Comprehensive Tax Report: HI6028 Taxation Theory, Practice & Law T2

VerifiedAdded on 2023/06/04

|15

|3031

|253

Report

AI Summary

This assignment provides a comprehensive analysis of taxation theory, practice, and law, focusing on capital gains tax (CGT) and fringe benefits tax (FBT). It addresses two key questions: the first examines the tax implications of asset sales by a client, determining whether proceeds are revenue or capital in nature, identifying pre-CGT assets, and calculating taxable capital gains on assets like land, antiques, and shares. The second question delves into fringe benefits provided to an employee, specifically car benefits, loan benefits, and internal expense benefits, outlining the relevant statutory sections, computation methods, and potential FBT liabilities. The report concludes by applying relevant tax laws and regulations to the provided scenarios, offering practical advice and solutions based on the findings. Desklib provides access to similar solved assignments and study tools for students.

Taxation Theory, Practice & Law

Student Name

[Pick the date]

Student Name

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

Issue

The client has enacted sale of certain items and in wake of the same intends to obtain tax related

advice so as to ascertain the likely tax liability that would arise on account of the transactions

undertaken.

Law

Receipts Classification

In the event of any cash that may be derived by the taxpayer, the first concern that must arise is

in relation to the proceeds classification where essentially there are two choices i.e. revenue and

capital. This determination holds significance in the backdrop of revenue receipts making

contribution to taxpayer’s ordinary income in contrast with capital receipts that are completely

exempt from any taxation related liability (Barkoczy, 2017). However, even capital receipts are

taxed to an extent but the same is on account of capital gains being booked. With regards to

segregating the two, the key factor is the underlying intention with which the transaction is

enacted and the frequency of these transactions. A case in point is the transaction involving sale

of a flat by a builder which would bring in receipts of revenue nature since it is part of business.

However, for an individual, selling of flat that his parents lived in would amount to capital

proceeds owing to these transactions not being part of business. Hence, the critical aspect is to

decipher the nature of the transaction underlying the sale of asset or the trading stock depending

on the circumstance (Nethercott, Richardson and Devos, 2016).

CGT Exemption

In case of capital transactions, it is possible for CGT implications to result. In order to avoid the

same, certain statutory rebates are available. One of these is indicated in s. 149-10 which defines

a type of asset which is pre-CGT asset. In layman terms, this would refer to an asset which the

taxpayer acquires in the period when the underlying gains on asset sale were not taxable. Taking

iuto cognisance that CGT regime began as on September 20, 1985, therefore the assets for which

the buying was done before the above cut-off date would be categorised as pre-CGT asset. This

1

Issue

The client has enacted sale of certain items and in wake of the same intends to obtain tax related

advice so as to ascertain the likely tax liability that would arise on account of the transactions

undertaken.

Law

Receipts Classification

In the event of any cash that may be derived by the taxpayer, the first concern that must arise is

in relation to the proceeds classification where essentially there are two choices i.e. revenue and

capital. This determination holds significance in the backdrop of revenue receipts making

contribution to taxpayer’s ordinary income in contrast with capital receipts that are completely

exempt from any taxation related liability (Barkoczy, 2017). However, even capital receipts are

taxed to an extent but the same is on account of capital gains being booked. With regards to

segregating the two, the key factor is the underlying intention with which the transaction is

enacted and the frequency of these transactions. A case in point is the transaction involving sale

of a flat by a builder which would bring in receipts of revenue nature since it is part of business.

However, for an individual, selling of flat that his parents lived in would amount to capital

proceeds owing to these transactions not being part of business. Hence, the critical aspect is to

decipher the nature of the transaction underlying the sale of asset or the trading stock depending

on the circumstance (Nethercott, Richardson and Devos, 2016).

CGT Exemption

In case of capital transactions, it is possible for CGT implications to result. In order to avoid the

same, certain statutory rebates are available. One of these is indicated in s. 149-10 which defines

a type of asset which is pre-CGT asset. In layman terms, this would refer to an asset which the

taxpayer acquires in the period when the underlying gains on asset sale were not taxable. Taking

iuto cognisance that CGT regime began as on September 20, 1985, therefore the assets for which

the buying was done before the above cut-off date would be categorised as pre-CGT asset. This

1

classification has significance considering the fact that no CGT can be imposed on any pre-CGT

asset (Wilmot, 2014).

Additionally, there are certain other rebates, which are available for specific assets. In this

context, for an asset termed as collectable as per s. 118-10 would be levied CGT only if the price

paid at the time of purchase was higher than $ 500. However, in the context of personal use

assets as per s. 108-20(1), levying of CGT is permissible only if the price paid at the time of

purchase was higher than $ 10,000. In the event of the above conditions net met in regards to

two type of assets indicated above, no CGT liability would arise for the asset (Woellner, 2017).

Capital Gains Derivation

CGT would be applied only on the capital gains that are derived on the asset sale which is done

through the following process.

There is a CGT event which begins the whole process which first involves identification of the

appropriate event from the list of such events as detailed under s. 104-5 ITAA 1997. In this

scenario, the relevant CGT event is chosen as A1 which deals with asset disposal of various

kinds. The proper event identification has high relevance as any mistake in this regards would

result in use of wrong methodology for capital gains derivation eventually leading to wrong

estimation of tax burden (Gilders, et. al., 2015).

A critical input parameter which aids in this process is termed as cost base. The various

components of this are taken as per s. 110-25 and consist of costs besides those incurred for asset

purchase (Deutsch, et.al., 2015). This is apparent from consideration of the various components

indicated as follows.

2

asset (Wilmot, 2014).

Additionally, there are certain other rebates, which are available for specific assets. In this

context, for an asset termed as collectable as per s. 118-10 would be levied CGT only if the price

paid at the time of purchase was higher than $ 500. However, in the context of personal use

assets as per s. 108-20(1), levying of CGT is permissible only if the price paid at the time of

purchase was higher than $ 10,000. In the event of the above conditions net met in regards to

two type of assets indicated above, no CGT liability would arise for the asset (Woellner, 2017).

Capital Gains Derivation

CGT would be applied only on the capital gains that are derived on the asset sale which is done

through the following process.

There is a CGT event which begins the whole process which first involves identification of the

appropriate event from the list of such events as detailed under s. 104-5 ITAA 1997. In this

scenario, the relevant CGT event is chosen as A1 which deals with asset disposal of various

kinds. The proper event identification has high relevance as any mistake in this regards would

result in use of wrong methodology for capital gains derivation eventually leading to wrong

estimation of tax burden (Gilders, et. al., 2015).

A critical input parameter which aids in this process is termed as cost base. The various

components of this are taken as per s. 110-25 and consist of costs besides those incurred for asset

purchase (Deutsch, et.al., 2015). This is apparent from consideration of the various components

indicated as follows.

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

For every asset, it is not essential that all the components outlined above would exist and hence

the relevant elements are considered for cost base computation.

Taking the asset cost base in conjunction with proceeds obtained from asset sale, the underlying

gains or losses can be derived as applicable for a given asset. Before moving ahead, any capital

losses that may exist need adjustment against the existing gains. These losses are not restricted to

the current year and may also be obtained on account of the previous year transactions as the

capital losses are allowed to be rolled over till settlement with an equivalent amount of capital

gain (Coleman, 2016).

The adjusted gains can further be trimmed through the application of two approaches that are

provided namely indexation and discount. The former approach was inserted in the statute so as

not to impose tax on the nominal gains and thereby provides reduction through the adjustment of

cost base on account of inflation. Usually this adjustment is not very significant and also this

method is deployed only for assets bought prior to September 1999. As a result, the discount

approach is widely used (Wilmot, 2014). It is explained in s. 115-25 ITAA 1997 and prescribed a

discount of 50% assuming the underlying gains are long term and not short term. The necessary

condition for deriving the long term capital gains is that the asset under question must have been

held by the investor for atleast an year (Woellner, 2017).

Timing in CGT

In asset liquidation since the quantum of sales proceeds can be potentially large, hence often

there are two events which are separated in time. One event is the execution of contract between

the buyer and seller in relation to the underlying asset sale. The other event is the receipt of sales

proceeds from the asset (Nethercott, Richardson and Devos, 2016). Owing to this difference in

time frame between the above mentioned time frames, it may so happen that these two events lie

in different tax period. This leads to issue at the end of the taxpayer to decide so to in which

period must the capital gains ought to be taxed. The answer to this is provided by TR 94/29

which clarifies that the tax results from the transactions ought to be taxed in the year when the

sale contract execution takes place (Barkoczy, 2017).

Application

3

the relevant elements are considered for cost base computation.

Taking the asset cost base in conjunction with proceeds obtained from asset sale, the underlying

gains or losses can be derived as applicable for a given asset. Before moving ahead, any capital

losses that may exist need adjustment against the existing gains. These losses are not restricted to

the current year and may also be obtained on account of the previous year transactions as the

capital losses are allowed to be rolled over till settlement with an equivalent amount of capital

gain (Coleman, 2016).

The adjusted gains can further be trimmed through the application of two approaches that are

provided namely indexation and discount. The former approach was inserted in the statute so as

not to impose tax on the nominal gains and thereby provides reduction through the adjustment of

cost base on account of inflation. Usually this adjustment is not very significant and also this

method is deployed only for assets bought prior to September 1999. As a result, the discount

approach is widely used (Wilmot, 2014). It is explained in s. 115-25 ITAA 1997 and prescribed a

discount of 50% assuming the underlying gains are long term and not short term. The necessary

condition for deriving the long term capital gains is that the asset under question must have been

held by the investor for atleast an year (Woellner, 2017).

Timing in CGT

In asset liquidation since the quantum of sales proceeds can be potentially large, hence often

there are two events which are separated in time. One event is the execution of contract between

the buyer and seller in relation to the underlying asset sale. The other event is the receipt of sales

proceeds from the asset (Nethercott, Richardson and Devos, 2016). Owing to this difference in

time frame between the above mentioned time frames, it may so happen that these two events lie

in different tax period. This leads to issue at the end of the taxpayer to decide so to in which

period must the capital gains ought to be taxed. The answer to this is provided by TR 94/29

which clarifies that the tax results from the transactions ought to be taxed in the year when the

sale contract execution takes place (Barkoczy, 2017).

Application

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Receipts Classification

The sale of asset by the client does not form part of any business as has been stated in the

information provided. This also gains further support from the fact that the client is an investor

besides being a collector. Hence, it is unlikely that the client is an asset trader or in such

business. The logical conclusion thereby derived is that the proceeds from asset sale would be

capital in nature. These proceeds would not be taxed since taxation is limited only to revenue

receipts. However, for capital receipts, there are potential capital gains also possible which may

not be exempt from the application of CGT.

CGT Exemption

The first step is to outline any pre-CGT assets as even though capital gains may be derived on

such assets, but these would not be considered taxable and thereby the computation of capital

gains on such assets may be avoided. The buying date for the given assets has been provided in

the question and by analysing those, conclusion may be drawn with regards to painting being the

sole asset to be placed under this category and hence exempted from CGT application under 1.

149(10).

A collectable asset present in the list of assets disposed by the taxpayer is antique bed which

would have CGT implications as the price at which it has been bought tends to be higher than the

minimum value required for application of capital gains tax. A personal use asset of significance

here is violin. The classification of this asset as personal use asset is derived from the behaviour

of client whereby the violin instead of being looked at as capital asset is used for entertainment

with high degree of regularity. Also, the purchase cost of this violin amounts to $ 5,500 which

falls short of the minimum requirement of $ 10000 and hence it can be thereby concluded that

violin sale would not produce any CGT consequence for the client.

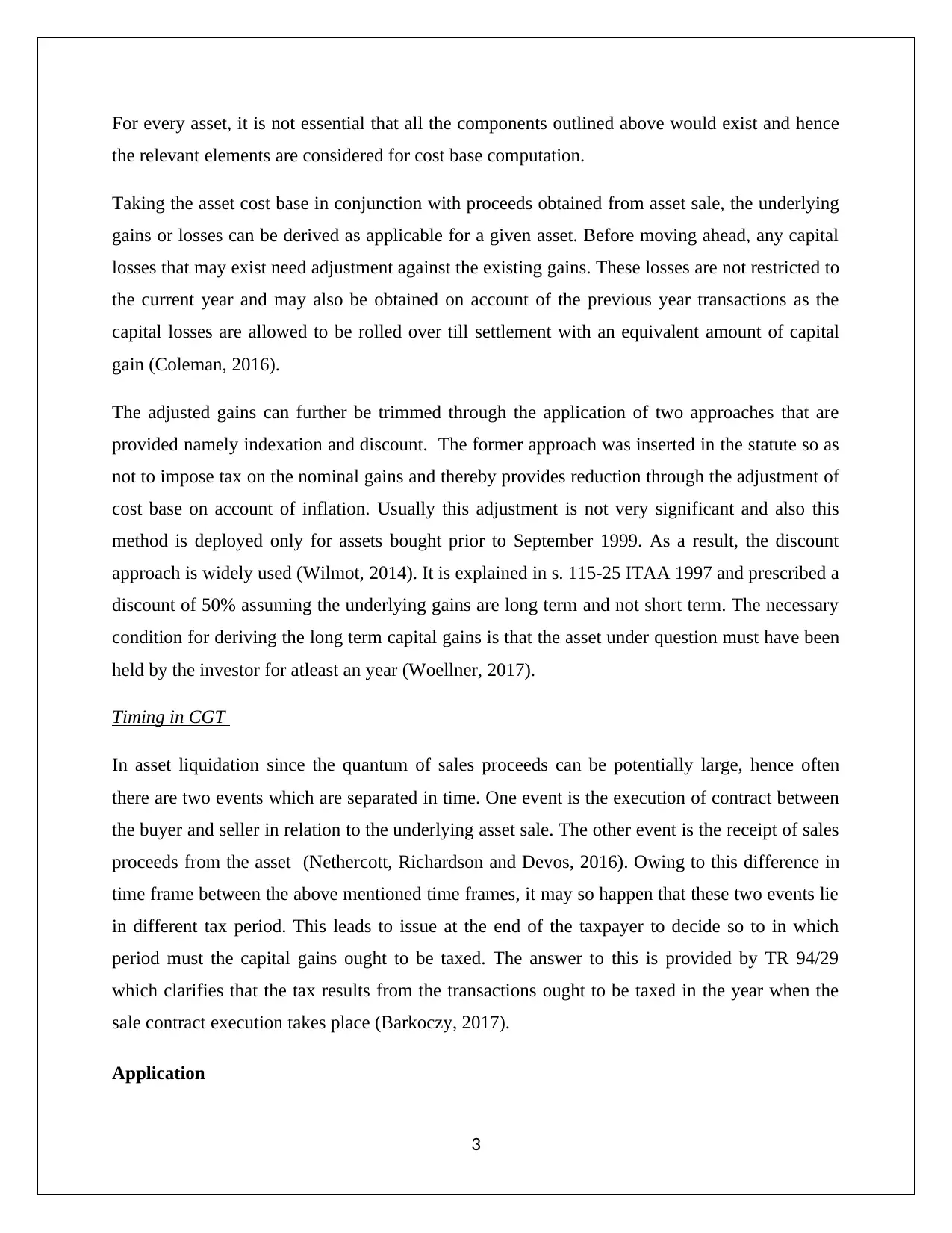

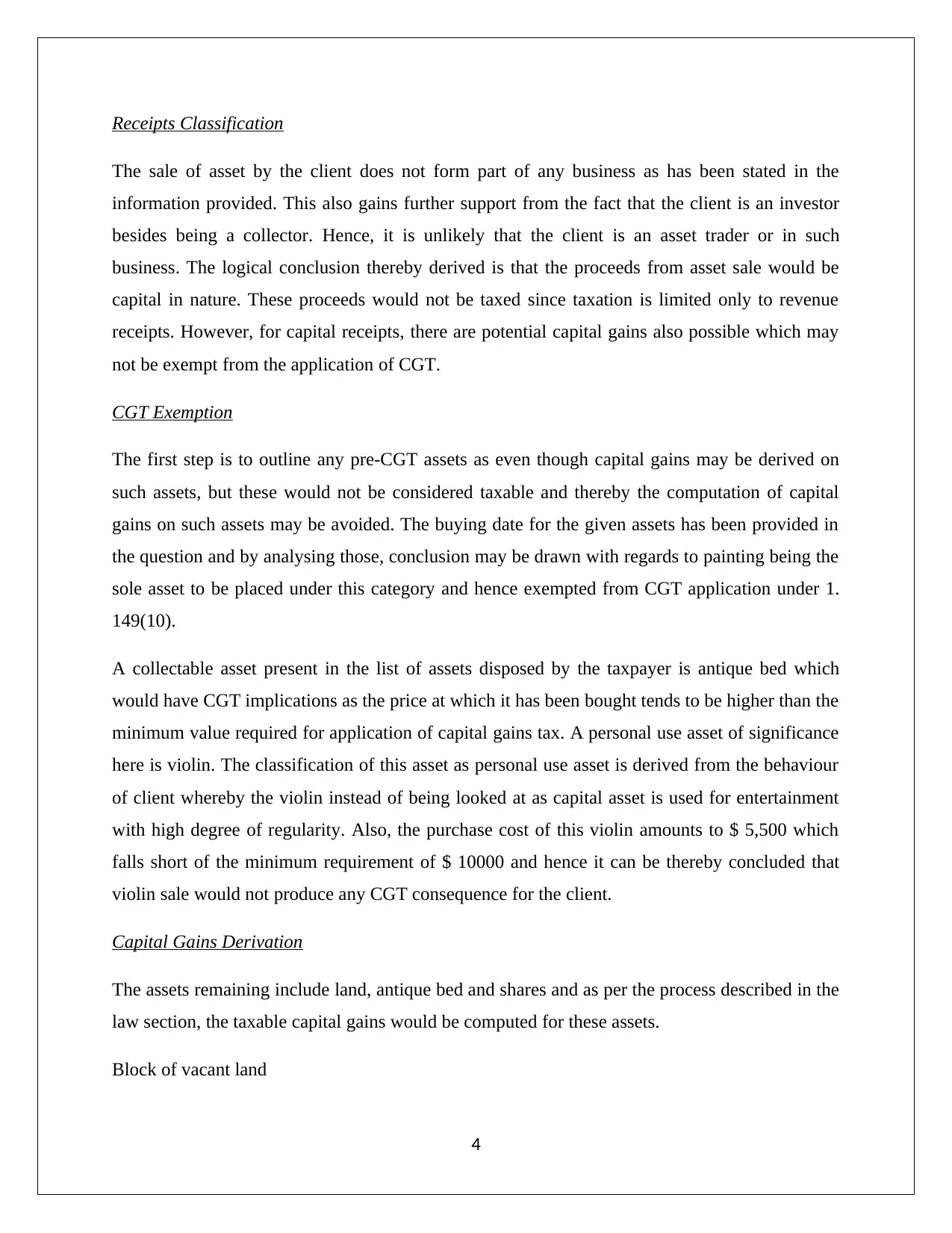

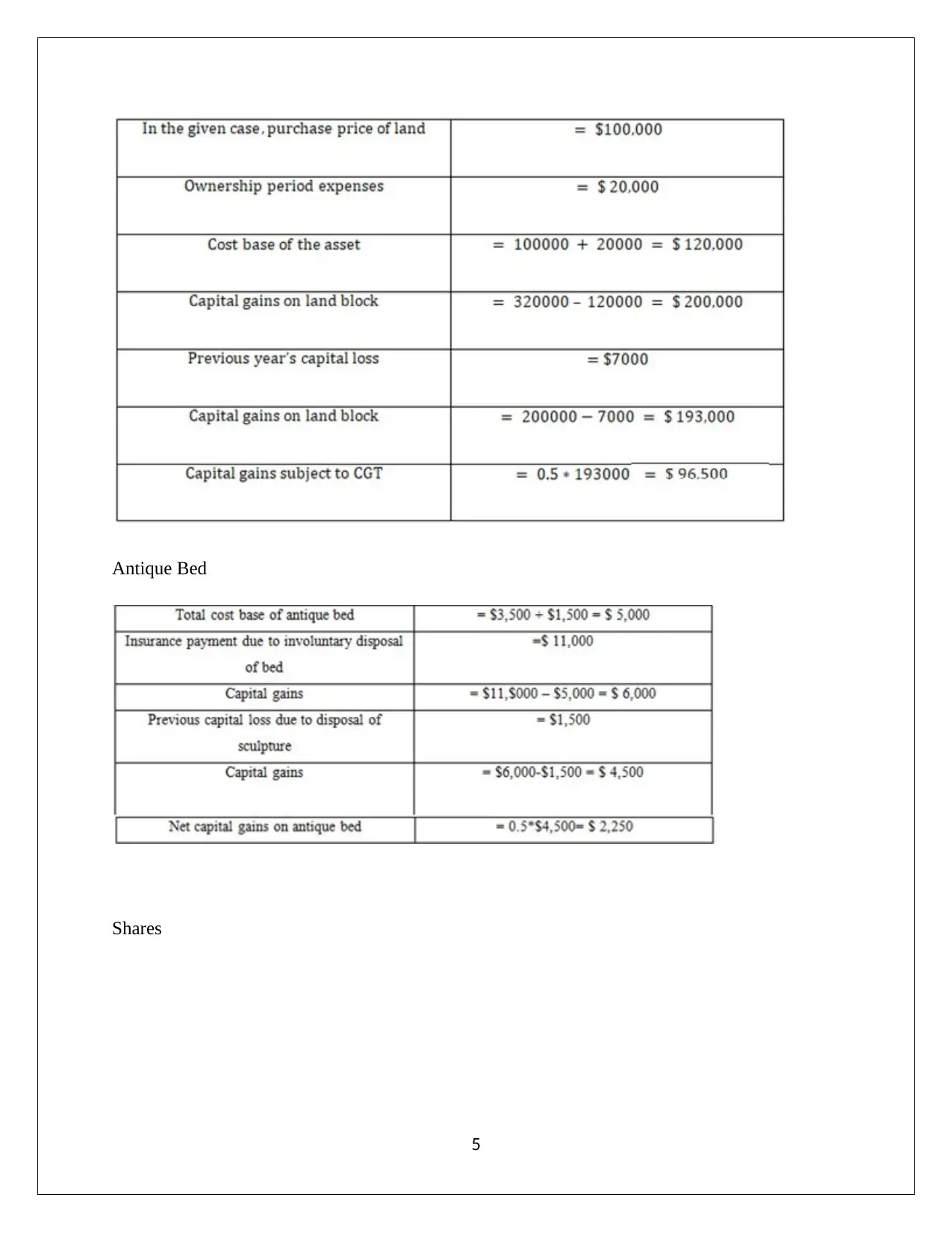

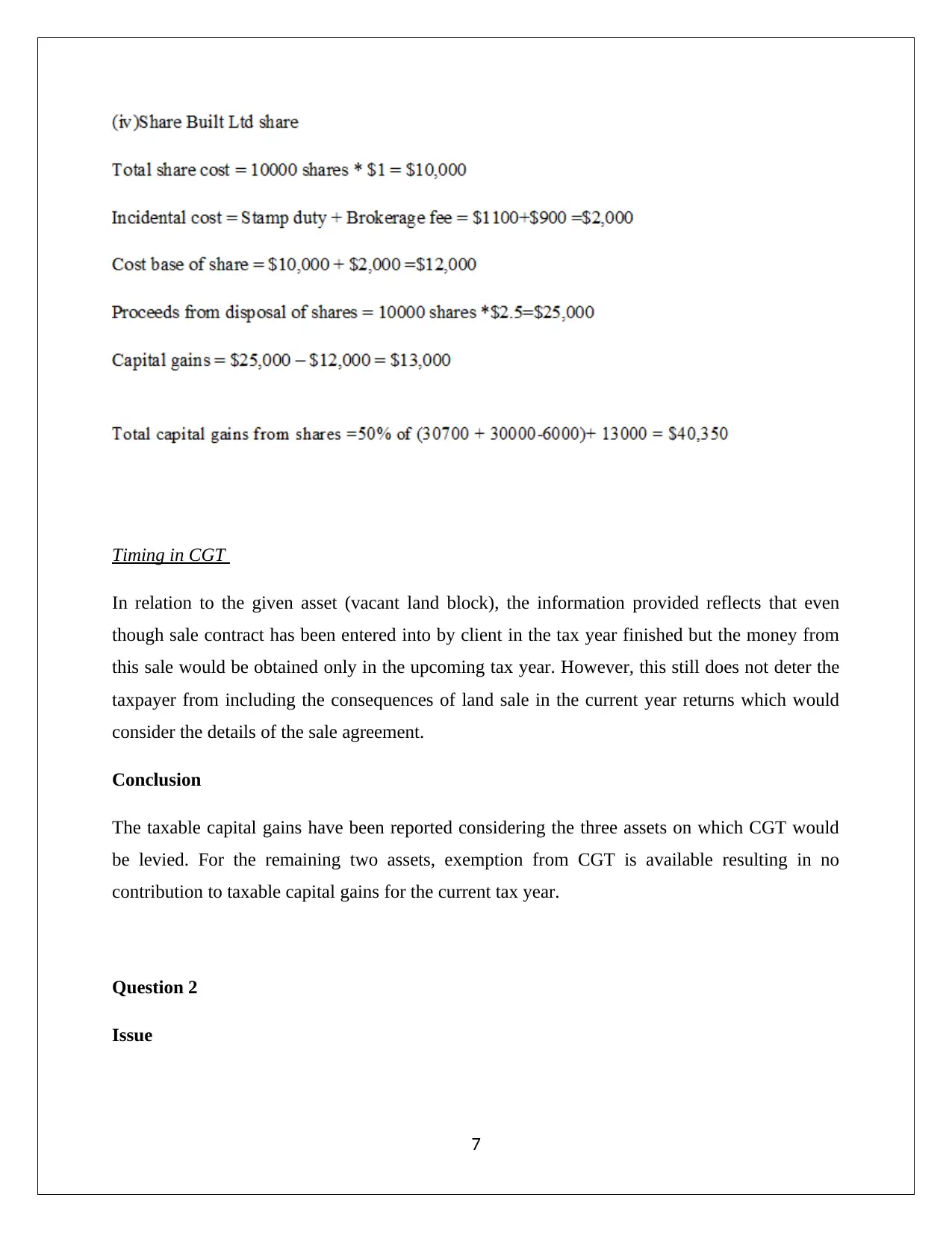

Capital Gains Derivation

The assets remaining include land, antique bed and shares and as per the process described in the

law section, the taxable capital gains would be computed for these assets.

Block of vacant land

4

The sale of asset by the client does not form part of any business as has been stated in the

information provided. This also gains further support from the fact that the client is an investor

besides being a collector. Hence, it is unlikely that the client is an asset trader or in such

business. The logical conclusion thereby derived is that the proceeds from asset sale would be

capital in nature. These proceeds would not be taxed since taxation is limited only to revenue

receipts. However, for capital receipts, there are potential capital gains also possible which may

not be exempt from the application of CGT.

CGT Exemption

The first step is to outline any pre-CGT assets as even though capital gains may be derived on

such assets, but these would not be considered taxable and thereby the computation of capital

gains on such assets may be avoided. The buying date for the given assets has been provided in

the question and by analysing those, conclusion may be drawn with regards to painting being the

sole asset to be placed under this category and hence exempted from CGT application under 1.

149(10).

A collectable asset present in the list of assets disposed by the taxpayer is antique bed which

would have CGT implications as the price at which it has been bought tends to be higher than the

minimum value required for application of capital gains tax. A personal use asset of significance

here is violin. The classification of this asset as personal use asset is derived from the behaviour

of client whereby the violin instead of being looked at as capital asset is used for entertainment

with high degree of regularity. Also, the purchase cost of this violin amounts to $ 5,500 which

falls short of the minimum requirement of $ 10000 and hence it can be thereby concluded that

violin sale would not produce any CGT consequence for the client.

Capital Gains Derivation

The assets remaining include land, antique bed and shares and as per the process described in the

law section, the taxable capital gains would be computed for these assets.

Block of vacant land

4

Antique Bed

Shares

5

Shares

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Timing in CGT

In relation to the given asset (vacant land block), the information provided reflects that even

though sale contract has been entered into by client in the tax year finished but the money from

this sale would be obtained only in the upcoming tax year. However, this still does not deter the

taxpayer from including the consequences of land sale in the current year returns which would

consider the details of the sale agreement.

Conclusion

The taxable capital gains have been reported considering the three assets on which CGT would

be levied. For the remaining two assets, exemption from CGT is available resulting in no

contribution to taxable capital gains for the current tax year.

Question 2

Issue

7

In relation to the given asset (vacant land block), the information provided reflects that even

though sale contract has been entered into by client in the tax year finished but the money from

this sale would be obtained only in the upcoming tax year. However, this still does not deter the

taxpayer from including the consequences of land sale in the current year returns which would

consider the details of the sale agreement.

Conclusion

The taxable capital gains have been reported considering the three assets on which CGT would

be levied. For the remaining two assets, exemption from CGT is available resulting in no

contribution to taxable capital gains for the current tax year.

Question 2

Issue

7

The given instance involves two main parties i.e. beneficiary which is the employee (Jasmine)

and provider which is employer (Rapid Heat). The central aim in the following discussion is to

consider the key facts related to fringe benefits that have been provided to Jasmine and work out

the potential liability of these benefits particularly the FBT tax burden.

Law

The various benefits that are potentially provided and the resultant tax implications need to be

outlined considered the main statute in the form of “Fringe Benefit Tax Assessment Act, 1986”.

Car Fringe Benefit

The relevant statutory section dealing with the stated benefit is Section 7 (Coleman, 2016).

Required Condition – The pivotal requirement is the employee being able to use the car that is

employer owned for his/her personal needs and uses. This only would result in any economic

benefit to the employee as professional work related use of car is the entitlement of the

employee.

Computations:

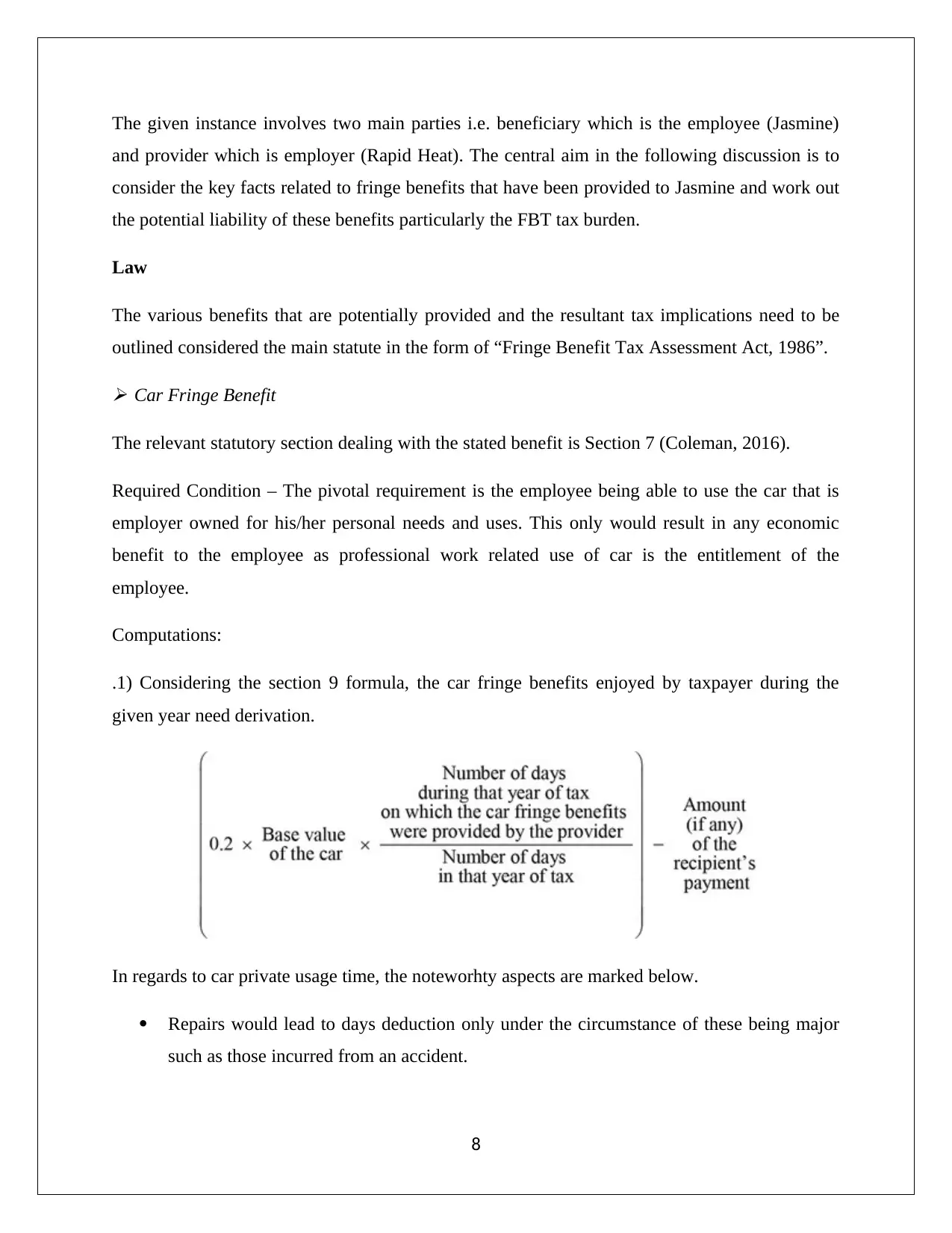

.1) Considering the section 9 formula, the car fringe benefits enjoyed by taxpayer during the

given year need derivation.

In regards to car private usage time, the noteworhty aspects are marked below.

Repairs would lead to days deduction only under the circumstance of these being major

such as those incurred from an accident.

8

and provider which is employer (Rapid Heat). The central aim in the following discussion is to

consider the key facts related to fringe benefits that have been provided to Jasmine and work out

the potential liability of these benefits particularly the FBT tax burden.

Law

The various benefits that are potentially provided and the resultant tax implications need to be

outlined considered the main statute in the form of “Fringe Benefit Tax Assessment Act, 1986”.

Car Fringe Benefit

The relevant statutory section dealing with the stated benefit is Section 7 (Coleman, 2016).

Required Condition – The pivotal requirement is the employee being able to use the car that is

employer owned for his/her personal needs and uses. This only would result in any economic

benefit to the employee as professional work related use of car is the entitlement of the

employee.

Computations:

.1) Considering the section 9 formula, the car fringe benefits enjoyed by taxpayer during the

given year need derivation.

In regards to car private usage time, the noteworhty aspects are marked below.

Repairs would lead to days deduction only under the circumstance of these being major

such as those incurred from an accident.

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Further, failure on the part of the employee to use car does not lead to the conclusion that

the car was not available.

2) The gross up factor acts as a key input leading to computation of the taxable value of the

concerned fringe benefit (Krever, 2017).

3) On the taxable value concerned with the given fringe benefit, there is application of the FBT

in accordance with the corresponding rate for the assessment year.

Loan Fringe Benefit

The relevant statutory section dealing with the stated benefit is Section 16.

Required Condition – Discount offered by the employer in the interest rate charged for the loan

provided to the employee. The discount needs to be present relative to the benchmark rate that

RBA has announced for the relevant assessment year (Wilmot, 2014).

Computations:

1) The computation begins with determining the extent of savings considering the time for which

loan is assumed, amount of loan and the discount relative to the RBA interest rate (Sadiq, et.al.,

2015).

2) The gross up factor acts as a key input leading to computation of the taxable value of the

concerned fringe benefit.

3) On the taxable value concerned with the given fringe benefit, there is application of the FBT

in accordance with the corresponding rate for the assessment year.

There is provision for CGT related deduction which employer may be entitled to provided the

proceeds of loan lead to providing income that is assessable for the employee but not any

associates (Hodgson, Mortimer and Butler, 2016).

Internal expense fringe benefit

The relevant statutory section dealing with the stated benefit is Section 20.

9

the car was not available.

2) The gross up factor acts as a key input leading to computation of the taxable value of the

concerned fringe benefit (Krever, 2017).

3) On the taxable value concerned with the given fringe benefit, there is application of the FBT

in accordance with the corresponding rate for the assessment year.

Loan Fringe Benefit

The relevant statutory section dealing with the stated benefit is Section 16.

Required Condition – Discount offered by the employer in the interest rate charged for the loan

provided to the employee. The discount needs to be present relative to the benchmark rate that

RBA has announced for the relevant assessment year (Wilmot, 2014).

Computations:

1) The computation begins with determining the extent of savings considering the time for which

loan is assumed, amount of loan and the discount relative to the RBA interest rate (Sadiq, et.al.,

2015).

2) The gross up factor acts as a key input leading to computation of the taxable value of the

concerned fringe benefit.

3) On the taxable value concerned with the given fringe benefit, there is application of the FBT

in accordance with the corresponding rate for the assessment year.

There is provision for CGT related deduction which employer may be entitled to provided the

proceeds of loan lead to providing income that is assessable for the employee but not any

associates (Hodgson, Mortimer and Butler, 2016).

Internal expense fringe benefit

The relevant statutory section dealing with the stated benefit is Section 20.

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Required Condition – Some part of an otherwise personal expense on part of employee must be

paid by the employer.

Computations:

1) The fringe benefit amount is linked to the savings that employee derives owing to employer

paying.

2) The gross up factor acts as a key input leading to computation of the taxable value of the

concerned fringe benefit.

3) On the taxable value concerned with the given fringe benefit, there is application of the FBT

in accordance with the corresponding rate for the assessment year (Nethercott, Richardson and

Devos, 2016).

Application

(a) The consequences in regards to tax burden in relation to FBT are derived in accordance with

the law in the previous section.

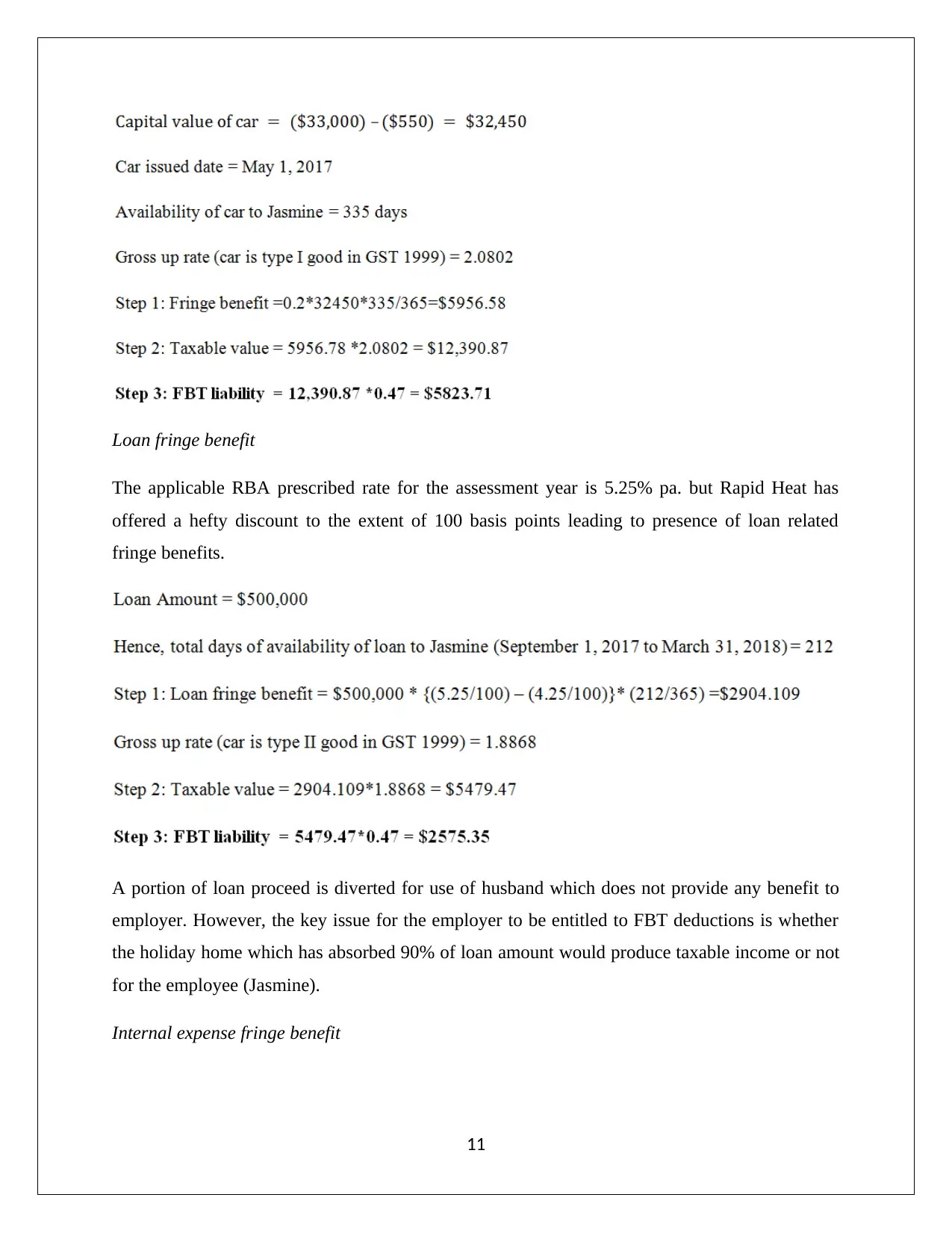

Car fringe benefit

Personal use is explicitly been allowed for jasmine at the time of car being extended to her.

Hence, the key requirement of this benefit has been complied with. The garage stay has arisen

owing to repairs of minor nature which do not warrant any deduction. Further, while the car was

parking at the airport for a 10 day period but the same could have been used and there was no

hurdle in using the car for personal use.

10

paid by the employer.

Computations:

1) The fringe benefit amount is linked to the savings that employee derives owing to employer

paying.

2) The gross up factor acts as a key input leading to computation of the taxable value of the

concerned fringe benefit.

3) On the taxable value concerned with the given fringe benefit, there is application of the FBT

in accordance with the corresponding rate for the assessment year (Nethercott, Richardson and

Devos, 2016).

Application

(a) The consequences in regards to tax burden in relation to FBT are derived in accordance with

the law in the previous section.

Car fringe benefit

Personal use is explicitly been allowed for jasmine at the time of car being extended to her.

Hence, the key requirement of this benefit has been complied with. The garage stay has arisen

owing to repairs of minor nature which do not warrant any deduction. Further, while the car was

parking at the airport for a 10 day period but the same could have been used and there was no

hurdle in using the car for personal use.

10

Loan fringe benefit

The applicable RBA prescribed rate for the assessment year is 5.25% pa. but Rapid Heat has

offered a hefty discount to the extent of 100 basis points leading to presence of loan related

fringe benefits.

A portion of loan proceed is diverted for use of husband which does not provide any benefit to

employer. However, the key issue for the employer to be entitled to FBT deductions is whether

the holiday home which has absorbed 90% of loan amount would produce taxable income or not

for the employee (Jasmine).

Internal expense fringe benefit

11

The applicable RBA prescribed rate for the assessment year is 5.25% pa. but Rapid Heat has

offered a hefty discount to the extent of 100 basis points leading to presence of loan related

fringe benefits.

A portion of loan proceed is diverted for use of husband which does not provide any benefit to

employer. However, the key issue for the employer to be entitled to FBT deductions is whether

the holiday home which has absorbed 90% of loan amount would produce taxable income or not

for the employee (Jasmine).

Internal expense fringe benefit

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.