An Analysis of Price Elasticity of Demand in Key Economic Sectors

VerifiedAdded on 2023/01/19

|11

|2874

|31

Report

AI Summary

This report delves into the concept of price elasticity of demand, exploring its application in three key sectors: housing, electricity, and healthcare. It defines price elasticity and differentiates between elastic and inelastic supply, emphasizing the macroeconomic impacts of housing supply responsiveness. The report examines how housing market reactions to demand shocks can influence affordability and price volatility. It then shifts focus to electricity, analyzing how price changes affect usage, considering factors such as economic health, available substitutes, and pricing plans. The report also investigates the price elasticity of demand in healthcare, noting the range of elasticity estimates and factors influencing consumer responses to healthcare costs, including income levels, availability of substitutes, and insurance coverage. The analysis includes cross-price elasticity, highlighting the sensitivity of demand to price changes in related goods and services, and how these elasticities affect consumer behavior and market dynamics. This comprehensive analysis provides insights into how price changes influence consumer behavior and market dynamics across different economic sectors.

Surname1

Name

Professor

Institution

Course

Date

PRICE ELASTICITY OF DEMAND

Name

Professor

Institution

Course

Date

PRICE ELASTICITY OF DEMAND

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Surname2

Price Elasticity of Demand for Houses

This is the degree of the sensitivity of the magnitude of housing that is provided to the

variation in the rate of housing. In terms of numerals; it refers to the proportion of the percentage

variation in the magnitude of housing provided to the percentage adjustment in the price of

houses (Rachel , Nicole , Christopher , & Steven , 2017, p. 34). In one extreme, there is perfectly

inflexible supply when the value pliability of lodging supply is zero and these types of changes

in the housing supply will have no influence on the amount of houses supplied. It is a case

whereby the price elasticity of housing is expected to be zero (Liu, 2019, p. 70). On the other

extreme, there is perfectly elastic housing supply whereby a trivial change in the house prices

will lead to a large change in the quantity of houses that are supplied.it is a case whereby the

housing supply is infinite. An elastic measure that is greater than one would generally mean that

there is elastic supply while an elastic measure of less than one would indicate an inelastic

supply (Rachel , Nicole , Christopher , & Steven , 2017, p. 57).

The prominence of housing receptiveness to the well-being of economy cannot be ignored.

A poor supply of housing will lead to instability in the macroeconomic sector and will at long

run hinder the labor market flexibility and thus constraining the economic growth (Xian, Yu ,

Eddie , HUI , & Linzi , 2018, p. 89). Lack of responsiveness to the housing supply also known as

inelasticity in the housing supply can impact the economy through to primary channels. It can at

first show negative impacts on the stability of macroeconomic stability; which is a demand side

impact and it can also impede the labor arcade suppleness which is a supply side implication

(Debarpita, 2018, p. 132). However, the overall effects of the housing elasticity is subdued

economic growth whereby the economy will operate below its full potential since the housing

markets will fall in order to adjust to the demand shocks.

Price Elasticity of Demand for Houses

This is the degree of the sensitivity of the magnitude of housing that is provided to the

variation in the rate of housing. In terms of numerals; it refers to the proportion of the percentage

variation in the magnitude of housing provided to the percentage adjustment in the price of

houses (Rachel , Nicole , Christopher , & Steven , 2017, p. 34). In one extreme, there is perfectly

inflexible supply when the value pliability of lodging supply is zero and these types of changes

in the housing supply will have no influence on the amount of houses supplied. It is a case

whereby the price elasticity of housing is expected to be zero (Liu, 2019, p. 70). On the other

extreme, there is perfectly elastic housing supply whereby a trivial change in the house prices

will lead to a large change in the quantity of houses that are supplied.it is a case whereby the

housing supply is infinite. An elastic measure that is greater than one would generally mean that

there is elastic supply while an elastic measure of less than one would indicate an inelastic

supply (Rachel , Nicole , Christopher , & Steven , 2017, p. 57).

The prominence of housing receptiveness to the well-being of economy cannot be ignored.

A poor supply of housing will lead to instability in the macroeconomic sector and will at long

run hinder the labor market flexibility and thus constraining the economic growth (Xian, Yu ,

Eddie , HUI , & Linzi , 2018, p. 89). Lack of responsiveness to the housing supply also known as

inelasticity in the housing supply can impact the economy through to primary channels. It can at

first show negative impacts on the stability of macroeconomic stability; which is a demand side

impact and it can also impede the labor arcade suppleness which is a supply side implication

(Debarpita, 2018, p. 132). However, the overall effects of the housing elasticity is subdued

economic growth whereby the economy will operate below its full potential since the housing

markets will fall in order to adjust to the demand shocks.

Surname3

The price pliability of supply is a major determinant of the degree to which to which the

lodging market reacts to the demand shocks by snowballing the number of housing or increasing

prices.in a case whereby the accommodation supply is charge inelastic, there exists adverse

outcomes for the affordability of houses since the increased demand is interpreted to the rapid

rising price of houses.

There also exist ramifications for the volatility in house prices and the macroeconomic

steadiness. When the supply of houses is value inelastic, the lodging prices turn out to be very

sensitive to the demand alterations triggered by the labor, financial shocks. The house price

bubbles are more likely to arise when the lodging supply is inelastic to prices (Debarpita, 2018,

p. 45). A tightly controlled housing supply gives courage to the homeowners to treat houses as an

investment asset which is to be held while expecting a future increase in prices and this fuels the

shortage in the housing sector and hence the house prices shoots up in the economy. Therefore,

in some cases whereby the housing supply is not responsive to the ultimatum shocks, the housing

prices will then end up revolving around a rising trend in the price of houses and this will lead to

the creation of an undesirable situation of long run volatility in the housing sector.

The impacts of the unresponsiveness of housing supply environment do not end with the

increasing and unfavorable housing prices (Xian, Yu , Eddie , HUI , & Linzi , 2018, p. 32). The

increasing house prices and house price induced debt will affect the consumption behavior of

individuals and this will have a direct impact in the financial stability.

The price pliability of supply is a major determinant of the degree to which to which the

lodging market reacts to the demand shocks by snowballing the number of housing or increasing

prices.in a case whereby the accommodation supply is charge inelastic, there exists adverse

outcomes for the affordability of houses since the increased demand is interpreted to the rapid

rising price of houses.

There also exist ramifications for the volatility in house prices and the macroeconomic

steadiness. When the supply of houses is value inelastic, the lodging prices turn out to be very

sensitive to the demand alterations triggered by the labor, financial shocks. The house price

bubbles are more likely to arise when the lodging supply is inelastic to prices (Debarpita, 2018,

p. 45). A tightly controlled housing supply gives courage to the homeowners to treat houses as an

investment asset which is to be held while expecting a future increase in prices and this fuels the

shortage in the housing sector and hence the house prices shoots up in the economy. Therefore,

in some cases whereby the housing supply is not responsive to the ultimatum shocks, the housing

prices will then end up revolving around a rising trend in the price of houses and this will lead to

the creation of an undesirable situation of long run volatility in the housing sector.

The impacts of the unresponsiveness of housing supply environment do not end with the

increasing and unfavorable housing prices (Xian, Yu , Eddie , HUI , & Linzi , 2018, p. 32). The

increasing house prices and house price induced debt will affect the consumption behavior of

individuals and this will have a direct impact in the financial stability.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Surname4

Price Elasticity of Demand for Electricity

The price elasticity of demand here serves as a measure of the changes in the price of

electricity affects its usage. It is used to provide a convenient, easy and precise way to measure

and interpret a performance metric since it denotes the percentage change that is attributable to a

single point change in the prices.in a situation whereby the elasticity is equal to one, a percentage

price decrease, say 10% would cause a proportionate change in the and for this matter, it would

be an equal change in the consumption of electricity (Paul , 2018, p. 47). Any elasticity which is

greater than one gives higher proportional than the adjustment usage and any vale less than one

gives a lesser proportional adjustment. The latter is achieved under the assumption that all other

factors that affect electricity consumption are kept constant.

The recent research demonstrated that the nature of how and the reasons as to why the

consumers change or adjust their usage when the price elasticity changes is very far from

simplistic it is definitely not static (Jorge , Esteban , & David , 2017, p. 132). Several factors

affect the consumers inclination and motivation to give their response to the changes in price and

these factors include; the general health of the economy (which has greater impact on the

household incomes and profitability of businesses) and the available substitutes of electricity

which are vital in the maintenance of overall welfare when there is a change in price.

The characters of prices that include the pricing plans affect the incentives to react to the

changes in prices. The frequency of the changes in prices, the time interval, season and the

magnitude of change in the price of electricity and the length of the alteration in these prices are

vital determinants of the benefits that are realized by the consumers (Chandra, Handel, &

Schwartzstein, 2018, p. 156). The latter therefore count in the degree of price elasticity.

Price Elasticity of Demand for Electricity

The price elasticity of demand here serves as a measure of the changes in the price of

electricity affects its usage. It is used to provide a convenient, easy and precise way to measure

and interpret a performance metric since it denotes the percentage change that is attributable to a

single point change in the prices.in a situation whereby the elasticity is equal to one, a percentage

price decrease, say 10% would cause a proportionate change in the and for this matter, it would

be an equal change in the consumption of electricity (Paul , 2018, p. 47). Any elasticity which is

greater than one gives higher proportional than the adjustment usage and any vale less than one

gives a lesser proportional adjustment. The latter is achieved under the assumption that all other

factors that affect electricity consumption are kept constant.

The recent research demonstrated that the nature of how and the reasons as to why the

consumers change or adjust their usage when the price elasticity changes is very far from

simplistic it is definitely not static (Jorge , Esteban , & David , 2017, p. 132). Several factors

affect the consumers inclination and motivation to give their response to the changes in price and

these factors include; the general health of the economy (which has greater impact on the

household incomes and profitability of businesses) and the available substitutes of electricity

which are vital in the maintenance of overall welfare when there is a change in price.

The characters of prices that include the pricing plans affect the incentives to react to the

changes in prices. The frequency of the changes in prices, the time interval, season and the

magnitude of change in the price of electricity and the length of the alteration in these prices are

vital determinants of the benefits that are realized by the consumers (Chandra, Handel, &

Schwartzstein, 2018, p. 156). The latter therefore count in the degree of price elasticity.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Surname5

Ignorance of these factors when planning for prices will result to unintended and unanticipated

consequences. A variety of market circumstances can cause a shift in the utilization of electricity.

Consumers adjust their level of consumption and the pattern too in response to the changes in

prices. The latter is evident by the amount of cash per kWh used. Consumers can agree to reduce

the use of electricity in return for a lump sum payment and they would pay a penalty of they

failed to tame their consumption (Jorge , Esteban , & David , 2017, p. 46).

The effective change incurred here is the opportunity cost. The demand for electricity

reveals the standard measures of the determinants of the elasticity of demand since an increase in

the price of electricity will make the consumers change their consumption behavior since their

income will be affected when the price of electricity changes (Jorge , Esteban , & David , 2017,

p. 45). The increase in the price of electricity will also have an impact on their income and hence

the consumers will also have to alter their consumption behavior so as to save on their income

(Teng, Burke, & Liao, 2019, p. 154).

Price Pliability of Ultimatum for Healthcare

In spite of the different experiential methods and data foundations available, the

ultimatum for healthcare has shown consistency in the elasticity in its price. The range of price

elasticity estimates in this matter appears to be very extensive and inclines to center on -0.17

meaning that a unit percentage surge in the charge of healthcare will definitely result to 0.17 %

drop in the expenditure in healthcare (Ellis, Martins, & Zhu, 2017, p. 232). The price prompted

variations in the ultimatum for healthcare can be accredited to the fluctuations in the profitability

of retrieving a given healthcare instead of the changes in the trips made once a patient accesses

Ignorance of these factors when planning for prices will result to unintended and unanticipated

consequences. A variety of market circumstances can cause a shift in the utilization of electricity.

Consumers adjust their level of consumption and the pattern too in response to the changes in

prices. The latter is evident by the amount of cash per kWh used. Consumers can agree to reduce

the use of electricity in return for a lump sum payment and they would pay a penalty of they

failed to tame their consumption (Jorge , Esteban , & David , 2017, p. 46).

The effective change incurred here is the opportunity cost. The demand for electricity

reveals the standard measures of the determinants of the elasticity of demand since an increase in

the price of electricity will make the consumers change their consumption behavior since their

income will be affected when the price of electricity changes (Jorge , Esteban , & David , 2017,

p. 45). The increase in the price of electricity will also have an impact on their income and hence

the consumers will also have to alter their consumption behavior so as to save on their income

(Teng, Burke, & Liao, 2019, p. 154).

Price Pliability of Ultimatum for Healthcare

In spite of the different experiential methods and data foundations available, the

ultimatum for healthcare has shown consistency in the elasticity in its price. The range of price

elasticity estimates in this matter appears to be very extensive and inclines to center on -0.17

meaning that a unit percentage surge in the charge of healthcare will definitely result to 0.17 %

drop in the expenditure in healthcare (Ellis, Martins, & Zhu, 2017, p. 232). The price prompted

variations in the ultimatum for healthcare can be accredited to the fluctuations in the profitability

of retrieving a given healthcare instead of the changes in the trips made once a patient accesses

Surname6

healthcare (Mahlich & Sruamsiri, 2019, p. 67). There are also lower levels of demand elasticity

at the lower levels of cost sharing.

Demand for healthcare services is revenue inflexible. The income pliability approximations

in this case are under an assortment of 0 to 0.2 (Ellis, Martins, & Zhu, 2017, p. 245). The

affirmative sign of elasticity degree shows that a fraction of revenue increased with an increase

in the demand for healthcare. The degree of elasticity nevertheless suggests that there is a

relatively low response to the demand (Zamzaireen, Rosliza, Lim, & Jun, 2018, p. 187). The

studies that have been done on the time series data suggest that there is greater revenue pliability.

The differences that occur thru time are caused by the incorporation of the impacts of the

alterations in the health expertise that utilize the long time series of statistics.

The ultimatum pliability for Medicare is generally low. However, particular types of care

are generally price sensitive. Examples of these kinds of healthcare include preventive care and

pharmacy gains. The latter have been noted to have large price elasticity. The ultimatum for

precautionary care is more subtle than the ultimatum for any other type of healthcare. The

availability of substitutes is a primary determinant of the elasticity of demand. As far as

healthcare is concerned; there are several goods and services that can serve as surrogates

(Horenstein & Santos, 2018, p. 51). When the prices of healthcare goes up, the consumers will

therefore have a choice of shifting to the substitutes and avoid the preventive care. They will

consume those alternatives which promote health including the nutritional complements and also

healthy foods. Precautionary therapeutic care services may also be considered as more of a

luxury good than a necessity good. When the price of preventive healthcare price goes up, then

the consumers may then cut off the preventive medical care services.

healthcare (Mahlich & Sruamsiri, 2019, p. 67). There are also lower levels of demand elasticity

at the lower levels of cost sharing.

Demand for healthcare services is revenue inflexible. The income pliability approximations

in this case are under an assortment of 0 to 0.2 (Ellis, Martins, & Zhu, 2017, p. 245). The

affirmative sign of elasticity degree shows that a fraction of revenue increased with an increase

in the demand for healthcare. The degree of elasticity nevertheless suggests that there is a

relatively low response to the demand (Zamzaireen, Rosliza, Lim, & Jun, 2018, p. 187). The

studies that have been done on the time series data suggest that there is greater revenue pliability.

The differences that occur thru time are caused by the incorporation of the impacts of the

alterations in the health expertise that utilize the long time series of statistics.

The ultimatum pliability for Medicare is generally low. However, particular types of care

are generally price sensitive. Examples of these kinds of healthcare include preventive care and

pharmacy gains. The latter have been noted to have large price elasticity. The ultimatum for

precautionary care is more subtle than the ultimatum for any other type of healthcare. The

availability of substitutes is a primary determinant of the elasticity of demand. As far as

healthcare is concerned; there are several goods and services that can serve as surrogates

(Horenstein & Santos, 2018, p. 51). When the prices of healthcare goes up, the consumers will

therefore have a choice of shifting to the substitutes and avoid the preventive care. They will

consume those alternatives which promote health including the nutritional complements and also

healthy foods. Precautionary therapeutic care services may also be considered as more of a

luxury good than a necessity good. When the price of preventive healthcare price goes up, then

the consumers may then cut off the preventive medical care services.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Surname7

The opportunity cost of acquiring precautionary medical care is relatively greater than

when in a situation whereby one falls sick and they have to see the doctor and particularly when

the patient needs to see a doctor severally. The benefits of pre-emptive healthcare in the long

term are in most cases reduced and thus it might not be necessary for an individual to demand

preventive healthcare (Yeung, Basu, Hansen, & Sullivan, 2018, p. 37). The differences that exist

in the inelasticity also replicate the fact that precautionary healthcare and the medicament drugs

administered are not roofed by insurance.

There is also a growing attention of the growing demand for the health insurance and the

sensitivity of ultimatum for the healthcare policies to alter prices of healthcare insurance. The

latter is important when we consider the demand for healthcare services that are delivered by a

certain healthcare plan (Zamzaireen, Rosliza, Lim, & Jun, 2018, p. 52). Any modification in the

cost will have a direct impact on the number of the people that enroll and this will have a direct

impact on the services paid for the particular plan.

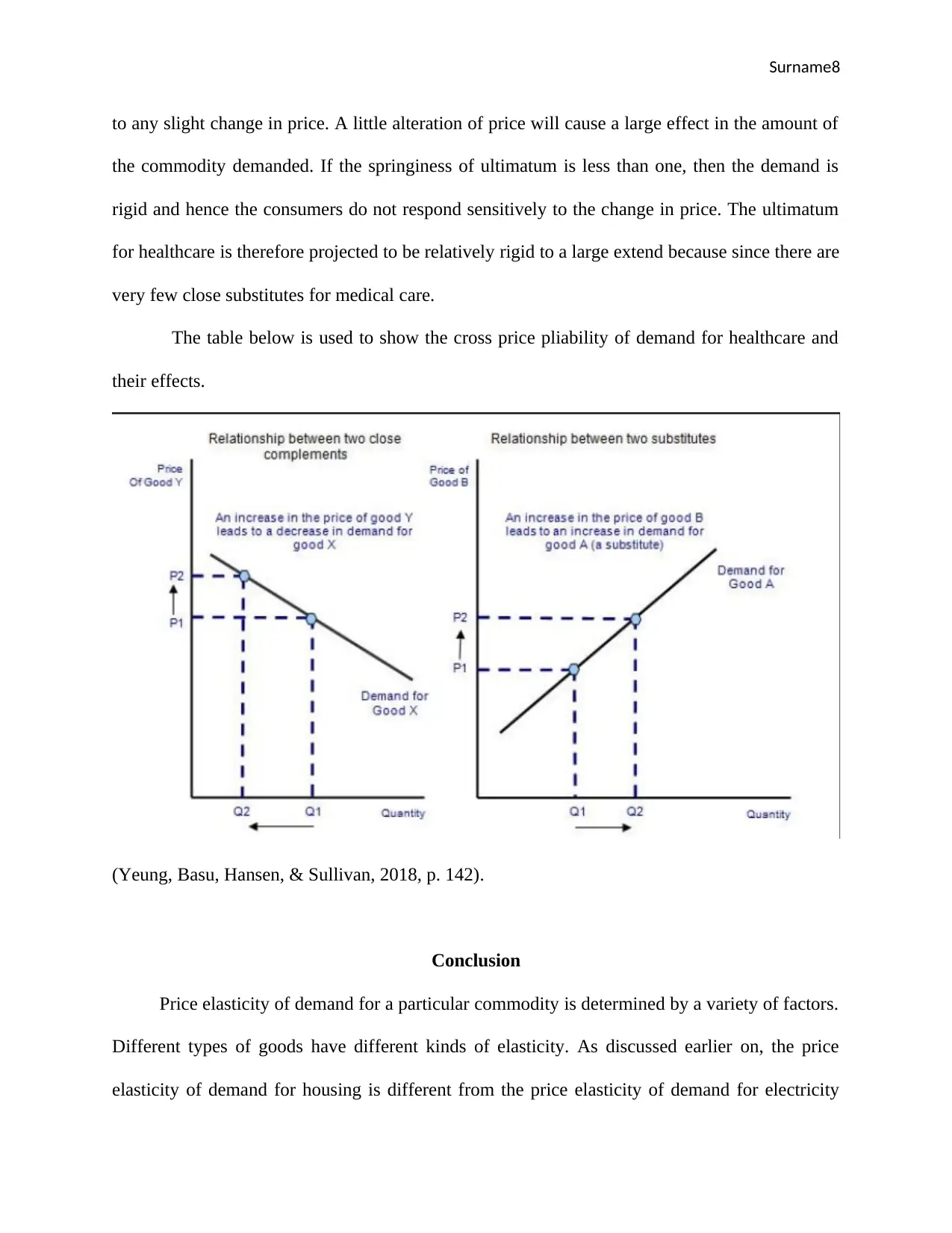

The cross price pliability of ultimatum in the case of healthcare measures the impact of

variation in the value of a particular commodity or overhaul on the ultimatum for an alternative

product, it can for instance be employed to calculate the proportionate change in the magnitude

of good X which is required resulting a 1% increase in the price of another product, say y. Cross

price elasticity is therefore depended on two goods. In a case whereby the two goods are close

replacements, therefore cross price elasticity is expected to be positive. In a case whereby the

own price elasticity of demand is greater than one, then the demand is said to be elastic (Mahlich

& Sruamsiri, 2019, p. 69). In a case whereby the ultimatum is flexible, the clients are very subtle

The opportunity cost of acquiring precautionary medical care is relatively greater than

when in a situation whereby one falls sick and they have to see the doctor and particularly when

the patient needs to see a doctor severally. The benefits of pre-emptive healthcare in the long

term are in most cases reduced and thus it might not be necessary for an individual to demand

preventive healthcare (Yeung, Basu, Hansen, & Sullivan, 2018, p. 37). The differences that exist

in the inelasticity also replicate the fact that precautionary healthcare and the medicament drugs

administered are not roofed by insurance.

There is also a growing attention of the growing demand for the health insurance and the

sensitivity of ultimatum for the healthcare policies to alter prices of healthcare insurance. The

latter is important when we consider the demand for healthcare services that are delivered by a

certain healthcare plan (Zamzaireen, Rosliza, Lim, & Jun, 2018, p. 52). Any modification in the

cost will have a direct impact on the number of the people that enroll and this will have a direct

impact on the services paid for the particular plan.

The cross price pliability of ultimatum in the case of healthcare measures the impact of

variation in the value of a particular commodity or overhaul on the ultimatum for an alternative

product, it can for instance be employed to calculate the proportionate change in the magnitude

of good X which is required resulting a 1% increase in the price of another product, say y. Cross

price elasticity is therefore depended on two goods. In a case whereby the two goods are close

replacements, therefore cross price elasticity is expected to be positive. In a case whereby the

own price elasticity of demand is greater than one, then the demand is said to be elastic (Mahlich

& Sruamsiri, 2019, p. 69). In a case whereby the ultimatum is flexible, the clients are very subtle

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Surname8

to any slight change in price. A little alteration of price will cause a large effect in the amount of

the commodity demanded. If the springiness of ultimatum is less than one, then the demand is

rigid and hence the consumers do not respond sensitively to the change in price. The ultimatum

for healthcare is therefore projected to be relatively rigid to a large extend because since there are

very few close substitutes for medical care.

The table below is used to show the cross price pliability of demand for healthcare and

their effects.

(Yeung, Basu, Hansen, & Sullivan, 2018, p. 142).

Conclusion

Price elasticity of demand for a particular commodity is determined by a variety of factors.

Different types of goods have different kinds of elasticity. As discussed earlier on, the price

elasticity of demand for housing is different from the price elasticity of demand for electricity

to any slight change in price. A little alteration of price will cause a large effect in the amount of

the commodity demanded. If the springiness of ultimatum is less than one, then the demand is

rigid and hence the consumers do not respond sensitively to the change in price. The ultimatum

for healthcare is therefore projected to be relatively rigid to a large extend because since there are

very few close substitutes for medical care.

The table below is used to show the cross price pliability of demand for healthcare and

their effects.

(Yeung, Basu, Hansen, & Sullivan, 2018, p. 142).

Conclusion

Price elasticity of demand for a particular commodity is determined by a variety of factors.

Different types of goods have different kinds of elasticity. As discussed earlier on, the price

elasticity of demand for housing is different from the price elasticity of demand for electricity

Surname9

and so is the price elasticity of demand for healthcare services. Demand for healthcare is inelastic

since there are no close substitutes while demand for housing is highly elastic. Demand for

electricity on the other hand is said to be relatively inelastic.

and so is the price elasticity of demand for healthcare services. Demand for healthcare is inelastic

since there are no close substitutes while demand for housing is highly elastic. Demand for

electricity on the other hand is said to be relatively inelastic.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Surname10

References

Chandra, A., Handel, B., & Schwartzstein, J. (2018). Behavioral economics and health-care

markets. Harvard: UC Berkeley.

Debarpita, R. (2018). Housing demand in Indian metros: a hedonic approach. Journal of

Housing Markets and Analysis, 1(2), 1-41.

Ellis, R. P., Martins, B., & Zhu, W. (2017). Health care demand elasticities by type of

service. Journal of health economics, 55, 220-256.

Horenstein, A. R., & Santos, M. S. (2018). Understanding Growth Patterns in US Health

Care Expenditures. Journal of the European Economic Association, 17(1), 271-302.

Jorge , B., Esteban , V., & David , T.-O. (2017). On the estimation of the price elasticity

of electricity demand in the manufacturing industry of Colombia. , Journal of Energy

Economics and Policy, 88(1), 155-182.

Liu, X. (2019). The income elasticity of housing demand in New South Wales, Australia.

Regional Science and Urban Economics, 75(1), 70-84.

Mahlich, J., & Sruamsiri, J. (2019). Co-insurance and health care utilization in Japanese

patients with rheumatoid arthritis: a discontinuity regression approach. International

journal for equity in health, 22(1), 1-19.

Paul , B. J. (2018). The Price Elasticity of Electricity Demand in the United States: A

ThreeDimensional Analysis. SSRN Electronic Journa, 12(2), 253-287.

References

Chandra, A., Handel, B., & Schwartzstein, J. (2018). Behavioral economics and health-care

markets. Harvard: UC Berkeley.

Debarpita, R. (2018). Housing demand in Indian metros: a hedonic approach. Journal of

Housing Markets and Analysis, 1(2), 1-41.

Ellis, R. P., Martins, B., & Zhu, W. (2017). Health care demand elasticities by type of

service. Journal of health economics, 55, 220-256.

Horenstein, A. R., & Santos, M. S. (2018). Understanding Growth Patterns in US Health

Care Expenditures. Journal of the European Economic Association, 17(1), 271-302.

Jorge , B., Esteban , V., & David , T.-O. (2017). On the estimation of the price elasticity

of electricity demand in the manufacturing industry of Colombia. , Journal of Energy

Economics and Policy, 88(1), 155-182.

Liu, X. (2019). The income elasticity of housing demand in New South Wales, Australia.

Regional Science and Urban Economics, 75(1), 70-84.

Mahlich, J., & Sruamsiri, J. (2019). Co-insurance and health care utilization in Japanese

patients with rheumatoid arthritis: a discontinuity regression approach. International

journal for equity in health, 22(1), 1-19.

Paul , B. J. (2018). The Price Elasticity of Electricity Demand in the United States: A

ThreeDimensional Analysis. SSRN Electronic Journa, 12(2), 253-287.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Surname11

Rachel , O., Nicole , G., Christopher , P., & Steven , R. (2017, May). Housing supply

responsiveness in Australia: distribution, drivers and institutional settings. Melbourne,

Australia: Australian Housing and Urban Research Institute Limited.

Teng, M., Burke, P. J., & Liao, H. (2019). The demand for coal among China's rural

households: Estimates of price and income elasticities. Energy Economics, 3(2), 132-

165.

Xian, Z., Yu , X., Eddie , C. M., HUI , M., & Linzi , Z. (2018). Urban housing demand,

permanent income and uncertainty: Microdata analysis of Hong Kong's rental market.

Journal of Habitat Intenrational, 3-109.

Yeung, K., Basu, A., Hansen, R. N., & Sullivan, S. (2018). Price elasticities of

pharmaceuticals in a value based‐formulary setting. Health Economics, 17(4), 217-265.

Zamzaireen, Z. A., Rosliza, A. M., Lim, P. Y., & Jun, M. H. (2018). HEALTHCARE

DEMAND AND ITS DETERMINANTS. International Journal of Public Health and

Clinical Sciences, 5(6), 37-53.

Rachel , O., Nicole , G., Christopher , P., & Steven , R. (2017, May). Housing supply

responsiveness in Australia: distribution, drivers and institutional settings. Melbourne,

Australia: Australian Housing and Urban Research Institute Limited.

Teng, M., Burke, P. J., & Liao, H. (2019). The demand for coal among China's rural

households: Estimates of price and income elasticities. Energy Economics, 3(2), 132-

165.

Xian, Z., Yu , X., Eddie , C. M., HUI , M., & Linzi , Z. (2018). Urban housing demand,

permanent income and uncertainty: Microdata analysis of Hong Kong's rental market.

Journal of Habitat Intenrational, 3-109.

Yeung, K., Basu, A., Hansen, R. N., & Sullivan, S. (2018). Price elasticities of

pharmaceuticals in a value based‐formulary setting. Health Economics, 17(4), 217-265.

Zamzaireen, Z. A., Rosliza, A. M., Lim, P. Y., & Jun, M. H. (2018). HEALTHCARE

DEMAND AND ITS DETERMINANTS. International Journal of Public Health and

Clinical Sciences, 5(6), 37-53.

1 out of 11

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.