Impact of IFRS on Business Performance

VerifiedAdded on 2020/03/23

|18

|4533

|97

AI Summary

This assignment examines the impact of the International Financial Reporting Standards (IFRS) on business performance. It requires students to analyze various research papers and case studies of companies like Nestle, Bellamy's Organic, and Devondale Murray Goulburn, which have adopted IFRS. The analysis should focus on how IFRS adoption has affected these companies' financial reporting practices, transparency, comparability, and ultimately, their overall performance. Students are also expected to discuss the challenges and benefits associated with IFRS implementation.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

Accounting in Australian Dairy Companies

Name of the Student:

Name of the University:

Author Note:

Accounting in Australian Dairy Companies

Name of the Student:

Name of the University:

Author Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

Table of Contents

1.0 Introduction:.........................................................................................................................2

1.1 Definitions and key concepts:...............................................................................................2

1.1.2. The main accounting regulatory in Australia-AASB:...........................................................2

1.1.3. International Financial Reporting Standards:........................................................................3

1.1.4. Dairy Industry in Australia:...................................................................................................3

1.2 Brief background including professional context:.....................................................................4

1.3 Literature review:.......................................................................................................................5

1.3.1. Presence of various types of commercial organisations in Australia:...............................5

1.3.2.Accounting in Australia’s dairy companies:.......................................................................6

1.3.3. Difference between IFRS and AASB:...............................................................................8

1.3.4. Problems caused due to multiple accounting standards:...................................................8

1.4. Research aim and objectives:..................................................................................................10

1.5. Research questions:................................................................................................................10

2.Methods:.....................................................................................................................................11

2.1. General approach:...................................................................................................................11

2.2 Population and Sampling:........................................................................................................11

2.3. Analytical Approach:..............................................................................................................11

3.0. Results:...................................................................................................................................12

Discussion and Conclusion:...........................................................................................................13

Table of Contents

1.0 Introduction:.........................................................................................................................2

1.1 Definitions and key concepts:...............................................................................................2

1.1.2. The main accounting regulatory in Australia-AASB:...........................................................2

1.1.3. International Financial Reporting Standards:........................................................................3

1.1.4. Dairy Industry in Australia:...................................................................................................3

1.2 Brief background including professional context:.....................................................................4

1.3 Literature review:.......................................................................................................................5

1.3.1. Presence of various types of commercial organisations in Australia:...............................5

1.3.2.Accounting in Australia’s dairy companies:.......................................................................6

1.3.3. Difference between IFRS and AASB:...............................................................................8

1.3.4. Problems caused due to multiple accounting standards:...................................................8

1.4. Research aim and objectives:..................................................................................................10

1.5. Research questions:................................................................................................................10

2.Methods:.....................................................................................................................................11

2.1. General approach:...................................................................................................................11

2.2 Population and Sampling:........................................................................................................11

2.3. Analytical Approach:..............................................................................................................11

3.0. Results:...................................................................................................................................12

Discussion and Conclusion:...........................................................................................................13

2ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

References:....................................................................................................................................15

1.0 Introduction:

1.1 Definitions and key concepts:

1.1.1 Financial accounting:

Gregory, Uys and Gregory(2014) defines accounting as the systematic process of

recording, reporting and analyzing financial transactions in the business organizations. The

finance departments and the apex management bodies of the organizations then analyze the

financial transactions.

1.1.2. The main accounting regulatory in Australia-AASB:

The Australian Accounting Standards Board(AASB) is the body of Australian

Government which develops and regulates financial reporting in all the public and private

companies within Australia. Its jurisdiction applies to all the companies including the dairy

companies. The financial accounting policies laid down by the Australian Accounting Standrads

Board(AASB) are legally binding on the entities under the Corporations Act 2001, state and

central government bodies of Australia, private companies, public companies and even non-

profit making organisations in Australia. The AASB 1053 Application of Tiers of Australian

Accounting Standards establishes two tiers of accounting for making general purpose accounting

statements(aasb.gov.au., 2017) The Tier 1 incorporate the international Financial Reporting

Standards(IFRS) including the interpretations of IFRS. The IFRS rules are followed by

paragraphs which mention the applicability of IFRS according to the Australian standard

References:....................................................................................................................................15

1.0 Introduction:

1.1 Definitions and key concepts:

1.1.1 Financial accounting:

Gregory, Uys and Gregory(2014) defines accounting as the systematic process of

recording, reporting and analyzing financial transactions in the business organizations. The

finance departments and the apex management bodies of the organizations then analyze the

financial transactions.

1.1.2. The main accounting regulatory in Australia-AASB:

The Australian Accounting Standards Board(AASB) is the body of Australian

Government which develops and regulates financial reporting in all the public and private

companies within Australia. Its jurisdiction applies to all the companies including the dairy

companies. The financial accounting policies laid down by the Australian Accounting Standrads

Board(AASB) are legally binding on the entities under the Corporations Act 2001, state and

central government bodies of Australia, private companies, public companies and even non-

profit making organisations in Australia. The AASB 1053 Application of Tiers of Australian

Accounting Standards establishes two tiers of accounting for making general purpose accounting

statements(aasb.gov.au., 2017) The Tier 1 incorporate the international Financial Reporting

Standards(IFRS) including the interpretations of IFRS. The IFRS rules are followed by

paragraphs which mention the applicability of IFRS according to the Australian standard

3ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

accounting procedure which is suited to the Australian industrial sector. Publicly accounting

profit making organisations are required to comply with tier 1 and follow IFRS. Tier 2 interprets

the first tier with measurements, presentations and requirements of tier 1. The members of the

Institute of Chartered Accountants in Australia, Certified Public Accountants and the Institute of

Public Accountants are empowered to take all steps to ensure that business entities within

Australia comply with the AASB norms.

1.1.3. International Financial Reporting Standards:

The International Financial Reporting Standards(IFRS) are the financial accounting

standards issued by the International Accounting Standards Board(IASB) to provide a common

layout of accounting standards for the companies to follow all around the world. These

internationally accepted accounting principles are very helpful to companies all around the

world, especially the multinational companies that are able to record the financial transactions of

their offices located in multiple location following one single accounting framework(IFRS.,

2017). The main elements dealt with by IFRS are assets, liabilities, equities, revenue and

expenses.

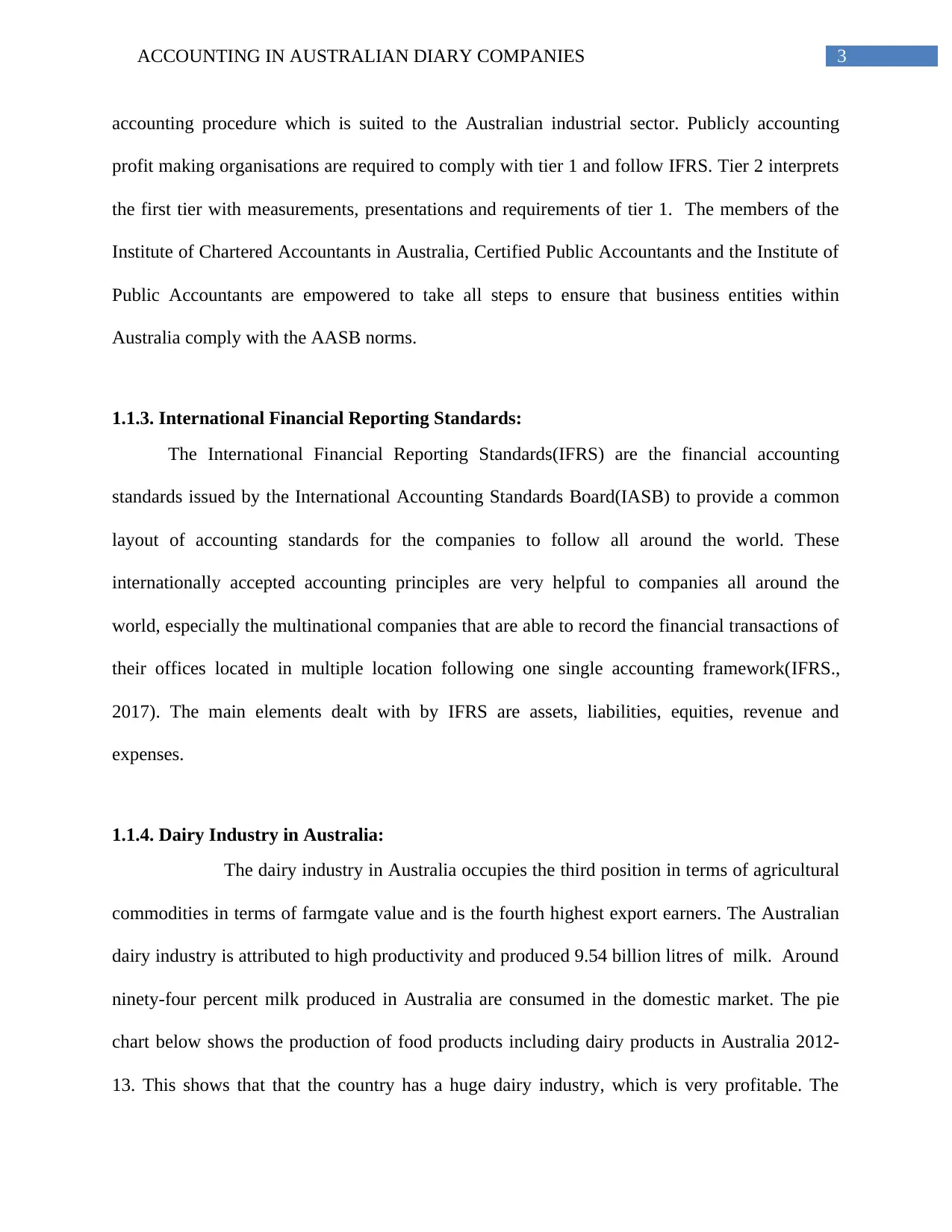

1.1.4. Dairy Industry in Australia:

The dairy industry in Australia occupies the third position in terms of agricultural

commodities in terms of farmgate value and is the fourth highest export earners. The Australian

dairy industry is attributed to high productivity and produced 9.54 billion litres of milk. Around

ninety-four percent milk produced in Australia are consumed in the domestic market. The pie

chart below shows the production of food products including dairy products in Australia 2012-

13. This shows that that the country has a huge dairy industry, which is very profitable. The

accounting procedure which is suited to the Australian industrial sector. Publicly accounting

profit making organisations are required to comply with tier 1 and follow IFRS. Tier 2 interprets

the first tier with measurements, presentations and requirements of tier 1. The members of the

Institute of Chartered Accountants in Australia, Certified Public Accountants and the Institute of

Public Accountants are empowered to take all steps to ensure that business entities within

Australia comply with the AASB norms.

1.1.3. International Financial Reporting Standards:

The International Financial Reporting Standards(IFRS) are the financial accounting

standards issued by the International Accounting Standards Board(IASB) to provide a common

layout of accounting standards for the companies to follow all around the world. These

internationally accepted accounting principles are very helpful to companies all around the

world, especially the multinational companies that are able to record the financial transactions of

their offices located in multiple location following one single accounting framework(IFRS.,

2017). The main elements dealt with by IFRS are assets, liabilities, equities, revenue and

expenses.

1.1.4. Dairy Industry in Australia:

The dairy industry in Australia occupies the third position in terms of agricultural

commodities in terms of farmgate value and is the fourth highest export earners. The Australian

dairy industry is attributed to high productivity and produced 9.54 billion litres of milk. Around

ninety-four percent milk produced in Australia are consumed in the domestic market. The pie

chart below shows the production of food products including dairy products in Australia 2012-

13. This shows that that the country has a huge dairy industry, which is very profitable. The

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

demand for milk production is so high in Australia that the country has to import milk products

from other countries. The industry has become profitable and extremely competitive. Three big

diary companies in Australia are Nestle, Australia, Murray Goulburn Cooperative Company

Limited and Bellamy, the main company of the study.

Figure 1. Pie chart showing food production in Australia 2012-13

(agriculture.gov.au, 2017)

1.2 Brief background including professional context:

The background of the study lies in the accounting practices and issues faced by the dairy

companies in Australia. These practices are impacted very several professional contexts like laws

regarding the accounting standards especially pertaining to the dairy industry. The dairy

industries in Australia are the third largest agricultural industry in the country with a gross value

over $4 billion. Australian dairy companies produce high quality dairy products and export a

robust quantity of dairy products annually. This shows that the companies engage in a robust

amount of financial transactions, which makes accounting practices important part of the daily

operations. The paper takes into account the accounting practices and issues taking Bellamy as

demand for milk production is so high in Australia that the country has to import milk products

from other countries. The industry has become profitable and extremely competitive. Three big

diary companies in Australia are Nestle, Australia, Murray Goulburn Cooperative Company

Limited and Bellamy, the main company of the study.

Figure 1. Pie chart showing food production in Australia 2012-13

(agriculture.gov.au, 2017)

1.2 Brief background including professional context:

The background of the study lies in the accounting practices and issues faced by the dairy

companies in Australia. These practices are impacted very several professional contexts like laws

regarding the accounting standards especially pertaining to the dairy industry. The dairy

industries in Australia are the third largest agricultural industry in the country with a gross value

over $4 billion. Australian dairy companies produce high quality dairy products and export a

robust quantity of dairy products annually. This shows that the companies engage in a robust

amount of financial transactions, which makes accounting practices important part of the daily

operations. The paper takes into account the accounting practices and issues taking Bellamy as

5ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

an example. The accounting policies followed in the dairy companies in Australia differ with

reference to the controlling bodies. Bellamy which is an Australian dairy producing company

prepares its financial statements in accordance to the guide lines of the Australian Accounting

Standard Board(AASB). Nestle Australia, which is the Australian subsidiary of Nestle follows

International Financial Reporting Standards(IFRS) to conduct financial reporting in all its

markets. Murray Goulburn Cooperative Company Limited follows IFRS in accordance to the

Australian standards. This multiplicity of accounting practices creates issues and makes the

accounting in the dairy companies in Australia complex. The disparity becomes more intense

during recording of financial transactions between these companies following different

accounting procedures. They also face a certain issues owing to their large scale operations and

complexity of the nature of the transactions.

1.3 Literature review:

1.3.1. Presence of various types of commercial organisations in Australia:

According to Estrin, Mickiewicz and Stephan, U. (2013), the economy of Australia is one

of the most developed markets in the world with a GDP of AUD $ 8.9 trillion. The country is

one of the largest mixed markets with presence of large number of commercial and non-

commercial organisations. Fowler(2013) states that this economic prosperity of Australia has

resulted in presence of a large number of commercial organisations. There are Australian public

companies, private limited companies, partnerships, joint ventures and sole proprietorships.

There are large number of government companies owned by central and state governments.

According to Shi et al.(2014) the Australian market has also attracted a large number of

multinational companies like Nestle from other countries. Australia also has its indigenous

multinational companies operating in several economies. The presence of these companies

an example. The accounting policies followed in the dairy companies in Australia differ with

reference to the controlling bodies. Bellamy which is an Australian dairy producing company

prepares its financial statements in accordance to the guide lines of the Australian Accounting

Standard Board(AASB). Nestle Australia, which is the Australian subsidiary of Nestle follows

International Financial Reporting Standards(IFRS) to conduct financial reporting in all its

markets. Murray Goulburn Cooperative Company Limited follows IFRS in accordance to the

Australian standards. This multiplicity of accounting practices creates issues and makes the

accounting in the dairy companies in Australia complex. The disparity becomes more intense

during recording of financial transactions between these companies following different

accounting procedures. They also face a certain issues owing to their large scale operations and

complexity of the nature of the transactions.

1.3 Literature review:

1.3.1. Presence of various types of commercial organisations in Australia:

According to Estrin, Mickiewicz and Stephan, U. (2013), the economy of Australia is one

of the most developed markets in the world with a GDP of AUD $ 8.9 trillion. The country is

one of the largest mixed markets with presence of large number of commercial and non-

commercial organisations. Fowler(2013) states that this economic prosperity of Australia has

resulted in presence of a large number of commercial organisations. There are Australian public

companies, private limited companies, partnerships, joint ventures and sole proprietorships.

There are large number of government companies owned by central and state governments.

According to Shi et al.(2014) the Australian market has also attracted a large number of

multinational companies like Nestle from other countries. Australia also has its indigenous

multinational companies operating in several economies. The presence of these companies

6ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

results in more products and higher employment generation in the country. Smith (2017)

contradicts this and state that the multiplicity of the types of companies and accounting standards

make accounting in the dairy companies extremely complex. This hinders dynamic decision

making process based on the accounting statements.

1.3.2.Accounting in Australia’s dairy companies:

Klychova, Faskhutdinova & Sadrieva(2014) states that accounting of dairy companies is

very complex and robust due to the large number of operations. The dairy companies obtain raw

materials like milk from farmers, fixed assets like machinery and buildings, employ a large

number of employees and enter into business transactions with large number of customers. This

shows that the volume of financial transactions is huge. As pointed out by Shi et al.(2014),

Australia’s booming and highly profitable dairy market attracts government, public and private

companies. The dairy market of Australia also has presence of multinational diary companies

like Nestle, the world biggest food manufacturer and seller based in Switzerland. All these

companies follow different processes of financial reporting though all of them confirm to IFRS.

Bellamy is an Australian multinational public limited company which manufactures food and

beverage. Its follows a financial accounting standard laid by AASB while Nestle follows IFRS

norms and does not follow AASB. Murray Goulburn Cooperative Company Limited is the

largest processor of milk in Australia and follows a cooperative format. The cooperative follows

IFRS policies and gives it preference in accounting over AASB. This analysis shows that

financial reporting in Australian dairy companies in not uniform and varies from company to

company. While delving into this differences in accounting policies used by different companies

Barkemeyer, Preuss and Lee(2015) state that multinational companies maintain uniform

financial reporting procedure to maintain transparency and clarity while recording financial

results in more products and higher employment generation in the country. Smith (2017)

contradicts this and state that the multiplicity of the types of companies and accounting standards

make accounting in the dairy companies extremely complex. This hinders dynamic decision

making process based on the accounting statements.

1.3.2.Accounting in Australia’s dairy companies:

Klychova, Faskhutdinova & Sadrieva(2014) states that accounting of dairy companies is

very complex and robust due to the large number of operations. The dairy companies obtain raw

materials like milk from farmers, fixed assets like machinery and buildings, employ a large

number of employees and enter into business transactions with large number of customers. This

shows that the volume of financial transactions is huge. As pointed out by Shi et al.(2014),

Australia’s booming and highly profitable dairy market attracts government, public and private

companies. The dairy market of Australia also has presence of multinational diary companies

like Nestle, the world biggest food manufacturer and seller based in Switzerland. All these

companies follow different processes of financial reporting though all of them confirm to IFRS.

Bellamy is an Australian multinational public limited company which manufactures food and

beverage. Its follows a financial accounting standard laid by AASB while Nestle follows IFRS

norms and does not follow AASB. Murray Goulburn Cooperative Company Limited is the

largest processor of milk in Australia and follows a cooperative format. The cooperative follows

IFRS policies and gives it preference in accounting over AASB. This analysis shows that

financial reporting in Australian dairy companies in not uniform and varies from company to

company. While delving into this differences in accounting policies used by different companies

Barkemeyer, Preuss and Lee(2015) state that multinational companies maintain uniform

financial reporting procedure to maintain transparency and clarity while recording financial

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

transactions taking place in the geographically distributed branches. For example, Nestle

Australia is the Australian subsidiary, which is present in more than a hundred countries across

Europe, North America, South America, Asia, Africa and Oceania. The company follows

International Financial Reporting System in its accounting procedures so that it can maintain

uniform system of accounting in its geographically dispersed branches(nestle.com., 2017).

Robinson, Stomberg and Towery(2015) analyses this accounting procedures followed by Nestle

and state that this trend of IFRS is followed by most of the multinational companies in the world.

It can be pointed Bellamy too is a multinational company with its headquarters in Launceston,

Australia and listed on the Australian Securities Exchange. The company has a very limited

international presence compared to Nestle and is presented in China, Hong Kong, Malaysia,

New Zealand, Singapore and Vietnam outside Australia(bellamysorganic.com.au., 2017). Frias‐

Aceituno, Rodriguez‐Ariza and Garcia‐Sanchez(2013) point out that this shows it is more

appropriate for Bellamy to follows Australian standards of accounting because its main market is

concentrated within Australia with very limited internal presence compared to the global

presence of Nestle. Murray Goulburn Cooperative is a the largest cooperative in the dairy

industry in Australia and finds it more appropriate to use IFRS(mgc.com.au., 2017).

Andrews(2014) points out that since these cooperatives fall under tier 1 of AASB, they follow

IFRS. Thus, it can be inferred from this discussion that there are different types of entities in the

Australian dairy market and they follow different financial accounting principles. The financial

reporting norms depend on several factors like their type(public or multinational) and size of

operations.

transactions taking place in the geographically distributed branches. For example, Nestle

Australia is the Australian subsidiary, which is present in more than a hundred countries across

Europe, North America, South America, Asia, Africa and Oceania. The company follows

International Financial Reporting System in its accounting procedures so that it can maintain

uniform system of accounting in its geographically dispersed branches(nestle.com., 2017).

Robinson, Stomberg and Towery(2015) analyses this accounting procedures followed by Nestle

and state that this trend of IFRS is followed by most of the multinational companies in the world.

It can be pointed Bellamy too is a multinational company with its headquarters in Launceston,

Australia and listed on the Australian Securities Exchange. The company has a very limited

international presence compared to Nestle and is presented in China, Hong Kong, Malaysia,

New Zealand, Singapore and Vietnam outside Australia(bellamysorganic.com.au., 2017). Frias‐

Aceituno, Rodriguez‐Ariza and Garcia‐Sanchez(2013) point out that this shows it is more

appropriate for Bellamy to follows Australian standards of accounting because its main market is

concentrated within Australia with very limited internal presence compared to the global

presence of Nestle. Murray Goulburn Cooperative is a the largest cooperative in the dairy

industry in Australia and finds it more appropriate to use IFRS(mgc.com.au., 2017).

Andrews(2014) points out that since these cooperatives fall under tier 1 of AASB, they follow

IFRS. Thus, it can be inferred from this discussion that there are different types of entities in the

Australian dairy market and they follow different financial accounting principles. The financial

reporting norms depend on several factors like their type(public or multinational) and size of

operations.

8ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

1.3.3. Difference between IFRS and AASB:

The Australian Accounting Standards Board(AASB) sets financial reporting norms for

the companies in Australia while confirming to the International Financial Reporting

System(IFRS). There lies differences between these two standards in spite of the fact that the

former sets policies according to the guidance of the latter. The first point of difference between

the IFRS and the AASB lies in the procedure the companies require to follow while presenting

the financial statements. The IFRS requires the companies to present income statement, balnce

sheet, cash flow statement and statement of changes of equity while the AASB does not

prescribe the fourth statement. The second point of difference between the two standards lies in

recording of inventories. The IFRS follow several methods while calculating of inventories like

LIFO(last in first out) and FIFO(first in first out) while AASB does not allow LIFO method

while calculating inventories. The third point of difference between IFRS and AASB lies while

preparation of income statement. The IFRS, since followed globally permits changing of

accounting policies to incorporate the legal frameworks of the countries while the AASB permits

changing of accounting procedures only if there is a need to incorporate financial transactions of

another country. This analysis shows that the two accounting standards follow different policies

though the AASB has to comply with the IFRS.

1.3.4. Problems caused due to multiple accounting standards:

The above discussion points out that the Australian companies like Bellamy and Nestle

Australia follow AASB and IFRS respectively. It also points out that there exists marked

differences in the accounting treatments according to the two standards namely, AASB and

IFRS. According to Young & Zeng (2015) the first problem due this multiplicity of accounting

standards is lack of comparability. The multinational companies like Nestle are present in

1.3.3. Difference between IFRS and AASB:

The Australian Accounting Standards Board(AASB) sets financial reporting norms for

the companies in Australia while confirming to the International Financial Reporting

System(IFRS). There lies differences between these two standards in spite of the fact that the

former sets policies according to the guidance of the latter. The first point of difference between

the IFRS and the AASB lies in the procedure the companies require to follow while presenting

the financial statements. The IFRS requires the companies to present income statement, balnce

sheet, cash flow statement and statement of changes of equity while the AASB does not

prescribe the fourth statement. The second point of difference between the two standards lies in

recording of inventories. The IFRS follow several methods while calculating of inventories like

LIFO(last in first out) and FIFO(first in first out) while AASB does not allow LIFO method

while calculating inventories. The third point of difference between IFRS and AASB lies while

preparation of income statement. The IFRS, since followed globally permits changing of

accounting policies to incorporate the legal frameworks of the countries while the AASB permits

changing of accounting procedures only if there is a need to incorporate financial transactions of

another country. This analysis shows that the two accounting standards follow different policies

though the AASB has to comply with the IFRS.

1.3.4. Problems caused due to multiple accounting standards:

The above discussion points out that the Australian companies like Bellamy and Nestle

Australia follow AASB and IFRS respectively. It also points out that there exists marked

differences in the accounting treatments according to the two standards namely, AASB and

IFRS. According to Young & Zeng (2015) the first problem due this multiplicity of accounting

standards is lack of comparability. The multinational companies like Nestle are present in

9ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

multiple countries like Australia with their individual accounting standards. This prevents these

companies from comparing between the financial transactions related to the companies taking

place in different markets. This forces these companies to follow IFRS over the accounting

standards like AASB prevailing in different countries like Australia.

Wang(2014) further strengthens the claims of Young and Zeng pointing out the second

issue caused due to multiple accounting standards. They point out that the professionals like the

chief financial officers and the financial managers in the multinational companies require to

analyze the financial statements like profit and loss accounts and balance sheets to take major

business decisions. Following of multiple accounting standards makes this comparison difficult

due to treatment of similar items like inventory differently according different accounting

standards. Christensen et al(2015) supports the claims of these three authors and state that the

multiplicity of accounting standards impacts the quality of accounting and hinders the top

management bodies in the companies from making accurate decisions.

Macve(2015) points out to the third impediment caused due to use of multiple accounting

standards which is measuring of historical costs. First of all historical costs consider the initial

prices at which assets were acquired by the companies. The historical cost method does not

recognise the change in the value of the asset and maintenance costs incurred to maintain the

assets. Some accounting standards like IFRS considers historical costs while other standards do

not. This results in inappropriate accounting and prevents the top management bodies from

taking appropriate business decisions based on the faulty accounting systems. Munoz, Zhao and

Yang(2017) in support of these claim state that following multiple accounting standards and their

various accounting treatments leaves spaces for mistakes and frauds which is the fourth issue.

It helps the companies in suppressing financial transactions intentionally by taking advantage of

multiple countries like Australia with their individual accounting standards. This prevents these

companies from comparing between the financial transactions related to the companies taking

place in different markets. This forces these companies to follow IFRS over the accounting

standards like AASB prevailing in different countries like Australia.

Wang(2014) further strengthens the claims of Young and Zeng pointing out the second

issue caused due to multiple accounting standards. They point out that the professionals like the

chief financial officers and the financial managers in the multinational companies require to

analyze the financial statements like profit and loss accounts and balance sheets to take major

business decisions. Following of multiple accounting standards makes this comparison difficult

due to treatment of similar items like inventory differently according different accounting

standards. Christensen et al(2015) supports the claims of these three authors and state that the

multiplicity of accounting standards impacts the quality of accounting and hinders the top

management bodies in the companies from making accurate decisions.

Macve(2015) points out to the third impediment caused due to use of multiple accounting

standards which is measuring of historical costs. First of all historical costs consider the initial

prices at which assets were acquired by the companies. The historical cost method does not

recognise the change in the value of the asset and maintenance costs incurred to maintain the

assets. Some accounting standards like IFRS considers historical costs while other standards do

not. This results in inappropriate accounting and prevents the top management bodies from

taking appropriate business decisions based on the faulty accounting systems. Munoz, Zhao and

Yang(2017) in support of these claim state that following multiple accounting standards and their

various accounting treatments leaves spaces for mistakes and frauds which is the fourth issue.

It helps the companies in suppressing financial transactions intentionally by taking advantage of

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

certain accounting standards and breach IFRS rules. Thus, multiplicity of accounting standards

leads the companies from resorting to fraudulent accounting practices to derive undue

advantages like abating paying of taxes.

1.4. Research aim and objectives:

The aim of the research is to study the different types of companies like public and

multinational companies present in Australia particularly with reference to the diary industry.

The paper further aims to delve into their accounting practices according to two standards

prevailing in Australia namely, the International Financial Reporting System(IFRS) and the

Australian Accounting Standards Board(AASB). The researcher then went onto study the

difference between these two standards based on companies following them. Then finally, the

researcher pointed out to the issues caused due to following different accounting standards in

different company.

1.5. Research questions:

The following are the research questions which the paper has addressed:

1. What are the different types of companies functioning in Australia particularly with reference

to the dairy industry?

2. What are the two types of accounting standards prevailing in the Australian dairy companies?

4. How are the AASB and IFRS linked?

5. What are the differences in treatment of different accounting items like income as per these

two standards?

6. What are the main issues caused by using multiple accounting standards?

certain accounting standards and breach IFRS rules. Thus, multiplicity of accounting standards

leads the companies from resorting to fraudulent accounting practices to derive undue

advantages like abating paying of taxes.

1.4. Research aim and objectives:

The aim of the research is to study the different types of companies like public and

multinational companies present in Australia particularly with reference to the diary industry.

The paper further aims to delve into their accounting practices according to two standards

prevailing in Australia namely, the International Financial Reporting System(IFRS) and the

Australian Accounting Standards Board(AASB). The researcher then went onto study the

difference between these two standards based on companies following them. Then finally, the

researcher pointed out to the issues caused due to following different accounting standards in

different company.

1.5. Research questions:

The following are the research questions which the paper has addressed:

1. What are the different types of companies functioning in Australia particularly with reference

to the dairy industry?

2. What are the two types of accounting standards prevailing in the Australian dairy companies?

4. How are the AASB and IFRS linked?

5. What are the differences in treatment of different accounting items like income as per these

two standards?

6. What are the main issues caused by using multiple accounting standards?

11ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

2.Methods:

2.1. General approach:

The general approach followed while conducting the research is qualitative in nature. The

researcher has consulted several qualitative sources like books, articles and journals to gain

information on the topic and analyse them. The number of companies in Australia is so huge that

quantitative approach like surveys would have been inappropriate and not deemed fit. That is

why the researcher selected qualitative approach as the appropriate approach of data collection.

2.2 Population and Sampling:

The researcher has considered three companies present in Australia as the samples to

conduct the study. The three companies selected as samples for the study are Bellamy which is

multinational Australian dairy company, Murray Goulburn Cooperative which is a dairy

cooperative in Australia and Nestle Australia, the Australian arm of Nestle, the world’s largest

food manufacturer with its head office in Switzerland. This considering of three different types

of companies following different accounting standards has enabled the researcher to analyse their

financial reporting policies to bring the difference between AASB and IFRS.

2.3. Analytical Approach:

The researcher has followed qualitative analytical approach to conduct the research. He

has analysed the types of companies functioning in the Australian dairy sector and the two

accounting standards they follow namely, IFRS and AASB. This analytical approach is

appropriate because it has enabled detailed comparison between IFRS and AASB and the

problems caused due to this multiplicity of accounting standards.

2.Methods:

2.1. General approach:

The general approach followed while conducting the research is qualitative in nature. The

researcher has consulted several qualitative sources like books, articles and journals to gain

information on the topic and analyse them. The number of companies in Australia is so huge that

quantitative approach like surveys would have been inappropriate and not deemed fit. That is

why the researcher selected qualitative approach as the appropriate approach of data collection.

2.2 Population and Sampling:

The researcher has considered three companies present in Australia as the samples to

conduct the study. The three companies selected as samples for the study are Bellamy which is

multinational Australian dairy company, Murray Goulburn Cooperative which is a dairy

cooperative in Australia and Nestle Australia, the Australian arm of Nestle, the world’s largest

food manufacturer with its head office in Switzerland. This considering of three different types

of companies following different accounting standards has enabled the researcher to analyse their

financial reporting policies to bring the difference between AASB and IFRS.

2.3. Analytical Approach:

The researcher has followed qualitative analytical approach to conduct the research. He

has analysed the types of companies functioning in the Australian dairy sector and the two

accounting standards they follow namely, IFRS and AASB. This analytical approach is

appropriate because it has enabled detailed comparison between IFRS and AASB and the

problems caused due to this multiplicity of accounting standards.

12ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

3.0. Results:

The above analysis of the various types of companies functioning in the Australian

market particularly in the dairy market and the multiplicity of the accounting standards they

follow bring out certain important results. First, the Australian dairy market is extremely

profitable which has several types of organisations functioning and competing in it. The market

has also attracted multinational companies from other countries, which have made the market

even more competitive. It can also be pointed out that there are Australian companies, which

have ventured into foreign markets. Secondly, the companies function according to their own

business requirements and follow two different accounting standards within Australia namely,

IFRS and AASB. The IFRS and the AASB have their own ways of recording and reporting

financial statements even in case of similar items like presentation of income statements. Third,

these differences of treatments of accounting items lead the different companies in the Australian

dairy market to follow either of these standards. Finally, this following of different account

standards create several problems. First, the multiplicity of financial reporting processes based

on different accounting standards makes comparing of financial statements difficult. Secondly,

the professionals like the top managers of the companies face problems in analysing these

statements based on different accounting standards. This prevents them from making business

strategies based on these statements. Thirdly, the treatments of historical costs in different

accounting standards make accounting and their reporting extremely complex. Fourthly, this

multiplicity of accounting standards gives the companies scopes to resort to frauds like abating

taxes by suppressing certain transactions.

3.0. Results:

The above analysis of the various types of companies functioning in the Australian

market particularly in the dairy market and the multiplicity of the accounting standards they

follow bring out certain important results. First, the Australian dairy market is extremely

profitable which has several types of organisations functioning and competing in it. The market

has also attracted multinational companies from other countries, which have made the market

even more competitive. It can also be pointed out that there are Australian companies, which

have ventured into foreign markets. Secondly, the companies function according to their own

business requirements and follow two different accounting standards within Australia namely,

IFRS and AASB. The IFRS and the AASB have their own ways of recording and reporting

financial statements even in case of similar items like presentation of income statements. Third,

these differences of treatments of accounting items lead the different companies in the Australian

dairy market to follow either of these standards. Finally, this following of different account

standards create several problems. First, the multiplicity of financial reporting processes based

on different accounting standards makes comparing of financial statements difficult. Secondly,

the professionals like the top managers of the companies face problems in analysing these

statements based on different accounting standards. This prevents them from making business

strategies based on these statements. Thirdly, the treatments of historical costs in different

accounting standards make accounting and their reporting extremely complex. Fourthly, this

multiplicity of accounting standards gives the companies scopes to resort to frauds like abating

taxes by suppressing certain transactions.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

Discussion and Conclusion:

The above discussion can be concluded by saying that there are multiple types of

commercial organisations in Australia, particularly in the dairy market. These companies follow

two different accounting standards while carrying out financial reporting namely the

International Financial Reporting System or IFRS and the Australian Accounting Standard Board

or the AASB. The dairy market in Australia is very competitive and profitable owing to these

large numbers of companies. These companies follow different accounting standards like IFRS

and AASB while preparing and presenting their financial statements. This multiplicity of

accounting is dependent on various factors like the type of company and its size of business like

national or international. However, the diversity of the financial reporting creates a number of

issues for the companies and their top management bodies. Some of these problems are lack of

comparability and difficulty faced by the top management in analysing these financial

statements. These issues as a result impede appropriate decision making by the top management

of the companies. The following recommendations can be made to the companies in the light of

the above discussion:

1. It can recommended that the companies based in Australia especially the dairy operating

within the Australian market should abide by the Australian Accounting Standard Board norms

while financial reporting in accordance to IFRS. This will enable the government to monitor

their financial reporting more transparently and this would create their positive image before the

government. It would enable the government to provide them more facilities which would

ultimately boost the business of these companies.

2. It can also be recommended that the multinational companies which enter the market of

Australia to follow the AASB as well at least while reporting transactions pertaining to the

Australian market. This would help them to carry on and record transactions with the companies

Discussion and Conclusion:

The above discussion can be concluded by saying that there are multiple types of

commercial organisations in Australia, particularly in the dairy market. These companies follow

two different accounting standards while carrying out financial reporting namely the

International Financial Reporting System or IFRS and the Australian Accounting Standard Board

or the AASB. The dairy market in Australia is very competitive and profitable owing to these

large numbers of companies. These companies follow different accounting standards like IFRS

and AASB while preparing and presenting their financial statements. This multiplicity of

accounting is dependent on various factors like the type of company and its size of business like

national or international. However, the diversity of the financial reporting creates a number of

issues for the companies and their top management bodies. Some of these problems are lack of

comparability and difficulty faced by the top management in analysing these financial

statements. These issues as a result impede appropriate decision making by the top management

of the companies. The following recommendations can be made to the companies in the light of

the above discussion:

1. It can recommended that the companies based in Australia especially the dairy operating

within the Australian market should abide by the Australian Accounting Standard Board norms

while financial reporting in accordance to IFRS. This will enable the government to monitor

their financial reporting more transparently and this would create their positive image before the

government. It would enable the government to provide them more facilities which would

ultimately boost the business of these companies.

2. It can also be recommended that the multinational companies which enter the market of

Australia to follow the AASB as well at least while reporting transactions pertaining to the

Australian market. This would help them to carry on and record transactions with the companies

14ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

in Australia following AASB more transparently. As a result they would be able expand their

business by partnering with the resident companies in Australia which would lead to their

business growth.

in Australia following AASB more transparently. As a result they would be able expand their

business by partnering with the resident companies in Australia which would lead to their

business growth.

15ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

References:

Andrews, A. M. (2014). Survey of co-operative capital. Madison, WI: Filene Research Institute.

Australian Accounting Standards Board (AASB) - Home. (2017). Aasb.gov.au. Retrieved 24

September 2017, from http://www.aasb.gov.au/

Australian Food Statistics 2012-13. (2017). agriculture.gov.au. Retrieved 24 September 2017,

from http://www.

/SiteCollectionDocuments/ag-food/publications/food-stats/australian-food-

statistics-2012-13.pdf

Barkemeyer, R., Preuss, L., & Lee, L. (2015). On the effectiveness of private transnational

governance regimes—Evaluating corporate sustainability reporting according to the

Global Reporting Initiative. Journal of World Business, 50(2), 312-325.

Beatty, A., Liao, S., & Yu, J. J. (2013). The spillover effect of fraudulent financial reporting on

peer firms' investments. Journal of Accounting and Economics, 55(2), 183-205.

Chircop, J., Collins, D. W., & Hass, L. H. (2016). Accounting Comparability and Corporate

Innovative Efficiency.

Christensen, H. B., Lee, E., Walker, M., & Zeng, C. (2015). Incentives or standards: What

determines accounting quality changes around IFRS adoption?. European Accounting

Review, 24(1), 31-61.

Estrin, S., Mickiewicz, T., & Stephan, U. (2013). Entrepreneurship, social capital, and

institutions: Social and commercial entrepreneurship across nations. Entrepreneurship

theory and practice, 37(3), 479-504.

Fowler, A. (2013). Striking a balance: A guide to enhancing the effectiveness of non-

governmental organisations in international development. Routledge.

References:

Andrews, A. M. (2014). Survey of co-operative capital. Madison, WI: Filene Research Institute.

Australian Accounting Standards Board (AASB) - Home. (2017). Aasb.gov.au. Retrieved 24

September 2017, from http://www.aasb.gov.au/

Australian Food Statistics 2012-13. (2017). agriculture.gov.au. Retrieved 24 September 2017,

from http://www.

/SiteCollectionDocuments/ag-food/publications/food-stats/australian-food-

statistics-2012-13.pdf

Barkemeyer, R., Preuss, L., & Lee, L. (2015). On the effectiveness of private transnational

governance regimes—Evaluating corporate sustainability reporting according to the

Global Reporting Initiative. Journal of World Business, 50(2), 312-325.

Beatty, A., Liao, S., & Yu, J. J. (2013). The spillover effect of fraudulent financial reporting on

peer firms' investments. Journal of Accounting and Economics, 55(2), 183-205.

Chircop, J., Collins, D. W., & Hass, L. H. (2016). Accounting Comparability and Corporate

Innovative Efficiency.

Christensen, H. B., Lee, E., Walker, M., & Zeng, C. (2015). Incentives or standards: What

determines accounting quality changes around IFRS adoption?. European Accounting

Review, 24(1), 31-61.

Estrin, S., Mickiewicz, T., & Stephan, U. (2013). Entrepreneurship, social capital, and

institutions: Social and commercial entrepreneurship across nations. Entrepreneurship

theory and practice, 37(3), 479-504.

Fowler, A. (2013). Striking a balance: A guide to enhancing the effectiveness of non-

governmental organisations in international development. Routledge.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

Frias‐Aceituno, J. V., Rodriguez‐Ariza, L., & Garcia‐Sanchez, I. M. (2013). The role of the

board in the dissemination of integrated corporate social reporting. Corporate Social

Responsibility and Environmental Management, 20(4), 219-233.

Gregory, B., Uys, P. and Gregory, S., 2014. The role of instant feedback in improving student

understanding of basic accounting concepts. Rhetoric and Reality: Critical perspectives

on educational technology. Proceedings ascilite Dunedin, pp.634-637.

Home - Devondale Murray Goulburn. (2017). Mgc.com.au. Retrieved 24 September 2017, from

http://www.mgc.com.au/

Home. (2017). Bellamy's Organic. Retrieved 24 September 2017, from

https://www.bellamysorganic.com.au/

IFRS. (2017). Ifrs.org. Retrieved 24 September 2017, from http://www.ifrs.org/

Iyoha, F. O. (2014). Searching for a pathway to priming accountants for ethical compliance with

International Financial Reporting Standards: The core value paradigm. Research Journal

of Finance and Accounting, 5(18).

Klychova, G.S., Faskhutdinova, М.S. and Sadrieva, E.R., 2014. Budget efficiency for cost

control purposes in management accounting system. Mediterranean journal of social

sciences, 5(24), p.79.

Macve, R. H. (2015). Fair value vs conservatism? Aspects of the history of accounting, auditing,

business and finance from ancient Mesopotamia to modern China. The British

Accounting Review, 47(2), 124-141.

Munoz, E., Zhao, L., & Yang, D. C. (2017). Issues in Sustainability Accounting

Reporting. Accounting and Finance Research, 6(3), 64.

Frias‐Aceituno, J. V., Rodriguez‐Ariza, L., & Garcia‐Sanchez, I. M. (2013). The role of the

board in the dissemination of integrated corporate social reporting. Corporate Social

Responsibility and Environmental Management, 20(4), 219-233.

Gregory, B., Uys, P. and Gregory, S., 2014. The role of instant feedback in improving student

understanding of basic accounting concepts. Rhetoric and Reality: Critical perspectives

on educational technology. Proceedings ascilite Dunedin, pp.634-637.

Home - Devondale Murray Goulburn. (2017). Mgc.com.au. Retrieved 24 September 2017, from

http://www.mgc.com.au/

Home. (2017). Bellamy's Organic. Retrieved 24 September 2017, from

https://www.bellamysorganic.com.au/

IFRS. (2017). Ifrs.org. Retrieved 24 September 2017, from http://www.ifrs.org/

Iyoha, F. O. (2014). Searching for a pathway to priming accountants for ethical compliance with

International Financial Reporting Standards: The core value paradigm. Research Journal

of Finance and Accounting, 5(18).

Klychova, G.S., Faskhutdinova, М.S. and Sadrieva, E.R., 2014. Budget efficiency for cost

control purposes in management accounting system. Mediterranean journal of social

sciences, 5(24), p.79.

Macve, R. H. (2015). Fair value vs conservatism? Aspects of the history of accounting, auditing,

business and finance from ancient Mesopotamia to modern China. The British

Accounting Review, 47(2), 124-141.

Munoz, E., Zhao, L., & Yang, D. C. (2017). Issues in Sustainability Accounting

Reporting. Accounting and Finance Research, 6(3), 64.

17ACCOUNTING IN AUSTRALIAN DIARY COMPANIES

Olango, E. O. (2014). The Effects of International Financial Reporting Standards Adoption on

Smes Performance: A Case Study Mombasa–Central Business District (CBD). Journal of

Finance and Accounting, 5(7), 95-101.

Results. (2017). Nestle.com. Retrieved 24 September 2017, from

http://www.nestle.com/investors/results

Robinson, L. A., Stomberg, B., & Towery, E. M. (2015). One size does not fit all: How the

uniform rules of FIN 48 affect the relevance of income tax accounting. The Accounting

Review, 91(4), 1195-1217.

Shi, W. S., Sun, S. L., Pinkham, B. C., & Peng, M. W. (2014). Domestic alliance network to

attract foreign partners: Evidence from international joint ventures in China. Journal of

International Business Studies, 45(3), 338-362.

Smith, M. (2017). Research methods in accounting. Sage.

Strine Jr, L. E. (2014). Making It Easier for Directors to Do the Right Thing. Harv. Bus. L.

Rev., 4, 235.

Wang, C. (2014). Accounting standards harmonization and financial statement comparability:

Evidence from transnational information transfer. Journal of Accounting Research, 52(4),

955-992.

Young, S., & Zeng, Y. (2015). Accounting comparability and the accuracy of peer-based

valuation models. The Accounting Review, 90(6), 2571-2601.

Olango, E. O. (2014). The Effects of International Financial Reporting Standards Adoption on

Smes Performance: A Case Study Mombasa–Central Business District (CBD). Journal of

Finance and Accounting, 5(7), 95-101.

Results. (2017). Nestle.com. Retrieved 24 September 2017, from

http://www.nestle.com/investors/results

Robinson, L. A., Stomberg, B., & Towery, E. M. (2015). One size does not fit all: How the

uniform rules of FIN 48 affect the relevance of income tax accounting. The Accounting

Review, 91(4), 1195-1217.

Shi, W. S., Sun, S. L., Pinkham, B. C., & Peng, M. W. (2014). Domestic alliance network to

attract foreign partners: Evidence from international joint ventures in China. Journal of

International Business Studies, 45(3), 338-362.

Smith, M. (2017). Research methods in accounting. Sage.

Strine Jr, L. E. (2014). Making It Easier for Directors to Do the Right Thing. Harv. Bus. L.

Rev., 4, 235.

Wang, C. (2014). Accounting standards harmonization and financial statement comparability:

Evidence from transnational information transfer. Journal of Accounting Research, 52(4),

955-992.

Young, S., & Zeng, Y. (2015). Accounting comparability and the accuracy of peer-based

valuation models. The Accounting Review, 90(6), 2571-2601.

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.