Production Output Performance in Singapore

VerifiedAdded on 2023/01/13

|10

|2755

|27

AI Summary

This article discusses the production output performance in Singapore and its impact on the economy. It explores the trends witnessed in this sector and the government measures taken to ensure growth. The article also provides insights into the labor market analysis, unemployment types, and government measures to control unemployment. Additionally, it discusses the price level analysis, inflation causes, and government measures to control inflation. Overall, it provides a comprehensive overview of the production output performance in Singapore.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

TABLE OF CONTENTS

Introduction....................................................................................................................................1

Production Output Performance - Singapore.............................................................................1

Production Output Performance – Witnessed trends explanation...............................................3

Production Output Performance –Government Measures...........................................................4

Labor Market Analysis - Singapore.............................................................................................4

Unemployment types in Singapore..............................................................................................5

Unemployment –Government Measures.....................................................................................6

Price Level Analysis - Singapore..................................................................................................6

Inflation Analysis – Causes.........................................................................................................7

Inflation control – Government Measures...................................................................................8

Conclusion......................................................................................................................................8

Reference........................................................................................................................................9

Introduction....................................................................................................................................1

Production Output Performance - Singapore.............................................................................1

Production Output Performance – Witnessed trends explanation...............................................3

Production Output Performance –Government Measures...........................................................4

Labor Market Analysis - Singapore.............................................................................................4

Unemployment types in Singapore..............................................................................................5

Unemployment –Government Measures.....................................................................................6

Price Level Analysis - Singapore..................................................................................................6

Inflation Analysis – Causes.........................................................................................................7

Inflation control – Government Measures...................................................................................8

Conclusion......................................................................................................................................8

Reference........................................................................................................................................9

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Introduction

Singapore is one of few developed countries based in Asia. However, at the time of

independence in 1965, it was a low income country. The initial growth engine was the rapid

industrialization which it witnessed during the 1960’s and 1970’s. High end manufacturing

fuelled this growth during the 1970’s and 1980’s. But from 1990 onwards, the service sector has

started playing a more pivotal role in the overall economic growth. As per the estimates in March

2015, 73.7% of the GDP is contributed from the services sector. The next in line is industry

which has a contribution of 25.6% to the GDP with agriculture making a contribution of only

0.7% to the GDP. The key industries include financial services, banking, biotechnology, real

estate, energy & infrastructure coupled with high end manufacturing such as telecom

equipments, scientific instruments along with oil drilling equipments (Tan, 2015). The recent

global economic events such as slowing growth rate in Europe and China, trade wars between

US and China, rising prices of oil and monetary easing by world central banks are bound to have

an impact on the economic performance of Singapore going ahead.

Production Output Performance - Singapore

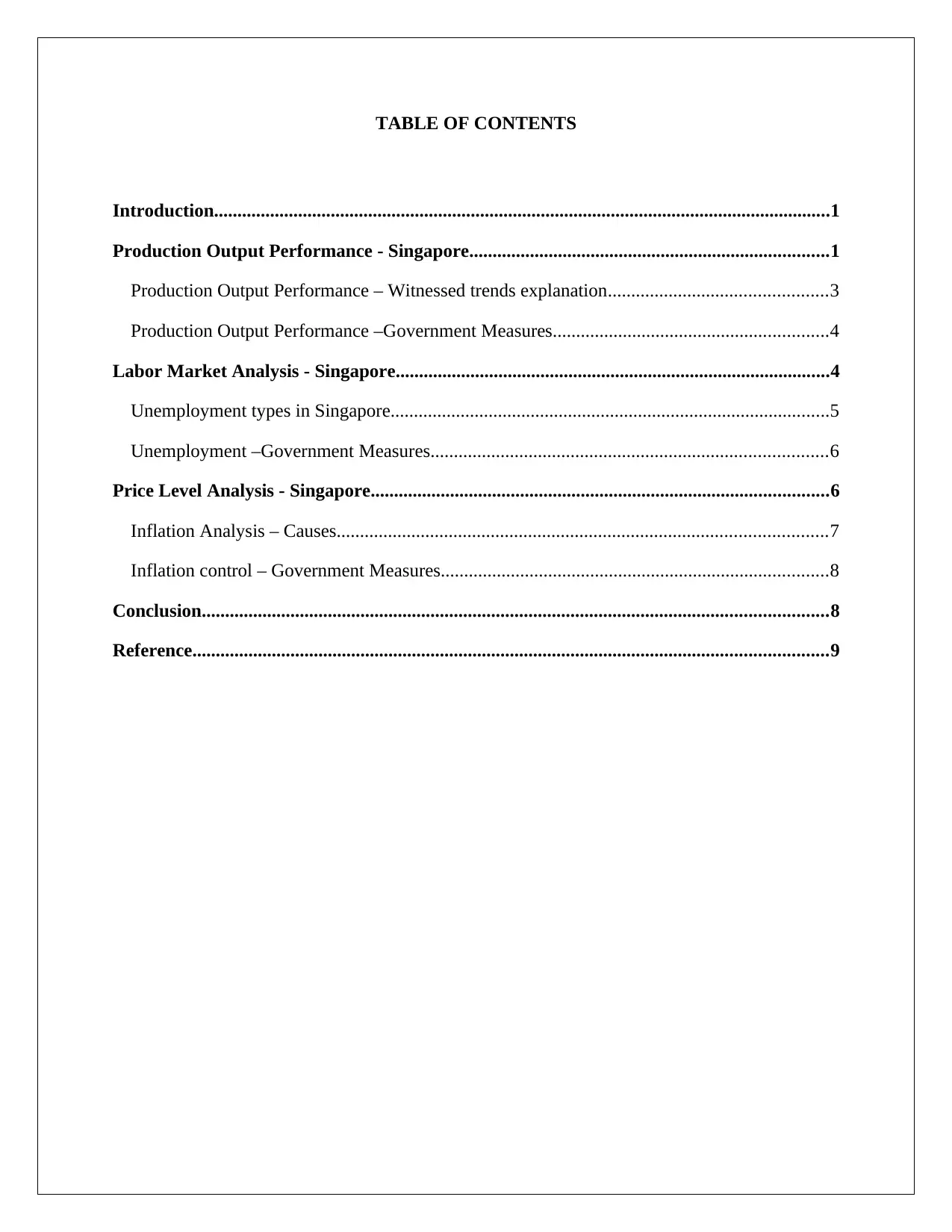

The real GDP trend for Singapore during the relevant period i.e. 2005-2014 is indicated through

the line graph shown as follows (TradingEconomics, 2016).

From the above graph, it is apparent that over the given period the Singaporean economy has

become strong considering that real GDP is highest in 2014 at USD 306.34 billion. This is more

than twice the starting level in 2004 when real GDP was about USD 140 billion. Also, the

1

Singapore is one of few developed countries based in Asia. However, at the time of

independence in 1965, it was a low income country. The initial growth engine was the rapid

industrialization which it witnessed during the 1960’s and 1970’s. High end manufacturing

fuelled this growth during the 1970’s and 1980’s. But from 1990 onwards, the service sector has

started playing a more pivotal role in the overall economic growth. As per the estimates in March

2015, 73.7% of the GDP is contributed from the services sector. The next in line is industry

which has a contribution of 25.6% to the GDP with agriculture making a contribution of only

0.7% to the GDP. The key industries include financial services, banking, biotechnology, real

estate, energy & infrastructure coupled with high end manufacturing such as telecom

equipments, scientific instruments along with oil drilling equipments (Tan, 2015). The recent

global economic events such as slowing growth rate in Europe and China, trade wars between

US and China, rising prices of oil and monetary easing by world central banks are bound to have

an impact on the economic performance of Singapore going ahead.

Production Output Performance - Singapore

The real GDP trend for Singapore during the relevant period i.e. 2005-2014 is indicated through

the line graph shown as follows (TradingEconomics, 2016).

From the above graph, it is apparent that over the given period the Singaporean economy has

become strong considering that real GDP is highest in 2014 at USD 306.34 billion. This is more

than twice the starting level in 2004 when real GDP was about USD 140 billion. Also, the

1

robustness of Singaporean economy can be witnessed from the fact that it remained resilient

even during the global financial crisis of 2008-2009 and did not show any significant decline.

However, the growth of GDP during 2010--2012 (i.e. aftermath of global financial crisis) was

quite impressive

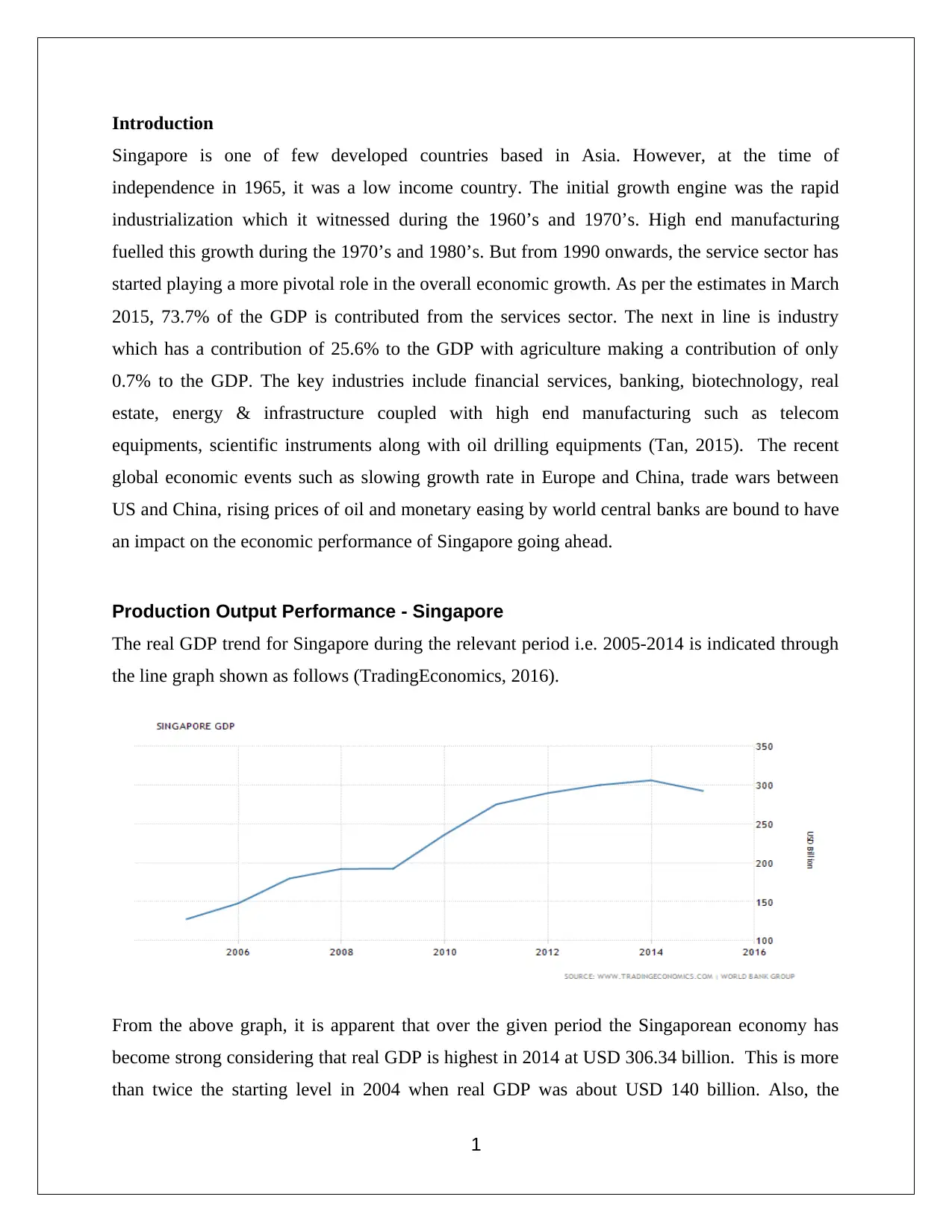

The line graph highlighted the real GDP growth for Singapore during 2005-2014 is as

highlighted below (TradingEconomics, 2016).

The above graph clearly highlights that the economy witnessed the highest quarterly GDP

growth of 37.2% . This was observed at the time when the economy was recovering from the

financial crisis that commenced in 2008. The least quarterly growth rate of -13.5% can also be

attributed to the global financial crisis which in 2009 was at peak. The key aspect highlighted in

the graph is that the economy has the ability to emerge stronger from a global crisis of the

magnitude of the actual financial crisis.

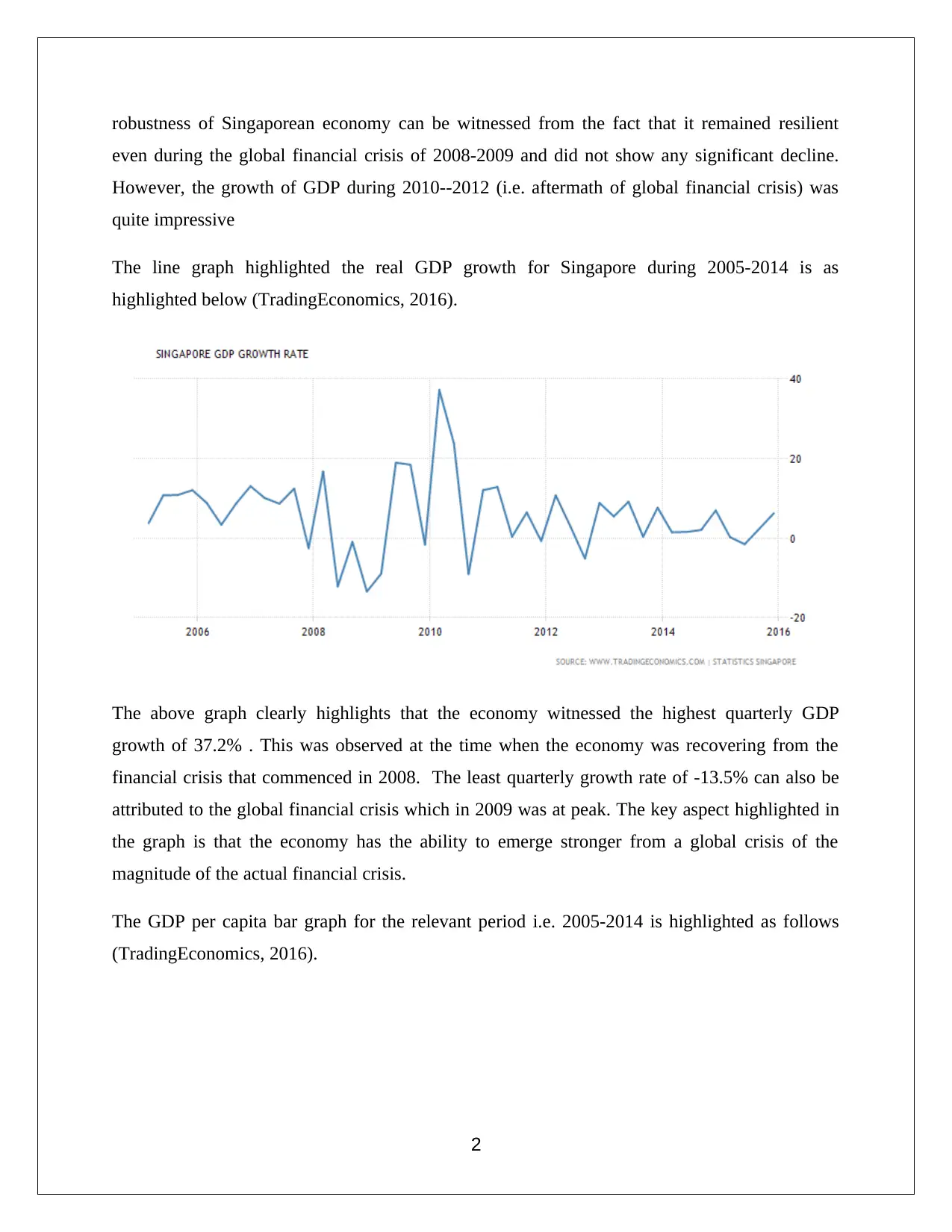

The GDP per capita bar graph for the relevant period i.e. 2005-2014 is highlighted as follows

(TradingEconomics, 2016).

2

even during the global financial crisis of 2008-2009 and did not show any significant decline.

However, the growth of GDP during 2010--2012 (i.e. aftermath of global financial crisis) was

quite impressive

The line graph highlighted the real GDP growth for Singapore during 2005-2014 is as

highlighted below (TradingEconomics, 2016).

The above graph clearly highlights that the economy witnessed the highest quarterly GDP

growth of 37.2% . This was observed at the time when the economy was recovering from the

financial crisis that commenced in 2008. The least quarterly growth rate of -13.5% can also be

attributed to the global financial crisis which in 2009 was at peak. The key aspect highlighted in

the graph is that the economy has the ability to emerge stronger from a global crisis of the

magnitude of the actual financial crisis.

The GDP per capita bar graph for the relevant period i.e. 2005-2014 is highlighted as follows

(TradingEconomics, 2016).

2

Barring the years of global financial crisis (i.e. 2008 and 2009), the GDP per capita for the

economy has witnessed a growth every year. The highest level in this regards was witnessed in

2014 at USD 51,440 while the lowest level during the relevant period was witnessed in 2005 at

USD 40,020. The improvement in the GDP per capita is irrefutable evidence about the

improvement of living standards of people of Singapore.

Production Output Performance – Witnessed trends explanation

It is evident that thee economic growth heading into the global financial crisis was quite robust.

This steady growth was attributed to flourishing global economy which bolstered global trade

and demand for services. Thus, the rapid GDP growth witnessed during 2005-2007 was in line

with the robust global economic growth. However, in 2008, USA was hit by the global financial

crisis which had ripple effects on the global economy. There was drop in global trade as the

demand for various products and services plummeted. The worst hit sector was financial services

which at that time was a key contributor to GDP in Singapore. As a result, there a minor blip in

GDP growth in 2009 when the financial crisis was at peak. However, the resilience of the

economy can be seen from the steady growth path that the economy has been on since 2010

onwards.

Considering the increase in real GDP, it is evident that the there has been significant increase in

the volume of goods and services produced in Singapore. The real GDP growth rate in the

3

economy has witnessed a growth every year. The highest level in this regards was witnessed in

2014 at USD 51,440 while the lowest level during the relevant period was witnessed in 2005 at

USD 40,020. The improvement in the GDP per capita is irrefutable evidence about the

improvement of living standards of people of Singapore.

Production Output Performance – Witnessed trends explanation

It is evident that thee economic growth heading into the global financial crisis was quite robust.

This steady growth was attributed to flourishing global economy which bolstered global trade

and demand for services. Thus, the rapid GDP growth witnessed during 2005-2007 was in line

with the robust global economic growth. However, in 2008, USA was hit by the global financial

crisis which had ripple effects on the global economy. There was drop in global trade as the

demand for various products and services plummeted. The worst hit sector was financial services

which at that time was a key contributor to GDP in Singapore. As a result, there a minor blip in

GDP growth in 2009 when the financial crisis was at peak. However, the resilience of the

economy can be seen from the steady growth path that the economy has been on since 2010

onwards.

Considering the increase in real GDP, it is evident that the there has been significant increase in

the volume of goods and services produced in Singapore. The real GDP growth rate in the

3

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

aftermath of global financial crisis has been quite stable which offers a steady GDP growth

without any major hiccups. There has been a steady improvement in the GDP per capita from

2010 onwards which highlights growing productivity and better living standards for people

which augers well for future growth of the economy (Mankiw, 2014).

Production Output Performance –Government Measures

The government has played a pivotal role in the economic performance highlighted for

Singapore during the period under consideration. A key aspect in this regards is to provide a

favorable investment climate through ease of doing business so as to attract foreign investors and

FDI. Also, the government through prudent budgetary allocation has ensured that there are

incentives for research related to advanced technology considering that it is a vital focus area.

Besides, the government has made sizable investments in skills development programs besides

investing in education and health related infrastructure which has led to improved productivity

for the Singaporean people. The government has ensured focus on businesses considering that

arable land availability in Singapore is quite minimal. Further, during the financial crisis, the

government took proactive measures to provide stimulus to the economy besides safeguarding

the financial services industry which is a lynchpin of the economy. As a result, Singapore has

been successful in retaining its position as a global financial hub (Waring & Lewer, 2013).

Labor Market Analysis - Singapore

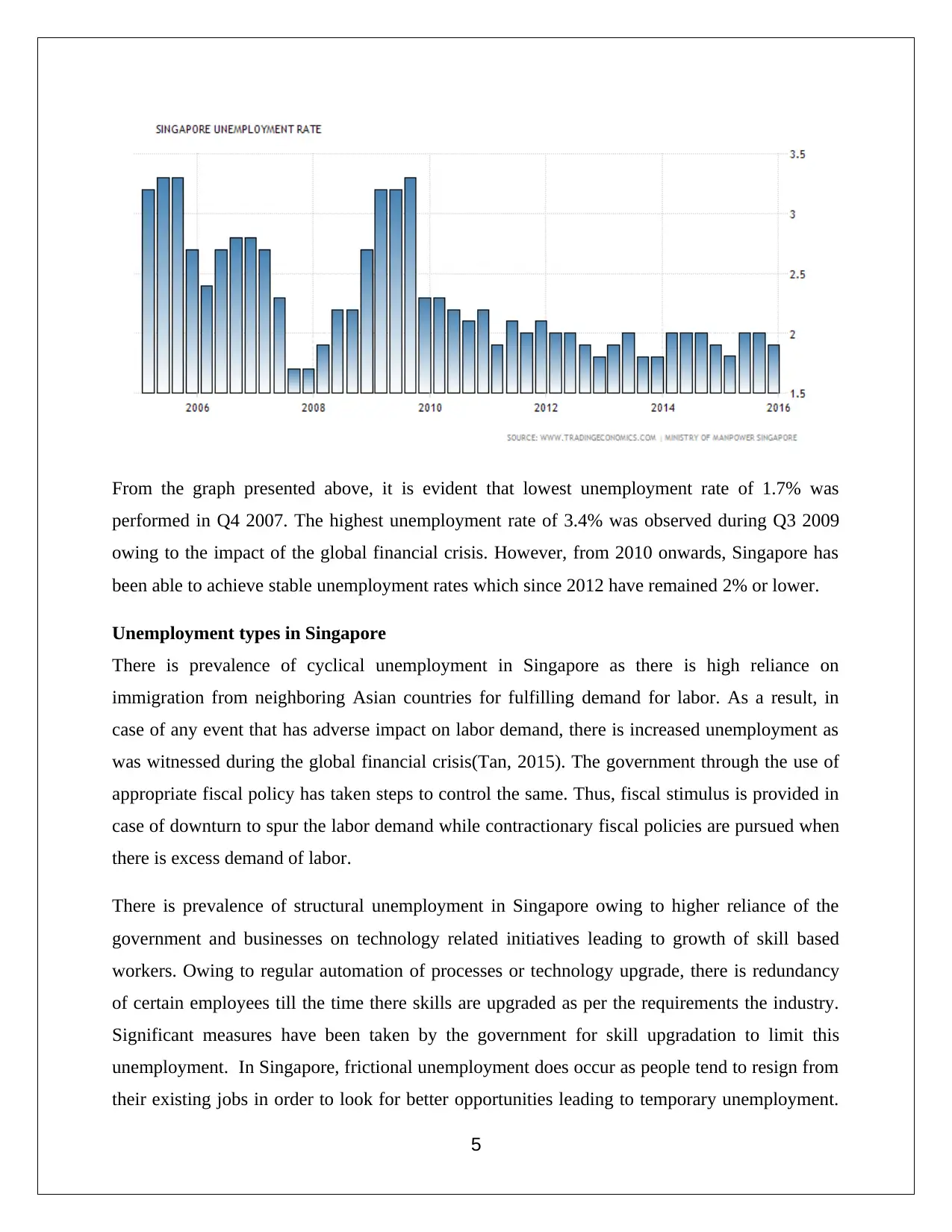

The bar chart highlighted the unemployment rate for Singapore for the concerned period from

2005-2014 is indicated as follows (TradingEconomics, 2016).

4

without any major hiccups. There has been a steady improvement in the GDP per capita from

2010 onwards which highlights growing productivity and better living standards for people

which augers well for future growth of the economy (Mankiw, 2014).

Production Output Performance –Government Measures

The government has played a pivotal role in the economic performance highlighted for

Singapore during the period under consideration. A key aspect in this regards is to provide a

favorable investment climate through ease of doing business so as to attract foreign investors and

FDI. Also, the government through prudent budgetary allocation has ensured that there are

incentives for research related to advanced technology considering that it is a vital focus area.

Besides, the government has made sizable investments in skills development programs besides

investing in education and health related infrastructure which has led to improved productivity

for the Singaporean people. The government has ensured focus on businesses considering that

arable land availability in Singapore is quite minimal. Further, during the financial crisis, the

government took proactive measures to provide stimulus to the economy besides safeguarding

the financial services industry which is a lynchpin of the economy. As a result, Singapore has

been successful in retaining its position as a global financial hub (Waring & Lewer, 2013).

Labor Market Analysis - Singapore

The bar chart highlighted the unemployment rate for Singapore for the concerned period from

2005-2014 is indicated as follows (TradingEconomics, 2016).

4

From the graph presented above, it is evident that lowest unemployment rate of 1.7% was

performed in Q4 2007. The highest unemployment rate of 3.4% was observed during Q3 2009

owing to the impact of the global financial crisis. However, from 2010 onwards, Singapore has

been able to achieve stable unemployment rates which since 2012 have remained 2% or lower.

Unemployment types in Singapore

There is prevalence of cyclical unemployment in Singapore as there is high reliance on

immigration from neighboring Asian countries for fulfilling demand for labor. As a result, in

case of any event that has adverse impact on labor demand, there is increased unemployment as

was witnessed during the global financial crisis(Tan, 2015). The government through the use of

appropriate fiscal policy has taken steps to control the same. Thus, fiscal stimulus is provided in

case of downturn to spur the labor demand while contractionary fiscal policies are pursued when

there is excess demand of labor.

There is prevalence of structural unemployment in Singapore owing to higher reliance of the

government and businesses on technology related initiatives leading to growth of skill based

workers. Owing to regular automation of processes or technology upgrade, there is redundancy

of certain employees till the time there skills are upgraded as per the requirements the industry.

Significant measures have been taken by the government for skill upgradation to limit this

unemployment. In Singapore, frictional unemployment does occur as people tend to resign from

their existing jobs in order to look for better opportunities leading to temporary unemployment.

5

performed in Q4 2007. The highest unemployment rate of 3.4% was observed during Q3 2009

owing to the impact of the global financial crisis. However, from 2010 onwards, Singapore has

been able to achieve stable unemployment rates which since 2012 have remained 2% or lower.

Unemployment types in Singapore

There is prevalence of cyclical unemployment in Singapore as there is high reliance on

immigration from neighboring Asian countries for fulfilling demand for labor. As a result, in

case of any event that has adverse impact on labor demand, there is increased unemployment as

was witnessed during the global financial crisis(Tan, 2015). The government through the use of

appropriate fiscal policy has taken steps to control the same. Thus, fiscal stimulus is provided in

case of downturn to spur the labor demand while contractionary fiscal policies are pursued when

there is excess demand of labor.

There is prevalence of structural unemployment in Singapore owing to higher reliance of the

government and businesses on technology related initiatives leading to growth of skill based

workers. Owing to regular automation of processes or technology upgrade, there is redundancy

of certain employees till the time there skills are upgraded as per the requirements the industry.

Significant measures have been taken by the government for skill upgradation to limit this

unemployment. In Singapore, frictional unemployment does occur as people tend to resign from

their existing jobs in order to look for better opportunities leading to temporary unemployment.

5

In order to reduce the same, there are job portals, job fairs and jobs offices set up by the

Community Development Centers.

Unemployment –Government Measures

A number of measures have been taken by the government to control the unemployment. This

was especially the case during the economic crisis of 2008 when there was an increase in the

unemployment rate. Resilience Package was introduced by the government in order to ensure

that unemployment remained within limits. Also, Jobs Credit Scheme was announced by the then

Minister of Finance in order to tackle cyclical unemployment created by the downturn.

A key role is played by the fiscal policy where suitable incentives are offered so as to encourage

measures for upgrading technology and improvement in productivity so that the businesses

remain cost competitive (Borio, 2014).Further, there are programs such as Workfare Income

Supplement (WIS) for providing active support to unemployed people which ensures that during

unemployment, people have enough financial resources for skill enhancement (Wagner, 2014).

To minimize the menace of structural unemployment, various measures such as Skill Programme

for Upgrading and Resilience (SPUR) have been initiated by the government which ensures that

trainees earn a living in the process of learning relevant skills (Cho & Newhouse, 2013).

Another key policy of the government is not to introduce any minimum wage. This has played a

vital part in ensuring that the natural unemployment rate for Singapore is lower than 2%. This is

because minimum wage imposition tends to lead to demand supply imbalances which are non-

existent in Singapore. As a result, the wage rates derived by the people are essentially driven by

their skills. This also provides adequate incentive for the people to constantly upgrade their skills

and lowers structural unemployment.

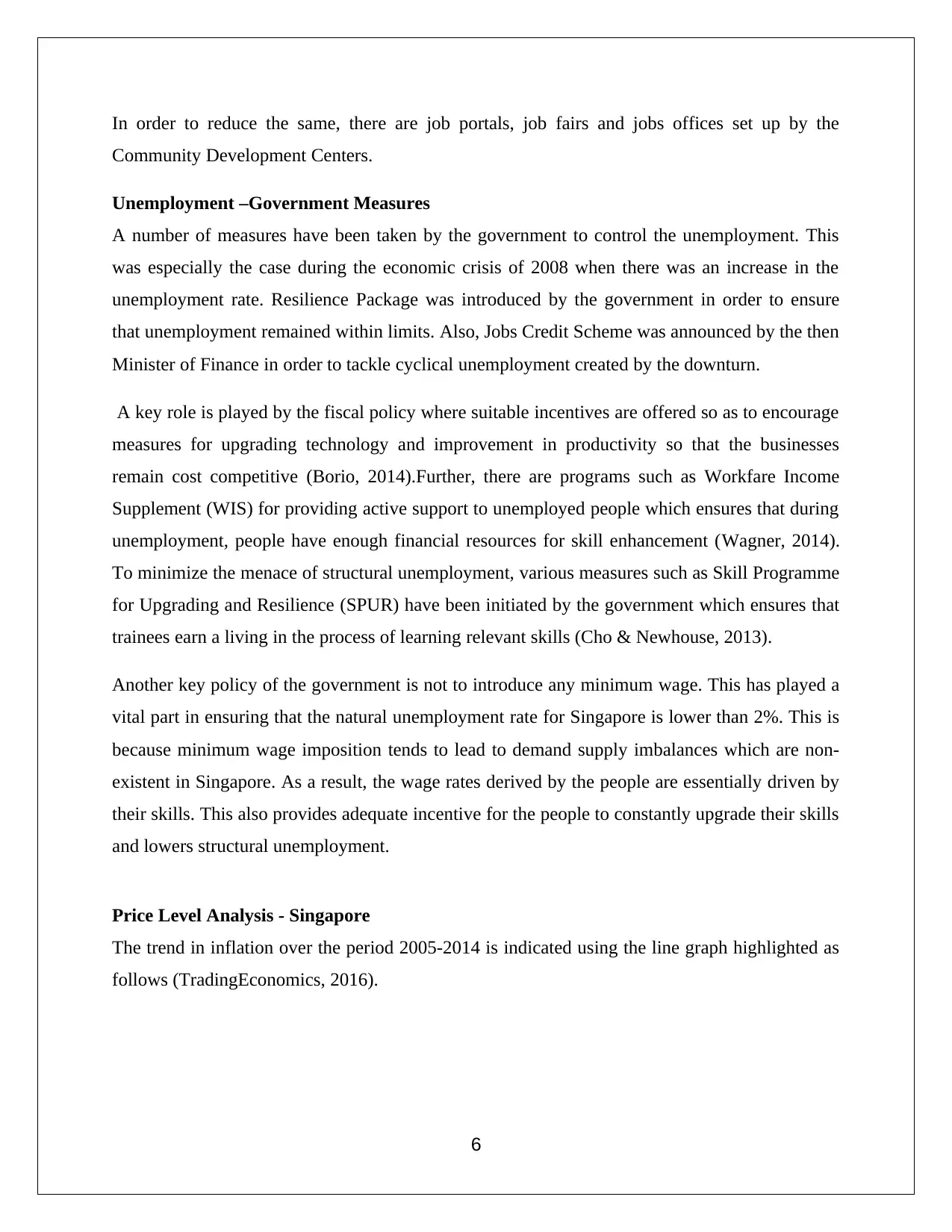

Price Level Analysis - Singapore

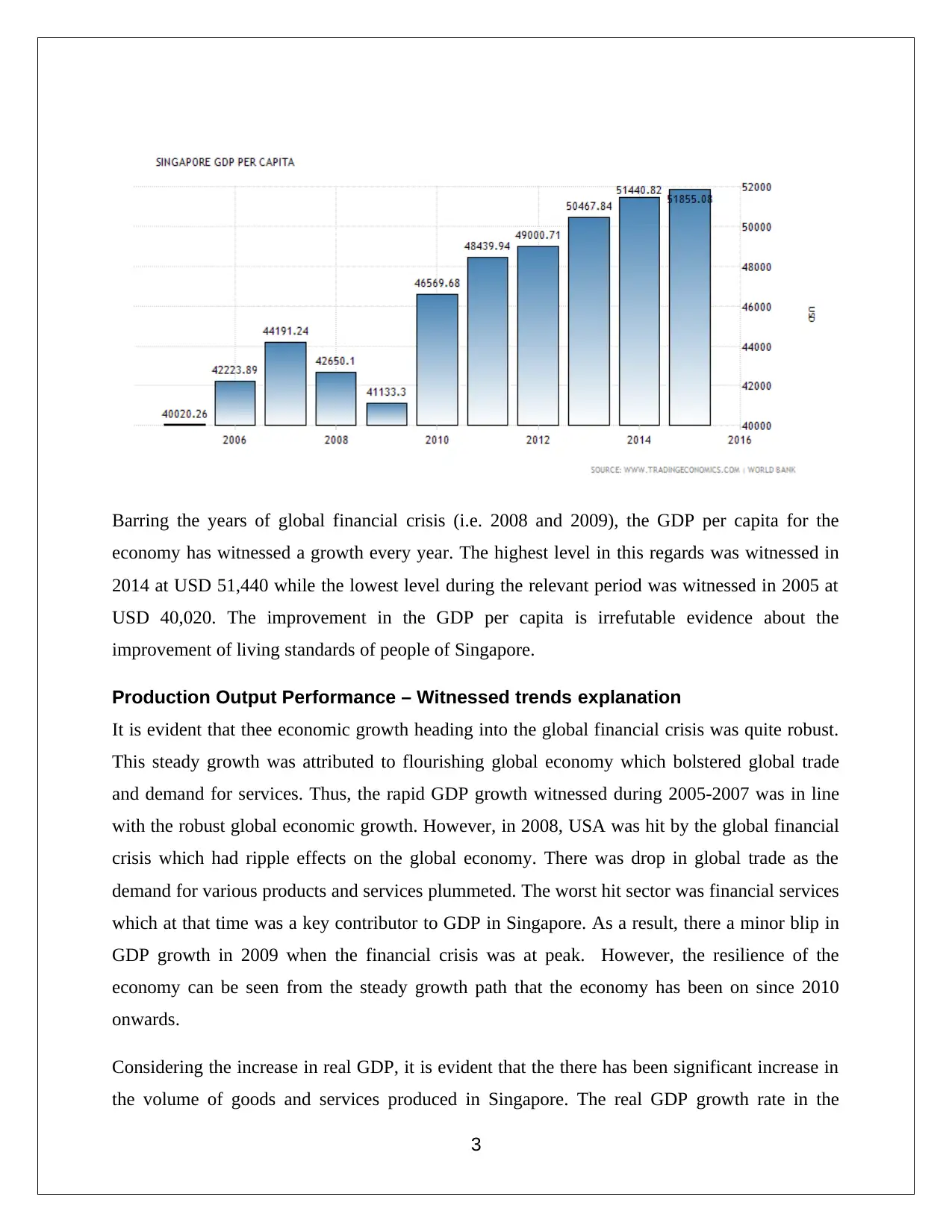

The trend in inflation over the period 2005-2014 is indicated using the line graph highlighted as

follows (TradingEconomics, 2016).

6

Community Development Centers.

Unemployment –Government Measures

A number of measures have been taken by the government to control the unemployment. This

was especially the case during the economic crisis of 2008 when there was an increase in the

unemployment rate. Resilience Package was introduced by the government in order to ensure

that unemployment remained within limits. Also, Jobs Credit Scheme was announced by the then

Minister of Finance in order to tackle cyclical unemployment created by the downturn.

A key role is played by the fiscal policy where suitable incentives are offered so as to encourage

measures for upgrading technology and improvement in productivity so that the businesses

remain cost competitive (Borio, 2014).Further, there are programs such as Workfare Income

Supplement (WIS) for providing active support to unemployed people which ensures that during

unemployment, people have enough financial resources for skill enhancement (Wagner, 2014).

To minimize the menace of structural unemployment, various measures such as Skill Programme

for Upgrading and Resilience (SPUR) have been initiated by the government which ensures that

trainees earn a living in the process of learning relevant skills (Cho & Newhouse, 2013).

Another key policy of the government is not to introduce any minimum wage. This has played a

vital part in ensuring that the natural unemployment rate for Singapore is lower than 2%. This is

because minimum wage imposition tends to lead to demand supply imbalances which are non-

existent in Singapore. As a result, the wage rates derived by the people are essentially driven by

their skills. This also provides adequate incentive for the people to constantly upgrade their skills

and lowers structural unemployment.

Price Level Analysis - Singapore

The trend in inflation over the period 2005-2014 is indicated using the line graph highlighted as

follows (TradingEconomics, 2016).

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

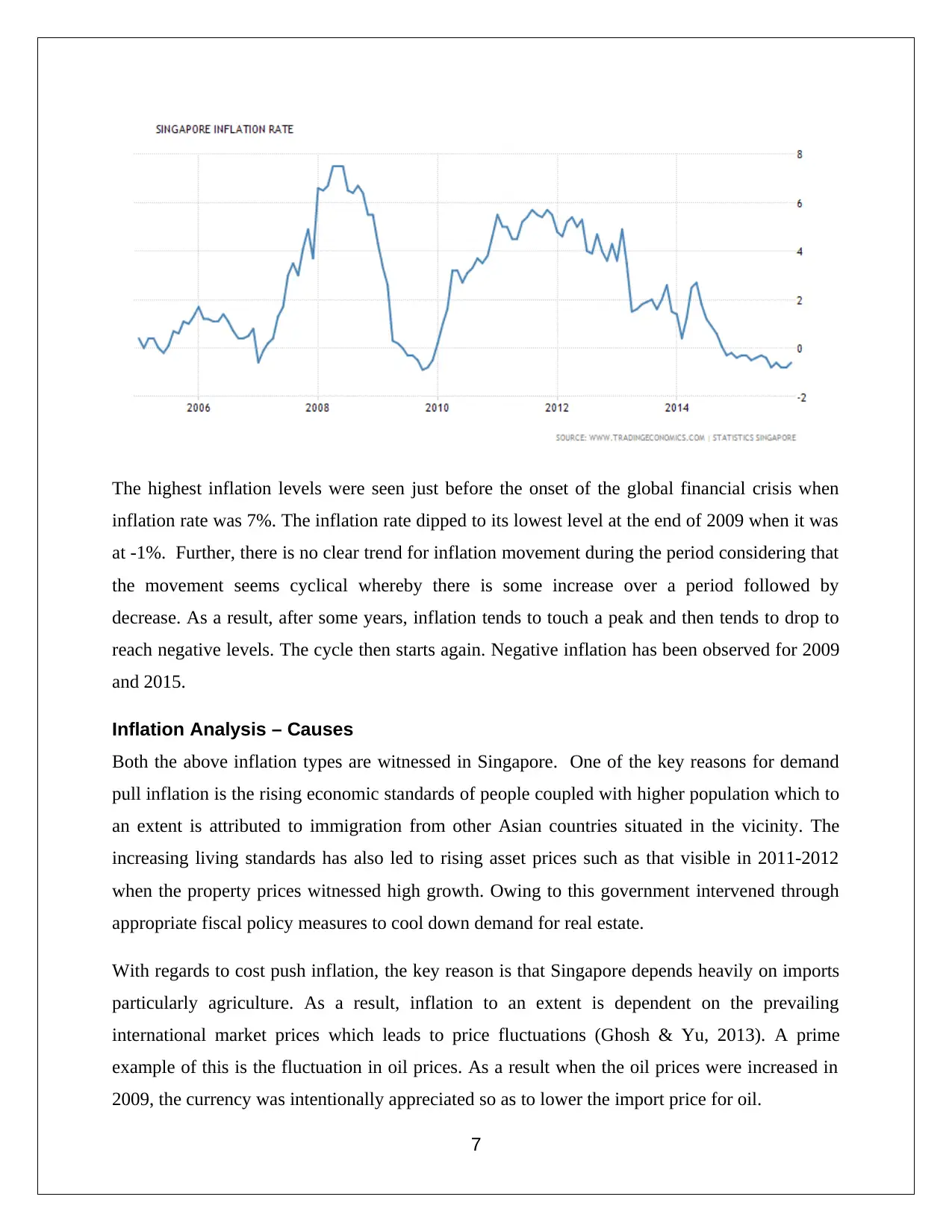

The highest inflation levels were seen just before the onset of the global financial crisis when

inflation rate was 7%. The inflation rate dipped to its lowest level at the end of 2009 when it was

at -1%. Further, there is no clear trend for inflation movement during the period considering that

the movement seems cyclical whereby there is some increase over a period followed by

decrease. As a result, after some years, inflation tends to touch a peak and then tends to drop to

reach negative levels. The cycle then starts again. Negative inflation has been observed for 2009

and 2015.

Inflation Analysis – Causes

Both the above inflation types are witnessed in Singapore. One of the key reasons for demand

pull inflation is the rising economic standards of people coupled with higher population which to

an extent is attributed to immigration from other Asian countries situated in the vicinity. The

increasing living standards has also led to rising asset prices such as that visible in 2011-2012

when the property prices witnessed high growth. Owing to this government intervened through

appropriate fiscal policy measures to cool down demand for real estate.

With regards to cost push inflation, the key reason is that Singapore depends heavily on imports

particularly agriculture. As a result, inflation to an extent is dependent on the prevailing

international market prices which leads to price fluctuations (Ghosh & Yu, 2013). A prime

example of this is the fluctuation in oil prices. As a result when the oil prices were increased in

2009, the currency was intentionally appreciated so as to lower the import price for oil.

7

inflation rate was 7%. The inflation rate dipped to its lowest level at the end of 2009 when it was

at -1%. Further, there is no clear trend for inflation movement during the period considering that

the movement seems cyclical whereby there is some increase over a period followed by

decrease. As a result, after some years, inflation tends to touch a peak and then tends to drop to

reach negative levels. The cycle then starts again. Negative inflation has been observed for 2009

and 2015.

Inflation Analysis – Causes

Both the above inflation types are witnessed in Singapore. One of the key reasons for demand

pull inflation is the rising economic standards of people coupled with higher population which to

an extent is attributed to immigration from other Asian countries situated in the vicinity. The

increasing living standards has also led to rising asset prices such as that visible in 2011-2012

when the property prices witnessed high growth. Owing to this government intervened through

appropriate fiscal policy measures to cool down demand for real estate.

With regards to cost push inflation, the key reason is that Singapore depends heavily on imports

particularly agriculture. As a result, inflation to an extent is dependent on the prevailing

international market prices which leads to price fluctuations (Ghosh & Yu, 2013). A prime

example of this is the fluctuation in oil prices. As a result when the oil prices were increased in

2009, the currency was intentionally appreciated so as to lower the import price for oil.

7

Inflation control – Government Measures

The mandate of the monetary authority of Singapore is to maintain the exchange rate within a

predefined range considering that dependence of the country on trade. Further, the country

depends on imports for fulfilling the shortfall in key items particularly food (Bhaskaran, 2014).

Also, suitable measures are taken so as to ensure stability of exchange rate in the wake of inflow

and outflow of money. The control of inflation is primarily carried out through fiscal policy

which ensures that the demand remains robust and takes measures so as to provide overheating

of economy. This is unlike other developed countries where inflation targeting is adhered to by

the central bank(Das, 2014).

Conclusion

The discussion above clearly highlights that during the given period (i.e. 2005-2014), the

economy of Singapore has strengthened. This is evident from the fact that highest GDP for the

country was seen in 2014 and also the GDP growth rate during the period was quite robust

despite the global financial crisis. The government policies and intervention has contributed to

this economic stability. All the three common types of unemployment persist in Singapore but

the government has taken proactive measures to minimize structural employment. The success is

visible from the fact that from 2012 onwards, the unemployment rate has not crossed 2 percent

which is commendable. The inflation trends seem to be variable which may be contributed to the

fact that monetary policy is focused through exchange rate stabilization. As a result, tight control

of inflation within a narrow range is not witnessed for Singapore.

Going forward, it is expected that the economic growth in Singapore is expected to be tepid in

the backdrop of a challenging global economy scenario. There has been lowering of global

growth estimates by the IMF. Further, increasing barriers to trade as indicated by the recent trade

wars does not auger well for Singapore’s open economy. Additionally, the increasing oil prices

also pose risk to economic growth going forward.

Reference

Bhaskaran, M., (2014).Challenges Facing the Singapore Economy. Southeast Asian

8

The mandate of the monetary authority of Singapore is to maintain the exchange rate within a

predefined range considering that dependence of the country on trade. Further, the country

depends on imports for fulfilling the shortfall in key items particularly food (Bhaskaran, 2014).

Also, suitable measures are taken so as to ensure stability of exchange rate in the wake of inflow

and outflow of money. The control of inflation is primarily carried out through fiscal policy

which ensures that the demand remains robust and takes measures so as to provide overheating

of economy. This is unlike other developed countries where inflation targeting is adhered to by

the central bank(Das, 2014).

Conclusion

The discussion above clearly highlights that during the given period (i.e. 2005-2014), the

economy of Singapore has strengthened. This is evident from the fact that highest GDP for the

country was seen in 2014 and also the GDP growth rate during the period was quite robust

despite the global financial crisis. The government policies and intervention has contributed to

this economic stability. All the three common types of unemployment persist in Singapore but

the government has taken proactive measures to minimize structural employment. The success is

visible from the fact that from 2012 onwards, the unemployment rate has not crossed 2 percent

which is commendable. The inflation trends seem to be variable which may be contributed to the

fact that monetary policy is focused through exchange rate stabilization. As a result, tight control

of inflation within a narrow range is not witnessed for Singapore.

Going forward, it is expected that the economic growth in Singapore is expected to be tepid in

the backdrop of a challenging global economy scenario. There has been lowering of global

growth estimates by the IMF. Further, increasing barriers to trade as indicated by the recent trade

wars does not auger well for Singapore’s open economy. Additionally, the increasing oil prices

also pose risk to economic growth going forward.

Reference

Bhaskaran, M., (2014).Challenges Facing the Singapore Economy. Southeast Asian

8

Affairs, 2014(1), 290-302.

Borio, C. (2014). The financial cycle and macroeconomics: What have we learnt?.Journal of

Banking & Finance, 45, 182-198.

Cho, Y., & Newhouse, D. (2013). How did the great recession affect different types of workers?

Evidence from 17 middle-income countries. World Development, 41, 31-50.

Gandolfo, G., (2013). International Economics II: International Monetary Theory and Open-

Economy Macroeconomics. Springer Science & Business Media.

Ghosh, A. & Yu, J., (2013). Singapore Inflation Expectations: Expecting the Unexpected.

SimKee Boon Institute for Financial Economics, Lee Kong Chian School of Business,

Singapore Management University.

Goodwin, N., Nelson, J., Harris, J., Torras, M. & Roach, B., (2013).Macroeconomics in

context.ME Sharpe.

Mankiw, N. (2014). Macroeconomics. New York: Worth Publishers

Simpson, B. (2014). Money, Banking, and the Business Cycle. Basingstoke: Palgrave Macmillan.

Tan, K. P. (2015). Singapore in 2014. Asian Survey, 55(1), 157-164.

Trading Economics (2016), 300,000 Indicators from 196 countries, Retrieved on 4 April, 2019

from http://www.tradingeconomics.com/

Waring, P., &Lewer, J. (2013).The global financial crisis, employment relations and the labour

market in Singapore and Australia. Asia Pacific Business Review, 19(2), 217-229.

Weale, M., Blake, A., &Christodoulakis, N. (2015). Macroeconomic Policy. Florence: Taylor

and Francis.

9

Borio, C. (2014). The financial cycle and macroeconomics: What have we learnt?.Journal of

Banking & Finance, 45, 182-198.

Cho, Y., & Newhouse, D. (2013). How did the great recession affect different types of workers?

Evidence from 17 middle-income countries. World Development, 41, 31-50.

Gandolfo, G., (2013). International Economics II: International Monetary Theory and Open-

Economy Macroeconomics. Springer Science & Business Media.

Ghosh, A. & Yu, J., (2013). Singapore Inflation Expectations: Expecting the Unexpected.

SimKee Boon Institute for Financial Economics, Lee Kong Chian School of Business,

Singapore Management University.

Goodwin, N., Nelson, J., Harris, J., Torras, M. & Roach, B., (2013).Macroeconomics in

context.ME Sharpe.

Mankiw, N. (2014). Macroeconomics. New York: Worth Publishers

Simpson, B. (2014). Money, Banking, and the Business Cycle. Basingstoke: Palgrave Macmillan.

Tan, K. P. (2015). Singapore in 2014. Asian Survey, 55(1), 157-164.

Trading Economics (2016), 300,000 Indicators from 196 countries, Retrieved on 4 April, 2019

from http://www.tradingeconomics.com/

Waring, P., &Lewer, J. (2013).The global financial crisis, employment relations and the labour

market in Singapore and Australia. Asia Pacific Business Review, 19(2), 217-229.

Weale, M., Blake, A., &Christodoulakis, N. (2015). Macroeconomic Policy. Florence: Taylor

and Francis.

9

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.