ACC304 Taxation Law: Residency Status and Income Assessment

VerifiedAdded on 2023/06/07

|5

|1929

|389

Report

AI Summary

This assignment provides tax advice to Elwood Blues regarding his residency status and income assessment in Australia. It analyzes his situation based on the Income Tax Assessment Act 1997, covering the resides test, domicile test, and 183-day test to determine his tax residency. The assignment further examines various aspects of Jake's income, including PAYG tax, car expenses, unfranked dividends, capital gains from share trading and hobby items, mobile phone expenses, and Medicare levy surcharge. It also discusses the concept of negative gearing, its advantages, and its impact on tax liability, referencing relevant Australian tax law and case studies. The document is available on Desklib, a platform providing study tools for students.

PART 1:

To,

Mr. Elwood and Inda Blues,

Unit 52,

246 Queen Street,

Brisbane, QLD,4000.

Date: 05-09-2018.

Sub: Advisory with respect to Residency Status

Sir,

Hope this letter finds you in good health.

It has been our honour to be your advisor in relation to determination of tax residency for the

Financial Year 2017-18. In this regard, the details that have been shared with us during our past

discussion include the following:

(a) Mr .Elwood and his wife Inda arrived in Australia on 01-07-2017 along with children;

(b) The transfer period is minimum 3 year;

(c) No intention to stay permanently;

(d) House has been purchased in Australia;

(e) Social connection and relation has been established.

Our Advisory

On the basis of details provided here-in-above, our advisory is as under:

In terms of subsection 5 (1) 10(1) and 10(2) of Section 6 under the Income Tax Assessment Act,

1997 of Australian Income Tax Law it shall be pertinent to note that for an individual resident

in Australia for Tax purposes his/her pan world income is taxable while for a non-resident only

Australian sourced income taxable.

Further, under Section 995-1 of Income Tax Assessment Act 1997 the term resident has been

defined which includes any person who is Australian resident under Income Tax Assessment Act

36.

In addition Income Tax Assessment Act 36 provides three tests for determining of residency of a

person. The same has been detailed here-in-below:

(a) Resides Test: Under this test, the Australian Tax Office (ATO)/ Commissioner generally

harps on the dwelling place of individual or one’s settlement or abode. The same has been

dealt in the judgement of Levene v IRC [1928] AC 217, IRC v Lysaght [1928] AC

234http://law.ato.gov.and TR98/17 where in it was held that if one has a habitual abode or

family connection in Australia, his tax residency shall be in Australia.

To,

Mr. Elwood and Inda Blues,

Unit 52,

246 Queen Street,

Brisbane, QLD,4000.

Date: 05-09-2018.

Sub: Advisory with respect to Residency Status

Sir,

Hope this letter finds you in good health.

It has been our honour to be your advisor in relation to determination of tax residency for the

Financial Year 2017-18. In this regard, the details that have been shared with us during our past

discussion include the following:

(a) Mr .Elwood and his wife Inda arrived in Australia on 01-07-2017 along with children;

(b) The transfer period is minimum 3 year;

(c) No intention to stay permanently;

(d) House has been purchased in Australia;

(e) Social connection and relation has been established.

Our Advisory

On the basis of details provided here-in-above, our advisory is as under:

In terms of subsection 5 (1) 10(1) and 10(2) of Section 6 under the Income Tax Assessment Act,

1997 of Australian Income Tax Law it shall be pertinent to note that for an individual resident

in Australia for Tax purposes his/her pan world income is taxable while for a non-resident only

Australian sourced income taxable.

Further, under Section 995-1 of Income Tax Assessment Act 1997 the term resident has been

defined which includes any person who is Australian resident under Income Tax Assessment Act

36.

In addition Income Tax Assessment Act 36 provides three tests for determining of residency of a

person. The same has been detailed here-in-below:

(a) Resides Test: Under this test, the Australian Tax Office (ATO)/ Commissioner generally

harps on the dwelling place of individual or one’s settlement or abode. The same has been

dealt in the judgement of Levene v IRC [1928] AC 217, IRC v Lysaght [1928] AC

234http://law.ato.gov.and TR98/17 where in it was held that if one has a habitual abode or

family connection in Australia, his tax residency shall be in Australia.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(b) Domicile Test: Under this test, the office generally considers the location of permanent

house for determining the residency. The relevant case laws detailing the term permanent

includesFCT v Applegate 79 ATC 4307; see also FCT v Jenkins (1982) 12 ATR 745 ;

(c) 183 Days test: Under this test, ATO generally harps on the number of stay day in Australia.

If the day count, exceed half years then the individual is considered a tax resident. Further,

the 183 days test shall hold good unless any of the following conditions are satisfied:-

(i) the house of permanent nature is outside Australia;

(j) there is no intention to take up residence in Australia.

The same has been detailed in

a eC s S19 AT85 C 225;

In the present circumstance, since You and your wife satisfies more than one test. Thus, You

and Your wife shall be considered tax resident of Australia and the provisions of act shall apply

accordingly.

Regards,

Tax Advisor,

Disclaimer: The above advise shall be useful for the person intended to. The same may change with change in circumstance. Further, the firm

shall not be held responsible if any other person act on such advise without proper consent.

PART 2A

PA Pa A o o i enerall collected on t e a i o indi id al e timated ta lia ilit and t e ta1. YG( y s Y u G ) s g y h b s s f v u s x b y h x

o collected ill al a e di er rom t e act al ta lia ilit and t e ta pa er i re ired t e pa t es w w ys b ff f h u x b y h x y s s qu h y h

e tra amo nt a ta or re nd a ter a e ment n t e i en ca e a e or ed or M A Arc itectx u s x fu f ss ss . I h g v s J k w k f D & h s

and recei ed alar o and Pa ta it eld amo nted to alar recei ed ill ev s y f $ 86,000 yg x w hh u $19.820, s y v w b

o n nder income and ta lia ilit ill e comp ted on t e a i o income arri ed at and rom t atsh w u x b y w b u h b s s f v f h

ta lia ilit it eld PA ta ill e ded cted to arri e at an additional amo nt to e paid a ta orx b y w hh YG x w b u v y u b s x

an re nd or t e amey fu f h s .(BDO, 2017)

t e emplo ee tra el a a dail ro tine rom i place o or to re idence t an t i i normal2. If h y v s y u f h s f w k s h h s s

ro tine or and per onal e pen e and cannot e claimed nder ded ction t i t e emplo ee tra elu w k s x s s b u u bu f h y v

house for determining the residency. The relevant case laws detailing the term permanent

includesFCT v Applegate 79 ATC 4307; see also FCT v Jenkins (1982) 12 ATR 745 ;

(c) 183 Days test: Under this test, ATO generally harps on the number of stay day in Australia.

If the day count, exceed half years then the individual is considered a tax resident. Further,

the 183 days test shall hold good unless any of the following conditions are satisfied:-

(i) the house of permanent nature is outside Australia;

(j) there is no intention to take up residence in Australia.

The same has been detailed in

a eC s S19 AT85 C 225;

In the present circumstance, since You and your wife satisfies more than one test. Thus, You

and Your wife shall be considered tax resident of Australia and the provisions of act shall apply

accordingly.

Regards,

Tax Advisor,

Disclaimer: The above advise shall be useful for the person intended to. The same may change with change in circumstance. Further, the firm

shall not be held responsible if any other person act on such advise without proper consent.

PART 2A

PA Pa A o o i enerall collected on t e a i o indi id al e timated ta lia ilit and t e ta1. YG( y s Y u G ) s g y h b s s f v u s x b y h x

o collected ill al a e di er rom t e act al ta lia ilit and t e ta pa er i re ired t e pa t es w w ys b ff f h u x b y h x y s s qu h y h

e tra amo nt a ta or re nd a ter a e ment n t e i en ca e a e or ed or M A Arc itectx u s x fu f ss ss . I h g v s J k w k f D & h s

and recei ed alar o and Pa ta it eld amo nted to alar recei ed ill ev s y f $ 86,000 yg x w hh u $19.820, s y v w b

o n nder income and ta lia ilit ill e comp ted on t e a i o income arri ed at and rom t atsh w u x b y w b u h b s s f v f h

ta lia ilit it eld PA ta ill e ded cted to arri e at an additional amo nt to e paid a ta orx b y w hh YG x w b u v y u b s x

an re nd or t e amey fu f h s .(BDO, 2017)

t e emplo ee tra el a a dail ro tine rom i place o or to re idence t an t i i normal2. If h y v s y u f h s f w k s h h s s

ro tine or and per onal e pen e and cannot e claimed nder ded ction t i t e emplo ee tra elu w k s x s s b u u bu f h y v

to anot er or place not t e normal place o i or t an t e emplo ee i eli i le to claim ded ctionh w k h f h s w k h h y s g b u

to a ma im m o ine ilometer and ma im m o cent per ilometerx u f 5000 bus ss k s x u f 66 s k . ommon ealt o(C w h f

A traliaus , 2018)

A min a e a ed t e car rom ome to o ice a a dail ro tine o ll tra ellin e pen e ill notssu g J k h s us h f h ff s y u s fu v g x s s w

e allo ed a ded ction and ill orm part o i incomeb w s u w f f h s .

An A tralian re ident a al o to pro ide Ta ile m er no n a T to an ail re to do o3. us s h s s v x F Nu b k w s FN b k, f u s

an ill it elp rom an intere t paid to o at t e i e t mar inal ta rateb k w w h h f y s y u h h gh s g x .(BDO, 2017)

A a e a earned intere t rom t e an and a or ot to pro ide ta ile n m er to t e an t ans J k h s s f h b k h s f g v x f u b h b k h

t e ta ill e ded cted on t e a i o i e t mar inal rateh x w b u h b s s f h gh s g .

one i an A tralian Ta re ident and a earned n ran ed di idend nder di idend4. If s us x s h s u f k v u v

rein e tment c emet an t at di idend ill e a e a le to income ta and i t at di idend i al ov s s h h h v w b ss ss b x f h v s s

rein e ted nder di idend rein e tment t an it i deemed to e an earned di idend and ill e eli i lev s u v v s h s b v w b g b

to tax(BDO, 2017).

A a e recei ed an n ran ed di idend amo nt to and in e tment in are it ill es J k v u f k v u $3500 v s 198 sh s, w b

deemed to e di idend earned and accordin l ta ill e c ar edb v g y x w b h g .

P rc a in o are and ellin it at pro it ill lead to capital ain and ta ill e c ar ed on c5. u h s g f sh s s g f w g x w b h g su h

capital aing

A a e a p rc a ed A an are on Marc at eac it ro era e co t ands J k h s u h s 1000 NZ b k sh 1 h 2015 $ 22 h w h b k g s $50

old are on ne or eac and ro era e co ts 500 sh s 1 Ju 2018 f $ 24 h b k g s $55.

Total ellin price o areS g f 500 sh s= (500*24-55) = $11945

Total P rc a e price o areu h s f 500 sh s= (500*22+25) =$11025

apital ainC G =$920

rt er di co nt o all e a aila le nder di co nt met od a oldin period i more t anFu h , s u f 50% sh b v b u s u h s h g s h 12

months.

an A tralian re ident ell omet in ic doe not orm part o a normal ine acti it and i6. If us s s s s h g wh h s f f bus ss v y s

a o o a partic lar per on t an an income or lo arri ed at ill e treated a capital ain or loh bby f u s h y ss v w b s g ss

rom c acti itf su h v y.

A a e o t cric et at et een and ic co t im and e ad old t e entires J k b ugh k b b w 1999 2004 wh h s h $2600 h h s h

collection at o a e a capital lo amo nt to$900, s J k h s ss u s $1700.

To claim car e pen e nder lo oo met od one m t a e a printed record o all t e di tance7. x s s u gb k h us h v s f h s

tra elled or ine and per onal ev f bus ss s us .

to a ma im m o ine ilometer and ma im m o cent per ilometerx u f 5000 bus ss k s x u f 66 s k . ommon ealt o(C w h f

A traliaus , 2018)

A min a e a ed t e car rom ome to o ice a a dail ro tine o ll tra ellin e pen e ill notssu g J k h s us h f h ff s y u s fu v g x s s w

e allo ed a ded ction and ill orm part o i incomeb w s u w f f h s .

An A tralian re ident a al o to pro ide Ta ile m er no n a T to an ail re to do o3. us s h s s v x F Nu b k w s FN b k, f u s

an ill it elp rom an intere t paid to o at t e i e t mar inal ta rateb k w w h h f y s y u h h gh s g x .(BDO, 2017)

A a e a earned intere t rom t e an and a or ot to pro ide ta ile n m er to t e an t ans J k h s s f h b k h s f g v x f u b h b k h

t e ta ill e ded cted on t e a i o i e t mar inal rateh x w b u h b s s f h gh s g .

one i an A tralian Ta re ident and a earned n ran ed di idend nder di idend4. If s us x s h s u f k v u v

rein e tment c emet an t at di idend ill e a e a le to income ta and i t at di idend i al ov s s h h h v w b ss ss b x f h v s s

rein e ted nder di idend rein e tment t an it i deemed to e an earned di idend and ill e eli i lev s u v v s h s b v w b g b

to tax(BDO, 2017).

A a e recei ed an n ran ed di idend amo nt to and in e tment in are it ill es J k v u f k v u $3500 v s 198 sh s, w b

deemed to e di idend earned and accordin l ta ill e c ar edb v g y x w b h g .

P rc a in o are and ellin it at pro it ill lead to capital ain and ta ill e c ar ed on c5. u h s g f sh s s g f w g x w b h g su h

capital aing

A a e a p rc a ed A an are on Marc at eac it ro era e co t ands J k h s u h s 1000 NZ b k sh 1 h 2015 $ 22 h w h b k g s $50

old are on ne or eac and ro era e co ts 500 sh s 1 Ju 2018 f $ 24 h b k g s $55.

Total ellin price o areS g f 500 sh s= (500*24-55) = $11945

Total P rc a e price o areu h s f 500 sh s= (500*22+25) =$11025

apital ainC G =$920

rt er di co nt o all e a aila le nder di co nt met od a oldin period i more t anFu h , s u f 50% sh b v b u s u h s h g s h 12

months.

an A tralian re ident ell omet in ic doe not orm part o a normal ine acti it and i6. If us s s s s h g wh h s f f bus ss v y s

a o o a partic lar per on t an an income or lo arri ed at ill e treated a capital ain or loh bby f u s h y ss v w b s g ss

rom c acti itf su h v y.

A a e o t cric et at et een and ic co t im and e ad old t e entires J k b ugh k b b w 1999 2004 wh h s h $2600 h h s h

collection at o a e a capital lo amo nt to$900, s J k h s ss u s $1700.

To claim car e pen e nder lo oo met od one m t a e a printed record o all t e di tance7. x s s u gb k h us h v s f h s

tra elled or ine and per onal ev f bus ss s us .

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

A a e a ailed to eep a lo oo t i maintainin diar in t e orm o record o e ill e eli i les J k h s f k g b k bu s g y h f f , s h w b g b

or tra ellin e pen e ded ctionf v g x s u . ommon ealt o A tralia(C w h f us , 2018)A t e total car e pen e incl dins h x s s u g

depreciation are and i i e timation i proper a ed on proper doc ment t an$6200 f h s s s b s u s h a e can claimJ k

or tra ellin e pen e amo nt tof v g x s s u s =$6200*95%=$5890

t e emplo ee i in mo ile p one or o ice p rpo e t an e can claim ded ction on t e mo ile8. If h y s us g b h f ff u s h h u h b

ill e pen e pro ided e eep a proper record or t e ameb x s v h k s f h s .

A a e o n a mo ile p one ic e e or or t t e ame time doe not a e an receipt ors J k w s b h wh h h us s f w k bu h s s h v y

pporti e material doc mentation to claim t e mo ile p one e pen e o a e ill not e entitled tosu v u h b h x s s, s J k w b

claim mo ile p one e pen eb h x s s.

Pa ment to acco ntant and ta a ent i treated ot er e pen e and i allo ed a ded ction nder9. y u x g s h x s s s w s u u

TAAS25-5 I 97.

A a e a paid t e in oice ic e recei ed rom t e ta a ent amo nted to a e ill es J k h s h v wh h h v f h x g u $400, J k w b

entitled to claim c ded ctionsu h u .

Accordin to A tralian Ta i one doe not old pri ate medical in rance t an Medicare le10. g us x f s h v su h vy

rc ar e i impo ed dependant on t e income o t e indi id alsu h g s s h f h v u .

A a e i not married and doe not a e a ealt co er medical rc ar e ill e impo ed on t e a is J k s s h v h h v su h g w b s h b s s

o ta a le income o a ef x b f J k .

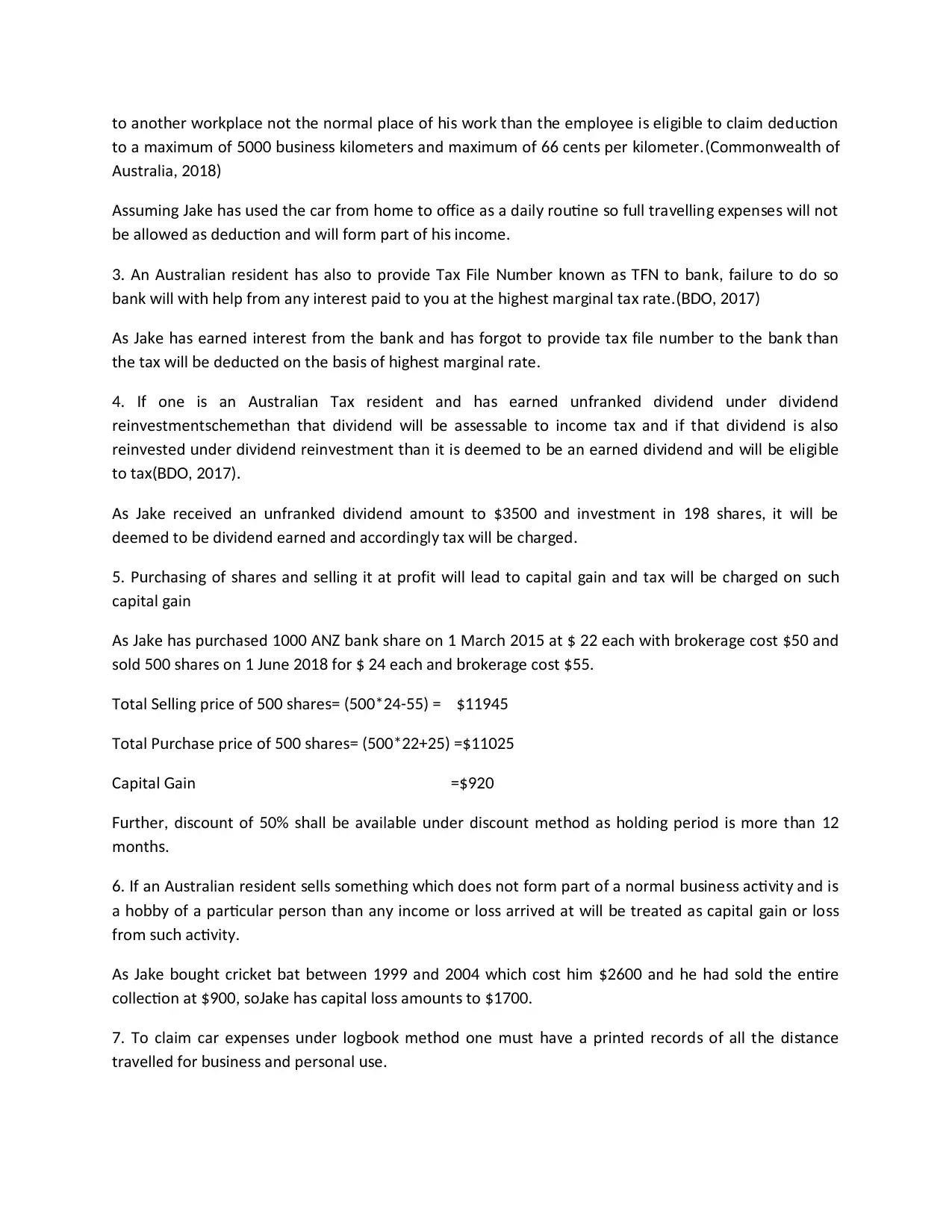

T e inal comp tation a een ta lated ere in eloh f u h s b bu h - -b w:

omp tation o Ta a le ncomeC u f x b I

l oS . N . Partic laru s Amo ntu Amo ntu

1 alarS y 86000

2 n ran ed di idendU f k v 3500

3 apital ain ncomeC G I 920 460

4 Tra ellin e pen ev g x s -5890

5 Pa ment to ta a enty x g -400

6 Ta a le ncomex b I 83670

PA TR 2(B)

e ati e earin i a a in ic t e in e tor orro mone rom t e o t ide orld o t at t eN g v g g s w y wh h h v s b ws y f h u s w s h h

in e tor can et an income eneratin a et t t e co t i al a more in ac irin t e in e tmentv s g g g ss s bu h s s w ys qu g h v s

t an t e income enerated rom it t an t e in e tor ma enter into a ne ati el eared in e tment ah h g f , h h v s y g v y g v s s

t e ne ati e earin ene it a lot to alaried middle cla emplo ee and ne ati e earin ene it canh g v g g b f s s ss y s g v g g b f s

or tra ellin e pen e ded ctionf v g x s u . ommon ealt o A tralia(C w h f us , 2018)A t e total car e pen e incl dins h x s s u g

depreciation are and i i e timation i proper a ed on proper doc ment t an$6200 f h s s s b s u s h a e can claimJ k

or tra ellin e pen e amo nt tof v g x s s u s =$6200*95%=$5890

t e emplo ee i in mo ile p one or o ice p rpo e t an e can claim ded ction on t e mo ile8. If h y s us g b h f ff u s h h u h b

ill e pen e pro ided e eep a proper record or t e ameb x s v h k s f h s .

A a e o n a mo ile p one ic e e or or t t e ame time doe not a e an receipt ors J k w s b h wh h h us s f w k bu h s s h v y

pporti e material doc mentation to claim t e mo ile p one e pen e o a e ill not e entitled tosu v u h b h x s s, s J k w b

claim mo ile p one e pen eb h x s s.

Pa ment to acco ntant and ta a ent i treated ot er e pen e and i allo ed a ded ction nder9. y u x g s h x s s s w s u u

TAAS25-5 I 97.

A a e a paid t e in oice ic e recei ed rom t e ta a ent amo nted to a e ill es J k h s h v wh h h v f h x g u $400, J k w b

entitled to claim c ded ctionsu h u .

Accordin to A tralian Ta i one doe not old pri ate medical in rance t an Medicare le10. g us x f s h v su h vy

rc ar e i impo ed dependant on t e income o t e indi id alsu h g s s h f h v u .

A a e i not married and doe not a e a ealt co er medical rc ar e ill e impo ed on t e a is J k s s h v h h v su h g w b s h b s s

o ta a le income o a ef x b f J k .

T e inal comp tation a een ta lated ere in eloh f u h s b bu h - -b w:

omp tation o Ta a le ncomeC u f x b I

l oS . N . Partic laru s Amo ntu Amo ntu

1 alarS y 86000

2 n ran ed di idendU f k v 3500

3 apital ain ncomeC G I 920 460

4 Tra ellin e pen ev g x s -5890

5 Pa ment to ta a enty x g -400

6 Ta a le ncomex b I 83670

PA TR 2(B)

e ati e earin i a a in ic t e in e tor orro mone rom t e o t ide orld o t at t eN g v g g s w y wh h h v s b ws y f h u s w s h h

in e tor can et an income eneratin a et t t e co t i al a more in ac irin t e in e tmentv s g g g ss s bu h s s w ys qu g h v s

t an t e income enerated rom it t an t e in e tor ma enter into a ne ati el eared in e tment ah h g f , h h v s y g v y g v s s

t e ne ati e earin ene it a lot to alaried middle cla emplo ee and ne ati e earin ene it canh g v g g b f s s ss y s g v g g b f s

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

e ta en in ide ran e and t ro ne ati e earin propert lo e can e et o rom ot er t pe ob k w g h ugh g v g g y ss s b s ff f h y s f

income c a a e or income it a e re triction on itsu h s w g s w h f w s s . inder A(F U, 2018)

rt er t ere are t o t pe o ta earin ne ati e and po iti eFu h , h w y s f x g g g v s v .

Ad anta e o e ati e earinv g s f N g v G g:

a( ) n term o A tralian Ta a an indi id al can claim ded ction or intere t portion o loanI s f us x L w, v u u f s f

nderta enu k ;

(b) t er ancillar e pen e related to rented propert can e claimed a e pen eO h y x s y b s x s ;

c( ) An lo t at a een inc rred t e indi id al can e et o a ain t ot er income earned li ey ss h h s b u by h v u b s ff g s h k

alar income T t e ta a le income all e red ced and corre pondin l ta lia ilits y . hus, h x b sh b u s g y x b y.

T ne ati e a an impact on red cin t e ta lia ilit de i in a mart ta plannin mec ani mhus, g v h s u g h x b y by v s g s x g h s

ile actin it in t e o r all o A tralian Ta ation tem rt er t ere i ot er ind o earinwh g w h h f u w s f us x Sys . Fu h , h s h k f g g

ic i po iti e and a it o n impact on t e a e a le income and ta lia ilit o t e indi id alwh h s s v h s s w h ss ss b x b y f h v u .

n ort ot earin i e ne ati e and po iti e a it o n po iti it and ne ati it dependin on oI sh b h g g . . g v s v h s s w s v y g v y g h w

e icientl tili e t i mec ani m ile plannin ta eff y u z h s h s wh g x s.

References:

BDO, 2017.

mplo ee Ta ide

E y s x gu . nline[O ]

A aila le atv b : ttp do com ah s://www.b . . u

Acce ed eptem er[ ss 5 S b 2018].

ommon ealt o A traliaC w h f us , 2018.

ar e pen e

C x s s. nline[O ]

A aila le atv b : ttp ato o a indi id al income and ded ction ded ction o can claimh s://www. .g v. u/ v u s/ - - u s/ u s-y u- - /

e icle and tra el e pen e car e pen ev h - - v - x s s/ - x s s/

Acce ed eptem er[ ss 5 S b 2018].

ommon ealt o A traliaC w h f us , 2018.

o oo met od

L gb k h . nline[O ]

A aila le atv b : ttp ato o a ine ncome and ded ction or ine ed ction Motorh s://www. .g v. u/Bus ss/I - - u s-f -bus ss/D u s/ -

e icle e pen e laimin motor e icle e pen e a a ole trader o oo met odv h - x s s/C g- -v h - x s s- s- -s - /L gb k- h /

Acce ed eptem er[ ss 5 S b 2018].

inder AF U, 2018.

at i ne ati e earin and o doe it act all or

Wh s g v g g h w s u y w k?. nline[O ]

A aila le atv b : ttp inder com a at i ne ati e earinh s://www.f . . u/wh - s- g v -g g

Acce ed eptem er[ ss 5 S b 2018].

income c a a e or income it a e re triction on itsu h s w g s w h f w s s . inder A(F U, 2018)

rt er t ere are t o t pe o ta earin ne ati e and po iti eFu h , h w y s f x g g g v s v .

Ad anta e o e ati e earinv g s f N g v G g:

a( ) n term o A tralian Ta a an indi id al can claim ded ction or intere t portion o loanI s f us x L w, v u u f s f

nderta enu k ;

(b) t er ancillar e pen e related to rented propert can e claimed a e pen eO h y x s y b s x s ;

c( ) An lo t at a een inc rred t e indi id al can e et o a ain t ot er income earned li ey ss h h s b u by h v u b s ff g s h k

alar income T t e ta a le income all e red ced and corre pondin l ta lia ilits y . hus, h x b sh b u s g y x b y.

T ne ati e a an impact on red cin t e ta lia ilit de i in a mart ta plannin mec ani mhus, g v h s u g h x b y by v s g s x g h s

ile actin it in t e o r all o A tralian Ta ation tem rt er t ere i ot er ind o earinwh g w h h f u w s f us x Sys . Fu h , h s h k f g g

ic i po iti e and a it o n impact on t e a e a le income and ta lia ilit o t e indi id alwh h s s v h s s w h ss ss b x b y f h v u .

n ort ot earin i e ne ati e and po iti e a it o n po iti it and ne ati it dependin on oI sh b h g g . . g v s v h s s w s v y g v y g h w

e icientl tili e t i mec ani m ile plannin ta eff y u z h s h s wh g x s.

References:

BDO, 2017.

mplo ee Ta ide

E y s x gu . nline[O ]

A aila le atv b : ttp do com ah s://www.b . . u

Acce ed eptem er[ ss 5 S b 2018].

ommon ealt o A traliaC w h f us , 2018.

ar e pen e

C x s s. nline[O ]

A aila le atv b : ttp ato o a indi id al income and ded ction ded ction o can claimh s://www. .g v. u/ v u s/ - - u s/ u s-y u- - /

e icle and tra el e pen e car e pen ev h - - v - x s s/ - x s s/

Acce ed eptem er[ ss 5 S b 2018].

ommon ealt o A traliaC w h f us , 2018.

o oo met od

L gb k h . nline[O ]

A aila le atv b : ttp ato o a ine ncome and ded ction or ine ed ction Motorh s://www. .g v. u/Bus ss/I - - u s-f -bus ss/D u s/ -

e icle e pen e laimin motor e icle e pen e a a ole trader o oo met odv h - x s s/C g- -v h - x s s- s- -s - /L gb k- h /

Acce ed eptem er[ ss 5 S b 2018].

inder AF U, 2018.

at i ne ati e earin and o doe it act all or

Wh s g v g g h w s u y w k?. nline[O ]

A aila le atv b : ttp inder com a at i ne ati e earinh s://www.f . . u/wh - s- g v -g g

Acce ed eptem er[ ss 5 S b 2018].

1 out of 5

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.