Business Simulation Project

VerifiedAdded on 2020/10/05

|31

|7316

|220

AI Summary

The assignment details provided describe a business simulation project where the author worked as a co-coordinator and had to manage team members, make decisions, and influence colleagues. The project involved understanding business strategies, operational activities, marketing, financial, and human resource decisions in an organization. The author analyzed various situations, conducted team meetings, and developed knowledge of different areas and their significance for an organization.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

STRATEGIC MANAGEMENT FOR

COMPETITIVE ADVANTAGE

COMPETITIVE ADVANTAGE

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

Company performance.....................................................................................................................6

A. Round 1..............................................................................................................................6

B. Round 2..............................................................................................................................7

C. Round 3..............................................................................................................................9

D. Round 4............................................................................................................................11

TREND ANALYSIS.....................................................................................................................13

LEARNING...................................................................................................................................22

Strategy ................................................................................................................................22

Financial decisions...............................................................................................................23

Marketing decisions..............................................................................................................23

Operating decisions..............................................................................................................24

Human resource decisions ...................................................................................................25

Conclusion ....................................................................................................................................25

Team Performance.........................................................................................................................25

Personal reflection ...............................................................................................................25

REFERENCES..............................................................................................................................28

INTRODUCTION...........................................................................................................................1

Company performance.....................................................................................................................6

A. Round 1..............................................................................................................................6

B. Round 2..............................................................................................................................7

C. Round 3..............................................................................................................................9

D. Round 4............................................................................................................................11

TREND ANALYSIS.....................................................................................................................13

LEARNING...................................................................................................................................22

Strategy ................................................................................................................................22

Financial decisions...............................................................................................................23

Marketing decisions..............................................................................................................23

Operating decisions..............................................................................................................24

Human resource decisions ...................................................................................................25

Conclusion ....................................................................................................................................25

Team Performance.........................................................................................................................25

Personal reflection ...............................................................................................................25

REFERENCES..............................................................................................................................28

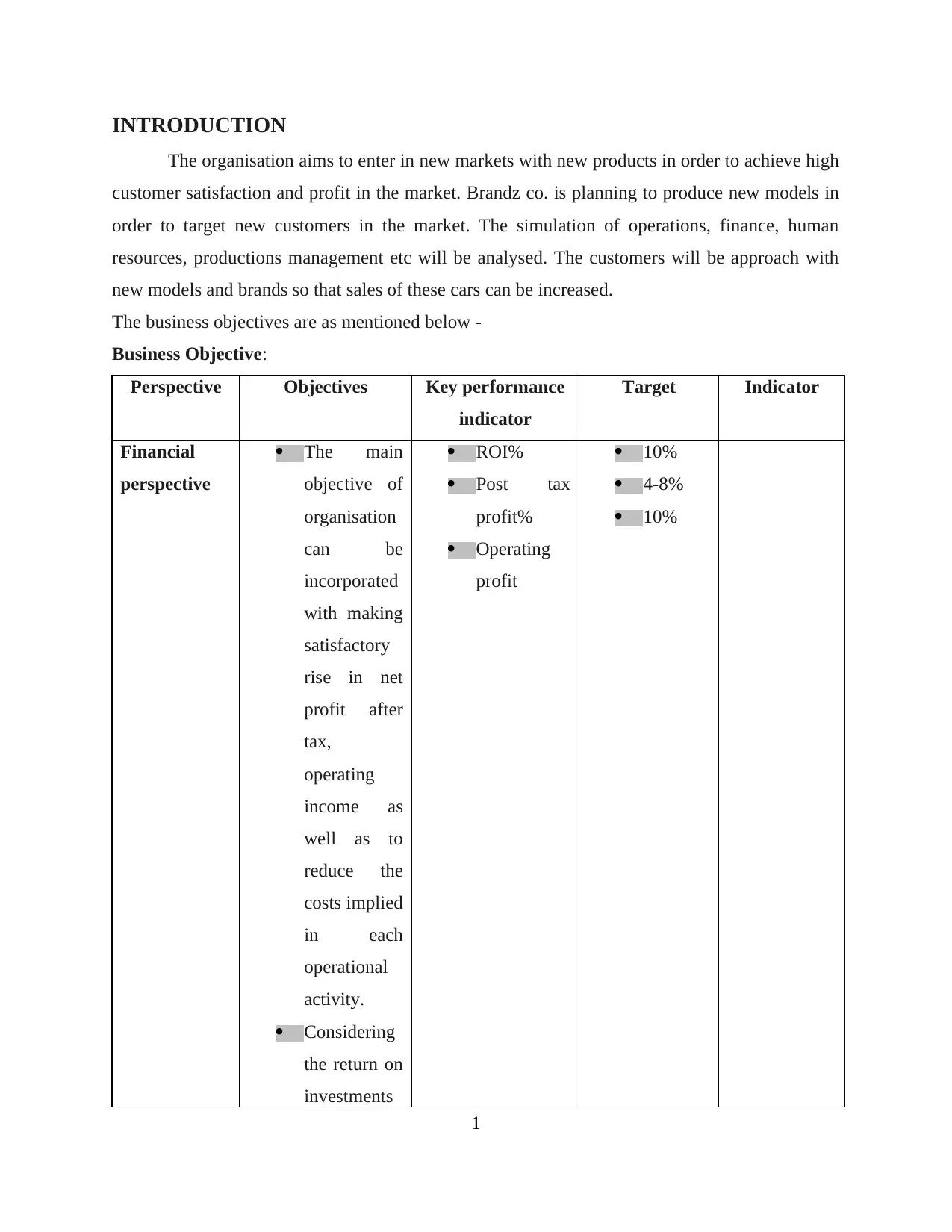

INTRODUCTION

The organisation aims to enter in new markets with new products in order to achieve high

customer satisfaction and profit in the market. Brandz co. is planning to produce new models in

order to target new customers in the market. The simulation of operations, finance, human

resources, productions management etc will be analysed. The customers will be approach with

new models and brands so that sales of these cars can be increased.

The business objectives are as mentioned below -

Business Objective:

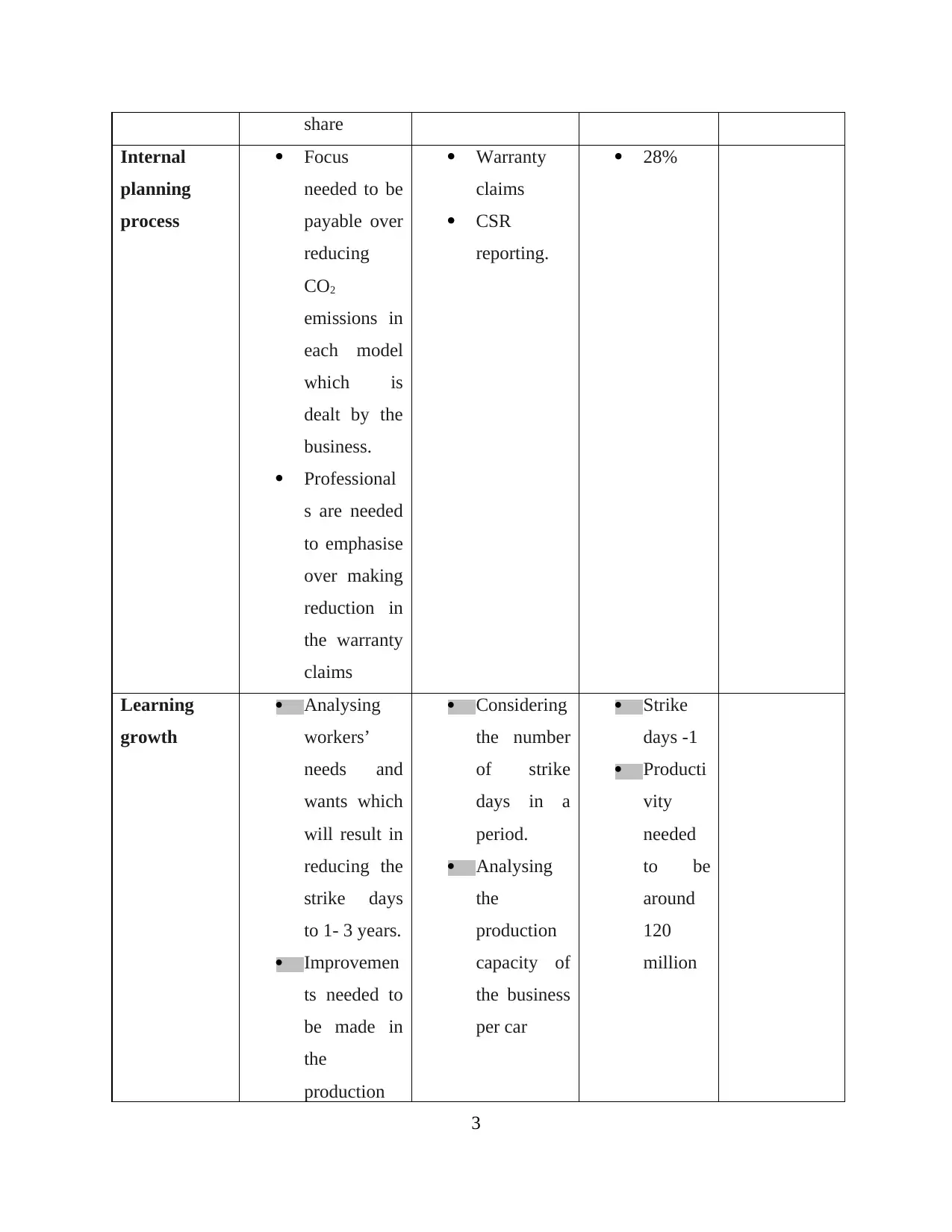

Perspective Objectives Key performance

indicator

Target Indicator

Financial

perspective

The main

objective of

organisation

can be

incorporated

with making

satisfactory

rise in net

profit after

tax,

operating

income as

well as to

reduce the

costs implied

in each

operational

activity.

Considering

the return on

investments

ROI%

Post tax

profit%

Operating

profit

10%

4-8%

10%

1

The organisation aims to enter in new markets with new products in order to achieve high

customer satisfaction and profit in the market. Brandz co. is planning to produce new models in

order to target new customers in the market. The simulation of operations, finance, human

resources, productions management etc will be analysed. The customers will be approach with

new models and brands so that sales of these cars can be increased.

The business objectives are as mentioned below -

Business Objective:

Perspective Objectives Key performance

indicator

Target Indicator

Financial

perspective

The main

objective of

organisation

can be

incorporated

with making

satisfactory

rise in net

profit after

tax,

operating

income as

well as to

reduce the

costs implied

in each

operational

activity.

Considering

the return on

investments

ROI%

Post tax

profit%

Operating

profit

10%

4-8%

10%

1

there, is need

of effective

policies

which will

result in

satisfactory

rise in

returns

Customer

perspective

As per

considering

the buyer’s

satisfaction

as well as

profitability

of entity

which will

be based on

rise in the

market value

of the cars in

each period

around 5-

10%

Effective

dividend

policies will

lead the firm

in attaining

adequate rise

in the market

Share value

of the cars.

6-12%

2

of effective

policies

which will

result in

satisfactory

rise in

returns

Customer

perspective

As per

considering

the buyer’s

satisfaction

as well as

profitability

of entity

which will

be based on

rise in the

market value

of the cars in

each period

around 5-

10%

Effective

dividend

policies will

lead the firm

in attaining

adequate rise

in the market

Share value

of the cars.

6-12%

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

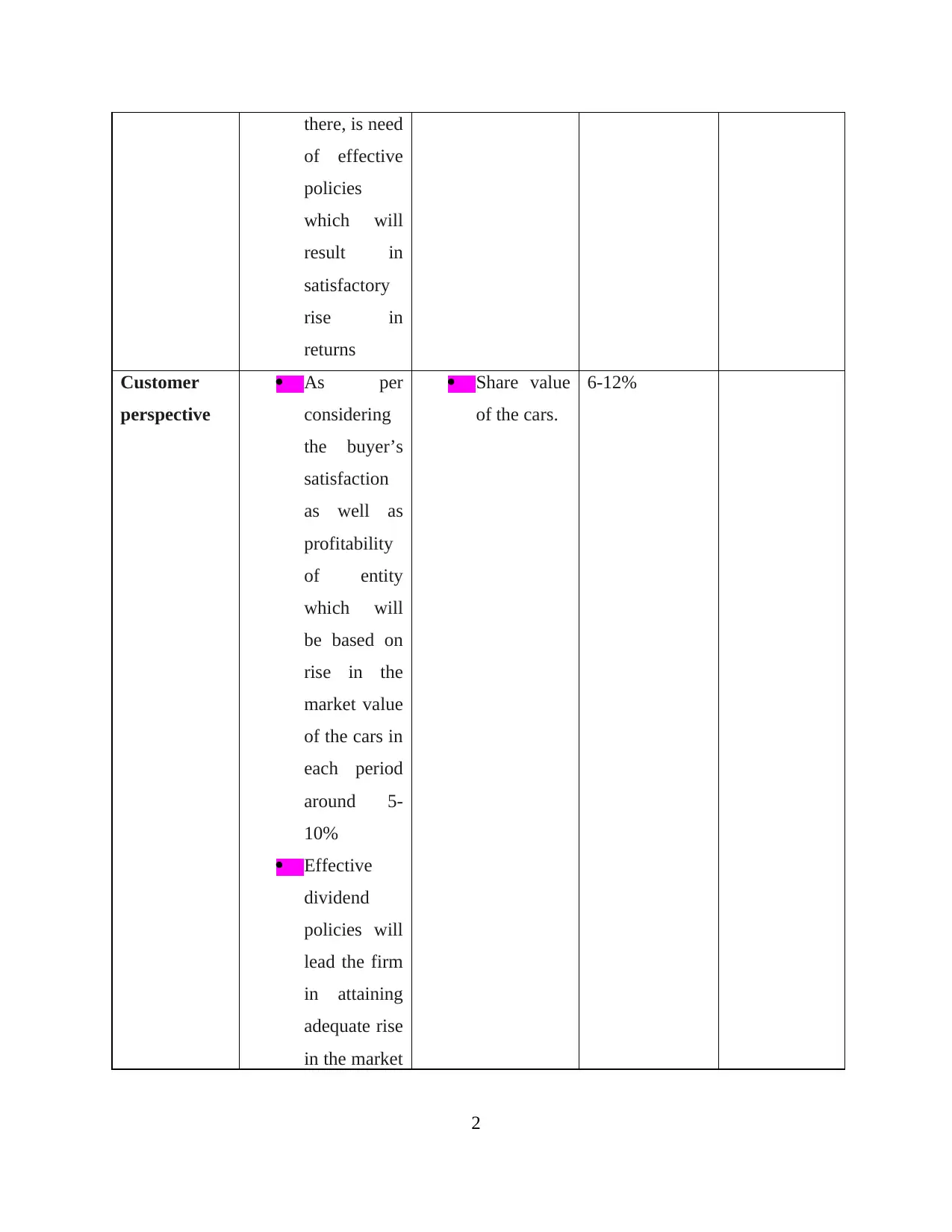

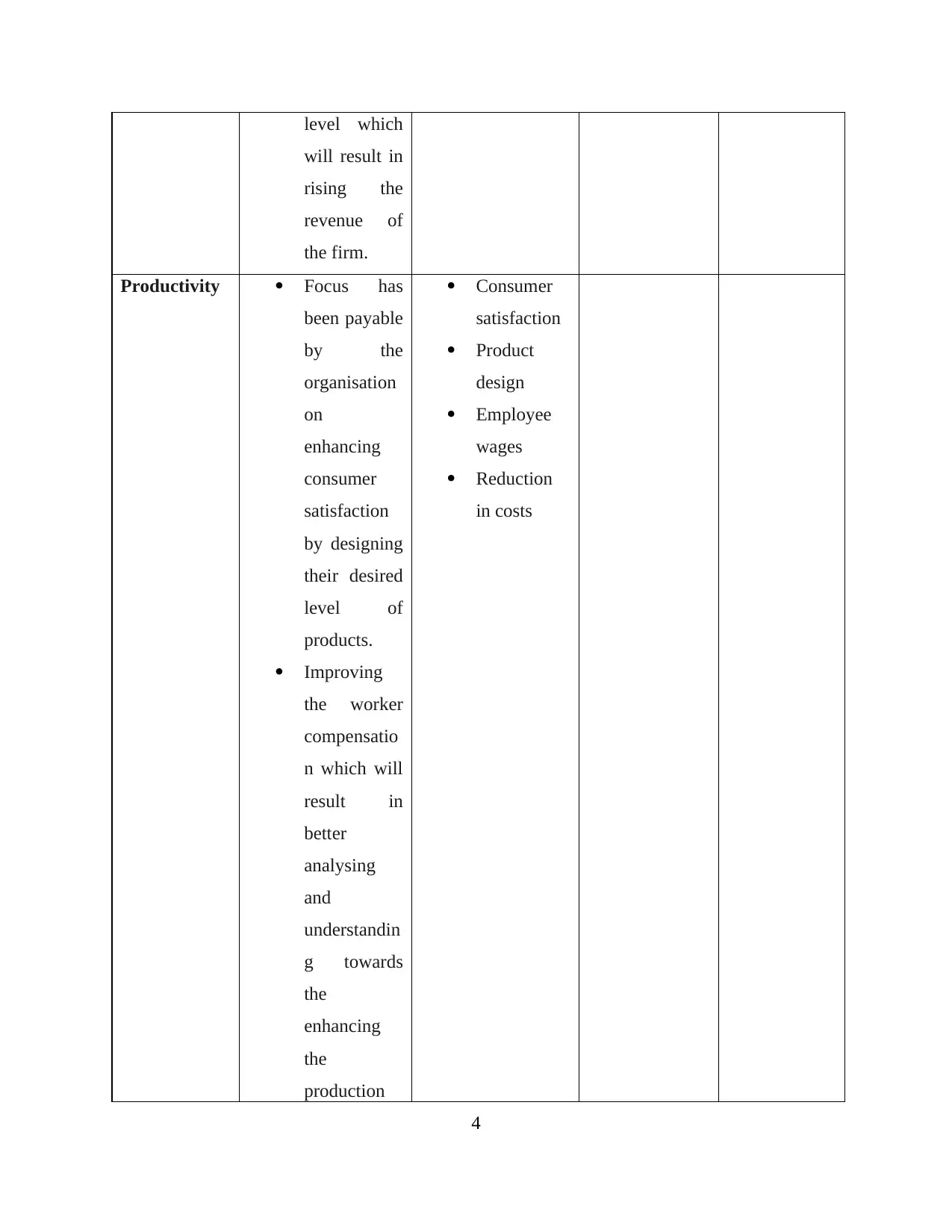

share

Internal

planning

process

Focus

needed to be

payable over

reducing

CO2

emissions in

each model

which is

dealt by the

business.

Professional

s are needed

to emphasise

over making

reduction in

the warranty

claims

Warranty

claims

CSR

reporting.

28%

Learning

growth

Analysing

workers’

needs and

wants which

will result in

reducing the

strike days

to 1- 3 years.

Improvemen

ts needed to

be made in

the

production

Considering

the number

of strike

days in a

period.

Analysing

the

production

capacity of

the business

per car

Strike

days -1

Producti

vity

needed

to be

around

120

million

3

Internal

planning

process

Focus

needed to be

payable over

reducing

CO2

emissions in

each model

which is

dealt by the

business.

Professional

s are needed

to emphasise

over making

reduction in

the warranty

claims

Warranty

claims

CSR

reporting.

28%

Learning

growth

Analysing

workers’

needs and

wants which

will result in

reducing the

strike days

to 1- 3 years.

Improvemen

ts needed to

be made in

the

production

Considering

the number

of strike

days in a

period.

Analysing

the

production

capacity of

the business

per car

Strike

days -1

Producti

vity

needed

to be

around

120

million

3

level which

will result in

rising the

revenue of

the firm.

Productivity Focus has

been payable

by the

organisation

on

enhancing

consumer

satisfaction

by designing

their desired

level of

products.

Improving

the worker

compensatio

n which will

result in

better

analysing

and

understandin

g towards

the

enhancing

the

production

Consumer

satisfaction

Product

design

Employee

wages

Reduction

in costs

4

will result in

rising the

revenue of

the firm.

Productivity Focus has

been payable

by the

organisation

on

enhancing

consumer

satisfaction

by designing

their desired

level of

products.

Improving

the worker

compensatio

n which will

result in

better

analysing

and

understandin

g towards

the

enhancing

the

production

Consumer

satisfaction

Product

design

Employee

wages

Reduction

in costs

4

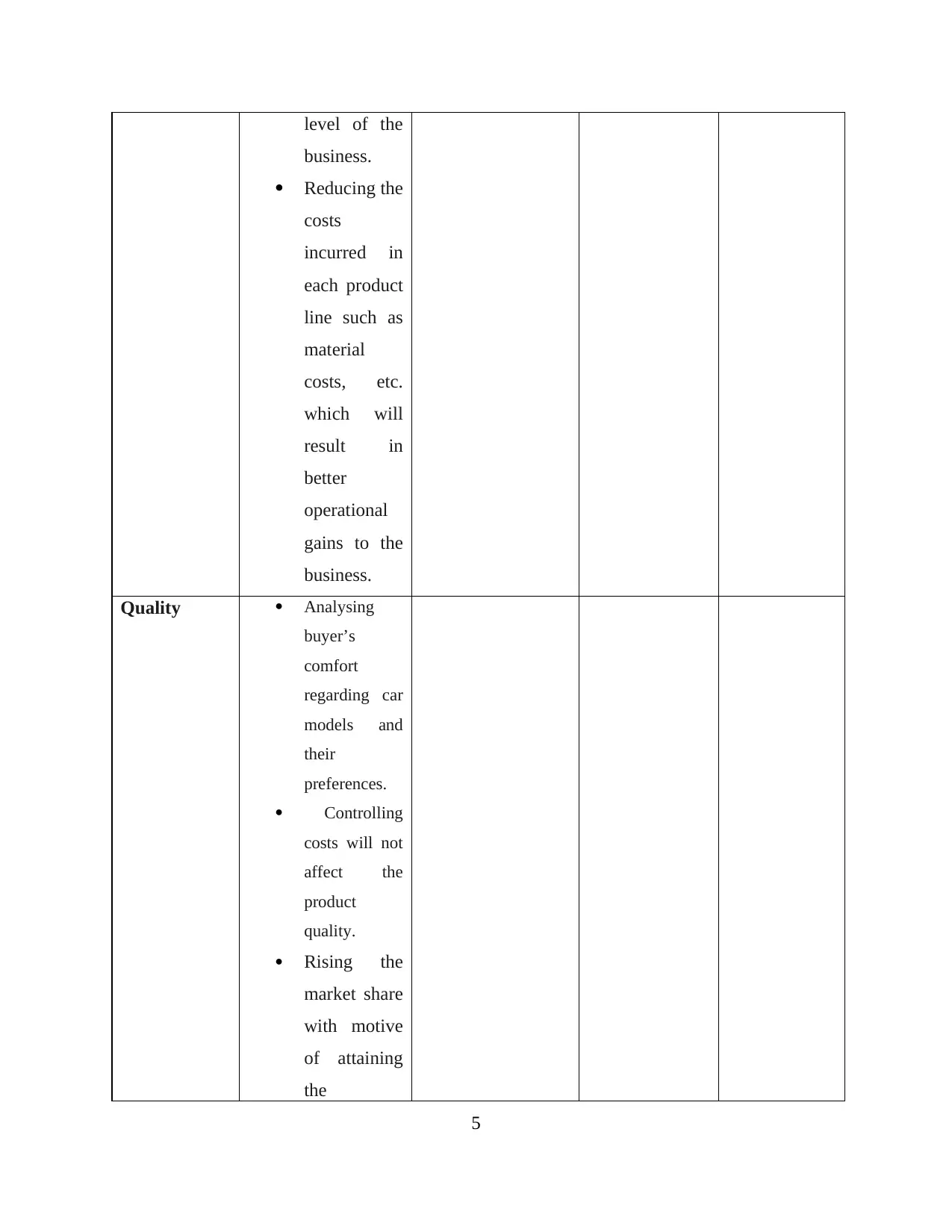

level of the

business.

Reducing the

costs

incurred in

each product

line such as

material

costs, etc.

which will

result in

better

operational

gains to the

business.

Quality Analysing

buyer’s

comfort

regarding car

models and

their

preferences.

Controlling

costs will not

affect the

product

quality.

Rising the

market share

with motive

of attaining

the

5

business.

Reducing the

costs

incurred in

each product

line such as

material

costs, etc.

which will

result in

better

operational

gains to the

business.

Quality Analysing

buyer’s

comfort

regarding car

models and

their

preferences.

Controlling

costs will not

affect the

product

quality.

Rising the

market share

with motive

of attaining

the

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

satisfactory

amount of

gains.

Summary of the performance

Rounds Total sales Total unsold Shareholder

funds

Closing

bank

balance

Outstanding

loan

Round 1 3801.28 0 781.88 -29.65 100

Round 2 6483.22 1472 1529.10 -221.59 0

Round 3 4608.52 135827 1500.98 -1380.79 500

Round 4 5322.97 236263 -4.78 -3613.65 1000

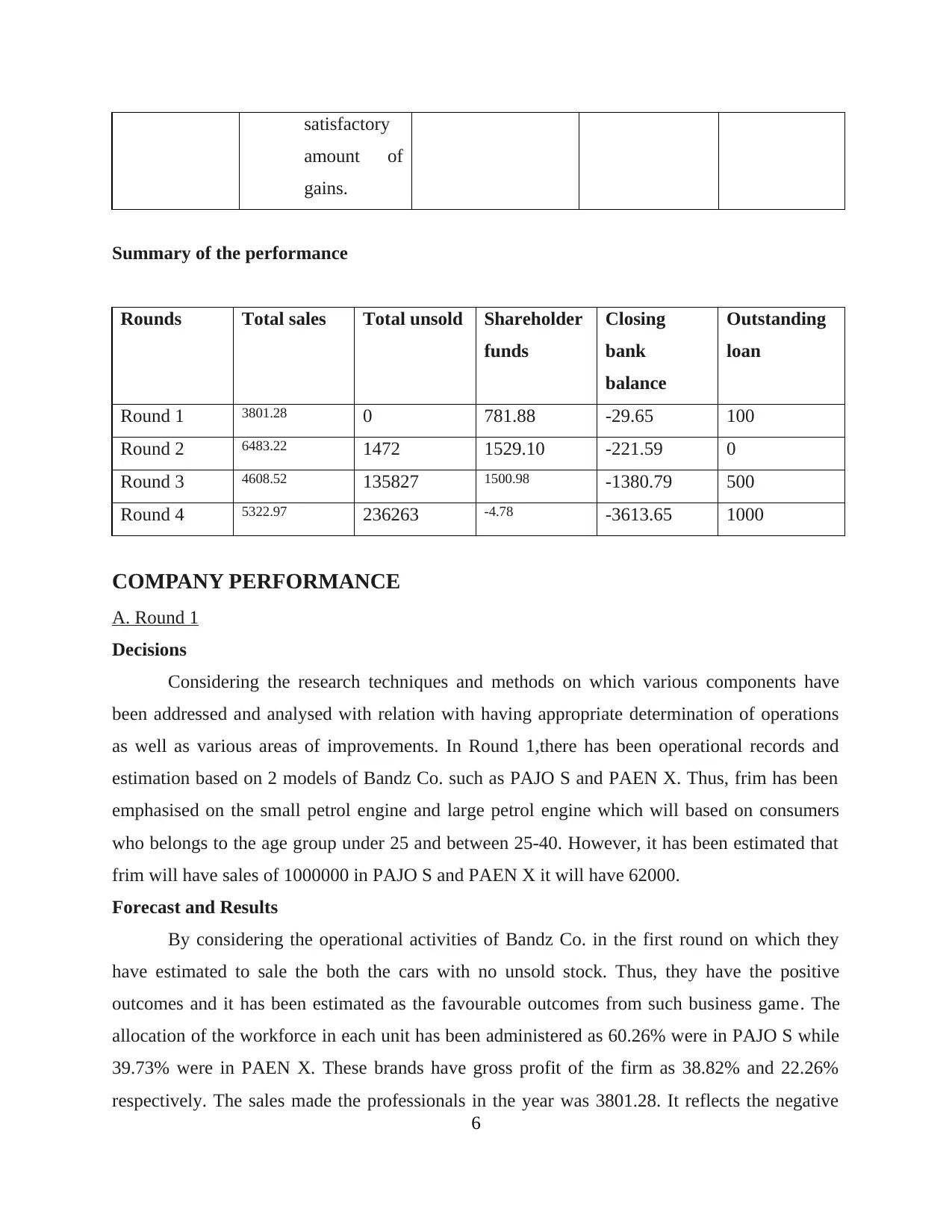

COMPANY PERFORMANCE

A. Round 1

Decisions

Considering the research techniques and methods on which various components have

been addressed and analysed with relation with having appropriate determination of operations

as well as various areas of improvements. In Round 1,there has been operational records and

estimation based on 2 models of Bandz Co. such as PAJO S and PAEN X. Thus, frim has been

emphasised on the small petrol engine and large petrol engine which will based on consumers

who belongs to the age group under 25 and between 25-40. However, it has been estimated that

frim will have sales of 1000000 in PAJO S and PAEN X it will have 62000.

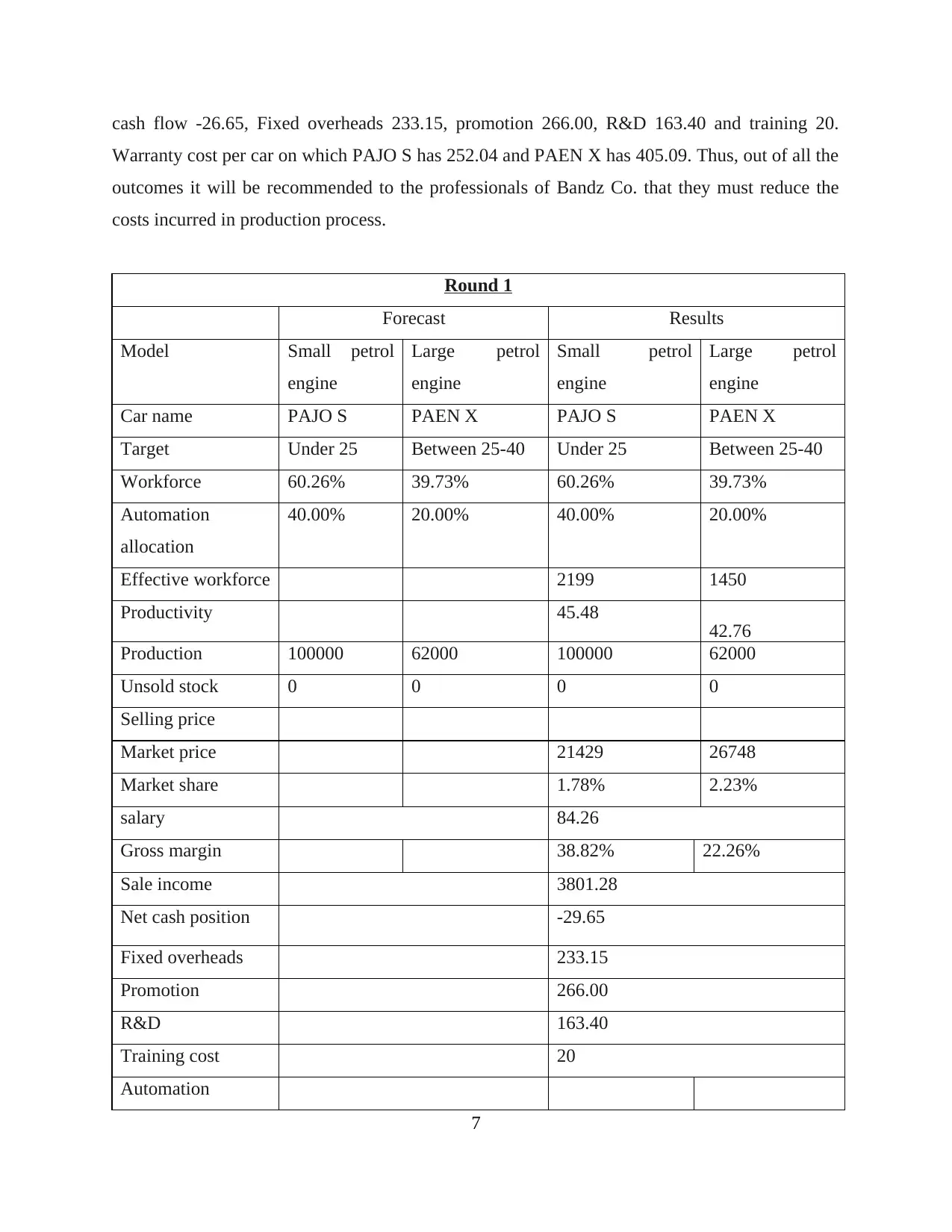

Forecast and Results

By considering the operational activities of Bandz Co. in the first round on which they

have estimated to sale the both the cars with no unsold stock. Thus, they have the positive

outcomes and it has been estimated as the favourable outcomes from such business game. The

allocation of the workforce in each unit has been administered as 60.26% were in PAJO S while

39.73% were in PAEN X. These brands have gross profit of the firm as 38.82% and 22.26%

respectively. The sales made the professionals in the year was 3801.28. It reflects the negative

6

amount of

gains.

Summary of the performance

Rounds Total sales Total unsold Shareholder

funds

Closing

bank

balance

Outstanding

loan

Round 1 3801.28 0 781.88 -29.65 100

Round 2 6483.22 1472 1529.10 -221.59 0

Round 3 4608.52 135827 1500.98 -1380.79 500

Round 4 5322.97 236263 -4.78 -3613.65 1000

COMPANY PERFORMANCE

A. Round 1

Decisions

Considering the research techniques and methods on which various components have

been addressed and analysed with relation with having appropriate determination of operations

as well as various areas of improvements. In Round 1,there has been operational records and

estimation based on 2 models of Bandz Co. such as PAJO S and PAEN X. Thus, frim has been

emphasised on the small petrol engine and large petrol engine which will based on consumers

who belongs to the age group under 25 and between 25-40. However, it has been estimated that

frim will have sales of 1000000 in PAJO S and PAEN X it will have 62000.

Forecast and Results

By considering the operational activities of Bandz Co. in the first round on which they

have estimated to sale the both the cars with no unsold stock. Thus, they have the positive

outcomes and it has been estimated as the favourable outcomes from such business game. The

allocation of the workforce in each unit has been administered as 60.26% were in PAJO S while

39.73% were in PAEN X. These brands have gross profit of the firm as 38.82% and 22.26%

respectively. The sales made the professionals in the year was 3801.28. It reflects the negative

6

cash flow -26.65, Fixed overheads 233.15, promotion 266.00, R&D 163.40 and training 20.

Warranty cost per car on which PAJO S has 252.04 and PAEN X has 405.09. Thus, out of all the

outcomes it will be recommended to the professionals of Bandz Co. that they must reduce the

costs incurred in production process.

Round 1

Forecast Results

Model Small petrol

engine

Large petrol

engine

Small petrol

engine

Large petrol

engine

Car name PAJO S PAEN X PAJO S PAEN X

Target Under 25 Between 25-40 Under 25 Between 25-40

Workforce 60.26% 39.73% 60.26% 39.73%

Automation

allocation

40.00% 20.00% 40.00% 20.00%

Effective workforce 2199 1450

Productivity 45.48 42.76

Production 100000 62000 100000 62000

Unsold stock 0 0 0 0

Selling price

Market price 21429 26748

Market share 1.78% 2.23%

salary 84.26

Gross margin 38.82% 22.26%

Sale income 3801.28

Net cash position -29.65

Fixed overheads 233.15

Promotion 266.00

R&D 163.40

Training cost 20

Automation

7

Warranty cost per car on which PAJO S has 252.04 and PAEN X has 405.09. Thus, out of all the

outcomes it will be recommended to the professionals of Bandz Co. that they must reduce the

costs incurred in production process.

Round 1

Forecast Results

Model Small petrol

engine

Large petrol

engine

Small petrol

engine

Large petrol

engine

Car name PAJO S PAEN X PAJO S PAEN X

Target Under 25 Between 25-40 Under 25 Between 25-40

Workforce 60.26% 39.73% 60.26% 39.73%

Automation

allocation

40.00% 20.00% 40.00% 20.00%

Effective workforce 2199 1450

Productivity 45.48 42.76

Production 100000 62000 100000 62000

Unsold stock 0 0 0 0

Selling price

Market price 21429 26748

Market share 1.78% 2.23%

salary 84.26

Gross margin 38.82% 22.26%

Sale income 3801.28

Net cash position -29.65

Fixed overheads 233.15

Promotion 266.00

R&D 163.40

Training cost 20

Automation

7

investment

Warranty cost per

car

252.04 405.09

depreciation 80.5

Operating profit -368.14

Post tax profit -281.88

Loan 100

B. Round 2

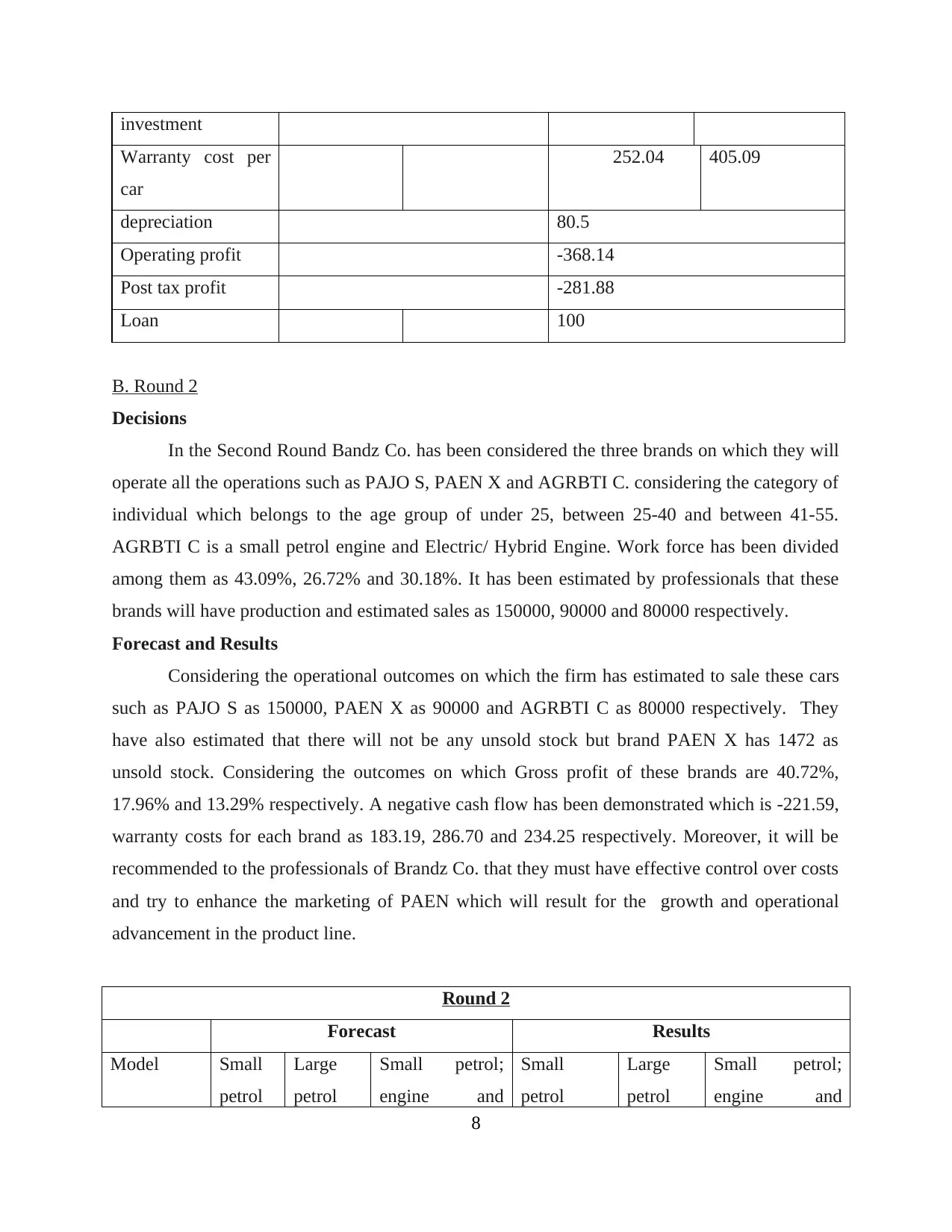

Decisions

In the Second Round Bandz Co. has been considered the three brands on which they will

operate all the operations such as PAJO S, PAEN X and AGRBTI C. considering the category of

individual which belongs to the age group of under 25, between 25-40 and between 41-55.

AGRBTI C is a small petrol engine and Electric/ Hybrid Engine. Work force has been divided

among them as 43.09%, 26.72% and 30.18%. It has been estimated by professionals that these

brands will have production and estimated sales as 150000, 90000 and 80000 respectively.

Forecast and Results

Considering the operational outcomes on which the firm has estimated to sale these cars

such as PAJO S as 150000, PAEN X as 90000 and AGRBTI C as 80000 respectively. They

have also estimated that there will not be any unsold stock but brand PAEN X has 1472 as

unsold stock. Considering the outcomes on which Gross profit of these brands are 40.72%,

17.96% and 13.29% respectively. A negative cash flow has been demonstrated which is -221.59,

warranty costs for each brand as 183.19, 286.70 and 234.25 respectively. Moreover, it will be

recommended to the professionals of Brandz Co. that they must have effective control over costs

and try to enhance the marketing of PAEN which will result for the growth and operational

advancement in the product line.

Round 2

Forecast Results

Model Small

petrol

Large

petrol

Small petrol;

engine and

Small

petrol

Large

petrol

Small petrol;

engine and

8

Warranty cost per

car

252.04 405.09

depreciation 80.5

Operating profit -368.14

Post tax profit -281.88

Loan 100

B. Round 2

Decisions

In the Second Round Bandz Co. has been considered the three brands on which they will

operate all the operations such as PAJO S, PAEN X and AGRBTI C. considering the category of

individual which belongs to the age group of under 25, between 25-40 and between 41-55.

AGRBTI C is a small petrol engine and Electric/ Hybrid Engine. Work force has been divided

among them as 43.09%, 26.72% and 30.18%. It has been estimated by professionals that these

brands will have production and estimated sales as 150000, 90000 and 80000 respectively.

Forecast and Results

Considering the operational outcomes on which the firm has estimated to sale these cars

such as PAJO S as 150000, PAEN X as 90000 and AGRBTI C as 80000 respectively. They

have also estimated that there will not be any unsold stock but brand PAEN X has 1472 as

unsold stock. Considering the outcomes on which Gross profit of these brands are 40.72%,

17.96% and 13.29% respectively. A negative cash flow has been demonstrated which is -221.59,

warranty costs for each brand as 183.19, 286.70 and 234.25 respectively. Moreover, it will be

recommended to the professionals of Brandz Co. that they must have effective control over costs

and try to enhance the marketing of PAEN which will result for the growth and operational

advancement in the product line.

Round 2

Forecast Results

Model Small

petrol

Large

petrol

Small petrol;

engine and

Small

petrol

Large

petrol

Small petrol;

engine and

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

engine engine Electric/Hybride

engine

engine engine Electric/Hybride

engine

Car name PAJO

S

PAEN X AGRBTI C PAJO S PAEN X AGRBTI C

Target Under

25

Between

25-40

Between 41-55 Under 25 Between

25-40

Between 41-55

Workforce 43.09% 26.72% 30.18% 43.09% 26.72% 30.18%

Automation

allocation

40.00% 20.00% 20.00% 40.00% 20.00% 20.00%

Effective

workforce

2499 1550 1750

Productivity 59.39 58.01 45.71

Production 150000 90000 80000 150000 88528 80000

Unsold

stock

0 0 0 0 1472 0

Selling

price

Market

price

22481.00 25448.00 11200

Market

share

2.56% 3.16% 1.54%

salary 144.83

Gross

margin

40.72% 17.96% 13.29%

Sale income 6483.22

Net cash

position

-221.59

Fixed

overheads

413.25

Promotion 261.00

9

engine

engine engine Electric/Hybride

engine

Car name PAJO

S

PAEN X AGRBTI C PAJO S PAEN X AGRBTI C

Target Under

25

Between

25-40

Between 41-55 Under 25 Between

25-40

Between 41-55

Workforce 43.09% 26.72% 30.18% 43.09% 26.72% 30.18%

Automation

allocation

40.00% 20.00% 20.00% 40.00% 20.00% 20.00%

Effective

workforce

2499 1550 1750

Productivity 59.39 58.01 45.71

Production 150000 90000 80000 150000 88528 80000

Unsold

stock

0 0 0 0 1472 0

Selling

price

Market

price

22481.00 25448.00 11200

Market

share

2.56% 3.16% 1.54%

salary 144.83

Gross

margin

40.72% 17.96% 13.29%

Sale income 6483.22

Net cash

position

-221.59

Fixed

overheads

413.25

Promotion 261.00

9

R&D 13.64

Training

cost

16

Automation

investment

Warranty

cost per car

183.19 286.70 234.25

depreciation 138.29

Operating

profit

-963.48

Post tax

profit

-747.22

Loan 85.18

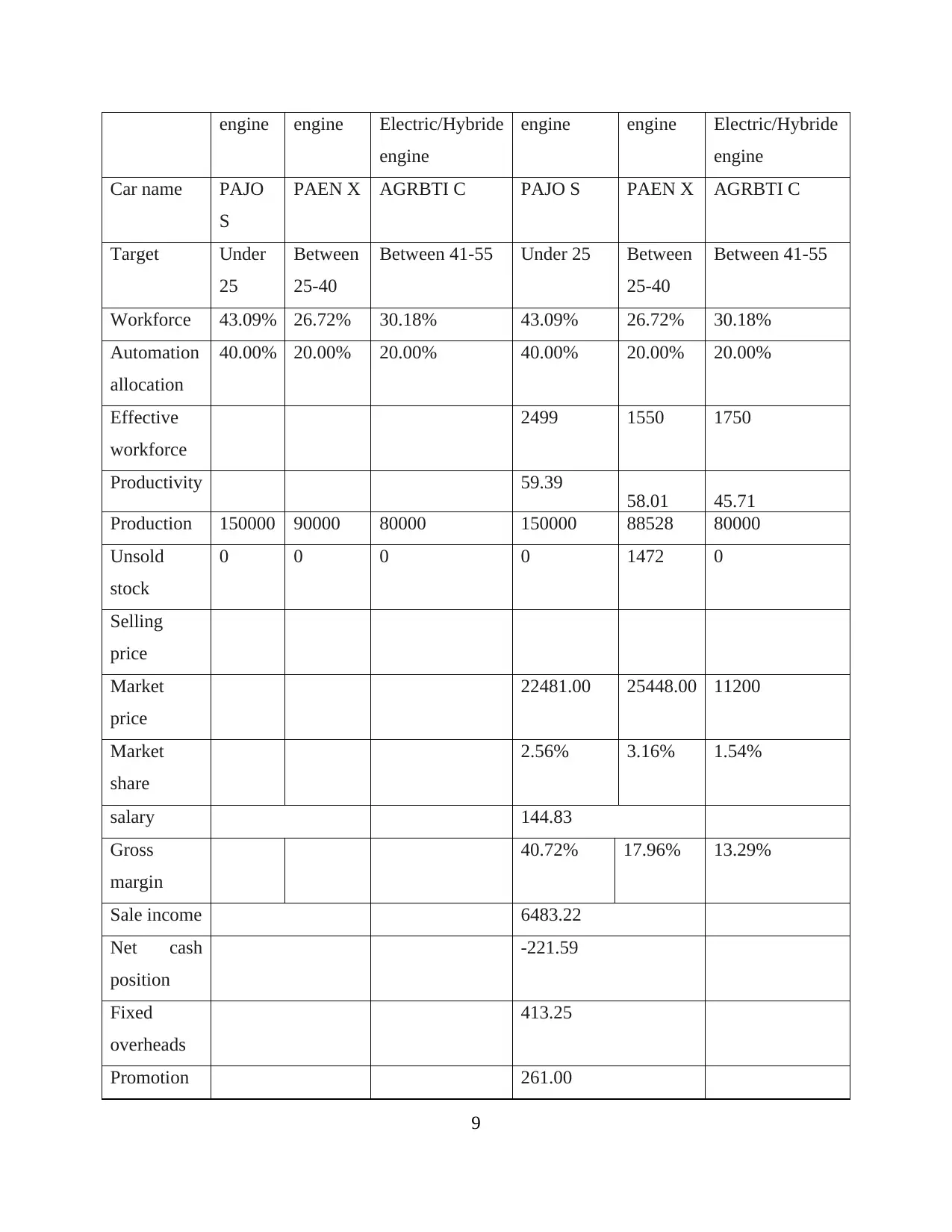

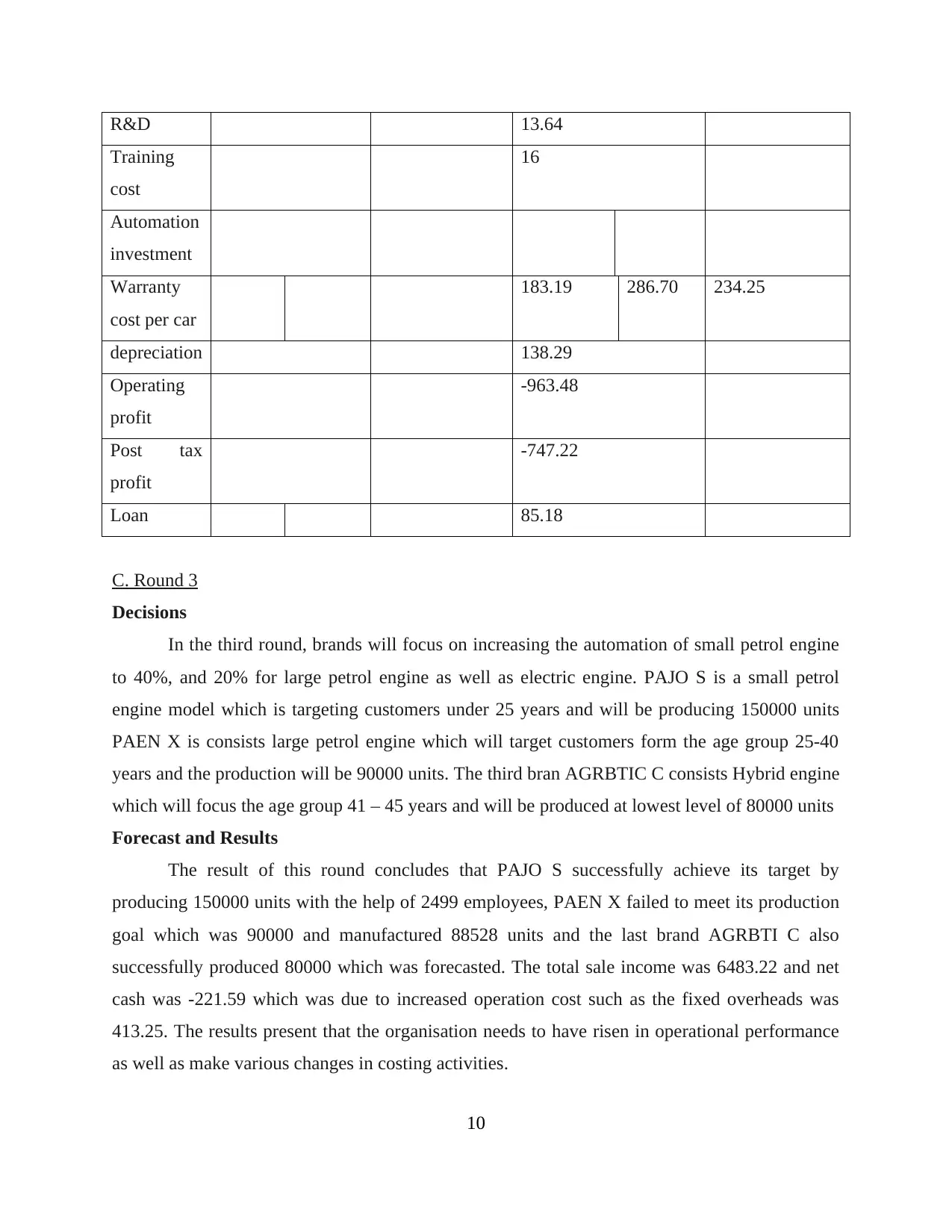

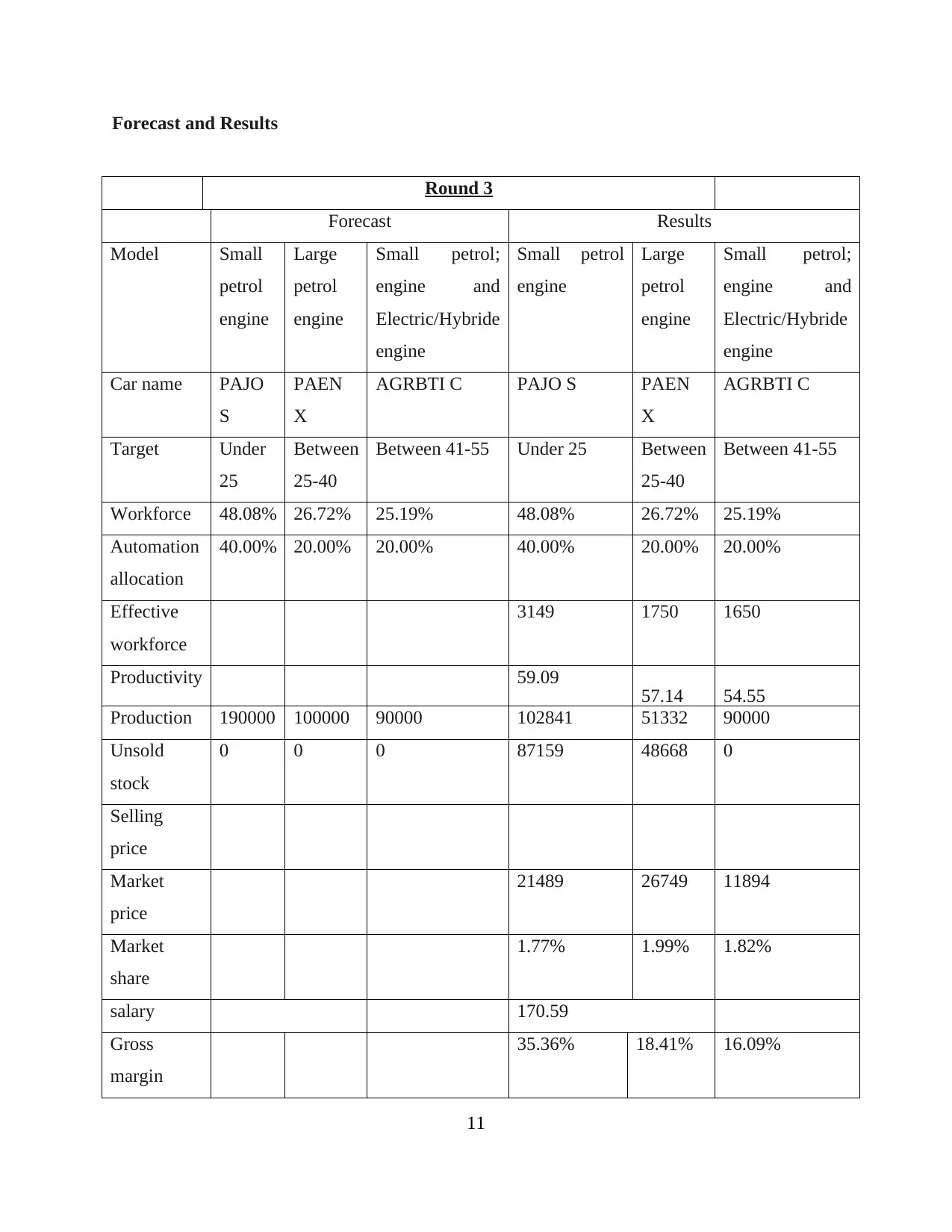

C. Round 3

Decisions

In the third round, brands will focus on increasing the automation of small petrol engine

to 40%, and 20% for large petrol engine as well as electric engine. PAJO S is a small petrol

engine model which is targeting customers under 25 years and will be producing 150000 units

PAEN X is consists large petrol engine which will target customers form the age group 25-40

years and the production will be 90000 units. The third bran AGRBTIC C consists Hybrid engine

which will focus the age group 41 – 45 years and will be produced at lowest level of 80000 units

Forecast and Results

The result of this round concludes that PAJO S successfully achieve its target by

producing 150000 units with the help of 2499 employees, PAEN X failed to meet its production

goal which was 90000 and manufactured 88528 units and the last brand AGRBTI C also

successfully produced 80000 which was forecasted. The total sale income was 6483.22 and net

cash was -221.59 which was due to increased operation cost such as the fixed overheads was

413.25. The results present that the organisation needs to have risen in operational performance

as well as make various changes in costing activities.

10

Training

cost

16

Automation

investment

Warranty

cost per car

183.19 286.70 234.25

depreciation 138.29

Operating

profit

-963.48

Post tax

profit

-747.22

Loan 85.18

C. Round 3

Decisions

In the third round, brands will focus on increasing the automation of small petrol engine

to 40%, and 20% for large petrol engine as well as electric engine. PAJO S is a small petrol

engine model which is targeting customers under 25 years and will be producing 150000 units

PAEN X is consists large petrol engine which will target customers form the age group 25-40

years and the production will be 90000 units. The third bran AGRBTIC C consists Hybrid engine

which will focus the age group 41 – 45 years and will be produced at lowest level of 80000 units

Forecast and Results

The result of this round concludes that PAJO S successfully achieve its target by

producing 150000 units with the help of 2499 employees, PAEN X failed to meet its production

goal which was 90000 and manufactured 88528 units and the last brand AGRBTI C also

successfully produced 80000 which was forecasted. The total sale income was 6483.22 and net

cash was -221.59 which was due to increased operation cost such as the fixed overheads was

413.25. The results present that the organisation needs to have risen in operational performance

as well as make various changes in costing activities.

10

Forecast and Results

Round 3

Forecast Results

Model Small

petrol

engine

Large

petrol

engine

Small petrol;

engine and

Electric/Hybride

engine

Small petrol

engine

Large

petrol

engine

Small petrol;

engine and

Electric/Hybride

engine

Car name PAJO

S

PAEN

X

AGRBTI C PAJO S PAEN

X

AGRBTI C

Target Under

25

Between

25-40

Between 41-55 Under 25 Between

25-40

Between 41-55

Workforce 48.08% 26.72% 25.19% 48.08% 26.72% 25.19%

Automation

allocation

40.00% 20.00% 20.00% 40.00% 20.00% 20.00%

Effective

workforce

3149 1750 1650

Productivity 59.09 57.14 54.55

Production 190000 100000 90000 102841 51332 90000

Unsold

stock

0 0 0 87159 48668 0

Selling

price

Market

price

21489 26749 11894

Market

share

1.77% 1.99% 1.82%

salary 170.59

Gross

margin

35.36% 18.41% 16.09%

11

Round 3

Forecast Results

Model Small

petrol

engine

Large

petrol

engine

Small petrol;

engine and

Electric/Hybride

engine

Small petrol

engine

Large

petrol

engine

Small petrol;

engine and

Electric/Hybride

engine

Car name PAJO

S

PAEN

X

AGRBTI C PAJO S PAEN

X

AGRBTI C

Target Under

25

Between

25-40

Between 41-55 Under 25 Between

25-40

Between 41-55

Workforce 48.08% 26.72% 25.19% 48.08% 26.72% 25.19%

Automation

allocation

40.00% 20.00% 20.00% 40.00% 20.00% 20.00%

Effective

workforce

3149 1750 1650

Productivity 59.09 57.14 54.55

Production 190000 100000 90000 102841 51332 90000

Unsold

stock

0 0 0 87159 48668 0

Selling

price

Market

price

21489 26749 11894

Market

share

1.77% 1.99% 1.82%

salary 170.59

Gross

margin

35.36% 18.41% 16.09%

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Sale income 4608.52

Net cash

position

-1380.79

Fixed

overheads

491.97

Promotion 267.00

R&D 164.05

Training

cost

14.00

Automation

investment

Warranty

cost per car

420.28 667.80 170.47

depreciation 139.56

Operating

profit

-5.50

Post tax

profit

-28.12

Loan 500

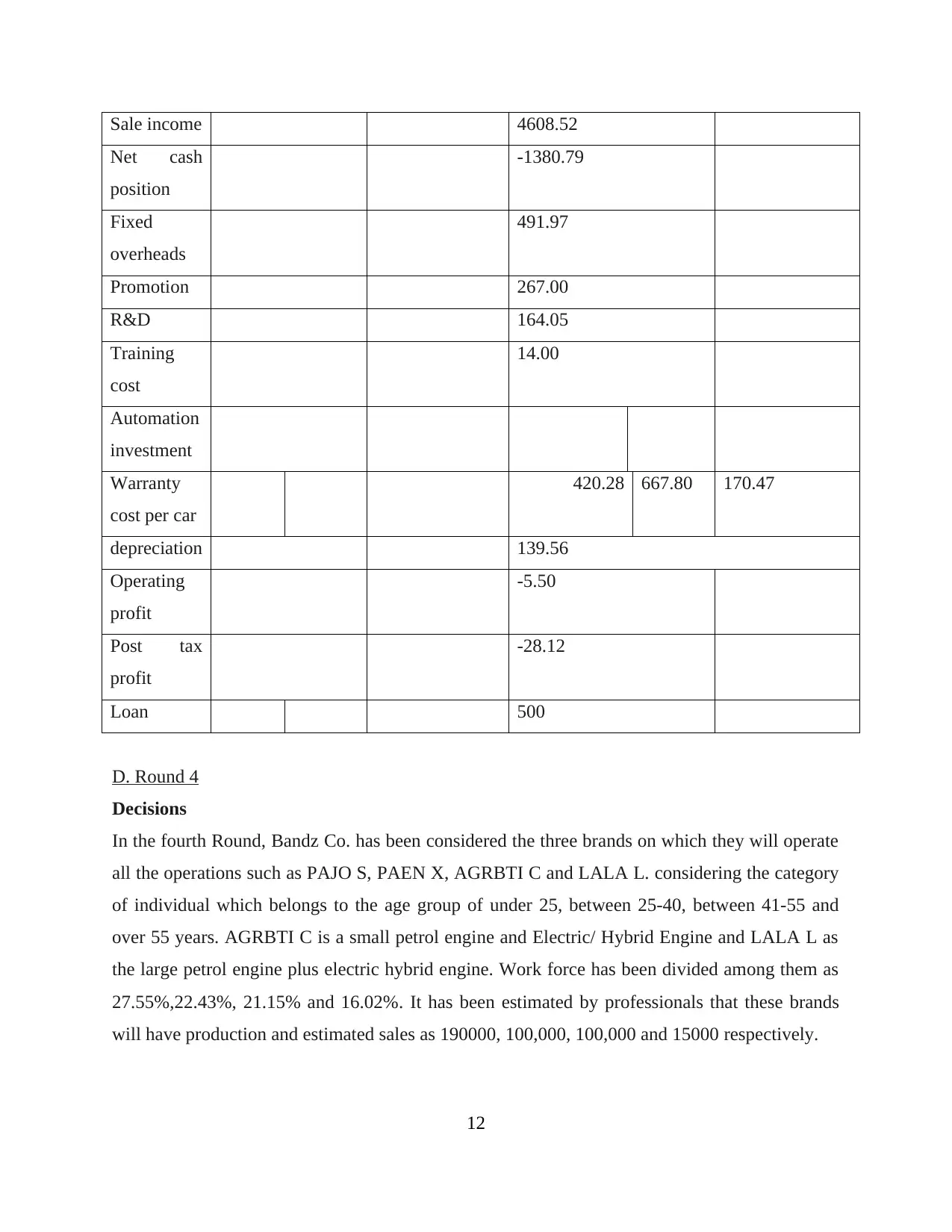

D. Round 4

Decisions

In the fourth Round, Bandz Co. has been considered the three brands on which they will operate

all the operations such as PAJO S, PAEN X, AGRBTI C and LALA L. considering the category

of individual which belongs to the age group of under 25, between 25-40, between 41-55 and

over 55 years. AGRBTI C is a small petrol engine and Electric/ Hybrid Engine and LALA L as

the large petrol engine plus electric hybrid engine. Work force has been divided among them as

27.55%,22.43%, 21.15% and 16.02%. It has been estimated by professionals that these brands

will have production and estimated sales as 190000, 100,000, 100,000 and 15000 respectively.

12

Net cash

position

-1380.79

Fixed

overheads

491.97

Promotion 267.00

R&D 164.05

Training

cost

14.00

Automation

investment

Warranty

cost per car

420.28 667.80 170.47

depreciation 139.56

Operating

profit

-5.50

Post tax

profit

-28.12

Loan 500

D. Round 4

Decisions

In the fourth Round, Bandz Co. has been considered the three brands on which they will operate

all the operations such as PAJO S, PAEN X, AGRBTI C and LALA L. considering the category

of individual which belongs to the age group of under 25, between 25-40, between 41-55 and

over 55 years. AGRBTI C is a small petrol engine and Electric/ Hybrid Engine and LALA L as

the large petrol engine plus electric hybrid engine. Work force has been divided among them as

27.55%,22.43%, 21.15% and 16.02%. It has been estimated by professionals that these brands

will have production and estimated sales as 190000, 100,000, 100,000 and 15000 respectively.

12

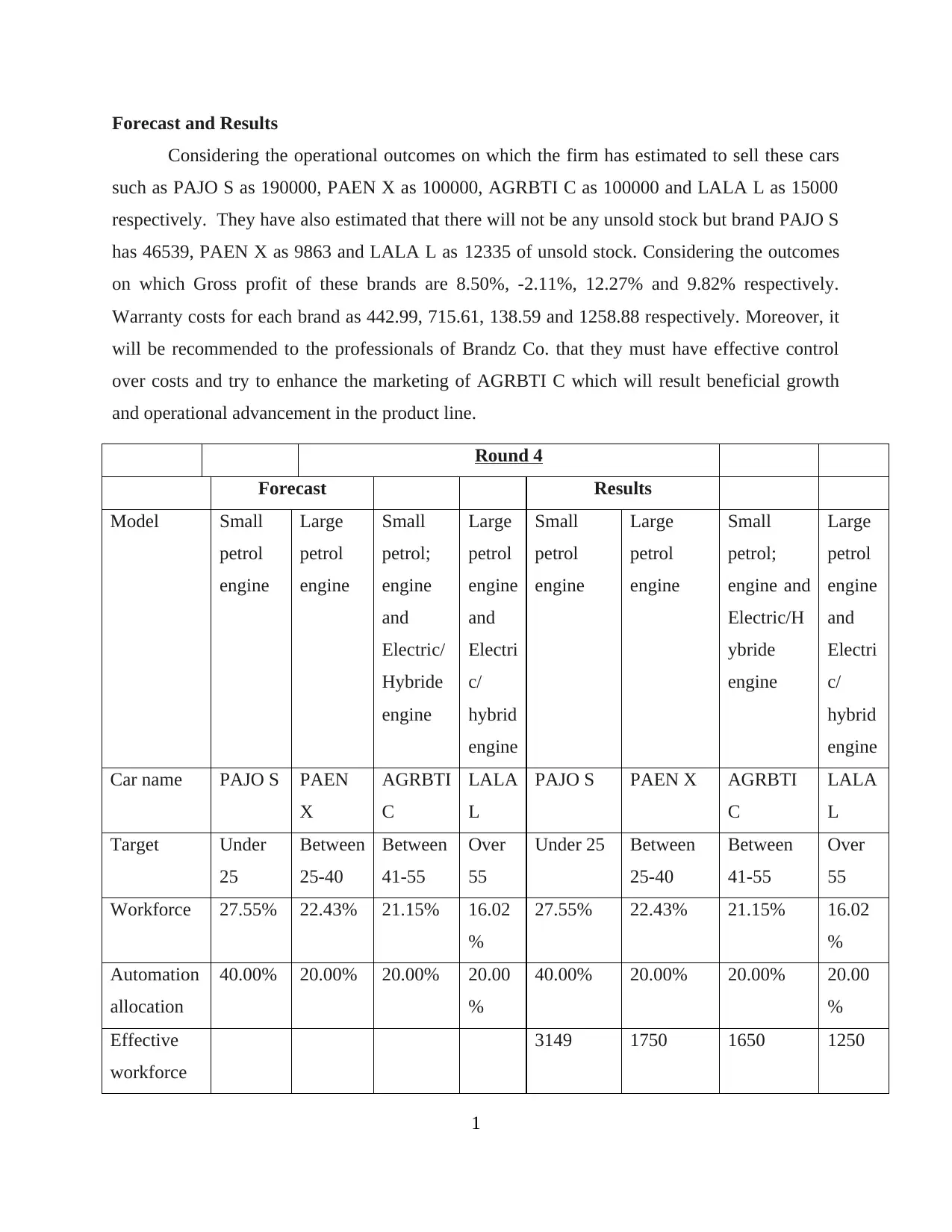

Forecast and Results

Considering the operational outcomes on which the firm has estimated to sell these cars

such as PAJO S as 190000, PAEN X as 100000, AGRBTI C as 100000 and LALA L as 15000

respectively. They have also estimated that there will not be any unsold stock but brand PAJO S

has 46539, PAEN X as 9863 and LALA L as 12335 of unsold stock. Considering the outcomes

on which Gross profit of these brands are 8.50%, -2.11%, 12.27% and 9.82% respectively.

Warranty costs for each brand as 442.99, 715.61, 138.59 and 1258.88 respectively. Moreover, it

will be recommended to the professionals of Brandz Co. that they must have effective control

over costs and try to enhance the marketing of AGRBTI C which will result beneficial growth

and operational advancement in the product line.

Round 4

Forecast Results

Model Small

petrol

engine

Large

petrol

engine

Small

petrol;

engine

and

Electric/

Hybride

engine

Large

petrol

engine

and

Electri

c/

hybrid

engine

Small

petrol

engine

Large

petrol

engine

Small

petrol;

engine and

Electric/H

ybride

engine

Large

petrol

engine

and

Electri

c/

hybrid

engine

Car name PAJO S PAEN

X

AGRBTI

C

LALA

L

PAJO S PAEN X AGRBTI

C

LALA

L

Target Under

25

Between

25-40

Between

41-55

Over

55

Under 25 Between

25-40

Between

41-55

Over

55

Workforce 27.55% 22.43% 21.15% 16.02

%

27.55% 22.43% 21.15% 16.02

%

Automation

allocation

40.00% 20.00% 20.00% 20.00

%

40.00% 20.00% 20.00% 20.00

%

Effective

workforce

3149 1750 1650 1250

1

Considering the operational outcomes on which the firm has estimated to sell these cars

such as PAJO S as 190000, PAEN X as 100000, AGRBTI C as 100000 and LALA L as 15000

respectively. They have also estimated that there will not be any unsold stock but brand PAJO S

has 46539, PAEN X as 9863 and LALA L as 12335 of unsold stock. Considering the outcomes

on which Gross profit of these brands are 8.50%, -2.11%, 12.27% and 9.82% respectively.

Warranty costs for each brand as 442.99, 715.61, 138.59 and 1258.88 respectively. Moreover, it

will be recommended to the professionals of Brandz Co. that they must have effective control

over costs and try to enhance the marketing of AGRBTI C which will result beneficial growth

and operational advancement in the product line.

Round 4

Forecast Results

Model Small

petrol

engine

Large

petrol

engine

Small

petrol;

engine

and

Electric/

Hybride

engine

Large

petrol

engine

and

Electri

c/

hybrid

engine

Small

petrol

engine

Large

petrol

engine

Small

petrol;

engine and

Electric/H

ybride

engine

Large

petrol

engine

and

Electri

c/

hybrid

engine

Car name PAJO S PAEN

X

AGRBTI

C

LALA

L

PAJO S PAEN X AGRBTI

C

LALA

L

Target Under

25

Between

25-40

Between

41-55

Over

55

Under 25 Between

25-40

Between

41-55

Over

55

Workforce 27.55% 22.43% 21.15% 16.02

%

27.55% 22.43% 21.15% 16.02

%

Automation

allocation

40.00% 20.00% 20.00% 20.00

%

40.00% 20.00% 20.00% 20.00

%

Effective

workforce

3149 1750 1650 1250

1

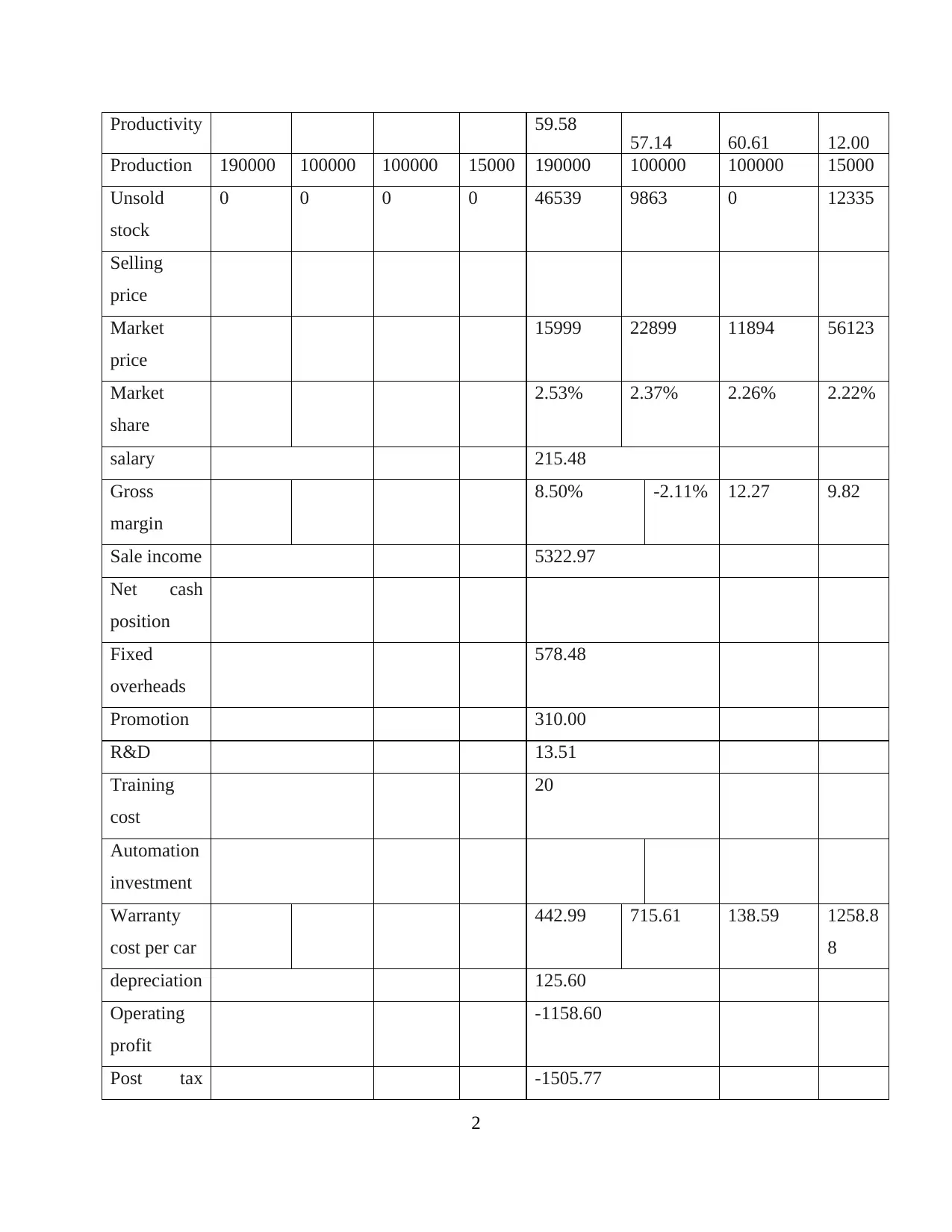

Productivity 59.58 57.14 60.61 12.00

Production 190000 100000 100000 15000 190000 100000 100000 15000

Unsold

stock

0 0 0 0 46539 9863 0 12335

Selling

price

Market

price

15999 22899 11894 56123

Market

share

2.53% 2.37% 2.26% 2.22%

salary 215.48

Gross

margin

8.50% -2.11% 12.27 9.82

Sale income 5322.97

Net cash

position

Fixed

overheads

578.48

Promotion 310.00

R&D 13.51

Training

cost

20

Automation

investment

Warranty

cost per car

442.99 715.61 138.59 1258.8

8

depreciation 125.60

Operating

profit

-1158.60

Post tax -1505.77

2

Production 190000 100000 100000 15000 190000 100000 100000 15000

Unsold

stock

0 0 0 0 46539 9863 0 12335

Selling

price

Market

price

15999 22899 11894 56123

Market

share

2.53% 2.37% 2.26% 2.22%

salary 215.48

Gross

margin

8.50% -2.11% 12.27 9.82

Sale income 5322.97

Net cash

position

Fixed

overheads

578.48

Promotion 310.00

R&D 13.51

Training

cost

20

Automation

investment

Warranty

cost per car

442.99 715.61 138.59 1258.8

8

depreciation 125.60

Operating

profit

-1158.60

Post tax -1505.77

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

profit

Loan 1500

TREND ANALYSIS

Production

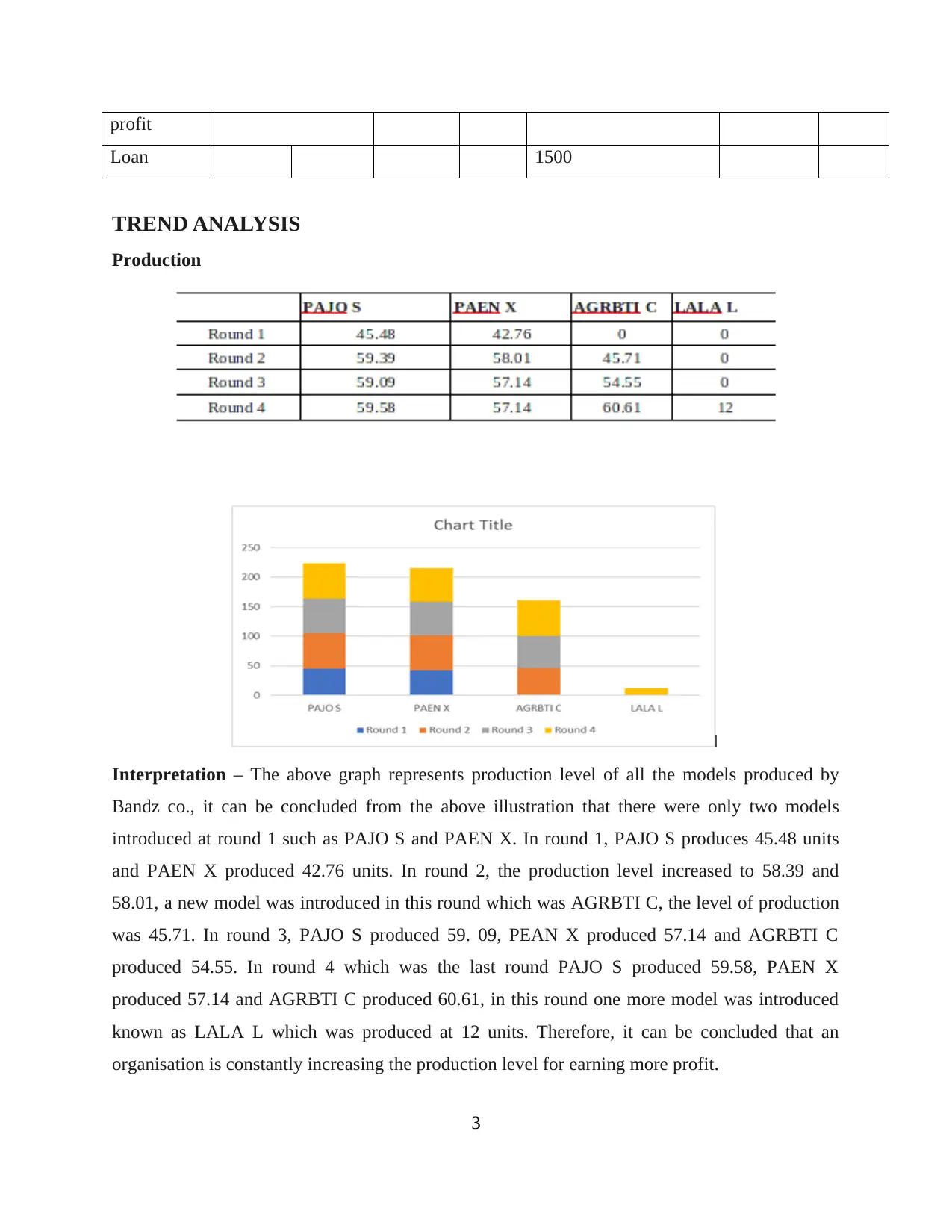

Interpretation – The above graph represents production level of all the models produced by

Bandz co., it can be concluded from the above illustration that there were only two models

introduced at round 1 such as PAJO S and PAEN X. In round 1, PAJO S produces 45.48 units

and PAEN X produced 42.76 units. In round 2, the production level increased to 58.39 and

58.01, a new model was introduced in this round which was AGRBTI C, the level of production

was 45.71. In round 3, PAJO S produced 59. 09, PEAN X produced 57.14 and AGRBTI C

produced 54.55. In round 4 which was the last round PAJO S produced 59.58, PAEN X

produced 57.14 and AGRBTI C produced 60.61, in this round one more model was introduced

known as LALA L which was produced at 12 units. Therefore, it can be concluded that an

organisation is constantly increasing the production level for earning more profit.

3

Loan 1500

TREND ANALYSIS

Production

Interpretation – The above graph represents production level of all the models produced by

Bandz co., it can be concluded from the above illustration that there were only two models

introduced at round 1 such as PAJO S and PAEN X. In round 1, PAJO S produces 45.48 units

and PAEN X produced 42.76 units. In round 2, the production level increased to 58.39 and

58.01, a new model was introduced in this round which was AGRBTI C, the level of production

was 45.71. In round 3, PAJO S produced 59. 09, PEAN X produced 57.14 and AGRBTI C

produced 54.55. In round 4 which was the last round PAJO S produced 59.58, PAEN X

produced 57.14 and AGRBTI C produced 60.61, in this round one more model was introduced

known as LALA L which was produced at 12 units. Therefore, it can be concluded that an

organisation is constantly increasing the production level for earning more profit.

3

Total sales

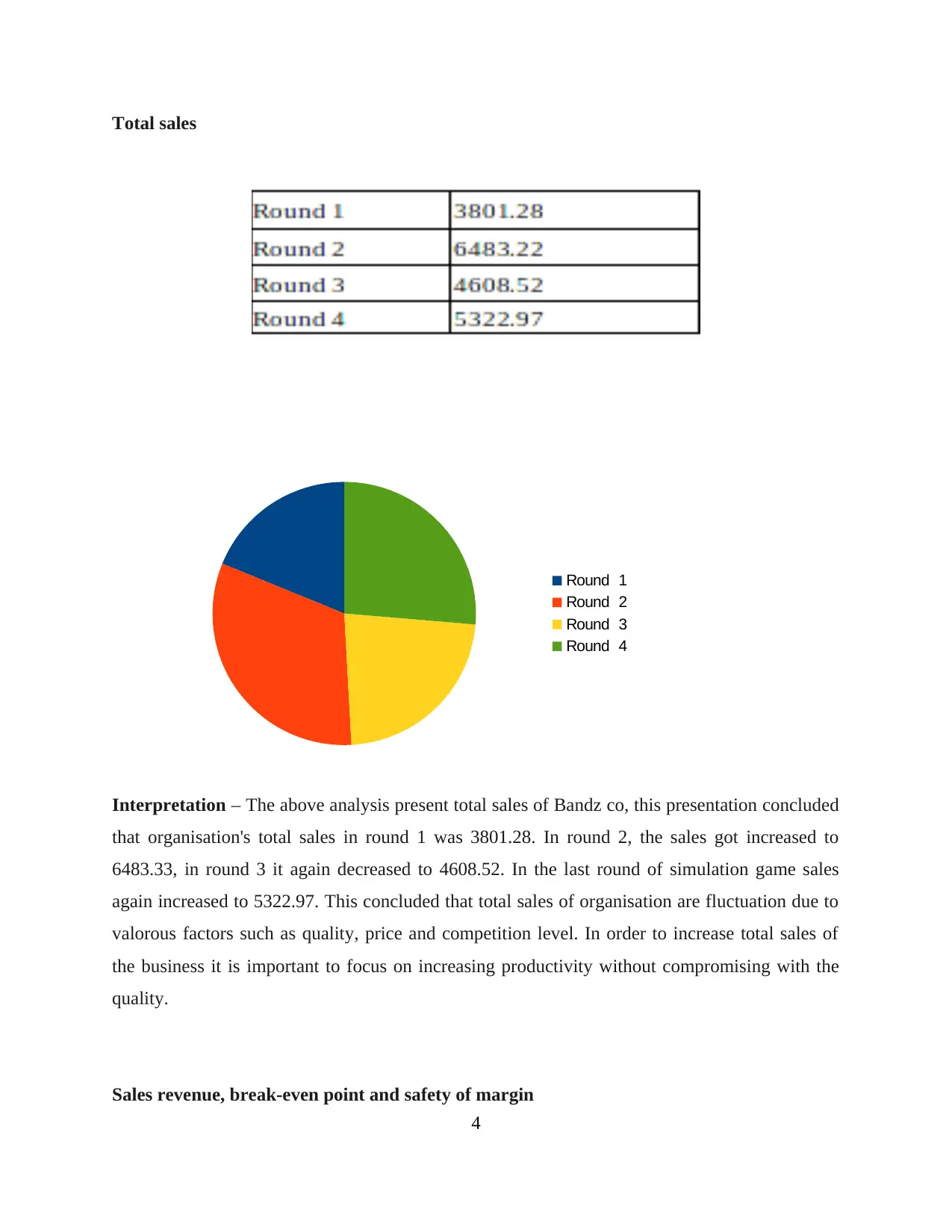

Interpretation – The above analysis present total sales of Bandz co, this presentation concluded

that organisation's total sales in round 1 was 3801.28. In round 2, the sales got increased to

6483.33, in round 3 it again decreased to 4608.52. In the last round of simulation game sales

again increased to 5322.97. This concluded that total sales of organisation are fluctuation due to

valorous factors such as quality, price and competition level. In order to increase total sales of

the business it is important to focus on increasing productivity without compromising with the

quality.

Sales revenue, break-even point and safety of margin

4

Round 1

Round 2

Round 3

Round 4

Interpretation – The above analysis present total sales of Bandz co, this presentation concluded

that organisation's total sales in round 1 was 3801.28. In round 2, the sales got increased to

6483.33, in round 3 it again decreased to 4608.52. In the last round of simulation game sales

again increased to 5322.97. This concluded that total sales of organisation are fluctuation due to

valorous factors such as quality, price and competition level. In order to increase total sales of

the business it is important to focus on increasing productivity without compromising with the

quality.

Sales revenue, break-even point and safety of margin

4

Round 1

Round 2

Round 3

Round 4

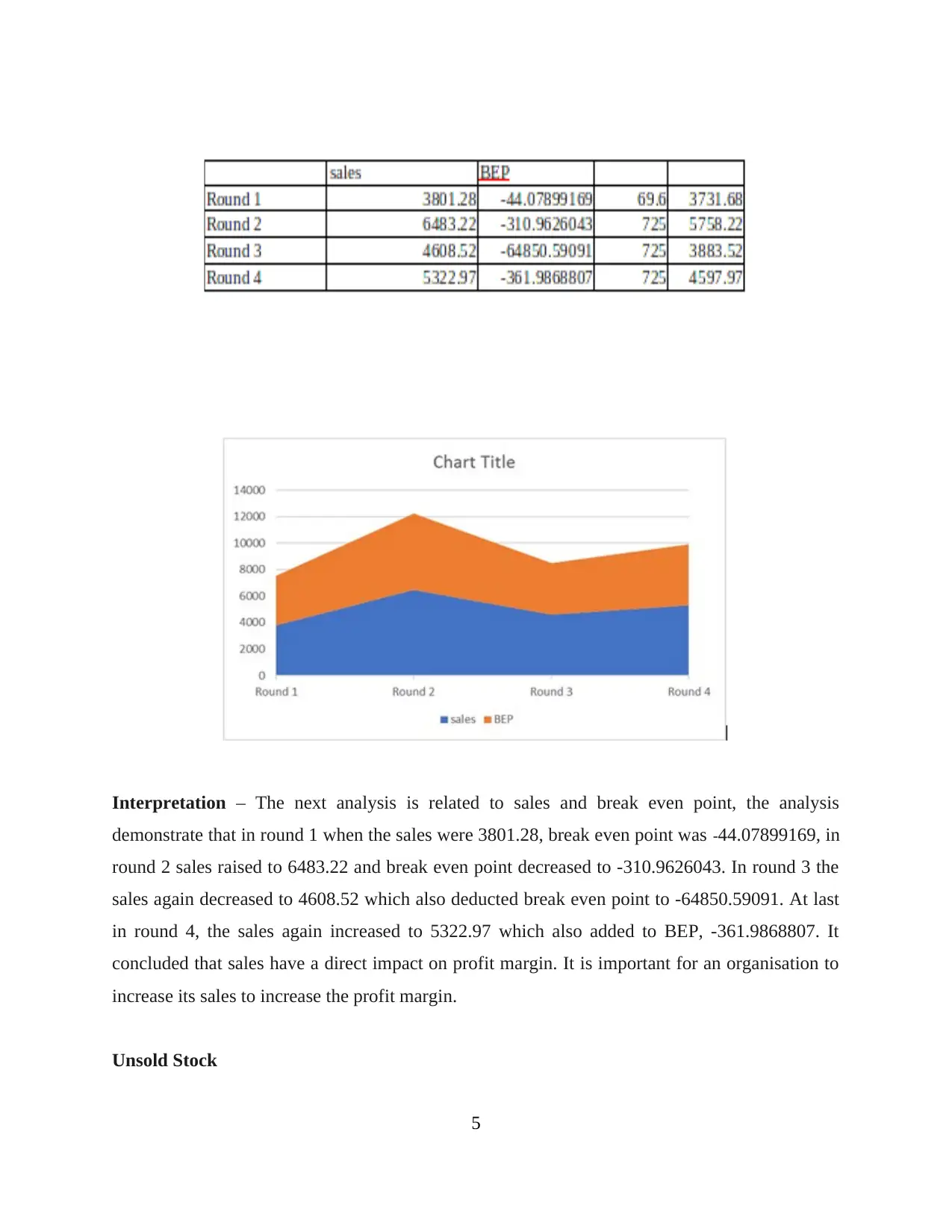

Interpretation – The next analysis is related to sales and break even point, the analysis

demonstrate that in round 1 when the sales were 3801.28, break even point was -44.07899169, in

round 2 sales raised to 6483.22 and break even point decreased to -310.9626043. In round 3 the

sales again decreased to 4608.52 which also deducted break even point to -64850.59091. At last

in round 4, the sales again increased to 5322.97 which also added to BEP, -361.9868807. It

concluded that sales have a direct impact on profit margin. It is important for an organisation to

increase its sales to increase the profit margin.

Unsold Stock

5

demonstrate that in round 1 when the sales were 3801.28, break even point was -44.07899169, in

round 2 sales raised to 6483.22 and break even point decreased to -310.9626043. In round 3 the

sales again decreased to 4608.52 which also deducted break even point to -64850.59091. At last

in round 4, the sales again increased to 5322.97 which also added to BEP, -361.9868807. It

concluded that sales have a direct impact on profit margin. It is important for an organisation to

increase its sales to increase the profit margin.

Unsold Stock

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

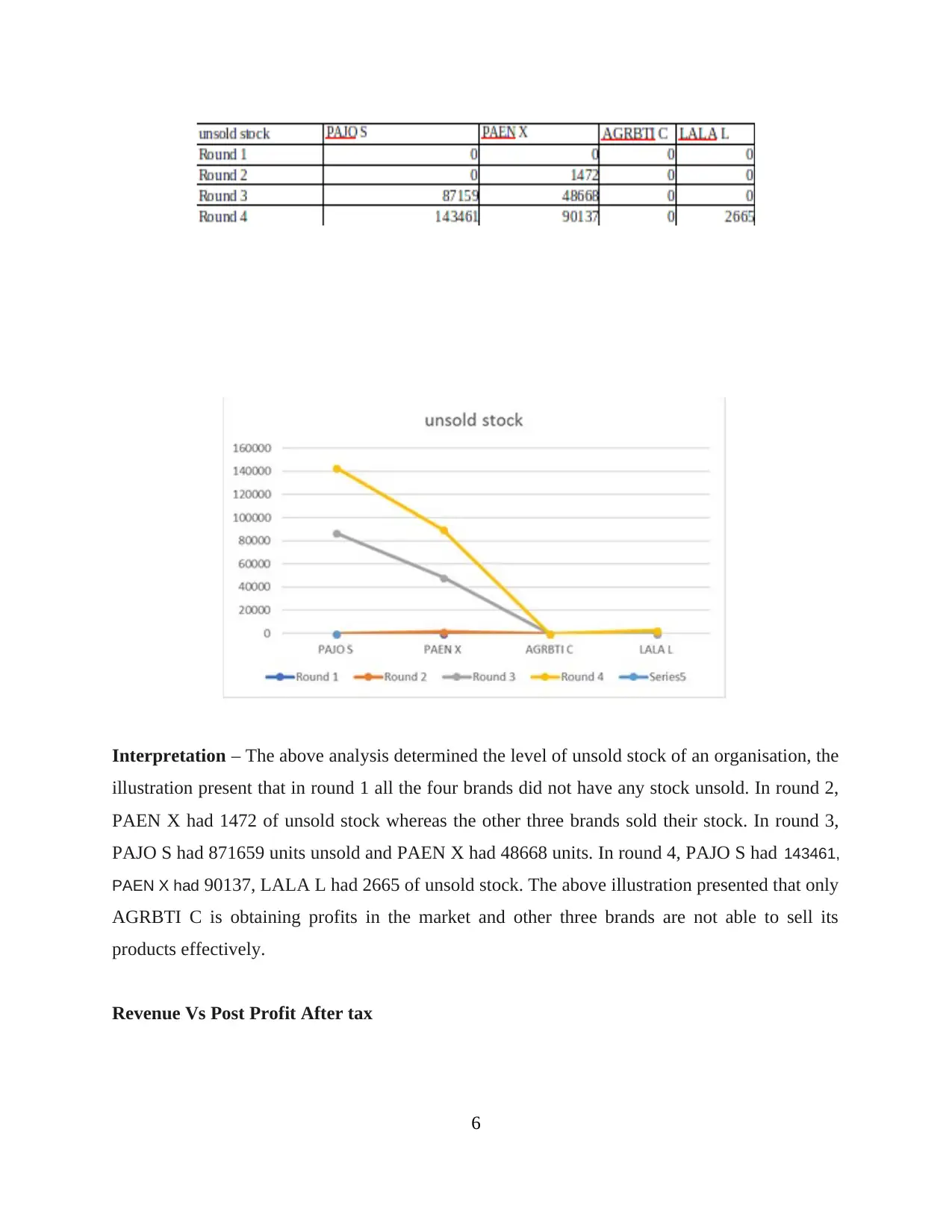

Interpretation – The above analysis determined the level of unsold stock of an organisation, the

illustration present that in round 1 all the four brands did not have any stock unsold. In round 2,

PAEN X had 1472 of unsold stock whereas the other three brands sold their stock. In round 3,

PAJO S had 871659 units unsold and PAEN X had 48668 units. In round 4, PAJO S had 143461,

PAEN X had 90137, LALA L had 2665 of unsold stock. The above illustration presented that only

AGRBTI C is obtaining profits in the market and other three brands are not able to sell its

products effectively.

Revenue Vs Post Profit After tax

6

illustration present that in round 1 all the four brands did not have any stock unsold. In round 2,

PAEN X had 1472 of unsold stock whereas the other three brands sold their stock. In round 3,

PAJO S had 871659 units unsold and PAEN X had 48668 units. In round 4, PAJO S had 143461,

PAEN X had 90137, LALA L had 2665 of unsold stock. The above illustration presented that only

AGRBTI C is obtaining profits in the market and other three brands are not able to sell its

products effectively.

Revenue Vs Post Profit After tax

6

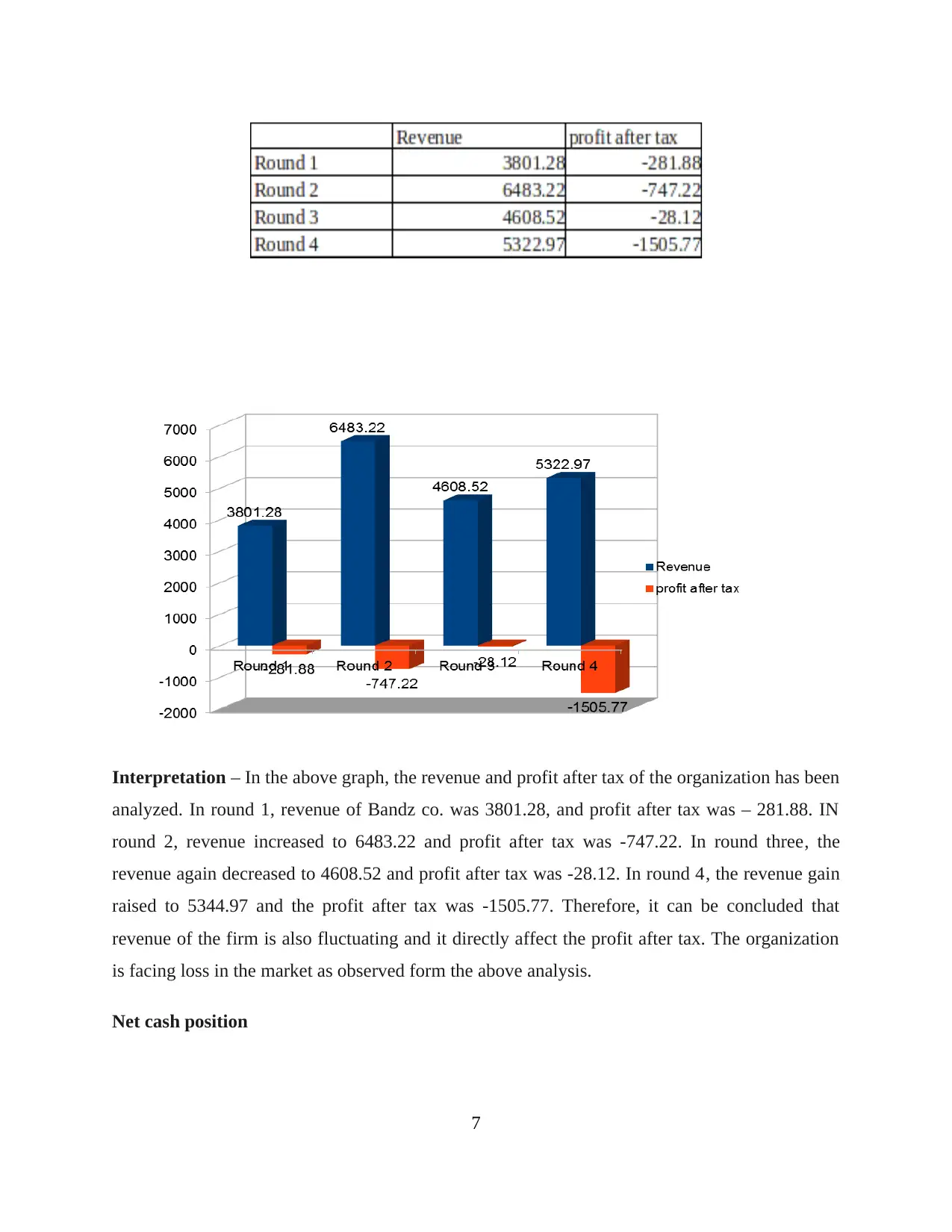

Interpretation – In the above graph, the revenue and profit after tax of the organization has been

analyzed. In round 1, revenue of Bandz co. was 3801.28, and profit after tax was – 281.88. IN

round 2, revenue increased to 6483.22 and profit after tax was -747.22. In round three, the

revenue again decreased to 4608.52 and profit after tax was -28.12. In round 4, the revenue gain

raised to 5344.97 and the profit after tax was -1505.77. Therefore, it can be concluded that

revenue of the firm is also fluctuating and it directly affect the profit after tax. The organization

is facing loss in the market as observed form the above analysis.

Net cash position

7

analyzed. In round 1, revenue of Bandz co. was 3801.28, and profit after tax was – 281.88. IN

round 2, revenue increased to 6483.22 and profit after tax was -747.22. In round three, the

revenue again decreased to 4608.52 and profit after tax was -28.12. In round 4, the revenue gain

raised to 5344.97 and the profit after tax was -1505.77. Therefore, it can be concluded that

revenue of the firm is also fluctuating and it directly affect the profit after tax. The organization

is facing loss in the market as observed form the above analysis.

Net cash position

7

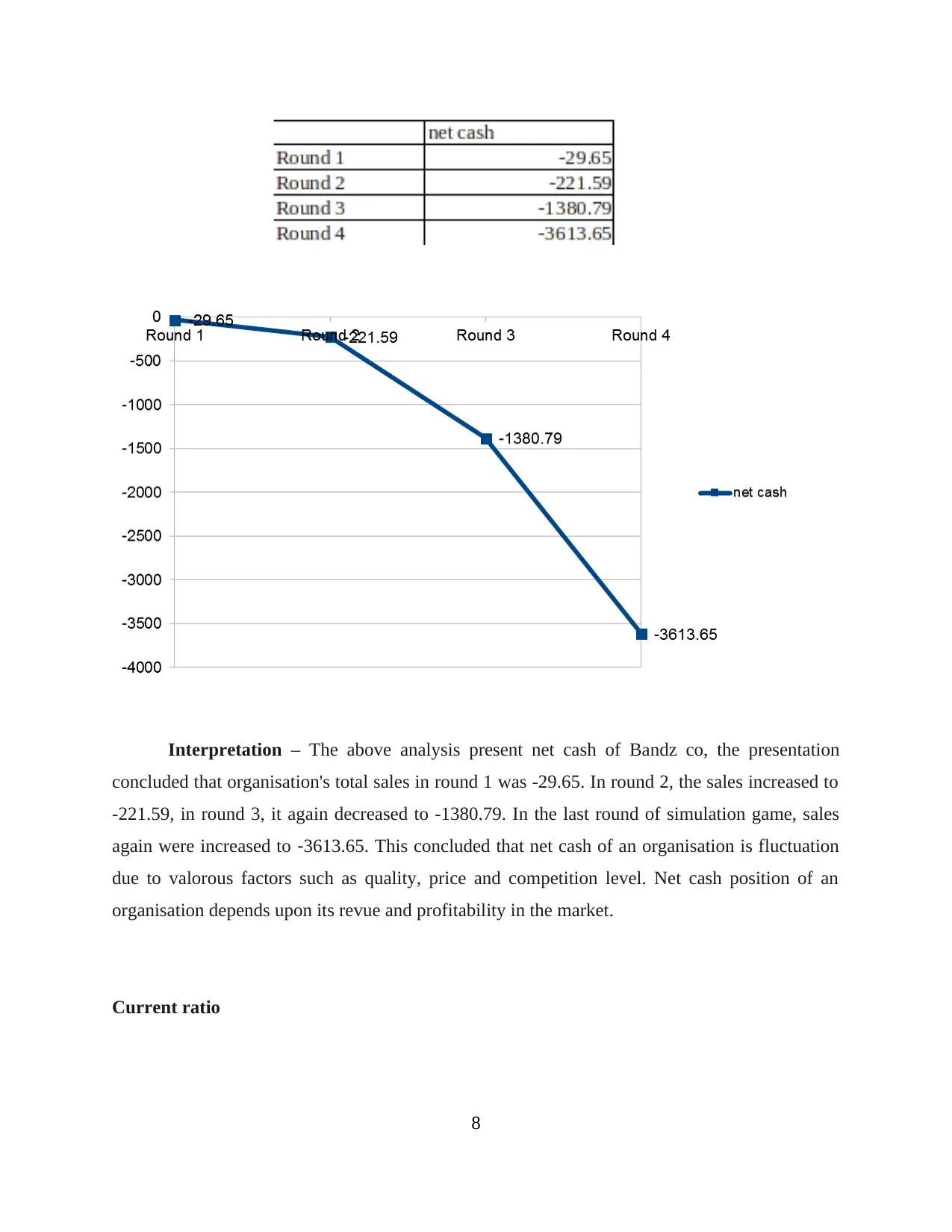

Interpretation – The above analysis present net cash of Bandz co, the presentation

concluded that organisation's total sales in round 1 was -29.65. In round 2, the sales increased to

-221.59, in round 3, it again decreased to -1380.79. In the last round of simulation game, sales

again were increased to -3613.65. This concluded that net cash of an organisation is fluctuation

due to valorous factors such as quality, price and competition level. Net cash position of an

organisation depends upon its revue and profitability in the market.

Current ratio

8

concluded that organisation's total sales in round 1 was -29.65. In round 2, the sales increased to

-221.59, in round 3, it again decreased to -1380.79. In the last round of simulation game, sales

again were increased to -3613.65. This concluded that net cash of an organisation is fluctuation

due to valorous factors such as quality, price and competition level. Net cash position of an

organisation depends upon its revue and profitability in the market.

Current ratio

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

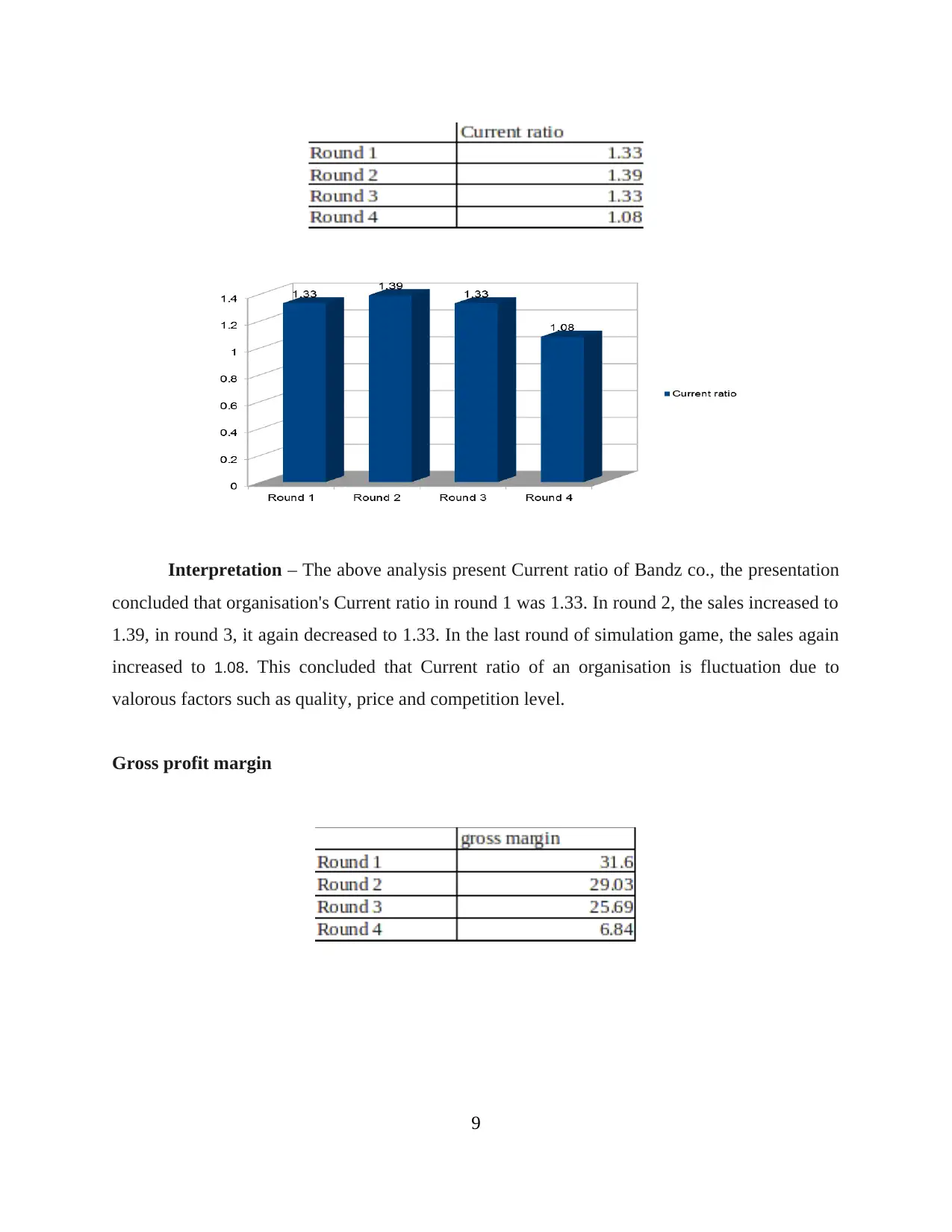

Interpretation – The above analysis present Current ratio of Bandz co., the presentation

concluded that organisation's Current ratio in round 1 was 1.33. In round 2, the sales increased to

1.39, in round 3, it again decreased to 1.33. In the last round of simulation game, the sales again

increased to 1.08. This concluded that Current ratio of an organisation is fluctuation due to

valorous factors such as quality, price and competition level.

Gross profit margin

9

concluded that organisation's Current ratio in round 1 was 1.33. In round 2, the sales increased to

1.39, in round 3, it again decreased to 1.33. In the last round of simulation game, the sales again

increased to 1.08. This concluded that Current ratio of an organisation is fluctuation due to

valorous factors such as quality, price and competition level.

Gross profit margin

9

Interpretation – The above analysis gross margin of Bandz co., the presentation

concluded that organization’s gross margin in round 1 was 31.6. In round 2, the sales increased to

29.03, in round 3, it again decreased to 25.69. In the last round of simulation game, sales again

increased to 6.84. This concluded that gross margin of an organization is fluctuation due to

valorous factors such as quality, price and competition level. Its important to increase the gross

profit margin to enhance an overall profit of the firm.

Return on investment

10

Round 1 Round 2 Round 3 Round 4-10

0

10

20

30

40

50

Return on equity

concluded that organization’s gross margin in round 1 was 31.6. In round 2, the sales increased to

29.03, in round 3, it again decreased to 25.69. In the last round of simulation game, sales again

increased to 6.84. This concluded that gross margin of an organization is fluctuation due to

valorous factors such as quality, price and competition level. Its important to increase the gross

profit margin to enhance an overall profit of the firm.

Return on investment

10

Round 1 Round 2 Round 3 Round 4-10

0

10

20

30

40

50

Return on equity

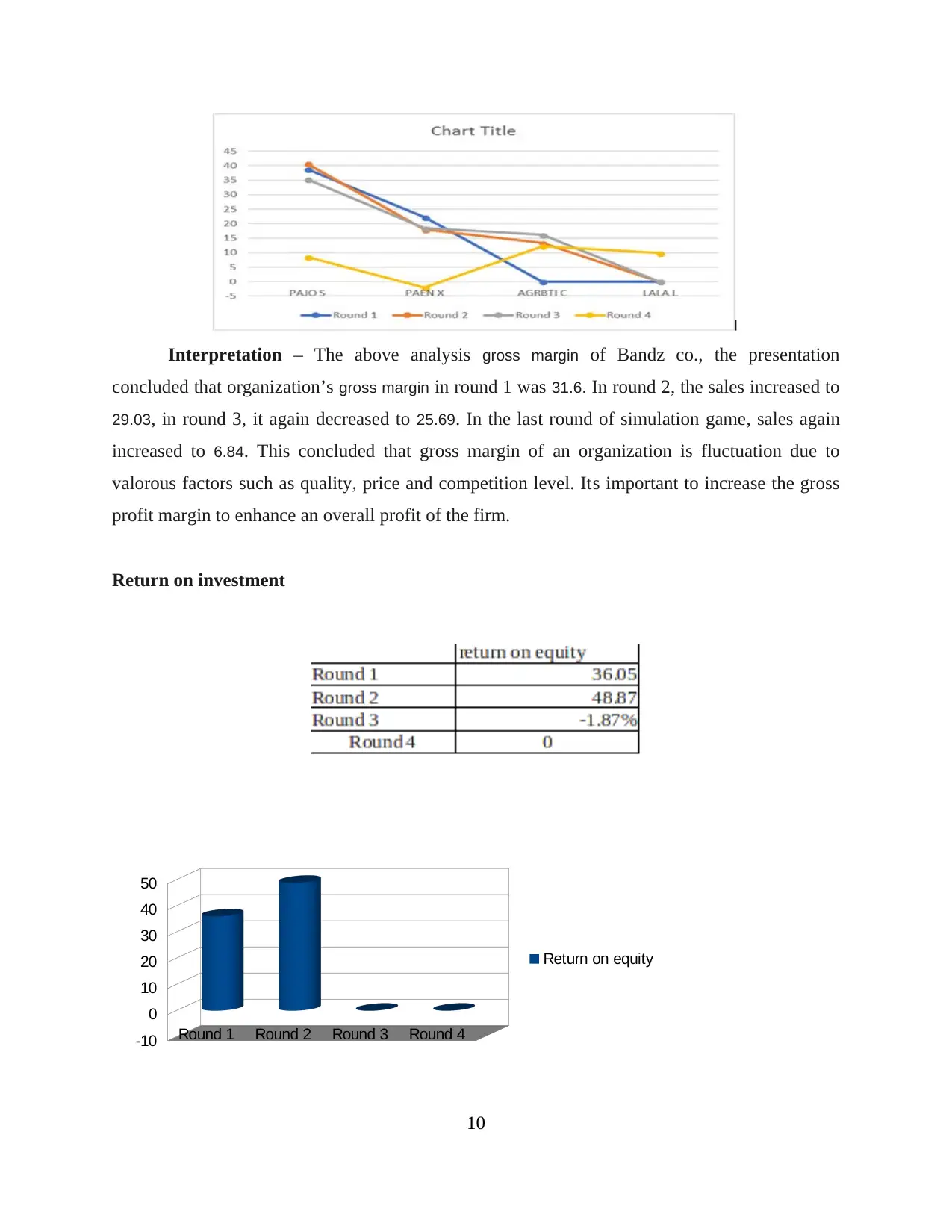

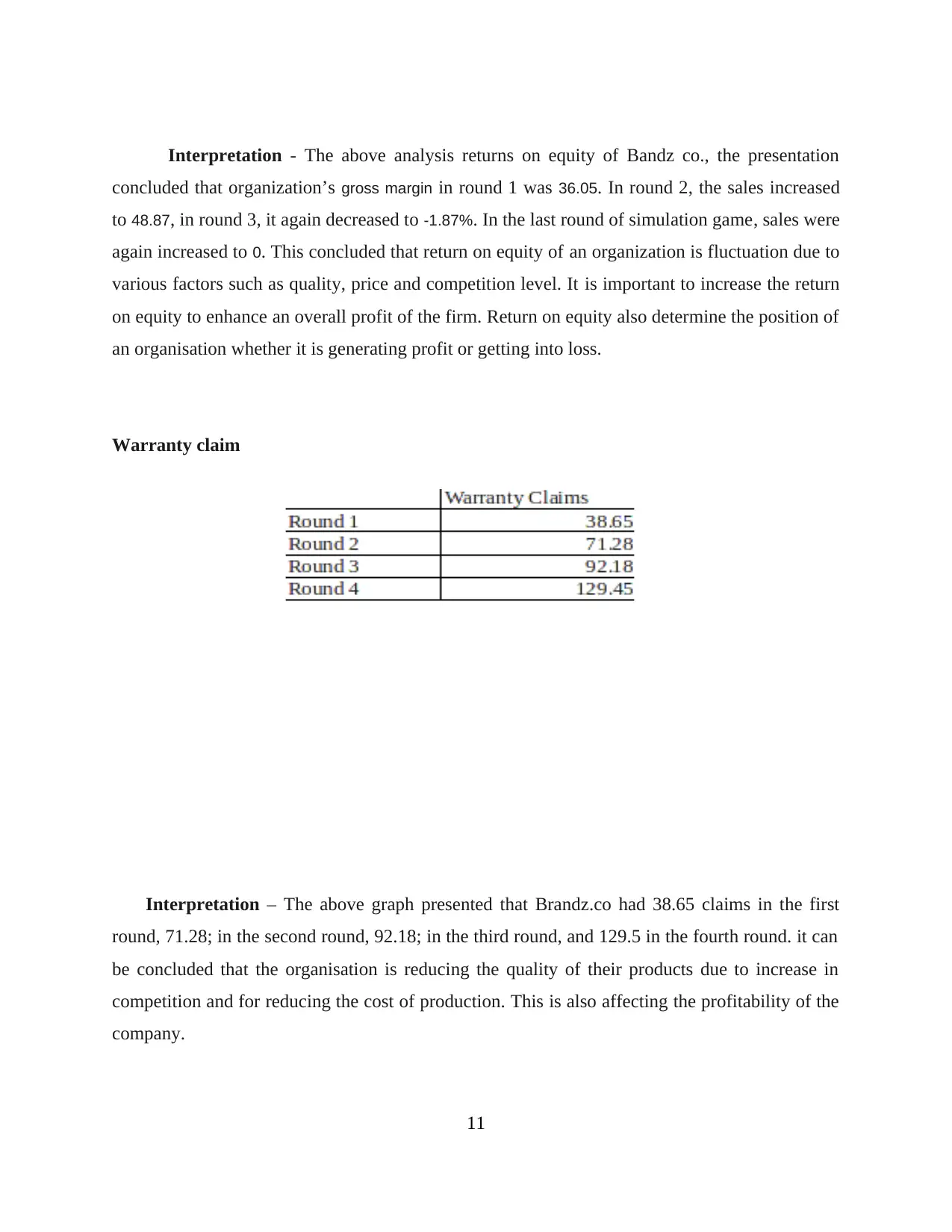

Interpretation - The above analysis returns on equity of Bandz co., the presentation

concluded that organization’s gross margin in round 1 was 36.05. In round 2, the sales increased

to 48.87, in round 3, it again decreased to -1.87%. In the last round of simulation game, sales were

again increased to 0. This concluded that return on equity of an organization is fluctuation due to

various factors such as quality, price and competition level. It is important to increase the return

on equity to enhance an overall profit of the firm. Return on equity also determine the position of

an organisation whether it is generating profit or getting into loss.

Warranty claim

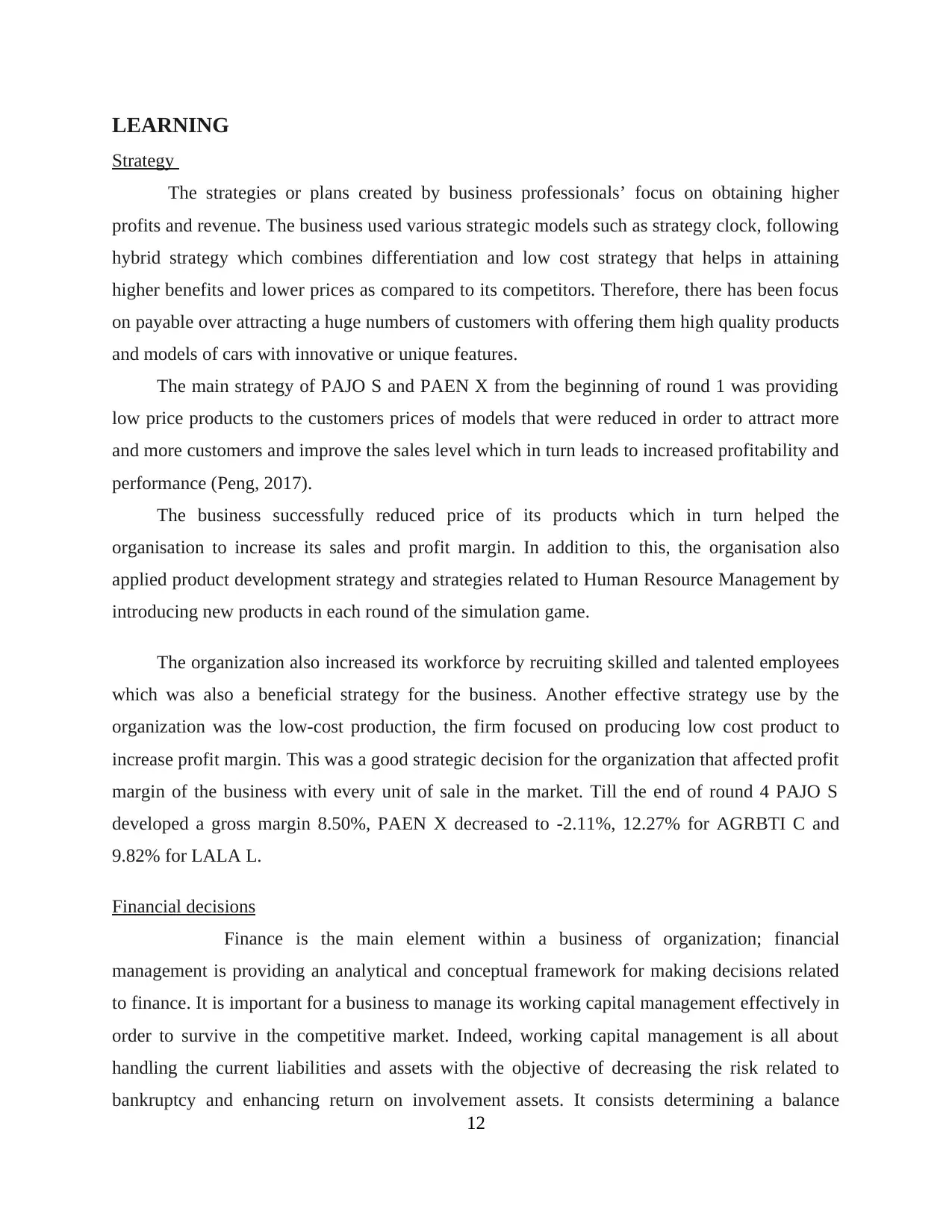

Interpretation – The above graph presented that Brandz.co had 38.65 claims in the first

round, 71.28; in the second round, 92.18; in the third round, and 129.5 in the fourth round. it can

be concluded that the organisation is reducing the quality of their products due to increase in

competition and for reducing the cost of production. This is also affecting the profitability of the

company.

11

concluded that organization’s gross margin in round 1 was 36.05. In round 2, the sales increased

to 48.87, in round 3, it again decreased to -1.87%. In the last round of simulation game, sales were

again increased to 0. This concluded that return on equity of an organization is fluctuation due to

various factors such as quality, price and competition level. It is important to increase the return

on equity to enhance an overall profit of the firm. Return on equity also determine the position of

an organisation whether it is generating profit or getting into loss.

Warranty claim

Interpretation – The above graph presented that Brandz.co had 38.65 claims in the first

round, 71.28; in the second round, 92.18; in the third round, and 129.5 in the fourth round. it can

be concluded that the organisation is reducing the quality of their products due to increase in

competition and for reducing the cost of production. This is also affecting the profitability of the

company.

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

LEARNING

Strategy

The strategies or plans created by business professionals’ focus on obtaining higher

profits and revenue. The business used various strategic models such as strategy clock, following

hybrid strategy which combines differentiation and low cost strategy that helps in attaining

higher benefits and lower prices as compared to its competitors. Therefore, there has been focus

on payable over attracting a huge numbers of customers with offering them high quality products

and models of cars with innovative or unique features.

The main strategy of PAJO S and PAEN X from the beginning of round 1 was providing

low price products to the customers prices of models that were reduced in order to attract more

and more customers and improve the sales level which in turn leads to increased profitability and

performance (Peng, 2017).

The business successfully reduced price of its products which in turn helped the

organisation to increase its sales and profit margin. In addition to this, the organisation also

applied product development strategy and strategies related to Human Resource Management by

introducing new products in each round of the simulation game.

The organization also increased its workforce by recruiting skilled and talented employees

which was also a beneficial strategy for the business. Another effective strategy use by the

organization was the low-cost production, the firm focused on producing low cost product to

increase profit margin. This was a good strategic decision for the organization that affected profit

margin of the business with every unit of sale in the market. Till the end of round 4 PAJO S

developed a gross margin 8.50%, PAEN X decreased to -2.11%, 12.27% for AGRBTI C and

9.82% for LALA L.

Financial decisions

Finance is the main element within a business of organization; financial

management is providing an analytical and conceptual framework for making decisions related

to finance. It is important for a business to manage its working capital management effectively in

order to survive in the competitive market. Indeed, working capital management is all about

handling the current liabilities and assets with the objective of decreasing the risk related to

bankruptcy and enhancing return on involvement assets. It consists determining a balance

12

Strategy

The strategies or plans created by business professionals’ focus on obtaining higher

profits and revenue. The business used various strategic models such as strategy clock, following

hybrid strategy which combines differentiation and low cost strategy that helps in attaining

higher benefits and lower prices as compared to its competitors. Therefore, there has been focus

on payable over attracting a huge numbers of customers with offering them high quality products

and models of cars with innovative or unique features.

The main strategy of PAJO S and PAEN X from the beginning of round 1 was providing

low price products to the customers prices of models that were reduced in order to attract more

and more customers and improve the sales level which in turn leads to increased profitability and

performance (Peng, 2017).

The business successfully reduced price of its products which in turn helped the

organisation to increase its sales and profit margin. In addition to this, the organisation also

applied product development strategy and strategies related to Human Resource Management by

introducing new products in each round of the simulation game.

The organization also increased its workforce by recruiting skilled and talented employees

which was also a beneficial strategy for the business. Another effective strategy use by the

organization was the low-cost production, the firm focused on producing low cost product to

increase profit margin. This was a good strategic decision for the organization that affected profit

margin of the business with every unit of sale in the market. Till the end of round 4 PAJO S

developed a gross margin 8.50%, PAEN X decreased to -2.11%, 12.27% for AGRBTI C and

9.82% for LALA L.

Financial decisions

Finance is the main element within a business of organization; financial

management is providing an analytical and conceptual framework for making decisions related

to finance. It is important for a business to manage its working capital management effectively in

order to survive in the competitive market. Indeed, working capital management is all about

handling the current liabilities and assets with the objective of decreasing the risk related to

bankruptcy and enhancing return on involvement assets. It consists determining a balance

12

between liquidity and profitability. An effective working capital management leads to the growth

and survival of a business or organisation.

To enhance and improve the financial health of an organization, there are various pricing

methods which can be utilized along with costing methods which can be very helpful and

effective for gaining high profit. The business is required to create appropriate decisions which

can help to improve health of the organizational entity. Therefore, it is observed that organization

effectively manage to maintain profitability and a good cash position in the market. Overall,

finance is the most important element in any organisation or business, allocation of financial

resources is the most essential function in every organisation. The cost of labour was decreased

in order to decrease the overall cost of production, which was a significant decision related to

finance in an organisation as it contributed in the increment of Gross profit margin.

Marketing decisions

There is a great need of adopting various tools or techniques which can assist the

company to increase sales of the cars. Marketing is an essential dimension of each and every

business in competitive environment or markets nowadays and financial success is mostly

dependent upon marketing ability. Any business or organization have two basic and important

functions innovation and marketing housecoat it is the purpose of every organization to attract

and create more customers. At the time of giving brand name to its cars model, the company

considered that it should be meaningful, memorable, transferable, protect-able, adaptable and

likable (Kumar and Reinartz, 2018).

Therefore, to increase the profitability and revenue of the business which leads to growth

and development, it essential to select the most appropriate promotional and marketing

strategies. The organization also utilized various tools for their promotional activities such as

4'ps of marketing – Place, price, promotion and product.

The companies increased their market share and profit margin with the help of these

promotional methods and tools. Tv advertisements, radio digital and social media, promotional

offers etc were used to attract more and more customers in the market to gain competitive

advantages. The marketing decisions helped a lot in increasing sales of the products in the

market place which in turn brought impressive change in profitability of the firms. Marketing

13

and survival of a business or organisation.

To enhance and improve the financial health of an organization, there are various pricing

methods which can be utilized along with costing methods which can be very helpful and

effective for gaining high profit. The business is required to create appropriate decisions which

can help to improve health of the organizational entity. Therefore, it is observed that organization

effectively manage to maintain profitability and a good cash position in the market. Overall,

finance is the most important element in any organisation or business, allocation of financial

resources is the most essential function in every organisation. The cost of labour was decreased

in order to decrease the overall cost of production, which was a significant decision related to

finance in an organisation as it contributed in the increment of Gross profit margin.

Marketing decisions

There is a great need of adopting various tools or techniques which can assist the

company to increase sales of the cars. Marketing is an essential dimension of each and every

business in competitive environment or markets nowadays and financial success is mostly

dependent upon marketing ability. Any business or organization have two basic and important

functions innovation and marketing housecoat it is the purpose of every organization to attract

and create more customers. At the time of giving brand name to its cars model, the company

considered that it should be meaningful, memorable, transferable, protect-able, adaptable and

likable (Kumar and Reinartz, 2018).

Therefore, to increase the profitability and revenue of the business which leads to growth

and development, it essential to select the most appropriate promotional and marketing

strategies. The organization also utilized various tools for their promotional activities such as

4'ps of marketing – Place, price, promotion and product.

The companies increased their market share and profit margin with the help of these

promotional methods and tools. Tv advertisements, radio digital and social media, promotional

offers etc were used to attract more and more customers in the market to gain competitive

advantages. The marketing decisions helped a lot in increasing sales of the products in the

market place which in turn brought impressive change in profitability of the firms. Marketing

13

functions can help an organisation promote its products and services to a wide range of

customers in local as well as international market.

Operating decisions

Operations management is the activity or task related to managing the resources to

develop and deliver products and services. Operations management consists of system design

and operating decisions related to design of products and design, section of processes, location

selection, inventory management, wok and supply management, scheduling, production

planning, quality assurance and project management. Operations strategy is concerned by putting

in place along with application of plans and rules that uses the resources of an organisation

effectively and efficiently. It greatly contributes to the long term competitive strategies. It

affects various designs which is beneficial in making appropriate decisions (Ming and Wang,

2017).

Therefore, an organisation utilizes various innovative and effective operational practices

which can be very adequate and impressive in increasing proficiency and revenue generation. It

consists assigning the cost of the activities, designing various strategies or plans and improving

business performance in order to meet the organizational goals and survive in a competitive

marketplace.

The organisation launched new products with every round which was also a great

promotional or marketing technique that helped to attract more customers and increase the level

of sales. Overall, the marketing decisions affected the internal shareholders in terms of market

share and profits and the external stakeholder such as customers in terms of competitors,

promotional offers and suppliers in terms of lower selling prices. The organisation increased its

workforce along with the products or models in every round of the simulation; this helped in

increasing the effectiveness of the business productivity. The operation's management is essential

as it helps in managing every task or activity effectively to ensure high performance of every

activity performed. Overall, operation management had a great impact on product quality and

internal stakeholders such as business owners as well as external stakeholders such as customers

in the market.

Human Resource Decisions

Human Resource Management is concerned with selection, recruitment, learning and

development, communication, rewards teamwork and management of employee performance. It

14

customers in local as well as international market.

Operating decisions

Operations management is the activity or task related to managing the resources to

develop and deliver products and services. Operations management consists of system design

and operating decisions related to design of products and design, section of processes, location

selection, inventory management, wok and supply management, scheduling, production

planning, quality assurance and project management. Operations strategy is concerned by putting

in place along with application of plans and rules that uses the resources of an organisation

effectively and efficiently. It greatly contributes to the long term competitive strategies. It

affects various designs which is beneficial in making appropriate decisions (Ming and Wang,

2017).

Therefore, an organisation utilizes various innovative and effective operational practices

which can be very adequate and impressive in increasing proficiency and revenue generation. It

consists assigning the cost of the activities, designing various strategies or plans and improving

business performance in order to meet the organizational goals and survive in a competitive

marketplace.

The organisation launched new products with every round which was also a great

promotional or marketing technique that helped to attract more customers and increase the level

of sales. Overall, the marketing decisions affected the internal shareholders in terms of market

share and profits and the external stakeholder such as customers in terms of competitors,

promotional offers and suppliers in terms of lower selling prices. The organisation increased its

workforce along with the products or models in every round of the simulation; this helped in

increasing the effectiveness of the business productivity. The operation's management is essential

as it helps in managing every task or activity effectively to ensure high performance of every

activity performed. Overall, operation management had a great impact on product quality and

internal stakeholders such as business owners as well as external stakeholders such as customers

in the market.

Human Resource Decisions

Human Resource Management is concerned with selection, recruitment, learning and

development, communication, rewards teamwork and management of employee performance. It

14

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

is very important for any business or organisation to select and recruit highly skilled employees

to perform various roles which lead to improvement in business performance. The efforts of

employees in relation to achievement of goals and objectives help an organisation to obtain its

aim at the right time. The human resource management of an organisation is highly effective in

recruiting skills and talented employees. It also focuses in providing different training and

development programs to employees which further improve their performance (Campbell, 2017).

In order to increase the productivity of the organisation it is very essential to recruit skilled

employees and train them to perform their best in different types of business functions and

activities. Human resource management is highly focused on ensuring significant recruitment,

training, managing, motivating and retaining employees to build a strong workforce in any kind

of organisation. In the present scenario it has been observed that Bandz.co increased the

workforce to enhance the productivity of every product or model.

CONCLUSION

The above report concluded that the stimulative game and the four rounds were

conducted in order to obtain impressive results or outcomes. It also identified that there are

different operational needs which are very beneficial in achieving business goals and objectives.

The market shares of PAJO S increased to 2.53%, 2.37% of PAEN X, 2.26% of AGRBTI C and

2.22% of LALA L till the end of 4th round.

The productivity of PAJO S and PAEN X increased from 45.48% and 42.76% to 59.58%

and 57.14% respectively. The organisation launched new products with every round which was

also a great promotional or marketing technique that helped to attract more customers and

increase the level of sales.Therefore, it can be concluded that the stimulation helped in increasing

overall performance and productivity of organisations. It also leads to increase in profitability of

the business or firm. Organization also increased its workforce or number of employees which

assisted in enhancing or improving business output or production effectively. The business

successfully reduced price of its products which in turn helped the organisation to increase its

sales and profit margin.

15

to perform various roles which lead to improvement in business performance. The efforts of

employees in relation to achievement of goals and objectives help an organisation to obtain its

aim at the right time. The human resource management of an organisation is highly effective in

recruiting skills and talented employees. It also focuses in providing different training and

development programs to employees which further improve their performance (Campbell, 2017).

In order to increase the productivity of the organisation it is very essential to recruit skilled

employees and train them to perform their best in different types of business functions and

activities. Human resource management is highly focused on ensuring significant recruitment,

training, managing, motivating and retaining employees to build a strong workforce in any kind

of organisation. In the present scenario it has been observed that Bandz.co increased the

workforce to enhance the productivity of every product or model.

CONCLUSION

The above report concluded that the stimulative game and the four rounds were

conducted in order to obtain impressive results or outcomes. It also identified that there are

different operational needs which are very beneficial in achieving business goals and objectives.

The market shares of PAJO S increased to 2.53%, 2.37% of PAEN X, 2.26% of AGRBTI C and

2.22% of LALA L till the end of 4th round.

The productivity of PAJO S and PAEN X increased from 45.48% and 42.76% to 59.58%

and 57.14% respectively. The organisation launched new products with every round which was

also a great promotional or marketing technique that helped to attract more customers and

increase the level of sales.Therefore, it can be concluded that the stimulation helped in increasing

overall performance and productivity of organisations. It also leads to increase in profitability of

the business or firm. Organization also increased its workforce or number of employees which

assisted in enhancing or improving business output or production effectively. The business

successfully reduced price of its products which in turn helped the organisation to increase its

sales and profit margin.

15

TEAM PERFORMANCE

Personal Reflection

The business simulation project helped me with an opportunity to lead and experience

professional management practices as well as apply theories to various business frameworks.

The team performance was observed to increase with each round of the simulation game; the

team members were assigned individual roles and duties which they needed to perform within

the game and simulation related activities (Bowers and et.al., 2018). The workforce was

developed with each round in the simulation which helped in managing different tasks and

activities effectively and efficiently.

As a Team leader, I focused on allotting duties and roles to the employees according to

their skills, abilities and experience. I successfully distributed roles to my team members such as

marketing functions, operation management functions, financial activities, production

management etc. This was very helpful in developing coordination and increasing the overall

performance of the business or organisation. I gained a lot of experience with respect to team

management, project management, simulation of business activities, and factors contributing to

the success of a business or company in long run. The team members were highly motivated in

the project as they were an important part of the simulation game and were presented with

significant efforts in the overall project(Operational decisions, 2016.).

I effectively contributed to the group for being on time with regards to planing the work

or activities . As per the Belbin approach, I observed that my role while working in a group is

important There are various factors which can help an organisation to improve its position,

productivity and performance in the competitive market. I developed various skills such as

communication skills, leadership skills, project management skills, etc. which can be very

helpful for my future projects and career. As in light of the fact that I am a effective and

motivated employee. In the group I worked as a team leader and this parts fit to my position. As

a more effective team leader I ensured that all colleague assumes their work liability and every

one of the targets met on time.

I ensured that all the tals are done on time and due to this I help my colleagues in their

intense assignment. I concentrated on quality of work and efforts to clear goals to finish it on

given time. Later on, I saw that my role of co-coordinator got affected as I identified that I was

offered more assignments rather than other individuals. At some point, I was not able to

16

Personal Reflection

The business simulation project helped me with an opportunity to lead and experience

professional management practices as well as apply theories to various business frameworks.

The team performance was observed to increase with each round of the simulation game; the

team members were assigned individual roles and duties which they needed to perform within

the game and simulation related activities (Bowers and et.al., 2018). The workforce was

developed with each round in the simulation which helped in managing different tasks and

activities effectively and efficiently.

As a Team leader, I focused on allotting duties and roles to the employees according to

their skills, abilities and experience. I successfully distributed roles to my team members such as

marketing functions, operation management functions, financial activities, production

management etc. This was very helpful in developing coordination and increasing the overall

performance of the business or organisation. I gained a lot of experience with respect to team

management, project management, simulation of business activities, and factors contributing to

the success of a business or company in long run. The team members were highly motivated in

the project as they were an important part of the simulation game and were presented with

significant efforts in the overall project(Operational decisions, 2016.).

I effectively contributed to the group for being on time with regards to planing the work

or activities . As per the Belbin approach, I observed that my role while working in a group is

important There are various factors which can help an organisation to improve its position,

productivity and performance in the competitive market. I developed various skills such as

communication skills, leadership skills, project management skills, etc. which can be very

helpful for my future projects and career. As in light of the fact that I am a effective and

motivated employee. In the group I worked as a team leader and this parts fit to my position. As

a more effective team leader I ensured that all colleague assumes their work liability and every

one of the targets met on time.

I ensured that all the tals are done on time and due to this I help my colleagues in their

intense assignment. I concentrated on quality of work and efforts to clear goals to finish it on

given time. Later on, I saw that my role of co-coordinator got affected as I identified that I was

offered more assignments rather than other individuals. At some point, I was not able to

16

influence my colleagues and because of this reason, their execution gets down. I analysed that

diverse circumstance occurs while working in a group and it is essential for me to manage each

circumstance without getting confounded.

At some point, it was difficult up trying for me to assign the task and this negatively

affected the work. I began concentrating on my weak zones and make change in my work which

help in finishing the whole work on time.

Furthermore, I developed a great understanding of strategies of a business or

organisation can use in order to increase the market share, productivity, profit margins etc. The

best part of this project or simulation was observing changes in business strategies and outputs

that were obtained by their implications in the organizational functions and activities. There were

many situations when our team required to make appropriate decisions related to the project;

during those situations, I conducted team meetings for all the team members. Every team

member was contributing in the decision-making process by sharing their views and ideas with

other team members. Overall, the simulation game assisted me to increase my knowledge and

understanding related to business simulation. I also analysed that an organisation utilizes various

innovative and effective operational activities which can be very adequate and impressive in

increasing proficiency and revenue generation. I identified the importance of marketing,