Managerial Accounting: SPMS Implementation and Reward System Analysis

VerifiedAdded on 2019/11/20

|20

|5476

|908

Report

AI Summary

This report provides a comprehensive analysis of Strategic Performance Measurement Systems (SPMS) and their significance in business corporations. It explores the use of multi-perspective SPMS, including balanced scorecards and Triple Bottom Line approaches, detailing their salient features and discussing the relationship between motivational theories and reward systems for both executive and non-executive employees. The report examines SPMS adoption by AGL Energy Limited and Westpac Banking Corporation, revealing that Westpac has a more quantitative and strategically aligned system, linking corporate objectives with key performance indicators and executive rewards. The report highlights the importance of integrating SPMS with compensation plans to achieve organizational goals and gain a competitive advantage, supported by a literature review on the salient features of SPMS and its impact on business transparency and stakeholder trust. The report also emphasizes the role of SPMS in measuring non-financial information and its contribution to the intellectual capital of the company.

Managerial Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive Summary

The present report addresses the importance and significance of adopting Strategic

Performance Measurement System (SPMS) in the business corporations. As such, the report

has provided a complete description regarding the use of multi-perspective SPMS such as

balanced scorecard or Triple Bottom line. The salient features of the SPMS systems are

discussed in detail in the report. Also, it has discussed the relation of motivational theories to

the reward system provided to the top executives and non-executives employees of a business

entity. This has been carried out in order to demonstrate the importance of liking strategic

performance measurement system with the compensation plans for achieving the

organizational objectives and goals.

The report has provided a disclosure of SPMS adoption by the two selected publicly

listed companies in Australia that are, AGL Energy Limited and Westpac Banking

Corporation. The examination of their SPMS disclosures revealed that both the companies

publicly disclosed the information related to their strategic performance measures in their

annual reports, sustainability reports and on their company websites. However, on a

comparative basis, Westpac Banking Corporation has implemented a better and improved

strategic performance metric system that provides a complete quantitative measurement of

each of its key performance indicators. The SPMS disclosure of Westpac Banking has clearly

illustrated the strategic aligning of its corporate objectives with that of its key performance

indicators. Thus, it can be said that SPMS disclosure pattern of Westpac is more on a

quantitative basis as compared to that of AGL Energy Limited as analyzed from their

sustainability reports. Also, the banking corporation has strategically aligned its SPMS

measures and targets with the executive rewards as depicted from analysis of its financial

measures. This has enabled the bank to achieve a competitive advantage in the marketplace

over all its competitors and thus it is recognized to be the most sustainable bank of Australia.

The present report addresses the importance and significance of adopting Strategic

Performance Measurement System (SPMS) in the business corporations. As such, the report

has provided a complete description regarding the use of multi-perspective SPMS such as

balanced scorecard or Triple Bottom line. The salient features of the SPMS systems are

discussed in detail in the report. Also, it has discussed the relation of motivational theories to

the reward system provided to the top executives and non-executives employees of a business

entity. This has been carried out in order to demonstrate the importance of liking strategic

performance measurement system with the compensation plans for achieving the

organizational objectives and goals.

The report has provided a disclosure of SPMS adoption by the two selected publicly

listed companies in Australia that are, AGL Energy Limited and Westpac Banking

Corporation. The examination of their SPMS disclosures revealed that both the companies

publicly disclosed the information related to their strategic performance measures in their

annual reports, sustainability reports and on their company websites. However, on a

comparative basis, Westpac Banking Corporation has implemented a better and improved

strategic performance metric system that provides a complete quantitative measurement of

each of its key performance indicators. The SPMS disclosure of Westpac Banking has clearly

illustrated the strategic aligning of its corporate objectives with that of its key performance

indicators. Thus, it can be said that SPMS disclosure pattern of Westpac is more on a

quantitative basis as compared to that of AGL Energy Limited as analyzed from their

sustainability reports. Also, the banking corporation has strategically aligned its SPMS

measures and targets with the executive rewards as depicted from analysis of its financial

measures. This has enabled the bank to achieve a competitive advantage in the marketplace

over all its competitors and thus it is recognized to be the most sustainable bank of Australia.

Contents

Introduction................................................................................................................................4

Literature Review.......................................................................................................................4

Salient feature of Multi-Perspective SPMS............................................................................4

Reward Systems Related to the Motivational Theory............................................................6

Company Research.....................................................................................................................8

Company Profile.....................................................................................................................8

SPMS Disclosure....................................................................................................................8

Comparing Financial Performance of two selected companies...........................................11

Link to Rewards/Compensation Plan...................................................................................13

Conclusion................................................................................................................................13

References................................................................................................................................15

Introduction................................................................................................................................4

Literature Review.......................................................................................................................4

Salient feature of Multi-Perspective SPMS............................................................................4

Reward Systems Related to the Motivational Theory............................................................6

Company Research.....................................................................................................................8

Company Profile.....................................................................................................................8

SPMS Disclosure....................................................................................................................8

Comparing Financial Performance of two selected companies...........................................11

Link to Rewards/Compensation Plan...................................................................................13

Conclusion................................................................................................................................13

References................................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction

This research study aims to identify the utility of multi-perspective Strategic

Performance Measurement System (SPMS) along with the effect of motivational theories on

reward system. This study describes real examples of the companies that integrated multi-

perspective SPMS and reward system in their management as an important tool of

motivation. It has been analysed that Australian companies are gradually increasing the

implementation of SPMS related to the social, sustainability and environmental measures that

are focused on the climate change legislations (Striteska and Jelinkova, 2015). The disclosure

of companies’ performance on various aspects such as social, environmental and economic

through the adoption of a SPMS system helps them to achieve transparency in their business

operations. This in turn is essential for maintaining trust and integrity in their business

operations in mind of its various stakeholders. Thus, the report undertakes a literature review

that determines the salient features of SPMS as well as creates profound knowledge for the

implementation of reward system and theory of motivation in companies. This has been

done to illustrate the importance of linking of SPMS measures to the compensation plan of

the executives and non-executives of a business entity in order to achieve a competitive

advantage in the marketplace.

The literature review has presented the importance of two of the major SPMS systems

adopted by business corporations around the world that are balanced scorecard and triple

bottom line. In addition to this, the report has carried out evaluation of two publicly listed top

100 corporations in Australia regarding the effectiveness of their SPMS disclosures. For this,

one company selected belongs to an environment sensitive industry whereas the other

belongs to a non-sensitive environment industry. This has been done to compare and contrast

the SPMS disclosure adopted by the companies belonging to different industry sectors. The

companies selected for the purpose are. AGL Energy Limited and Westpac Banking

Corporation as these are renowned Australian companies and have provided good sustainable

performances over the years. The report analyse the annual report, sustainability reports and

the information extracted from the companies websites for evaluating the effectiveness of

their SPMS system. The financial measures of both the companies are also evaluated for

assessing the linking of their SPMS financial measures with that of the executive’s

compensation plan.

This research study aims to identify the utility of multi-perspective Strategic

Performance Measurement System (SPMS) along with the effect of motivational theories on

reward system. This study describes real examples of the companies that integrated multi-

perspective SPMS and reward system in their management as an important tool of

motivation. It has been analysed that Australian companies are gradually increasing the

implementation of SPMS related to the social, sustainability and environmental measures that

are focused on the climate change legislations (Striteska and Jelinkova, 2015). The disclosure

of companies’ performance on various aspects such as social, environmental and economic

through the adoption of a SPMS system helps them to achieve transparency in their business

operations. This in turn is essential for maintaining trust and integrity in their business

operations in mind of its various stakeholders. Thus, the report undertakes a literature review

that determines the salient features of SPMS as well as creates profound knowledge for the

implementation of reward system and theory of motivation in companies. This has been

done to illustrate the importance of linking of SPMS measures to the compensation plan of

the executives and non-executives of a business entity in order to achieve a competitive

advantage in the marketplace.

The literature review has presented the importance of two of the major SPMS systems

adopted by business corporations around the world that are balanced scorecard and triple

bottom line. In addition to this, the report has carried out evaluation of two publicly listed top

100 corporations in Australia regarding the effectiveness of their SPMS disclosures. For this,

one company selected belongs to an environment sensitive industry whereas the other

belongs to a non-sensitive environment industry. This has been done to compare and contrast

the SPMS disclosure adopted by the companies belonging to different industry sectors. The

companies selected for the purpose are. AGL Energy Limited and Westpac Banking

Corporation as these are renowned Australian companies and have provided good sustainable

performances over the years. The report analyse the annual report, sustainability reports and

the information extracted from the companies websites for evaluating the effectiveness of

their SPMS system. The financial measures of both the companies are also evaluated for

assessing the linking of their SPMS financial measures with that of the executive’s

compensation plan.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Literature Review

Salient feature of Multi-Perspective SPMS

Almeida, and Azevedo, (2016) reports that in the contemporary world, where

immense and cut-throat competition is there, incorporation of strategic tools to measure the

performance of the organisations are very imperative part of management. For the long-term

success of operations and consistency in the performance, it is mandatory for the organisation

that it implements corporate strategies focused on the social and environmental prospective

(Almeida, and Azevedo, 2016). The business corporations are operating in a continuously

dynamic environment where it has become extremely important for them to achieve the trust

and satisfaction of all its stakeholders. The sustainable growth and development of business

entities depends on meeting the needs of all its stakeholders. This can be done through

promoting transparency in business procedures through disclosing its performances on

various aspects, such as, social, environmental and economic. The strategic performance

measurement systems adopted by a business entity helps to provide all the non-financial

information to its stakeholders. The strategic performance measures of a business entity helps

in providing information regarding the business strategies adopted by it for meeting the

various needs and demands of its stakeholders. These are the key performance indicators of a

business entity provides a measurable value that helps in analysing the effectiveness of a

business entity for meeting its pre-determined goals and objectives. Multi dimensional

strategic performance measurement system (SPMS) comprised of balance score cards and

other techniques are used to determine comprehensive and profound information about the

performance of the company. It has also been analysed that it controls internal and external

context of the company along with the constant assessment of priorities and objectives of the

company (Almeida, and Azevedo, 2016). Furthermore, SPMS are designed for the

organisations to measure the changes and to reach prompt feedbacks in the strategic

operations.

Besides that, Chenhall and Smith, (2007) explores that key characteristic of SPMS is

to measure the performance of the company in multi perspective. It evaluates the ‘balanced’

picture of an organisation that can be improved simultaneously. SPMS is mainly integrated in

an organisation to analysed the performance of the organisation and provide a concise

overview of business activities. Comprehensive mapping has also been created with the help

of performance measurement matrix. Moreover, the strategic performance measurement can

be used to critically examine the past performance of the company (Chenhall and Smith,

Salient feature of Multi-Perspective SPMS

Almeida, and Azevedo, (2016) reports that in the contemporary world, where

immense and cut-throat competition is there, incorporation of strategic tools to measure the

performance of the organisations are very imperative part of management. For the long-term

success of operations and consistency in the performance, it is mandatory for the organisation

that it implements corporate strategies focused on the social and environmental prospective

(Almeida, and Azevedo, 2016). The business corporations are operating in a continuously

dynamic environment where it has become extremely important for them to achieve the trust

and satisfaction of all its stakeholders. The sustainable growth and development of business

entities depends on meeting the needs of all its stakeholders. This can be done through

promoting transparency in business procedures through disclosing its performances on

various aspects, such as, social, environmental and economic. The strategic performance

measurement systems adopted by a business entity helps to provide all the non-financial

information to its stakeholders. The strategic performance measures of a business entity helps

in providing information regarding the business strategies adopted by it for meeting the

various needs and demands of its stakeholders. These are the key performance indicators of a

business entity provides a measurable value that helps in analysing the effectiveness of a

business entity for meeting its pre-determined goals and objectives. Multi dimensional

strategic performance measurement system (SPMS) comprised of balance score cards and

other techniques are used to determine comprehensive and profound information about the

performance of the company. It has also been analysed that it controls internal and external

context of the company along with the constant assessment of priorities and objectives of the

company (Almeida, and Azevedo, 2016). Furthermore, SPMS are designed for the

organisations to measure the changes and to reach prompt feedbacks in the strategic

operations.

Besides that, Chenhall and Smith, (2007) explores that key characteristic of SPMS is

to measure the performance of the company in multi perspective. It evaluates the ‘balanced’

picture of an organisation that can be improved simultaneously. SPMS is mainly integrated in

an organisation to analysed the performance of the organisation and provide a concise

overview of business activities. Comprehensive mapping has also been created with the help

of performance measurement matrix. Moreover, the strategic performance measurement can

be used to critically examine the past performance of the company (Chenhall and Smith,

2007). The future planning for the performance of the organisation to set parameters can also

be incorporated through SPMS. Some of the models of SPMS are SMART performance

pyramid, the performance pyramid, performance prism and the performance measurement

matrix. Furthermore, the performance measurement system is comprised of balance scorecard

and EFQM business excellence model (Chenhall and Smith, 2007).

On the other hand, Iselin, Sands and Mia, (2009) states that the balance scorecards has

four perspectives that is financial, customers, internal business process and learning and

growth which help the organisations in achieving strategic goals and objectives. These factors

facilitate measurement of performance through variables like revenue, cost/productivity, asset

utilisation and investment strategies for the financial performance evaluation. In addition to

this, customer satisfaction, profitability of customers, customers acquisition, retention and

market shares are other parameters and data that provides wide information about the

customers. Post sale service, innovation and quality of the operations emphasises on the

internal business processes (Iselin, Sands and Mia, 2009). However, motivation,

configuration and empowerment with information system capability and employee capability

dimensions are analysed as learning and growth features of the company. The performance

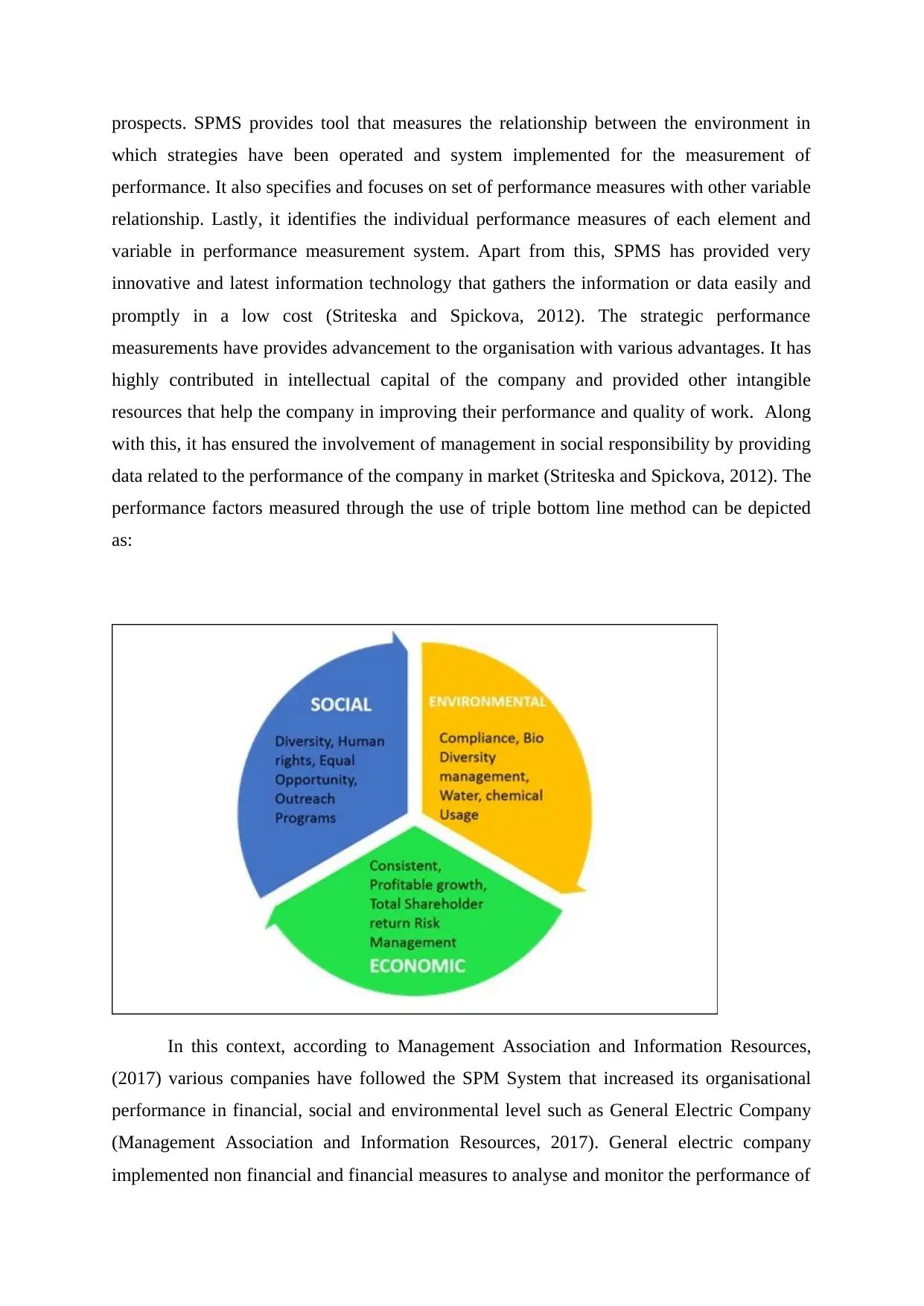

factors measured by balanced scorecard can be illustrated as:

Striteska and Spickova (2012) describes that the use of triple bottom line as a

performance measurement system can be highlighted in three stages which can help the

organisation in achieving the strategic goals that includes environmental, social and financial

be incorporated through SPMS. Some of the models of SPMS are SMART performance

pyramid, the performance pyramid, performance prism and the performance measurement

matrix. Furthermore, the performance measurement system is comprised of balance scorecard

and EFQM business excellence model (Chenhall and Smith, 2007).

On the other hand, Iselin, Sands and Mia, (2009) states that the balance scorecards has

four perspectives that is financial, customers, internal business process and learning and

growth which help the organisations in achieving strategic goals and objectives. These factors

facilitate measurement of performance through variables like revenue, cost/productivity, asset

utilisation and investment strategies for the financial performance evaluation. In addition to

this, customer satisfaction, profitability of customers, customers acquisition, retention and

market shares are other parameters and data that provides wide information about the

customers. Post sale service, innovation and quality of the operations emphasises on the

internal business processes (Iselin, Sands and Mia, 2009). However, motivation,

configuration and empowerment with information system capability and employee capability

dimensions are analysed as learning and growth features of the company. The performance

factors measured by balanced scorecard can be illustrated as:

Striteska and Spickova (2012) describes that the use of triple bottom line as a

performance measurement system can be highlighted in three stages which can help the

organisation in achieving the strategic goals that includes environmental, social and financial

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

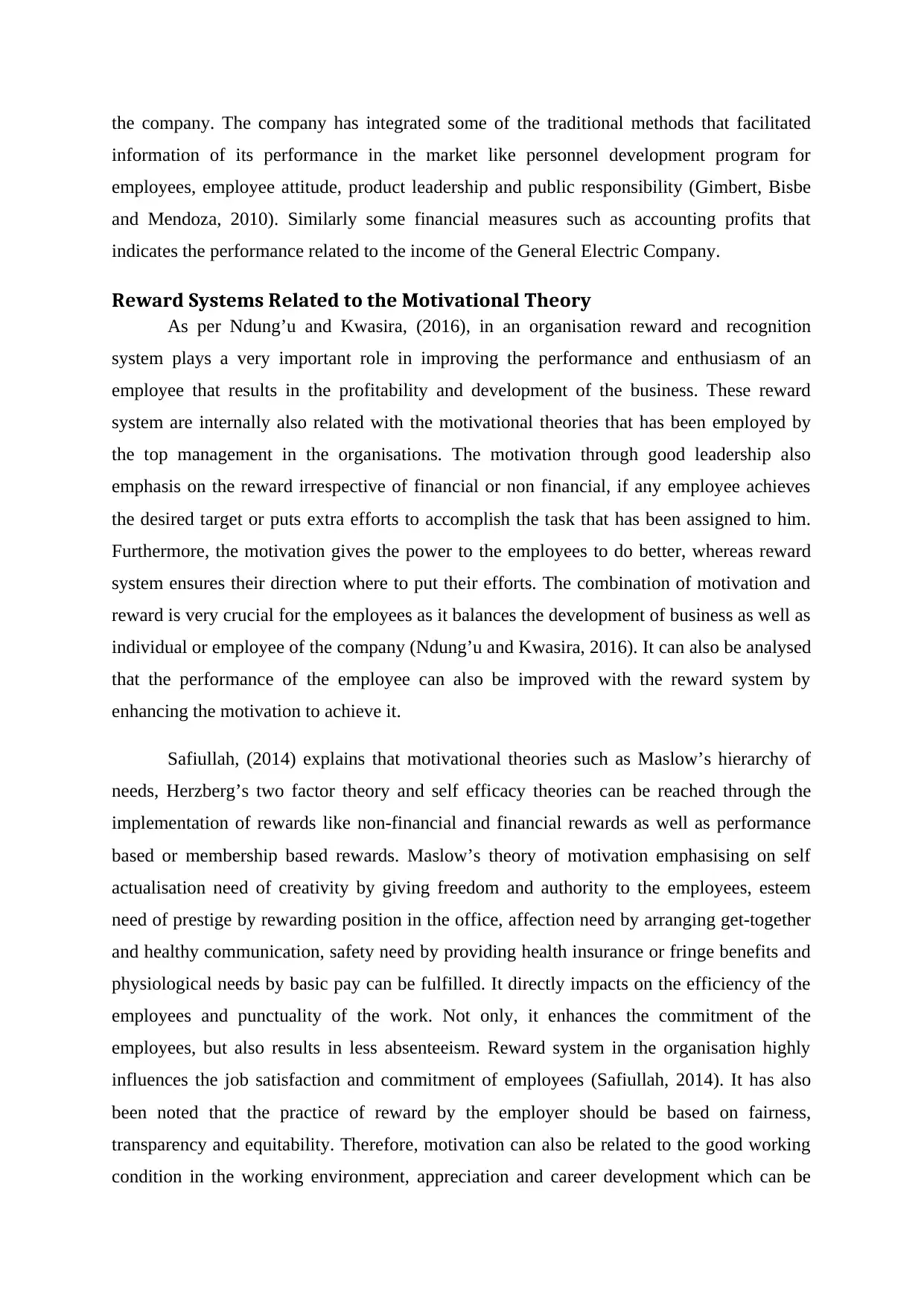

prospects. SPMS provides tool that measures the relationship between the environment in

which strategies have been operated and system implemented for the measurement of

performance. It also specifies and focuses on set of performance measures with other variable

relationship. Lastly, it identifies the individual performance measures of each element and

variable in performance measurement system. Apart from this, SPMS has provided very

innovative and latest information technology that gathers the information or data easily and

promptly in a low cost (Striteska and Spickova, 2012). The strategic performance

measurements have provides advancement to the organisation with various advantages. It has

highly contributed in intellectual capital of the company and provided other intangible

resources that help the company in improving their performance and quality of work. Along

with this, it has ensured the involvement of management in social responsibility by providing

data related to the performance of the company in market (Striteska and Spickova, 2012). The

performance factors measured through the use of triple bottom line method can be depicted

as:

In this context, according to Management Association and Information Resources,

(2017) various companies have followed the SPM System that increased its organisational

performance in financial, social and environmental level such as General Electric Company

(Management Association and Information Resources, 2017). General electric company

implemented non financial and financial measures to analyse and monitor the performance of

which strategies have been operated and system implemented for the measurement of

performance. It also specifies and focuses on set of performance measures with other variable

relationship. Lastly, it identifies the individual performance measures of each element and

variable in performance measurement system. Apart from this, SPMS has provided very

innovative and latest information technology that gathers the information or data easily and

promptly in a low cost (Striteska and Spickova, 2012). The strategic performance

measurements have provides advancement to the organisation with various advantages. It has

highly contributed in intellectual capital of the company and provided other intangible

resources that help the company in improving their performance and quality of work. Along

with this, it has ensured the involvement of management in social responsibility by providing

data related to the performance of the company in market (Striteska and Spickova, 2012). The

performance factors measured through the use of triple bottom line method can be depicted

as:

In this context, according to Management Association and Information Resources,

(2017) various companies have followed the SPM System that increased its organisational

performance in financial, social and environmental level such as General Electric Company

(Management Association and Information Resources, 2017). General electric company

implemented non financial and financial measures to analyse and monitor the performance of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the company. The company has integrated some of the traditional methods that facilitated

information of its performance in the market like personnel development program for

employees, employee attitude, product leadership and public responsibility (Gimbert, Bisbe

and Mendoza, 2010). Similarly some financial measures such as accounting profits that

indicates the performance related to the income of the General Electric Company.

Reward Systems Related to the Motivational Theory

As per Ndung’u and Kwasira, (2016), in an organisation reward and recognition

system plays a very important role in improving the performance and enthusiasm of an

employee that results in the profitability and development of the business. These reward

system are internally also related with the motivational theories that has been employed by

the top management in the organisations. The motivation through good leadership also

emphasis on the reward irrespective of financial or non financial, if any employee achieves

the desired target or puts extra efforts to accomplish the task that has been assigned to him.

Furthermore, the motivation gives the power to the employees to do better, whereas reward

system ensures their direction where to put their efforts. The combination of motivation and

reward is very crucial for the employees as it balances the development of business as well as

individual or employee of the company (Ndung’u and Kwasira, 2016). It can also be analysed

that the performance of the employee can also be improved with the reward system by

enhancing the motivation to achieve it.

Safiullah, (2014) explains that motivational theories such as Maslow’s hierarchy of

needs, Herzberg’s two factor theory and self efficacy theories can be reached through the

implementation of rewards like non-financial and financial rewards as well as performance

based or membership based rewards. Maslow’s theory of motivation emphasising on self

actualisation need of creativity by giving freedom and authority to the employees, esteem

need of prestige by rewarding position in the office, affection need by arranging get-together

and healthy communication, safety need by providing health insurance or fringe benefits and

physiological needs by basic pay can be fulfilled. It directly impacts on the efficiency of the

employees and punctuality of the work. Not only, it enhances the commitment of the

employees, but also results in less absenteeism. Reward system in the organisation highly

influences the job satisfaction and commitment of employees (Safiullah, 2014). It has also

been noted that the practice of reward by the employer should be based on fairness,

transparency and equitability. Therefore, motivation can also be related to the good working

condition in the working environment, appreciation and career development which can be

information of its performance in the market like personnel development program for

employees, employee attitude, product leadership and public responsibility (Gimbert, Bisbe

and Mendoza, 2010). Similarly some financial measures such as accounting profits that

indicates the performance related to the income of the General Electric Company.

Reward Systems Related to the Motivational Theory

As per Ndung’u and Kwasira, (2016), in an organisation reward and recognition

system plays a very important role in improving the performance and enthusiasm of an

employee that results in the profitability and development of the business. These reward

system are internally also related with the motivational theories that has been employed by

the top management in the organisations. The motivation through good leadership also

emphasis on the reward irrespective of financial or non financial, if any employee achieves

the desired target or puts extra efforts to accomplish the task that has been assigned to him.

Furthermore, the motivation gives the power to the employees to do better, whereas reward

system ensures their direction where to put their efforts. The combination of motivation and

reward is very crucial for the employees as it balances the development of business as well as

individual or employee of the company (Ndung’u and Kwasira, 2016). It can also be analysed

that the performance of the employee can also be improved with the reward system by

enhancing the motivation to achieve it.

Safiullah, (2014) explains that motivational theories such as Maslow’s hierarchy of

needs, Herzberg’s two factor theory and self efficacy theories can be reached through the

implementation of rewards like non-financial and financial rewards as well as performance

based or membership based rewards. Maslow’s theory of motivation emphasising on self

actualisation need of creativity by giving freedom and authority to the employees, esteem

need of prestige by rewarding position in the office, affection need by arranging get-together

and healthy communication, safety need by providing health insurance or fringe benefits and

physiological needs by basic pay can be fulfilled. It directly impacts on the efficiency of the

employees and punctuality of the work. Not only, it enhances the commitment of the

employees, but also results in less absenteeism. Reward system in the organisation highly

influences the job satisfaction and commitment of employees (Safiullah, 2014). It has also

been noted that the practice of reward by the employer should be based on fairness,

transparency and equitability. Therefore, motivation can also be related to the good working

condition in the working environment, appreciation and career development which can be

ensured as reward to the employees. The reward system with apt motivation results in

increase in productivity and performance of employee. In real life scenario, there are various

companies such as Apple, Woolworths, Toyota that provides motivation to the employees

with the reward as an achievement and successful in raising their profitability in the market

(Safiullah, 2014). In addition to this, these organisations are continuously improving their

internal environment by strengthening their manpower resource.

In the view of Ranjan and Mishra, (2017), as an example, Motonet-Espoo has

integrated such a reward system for its employees that motivate them to increase their

performance and productivity. The process of decision making regarding the reward system

in the company was also been taken with the help of employees. The system has also

improved the job satisfaction in employees and increases their motivation as well. The result

has also attained enhancement in the employee’s engagement in the business activities of

Motonet-Espoo. The reward system of the company is being decided by the top level

management. It is a retail store and therefore, there are different levels of store mangers that

help in employing the reward system in each department. The store managers are not static

and consequences in problems that are resolved by learning and development practices

(Ranjan and Mishra, 2017). The employee involvement in feedbacks session every year and

discussion for further improvement also encourages employees in the company. Apart from

this, the store manager that participates in the discussion also changes every year. The reward

has been categorised into three types that is tangible recognition, personal bonus and profit

sharing. Different rewards for full-time and part-employees have been arranged. This system

has immensely changed the working environment of the company in a positive way (Ranjan

and Mishra, 2017). Hence, it can be depicted that there is an affirmative relationship between

the motivational theory and reward from the above text.

Company Research

The present section of the report aims to analyze and examine the Strategic

Performance Measurement System (SPMS) of two top 100 publicly listed companies in

Australia. The companies selected for the purpose are, AGL Energy Limited and Westpac

Banking Corporation. In addition to this, the financial performance of the selected companies

has been analyzed for the year 2015 and 2016 through the adoption of financial measures.

increase in productivity and performance of employee. In real life scenario, there are various

companies such as Apple, Woolworths, Toyota that provides motivation to the employees

with the reward as an achievement and successful in raising their profitability in the market

(Safiullah, 2014). In addition to this, these organisations are continuously improving their

internal environment by strengthening their manpower resource.

In the view of Ranjan and Mishra, (2017), as an example, Motonet-Espoo has

integrated such a reward system for its employees that motivate them to increase their

performance and productivity. The process of decision making regarding the reward system

in the company was also been taken with the help of employees. The system has also

improved the job satisfaction in employees and increases their motivation as well. The result

has also attained enhancement in the employee’s engagement in the business activities of

Motonet-Espoo. The reward system of the company is being decided by the top level

management. It is a retail store and therefore, there are different levels of store mangers that

help in employing the reward system in each department. The store managers are not static

and consequences in problems that are resolved by learning and development practices

(Ranjan and Mishra, 2017). The employee involvement in feedbacks session every year and

discussion for further improvement also encourages employees in the company. Apart from

this, the store manager that participates in the discussion also changes every year. The reward

has been categorised into three types that is tangible recognition, personal bonus and profit

sharing. Different rewards for full-time and part-employees have been arranged. This system

has immensely changed the working environment of the company in a positive way (Ranjan

and Mishra, 2017). Hence, it can be depicted that there is an affirmative relationship between

the motivational theory and reward from the above text.

Company Research

The present section of the report aims to analyze and examine the Strategic

Performance Measurement System (SPMS) of two top 100 publicly listed companies in

Australia. The companies selected for the purpose are, AGL Energy Limited and Westpac

Banking Corporation. In addition to this, the financial performance of the selected companies

has been analyzed for the year 2015 and 2016 through the adoption of financial measures.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Company Profile

AGL Energy, an ASX listed public company that is involved in providing energy

products and services to the economy of the country. The company is actively involved in

development and retail of energy related products for both housing and business usage. The

company serves about 3.6 million customers across the country. The company carries out its

business operations through generating thermal, hydro and wind power. The major segments

of the company are energy markets, group operations and data provider business that are

involved in various energy related business activities (About AGL, 2017).

On the other hand, Westpac Banking Corporation, an Australian bank and financial

services provider is recognized as one of big four banks of Australia. It is recognized to be

the first bank of Australia established in the year 1817 by the name of Bank of New South

Wales and in the year 1982 has came to known by the name of Westpac. The banking

corporation serves about 13 million customers across Australia with the main objective of

meeting appropriately their financial goals. The banking corporation aspires to become the

largest company around the world through providing financial assistance to the customers

and communities for promoting their economic prosperity and growth (Westpac Banking

Corporation, 2017).

SPMS Disclosure

The Strategic performance Measurement System (SPMS) has a large impact on the

performance of a business entity as it plays a critical role in developing the strategic

decisions. The Australian firms are placing large emphasis on transforming their performance

measurement systems over the lat years through adopting a strategic performance

measurement system. The strategic performance measurement system provides an analysis of

financial and non-financial performance of a business entity through the adoption of tools

such as Balanced Score Card (BSC). The implementation of multi-perspective approach of

SPMS is essential for AGL Energy Limited as it is an environment sensitive company and

thus need to analyze its performance through the help of adopting environment indicators.

The adoption of a proper environment strategy is essential for AGL as it needs to

continuously monitor the impact of its operational activities on the communities for ensuring

its long-term growth and development. The SPMS will enable quantification of

environmental performance measures and therefore proving beneficial for the company to

measure its sustainable performances (About AGL, 2017).

AGL Energy, an ASX listed public company that is involved in providing energy

products and services to the economy of the country. The company is actively involved in

development and retail of energy related products for both housing and business usage. The

company serves about 3.6 million customers across the country. The company carries out its

business operations through generating thermal, hydro and wind power. The major segments

of the company are energy markets, group operations and data provider business that are

involved in various energy related business activities (About AGL, 2017).

On the other hand, Westpac Banking Corporation, an Australian bank and financial

services provider is recognized as one of big four banks of Australia. It is recognized to be

the first bank of Australia established in the year 1817 by the name of Bank of New South

Wales and in the year 1982 has came to known by the name of Westpac. The banking

corporation serves about 13 million customers across Australia with the main objective of

meeting appropriately their financial goals. The banking corporation aspires to become the

largest company around the world through providing financial assistance to the customers

and communities for promoting their economic prosperity and growth (Westpac Banking

Corporation, 2017).

SPMS Disclosure

The Strategic performance Measurement System (SPMS) has a large impact on the

performance of a business entity as it plays a critical role in developing the strategic

decisions. The Australian firms are placing large emphasis on transforming their performance

measurement systems over the lat years through adopting a strategic performance

measurement system. The strategic performance measurement system provides an analysis of

financial and non-financial performance of a business entity through the adoption of tools

such as Balanced Score Card (BSC). The implementation of multi-perspective approach of

SPMS is essential for AGL Energy Limited as it is an environment sensitive company and

thus need to analyze its performance through the help of adopting environment indicators.

The adoption of a proper environment strategy is essential for AGL as it needs to

continuously monitor the impact of its operational activities on the communities for ensuring

its long-term growth and development. The SPMS will enable quantification of

environmental performance measures and therefore proving beneficial for the company to

measure its sustainable performances (About AGL, 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The corporate policies of the company aim to minimize the environmental risk by

assessing the outcomes on the environment by its operational activities. The major corporate

policies as outlined by the company in respect of realizing high environmental management

and performance are as follows:

Integrating the environmental considerations into all its operational activities

Improving the business processes for reducing the environmental hazards

Efficient use of energy for reducing the waste emissions

The company has implemented and adopted a health, safety and environment

management system as per the Australian Standard AS/NZS ISO 14001 for measuring and

controlling the negative impacts on environment by its regular business activities. The system

is specially designed for benchmarking environment performance and thereby implementing

effective strategies for improving its sustainable performance (About AGL, 2017).

The development of such an environment management system helps in quantification of

its environmental performance. Thus, it helps in strategic aligning of performance measures

with the company’s corporate policies and goals and therefore developing a strategic

performance measurement system of the company. The websites of the company has

provided all the necessary data relating to air and water monitoring, irrigation program and

gas projects undertaken by it for promoting the sustainable growth and development of the

environment. The company has also disclosed its strategic performance on environmental

perspective in its sustainability reports through disclosing the measures adopted for

improving economic, customers, community and environment performance. The

sustainability reports act as a tool for the company in disseminating the information about its

daily work activities aligned with its corporate policies and monitoring the progress towards

its strategic targets (AGL Sustainability Report 2015, 2015). Therefore, it can be said that

company has published all detailed information regarding its key performance indicators in

its sustainability reports and company websites. Also, the comparison of the public

disclosures of the company regarding its SPMS over the last two years of 2015 and 2016

indicated that it has adopted same pattern of providing information in relation to its strategic

performances (AGL Sustainability Report 2016, 2016).

On the other hand, Westpac banking corporation places strategic performance

measurement at the core of its business strategy. The banking corporation provides disclosure

of its strategic performance measurement system in its sustainability reports. The bank

assessing the outcomes on the environment by its operational activities. The major corporate

policies as outlined by the company in respect of realizing high environmental management

and performance are as follows:

Integrating the environmental considerations into all its operational activities

Improving the business processes for reducing the environmental hazards

Efficient use of energy for reducing the waste emissions

The company has implemented and adopted a health, safety and environment

management system as per the Australian Standard AS/NZS ISO 14001 for measuring and

controlling the negative impacts on environment by its regular business activities. The system

is specially designed for benchmarking environment performance and thereby implementing

effective strategies for improving its sustainable performance (About AGL, 2017).

The development of such an environment management system helps in quantification of

its environmental performance. Thus, it helps in strategic aligning of performance measures

with the company’s corporate policies and goals and therefore developing a strategic

performance measurement system of the company. The websites of the company has

provided all the necessary data relating to air and water monitoring, irrigation program and

gas projects undertaken by it for promoting the sustainable growth and development of the

environment. The company has also disclosed its strategic performance on environmental

perspective in its sustainability reports through disclosing the measures adopted for

improving economic, customers, community and environment performance. The

sustainability reports act as a tool for the company in disseminating the information about its

daily work activities aligned with its corporate policies and monitoring the progress towards

its strategic targets (AGL Sustainability Report 2015, 2015). Therefore, it can be said that

company has published all detailed information regarding its key performance indicators in

its sustainability reports and company websites. Also, the comparison of the public

disclosures of the company regarding its SPMS over the last two years of 2015 and 2016

indicated that it has adopted same pattern of providing information in relation to its strategic

performances (AGL Sustainability Report 2016, 2016).

On the other hand, Westpac banking corporation places strategic performance

measurement at the core of its business strategy. The banking corporation provides disclosure

of its strategic performance measurement system in its sustainability reports. The bank

prepares and publishes its performance metrics in its sustainability report that provide a

measurement of its performances on all perspectives that are, customers, employees,

environment, suppliers and social and economical impact. The sustainability report of the

bank has provided a complete disclosure regarding the sustainability of its workforce through

measuring and reporting their progress via a number of indicators. The customer satisfaction

is also measured against a number of indicators such as examining the customer numbers,

customer relationships, no. of complaints received and customer service quality (2015

Westpac Group, 2015).

Also, it assesses its environmental performance through a number of indicators such as

GHG Emissions, energy consumption, carbon footprint; waste recycling, water consumption

and air travel. The sustainable performance of suppliers is measured against suppler

validations, expenditure in total supply chain and continuous improvement in SSCM code of

conduct. The social and economic performance is assessed through measuring value

generation and community investment. The analysis of public disclosures of the banking

corporation regarding its SPMS indicates that it has adopted same pattern of developing its

performance metrics over the last two years (2016 Westpac Group, 2016). The comparison of

SPMS disclosures of AGL and Westpac reveals that Westpac has adopted a better and

improved strategic performance measurement system. It sustainability report revels that it has

measured performance against each of its strategic perspectives through quantitative

measurement of performance indicators. On the other hand, AGL Energy Ltd has not adopted

quantitative measurement of all its performance indicators.

Comparing Financial Performance of two selected companies

There are three accounting based performance measure that help in comparing the

financial performance of the two selected companies. These accounting based measures are:

Return on Investment (ROI)

Residual Income (RI)

Economic Value Added (EVA)

Return on Investment (ROI): Formula to calculate the Return on Investment is as under

Operating Income/Average Operating Assets

In order to calculate the numerator some analyst uses operating income and some uses

net profit. For denominator either total asset is used or total assets less current liabilities.

Formula Used here: Net Income/Total Assets

measurement of its performances on all perspectives that are, customers, employees,

environment, suppliers and social and economical impact. The sustainability report of the

bank has provided a complete disclosure regarding the sustainability of its workforce through

measuring and reporting their progress via a number of indicators. The customer satisfaction

is also measured against a number of indicators such as examining the customer numbers,

customer relationships, no. of complaints received and customer service quality (2015

Westpac Group, 2015).

Also, it assesses its environmental performance through a number of indicators such as

GHG Emissions, energy consumption, carbon footprint; waste recycling, water consumption

and air travel. The sustainable performance of suppliers is measured against suppler

validations, expenditure in total supply chain and continuous improvement in SSCM code of

conduct. The social and economic performance is assessed through measuring value

generation and community investment. The analysis of public disclosures of the banking

corporation regarding its SPMS indicates that it has adopted same pattern of developing its

performance metrics over the last two years (2016 Westpac Group, 2016). The comparison of

SPMS disclosures of AGL and Westpac reveals that Westpac has adopted a better and

improved strategic performance measurement system. It sustainability report revels that it has

measured performance against each of its strategic perspectives through quantitative

measurement of performance indicators. On the other hand, AGL Energy Ltd has not adopted

quantitative measurement of all its performance indicators.

Comparing Financial Performance of two selected companies

There are three accounting based performance measure that help in comparing the

financial performance of the two selected companies. These accounting based measures are:

Return on Investment (ROI)

Residual Income (RI)

Economic Value Added (EVA)

Return on Investment (ROI): Formula to calculate the Return on Investment is as under

Operating Income/Average Operating Assets

In order to calculate the numerator some analyst uses operating income and some uses

net profit. For denominator either total asset is used or total assets less current liabilities.

Formula Used here: Net Income/Total Assets

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.