6004LBSAF Taxation: Income Tax, NICs, and Self-Employment Analysis

VerifiedAdded on 2023/06/12

|17

|3204

|207

Report

AI Summary

This report provides a detailed analysis of Bridget's tax liabilities under two different scenarios: employment and self-employment, in accordance with the UK's taxation laws. The employment scenario includes calculations of property income, taxable employment income, savings income, and dividend income, followed by the computation of total income tax and National Insurance Contributions (NICs) payable by both Bridget and her employer, Air Engineering Limited. The self-employment scenario covers the calculation of income from self-employment, allowable deductions, and taxable income, along with the computation of income tax and NICs. It also includes a memo offering advice on option selection or tax planning, suggesting that employment is more advantageous due to lower tax liability compared to self-employment. Desklib offers a range of solved assignments and past papers for students.

TAXATION

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

SECTION A.....................................................................................................................................3

Option 1: Employment....................................................................................................................3

1. Calculation of Property Income taxable in 2022-23................................................................3

2. Calculation of total income tax payable by Bridget for 2022-23............................................6

3. Calculation of National Insurance Contributions payable by Bridget for 2022-2023.............7

4. Calculation of NIC payable by Air Engineering Limited........................................................7

Option: 2 – Self employment...........................................................................................................7

1. Calculation of total income tax payable by Bridget for 2022-23............................................9

2. Calculation of amount of NIC payable by Bridget 2022-23..................................................10

3. Calculation of amount of employer NIC payable by Bridget................................................10

SECTION B...................................................................................................................................10

REFERENCES................................................................................................................................1

1

SECTION A.....................................................................................................................................3

Option 1: Employment....................................................................................................................3

1. Calculation of Property Income taxable in 2022-23................................................................3

2. Calculation of total income tax payable by Bridget for 2022-23............................................6

3. Calculation of National Insurance Contributions payable by Bridget for 2022-2023.............7

4. Calculation of NIC payable by Air Engineering Limited........................................................7

Option: 2 – Self employment...........................................................................................................7

1. Calculation of total income tax payable by Bridget for 2022-23............................................9

2. Calculation of amount of NIC payable by Bridget 2022-23..................................................10

3. Calculation of amount of employer NIC payable by Bridget................................................10

SECTION B...................................................................................................................................10

REFERENCES................................................................................................................................1

1

SECTION A

Option 1: Employment

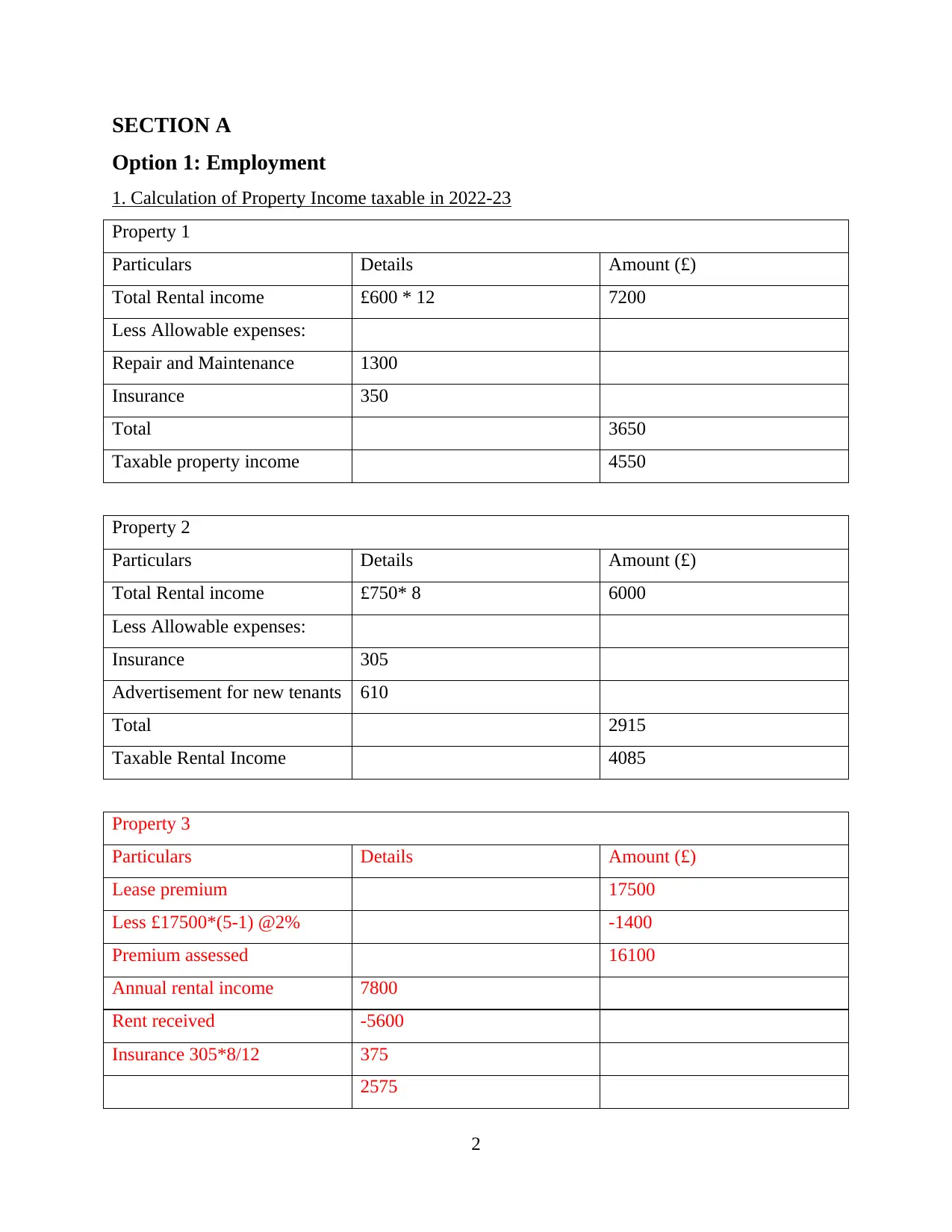

1. Calculation of Property Income taxable in 2022-23

Property 1

Particulars Details Amount (£)

Total Rental income £600 * 12 7200

Less Allowable expenses:

Repair and Maintenance 1300

Insurance 350

Total 3650

Taxable property income 4550

Property 2

Particulars Details Amount (£)

Total Rental income £750* 8 6000

Less Allowable expenses:

Insurance 305

Advertisement for new tenants 610

Total 2915

Taxable Rental Income 4085

Property 3

Particulars Details Amount (£)

Lease premium 17500

Less £17500*(5-1) @2% -1400

Premium assessed 16100

Annual rental income 7800

Rent received -5600

Insurance 305*8/12 375

2575

2

Option 1: Employment

1. Calculation of Property Income taxable in 2022-23

Property 1

Particulars Details Amount (£)

Total Rental income £600 * 12 7200

Less Allowable expenses:

Repair and Maintenance 1300

Insurance 350

Total 3650

Taxable property income 4550

Property 2

Particulars Details Amount (£)

Total Rental income £750* 8 6000

Less Allowable expenses:

Insurance 305

Advertisement for new tenants 610

Total 2915

Taxable Rental Income 4085

Property 3

Particulars Details Amount (£)

Lease premium 17500

Less £17500*(5-1) @2% -1400

Premium assessed 16100

Annual rental income 7800

Rent received -5600

Insurance 305*8/12 375

2575

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

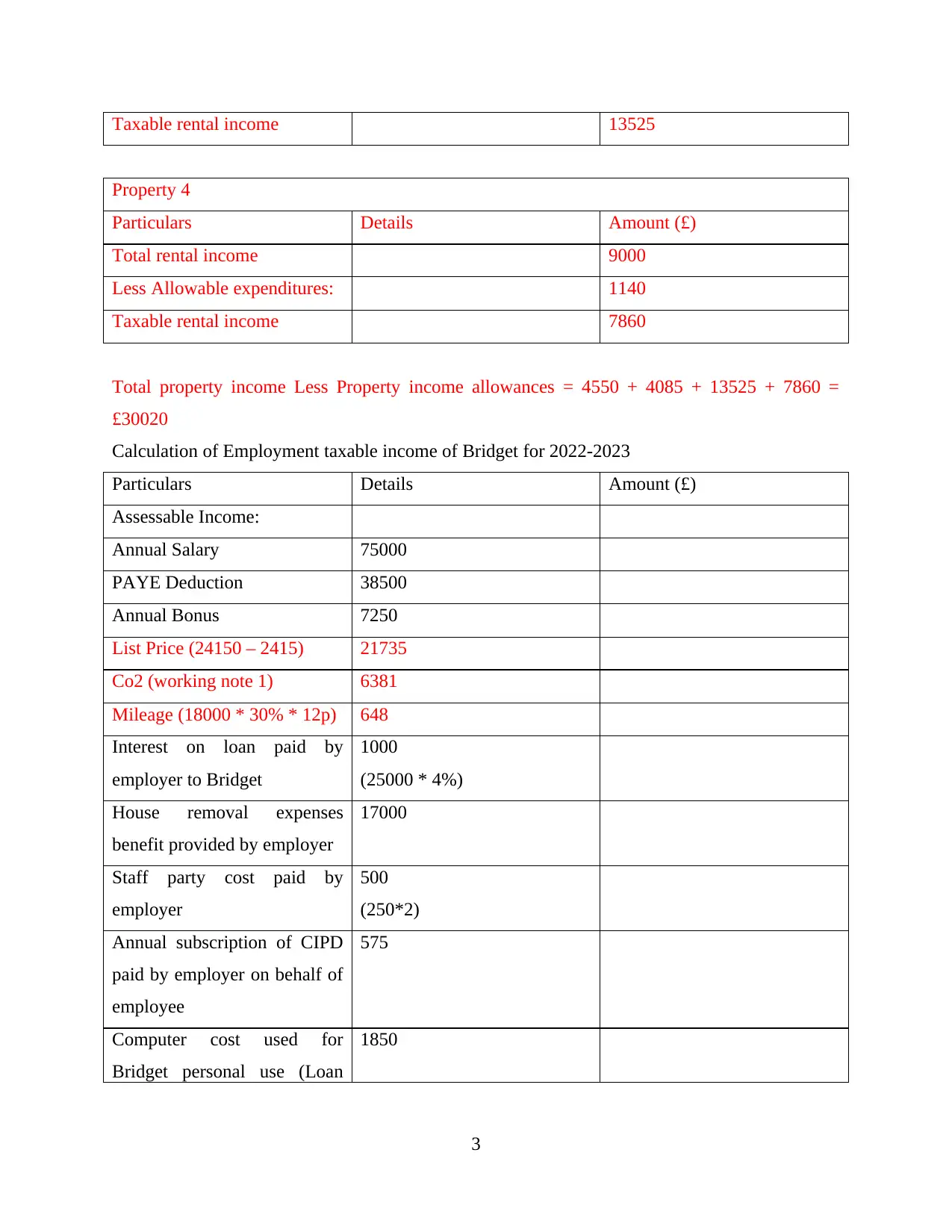

Taxable rental income 13525

Property 4

Particulars Details Amount (£)

Total rental income 9000

Less Allowable expenditures: 1140

Taxable rental income 7860

Total property income Less Property income allowances = 4550 + 4085 + 13525 + 7860 =

£30020

Calculation of Employment taxable income of Bridget for 2022-2023

Particulars Details Amount (£)

Assessable Income:

Annual Salary 75000

PAYE Deduction 38500

Annual Bonus 7250

List Price (24150 – 2415) 21735

Co2 (working note 1) 6381

Mileage (18000 * 30% * 12p) 648

Interest on loan paid by

employer to Bridget

1000

(25000 * 4%)

House removal expenses

benefit provided by employer

17000

Staff party cost paid by

employer

500

(250*2)

Annual subscription of CIPD

paid by employer on behalf of

employee

575

Computer cost used for

Bridget personal use (Loan

1850

3

Property 4

Particulars Details Amount (£)

Total rental income 9000

Less Allowable expenditures: 1140

Taxable rental income 7860

Total property income Less Property income allowances = 4550 + 4085 + 13525 + 7860 =

£30020

Calculation of Employment taxable income of Bridget for 2022-2023

Particulars Details Amount (£)

Assessable Income:

Annual Salary 75000

PAYE Deduction 38500

Annual Bonus 7250

List Price (24150 – 2415) 21735

Co2 (working note 1) 6381

Mileage (18000 * 30% * 12p) 648

Interest on loan paid by

employer to Bridget

1000

(25000 * 4%)

House removal expenses

benefit provided by employer

17000

Staff party cost paid by

employer

500

(250*2)

Annual subscription of CIPD

paid by employer on behalf of

employee

575

Computer cost used for

Bridget personal use (Loan

1850

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

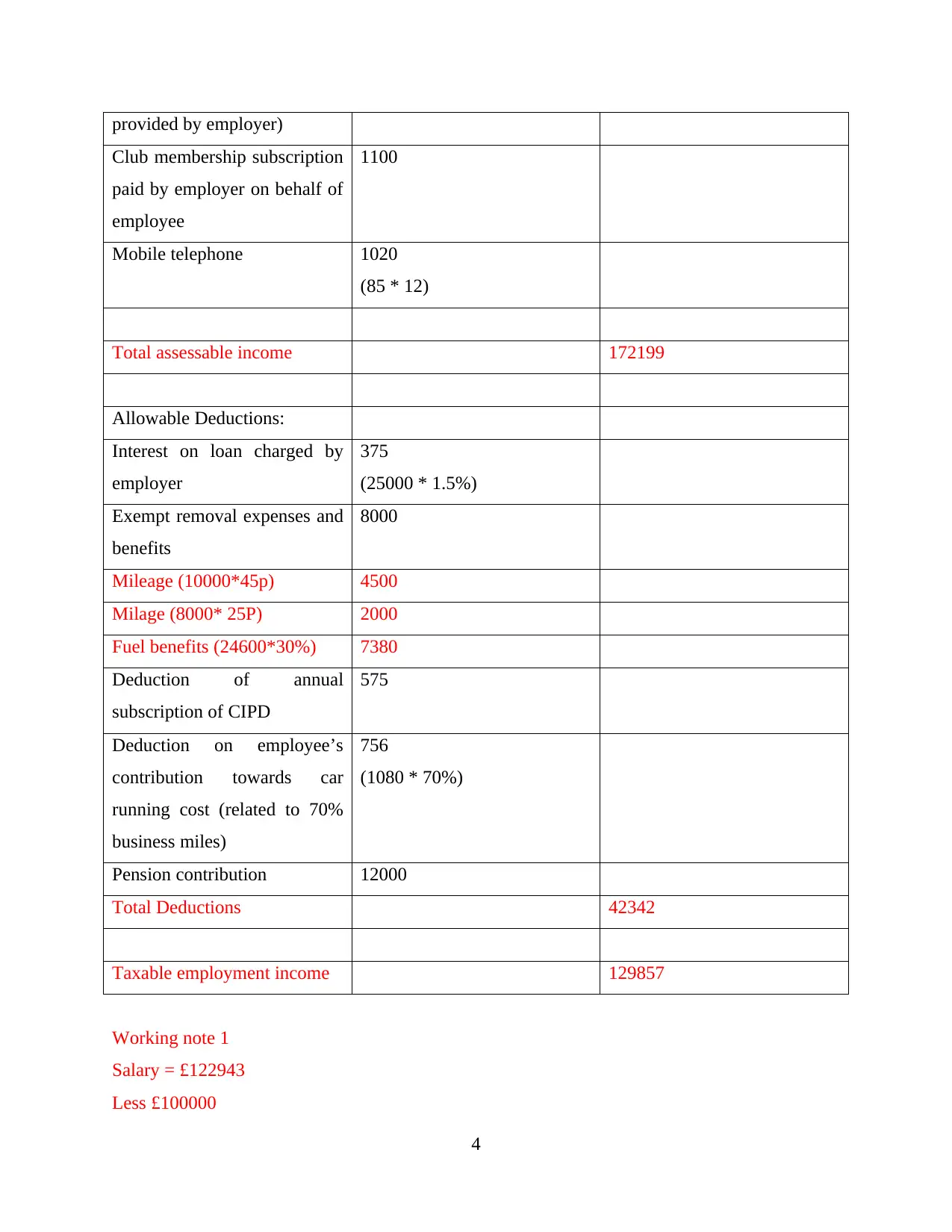

provided by employer)

Club membership subscription

paid by employer on behalf of

employee

1100

Mobile telephone 1020

(85 * 12)

Total assessable income 172199

Allowable Deductions:

Interest on loan charged by

employer

375

(25000 * 1.5%)

Exempt removal expenses and

benefits

8000

Mileage (10000*45p) 4500

Milage (8000* 25P) 2000

Fuel benefits (24600*30%) 7380

Deduction of annual

subscription of CIPD

575

Deduction on employee’s

contribution towards car

running cost (related to 70%

business miles)

756

(1080 * 70%)

Pension contribution 12000

Total Deductions 42342

Taxable employment income 129857

Working note 1

Salary = £122943

Less £100000

4

Club membership subscription

paid by employer on behalf of

employee

1100

Mobile telephone 1020

(85 * 12)

Total assessable income 172199

Allowable Deductions:

Interest on loan charged by

employer

375

(25000 * 1.5%)

Exempt removal expenses and

benefits

8000

Mileage (10000*45p) 4500

Milage (8000* 25P) 2000

Fuel benefits (24600*30%) 7380

Deduction of annual

subscription of CIPD

575

Deduction on employee’s

contribution towards car

running cost (related to 70%

business miles)

756

(1080 * 70%)

Pension contribution 12000

Total Deductions 42342

Taxable employment income 129857

Working note 1

Salary = £122943

Less £100000

4

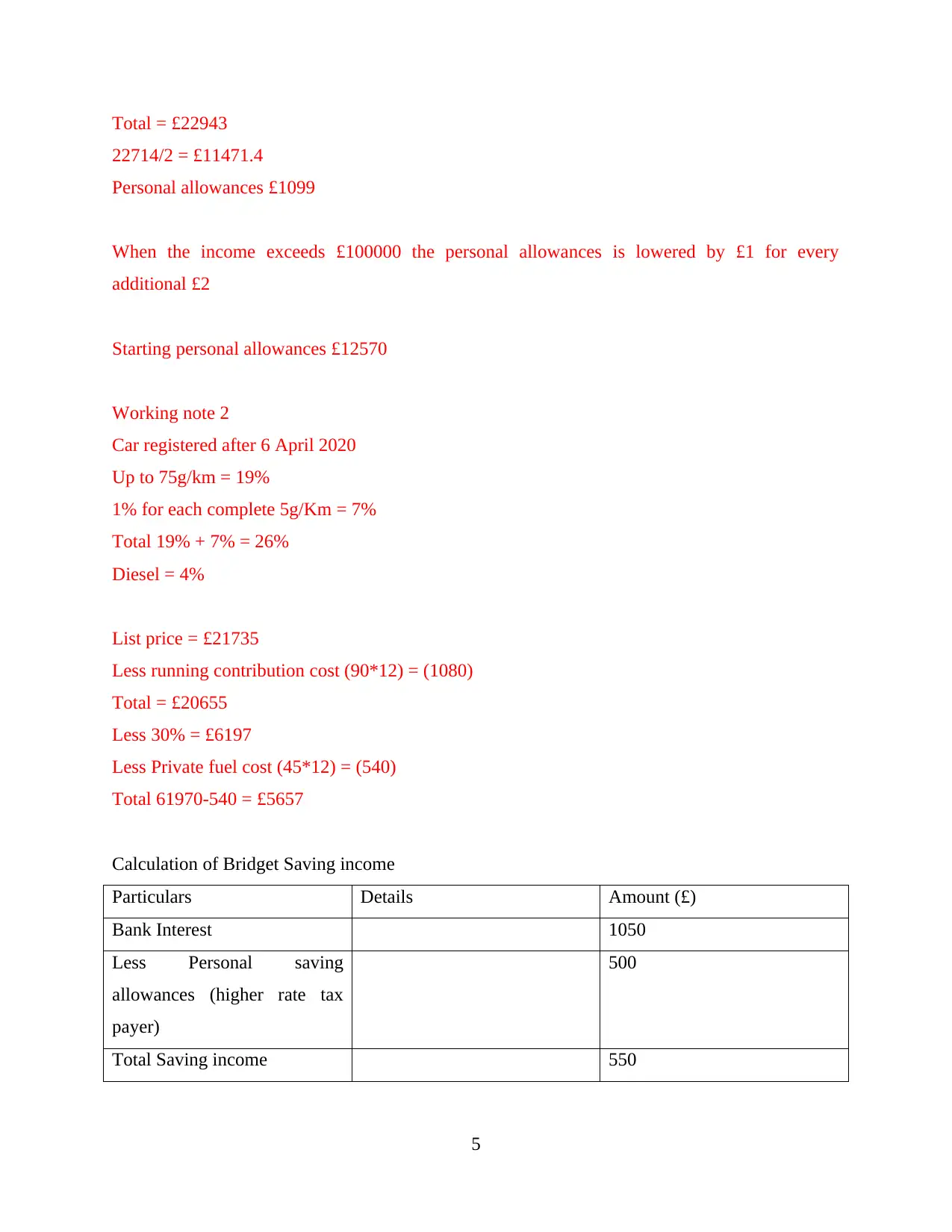

Total = £22943

22714/2 = £11471.4

Personal allowances £1099

When the income exceeds £100000 the personal allowances is lowered by £1 for every

additional £2

Starting personal allowances £12570

Working note 2

Car registered after 6 April 2020

Up to 75g/km = 19%

1% for each complete 5g/Km = 7%

Total 19% + 7% = 26%

Diesel = 4%

List price = £21735

Less running contribution cost (90*12) = (1080)

Total = £20655

Less 30% = £6197

Less Private fuel cost (45*12) = (540)

Total 61970-540 = £5657

Calculation of Bridget Saving income

Particulars Details Amount (£)

Bank Interest 1050

Less Personal saving

allowances (higher rate tax

payer)

500

Total Saving income 550

5

22714/2 = £11471.4

Personal allowances £1099

When the income exceeds £100000 the personal allowances is lowered by £1 for every

additional £2

Starting personal allowances £12570

Working note 2

Car registered after 6 April 2020

Up to 75g/km = 19%

1% for each complete 5g/Km = 7%

Total 19% + 7% = 26%

Diesel = 4%

List price = £21735

Less running contribution cost (90*12) = (1080)

Total = £20655

Less 30% = £6197

Less Private fuel cost (45*12) = (540)

Total 61970-540 = £5657

Calculation of Bridget Saving income

Particulars Details Amount (£)

Bank Interest 1050

Less Personal saving

allowances (higher rate tax

payer)

500

Total Saving income 550

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Calculation of Bridget Dividend income

Particulars Details Amount (£)

Dividend income 2450

Less Dividend allowances 2000

Taxable dividend income 450

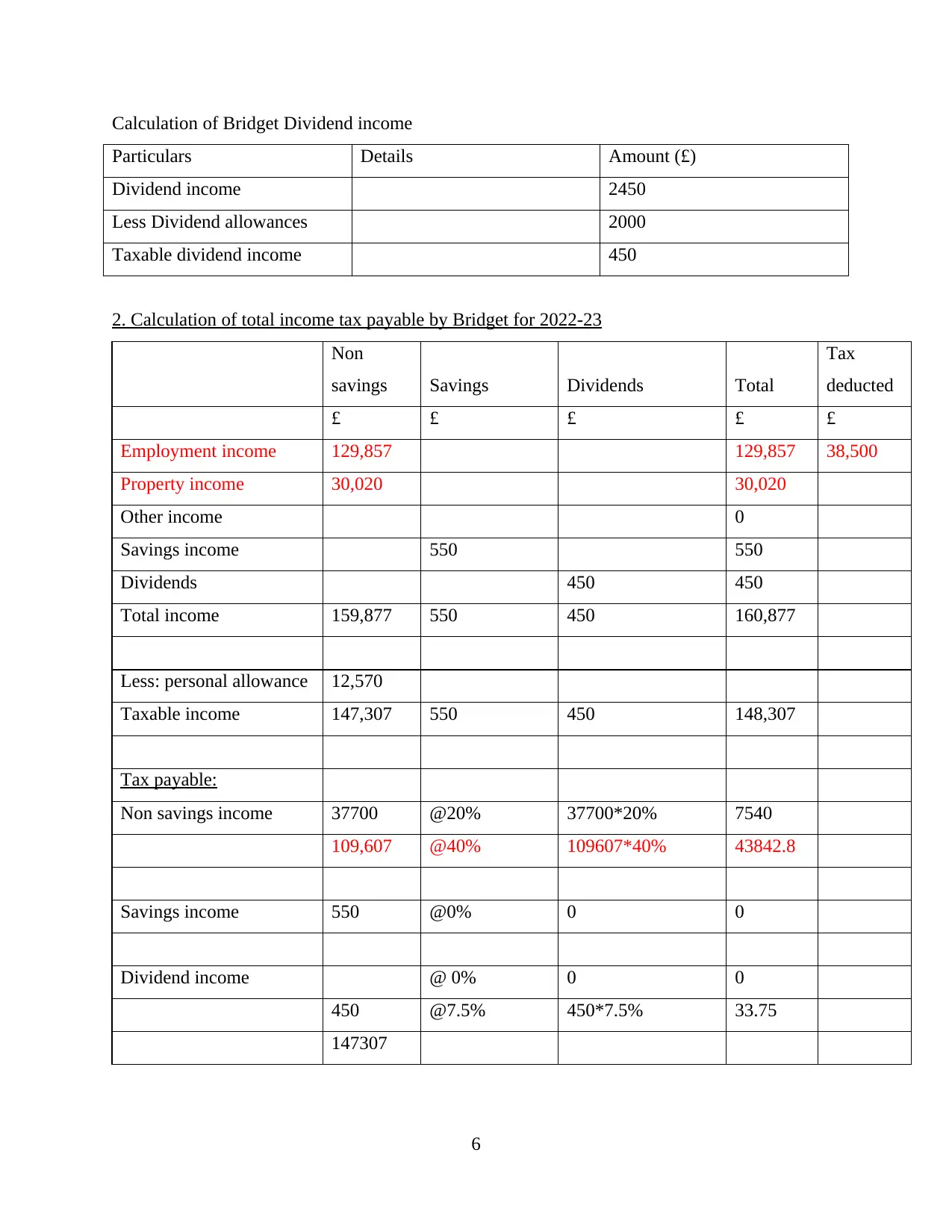

2. Calculation of total income tax payable by Bridget for 2022-23

Non

savings Savings Dividends Total

Tax

deducted

£ £ £ £ £

Employment income 129,857 129,857 38,500

Property income 30,020 30,020

Other income 0

Savings income 550 550

Dividends 450 450

Total income 159,877 550 450 160,877

Less: personal allowance 12,570

Taxable income 147,307 550 450 148,307

Tax payable:

Non savings income 37700 @20% 37700*20% 7540

109,607 @40% 109607*40% 43842.8

Savings income 550 @0% 0 0

Dividend income @ 0% 0 0

450 @7.5% 450*7.5% 33.75

147307

6

Particulars Details Amount (£)

Dividend income 2450

Less Dividend allowances 2000

Taxable dividend income 450

2. Calculation of total income tax payable by Bridget for 2022-23

Non

savings Savings Dividends Total

Tax

deducted

£ £ £ £ £

Employment income 129,857 129,857 38,500

Property income 30,020 30,020

Other income 0

Savings income 550 550

Dividends 450 450

Total income 159,877 550 450 160,877

Less: personal allowance 12,570

Taxable income 147,307 550 450 148,307

Tax payable:

Non savings income 37700 @20% 37700*20% 7540

109,607 @40% 109607*40% 43842.8

Savings income 550 @0% 0 0

Dividend income @ 0% 0 0

450 @7.5% 450*7.5% 33.75

147307

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Less: tax already paid (PAYE

Deduction) 38,500.00

Less Tax relief on

mortgage interest 600*20% 120.00

Tax payable 12796.55

3. Calculation of National Insurance Contributions payable by Bridget for 2022-2023

Being an employee, Bridget needs to pay Class 1 NIC on their earnings from employment such

as salaries and bonuses.

Annual Salary of Bridget + Bonuses = £75000 + £38500 = £113500

Earnings per week = £113500 / 52 = £2184 (approx.)

On first £184 = Nil

Income between £184 and £967 = 12% = £783*12% = £93.96

Income above £967 = 2% = £1217 * 2% = £24.34

Total Class 1 NIC payable by Bridget = £96.96 + £24.34 = £118.3

4. Calculation of NIC payable by Air Engineering Limited

Being an employer, Air Engineering Limited need to pay Class 1A NIC on the value of the

benefit in kind at the rate of 13.8%.

= £24600 * 13.8% = £3394.8

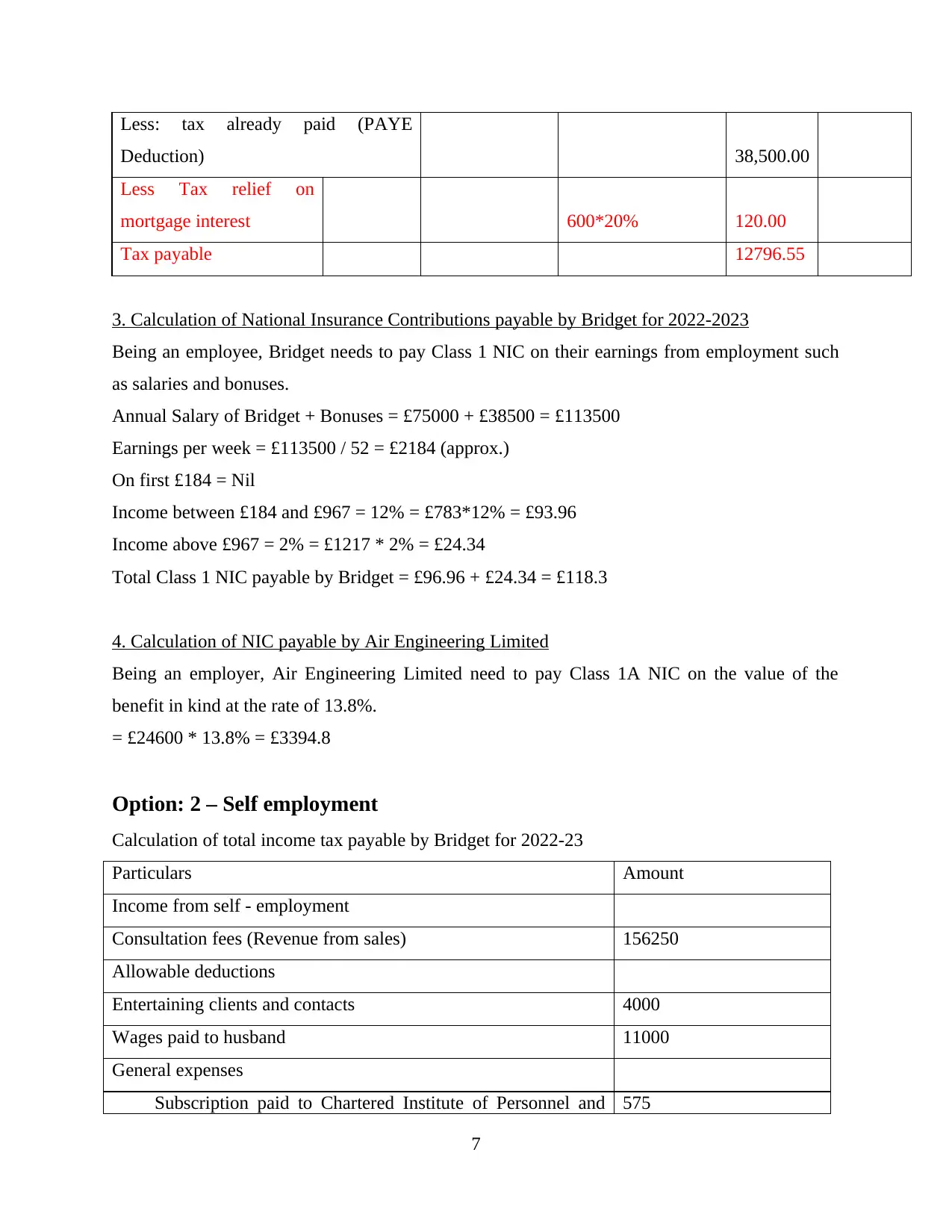

Option: 2 – Self employment

Calculation of total income tax payable by Bridget for 2022-23

Particulars Amount

Income from self - employment

Consultation fees (Revenue from sales) 156250

Allowable deductions

Entertaining clients and contacts 4000

Wages paid to husband 11000

General expenses

Subscription paid to Chartered Institute of Personnel and 575

7

Deduction) 38,500.00

Less Tax relief on

mortgage interest 600*20% 120.00

Tax payable 12796.55

3. Calculation of National Insurance Contributions payable by Bridget for 2022-2023

Being an employee, Bridget needs to pay Class 1 NIC on their earnings from employment such

as salaries and bonuses.

Annual Salary of Bridget + Bonuses = £75000 + £38500 = £113500

Earnings per week = £113500 / 52 = £2184 (approx.)

On first £184 = Nil

Income between £184 and £967 = 12% = £783*12% = £93.96

Income above £967 = 2% = £1217 * 2% = £24.34

Total Class 1 NIC payable by Bridget = £96.96 + £24.34 = £118.3

4. Calculation of NIC payable by Air Engineering Limited

Being an employer, Air Engineering Limited need to pay Class 1A NIC on the value of the

benefit in kind at the rate of 13.8%.

= £24600 * 13.8% = £3394.8

Option: 2 – Self employment

Calculation of total income tax payable by Bridget for 2022-23

Particulars Amount

Income from self - employment

Consultation fees (Revenue from sales) 156250

Allowable deductions

Entertaining clients and contacts 4000

Wages paid to husband 11000

General expenses

Subscription paid to Chartered Institute of Personnel and 575

7

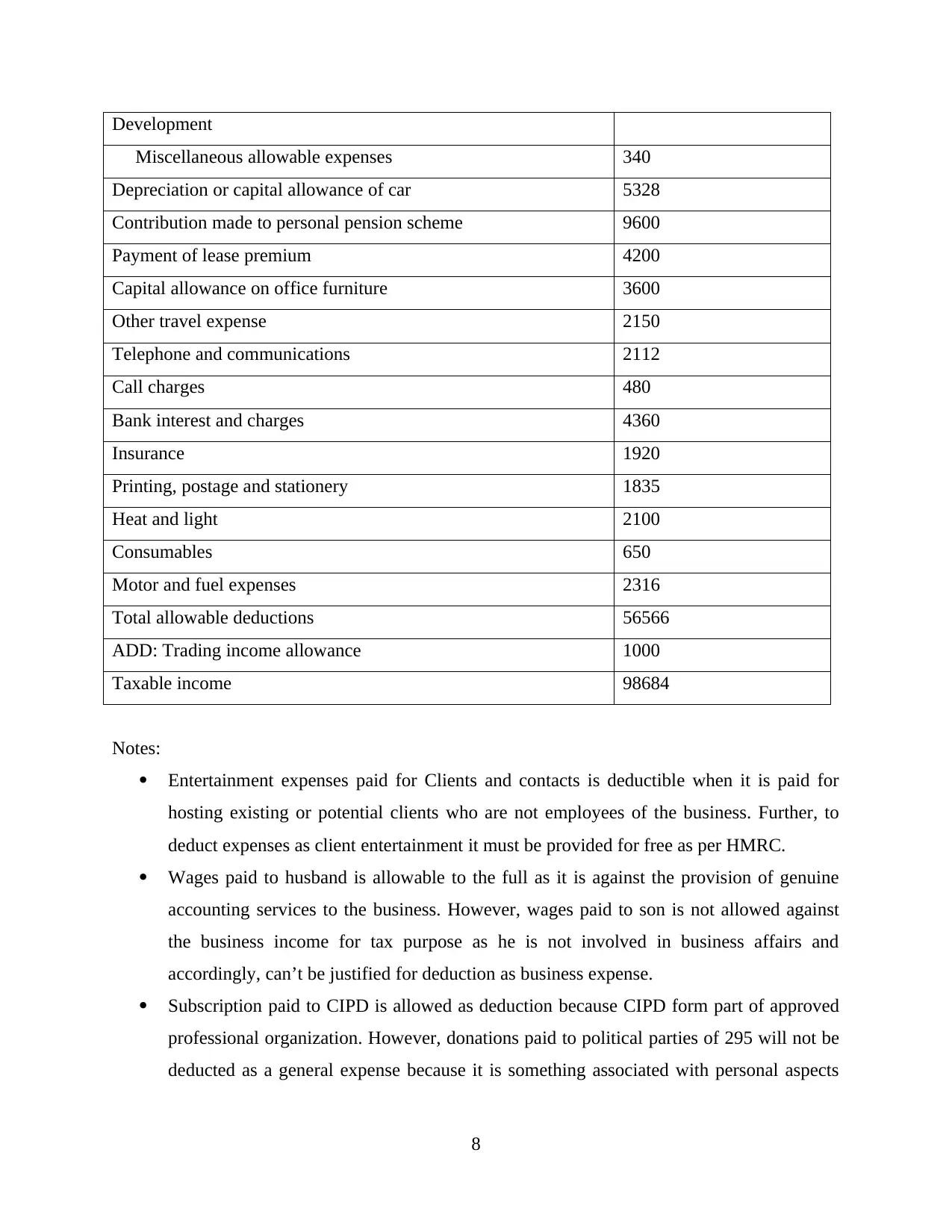

Development

Miscellaneous allowable expenses 340

Depreciation or capital allowance of car 5328

Contribution made to personal pension scheme 9600

Payment of lease premium 4200

Capital allowance on office furniture 3600

Other travel expense 2150

Telephone and communications 2112

Call charges 480

Bank interest and charges 4360

Insurance 1920

Printing, postage and stationery 1835

Heat and light 2100

Consumables 650

Motor and fuel expenses 2316

Total allowable deductions 56566

ADD: Trading income allowance 1000

Taxable income 98684

Notes:

Entertainment expenses paid for Clients and contacts is deductible when it is paid for

hosting existing or potential clients who are not employees of the business. Further, to

deduct expenses as client entertainment it must be provided for free as per HMRC.

Wages paid to husband is allowable to the full as it is against the provision of genuine

accounting services to the business. However, wages paid to son is not allowed against

the business income for tax purpose as he is not involved in business affairs and

accordingly, can’t be justified for deduction as business expense.

Subscription paid to CIPD is allowed as deduction because CIPD form part of approved

professional organization. However, donations paid to political parties of 295 will not be

deducted as a general expense because it is something associated with personal aspects

8

Miscellaneous allowable expenses 340

Depreciation or capital allowance of car 5328

Contribution made to personal pension scheme 9600

Payment of lease premium 4200

Capital allowance on office furniture 3600

Other travel expense 2150

Telephone and communications 2112

Call charges 480

Bank interest and charges 4360

Insurance 1920

Printing, postage and stationery 1835

Heat and light 2100

Consumables 650

Motor and fuel expenses 2316

Total allowable deductions 56566

ADD: Trading income allowance 1000

Taxable income 98684

Notes:

Entertainment expenses paid for Clients and contacts is deductible when it is paid for

hosting existing or potential clients who are not employees of the business. Further, to

deduct expenses as client entertainment it must be provided for free as per HMRC.

Wages paid to husband is allowable to the full as it is against the provision of genuine

accounting services to the business. However, wages paid to son is not allowed against

the business income for tax purpose as he is not involved in business affairs and

accordingly, can’t be justified for deduction as business expense.

Subscription paid to CIPD is allowed as deduction because CIPD form part of approved

professional organization. However, donations paid to political parties of 295 will not be

deducted as a general expense because it is something associated with personal aspects

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

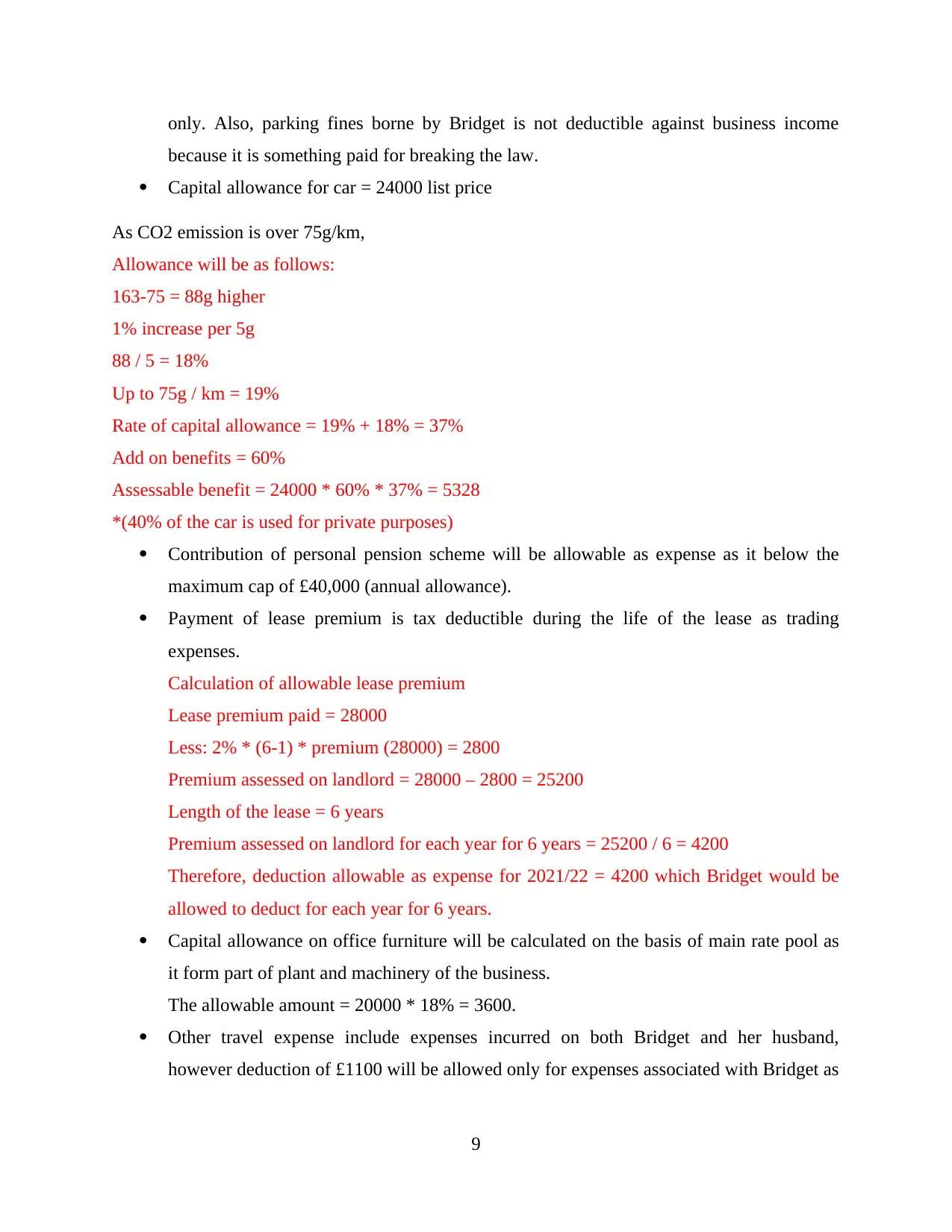

only. Also, parking fines borne by Bridget is not deductible against business income

because it is something paid for breaking the law.

Capital allowance for car = 24000 list price

As CO2 emission is over 75g/km,

Allowance will be as follows:

163-75 = 88g higher

1% increase per 5g

88 / 5 = 18%

Up to 75g / km = 19%

Rate of capital allowance = 19% + 18% = 37%

Add on benefits = 60%

Assessable benefit = 24000 * 60% * 37% = 5328

*(40% of the car is used for private purposes)

Contribution of personal pension scheme will be allowable as expense as it below the

maximum cap of £40,000 (annual allowance).

Payment of lease premium is tax deductible during the life of the lease as trading

expenses.

Calculation of allowable lease premium

Lease premium paid = 28000

Less: 2% * (6-1) * premium (28000) = 2800

Premium assessed on landlord = 28000 – 2800 = 25200

Length of the lease = 6 years

Premium assessed on landlord for each year for 6 years = 25200 / 6 = 4200

Therefore, deduction allowable as expense for 2021/22 = 4200 which Bridget would be

allowed to deduct for each year for 6 years.

Capital allowance on office furniture will be calculated on the basis of main rate pool as

it form part of plant and machinery of the business.

The allowable amount = 20000 * 18% = 3600.

Other travel expense include expenses incurred on both Bridget and her husband,

however deduction of £1100 will be allowed only for expenses associated with Bridget as

9

because it is something paid for breaking the law.

Capital allowance for car = 24000 list price

As CO2 emission is over 75g/km,

Allowance will be as follows:

163-75 = 88g higher

1% increase per 5g

88 / 5 = 18%

Up to 75g / km = 19%

Rate of capital allowance = 19% + 18% = 37%

Add on benefits = 60%

Assessable benefit = 24000 * 60% * 37% = 5328

*(40% of the car is used for private purposes)

Contribution of personal pension scheme will be allowable as expense as it below the

maximum cap of £40,000 (annual allowance).

Payment of lease premium is tax deductible during the life of the lease as trading

expenses.

Calculation of allowable lease premium

Lease premium paid = 28000

Less: 2% * (6-1) * premium (28000) = 2800

Premium assessed on landlord = 28000 – 2800 = 25200

Length of the lease = 6 years

Premium assessed on landlord for each year for 6 years = 25200 / 6 = 4200

Therefore, deduction allowable as expense for 2021/22 = 4200 which Bridget would be

allowed to deduct for each year for 6 years.

Capital allowance on office furniture will be calculated on the basis of main rate pool as

it form part of plant and machinery of the business.

The allowable amount = 20000 * 18% = 3600.

Other travel expense include expenses incurred on both Bridget and her husband,

however deduction of £1100 will be allowed only for expenses associated with Bridget as

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

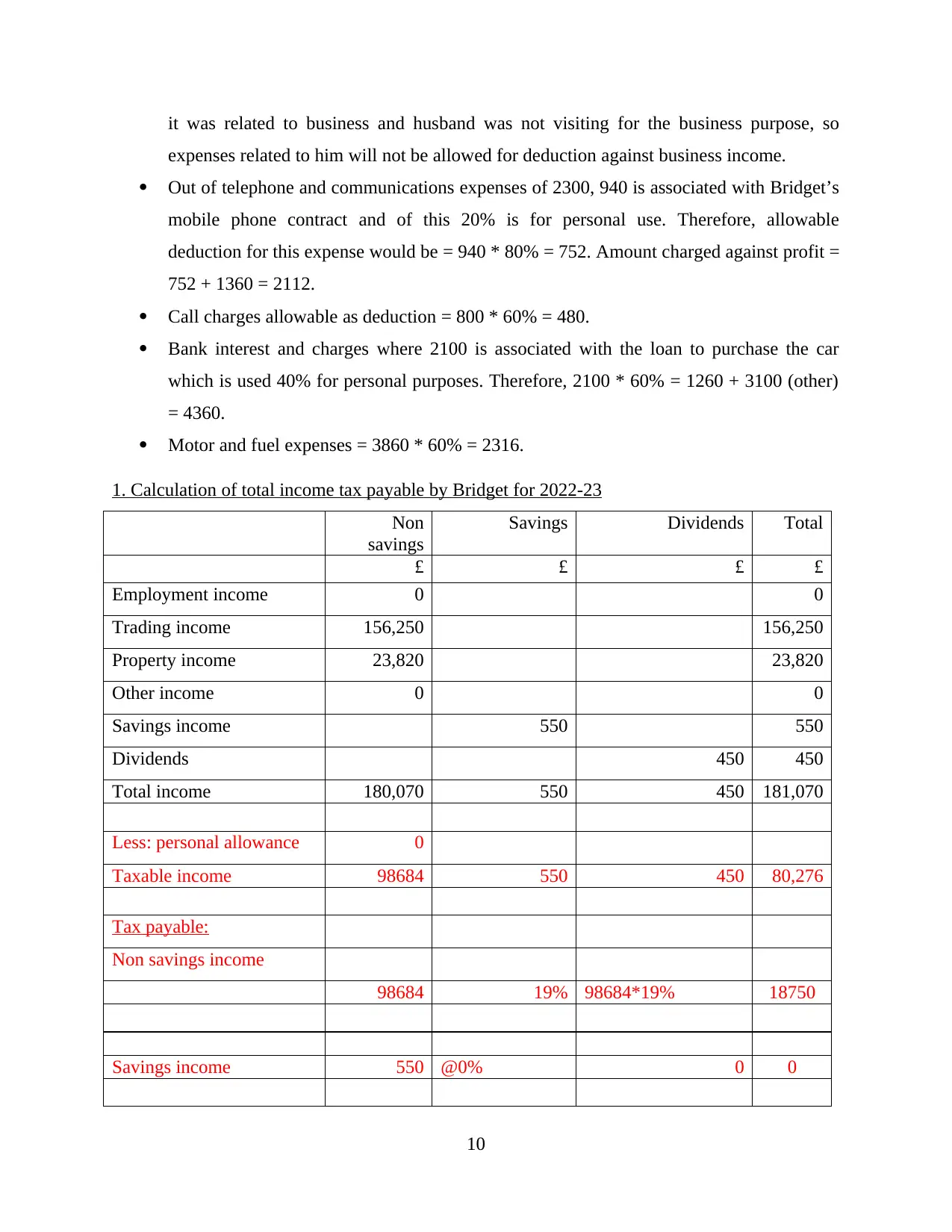

it was related to business and husband was not visiting for the business purpose, so

expenses related to him will not be allowed for deduction against business income.

Out of telephone and communications expenses of 2300, 940 is associated with Bridget’s

mobile phone contract and of this 20% is for personal use. Therefore, allowable

deduction for this expense would be = 940 * 80% = 752. Amount charged against profit =

752 + 1360 = 2112.

Call charges allowable as deduction = 800 * 60% = 480.

Bank interest and charges where 2100 is associated with the loan to purchase the car

which is used 40% for personal purposes. Therefore, 2100 * 60% = 1260 + 3100 (other)

= 4360.

Motor and fuel expenses = 3860 * 60% = 2316.

1. Calculation of total income tax payable by Bridget for 2022-23

Non

savings

Savings Dividends Total

£ £ £ £

Employment income 0 0

Trading income 156,250 156,250

Property income 23,820 23,820

Other income 0 0

Savings income 550 550

Dividends 450 450

Total income 180,070 550 450 181,070

Less: personal allowance 0

Taxable income 98684 550 450 80,276

Tax payable:

Non savings income

98684 19% 98684*19% 18750

Savings income 550 @0% 0 0

10

expenses related to him will not be allowed for deduction against business income.

Out of telephone and communications expenses of 2300, 940 is associated with Bridget’s

mobile phone contract and of this 20% is for personal use. Therefore, allowable

deduction for this expense would be = 940 * 80% = 752. Amount charged against profit =

752 + 1360 = 2112.

Call charges allowable as deduction = 800 * 60% = 480.

Bank interest and charges where 2100 is associated with the loan to purchase the car

which is used 40% for personal purposes. Therefore, 2100 * 60% = 1260 + 3100 (other)

= 4360.

Motor and fuel expenses = 3860 * 60% = 2316.

1. Calculation of total income tax payable by Bridget for 2022-23

Non

savings

Savings Dividends Total

£ £ £ £

Employment income 0 0

Trading income 156,250 156,250

Property income 23,820 23,820

Other income 0 0

Savings income 550 550

Dividends 450 450

Total income 180,070 550 450 181,070

Less: personal allowance 0

Taxable income 98684 550 450 80,276

Tax payable:

Non savings income

98684 19% 98684*19% 18750

Savings income 550 @0% 0 0

10

Dividend income @ 0%

450 @7.5% 450*7.5% 33.75

Tax payable 18784

2. Calculation of amount of NIC payable by Bridget 2022-23

Under class 2

3.05 * 52 week = 158.6

Under class 4

Profits = 98684

Up to 9568 = NIL

9568 to 50270 = 9% (50270 – 9568 = 40702 * 9% = 3663.18)

Over 50270 = 98684 – 50270 = 48414 * 2% = 968.28

3. Calculation of amount of employer NIC payable by Bridget

Travel expense borne by Bridget for her husband = 1100 * 13.8% = 151.8

SECTION B

MEMO

To: Bridget

From: Taxation Consultant (Chartered Accountants, Hart & Bannon LLP)

Date: 1st April 2022

Subject: Advice on Option selection or tax planning.

Option 1 Employment

Employment is a term demonstrate in respect to all such individual who are earning their income

in the form of salary. The salaried individual become a part of this section of income tax

liability. They earn income every month by the employer. This option can also select by the

Bridget as a part of earning income. In this individual require to join certain organization as an

11

450 @7.5% 450*7.5% 33.75

Tax payable 18784

2. Calculation of amount of NIC payable by Bridget 2022-23

Under class 2

3.05 * 52 week = 158.6

Under class 4

Profits = 98684

Up to 9568 = NIL

9568 to 50270 = 9% (50270 – 9568 = 40702 * 9% = 3663.18)

Over 50270 = 98684 – 50270 = 48414 * 2% = 968.28

3. Calculation of amount of employer NIC payable by Bridget

Travel expense borne by Bridget for her husband = 1100 * 13.8% = 151.8

SECTION B

MEMO

To: Bridget

From: Taxation Consultant (Chartered Accountants, Hart & Bannon LLP)

Date: 1st April 2022

Subject: Advice on Option selection or tax planning.

Option 1 Employment

Employment is a term demonstrate in respect to all such individual who are earning their income

in the form of salary. The salaried individual become a part of this section of income tax

liability. They earn income every month by the employer. This option can also select by the

Bridget as a part of earning income. In this individual require to join certain organization as an

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.