Empirical Study on Capital Structure Optimization

VerifiedAdded on 2021/04/26

|18

|3846

|78

AI Summary

This assignment involves an empirical study on the optimization of capital structure for companies. It includes a comprehensive review of various capital structure theories, such as Static Trade-off theory and Pecking order theory, along with a critical analysis of the current situation of capital structure in China. The assignment also provides case studies from Atlan Holdings Bhd., including an examination of their financial statements and debt financing strategies.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1

Table of Contents

1.0Introduction on the two selected companies........................... 2

2.0Analysis Company A...............................................................5

3.0Analysis of company B........................................................... 8

4.0Evaluation of two companies.........................错错错错错错错错。

5.0references............................................................................... 16

Table of Contents

1.0Introduction on the two selected companies........................... 2

2.0Analysis Company A...............................................................5

3.0Analysis of company B........................................................... 8

4.0Evaluation of two companies.........................错错错错错错错错。

5.0references............................................................................... 16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2

1.0Introduction on the two selected companies.

DATASONIC GROUP BERHAD (" data company ") was incorporated on October

22, 1980. datasonic group berhad was originally called Bumi Packaging & Storage (M)

Sdn Bhd. In its initial phase, the company sold ICT products in the form of computer

forms and credit card printers to financial institutions in Malaysia. Datasonic Smart

solutions, incorporated in Malaysia on 2 April 2004, is a private limited company

providing research and development and technical consulting services to Datasonic

corporation and Datasonic Technologies. Our group using Datasonic intelligent

solution as the main channel to carry out research and development activities of the

smart card operating system solutions and other key ICT development including the

development of centralized and decentralized card issuance systems and solutions,

multi-purpose ID system, integration of front-end and back-end system solutions and

total system based on network solutions to support our group's current and future

business. Datasonic Innovation Sdn Bhd (" Datasonic Innovation "), established on

July 25, 2014, is a subsidiary of Datasonic Group and is engaged in biometric

solutions. datasonic group berhad was acquired by Datasonic Group on July 16,

2014. It is a controlled subsidiary of Datasonic Group and its wholly owned

subsidiary Constant Ahead Sdn Bhd. The main activity of data manufacturing is the

manufacture of electronic integrated circuit CARDS, or smart CARDS and related

products.

1.0Introduction on the two selected companies.

DATASONIC GROUP BERHAD (" data company ") was incorporated on October

22, 1980. datasonic group berhad was originally called Bumi Packaging & Storage (M)

Sdn Bhd. In its initial phase, the company sold ICT products in the form of computer

forms and credit card printers to financial institutions in Malaysia. Datasonic Smart

solutions, incorporated in Malaysia on 2 April 2004, is a private limited company

providing research and development and technical consulting services to Datasonic

corporation and Datasonic Technologies. Our group using Datasonic intelligent

solution as the main channel to carry out research and development activities of the

smart card operating system solutions and other key ICT development including the

development of centralized and decentralized card issuance systems and solutions,

multi-purpose ID system, integration of front-end and back-end system solutions and

total system based on network solutions to support our group's current and future

business. Datasonic Innovation Sdn Bhd (" Datasonic Innovation "), established on

July 25, 2014, is a subsidiary of Datasonic Group and is engaged in biometric

solutions. datasonic group berhad was acquired by Datasonic Group on July 16,

2014. It is a controlled subsidiary of Datasonic Group and its wholly owned

subsidiary Constant Ahead Sdn Bhd. The main activity of data manufacturing is the

manufacture of electronic integrated circuit CARDS, or smart CARDS and related

products.

3

B错 ATLAN HOLDINGS BHD.

Atlan Holdings Limited is a private limited company, established in 1988 and located

at 8 Lebuhraya Kampung Jawa 11900 Bayan Lepas Pulau Pinang. The company was

listed on the second board of the Bursa Securities in 1996 and then moved to the main

market. In 2009, Atlan ’s main business was investment holding, provision of

management, finance, technology and other ancillary services, while its subsidiaries

were engaged in the trading of commodities in real estate investment, hotels, and auto

parts manufacturing.The company type is Manufacturer.

The 4.6 acres of main agreement road Jamp Ampang in the center of Kuala Lumpur is

Menara Atlan, which is an office building, which is the company's reflection on

property investment. Menara Atlan main tenant: Malaysia's biotechnology research

and development, one of Malaysia's major telecommunications service providers and

major real estate developers.

Atlan's subsidiary United Industries Holdings Sdn Bhd is currently one of the market

leaders in manufacturing metal pipes, fuel fillers, fuel tank modules, metal stampings

and accessories. This is the company's manifestation in manufacturing. UI Group is

B错 ATLAN HOLDINGS BHD.

Atlan Holdings Limited is a private limited company, established in 1988 and located

at 8 Lebuhraya Kampung Jawa 11900 Bayan Lepas Pulau Pinang. The company was

listed on the second board of the Bursa Securities in 1996 and then moved to the main

market. In 2009, Atlan ’s main business was investment holding, provision of

management, finance, technology and other ancillary services, while its subsidiaries

were engaged in the trading of commodities in real estate investment, hotels, and auto

parts manufacturing.The company type is Manufacturer.

The 4.6 acres of main agreement road Jamp Ampang in the center of Kuala Lumpur is

Menara Atlan, which is an office building, which is the company's reflection on

property investment. Menara Atlan main tenant: Malaysia's biotechnology research

and development, one of Malaysia's major telecommunications service providers and

major real estate developers.

Atlan's subsidiary United Industries Holdings Sdn Bhd is currently one of the market

leaders in manufacturing metal pipes, fuel fillers, fuel tank modules, metal stampings

and accessories. This is the company's manifestation in manufacturing. UI Group is

4

fully equipped with design and engineering capabilities and facilities, and has a

laboratory equipped with inspection and testing equipment.

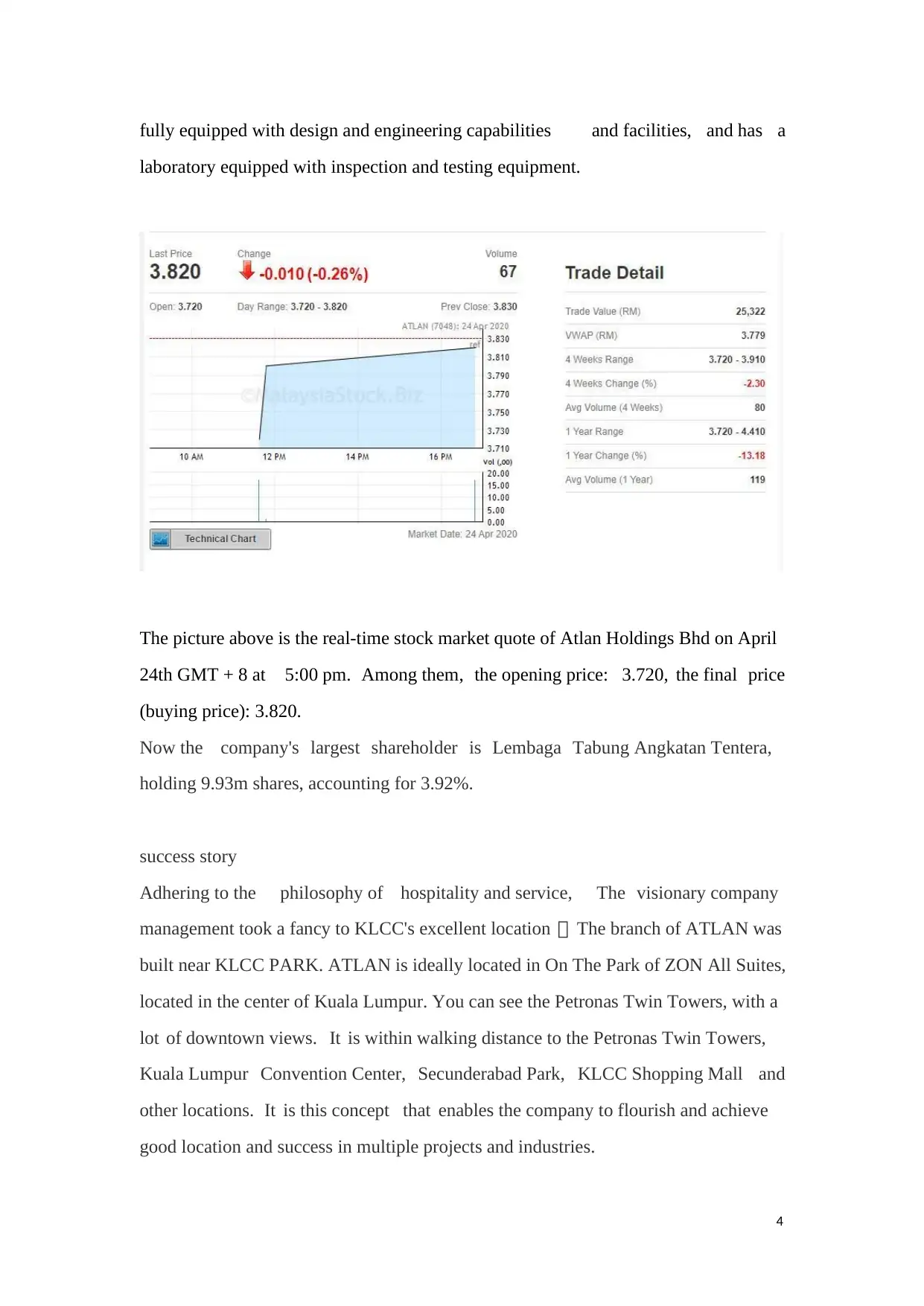

The picture above is the real-time stock market quote of Atlan Holdings Bhd on April

24th GMT + 8 at 5:00 pm. Among them, the opening price: 3.720, the final price

(buying price): 3.820.

Now the company's largest shareholder is Lembaga Tabung Angkatan Tentera,

holding 9.93m shares, accounting for 3.92%.

success story

Adhering to the philosophy of hospitality and service, The visionary company

management took a fancy to KLCC's excellent location , The branch of ATLAN was

built near KLCC PARK. ATLAN is ideally located in On The Park of ZON All Suites,

located in the center of Kuala Lumpur. You can see the Petronas Twin Towers, with a

lot of downtown views. It is within walking distance to the Petronas Twin Towers,

Kuala Lumpur Convention Center, Secunderabad Park, KLCC Shopping Mall and

other locations. It is this concept that enables the company to flourish and achieve

good location and success in multiple projects and industries.

fully equipped with design and engineering capabilities and facilities, and has a

laboratory equipped with inspection and testing equipment.

The picture above is the real-time stock market quote of Atlan Holdings Bhd on April

24th GMT + 8 at 5:00 pm. Among them, the opening price: 3.720, the final price

(buying price): 3.820.

Now the company's largest shareholder is Lembaga Tabung Angkatan Tentera,

holding 9.93m shares, accounting for 3.92%.

success story

Adhering to the philosophy of hospitality and service, The visionary company

management took a fancy to KLCC's excellent location , The branch of ATLAN was

built near KLCC PARK. ATLAN is ideally located in On The Park of ZON All Suites,

located in the center of Kuala Lumpur. You can see the Petronas Twin Towers, with a

lot of downtown views. It is within walking distance to the Petronas Twin Towers,

Kuala Lumpur Convention Center, Secunderabad Park, KLCC Shopping Mall and

other locations. It is this concept that enables the company to flourish and achieve

good location and success in multiple projects and industries.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

5

2.0Analysis Company A

2.1 Company Profile

Datasonic Group Berhad was established on October 22, 1980. In the early days,

Datasonic Group Berhad's main business content was: selling ICT products to

financial institutions in Malaysia in the form of computer forms and credit card

imprints. Subsequently, Datasonic Group Berhad then set foot in personalized

services, and began to establish business relations with Datacard Corporation in 1983.

And obtained the distribution right of Datacard® central issuance system and solution

in Malaysia.

In 2003, Datasonic Group Berhad and the National Bank of Malaysia Simpanan

Nasional established an RPS center to provide outsourcing services for the

personalization of financial PMPC, ATM and EMV credit cards of major Malaysian

banks. In 2007, Datasonic Group Berhad established its own independent RPS center

to improve its production capacity to meet the needs of the growing financial industry

customers and get rapid development.

2.2 Capital structure analysis

(1) Analysis of financing methods

The financing methods of listed companies are divided into endogenous financing and

exogenous financing. Endogenous financing is composed of retained earnings and

depreciation. It refers to the process in which companies continuously convert their

savings into investments. The following table is a summary of the size of Datasonic

Group Berhad's internal financing from 2016 to 2019:

Table 1 Datasonic Group Berhad endogenous financing scale summary table from

2016 to 2019

(Unit: Million MYR)

years 2016 2017 2018 2019

Depreciation and asset

impairment losses 93.32 118.92 128.17 143.61

retained earnings 110.39 125.77 132.27 128.3

2.0Analysis Company A

2.1 Company Profile

Datasonic Group Berhad was established on October 22, 1980. In the early days,

Datasonic Group Berhad's main business content was: selling ICT products to

financial institutions in Malaysia in the form of computer forms and credit card

imprints. Subsequently, Datasonic Group Berhad then set foot in personalized

services, and began to establish business relations with Datacard Corporation in 1983.

And obtained the distribution right of Datacard® central issuance system and solution

in Malaysia.

In 2003, Datasonic Group Berhad and the National Bank of Malaysia Simpanan

Nasional established an RPS center to provide outsourcing services for the

personalization of financial PMPC, ATM and EMV credit cards of major Malaysian

banks. In 2007, Datasonic Group Berhad established its own independent RPS center

to improve its production capacity to meet the needs of the growing financial industry

customers and get rapid development.

2.2 Capital structure analysis

(1) Analysis of financing methods

The financing methods of listed companies are divided into endogenous financing and

exogenous financing. Endogenous financing is composed of retained earnings and

depreciation. It refers to the process in which companies continuously convert their

savings into investments. The following table is a summary of the size of Datasonic

Group Berhad's internal financing from 2016 to 2019:

Table 1 Datasonic Group Berhad endogenous financing scale summary table from

2016 to 2019

(Unit: Million MYR)

years 2016 2017 2018 2019

Depreciation and asset

impairment losses 93.32 118.92 128.17 143.61

retained earnings 110.39 125.77 132.27 128.3

6

Endogenous financing 203.71 244.69 260.44 271.91

It can be seen from Table 1 that Datasonic Group Berhad's endogenous financing

scale in the past five years is summarized. It can be seen that Datasonic Group

Berhad's endogenous financing scale is relatively large and increases every year, from

203 million MYR to 2.71 The scale of 100 million MYR is mainly due to the fact that

Datasonic Group Berhad has good profitability in recent years, and corporate income

has increased rapidly, laying a good foundation for the company's development.

Exogenous financing is to absorb the savings of other economic entities, mainly

relying on debt financing and equity financing. The following table summarizes the

external financing scale of Datasonic Group Berhad in the past five years.

Table 2 Datasonic Group Berhad's external financing scale summary table from 2016

to 2019

(Unit: Million MYR)

years 2016 2017 2018 2019

Bills payable / short-term

debt 45.72 72.15 41.35 43.89

accounts payable 9.94 29.35 6.93 12.17

Total other current

liabilities 21.61 12.53 6.55 11.03

Long-term debt 75.13 76.91 78.51 76.51

Total external financing 152.4 190.94 133.34 143.6

It can be seen from Table 2 that Datasonic Group Berhad's external financing is

smaller than internal financing. Except for the increase in 2017, the others are in a

downward trend, mainly because Datasonic Group Berhad's internal financing

increased, and the company's capital flow was more Fluent.

(2) Capital structure analysis

Endogenous financing 203.71 244.69 260.44 271.91

It can be seen from Table 1 that Datasonic Group Berhad's endogenous financing

scale in the past five years is summarized. It can be seen that Datasonic Group

Berhad's endogenous financing scale is relatively large and increases every year, from

203 million MYR to 2.71 The scale of 100 million MYR is mainly due to the fact that

Datasonic Group Berhad has good profitability in recent years, and corporate income

has increased rapidly, laying a good foundation for the company's development.

Exogenous financing is to absorb the savings of other economic entities, mainly

relying on debt financing and equity financing. The following table summarizes the

external financing scale of Datasonic Group Berhad in the past five years.

Table 2 Datasonic Group Berhad's external financing scale summary table from 2016

to 2019

(Unit: Million MYR)

years 2016 2017 2018 2019

Bills payable / short-term

debt 45.72 72.15 41.35 43.89

accounts payable 9.94 29.35 6.93 12.17

Total other current

liabilities 21.61 12.53 6.55 11.03

Long-term debt 75.13 76.91 78.51 76.51

Total external financing 152.4 190.94 133.34 143.6

It can be seen from Table 2 that Datasonic Group Berhad's external financing is

smaller than internal financing. Except for the increase in 2017, the others are in a

downward trend, mainly because Datasonic Group Berhad's internal financing

increased, and the company's capital flow was more Fluent.

(2) Capital structure analysis

7

The changes in Datasonic Group Berhad ’s asset-liability ratio and shareholder ’s

equity ratio can more comprehensively reflect Datasonic Group Berhad ’s

asset-liability situation.

Table 3 Datasonic Group Berhad's gearing ratio from 2016 to 2019

years 2016 2017 2018 2019

Assets and liabilities(%) 39.41 44.97 40.01 41.15

Shareholders' equity ratio

(%) 60.59 55.03 59.99 58.85

Debt to owner's equity ratio

(%) 65.06 81.73 66.70 69.93

As can be seen from Table 3, Datasonic Group Berhad's asset-liability ratio is

relatively low, basically staying below 45%. Datasonic Group Berhad's asset-liability

ratio has remained volatile in recent years, on the one hand because of changes in

bank loans, On the other hand, due to the improvement of Datasonic Group Berhad's

business capabilities, the scale of commercial credit financing has been reduced, and

the scale of liabilities has remained at a relatively low level, which makes Datasonic

Group Berhad's financing costs and risks lower.

Table 4 summarizes the liability structure of Datasonic Group Berhad in the past five

years. It can be seen that Datasonic Group Berhad ’s liabilities are mainly current

liabilities, which have remained volatile from 2016 to 2019, with a maximum of

62.14% in 2017 and a minimum of 2018 49.29%. This shows that Datasonic Group

Berhad's net cash flow is unstable, and sometimes it needs to rely on a large amount

of short-term debt capital to maintain daily operations.

Table 4 2015 to 2019 Datasonic Group Berhad liability structure change table

years 2016 2017 2018 2019

Current liabilities /

liabilities (%) 52.02 62.14 49.29 55.04

Non-current liabilities /

liabilities (%) 47.98 37.86 50.71 44.96

The changes in Datasonic Group Berhad ’s asset-liability ratio and shareholder ’s

equity ratio can more comprehensively reflect Datasonic Group Berhad ’s

asset-liability situation.

Table 3 Datasonic Group Berhad's gearing ratio from 2016 to 2019

years 2016 2017 2018 2019

Assets and liabilities(%) 39.41 44.97 40.01 41.15

Shareholders' equity ratio

(%) 60.59 55.03 59.99 58.85

Debt to owner's equity ratio

(%) 65.06 81.73 66.70 69.93

As can be seen from Table 3, Datasonic Group Berhad's asset-liability ratio is

relatively low, basically staying below 45%. Datasonic Group Berhad's asset-liability

ratio has remained volatile in recent years, on the one hand because of changes in

bank loans, On the other hand, due to the improvement of Datasonic Group Berhad's

business capabilities, the scale of commercial credit financing has been reduced, and

the scale of liabilities has remained at a relatively low level, which makes Datasonic

Group Berhad's financing costs and risks lower.

Table 4 summarizes the liability structure of Datasonic Group Berhad in the past five

years. It can be seen that Datasonic Group Berhad ’s liabilities are mainly current

liabilities, which have remained volatile from 2016 to 2019, with a maximum of

62.14% in 2017 and a minimum of 2018 49.29%. This shows that Datasonic Group

Berhad's net cash flow is unstable, and sometimes it needs to rely on a large amount

of short-term debt capital to maintain daily operations.

Table 4 2015 to 2019 Datasonic Group Berhad liability structure change table

years 2016 2017 2018 2019

Current liabilities /

liabilities (%) 52.02 62.14 49.29 55.04

Non-current liabilities /

liabilities (%) 47.98 37.86 50.71 44.96

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

But Datasonic Group Berhad's current liabilities account for about 50% of total

liabilities, which is in a relatively reasonable range. Datasonic Group Berhad's credit

risk and financial risk are low.

(3) Capital structure evaluation

Datasonic Group Berhad's internal and external financing structure is relatively

reasonable, and the company's financing method is mainly endogenous financing.

Datasonic Group Berhad has greater autonomy, a good profit level, and retained

earnings can meet part of the company's capital needs.

Datasonic Group Berhad's capital structure is relatively stable, with equity capital as

the mainstay. In the early days of the establishment of Datasonic Group Berhad, due

to the reasons for the start-up of the company, there may be more equity capital. Later,

as the development needs of the enterprise, debt capital gradually increased, and the

capital structure tended to stabilize, mainly based on equity capital.

3.0Analysis of company B

ATLAN HOLDINGS BHD.

In 2017 (Atlan Holdings Bhd.)

Figures : Revenue and Revenue by business segments of Atlan Holdings Bhd in 2017

But Datasonic Group Berhad's current liabilities account for about 50% of total

liabilities, which is in a relatively reasonable range. Datasonic Group Berhad's credit

risk and financial risk are low.

(3) Capital structure evaluation

Datasonic Group Berhad's internal and external financing structure is relatively

reasonable, and the company's financing method is mainly endogenous financing.

Datasonic Group Berhad has greater autonomy, a good profit level, and retained

earnings can meet part of the company's capital needs.

Datasonic Group Berhad's capital structure is relatively stable, with equity capital as

the mainstay. In the early days of the establishment of Datasonic Group Berhad, due

to the reasons for the start-up of the company, there may be more equity capital. Later,

as the development needs of the enterprise, debt capital gradually increased, and the

capital structure tended to stabilize, mainly based on equity capital.

3.0Analysis of company B

ATLAN HOLDINGS BHD.

In 2017 (Atlan Holdings Bhd.)

Figures : Revenue and Revenue by business segments of Atlan Holdings Bhd in 2017

9

The Group posted robust sales of RM809.4 million for the financial year under

examination, hitting 5.4 percent growth for FYE2017 relative to 29 February 2016.

The main sources of financing is from revenue. The main funding source of 78.0 per

cent comes from the duty-free market, with a total revenue of RM631.7 million, a rise

of 4.6 per cent relative to FYE2016. The rise in source of financing was partly

attributed to an increase in selling volume and a rise in prices for other goods, as well

as a contribution from new outlets at Kuala Lumpur International Airport 2. The

automobile market is the second biggest contributor, accounting for a combined sale

of RM147.2 million, an rise of 11.1 per cent relative to FYE2016. For property and

hospitality, the Group posted a total financing of RM28.8 million, marginally lower

compared to FYE2016 due to lower vacancy levels and higher rental prices. The rise

further led to the total foreign exchange income of RM9.0 million. The Group's

financial situation continues to expand with shareholders' assets of RM648.8 million,

capital and bank accounts of RM303.2 million and total cash situation of RM231.0

million. Through retaining a stable financial stance, the Group has lowered its

borrowings to RM72.2 million, its inventories to RM243.7 million and its trade and

other obligations to RM143.2 million. The Company's gross capital obligations,

accepted, contracted for and not contracted for, as at 28 February 2017, increased to

RM6.9 million compared to RM14.2 million) in 2016 for the Group.

The Company shall contain all capital borrowings of the Business within the

aggregate external debt. Gross unpaid liability due and payable over 12 months

consisting of banker's refunds, loan overdrafts, interest owed and the existing part of

financial lease commitments. Capital requires shares attributed to corporate

shareholders and non-controlling interests.

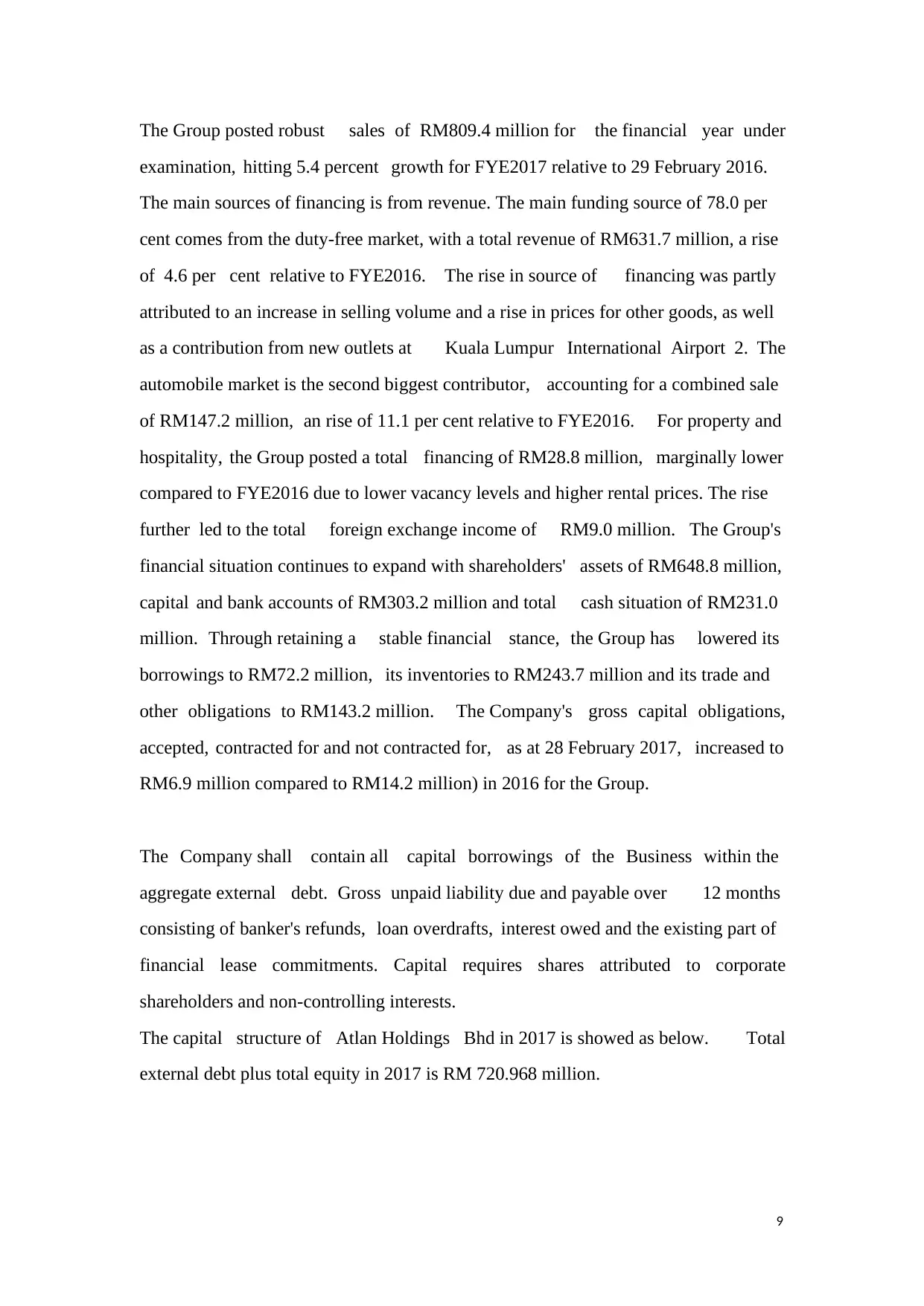

The capital structure of Atlan Holdings Bhd in 2017 is showed as below. Total

external debt plus total equity in 2017 is RM 720.968 million.

The Group posted robust sales of RM809.4 million for the financial year under

examination, hitting 5.4 percent growth for FYE2017 relative to 29 February 2016.

The main sources of financing is from revenue. The main funding source of 78.0 per

cent comes from the duty-free market, with a total revenue of RM631.7 million, a rise

of 4.6 per cent relative to FYE2016. The rise in source of financing was partly

attributed to an increase in selling volume and a rise in prices for other goods, as well

as a contribution from new outlets at Kuala Lumpur International Airport 2. The

automobile market is the second biggest contributor, accounting for a combined sale

of RM147.2 million, an rise of 11.1 per cent relative to FYE2016. For property and

hospitality, the Group posted a total financing of RM28.8 million, marginally lower

compared to FYE2016 due to lower vacancy levels and higher rental prices. The rise

further led to the total foreign exchange income of RM9.0 million. The Group's

financial situation continues to expand with shareholders' assets of RM648.8 million,

capital and bank accounts of RM303.2 million and total cash situation of RM231.0

million. Through retaining a stable financial stance, the Group has lowered its

borrowings to RM72.2 million, its inventories to RM243.7 million and its trade and

other obligations to RM143.2 million. The Company's gross capital obligations,

accepted, contracted for and not contracted for, as at 28 February 2017, increased to

RM6.9 million compared to RM14.2 million) in 2016 for the Group.

The Company shall contain all capital borrowings of the Business within the

aggregate external debt. Gross unpaid liability due and payable over 12 months

consisting of banker's refunds, loan overdrafts, interest owed and the existing part of

financial lease commitments. Capital requires shares attributed to corporate

shareholders and non-controlling interests.

The capital structure of Atlan Holdings Bhd in 2017 is showed as below. Total

external debt plus total equity in 2017 is RM 720.968 million.

10

Figures : Total external debt with total equity in 2017

In 2018 (Atlan Holdings Bhd)

Figures : Revenue and Revenue by business segments of Atlan Holdings Bhd in 2018

The Company generated a high turnover of RM826.3 million for the financial year

under analysis. Revenue is the primary source of funding. The Group's main sales

driver is the duty-free division contributing 74.9 per cent of overall revenue of

RM619.0 million, a small decline of 3.1 per cent relative to the financial year ended

28 February 2017. The decline in sales was mainly due to lower consumer demand,

especially in the first quarter of the financial year ended 28 February 2018. Following

the introduction of the Goods and Services Tax on border outlets and duty-free areas

Figures : Total external debt with total equity in 2017

In 2018 (Atlan Holdings Bhd)

Figures : Revenue and Revenue by business segments of Atlan Holdings Bhd in 2018

The Company generated a high turnover of RM826.3 million for the financial year

under analysis. Revenue is the primary source of funding. The Group's main sales

driver is the duty-free division contributing 74.9 per cent of overall revenue of

RM619.0 million, a small decline of 3.1 per cent relative to the financial year ended

28 February 2017. The decline in sales was mainly due to lower consumer demand,

especially in the first quarter of the financial year ended 28 February 2018. Following

the introduction of the Goods and Services Tax on border outlets and duty-free areas

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

11

with effect from 1 January 2017. The automotive division remains the Group's second

largest contributor, accounting for a combined sale of RM175.9 million, a rise of 3.1

per cent relative to FYE2017. For the property and hospitality division, the Group

reported revenue of RM28.1 million, marginally lower compared to FYE2017 due to

reduced occupancy for both properties in FYE2018. In 2018, the Group's balance

sheet remained stable and strong, with total cash and cash equivalents of RM398.3

million and total equity position of RM340.5 million, which is equal to RM1.34 per

share. The gross capital obligations of the Company, authorised, negotiated and not

negotiated as at 28 February 2018, amounted to RM6.9 million compared to

RM6.9million in 2017.

The capital structure of Atlan Holdings Bhd in 2018 is showed as below. Total

external debt plus total equity in 2018 is RM 781,711 million.

Figures : Total external debt with total equity in 2018

4.0Evaluate the Source of Financing of the two Companies

and Provide Possible Reasoning for the types of the Capital

Structure

with effect from 1 January 2017. The automotive division remains the Group's second

largest contributor, accounting for a combined sale of RM175.9 million, a rise of 3.1

per cent relative to FYE2017. For the property and hospitality division, the Group

reported revenue of RM28.1 million, marginally lower compared to FYE2017 due to

reduced occupancy for both properties in FYE2018. In 2018, the Group's balance

sheet remained stable and strong, with total cash and cash equivalents of RM398.3

million and total equity position of RM340.5 million, which is equal to RM1.34 per

share. The gross capital obligations of the Company, authorised, negotiated and not

negotiated as at 28 February 2018, amounted to RM6.9 million compared to

RM6.9million in 2017.

The capital structure of Atlan Holdings Bhd in 2018 is showed as below. Total

external debt plus total equity in 2018 is RM 781,711 million.

Figures : Total external debt with total equity in 2018

4.0Evaluate the Source of Financing of the two Companies

and Provide Possible Reasoning for the types of the Capital

Structure

12

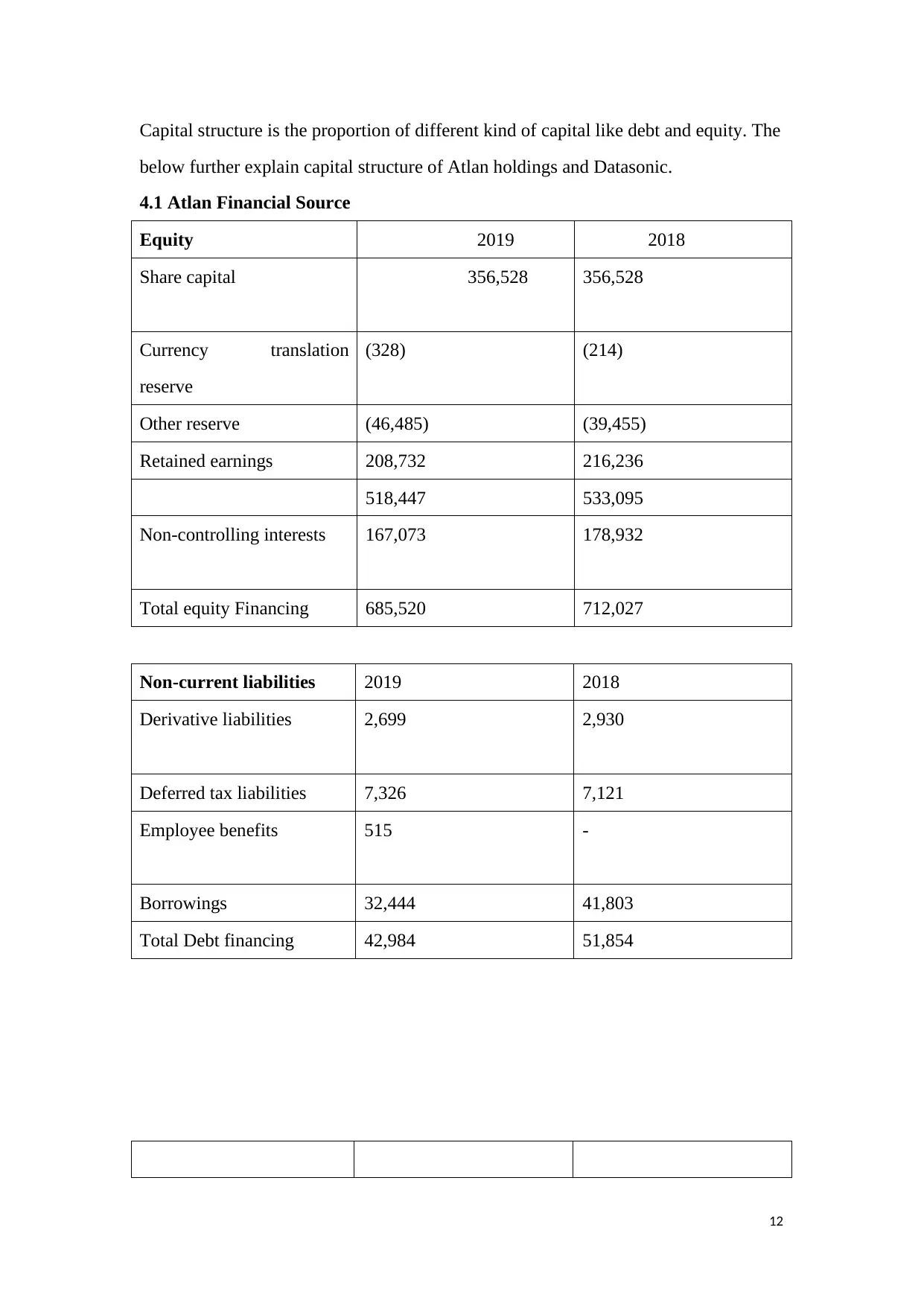

Capital structure is the proportion of different kind of capital like debt and equity. The

below further explain capital structure of Atlan holdings and Datasonic.

4.1 Atlan Financial Source

Equity 2019 2018

Share capital 356,528 356,528

Currency translation

reserve

(328) (214)

Other reserve (46,485) (39,455)

Retained earnings 208,732 216,236

518,447 533,095

Non-controlling interests 167,073 178,932

Total equity Financing 685,520 712,027

Non-current liabilities 2019 2018

Derivative liabilities 2,699 2,930

Deferred tax liabilities 7,326 7,121

Employee benefits 515 -

Borrowings 32,444 41,803

Total Debt financing 42,984 51,854

Capital structure is the proportion of different kind of capital like debt and equity. The

below further explain capital structure of Atlan holdings and Datasonic.

4.1 Atlan Financial Source

Equity 2019 2018

Share capital 356,528 356,528

Currency translation

reserve

(328) (214)

Other reserve (46,485) (39,455)

Retained earnings 208,732 216,236

518,447 533,095

Non-controlling interests 167,073 178,932

Total equity Financing 685,520 712,027

Non-current liabilities 2019 2018

Derivative liabilities 2,699 2,930

Deferred tax liabilities 7,326 7,121

Employee benefits 515 -

Borrowings 32,444 41,803

Total Debt financing 42,984 51,854

13

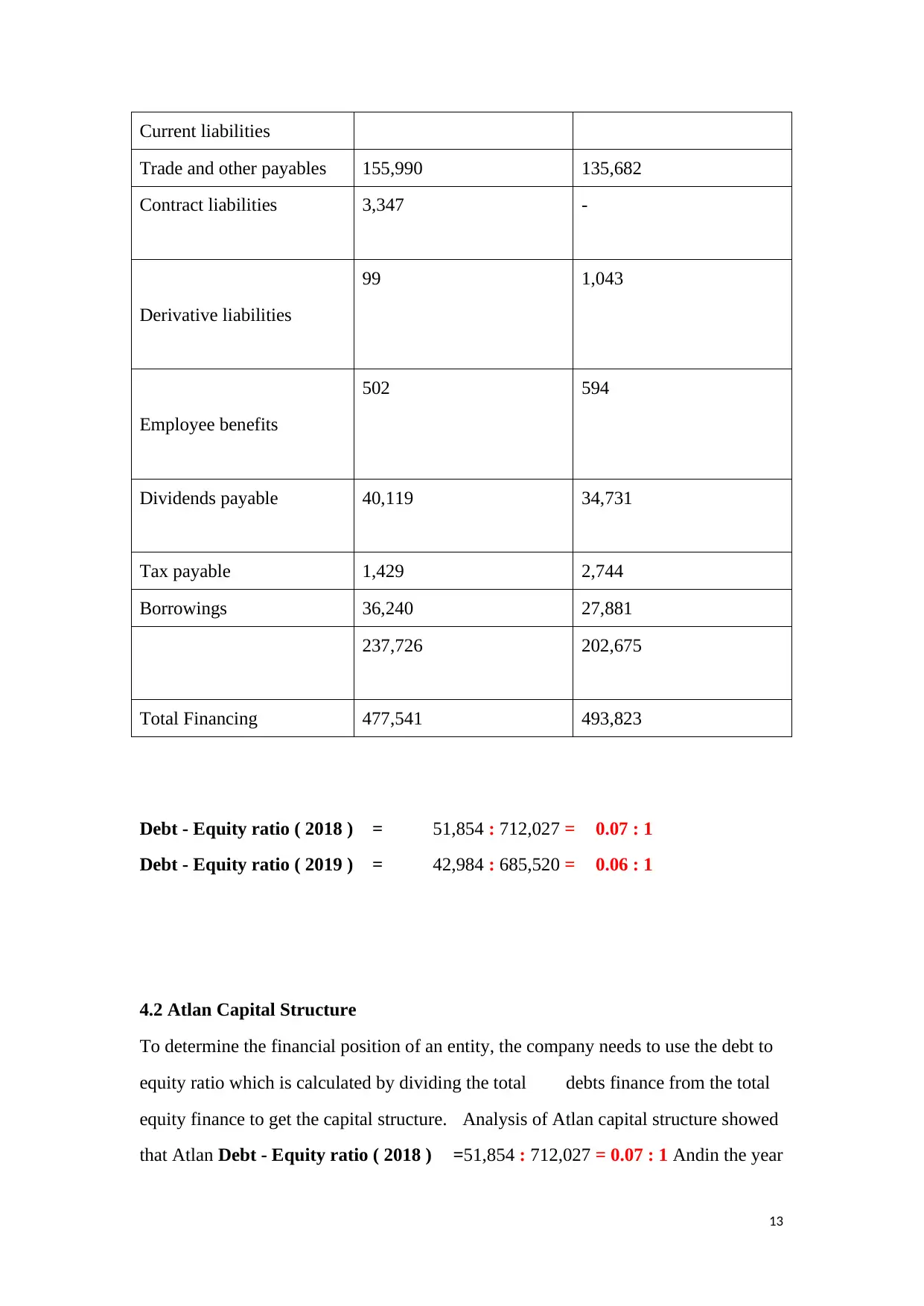

Current liabilities

Trade and other payables 155,990 135,682

Contract liabilities 3,347 -

Derivative liabilities

99 1,043

Employee benefits

502 594

Dividends payable 40,119 34,731

Tax payable 1,429 2,744

Borrowings 36,240 27,881

237,726 202,675

Total Financing 477,541 493,823

Debt - Equity ratio ( 2018 ) = 51,854 : 712,027 = 0.07 : 1

Debt - Equity ratio ( 2019 ) = 42,984 : 685,520 = 0.06 : 1

4.2 Atlan Capital Structure

To determine the financial position of an entity, the company needs to use the debt to

equity ratio which is calculated by dividing the total debts finance from the total

equity finance to get the capital structure. Analysis of Atlan capital structure showed

that Atlan Debt - Equity ratio ( 2018 ) =51,854 : 712,027 = 0.07 : 1 Andin the year

Current liabilities

Trade and other payables 155,990 135,682

Contract liabilities 3,347 -

Derivative liabilities

99 1,043

Employee benefits

502 594

Dividends payable 40,119 34,731

Tax payable 1,429 2,744

Borrowings 36,240 27,881

237,726 202,675

Total Financing 477,541 493,823

Debt - Equity ratio ( 2018 ) = 51,854 : 712,027 = 0.07 : 1

Debt - Equity ratio ( 2019 ) = 42,984 : 685,520 = 0.06 : 1

4.2 Atlan Capital Structure

To determine the financial position of an entity, the company needs to use the debt to

equity ratio which is calculated by dividing the total debts finance from the total

equity finance to get the capital structure. Analysis of Atlan capital structure showed

that Atlan Debt - Equity ratio ( 2018 ) =51,854 : 712,027 = 0.07 : 1 Andin the year

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14

2019 Atlan Debt - Equity ratio = 42,984 : 685,520 = 0.06 : 1. This showed the

company was able to maintain it financial performance through efficient use of debt

and equity financing (Popescu & Visinescu, 2010).

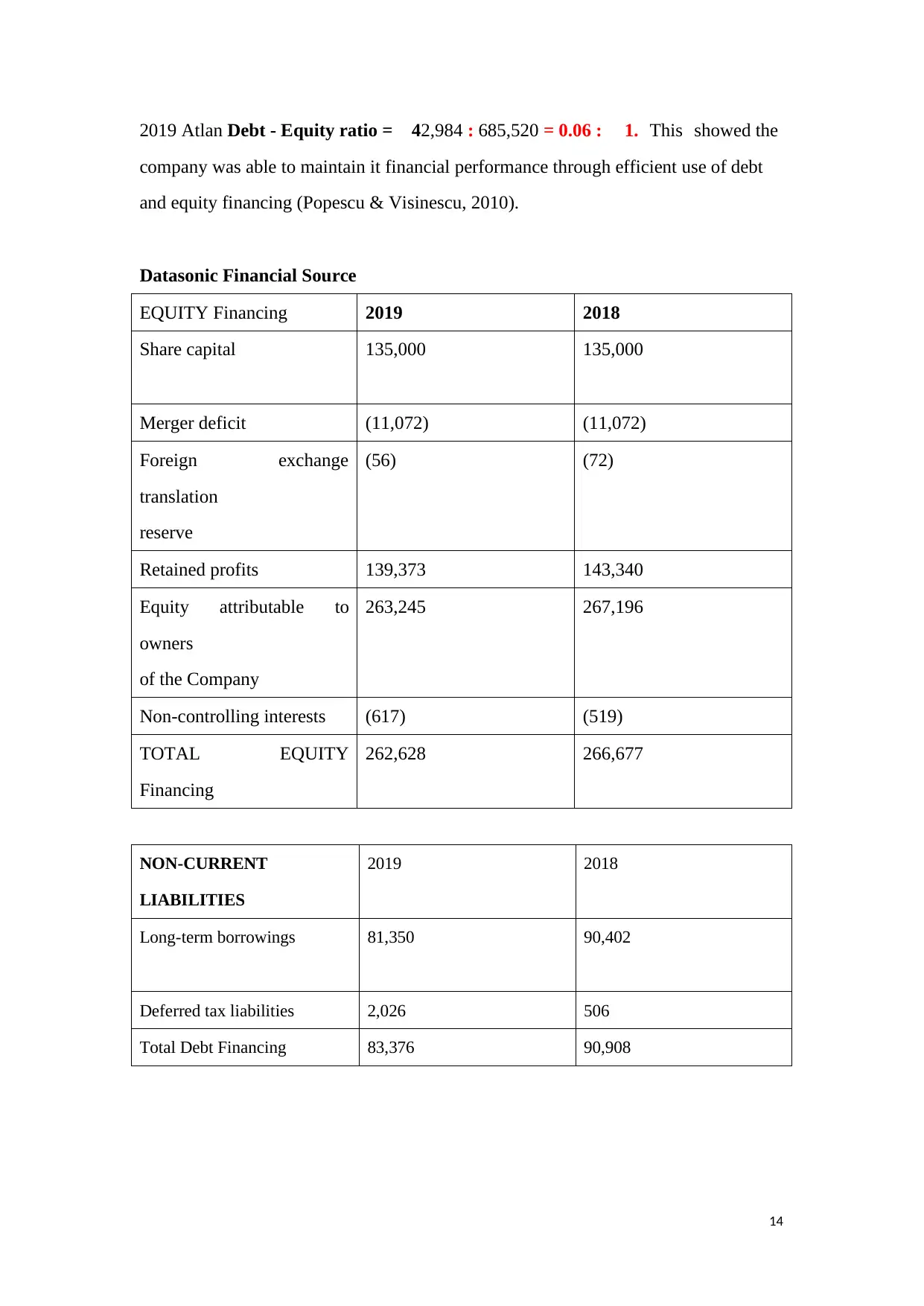

Datasonic Financial Source

EQUITY Financing 2019 2018

Share capital 135,000 135,000

Merger deficit (11,072) (11,072)

Foreign exchange

translation

reserve

(56) (72)

Retained profits 139,373 143,340

Equity attributable to

owners

of the Company

263,245 267,196

Non-controlling interests (617) (519)

TOTAL EQUITY

Financing

262,628 266,677

NON-CURRENT

LIABILITIES

2019 2018

Long-term borrowings 81,350 90,402

Deferred tax liabilities 2,026 506

Total Debt Financing 83,376 90,908

2019 Atlan Debt - Equity ratio = 42,984 : 685,520 = 0.06 : 1. This showed the

company was able to maintain it financial performance through efficient use of debt

and equity financing (Popescu & Visinescu, 2010).

Datasonic Financial Source

EQUITY Financing 2019 2018

Share capital 135,000 135,000

Merger deficit (11,072) (11,072)

Foreign exchange

translation

reserve

(56) (72)

Retained profits 139,373 143,340

Equity attributable to

owners

of the Company

263,245 267,196

Non-controlling interests (617) (519)

TOTAL EQUITY

Financing

262,628 266,677

NON-CURRENT

LIABILITIES

2019 2018

Long-term borrowings 81,350 90,402

Deferred tax liabilities 2,026 506

Total Debt Financing 83,376 90,908

15

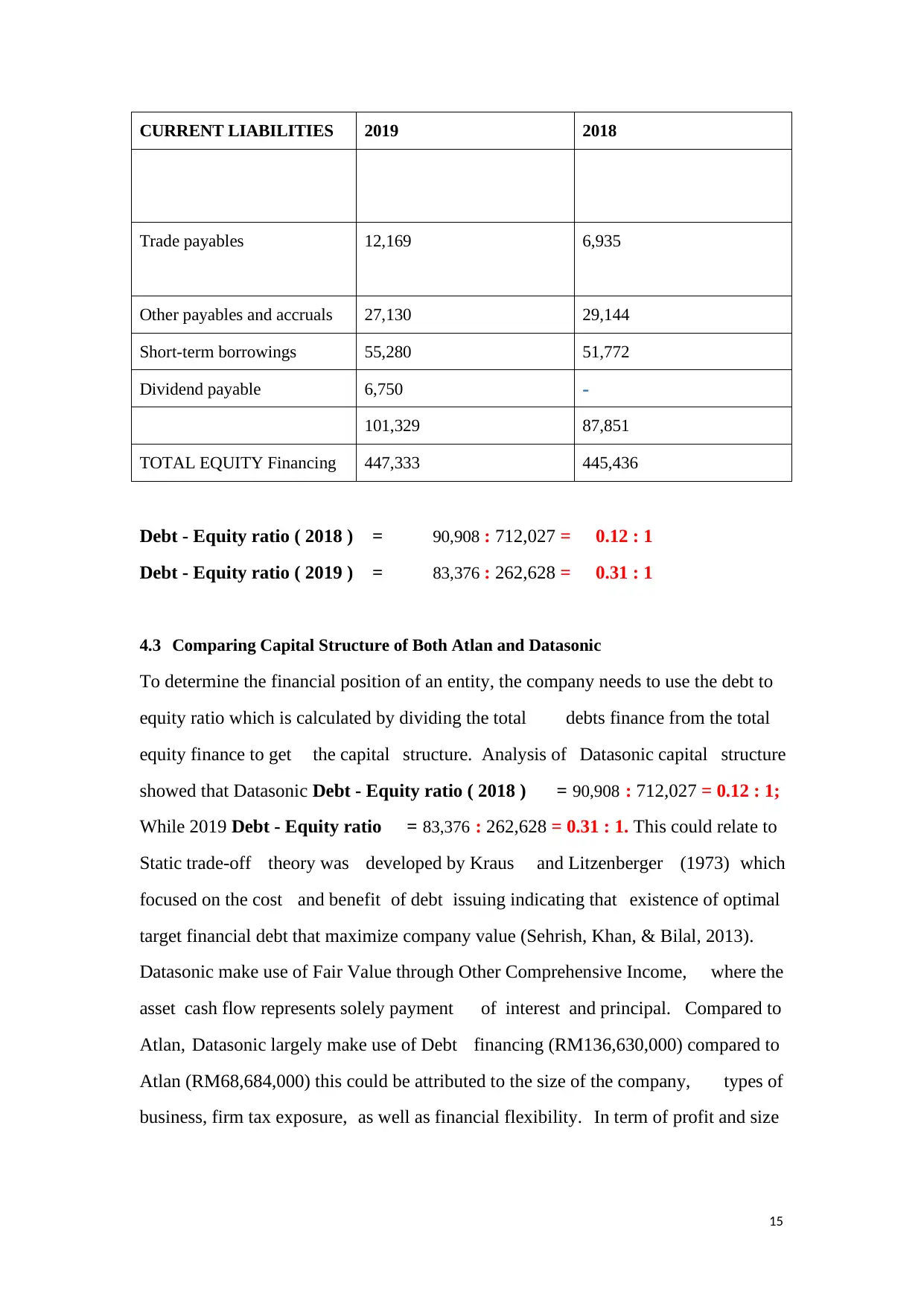

CURRENT LIABILITIES 2019 2018

Trade payables 12,169 6,935

Other payables and accruals 27,130 29,144

Short-term borrowings 55,280 51,772

Dividend payable 6,750 -

101,329 87,851

TOTAL EQUITY Financing 447,333 445,436

Debt - Equity ratio ( 2018 ) = 90,908 : 712,027 = 0.12 : 1

Debt - Equity ratio ( 2019 ) = 83,376 : 262,628 = 0.31 : 1

4.3 Comparing Capital Structure of Both Atlan and Datasonic

To determine the financial position of an entity, the company needs to use the debt to

equity ratio which is calculated by dividing the total debts finance from the total

equity finance to get the capital structure. Analysis of Datasonic capital structure

showed that Datasonic Debt - Equity ratio ( 2018 ) = 90,908 : 712,027 = 0.12 : 1;

While 2019 Debt - Equity ratio = 83,376 : 262,628 = 0.31 : 1. This could relate to

Static trade-off theory was developed by Kraus and Litzenberger (1973) which

focused on the cost and benefit of debt issuing indicating that existence of optimal

target financial debt that maximize company value (Sehrish, Khan, & Bilal, 2013).

Datasonic make use of Fair Value through Other Comprehensive Income, where the

asset cash flow represents solely payment of interest and principal. Compared to

Atlan, Datasonic largely make use of Debt financing (RM136,630,000) compared to

Atlan (RM68,684,000) this could be attributed to the size of the company, types of

business, firm tax exposure, as well as financial flexibility. In term of profit and size

CURRENT LIABILITIES 2019 2018

Trade payables 12,169 6,935

Other payables and accruals 27,130 29,144

Short-term borrowings 55,280 51,772

Dividend payable 6,750 -

101,329 87,851

TOTAL EQUITY Financing 447,333 445,436

Debt - Equity ratio ( 2018 ) = 90,908 : 712,027 = 0.12 : 1

Debt - Equity ratio ( 2019 ) = 83,376 : 262,628 = 0.31 : 1

4.3 Comparing Capital Structure of Both Atlan and Datasonic

To determine the financial position of an entity, the company needs to use the debt to

equity ratio which is calculated by dividing the total debts finance from the total

equity finance to get the capital structure. Analysis of Datasonic capital structure

showed that Datasonic Debt - Equity ratio ( 2018 ) = 90,908 : 712,027 = 0.12 : 1;

While 2019 Debt - Equity ratio = 83,376 : 262,628 = 0.31 : 1. This could relate to

Static trade-off theory was developed by Kraus and Litzenberger (1973) which

focused on the cost and benefit of debt issuing indicating that existence of optimal

target financial debt that maximize company value (Sehrish, Khan, & Bilal, 2013).

Datasonic make use of Fair Value through Other Comprehensive Income, where the

asset cash flow represents solely payment of interest and principal. Compared to

Atlan, Datasonic largely make use of Debt financing (RM136,630,000) compared to

Atlan (RM68,684,000) this could be attributed to the size of the company, types of

business, firm tax exposure, as well as financial flexibility. In term of profit and size

16

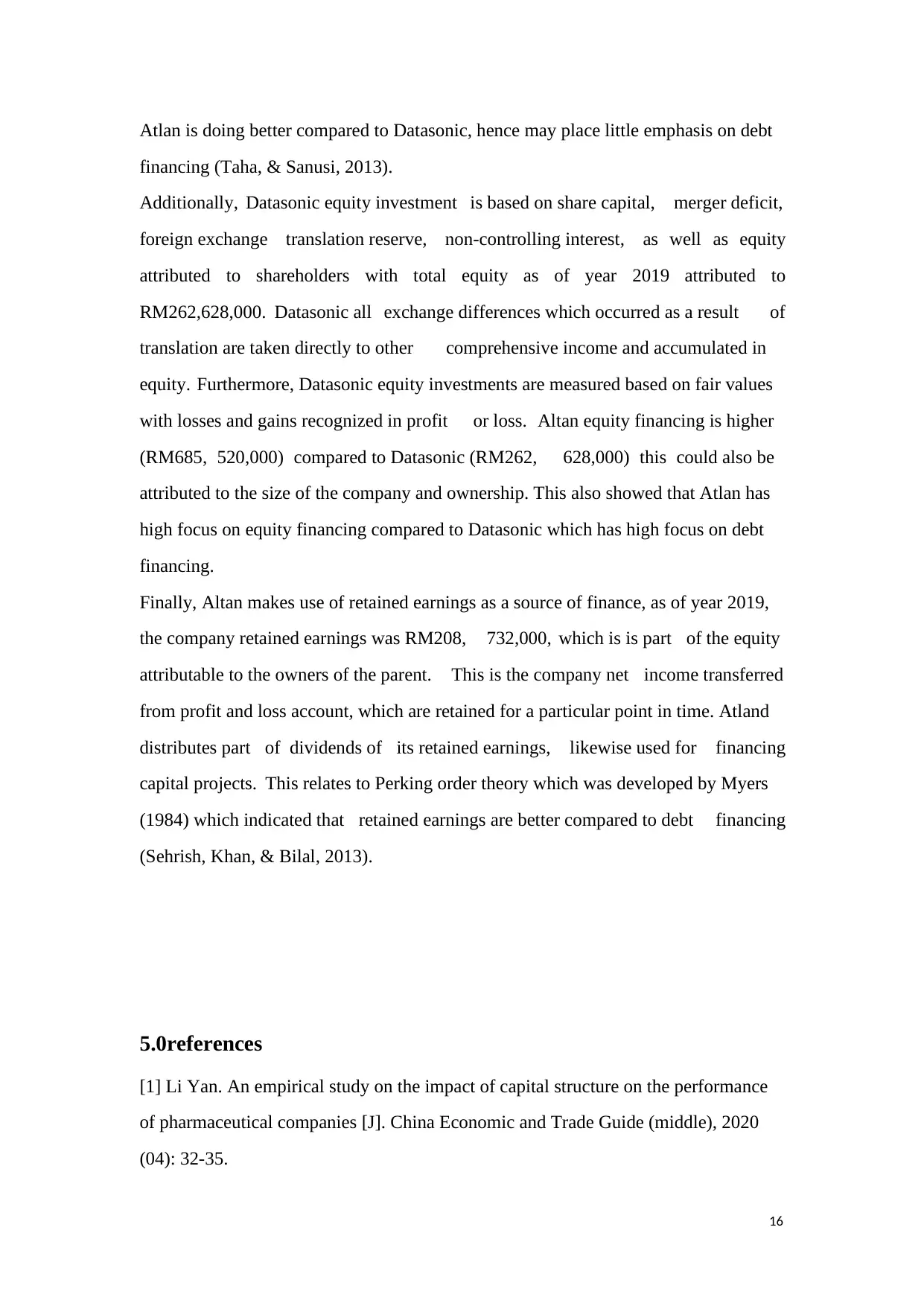

Atlan is doing better compared to Datasonic, hence may place little emphasis on debt

financing (Taha, & Sanusi, 2013).

Additionally, Datasonic equity investment is based on share capital, merger deficit,

foreign exchange translation reserve, non-controlling interest, as well as equity

attributed to shareholders with total equity as of year 2019 attributed to

RM262,628,000. Datasonic all exchange differences which occurred as a result of

translation are taken directly to other comprehensive income and accumulated in

equity. Furthermore, Datasonic equity investments are measured based on fair values

with losses and gains recognized in profit or loss. Altan equity financing is higher

(RM685, 520,000) compared to Datasonic (RM262, 628,000) this could also be

attributed to the size of the company and ownership. This also showed that Atlan has

high focus on equity financing compared to Datasonic which has high focus on debt

financing.

Finally, Altan makes use of retained earnings as a source of finance, as of year 2019,

the company retained earnings was RM208, 732,000, which is is part of the equity

attributable to the owners of the parent. This is the company net income transferred

from profit and loss account, which are retained for a particular point in time. Atland

distributes part of dividends of its retained earnings, likewise used for financing

capital projects. This relates to Perking order theory which was developed by Myers

(1984) which indicated that retained earnings are better compared to debt financing

(Sehrish, Khan, & Bilal, 2013).

5.0references

[1] Li Yan. An empirical study on the impact of capital structure on the performance

of pharmaceutical companies [J]. China Economic and Trade Guide (middle), 2020

(04): 32-35.

Atlan is doing better compared to Datasonic, hence may place little emphasis on debt

financing (Taha, & Sanusi, 2013).

Additionally, Datasonic equity investment is based on share capital, merger deficit,

foreign exchange translation reserve, non-controlling interest, as well as equity

attributed to shareholders with total equity as of year 2019 attributed to

RM262,628,000. Datasonic all exchange differences which occurred as a result of

translation are taken directly to other comprehensive income and accumulated in

equity. Furthermore, Datasonic equity investments are measured based on fair values

with losses and gains recognized in profit or loss. Altan equity financing is higher

(RM685, 520,000) compared to Datasonic (RM262, 628,000) this could also be

attributed to the size of the company and ownership. This also showed that Atlan has

high focus on equity financing compared to Datasonic which has high focus on debt

financing.

Finally, Altan makes use of retained earnings as a source of finance, as of year 2019,

the company retained earnings was RM208, 732,000, which is is part of the equity

attributable to the owners of the parent. This is the company net income transferred

from profit and loss account, which are retained for a particular point in time. Atland

distributes part of dividends of its retained earnings, likewise used for financing

capital projects. This relates to Perking order theory which was developed by Myers

(1984) which indicated that retained earnings are better compared to debt financing

(Sehrish, Khan, & Bilal, 2013).

5.0references

[1] Li Yan. An empirical study on the impact of capital structure on the performance

of pharmaceutical companies [J]. China Economic and Trade Guide (middle), 2020

(04): 32-35.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

17

[2] Li Qiuyue. Analysis of optimization of capital structure of real estate

enterprises——Taking Vanke Group as an example [J]. China Economic and Trade

Guide (middle), 2020 (04): 115-117.

[3] Liu Quanxiu, Li Xinglin. An empirical analysis of the impact of listed

companies ’capital structure on corporate value [J]. China Business Review, 2019

(24): 36-38.

[4] Chen Haijun. Corporate governance and dynamic adjustment of capital structure

under the background of big data [J]. Shopping Mall Modernization, 2019 (24):

107-108.

[5] Yu Jingneng. Research on the optimization of corporate capital structure [J].

Times Finance, 2018 (36): 116-117.

[6] Gao Shuang. Analysis of the current situation of capital structure of listed

companies in China [J]. Times Finance, 2018 (36): 193-194.

2018 Atlan Holdings Bhd (173250-W)

http://www.atlan.com.my/index.html

ATLAN real-time stock market

https://www.malaysiastock.biz/Corporate-Infomation.aspx?securityCode=

7048

Atlan Holdings Bhd. (2017) Annual Report 2017. Available at:

http://www.atlan.com.my/_content/annual%20report/documents/ATLAN-AnnualRe

port2017.pdf (Accessed: 22 April 2020).

Atlan Holdings Bhd. (2018) Annual Report 2018. Available at:

http://www.atlan.com.my/_content/annual%20report/documents/ATLAN-AnnualRe

port2018.pdf (Accessed: 22 April 2020).

Popescu L., & Visinescu S. (2010) A Review of the Capital Structure Theories

p.315-320

[2] Li Qiuyue. Analysis of optimization of capital structure of real estate

enterprises——Taking Vanke Group as an example [J]. China Economic and Trade

Guide (middle), 2020 (04): 115-117.

[3] Liu Quanxiu, Li Xinglin. An empirical analysis of the impact of listed

companies ’capital structure on corporate value [J]. China Business Review, 2019

(24): 36-38.

[4] Chen Haijun. Corporate governance and dynamic adjustment of capital structure

under the background of big data [J]. Shopping Mall Modernization, 2019 (24):

107-108.

[5] Yu Jingneng. Research on the optimization of corporate capital structure [J].

Times Finance, 2018 (36): 116-117.

[6] Gao Shuang. Analysis of the current situation of capital structure of listed

companies in China [J]. Times Finance, 2018 (36): 193-194.

2018 Atlan Holdings Bhd (173250-W)

http://www.atlan.com.my/index.html

ATLAN real-time stock market

https://www.malaysiastock.biz/Corporate-Infomation.aspx?securityCode=

7048

Atlan Holdings Bhd. (2017) Annual Report 2017. Available at:

http://www.atlan.com.my/_content/annual%20report/documents/ATLAN-AnnualRe

port2017.pdf (Accessed: 22 April 2020).

Atlan Holdings Bhd. (2018) Annual Report 2018. Available at:

http://www.atlan.com.my/_content/annual%20report/documents/ATLAN-AnnualRe

port2018.pdf (Accessed: 22 April 2020).

Popescu L., & Visinescu S. (2010) A Review of the Capital Structure Theories

p.315-320

18

Sehrish B., Khan, A., & Bilal N. (2013) Static Trade-off theory or Pecking order

theory which one suits best to the financial sector. Evidence from Pakistan,

European Journal of Business and Management, Vol.5, No.23, p. 132-140

Taha, R. & Sanusi N. (2013) Overview of Capital Structure Theory, Studies in

Business and Economics, p. 108-116

Popescu L., & Visinescu S. (2010) A Review of the Capital Structure Theories

p.315-320

Sehrish B., Khan, A., & Bilal N. (2013) Static Trade-off theory or Pecking order

theory which one suits best to the financial sector. Evidence from Pakistan,

European Journal of Business and Management, Vol.5, No.23, p. 132-140

Sehrish B., Khan, A., & Bilal N. (2013) Static Trade-off theory or Pecking order

theory which one suits best to the financial sector. Evidence from Pakistan,

European Journal of Business and Management, Vol.5, No.23, p. 132-140

Taha, R. & Sanusi N. (2013) Overview of Capital Structure Theory, Studies in

Business and Economics, p. 108-116

Popescu L., & Visinescu S. (2010) A Review of the Capital Structure Theories

p.315-320

Sehrish B., Khan, A., & Bilal N. (2013) Static Trade-off theory or Pecking order

theory which one suits best to the financial sector. Evidence from Pakistan,

European Journal of Business and Management, Vol.5, No.23, p. 132-140

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.