Tapping into New and International Markets: Analysis of Opportunities and Challenges for Global Growth

VerifiedAdded on 2023/06/15

|13

|4848

|472

AI Summary

This report discusses the critical analysis of global business environment and influence of key global drivers, rationale for SME to expand their business internationally, analysis of opportunities and challenges for global growth, range of trading blocs and agreements and advantage of specific trading agreements which will have direct significance.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

TAPPING INTO NEW AND

INTERNATIONAL

MARKETS

INTERNATIONAL

MARKETS

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION....................................................................................................................3

PART 1......................................................................................................................................3

Critical analysis of global business environment and influence of key global drivers..........3

Rationale for SME to expand their business internationally..................................................5

Analysis of opportunities and challenges for global growth..................................................5

Range of trading blocs and agreements and advantage of specific trading agreements which

will have direct significance...................................................................................................7

Evaluation of the above and how these will stimulate and generate global growth..............8

PART2.......................................................................................................................................9

CONCLUSION.......................................................................................................................11

REFERENCES.......................................................................................................................12

INTRODUCTION....................................................................................................................3

PART 1......................................................................................................................................3

Critical analysis of global business environment and influence of key global drivers..........3

Rationale for SME to expand their business internationally..................................................5

Analysis of opportunities and challenges for global growth..................................................5

Range of trading blocs and agreements and advantage of specific trading agreements which

will have direct significance...................................................................................................7

Evaluation of the above and how these will stimulate and generate global growth..............8

PART2.......................................................................................................................................9

CONCLUSION.......................................................................................................................11

REFERENCES.......................................................................................................................12

INTRODUCTION

Internationalization is the process followed by business to expand their global

footprints across domestic market by understanding global consumer preferences and patterns

(What is internalization, 2021). The global corporate trend towards internationalization

develops the economy, interconnects different economies due to cross border commerce and

finance and also involves international transaction throughout the global market place. A

market that exists outside of a company's native country or operates in international borders

is referred to as an international market. Globalisation is the growth of interdependency of

world economy, culture and cross border transactions which will facilitate movements among

different countries (What is globalization, 2021). Monzo bank is an online bank based on

UK. This bank was created in 2015 by Tom Blomfield, Paul Rippon, Jason Bates, Jonas

Huckestein, and Gary Dolman in London, United Kingdom. The country chosen for this

report is Iceland of European region. This report will define the global business environment

in which business operates and will outline threats and opportunities. The project will also list

some advantages and of international trading and importing and exporting. Tariff and non-

tariff activities will be listed in the report which exist in international trading environment.

The study will also outline different methods which will help an SME business to operate in

international market with listing the benefits and drawbacks.

PART 1

Critical analysis of global business environment and influence of key global drivers

The word "globalisation" refers to the growing commercial and financial

interconnectedness of the global economy (Global business environment, 2019). Participating

in the global environment may be tremendously advantageous to a business, but it can also be

quite harmful. The global business environment compromises of internal and external factors

which involves various factors, such as- political socio-cultural, economic, environmental,

technological and legal factors.

PESTEL analysis

PESTEL analysis is a strategic technique that is used to assess an organization's

macro environment. In context of Monzo bank, the company will be expanding their business

in Iceland, the global business environment factors and key drivers of change for the

company is analysed with the help of PESTEL analysis which is discussed below:

Internationalization is the process followed by business to expand their global

footprints across domestic market by understanding global consumer preferences and patterns

(What is internalization, 2021). The global corporate trend towards internationalization

develops the economy, interconnects different economies due to cross border commerce and

finance and also involves international transaction throughout the global market place. A

market that exists outside of a company's native country or operates in international borders

is referred to as an international market. Globalisation is the growth of interdependency of

world economy, culture and cross border transactions which will facilitate movements among

different countries (What is globalization, 2021). Monzo bank is an online bank based on

UK. This bank was created in 2015 by Tom Blomfield, Paul Rippon, Jason Bates, Jonas

Huckestein, and Gary Dolman in London, United Kingdom. The country chosen for this

report is Iceland of European region. This report will define the global business environment

in which business operates and will outline threats and opportunities. The project will also list

some advantages and of international trading and importing and exporting. Tariff and non-

tariff activities will be listed in the report which exist in international trading environment.

The study will also outline different methods which will help an SME business to operate in

international market with listing the benefits and drawbacks.

PART 1

Critical analysis of global business environment and influence of key global drivers

The word "globalisation" refers to the growing commercial and financial

interconnectedness of the global economy (Global business environment, 2019). Participating

in the global environment may be tremendously advantageous to a business, but it can also be

quite harmful. The global business environment compromises of internal and external factors

which involves various factors, such as- political socio-cultural, economic, environmental,

technological and legal factors.

PESTEL analysis

PESTEL analysis is a strategic technique that is used to assess an organization's

macro environment. In context of Monzo bank, the company will be expanding their business

in Iceland, the global business environment factors and key drivers of change for the

company is analysed with the help of PESTEL analysis which is discussed below:

Political factors- Political issues are important to consider when assessing the aspects

that may have an influence on Monzo Bank's long-term profitability in the free market.

Before entering Iceland's markets, Monzo Bank must assess political stability, amount of

corruption, bureaucracy, legislative framework, trade rules, pricing restrictions, preferred

trading partners, and other political aspects that will aid in comprehending the country's

political climate.

Economic factors- Inflation rate, savings and interest rate, foreign exchange rate,

aggregate demand, bank industry growth rate, consumer spending potential, government

intervention, infrastructure quality in banks industry, and labor skill level in banking industry

of the market in Iceland are all economic factors that Monzo bank must consider (Culkin,

Murzacheva and Davis, 2016). Such factors are responsible to create an impact on the

stability and operations of Monzo bank in the European marketplace.

Social factors- Societies culture, shared believes and attitudes of population plays a

crucial role in understanding the customers of the chosen market for Monzo bank. The social

factors which can bring change must be evaluated by Monzo bank, some of these factors are-

skill level of population, class structure, education level, culture and leisure interest. These

social factors can limit the operations and can also support business in successful expansion

into new markets which will be helpful in managing the profit margin of the company.

Technological factors- As technology is rapidly developing, this has been creating a

huge impact in driving change in business environment of companies operating at domestic

and global level. In case of Monzo bank, the company must understand some of the

technological factors which will help them in successful expansion of business in Iceland

(Frieden, 2015). Influence on cost structure in the banking industry, impact on value chain

structure in the financial sector, pace of technological diffusion, and impact of technology on

product offering are some of the technological elements that must be considered while

expanding the business into the European market.

Environmental factors- Different environmental standards can impact an

organization's profitability in a dynamic commercial environment. Weather, climate change,

laws regulating environmental pollution, air and water pollution regulation in the banking

industry, waste management in financial sectors, and attitude toward support for renewable

energy are some of the environmental factors that Monzo bank must consider before entering

that may have an influence on Monzo Bank's long-term profitability in the free market.

Before entering Iceland's markets, Monzo Bank must assess political stability, amount of

corruption, bureaucracy, legislative framework, trade rules, pricing restrictions, preferred

trading partners, and other political aspects that will aid in comprehending the country's

political climate.

Economic factors- Inflation rate, savings and interest rate, foreign exchange rate,

aggregate demand, bank industry growth rate, consumer spending potential, government

intervention, infrastructure quality in banks industry, and labor skill level in banking industry

of the market in Iceland are all economic factors that Monzo bank must consider (Culkin,

Murzacheva and Davis, 2016). Such factors are responsible to create an impact on the

stability and operations of Monzo bank in the European marketplace.

Social factors- Societies culture, shared believes and attitudes of population plays a

crucial role in understanding the customers of the chosen market for Monzo bank. The social

factors which can bring change must be evaluated by Monzo bank, some of these factors are-

skill level of population, class structure, education level, culture and leisure interest. These

social factors can limit the operations and can also support business in successful expansion

into new markets which will be helpful in managing the profit margin of the company.

Technological factors- As technology is rapidly developing, this has been creating a

huge impact in driving change in business environment of companies operating at domestic

and global level. In case of Monzo bank, the company must understand some of the

technological factors which will help them in successful expansion of business in Iceland

(Frieden, 2015). Influence on cost structure in the banking industry, impact on value chain

structure in the financial sector, pace of technological diffusion, and impact of technology on

product offering are some of the technological elements that must be considered while

expanding the business into the European market.

Environmental factors- Different environmental standards can impact an

organization's profitability in a dynamic commercial environment. Weather, climate change,

laws regulating environmental pollution, air and water pollution regulation in the banking

industry, waste management in financial sectors, and attitude toward support for renewable

energy are some of the environmental factors that Monzo bank must consider before entering

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

the European market in Iceland. These factors can have a significant impact on the company's

brand image and profitability in the banking industry in Iceland, Europe.

Legal factors- The legal structure and institutions are insufficient to secure an

organization's intellectual property rights while growing its company into foreign markets,

thus Monzo Bank must concentrate on a number of legal issues (Hampshire, 2017). Some of

the legal factors which must be considered by Monzo bank while expanding their business in

Iceland are- discrimination law, copyright law, employment law, health and safety law,

antitrust law in bank industry, consumer protection and health and safety law through which

they can successfully attract the opportunities of business growth and development.

Rationale for SME to expand their business internationally

In context of Monzo bank, the rational for banking company to expand their business in

Iceland, the European market is to offset the risk of stagnating growth in the home country

and this will also help in diversifying their portfolio. The purpose of Monzo bank to expand

their business in Iceland is to narrow down the interest rate and lower the cost of capital

through which they can offer low interest rate in their native country. Monzo bank will

expand their business in European market in Iceland which will help the company in

positioning for growth in emerging markets through which they can reduce impact of

financial crisis and develop a strong balance sheet that will attract growth opportunities.

Moreover, some of the other benefits which are expected by Monzo bank from their

business expansion in Iceland are- tax efficiency, greater flexibility, easy transfer with low

exchange rates, more flexible credit facilities and incline in access to investment

opportunities which will attract greater regulatory scrutiny and higher cost (David Cooper,

2020).With business expansion in Iceland, this will support Monzo bank in increasing their

revenues, access to new talent, use cost saving approach and stay ahead of competition

through which they can create a strong competitive position within the industry.

Analysis of opportunities and challenges for global growth

Swot analysis

SWOT analysis is a method for assessing an organization's strengths, weaknesses,

opportunities, and threats. In case of Monzo bank, this framework is used to identify the

opportunities and challenges which can be encountered by Monzo bank in their business

expansion in Iceland for global growth, which is discussed below:

brand image and profitability in the banking industry in Iceland, Europe.

Legal factors- The legal structure and institutions are insufficient to secure an

organization's intellectual property rights while growing its company into foreign markets,

thus Monzo Bank must concentrate on a number of legal issues (Hampshire, 2017). Some of

the legal factors which must be considered by Monzo bank while expanding their business in

Iceland are- discrimination law, copyright law, employment law, health and safety law,

antitrust law in bank industry, consumer protection and health and safety law through which

they can successfully attract the opportunities of business growth and development.

Rationale for SME to expand their business internationally

In context of Monzo bank, the rational for banking company to expand their business in

Iceland, the European market is to offset the risk of stagnating growth in the home country

and this will also help in diversifying their portfolio. The purpose of Monzo bank to expand

their business in Iceland is to narrow down the interest rate and lower the cost of capital

through which they can offer low interest rate in their native country. Monzo bank will

expand their business in European market in Iceland which will help the company in

positioning for growth in emerging markets through which they can reduce impact of

financial crisis and develop a strong balance sheet that will attract growth opportunities.

Moreover, some of the other benefits which are expected by Monzo bank from their

business expansion in Iceland are- tax efficiency, greater flexibility, easy transfer with low

exchange rates, more flexible credit facilities and incline in access to investment

opportunities which will attract greater regulatory scrutiny and higher cost (David Cooper,

2020).With business expansion in Iceland, this will support Monzo bank in increasing their

revenues, access to new talent, use cost saving approach and stay ahead of competition

through which they can create a strong competitive position within the industry.

Analysis of opportunities and challenges for global growth

Swot analysis

SWOT analysis is a method for assessing an organization's strengths, weaknesses,

opportunities, and threats. In case of Monzo bank, this framework is used to identify the

opportunities and challenges which can be encountered by Monzo bank in their business

expansion in Iceland for global growth, which is discussed below:

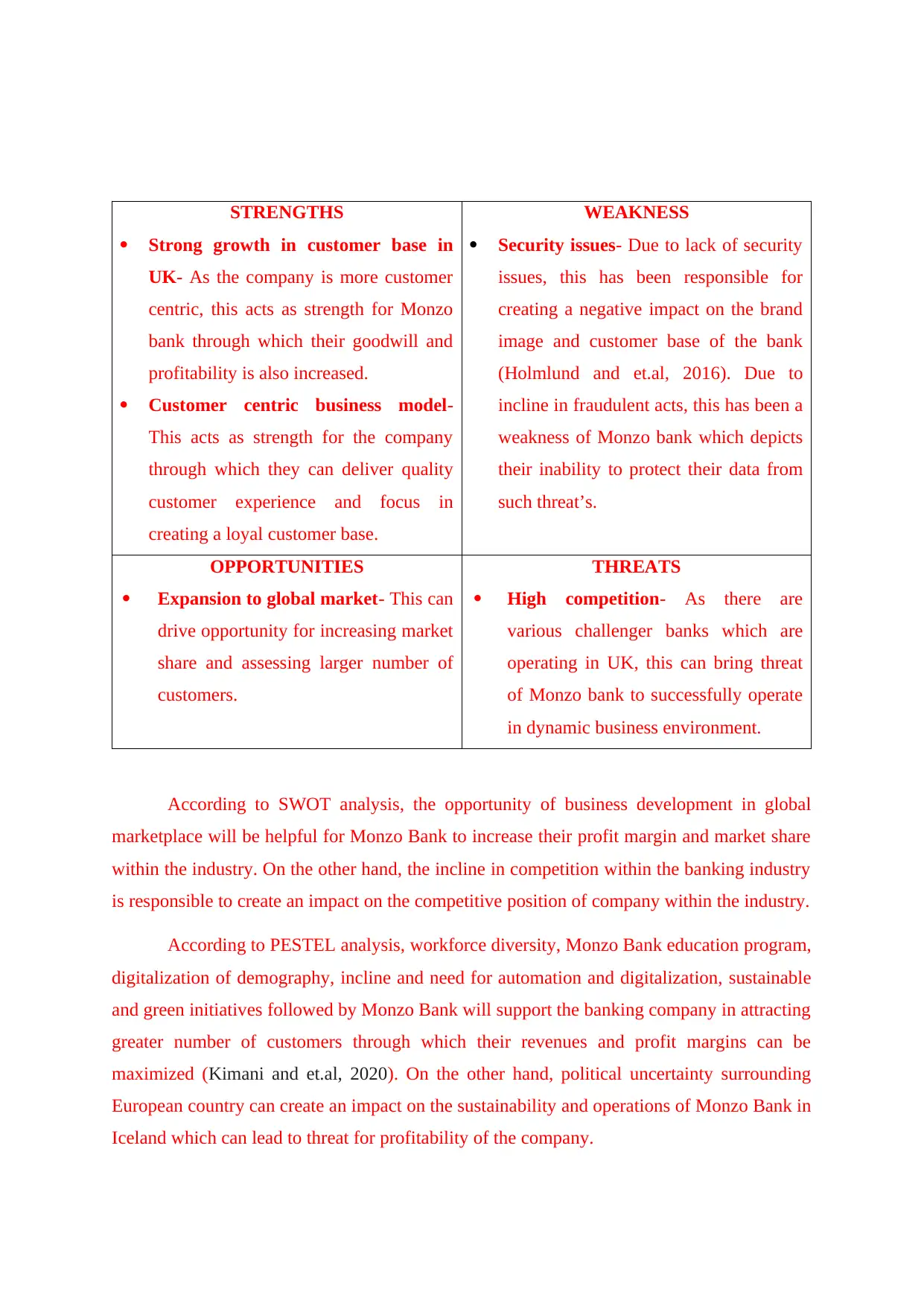

STRENGTHS

Strong growth in customer base in

UK- As the company is more customer

centric, this acts as strength for Monzo

bank through which their goodwill and

profitability is also increased.

Customer centric business model-

This acts as strength for the company

through which they can deliver quality

customer experience and focus in

creating a loyal customer base.

WEAKNESS

Security issues- Due to lack of security

issues, this has been responsible for

creating a negative impact on the brand

image and customer base of the bank

(Holmlund and et.al, 2016). Due to

incline in fraudulent acts, this has been a

weakness of Monzo bank which depicts

their inability to protect their data from

such threat’s.

OPPORTUNITIES

Expansion to global market- This can

drive opportunity for increasing market

share and assessing larger number of

customers.

THREATS

High competition- As there are

various challenger banks which are

operating in UK, this can bring threat

of Monzo bank to successfully operate

in dynamic business environment.

According to SWOT analysis, the opportunity of business development in global

marketplace will be helpful for Monzo Bank to increase their profit margin and market share

within the industry. On the other hand, the incline in competition within the banking industry

is responsible to create an impact on the competitive position of company within the industry.

According to PESTEL analysis, workforce diversity, Monzo Bank education program,

digitalization of demography, incline and need for automation and digitalization, sustainable

and green initiatives followed by Monzo Bank will support the banking company in attracting

greater number of customers through which their revenues and profit margins can be

maximized (Kimani and et.al, 2020). On the other hand, political uncertainty surrounding

European country can create an impact on the sustainability and operations of Monzo Bank in

Iceland which can lead to threat for profitability of the company.

Strong growth in customer base in

UK- As the company is more customer

centric, this acts as strength for Monzo

bank through which their goodwill and

profitability is also increased.

Customer centric business model-

This acts as strength for the company

through which they can deliver quality

customer experience and focus in

creating a loyal customer base.

WEAKNESS

Security issues- Due to lack of security

issues, this has been responsible for

creating a negative impact on the brand

image and customer base of the bank

(Holmlund and et.al, 2016). Due to

incline in fraudulent acts, this has been a

weakness of Monzo bank which depicts

their inability to protect their data from

such threat’s.

OPPORTUNITIES

Expansion to global market- This can

drive opportunity for increasing market

share and assessing larger number of

customers.

THREATS

High competition- As there are

various challenger banks which are

operating in UK, this can bring threat

of Monzo bank to successfully operate

in dynamic business environment.

According to SWOT analysis, the opportunity of business development in global

marketplace will be helpful for Monzo Bank to increase their profit margin and market share

within the industry. On the other hand, the incline in competition within the banking industry

is responsible to create an impact on the competitive position of company within the industry.

According to PESTEL analysis, workforce diversity, Monzo Bank education program,

digitalization of demography, incline and need for automation and digitalization, sustainable

and green initiatives followed by Monzo Bank will support the banking company in attracting

greater number of customers through which their revenues and profit margins can be

maximized (Kimani and et.al, 2020). On the other hand, political uncertainty surrounding

European country can create an impact on the sustainability and operations of Monzo Bank in

Iceland which can lead to threat for profitability of the company.

Range of trading blocs and agreements and advantage of specific trading agreements which

will have direct significance

A trading bloc is an intergovernmental arrangement in which regional barriers to

international commerce are removed among member governments, allowing them to trade

freely with one another. The emergence of trade blocs such as the European Union and

NAFTA has resulted in increased commerce amongst members as it is more difficult for

nations outside the bloc to trade, a process known as trade diversification. There are different

types of trading blocs, some of these involves- free trade are, customs union, common

markets and economic unions (What is trading bloc, 2016). According to Adam Smith, free

trade among nations is helpful in improving the economic welfare condition which will allow

any country to specialize goods through which they can manufacture products at cheap rate

effectively in comparison to other countries (International trade agreements, 2019). Tariffs

barriers are a type of protectionist trade barrier which are created to protect small industries

and developing economies (Basics of tariff and trade barriers, 2021). Non-tariff barriers are

hurdles to international commerce that governments might erect in order to prevent goods

from other nations from entering the country and encourage domestically produced goods

(Tariff and non-tariff barriers, 2020). In case of Monzo bank, a range of trading blocs and

agreements with their benefits and their direct significance to European region of Iceland is

addressed underneath:

European/Economic union- European Union is one of the most integrated trade blocs which

was developed in 1951. This trading bloc and agreement consist of 28 member countries and

also launched euro as a single currency for regional trading. The European Parliament,

Council of the EU, European Commission, Court of Auditors, and Court of Justice are the

five EU institutions that make up the European Union.

Benefit: Some of the advantages of European Union are- it makes euro easier, cheaper

and safer for business to buy, sell and to trade within rest of the world. This also helps

in improving economic stability and growth by integrating better and efficient

financial market which creates a significant impact on global economy.

Free trade area- All trade restrictions between members are removed in a free trade area,

resulting in unrestricted flow of goods and services. When dealing with non-members, such

trade blocs and agreements have an impact on each member's trade policy.

will have direct significance

A trading bloc is an intergovernmental arrangement in which regional barriers to

international commerce are removed among member governments, allowing them to trade

freely with one another. The emergence of trade blocs such as the European Union and

NAFTA has resulted in increased commerce amongst members as it is more difficult for

nations outside the bloc to trade, a process known as trade diversification. There are different

types of trading blocs, some of these involves- free trade are, customs union, common

markets and economic unions (What is trading bloc, 2016). According to Adam Smith, free

trade among nations is helpful in improving the economic welfare condition which will allow

any country to specialize goods through which they can manufacture products at cheap rate

effectively in comparison to other countries (International trade agreements, 2019). Tariffs

barriers are a type of protectionist trade barrier which are created to protect small industries

and developing economies (Basics of tariff and trade barriers, 2021). Non-tariff barriers are

hurdles to international commerce that governments might erect in order to prevent goods

from other nations from entering the country and encourage domestically produced goods

(Tariff and non-tariff barriers, 2020). In case of Monzo bank, a range of trading blocs and

agreements with their benefits and their direct significance to European region of Iceland is

addressed underneath:

European/Economic union- European Union is one of the most integrated trade blocs which

was developed in 1951. This trading bloc and agreement consist of 28 member countries and

also launched euro as a single currency for regional trading. The European Parliament,

Council of the EU, European Commission, Court of Auditors, and Court of Justice are the

five EU institutions that make up the European Union.

Benefit: Some of the advantages of European Union are- it makes euro easier, cheaper

and safer for business to buy, sell and to trade within rest of the world. This also helps

in improving economic stability and growth by integrating better and efficient

financial market which creates a significant impact on global economy.

Free trade area- All trade restrictions between members are removed in a free trade area,

resulting in unrestricted flow of goods and services. When dealing with non-members, such

trade blocs and agreements have an impact on each member's trade policy.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Benefit: In context of Monzo bank, a free trade area will be helpful in enhancing

efficiency which will encourage competition and will lead to decline in prices and

incline in variety of products and services.

NAFTA- The North American Free Trade Agreement, which went into force in January

1993, is a strategy for removing trade obstacles between the United States, Canada, and

Mexico.

Benefits: This medium is helpful in reducing government spending, lower prices,

create more job opportunities, incline the use of foreign direct investment and also

boost the economic growth.

Product lifecycle theory- As a product progress through its life cycle, product life

circle management is a series of methods implemented by company management.

Introduction, growth, maturity, and decline are the four stages of a product's life cycle. The

product life cycle hypothesis, in the context of Monzo bank, is a sequence of stages that a

product goes through throughout its existence on the market (Klagge, Martin and Sunley,

2017). Due to incline in rate of innovation in banking industry, this introduces new and more

innovative products which are responsible to eliminate the existing products from the

marketplace.

Evaluation of the above and how these will stimulate and generate global growth

In context of Monzo bank, trade bloc and agreement will be helpful in boosting the

economy growth through which more job opportunities can be developed and will also

support in market expansion. The banking company can enjoy greater incentives to trade and

new markets which will also offer opportunity of quality and diversified range of products

and services to global economy. Trade blocs and agreements can be helpful in increasing

sales to other member countries without focusing in protection. With the help of larger and

diversified market, this will allow Monzo bank to take benefits from economies of scale

while operating in Iceland. By eliminating tariffs, this can be helpful in reducing the prices

for consumers in member countries (Trade blocs, 2021). With free flow of goods, this can

increase access of Monzo bank to a wider range of goods in global marketplace.

efficiency which will encourage competition and will lead to decline in prices and

incline in variety of products and services.

NAFTA- The North American Free Trade Agreement, which went into force in January

1993, is a strategy for removing trade obstacles between the United States, Canada, and

Mexico.

Benefits: This medium is helpful in reducing government spending, lower prices,

create more job opportunities, incline the use of foreign direct investment and also

boost the economic growth.

Product lifecycle theory- As a product progress through its life cycle, product life

circle management is a series of methods implemented by company management.

Introduction, growth, maturity, and decline are the four stages of a product's life cycle. The

product life cycle hypothesis, in the context of Monzo bank, is a sequence of stages that a

product goes through throughout its existence on the market (Klagge, Martin and Sunley,

2017). Due to incline in rate of innovation in banking industry, this introduces new and more

innovative products which are responsible to eliminate the existing products from the

marketplace.

Evaluation of the above and how these will stimulate and generate global growth

In context of Monzo bank, trade bloc and agreement will be helpful in boosting the

economy growth through which more job opportunities can be developed and will also

support in market expansion. The banking company can enjoy greater incentives to trade and

new markets which will also offer opportunity of quality and diversified range of products

and services to global economy. Trade blocs and agreements can be helpful in increasing

sales to other member countries without focusing in protection. With the help of larger and

diversified market, this will allow Monzo bank to take benefits from economies of scale

while operating in Iceland. By eliminating tariffs, this can be helpful in reducing the prices

for consumers in member countries (Trade blocs, 2021). With free flow of goods, this can

increase access of Monzo bank to a wider range of goods in global marketplace.

PART 2

HOW TO START AN EXPORTING BUSINESS

Advantages and disadvantage of different types of exporting processes for

exporting merchandising and services documentation

Exporting is the defined as the sale of products and services in foreign countries that are proceeded in home country.

Export and international trade are goods produced in one country that is sold in another country. Exporting can be

classified under 2 categories, which are- direct exporting and indirect exporting. The advantages and disadvantages of

different types of exporting are discussed underneath:

Direct exporting- This type of exporting entails selling items overseas without the use of an intermediary.

Direct exporting allows a corporation to sell its products internationally while also working directly with foreign

companies.

Advantages: through direct exporting the potential profits over company can be increased by eliminating

intermediaries which will also help in understanding customers. This form of exporting offers greater

flexibility which improves or re direct marketing efforts of an organization.

Disadvantages: The direct exporting can make business face greater financial risk while expanding their

business into international market (Taskinsoy, 2019). Due to direct exporting, this limits the market

coverage and also leads to insufficient knowledge of market and culture which creates an impact on the

profitability and organization culture of companies while operating in global marketplace.

Indirect exporting- The sale of commodities overseas through an intermediary is referred to as indirect

exporting (Kane Dane, 2022). As a result, indirect exporting is carried out with the assistance of independent

middlemen and sales intermediates who are in charge of delivering goods and services to other nations.

Advantages: indirect exporting will be helpful in covering larger market area and will offer access to

market and distribution channels at greater extent through which business profitability can be increased.

In such form of exporting, the number of staff required is less and will support business in engaging into

smaller financial risk.

Disadvantages: One of the drawbacks of indirect exporting is lower profit margins and no direct contact

with customer which can create an impact on the sales revenues and profitability of organization in global

marketplace. Such form of exporting also increases the dependency on partner which is another drawback

for a company to successfully operate in international markets.

How to secure a deal: Businesses will employ certain tactics to ensure the security of commercial transactions while

importing and exporting. Some of the approaches are as follows:

Businesses should classify their competencies according to the significance of the market.

All parties should agree on a simple payment and product delivery arrangement on the international

market before negotiating on exports and imports.

With the help of documentary drafts, letters of credit and payment in advance will be helpful in securing

a successful deal in exporting business.

Documentation required

In order to develop expand business, Monzo bank must focus on these documents while expanding in the European

market of Iceland:

Letter of credit- A credit letter is a document from a bank that guarantees that a buyer's payment to a

seller will be received on time.

Packing list- Packaging list is a document used in international trade which provides exporter with

information about the shipment involving how it’s packed, dimension and weight of each package

which is listed outside the box.

Commercial invoice- it is an export document which serves as legal evidence checklist over sales

transaction between the buyers and seller. This helps in the determination and assessment of duties and

tax payable.

Terms of payment- Payment terms are the criteria around a sale's payment portion that the seller

specifies to the buyer. This is an invoice that indicates how much the customer must pay on the

purchase of a company's products and services.

Customer document- customer document is used to add or maintain information for all persons,

companies and groups.

HOW TO START AN EXPORTING BUSINESS

Advantages and disadvantage of different types of exporting processes for

exporting merchandising and services documentation

Exporting is the defined as the sale of products and services in foreign countries that are proceeded in home country.

Export and international trade are goods produced in one country that is sold in another country. Exporting can be

classified under 2 categories, which are- direct exporting and indirect exporting. The advantages and disadvantages of

different types of exporting are discussed underneath:

Direct exporting- This type of exporting entails selling items overseas without the use of an intermediary.

Direct exporting allows a corporation to sell its products internationally while also working directly with foreign

companies.

Advantages: through direct exporting the potential profits over company can be increased by eliminating

intermediaries which will also help in understanding customers. This form of exporting offers greater

flexibility which improves or re direct marketing efforts of an organization.

Disadvantages: The direct exporting can make business face greater financial risk while expanding their

business into international market (Taskinsoy, 2019). Due to direct exporting, this limits the market

coverage and also leads to insufficient knowledge of market and culture which creates an impact on the

profitability and organization culture of companies while operating in global marketplace.

Indirect exporting- The sale of commodities overseas through an intermediary is referred to as indirect

exporting (Kane Dane, 2022). As a result, indirect exporting is carried out with the assistance of independent

middlemen and sales intermediates who are in charge of delivering goods and services to other nations.

Advantages: indirect exporting will be helpful in covering larger market area and will offer access to

market and distribution channels at greater extent through which business profitability can be increased.

In such form of exporting, the number of staff required is less and will support business in engaging into

smaller financial risk.

Disadvantages: One of the drawbacks of indirect exporting is lower profit margins and no direct contact

with customer which can create an impact on the sales revenues and profitability of organization in global

marketplace. Such form of exporting also increases the dependency on partner which is another drawback

for a company to successfully operate in international markets.

How to secure a deal: Businesses will employ certain tactics to ensure the security of commercial transactions while

importing and exporting. Some of the approaches are as follows:

Businesses should classify their competencies according to the significance of the market.

All parties should agree on a simple payment and product delivery arrangement on the international

market before negotiating on exports and imports.

With the help of documentary drafts, letters of credit and payment in advance will be helpful in securing

a successful deal in exporting business.

Documentation required

In order to develop expand business, Monzo bank must focus on these documents while expanding in the European

market of Iceland:

Letter of credit- A credit letter is a document from a bank that guarantees that a buyer's payment to a

seller will be received on time.

Packing list- Packaging list is a document used in international trade which provides exporter with

information about the shipment involving how it’s packed, dimension and weight of each package

which is listed outside the box.

Commercial invoice- it is an export document which serves as legal evidence checklist over sales

transaction between the buyers and seller. This helps in the determination and assessment of duties and

tax payable.

Terms of payment- Payment terms are the criteria around a sale's payment portion that the seller

specifies to the buyer. This is an invoice that indicates how much the customer must pay on the

purchase of a company's products and services.

Customer document- customer document is used to add or maintain information for all persons,

companies and groups.

Evaluation of different methods of tapping into new international markets with their benefits and limitations

Market is an institutional structure which permits people and companies to exchange their goods and services. The process of globalization can be helpful for SME for perform

their business activities across national borders where an organization make radical changes through which they can succeed in global marketplace. In case of an SME, in order

to expand a business in international market here Monzo bank will be expanding their business in Iceland which is European market, an organisation can make use of various

methods, some of the methods are discussed below:

Exporting- Marketing the things in the countries where the company intends to sell them is a part of exporting. Direct exporting is a method in which a corporation sells its

own products in overseas markets without using a middleman. This strategy is commonly used by companies who offer luxury items or have previously marketed their products

on worldwide marketplaces. Using middlemen such as foreign wholesalers, a corporation can also export indirectly.

Benefits: This form helps in greater production through which companies can economies of scale and better margins. it helps in better knowledge of customer

requirements which helps in improving the goodwill of the organization within the international market.

Limitations: Such form leads to larger risk which can be faced by companies and also makes the company faces higher distribution cost. This also limits the

managerial ability and difficulty in managing the products and services of the company in international markets.

Joint venture- Businesses create joint ventures with other firms that wish to sell in a worldwide market to reduce the risk of entering that market. Joint ventures can create

more money than individual firms since they frequently function as large, distinct organisations rather than a merging of two smaller enterprises. Although both groups can work

together to build fair methods and avoid this issue, this kind of market entrance has the potential to create an imbalance in corporate activity.

Benefits: Allows businesses to enter new sectors or geographic markets while also gaining access to cutting-edge technologies (Advantages and disadvantages of joint

venture, 2021). It allows companies to broaden their talents and expertise.

Limitations: The formation of a joint venture may result in more complicated tax arrangements. The success of a joint venture is dependent on thorough research and

analysis of the objectives.

Franchising- A franchise is a retail chain in which an individual or a group of people pays for the right to manage a company's corporate branches (International market

entry strategies, 2021). Because consumers in your target market should know what you provide and want to obtain it, franchising typically necessitates a high level of brand

awareness. Franchising allows well-known companies to profit while adopting a more indirect management technique.

Benefits: Since they have the support and backing of a bigger, established firm, franchises are a safer investment than new enterprises. These businesses have tried and

proven business models in a variety of markets around the country.

Limitations: Establishing and implementing a solid training programme that results in compliant franchisees takes time and resources. Franchisees also expect regular

support (Pros and cons of franchise, 2020). This, too, requires additional resources; an organisation can pay specialised staff to perform this task.

Partnership- Partnership is a formal agreement by two or more parties which is managed and operated by business through which they can share profits. In such form of

approach, the company can enter a new marketplace by a formal agreement with the company of mutual interest.

Benefits: This helps in managing the gap between expertise and knowledge, offers higher business growth opportunities and implement cost saving approach through

which an organization can successfully operate in international markets.

Limitations: This form of approach limits the profits and loss of companies due to the liability of the company by operating on international market through

partnership. The lack of stability also affects the partners to effectively operate in international markets.

Recommendations on appropriate methods

and countries to meet specific business

requirements

It has been identified from the above-mentioned method that,

Monzo bank is leading in the financial services in which exporting

and licensing not a suitable method for banking services. In this

context the well suitable method that can be adapted by this Bank

involves utilization of wholly owned subsidiary or joint venture.

Iceland is at climatically challenged country in Europe (Wójcik and

MacDonald-Korth, 2015). In such type of country company can

hold its subsidiary wholly owned so that there should be a limited

consumption of capital as well as smoothly functioning of business

activities.

Furthermore, it is also determined that there are large number of

challenges associated with the climatic conditions that are not

favorable for business units and Iceland so company can utilize the

information from existing organizations by making joint ventures.

Through establishing business in Iceland, Monzo bank can promote

further by focusing up on wholly owned subsidiary after improving

its supply chain and network in this market.

Market is an institutional structure which permits people and companies to exchange their goods and services. The process of globalization can be helpful for SME for perform

their business activities across national borders where an organization make radical changes through which they can succeed in global marketplace. In case of an SME, in order

to expand a business in international market here Monzo bank will be expanding their business in Iceland which is European market, an organisation can make use of various

methods, some of the methods are discussed below:

Exporting- Marketing the things in the countries where the company intends to sell them is a part of exporting. Direct exporting is a method in which a corporation sells its

own products in overseas markets without using a middleman. This strategy is commonly used by companies who offer luxury items or have previously marketed their products

on worldwide marketplaces. Using middlemen such as foreign wholesalers, a corporation can also export indirectly.

Benefits: This form helps in greater production through which companies can economies of scale and better margins. it helps in better knowledge of customer

requirements which helps in improving the goodwill of the organization within the international market.

Limitations: Such form leads to larger risk which can be faced by companies and also makes the company faces higher distribution cost. This also limits the

managerial ability and difficulty in managing the products and services of the company in international markets.

Joint venture- Businesses create joint ventures with other firms that wish to sell in a worldwide market to reduce the risk of entering that market. Joint ventures can create

more money than individual firms since they frequently function as large, distinct organisations rather than a merging of two smaller enterprises. Although both groups can work

together to build fair methods and avoid this issue, this kind of market entrance has the potential to create an imbalance in corporate activity.

Benefits: Allows businesses to enter new sectors or geographic markets while also gaining access to cutting-edge technologies (Advantages and disadvantages of joint

venture, 2021). It allows companies to broaden their talents and expertise.

Limitations: The formation of a joint venture may result in more complicated tax arrangements. The success of a joint venture is dependent on thorough research and

analysis of the objectives.

Franchising- A franchise is a retail chain in which an individual or a group of people pays for the right to manage a company's corporate branches (International market

entry strategies, 2021). Because consumers in your target market should know what you provide and want to obtain it, franchising typically necessitates a high level of brand

awareness. Franchising allows well-known companies to profit while adopting a more indirect management technique.

Benefits: Since they have the support and backing of a bigger, established firm, franchises are a safer investment than new enterprises. These businesses have tried and

proven business models in a variety of markets around the country.

Limitations: Establishing and implementing a solid training programme that results in compliant franchisees takes time and resources. Franchisees also expect regular

support (Pros and cons of franchise, 2020). This, too, requires additional resources; an organisation can pay specialised staff to perform this task.

Partnership- Partnership is a formal agreement by two or more parties which is managed and operated by business through which they can share profits. In such form of

approach, the company can enter a new marketplace by a formal agreement with the company of mutual interest.

Benefits: This helps in managing the gap between expertise and knowledge, offers higher business growth opportunities and implement cost saving approach through

which an organization can successfully operate in international markets.

Limitations: This form of approach limits the profits and loss of companies due to the liability of the company by operating on international market through

partnership. The lack of stability also affects the partners to effectively operate in international markets.

Recommendations on appropriate methods

and countries to meet specific business

requirements

It has been identified from the above-mentioned method that,

Monzo bank is leading in the financial services in which exporting

and licensing not a suitable method for banking services. In this

context the well suitable method that can be adapted by this Bank

involves utilization of wholly owned subsidiary or joint venture.

Iceland is at climatically challenged country in Europe (Wójcik and

MacDonald-Korth, 2015). In such type of country company can

hold its subsidiary wholly owned so that there should be a limited

consumption of capital as well as smoothly functioning of business

activities.

Furthermore, it is also determined that there are large number of

challenges associated with the climatic conditions that are not

favorable for business units and Iceland so company can utilize the

information from existing organizations by making joint ventures.

Through establishing business in Iceland, Monzo bank can promote

further by focusing up on wholly owned subsidiary after improving

its supply chain and network in this market.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

CONCLUSION

From the detailed study of above project, it can be concluded that international

marketing is the activity encompasses sale of goods and services of one country in the other.

International marketing is the marketing activity where business operations are carried out

beyond the national borders and this involves diversified market and offers larger consumer

base to business. While operating in a global business environment, there are various

opportunities and threats which can be faced by an organization. In order to successfully

operate in international marketplace, an organization must understand their consumers and

their preferences through which the company can make their place in the industry and

generate higher revenues. It can be understood that there are various mediums to expand a

business in international market. Import and export business can bring various advantages

and disadvantages to an organization which can develop or hamper business growth and

sustainability in the industry. It can be stated that there are various methods which can be

helpful for a business to tap into international marketplace.

From the detailed study of above project, it can be concluded that international

marketing is the activity encompasses sale of goods and services of one country in the other.

International marketing is the marketing activity where business operations are carried out

beyond the national borders and this involves diversified market and offers larger consumer

base to business. While operating in a global business environment, there are various

opportunities and threats which can be faced by an organization. In order to successfully

operate in international marketplace, an organization must understand their consumers and

their preferences through which the company can make their place in the industry and

generate higher revenues. It can be understood that there are various mediums to expand a

business in international market. Import and export business can bring various advantages

and disadvantages to an organization which can develop or hamper business growth and

sustainability in the industry. It can be stated that there are various methods which can be

helpful for a business to tap into international marketplace.

REFERENCES

Books and journals

Culkin, N., Murzacheva, E. and Davis, A., 2016. Critical innovations in the UK peer-to-peer

(P2P) and equity alternative finance markets for small firm growth. The International

Journal of Entrepreneurship and Innovation. 17(3). pp.194-202.

Frieden, J. A., 2015. Banking on the world: the politics of American international finance.

Routledge.

Hampshire, C., 2017. A mixed methods empirical exploration of UK consumer perceptions of

trust, risk and usefulness of mobile payments. International Journal of Bank Marketing.

Holmlund, M and et.al., 2016. Organizational behavior in innovation, marketing, and

purchasing in business service contexts—An agenda for academic inquiry. Journal of

Business Research. 69(7). pp.2457-2462.

Kimani, D and et.al., 2020. Blockchain, business and the fourth industrial revolution:

Whence, whither, wherefore and how?. Technological Forecasting and Social

Change. 161. p.120254.

Klagge, B., Martin, R. and Sunley, P., 2017. The spatial structure of the financial system and

the funding of regional business: a comparison of Britain and Germany. In Handbook

on the Geographies of Money and Finance. Edward Elgar Publishing.

Taskinsoy, J., 2019. This time is different: facebook’s libra can improve both financial

inclusion and global financial stability as a viable alternative currency to the US

Dollar. Available at SSRN 3434493.

Wójcik, D. and MacDonald-Korth, D., 2015. The British and the German financial sectors in

the wake of the crisis: size, structure and spatial concentration. Journal of Economic

Geography. 15(5). pp.1033-1054.

Online

What is internalization, 2021 [Online]. Available through

<https://www.investopedia.com/terms/i/internationalization.asp>

What is globalization, 2021 [Online]. Available through

<https://www.piie.com/microsites/globalization/what-is-globalization>

Global business environment, 2019 [Online]. Available through <https://www.igi-

global.com/chapter/global-business-environment/215466>

David Cooper, 2020. 5 advantages of international banking for expats [Online]. Available

through <https://www.unitedadvisersgroup.com/5-advantages-international-banking-

expats/>

What is trading bloc, 2016 [Online]. Available through

<dhttps://opentoexport.com/article/what-is-a-trading-bloc/>

International trade agreements, 2019 [Online]. Available through

<https://www.econlib.org/library/Enc/InternationalTradeAgreements.html>

Basics of tariff and trade barriers, 2021 [Online]. Available through

<https://www.investopedia.com/articles/economics/08/tariff-trade-barrier-basics.asp>

Tariff and non-tariff barriers, 2020 [Online]. Available through

<https://keydifferences.com/difference-between-tariff-and-non-tariff-barriers.html>

Trade blocs, 2021 [Online]. Available through <https://penpoin.com/trade-bloc/>

Kane Dane, 2022. Describe the different Types of Exporting [Online]. Available through

<https://www.owlgen.in/describe-the-different-types-of-exporting/>

Books and journals

Culkin, N., Murzacheva, E. and Davis, A., 2016. Critical innovations in the UK peer-to-peer

(P2P) and equity alternative finance markets for small firm growth. The International

Journal of Entrepreneurship and Innovation. 17(3). pp.194-202.

Frieden, J. A., 2015. Banking on the world: the politics of American international finance.

Routledge.

Hampshire, C., 2017. A mixed methods empirical exploration of UK consumer perceptions of

trust, risk and usefulness of mobile payments. International Journal of Bank Marketing.

Holmlund, M and et.al., 2016. Organizational behavior in innovation, marketing, and

purchasing in business service contexts—An agenda for academic inquiry. Journal of

Business Research. 69(7). pp.2457-2462.

Kimani, D and et.al., 2020. Blockchain, business and the fourth industrial revolution:

Whence, whither, wherefore and how?. Technological Forecasting and Social

Change. 161. p.120254.

Klagge, B., Martin, R. and Sunley, P., 2017. The spatial structure of the financial system and

the funding of regional business: a comparison of Britain and Germany. In Handbook

on the Geographies of Money and Finance. Edward Elgar Publishing.

Taskinsoy, J., 2019. This time is different: facebook’s libra can improve both financial

inclusion and global financial stability as a viable alternative currency to the US

Dollar. Available at SSRN 3434493.

Wójcik, D. and MacDonald-Korth, D., 2015. The British and the German financial sectors in

the wake of the crisis: size, structure and spatial concentration. Journal of Economic

Geography. 15(5). pp.1033-1054.

Online

What is internalization, 2021 [Online]. Available through

<https://www.investopedia.com/terms/i/internationalization.asp>

What is globalization, 2021 [Online]. Available through

<https://www.piie.com/microsites/globalization/what-is-globalization>

Global business environment, 2019 [Online]. Available through <https://www.igi-

global.com/chapter/global-business-environment/215466>

David Cooper, 2020. 5 advantages of international banking for expats [Online]. Available

through <https://www.unitedadvisersgroup.com/5-advantages-international-banking-

expats/>

What is trading bloc, 2016 [Online]. Available through

<dhttps://opentoexport.com/article/what-is-a-trading-bloc/>

International trade agreements, 2019 [Online]. Available through

<https://www.econlib.org/library/Enc/InternationalTradeAgreements.html>

Basics of tariff and trade barriers, 2021 [Online]. Available through

<https://www.investopedia.com/articles/economics/08/tariff-trade-barrier-basics.asp>

Tariff and non-tariff barriers, 2020 [Online]. Available through

<https://keydifferences.com/difference-between-tariff-and-non-tariff-barriers.html>

Trade blocs, 2021 [Online]. Available through <https://penpoin.com/trade-bloc/>

Kane Dane, 2022. Describe the different Types of Exporting [Online]. Available through

<https://www.owlgen.in/describe-the-different-types-of-exporting/>

Advantages and disadvantages of joint venture, 2021 [Online]. Available through

<https://www.sa-tenders.co.za/content/hints-tips-and-news/advantages-and-

disadvantages-joint-ventures>

International market entry strategies, 2021 [Online]. Available through

<https://www.indeed.com/career-advice/career-development/market-entry-strategies>

Pros and cons of franchise, 2020 [Online]. Available through

<https://franchisebusinessreview.com/post/franchise-advantages-disadvantages/>

<https://www.sa-tenders.co.za/content/hints-tips-and-news/advantages-and-

disadvantages-joint-ventures>

International market entry strategies, 2021 [Online]. Available through

<https://www.indeed.com/career-advice/career-development/market-entry-strategies>

Pros and cons of franchise, 2020 [Online]. Available through

<https://franchisebusinessreview.com/post/franchise-advantages-disadvantages/>

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.