Business Decision Making Report: Sygenta's US Market Entry Strategy

VerifiedAdded on 2020/01/21

|21

|4914

|433

Report

AI Summary

This report presents a comprehensive analysis of Sygenta's business decisions regarding the potential launch of its fungicide product, Amistar, in the USA. The report begins with an introduction to the challenges of modern business decision-making, emphasizing the use of statistical tools for predicting future trends. The research methodology includes the creation of a plan for collecting primary and secondary data, survey methodology, and a questionnaire for gathering information. Statistical tools such as mean, median, mode, and standard deviation are applied to analyze the collected data, with interpretations and recommendations provided. The report also includes graphic representations of the data, trend line creation for prediction, and the development of a formal business report. Furthermore, it covers information processing tools, a project plan, and project evaluation techniques, including payback period, ARR, NPV, and IRR calculations. The findings suggest that Sygenta should focus on making expenditures in the range of 30-40 million to expand its business rapidly in the USA.

BUSINESS DECISION MAKING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Creation of plan for collection of primary and secondary data ............................................3

1.2 Survey methodology for sampling frame used ....................................................................3

1.3 Questionnaire for research....................................................................................................4

TASK 2............................................................................................................................................5

2.1 Representative values of statistical tools...............................................................................5

2.2 Analysis of results of mean median and mode......................................................................7

2.3 Measures of dispersion..........................................................................................................7

2.4 Calculation of quartile, percentile and correlation................................................................8

TASK 3............................................................................................................................................9

3.1 Graphic representation of collected data...............................................................................9

3.2 Creation of trend line for prediction....................................................................................14

3.4 Formal business report........................................................................................................14

TASK 4..........................................................................................................................................15

4.1 Information processing tools...............................................................................................15

4.2 Project plan for business project ........................................................................................16

4.3 Project evaluation techniques..............................................................................................18

CONCLUSION..............................................................................................................................20

REFERENCES..............................................................................................................................21

INDEX OF TABLES

Table 1: Calculation of mean, median and mode............................................................................6

Table 2: Measures of dispersion......................................................................................................8

Table 3: Calculation of quartile and percentile................................................................................9

Table 4: Calculation of correlation..................................................................................................9

Table 5: Sales, cost and profit data................................................................................................10

Table 6: Which of the below given factors you think mostly affect your purchasing decisions?. 13

Table 7: Do you think that Sygenta must launch Amistar in USA?.............................................14

Table 8: Calculation of pay back period method...........................................................................19

Table 9: Calculation of ARR.........................................................................................................19

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Creation of plan for collection of primary and secondary data ............................................3

1.2 Survey methodology for sampling frame used ....................................................................3

1.3 Questionnaire for research....................................................................................................4

TASK 2............................................................................................................................................5

2.1 Representative values of statistical tools...............................................................................5

2.2 Analysis of results of mean median and mode......................................................................7

2.3 Measures of dispersion..........................................................................................................7

2.4 Calculation of quartile, percentile and correlation................................................................8

TASK 3............................................................................................................................................9

3.1 Graphic representation of collected data...............................................................................9

3.2 Creation of trend line for prediction....................................................................................14

3.4 Formal business report........................................................................................................14

TASK 4..........................................................................................................................................15

4.1 Information processing tools...............................................................................................15

4.2 Project plan for business project ........................................................................................16

4.3 Project evaluation techniques..............................................................................................18

CONCLUSION..............................................................................................................................20

REFERENCES..............................................................................................................................21

INDEX OF TABLES

Table 1: Calculation of mean, median and mode............................................................................6

Table 2: Measures of dispersion......................................................................................................8

Table 3: Calculation of quartile and percentile................................................................................9

Table 4: Calculation of correlation..................................................................................................9

Table 5: Sales, cost and profit data................................................................................................10

Table 6: Which of the below given factors you think mostly affect your purchasing decisions?. 13

Table 7: Do you think that Sygenta must launch Amistar in USA?.............................................14

Table 8: Calculation of pay back period method...........................................................................19

Table 9: Calculation of ARR.........................................................................................................19

Table 10: Calculation of NPV........................................................................................................20

Table 11: Calculation of IRR.........................................................................................................20

ILLUSTRATION INDEX

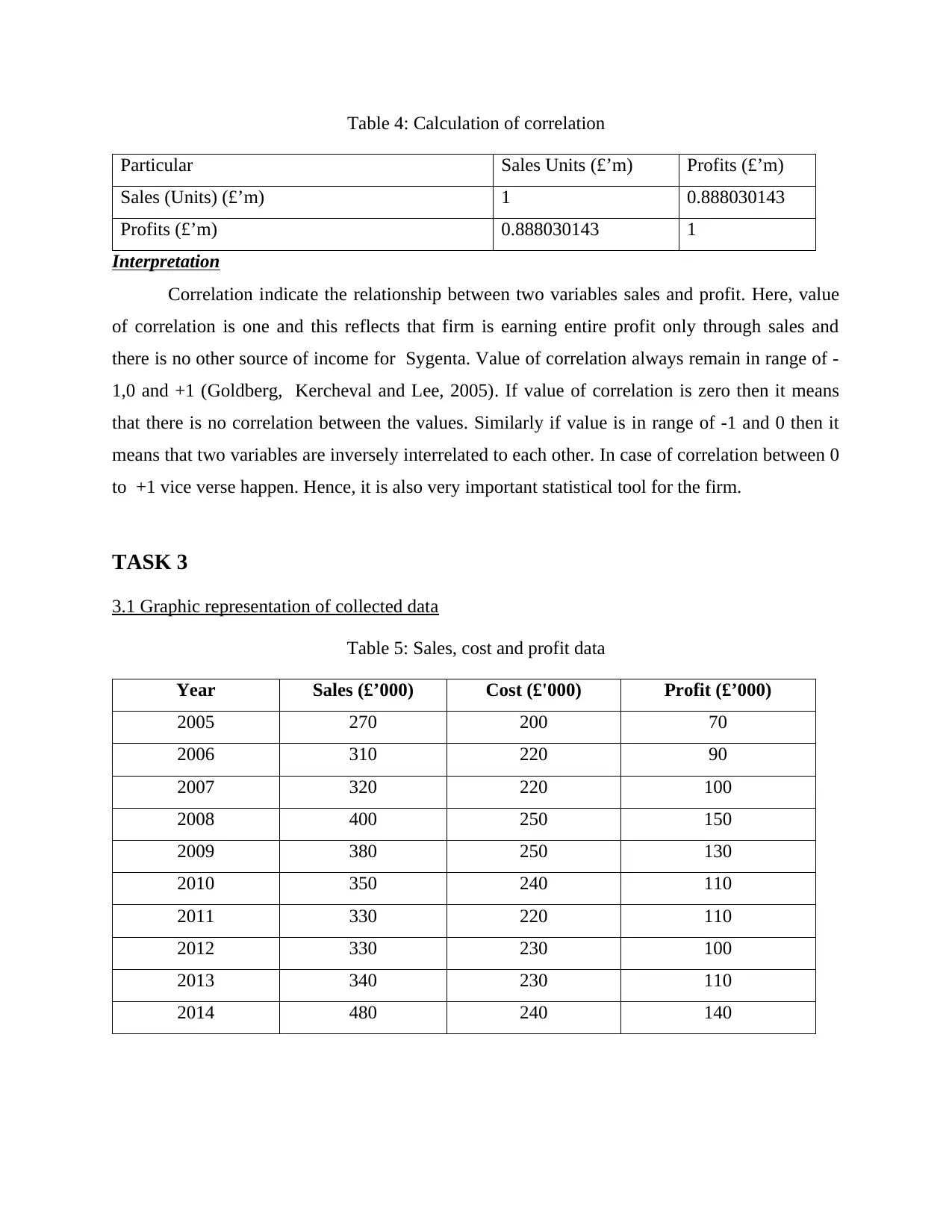

Illustration 1: Chart on sales, cost and profit data.........................................................................11

Illustration 2: People opinion on Which of the below given factors you think mostly affect your

purchasing decisions?....................................................................................................................13

Illustration 3: People opinion regarding opening of business in USA...........................................14

Illustration 4: Trend line for Sygenta.............................................................................................15

Illustration 5: GANTT chart..........................................................................................................18

Illustration 6: Network diagram.....................................................................................................18

Table 11: Calculation of IRR.........................................................................................................20

ILLUSTRATION INDEX

Illustration 1: Chart on sales, cost and profit data.........................................................................11

Illustration 2: People opinion on Which of the below given factors you think mostly affect your

purchasing decisions?....................................................................................................................13

Illustration 3: People opinion regarding opening of business in USA...........................................14

Illustration 4: Trend line for Sygenta.............................................................................................15

Illustration 5: GANTT chart..........................................................................................................18

Illustration 6: Network diagram.....................................................................................................18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

In today era, it is very difficult to make business decisions due to complexity of business

environment. It is facts which are used to predict future trends and in this regard various tools are

used like mean, median, mode and standard deviation. In this report a research is conducted

regard to opening of business in USA. In respect to this primary and secondary data is collected

by the researcher. In case of primary data questionnaire is distributed and response is collected.

On the secondary data statistical tools like mean, median, mode and standard deviation is

applied. On he basis of results of these tools recommendations are made in the formal business

report. Apart from this, project evaluation techniques are also applied and their results are

interpreted in proper manner. In this way entire project is prepared in systematic manner.

TASK 1

1.1 Creation of plan for collection of primary and secondary data

Sygenta is a company which wants to launch its fungicide product named Amistar for

the pest control. In study, USA is selected because it is a nation in which in large quantity crops

are produced. Also it is large in size and due to this reason; it has become easy to earn a huge

amount of revenue in USA (Groves, 2011). In order to launch business, it is necessary to conduct

market research. Hence, primary and secondary data is collected for doing market research. In

order to conduct a secondary research, data will be taken from newspapers, books and journals

etc. Secondary data is a data that is already collected by someone else and is published in the

specific source of information. Whereas, primary research is a research in which data is

collected for the first time by the researcher (Jankowicz, 2005). For conducting primary

research, sample of 50 people will be taken which reside in different villages of Texas. By

carrying out the research, Sygenta would be able to identify potential of the specific geographic

area in terms of revenue. Hence, in this way research will be conducted in a proper manner.

1.2 Survey methodology for sampling frame used

Survey methodology and sampling techniques are used to conduct research in a proper

manner and to select appropriate data collection techniques for the research. Following are

sample techniques that can be used by the Sygenta for conducting a research.

In today era, it is very difficult to make business decisions due to complexity of business

environment. It is facts which are used to predict future trends and in this regard various tools are

used like mean, median, mode and standard deviation. In this report a research is conducted

regard to opening of business in USA. In respect to this primary and secondary data is collected

by the researcher. In case of primary data questionnaire is distributed and response is collected.

On the secondary data statistical tools like mean, median, mode and standard deviation is

applied. On he basis of results of these tools recommendations are made in the formal business

report. Apart from this, project evaluation techniques are also applied and their results are

interpreted in proper manner. In this way entire project is prepared in systematic manner.

TASK 1

1.1 Creation of plan for collection of primary and secondary data

Sygenta is a company which wants to launch its fungicide product named Amistar for

the pest control. In study, USA is selected because it is a nation in which in large quantity crops

are produced. Also it is large in size and due to this reason; it has become easy to earn a huge

amount of revenue in USA (Groves, 2011). In order to launch business, it is necessary to conduct

market research. Hence, primary and secondary data is collected for doing market research. In

order to conduct a secondary research, data will be taken from newspapers, books and journals

etc. Secondary data is a data that is already collected by someone else and is published in the

specific source of information. Whereas, primary research is a research in which data is

collected for the first time by the researcher (Jankowicz, 2005). For conducting primary

research, sample of 50 people will be taken which reside in different villages of Texas. By

carrying out the research, Sygenta would be able to identify potential of the specific geographic

area in terms of revenue. Hence, in this way research will be conducted in a proper manner.

1.2 Survey methodology for sampling frame used

Survey methodology and sampling techniques are used to conduct research in a proper

manner and to select appropriate data collection techniques for the research. Following are

sample techniques that can be used by the Sygenta for conducting a research.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Simple random sampling-. If this technique is applied then Sygenta will take all sample

units from population of Texas without considering any parameter for the sample

selection. Hence, it is very easy to use this method. Stratified sample units- It is a method of sampling in which entire popularity is divided

into several parts on the basis of specific parameter (Berg, 2001). Sample units are

selected from these strata to conduct a research.

Cluster sampling- It is a method in which all sample units are taken from different

geographic area. From these different areas, all sample units are taken for the research.

It will be better for Sygenta to use stratified sampling technique for conducting a research

because in this by using several factors population is divided and data is colcted in appropriate

manner. Hence, it can be said that this method of sampling will be appropriate for the firm.

1.3 Questionnaire for research

Name:

Age:

Gender:

1. Do you use Sygenta's products?

Yes

No

2. Do you think that Sygenta's products help in controlling pests?

Yes

No

3. Which of the below given factors affect your purchasing decisions?

Good quality

Cheaper price

Discount rates

Any other ________

4. Do you think that Sygenta’s pricing policy is good?

Yes

No

5. Do products of Sygenta's meet your requirement?

Yes

units from population of Texas without considering any parameter for the sample

selection. Hence, it is very easy to use this method. Stratified sample units- It is a method of sampling in which entire popularity is divided

into several parts on the basis of specific parameter (Berg, 2001). Sample units are

selected from these strata to conduct a research.

Cluster sampling- It is a method in which all sample units are taken from different

geographic area. From these different areas, all sample units are taken for the research.

It will be better for Sygenta to use stratified sampling technique for conducting a research

because in this by using several factors population is divided and data is colcted in appropriate

manner. Hence, it can be said that this method of sampling will be appropriate for the firm.

1.3 Questionnaire for research

Name:

Age:

Gender:

1. Do you use Sygenta's products?

Yes

No

2. Do you think that Sygenta's products help in controlling pests?

Yes

No

3. Which of the below given factors affect your purchasing decisions?

Good quality

Cheaper price

Discount rates

Any other ________

4. Do you think that Sygenta’s pricing policy is good?

Yes

No

5. Do products of Sygenta's meet your requirement?

Yes

No

6. Do you think that Sygenta's marketing operations are effective in the nature?

Yes

No

7. Do you think that Sygenta must launch Amistar in USA?

Yes

No

9. Do you think that if firm will enter in the market then it will face stiff competition?

Yes

No

10. What kind of strategies firm can adopt to expand business sharply in USA?

Pricing strategy

Product USP marketing strategy

11. Small decline in prices of products will increase product market demand to a great extent for

Sygenta.

Strongly agree

Agree

Somewhat agree

Disagree

Highly disagree

12. Any suggestion to Sygenta for making improvement in its product?

(Kindly mention)_______________________________________________________

TASK 2

2.1 Representative values of statistical tools

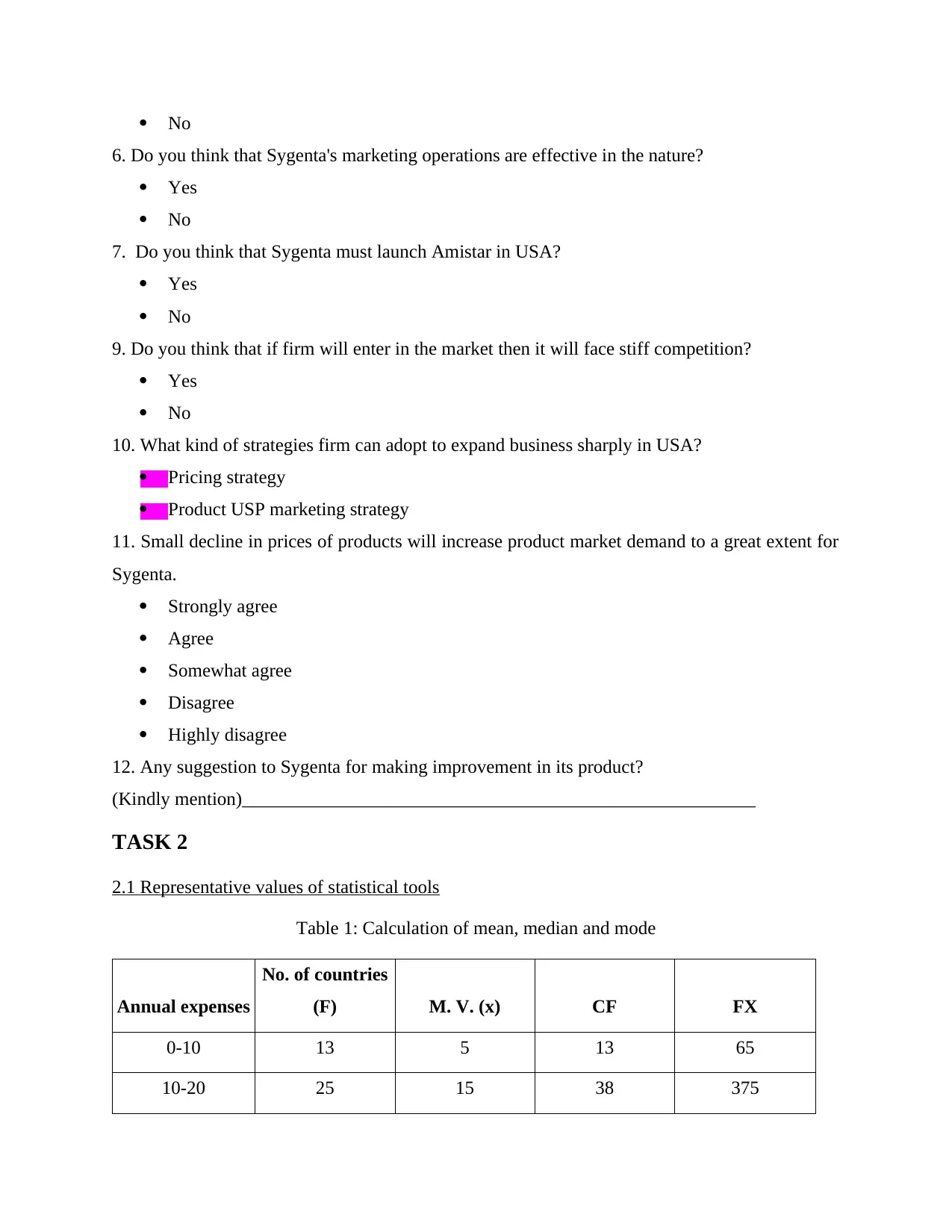

Table 1: Calculation of mean, median and mode

Annual expenses

No. of countries

(F) M. V. (x) CF FX

0-10 13 5 13 65

10-20 25 15 38 375

6. Do you think that Sygenta's marketing operations are effective in the nature?

Yes

No

7. Do you think that Sygenta must launch Amistar in USA?

Yes

No

9. Do you think that if firm will enter in the market then it will face stiff competition?

Yes

No

10. What kind of strategies firm can adopt to expand business sharply in USA?

Pricing strategy

Product USP marketing strategy

11. Small decline in prices of products will increase product market demand to a great extent for

Sygenta.

Strongly agree

Agree

Somewhat agree

Disagree

Highly disagree

12. Any suggestion to Sygenta for making improvement in its product?

(Kindly mention)_______________________________________________________

TASK 2

2.1 Representative values of statistical tools

Table 1: Calculation of mean, median and mode

Annual expenses

No. of countries

(F) M. V. (x) CF FX

0-10 13 5 13 65

10-20 25 15 38 375

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

20-30 37 25 75 925

30-40 22 35 97 770

40-50 21 45 118 945

50-60 20 55 138 1100

60-70 12 65 150 780

150 4960

Mean = ∑FX/∑F = 4960/150 = 33.07

Median = L1 + (N/2-C)/F * Class Interval

= 20 + (150/2 – 38)/37*10

= 30

Mode = L1 + (F1-F0)/ [(2F1-F0-F2)*Class interval

= 24.44 Mean- It indicates the average value of the specific variable for a specific duration. This

states the average performance of specific variable. By comparing current performance

with the average value, research analyst can identify that firm give a good or poor

performance ( Mean, Median, Mode and Range. 2016). For example, if current sales are

above average sales then it can be assumed that the company gives a good performance. Median- It is a statistical tool that divides entire data into two parts. There may be

different trends in these data set. By making use of this statistical tool, research analyst

can easily identify the pattern of movement in variable and can determine that variable is

moving in the positive or negative direction (Cohen and et. al., 2013). Due to this specific

feature, this tool is widely used by the business for analyzing data.

Mode- It is a statistical tool that reflects the value which often gets repeated in the data

set. This statistical tool is used for identifying patterns of movement in variable. If value

of mode is zero then it means that none of the value is repeated in the data set. Thus, this

tool is often used by the equity research analyst for analyzing share price pattern.

30-40 22 35 97 770

40-50 21 45 118 945

50-60 20 55 138 1100

60-70 12 65 150 780

150 4960

Mean = ∑FX/∑F = 4960/150 = 33.07

Median = L1 + (N/2-C)/F * Class Interval

= 20 + (150/2 – 38)/37*10

= 30

Mode = L1 + (F1-F0)/ [(2F1-F0-F2)*Class interval

= 24.44 Mean- It indicates the average value of the specific variable for a specific duration. This

states the average performance of specific variable. By comparing current performance

with the average value, research analyst can identify that firm give a good or poor

performance ( Mean, Median, Mode and Range. 2016). For example, if current sales are

above average sales then it can be assumed that the company gives a good performance. Median- It is a statistical tool that divides entire data into two parts. There may be

different trends in these data set. By making use of this statistical tool, research analyst

can easily identify the pattern of movement in variable and can determine that variable is

moving in the positive or negative direction (Cohen and et. al., 2013). Due to this specific

feature, this tool is widely used by the business for analyzing data.

Mode- It is a statistical tool that reflects the value which often gets repeated in the data

set. This statistical tool is used for identifying patterns of movement in variable. If value

of mode is zero then it means that none of the value is repeated in the data set. Thus, this

tool is often used by the equity research analyst for analyzing share price pattern.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2.2 Analysis of results of mean median and mode

Below results of mean, median and mode are analyzed in a proper manner. Mean- The mean value is 33.07 and this reflects that average annual expenditure of

Amritsar is in range of 30-40 million. Hence, Sygenta is required to make expenditures in

this range in order to make sure that it produces pesticides in sufficient quantity in order

to meet demand of the people of USA on time. Even, if firm make an annual expenditure

nearby to 30 million then also there is no problem. If firm will make expenditures

equivalent to the average expenditure then its chances of expansion of the business at a

fast pace will increased in the USA. Median- It is a middle value in a data set and here the value is this statistical tool is 30.

This means that most of the counties are making investment nearby to the above given

value which is in million. If we look at the values above the value 30, then it can be seen

that frequency of counties is very low. After 30, the value of frequency is increased. This

means that 30 million is the value of the annual expense that firm needs to made in order

to grown business at rapid pace.

Mode- Value of mode is 24 and it states that there is a specific value which is often

repeated in the data set. This means that values of the variable is repeated again and again

in the data set.

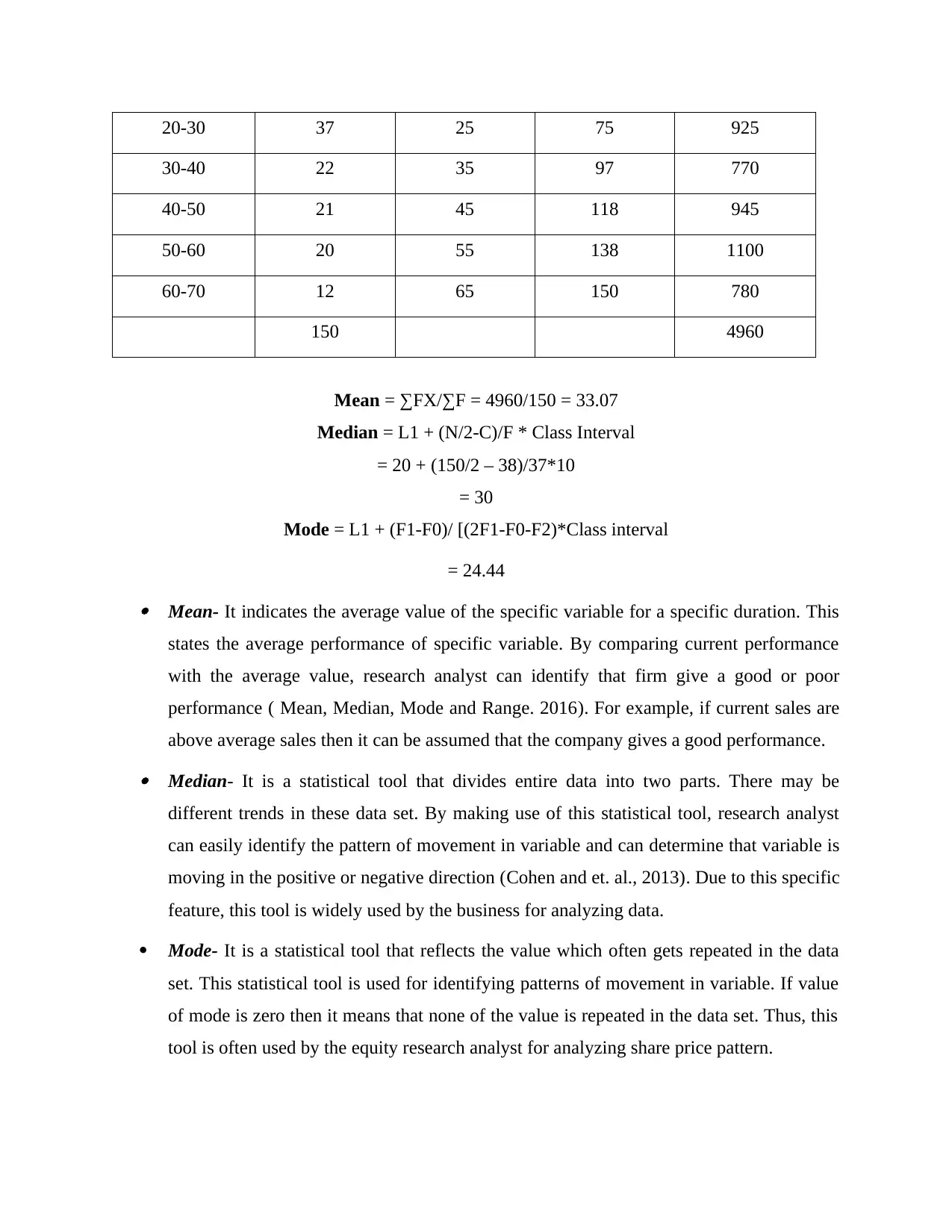

2.3 Measures of dispersion

Table 2: Measures of dispersion

Annual

expenses

No. of

countries (F) M. V. (x) FX X^2 F*X^2

0-10 13 5 65 25 325

10-20 25 15 375 225 5625

20-30 37 25 925 625 23125

30-40 22 35 770 1225 26950

40-50 21 45 945 2025 42525

50-60 20 55 1100 3025 60500

Below results of mean, median and mode are analyzed in a proper manner. Mean- The mean value is 33.07 and this reflects that average annual expenditure of

Amritsar is in range of 30-40 million. Hence, Sygenta is required to make expenditures in

this range in order to make sure that it produces pesticides in sufficient quantity in order

to meet demand of the people of USA on time. Even, if firm make an annual expenditure

nearby to 30 million then also there is no problem. If firm will make expenditures

equivalent to the average expenditure then its chances of expansion of the business at a

fast pace will increased in the USA. Median- It is a middle value in a data set and here the value is this statistical tool is 30.

This means that most of the counties are making investment nearby to the above given

value which is in million. If we look at the values above the value 30, then it can be seen

that frequency of counties is very low. After 30, the value of frequency is increased. This

means that 30 million is the value of the annual expense that firm needs to made in order

to grown business at rapid pace.

Mode- Value of mode is 24 and it states that there is a specific value which is often

repeated in the data set. This means that values of the variable is repeated again and again

in the data set.

2.3 Measures of dispersion

Table 2: Measures of dispersion

Annual

expenses

No. of

countries (F) M. V. (x) FX X^2 F*X^2

0-10 13 5 65 25 325

10-20 25 15 375 225 5625

20-30 37 25 925 625 23125

30-40 22 35 770 1225 26950

40-50 21 45 945 2025 42525

50-60 20 55 1100 3025 60500

60-70 12 65 780 4225 50700

150 4960 11375 209750

Variance = ∑Fx2 – ((∑Fx) 2/n)/ n – 1 = 208649.257

Standard deviation =

= 456.7814

Interpretation

It is a statistical tool that reflects the deviation in the value of the specific variable relative

to the average value (Day, 2005). Here standard deviation is 456.78 which is positive and it

reflects that variables are moving in positive direction in comparison to actual value. This

indicates that firms are increasing their expenditures on the Amitsar. Hence, Sygenta at least

needs to make expenditures equivalent to mean value in order to expand and establish its

business strongly in USA.

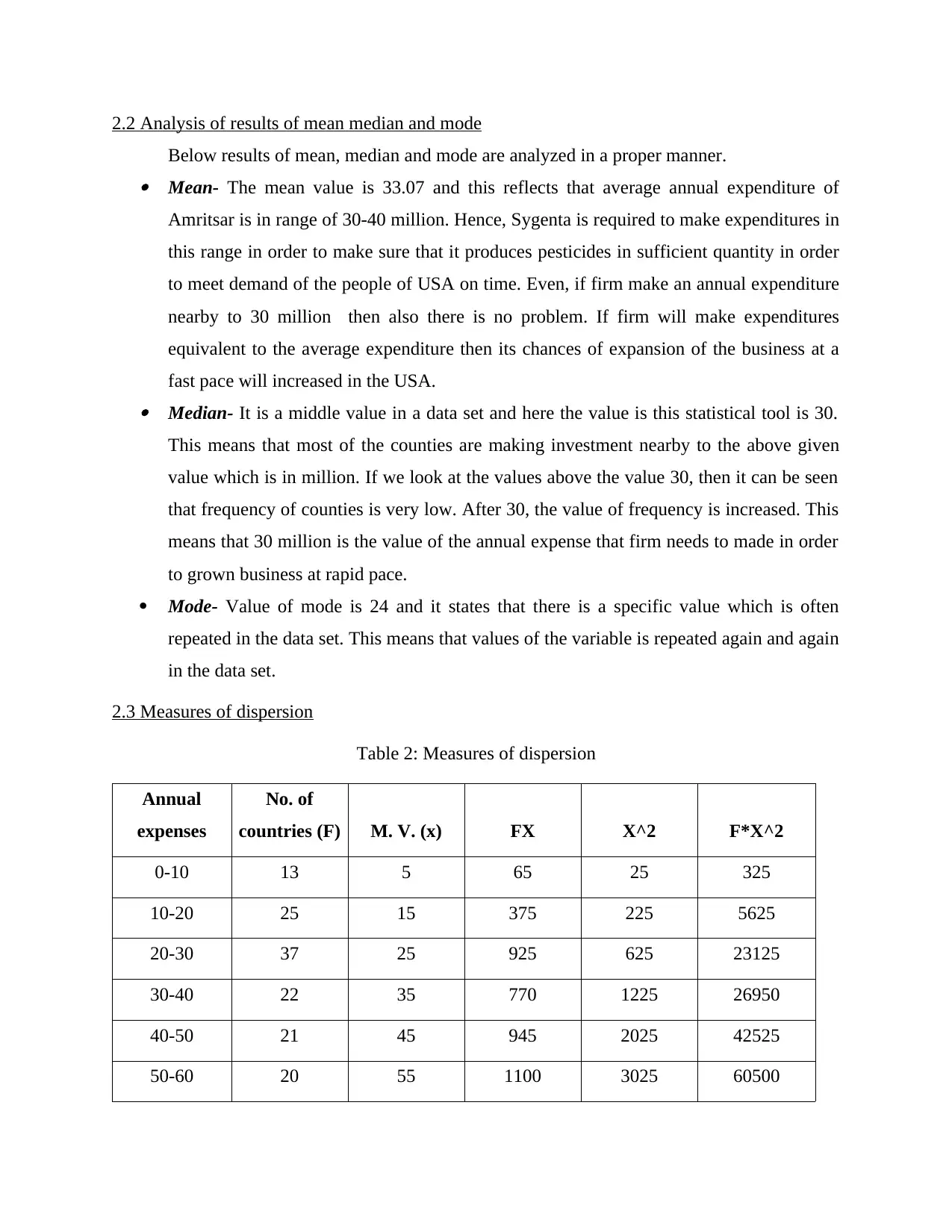

2.4 Calculation of quartile, percentile and correlation

Table 3: Calculation of quartile and percentile

Quartile 1 20.2 percentile 25 20.2

Quartile 2 24.44 percentile 50 24.44

Quartile 3 47.38 percentile 75 47.38

Interpretation

Quartile and percentile- It is a statistical tool that divide entire data in to several parts. It can be

said that quartile is extension of median as a statistical tool. Median divide data set in to two

parts but quartile divide data in to four parts (Black, 2006). Hence, pattern in the specific

variable can be analyzed in proper manner and all moves will be come in light of research

analyst. Hence, it can be said that by using this tool data analysis can be done in proper manner.

Quartile and percentile both are same things and only method of calculation is different in both

cases. Here it can be seen that quartile value is continuously increasing and value in question

table is also increasing. Thus, it can be said that firm needs to increase its annual expenses on

Amitsar consistently.

150 4960 11375 209750

Variance = ∑Fx2 – ((∑Fx) 2/n)/ n – 1 = 208649.257

Standard deviation =

= 456.7814

Interpretation

It is a statistical tool that reflects the deviation in the value of the specific variable relative

to the average value (Day, 2005). Here standard deviation is 456.78 which is positive and it

reflects that variables are moving in positive direction in comparison to actual value. This

indicates that firms are increasing their expenditures on the Amitsar. Hence, Sygenta at least

needs to make expenditures equivalent to mean value in order to expand and establish its

business strongly in USA.

2.4 Calculation of quartile, percentile and correlation

Table 3: Calculation of quartile and percentile

Quartile 1 20.2 percentile 25 20.2

Quartile 2 24.44 percentile 50 24.44

Quartile 3 47.38 percentile 75 47.38

Interpretation

Quartile and percentile- It is a statistical tool that divide entire data in to several parts. It can be

said that quartile is extension of median as a statistical tool. Median divide data set in to two

parts but quartile divide data in to four parts (Black, 2006). Hence, pattern in the specific

variable can be analyzed in proper manner and all moves will be come in light of research

analyst. Hence, it can be said that by using this tool data analysis can be done in proper manner.

Quartile and percentile both are same things and only method of calculation is different in both

cases. Here it can be seen that quartile value is continuously increasing and value in question

table is also increasing. Thus, it can be said that firm needs to increase its annual expenses on

Amitsar consistently.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

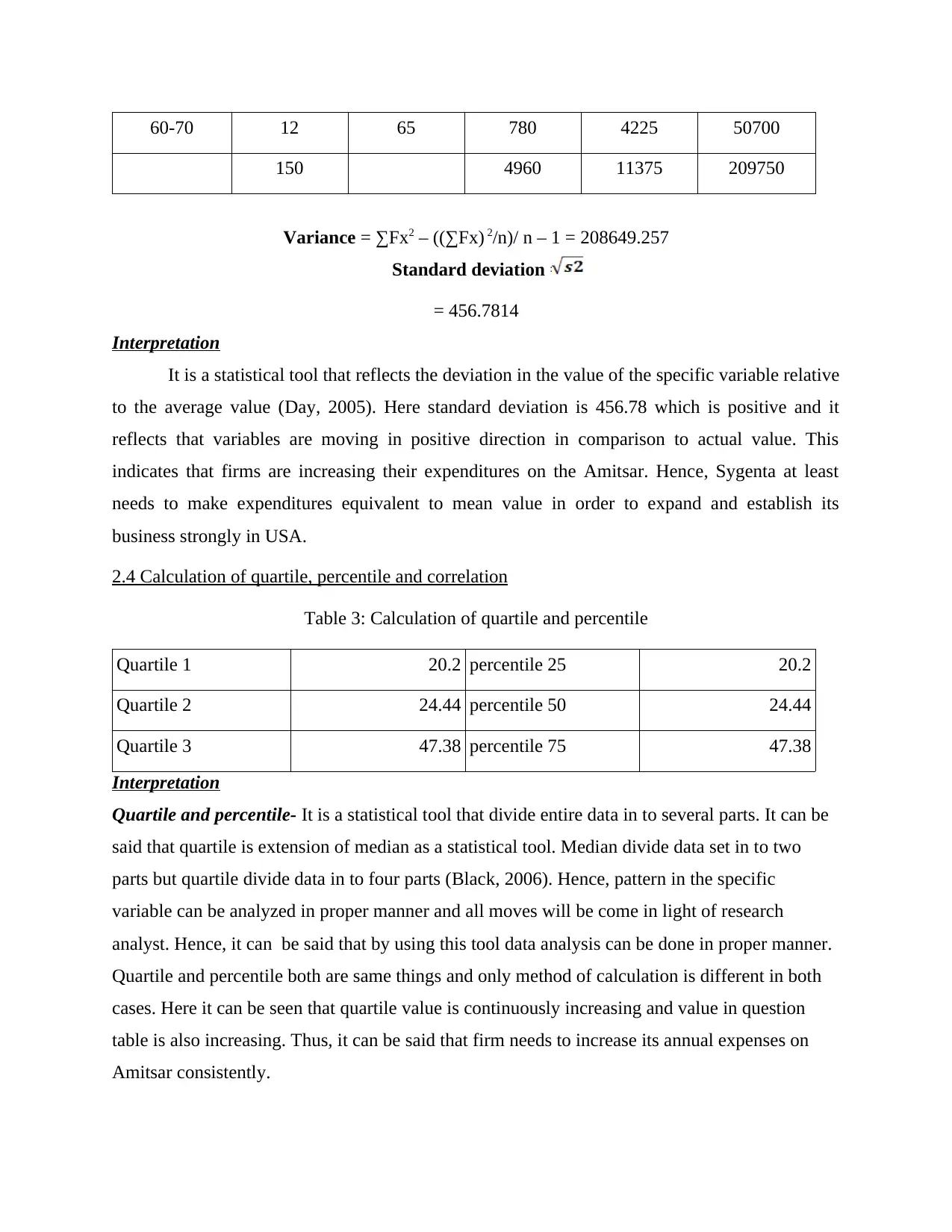

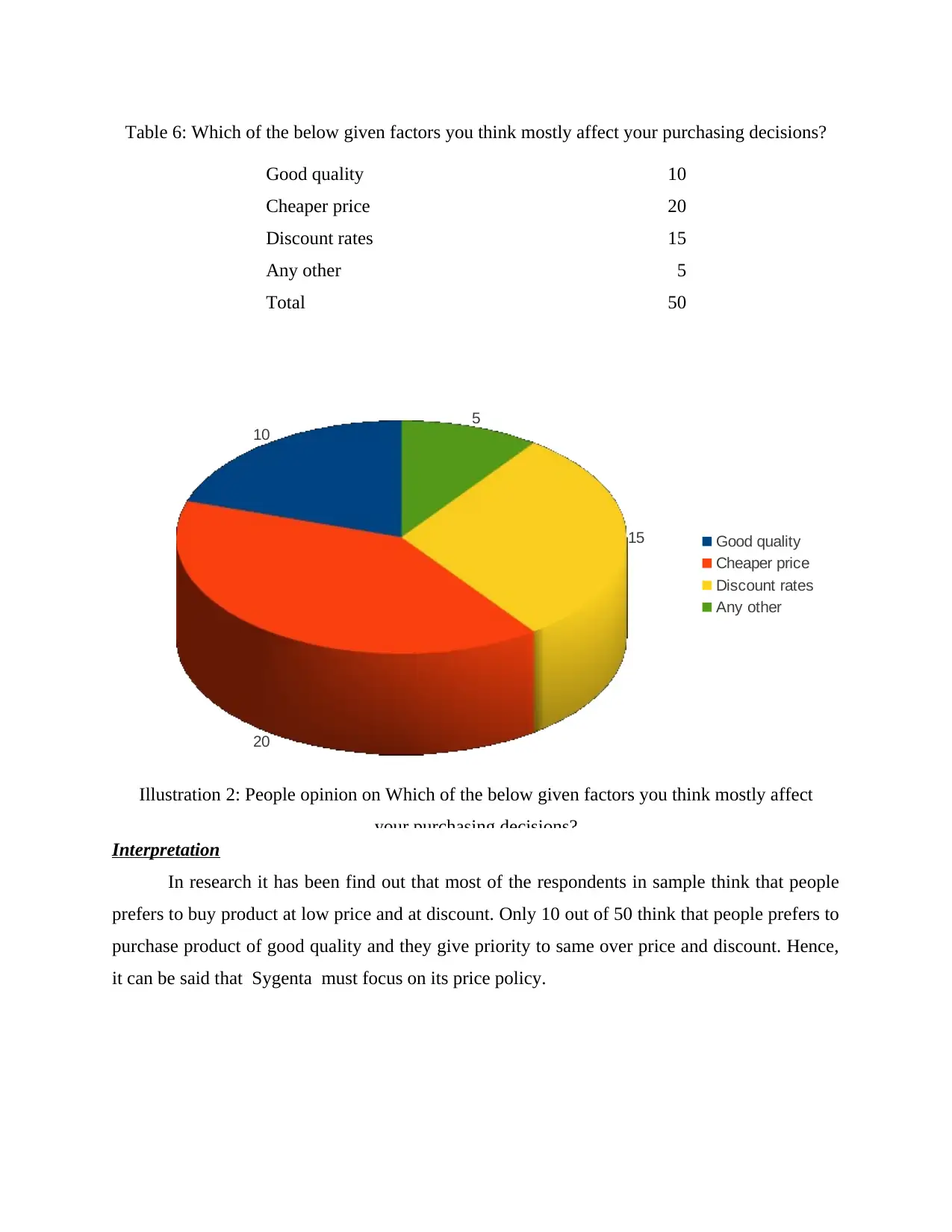

Table 4: Calculation of correlation

Particular Sales Units (£’m) Profits (£’m)

Sales (Units) (£’m) 1 0.888030143

Profits (£’m) 0.888030143 1

Interpretation

Correlation indicate the relationship between two variables sales and profit. Here, value

of correlation is one and this reflects that firm is earning entire profit only through sales and

there is no other source of income for Sygenta. Value of correlation always remain in range of -

1,0 and +1 (Goldberg, Kercheval and Lee, 2005). If value of correlation is zero then it means

that there is no correlation between the values. Similarly if value is in range of -1 and 0 then it

means that two variables are inversely interrelated to each other. In case of correlation between 0

to +1 vice verse happen. Hence, it is also very important statistical tool for the firm.

TASK 3

3.1 Graphic representation of collected data

Table 5: Sales, cost and profit data

Year Sales (£’000) Cost (£'000) Profit (£’000)

2005 270 200 70

2006 310 220 90

2007 320 220 100

2008 400 250 150

2009 380 250 130

2010 350 240 110

2011 330 220 110

2012 330 230 100

2013 340 230 110

2014 480 240 140

Particular Sales Units (£’m) Profits (£’m)

Sales (Units) (£’m) 1 0.888030143

Profits (£’m) 0.888030143 1

Interpretation

Correlation indicate the relationship between two variables sales and profit. Here, value

of correlation is one and this reflects that firm is earning entire profit only through sales and

there is no other source of income for Sygenta. Value of correlation always remain in range of -

1,0 and +1 (Goldberg, Kercheval and Lee, 2005). If value of correlation is zero then it means

that there is no correlation between the values. Similarly if value is in range of -1 and 0 then it

means that two variables are inversely interrelated to each other. In case of correlation between 0

to +1 vice verse happen. Hence, it is also very important statistical tool for the firm.

TASK 3

3.1 Graphic representation of collected data

Table 5: Sales, cost and profit data

Year Sales (£’000) Cost (£'000) Profit (£’000)

2005 270 200 70

2006 310 220 90

2007 320 220 100

2008 400 250 150

2009 380 250 130

2010 350 240 110

2011 330 220 110

2012 330 230 100

2013 340 230 110

2014 480 240 140

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Illustration 1: Chart on sales, cost and profit data

Interpretation

On analysis of data it can be seen that sales of the firm fluctuating continuously and due

to this reason cost and profit of the firm also changes year to year. This happens due to

fluctuation in economic trade cycle. Hence, firm needs to follow a cautious approach in its

business.

Interpretation

On analysis of data it can be seen that sales of the firm fluctuating continuously and due

to this reason cost and profit of the firm also changes year to year. This happens due to

fluctuation in economic trade cycle. Hence, firm needs to follow a cautious approach in its

business.

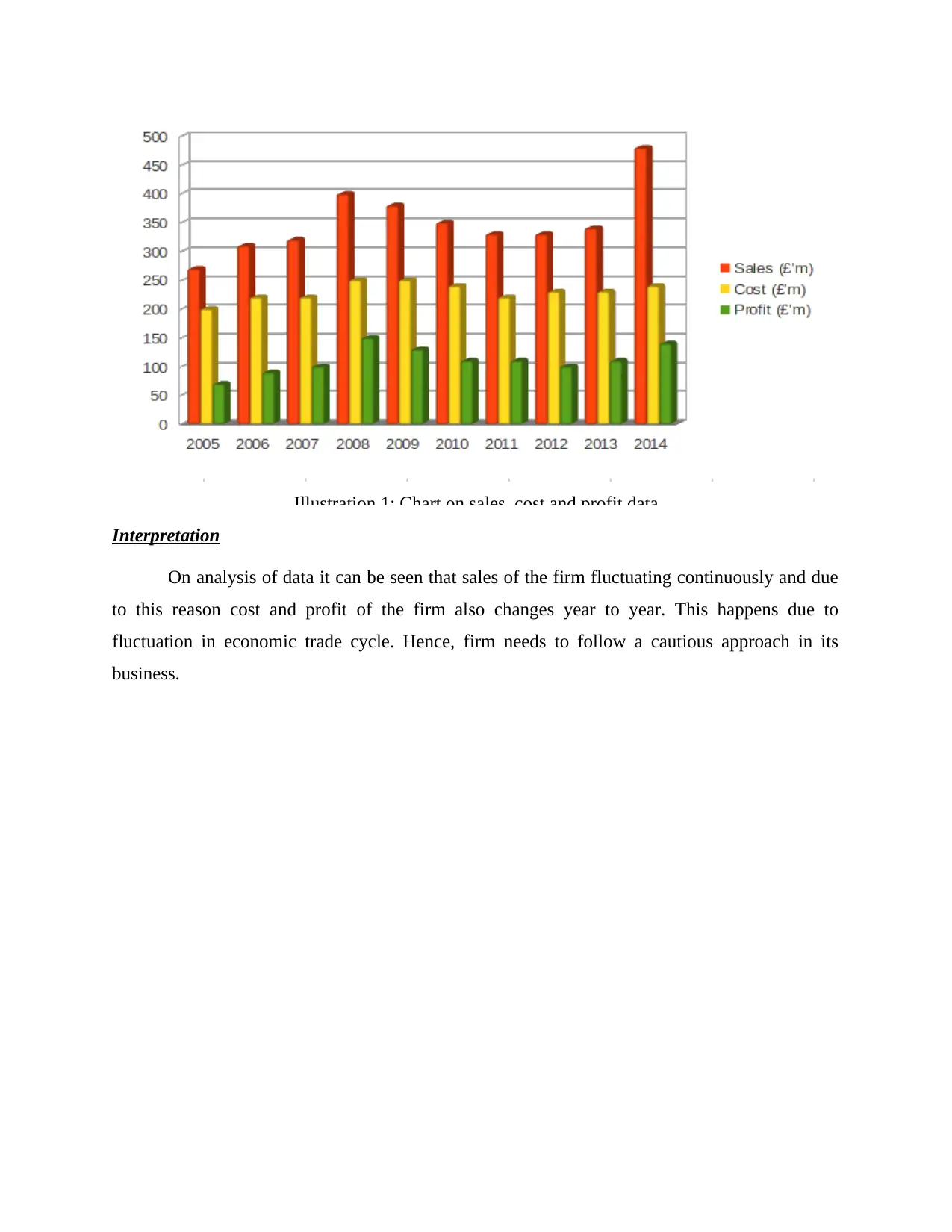

Table 6: Which of the below given factors you think mostly affect your purchasing decisions?

Good quality 10

Cheaper price 20

Discount rates 15

Any other 5

Total 50

Interpretation

In research it has been find out that most of the respondents in sample think that people

prefers to buy product at low price and at discount. Only 10 out of 50 think that people prefers to

purchase product of good quality and they give priority to same over price and discount. Hence,

it can be said that Sygenta must focus on its price policy.

10

20

15

5

Good quality

Cheaper price

Discount rates

Any other

Illustration 2: People opinion on Which of the below given factors you think mostly affect

your purchasing decisions?

Good quality 10

Cheaper price 20

Discount rates 15

Any other 5

Total 50

Interpretation

In research it has been find out that most of the respondents in sample think that people

prefers to buy product at low price and at discount. Only 10 out of 50 think that people prefers to

purchase product of good quality and they give priority to same over price and discount. Hence,

it can be said that Sygenta must focus on its price policy.

10

20

15

5

Good quality

Cheaper price

Discount rates

Any other

Illustration 2: People opinion on Which of the below given factors you think mostly affect

your purchasing decisions?

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.