Analysis of Market Structures, GDP, and Economic Policies

VerifiedAdded on 2020/02/19

|15

|2649

|48

Homework Assignment

AI Summary

This economics assignment analyzes firm behavior in imperfectly competitive markets, including monopolistic and oligopolistic competition, and the use of product differentiation. It explores market failures, particularly externalities like those related to alcohol consumption and environmental issues, and discusses government policies such as excise taxes, bus lanes, and smart cards. The assignment also examines the Australian circular flow of income, detailing injections, withdrawals, and the determination of GDP growth. It further explains inflationary and deflationary gaps, and how factors like savings rates and international trade affect GDP growth. The solution provides diagrams and calculations to illustrate key economic concepts and principles.

Running head: PRINCIPLES OF ECONOMICS

PRINCIPLES OF ECONOMICS

Name of the Student

Name of the University

Authors Note

PRINCIPLES OF ECONOMICS

Name of the Student

Name of the University

Authors Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1PRINCIPLES OF ECONOMICS

Table of Contents

Introduction......................................................................................................................................3

Question 1........................................................................................................................................3

Question 2........................................................................................................................................6

Question 3........................................................................................................................................8

Question 4......................................................................................................................................10

Conclusion.....................................................................................................................................13

References......................................................................................................................................14

Table of Contents

Introduction......................................................................................................................................3

Question 1........................................................................................................................................3

Question 2........................................................................................................................................6

Question 3........................................................................................................................................8

Question 4......................................................................................................................................10

Conclusion.....................................................................................................................................13

References......................................................................................................................................14

2PRINCIPLES OF ECONOMICS

Introduction

The aim of this study is to analyze on the firms behavior under the imperfect competitive market

structures. In addition, market failure and imposition of government policy for controlling the

market is also illustrated in this paper. This study also discusses about the Australian circular

flow of income and various determination of GDP growth rate. The circular flow of income

helps in assessing the respective nation in terms of national income and product account (NIPA).

Moreover, the GDP, withdrawals and injections are also estimated from the national accounts

data for the hypothetical economy.

Question 1

a) Firms under monopolistic and oligopolistic competition resort to differentiation of products as

it facilitate them in earning higher profitability (Baumol and Blinder, 2014). Few entities in this

imperfect competitive market produce dissimilar products because they do not ability to imitate

the products of their competitors. Product differentiation makes the commodities more attractive

and aids the firms in attracting more customers. This aid the companies in gaining competition

advantage as these products becomes superior in the view of customers.

The restaurants in the monopolistic competitive market offer different food items to the

customers that possess some unique element within it (Friedman, 2017). On the other hand, cell

phones Company in the oligopolistic market such as Apple, Nokia differentiate their mobiles in

terms quality, innovative features and design. This strategy helps the firms in existing in the

competitive environment and expands their business globally.

Introduction

The aim of this study is to analyze on the firms behavior under the imperfect competitive market

structures. In addition, market failure and imposition of government policy for controlling the

market is also illustrated in this paper. This study also discusses about the Australian circular

flow of income and various determination of GDP growth rate. The circular flow of income

helps in assessing the respective nation in terms of national income and product account (NIPA).

Moreover, the GDP, withdrawals and injections are also estimated from the national accounts

data for the hypothetical economy.

Question 1

a) Firms under monopolistic and oligopolistic competition resort to differentiation of products as

it facilitate them in earning higher profitability (Baumol and Blinder, 2014). Few entities in this

imperfect competitive market produce dissimilar products because they do not ability to imitate

the products of their competitors. Product differentiation makes the commodities more attractive

and aids the firms in attracting more customers. This aid the companies in gaining competition

advantage as these products becomes superior in the view of customers.

The restaurants in the monopolistic competitive market offer different food items to the

customers that possess some unique element within it (Friedman, 2017). On the other hand, cell

phones Company in the oligopolistic market such as Apple, Nokia differentiate their mobiles in

terms quality, innovative features and design. This strategy helps the firms in existing in the

competitive environment and expands their business globally.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3PRINCIPLES OF ECONOMICS

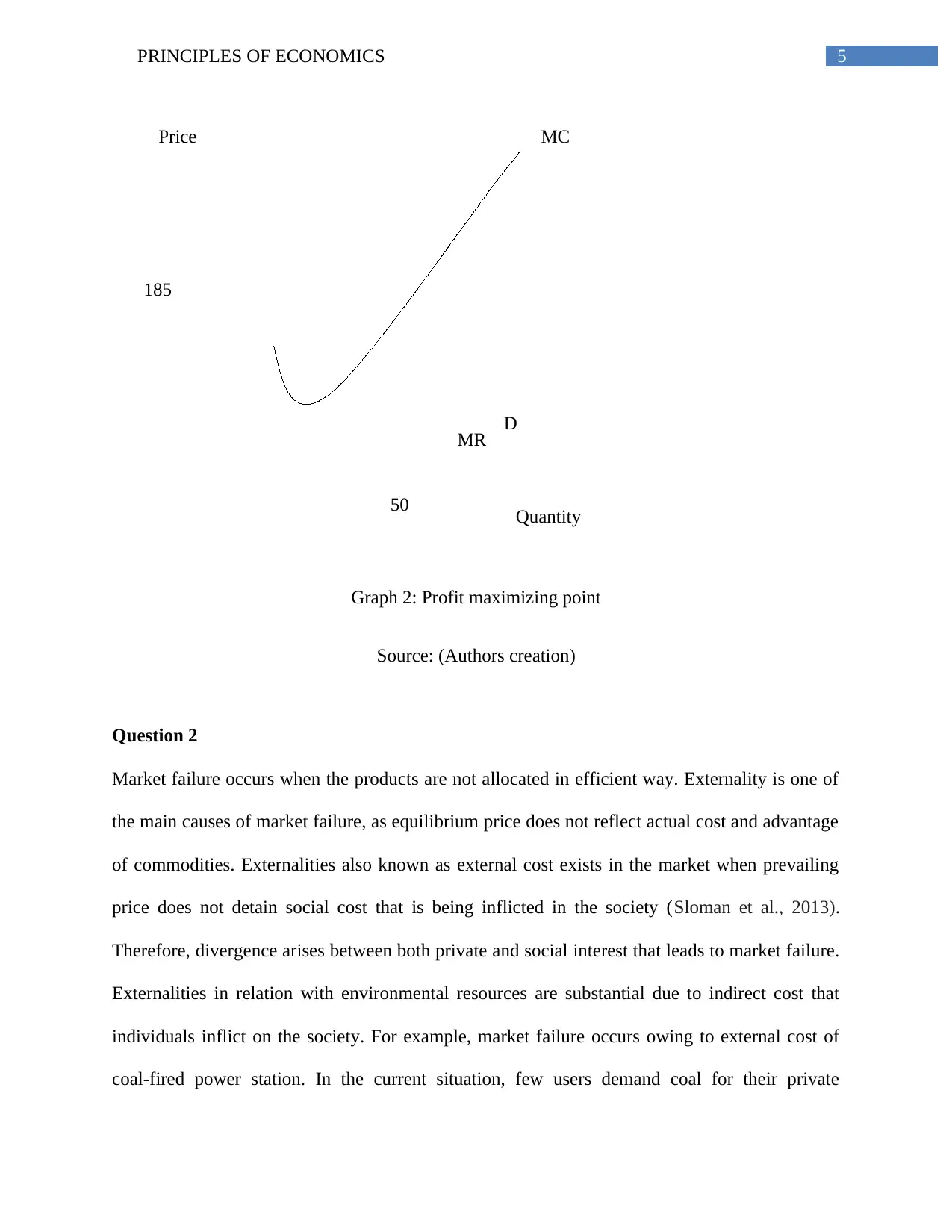

b)i) The framework of kinked demand curve assumes that the company’s will face commodities

dual demand curve based on rivalries reactions to the price change or other variable. The demand

curve of the oligopolistic competitive market according to the hypothesis of kinked demand

curve has ‘kink’ given the certain price level. The kink occurs at that price level prevailing in

the market because the demand curve segment above that present price level is elastic in nature

while the demand curve section below prevailing price is highly inelastic (Tinkler and Woods,

2013). In this case, the kink occurs at price $185 corresponding to the quantity demanded at 50.

At product price above $185 and amount less than 50, the demand curve becomes elastic.

However if the firm increases the product price, its rivalries will not change the price and its

quantity will decline. At prices below $185, demand curve becomes inelastic. This is because if

one entity declines its product price, others will also tend to decline their commodities price.

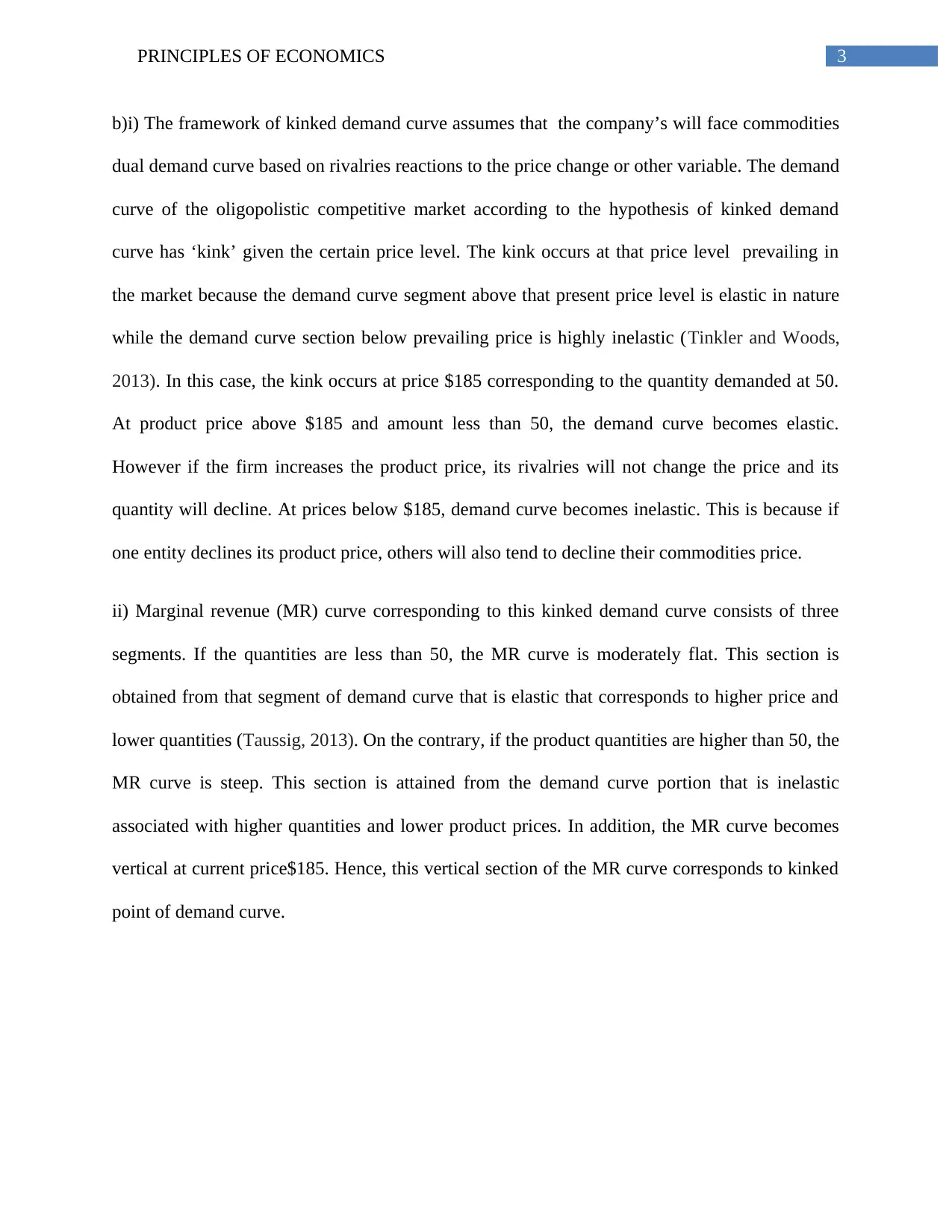

ii) Marginal revenue (MR) curve corresponding to this kinked demand curve consists of three

segments. If the quantities are less than 50, the MR curve is moderately flat. This section is

obtained from that segment of demand curve that is elastic that corresponds to higher price and

lower quantities (Taussig, 2013). On the contrary, if the product quantities are higher than 50, the

MR curve is steep. This section is attained from the demand curve portion that is inelastic

associated with higher quantities and lower product prices. In addition, the MR curve becomes

vertical at current price$185. Hence, this vertical section of the MR curve corresponds to kinked

point of demand curve.

b)i) The framework of kinked demand curve assumes that the company’s will face commodities

dual demand curve based on rivalries reactions to the price change or other variable. The demand

curve of the oligopolistic competitive market according to the hypothesis of kinked demand

curve has ‘kink’ given the certain price level. The kink occurs at that price level prevailing in

the market because the demand curve segment above that present price level is elastic in nature

while the demand curve section below prevailing price is highly inelastic (Tinkler and Woods,

2013). In this case, the kink occurs at price $185 corresponding to the quantity demanded at 50.

At product price above $185 and amount less than 50, the demand curve becomes elastic.

However if the firm increases the product price, its rivalries will not change the price and its

quantity will decline. At prices below $185, demand curve becomes inelastic. This is because if

one entity declines its product price, others will also tend to decline their commodities price.

ii) Marginal revenue (MR) curve corresponding to this kinked demand curve consists of three

segments. If the quantities are less than 50, the MR curve is moderately flat. This section is

obtained from that segment of demand curve that is elastic that corresponds to higher price and

lower quantities (Taussig, 2013). On the contrary, if the product quantities are higher than 50, the

MR curve is steep. This section is attained from the demand curve portion that is inelastic

associated with higher quantities and lower product prices. In addition, the MR curve becomes

vertical at current price$185. Hence, this vertical section of the MR curve corresponds to kinked

point of demand curve.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4PRINCIPLES OF ECONOMICS

$185

Price

Quantity50

Demand curve

MR

Graph 1: MR curve

Source: (Authors creation)

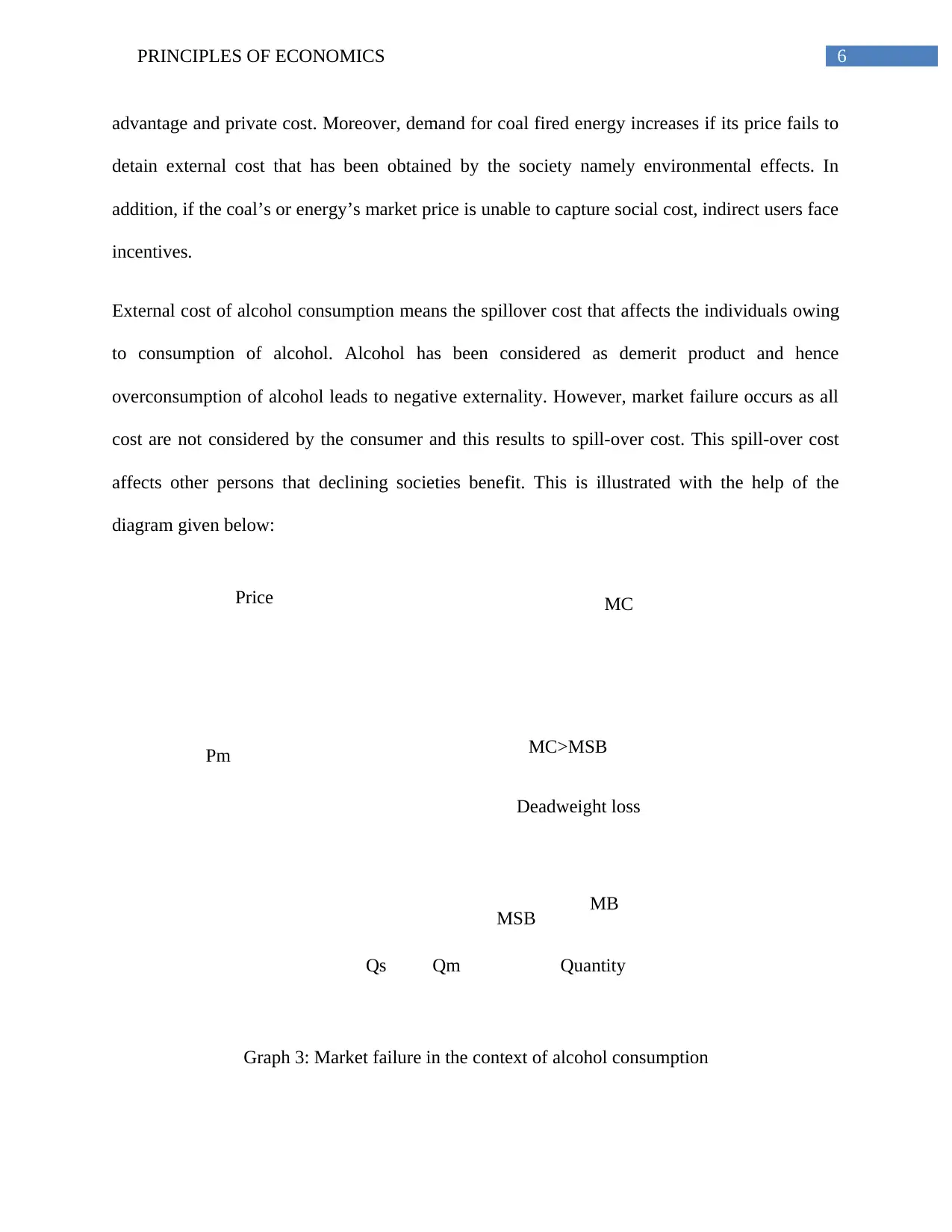

iii) Maximization of profit is attained at the point where marginal revenue (MR) curve becomes

equivalent to marginal cost (MC) curve. The MC curve cuts the vertical portion of the MR curve

that corresponds to the equilibrium price $185 and equilibrium quantity 50.

$185

Price

Quantity50

Demand curve

MR

Graph 1: MR curve

Source: (Authors creation)

iii) Maximization of profit is attained at the point where marginal revenue (MR) curve becomes

equivalent to marginal cost (MC) curve. The MC curve cuts the vertical portion of the MR curve

that corresponds to the equilibrium price $185 and equilibrium quantity 50.

5PRINCIPLES OF ECONOMICS

Quantity

Price MC

D

50

185

MR

Graph 2: Profit maximizing point

Source: (Authors creation)

Question 2

Market failure occurs when the products are not allocated in efficient way. Externality is one of

the main causes of market failure, as equilibrium price does not reflect actual cost and advantage

of commodities. Externalities also known as external cost exists in the market when prevailing

price does not detain social cost that is being inflicted in the society (Sloman et al., 2013).

Therefore, divergence arises between both private and social interest that leads to market failure.

Externalities in relation with environmental resources are substantial due to indirect cost that

individuals inflict on the society. For example, market failure occurs owing to external cost of

coal-fired power station. In the current situation, few users demand coal for their private

Quantity

Price MC

D

50

185

MR

Graph 2: Profit maximizing point

Source: (Authors creation)

Question 2

Market failure occurs when the products are not allocated in efficient way. Externality is one of

the main causes of market failure, as equilibrium price does not reflect actual cost and advantage

of commodities. Externalities also known as external cost exists in the market when prevailing

price does not detain social cost that is being inflicted in the society (Sloman et al., 2013).

Therefore, divergence arises between both private and social interest that leads to market failure.

Externalities in relation with environmental resources are substantial due to indirect cost that

individuals inflict on the society. For example, market failure occurs owing to external cost of

coal-fired power station. In the current situation, few users demand coal for their private

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6PRINCIPLES OF ECONOMICS

QmQs

Pm

MSB MB

MC>MSB

MC

Deadweight loss

Quantity

Price

advantage and private cost. Moreover, demand for coal fired energy increases if its price fails to

detain external cost that has been obtained by the society namely environmental effects. In

addition, if the coal’s or energy’s market price is unable to capture social cost, indirect users face

incentives.

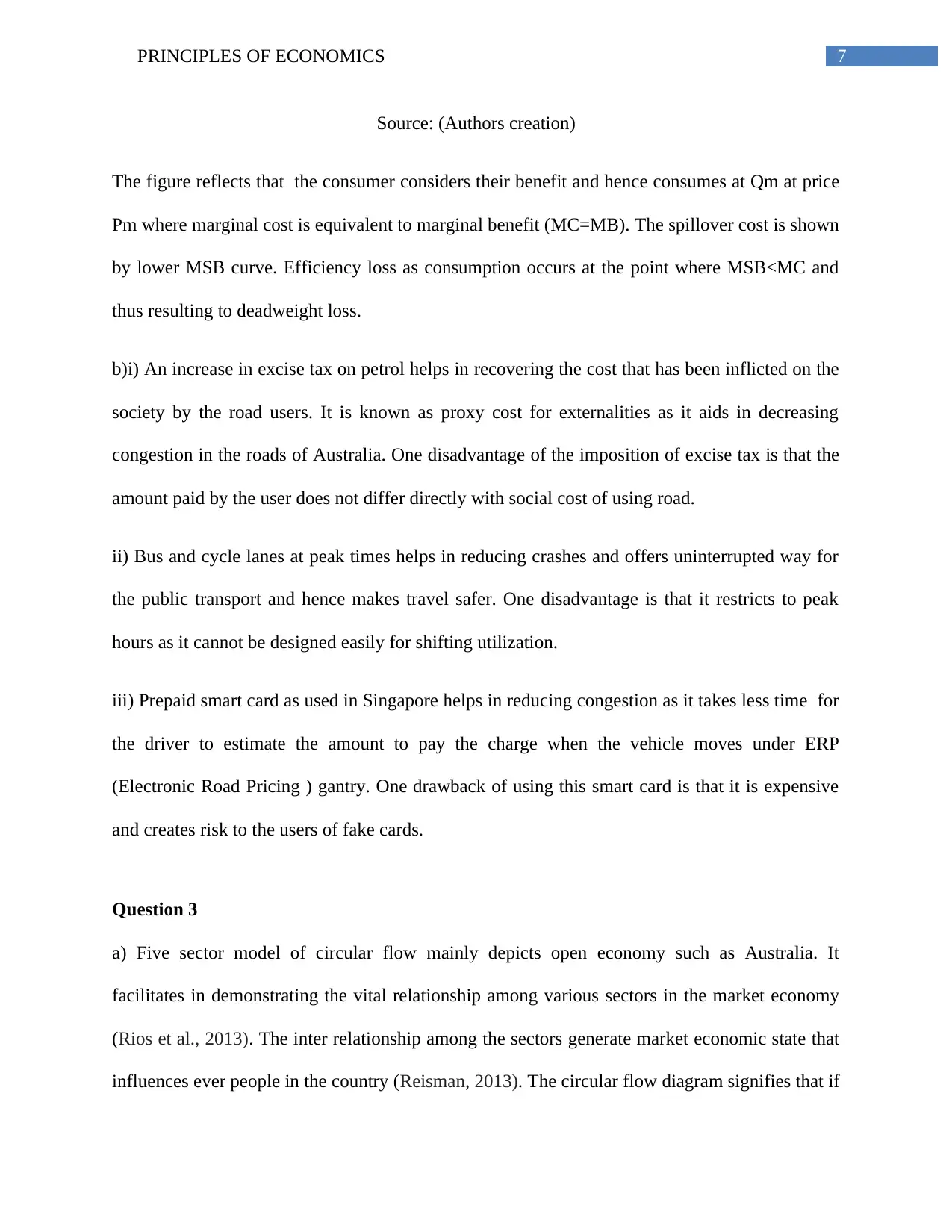

External cost of alcohol consumption means the spillover cost that affects the individuals owing

to consumption of alcohol. Alcohol has been considered as demerit product and hence

overconsumption of alcohol leads to negative externality. However, market failure occurs as all

cost are not considered by the consumer and this results to spill-over cost. This spill-over cost

affects other persons that declining societies benefit. This is illustrated with the help of the

diagram given below:

Graph 3: Market failure in the context of alcohol consumption

QmQs

Pm

MSB MB

MC>MSB

MC

Deadweight loss

Quantity

Price

advantage and private cost. Moreover, demand for coal fired energy increases if its price fails to

detain external cost that has been obtained by the society namely environmental effects. In

addition, if the coal’s or energy’s market price is unable to capture social cost, indirect users face

incentives.

External cost of alcohol consumption means the spillover cost that affects the individuals owing

to consumption of alcohol. Alcohol has been considered as demerit product and hence

overconsumption of alcohol leads to negative externality. However, market failure occurs as all

cost are not considered by the consumer and this results to spill-over cost. This spill-over cost

affects other persons that declining societies benefit. This is illustrated with the help of the

diagram given below:

Graph 3: Market failure in the context of alcohol consumption

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7PRINCIPLES OF ECONOMICS

Source: (Authors creation)

The figure reflects that the consumer considers their benefit and hence consumes at Qm at price

Pm where marginal cost is equivalent to marginal benefit (MC=MB). The spillover cost is shown

by lower MSB curve. Efficiency loss as consumption occurs at the point where MSB<MC and

thus resulting to deadweight loss.

b)i) An increase in excise tax on petrol helps in recovering the cost that has been inflicted on the

society by the road users. It is known as proxy cost for externalities as it aids in decreasing

congestion in the roads of Australia. One disadvantage of the imposition of excise tax is that the

amount paid by the user does not differ directly with social cost of using road.

ii) Bus and cycle lanes at peak times helps in reducing crashes and offers uninterrupted way for

the public transport and hence makes travel safer. One disadvantage is that it restricts to peak

hours as it cannot be designed easily for shifting utilization.

iii) Prepaid smart card as used in Singapore helps in reducing congestion as it takes less time for

the driver to estimate the amount to pay the charge when the vehicle moves under ERP

(Electronic Road Pricing ) gantry. One drawback of using this smart card is that it is expensive

and creates risk to the users of fake cards.

Question 3

a) Five sector model of circular flow mainly depicts open economy such as Australia. It

facilitates in demonstrating the vital relationship among various sectors in the market economy

(Rios et al., 2013). The inter relationship among the sectors generate market economic state that

influences ever people in the country (Reisman, 2013). The circular flow diagram signifies that if

Source: (Authors creation)

The figure reflects that the consumer considers their benefit and hence consumes at Qm at price

Pm where marginal cost is equivalent to marginal benefit (MC=MB). The spillover cost is shown

by lower MSB curve. Efficiency loss as consumption occurs at the point where MSB<MC and

thus resulting to deadweight loss.

b)i) An increase in excise tax on petrol helps in recovering the cost that has been inflicted on the

society by the road users. It is known as proxy cost for externalities as it aids in decreasing

congestion in the roads of Australia. One disadvantage of the imposition of excise tax is that the

amount paid by the user does not differ directly with social cost of using road.

ii) Bus and cycle lanes at peak times helps in reducing crashes and offers uninterrupted way for

the public transport and hence makes travel safer. One disadvantage is that it restricts to peak

hours as it cannot be designed easily for shifting utilization.

iii) Prepaid smart card as used in Singapore helps in reducing congestion as it takes less time for

the driver to estimate the amount to pay the charge when the vehicle moves under ERP

(Electronic Road Pricing ) gantry. One drawback of using this smart card is that it is expensive

and creates risk to the users of fake cards.

Question 3

a) Five sector model of circular flow mainly depicts open economy such as Australia. It

facilitates in demonstrating the vital relationship among various sectors in the market economy

(Rios et al., 2013). The inter relationship among the sectors generate market economic state that

influences ever people in the country (Reisman, 2013). The circular flow diagram signifies that if

8PRINCIPLES OF ECONOMICS

one sector faces risk, then it creates jeopardy in market conditions of this economy as they are

dependent upon each other. As it is an open economy, income is utilized for consumption, tax,

expenditure and on imports. Thus, the amount spent by the households on import of goods is

categorized as leakages. Moreover, investment is considered as injection and saving is denoted

as leakage in this circular flow diagram. Thus , income level declines if the money flow in the

nation becomes smaller.

i) Firms spending money on research and development is considered as net injections or

investment in the economy (Mankiw, 2014). This is because money spent on research helps the

firms in gaining knowledge for developing and designing the products and technologies in order

to enhance overall productivity. Thus it aids in increasing national income of Australia.

ii) Public investing more money in credit unions is considered as increase in savings or net

withdrawals. Credit unions pays back the amount invested by the public in form of high rate of

savings and low rate of loans (Murota and Ono, 2015). However, the aim of credit unions is to

increase the customers money and helping them to solve any financial related problem.

iii) It is considered as net injections as rise in government spending is not counterbalance by any

changes. However, more money is being printed in order to finance the investment if the

government runs s budget deficit.

iv) Australian investors earning higher dividends on overseas investment is considered as decline

in net withdrawals (Marshall, 2015). Overseas investment helps in diversifying their portfolio

and add benefits of higher economic growth. Therefore, net outflow of money reduces abroad

from domestic sectors.

one sector faces risk, then it creates jeopardy in market conditions of this economy as they are

dependent upon each other. As it is an open economy, income is utilized for consumption, tax,

expenditure and on imports. Thus, the amount spent by the households on import of goods is

categorized as leakages. Moreover, investment is considered as injection and saving is denoted

as leakage in this circular flow diagram. Thus , income level declines if the money flow in the

nation becomes smaller.

i) Firms spending money on research and development is considered as net injections or

investment in the economy (Mankiw, 2014). This is because money spent on research helps the

firms in gaining knowledge for developing and designing the products and technologies in order

to enhance overall productivity. Thus it aids in increasing national income of Australia.

ii) Public investing more money in credit unions is considered as increase in savings or net

withdrawals. Credit unions pays back the amount invested by the public in form of high rate of

savings and low rate of loans (Murota and Ono, 2015). However, the aim of credit unions is to

increase the customers money and helping them to solve any financial related problem.

iii) It is considered as net injections as rise in government spending is not counterbalance by any

changes. However, more money is being printed in order to finance the investment if the

government runs s budget deficit.

iv) Australian investors earning higher dividends on overseas investment is considered as decline

in net withdrawals (Marshall, 2015). Overseas investment helps in diversifying their portfolio

and add benefits of higher economic growth. Therefore, net outflow of money reduces abroad

from domestic sectors.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9PRINCIPLES OF ECONOMICS

b)i) GDP refers to the final commodities and services that are produced within the geographical

boundary in particular time limit. The expenditure method estimates GDP as –

GDP= Private consumption+ investment (government + gross) + government expenditure on

consumption +net exports (Import – Export)

From the above table, GDP is calculated as –

Gross Domestic Product

(GDP=C+I+G+NX) 130000

ii)Withdrawals

Withdrawals (S+T+M) 41000

iii)Injections

Injections (I+G+X) 90000

Question 4

a) i) An inflationary gap also termed as expansionary gap explains the total amount by which

present level of nations real GDP (Gross domestic product) surpass expected GDP that the nation

experiences at full employment and is also known as potential GDP (Mankiw, 2014). This gap

occurs when the product and services demand exceeds factors production that includes overall

employment level, rising activities of trading. The figure below shows the inflationary gap-

b)i) GDP refers to the final commodities and services that are produced within the geographical

boundary in particular time limit. The expenditure method estimates GDP as –

GDP= Private consumption+ investment (government + gross) + government expenditure on

consumption +net exports (Import – Export)

From the above table, GDP is calculated as –

Gross Domestic Product

(GDP=C+I+G+NX) 130000

ii)Withdrawals

Withdrawals (S+T+M) 41000

iii)Injections

Injections (I+G+X) 90000

Question 4

a) i) An inflationary gap also termed as expansionary gap explains the total amount by which

present level of nations real GDP (Gross domestic product) surpass expected GDP that the nation

experiences at full employment and is also known as potential GDP (Mankiw, 2014). This gap

occurs when the product and services demand exceeds factors production that includes overall

employment level, rising activities of trading. The figure below shows the inflationary gap-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10PRINCIPLES OF ECONOMICS

Full Employment Line

Inflationary gap

Y*Yf

E

A

B

AD’

AD(C+I+G+X-M)

National Output

Aggregate expenditure

Graph 4: Inflationary gap

Source: (Authors creation)

ii) Deflationary gap refers to the difference between the outputs at full employment level and the

original output (Bauer, 2014). It is defined as the measurement of aggregate demand deficiency

at full employment level. This gap is affected by the economic growth rate in comparison with

the growth rate trend in the long run. It is also termed as recessionary gap. The diagram below

reflects deflationary gap-

Full Employment Line

Inflationary gap

Y*Yf

E

A

B

AD’

AD(C+I+G+X-M)

National Output

Aggregate expenditure

Graph 4: Inflationary gap

Source: (Authors creation)

ii) Deflationary gap refers to the difference between the outputs at full employment level and the

original output (Bauer, 2014). It is defined as the measurement of aggregate demand deficiency

at full employment level. This gap is affected by the economic growth rate in comparison with

the growth rate trend in the long run. It is also termed as recessionary gap. The diagram below

reflects deflationary gap-

11PRINCIPLES OF ECONOMICS

National output

Aggregate expenditure

A

B

Deflationary gap

Y* Yf

Graph 1: Deflationary Gap

Source: (Authors creation)

The difference between the inflationary and deflationary gap is that inflationary gap occurs when

aggregate demand is higher than the aggregate supply (AD>AS) while deflationary gap arises

when aggregate demand becomes less than aggregate supply (AD<AS) at full employment

output level (Antal and Van den, 2013). Equilibrium national income level is determined when

aggregate demand becomes equivalent to aggregate supply. However, full employment

equilibrium in the economy occurs when the AD and AS are equal and all resources are

employed fully.

b) i) If a large proportion of peoples incomes is saved , then the comsumers spending

automatically decreases. In addition, changes in interest rate implemented by the central bank of

National output

Aggregate expenditure

A

B

Deflationary gap

Y* Yf

Graph 1: Deflationary Gap

Source: (Authors creation)

The difference between the inflationary and deflationary gap is that inflationary gap occurs when

aggregate demand is higher than the aggregate supply (AD>AS) while deflationary gap arises

when aggregate demand becomes less than aggregate supply (AD<AS) at full employment

output level (Antal and Van den, 2013). Equilibrium national income level is determined when

aggregate demand becomes equivalent to aggregate supply. However, full employment

equilibrium in the economy occurs when the AD and AS are equal and all resources are

employed fully.

b) i) If a large proportion of peoples incomes is saved , then the comsumers spending

automatically decreases. In addition, changes in interest rate implemented by the central bank of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.