Superannuation: Case Studies on Retirement Income and Tax Implications

VerifiedAdded on 2020/10/22

|30

|6444

|90

Homework Assignment

AI Summary

This assignment delves into the complexities of superannuation, covering various aspects such as contribution calculations, salary sacrifice, and non-concessional contributions. It examines scenarios involving individuals like George and Robyn, analyzing their financial situations and potential strategies for retirement planning. The assignment explores the implications of inheritance on superannuation contributions and the benefits of retirement income streams compared to accumulation phases. Furthermore, it presents case studies featuring Wendy and Jacquie, addressing topics like tax treatment of superannuation investments, lump-sum withdrawals, and the components of taxable and tax-free benefits. The analysis includes detailed calculations, explanations of tax implications, and comparisons of different financial approaches, providing a comprehensive understanding of superannuation principles and their practical application in retirement planning.

SUPPERANNUATION

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

TABLE OF CONTENTS..............................................................................................................2

PROJECT A.....................................................................................................................................1

PROJECT B...................................................................................................................................11

REFERENCES..............................................................................................................................29

TABLE OF CONTENTS..............................................................................................................2

PROJECT A.....................................................................................................................................1

PROJECT B...................................................................................................................................11

REFERENCES..............................................................................................................................29

PROJECT A

ACTIVITY 1

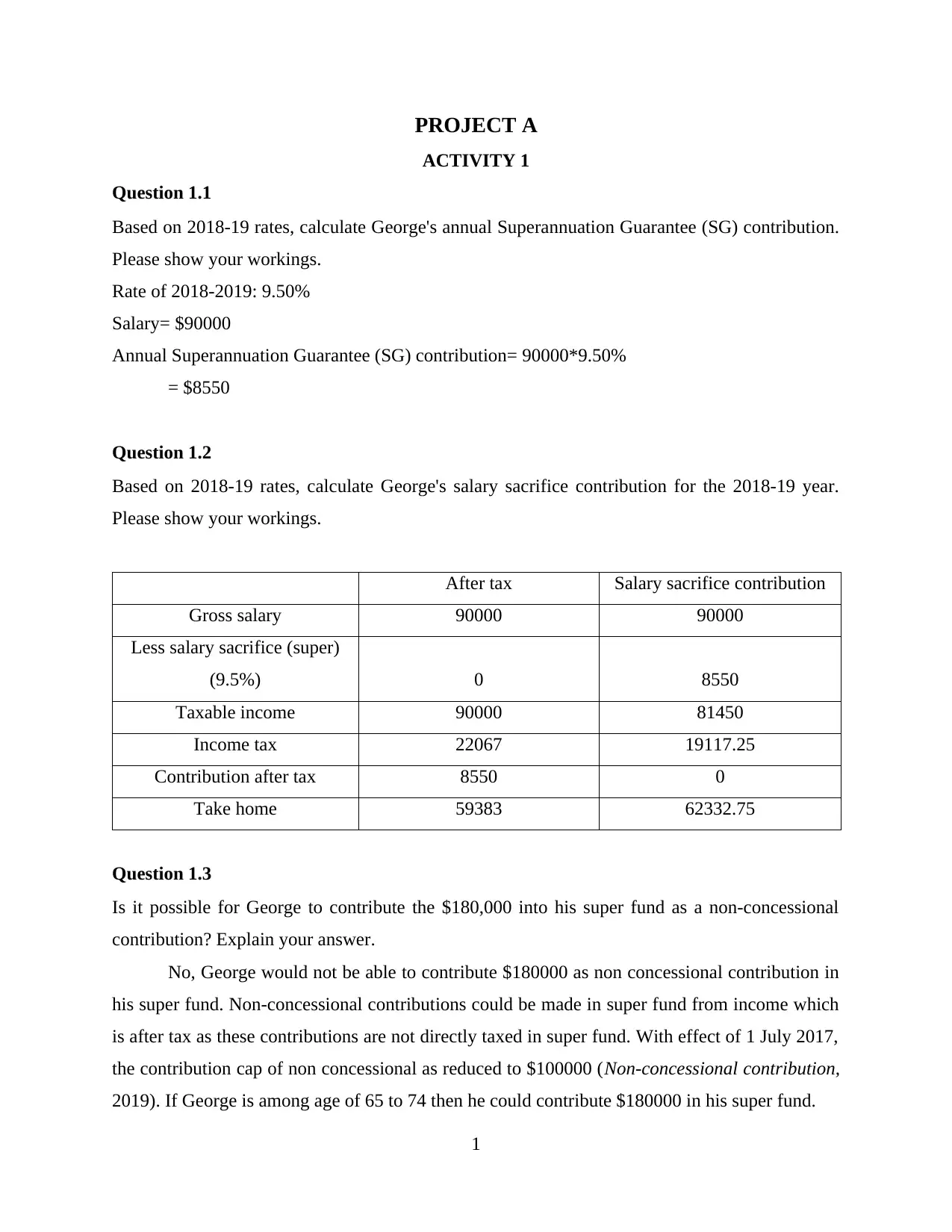

Question 1.1

Based on 2018-19 rates, calculate George's annual Superannuation Guarantee (SG) contribution.

Please show your workings.

Rate of 2018-2019: 9.50%

Salary= $90000

Annual Superannuation Guarantee (SG) contribution= 90000*9.50%

= $8550

Question 1.2

Based on 2018-19 rates, calculate George's salary sacrifice contribution for the 2018-19 year.

Please show your workings.

After tax Salary sacrifice contribution

Gross salary 90000 90000

Less salary sacrifice (super)

(9.5%) 0 8550

Taxable income 90000 81450

Income tax 22067 19117.25

Contribution after tax 8550 0

Take home 59383 62332.75

Question 1.3

Is it possible for George to contribute the $180,000 into his super fund as a non-concessional

contribution? Explain your answer.

No, George would not be able to contribute $180000 as non concessional contribution in

his super fund. Non-concessional contributions could be made in super fund from income which

is after tax as these contributions are not directly taxed in super fund. With effect of 1 July 2017,

the contribution cap of non concessional as reduced to $100000 (Non-concessional contribution,

2019). If George is among age of 65 to 74 then he could contribute $180000 in his super fund.

1

ACTIVITY 1

Question 1.1

Based on 2018-19 rates, calculate George's annual Superannuation Guarantee (SG) contribution.

Please show your workings.

Rate of 2018-2019: 9.50%

Salary= $90000

Annual Superannuation Guarantee (SG) contribution= 90000*9.50%

= $8550

Question 1.2

Based on 2018-19 rates, calculate George's salary sacrifice contribution for the 2018-19 year.

Please show your workings.

After tax Salary sacrifice contribution

Gross salary 90000 90000

Less salary sacrifice (super)

(9.5%) 0 8550

Taxable income 90000 81450

Income tax 22067 19117.25

Contribution after tax 8550 0

Take home 59383 62332.75

Question 1.3

Is it possible for George to contribute the $180,000 into his super fund as a non-concessional

contribution? Explain your answer.

No, George would not be able to contribute $180000 as non concessional contribution in

his super fund. Non-concessional contributions could be made in super fund from income which

is after tax as these contributions are not directly taxed in super fund. With effect of 1 July 2017,

the contribution cap of non concessional as reduced to $100000 (Non-concessional contribution,

2019). If George is among age of 65 to 74 then he could contribute $180000 in his super fund.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

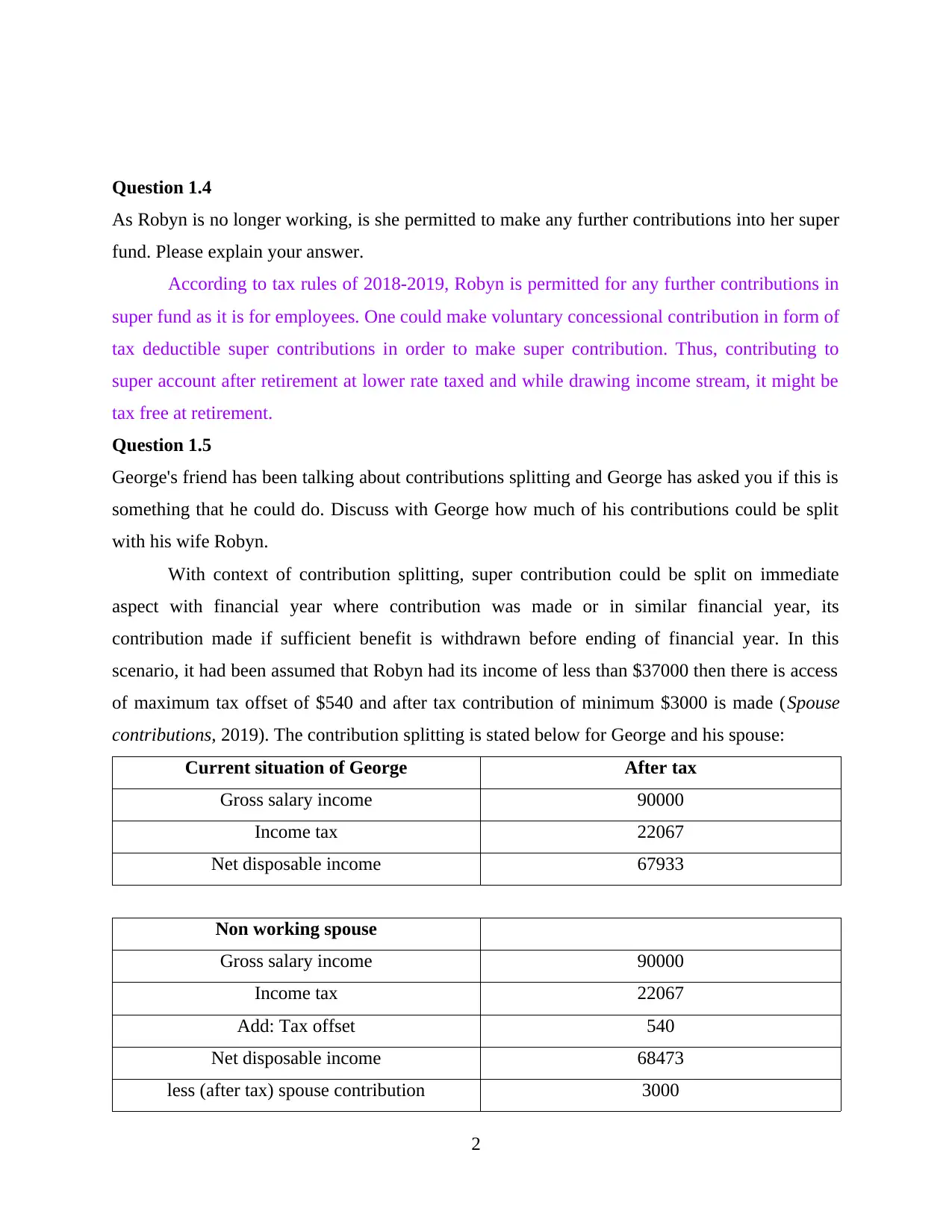

Question 1.4

As Robyn is no longer working, is she permitted to make any further contributions into her super

fund. Please explain your answer.

According to tax rules of 2018-2019, Robyn is permitted for any further contributions in

super fund as it is for employees. One could make voluntary concessional contribution in form of

tax deductible super contributions in order to make super contribution. Thus, contributing to

super account after retirement at lower rate taxed and while drawing income stream, it might be

tax free at retirement.

Question 1.5

George's friend has been talking about contributions splitting and George has asked you if this is

something that he could do. Discuss with George how much of his contributions could be split

with his wife Robyn.

With context of contribution splitting, super contribution could be split on immediate

aspect with financial year where contribution was made or in similar financial year, its

contribution made if sufficient benefit is withdrawn before ending of financial year. In this

scenario, it had been assumed that Robyn had its income of less than $37000 then there is access

of maximum tax offset of $540 and after tax contribution of minimum $3000 is made (Spouse

contributions, 2019). The contribution splitting is stated below for George and his spouse:

Current situation of George After tax

Gross salary income 90000

Income tax 22067

Net disposable income 67933

Non working spouse

Gross salary income 90000

Income tax 22067

Add: Tax offset 540

Net disposable income 68473

less (after tax) spouse contribution 3000

2

As Robyn is no longer working, is she permitted to make any further contributions into her super

fund. Please explain your answer.

According to tax rules of 2018-2019, Robyn is permitted for any further contributions in

super fund as it is for employees. One could make voluntary concessional contribution in form of

tax deductible super contributions in order to make super contribution. Thus, contributing to

super account after retirement at lower rate taxed and while drawing income stream, it might be

tax free at retirement.

Question 1.5

George's friend has been talking about contributions splitting and George has asked you if this is

something that he could do. Discuss with George how much of his contributions could be split

with his wife Robyn.

With context of contribution splitting, super contribution could be split on immediate

aspect with financial year where contribution was made or in similar financial year, its

contribution made if sufficient benefit is withdrawn before ending of financial year. In this

scenario, it had been assumed that Robyn had its income of less than $37000 then there is access

of maximum tax offset of $540 and after tax contribution of minimum $3000 is made (Spouse

contributions, 2019). The contribution splitting is stated below for George and his spouse:

Current situation of George After tax

Gross salary income 90000

Income tax 22067

Net disposable income 67933

Non working spouse

Gross salary income 90000

Income tax 22067

Add: Tax offset 540

Net disposable income 68473

less (after tax) spouse contribution 3000

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Net income after spouse contribution 65473

Question 1.6

If George gave his $180,000 to Robyn, would Robyn be able to contribute the $180,000 to her

super fund as a non-concessional contribution? Explain your answer.

In this scenario, Robyn would not be able to contribute $180000 as her super fund as non

concessional contribution as it could be personal contribution after tax pay but on that could not

be claimed as income tax deduction. However, in the latest update it is capped with limit of

$100000 of super fund as con concessional contribution (Super contribution limits, 2019).

Year 2 scenario

In year 2 when George is 61, his father passed away leaving him an inheritance of $400,000.The share market

suffered some dramatic losses in June of the previous year and George's super account balance fell to $1.1 million as

at 30 June of the previous year. George is not concerned about the losses as he understands the volatile nature of

equities and his investments are still producing dividends.

Question 1.7

Out of the $400,000, what is the maximum amount that George could contribute as a non-

concessional contribution, in the year that he receives the inheritance? Explain your answer.

In this scenario, $200,000 as non concessional contribution and bring forward allowed

from 1st July for 2 years as he got inheritance amount.

Question 1.8

As Georgeis now 61 years old, he is considering the aspects of retirement. He plans to retire at

age 65 and move his money to a retirement phase income stream. You have been discussing the

pension benefits cap with him.

Explain to George how giving his $400,000 inheritance to Robyn to contribute to her super fund

over a period of time would enable them, as a couple, to have a higher balance in the retirement

income stream phase.

The current pension benefit cap is $1.6 million with subject of future indexation. George

is at retirement age, which ensures that pension unrestricted non-preserved, then value of

position TTR pension would be included in its transfer balance account.

3

Question 1.6

If George gave his $180,000 to Robyn, would Robyn be able to contribute the $180,000 to her

super fund as a non-concessional contribution? Explain your answer.

In this scenario, Robyn would not be able to contribute $180000 as her super fund as non

concessional contribution as it could be personal contribution after tax pay but on that could not

be claimed as income tax deduction. However, in the latest update it is capped with limit of

$100000 of super fund as con concessional contribution (Super contribution limits, 2019).

Year 2 scenario

In year 2 when George is 61, his father passed away leaving him an inheritance of $400,000.The share market

suffered some dramatic losses in June of the previous year and George's super account balance fell to $1.1 million as

at 30 June of the previous year. George is not concerned about the losses as he understands the volatile nature of

equities and his investments are still producing dividends.

Question 1.7

Out of the $400,000, what is the maximum amount that George could contribute as a non-

concessional contribution, in the year that he receives the inheritance? Explain your answer.

In this scenario, $200,000 as non concessional contribution and bring forward allowed

from 1st July for 2 years as he got inheritance amount.

Question 1.8

As Georgeis now 61 years old, he is considering the aspects of retirement. He plans to retire at

age 65 and move his money to a retirement phase income stream. You have been discussing the

pension benefits cap with him.

Explain to George how giving his $400,000 inheritance to Robyn to contribute to her super fund

over a period of time would enable them, as a couple, to have a higher balance in the retirement

income stream phase.

The current pension benefit cap is $1.6 million with subject of future indexation. George

is at retirement age, which ensures that pension unrestricted non-preserved, then value of

position TTR pension would be included in its transfer balance account.

3

On basis of super account at retirement income stream phase by introduction of super

reform package which was effective from 1st July 2017, super splitting might become effective

strategy for couples with objective to equalize superannuation balances to get benefit of tax free

earnings.

Question 1.9

Why may it be more beneficial to have as much money invested in the retirement income stream

phase as possible compared with leaving it in the accumulation phase?

Retirement income stream is popular option for turning savings in regular income stream

with five advantages:

Offers flexibility for drawing according to need in any year when least required

minimum.

Option for selecting invested money for managing risk prepared with volatility of returns.

Income payments for drawing tax free.

Nominate spouse for re visionary beneficiary.

Income assessed under age pension means test.

Disadvantages

Accumulation phase is taxed as retirement income stream phase is not taxed.

Question 1.10

If a client already has sufficient cash flow from other investments outside of superannuation,

what is a potential downside to transferring money to a retirement phase income stream?

It might be more risk averse and might wish for switching guaranteed and secure

products as if in case investments diminished then tax might be problem after application of

4

reform package which was effective from 1st July 2017, super splitting might become effective

strategy for couples with objective to equalize superannuation balances to get benefit of tax free

earnings.

Question 1.9

Why may it be more beneficial to have as much money invested in the retirement income stream

phase as possible compared with leaving it in the accumulation phase?

Retirement income stream is popular option for turning savings in regular income stream

with five advantages:

Offers flexibility for drawing according to need in any year when least required

minimum.

Option for selecting invested money for managing risk prepared with volatility of returns.

Income payments for drawing tax free.

Nominate spouse for re visionary beneficiary.

Income assessed under age pension means test.

Disadvantages

Accumulation phase is taxed as retirement income stream phase is not taxed.

Question 1.10

If a client already has sufficient cash flow from other investments outside of superannuation,

what is a potential downside to transferring money to a retirement phase income stream?

It might be more risk averse and might wish for switching guaranteed and secure

products as if in case investments diminished then tax might be problem after application of

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

senior Australian tax offsets. It might decrease advantage of account based pension

comparatively to non superannuation investments.

One must be aware of prior for implementation of this strategy as superannuation

transition to retirement income stream phase is commenced with application of superannuation

accumulation balance.

Assessment Activity 2

Case Study

Superannuation

Activity instructions to candidates

This is an open book assessment activity.

You are required to read this assessment and answer all11 questions that follow.

Please type your answers in the spaces provided.

Please ensure you have read “Important assessment information” at the front of this assessment

Estimated time for completion of this assessment activity: 2-3 hours

5

comparatively to non superannuation investments.

One must be aware of prior for implementation of this strategy as superannuation

transition to retirement income stream phase is commenced with application of superannuation

accumulation balance.

Assessment Activity 2

Case Study

Superannuation

Activity instructions to candidates

This is an open book assessment activity.

You are required to read this assessment and answer all11 questions that follow.

Please type your answers in the spaces provided.

Please ensure you have read “Important assessment information” at the front of this assessment

Estimated time for completion of this assessment activity: 2-3 hours

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Scenario 1 - Background

Wendy is age 58, she has reached her preservation age and is considering retiring permanently

from the workforce, however, she is not sure if retiring early is the best option for her financially.

She has come in to discuss some issues around taking a pension from her superannuation account

which is currently in the accumulation phase.

Required:

Answer Wendy’s queries in a way that will be both clear to her and also comprehensive.

Question 2.1

If Wendy retires and commences a retirement phase income stream in July 2018, explain how the

earnings on her superannuation investments will be taxed.

With context to retirement phase income stream (i.e. drawing a retirement income

stream), so in this context earnings on saving in pension account is tax exempted along with

capital gains as well. For people age group of 55 to 59, no tax is payable on tax free component

of income payment as taxable component of income payment would be added to taxable income.

This would be taxed at marginal tax rate less a tax offset equal to 15% of taxable portion of

payment.

Question 2.2

Explain to Wendy how the tax treatment of her super investments will be different if she

continues to work and her super remains in the accumulation phase.

Earnings on investments of super fund is taxed at no more than 15% along with its capital

gains in super fund which is usually taxed at even lower rate. Wendy would transfer most of

super to an account based pension as fund is in need to leave minimum of $5000 in accumulation

account, to keep it open and maintain insurance. The investment returns on super transition to

retirement pension is taxed upto 15%.

Question 2.3

Wendy has now decided to retire at age 58 as she has a balance of $900,000 which she will use

to commence a retirement phase income stream.

6

Wendy is age 58, she has reached her preservation age and is considering retiring permanently

from the workforce, however, she is not sure if retiring early is the best option for her financially.

She has come in to discuss some issues around taking a pension from her superannuation account

which is currently in the accumulation phase.

Required:

Answer Wendy’s queries in a way that will be both clear to her and also comprehensive.

Question 2.1

If Wendy retires and commences a retirement phase income stream in July 2018, explain how the

earnings on her superannuation investments will be taxed.

With context to retirement phase income stream (i.e. drawing a retirement income

stream), so in this context earnings on saving in pension account is tax exempted along with

capital gains as well. For people age group of 55 to 59, no tax is payable on tax free component

of income payment as taxable component of income payment would be added to taxable income.

This would be taxed at marginal tax rate less a tax offset equal to 15% of taxable portion of

payment.

Question 2.2

Explain to Wendy how the tax treatment of her super investments will be different if she

continues to work and her super remains in the accumulation phase.

Earnings on investments of super fund is taxed at no more than 15% along with its capital

gains in super fund which is usually taxed at even lower rate. Wendy would transfer most of

super to an account based pension as fund is in need to leave minimum of $5000 in accumulation

account, to keep it open and maintain insurance. The investment returns on super transition to

retirement pension is taxed upto 15%.

Question 2.3

Wendy has now decided to retire at age 58 as she has a balance of $900,000 which she will use

to commence a retirement phase income stream.

6

Let’s assume that Wendy commences her income stream with the whole $900,000 on 5th July

2018, and withdraws pension payments amounting to $36,000 for the year. Also, on 1 September

2018, she decides that she would like to take a fancy river cruise which will cost $40,000.

Wendy commutes $40,000 as a lump sum benefit to supplement her pension payments. Show the

debits and credits that will appear in Wendy’s transfer balance account.

Credit items:

Income stream of $900000

Debit items:

Withdrawal of pension payments $36000

Lump-sum benefit $40000

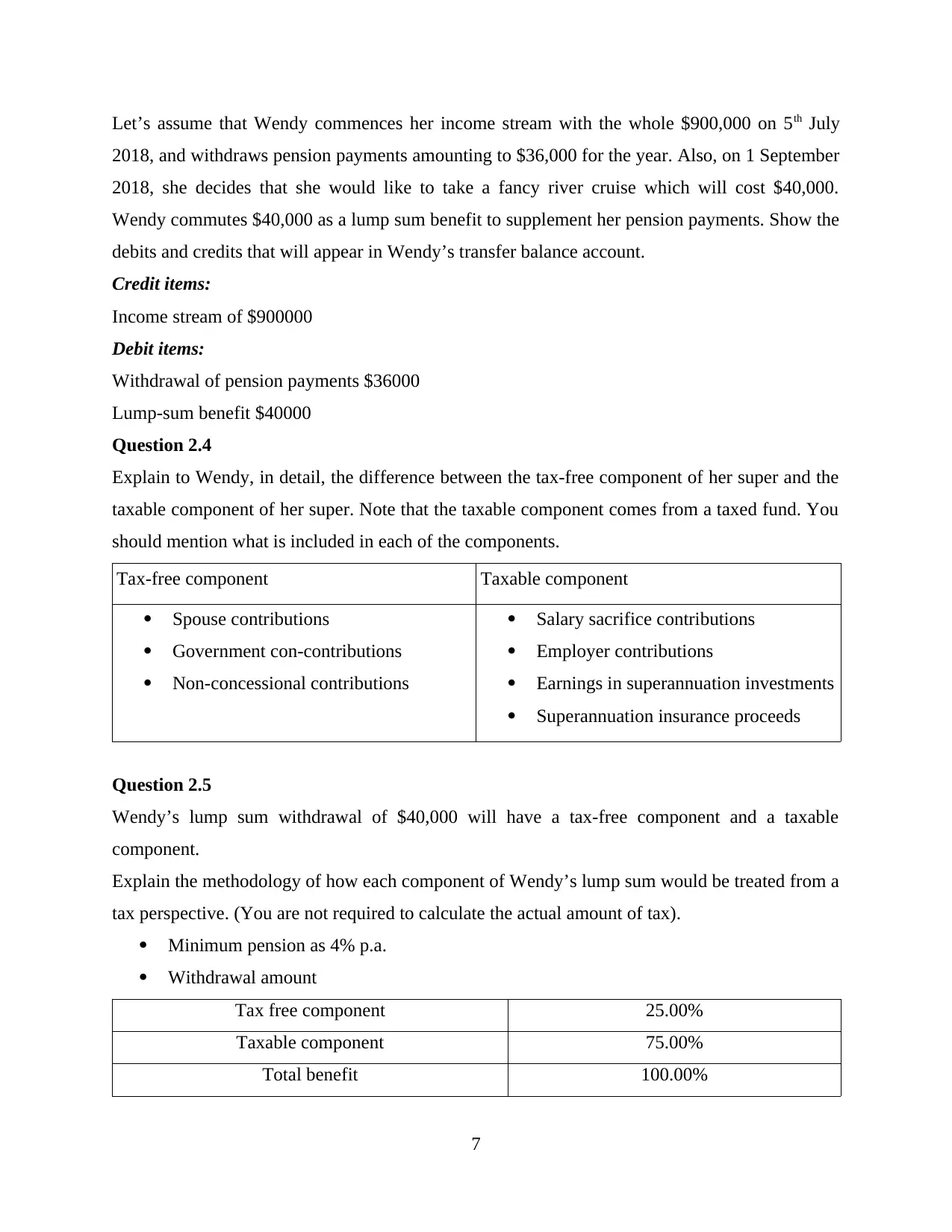

Question 2.4

Explain to Wendy, in detail, the difference between the tax-free component of her super and the

taxable component of her super. Note that the taxable component comes from a taxed fund. You

should mention what is included in each of the components.

Tax-free component Taxable component

Spouse contributions

Government con-contributions

Non-concessional contributions

Salary sacrifice contributions

Employer contributions

Earnings in superannuation investments

Superannuation insurance proceeds

Question 2.5

Wendy’s lump sum withdrawal of $40,000 will have a tax-free component and a taxable

component.

Explain the methodology of how each component of Wendy’s lump sum would be treated from a

tax perspective. (You are not required to calculate the actual amount of tax).

Minimum pension as 4% p.a.

Withdrawal amount

Tax free component 25.00%

Taxable component 75.00%

Total benefit 100.00%

7

2018, and withdraws pension payments amounting to $36,000 for the year. Also, on 1 September

2018, she decides that she would like to take a fancy river cruise which will cost $40,000.

Wendy commutes $40,000 as a lump sum benefit to supplement her pension payments. Show the

debits and credits that will appear in Wendy’s transfer balance account.

Credit items:

Income stream of $900000

Debit items:

Withdrawal of pension payments $36000

Lump-sum benefit $40000

Question 2.4

Explain to Wendy, in detail, the difference between the tax-free component of her super and the

taxable component of her super. Note that the taxable component comes from a taxed fund. You

should mention what is included in each of the components.

Tax-free component Taxable component

Spouse contributions

Government con-contributions

Non-concessional contributions

Salary sacrifice contributions

Employer contributions

Earnings in superannuation investments

Superannuation insurance proceeds

Question 2.5

Wendy’s lump sum withdrawal of $40,000 will have a tax-free component and a taxable

component.

Explain the methodology of how each component of Wendy’s lump sum would be treated from a

tax perspective. (You are not required to calculate the actual amount of tax).

Minimum pension as 4% p.a.

Withdrawal amount

Tax free component 25.00%

Taxable component 75.00%

Total benefit 100.00%

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Wendy is in preservation age, tax free component of her pension funds would be tax free

and taxable and asses as marginal tax rate with 15% tax rebate on basis of taxable

component.

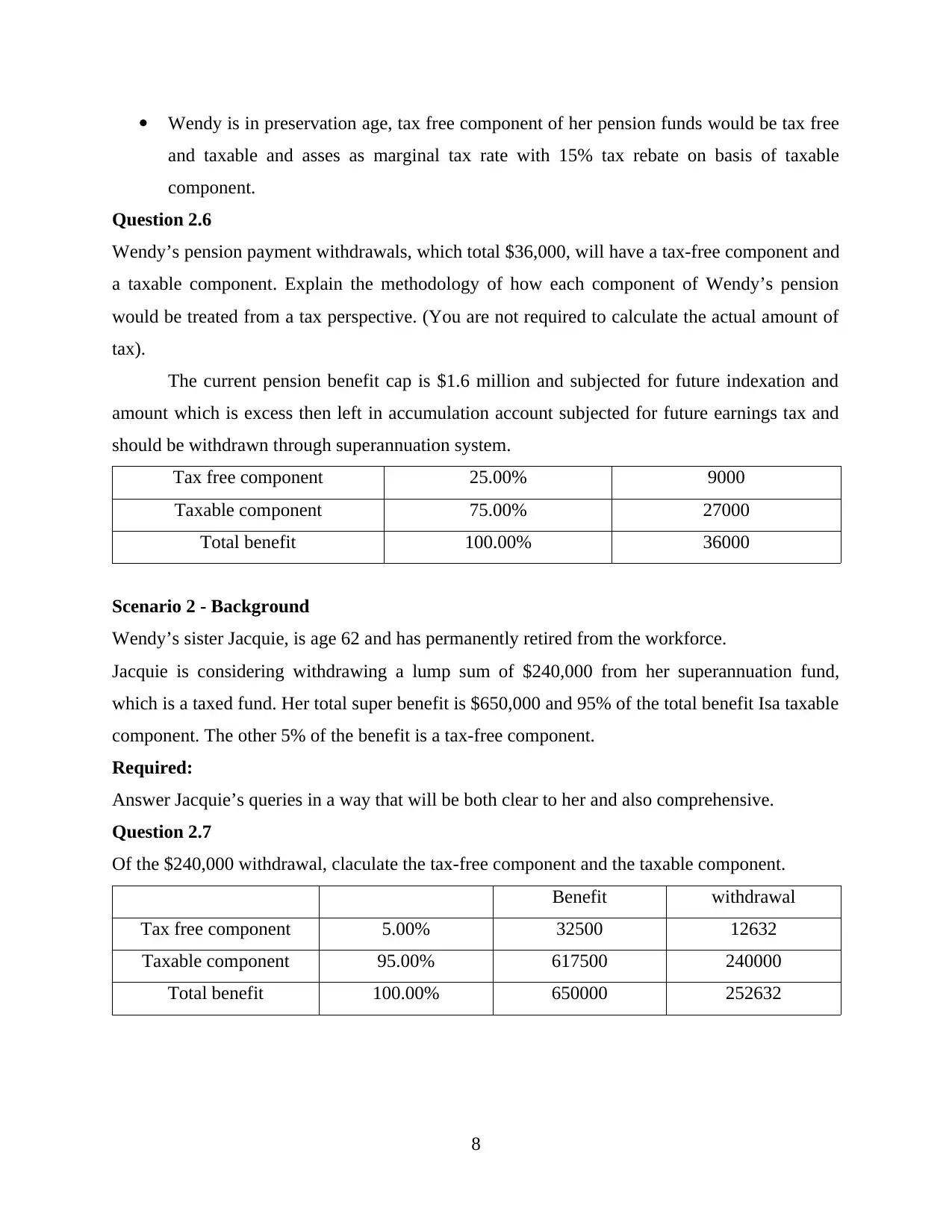

Question 2.6

Wendy’s pension payment withdrawals, which total $36,000, will have a tax-free component and

a taxable component. Explain the methodology of how each component of Wendy’s pension

would be treated from a tax perspective. (You are not required to calculate the actual amount of

tax).

The current pension benefit cap is $1.6 million and subjected for future indexation and

amount which is excess then left in accumulation account subjected for future earnings tax and

should be withdrawn through superannuation system.

Tax free component 25.00% 9000

Taxable component 75.00% 27000

Total benefit 100.00% 36000

Scenario 2 - Background

Wendy’s sister Jacquie, is age 62 and has permanently retired from the workforce.

Jacquie is considering withdrawing a lump sum of $240,000 from her superannuation fund,

which is a taxed fund. Her total super benefit is $650,000 and 95% of the total benefit Isa taxable

component. The other 5% of the benefit is a tax-free component.

Required:

Answer Jacquie’s queries in a way that will be both clear to her and also comprehensive.

Question 2.7

Of the $240,000 withdrawal, claculate the tax-free component and the taxable component.

Benefit withdrawal

Tax free component 5.00% 32500 12632

Taxable component 95.00% 617500 240000

Total benefit 100.00% 650000 252632

8

and taxable and asses as marginal tax rate with 15% tax rebate on basis of taxable

component.

Question 2.6

Wendy’s pension payment withdrawals, which total $36,000, will have a tax-free component and

a taxable component. Explain the methodology of how each component of Wendy’s pension

would be treated from a tax perspective. (You are not required to calculate the actual amount of

tax).

The current pension benefit cap is $1.6 million and subjected for future indexation and

amount which is excess then left in accumulation account subjected for future earnings tax and

should be withdrawn through superannuation system.

Tax free component 25.00% 9000

Taxable component 75.00% 27000

Total benefit 100.00% 36000

Scenario 2 - Background

Wendy’s sister Jacquie, is age 62 and has permanently retired from the workforce.

Jacquie is considering withdrawing a lump sum of $240,000 from her superannuation fund,

which is a taxed fund. Her total super benefit is $650,000 and 95% of the total benefit Isa taxable

component. The other 5% of the benefit is a tax-free component.

Required:

Answer Jacquie’s queries in a way that will be both clear to her and also comprehensive.

Question 2.7

Of the $240,000 withdrawal, claculate the tax-free component and the taxable component.

Benefit withdrawal

Tax free component 5.00% 32500 12632

Taxable component 95.00% 617500 240000

Total benefit 100.00% 650000 252632

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

In the above scenario, 5% is tax free component and 95% is taxable which is 32500 and

617500 respectively. The withdrawal amount is 5% is divided by total benefit and 95% is

divided by total benefit.

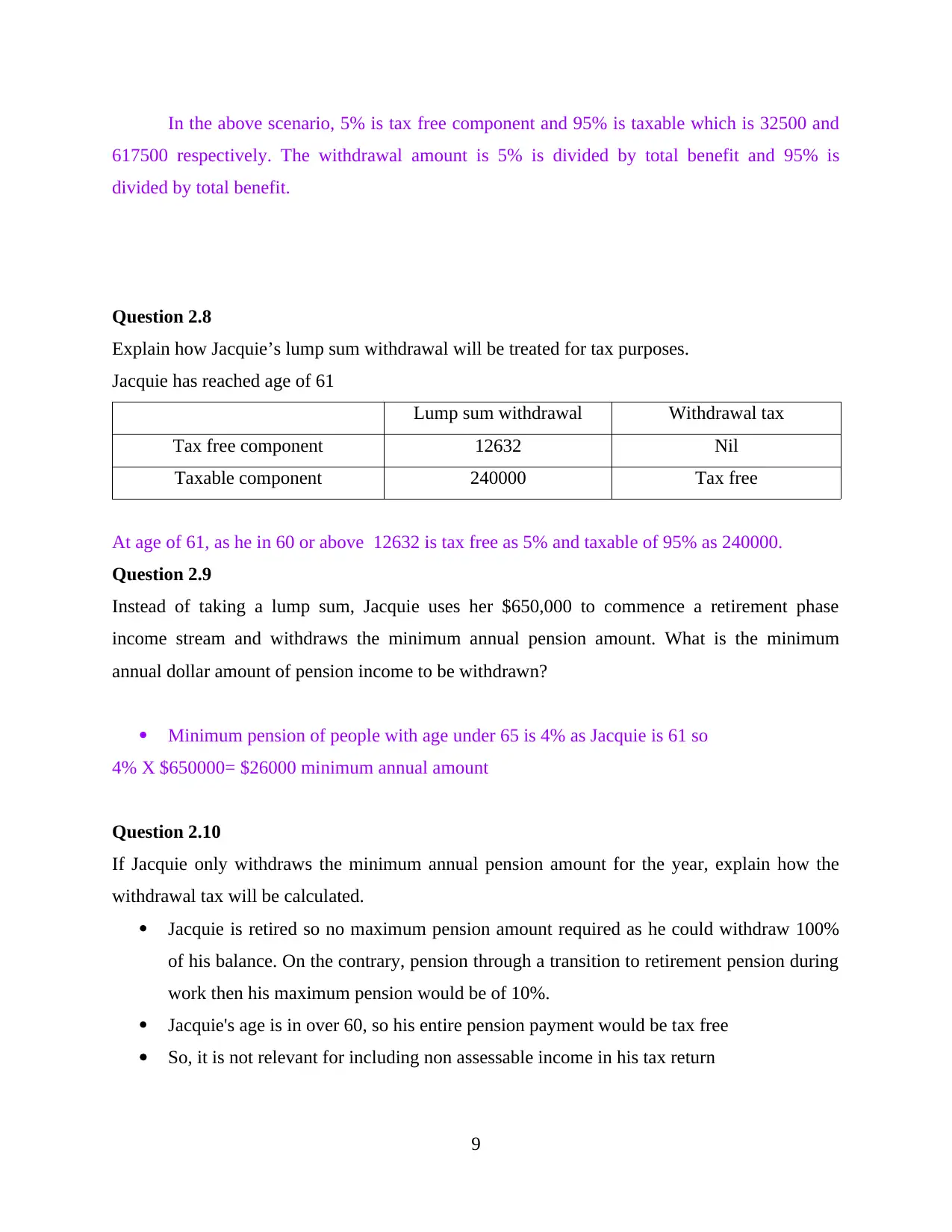

Question 2.8

Explain how Jacquie’s lump sum withdrawal will be treated for tax purposes.

Jacquie has reached age of 61

Lump sum withdrawal Withdrawal tax

Tax free component 12632 Nil

Taxable component 240000 Tax free

At age of 61, as he in 60 or above 12632 is tax free as 5% and taxable of 95% as 240000.

Question 2.9

Instead of taking a lump sum, Jacquie uses her $650,000 to commence a retirement phase

income stream and withdraws the minimum annual pension amount. What is the minimum

annual dollar amount of pension income to be withdrawn?

Minimum pension of people with age under 65 is 4% as Jacquie is 61 so

4% X $650000= $26000 minimum annual amount

Question 2.10

If Jacquie only withdraws the minimum annual pension amount for the year, explain how the

withdrawal tax will be calculated.

Jacquie is retired so no maximum pension amount required as he could withdraw 100%

of his balance. On the contrary, pension through a transition to retirement pension during

work then his maximum pension would be of 10%.

Jacquie's age is in over 60, so his entire pension payment would be tax free

So, it is not relevant for including non assessable income in his tax return

9

617500 respectively. The withdrawal amount is 5% is divided by total benefit and 95% is

divided by total benefit.

Question 2.8

Explain how Jacquie’s lump sum withdrawal will be treated for tax purposes.

Jacquie has reached age of 61

Lump sum withdrawal Withdrawal tax

Tax free component 12632 Nil

Taxable component 240000 Tax free

At age of 61, as he in 60 or above 12632 is tax free as 5% and taxable of 95% as 240000.

Question 2.9

Instead of taking a lump sum, Jacquie uses her $650,000 to commence a retirement phase

income stream and withdraws the minimum annual pension amount. What is the minimum

annual dollar amount of pension income to be withdrawn?

Minimum pension of people with age under 65 is 4% as Jacquie is 61 so

4% X $650000= $26000 minimum annual amount

Question 2.10

If Jacquie only withdraws the minimum annual pension amount for the year, explain how the

withdrawal tax will be calculated.

Jacquie is retired so no maximum pension amount required as he could withdraw 100%

of his balance. On the contrary, pension through a transition to retirement pension during

work then his maximum pension would be of 10%.

Jacquie's age is in over 60, so his entire pension payment would be tax free

So, it is not relevant for including non assessable income in his tax return

9

Scenario 3 - Background

Jacquie used to work with Patty and they are now best friends. Whilst Jacquie chose to

permanently retire, Patty, who is 62 years old, has decided to leave the company where she and

Jacquie worked for the last 25 years and start a new job with a rival company.

Question 2.11

Patty would like to renovate her home and asks you if she is able to access her superannuation

money.

It is not possible for patty to get access for Jacquie's superannuation fund as it is possible

as superannuation is continual attack as it is not recommended for avoiding superannuation but

there should be various strategies for purpose of preventing consequences of alterations which

are certain in the future. This access of superannuation is only possible between spouse.

10

Jacquie used to work with Patty and they are now best friends. Whilst Jacquie chose to

permanently retire, Patty, who is 62 years old, has decided to leave the company where she and

Jacquie worked for the last 25 years and start a new job with a rival company.

Question 2.11

Patty would like to renovate her home and asks you if she is able to access her superannuation

money.

It is not possible for patty to get access for Jacquie's superannuation fund as it is possible

as superannuation is continual attack as it is not recommended for avoiding superannuation but

there should be various strategies for purpose of preventing consequences of alterations which

are certain in the future. This access of superannuation is only possible between spouse.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 30

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.