Taxation: Income, Deductions, and Taxable Income Analysis

VerifiedAdded on 2022/10/17

|11

|1399

|287

Homework Assignment

AI Summary

This taxation assignment analyzes various financial transactions to determine their tax implications. It covers earnings, further benefits, investment earnings, marriage celebrant fees, bingo winnings, settlement proceeds, superannuation payments, sale of residence, sale of personal items, work expenses, and car expenses. The analysis applies relevant sections of the Income Tax Assessment Act 1997 (ITAA 97) and other legal precedents to classify income as ordinary income, statutory income, or capital gains. It calculates taxable income, medicare levy, and tax payable, including PAYG and franking credits. The assignment assesses the impact of each transaction, distinguishing between assessable income, non-deductible expenses, and capital gains, providing a comprehensive overview of tax liabilities.

Running head: TAXATION

Taxation

Name of the Student

Name of the University

Author Note

Taxation

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION

1. Earnings from Koles:

Issue

The tax implications of the given transactions.

Reason

ITAA 97, s 6.5: all receipts received that can be treated as an income through the

ordinary concepts is required to be treated as ordinary income.

PAYG is required to be deducted from net tax.

ITAA 97, s 15.2: allowance to employee is to be treated as statutory income.

Impact on income

$80000 – to be treated as ordinary income as per ITAA 97, s 6.5.

$24000 – needs to be deducted from net tax.

$10000 – statutory income as per ITAA 97, s 15.2.

$(5000 + 5000) = $ 10000 - statutory income as per ITAA 97, s 15.2.

$1000 – it cannot be treated as a gift. statutory income as per ITAA 97, s 15.2.

$1000 – not to be included in assessable income as it has not been received in the

furtherance of employment.

2. Further Benefits from Koles

Issue

The tax implications of the given transactions.

1. Earnings from Koles:

Issue

The tax implications of the given transactions.

Reason

ITAA 97, s 6.5: all receipts received that can be treated as an income through the

ordinary concepts is required to be treated as ordinary income.

PAYG is required to be deducted from net tax.

ITAA 97, s 15.2: allowance to employee is to be treated as statutory income.

Impact on income

$80000 – to be treated as ordinary income as per ITAA 97, s 6.5.

$24000 – needs to be deducted from net tax.

$10000 – statutory income as per ITAA 97, s 15.2.

$(5000 + 5000) = $ 10000 - statutory income as per ITAA 97, s 15.2.

$1000 – it cannot be treated as a gift. statutory income as per ITAA 97, s 15.2.

$1000 – not to be included in assessable income as it has not been received in the

furtherance of employment.

2. Further Benefits from Koles

Issue

The tax implications of the given transactions.

2TAXATION

Reason

Eisner v Macomber (1920) 252 US 189: lump sum receipt is required to be treated as a

capital gain as it does not comply with the flow concept.

ITAA 97, s 15.2: allowance to employee is to be treated as statutory income.

Impact in income

$10000 – lump sum capital receipt.

$3000 - statutory income as per ITAA 97, s 15.2.

$1500 – Flyer points not assessable income.

3. Investment Earnings

Issue

The tax implications of the given transactions.

Reason

ITAA 97, s 6.5: all receipts received that can be treated as an income through the

ordinary concepts is required to be treated as ordinary income.

ITAA 97, s 44: dividends are to be treated as statutory income.

Franking credit needs to be deducted from net tax.

Impact

$500 - to be treated as ordinary income as per ITAA 97, s 6.5.

$14000 – as statutory as per ITAA 97, s 44.

Reason

Eisner v Macomber (1920) 252 US 189: lump sum receipt is required to be treated as a

capital gain as it does not comply with the flow concept.

ITAA 97, s 15.2: allowance to employee is to be treated as statutory income.

Impact in income

$10000 – lump sum capital receipt.

$3000 - statutory income as per ITAA 97, s 15.2.

$1500 – Flyer points not assessable income.

3. Investment Earnings

Issue

The tax implications of the given transactions.

Reason

ITAA 97, s 6.5: all receipts received that can be treated as an income through the

ordinary concepts is required to be treated as ordinary income.

ITAA 97, s 44: dividends are to be treated as statutory income.

Franking credit needs to be deducted from net tax.

Impact

$500 - to be treated as ordinary income as per ITAA 97, s 6.5.

$14000 – as statutory as per ITAA 97, s 44.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION

Franking credit – 1400*70/30 = $3267

4. Marriage Celebrant Fees

Issue

The tax implications of the given transactions.

Reason

ITAA 36, s 6.1: income that has been accrued from the application of personal exertion is

required to be treated as ordinary income.

Impact

$600 – needs to be treated as ordinary income as per ITAA 36, s 6.1.

5. Bingo Winnings and TAB Account

Issue

The tax implications of the given transactions.

Reason

ITAA 97, s 6.5: all receipts received that can be treated as an income through the

ordinary concepts is required to be treated as ordinary income.

Federal Coke Co Pty Ltd v FC of T 77 ATC 4255: income from windfall games are not to

be treated as assessable income, if it has not been carried out in business-like manner.

Taxation Ruling 97/11: income received form business is required to be treated as

ordinary income to be included under ITAA 97, s 6.5.

Franking credit – 1400*70/30 = $3267

4. Marriage Celebrant Fees

Issue

The tax implications of the given transactions.

Reason

ITAA 36, s 6.1: income that has been accrued from the application of personal exertion is

required to be treated as ordinary income.

Impact

$600 – needs to be treated as ordinary income as per ITAA 36, s 6.1.

5. Bingo Winnings and TAB Account

Issue

The tax implications of the given transactions.

Reason

ITAA 97, s 6.5: all receipts received that can be treated as an income through the

ordinary concepts is required to be treated as ordinary income.

Federal Coke Co Pty Ltd v FC of T 77 ATC 4255: income from windfall games are not to

be treated as assessable income, if it has not been carried out in business-like manner.

Taxation Ruling 97/11: income received form business is required to be treated as

ordinary income to be included under ITAA 97, s 6.5.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION

Impact

$1000 – not assessable

$50000 - to be treated as ordinary income as per ITAA 97, s 6.5.

$25000 - to be treated as ordinary income as per ITAA 97, s 6.5.

6. Settlement Proceeds

Issue

The tax implications of the given transactions.

Reason

FC of T v Sydney Refractive Surgery Centre Pty Ltd 2008 ATC ¶20-081: lump sum

received against a personal injury as a compensation is required to be treated capital income as

compensation replaces the income replaces the capital nature of the asset.

ITAA 97, s 8.1: the expenses that has been incurred as for personal purposes is to be

treated as non-deductible income as it comes under the negative limb of this section.

Impact

$10000: needs to be treated as a capital receipt.

$8000: non-deductible private expenditure.

7. Superannuation Payment

Issue

The tax implications of the given transactions.

Impact

$1000 – not assessable

$50000 - to be treated as ordinary income as per ITAA 97, s 6.5.

$25000 - to be treated as ordinary income as per ITAA 97, s 6.5.

6. Settlement Proceeds

Issue

The tax implications of the given transactions.

Reason

FC of T v Sydney Refractive Surgery Centre Pty Ltd 2008 ATC ¶20-081: lump sum

received against a personal injury as a compensation is required to be treated capital income as

compensation replaces the income replaces the capital nature of the asset.

ITAA 97, s 8.1: the expenses that has been incurred as for personal purposes is to be

treated as non-deductible income as it comes under the negative limb of this section.

Impact

$10000: needs to be treated as a capital receipt.

$8000: non-deductible private expenditure.

7. Superannuation Payment

Issue

The tax implications of the given transactions.

5TAXATION

Reason

Under the benefits phase of superannuation, the receipts that has been received as lump

sum is to be treated as capital receipt and to be subjected to taxation as statutory income.

Impact

$50000 – needs to be treated as statutory income.

8. Sale of Residence

Issue

The tax implications of the given transactions.

Reasons

ITAA 97, 104.10: a CGT event is required to be classified as an A1 event when it

involves disposal of a property by way of sale. The gain accrued from the same would be

included as a statutory income.

ITAA 97, s 118.20: any proceeds that has been accruing from a property used as a

residential property is required to be treated as an exempt from being subjected to taxation.

However, for the claiming of such exemption, the property should have been used as a resident

and should not have been rented out.

In case the property has been used as a rental property for a part of the time it has been

held, the rent thus incurred is required to be treated as an assessable income.

Impact

Cost Base = $(500000 – 25000) = $ 475000

Cost Proceed = $(1000000 – 25000) = $ 975000

Reason

Under the benefits phase of superannuation, the receipts that has been received as lump

sum is to be treated as capital receipt and to be subjected to taxation as statutory income.

Impact

$50000 – needs to be treated as statutory income.

8. Sale of Residence

Issue

The tax implications of the given transactions.

Reasons

ITAA 97, 104.10: a CGT event is required to be classified as an A1 event when it

involves disposal of a property by way of sale. The gain accrued from the same would be

included as a statutory income.

ITAA 97, s 118.20: any proceeds that has been accruing from a property used as a

residential property is required to be treated as an exempt from being subjected to taxation.

However, for the claiming of such exemption, the property should have been used as a resident

and should not have been rented out.

In case the property has been used as a rental property for a part of the time it has been

held, the rent thus incurred is required to be treated as an assessable income.

Impact

Cost Base = $(500000 – 25000) = $ 475000

Cost Proceed = $(1000000 – 25000) = $ 975000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION

CGT gain = $ 500000

CGT gain after discount (div 115) = $(50% * 500000) = $250000

$ 250000 – needs to be treated as capital gain.

Amount received as rent needs to be treated assessable income. However, the exemption

of capital gain will not be included as it has been rented out by the taxpayer.

9. Sale of Personal Things

Issue

The tax implications of the given transactions.

Reason

ITAA 97, subdiv 108C: any capital gain that has been accrued from the sale of an item

held for personal use if the acquisition cost is above $10000.

Impact

$11000 – needs to be treated as a capital gain.

10. Work Expenses

Issue

The tax implications of the given transactions.

Reason

ITAA 97, s 8.1: any outgoing that has been accrued in the furtherance of the process of

earning income is to be treated as a deduction from the assessable income. In case it has been

CGT gain = $ 500000

CGT gain after discount (div 115) = $(50% * 500000) = $250000

$ 250000 – needs to be treated as capital gain.

Amount received as rent needs to be treated assessable income. However, the exemption

of capital gain will not be included as it has been rented out by the taxpayer.

9. Sale of Personal Things

Issue

The tax implications of the given transactions.

Reason

ITAA 97, subdiv 108C: any capital gain that has been accrued from the sale of an item

held for personal use if the acquisition cost is above $10000.

Impact

$11000 – needs to be treated as a capital gain.

10. Work Expenses

Issue

The tax implications of the given transactions.

Reason

ITAA 97, s 8.1: any outgoing that has been accrued in the furtherance of the process of

earning income is to be treated as a deduction from the assessable income. In case it has been

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION

proved that the expense has been accrued from a personal purpose it would not be allowed as a

deduction.

Impact

$4000 – non-deductible as incurred from personal purpose.

$3000 - non-deductible as incurred from personal purpose.

$1000 - non-deductible as incurred from personal purpose.

$5000 - non-deductible as incurred from personal purpose.

11. Car Expenses

Issue

The tax implications of the given transactions.

Reason

FBTAA, s 7: car FBT accrues when a car is provided to an employee by an employer.

Impact

[0.2 * car BV * (no. of days in the taxation year when the car has been provided / no. of

days in the year)] – employee’s contribution

= C x (100 % - BP)]

= 10000 * 50%

= 5000.

Particulars Amount Amount

proved that the expense has been accrued from a personal purpose it would not be allowed as a

deduction.

Impact

$4000 – non-deductible as incurred from personal purpose.

$3000 - non-deductible as incurred from personal purpose.

$1000 - non-deductible as incurred from personal purpose.

$5000 - non-deductible as incurred from personal purpose.

11. Car Expenses

Issue

The tax implications of the given transactions.

Reason

FBTAA, s 7: car FBT accrues when a car is provided to an employee by an employer.

Impact

[0.2 * car BV * (no. of days in the taxation year when the car has been provided / no. of

days in the year)] – employee’s contribution

= C x (100 % - BP)]

= 10000 * 50%

= 5000.

Particulars Amount Amount

8TAXATION

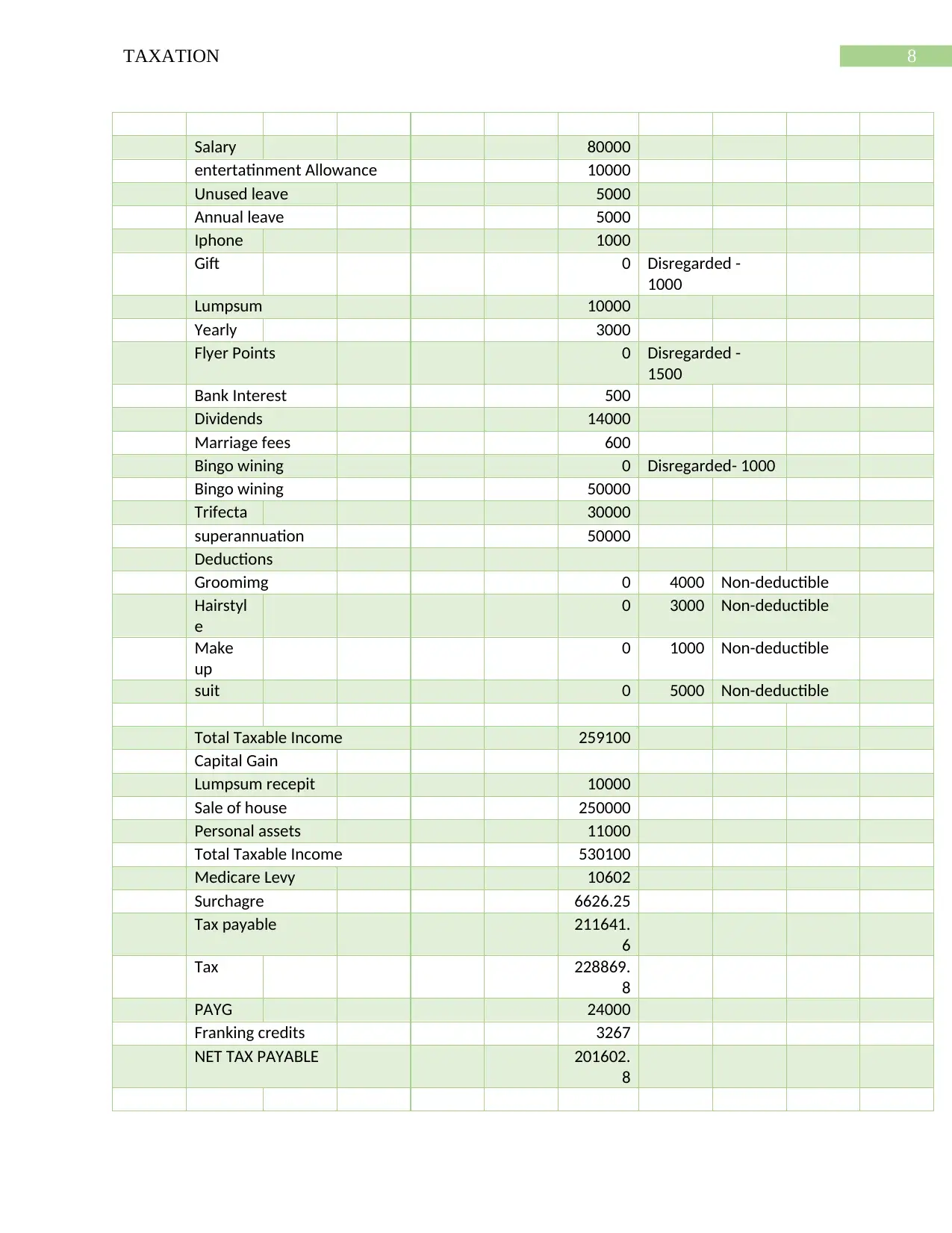

Salary 80000

entertatinment Allowance 10000

Unused leave 5000

Annual leave 5000

Iphone 1000

Gift 0 Disregarded -

1000

Lumpsum 10000

Yearly 3000

Flyer Points 0 Disregarded -

1500

Bank Interest 500

Dividends 14000

Marriage fees 600

Bingo wining 0 Disregarded- 1000

Bingo wining 50000

Trifecta 30000

superannuation 50000

Deductions

Groomimg 0 4000 Non-deductible

Hairstyl

e

0 3000 Non-deductible

Make

up

0 1000 Non-deductible

suit 0 5000 Non-deductible

Total Taxable Income 259100

Capital Gain

Lumpsum recepit 10000

Sale of house 250000

Personal assets 11000

Total Taxable Income 530100

Medicare Levy 10602

Surchagre 6626.25

Tax payable 211641.

6

Tax 228869.

8

PAYG 24000

Franking credits 3267

NET TAX PAYABLE 201602.

8

Salary 80000

entertatinment Allowance 10000

Unused leave 5000

Annual leave 5000

Iphone 1000

Gift 0 Disregarded -

1000

Lumpsum 10000

Yearly 3000

Flyer Points 0 Disregarded -

1500

Bank Interest 500

Dividends 14000

Marriage fees 600

Bingo wining 0 Disregarded- 1000

Bingo wining 50000

Trifecta 30000

superannuation 50000

Deductions

Groomimg 0 4000 Non-deductible

Hairstyl

e

0 3000 Non-deductible

Make

up

0 1000 Non-deductible

suit 0 5000 Non-deductible

Total Taxable Income 259100

Capital Gain

Lumpsum recepit 10000

Sale of house 250000

Personal assets 11000

Total Taxable Income 530100

Medicare Levy 10602

Surchagre 6626.25

Tax payable 211641.

6

Tax 228869.

8

PAYG 24000

Franking credits 3267

NET TAX PAYABLE 201602.

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION

Reference

The Income Tax Assessment Act 1997 (Cth)

The Income Tax Assessment Act 1936 (Cth)

Reference

The Income Tax Assessment Act 1997 (Cth)

The Income Tax Assessment Act 1936 (Cth)

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.