Sum Function Sales (Part A)

VerifiedAdded on 2023/04/23

|9

|2188

|114

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Accounts

PART A

Answer 1

The three excel functions that I have used and found them useful has been described here-in-

below:

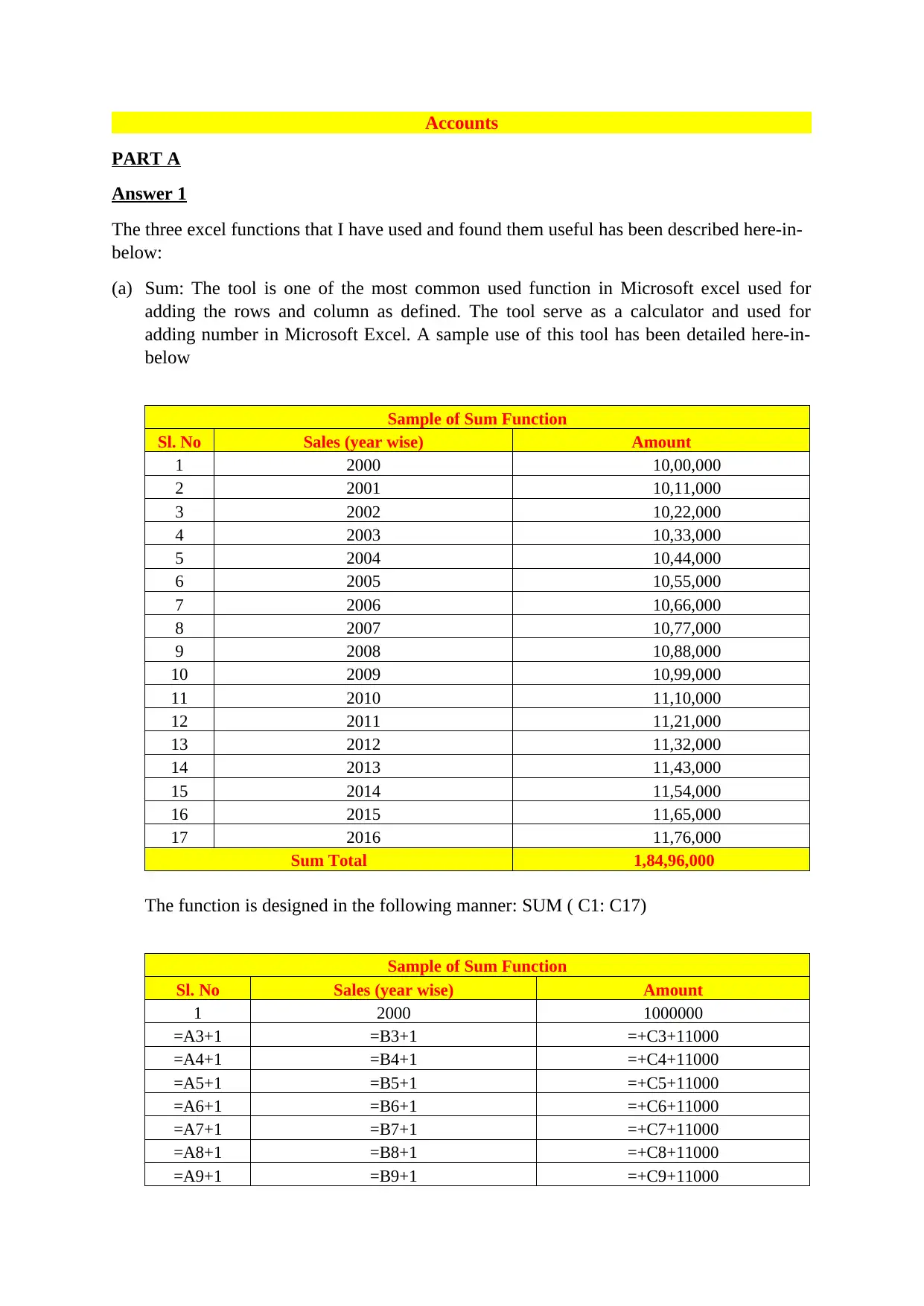

(a) Sum: The tool is one of the most common used function in Microsoft excel used for

adding the rows and column as defined. The tool serve as a calculator and used for

adding number in Microsoft Excel. A sample use of this tool has been detailed here-in-

below

Sample of Sum Function

Sl. No Sales (year wise) Amount

1 2000 10,00,000

2 2001 10,11,000

3 2002 10,22,000

4 2003 10,33,000

5 2004 10,44,000

6 2005 10,55,000

7 2006 10,66,000

8 2007 10,77,000

9 2008 10,88,000

10 2009 10,99,000

11 2010 11,10,000

12 2011 11,21,000

13 2012 11,32,000

14 2013 11,43,000

15 2014 11,54,000

16 2015 11,65,000

17 2016 11,76,000

Sum Total 1,84,96,000

The function is designed in the following manner: SUM ( C1: C17)

Sample of Sum Function

Sl. No Sales (year wise) Amount

1 2000 1000000

=A3+1 =B3+1 =+C3+11000

=A4+1 =B4+1 =+C4+11000

=A5+1 =B5+1 =+C5+11000

=A6+1 =B6+1 =+C6+11000

=A7+1 =B7+1 =+C7+11000

=A8+1 =B8+1 =+C8+11000

=A9+1 =B9+1 =+C9+11000

PART A

Answer 1

The three excel functions that I have used and found them useful has been described here-in-

below:

(a) Sum: The tool is one of the most common used function in Microsoft excel used for

adding the rows and column as defined. The tool serve as a calculator and used for

adding number in Microsoft Excel. A sample use of this tool has been detailed here-in-

below

Sample of Sum Function

Sl. No Sales (year wise) Amount

1 2000 10,00,000

2 2001 10,11,000

3 2002 10,22,000

4 2003 10,33,000

5 2004 10,44,000

6 2005 10,55,000

7 2006 10,66,000

8 2007 10,77,000

9 2008 10,88,000

10 2009 10,99,000

11 2010 11,10,000

12 2011 11,21,000

13 2012 11,32,000

14 2013 11,43,000

15 2014 11,54,000

16 2015 11,65,000

17 2016 11,76,000

Sum Total 1,84,96,000

The function is designed in the following manner: SUM ( C1: C17)

Sample of Sum Function

Sl. No Sales (year wise) Amount

1 2000 1000000

=A3+1 =B3+1 =+C3+11000

=A4+1 =B4+1 =+C4+11000

=A5+1 =B5+1 =+C5+11000

=A6+1 =B6+1 =+C6+11000

=A7+1 =B7+1 =+C7+11000

=A8+1 =B8+1 =+C8+11000

=A9+1 =B9+1 =+C9+11000

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Sample of Sum Function

Sl. No Sales (year wise) Amount

=A10+1 =B10+1 =+C10+11000

=A11+1 =B11+1 =+C11+11000

=A12+1 =B12+1 =+C12+11000

=A13+1 =B13+1 =+C13+11000

=A14+1 =B14+1 =+C14+11000

=A15+1 =B15+1 =+C15+11000

=A16+1 =B16+1 =+C16+11000

=A17+1 =B17+1 =+C17+11000

=A18+1 =B18+1 =+C18+11000

Sum Total =SUM(C3:C19)

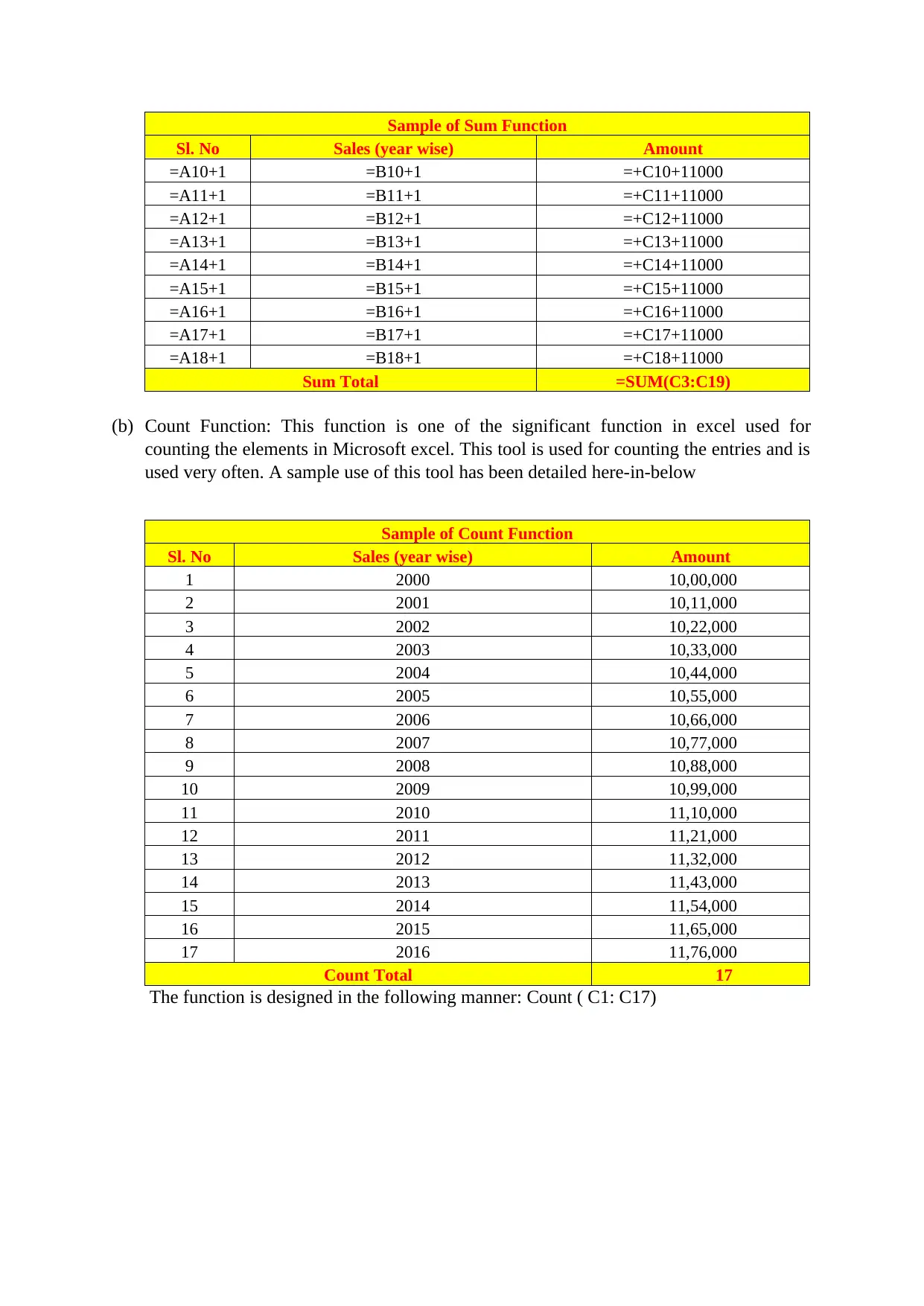

(b) Count Function: This function is one of the significant function in excel used for

counting the elements in Microsoft excel. This tool is used for counting the entries and is

used very often. A sample use of this tool has been detailed here-in-below

Sample of Count Function

Sl. No Sales (year wise) Amount

1 2000 10,00,000

2 2001 10,11,000

3 2002 10,22,000

4 2003 10,33,000

5 2004 10,44,000

6 2005 10,55,000

7 2006 10,66,000

8 2007 10,77,000

9 2008 10,88,000

10 2009 10,99,000

11 2010 11,10,000

12 2011 11,21,000

13 2012 11,32,000

14 2013 11,43,000

15 2014 11,54,000

16 2015 11,65,000

17 2016 11,76,000

Count Total 17

The function is designed in the following manner: Count ( C1: C17)

Sl. No Sales (year wise) Amount

=A10+1 =B10+1 =+C10+11000

=A11+1 =B11+1 =+C11+11000

=A12+1 =B12+1 =+C12+11000

=A13+1 =B13+1 =+C13+11000

=A14+1 =B14+1 =+C14+11000

=A15+1 =B15+1 =+C15+11000

=A16+1 =B16+1 =+C16+11000

=A17+1 =B17+1 =+C17+11000

=A18+1 =B18+1 =+C18+11000

Sum Total =SUM(C3:C19)

(b) Count Function: This function is one of the significant function in excel used for

counting the elements in Microsoft excel. This tool is used for counting the entries and is

used very often. A sample use of this tool has been detailed here-in-below

Sample of Count Function

Sl. No Sales (year wise) Amount

1 2000 10,00,000

2 2001 10,11,000

3 2002 10,22,000

4 2003 10,33,000

5 2004 10,44,000

6 2005 10,55,000

7 2006 10,66,000

8 2007 10,77,000

9 2008 10,88,000

10 2009 10,99,000

11 2010 11,10,000

12 2011 11,21,000

13 2012 11,32,000

14 2013 11,43,000

15 2014 11,54,000

16 2015 11,65,000

17 2016 11,76,000

Count Total 17

The function is designed in the following manner: Count ( C1: C17)

Sample of Count Function

Sl. No Sales (year wise) Amount

1 2000 1000000

=A3+1 =B3+1 =+C3+11000

=A4+1 =B4+1 =+C4+11000

=A5+1 =B5+1 =+C5+11000

=A6+1 =B6+1 =+C6+11000

=A7+1 =B7+1 =+C7+11000

=A8+1 =B8+1 =+C8+11000

=A9+1 =B9+1 =+C9+11000

=A10+1 =B10+1 =+C10+11000

=A11+1 =B11+1 =+C11+11000

=A12+1 =B12+1 =+C12+11000

=A13+1 =B13+1 =+C13+11000

=A14+1 =B14+1 =+C14+11000

=A15+1 =B15+1 =+C15+11000

=A16+1 =B16+1 =+C16+11000

=A17+1 =B17+1 =+C17+11000

=A18+1 =B18+1 =+C18+11000

Count Total =COUNT(C3:C19)

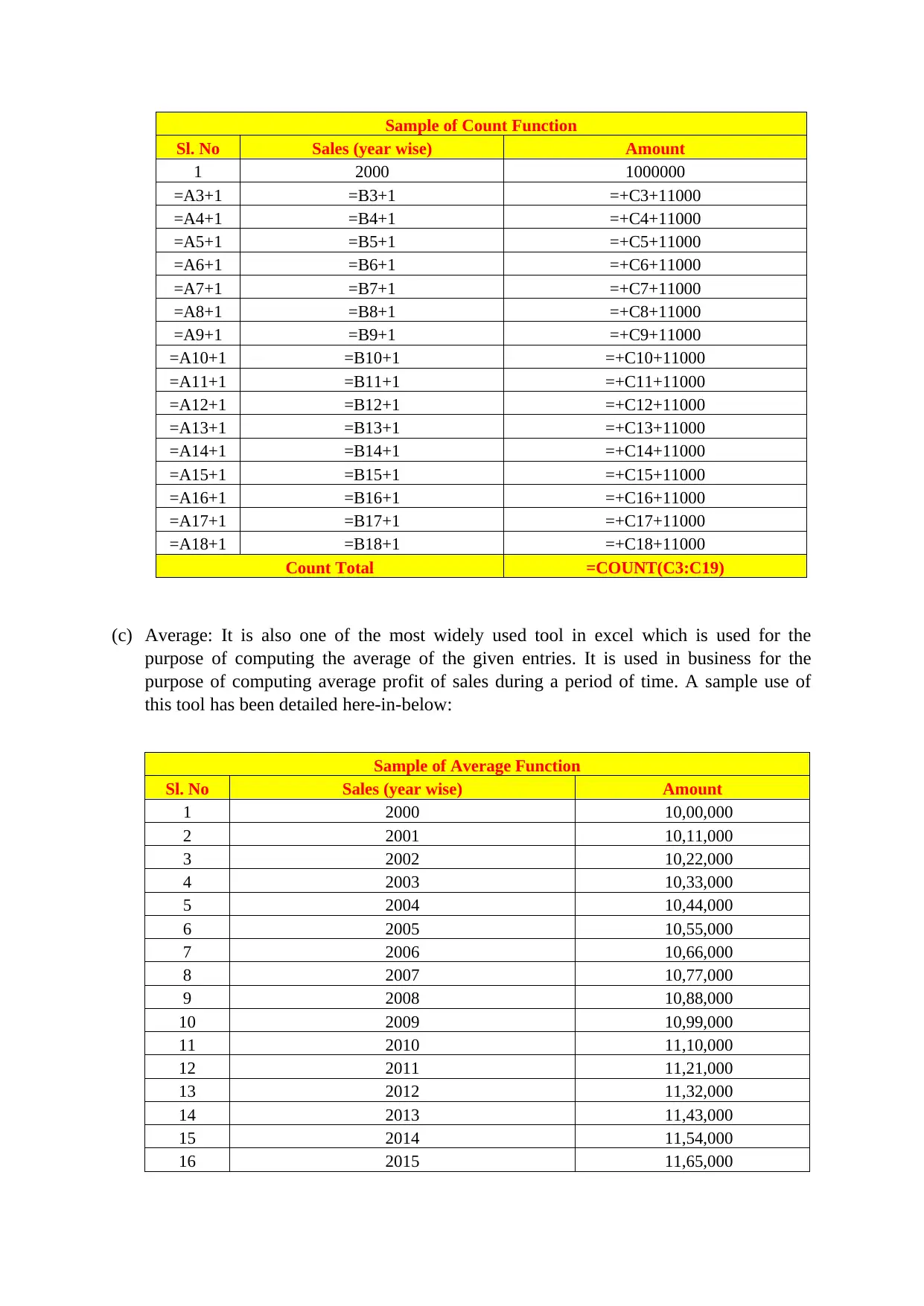

(c) Average: It is also one of the most widely used tool in excel which is used for the

purpose of computing the average of the given entries. It is used in business for the

purpose of computing average profit of sales during a period of time. A sample use of

this tool has been detailed here-in-below:

Sample of Average Function

Sl. No Sales (year wise) Amount

1 2000 10,00,000

2 2001 10,11,000

3 2002 10,22,000

4 2003 10,33,000

5 2004 10,44,000

6 2005 10,55,000

7 2006 10,66,000

8 2007 10,77,000

9 2008 10,88,000

10 2009 10,99,000

11 2010 11,10,000

12 2011 11,21,000

13 2012 11,32,000

14 2013 11,43,000

15 2014 11,54,000

16 2015 11,65,000

Sl. No Sales (year wise) Amount

1 2000 1000000

=A3+1 =B3+1 =+C3+11000

=A4+1 =B4+1 =+C4+11000

=A5+1 =B5+1 =+C5+11000

=A6+1 =B6+1 =+C6+11000

=A7+1 =B7+1 =+C7+11000

=A8+1 =B8+1 =+C8+11000

=A9+1 =B9+1 =+C9+11000

=A10+1 =B10+1 =+C10+11000

=A11+1 =B11+1 =+C11+11000

=A12+1 =B12+1 =+C12+11000

=A13+1 =B13+1 =+C13+11000

=A14+1 =B14+1 =+C14+11000

=A15+1 =B15+1 =+C15+11000

=A16+1 =B16+1 =+C16+11000

=A17+1 =B17+1 =+C17+11000

=A18+1 =B18+1 =+C18+11000

Count Total =COUNT(C3:C19)

(c) Average: It is also one of the most widely used tool in excel which is used for the

purpose of computing the average of the given entries. It is used in business for the

purpose of computing average profit of sales during a period of time. A sample use of

this tool has been detailed here-in-below:

Sample of Average Function

Sl. No Sales (year wise) Amount

1 2000 10,00,000

2 2001 10,11,000

3 2002 10,22,000

4 2003 10,33,000

5 2004 10,44,000

6 2005 10,55,000

7 2006 10,66,000

8 2007 10,77,000

9 2008 10,88,000

10 2009 10,99,000

11 2010 11,10,000

12 2011 11,21,000

13 2012 11,32,000

14 2013 11,43,000

15 2014 11,54,000

16 2015 11,65,000

Sample of Average Function

Sl. No Sales (year wise) Amount

17 2016 11,76,000

Average 10,88,000

The function is designed in the following manner: Average ( C1: C17)

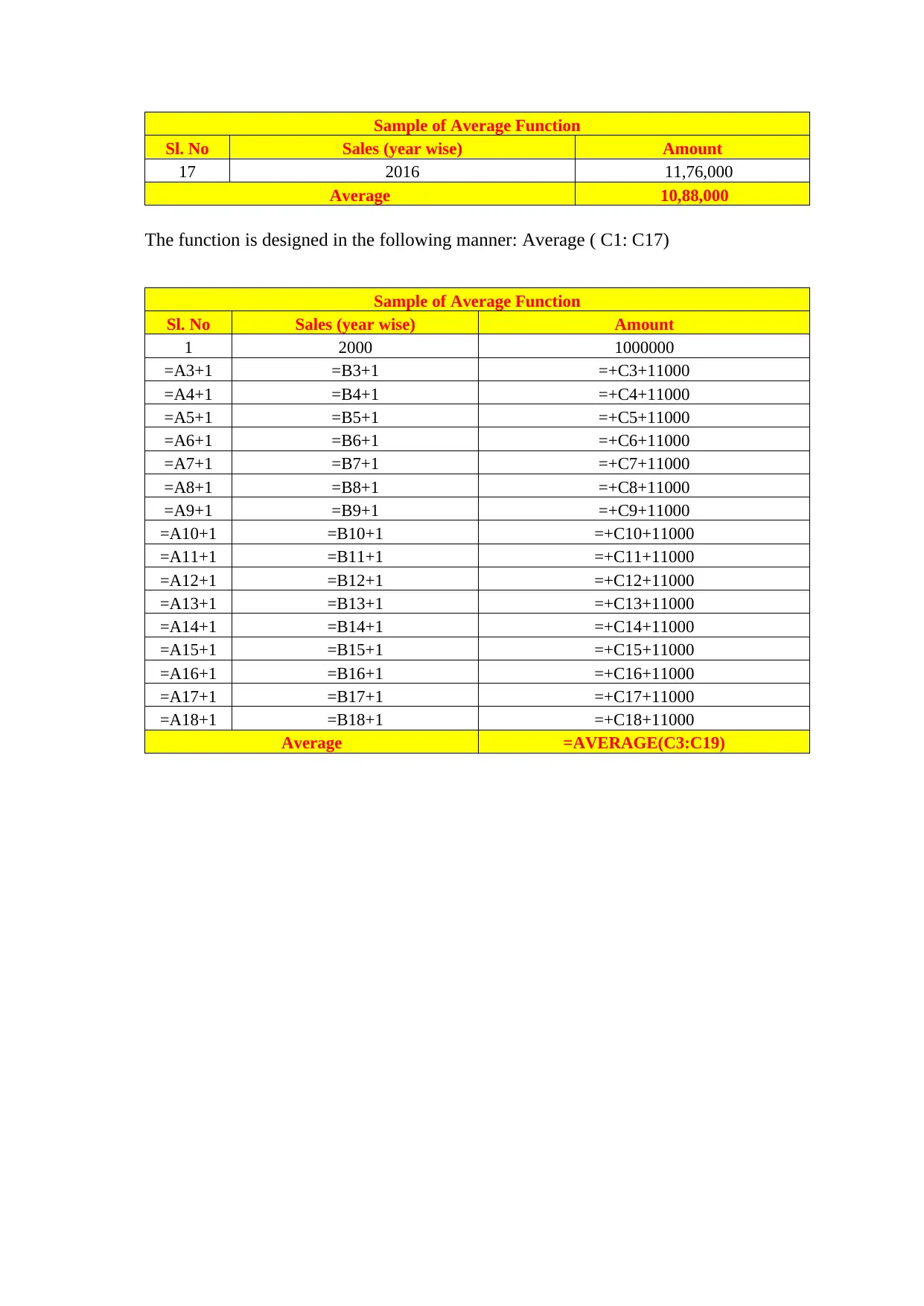

Sample of Average Function

Sl. No Sales (year wise) Amount

1 2000 1000000

=A3+1 =B3+1 =+C3+11000

=A4+1 =B4+1 =+C4+11000

=A5+1 =B5+1 =+C5+11000

=A6+1 =B6+1 =+C6+11000

=A7+1 =B7+1 =+C7+11000

=A8+1 =B8+1 =+C8+11000

=A9+1 =B9+1 =+C9+11000

=A10+1 =B10+1 =+C10+11000

=A11+1 =B11+1 =+C11+11000

=A12+1 =B12+1 =+C12+11000

=A13+1 =B13+1 =+C13+11000

=A14+1 =B14+1 =+C14+11000

=A15+1 =B15+1 =+C15+11000

=A16+1 =B16+1 =+C16+11000

=A17+1 =B17+1 =+C17+11000

=A18+1 =B18+1 =+C18+11000

Average =AVERAGE(C3:C19)

Sl. No Sales (year wise) Amount

17 2016 11,76,000

Average 10,88,000

The function is designed in the following manner: Average ( C1: C17)

Sample of Average Function

Sl. No Sales (year wise) Amount

1 2000 1000000

=A3+1 =B3+1 =+C3+11000

=A4+1 =B4+1 =+C4+11000

=A5+1 =B5+1 =+C5+11000

=A6+1 =B6+1 =+C6+11000

=A7+1 =B7+1 =+C7+11000

=A8+1 =B8+1 =+C8+11000

=A9+1 =B9+1 =+C9+11000

=A10+1 =B10+1 =+C10+11000

=A11+1 =B11+1 =+C11+11000

=A12+1 =B12+1 =+C12+11000

=A13+1 =B13+1 =+C13+11000

=A14+1 =B14+1 =+C14+11000

=A15+1 =B15+1 =+C15+11000

=A16+1 =B16+1 =+C16+11000

=A17+1 =B17+1 =+C17+11000

=A18+1 =B18+1 =+C18+11000

Average =AVERAGE(C3:C19)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

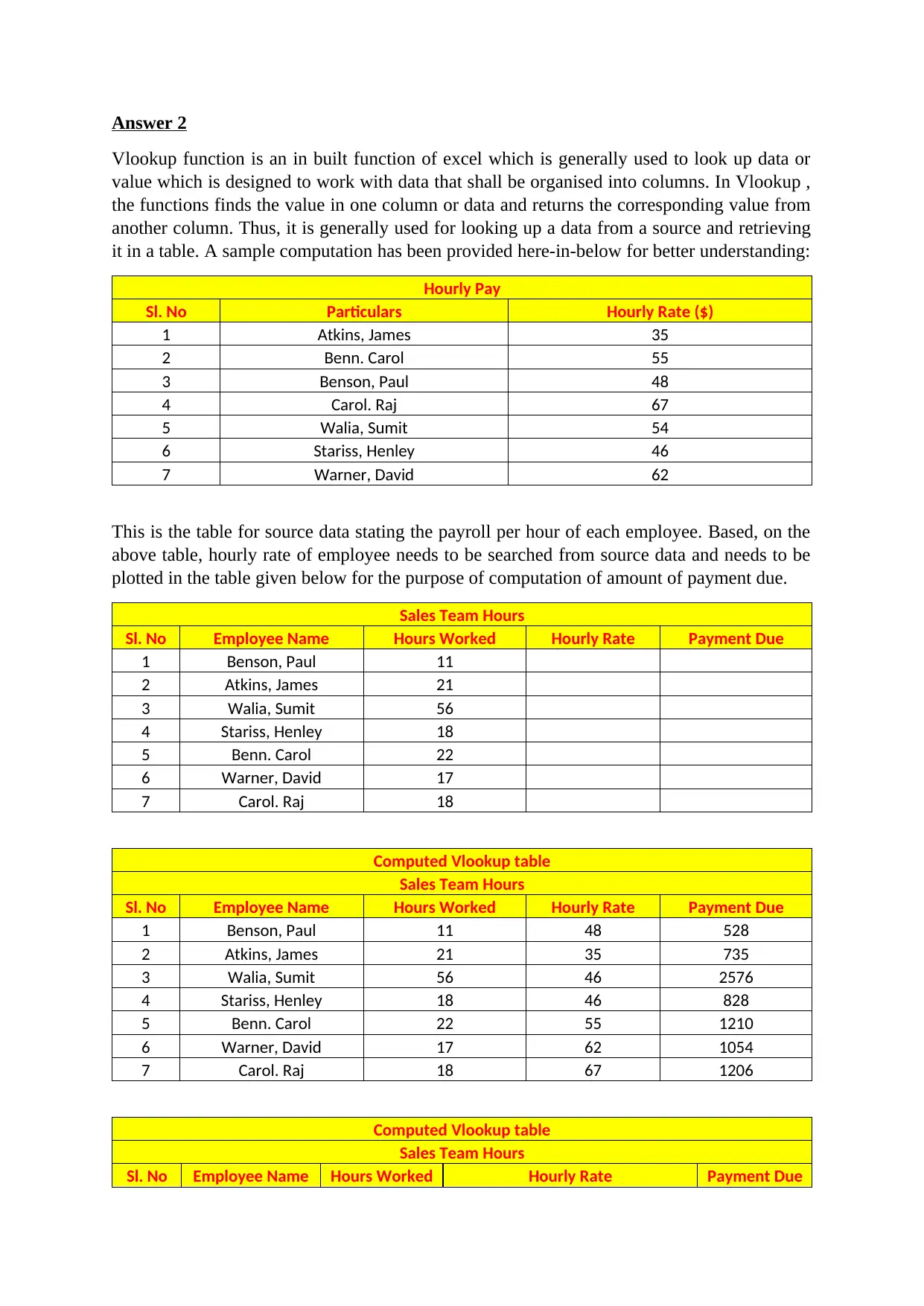

Answer 2

Vlookup function is an in built function of excel which is generally used to look up data or

value which is designed to work with data that shall be organised into columns. In Vlookup ,

the functions finds the value in one column or data and returns the corresponding value from

another column. Thus, it is generally used for looking up a data from a source and retrieving

it in a table. A sample computation has been provided here-in-below for better understanding:

Hourly Pay

Sl. No Particulars Hourly Rate ($)

1 Atkins, James 35

2 Benn. Carol 55

3 Benson, Paul 48

4 Carol. Raj 67

5 Walia, Sumit 54

6 Stariss, Henley 46

7 Warner, David 62

This is the table for source data stating the payroll per hour of each employee. Based, on the

above table, hourly rate of employee needs to be searched from source data and needs to be

plotted in the table given below for the purpose of computation of amount of payment due.

Sales Team Hours

Sl. No Employee Name Hours Worked Hourly Rate Payment Due

1 Benson, Paul 11

2 Atkins, James 21

3 Walia, Sumit 56

4 Stariss, Henley 18

5 Benn. Carol 22

6 Warner, David 17

7 Carol. Raj 18

Computed Vlookup table

Sales Team Hours

Sl. No Employee Name Hours Worked Hourly Rate Payment Due

1 Benson, Paul 11 48 528

2 Atkins, James 21 35 735

3 Walia, Sumit 56 46 2576

4 Stariss, Henley 18 46 828

5 Benn. Carol 22 55 1210

6 Warner, David 17 62 1054

7 Carol. Raj 18 67 1206

Computed Vlookup table

Sales Team Hours

Sl. No Employee Name Hours Worked Hourly Rate Payment Due

Vlookup function is an in built function of excel which is generally used to look up data or

value which is designed to work with data that shall be organised into columns. In Vlookup ,

the functions finds the value in one column or data and returns the corresponding value from

another column. Thus, it is generally used for looking up a data from a source and retrieving

it in a table. A sample computation has been provided here-in-below for better understanding:

Hourly Pay

Sl. No Particulars Hourly Rate ($)

1 Atkins, James 35

2 Benn. Carol 55

3 Benson, Paul 48

4 Carol. Raj 67

5 Walia, Sumit 54

6 Stariss, Henley 46

7 Warner, David 62

This is the table for source data stating the payroll per hour of each employee. Based, on the

above table, hourly rate of employee needs to be searched from source data and needs to be

plotted in the table given below for the purpose of computation of amount of payment due.

Sales Team Hours

Sl. No Employee Name Hours Worked Hourly Rate Payment Due

1 Benson, Paul 11

2 Atkins, James 21

3 Walia, Sumit 56

4 Stariss, Henley 18

5 Benn. Carol 22

6 Warner, David 17

7 Carol. Raj 18

Computed Vlookup table

Sales Team Hours

Sl. No Employee Name Hours Worked Hourly Rate Payment Due

1 Benson, Paul 11 48 528

2 Atkins, James 21 35 735

3 Walia, Sumit 56 46 2576

4 Stariss, Henley 18 46 828

5 Benn. Carol 22 55 1210

6 Warner, David 17 62 1054

7 Carol. Raj 18 67 1206

Computed Vlookup table

Sales Team Hours

Sl. No Employee Name Hours Worked Hourly Rate Payment Due

1 Benson, Paul 11 =VLOOKUP(B16,$B$4:$C$10,2) =C16*D16

=A16+1 Atkins, James 21 =VLOOKUP(B17,$B$4:$C$10,2) =C17*D17

=A17+1 Walia, Sumit 56 =VLOOKUP(B18,$B$4:$C$10,2) =C18*D18

=A18+1 Stariss, Henley 18 =VLOOKUP(B19,$B$4:$C$10,2) =C19*D19

=A19+1 Benn. Carol 22 =VLOOKUP(B20,$B$4:$C$10,2) =C20*D20

=A20+1 Warner, David 17 =VLOOKUP(B21,$B$4:$C$10,2) =C21*D21

=A21+1 Carol. Raj 18 =VLOOKUP(B22,$B$4:$C$10,2) =C22*D22

The computation has been done based on using the Vlookup function and has been computed

above on the basis of same.

PART B

Answer 1

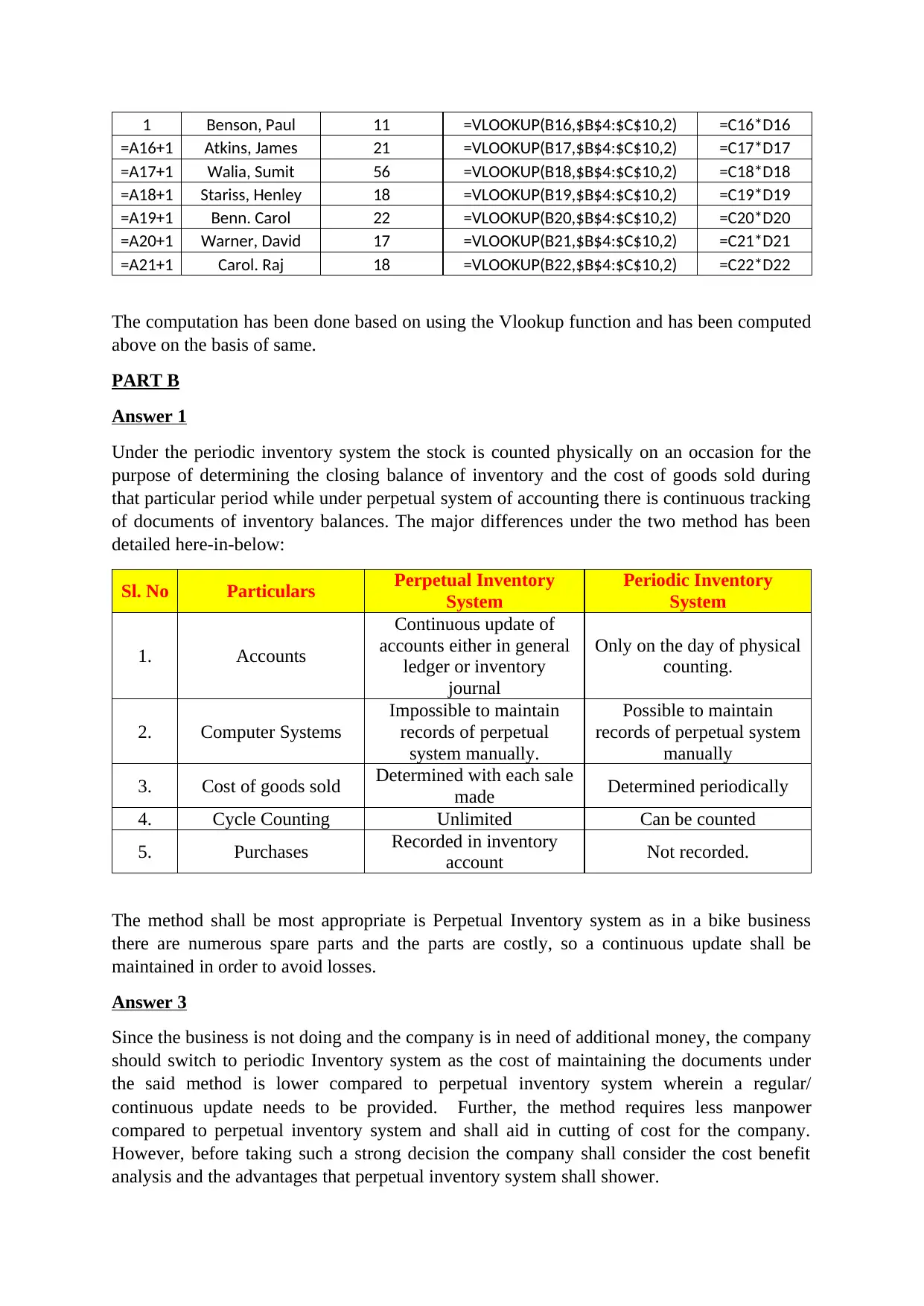

Under the periodic inventory system the stock is counted physically on an occasion for the

purpose of determining the closing balance of inventory and the cost of goods sold during

that particular period while under perpetual system of accounting there is continuous tracking

of documents of inventory balances. The major differences under the two method has been

detailed here-in-below:

Sl. No Particulars Perpetual Inventory

System

Periodic Inventory

System

1. Accounts

Continuous update of

accounts either in general

ledger or inventory

journal

Only on the day of physical

counting.

2. Computer Systems

Impossible to maintain

records of perpetual

system manually.

Possible to maintain

records of perpetual system

manually

3. Cost of goods sold Determined with each sale

made Determined periodically

4. Cycle Counting Unlimited Can be counted

5. Purchases Recorded in inventory

account Not recorded.

The method shall be most appropriate is Perpetual Inventory system as in a bike business

there are numerous spare parts and the parts are costly, so a continuous update shall be

maintained in order to avoid losses.

Answer 3

Since the business is not doing and the company is in need of additional money, the company

should switch to periodic Inventory system as the cost of maintaining the documents under

the said method is lower compared to perpetual inventory system wherein a regular/

continuous update needs to be provided. Further, the method requires less manpower

compared to perpetual inventory system and shall aid in cutting of cost for the company.

However, before taking such a strong decision the company shall consider the cost benefit

analysis and the advantages that perpetual inventory system shall shower.

=A16+1 Atkins, James 21 =VLOOKUP(B17,$B$4:$C$10,2) =C17*D17

=A17+1 Walia, Sumit 56 =VLOOKUP(B18,$B$4:$C$10,2) =C18*D18

=A18+1 Stariss, Henley 18 =VLOOKUP(B19,$B$4:$C$10,2) =C19*D19

=A19+1 Benn. Carol 22 =VLOOKUP(B20,$B$4:$C$10,2) =C20*D20

=A20+1 Warner, David 17 =VLOOKUP(B21,$B$4:$C$10,2) =C21*D21

=A21+1 Carol. Raj 18 =VLOOKUP(B22,$B$4:$C$10,2) =C22*D22

The computation has been done based on using the Vlookup function and has been computed

above on the basis of same.

PART B

Answer 1

Under the periodic inventory system the stock is counted physically on an occasion for the

purpose of determining the closing balance of inventory and the cost of goods sold during

that particular period while under perpetual system of accounting there is continuous tracking

of documents of inventory balances. The major differences under the two method has been

detailed here-in-below:

Sl. No Particulars Perpetual Inventory

System

Periodic Inventory

System

1. Accounts

Continuous update of

accounts either in general

ledger or inventory

journal

Only on the day of physical

counting.

2. Computer Systems

Impossible to maintain

records of perpetual

system manually.

Possible to maintain

records of perpetual system

manually

3. Cost of goods sold Determined with each sale

made Determined periodically

4. Cycle Counting Unlimited Can be counted

5. Purchases Recorded in inventory

account Not recorded.

The method shall be most appropriate is Perpetual Inventory system as in a bike business

there are numerous spare parts and the parts are costly, so a continuous update shall be

maintained in order to avoid losses.

Answer 3

Since the business is not doing and the company is in need of additional money, the company

should switch to periodic Inventory system as the cost of maintaining the documents under

the said method is lower compared to perpetual inventory system wherein a regular/

continuous update needs to be provided. Further, the method requires less manpower

compared to perpetual inventory system and shall aid in cutting of cost for the company.

However, before taking such a strong decision the company shall consider the cost benefit

analysis and the advantages that perpetual inventory system shall shower.

PART C

Answer 1

The item that can increase the bank balance shall be interest from bank not recorded in cash

statement, payment made by customers not intimated to company etc.

The item that increase the cash balance shall be cheques pending clearance and according not

shown in bank statement.

PART D

Answer 1

There are generally two methods of recognising bad debt in the books of accounts of the

company. The same has been described here-in-below:

(a) Direct write –off method: Under this method of recognising bad debt, bad debt is directly

reduced from account receivable account and the bad debt under such circumstance is

specific and recognisable;

(b) Allowance Method: This is computed on the basis of estimation by taking a certain

percentage of account receivable. Under the said method accounts receivable account is

not reduced by bad debt instead a provision for bad and doubtful debt is opened.

On the basis of above and the annual report, it can be inferred that the Allowance method has

been used by the company.

The amount of bad and doubtful debt reported in 2016 annual report stands at $ 69,000.

Answer 2

The other method of estimating bad debt has been detailed here-in-below:

Direct write –off method: Under this method of recognising bad debt, bad debt is directly

reduced from account receivable account and the bad debt under such circumstance is

specific and recognisable.

Further, the major difference is that under this method only the actual bad debt are written

off. However, under allowance method bad debt is written off on the basis of estimation

without crystallisation.

Answer 3

The three ratios that have been analysed for the purpose of analysis has been presented here-

in-below:

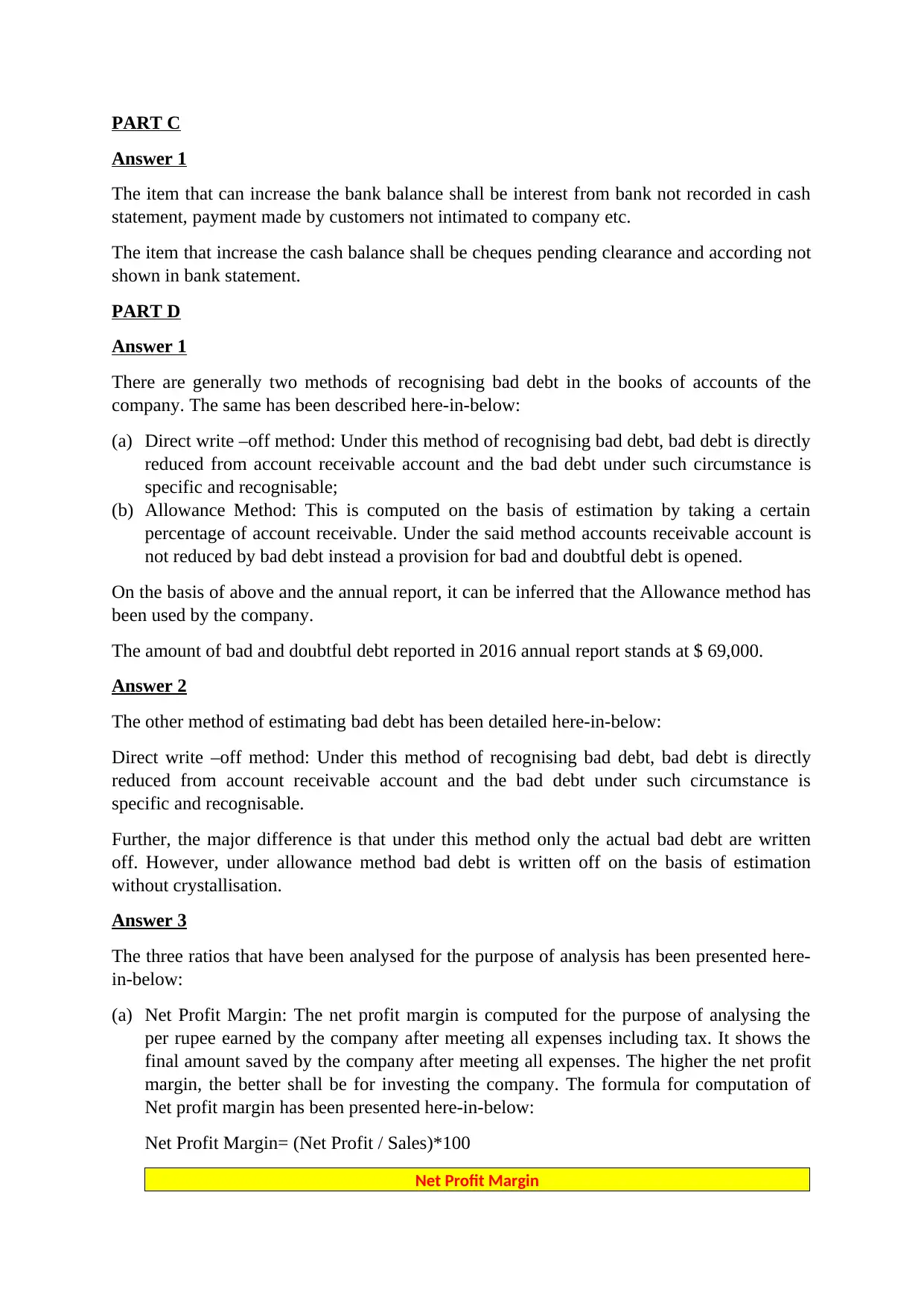

(a) Net Profit Margin: The net profit margin is computed for the purpose of analysing the

per rupee earned by the company after meeting all expenses including tax. It shows the

final amount saved by the company after meeting all expenses. The higher the net profit

margin, the better shall be for investing the company. The formula for computation of

Net profit margin has been presented here-in-below:

Net Profit Margin= (Net Profit / Sales)*100

Net Profit Margin

Answer 1

The item that can increase the bank balance shall be interest from bank not recorded in cash

statement, payment made by customers not intimated to company etc.

The item that increase the cash balance shall be cheques pending clearance and according not

shown in bank statement.

PART D

Answer 1

There are generally two methods of recognising bad debt in the books of accounts of the

company. The same has been described here-in-below:

(a) Direct write –off method: Under this method of recognising bad debt, bad debt is directly

reduced from account receivable account and the bad debt under such circumstance is

specific and recognisable;

(b) Allowance Method: This is computed on the basis of estimation by taking a certain

percentage of account receivable. Under the said method accounts receivable account is

not reduced by bad debt instead a provision for bad and doubtful debt is opened.

On the basis of above and the annual report, it can be inferred that the Allowance method has

been used by the company.

The amount of bad and doubtful debt reported in 2016 annual report stands at $ 69,000.

Answer 2

The other method of estimating bad debt has been detailed here-in-below:

Direct write –off method: Under this method of recognising bad debt, bad debt is directly

reduced from account receivable account and the bad debt under such circumstance is

specific and recognisable.

Further, the major difference is that under this method only the actual bad debt are written

off. However, under allowance method bad debt is written off on the basis of estimation

without crystallisation.

Answer 3

The three ratios that have been analysed for the purpose of analysis has been presented here-

in-below:

(a) Net Profit Margin: The net profit margin is computed for the purpose of analysing the

per rupee earned by the company after meeting all expenses including tax. It shows the

final amount saved by the company after meeting all expenses. The higher the net profit

margin, the better shall be for investing the company. The formula for computation of

Net profit margin has been presented here-in-below:

Net Profit Margin= (Net Profit / Sales)*100

Net Profit Margin

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Sl.No

. Particulars Net Profit Sales Net Profit Margin

1 2016 30430 353502 8.61%

2 2015 -2091 154803 -1.35%

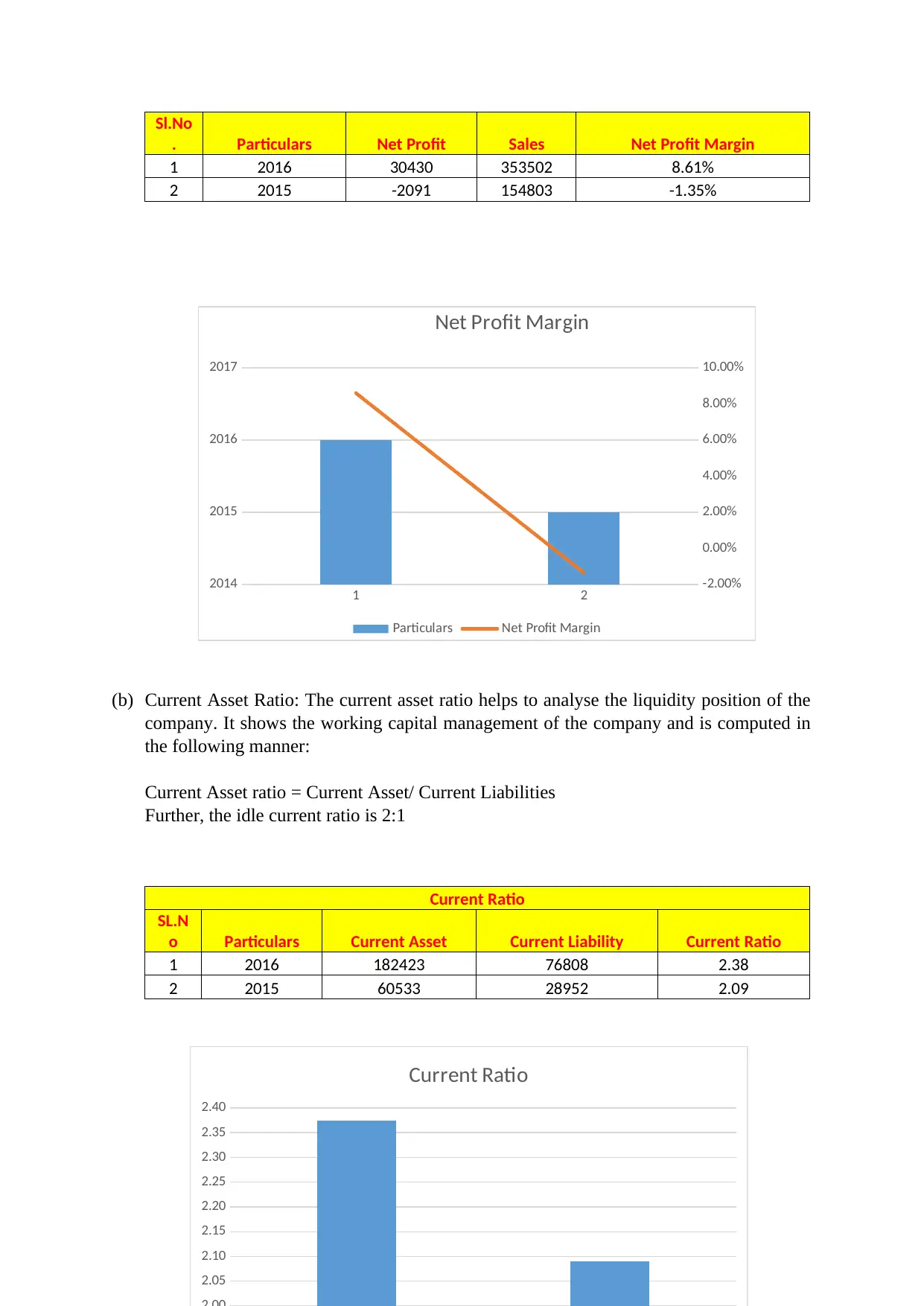

(b) Current Asset Ratio: The current asset ratio helps to analyse the liquidity position of the

company. It shows the working capital management of the company and is computed in

the following manner:

Current Asset ratio = Current Asset/ Current Liabilities

Further, the idle current ratio is 2:1

Current Ratio

SL.N

o Particulars Current Asset Current Liability Current Ratio

1 2016 182423 76808 2.38

2 2015 60533 28952 2.09

1 2

2014

2015

2016

2017

-2.00%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

Net Profit Margin

Particulars Net Profit Margin

2.05

2.10

2.15

2.20

2.25

2.30

2.35

2.40

Current Ratio

. Particulars Net Profit Sales Net Profit Margin

1 2016 30430 353502 8.61%

2 2015 -2091 154803 -1.35%

(b) Current Asset Ratio: The current asset ratio helps to analyse the liquidity position of the

company. It shows the working capital management of the company and is computed in

the following manner:

Current Asset ratio = Current Asset/ Current Liabilities

Further, the idle current ratio is 2:1

Current Ratio

SL.N

o Particulars Current Asset Current Liability Current Ratio

1 2016 182423 76808 2.38

2 2015 60533 28952 2.09

1 2

2014

2015

2016

2017

-2.00%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

Net Profit Margin

Particulars Net Profit Margin

2.05

2.10

2.15

2.20

2.25

2.30

2.35

2.40

Current Ratio

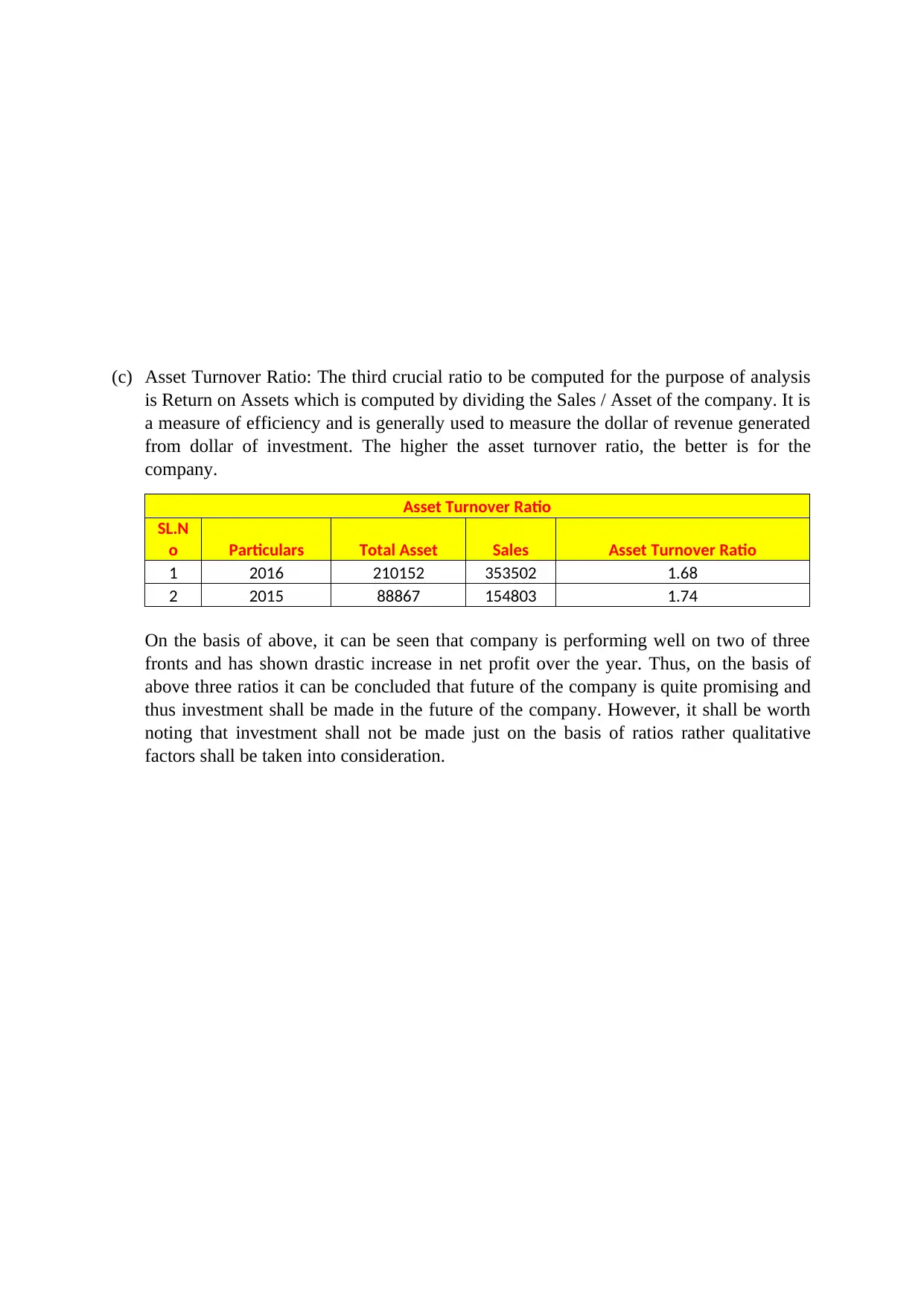

(c) Asset Turnover Ratio: The third crucial ratio to be computed for the purpose of analysis

is Return on Assets which is computed by dividing the Sales / Asset of the company. It is

a measure of efficiency and is generally used to measure the dollar of revenue generated

from dollar of investment. The higher the asset turnover ratio, the better is for the

company.

Asset Turnover Ratio

SL.N

o Particulars Total Asset Sales Asset Turnover Ratio

1 2016 210152 353502 1.68

2 2015 88867 154803 1.74

On the basis of above, it can be seen that company is performing well on two of three

fronts and has shown drastic increase in net profit over the year. Thus, on the basis of

above three ratios it can be concluded that future of the company is quite promising and

thus investment shall be made in the future of the company. However, it shall be worth

noting that investment shall not be made just on the basis of ratios rather qualitative

factors shall be taken into consideration.

2016 2015

1.90

1.95

is Return on Assets which is computed by dividing the Sales / Asset of the company. It is

a measure of efficiency and is generally used to measure the dollar of revenue generated

from dollar of investment. The higher the asset turnover ratio, the better is for the

company.

Asset Turnover Ratio

SL.N

o Particulars Total Asset Sales Asset Turnover Ratio

1 2016 210152 353502 1.68

2 2015 88867 154803 1.74

On the basis of above, it can be seen that company is performing well on two of three

fronts and has shown drastic increase in net profit over the year. Thus, on the basis of

above three ratios it can be concluded that future of the company is quite promising and

thus investment shall be made in the future of the company. However, it shall be worth

noting that investment shall not be made just on the basis of ratios rather qualitative

factors shall be taken into consideration.

2016 2015

1.90

1.95

1 out of 9

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.