Accounting 217 Personal Taxation: Individual Tax Computation 2017

VerifiedAdded on 2023/06/13

|14

|1143

|95

Homework Assignment

AI Summary

This assignment solution provides a detailed computation of federal taxes payable for Mr. and Mrs. Sorter for the 2017 taxation year, as per the requirements of Accounting 217 Personal Taxation. It includes the calculation of Rachel's total income from employment, investments, RRSP, and pension, followed by deductions for RRSP, operating expenses, asset costs, and machinery costs to arrive at her net income and taxable income. The federal tax amount payable by Rachel is then computed based on the applicable tax brackets. Similarly, the assignment calculates Roland's total income from employment and RRSP, followed by deductions for RRSP and vehicle costs to determine his net income and taxable income. Finally, the federal tax payable by Roland is computed based on his taxable income. The document is formatted as a memo to the clients, providing a clear and concise overview of their tax obligations.

Tax Computation of Individual

1 | P a g e

Name of the student

Topic-

University Name

TABLE OF CONTENT

1 | P a g e

Name of the student

Topic-

University Name

TABLE OF CONTENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Tax Computation of Individual

2 | P a g e

S

memo....................................................................................................................................................1

Computation of the Net income of the Rachel......................................................................................1

Commutation of the net income after deducting all the expenses.......................................................4

Taxable income for the Rachel IN 2017.................................................................................................6

Net income of Roland............................................................................................................................9

Computation of the Net income of Roland..........................................................................................10

Computation of the taxable income for Roland..................................................................................11

Computation of the Tax of the Roland................................................................................................12

REFERENCES........................................................................................................................................14

2 | P a g e

S

memo....................................................................................................................................................1

Computation of the Net income of the Rachel......................................................................................1

Commutation of the net income after deducting all the expenses.......................................................4

Taxable income for the Rachel IN 2017.................................................................................................6

Net income of Roland............................................................................................................................9

Computation of the Net income of Roland..........................................................................................10

Computation of the taxable income for Roland..................................................................................11

Computation of the Tax of the Roland................................................................................................12

REFERENCES........................................................................................................................................14

Running Head: Tax Computation of Individual

1 | P a g e

MEMO

To Mr. and Mrs. Sorter

Addresses

Date-

Dear Sir/ Madam

It is the amount of tax which need to be paid by individual on their income. There is income

tax slab issued by the income tax authority of the Canada. This slab rate is used by the

individual to compute his income tax payment.

Individual in the Canada needs to pay tax on their income.

This could be understood with the simple example that income tax is chargeable by

zero % for the starting income of $ 46605 as it is exempted amount to pay tax to government.

After that, rest amount will be taxed accordingly.

Description of the payment of tax

Exempt income till $ 46605.

Next 46605 amount of income will be charged @ 15%.

Next following $ 46605 will be charged @ 20.5%.

After that 29% will be tax charged till $ 205843.

Rest of the income will be charged at the rate of 33% $205,842

It is analysed that Ronald will pay tax amount of 7,463.00 to government. In

addition to this, Rachel will pay tax of $ 55242 to government (Caron, et al. 2018).

1

1 | P a g e

MEMO

To Mr. and Mrs. Sorter

Addresses

Date-

Dear Sir/ Madam

It is the amount of tax which need to be paid by individual on their income. There is income

tax slab issued by the income tax authority of the Canada. This slab rate is used by the

individual to compute his income tax payment.

Individual in the Canada needs to pay tax on their income.

This could be understood with the simple example that income tax is chargeable by

zero % for the starting income of $ 46605 as it is exempted amount to pay tax to government.

After that, rest amount will be taxed accordingly.

Description of the payment of tax

Exempt income till $ 46605.

Next 46605 amount of income will be charged @ 15%.

Next following $ 46605 will be charged @ 20.5%.

After that 29% will be tax charged till $ 205843.

Rest of the income will be charged at the rate of 33% $205,842

It is analysed that Ronald will pay tax amount of 7,463.00 to government. In

addition to this, Rachel will pay tax of $ 55242 to government (Caron, et al. 2018).

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Running Head: Tax Computation of Individual

2 | P a g e

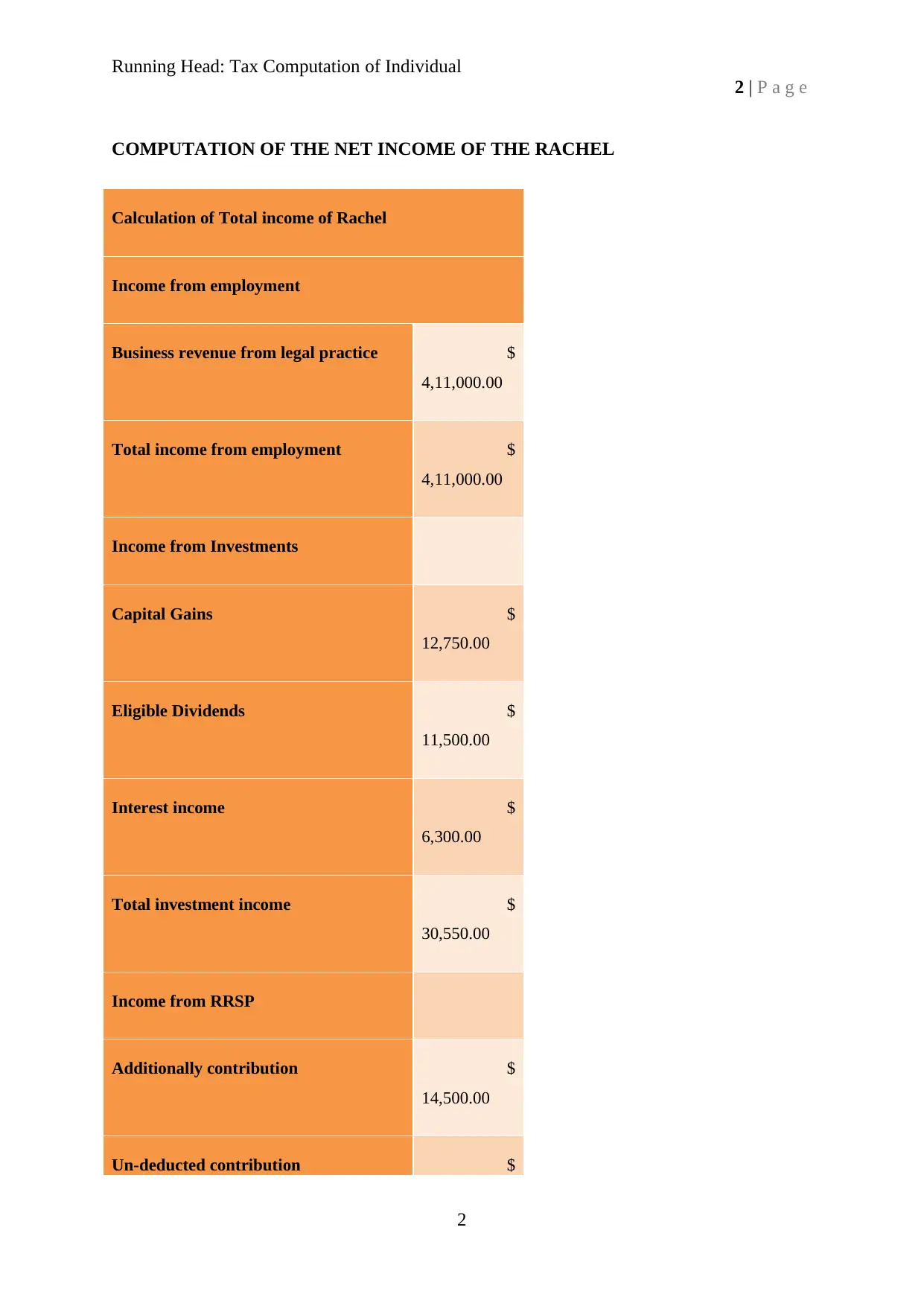

COMPUTATION OF THE NET INCOME OF THE RACHEL

Calculation of Total income of Rachel

Income from employment

Business revenue from legal practice $

4,11,000.00

Total income from employment $

4,11,000.00

Income from Investments

Capital Gains $

12,750.00

Eligible Dividends $

11,500.00

Interest income $

6,300.00

Total investment income $

30,550.00

Income from RRSP

Additionally contribution $

14,500.00

Un-deducted contribution $

2

2 | P a g e

COMPUTATION OF THE NET INCOME OF THE RACHEL

Calculation of Total income of Rachel

Income from employment

Business revenue from legal practice $

4,11,000.00

Total income from employment $

4,11,000.00

Income from Investments

Capital Gains $

12,750.00

Eligible Dividends $

11,500.00

Interest income $

6,300.00

Total investment income $

30,550.00

Income from RRSP

Additionally contribution $

14,500.00

Un-deducted contribution $

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running Head: Tax Computation of Individual

3 | P a g e

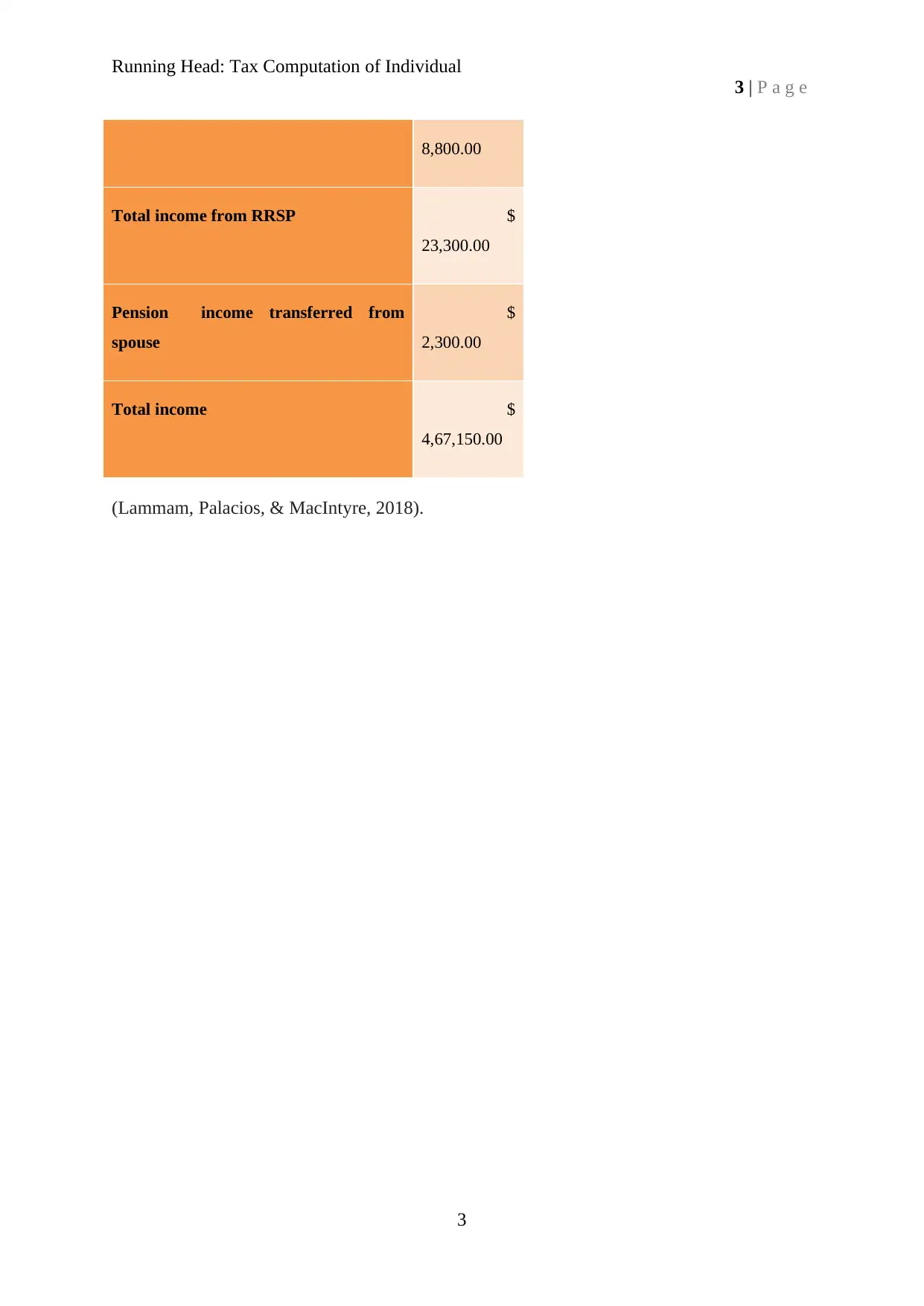

8,800.00

Total income from RRSP $

23,300.00

Pension income transferred from

spouse

$

2,300.00

Total income $

4,67,150.00

(Lammam, Palacios, & MacIntyre, 2018).

3

3 | P a g e

8,800.00

Total income from RRSP $

23,300.00

Pension income transferred from

spouse

$

2,300.00

Total income $

4,67,150.00

(Lammam, Palacios, & MacIntyre, 2018).

3

Running Head: Tax Computation of Individual

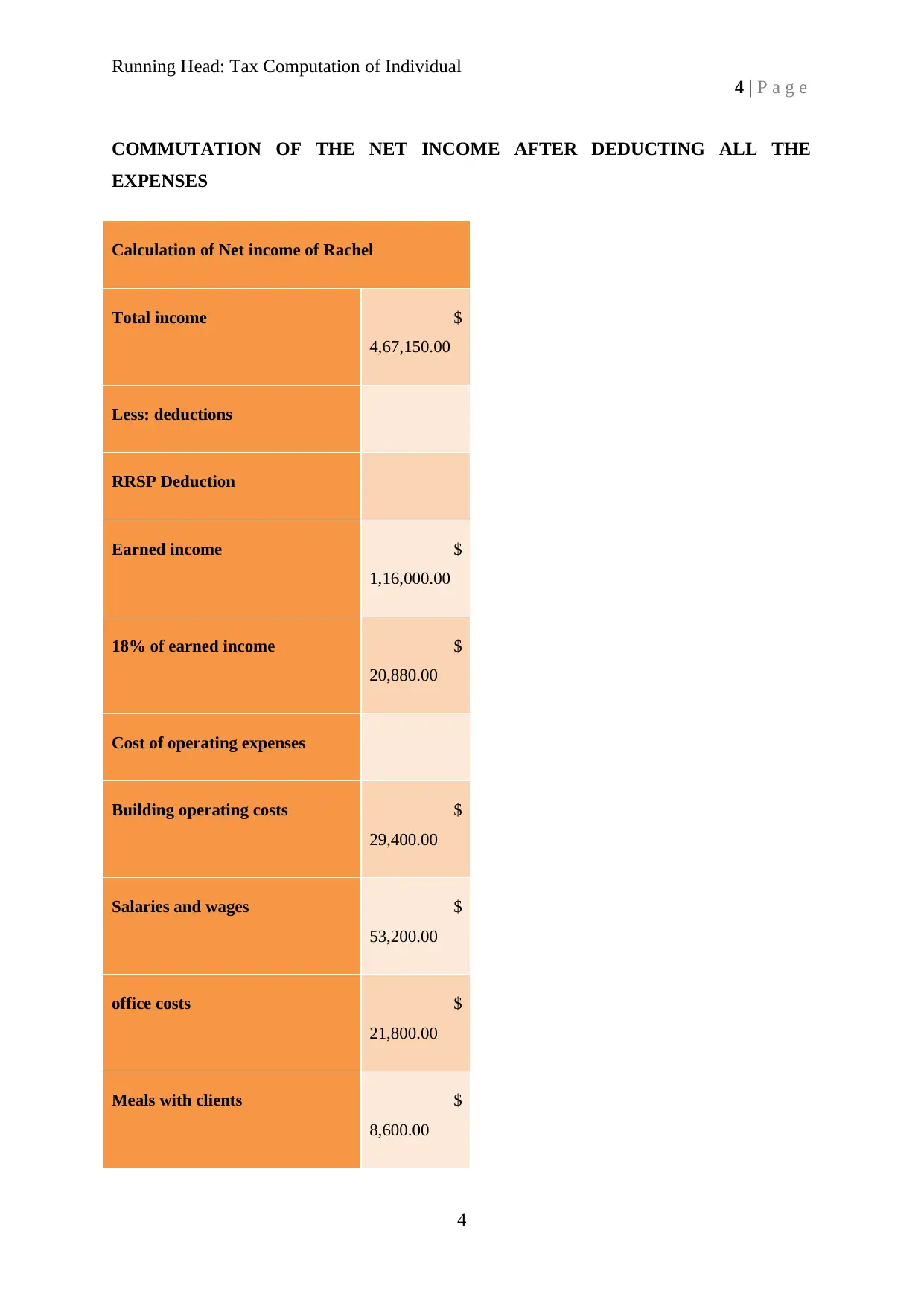

4 | P a g e

COMMUTATION OF THE NET INCOME AFTER DEDUCTING ALL THE

EXPENSES

Calculation of Net income of Rachel

Total income $

4,67,150.00

Less: deductions

RRSP Deduction

Earned income $

1,16,000.00

18% of earned income $

20,880.00

Cost of operating expenses

Building operating costs $

29,400.00

Salaries and wages $

53,200.00

office costs $

21,800.00

Meals with clients $

8,600.00

4

4 | P a g e

COMMUTATION OF THE NET INCOME AFTER DEDUCTING ALL THE

EXPENSES

Calculation of Net income of Rachel

Total income $

4,67,150.00

Less: deductions

RRSP Deduction

Earned income $

1,16,000.00

18% of earned income $

20,880.00

Cost of operating expenses

Building operating costs $

29,400.00

Salaries and wages $

53,200.00

office costs $

21,800.00

Meals with clients $

8,600.00

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Running Head: Tax Computation of Individual

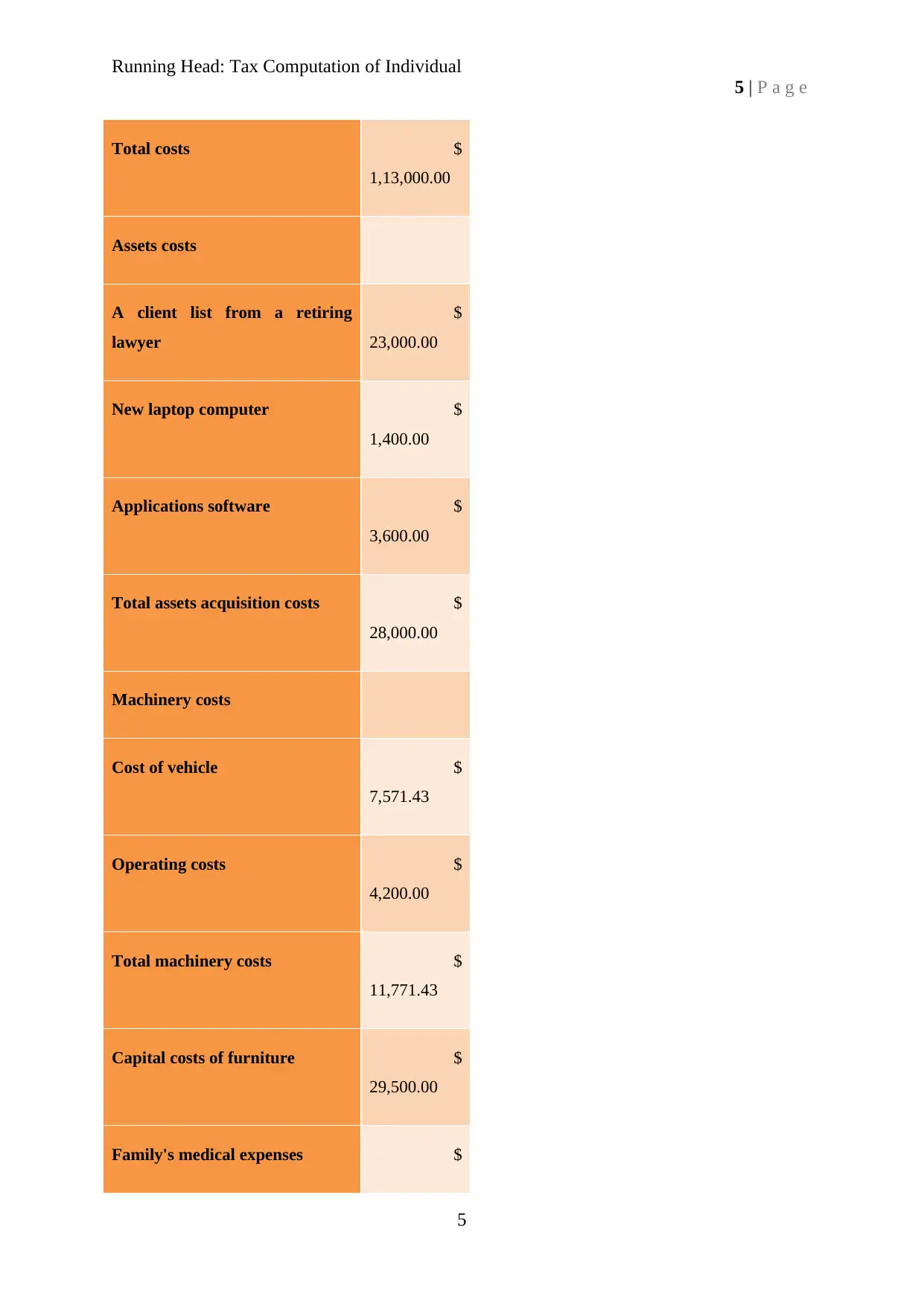

5 | P a g e

Total costs $

1,13,000.00

Assets costs

A client list from a retiring

lawyer

$

23,000.00

New laptop computer $

1,400.00

Applications software $

3,600.00

Total assets acquisition costs $

28,000.00

Machinery costs

Cost of vehicle $

7,571.43

Operating costs $

4,200.00

Total machinery costs $

11,771.43

Capital costs of furniture $

29,500.00

Family's medical expenses $

5

5 | P a g e

Total costs $

1,13,000.00

Assets costs

A client list from a retiring

lawyer

$

23,000.00

New laptop computer $

1,400.00

Applications software $

3,600.00

Total assets acquisition costs $

28,000.00

Machinery costs

Cost of vehicle $

7,571.43

Operating costs $

4,200.00

Total machinery costs $

11,771.43

Capital costs of furniture $

29,500.00

Family's medical expenses $

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running Head: Tax Computation of Individual

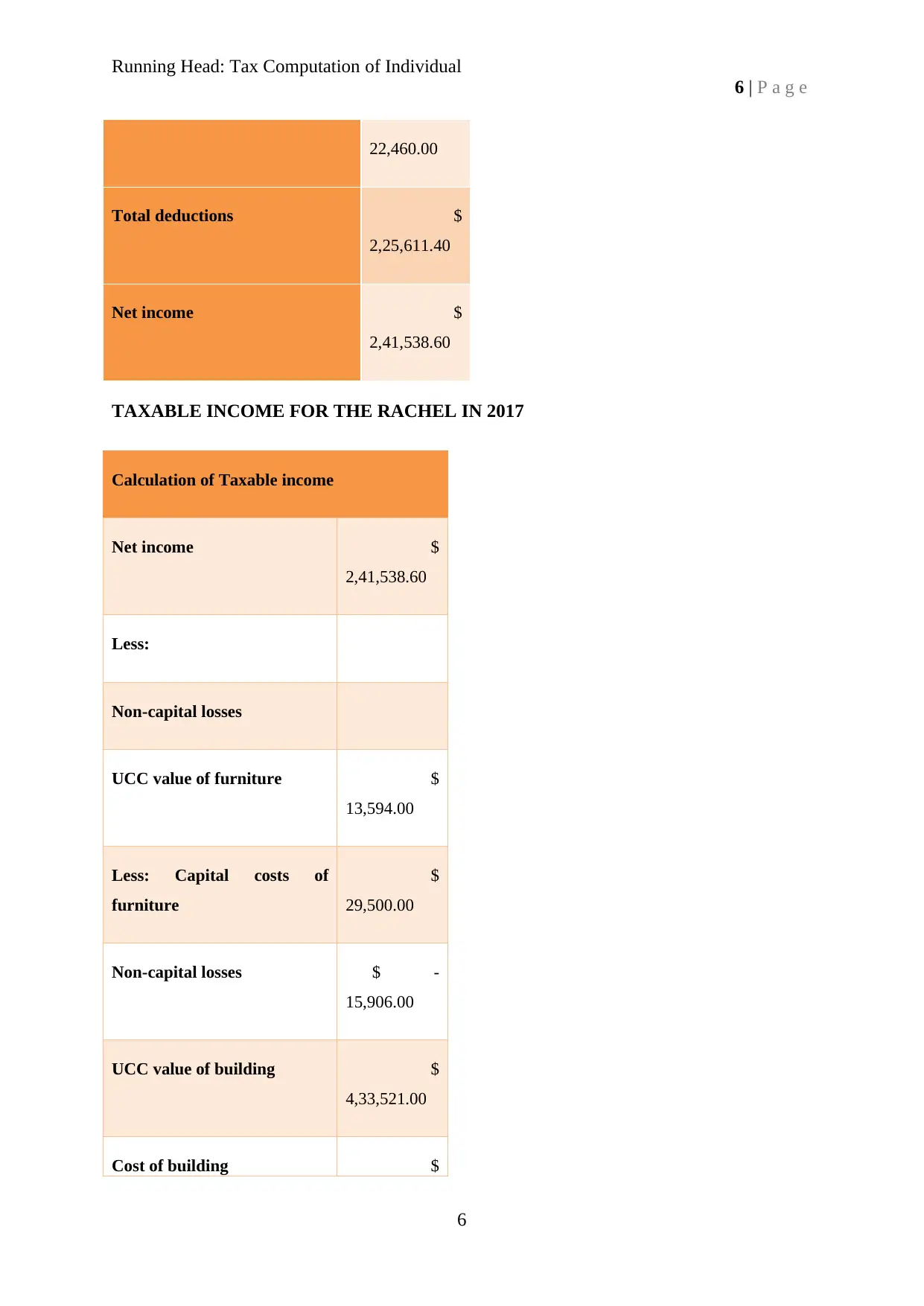

6 | P a g e

22,460.00

Total deductions $

2,25,611.40

Net income $

2,41,538.60

TAXABLE INCOME FOR THE RACHEL IN 2017

Calculation of Taxable income

Net income $

2,41,538.60

Less:

Non-capital losses

UCC value of furniture $

13,594.00

Less: Capital costs of

furniture

$

29,500.00

Non-capital losses $ -

15,906.00

UCC value of building $

4,33,521.00

Cost of building $

6

6 | P a g e

22,460.00

Total deductions $

2,25,611.40

Net income $

2,41,538.60

TAXABLE INCOME FOR THE RACHEL IN 2017

Calculation of Taxable income

Net income $

2,41,538.60

Less:

Non-capital losses

UCC value of furniture $

13,594.00

Less: Capital costs of

furniture

$

29,500.00

Non-capital losses $ -

15,906.00

UCC value of building $

4,33,521.00

Cost of building $

6

Running Head: Tax Computation of Individual

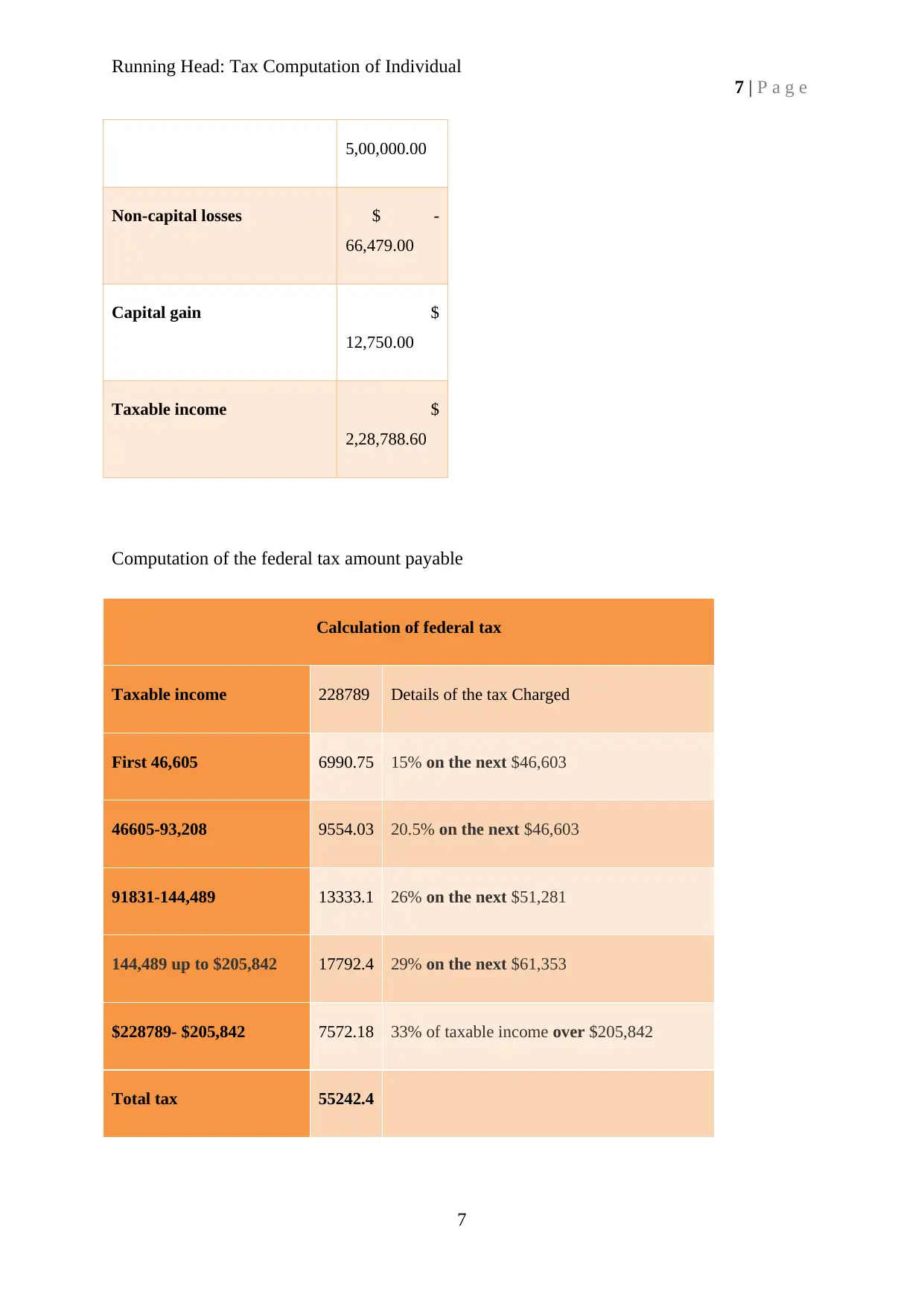

7 | P a g e

5,00,000.00

Non-capital losses $ -

66,479.00

Capital gain $

12,750.00

Taxable income $

2,28,788.60

Computation of the federal tax amount payable

Calculation of federal tax

Taxable income 228789 Details of the tax Charged

First 46,605 6990.75 15% on the next $46,603

46605-93,208 9554.03 20.5% on the next $46,603

91831-144,489 13333.1 26% on the next $51,281

144,489 up to $205,842 17792.4 29% on the next $61,353

$228789- $205,842 7572.18 33% of taxable income over $205,842

Total tax 55242.4

7

7 | P a g e

5,00,000.00

Non-capital losses $ -

66,479.00

Capital gain $

12,750.00

Taxable income $

2,28,788.60

Computation of the federal tax amount payable

Calculation of federal tax

Taxable income 228789 Details of the tax Charged

First 46,605 6990.75 15% on the next $46,603

46605-93,208 9554.03 20.5% on the next $46,603

91831-144,489 13333.1 26% on the next $51,281

144,489 up to $205,842 17792.4 29% on the next $61,353

$228789- $205,842 7572.18 33% of taxable income over $205,842

Total tax 55242.4

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Running Head: Tax Computation of Individual

8 | P a g e

Tax rounded up 55242

NET INCOME OF Roland

Calculation of Total income of

Roland

Income from Employment

Salary $ 66,500.00

RPPC $ 4,600.00

EI premiums $ 836.00

Total income from

employment

$ 71,936.00

Income from investment

Income from RRSP

Unused contribution $ 5,500.00

No Income portion $ 4,500.00

Income $ 1,000.00

Total income $ 72,936.00

8

8 | P a g e

Tax rounded up 55242

NET INCOME OF Roland

Calculation of Total income of

Roland

Income from Employment

Salary $ 66,500.00

RPPC $ 4,600.00

EI premiums $ 836.00

Total income from

employment

$ 71,936.00

Income from investment

Income from RRSP

Unused contribution $ 5,500.00

No Income portion $ 4,500.00

Income $ 1,000.00

Total income $ 72,936.00

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running Head: Tax Computation of Individual

9 | P a g e

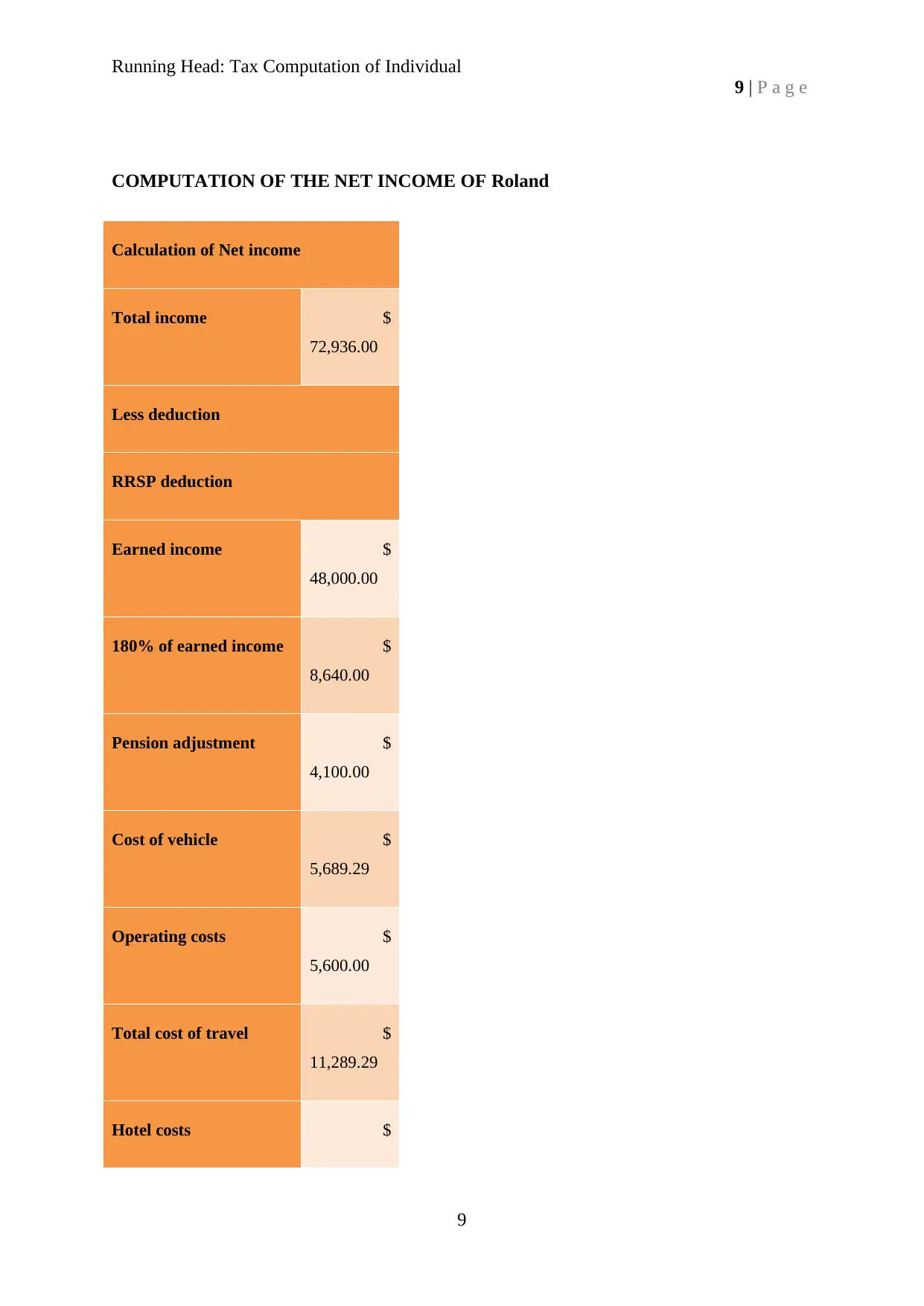

COMPUTATION OF THE NET INCOME OF Roland

Calculation of Net income

Total income $

72,936.00

Less deduction

RRSP deduction

Earned income $

48,000.00

180% of earned income $

8,640.00

Pension adjustment $

4,100.00

Cost of vehicle $

5,689.29

Operating costs $

5,600.00

Total cost of travel $

11,289.29

Hotel costs $

9

9 | P a g e

COMPUTATION OF THE NET INCOME OF Roland

Calculation of Net income

Total income $

72,936.00

Less deduction

RRSP deduction

Earned income $

48,000.00

180% of earned income $

8,640.00

Pension adjustment $

4,100.00

Cost of vehicle $

5,689.29

Operating costs $

5,600.00

Total cost of travel $

11,289.29

Hotel costs $

9

Running Head: Tax Computation of Individual

10 | P a g e

2,800.00

Food on out of town

trips

$

930.00

Total $

3,730.00

Allowance $

3,730.00

Total deductions $

24,029.29

Net Income $

48,906.71

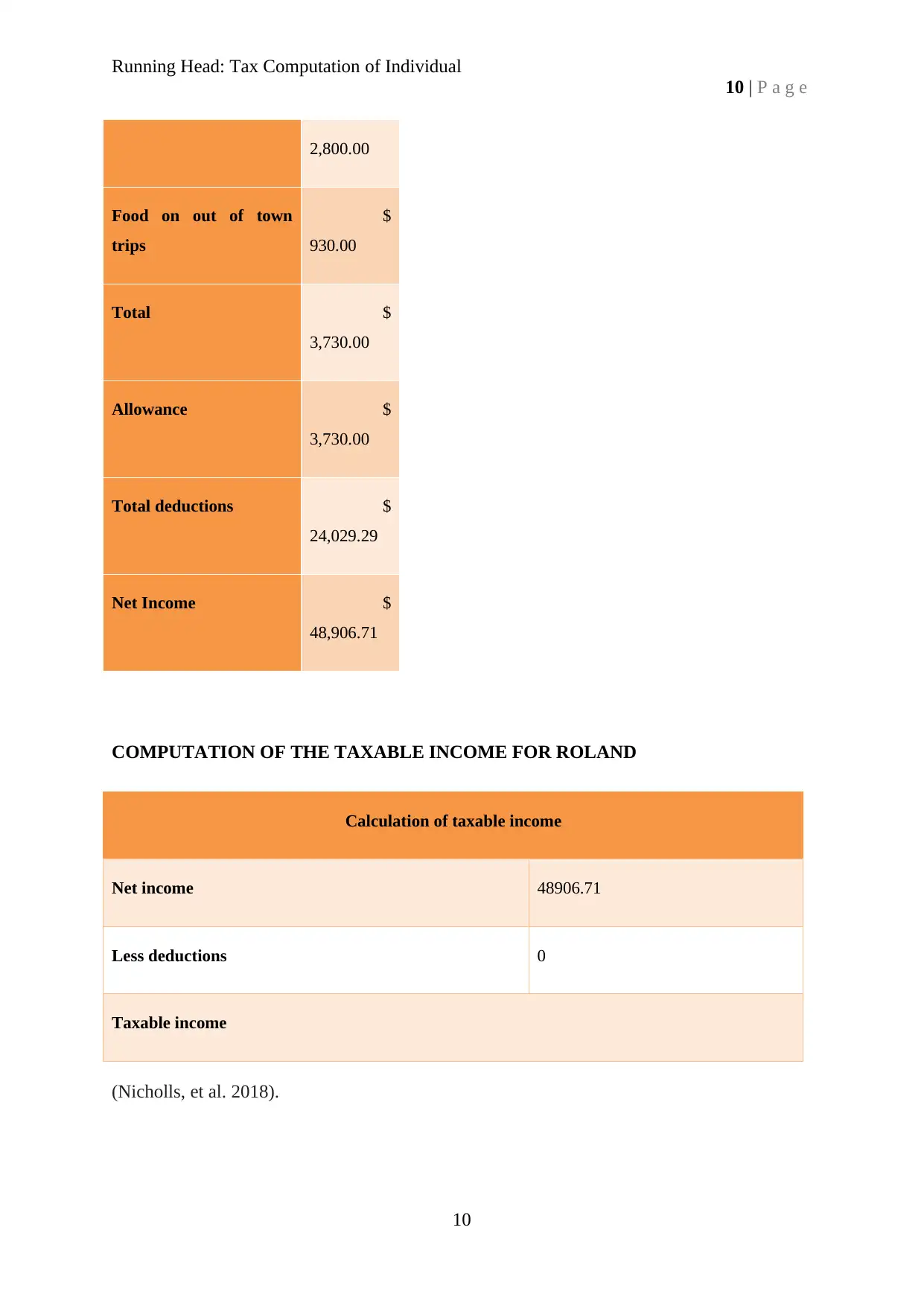

COMPUTATION OF THE TAXABLE INCOME FOR ROLAND

Calculation of taxable income

Net income 48906.71

Less deductions 0

Taxable income

(Nicholls, et al. 2018).

10

10 | P a g e

2,800.00

Food on out of town

trips

$

930.00

Total $

3,730.00

Allowance $

3,730.00

Total deductions $

24,029.29

Net Income $

48,906.71

COMPUTATION OF THE TAXABLE INCOME FOR ROLAND

Calculation of taxable income

Net income 48906.71

Less deductions 0

Taxable income

(Nicholls, et al. 2018).

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.