Analysis of the Sun Pharmaceutical Industries Ltd. and Ranbaxy Merger

VerifiedAdded on 2022/03/19

|20

|5028

|333

Report

AI Summary

This report provides a comprehensive analysis of the Sun Pharmaceutical Industries Ltd. and Ranbaxy Laboratories merger. It begins with an overview of the Indian pharmaceutical industry, its market share, major players, export trends, government initiatives, and future potential. The report then presents the hypothesis of the study, focusing on the performance of Sun Pharma pre and post-merger. It details the profiles of both companies, outlining the rationale behind the merger, including market expansion, product portfolio diversification, and the resolution of regulatory issues faced by Ranbaxy. The report discusses the specifics of the transaction, anticipated outcomes, and synergies for Sun Pharma, such as increased market share, enhanced global footprint, and cost savings. It also addresses issues related to the merger, including post-deal challenges and strategies for building synergies. The report concludes with an analysis of the post-merger repercussions and offers key insights into the strategic implications of the merger within the context of the Indian pharmaceutical landscape. The report also includes references for further reading.

SUN PHARMA – RANBAXY MERGER

Submitted by:

Group 1

Ritam Khanna F028

Saundarya Mehra F038

Nahid Seliya F050

Vatsal Shah F054

Himanshu Sharma F055

Shantanu Sharma F057

August 2019

Submitted to:

Dr. M.K. Satish

Associate Professor, SBM, NMIMS

Submitted in partial fulfilment for the course requirements in Strategy Implementation

(Trimester IV)

School of Business Management

NMIMS UNIVERSITY

1

Submitted by:

Group 1

Ritam Khanna F028

Saundarya Mehra F038

Nahid Seliya F050

Vatsal Shah F054

Himanshu Sharma F055

Shantanu Sharma F057

August 2019

Submitted to:

Dr. M.K. Satish

Associate Professor, SBM, NMIMS

Submitted in partial fulfilment for the course requirements in Strategy Implementation

(Trimester IV)

School of Business Management

NMIMS UNIVERSITY

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

1. Indian Pharmaceutical Industry.........................................................................................................3

Overview...........................................................................................................................................3

1.1 Industry share and major players.................................................................................................3

1.2 Export trends...............................................................................................................................3

1.4 Opportunities and future potential...............................................................................................4

1.5 Indian Government initiatives......................................................................................................5

2. Hypothesis.........................................................................................................................................5

3. About the Companies.......................................................................................................................5

3.1 Sun Pharmaceutical Industries Ltd..............................................................................................5

3.2 Ranbaxy Laboratories..................................................................................................................6

4. Need of the Merger............................................................................................................................6

5. Details of Transaction........................................................................................................................8

6. Anticipated Outcomes & Synergies for Sun Pharma.......................................................................10

7. Issues Related To The Merger.........................................................................................................10

7.1 Issues: Sun Pharma faced with in return of the deal..................................................................11

7.2 Post Deal Challenges:................................................................................................................11

8. Post-Acquisition Stage....................................................................................................................13

8.1 Planned measures......................................................................................................................13

8.2 Strategy to build synergies.........................................................................................................14

9. Post-merger repercussions...............................................................................................................15

10. Conclusion.....................................................................................................................................16

References:..........................................................................................................................................18

2

1. Indian Pharmaceutical Industry.........................................................................................................3

Overview...........................................................................................................................................3

1.1 Industry share and major players.................................................................................................3

1.2 Export trends...............................................................................................................................3

1.4 Opportunities and future potential...............................................................................................4

1.5 Indian Government initiatives......................................................................................................5

2. Hypothesis.........................................................................................................................................5

3. About the Companies.......................................................................................................................5

3.1 Sun Pharmaceutical Industries Ltd..............................................................................................5

3.2 Ranbaxy Laboratories..................................................................................................................6

4. Need of the Merger............................................................................................................................6

5. Details of Transaction........................................................................................................................8

6. Anticipated Outcomes & Synergies for Sun Pharma.......................................................................10

7. Issues Related To The Merger.........................................................................................................10

7.1 Issues: Sun Pharma faced with in return of the deal..................................................................11

7.2 Post Deal Challenges:................................................................................................................11

8. Post-Acquisition Stage....................................................................................................................13

8.1 Planned measures......................................................................................................................13

8.2 Strategy to build synergies.........................................................................................................14

9. Post-merger repercussions...............................................................................................................15

10. Conclusion.....................................................................................................................................16

References:..........................................................................................................................................18

2

1. Indian Pharmaceutical Industry

Overview

Indian pharmaceutical industry is the world’s largest provider of generic drugs accounting for

supplying more than 50 per cent of the global demand for various vaccines, around 40 per

cent of generic demand in the US and almost 25 per cent of all medicine in the UK.

India is the global leader in producing cost-effective generic medicines and vaccines,

supplying 20 percent of the total global demand by volume. India has an established domestic

pharmaceutical industry, with a very strong network of over 3000 drug companies and about

10,500 manufacturing units.

1.1 Industry share and major players

With 71 per cent market share, generic drugs form the largest segment of the Indian

pharmaceutical sector. Based on moving annual turnover, Anti-Infectives (13.6%), Cardiac

(12.4%), Gastrointestinals (11.5%) had the biggest market share in the Indian pharma market

in 2018.

Some of the major domestic players in the industry include Sun Pharmaceutical Industries,

Cipla, Lupin, Dr. Reddy’s Laboratories, Aurobindo Pharma, Zydus Cadila, Piramal

Enterprises, Glenmark Pharmaceuticals, and Torrent Pharmaceuticals.

1.2 Export trends

Almost half of the total production of Indian pharmaceuticals are exported to more than 200

countries in the world.

Valued at US$ 33 billion in 2017, India’s pharmaceutical exports stood at US$ 17.27 billion

in FY18 and as of FY 2019 have reached US$ 19.14 billion. Pharmaceutical exports from

India majorly include bulk drugs, drug formulations, intermediates, biologicals, AYUSH and

herbal products and surgicals.

India’s other important export destination include the United Kingdom (US$383.3 million),

South Africa (US$ 367.35 million), Russia (US$ 283.33 million) and Nigeria (US$ 255.89

million).

By 2020, the industry estimates the exports to grow by 30 per cent to reach US$ 20 billion.

1.3 FDI and recent developments

3

Overview

Indian pharmaceutical industry is the world’s largest provider of generic drugs accounting for

supplying more than 50 per cent of the global demand for various vaccines, around 40 per

cent of generic demand in the US and almost 25 per cent of all medicine in the UK.

India is the global leader in producing cost-effective generic medicines and vaccines,

supplying 20 percent of the total global demand by volume. India has an established domestic

pharmaceutical industry, with a very strong network of over 3000 drug companies and about

10,500 manufacturing units.

1.1 Industry share and major players

With 71 per cent market share, generic drugs form the largest segment of the Indian

pharmaceutical sector. Based on moving annual turnover, Anti-Infectives (13.6%), Cardiac

(12.4%), Gastrointestinals (11.5%) had the biggest market share in the Indian pharma market

in 2018.

Some of the major domestic players in the industry include Sun Pharmaceutical Industries,

Cipla, Lupin, Dr. Reddy’s Laboratories, Aurobindo Pharma, Zydus Cadila, Piramal

Enterprises, Glenmark Pharmaceuticals, and Torrent Pharmaceuticals.

1.2 Export trends

Almost half of the total production of Indian pharmaceuticals are exported to more than 200

countries in the world.

Valued at US$ 33 billion in 2017, India’s pharmaceutical exports stood at US$ 17.27 billion

in FY18 and as of FY 2019 have reached US$ 19.14 billion. Pharmaceutical exports from

India majorly include bulk drugs, drug formulations, intermediates, biologicals, AYUSH and

herbal products and surgicals.

India’s other important export destination include the United Kingdom (US$383.3 million),

South Africa (US$ 367.35 million), Russia (US$ 283.33 million) and Nigeria (US$ 255.89

million).

By 2020, the industry estimates the exports to grow by 30 per cent to reach US$ 20 billion.

1.3 FDI and recent developments

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

India’s current foreign direct investment (FDI) policy allows 100 per cent FDI under

automatic route in green field pharmaceutical projects and up to 100 per cent FDI under

government approval in brownfield projects.

According to the data that has been released by the Department of Industrial Policy and

Promotion (DIPP), the Indian pharmaceutical sector has attracted cumulative FDI inflows

worth US$ 15.98 billion between the time - April 2000 and March 2019.

Following have been some of the recent developments and investments in the Indian

pharmaceutical sector:

The Indian pharma sector saw 39 PE investment deals worth US$ 217 million in

2018.

Investment (as a % of sales) in the R&D segment by the Indian pharma companies

increased from 5.3 per cent in FY12 to 8.5 per cent in FY18.

The Indian pharmaceutical industry exports to the US expected to get a boost, as

branded drugs worth US$ 55 billion become off-patent.

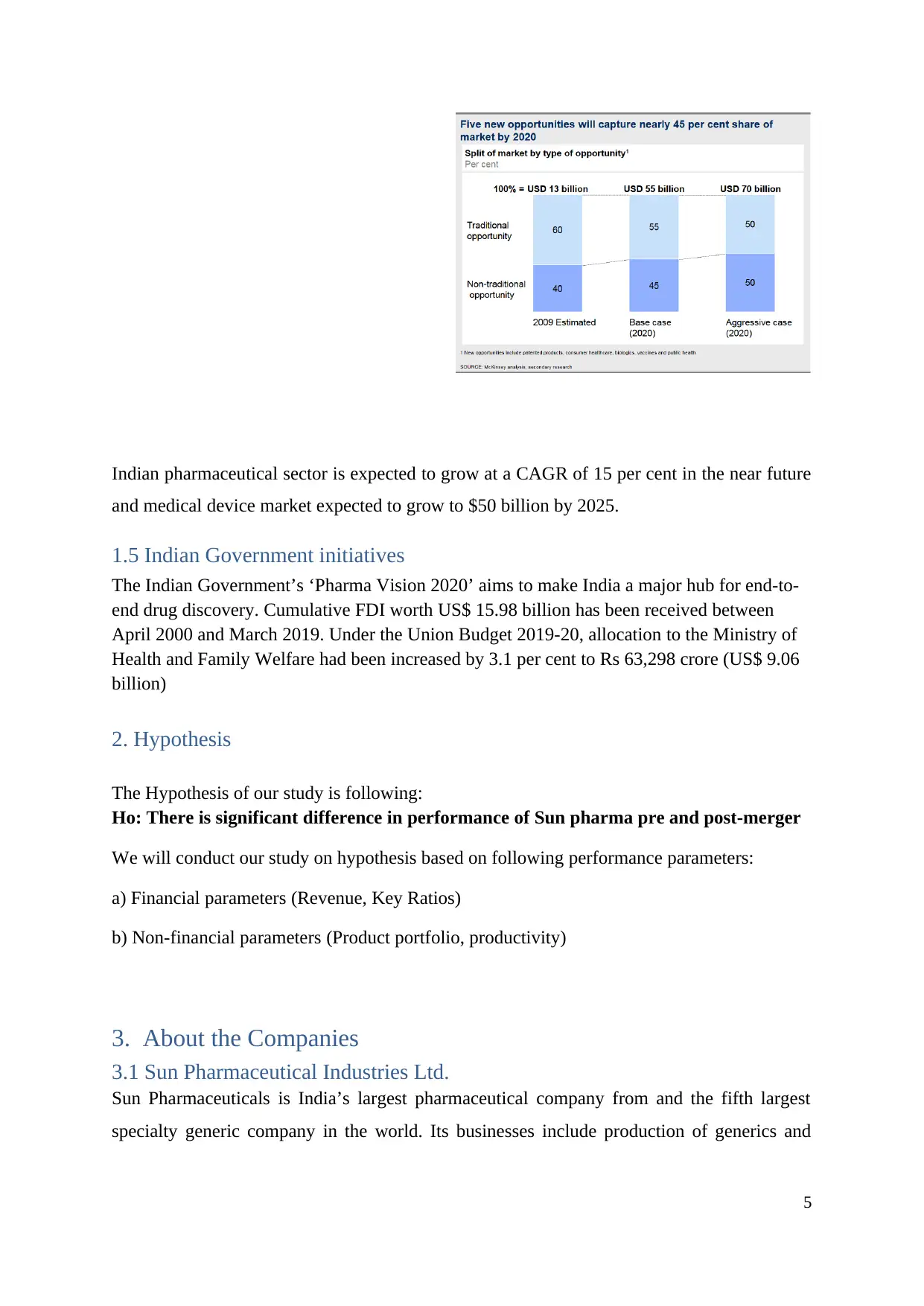

1.4 Opportunities and future potential

In terms of having significant potential in the Indian pharmaceutical industry going forward,

following FIVE opportunities seem to be among the most emerging ones [2] –

(i) patented products

(ii) consumer healthcare

(iii) biologics

(iv) vaccines

(v) public health

4

automatic route in green field pharmaceutical projects and up to 100 per cent FDI under

government approval in brownfield projects.

According to the data that has been released by the Department of Industrial Policy and

Promotion (DIPP), the Indian pharmaceutical sector has attracted cumulative FDI inflows

worth US$ 15.98 billion between the time - April 2000 and March 2019.

Following have been some of the recent developments and investments in the Indian

pharmaceutical sector:

The Indian pharma sector saw 39 PE investment deals worth US$ 217 million in

2018.

Investment (as a % of sales) in the R&D segment by the Indian pharma companies

increased from 5.3 per cent in FY12 to 8.5 per cent in FY18.

The Indian pharmaceutical industry exports to the US expected to get a boost, as

branded drugs worth US$ 55 billion become off-patent.

1.4 Opportunities and future potential

In terms of having significant potential in the Indian pharmaceutical industry going forward,

following FIVE opportunities seem to be among the most emerging ones [2] –

(i) patented products

(ii) consumer healthcare

(iii) biologics

(iv) vaccines

(v) public health

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Indian pharmaceutical sector is expected to grow at a CAGR of 15 per cent in the near future

and medical device market expected to grow to $50 billion by 2025.

1.5 Indian Government initiatives

The Indian Government’s ‘Pharma Vision 2020’ aims to make India a major hub for end-to-

end drug discovery. Cumulative FDI worth US$ 15.98 billion has been received between

April 2000 and March 2019. Under the Union Budget 2019-20, allocation to the Ministry of

Health and Family Welfare had been increased by 3.1 per cent to Rs 63,298 crore (US$ 9.06

billion)

2. Hypothesis

The Hypothesis of our study is following:

Ho: There is significant difference in performance of Sun pharma pre and post-merger

We will conduct our study on hypothesis based on following performance parameters:

a) Financial parameters (Revenue, Key Ratios)

b) Non-financial parameters (Product portfolio, productivity)

3. About the Companies

3.1 Sun Pharmaceutical Industries Ltd.

Sun Pharmaceuticals is India’s largest pharmaceutical company from and the fifth largest

specialty generic company in the world. Its businesses include production of generics and

5

and medical device market expected to grow to $50 billion by 2025.

1.5 Indian Government initiatives

The Indian Government’s ‘Pharma Vision 2020’ aims to make India a major hub for end-to-

end drug discovery. Cumulative FDI worth US$ 15.98 billion has been received between

April 2000 and March 2019. Under the Union Budget 2019-20, allocation to the Ministry of

Health and Family Welfare had been increased by 3.1 per cent to Rs 63,298 crore (US$ 9.06

billion)

2. Hypothesis

The Hypothesis of our study is following:

Ho: There is significant difference in performance of Sun pharma pre and post-merger

We will conduct our study on hypothesis based on following performance parameters:

a) Financial parameters (Revenue, Key Ratios)

b) Non-financial parameters (Product portfolio, productivity)

3. About the Companies

3.1 Sun Pharmaceutical Industries Ltd.

Sun Pharmaceuticals is India’s largest pharmaceutical company from and the fifth largest

specialty generic company in the world. Its businesses include production of generics and

5

branded generics, speciality, over the counter (OTC) products, anti-retrovirals (ARVs),

Active Pharmaceutical Ingredients (APIs) and intermediates.

With more than 2,000 marketed products and 40 manufacturing sites spread across 6

continents and 15 countries, Sun Pharma serves over 150 markets across the world.

US formulations contributed the most to company’s US$ 4 billion sales in FY18 with a

contribution of 34 per cent, followed by India branded formulations at 31 per cent. In FY19,

the total income of the company reached Rs 30,091.40 crore (US$ 4.33 billion).

Stringent audits of all Sun Pharma manufacturing facilities are conducted by regulatory

agencies routinely conducting for compliance with Current Good Manufacturing Practices

(cGMP).

3.2 Ranbaxy Laboratories

Ranbaxy Laboratories is a major research-oriented international pharmaceutical company

established in 1961 and serves in over 150 countries and with experience of more than 50

years in providing high quality, affordable medicines.

It has 21 manufacturing facilities spread across eight countries. Additionally, the company

covers all the top 25 pharmaceutical markets of the world and has a robust presence across

both developed and emerging markets.

Started by two cousins Ranjit and Gurbax (and hence the name Ranbaxy) as a drug

distribution firm in 1937 in Amritsar), it was acquired by Bhai Mohan Singh in 1947 as the

original owners of the firm had failed to repay the money that had been lent by Bhai Mohan

Singh. Over the course of next few years, Bhai Mohan Singh managed to save the company

from takeover - not once but twice - first from Mr. Gurbax Singh himself and later from

Lapetit of Italy. It was under Bhai Mohan Singh that Ranbaxy as a company was incorporated

in 1961 and launched its first blockbuster drug Calmpose, in 1969.

4. Need of the Merger

Sun Pharma and Ranbaxy both were in the middle of a landmark transaction that was to

provide a win-win situation for both the companies. The need for the merger arose mainly

due to the following reasons:

6

Active Pharmaceutical Ingredients (APIs) and intermediates.

With more than 2,000 marketed products and 40 manufacturing sites spread across 6

continents and 15 countries, Sun Pharma serves over 150 markets across the world.

US formulations contributed the most to company’s US$ 4 billion sales in FY18 with a

contribution of 34 per cent, followed by India branded formulations at 31 per cent. In FY19,

the total income of the company reached Rs 30,091.40 crore (US$ 4.33 billion).

Stringent audits of all Sun Pharma manufacturing facilities are conducted by regulatory

agencies routinely conducting for compliance with Current Good Manufacturing Practices

(cGMP).

3.2 Ranbaxy Laboratories

Ranbaxy Laboratories is a major research-oriented international pharmaceutical company

established in 1961 and serves in over 150 countries and with experience of more than 50

years in providing high quality, affordable medicines.

It has 21 manufacturing facilities spread across eight countries. Additionally, the company

covers all the top 25 pharmaceutical markets of the world and has a robust presence across

both developed and emerging markets.

Started by two cousins Ranjit and Gurbax (and hence the name Ranbaxy) as a drug

distribution firm in 1937 in Amritsar), it was acquired by Bhai Mohan Singh in 1947 as the

original owners of the firm had failed to repay the money that had been lent by Bhai Mohan

Singh. Over the course of next few years, Bhai Mohan Singh managed to save the company

from takeover - not once but twice - first from Mr. Gurbax Singh himself and later from

Lapetit of Italy. It was under Bhai Mohan Singh that Ranbaxy as a company was incorporated

in 1961 and launched its first blockbuster drug Calmpose, in 1969.

4. Need of the Merger

Sun Pharma and Ranbaxy both were in the middle of a landmark transaction that was to

provide a win-win situation for both the companies. The need for the merger arose mainly

due to the following reasons:

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

- Entry into new markets and Increased market penetration

One of the prime considerations of this transaction was the integration of product portfolio,

supply chain and manufacturing. Both the companies had a strong presence in India and US,

and ROW (Rest of world), and the combined entity was to provide more diversification with

US contributing 47%, India contributing 31% and ROW contributing 22% of sales. Sun

Pharma had estimated that It will save $250 million in the third year of the merger due to

great operating synergies. Sun Pharma was to benefit from Ranbaxy’s distribution network

as well. Since Ranbaxy has a strong reach in the rural markets, Sun Pharma can leverage

Ranbaxy’s distribution network and its strengths in various product categories.

The combined entity was to have a stronger position in the Indian market with presence in

wider therapeutic basket. The outcomes as predicted were that the new entity would be

world’s fifth largest speciality-generic pharma company with sales of $4.2 billion for CY

2013. Also, in the US, it would be 1st in generic dermatology and 3rd in branded dermatology

market. And in India, it would become the largest Indian Pharma company operating in US.,

ahead of Abbott.

- Diversified Product Portfolio

The merger company was expected to have a diverse, highly complementary portfolio of

speciality and generic products marketed globally, including 445 ANDAs (Abbreviated New

Drug Application). Rising healthcare costs and increasing awareness of efficacy of generics

has also led to a surge in demand for generics in developed world, making a good case for the

company.

- Ranbaxy’s Regulatory issues

Ranbaxy faced many quality issues in its manufacturing facilities in Mohali, Dewas and

Panota Sahib. This prompted USFDA (United States Food and Drug Administration) to

impose a ban on its drugs affecting US market. As a result, the Panota and Dewas facilities

were banned in 2008 and Mohali was banned in 2013. Only a New Jersey facility produced

drugs, but with increased pressure on this facility, Ranbaxy’s smooth operations took a hit.

It further faced problems with improper handling of data and inferior facilities of production,

which led to $500 million payments as a settlement fee. In addition to this FDA further

banned few more generic drugs produced by Ranbaxy.

7

One of the prime considerations of this transaction was the integration of product portfolio,

supply chain and manufacturing. Both the companies had a strong presence in India and US,

and ROW (Rest of world), and the combined entity was to provide more diversification with

US contributing 47%, India contributing 31% and ROW contributing 22% of sales. Sun

Pharma had estimated that It will save $250 million in the third year of the merger due to

great operating synergies. Sun Pharma was to benefit from Ranbaxy’s distribution network

as well. Since Ranbaxy has a strong reach in the rural markets, Sun Pharma can leverage

Ranbaxy’s distribution network and its strengths in various product categories.

The combined entity was to have a stronger position in the Indian market with presence in

wider therapeutic basket. The outcomes as predicted were that the new entity would be

world’s fifth largest speciality-generic pharma company with sales of $4.2 billion for CY

2013. Also, in the US, it would be 1st in generic dermatology and 3rd in branded dermatology

market. And in India, it would become the largest Indian Pharma company operating in US.,

ahead of Abbott.

- Diversified Product Portfolio

The merger company was expected to have a diverse, highly complementary portfolio of

speciality and generic products marketed globally, including 445 ANDAs (Abbreviated New

Drug Application). Rising healthcare costs and increasing awareness of efficacy of generics

has also led to a surge in demand for generics in developed world, making a good case for the

company.

- Ranbaxy’s Regulatory issues

Ranbaxy faced many quality issues in its manufacturing facilities in Mohali, Dewas and

Panota Sahib. This prompted USFDA (United States Food and Drug Administration) to

impose a ban on its drugs affecting US market. As a result, the Panota and Dewas facilities

were banned in 2008 and Mohali was banned in 2013. Only a New Jersey facility produced

drugs, but with increased pressure on this facility, Ranbaxy’s smooth operations took a hit.

It further faced problems with improper handling of data and inferior facilities of production,

which led to $500 million payments as a settlement fee. In addition to this FDA further

banned few more generic drugs produced by Ranbaxy.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

With such compliance issues, it posed a big challenge for Sun Pharma post-merger, but

according to Dilip Sanghvi (promotor of Sun Pharma), it was not the size of deal which

mattered, but the quality of business and its integration. According to him, the company’s

prime focus would be to comply with regulatory standards which was one of the key issues

that Ranbaxy faced.

This attitude showed that Sun Pharma was willing to take Ranbaxy with all its challenges and

help it turnaround its business, in return of which it felt that the many first-to-file applications

of Ranbaxy could help it give a major boost to revenues once the approval comes through and

once they are able to resolve many regulatory issues. This was also a chance for Ranbaxy to

regain its trust from USFDA.[3]

5. Details of Transaction

Ranbaxy Laboratories was acquired by Sun Pharmaceutical Industries for 3.2billion USD in

stock with addition of 800 million USD of debt. This acquisition resulted in creating world’s

fifth biggest generic pharmaceutical company by revenue and also the largest Indian drug

maker with a local market share of 10 per cent.

Under the agreement signed and approved, Ranbaxy shareholders received 0.8 shares of Sun

Pharma for each share of Ranbaxy. This ratio represented each Ranbaxy share an implied

value of Rs 457. This was a premium of 18% to Ranbaxy’s 30-dy volume-weighted average

share price.[3]

8

Pre transaction Structure

Transaction

36%

36%

according to Dilip Sanghvi (promotor of Sun Pharma), it was not the size of deal which

mattered, but the quality of business and its integration. According to him, the company’s

prime focus would be to comply with regulatory standards which was one of the key issues

that Ranbaxy faced.

This attitude showed that Sun Pharma was willing to take Ranbaxy with all its challenges and

help it turnaround its business, in return of which it felt that the many first-to-file applications

of Ranbaxy could help it give a major boost to revenues once the approval comes through and

once they are able to resolve many regulatory issues. This was also a chance for Ranbaxy to

regain its trust from USFDA.[3]

5. Details of Transaction

Ranbaxy Laboratories was acquired by Sun Pharmaceutical Industries for 3.2billion USD in

stock with addition of 800 million USD of debt. This acquisition resulted in creating world’s

fifth biggest generic pharmaceutical company by revenue and also the largest Indian drug

maker with a local market share of 10 per cent.

Under the agreement signed and approved, Ranbaxy shareholders received 0.8 shares of Sun

Pharma for each share of Ranbaxy. This ratio represented each Ranbaxy share an implied

value of Rs 457. This was a premium of 18% to Ranbaxy’s 30-dy volume-weighted average

share price.[3]

8

Pre transaction Structure

Transaction

36%

36%

6. Anticipated Outcomes & Synergies for Sun Pharma

1. The new entity formed will be the world’s fifth largest specialty-generic pharma company

with sales of US$ 4.2 billion.

2. The entity will be present in 55 countries and will have 40 manufacturing facilities

worldwide, having a portfolio of products for both acute and chronic treatments.

3. It will also become the largest Indian pharma company operating in the U.S.

4. The pro-forma U.S. revenues of the merged entity for CY 2013 are estimated at US$ 2.2

billion and the entity will have a strong potential in developing complex products through a

broad portfolio of 184 ANDAs (Abbreviated New Drug Application) awaiting US FDA

approval, including many High-value FTF (First to File) opportunities.

5. This merger will result in Sun Pharma being the largest pharma company in India with pro-

forma revenues of US$ 1.1 billion and over 9% of market share.

6. The acquisition will help Sun Pharma to enhance its edge in acute care, hospitals and OTC

businesses with its 31 brands among India’s top 300 brands along with improved distribution

network.

7. This merger will also improve Sun Pharma’s global footprint in emerging pharmaceutical

markets like Russia, Romania, Brazil, Malaysia and South Africa having combined pro-forma

revenues of 0.9 billion USD in the above mentioned markets.

8. Pro-forma EBITDA of the merged entity for the year 2013 is estimated at US$ 1.2 billion.

9. Synergy benefits of 250 million USD are expected to be realized by the third year once the

deal is closed.

10. Post-deal closure, Daiichi Sankyo (the majority shareholder of Ranbaxy) will become the

second largest shareholder of Sun Pharma with a 9% stake.

9

1. The new entity formed will be the world’s fifth largest specialty-generic pharma company

with sales of US$ 4.2 billion.

2. The entity will be present in 55 countries and will have 40 manufacturing facilities

worldwide, having a portfolio of products for both acute and chronic treatments.

3. It will also become the largest Indian pharma company operating in the U.S.

4. The pro-forma U.S. revenues of the merged entity for CY 2013 are estimated at US$ 2.2

billion and the entity will have a strong potential in developing complex products through a

broad portfolio of 184 ANDAs (Abbreviated New Drug Application) awaiting US FDA

approval, including many High-value FTF (First to File) opportunities.

5. This merger will result in Sun Pharma being the largest pharma company in India with pro-

forma revenues of US$ 1.1 billion and over 9% of market share.

6. The acquisition will help Sun Pharma to enhance its edge in acute care, hospitals and OTC

businesses with its 31 brands among India’s top 300 brands along with improved distribution

network.

7. This merger will also improve Sun Pharma’s global footprint in emerging pharmaceutical

markets like Russia, Romania, Brazil, Malaysia and South Africa having combined pro-forma

revenues of 0.9 billion USD in the above mentioned markets.

8. Pro-forma EBITDA of the merged entity for the year 2013 is estimated at US$ 1.2 billion.

9. Synergy benefits of 250 million USD are expected to be realized by the third year once the

deal is closed.

10. Post-deal closure, Daiichi Sankyo (the majority shareholder of Ranbaxy) will become the

second largest shareholder of Sun Pharma with a 9% stake.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7. Issues Related To The Merger

The merger was approved by the Competition Commission of India (CCI), Bombay Stock

Exchange (BSE), and National Stock Exchange (NSE) but the challenge in the road ahead

was to garner 100% compliance of manufacturing standards as laid down by the regulators,

achieving the projected synergy of $250 million within 3 years and a robust expansion with a

focus on R&D.

7.1 Issues: Sun Pharma faced with in return of the deal

Ranbaxy plants at Mohali, Dewas and Paonta Sahib faced quality issues which led to the US

Food and Drug Administration (FDA) to impose a ban on the drugs being produced in these

manufacturing plants. Adding to these issues, Ranbaxy was plagued with problems like

mishandling of data and inferior facilities of production leading to a payment of $500 million

as settlement with the federal legislation and a further ban on a few generic drugs of Ranbaxy

due to manufacturing woes.

7.2 Post Deal Challenges:

7.2.1 Expected Synergies

Synergy benefits valuing to $250 million by the third year of the closing of the deal, revenue

acceleration and cost management along with supply chain efficiencies were the benefits

expected.

Sun Pharma was ranked fifth largest specialty- generic Pharma company prior to the merger

with sales of US $4.2 billion.[4] Post-merger, it became the first ranking entity with US FDA

approval for a potential to manufacture complex drugs. The deal was to make Sun Pharma the

leading pharma company in India with a 9% market share and a rising challenge to improve

presence and global footprint in emerging markets like Russia, Brazil, Malaysia and South

Africa.[5]

7.2.2 Achieving Compliance

Amidst the regulatory issues, the biggest challenge faced by Sun Pharma was to restore and

regain confidence and trust of the regulators, especially the ones in the US. At the time of the

merger, four of Ranbaxy plants were banned by USFDA and were ongoing consent decree

7.2.3 Integration

10

The merger was approved by the Competition Commission of India (CCI), Bombay Stock

Exchange (BSE), and National Stock Exchange (NSE) but the challenge in the road ahead

was to garner 100% compliance of manufacturing standards as laid down by the regulators,

achieving the projected synergy of $250 million within 3 years and a robust expansion with a

focus on R&D.

7.1 Issues: Sun Pharma faced with in return of the deal

Ranbaxy plants at Mohali, Dewas and Paonta Sahib faced quality issues which led to the US

Food and Drug Administration (FDA) to impose a ban on the drugs being produced in these

manufacturing plants. Adding to these issues, Ranbaxy was plagued with problems like

mishandling of data and inferior facilities of production leading to a payment of $500 million

as settlement with the federal legislation and a further ban on a few generic drugs of Ranbaxy

due to manufacturing woes.

7.2 Post Deal Challenges:

7.2.1 Expected Synergies

Synergy benefits valuing to $250 million by the third year of the closing of the deal, revenue

acceleration and cost management along with supply chain efficiencies were the benefits

expected.

Sun Pharma was ranked fifth largest specialty- generic Pharma company prior to the merger

with sales of US $4.2 billion.[4] Post-merger, it became the first ranking entity with US FDA

approval for a potential to manufacture complex drugs. The deal was to make Sun Pharma the

leading pharma company in India with a 9% market share and a rising challenge to improve

presence and global footprint in emerging markets like Russia, Brazil, Malaysia and South

Africa.[5]

7.2.2 Achieving Compliance

Amidst the regulatory issues, the biggest challenge faced by Sun Pharma was to restore and

regain confidence and trust of the regulators, especially the ones in the US. At the time of the

merger, four of Ranbaxy plants were banned by USFDA and were ongoing consent decree

7.2.3 Integration

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

A major challenge post-merger was to align business operations and every element, finance,

technology and human resources to achieve the projected synergies. Also, the integration of

product portfolio, manufacturing and supply chain was a key concern due to different views

and objectives.

(i) Finance

A declined net worth of Ranbaxy due to factors like payment of US $515 million to the US-

Department of Justice to settle charges of manipulation of data and facility management

issues, decreased investments with losses on foreign currency derivatives. The merger was

executed at a time where Ranbaxy was trying to restore its financial health, posing a

challenge for Sun Pharma to meet its set target of $250 million synergies under those fluid

conditions.

Amidst the concerns surrounding the deal, Sun Pharma had recorded sharp declining trends in

the financial year ending March 2016, where the year on year change in sales was mere 2%.

The adjusted net profit declined by 16% in 2015 (YoY), however showed a marginal growth

in 2016 of 13% YoY. The investment scenario was also dismal with negative changes of (-

52%) in 2016. Thus, financial challenges were a major concern point for Sun Pharma. [6]

(ii) Technology

Necessary focus on productivity and Supply chain efficiency was a priority due to the

reputation of Ranbaxy in the recent past for Sun Pharma. Concentration on global business

growth became the top priority. Issues concerning expanding the product portfolio, deciding

the focus on particular areas like dermatology, oncology, ophthalmology etc, focus on

innovation to harness revenue worldline, optimizing best practices of both Ranbaxy and Sun

Pharma to minimize disruptions.

(iii) Managing a Diverse Portfolio

The deal brought Sun Pharma a vastly diversified product and market portfolio raising

a need for different regulations and distinguished management skill sets

People: The Integration Management Office (IMO) oversaw the complete integration

process. An important aspect of the merger was strengthening the multi-cultural team of Sun

Pharma of around 30000 from across 50 global cultures. Alignment of the two firms on work

11

technology and human resources to achieve the projected synergies. Also, the integration of

product portfolio, manufacturing and supply chain was a key concern due to different views

and objectives.

(i) Finance

A declined net worth of Ranbaxy due to factors like payment of US $515 million to the US-

Department of Justice to settle charges of manipulation of data and facility management

issues, decreased investments with losses on foreign currency derivatives. The merger was

executed at a time where Ranbaxy was trying to restore its financial health, posing a

challenge for Sun Pharma to meet its set target of $250 million synergies under those fluid

conditions.

Amidst the concerns surrounding the deal, Sun Pharma had recorded sharp declining trends in

the financial year ending March 2016, where the year on year change in sales was mere 2%.

The adjusted net profit declined by 16% in 2015 (YoY), however showed a marginal growth

in 2016 of 13% YoY. The investment scenario was also dismal with negative changes of (-

52%) in 2016. Thus, financial challenges were a major concern point for Sun Pharma. [6]

(ii) Technology

Necessary focus on productivity and Supply chain efficiency was a priority due to the

reputation of Ranbaxy in the recent past for Sun Pharma. Concentration on global business

growth became the top priority. Issues concerning expanding the product portfolio, deciding

the focus on particular areas like dermatology, oncology, ophthalmology etc, focus on

innovation to harness revenue worldline, optimizing best practices of both Ranbaxy and Sun

Pharma to minimize disruptions.

(iii) Managing a Diverse Portfolio

The deal brought Sun Pharma a vastly diversified product and market portfolio raising

a need for different regulations and distinguished management skill sets

People: The Integration Management Office (IMO) oversaw the complete integration

process. An important aspect of the merger was strengthening the multi-cultural team of Sun

Pharma of around 30000 from across 50 global cultures. Alignment of the two firms on work

11

cultures and bringing them on a common platform was one of the biggest operational

challenges facing Sun Pharma [7]

Leadership Team: To meet the road map laid down the firm needs to draw expertise from

the Management Team of both Sun Pharma and Ranbaxy. Ranbaxy being one of the oldest

generic Indian drug brands with the highest recall value made it a challenge to restore faith

and trust of employees towards the cultural integration. The post deal woe of loss of identity

was a disturbing element leading to loss of morale of Ranbaxy employees. It was a major

challenge to form a management team that highlights the skill sets of both the firms dwelling

towards a common interest and building up morale of employees to improve productivity.

8. Post-Acquisition Stage

8.1 Planned measures

The post-acquisition stage involves the process of preparation of the official documents,

getting the agreed agreements signed, and finally negotiation of the deal. Also, it includes

integration of the companies on various parameters. Additionally, it also defines the

parameters of the future relationship between the two.

After signing and entering into the venture, the various plans implemented by Sun Pharma

were:

1. In the first year, the basic structure and the functions of the company were managed, by

streamlining and rationalizing various functions.

2. In order to finally expect contributions from the buyout, Sun Pharma executives had

prepared a three-pronged strategy which included:

· Supply chain and field force to be integrated for enhanced efficiency and productivity

· Achieving higher growth through synergies in domestic and emerging markets.

· Targeting full turnaround of Ranbaxy in three to four-year period after closure of the

deal.

3. The letterheads, visiting cards and all the company marketing and packaging material had

to be redesigned to reflect the new branding.

4. Further, Sun Pharma took the following measures in the aftermath of the merger:

12

challenges facing Sun Pharma [7]

Leadership Team: To meet the road map laid down the firm needs to draw expertise from

the Management Team of both Sun Pharma and Ranbaxy. Ranbaxy being one of the oldest

generic Indian drug brands with the highest recall value made it a challenge to restore faith

and trust of employees towards the cultural integration. The post deal woe of loss of identity

was a disturbing element leading to loss of morale of Ranbaxy employees. It was a major

challenge to form a management team that highlights the skill sets of both the firms dwelling

towards a common interest and building up morale of employees to improve productivity.

8. Post-Acquisition Stage

8.1 Planned measures

The post-acquisition stage involves the process of preparation of the official documents,

getting the agreed agreements signed, and finally negotiation of the deal. Also, it includes

integration of the companies on various parameters. Additionally, it also defines the

parameters of the future relationship between the two.

After signing and entering into the venture, the various plans implemented by Sun Pharma

were:

1. In the first year, the basic structure and the functions of the company were managed, by

streamlining and rationalizing various functions.

2. In order to finally expect contributions from the buyout, Sun Pharma executives had

prepared a three-pronged strategy which included:

· Supply chain and field force to be integrated for enhanced efficiency and productivity

· Achieving higher growth through synergies in domestic and emerging markets.

· Targeting full turnaround of Ranbaxy in three to four-year period after closure of the

deal.

3. The letterheads, visiting cards and all the company marketing and packaging material had

to be redesigned to reflect the new branding.

4. Further, Sun Pharma took the following measures in the aftermath of the merger:

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.