Taxation: Assessable Income and Capital Gains Tax Consequences

VerifiedAdded on 2023/01/13

|7

|1709

|84

AI Summary

This document provides an overview of taxation, focusing on assessable income and capital gains tax consequences. It includes a computation of assessable income for an individual and provides advice on capital gains tax for a retiring business owner. The document also discusses the exemptions available for certain assets and provides practical implications of tax rules and regulations.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Taxation

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK...............................................................................................................................................3

Question 1: Emmi’s Total Assessable income:...........................................................................3

Question 2: Capital Gains Tax (CGT) consequences:.................................................................4

CONCLUSIONS..............................................................................................................................6

REFERENCES................................................................................................................................7

INTRODUCTION...........................................................................................................................3

TASK...............................................................................................................................................3

Question 1: Emmi’s Total Assessable income:...........................................................................3

Question 2: Capital Gains Tax (CGT) consequences:.................................................................4

CONCLUSIONS..............................................................................................................................6

REFERENCES................................................................................................................................7

INTRODUCTION

Taxation refers to term with respect to event when any taxing authority/body, which is

generally government, levies/imposes tax. Taxation generally relates to all forms of non-

voluntary charge, from incomes/capital gain. In Australia, income tax is main source of

government's income. In country, overall taxation structure is user friendly and administrated by

Australian Taxation Office (Braithwaite and Reinhart, 2019). tax structures have greatly varied

throughout jurisdictions and over time. Taxation happens in many other contemporary systems

on the both physical assets, like property as well as particular events, including a sales transfer.

Tax policy formulation is among the most crucial and divisive questions in today's politics.

Taxes in Australia is mainly imposed by federal government on different incomes of individuals

as well as companies. Since WW-II, in country state governments haven't levied any income

taxes (Hobson, 2019). This assessment consists of two tasks, one is related to assessment of

assessable income of Emmi who is individual assessee and second task involves some advices

related to different capital gain consequences. The aim of whole assessment is to present

practical implications of rules and regulations stated in Income tax act.

TASK

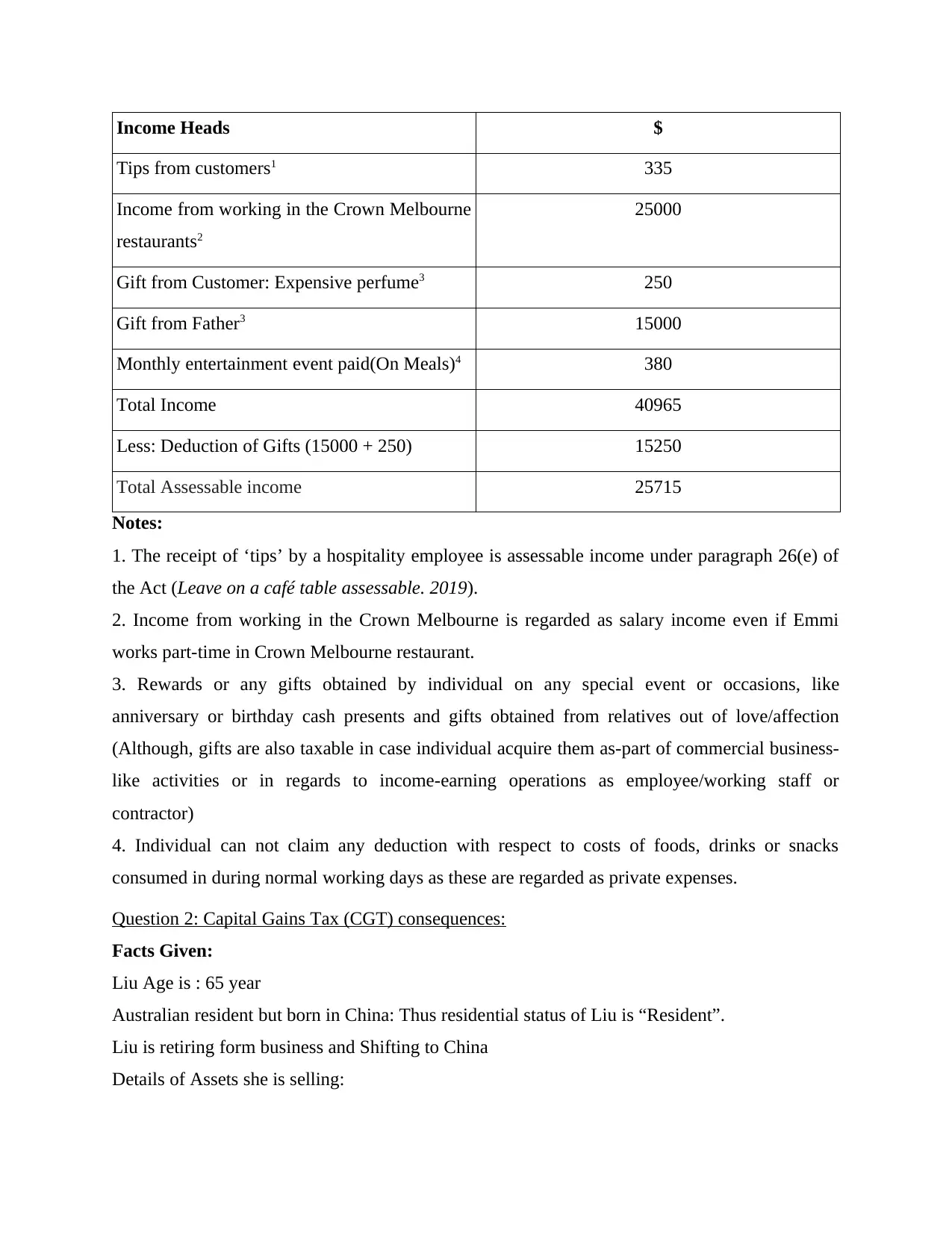

Question 1: Emmi’s Total Assessable income:

Facts Given:

Emmi studies accounting at Holmes Institute and also a part-time worker in Crown

Melbourne restaurant(Hospitality Employees).

Tips from customers: $335 cash

Income through working in the Crown Melbourne restaurants: $25,000

Expensive perfume received as gift from regular customer by Emmi at Christmas time:

worth $250 (She gave the perfume to her mother)

Monthly entertainment event paid by the restaurant owner (on the meals that Emmi

consumed): $380

Based on the above listed facts, here following is the Computation of Emmi’s Total Assessable

income, as follows:

Computation Emmi's Total Assessable Income

Taxation refers to term with respect to event when any taxing authority/body, which is

generally government, levies/imposes tax. Taxation generally relates to all forms of non-

voluntary charge, from incomes/capital gain. In Australia, income tax is main source of

government's income. In country, overall taxation structure is user friendly and administrated by

Australian Taxation Office (Braithwaite and Reinhart, 2019). tax structures have greatly varied

throughout jurisdictions and over time. Taxation happens in many other contemporary systems

on the both physical assets, like property as well as particular events, including a sales transfer.

Tax policy formulation is among the most crucial and divisive questions in today's politics.

Taxes in Australia is mainly imposed by federal government on different incomes of individuals

as well as companies. Since WW-II, in country state governments haven't levied any income

taxes (Hobson, 2019). This assessment consists of two tasks, one is related to assessment of

assessable income of Emmi who is individual assessee and second task involves some advices

related to different capital gain consequences. The aim of whole assessment is to present

practical implications of rules and regulations stated in Income tax act.

TASK

Question 1: Emmi’s Total Assessable income:

Facts Given:

Emmi studies accounting at Holmes Institute and also a part-time worker in Crown

Melbourne restaurant(Hospitality Employees).

Tips from customers: $335 cash

Income through working in the Crown Melbourne restaurants: $25,000

Expensive perfume received as gift from regular customer by Emmi at Christmas time:

worth $250 (She gave the perfume to her mother)

Monthly entertainment event paid by the restaurant owner (on the meals that Emmi

consumed): $380

Based on the above listed facts, here following is the Computation of Emmi’s Total Assessable

income, as follows:

Computation Emmi's Total Assessable Income

Income Heads $

Tips from customers1 335

Income from working in the Crown Melbourne

restaurants2

25000

Gift from Customer: Expensive perfume3 250

Gift from Father3 15000

Monthly entertainment event paid(On Meals)4 380

Total Income 40965

Less: Deduction of Gifts (15000 + 250) 15250

Total Assessable income 25715

Notes:

1. The receipt of ‘tips’ by a hospitality employee is assessable income under paragraph 26(e) of

the Act (Leave on a café table assessable. 2019).

2. Income from working in the Crown Melbourne is regarded as salary income even if Emmi

works part-time in Crown Melbourne restaurant.

3. Rewards or any gifts obtained by individual on any special event or occasions, like

anniversary or birthday cash presents and gifts obtained from relatives out of love/affection

(Although, gifts are also taxable in case individual acquire them as-part of commercial business-

like activities or in regards to income-earning operations as employee/working staff or

contractor)

4. Individual can not claim any deduction with respect to costs of foods, drinks or snacks

consumed in during normal working days as these are regarded as private expenses.

Question 2: Capital Gains Tax (CGT) consequences:

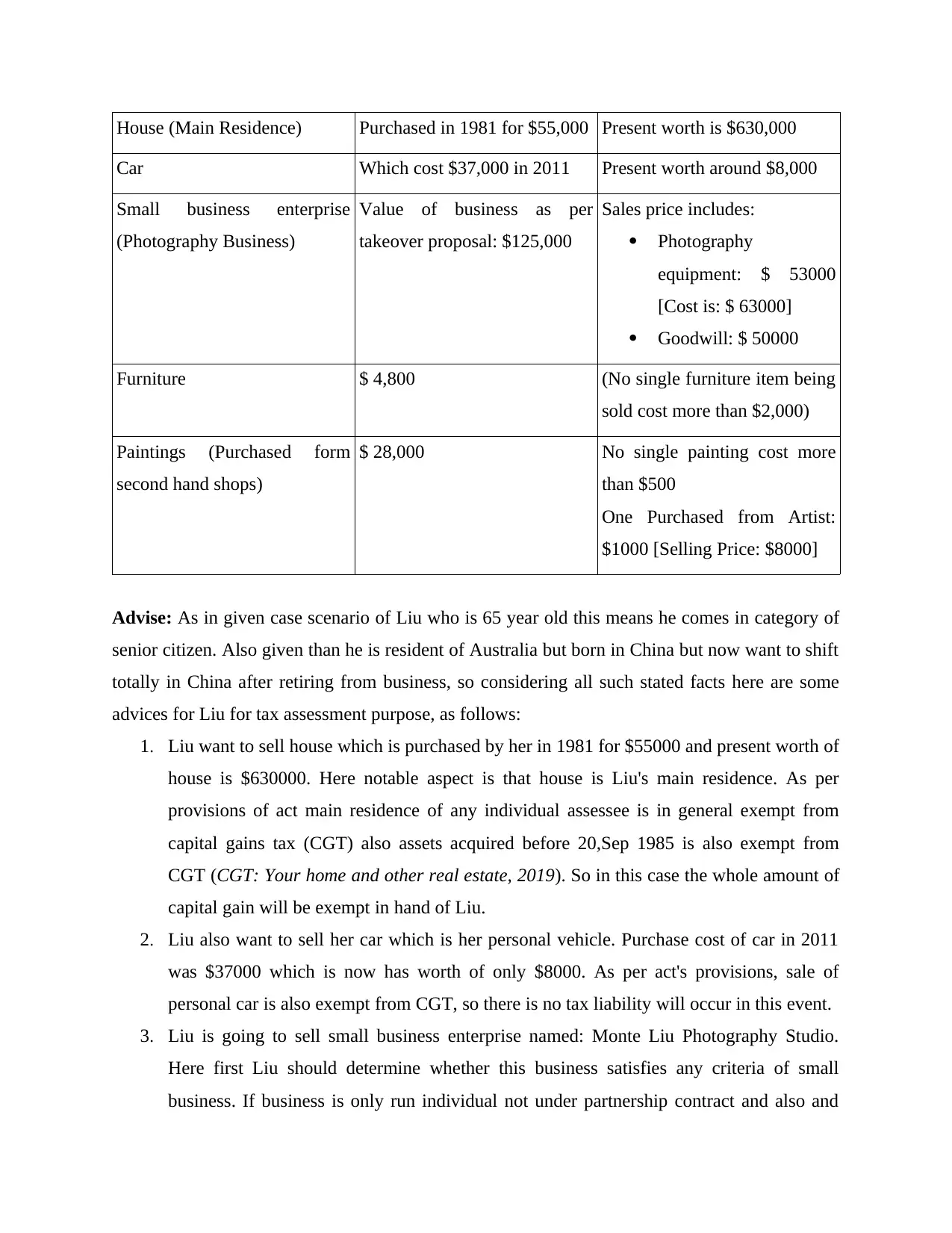

Facts Given:

Liu Age is : 65 year

Australian resident but born in China: Thus residential status of Liu is “Resident”.

Liu is retiring form business and Shifting to China

Details of Assets she is selling:

Tips from customers1 335

Income from working in the Crown Melbourne

restaurants2

25000

Gift from Customer: Expensive perfume3 250

Gift from Father3 15000

Monthly entertainment event paid(On Meals)4 380

Total Income 40965

Less: Deduction of Gifts (15000 + 250) 15250

Total Assessable income 25715

Notes:

1. The receipt of ‘tips’ by a hospitality employee is assessable income under paragraph 26(e) of

the Act (Leave on a café table assessable. 2019).

2. Income from working in the Crown Melbourne is regarded as salary income even if Emmi

works part-time in Crown Melbourne restaurant.

3. Rewards or any gifts obtained by individual on any special event or occasions, like

anniversary or birthday cash presents and gifts obtained from relatives out of love/affection

(Although, gifts are also taxable in case individual acquire them as-part of commercial business-

like activities or in regards to income-earning operations as employee/working staff or

contractor)

4. Individual can not claim any deduction with respect to costs of foods, drinks or snacks

consumed in during normal working days as these are regarded as private expenses.

Question 2: Capital Gains Tax (CGT) consequences:

Facts Given:

Liu Age is : 65 year

Australian resident but born in China: Thus residential status of Liu is “Resident”.

Liu is retiring form business and Shifting to China

Details of Assets she is selling:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

House (Main Residence) Purchased in 1981 for $55,000 Present worth is $630,000

Car Which cost $37,000 in 2011 Present worth around $8,000

Small business enterprise

(Photography Business)

Value of business as per

takeover proposal: $125,000

Sales price includes:

Photography

equipment: $ 53000

[Cost is: $ 63000]

Goodwill: $ 50000

Furniture $ 4,800 (No single furniture item being

sold cost more than $2,000)

Paintings (Purchased form

second hand shops)

$ 28,000 No single painting cost more

than $500

One Purchased from Artist:

$1000 [Selling Price: $8000]

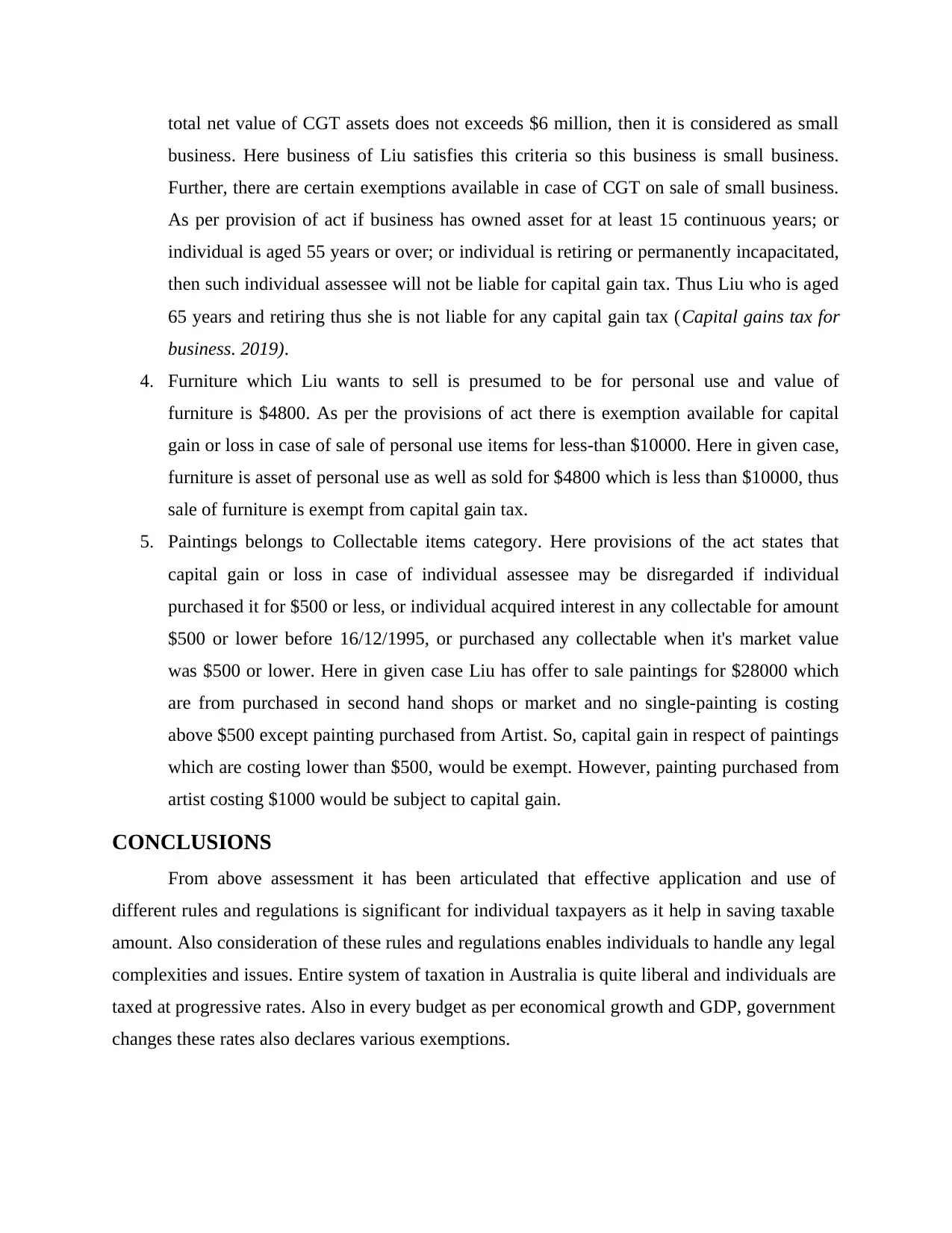

Advise: As in given case scenario of Liu who is 65 year old this means he comes in category of

senior citizen. Also given than he is resident of Australia but born in China but now want to shift

totally in China after retiring from business, so considering all such stated facts here are some

advices for Liu for tax assessment purpose, as follows:

1. Liu want to sell house which is purchased by her in 1981 for $55000 and present worth of

house is $630000. Here notable aspect is that house is Liu's main residence. As per

provisions of act main residence of any individual assessee is in general exempt from

capital gains tax (CGT) also assets acquired before 20,Sep 1985 is also exempt from

CGT (CGT: Your home and other real estate, 2019). So in this case the whole amount of

capital gain will be exempt in hand of Liu.

2. Liu also want to sell her car which is her personal vehicle. Purchase cost of car in 2011

was $37000 which is now has worth of only $8000. As per act's provisions, sale of

personal car is also exempt from CGT, so there is no tax liability will occur in this event.

3. Liu is going to sell small business enterprise named: Monte Liu Photography Studio.

Here first Liu should determine whether this business satisfies any criteria of small

business. If business is only run individual not under partnership contract and also and

Car Which cost $37,000 in 2011 Present worth around $8,000

Small business enterprise

(Photography Business)

Value of business as per

takeover proposal: $125,000

Sales price includes:

Photography

equipment: $ 53000

[Cost is: $ 63000]

Goodwill: $ 50000

Furniture $ 4,800 (No single furniture item being

sold cost more than $2,000)

Paintings (Purchased form

second hand shops)

$ 28,000 No single painting cost more

than $500

One Purchased from Artist:

$1000 [Selling Price: $8000]

Advise: As in given case scenario of Liu who is 65 year old this means he comes in category of

senior citizen. Also given than he is resident of Australia but born in China but now want to shift

totally in China after retiring from business, so considering all such stated facts here are some

advices for Liu for tax assessment purpose, as follows:

1. Liu want to sell house which is purchased by her in 1981 for $55000 and present worth of

house is $630000. Here notable aspect is that house is Liu's main residence. As per

provisions of act main residence of any individual assessee is in general exempt from

capital gains tax (CGT) also assets acquired before 20,Sep 1985 is also exempt from

CGT (CGT: Your home and other real estate, 2019). So in this case the whole amount of

capital gain will be exempt in hand of Liu.

2. Liu also want to sell her car which is her personal vehicle. Purchase cost of car in 2011

was $37000 which is now has worth of only $8000. As per act's provisions, sale of

personal car is also exempt from CGT, so there is no tax liability will occur in this event.

3. Liu is going to sell small business enterprise named: Monte Liu Photography Studio.

Here first Liu should determine whether this business satisfies any criteria of small

business. If business is only run individual not under partnership contract and also and

total net value of CGT assets does not exceeds $6 million, then it is considered as small

business. Here business of Liu satisfies this criteria so this business is small business.

Further, there are certain exemptions available in case of CGT on sale of small business.

As per provision of act if business has owned asset for at least 15 continuous years; or

individual is aged 55 years or over; or individual is retiring or permanently incapacitated,

then such individual assessee will not be liable for capital gain tax. Thus Liu who is aged

65 years and retiring thus she is not liable for any capital gain tax (Capital gains tax for

business. 2019).

4. Furniture which Liu wants to sell is presumed to be for personal use and value of

furniture is $4800. As per the provisions of act there is exemption available for capital

gain or loss in case of sale of personal use items for less-than $10000. Here in given case,

furniture is asset of personal use as well as sold for $4800 which is less than $10000, thus

sale of furniture is exempt from capital gain tax.

5. Paintings belongs to Collectable items category. Here provisions of the act states that

capital gain or loss in case of individual assessee may be disregarded if individual

purchased it for $500 or less, or individual acquired interest in any collectable for amount

$500 or lower before 16/12/1995, or purchased any collectable when it's market value

was $500 or lower. Here in given case Liu has offer to sale paintings for $28000 which

are from purchased in second hand shops or market and no single-painting is costing

above $500 except painting purchased from Artist. So, capital gain in respect of paintings

which are costing lower than $500, would be exempt. However, painting purchased from

artist costing $1000 would be subject to capital gain.

CONCLUSIONS

From above assessment it has been articulated that effective application and use of

different rules and regulations is significant for individual taxpayers as it help in saving taxable

amount. Also consideration of these rules and regulations enables individuals to handle any legal

complexities and issues. Entire system of taxation in Australia is quite liberal and individuals are

taxed at progressive rates. Also in every budget as per economical growth and GDP, government

changes these rates also declares various exemptions.

business. Here business of Liu satisfies this criteria so this business is small business.

Further, there are certain exemptions available in case of CGT on sale of small business.

As per provision of act if business has owned asset for at least 15 continuous years; or

individual is aged 55 years or over; or individual is retiring or permanently incapacitated,

then such individual assessee will not be liable for capital gain tax. Thus Liu who is aged

65 years and retiring thus she is not liable for any capital gain tax (Capital gains tax for

business. 2019).

4. Furniture which Liu wants to sell is presumed to be for personal use and value of

furniture is $4800. As per the provisions of act there is exemption available for capital

gain or loss in case of sale of personal use items for less-than $10000. Here in given case,

furniture is asset of personal use as well as sold for $4800 which is less than $10000, thus

sale of furniture is exempt from capital gain tax.

5. Paintings belongs to Collectable items category. Here provisions of the act states that

capital gain or loss in case of individual assessee may be disregarded if individual

purchased it for $500 or less, or individual acquired interest in any collectable for amount

$500 or lower before 16/12/1995, or purchased any collectable when it's market value

was $500 or lower. Here in given case Liu has offer to sale paintings for $28000 which

are from purchased in second hand shops or market and no single-painting is costing

above $500 except painting purchased from Artist. So, capital gain in respect of paintings

which are costing lower than $500, would be exempt. However, painting purchased from

artist costing $1000 would be subject to capital gain.

CONCLUSIONS

From above assessment it has been articulated that effective application and use of

different rules and regulations is significant for individual taxpayers as it help in saving taxable

amount. Also consideration of these rules and regulations enables individuals to handle any legal

complexities and issues. Entire system of taxation in Australia is quite liberal and individuals are

taxed at progressive rates. Also in every budget as per economical growth and GDP, government

changes these rates also declares various exemptions.

REFERENCES

Books and Journals:

Braithwaite, V. and Reinhart, M., 2019. Preliminary Findings and Codebook for the Australian

Tax System: Fair or Not Survey. Centre for Tax System Integrity (CTSI), Research

School of Social Sciences, The Australian National University.

Hobson, K., 2019. 'Say no to the ATO': The cultural politics of protest against the Australian

Tax Office. Centre for Tax System Integrity (CTSI), Research School of Social

Sciences, The Australian National University.

Murphy, K., 2019. Moving towards a more effective model of regulatory enforcement in the

Australian Taxation Office. Centre for Tax System Integrity (CTSI), Research School of

Social Sciences, The Australian National University.

Online:

CGT: Your home and other real estate. 2019. [Online]. Available through:

<https://www.ato.gov.au/General/Capital-gains-tax/Your-home-and-other-real-estate/>

CGT assets and exemptions. 2019. [Online]. Available through:

<https://www.ato.gov.au/general/capital-gains-tax/cgt-assets-and

exemptions/#Personal_use_assets>

Capital gains tax for business. 2019. [Online]. Available through:

<https://www.business.gov.au/Finance/Taxation/Capital-gains-tax-for-business>

Leave on a café table assessable. 2019. [Online]. Available through:

<https://www.lewistaxation.com.au/business/general-business/tax-on-tips-gratuities>

Books and Journals:

Braithwaite, V. and Reinhart, M., 2019. Preliminary Findings and Codebook for the Australian

Tax System: Fair or Not Survey. Centre for Tax System Integrity (CTSI), Research

School of Social Sciences, The Australian National University.

Hobson, K., 2019. 'Say no to the ATO': The cultural politics of protest against the Australian

Tax Office. Centre for Tax System Integrity (CTSI), Research School of Social

Sciences, The Australian National University.

Murphy, K., 2019. Moving towards a more effective model of regulatory enforcement in the

Australian Taxation Office. Centre for Tax System Integrity (CTSI), Research School of

Social Sciences, The Australian National University.

Online:

CGT: Your home and other real estate. 2019. [Online]. Available through:

<https://www.ato.gov.au/General/Capital-gains-tax/Your-home-and-other-real-estate/>

CGT assets and exemptions. 2019. [Online]. Available through:

<https://www.ato.gov.au/general/capital-gains-tax/cgt-assets-and

exemptions/#Personal_use_assets>

Capital gains tax for business. 2019. [Online]. Available through:

<https://www.business.gov.au/Finance/Taxation/Capital-gains-tax-for-business>

Leave on a café table assessable. 2019. [Online]. Available through:

<https://www.lewistaxation.com.au/business/general-business/tax-on-tips-gratuities>

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.