Taxation Advice for Sale of Assets and FBT Liability for Rapid Heat

VerifiedAdded on 2023/06/04

|15

|3030

|197

AI Summary

The article provides taxation advice for the sale of assets and FBT liability for Rapid Heat. It explains the applicable taxation rules and details of transactions for CGT relief, CGT calculation, and timing of CGT. The article also outlines the FBT liability that would arise for the employer based on the key fringe benefits that have been passed on to Jasmine, who is employed by Rapid Heat.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Taxation Theory, Practice & Law

Student Name

[Pick the date]

Student Name

[Pick the date]

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Question 1

Issue

The given information highlights that there has been sale of multiple assets during 2017/2018 tax

year. The objective is to offer tax advice to client in wake of these transactions with reference to

the applicable taxation rules and the details of the transactions.

Law

Proceeds Type

In wake of the transactions involving sale of certain assets, it needs to be highlighted as to the

proceeds would be having capital nature or revenue nature. Both the possibilities arise when an

item is sold. Selling of property as a trading stock would bring in revenue receipts since the

underlying taxpayer would be assumed to have a business dealing with real estate. On the

contrary, the proceeds from the sale of a property in which the taxpayer had bought for

investment purposes would yield capital proceeds (Barkoczy, 2017). It is essential to

differentiate between these two proceeds since revenue proceeds would contribute to assessable

income in sharp contradiction to capital proceeds which would not be levied any taxation burden.

However, tax can be applied for capital transactions by way of taxing the capital gains in the

process (Wilmot, 2014).

Relief from CGT

CGT relief can be availed by a particular asset class known as pre-CGT asset. In order to belong

to this class of assets, it is necessary that the asset purchase should have been concluded when

there was no taxation of the capital gains resulting from liquidation of capital assets. This would

imply that the time would lie before September 20,1985 as on this date CGT was introduced by

the Australia government (Austlii, 2018 a). Thus, assets purchased prior to this date would not

attract any CGT related liability.

While the above category provides a blanket exemption to a host of asset classes, there are

certain other limits which provide relief to specific asset classes. One of these would be

collectables where it is necessary that a threshold of $ 500 has to be crossed in the buying price

1

Issue

The given information highlights that there has been sale of multiple assets during 2017/2018 tax

year. The objective is to offer tax advice to client in wake of these transactions with reference to

the applicable taxation rules and the details of the transactions.

Law

Proceeds Type

In wake of the transactions involving sale of certain assets, it needs to be highlighted as to the

proceeds would be having capital nature or revenue nature. Both the possibilities arise when an

item is sold. Selling of property as a trading stock would bring in revenue receipts since the

underlying taxpayer would be assumed to have a business dealing with real estate. On the

contrary, the proceeds from the sale of a property in which the taxpayer had bought for

investment purposes would yield capital proceeds (Barkoczy, 2017). It is essential to

differentiate between these two proceeds since revenue proceeds would contribute to assessable

income in sharp contradiction to capital proceeds which would not be levied any taxation burden.

However, tax can be applied for capital transactions by way of taxing the capital gains in the

process (Wilmot, 2014).

Relief from CGT

CGT relief can be availed by a particular asset class known as pre-CGT asset. In order to belong

to this class of assets, it is necessary that the asset purchase should have been concluded when

there was no taxation of the capital gains resulting from liquidation of capital assets. This would

imply that the time would lie before September 20,1985 as on this date CGT was introduced by

the Australia government (Austlii, 2018 a). Thus, assets purchased prior to this date would not

attract any CGT related liability.

While the above category provides a blanket exemption to a host of asset classes, there are

certain other limits which provide relief to specific asset classes. One of these would be

collectables where it is necessary that a threshold of $ 500 has to be crossed in the buying price

1

so as to ensure that applicability of CGT is there (Barkoczy, 2017). Any collectable bought for

lesser price would not attract any CGT. A threshold tends to exist for assets kept for personal use

also where the minimum purchase price ought to exceed $ 10,000 for application of CGT.

Failure to reach that level in terms of buying price would provide exemption from CGT

(Woellner, 2017).

CGT calculation

The calculation regarding CGT liability involves a host of steps that ought to be followed. The

initial step is the taking place of a CGT event which triggers the need to compute potential

capital gains on the underlying transaction. A list of possible CGT event is drawn in s. 104-5 but

these are not relevant to the current discussion and hence the focus is only limited to a particular

event called as A1 which deals with the situation involving asset disposal (Reuters, 2017).

Further, this event also highlights the precise mechanism in which the underlying capital gains

may be found.

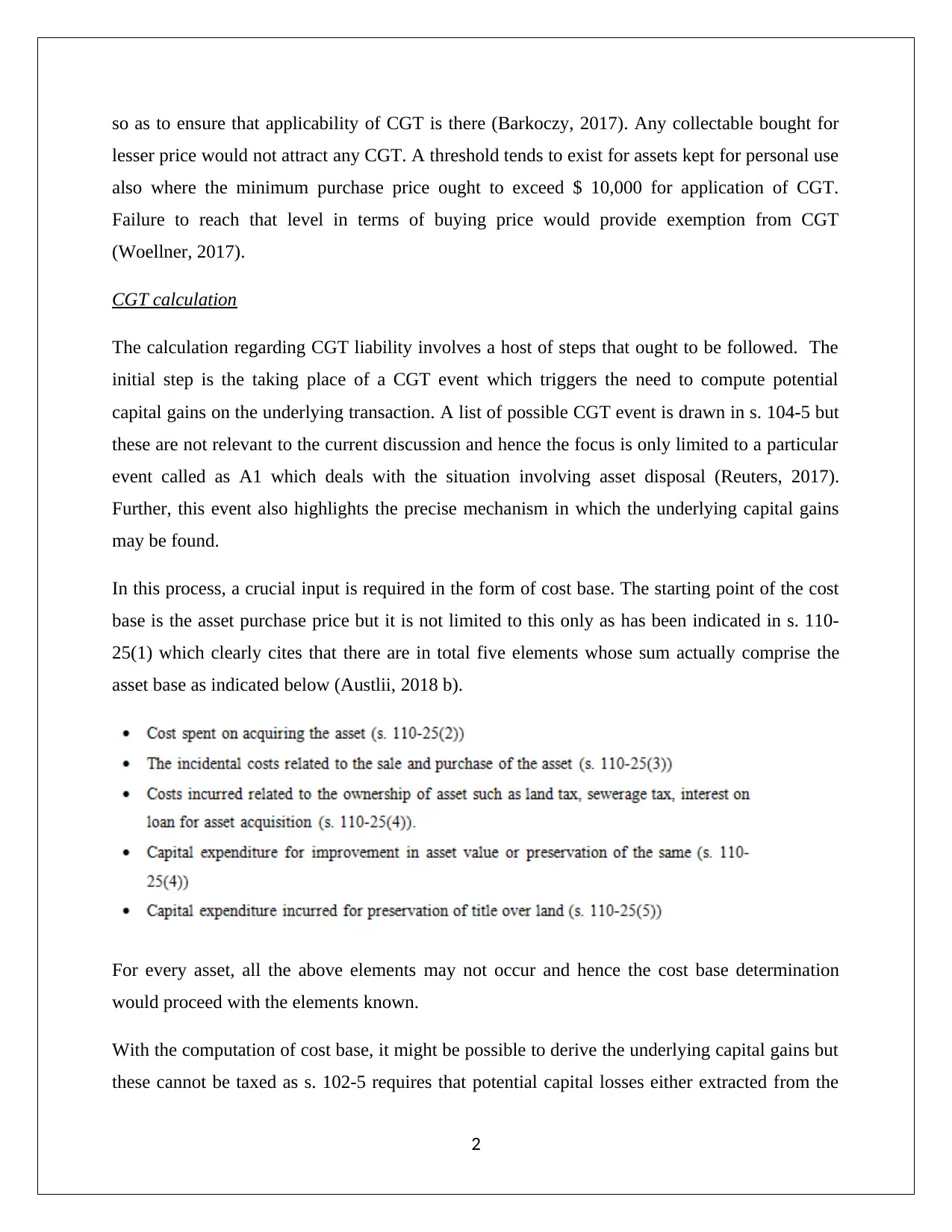

In this process, a crucial input is required in the form of cost base. The starting point of the cost

base is the asset purchase price but it is not limited to this only as has been indicated in s. 110-

25(1) which clearly cites that there are in total five elements whose sum actually comprise the

asset base as indicated below (Austlii, 2018 b).

For every asset, all the above elements may not occur and hence the cost base determination

would proceed with the elements known.

With the computation of cost base, it might be possible to derive the underlying capital gains but

these cannot be taxed as s. 102-5 requires that potential capital losses either extracted from the

2

lesser price would not attract any CGT. A threshold tends to exist for assets kept for personal use

also where the minimum purchase price ought to exceed $ 10,000 for application of CGT.

Failure to reach that level in terms of buying price would provide exemption from CGT

(Woellner, 2017).

CGT calculation

The calculation regarding CGT liability involves a host of steps that ought to be followed. The

initial step is the taking place of a CGT event which triggers the need to compute potential

capital gains on the underlying transaction. A list of possible CGT event is drawn in s. 104-5 but

these are not relevant to the current discussion and hence the focus is only limited to a particular

event called as A1 which deals with the situation involving asset disposal (Reuters, 2017).

Further, this event also highlights the precise mechanism in which the underlying capital gains

may be found.

In this process, a crucial input is required in the form of cost base. The starting point of the cost

base is the asset purchase price but it is not limited to this only as has been indicated in s. 110-

25(1) which clearly cites that there are in total five elements whose sum actually comprise the

asset base as indicated below (Austlii, 2018 b).

For every asset, all the above elements may not occur and hence the cost base determination

would proceed with the elements known.

With the computation of cost base, it might be possible to derive the underlying capital gains but

these cannot be taxed as s. 102-5 requires that potential capital losses either extracted from the

2

asset sale in current year or brought forward from past need to be first balanced so as to derive

the net capital gains (Krever, 2017). It is imperative to note that while for other assets, the capital

losses may be adjusted against capital gains of any other asset class also but in collectables, the

capital losses ,may be adjusted only against the same asset class only or rolled over to future

(Nethercott, Richardson and Devos, 2016).

The net capital gains after accounting for the capital losses are provided concession in the form

of indexation method and discount method. These can enable lowering of capital gains provided

the respective conditions required by each are fulfilled (Reuters, 2017). Indexation method has

limited utility post the allowance of discount method in 1999 and primarily applies to asset

bought before 1999 whose cost base can be inflation adjusted to lower taxable capital gains.

Discount method (s. 115-25) is able to provide a flat 50% discount to the capital gains provided

these are long term in nature. The gains would be long term when the underlying asset from

which these arise would have a holding period which was greater than a year. The capital gains

hence derived would be applied CGT at the rate of 30% to highlight the tax liability for the

taxpayer (Coleman, 2016).

Timing of CGT

In liquidation of capital assets, often situation arises whereby a timing mismatch exists between

the two events namely the contract of sale and the proceeds of sale receipt (Sadiq, et.al., 2015).

This is typical of transactions involving land, property as the receipt amount may be significant

and hence some period may be provided to the buyer to make the complete payment thereby

leading to ownership transfer of the asset (Wilmot, 2014). This may lead to situation where the

above two events fall in different tax year and hence decision regarding timing of CGT ought to

be taken. TR 94/29 highlights that in such situation, the tax consequences must be levied in the

year when the sale contract is executed and the timing of the proceeds does not matter (ATO,

1994).

Application

Proceeds Type

3

the net capital gains (Krever, 2017). It is imperative to note that while for other assets, the capital

losses may be adjusted against capital gains of any other asset class also but in collectables, the

capital losses ,may be adjusted only against the same asset class only or rolled over to future

(Nethercott, Richardson and Devos, 2016).

The net capital gains after accounting for the capital losses are provided concession in the form

of indexation method and discount method. These can enable lowering of capital gains provided

the respective conditions required by each are fulfilled (Reuters, 2017). Indexation method has

limited utility post the allowance of discount method in 1999 and primarily applies to asset

bought before 1999 whose cost base can be inflation adjusted to lower taxable capital gains.

Discount method (s. 115-25) is able to provide a flat 50% discount to the capital gains provided

these are long term in nature. The gains would be long term when the underlying asset from

which these arise would have a holding period which was greater than a year. The capital gains

hence derived would be applied CGT at the rate of 30% to highlight the tax liability for the

taxpayer (Coleman, 2016).

Timing of CGT

In liquidation of capital assets, often situation arises whereby a timing mismatch exists between

the two events namely the contract of sale and the proceeds of sale receipt (Sadiq, et.al., 2015).

This is typical of transactions involving land, property as the receipt amount may be significant

and hence some period may be provided to the buyer to make the complete payment thereby

leading to ownership transfer of the asset (Wilmot, 2014). This may lead to situation where the

above two events fall in different tax year and hence decision regarding timing of CGT ought to

be taken. TR 94/29 highlights that in such situation, the tax consequences must be levied in the

year when the sale contract is executed and the timing of the proceeds does not matter (ATO,

1994).

Application

Proceeds Type

3

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

The information about client clearly highlights that the sale of the various assets does not

comprise business transactions. Also, it is known that the client is an investor and collector.

Hence, this information leads to the conclusion that the underlying receipts would be essentially

capital as the client is not dealing with these assets as business transactions. Considering the

receipts nature as capital, the taxation burden on the receipts would not be present. Thus, the

only possible tax that could be levied on the client is the CGT based on the underling capital

gains realised.

Relief from CGT

Considering the various assets that have been sold on behalf of the client, it needs to be

determined if any of these falls within pre-CGT asset class based on the date on which these

were bought. This has been performed and it has been realised that only one asset namely

painting can be termed as a pre-CGT asset. All the other assets which have been liquidated were

acquired after September 19, 1985 and CGT was in place at these times. The result is that there

would not be any CGT burden on the painting.

One of the collectables sold is the antique bed which has a purchase price of $ 3,500 thereby

staying above the minimum threshold of $500 for application of CGT. Also, an example of an

asset for personal use is violin. This can be said considering the fact that the client uses violin for

her own entertainment and plays the violin quite well and often. For CGT liability to arise on this

asset, the threshold value of $ 10,000 as purchase price need to be crossed which violin has

failed to do and thereby it is exempt from the application of CGT related liabilities.

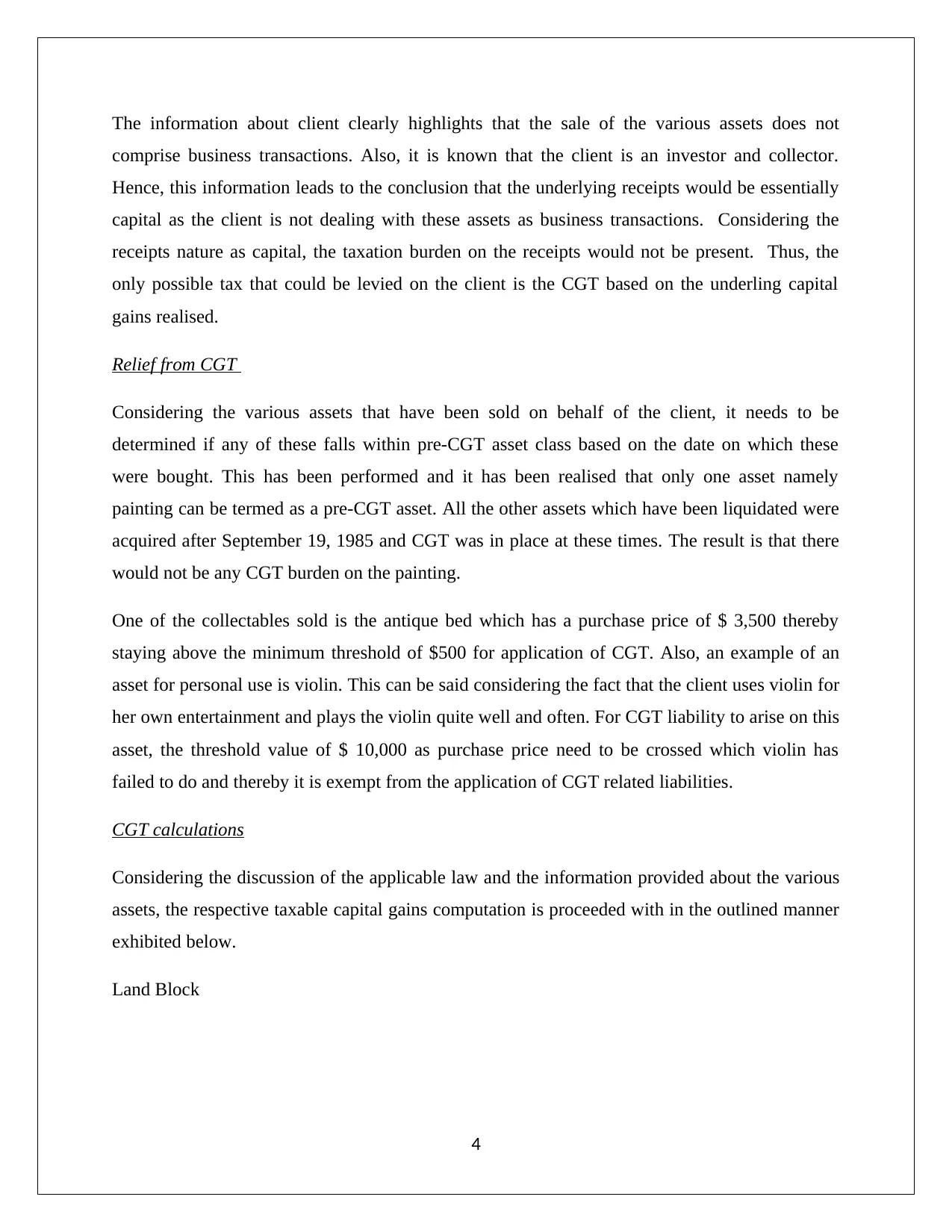

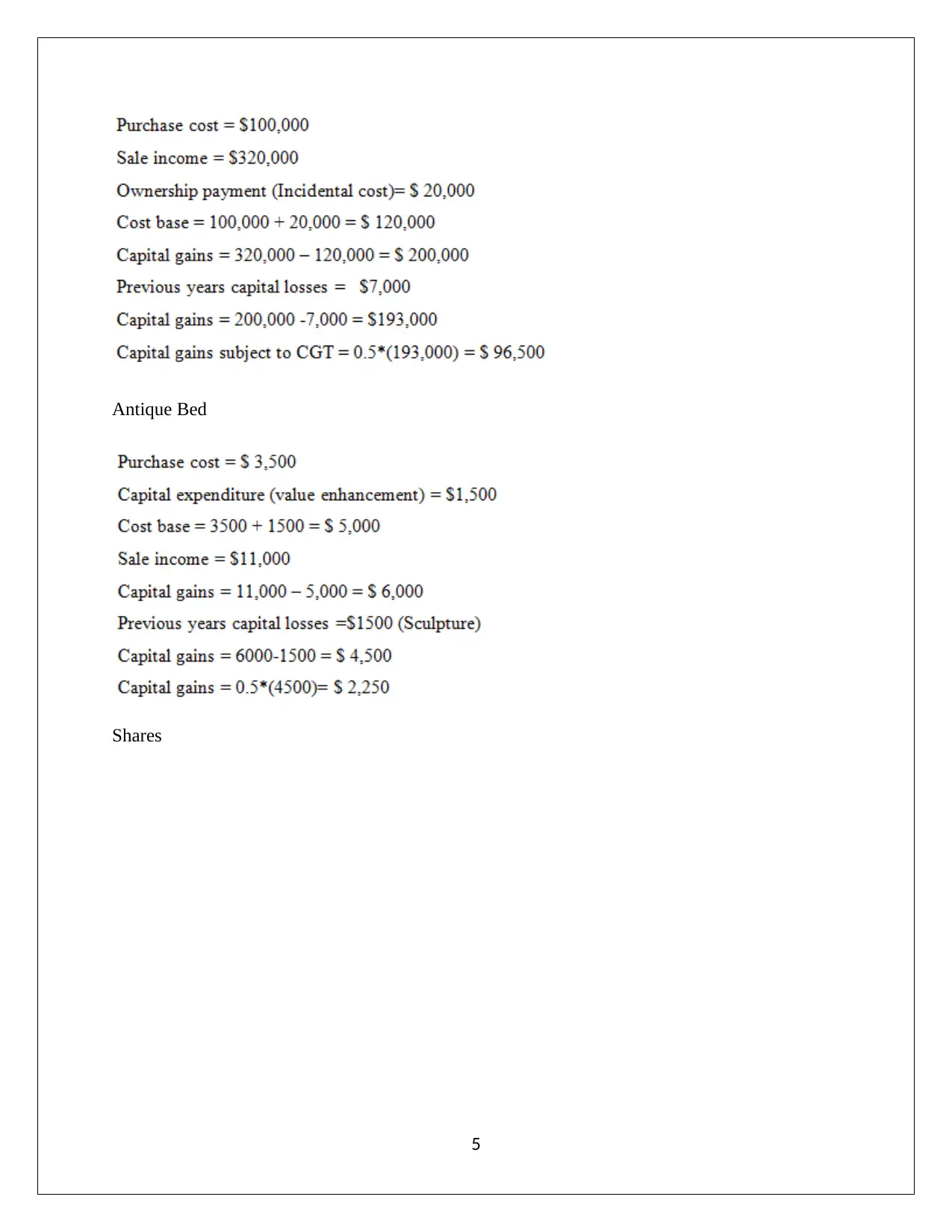

CGT calculations

Considering the discussion of the applicable law and the information provided about the various

assets, the respective taxable capital gains computation is proceeded with in the outlined manner

exhibited below.

Land Block

4

comprise business transactions. Also, it is known that the client is an investor and collector.

Hence, this information leads to the conclusion that the underlying receipts would be essentially

capital as the client is not dealing with these assets as business transactions. Considering the

receipts nature as capital, the taxation burden on the receipts would not be present. Thus, the

only possible tax that could be levied on the client is the CGT based on the underling capital

gains realised.

Relief from CGT

Considering the various assets that have been sold on behalf of the client, it needs to be

determined if any of these falls within pre-CGT asset class based on the date on which these

were bought. This has been performed and it has been realised that only one asset namely

painting can be termed as a pre-CGT asset. All the other assets which have been liquidated were

acquired after September 19, 1985 and CGT was in place at these times. The result is that there

would not be any CGT burden on the painting.

One of the collectables sold is the antique bed which has a purchase price of $ 3,500 thereby

staying above the minimum threshold of $500 for application of CGT. Also, an example of an

asset for personal use is violin. This can be said considering the fact that the client uses violin for

her own entertainment and plays the violin quite well and often. For CGT liability to arise on this

asset, the threshold value of $ 10,000 as purchase price need to be crossed which violin has

failed to do and thereby it is exempt from the application of CGT related liabilities.

CGT calculations

Considering the discussion of the applicable law and the information provided about the various

assets, the respective taxable capital gains computation is proceeded with in the outlined manner

exhibited below.

Land Block

4

Antique Bed

Shares

5

Shares

5

Cumulative

6

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

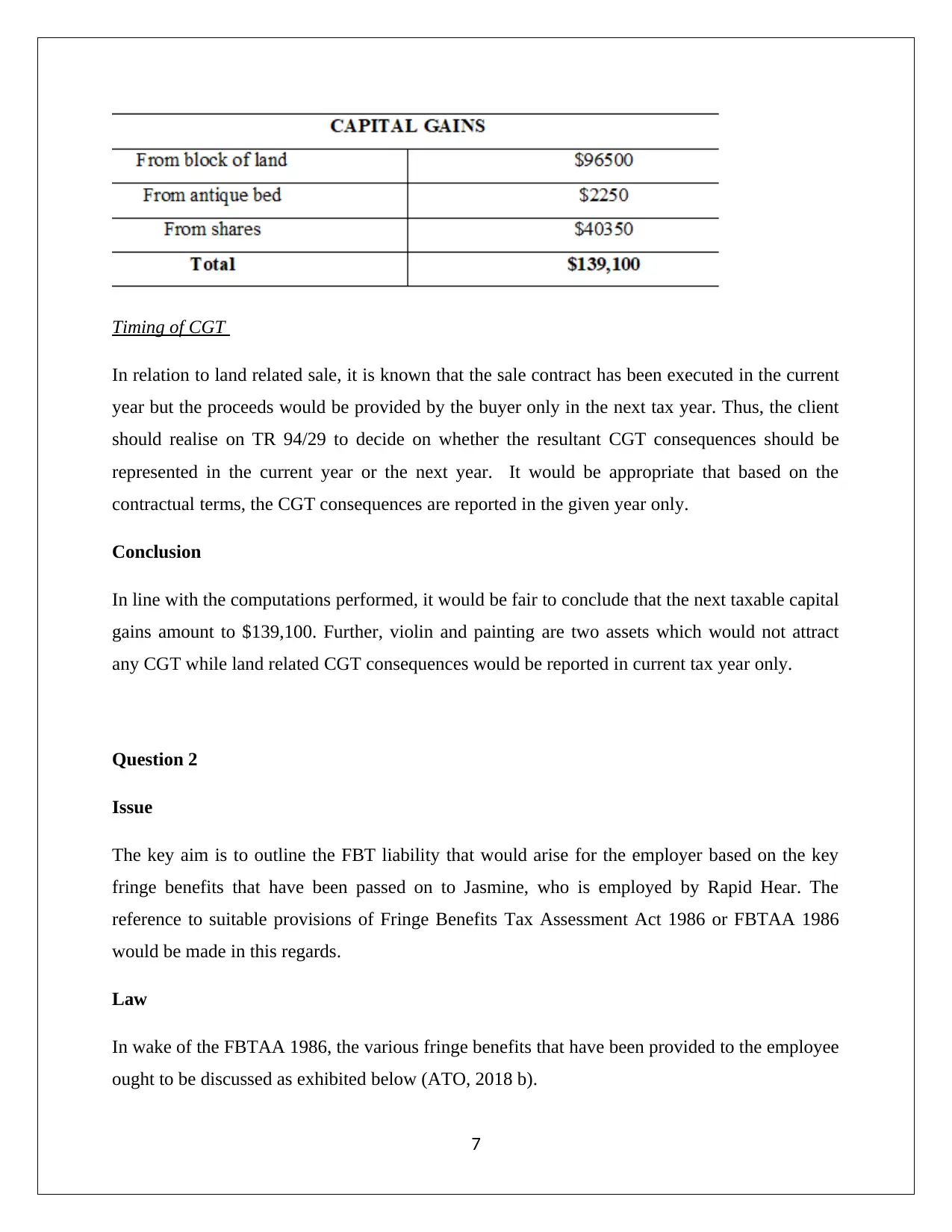

Timing of CGT

In relation to land related sale, it is known that the sale contract has been executed in the current

year but the proceeds would be provided by the buyer only in the next tax year. Thus, the client

should realise on TR 94/29 to decide on whether the resultant CGT consequences should be

represented in the current year or the next year. It would be appropriate that based on the

contractual terms, the CGT consequences are reported in the given year only.

Conclusion

In line with the computations performed, it would be fair to conclude that the next taxable capital

gains amount to $139,100. Further, violin and painting are two assets which would not attract

any CGT while land related CGT consequences would be reported in current tax year only.

Question 2

Issue

The key aim is to outline the FBT liability that would arise for the employer based on the key

fringe benefits that have been passed on to Jasmine, who is employed by Rapid Hear. The

reference to suitable provisions of Fringe Benefits Tax Assessment Act 1986 or FBTAA 1986

would be made in this regards.

Law

In wake of the FBTAA 1986, the various fringe benefits that have been provided to the employee

ought to be discussed as exhibited below (ATO, 2018 b).

7

In relation to land related sale, it is known that the sale contract has been executed in the current

year but the proceeds would be provided by the buyer only in the next tax year. Thus, the client

should realise on TR 94/29 to decide on whether the resultant CGT consequences should be

represented in the current year or the next year. It would be appropriate that based on the

contractual terms, the CGT consequences are reported in the given year only.

Conclusion

In line with the computations performed, it would be fair to conclude that the next taxable capital

gains amount to $139,100. Further, violin and painting are two assets which would not attract

any CGT while land related CGT consequences would be reported in current tax year only.

Question 2

Issue

The key aim is to outline the FBT liability that would arise for the employer based on the key

fringe benefits that have been passed on to Jasmine, who is employed by Rapid Hear. The

reference to suitable provisions of Fringe Benefits Tax Assessment Act 1986 or FBTAA 1986

would be made in this regards.

Law

In wake of the FBTAA 1986, the various fringe benefits that have been provided to the employee

ought to be discussed as exhibited below (ATO, 2018 b).

7

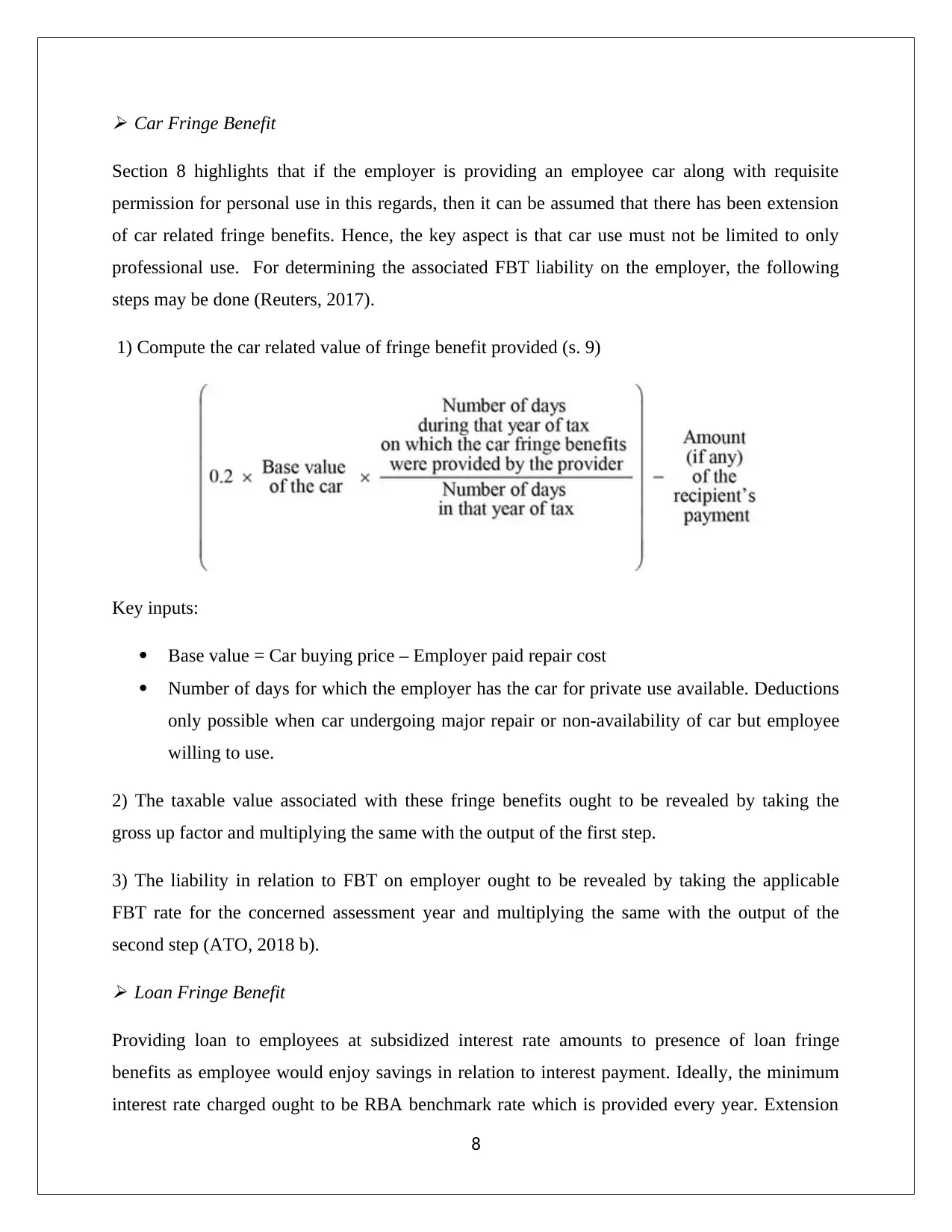

Car Fringe Benefit

Section 8 highlights that if the employer is providing an employee car along with requisite

permission for personal use in this regards, then it can be assumed that there has been extension

of car related fringe benefits. Hence, the key aspect is that car use must not be limited to only

professional use. For determining the associated FBT liability on the employer, the following

steps may be done (Reuters, 2017).

1) Compute the car related value of fringe benefit provided (s. 9)

Key inputs:

Base value = Car buying price – Employer paid repair cost

Number of days for which the employer has the car for private use available. Deductions

only possible when car undergoing major repair or non-availability of car but employee

willing to use.

2) The taxable value associated with these fringe benefits ought to be revealed by taking the

gross up factor and multiplying the same with the output of the first step.

3) The liability in relation to FBT on employer ought to be revealed by taking the applicable

FBT rate for the concerned assessment year and multiplying the same with the output of the

second step (ATO, 2018 b).

Loan Fringe Benefit

Providing loan to employees at subsidized interest rate amounts to presence of loan fringe

benefits as employee would enjoy savings in relation to interest payment. Ideally, the minimum

interest rate charged ought to be RBA benchmark rate which is provided every year. Extension

8

Section 8 highlights that if the employer is providing an employee car along with requisite

permission for personal use in this regards, then it can be assumed that there has been extension

of car related fringe benefits. Hence, the key aspect is that car use must not be limited to only

professional use. For determining the associated FBT liability on the employer, the following

steps may be done (Reuters, 2017).

1) Compute the car related value of fringe benefit provided (s. 9)

Key inputs:

Base value = Car buying price – Employer paid repair cost

Number of days for which the employer has the car for private use available. Deductions

only possible when car undergoing major repair or non-availability of car but employee

willing to use.

2) The taxable value associated with these fringe benefits ought to be revealed by taking the

gross up factor and multiplying the same with the output of the first step.

3) The liability in relation to FBT on employer ought to be revealed by taking the applicable

FBT rate for the concerned assessment year and multiplying the same with the output of the

second step (ATO, 2018 b).

Loan Fringe Benefit

Providing loan to employees at subsidized interest rate amounts to presence of loan fringe

benefits as employee would enjoy savings in relation to interest payment. Ideally, the minimum

interest rate charged ought to be RBA benchmark rate which is provided every year. Extension

8

of loan amount at rate lesser than the RBA benchmark rate would result to providing employee

with loan fringe benefit. For determining the associated FBT liability on the employer, the

following steps may be done (ATO, 2018 a).

1) Compute the total interest payment savings reaped by employee based on the given

assessment year considering the RBA rate, employer interest rate and date of loan extension.

2) The taxable value associated with these fringe benefits ought to be revealed by taking the

gross up factor and multiplying the same with the output of the first step.

3) The liability in relation to FBT on employer ought to be revealed by taking the applicable

FBT rate for the concerned assessment year and multiplying the same with the output of the

second step.

Possible deduction is available for employer in FBT liability on account of this fringe benefit is

assessable income is produced by employee (and not any associates) through the use of proceeds

extended through loan (Woellner, 2017).

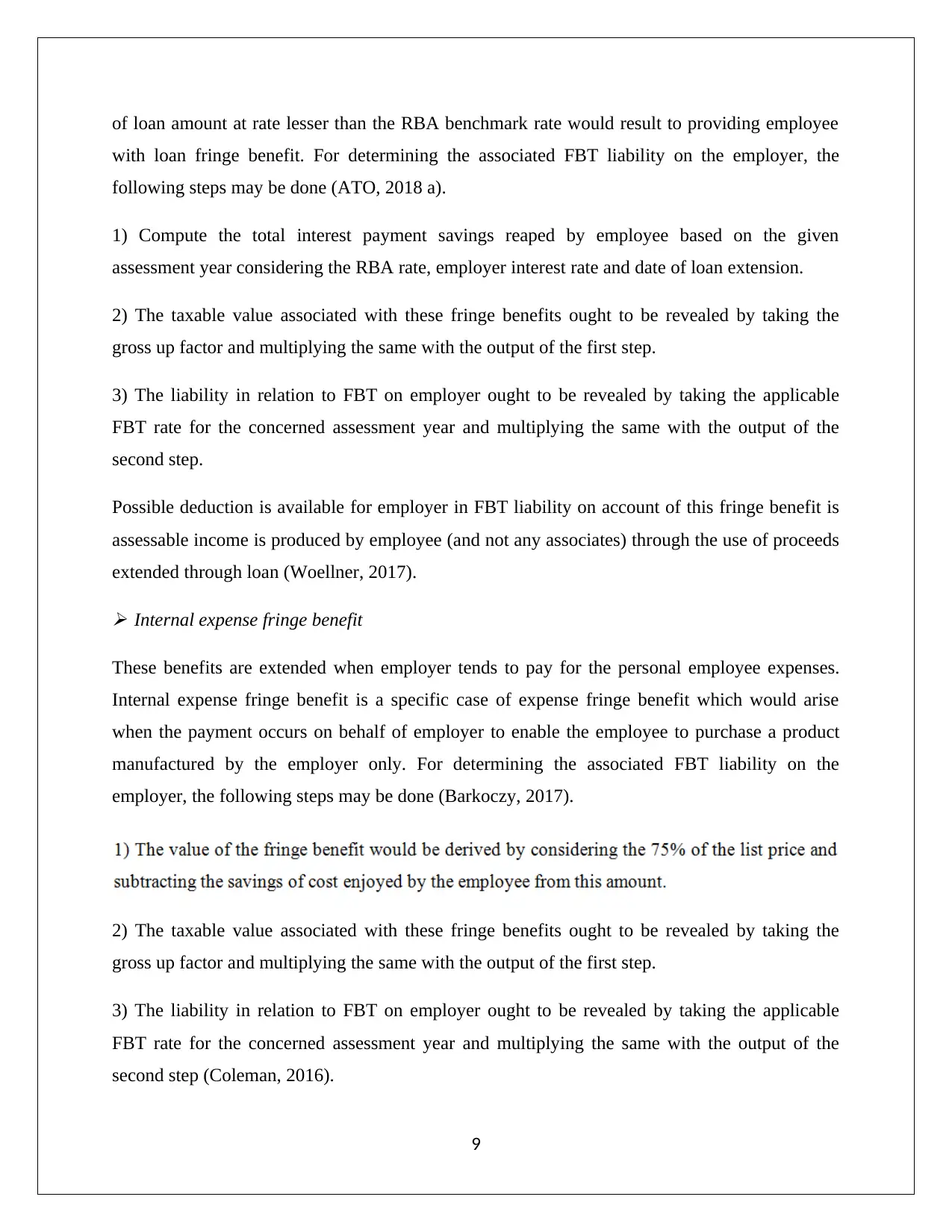

Internal expense fringe benefit

These benefits are extended when employer tends to pay for the personal employee expenses.

Internal expense fringe benefit is a specific case of expense fringe benefit which would arise

when the payment occurs on behalf of employer to enable the employee to purchase a product

manufactured by the employer only. For determining the associated FBT liability on the

employer, the following steps may be done (Barkoczy, 2017).

2) The taxable value associated with these fringe benefits ought to be revealed by taking the

gross up factor and multiplying the same with the output of the first step.

3) The liability in relation to FBT on employer ought to be revealed by taking the applicable

FBT rate for the concerned assessment year and multiplying the same with the output of the

second step (Coleman, 2016).

9

with loan fringe benefit. For determining the associated FBT liability on the employer, the

following steps may be done (ATO, 2018 a).

1) Compute the total interest payment savings reaped by employee based on the given

assessment year considering the RBA rate, employer interest rate and date of loan extension.

2) The taxable value associated with these fringe benefits ought to be revealed by taking the

gross up factor and multiplying the same with the output of the first step.

3) The liability in relation to FBT on employer ought to be revealed by taking the applicable

FBT rate for the concerned assessment year and multiplying the same with the output of the

second step.

Possible deduction is available for employer in FBT liability on account of this fringe benefit is

assessable income is produced by employee (and not any associates) through the use of proceeds

extended through loan (Woellner, 2017).

Internal expense fringe benefit

These benefits are extended when employer tends to pay for the personal employee expenses.

Internal expense fringe benefit is a specific case of expense fringe benefit which would arise

when the payment occurs on behalf of employer to enable the employee to purchase a product

manufactured by the employer only. For determining the associated FBT liability on the

employer, the following steps may be done (Barkoczy, 2017).

2) The taxable value associated with these fringe benefits ought to be revealed by taking the

gross up factor and multiplying the same with the output of the first step.

3) The liability in relation to FBT on employer ought to be revealed by taking the applicable

FBT rate for the concerned assessment year and multiplying the same with the output of the

second step (Coleman, 2016).

9

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

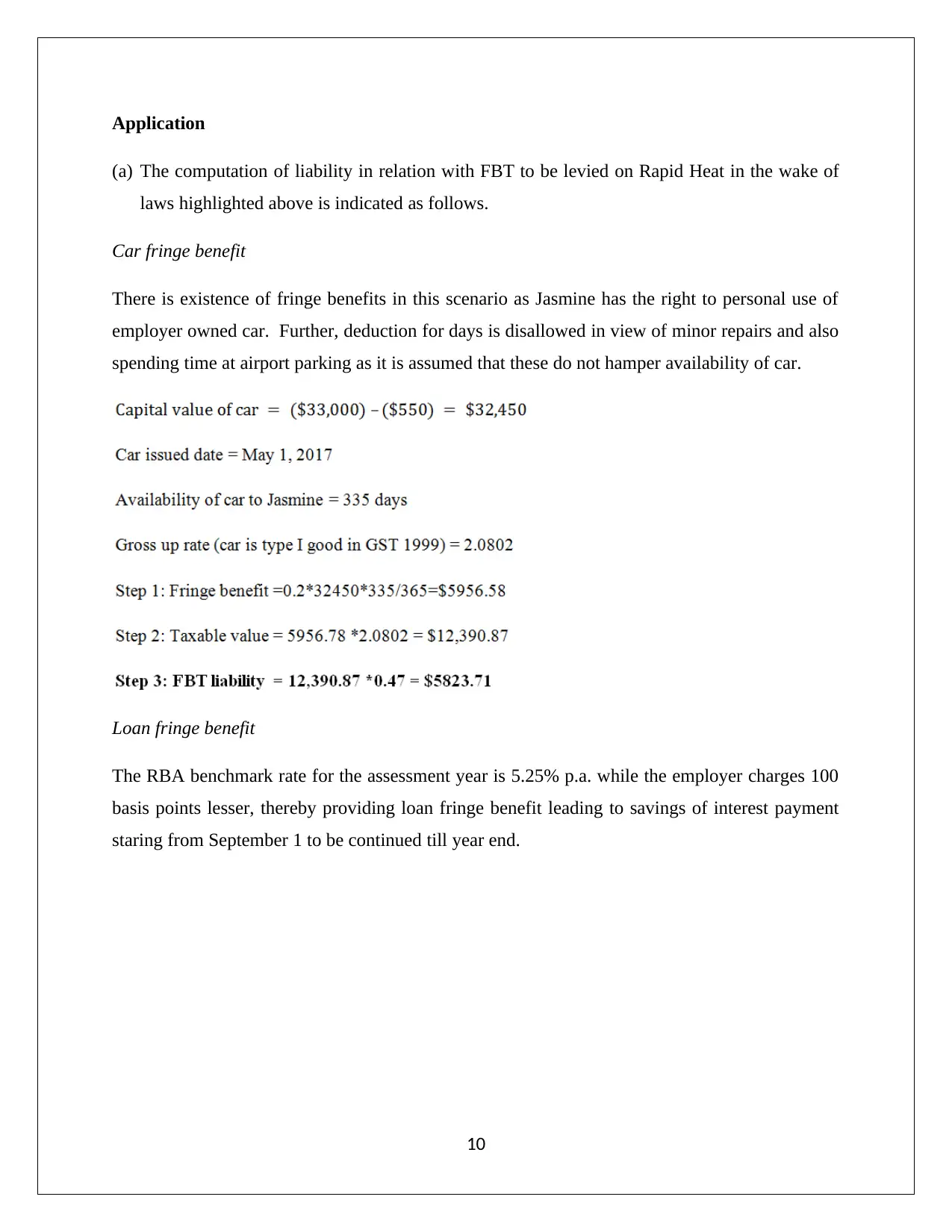

Application

(a) The computation of liability in relation with FBT to be levied on Rapid Heat in the wake of

laws highlighted above is indicated as follows.

Car fringe benefit

There is existence of fringe benefits in this scenario as Jasmine has the right to personal use of

employer owned car. Further, deduction for days is disallowed in view of minor repairs and also

spending time at airport parking as it is assumed that these do not hamper availability of car.

Loan fringe benefit

The RBA benchmark rate for the assessment year is 5.25% p.a. while the employer charges 100

basis points lesser, thereby providing loan fringe benefit leading to savings of interest payment

staring from September 1 to be continued till year end.

10

(a) The computation of liability in relation with FBT to be levied on Rapid Heat in the wake of

laws highlighted above is indicated as follows.

Car fringe benefit

There is existence of fringe benefits in this scenario as Jasmine has the right to personal use of

employer owned car. Further, deduction for days is disallowed in view of minor repairs and also

spending time at airport parking as it is assumed that these do not hamper availability of car.

Loan fringe benefit

The RBA benchmark rate for the assessment year is 5.25% p.a. while the employer charges 100

basis points lesser, thereby providing loan fringe benefit leading to savings of interest payment

staring from September 1 to be continued till year end.

10

The loan provided is divided into two components. One component is expected to produce some

rebate in FBT for Rapid Heat as the holiday home purchased by Jasmine may act as a source of

taxable income for Jasmine. However, the other component would not provide any FBT relief as

the same is used by associate (husband).

Internal expense fringe benefit

The employer producer electric heater and provides to buyer @ 2,600 per heater. In case of

Jasmine, half of the amount is paid by employer and hence Jasmine only has to pay $ 1,300 to

buy the heater.

(b) The component of loan earlier utilised by husband is not brought back to Jasmine who

utilises it for the same purpose as her husband. Assessable income generation is possible in

terms of dividends received on shares held and incremental FBT reduction to the tune of $

500 may arise as demonstrated below.

11

rebate in FBT for Rapid Heat as the holiday home purchased by Jasmine may act as a source of

taxable income for Jasmine. However, the other component would not provide any FBT relief as

the same is used by associate (husband).

Internal expense fringe benefit

The employer producer electric heater and provides to buyer @ 2,600 per heater. In case of

Jasmine, half of the amount is paid by employer and hence Jasmine only has to pay $ 1,300 to

buy the heater.

(b) The component of loan earlier utilised by husband is not brought back to Jasmine who

utilises it for the same purpose as her husband. Assessable income generation is possible in

terms of dividends received on shares held and incremental FBT reduction to the tune of $

500 may arise as demonstrated below.

11

Conclusion

It would be correct to conclude that the employer would have to pay FBT on account of the

fringe benefits doled to Jasmine while no liability would fall on Jasmine. Some deduction in FBT

for employer could be viable based on the utilisation of the loan proceeds by Jasmine.

.

12

It would be correct to conclude that the employer would have to pay FBT on account of the

fringe benefits doled to Jasmine while no liability would fall on Jasmine. Some deduction in FBT

for employer could be viable based on the utilisation of the loan proceeds by Jasmine.

.

12

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

References

ATO, (1994) Taxation Ruling –TR 94/29 [Online]. Available at: Income tax: capital gains tax

consequences of a contract for the sale of land falling through.

https://www.ato.gov.au/law/view/document?DocID=TXR/TR9429/NAT/ATO/

00001&PiT=99991231235958 (Accessed: 30 September 2018)

ATO, (2018 a) Loan Fringe Benefits https://www.ato.gov.au/General/Fringe-benefits-tax-

(FBT)/Types-of-fringe-benefits/Loan-fringe-benefits/ (Accessed: 30 September 2018)

ATO, (2018 b) Fringe Benefits Tax- A Guide For Employers.

http://law.ato.gov.au/atolaw/view.htm?DocID=SAV%2FFBTGEMP%2F00010 (Accessed: 30

September 2018)

Austlii, (2018 a) Income Tax Assessment Act 1997- SECT 149.10 [Online]. Available at:

http://www5.austlii.edu.au/au/legis/cth/consol_act/itaa1997240/s149.10.html (Accessed: 30

September 2018)

Austlii, (2018 b) Income Tax Assessment Act 1997- SECT 110.25.General Rules About Cost

Base [Online]. Available at:

http://www5.austlii.edu.au/au/legis/cth/consol_act/itaa1997240/s104.5.html (Accessed: 30

September 2018)

Barkoczy, S. (2017) Foundation of Taxation Law 2017. 9th ed. Sydney: Oxford University Press.

Coleman, C. (2016) Australian Tax Analysis. 4th ed. Sydney: Thomson Reuters (Professional)

Australia.

Krever, R. (2017) Australian Taxation Law Cases 2017. 2nd ed. Brisbane: THOMSON

LAWBOOK Company.

Nethercott, L., Richardson, G., & Devos, K. (2016) Australian Taxation Study Manual 2016. 8th

ed. Sydney: Oxford University Press.

Reuters, T. (2017) Australian Tax Legislation (2017). 4th ed. Sydney. THOMSON REUTERS.

13

ATO, (1994) Taxation Ruling –TR 94/29 [Online]. Available at: Income tax: capital gains tax

consequences of a contract for the sale of land falling through.

https://www.ato.gov.au/law/view/document?DocID=TXR/TR9429/NAT/ATO/

00001&PiT=99991231235958 (Accessed: 30 September 2018)

ATO, (2018 a) Loan Fringe Benefits https://www.ato.gov.au/General/Fringe-benefits-tax-

(FBT)/Types-of-fringe-benefits/Loan-fringe-benefits/ (Accessed: 30 September 2018)

ATO, (2018 b) Fringe Benefits Tax- A Guide For Employers.

http://law.ato.gov.au/atolaw/view.htm?DocID=SAV%2FFBTGEMP%2F00010 (Accessed: 30

September 2018)

Austlii, (2018 a) Income Tax Assessment Act 1997- SECT 149.10 [Online]. Available at:

http://www5.austlii.edu.au/au/legis/cth/consol_act/itaa1997240/s149.10.html (Accessed: 30

September 2018)

Austlii, (2018 b) Income Tax Assessment Act 1997- SECT 110.25.General Rules About Cost

Base [Online]. Available at:

http://www5.austlii.edu.au/au/legis/cth/consol_act/itaa1997240/s104.5.html (Accessed: 30

September 2018)

Barkoczy, S. (2017) Foundation of Taxation Law 2017. 9th ed. Sydney: Oxford University Press.

Coleman, C. (2016) Australian Tax Analysis. 4th ed. Sydney: Thomson Reuters (Professional)

Australia.

Krever, R. (2017) Australian Taxation Law Cases 2017. 2nd ed. Brisbane: THOMSON

LAWBOOK Company.

Nethercott, L., Richardson, G., & Devos, K. (2016) Australian Taxation Study Manual 2016. 8th

ed. Sydney: Oxford University Press.

Reuters, T. (2017) Australian Tax Legislation (2017). 4th ed. Sydney. THOMSON REUTERS.

13

Sadiq, K., Coleman, C., Hanegbi, R., Jogarajan, S., Krever, R., Obst, W., and Ting, A.

(2015) Principles of Taxation Law 2015. 7th ed. Pymont: Thomson Reuters.

Wilmot, C. (2014) FBT Compliance guide. 6th ed. North Ryde: CCH Australia Limited.

Woellner, R. (2014) Australian taxation law 2014. 8th ed. North Ryde: CCH Australia.

14

(2015) Principles of Taxation Law 2015. 7th ed. Pymont: Thomson Reuters.

Wilmot, C. (2014) FBT Compliance guide. 6th ed. North Ryde: CCH Australia Limited.

Woellner, R. (2014) Australian taxation law 2014. 8th ed. North Ryde: CCH Australia.

14

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.