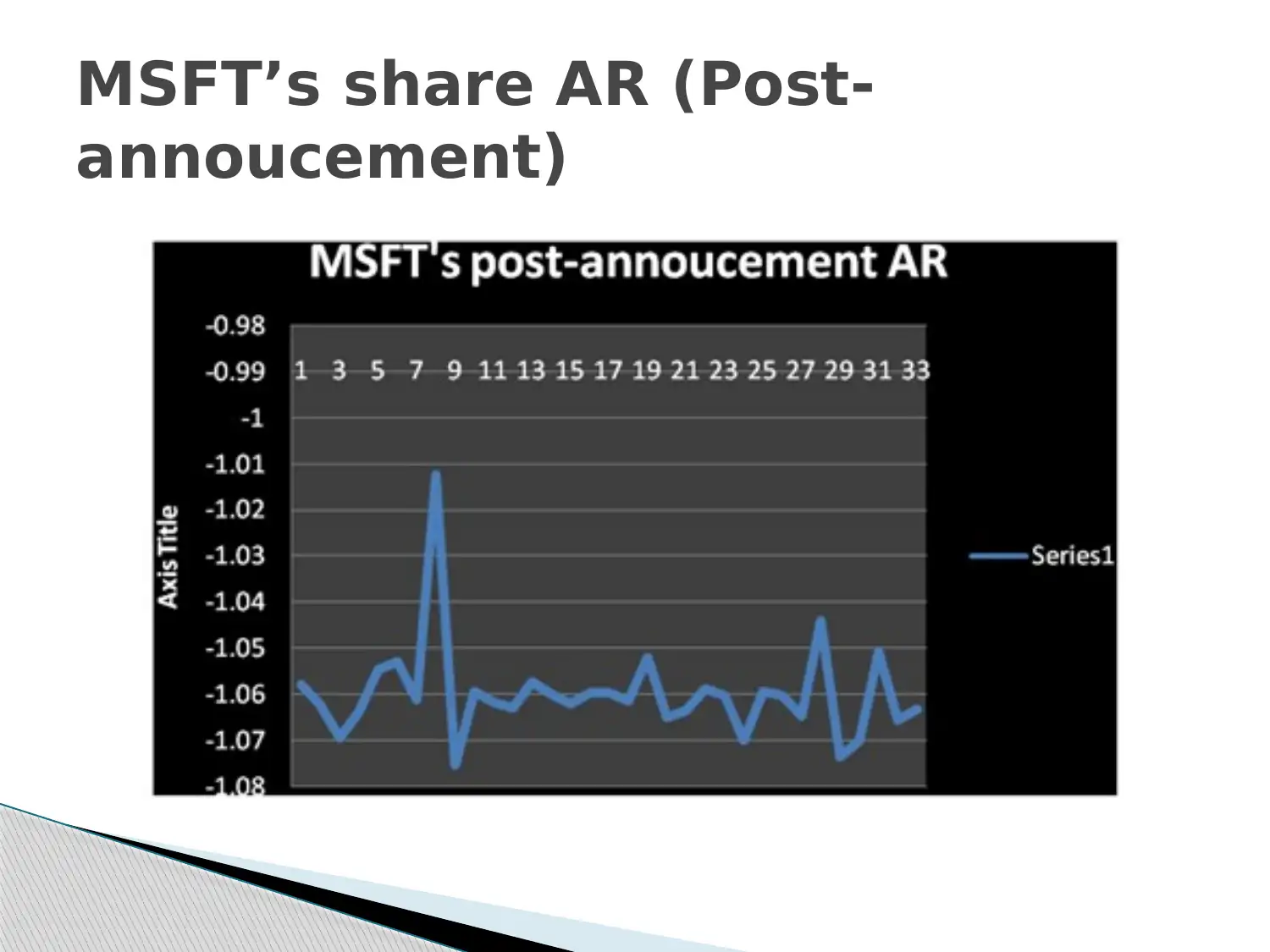

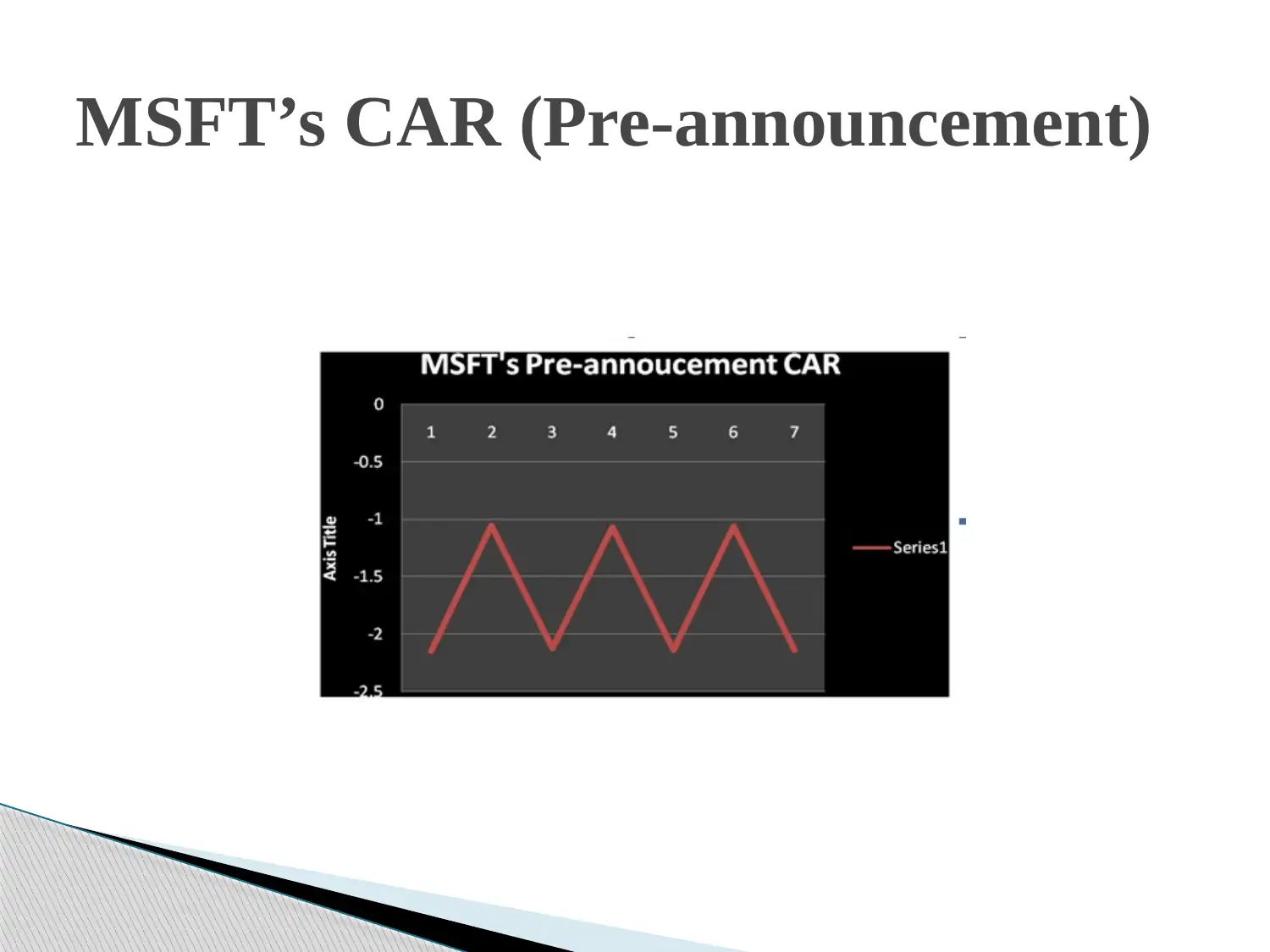

CAR is just the cumulative values of abnormal return

for the event, in other words, it refers to sum of

abnormal returns.

AR and CAR

estimated return on share over actual return.

CAR is just the cumulative values of abnormal return

for the event, in other words, it refers to sum of

abnormal returns.

AR and CAR

MSFT’s stock AR (pre-annoncement)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

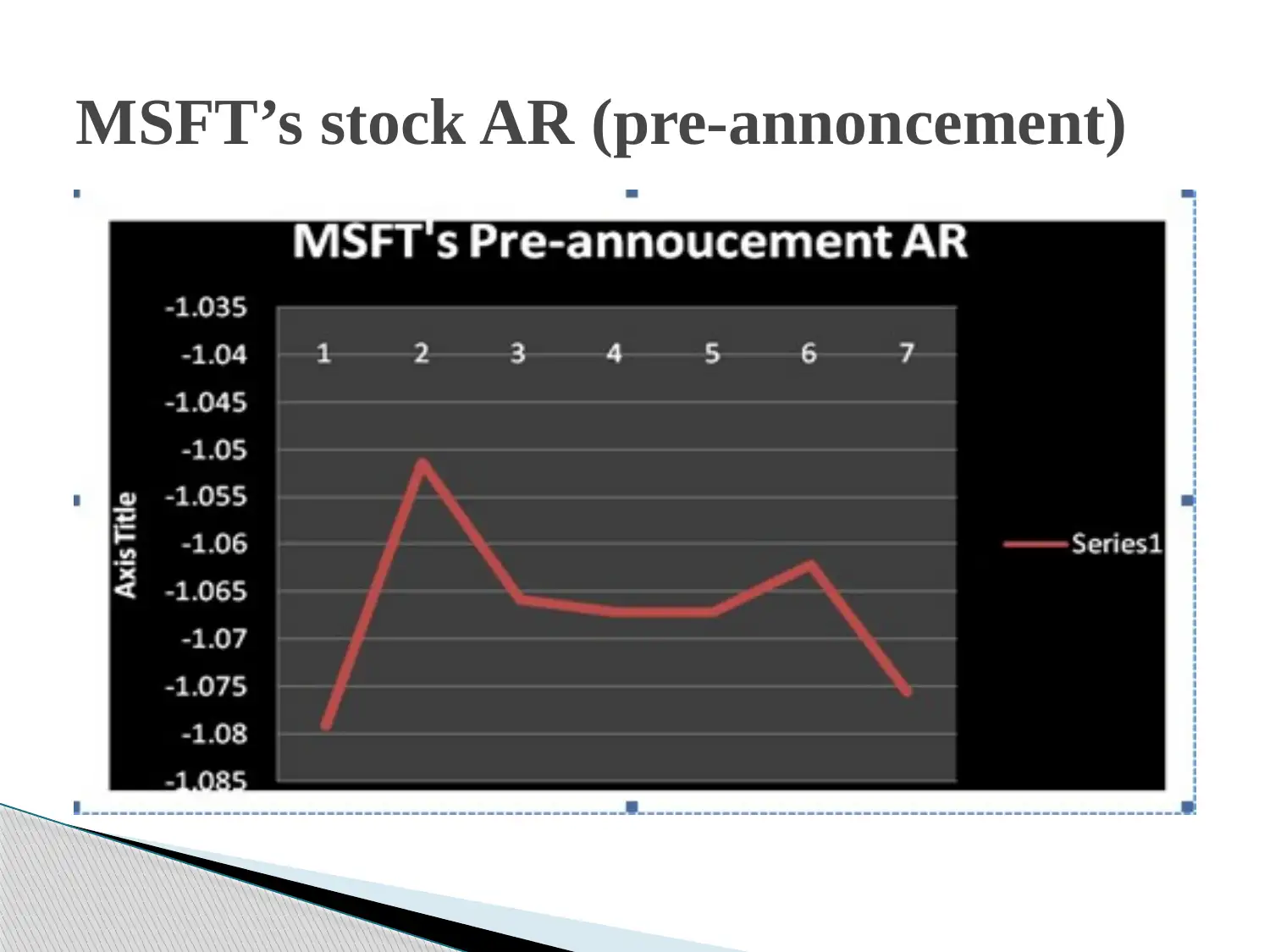

MSFT’s share AR (Post-

annoucement)

annoucement)

MSFT’s CAR (Pre-announcement)

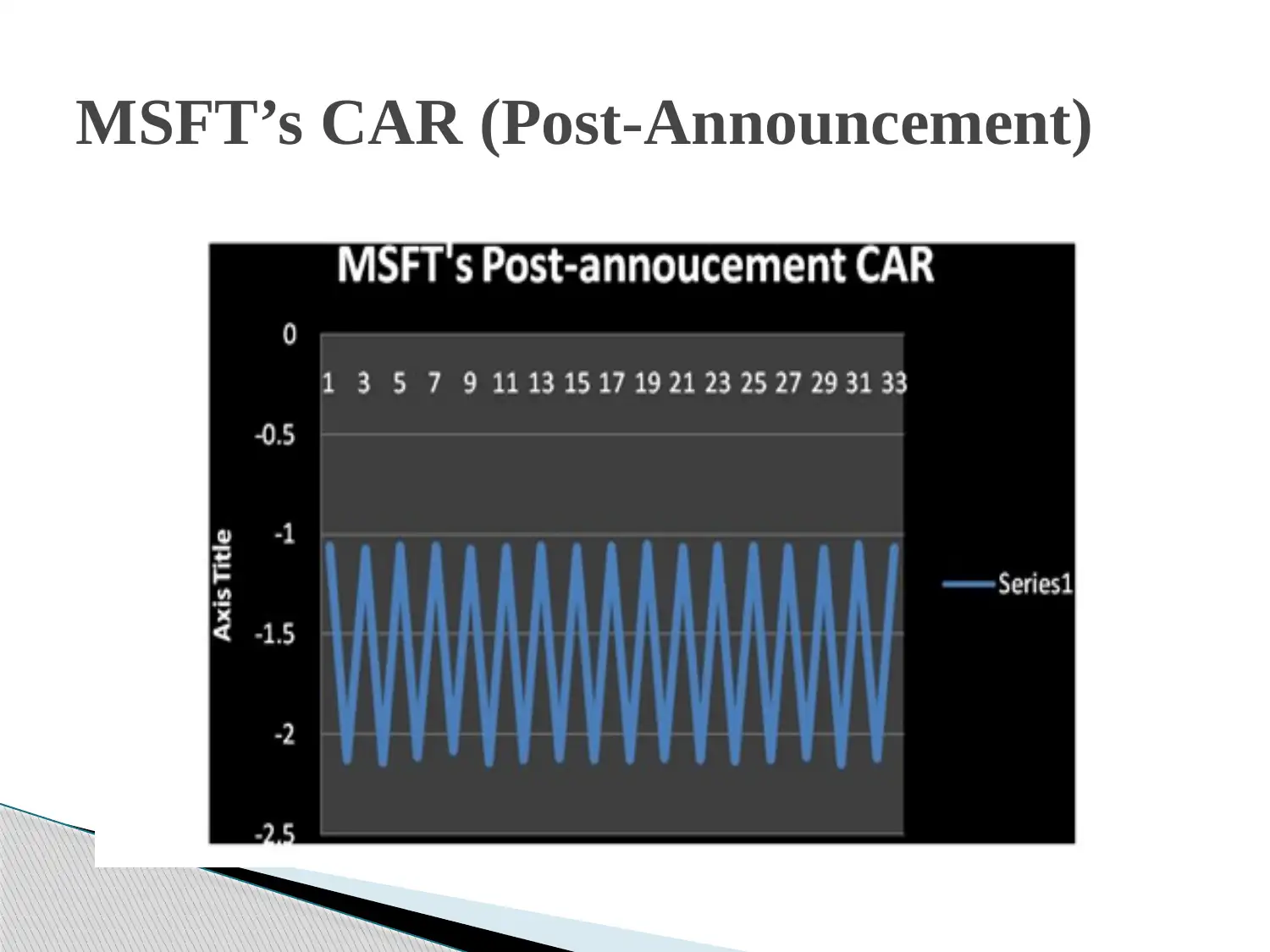

MSFT’s CAR (Post-Announcement)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

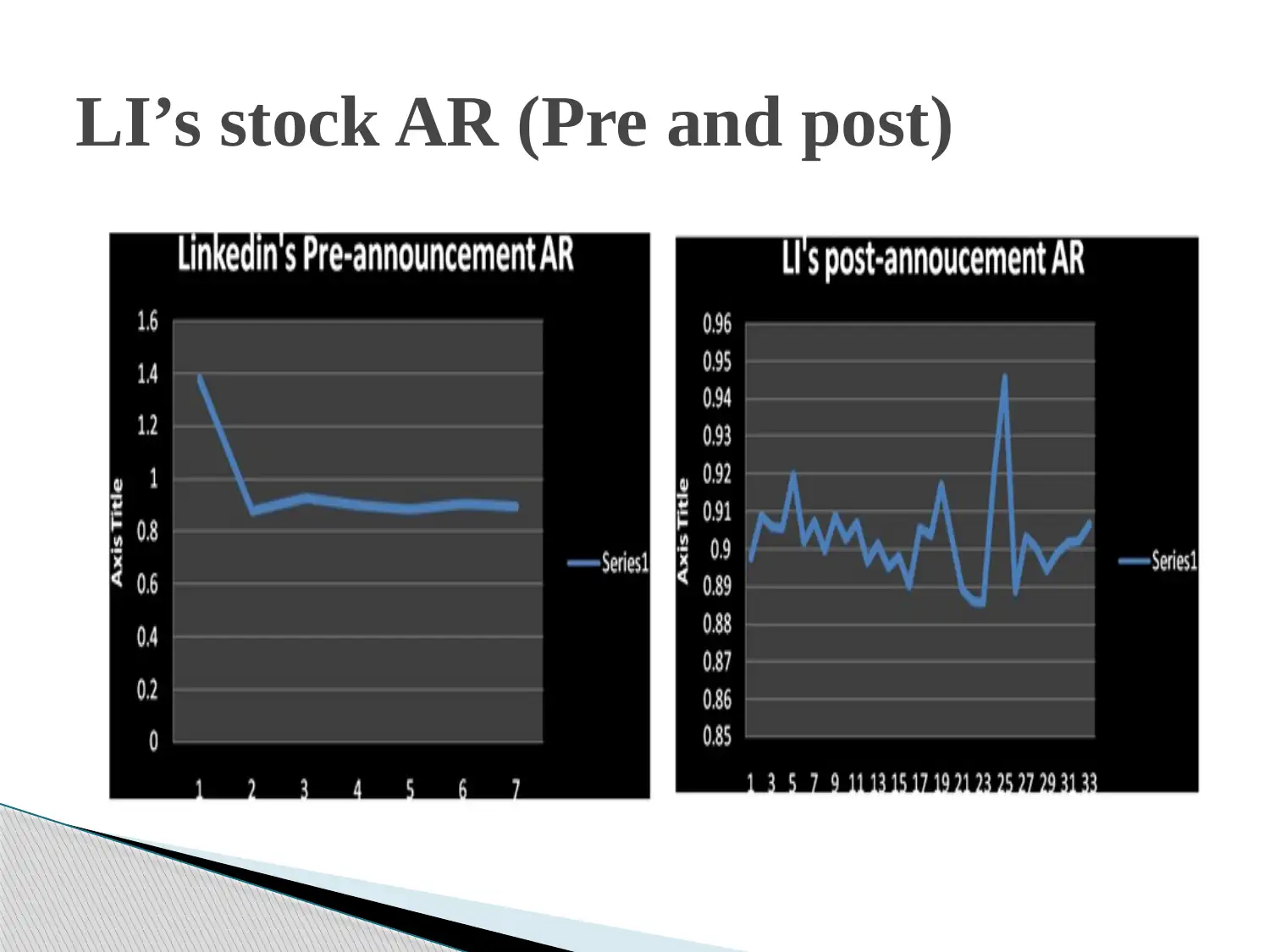

LI’s stock AR (Pre and post)

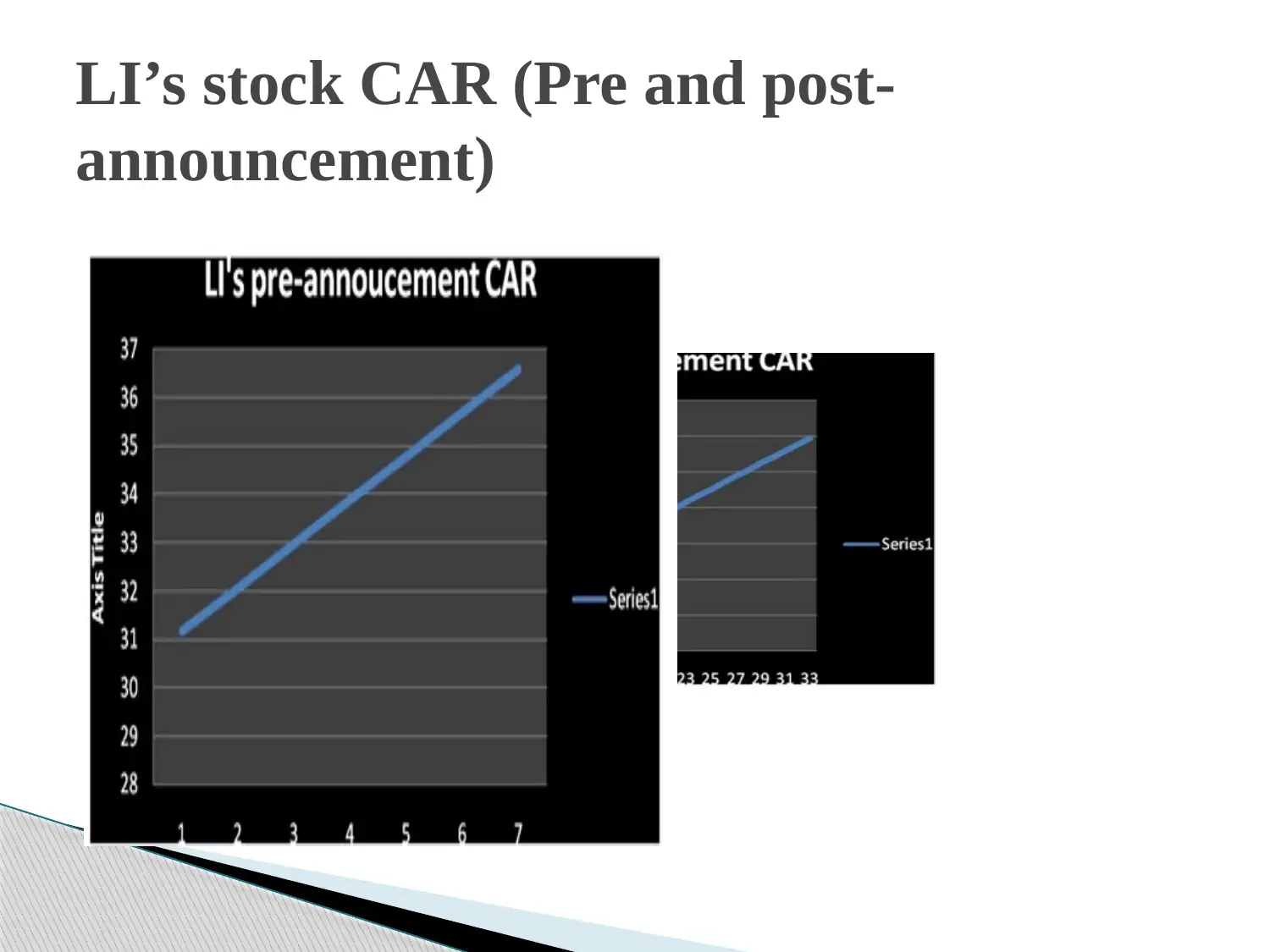

LI’s stock CAR (Pre and post-

announcement)

announcement)

As per the calculation, it can be seen that before the

announcement of acquisition, in the initial period,

MSFT’s stock performance tends to increase, but at the

closure of announcement, it goes decrease.

However, on the other hand, after the announcement,

suddenly its stock price moves upward while,

thereafter, it dropped down and then fluctuations

continuously.

Analysis of stock performance

announcement of acquisition, in the initial period,

MSFT’s stock performance tends to increase, but at the

closure of announcement, it goes decrease.

However, on the other hand, after the announcement,

suddenly its stock price moves upward while,

thereafter, it dropped down and then fluctuations

continuously.

Analysis of stock performance

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

During the period of 1st July to 29th July, stock price got

improved from 51.16 to 56.58 which show that

MSFT’s share price got improved, but still, the rate of

growth in the stock prices is fluctuating.

However, in context to LinkedIn Corporation, it has

been found that cumulative abnormal return (CAR) of

LinkedIn was higher. For example, on 3rd June CAR

was 36.57 which is continuously decreasing till 13th

June. At the same time, abnormal return (AR) is also

fluctuating with the passage of time.

Contd.

improved from 51.16 to 56.58 which show that

MSFT’s share price got improved, but still, the rate of

growth in the stock prices is fluctuating.

However, in context to LinkedIn Corporation, it has

been found that cumulative abnormal return (CAR) of

LinkedIn was higher. For example, on 3rd June CAR

was 36.57 which is continuously decreasing till 13th

June. At the same time, abnormal return (AR) is also

fluctuating with the passage of time.

Contd.

LI’s CAR has been reduced to a great extent after the

announcement of merger. This affected performance of

the corporation to a great extent. It is because on 14th

June CAR was 29.80 but on 1 July it reached to 18.07.

Moreover, till the end of July month CAR reduced to

0.89.

Contd.

announcement of merger. This affected performance of

the corporation to a great extent. It is because on 14th

June CAR was 29.80 but on 1 July it reached to 18.07.

Moreover, till the end of July month CAR reduced to

0.89.

Contd.

4 Reasons why Microsoft wasted $26.2 billion to buy

LikedIn. (2016). [Online]. Available through:

<http://www.forbes.com/sites/petercohan/2016/06/13/4-

reasons-microsoft-wasted-26-2-billion-to-buy-linkedin/

#c692ce7533d1>. [Accessed on 12th November 2016].

Gara, A. (2016). LinkedIn is the Latest Tech Company To

Give Up On The Stock Market. [Online]. Available through:

http://www.forbes.com/sites/antoinegara/2016/06/13/linkedi

n-is-the-latest-fast-growing-tech-company-to-give-up-on-

the-stock-market/#8757b1c50bed. [Accessed on 12th

November 2016].

REFERENCES

LikedIn. (2016). [Online]. Available through:

<http://www.forbes.com/sites/petercohan/2016/06/13/4-

reasons-microsoft-wasted-26-2-billion-to-buy-linkedin/

#c692ce7533d1>. [Accessed on 12th November 2016].

Gara, A. (2016). LinkedIn is the Latest Tech Company To

Give Up On The Stock Market. [Online]. Available through:

http://www.forbes.com/sites/antoinegara/2016/06/13/linkedi

n-is-the-latest-fast-growing-tech-company-to-give-up-on-

the-stock-market/#8757b1c50bed. [Accessed on 12th

November 2016].

REFERENCES

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Thank You!

1 out of 26

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.