Oak Cash & Carry Ltd: Report on Tapping into New Global Markets

VerifiedAdded on 2024/06/21

|23

|5298

|406

Report

AI Summary

This report assesses Oak Cash & Carry Limited's strategy for tapping into new and international markets. It examines the impact of the global business environment on SMEs, highlighting threats and opportunities in international markets. The report details the import and export processes, discussing the advantages and disadvantages of each, and explores various market entry methods available to SMEs. A PESTLE analysis is conducted to understand the global business environment, and the report addresses challenges such as finance, technology, and currency fluctuations, alongside opportunities arising from Brexit. The advantages of trading blocs and the impact of tariff and non-tariff barriers are also discussed, providing a comprehensive overview of the factors influencing Oak Cash & Carry's international expansion.

Tapping into New and

International Markets

1

International Markets

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION.................................................................................................................................3

SECTION 1........................................................................................................................................4

GLOBAL BUSINESS ENVIRONMENT IN WHICH SMEs OPERATES.................................................4

THREATS AND OPPORTUNITIES FACED BY OAK CASH & CARRY IN AN INCREASINGLY

GLOBALIZED ENVIRONMENT.......................................................................................................6

ADVANTAGES OF TRADING BLOCKS FOR FIRMS..........................................................................8

VARIOUS TARIFF AND NON-TARIFF BARRIERS.............................................................................9

TRADING BLOC AGREEMENTS....................................................................................................11

SECTION 2......................................................................................................................................14

IMPORT AND EXPORT PROCESS TO AN OAK CASH & CARRY LIMITED......................................14

JUSTIFIED RECOMMENDATIONS................................................................................................16

SECTION 3......................................................................................................................................17

DIFFERENT MARKET ENTRY METHODS......................................................................................17

CONCLUSION.................................................................................................................................20

REFERENCES...................................................................................................................................21

2

INTRODUCTION.................................................................................................................................3

SECTION 1........................................................................................................................................4

GLOBAL BUSINESS ENVIRONMENT IN WHICH SMEs OPERATES.................................................4

THREATS AND OPPORTUNITIES FACED BY OAK CASH & CARRY IN AN INCREASINGLY

GLOBALIZED ENVIRONMENT.......................................................................................................6

ADVANTAGES OF TRADING BLOCKS FOR FIRMS..........................................................................8

VARIOUS TARIFF AND NON-TARIFF BARRIERS.............................................................................9

TRADING BLOC AGREEMENTS....................................................................................................11

SECTION 2......................................................................................................................................14

IMPORT AND EXPORT PROCESS TO AN OAK CASH & CARRY LIMITED......................................14

JUSTIFIED RECOMMENDATIONS................................................................................................16

SECTION 3......................................................................................................................................17

DIFFERENT MARKET ENTRY METHODS......................................................................................17

CONCLUSION.................................................................................................................................20

REFERENCES...................................................................................................................................21

2

INTRODUCTION

The companies can develop new customers and increase demand for their products by tapping

into new and international markets. The well-prepared plan is needed by companies that are

trying to tap the international market (Eaton et al. 2016). This report will include the impact of

the global business environment on SMEs. It will also include threats and opportunities to tap

into international markets. The second part of the report will include the export and import

process along with the advantages and disadvantages of exporting and importing. The various

methods by which the SMEs can tap into new and international markets will be discussed in the

last part of the report.

Oak Cash & Carry Limited is a company that offers a wide range of products in bulk for offices,

newsagents, and retailers. The number of employees working in the company is 37 and it is

located in the United Kingdom. Oak Cash & Carry was founded in 2000 and it is a non-

specialized wholesaler of beverages, food, and tobacco.

3

The companies can develop new customers and increase demand for their products by tapping

into new and international markets. The well-prepared plan is needed by companies that are

trying to tap the international market (Eaton et al. 2016). This report will include the impact of

the global business environment on SMEs. It will also include threats and opportunities to tap

into international markets. The second part of the report will include the export and import

process along with the advantages and disadvantages of exporting and importing. The various

methods by which the SMEs can tap into new and international markets will be discussed in the

last part of the report.

Oak Cash & Carry Limited is a company that offers a wide range of products in bulk for offices,

newsagents, and retailers. The number of employees working in the company is 37 and it is

located in the United Kingdom. Oak Cash & Carry was founded in 2000 and it is a non-

specialized wholesaler of beverages, food, and tobacco.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

SECTION 1

The global business environment affects companies when trying to tap into new and

international markets. The high-level competition exists among businesses when operating

globally. The company also needs to compete with the local business in the country it is

tapping. There are many factors and market risks that hinder the company in tapping into

international markets (Hamilton and Webster, 2018).

GLOBAL BUSINESS ENVIRONMENT IN WHICH SMEs OPERATES

The vital role is played by the SMEs in the economic development of the company. The new

business challenges are faced by Oak Cash & Carry in a competitive business environment. The

PESTLE analysis tool will help in understanding the global business environment in which SMEs

operate (Adagba and Shakpande, 2017).

Political factors- The Oak Cash & Carry has to face many political challenges when tapping into

international markets. The government regulations and rules in new markets should be

followed by Oak Cash & Carry (Hans, 2018). The rise or low in corporation tax by the

government impacts the profit of the company. The company needs to consider different

political factors like tax policy, government stability, etc.

Economic factors- The economic factors of the countries in which SMEs operate affect the

operations of the Oak Cash & Carry. The economic factors include interest rates, inflation,

exchange rates, recession, demand/supply, and many others (Adagba and Shakpande, 2017)

Social factors- The cultural aspects of the country are included in social factors. The social

factors that affect Oak Cash & Carry are buying habits. Education level, CSR, etc.

Technological factors-

The use of advanced and updated technology is needed by Oak Cash & Carry to compete in

different markets (Hamilton and Webster, 2018). The technological factors include the

existence of 3D technology for food, beverages, and tobacco, internet connectivity for fast

services to customers, etc.

4

The global business environment affects companies when trying to tap into new and

international markets. The high-level competition exists among businesses when operating

globally. The company also needs to compete with the local business in the country it is

tapping. There are many factors and market risks that hinder the company in tapping into

international markets (Hamilton and Webster, 2018).

GLOBAL BUSINESS ENVIRONMENT IN WHICH SMEs OPERATES

The vital role is played by the SMEs in the economic development of the company. The new

business challenges are faced by Oak Cash & Carry in a competitive business environment. The

PESTLE analysis tool will help in understanding the global business environment in which SMEs

operate (Adagba and Shakpande, 2017).

Political factors- The Oak Cash & Carry has to face many political challenges when tapping into

international markets. The government regulations and rules in new markets should be

followed by Oak Cash & Carry (Hans, 2018). The rise or low in corporation tax by the

government impacts the profit of the company. The company needs to consider different

political factors like tax policy, government stability, etc.

Economic factors- The economic factors of the countries in which SMEs operate affect the

operations of the Oak Cash & Carry. The economic factors include interest rates, inflation,

exchange rates, recession, demand/supply, and many others (Adagba and Shakpande, 2017)

Social factors- The cultural aspects of the country are included in social factors. The social

factors that affect Oak Cash & Carry are buying habits. Education level, CSR, etc.

Technological factors-

The use of advanced and updated technology is needed by Oak Cash & Carry to compete in

different markets (Hamilton and Webster, 2018). The technological factors include the

existence of 3D technology for food, beverages, and tobacco, internet connectivity for fast

services to customers, etc.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Legal factors- There are different laws and regulations in international markets which include

health and safety law, import/export law, consumer law, etc. These laws should be used by the

Oak Cash & Carry to protect its labor and consumers.

Environmental factors- The demand pattern of different products and services of the Oak Cash

& Carry is affected by changes in factors like weather, temperature, etc. Oak Cash & Carry

should consider these factors due to increasing environmental awareness (Hans, 2018).

The global business environment in which the Oak Cash & Carry is planning to operate requires

huge planning. The market analysis and internal analysis of the company is very important

before entering into the international market. The company should invest in advanced

technology to gain a competitive advantage. Oak Cash & Carry should come up with innovative

products and services for increasing its customer base in the new market (Hans, 2018).

5

health and safety law, import/export law, consumer law, etc. These laws should be used by the

Oak Cash & Carry to protect its labor and consumers.

Environmental factors- The demand pattern of different products and services of the Oak Cash

& Carry is affected by changes in factors like weather, temperature, etc. Oak Cash & Carry

should consider these factors due to increasing environmental awareness (Hans, 2018).

The global business environment in which the Oak Cash & Carry is planning to operate requires

huge planning. The market analysis and internal analysis of the company is very important

before entering into the international market. The company should invest in advanced

technology to gain a competitive advantage. Oak Cash & Carry should come up with innovative

products and services for increasing its customer base in the new market (Hans, 2018).

5

THREATS AND OPPORTUNITIES FACED BY OAK CASH & CARRY IN

AN INCREASINGLY GLOBALIZED ENVIRONMENT

THREATS

Finance and technology are the major threats faced by Oak Cash & Carry. The key issue faced

by the Oak Cash & Carry is keeping up with technology. The experts are required for

cybersecurity, online marketing, and compliance. The Oak Cash & Carry won't always have

these specialist skills employees available. The planning to cope with the financial crisis will be

made by Oak Cash & Carry (Stankovska et al. 2016).

The real economic concern includes the weakening oil sector and slows down in China which is

the threat for Oak Cash & Carry. The unstable growth in the Eurozone and weak Euro in the

wake of the Greek debt crisis and migrants affects the Oak Cash & Carry. The plan will be made

by the company to cope with a global financial emergency (Masood and Sonntag, 2020).

The prices of fuel play important role in the profitability of the Oak Cash & Carry as it is a

wholesaling company in which the products are transported. The total operating costs of the

company are affected and some SMEs do not afford these.

The currency fluctuation is also a threat for Oak Cash & Carry as it directly impacts the pricing

when selling and buying overseas. Oak Cash & Carry overcome this barrier by using a forward

contract which leads to the amount paid to foreign suppliers in advance. The Oak Cash & Carry

will be protected from any drop in the value of the pound (Van Roy et al. 2020).

The willingness of the Oak Cash & Carry to grow its business is impacted due to uncertainty and

ambiguity caused by the EU. The biggest uncertainty for the Oak Cash & Carry is a possible exit

from the EU. The company makes sure that the plan for research and all eventualities into the

probable implication of Brexit for overcoming this barrier (Van Roy et al. 2020).

Oak Cash & Carry needs to use AI and robotics for making its operations more efficient and

smarter in international markets. A huge investment is required for this technology

advancement. Trained and high skilled employees are needed to use them effectively (Van Roy

et al. 2020).

6

AN INCREASINGLY GLOBALIZED ENVIRONMENT

THREATS

Finance and technology are the major threats faced by Oak Cash & Carry. The key issue faced

by the Oak Cash & Carry is keeping up with technology. The experts are required for

cybersecurity, online marketing, and compliance. The Oak Cash & Carry won't always have

these specialist skills employees available. The planning to cope with the financial crisis will be

made by Oak Cash & Carry (Stankovska et al. 2016).

The real economic concern includes the weakening oil sector and slows down in China which is

the threat for Oak Cash & Carry. The unstable growth in the Eurozone and weak Euro in the

wake of the Greek debt crisis and migrants affects the Oak Cash & Carry. The plan will be made

by the company to cope with a global financial emergency (Masood and Sonntag, 2020).

The prices of fuel play important role in the profitability of the Oak Cash & Carry as it is a

wholesaling company in which the products are transported. The total operating costs of the

company are affected and some SMEs do not afford these.

The currency fluctuation is also a threat for Oak Cash & Carry as it directly impacts the pricing

when selling and buying overseas. Oak Cash & Carry overcome this barrier by using a forward

contract which leads to the amount paid to foreign suppliers in advance. The Oak Cash & Carry

will be protected from any drop in the value of the pound (Van Roy et al. 2020).

The willingness of the Oak Cash & Carry to grow its business is impacted due to uncertainty and

ambiguity caused by the EU. The biggest uncertainty for the Oak Cash & Carry is a possible exit

from the EU. The company makes sure that the plan for research and all eventualities into the

probable implication of Brexit for overcoming this barrier (Van Roy et al. 2020).

Oak Cash & Carry needs to use AI and robotics for making its operations more efficient and

smarter in international markets. A huge investment is required for this technology

advancement. Trained and high skilled employees are needed to use them effectively (Van Roy

et al. 2020).

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

OPPORTUNITIES

Every business aims to grow and tap into new markets and it requires looking at scale-up

opportunities. Oak Cash & Carry looked beyond the UK due to the beginning of Brexit and think

for operating internationally (Gaganis et al. 2019)

Oak Cash & Carry is targeting the international market for expansion due to post Brexit. British

products and services are more reasonable for international buyers due to fluctuating exchange

rates. It provides an opportunity for Oak Cash & Carry to export its products abroad. The

international sales of the SMEs were triple due to the post-Brexit currency fall (Orazulike,

2018).

The expansion in non-EU countries will provide many benefits to Oak Cash & Carry as the many

companies are looking to non-EU countries to trade with due to the impact of Brexit. The no

more EU red tape means that the UK is no longer bounded to 19,000 EU regulations and rules.

This will be a great opportunity for the Oak Cash & Carry to expand internationally (Orazulike,

2018).

The profitability of the company depends on many factors and the many challenges and risks

are faced when entering into new markets. There will be many opportunities available with Oak

Cash & Carry if a company invests in the updated and latest technology which leads to a unique

experience for its customers. To attract customers in a new market, the Oak Cash & Carry needs

to offer innovative services and products (Gaganis et al. 2019). The company can increase its

customer base with continuous innovation, market research, etc. There also exist many threats

like financial risk, political and legal challenges, economic challenges that affect the operations

of the company. The proper planning and market analysis will help Oak Cash & Carry to

overcome these barriers (Hans, 2018).

7

Every business aims to grow and tap into new markets and it requires looking at scale-up

opportunities. Oak Cash & Carry looked beyond the UK due to the beginning of Brexit and think

for operating internationally (Gaganis et al. 2019)

Oak Cash & Carry is targeting the international market for expansion due to post Brexit. British

products and services are more reasonable for international buyers due to fluctuating exchange

rates. It provides an opportunity for Oak Cash & Carry to export its products abroad. The

international sales of the SMEs were triple due to the post-Brexit currency fall (Orazulike,

2018).

The expansion in non-EU countries will provide many benefits to Oak Cash & Carry as the many

companies are looking to non-EU countries to trade with due to the impact of Brexit. The no

more EU red tape means that the UK is no longer bounded to 19,000 EU regulations and rules.

This will be a great opportunity for the Oak Cash & Carry to expand internationally (Orazulike,

2018).

The profitability of the company depends on many factors and the many challenges and risks

are faced when entering into new markets. There will be many opportunities available with Oak

Cash & Carry if a company invests in the updated and latest technology which leads to a unique

experience for its customers. To attract customers in a new market, the Oak Cash & Carry needs

to offer innovative services and products (Gaganis et al. 2019). The company can increase its

customer base with continuous innovation, market research, etc. There also exist many threats

like financial risk, political and legal challenges, economic challenges that affect the operations

of the company. The proper planning and market analysis will help Oak Cash & Carry to

overcome these barriers (Hans, 2018).

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ADVANTAGES OF TRADING BLOCKS FOR FIRMS

The trading bloc facilitates smooth trading between different countries. The type of

intergovernmental agreement where barriers to international trade are eliminated or reduced

among the participating states. It makes trading easy and smooth (Ogbor and Eromafuru,

2018).

The market efficiency improved as the removal of tariffs and increase competition drive

down price and consumption increase which reduces the deadweight loss.

The cost of imports drives down as trade blocs eliminate tariffs. It also reduces the cost

of locally produced goods (Ogbor and Eromafuru, 2018).

The prices for consumers are lower as production increases due to a fall in the average

cost of each good produced. The Oak Cash & Carry can take advantage of economies of

scale (Ogbor and Eromafuru, 2018).

8

The trading bloc facilitates smooth trading between different countries. The type of

intergovernmental agreement where barriers to international trade are eliminated or reduced

among the participating states. It makes trading easy and smooth (Ogbor and Eromafuru,

2018).

The market efficiency improved as the removal of tariffs and increase competition drive

down price and consumption increase which reduces the deadweight loss.

The cost of imports drives down as trade blocs eliminate tariffs. It also reduces the cost

of locally produced goods (Ogbor and Eromafuru, 2018).

The prices for consumers are lower as production increases due to a fall in the average

cost of each good produced. The Oak Cash & Carry can take advantage of economies of

scale (Ogbor and Eromafuru, 2018).

8

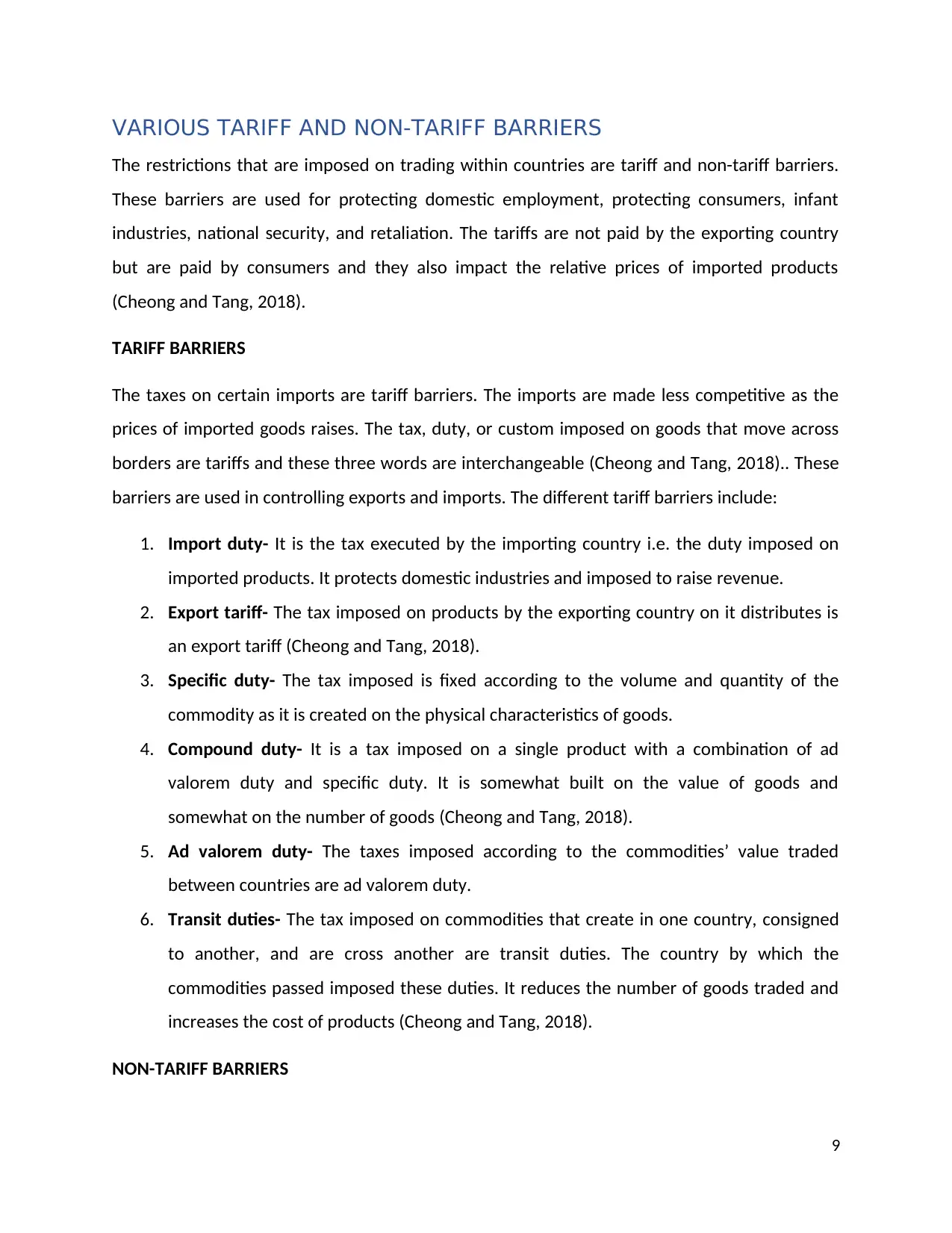

VARIOUS TARIFF AND NON-TARIFF BARRIERS

The restrictions that are imposed on trading within countries are tariff and non-tariff barriers.

These barriers are used for protecting domestic employment, protecting consumers, infant

industries, national security, and retaliation. The tariffs are not paid by the exporting country

but are paid by consumers and they also impact the relative prices of imported products

(Cheong and Tang, 2018).

TARIFF BARRIERS

The taxes on certain imports are tariff barriers. The imports are made less competitive as the

prices of imported goods raises. The tax, duty, or custom imposed on goods that move across

borders are tariffs and these three words are interchangeable (Cheong and Tang, 2018).. These

barriers are used in controlling exports and imports. The different tariff barriers include:

1. Import duty- It is the tax executed by the importing country i.e. the duty imposed on

imported products. It protects domestic industries and imposed to raise revenue.

2. Export tariff- The tax imposed on products by the exporting country on it distributes is

an export tariff (Cheong and Tang, 2018).

3. Specific duty- The tax imposed is fixed according to the volume and quantity of the

commodity as it is created on the physical characteristics of goods.

4. Compound duty- It is a tax imposed on a single product with a combination of ad

valorem duty and specific duty. It is somewhat built on the value of goods and

somewhat on the number of goods (Cheong and Tang, 2018).

5. Ad valorem duty- The taxes imposed according to the commodities’ value traded

between countries are ad valorem duty.

6. Transit duties- The tax imposed on commodities that create in one country, consigned

to another, and are cross another are transit duties. The country by which the

commodities passed imposed these duties. It reduces the number of goods traded and

increases the cost of products (Cheong and Tang, 2018).

NON-TARIFF BARRIERS

9

The restrictions that are imposed on trading within countries are tariff and non-tariff barriers.

These barriers are used for protecting domestic employment, protecting consumers, infant

industries, national security, and retaliation. The tariffs are not paid by the exporting country

but are paid by consumers and they also impact the relative prices of imported products

(Cheong and Tang, 2018).

TARIFF BARRIERS

The taxes on certain imports are tariff barriers. The imports are made less competitive as the

prices of imported goods raises. The tax, duty, or custom imposed on goods that move across

borders are tariffs and these three words are interchangeable (Cheong and Tang, 2018).. These

barriers are used in controlling exports and imports. The different tariff barriers include:

1. Import duty- It is the tax executed by the importing country i.e. the duty imposed on

imported products. It protects domestic industries and imposed to raise revenue.

2. Export tariff- The tax imposed on products by the exporting country on it distributes is

an export tariff (Cheong and Tang, 2018).

3. Specific duty- The tax imposed is fixed according to the volume and quantity of the

commodity as it is created on the physical characteristics of goods.

4. Compound duty- It is a tax imposed on a single product with a combination of ad

valorem duty and specific duty. It is somewhat built on the value of goods and

somewhat on the number of goods (Cheong and Tang, 2018).

5. Ad valorem duty- The taxes imposed according to the commodities’ value traded

between countries are ad valorem duty.

6. Transit duties- The tax imposed on commodities that create in one country, consigned

to another, and are cross another are transit duties. The country by which the

commodities passed imposed these duties. It reduces the number of goods traded and

increases the cost of products (Cheong and Tang, 2018).

NON-TARIFF BARRIERS

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

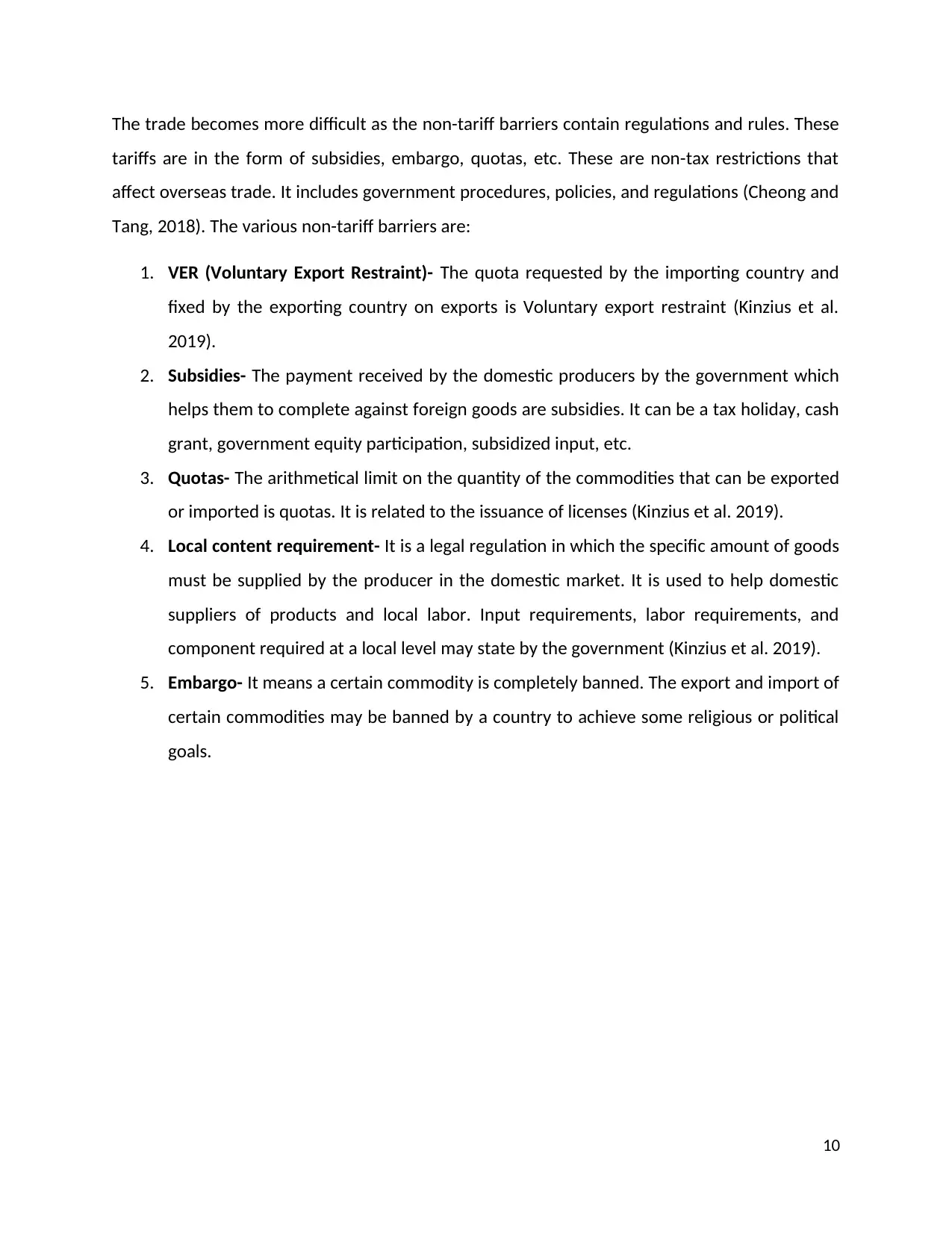

The trade becomes more difficult as the non-tariff barriers contain regulations and rules. These

tariffs are in the form of subsidies, embargo, quotas, etc. These are non-tax restrictions that

affect overseas trade. It includes government procedures, policies, and regulations (Cheong and

Tang, 2018). The various non-tariff barriers are:

1. VER (Voluntary Export Restraint)- The quota requested by the importing country and

fixed by the exporting country on exports is Voluntary export restraint (Kinzius et al.

2019).

2. Subsidies- The payment received by the domestic producers by the government which

helps them to complete against foreign goods are subsidies. It can be a tax holiday, cash

grant, government equity participation, subsidized input, etc.

3. Quotas- The arithmetical limit on the quantity of the commodities that can be exported

or imported is quotas. It is related to the issuance of licenses (Kinzius et al. 2019).

4. Local content requirement- It is a legal regulation in which the specific amount of goods

must be supplied by the producer in the domestic market. It is used to help domestic

suppliers of products and local labor. Input requirements, labor requirements, and

component required at a local level may state by the government (Kinzius et al. 2019).

5. Embargo- It means a certain commodity is completely banned. The export and import of

certain commodities may be banned by a country to achieve some religious or political

goals.

10

tariffs are in the form of subsidies, embargo, quotas, etc. These are non-tax restrictions that

affect overseas trade. It includes government procedures, policies, and regulations (Cheong and

Tang, 2018). The various non-tariff barriers are:

1. VER (Voluntary Export Restraint)- The quota requested by the importing country and

fixed by the exporting country on exports is Voluntary export restraint (Kinzius et al.

2019).

2. Subsidies- The payment received by the domestic producers by the government which

helps them to complete against foreign goods are subsidies. It can be a tax holiday, cash

grant, government equity participation, subsidized input, etc.

3. Quotas- The arithmetical limit on the quantity of the commodities that can be exported

or imported is quotas. It is related to the issuance of licenses (Kinzius et al. 2019).

4. Local content requirement- It is a legal regulation in which the specific amount of goods

must be supplied by the producer in the domestic market. It is used to help domestic

suppliers of products and local labor. Input requirements, labor requirements, and

component required at a local level may state by the government (Kinzius et al. 2019).

5. Embargo- It means a certain commodity is completely banned. The export and import of

certain commodities may be banned by a country to achieve some religious or political

goals.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

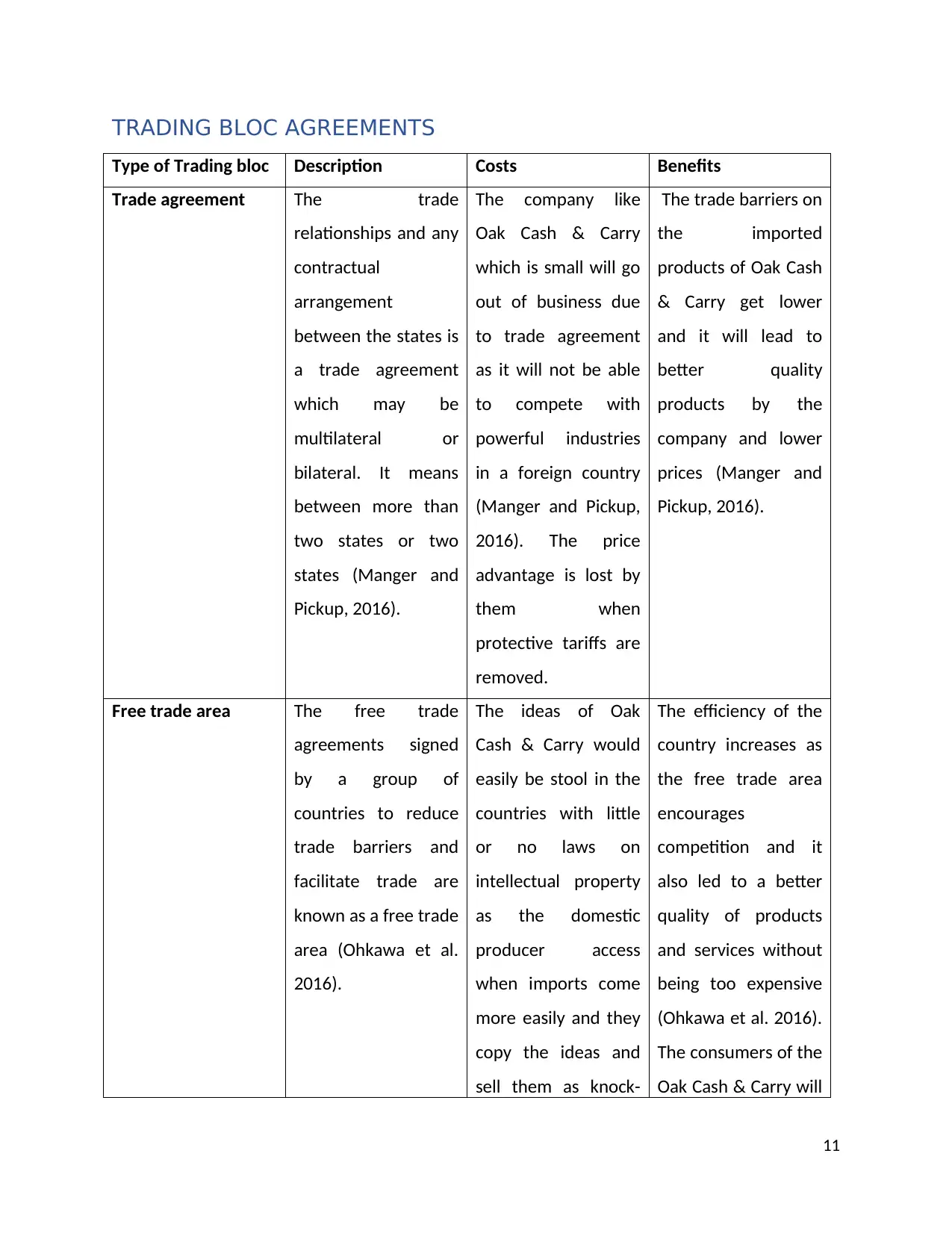

TRADING BLOC AGREEMENTS

Type of Trading bloc Description Costs Benefits

Trade agreement The trade

relationships and any

contractual

arrangement

between the states is

a trade agreement

which may be

multilateral or

bilateral. It means

between more than

two states or two

states (Manger and

Pickup, 2016).

The company like

Oak Cash & Carry

which is small will go

out of business due

to trade agreement

as it will not be able

to compete with

powerful industries

in a foreign country

(Manger and Pickup,

2016). The price

advantage is lost by

them when

protective tariffs are

removed.

The trade barriers on

the imported

products of Oak Cash

& Carry get lower

and it will lead to

better quality

products by the

company and lower

prices (Manger and

Pickup, 2016).

Free trade area The free trade

agreements signed

by a group of

countries to reduce

trade barriers and

facilitate trade are

known as a free trade

area (Ohkawa et al.

2016).

The ideas of Oak

Cash & Carry would

easily be stool in the

countries with little

or no laws on

intellectual property

as the domestic

producer access

when imports come

more easily and they

copy the ideas and

sell them as knock-

The efficiency of the

country increases as

the free trade area

encourages

competition and it

also led to a better

quality of products

and services without

being too expensive

(Ohkawa et al. 2016).

The consumers of the

Oak Cash & Carry will

11

Type of Trading bloc Description Costs Benefits

Trade agreement The trade

relationships and any

contractual

arrangement

between the states is

a trade agreement

which may be

multilateral or

bilateral. It means

between more than

two states or two

states (Manger and

Pickup, 2016).

The company like

Oak Cash & Carry

which is small will go

out of business due

to trade agreement

as it will not be able

to compete with

powerful industries

in a foreign country

(Manger and Pickup,

2016). The price

advantage is lost by

them when

protective tariffs are

removed.

The trade barriers on

the imported

products of Oak Cash

& Carry get lower

and it will lead to

better quality

products by the

company and lower

prices (Manger and

Pickup, 2016).

Free trade area The free trade

agreements signed

by a group of

countries to reduce

trade barriers and

facilitate trade are

known as a free trade

area (Ohkawa et al.

2016).

The ideas of Oak

Cash & Carry would

easily be stool in the

countries with little

or no laws on

intellectual property

as the domestic

producer access

when imports come

more easily and they

copy the ideas and

sell them as knock-

The efficiency of the

country increases as

the free trade area

encourages

competition and it

also led to a better

quality of products

and services without

being too expensive

(Ohkawa et al. 2016).

The consumers of the

Oak Cash & Carry will

11

offs (Ohkawa et al.

2016).

enjoy a higher

purchasing power as

the prices go downs.

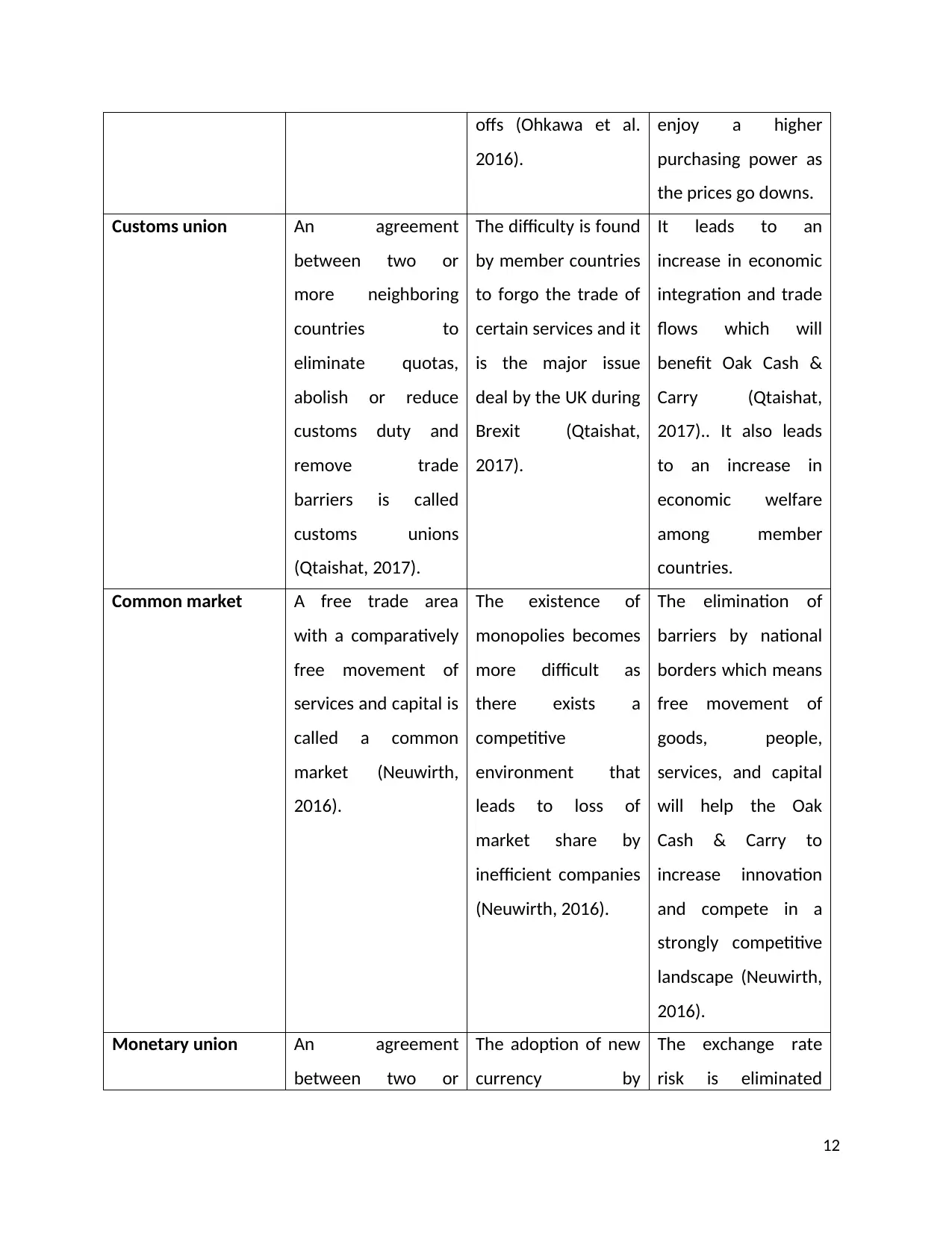

Customs union An agreement

between two or

more neighboring

countries to

eliminate quotas,

abolish or reduce

customs duty and

remove trade

barriers is called

customs unions

(Qtaishat, 2017).

The difficulty is found

by member countries

to forgo the trade of

certain services and it

is the major issue

deal by the UK during

Brexit (Qtaishat,

2017).

It leads to an

increase in economic

integration and trade

flows which will

benefit Oak Cash &

Carry (Qtaishat,

2017).. It also leads

to an increase in

economic welfare

among member

countries.

Common market A free trade area

with a comparatively

free movement of

services and capital is

called a common

market (Neuwirth,

2016).

The existence of

monopolies becomes

more difficult as

there exists a

competitive

environment that

leads to loss of

market share by

inefficient companies

(Neuwirth, 2016).

The elimination of

barriers by national

borders which means

free movement of

goods, people,

services, and capital

will help the Oak

Cash & Carry to

increase innovation

and compete in a

strongly competitive

landscape (Neuwirth,

2016).

Monetary union An agreement

between two or

The adoption of new

currency by

The exchange rate

risk is eliminated

12

2016).

enjoy a higher

purchasing power as

the prices go downs.

Customs union An agreement

between two or

more neighboring

countries to

eliminate quotas,

abolish or reduce

customs duty and

remove trade

barriers is called

customs unions

(Qtaishat, 2017).

The difficulty is found

by member countries

to forgo the trade of

certain services and it

is the major issue

deal by the UK during

Brexit (Qtaishat,

2017).

It leads to an

increase in economic

integration and trade

flows which will

benefit Oak Cash &

Carry (Qtaishat,

2017).. It also leads

to an increase in

economic welfare

among member

countries.

Common market A free trade area

with a comparatively

free movement of

services and capital is

called a common

market (Neuwirth,

2016).

The existence of

monopolies becomes

more difficult as

there exists a

competitive

environment that

leads to loss of

market share by

inefficient companies

(Neuwirth, 2016).

The elimination of

barriers by national

borders which means

free movement of

goods, people,

services, and capital

will help the Oak

Cash & Carry to

increase innovation

and compete in a

strongly competitive

landscape (Neuwirth,

2016).

Monetary union An agreement

between two or

The adoption of new

currency by

The exchange rate

risk is eliminated

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.