Tax Implications of Various Cash Inflows and Outflows for Employee and Employer

VerifiedAdded on 2023/06/04

|12

|3448

|67

AI Summary

This article discusses the tax implications of various cash inflows and outflows for employees and employers. It covers the tax treatment of car benefits, loan extensions, receipts such as salary, commission, entertainment allowance, and subscription, and deductions. The article provides relevant laws and their application to each scenario.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

TAXATION

Student Name

[Pick the date]

Student Name

[Pick the date]

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Question 1

Issue

As per the case facts outlined, Amber has enacted certain transactions involving sale of certain

assets and other contractual agreements. In this background, it is essential to outline the various

tax liabilities that would potentially arise for Amber. The various issues in this regards are

indicated below.

1) Owing to liquidation to chocolate shop, proceeds would be obtained and it needs to be

outlined if capital gains tax would be applicable on any or all of these assuming the proceeds are

capital.

2) Owing to the contract regarding restrictive covenant, proceeds would be realised and it needs

to be analysed if this is revenue or capital and suitable taxation treatment discussed.

3) Owing to the apartment sale, the tax treatment of the proceeds and potential capital gains

implications of the same.

Law

The relevant law keeping in mind the various transactions have been discussed as indicated

below.

Sale of Shop

The first critical question that arises with regards to certain assets is whether these can be

labelled as capital assets or not. To answer the same, s. 108-5 ITAA 1997 is relevant since it lists

down the various capital assets from the perspective of taxation. A noteworthy aspect as per this

section is that capital assets does not consist of only tangible assets but also consists of intangible

assets (example: goodwill) (Woellner, 2015). Identification of assets as capital assets is a key

step as for a capital asset the proceeds arising from sale would be capital and hence tax free.

Thus, in case of capital assets sale, the only potential tax implications can arise on account of

loss or gain in capital owing to higher or lower cash proceeds when compared with the cost base.

Another vital point to note is that in case of trading stock any capital gains or loss would be

ignored from CGT liability in accordance with s. 118-25 ITAA 1997 (Sadiq et. al., 2015).

1

Issue

As per the case facts outlined, Amber has enacted certain transactions involving sale of certain

assets and other contractual agreements. In this background, it is essential to outline the various

tax liabilities that would potentially arise for Amber. The various issues in this regards are

indicated below.

1) Owing to liquidation to chocolate shop, proceeds would be obtained and it needs to be

outlined if capital gains tax would be applicable on any or all of these assuming the proceeds are

capital.

2) Owing to the contract regarding restrictive covenant, proceeds would be realised and it needs

to be analysed if this is revenue or capital and suitable taxation treatment discussed.

3) Owing to the apartment sale, the tax treatment of the proceeds and potential capital gains

implications of the same.

Law

The relevant law keeping in mind the various transactions have been discussed as indicated

below.

Sale of Shop

The first critical question that arises with regards to certain assets is whether these can be

labelled as capital assets or not. To answer the same, s. 108-5 ITAA 1997 is relevant since it lists

down the various capital assets from the perspective of taxation. A noteworthy aspect as per this

section is that capital assets does not consist of only tangible assets but also consists of intangible

assets (example: goodwill) (Woellner, 2015). Identification of assets as capital assets is a key

step as for a capital asset the proceeds arising from sale would be capital and hence tax free.

Thus, in case of capital assets sale, the only potential tax implications can arise on account of

loss or gain in capital owing to higher or lower cash proceeds when compared with the cost base.

Another vital point to note is that in case of trading stock any capital gains or loss would be

ignored from CGT liability in accordance with s. 118-25 ITAA 1997 (Sadiq et. al., 2015).

1

Potential capital gains or losses can arise when a capital event takes place which are highlighted

in s. 104-5 ITAA 1997. In relation to sale of a capital asset, the relevant event is named A1. The

listing of correct capital event is imperative as every event has a particular methodology for

capital gains /losses computations which is outlined in s. 104-5 ITAA 1997. In case of asset

disposal, capital gains can be derived by finding the difference between asset cost base and

proceeds derived from sale (Coleman, 2015). Further, there are two methods provided in tax

legislation to avail capital gains concessions which are discount method and indexation method.

The discount method is explained under Division 115 ITAA 1997 and provides for a flat 50%

capital gains discount only when the underlying capital gains are long term which would happen

when the asset holding period would be higher than a year. The other method i.e. indexation

method aims to provide concessions by providing inflation adjustment in the cost base of asset

which would result in lower capital gains which are subject to CGT or capital gains tax

(Barkoczy, 2017).

Restrictive Covenant

A crucial issue in relation to restrictive covenant is the nature of proceeds which becomes a vital

aspect as revenue proceeds would be assessable income while capital proceeds would not be

assessable income. In case of capital receipts, the potential capital gains tax implications gain

prominence. Some direction with regards to ascertaining the nature of proceeds from restrictive

covenant can be obtained by analysing tax ruling TR 95/35. One of the noteworthy principles is

that any restriction imposed on any legally available right of the taxpayer though compensation

would result in capital proceeds (Krever, 2016). This is because the underlying right of the

taxpayer was an asset which has been restricted and adversely impacts future earnings potential.

The same is also reflected in a relevant case i.e. Reuter v. FC of T 93 ATC 4037; (1993) 24 ATR

527 where constraint on the right to sue was levied in exchange for payments or compensation.

The honourable court indicated that if the right to sue was legally permissible to the taxpayer,

then the restriction of the same would lead to capital proceeds (Nethercott, Richardson & Devos,

2016).

Apartment

2

in s. 104-5 ITAA 1997. In relation to sale of a capital asset, the relevant event is named A1. The

listing of correct capital event is imperative as every event has a particular methodology for

capital gains /losses computations which is outlined in s. 104-5 ITAA 1997. In case of asset

disposal, capital gains can be derived by finding the difference between asset cost base and

proceeds derived from sale (Coleman, 2015). Further, there are two methods provided in tax

legislation to avail capital gains concessions which are discount method and indexation method.

The discount method is explained under Division 115 ITAA 1997 and provides for a flat 50%

capital gains discount only when the underlying capital gains are long term which would happen

when the asset holding period would be higher than a year. The other method i.e. indexation

method aims to provide concessions by providing inflation adjustment in the cost base of asset

which would result in lower capital gains which are subject to CGT or capital gains tax

(Barkoczy, 2017).

Restrictive Covenant

A crucial issue in relation to restrictive covenant is the nature of proceeds which becomes a vital

aspect as revenue proceeds would be assessable income while capital proceeds would not be

assessable income. In case of capital receipts, the potential capital gains tax implications gain

prominence. Some direction with regards to ascertaining the nature of proceeds from restrictive

covenant can be obtained by analysing tax ruling TR 95/35. One of the noteworthy principles is

that any restriction imposed on any legally available right of the taxpayer though compensation

would result in capital proceeds (Krever, 2016). This is because the underlying right of the

taxpayer was an asset which has been restricted and adversely impacts future earnings potential.

The same is also reflected in a relevant case i.e. Reuter v. FC of T 93 ATC 4037; (1993) 24 ATR

527 where constraint on the right to sue was levied in exchange for payments or compensation.

The honourable court indicated that if the right to sue was legally permissible to the taxpayer,

then the restriction of the same would lead to capital proceeds (Nethercott, Richardson & Devos,

2016).

Apartment

2

It has already been discussed that capital gains or losses are computed only when there is a

capital event. However, death of the owner is not such an event and is not mentioned in s. 104-5

ITAA 1997. The asset typically passes on the legal heir and when there is asset disposal on the

part legal heir, then implications in terms of capital gains could arise. To compute the extent of

these capital gains, the market value of the asset at time of death needs to be deducted from the

proceeds obtained on asset sale (Krever, 2016). Another issue in sale of property relates to

signing of contract in current tax year and settlement in the next tax year. Guidance is provided

in accordance with tax ruling TR 94/29 which makes it clear that for such cases, CGT liability

has to be computed and levied in the same year as contract enactment irrespective of time of

settlement (Woellner, 2015). Also, certain residential apartments may be exempt from any CGT

liability if the same has been used by the taxpayer as main residence from the time of purchase.

This is as per subdivision 118-B ITAA 1997 which allows 100% exemption for any capital gains

derived from main residence same. Critical aspect for main residence is usage of property as

residence and no assessable income being derived from the house through rent or other means

(Barkoczy, 2017).

Application

Sale of shop

The boutique chocolate shop which has been liquidated by Amber comprised of following three

assets namely goodwill, equipment and stock. The relevant tax treatment of each is highlighted

as follows.

1) Goodwill – It is a capital asset as per s. 108-5 and hence sale proceeds would not be taxed.

Disposal of goodwill would be A1 event and hence the deduction of cost of goodwill from sale

price would provide the capital gains made on the transactions. Concession in the form of

Division 115 discount method would be applied as holding period exceeds one year. CGT would

be applied on the remaining capital gains.

2) Equipment – The treatment of equipment differs from that of goodwill owing to regular

depreciation and related taxation deduction that the taxpayer obtains. Thus, for computing the

capital gains or losses comparison between book value and market value ought to be drawn. A

3

capital event. However, death of the owner is not such an event and is not mentioned in s. 104-5

ITAA 1997. The asset typically passes on the legal heir and when there is asset disposal on the

part legal heir, then implications in terms of capital gains could arise. To compute the extent of

these capital gains, the market value of the asset at time of death needs to be deducted from the

proceeds obtained on asset sale (Krever, 2016). Another issue in sale of property relates to

signing of contract in current tax year and settlement in the next tax year. Guidance is provided

in accordance with tax ruling TR 94/29 which makes it clear that for such cases, CGT liability

has to be computed and levied in the same year as contract enactment irrespective of time of

settlement (Woellner, 2015). Also, certain residential apartments may be exempt from any CGT

liability if the same has been used by the taxpayer as main residence from the time of purchase.

This is as per subdivision 118-B ITAA 1997 which allows 100% exemption for any capital gains

derived from main residence same. Critical aspect for main residence is usage of property as

residence and no assessable income being derived from the house through rent or other means

(Barkoczy, 2017).

Application

Sale of shop

The boutique chocolate shop which has been liquidated by Amber comprised of following three

assets namely goodwill, equipment and stock. The relevant tax treatment of each is highlighted

as follows.

1) Goodwill – It is a capital asset as per s. 108-5 and hence sale proceeds would not be taxed.

Disposal of goodwill would be A1 event and hence the deduction of cost of goodwill from sale

price would provide the capital gains made on the transactions. Concession in the form of

Division 115 discount method would be applied as holding period exceeds one year. CGT would

be applied on the remaining capital gains.

2) Equipment – The treatment of equipment differs from that of goodwill owing to regular

depreciation and related taxation deduction that the taxpayer obtains. Thus, for computing the

capital gains or losses comparison between book value and market value ought to be drawn. A

3

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

higher market value than book value yields capital losses while the other would lead to capital

losses. Suitable concessions would apply for reduction of capital gains tax liability.

3) Trading stock – Any gains or losses made on trading stock sale would not be levied CGT but

rather would be treated as assessable income under s. 6-5 ITAA 1997 or tax deductible loss

under s. 8-1 ITAA 1997.

Restrictive Covenant

On account of the contract that Amber has entered into with the buyer of her chocolate business,

he legal right of operating business of her choice at any time and geography becomes

constrained. This would have adverse implications for the future earnings potential over the

period of applicability of covenant. In accordance with the relevant discussion, it is apparent that

the relevant proceeds drawn would be capital and non –taxable. But it is possible that Amber

may have realised capital gains owing to which capital gains tax would apply.

Apartment

As per the information provided in the given case, the apartment has been inherited by Amber

after her uncle passed away in 2013 and hence it is an example of deceased estate. It is known

that her uncle resided in the apartment which commenced from the time of purchase and

continued until his death. Thus, this was the main residence for his uncle. After inheriting the

apartment, Amber also has resided till the time of sale. Therefore, it would be appropriate to

indicate that neither Amber nor her uncle has drawn any assessable income from the apartment

and have continued to use this as main residence. As a result, the sale of house would not result

in any CGT liability as main residence exemption would be provided. Also, the proceeds from

house sale would be capital and thereby immune from any taxation.

Conclusion\

It can be concluded from the above discussion that no tax would be levied on proceeds of the

apartment. Further, the proceeds obtained from restrictive covenant might lead to CGT liability

but the proceeds are non-taxable owing to their capital nature. In relation to shop, CGT and

equipment are capital assets whose proceeds are non-taxable but CGT liability would arise.

4

losses. Suitable concessions would apply for reduction of capital gains tax liability.

3) Trading stock – Any gains or losses made on trading stock sale would not be levied CGT but

rather would be treated as assessable income under s. 6-5 ITAA 1997 or tax deductible loss

under s. 8-1 ITAA 1997.

Restrictive Covenant

On account of the contract that Amber has entered into with the buyer of her chocolate business,

he legal right of operating business of her choice at any time and geography becomes

constrained. This would have adverse implications for the future earnings potential over the

period of applicability of covenant. In accordance with the relevant discussion, it is apparent that

the relevant proceeds drawn would be capital and non –taxable. But it is possible that Amber

may have realised capital gains owing to which capital gains tax would apply.

Apartment

As per the information provided in the given case, the apartment has been inherited by Amber

after her uncle passed away in 2013 and hence it is an example of deceased estate. It is known

that her uncle resided in the apartment which commenced from the time of purchase and

continued until his death. Thus, this was the main residence for his uncle. After inheriting the

apartment, Amber also has resided till the time of sale. Therefore, it would be appropriate to

indicate that neither Amber nor her uncle has drawn any assessable income from the apartment

and have continued to use this as main residence. As a result, the sale of house would not result

in any CGT liability as main residence exemption would be provided. Also, the proceeds from

house sale would be capital and thereby immune from any taxation.

Conclusion\

It can be concluded from the above discussion that no tax would be levied on proceeds of the

apartment. Further, the proceeds obtained from restrictive covenant might lead to CGT liability

but the proceeds are non-taxable owing to their capital nature. In relation to shop, CGT and

equipment are capital assets whose proceeds are non-taxable but CGT liability would arise.

4

However, the profits or losses on sale of stock would be revenue income or expenses and would

be suitably recognised.

Question 2

Issue

In the given case, various cash inflows and outflows are realised by employee (Jamie) and

employer (House R Us) and the objective is to highlight the tax implications of these for both

these parties with specific emphasis on the following.

1) The tax treatment of car benefit with regards to employee and employer.

2) The tax implication of extension of loan to employer for both Jamie and his employer.

3) The treatment of various receipts such as salary, commission, entertainment allowance,

subscription at the end of employee and employer.

4) The tax deduction available to Jamie with regards to interest on loan.

Law & Application

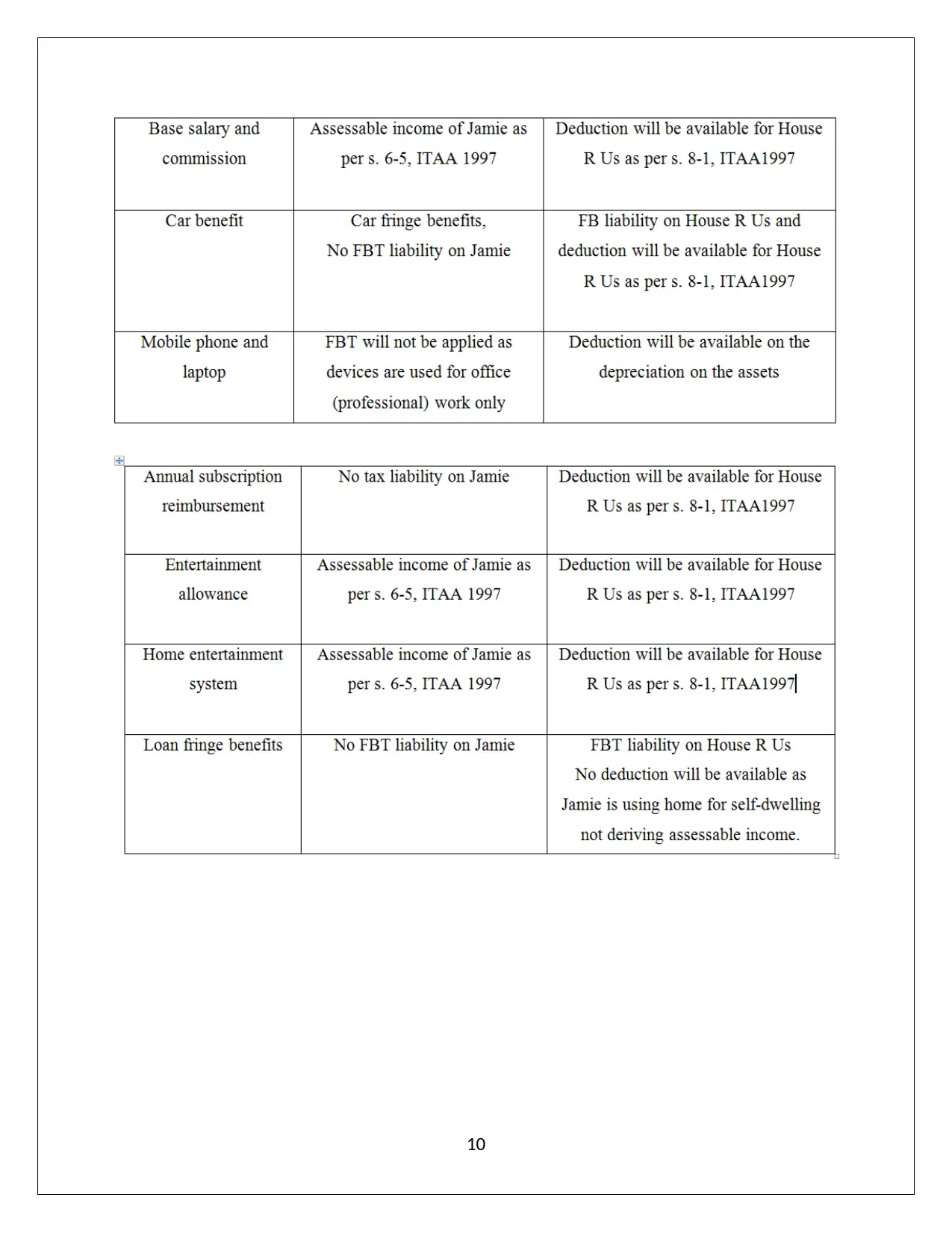

Salary and Commission

Any income which is derived from ordinary income is categorised as ordinary income and

contributes to assessable income as per s. 6-5 ITAA 1997. One of the key elements of ordinary

income is employment related income which includes salary and other related cash benefits.

Further s. 8-1 ITAA 1997 allows general deduction in regards to any outgoing or expense

provided that a direct and sufficiently close relationship with the assessable income production

can be established. Further, the expense should not be capital or else general deduction would

not apply as highlighted in ss. 8-1(2) ITAA 1997 (Nethercott, Richardson & Devos, 2016).

Employee (Jamie): Salary and 10% commission would both be ordinary income and therefore

taxable for the employee in accordance with s. 6 (5) ITAA 1997.

5

be suitably recognised.

Question 2

Issue

In the given case, various cash inflows and outflows are realised by employee (Jamie) and

employer (House R Us) and the objective is to highlight the tax implications of these for both

these parties with specific emphasis on the following.

1) The tax treatment of car benefit with regards to employee and employer.

2) The tax implication of extension of loan to employer for both Jamie and his employer.

3) The treatment of various receipts such as salary, commission, entertainment allowance,

subscription at the end of employee and employer.

4) The tax deduction available to Jamie with regards to interest on loan.

Law & Application

Salary and Commission

Any income which is derived from ordinary income is categorised as ordinary income and

contributes to assessable income as per s. 6-5 ITAA 1997. One of the key elements of ordinary

income is employment related income which includes salary and other related cash benefits.

Further s. 8-1 ITAA 1997 allows general deduction in regards to any outgoing or expense

provided that a direct and sufficiently close relationship with the assessable income production

can be established. Further, the expense should not be capital or else general deduction would

not apply as highlighted in ss. 8-1(2) ITAA 1997 (Nethercott, Richardson & Devos, 2016).

Employee (Jamie): Salary and 10% commission would both be ordinary income and therefore

taxable for the employee in accordance with s. 6 (5) ITAA 1997.

5

Employer (House R Us): The salary and related benefits to the employee is a crucial aspect

which directly assists the company in assessable income production. Besides, it is an expenditure

of revenue nature and hence employer would enjoy general tax deduction.

Car benefit

In accordance with Division 2, FBTAA 1986, car benefit is extended to the employee when an

employer owned car is given to the employee for use in personal work besides professional

work. The computation of related FBT liability is listed in s. 9 and s.10 FBTAA 1986. Further,

the employee does not have to pay FBT or any other tax. Complete FBT liability is on the

employer (Wilmot, 2016).

Employee (Jamie): The employer has provided a Toyota Kluger car to Jamie which he uses for

personal use on holidays and weekends. Hence, car fringe benefit has been extended but no

taxation implication for Jamie.

Employer (House R Us): It is apparent that the employer has extended car fringe benefit to the

employee Jamie. The relevant car fringe benefits are computed as per s. 9 FBTAA 1986 as is

indicated below.

Further, the above value is used and multiplied by gross up factor to compute the taxable value

of car fringe benefit on which FBT tax at the rate of 47% would be levied. It is imperative to

note that the car benefit is part of employee benefit which is integral to production of assessable

income, hence tax deduction can be availed by the employer as per s. 8-1 ITAA 1997.

Laptop & Mobile

6

which directly assists the company in assessable income production. Besides, it is an expenditure

of revenue nature and hence employer would enjoy general tax deduction.

Car benefit

In accordance with Division 2, FBTAA 1986, car benefit is extended to the employee when an

employer owned car is given to the employee for use in personal work besides professional

work. The computation of related FBT liability is listed in s. 9 and s.10 FBTAA 1986. Further,

the employee does not have to pay FBT or any other tax. Complete FBT liability is on the

employer (Wilmot, 2016).

Employee (Jamie): The employer has provided a Toyota Kluger car to Jamie which he uses for

personal use on holidays and weekends. Hence, car fringe benefit has been extended but no

taxation implication for Jamie.

Employer (House R Us): It is apparent that the employer has extended car fringe benefit to the

employee Jamie. The relevant car fringe benefits are computed as per s. 9 FBTAA 1986 as is

indicated below.

Further, the above value is used and multiplied by gross up factor to compute the taxable value

of car fringe benefit on which FBT tax at the rate of 47% would be levied. It is imperative to

note that the car benefit is part of employee benefit which is integral to production of assessable

income, hence tax deduction can be availed by the employer as per s. 8-1 ITAA 1997.

Laptop & Mobile

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The issuance of mobile electronic devices by employer does not amount to any FBT since the

same is done to assist in professional work and derivation of assessable income. Therefore, under

the provisions of FBTAA 1986, no FBT obligations would arise (Coleman, 2015).

Employee (Jamie): The employer has provided Jamie with a mobile phone and laptop device.

These are however for professional work and would be taken back if the job is terminated. Thus,

this does not extend any economic benefit to the employee and therefore no tax implications.

Employer (House R Us): As has already been highlighted, in this case, no FBT would be

applicable. Further, the nature of expense on the laptop and mobile would be capital in nature

and therefore non-deductible under s. 8-1 ITAA 1997. However, annual depreciation would be

charged on the assets based on their useful life. This decline in value is tax deductible and would

allow deduction for the employer.

Annual Professional Subscription

For assessable income to arise for the taxpayer, some economic benefit ought to be realised as

has been hinted in tax ruling TR 92/15. This is the case with allowance since amount received is

not linked with amount spent by employee. However, in case of reimbursement no economic

benefit derived since only the amount spent is returned back. Therefore, no economic loss or

economic profit for employee arises. However, deduction on part of employer may be available

under s.8-1 if the reimbursement or allowance is related to assessable income production

(Nethercott, Richardson & Devos, 2016).

Employee (Jamie): No tax implication for the employee arises since owing to reimbursement of

the subscription amount, Jamie is not better off nor worse off.

Employer (House R Us): The given expense has direct connection with assessable income

production and therefore general deduction for subscription fee of professional magazine is

permissible under the aegis of s. 8-1, ITAA 1997.

Entertainment Allowance

7

same is done to assist in professional work and derivation of assessable income. Therefore, under

the provisions of FBTAA 1986, no FBT obligations would arise (Coleman, 2015).

Employee (Jamie): The employer has provided Jamie with a mobile phone and laptop device.

These are however for professional work and would be taken back if the job is terminated. Thus,

this does not extend any economic benefit to the employee and therefore no tax implications.

Employer (House R Us): As has already been highlighted, in this case, no FBT would be

applicable. Further, the nature of expense on the laptop and mobile would be capital in nature

and therefore non-deductible under s. 8-1 ITAA 1997. However, annual depreciation would be

charged on the assets based on their useful life. This decline in value is tax deductible and would

allow deduction for the employer.

Annual Professional Subscription

For assessable income to arise for the taxpayer, some economic benefit ought to be realised as

has been hinted in tax ruling TR 92/15. This is the case with allowance since amount received is

not linked with amount spent by employee. However, in case of reimbursement no economic

benefit derived since only the amount spent is returned back. Therefore, no economic loss or

economic profit for employee arises. However, deduction on part of employer may be available

under s.8-1 if the reimbursement or allowance is related to assessable income production

(Nethercott, Richardson & Devos, 2016).

Employee (Jamie): No tax implication for the employee arises since owing to reimbursement of

the subscription amount, Jamie is not better off nor worse off.

Employer (House R Us): The given expense has direct connection with assessable income

production and therefore general deduction for subscription fee of professional magazine is

permissible under the aegis of s. 8-1, ITAA 1997.

Entertainment Allowance

7

For assessable income to arise for the taxpayer, some economic benefit ought to be realised as

has been hinted in tax ruling TR 92/15. This is the case with allowance since amount received is

not linked with amount spent by employee. However, in case of reimbursement no economic

benefit derived since only the amount spent is returned back (Sadiq et. al., 2015).

Employee (Jamie): Economic benefit is derived by employee since even in case of no expense

related to entertainment, he would receive the same as entitlements. Hence, this is not

reimbursement on basis of actual and therefore under s. 6-5, assessable income is derived by

taxpayer.

Employer (House R Us): This is a revenue expense related to employee compensation which has

direct nexus with assessable income production and hence s. 8-1 ITAA 1997 allows for tax

deduction in this regards.

Home Entertainment System

A crucial portion of assessable income is derived from statutory income which essentially deals

with non-cash benefits that may be provided by the employer. The employer can also derived s.

8-1 deduction if the underlying expense is not capital and is linked to the production of

assessable income (Woellner, 2015).

Employee (Jamie): The employee has been provided the home entertainment system as a prize

for the performance on job where he has been the highest sales generator for the business over

the past six months. Hence, the underlying value would be assessable income since this amount

to employment related non-cash benefit which would be taxable.

Employer (House R Us): Considering that these gifts tend to provide encouragement to

employees and part of normal business so as to maximise sales, hence s. 8-1 ITAA 1997

deduction would be available for the employer on the home entertainment system extended to

Jamie.

Loan to employee

As per division 4, FBTAA 1986, loan fringe benefits are provided to the employee when

financial assistance is provided by the employer and the interest rate charged tends to be lower

8

has been hinted in tax ruling TR 92/15. This is the case with allowance since amount received is

not linked with amount spent by employee. However, in case of reimbursement no economic

benefit derived since only the amount spent is returned back (Sadiq et. al., 2015).

Employee (Jamie): Economic benefit is derived by employee since even in case of no expense

related to entertainment, he would receive the same as entitlements. Hence, this is not

reimbursement on basis of actual and therefore under s. 6-5, assessable income is derived by

taxpayer.

Employer (House R Us): This is a revenue expense related to employee compensation which has

direct nexus with assessable income production and hence s. 8-1 ITAA 1997 allows for tax

deduction in this regards.

Home Entertainment System

A crucial portion of assessable income is derived from statutory income which essentially deals

with non-cash benefits that may be provided by the employer. The employer can also derived s.

8-1 deduction if the underlying expense is not capital and is linked to the production of

assessable income (Woellner, 2015).

Employee (Jamie): The employee has been provided the home entertainment system as a prize

for the performance on job where he has been the highest sales generator for the business over

the past six months. Hence, the underlying value would be assessable income since this amount

to employment related non-cash benefit which would be taxable.

Employer (House R Us): Considering that these gifts tend to provide encouragement to

employees and part of normal business so as to maximise sales, hence s. 8-1 ITAA 1997

deduction would be available for the employer on the home entertainment system extended to

Jamie.

Loan to employee

As per division 4, FBTAA 1986, loan fringe benefits are provided to the employee when

financial assistance is provided by the employer and the interest rate charged tends to be lower

8

than the benchmark interest rate that RBA releases on an yearly basis. The benefits are passed on

to the employee in the form of interest savings owing to rate being lower than RBA

recommended value. In regards to possible deduction for the employer and employee, it is

permissible if the employee uses the loan for producing assessable income. However, the FBT

liability arising on account of loan fringe benefit would be applicable only on the employer

(Hodgson, Mortimer & Butler, 2016).

Employee (Jamie): The employee has been provided financial assistance to the tune of $ 100,000

with an applicable interest rate of 4% p.a. Loan fringe benefits would be applicable as the RBA

benchmark rate for 2017.2018 stands at 5.25%. Jamie would save on interest but no FBT payable

by Jamie. He is using the loan proceeds for main residence and hence no deduction on interest

payment since it is highly likely that it would be used for his residence and not for rental income.

Employer (House R Us): The interest rate levied by the employer is lesser than the rate given by

RBA for the tax year under consideration and hence loan fringe benefit has been extended. The

resultant FBT liability on employer would be dependent on the interest savings reaped by

employee Jamie during the tax year along with the relevant FBT rate applicable. Further, no

deduction for employer is available as the loan would not be utilised in assessable income

production.

Conclusion

Based on the discussion of the various payments made and derived, the following summary may

be drawn.

9

to the employee in the form of interest savings owing to rate being lower than RBA

recommended value. In regards to possible deduction for the employer and employee, it is

permissible if the employee uses the loan for producing assessable income. However, the FBT

liability arising on account of loan fringe benefit would be applicable only on the employer

(Hodgson, Mortimer & Butler, 2016).

Employee (Jamie): The employee has been provided financial assistance to the tune of $ 100,000

with an applicable interest rate of 4% p.a. Loan fringe benefits would be applicable as the RBA

benchmark rate for 2017.2018 stands at 5.25%. Jamie would save on interest but no FBT payable

by Jamie. He is using the loan proceeds for main residence and hence no deduction on interest

payment since it is highly likely that it would be used for his residence and not for rental income.

Employer (House R Us): The interest rate levied by the employer is lesser than the rate given by

RBA for the tax year under consideration and hence loan fringe benefit has been extended. The

resultant FBT liability on employer would be dependent on the interest savings reaped by

employee Jamie during the tax year along with the relevant FBT rate applicable. Further, no

deduction for employer is available as the loan would not be utilised in assessable income

production.

Conclusion

Based on the discussion of the various payments made and derived, the following summary may

be drawn.

9

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

References

Barkoczy, S. (2017) Foundation of Taxation Law 2017 (9th ed.). North Ryde: CCH Publications.

Coleman, C. (2015) Australian Tax Analysis (4th ed.). Sydney: Thomson Reuters (Professional)

Australia.

Hodgson, H., Mortimer, C. & Butler, J. (2016) Tax Questions and Answers 2016 (6th ed.).

Sydney: Thomson Reuters.

Krever, R. (2017) Australian Taxation Law Cases 2017 (2nd ed.). Brisbane: THOMSON

LAWBOOK Company.

Nethercott, L., Richardson, G., & Devos, K. (2016) Australian Taxation Study Manual 2016. (8th

ed.). Sydney: Oxford University Press.

Reuters, T. (2017) Australian Tax Legislation 2017 (4th ed.). Sydney. THOMSON REUTERS.

Sadiq, K., Coleman, C., Hanegbi, R., Jogarajan, S., Krever, R., Obst, W., & Ting, A.

(2015) Principles of Taxation Law 2015 (7th ed.). Pymont: Thomson Reuters.

Wilmot, C. (2016) FBT Compliance guide (6th ed.). North Ryde: CCH Australia Limited.

Woellner, R. (2015) Australian taxation law 2015 (8th ed.). North Ryde: CCH Australia.

11

Barkoczy, S. (2017) Foundation of Taxation Law 2017 (9th ed.). North Ryde: CCH Publications.

Coleman, C. (2015) Australian Tax Analysis (4th ed.). Sydney: Thomson Reuters (Professional)

Australia.

Hodgson, H., Mortimer, C. & Butler, J. (2016) Tax Questions and Answers 2016 (6th ed.).

Sydney: Thomson Reuters.

Krever, R. (2017) Australian Taxation Law Cases 2017 (2nd ed.). Brisbane: THOMSON

LAWBOOK Company.

Nethercott, L., Richardson, G., & Devos, K. (2016) Australian Taxation Study Manual 2016. (8th

ed.). Sydney: Oxford University Press.

Reuters, T. (2017) Australian Tax Legislation 2017 (4th ed.). Sydney. THOMSON REUTERS.

Sadiq, K., Coleman, C., Hanegbi, R., Jogarajan, S., Krever, R., Obst, W., & Ting, A.

(2015) Principles of Taxation Law 2015 (7th ed.). Pymont: Thomson Reuters.

Wilmot, C. (2016) FBT Compliance guide (6th ed.). North Ryde: CCH Australia Limited.

Woellner, R. (2015) Australian taxation law 2015 (8th ed.). North Ryde: CCH Australia.

11

1 out of 12

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.