Taxation Theory, Practice & Law: Analysis of CGT & FBT Liabilities

VerifiedAdded on 2023/06/05

|13

|3076

|425

Homework Assignment

AI Summary

This assignment solution provides a detailed analysis of capital gains tax (CGT) and fringe benefits tax (FBT) implications based on the provided scenarios. The first question examines the CGT consequences of disposing of various capital assets, including a block of land, antique bed, shares, painting, and violin, considering pre-CGT assets, CGT events, cost base, balancing capital losses, and discount methods. It determines the capital gains for the taxpayer for FY2018. The second question focuses on calculating the Fringe Benefits Tax (FBT) payable by Rapid Heat Pty Ltd for fringe benefits provided to employee Jasmine, specifically car fringe benefits and loan fringe benefits, considering relevant sections of the Fringe Benefits Tax Assessment Act 1986 and guidelines from the Australian Taxation Office (ATO).

Taxation Theory, Practice & Law

STUDENT NAME/ID

[Pick the date]

STUDENT NAME/ID

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

The client is investor along with the collector of musical instruments mainly violins and has

disposed given capital assets and therefore, the task is to analyse the transaction type and derived

proceeds so as to find the taxation consequences.

Further, it is evident that taxpayer does not run a business of trading assets and hence, the

disposal of capital assets would not result in generation of assessable income of ordinary concept

and rather generate capital income. These capital proceeds would be examined and would be

taken for the computation of any incurred capital gains/losses which are then taxed under the

applicability of Capital Gains Tax (CGT). Therefore, the main focus of the given situation is to

do analysis of the transactions incurred for the sale of vacant land block, antique bed, shares,

painting and violin (Coleman, 2016).

There are key elements related to CGT implications on the respective transactions and are

discussed below. These elements are pivotal and need to be considered so as to determine the net

cumulative capital gains/loss that would arise from the disposed capital assets during the

assessment income tax year (Barkoczy, 2017).

Key element 1: Pre-CGT Asset

Relevant section- s.140-10, ITAA 1997

The concept which can be derived from the above highlighted section is that all the respective

assets of the taxpayer that he/she acquires before the enactment of CGT liability (September 20,

1985) are known as pre-CGT asset. This element is the initial aspect for the determination of

CGT payable because any asset that is a pre-CGT asset will not result in any CGT implication on

taxpayer when being disposed by taxpayer irrespective of the significant gains which are derived

from the sale (Gilders, et. al., 2015).

Key element 2: CGT event

Relevant section- s. 104-5, ITAA 1997

This element is crucial because the calculation of capital gains/losses will be done based on the

underlying method discussed for the relevant CGT event. The taxpayer’s transactions for the

1

The client is investor along with the collector of musical instruments mainly violins and has

disposed given capital assets and therefore, the task is to analyse the transaction type and derived

proceeds so as to find the taxation consequences.

Further, it is evident that taxpayer does not run a business of trading assets and hence, the

disposal of capital assets would not result in generation of assessable income of ordinary concept

and rather generate capital income. These capital proceeds would be examined and would be

taken for the computation of any incurred capital gains/losses which are then taxed under the

applicability of Capital Gains Tax (CGT). Therefore, the main focus of the given situation is to

do analysis of the transactions incurred for the sale of vacant land block, antique bed, shares,

painting and violin (Coleman, 2016).

There are key elements related to CGT implications on the respective transactions and are

discussed below. These elements are pivotal and need to be considered so as to determine the net

cumulative capital gains/loss that would arise from the disposed capital assets during the

assessment income tax year (Barkoczy, 2017).

Key element 1: Pre-CGT Asset

Relevant section- s.140-10, ITAA 1997

The concept which can be derived from the above highlighted section is that all the respective

assets of the taxpayer that he/she acquires before the enactment of CGT liability (September 20,

1985) are known as pre-CGT asset. This element is the initial aspect for the determination of

CGT payable because any asset that is a pre-CGT asset will not result in any CGT implication on

taxpayer when being disposed by taxpayer irrespective of the significant gains which are derived

from the sale (Gilders, et. al., 2015).

Key element 2: CGT event

Relevant section- s. 104-5, ITAA 1997

This element is crucial because the calculation of capital gains/losses will be done based on the

underlying method discussed for the relevant CGT event. The taxpayer’s transactions for the

1

selling of the capital assets are part of CGT event of type A1. This method illustrates that capital

proceeds received from the sale of the capital asset will be used to deduct the total cost base of

the capital asset in regards to compute the net capital gains/losses subject to CGT liability of the

taxpayer (Barkoczy, 2017).

Key element 3: Asset Cost Base

Relevant section- s. 110-25, ITAA 1997

As highlighted above in key element 2, the essential variable for the computation of capital

gains/loss from the disposed asset is cost base. It comprises the combination of five components

which are defined as shown below. It is not necessary that taxpayer has made the transactions of

all the five components and hence, the sum of the available components which is termed as cost

base of the capital asset and are paid by the taxpayer only (Austlii, 2018 c).

Cost of buying the asset

Incidental Cost paid for increment works during the liquidation as well as at the procurement

time of the asset (legal fees, brokerage fee, stamp duties and so forth)

Capital expense for the ownership related works (taxes, interest on loan or on investment and

so forth)

Capital expenses for maintaining or appreciating the asset value

Capital expense for maintaining the ownership (this is essential when the asset is a property)

Key element 4: Balancing capital losses

Relevant section –s.102-25, ITAA 1997

There may arise a case where the concerned taxpayer has received capital losses from the

disposal of the capital asset. In such situation the taxpayer’s capital losses will be adjusted with

the received capital gains. Further, if the taxpayer does not receive the capital gains, then these

capital losses would not be taken to negate the total taxable income of the taxpayer and rather

would be shifted to next financial year (Krever, 2017). This process would be continued to five

consecutive years and still there be no capital gains received by taxpayer to adjust the capital

losses then the capital losses would be terminated.

2

proceeds received from the sale of the capital asset will be used to deduct the total cost base of

the capital asset in regards to compute the net capital gains/losses subject to CGT liability of the

taxpayer (Barkoczy, 2017).

Key element 3: Asset Cost Base

Relevant section- s. 110-25, ITAA 1997

As highlighted above in key element 2, the essential variable for the computation of capital

gains/loss from the disposed asset is cost base. It comprises the combination of five components

which are defined as shown below. It is not necessary that taxpayer has made the transactions of

all the five components and hence, the sum of the available components which is termed as cost

base of the capital asset and are paid by the taxpayer only (Austlii, 2018 c).

Cost of buying the asset

Incidental Cost paid for increment works during the liquidation as well as at the procurement

time of the asset (legal fees, brokerage fee, stamp duties and so forth)

Capital expense for the ownership related works (taxes, interest on loan or on investment and

so forth)

Capital expenses for maintaining or appreciating the asset value

Capital expense for maintaining the ownership (this is essential when the asset is a property)

Key element 4: Balancing capital losses

Relevant section –s.102-25, ITAA 1997

There may arise a case where the concerned taxpayer has received capital losses from the

disposal of the capital asset. In such situation the taxpayer’s capital losses will be adjusted with

the received capital gains. Further, if the taxpayer does not receive the capital gains, then these

capital losses would not be taken to negate the total taxable income of the taxpayer and rather

would be shifted to next financial year (Krever, 2017). This process would be continued to five

consecutive years and still there be no capital gains received by taxpayer to adjust the capital

losses then the capital losses would be terminated.

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Key element 5: Discount on Capital Gains

Relevant section- s. 115-25(1), ITAA 1997

Indexation method and discount method are the two methods which are used to reduce the total

CGT liability on the capital gains. The indexation is assumed to be useful when there is an asset

bought before September 1999 while the discount method is quite popular and would be applied

only on the long term capital gains received from sale of capital asset. In discount method, 50%

discount would only be used for the capital gains taxation purpose. Further, the simple way to

define the long term capital gains is that any asset which is having higher than 1 year of holding

period will generate long term capital gains (Nethercott, Richardson and Devos, 2016).

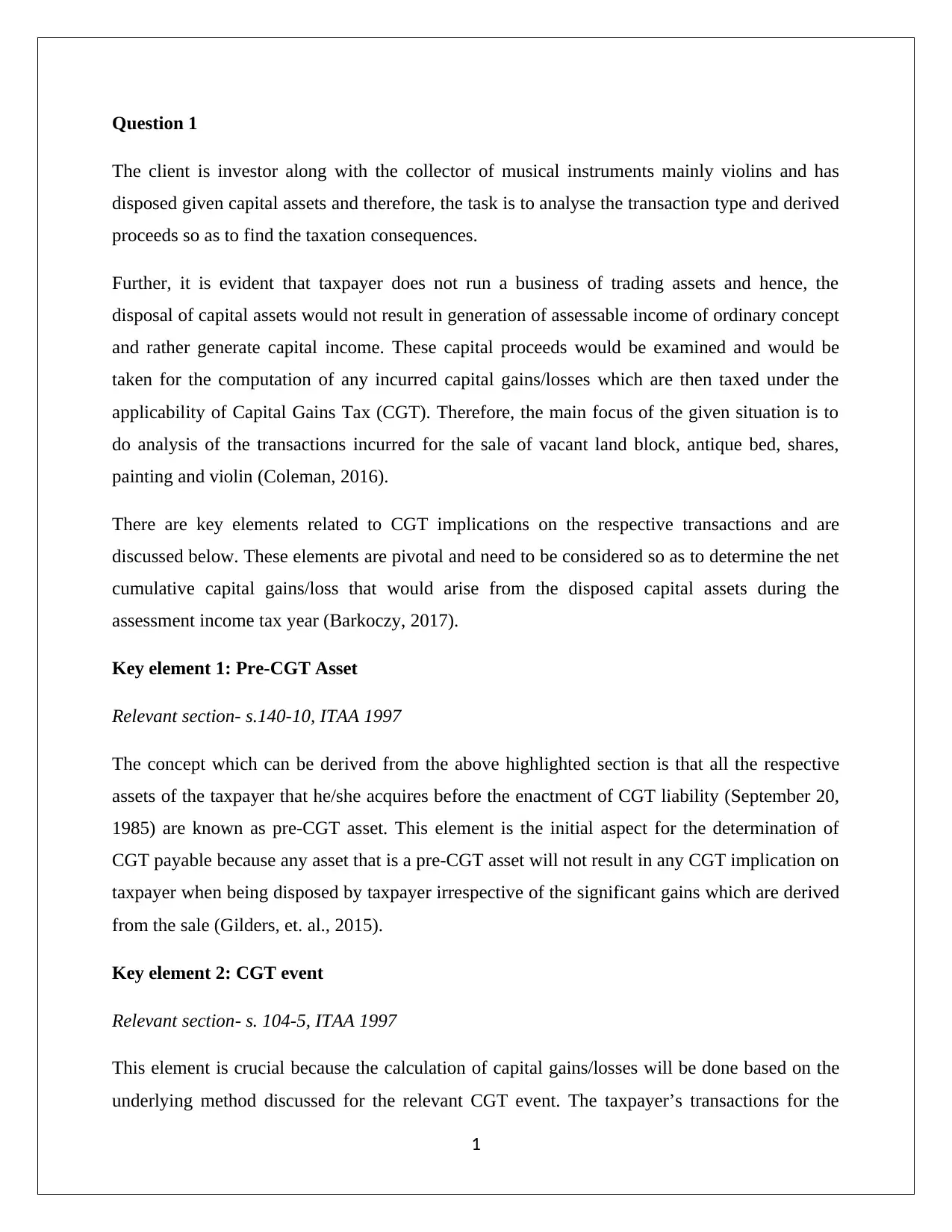

Block of Land

It would be fair to make the decision that block of land is not a pre-CGT asset of the taxpayer as

the taxpayer has purchased it well after the enactment of CGT implication and as a result, CGT

will not be exempted for this transaction. Moreover, the sale of land is a CGT event of type A1

and the relevant method which includes sale income from the asset and cost base of the asset will

be taken into consideration (Nethercott, Richardson and Devos, 2016). It is also imperative to

note that as per TR 94/29, agreed payment of the sale would be realised in the year in which the

agreement of sale of the block of land has been signed by taxpayer despite that the payment

being collected by the taxpayer in the next year (ATO, 1994).

3

Relevant section- s. 115-25(1), ITAA 1997

Indexation method and discount method are the two methods which are used to reduce the total

CGT liability on the capital gains. The indexation is assumed to be useful when there is an asset

bought before September 1999 while the discount method is quite popular and would be applied

only on the long term capital gains received from sale of capital asset. In discount method, 50%

discount would only be used for the capital gains taxation purpose. Further, the simple way to

define the long term capital gains is that any asset which is having higher than 1 year of holding

period will generate long term capital gains (Nethercott, Richardson and Devos, 2016).

Block of Land

It would be fair to make the decision that block of land is not a pre-CGT asset of the taxpayer as

the taxpayer has purchased it well after the enactment of CGT implication and as a result, CGT

will not be exempted for this transaction. Moreover, the sale of land is a CGT event of type A1

and the relevant method which includes sale income from the asset and cost base of the asset will

be taken into consideration (Nethercott, Richardson and Devos, 2016). It is also imperative to

note that as per TR 94/29, agreed payment of the sale would be realised in the year in which the

agreement of sale of the block of land has been signed by taxpayer despite that the payment

being collected by the taxpayer in the next year (ATO, 1994).

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

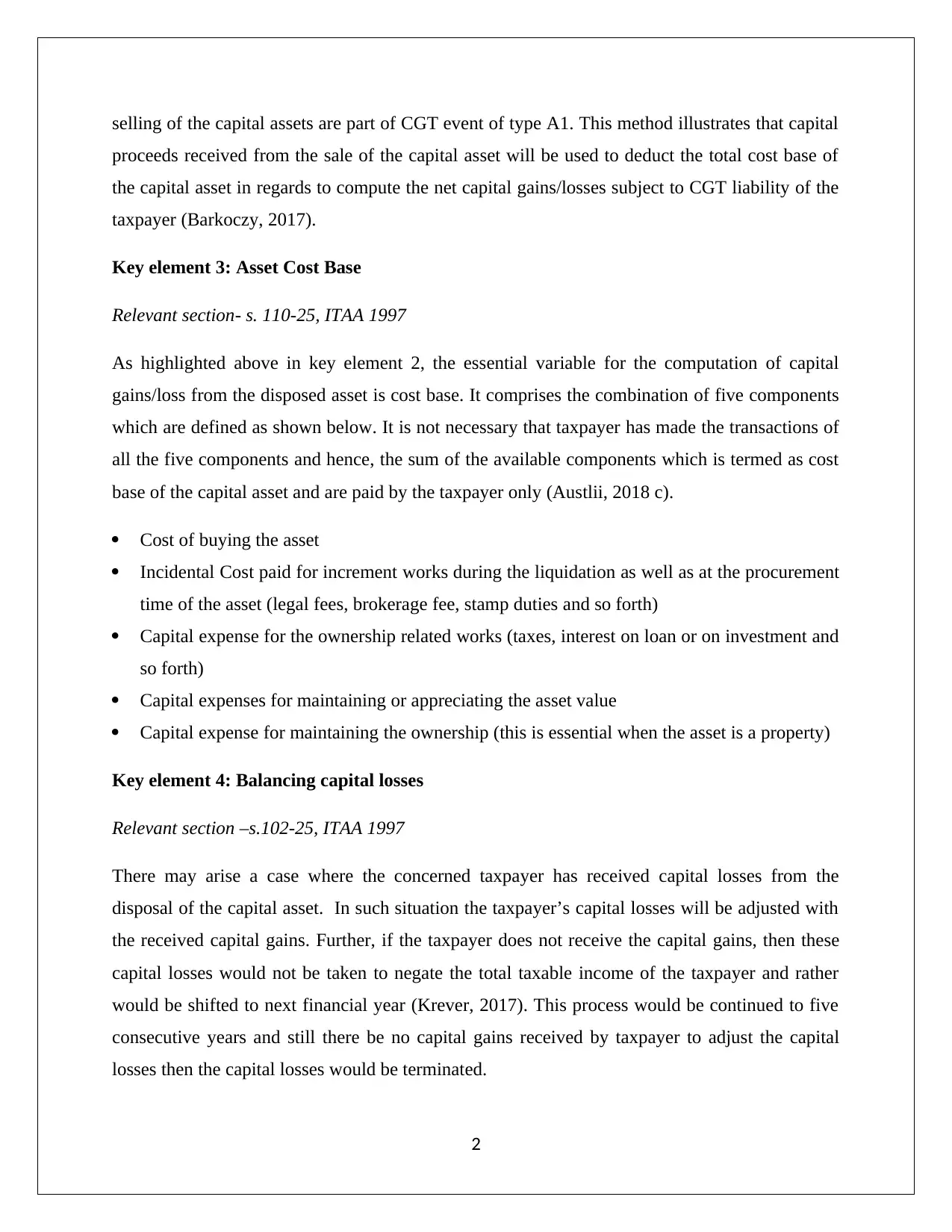

Antique Bed

According to TD 1999/40, the antique items come in the domain of collectables (as capital

assets). Also, the transaction for selling an antique item is CGT event of type A1. Further, the

taxpayer purchases the bed after the CGT threshold date and hence, the CGT will be imposed on

the act of disposal of antique bed (Nethercott, Richardson and Devos, 2016). Further, the

essential condition for the CGT implication of collectable is that it must be purchased for an

amount exceeded than $500 as per s. 118-10 ITAA 1997 which is true in present case because

she purchased the bed for $3500. 50% rebate will also be true and would be applied after

compensating the capital losses raised for sale of sculpture in year 2016/2017.

Painting

Capital proceeds received from liquation of painting will be exempted from application of CGT

as it falls within the category of a pre-CGT asset.. It is because purchase of the painting was

made on May 2, 1985 and the CGT implication has come into existence on September 20, 1985

and therefore, no CGT will be charged (Gilders, et. al., 2015).

Shares

It would be fair to make the decision that shares are not pre-CGT asset of the taxpayer as the

taxpayer has purchased it well after the formation of CGT implication and as a result, CGT will

4

According to TD 1999/40, the antique items come in the domain of collectables (as capital

assets). Also, the transaction for selling an antique item is CGT event of type A1. Further, the

taxpayer purchases the bed after the CGT threshold date and hence, the CGT will be imposed on

the act of disposal of antique bed (Nethercott, Richardson and Devos, 2016). Further, the

essential condition for the CGT implication of collectable is that it must be purchased for an

amount exceeded than $500 as per s. 118-10 ITAA 1997 which is true in present case because

she purchased the bed for $3500. 50% rebate will also be true and would be applied after

compensating the capital losses raised for sale of sculpture in year 2016/2017.

Painting

Capital proceeds received from liquation of painting will be exempted from application of CGT

as it falls within the category of a pre-CGT asset.. It is because purchase of the painting was

made on May 2, 1985 and the CGT implication has come into existence on September 20, 1985

and therefore, no CGT will be charged (Gilders, et. al., 2015).

Shares

It would be fair to make the decision that shares are not pre-CGT asset of the taxpayer as the

taxpayer has purchased it well after the formation of CGT implication and as a result, CGT will

4

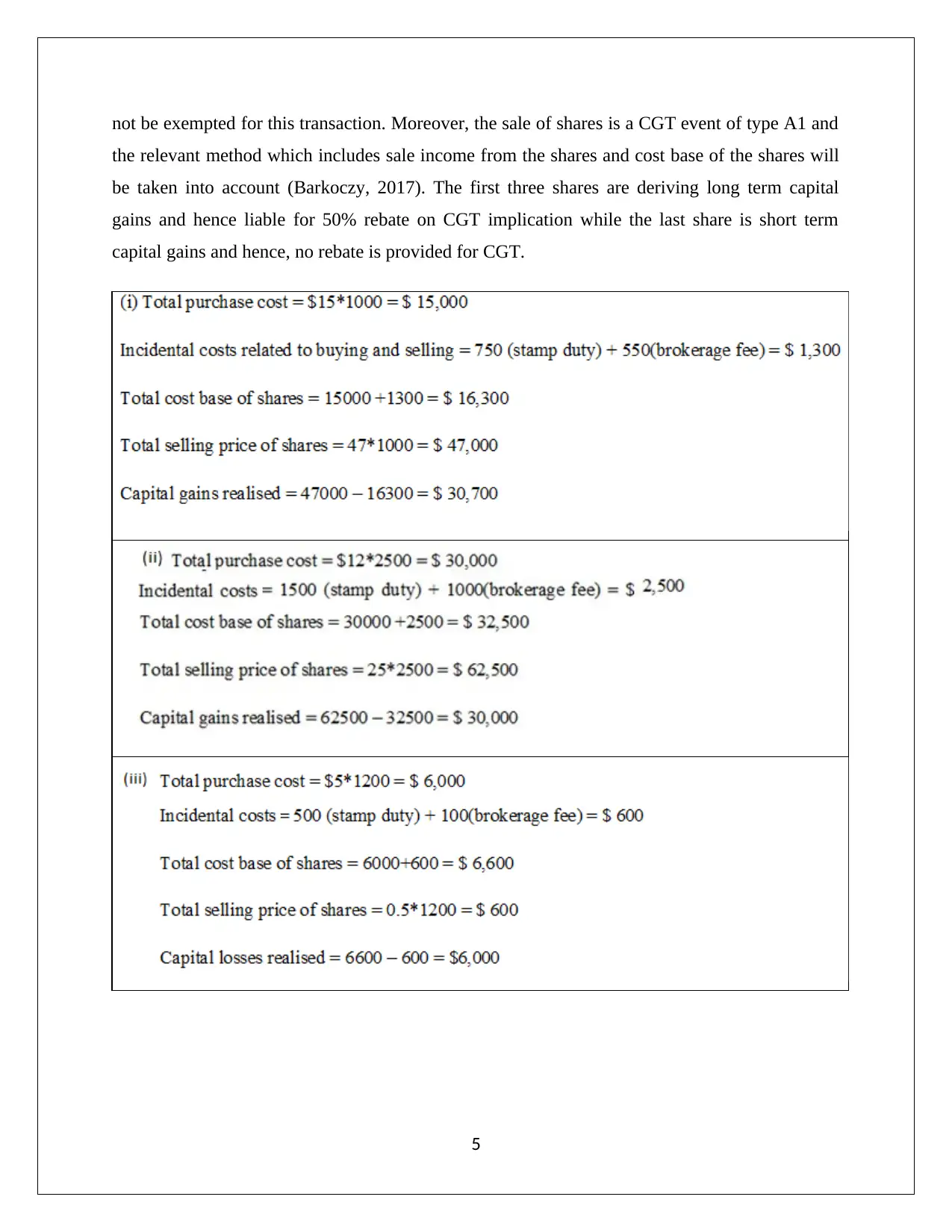

not be exempted for this transaction. Moreover, the sale of shares is a CGT event of type A1 and

the relevant method which includes sale income from the shares and cost base of the shares will

be taken into account (Barkoczy, 2017). The first three shares are deriving long term capital

gains and hence liable for 50% rebate on CGT implication while the last share is short term

capital gains and hence, no rebate is provided for CGT.

5

the relevant method which includes sale income from the shares and cost base of the shares will

be taken into account (Barkoczy, 2017). The first three shares are deriving long term capital

gains and hence liable for 50% rebate on CGT implication while the last share is short term

capital gains and hence, no rebate is provided for CGT.

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Violin

It would be fair to make the decision that violin is not pre-CGT asset of the taxpayer as the

taxpayer has purchased it well after the formation of CGT implication and as a result, CGT will

not be exempted for this transaction (Sadiq, et.al., 2015). However, violin which she has

liquidated in income year 2017 is personal use asset because she acquires several violins in

collections and has learned it so that she could play it well. Furthermore, she used to play it every

day which indicates that she has violin which would be categorised as personal use asset. The

CGT will be only be levied when she purchased it for a value exceeded $10,000 as per s. 108-

20(1) ITAA 1997. However, she purchased the violin for less than $10,000 and hence, the

imperative condition has not been fulfilled. Hence, no CGT consequence will be validated on

this.

The Capital gains for taxpayer for FY2018 is computed as show below.

6

It would be fair to make the decision that violin is not pre-CGT asset of the taxpayer as the

taxpayer has purchased it well after the formation of CGT implication and as a result, CGT will

not be exempted for this transaction (Sadiq, et.al., 2015). However, violin which she has

liquidated in income year 2017 is personal use asset because she acquires several violins in

collections and has learned it so that she could play it well. Furthermore, she used to play it every

day which indicates that she has violin which would be categorised as personal use asset. The

CGT will be only be levied when she purchased it for a value exceeded $10,000 as per s. 108-

20(1) ITAA 1997. However, she purchased the violin for less than $10,000 and hence, the

imperative condition has not been fulfilled. Hence, no CGT consequence will be validated on

this.

The Capital gains for taxpayer for FY2018 is computed as show below.

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

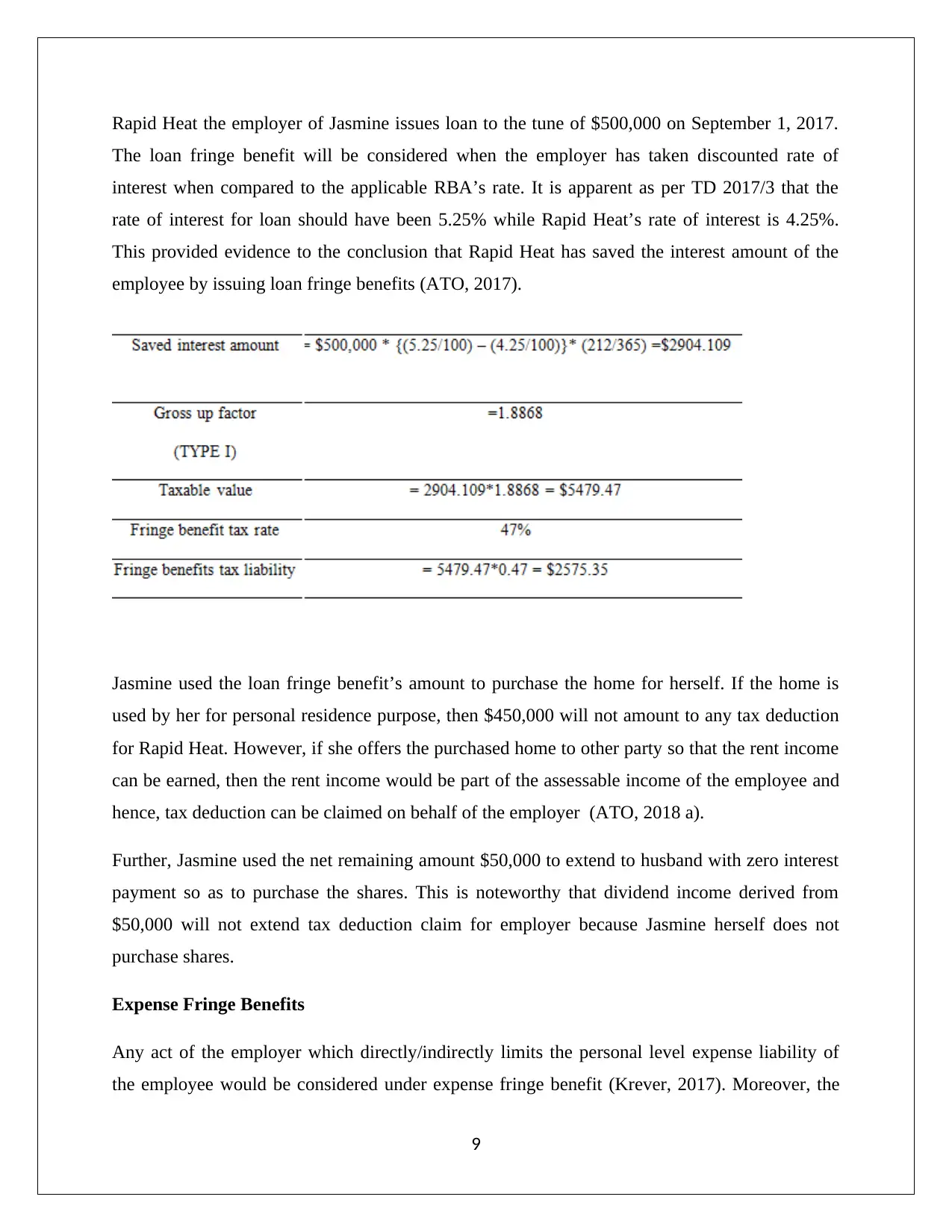

Question 2

(a) The Fringe Benefits Tax (FBT) payable needs to be furnished for the given fringe benefits to

employee Jasmine by employer Rapid Heat Pty Ltd during her employment period with the

company.

Fringe benefits are set of benefits of personal nature given to employee which are extended by

the employer and are taxed on behalf of the employer only. The tax liability in case of fringe

benefits is termed as FBT and is not applicable on employee even if the utilization of the fringe

benefits is done by employee only (ATO, 2018 a). The employer who is liable for FBT payable

will also receive the tax deduction on the provided loan if employee uses the same to produce

assessable income. Further, this is not applicable in the situation when the extended loan amount

which has been extended to employee would then be issued to respective associated to conduct

work of generating assessable income (Nethercott, Richardson and Devos, 2016).

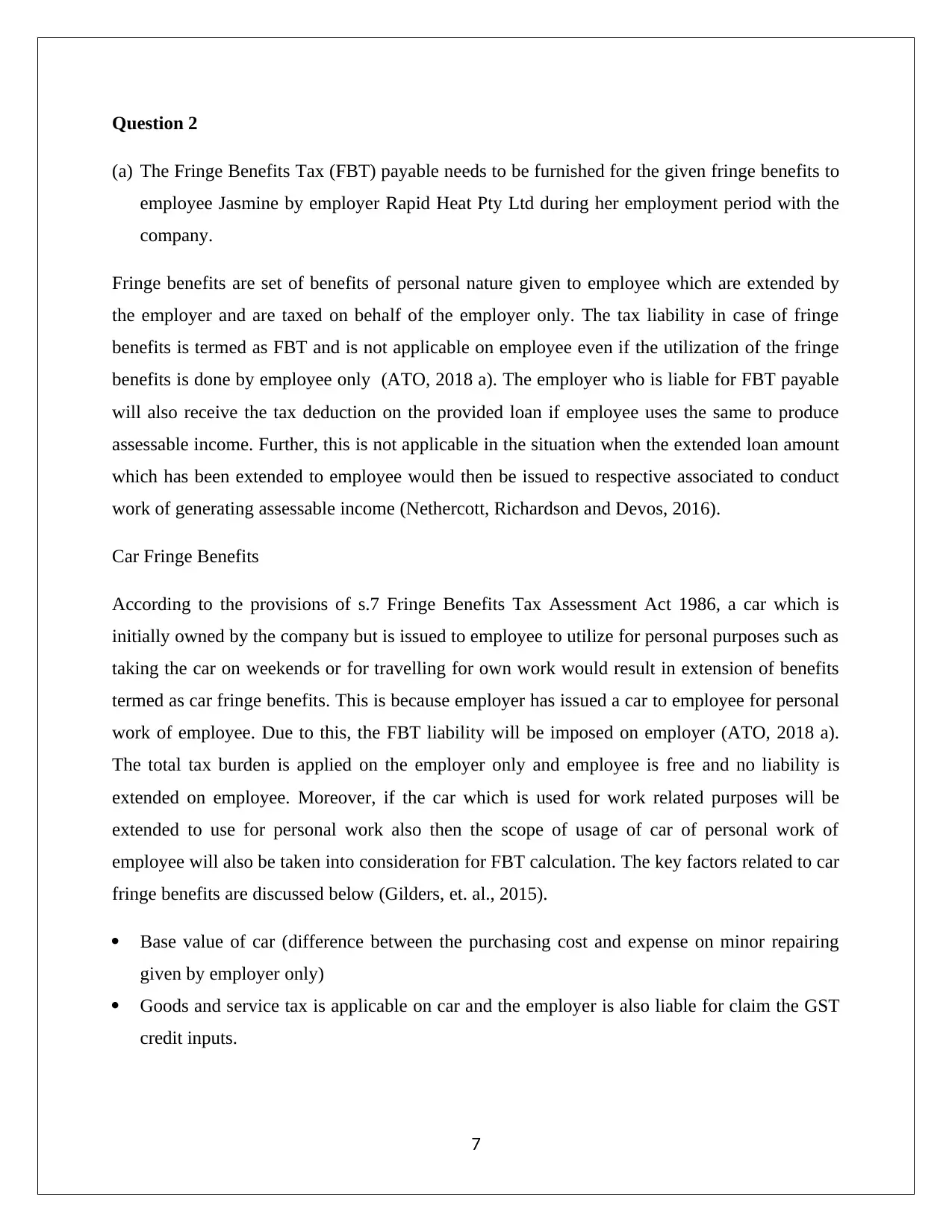

Car Fringe Benefits

According to the provisions of s.7 Fringe Benefits Tax Assessment Act 1986, a car which is

initially owned by the company but is issued to employee to utilize for personal purposes such as

taking the car on weekends or for travelling for own work would result in extension of benefits

termed as car fringe benefits. This is because employer has issued a car to employee for personal

work of employee. Due to this, the FBT liability will be imposed on employer (ATO, 2018 a).

The total tax burden is applied on the employer only and employee is free and no liability is

extended on employee. Moreover, if the car which is used for work related purposes will be

extended to use for personal work also then the scope of usage of car of personal work of

employee will also be taken into consideration for FBT calculation. The key factors related to car

fringe benefits are discussed below (Gilders, et. al., 2015).

Base value of car (difference between the purchasing cost and expense on minor repairing

given by employer only)

Goods and service tax is applicable on car and the employer is also liable for claim the GST

credit inputs.

7

(a) The Fringe Benefits Tax (FBT) payable needs to be furnished for the given fringe benefits to

employee Jasmine by employer Rapid Heat Pty Ltd during her employment period with the

company.

Fringe benefits are set of benefits of personal nature given to employee which are extended by

the employer and are taxed on behalf of the employer only. The tax liability in case of fringe

benefits is termed as FBT and is not applicable on employee even if the utilization of the fringe

benefits is done by employee only (ATO, 2018 a). The employer who is liable for FBT payable

will also receive the tax deduction on the provided loan if employee uses the same to produce

assessable income. Further, this is not applicable in the situation when the extended loan amount

which has been extended to employee would then be issued to respective associated to conduct

work of generating assessable income (Nethercott, Richardson and Devos, 2016).

Car Fringe Benefits

According to the provisions of s.7 Fringe Benefits Tax Assessment Act 1986, a car which is

initially owned by the company but is issued to employee to utilize for personal purposes such as

taking the car on weekends or for travelling for own work would result in extension of benefits

termed as car fringe benefits. This is because employer has issued a car to employee for personal

work of employee. Due to this, the FBT liability will be imposed on employer (ATO, 2018 a).

The total tax burden is applied on the employer only and employee is free and no liability is

extended on employee. Moreover, if the car which is used for work related purposes will be

extended to use for personal work also then the scope of usage of car of personal work of

employee will also be taken into consideration for FBT calculation. The key factors related to car

fringe benefits are discussed below (Gilders, et. al., 2015).

Base value of car (difference between the purchasing cost and expense on minor repairing

given by employer only)

Goods and service tax is applicable on car and the employer is also liable for claim the GST

credit inputs.

7

Available days of car private usage of employee which will not be reduced for two cases

when the car itself left by employee at the airport and the car is s taken by employee for

minor repair works.

Rapid Heat issued car to Jasmine that she can use for her own personal use. It is clear indication

that car fringe benefit is issued to her. The FBT liability for the given information is computed in

the table show below.

Loan Fringe Benefits

Loan is a type of financial support to the employee so that the respective employee can satisfy

their personal need by purchasing assets or home. The essential factor in relation to the loan is

that employer must choose the rate of interest which is defined by the Reserve Bank of Australia

(RBA). Further, if the loan is given at the discounted rate which is lower than the benchmark rate

defined by RBA, then the loan would come under the category of loan fringe benefits. As a

result, the interest saving of the employee will be considered for the establishment of the FBT

liability (ATO, 2018 b).

8

when the car itself left by employee at the airport and the car is s taken by employee for

minor repair works.

Rapid Heat issued car to Jasmine that she can use for her own personal use. It is clear indication

that car fringe benefit is issued to her. The FBT liability for the given information is computed in

the table show below.

Loan Fringe Benefits

Loan is a type of financial support to the employee so that the respective employee can satisfy

their personal need by purchasing assets or home. The essential factor in relation to the loan is

that employer must choose the rate of interest which is defined by the Reserve Bank of Australia

(RBA). Further, if the loan is given at the discounted rate which is lower than the benchmark rate

defined by RBA, then the loan would come under the category of loan fringe benefits. As a

result, the interest saving of the employee will be considered for the establishment of the FBT

liability (ATO, 2018 b).

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

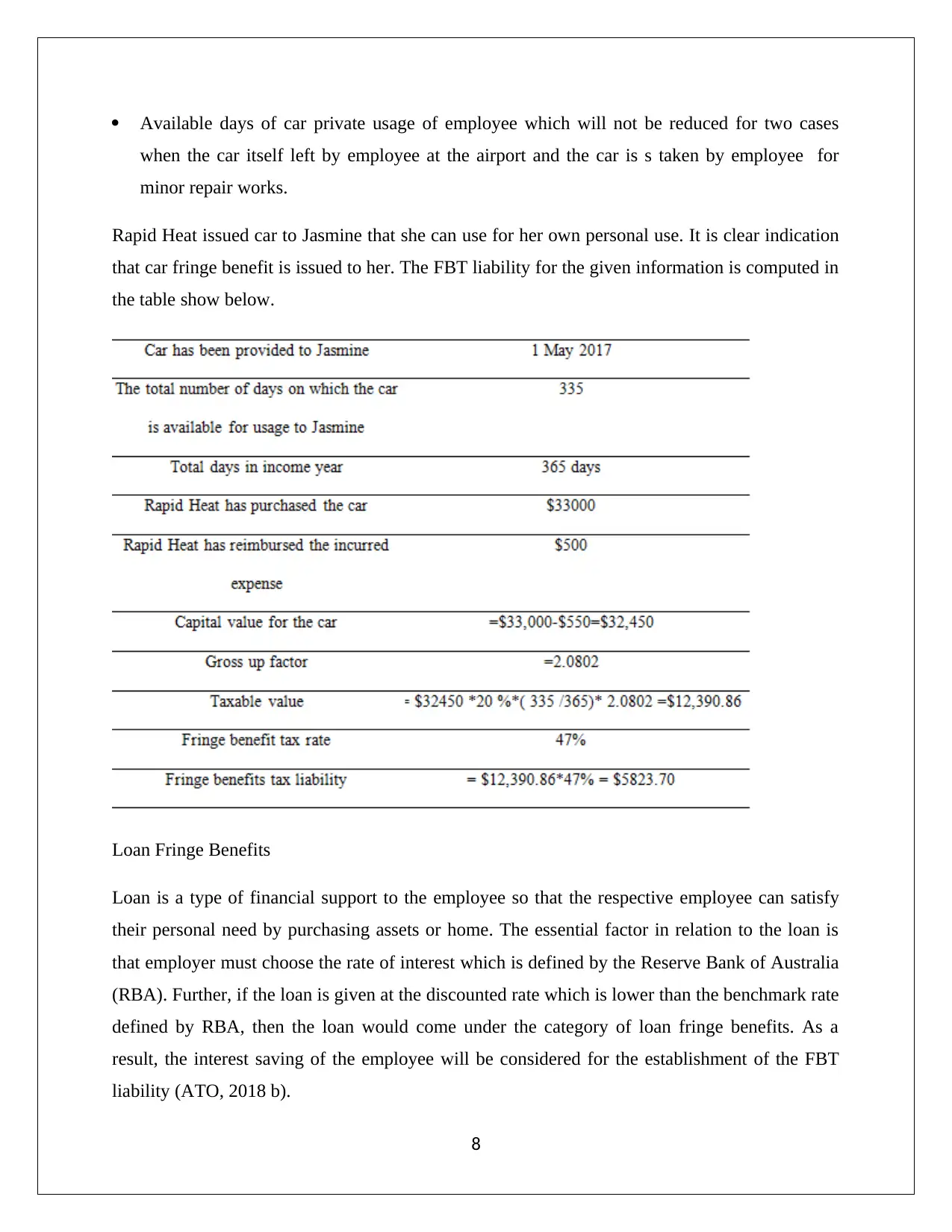

Rapid Heat the employer of Jasmine issues loan to the tune of $500,000 on September 1, 2017.

The loan fringe benefit will be considered when the employer has taken discounted rate of

interest when compared to the applicable RBA’s rate. It is apparent as per TD 2017/3 that the

rate of interest for loan should have been 5.25% while Rapid Heat’s rate of interest is 4.25%.

This provided evidence to the conclusion that Rapid Heat has saved the interest amount of the

employee by issuing loan fringe benefits (ATO, 2017).

Jasmine used the loan fringe benefit’s amount to purchase the home for herself. If the home is

used by her for personal residence purpose, then $450,000 will not amount to any tax deduction

for Rapid Heat. However, if she offers the purchased home to other party so that the rent income

can be earned, then the rent income would be part of the assessable income of the employee and

hence, tax deduction can be claimed on behalf of the employer (ATO, 2018 a).

Further, Jasmine used the net remaining amount $50,000 to extend to husband with zero interest

payment so as to purchase the shares. This is noteworthy that dividend income derived from

$50,000 will not extend tax deduction claim for employer because Jasmine herself does not

purchase shares.

Expense Fringe Benefits

Any act of the employer which directly/indirectly limits the personal level expense liability of

the employee would be considered under expense fringe benefit (Krever, 2017). Moreover, the

9

The loan fringe benefit will be considered when the employer has taken discounted rate of

interest when compared to the applicable RBA’s rate. It is apparent as per TD 2017/3 that the

rate of interest for loan should have been 5.25% while Rapid Heat’s rate of interest is 4.25%.

This provided evidence to the conclusion that Rapid Heat has saved the interest amount of the

employee by issuing loan fringe benefits (ATO, 2017).

Jasmine used the loan fringe benefit’s amount to purchase the home for herself. If the home is

used by her for personal residence purpose, then $450,000 will not amount to any tax deduction

for Rapid Heat. However, if she offers the purchased home to other party so that the rent income

can be earned, then the rent income would be part of the assessable income of the employee and

hence, tax deduction can be claimed on behalf of the employer (ATO, 2018 a).

Further, Jasmine used the net remaining amount $50,000 to extend to husband with zero interest

payment so as to purchase the shares. This is noteworthy that dividend income derived from

$50,000 will not extend tax deduction claim for employer because Jasmine herself does not

purchase shares.

Expense Fringe Benefits

Any act of the employer which directly/indirectly limits the personal level expense liability of

the employee would be considered under expense fringe benefit (Krever, 2017). Moreover, the

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

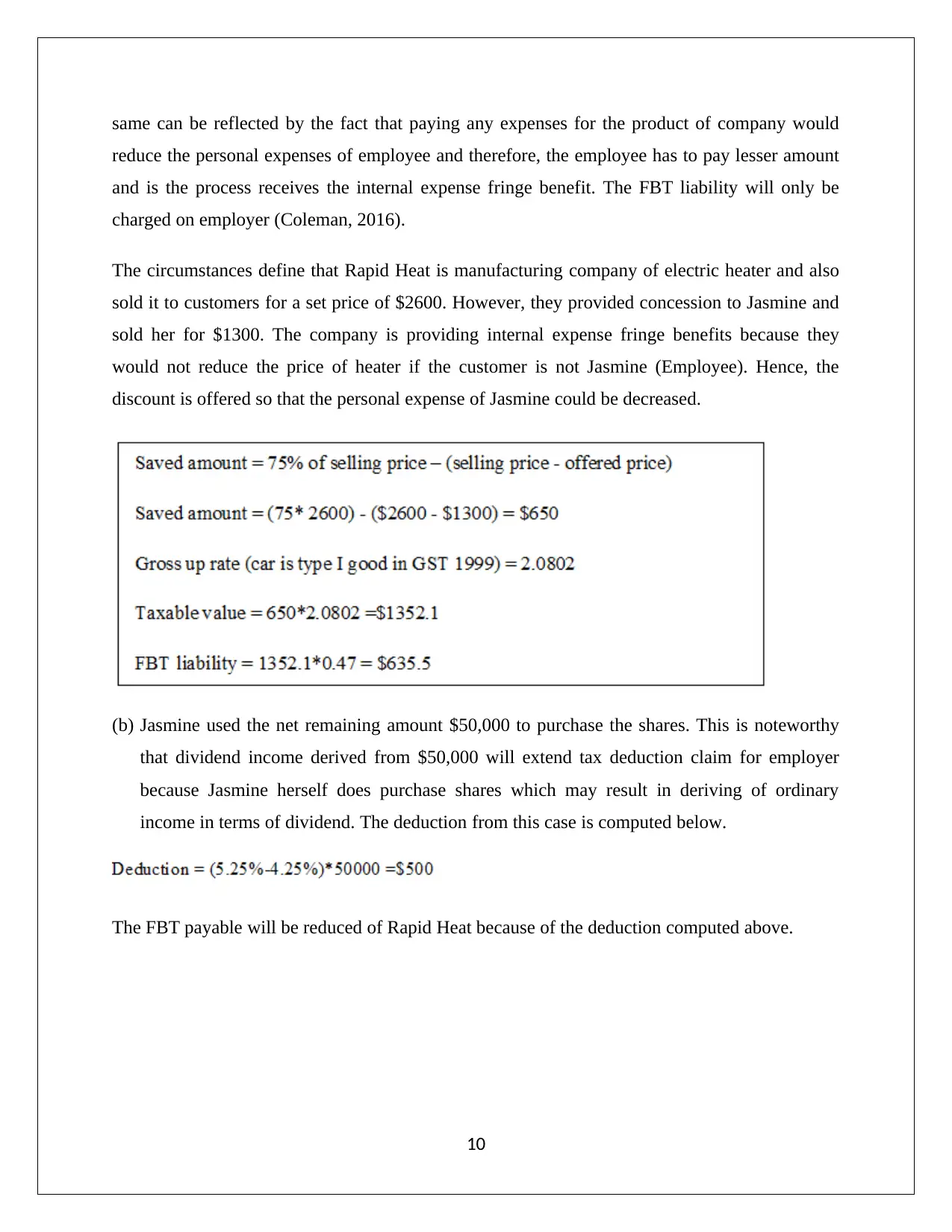

same can be reflected by the fact that paying any expenses for the product of company would

reduce the personal expenses of employee and therefore, the employee has to pay lesser amount

and is the process receives the internal expense fringe benefit. The FBT liability will only be

charged on employer (Coleman, 2016).

The circumstances define that Rapid Heat is manufacturing company of electric heater and also

sold it to customers for a set price of $2600. However, they provided concession to Jasmine and

sold her for $1300. The company is providing internal expense fringe benefits because they

would not reduce the price of heater if the customer is not Jasmine (Employee). Hence, the

discount is offered so that the personal expense of Jasmine could be decreased.

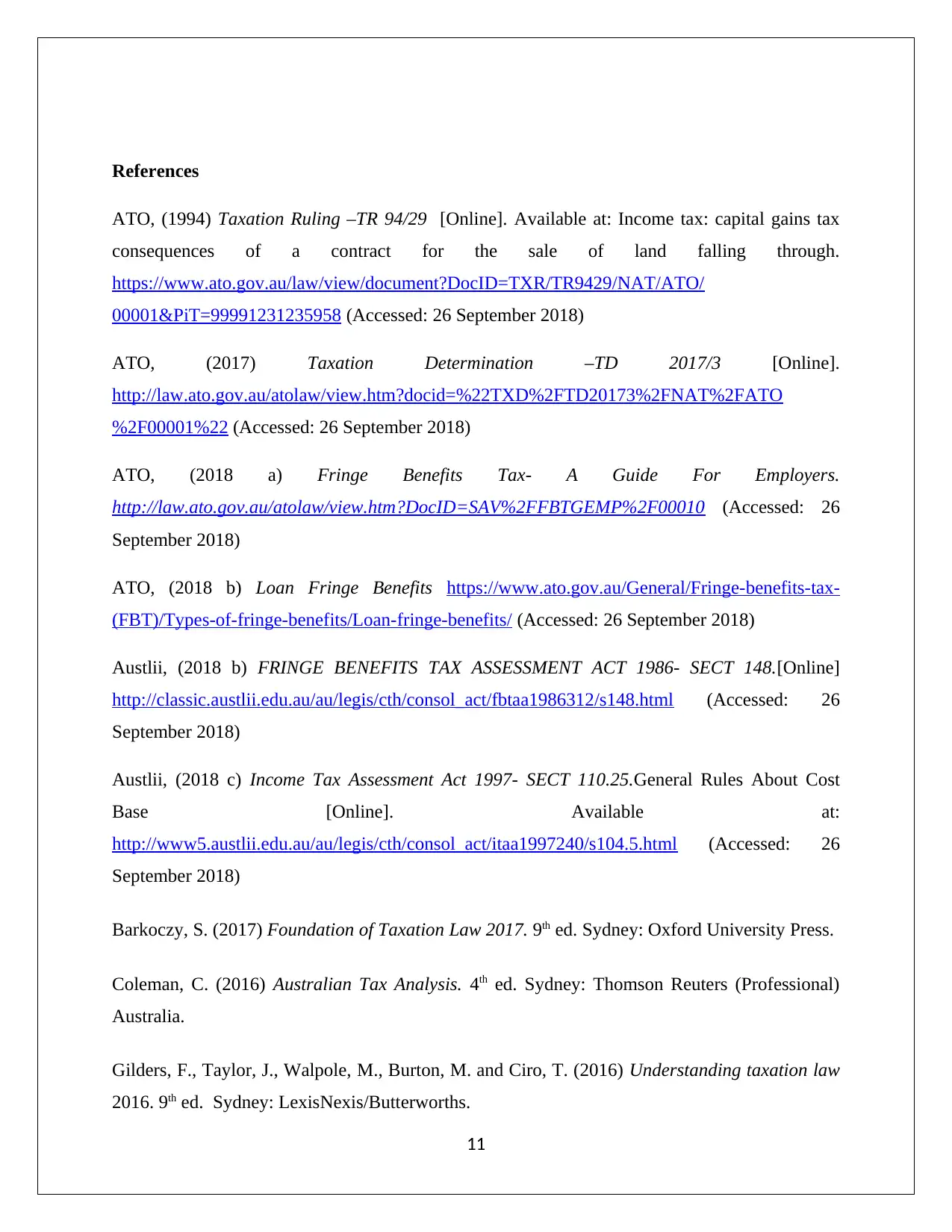

(b) Jasmine used the net remaining amount $50,000 to purchase the shares. This is noteworthy

that dividend income derived from $50,000 will extend tax deduction claim for employer

because Jasmine herself does purchase shares which may result in deriving of ordinary

income in terms of dividend. The deduction from this case is computed below.

The FBT payable will be reduced of Rapid Heat because of the deduction computed above.

10

reduce the personal expenses of employee and therefore, the employee has to pay lesser amount

and is the process receives the internal expense fringe benefit. The FBT liability will only be

charged on employer (Coleman, 2016).

The circumstances define that Rapid Heat is manufacturing company of electric heater and also

sold it to customers for a set price of $2600. However, they provided concession to Jasmine and

sold her for $1300. The company is providing internal expense fringe benefits because they

would not reduce the price of heater if the customer is not Jasmine (Employee). Hence, the

discount is offered so that the personal expense of Jasmine could be decreased.

(b) Jasmine used the net remaining amount $50,000 to purchase the shares. This is noteworthy

that dividend income derived from $50,000 will extend tax deduction claim for employer

because Jasmine herself does purchase shares which may result in deriving of ordinary

income in terms of dividend. The deduction from this case is computed below.

The FBT payable will be reduced of Rapid Heat because of the deduction computed above.

10

References

ATO, (1994) Taxation Ruling –TR 94/29 [Online]. Available at: Income tax: capital gains tax

consequences of a contract for the sale of land falling through.

https://www.ato.gov.au/law/view/document?DocID=TXR/TR9429/NAT/ATO/

00001&PiT=99991231235958 (Accessed: 26 September 2018)

ATO, (2017) Taxation Determination –TD 2017/3 [Online].

http://law.ato.gov.au/atolaw/view.htm?docid=%22TXD%2FTD20173%2FNAT%2FATO

%2F00001%22 (Accessed: 26 September 2018)

ATO, (2018 a) Fringe Benefits Tax- A Guide For Employers.

http://law.ato.gov.au/atolaw/view.htm?DocID=SAV%2FFBTGEMP%2F00010 (Accessed: 26

September 2018)

ATO, (2018 b) Loan Fringe Benefits https://www.ato.gov.au/General/Fringe-benefits-tax-

(FBT)/Types-of-fringe-benefits/Loan-fringe-benefits/ (Accessed: 26 September 2018)

Austlii, (2018 b) FRINGE BENEFITS TAX ASSESSMENT ACT 1986- SECT 148.[Online]

http://classic.austlii.edu.au/au/legis/cth/consol_act/fbtaa1986312/s148.html (Accessed: 26

September 2018)

Austlii, (2018 c) Income Tax Assessment Act 1997- SECT 110.25.General Rules About Cost

Base [Online]. Available at:

http://www5.austlii.edu.au/au/legis/cth/consol_act/itaa1997240/s104.5.html (Accessed: 26

September 2018)

Barkoczy, S. (2017) Foundation of Taxation Law 2017. 9th ed. Sydney: Oxford University Press.

Coleman, C. (2016) Australian Tax Analysis. 4th ed. Sydney: Thomson Reuters (Professional)

Australia.

Gilders, F., Taylor, J., Walpole, M., Burton, M. and Ciro, T. (2016) Understanding taxation law

2016. 9th ed. Sydney: LexisNexis/Butterworths.

11

ATO, (1994) Taxation Ruling –TR 94/29 [Online]. Available at: Income tax: capital gains tax

consequences of a contract for the sale of land falling through.

https://www.ato.gov.au/law/view/document?DocID=TXR/TR9429/NAT/ATO/

00001&PiT=99991231235958 (Accessed: 26 September 2018)

ATO, (2017) Taxation Determination –TD 2017/3 [Online].

http://law.ato.gov.au/atolaw/view.htm?docid=%22TXD%2FTD20173%2FNAT%2FATO

%2F00001%22 (Accessed: 26 September 2018)

ATO, (2018 a) Fringe Benefits Tax- A Guide For Employers.

http://law.ato.gov.au/atolaw/view.htm?DocID=SAV%2FFBTGEMP%2F00010 (Accessed: 26

September 2018)

ATO, (2018 b) Loan Fringe Benefits https://www.ato.gov.au/General/Fringe-benefits-tax-

(FBT)/Types-of-fringe-benefits/Loan-fringe-benefits/ (Accessed: 26 September 2018)

Austlii, (2018 b) FRINGE BENEFITS TAX ASSESSMENT ACT 1986- SECT 148.[Online]

http://classic.austlii.edu.au/au/legis/cth/consol_act/fbtaa1986312/s148.html (Accessed: 26

September 2018)

Austlii, (2018 c) Income Tax Assessment Act 1997- SECT 110.25.General Rules About Cost

Base [Online]. Available at:

http://www5.austlii.edu.au/au/legis/cth/consol_act/itaa1997240/s104.5.html (Accessed: 26

September 2018)

Barkoczy, S. (2017) Foundation of Taxation Law 2017. 9th ed. Sydney: Oxford University Press.

Coleman, C. (2016) Australian Tax Analysis. 4th ed. Sydney: Thomson Reuters (Professional)

Australia.

Gilders, F., Taylor, J., Walpole, M., Burton, M. and Ciro, T. (2016) Understanding taxation law

2016. 9th ed. Sydney: LexisNexis/Butterworths.

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.