Taxation Law Assignment - Analysis of Income and Capital Gains Tax

VerifiedAdded on 2023/01/13

|10

|2664

|50

Homework Assignment

AI Summary

This assignment solution addresses key aspects of Australian taxation law, focusing on income tax, capital gains tax (CGT), and allowable deductions. The introduction provides an overview of the Australian taxation system, including the role of the Australian Taxation Office (ATO) and the concept of progressive taxation. Question 1 delves into CGT, explaining its application to various asset sales, such as land, shares, and collectables like stamps and a Bob Marley guitar. The analysis includes detailed calculations of capital gains and losses, considering cost bases, sale proceeds, and relevant exemptions. Question 2 examines various expenses incurred by an individual, Ava, determining whether they qualify as allowable deductions. The analysis covers travel expenses, moving expenses, uniform costs, childcare expenses, phone calls, food purchases, speeding fines, and travelling expenses. The solution explains the criteria for deductibility, distinguishing between work-related and personal expenses, and referencing relevant tax laws and guidelines.

TAXATION LAW

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...............................................................................................................1

QUESTION 1.....................................................................................................................1

a) Sale of land ...............................................................................................................1

b) Sale of Shares............................................................................................................3

c) Sale of stamp collection ............................................................................................3

d) Sale of Bob Marley Guitar..........................................................................................4

QUESTION 2.....................................................................................................................4

a) Travel Expenses. ......................................................................................................5

b) Moving expenses to relocate in Darwin. ...................................................................5

c) Payment of white uniform...........................................................................................6

d) Childcare expenses...................................................................................................6

e) Phone calls for attending patients. ............................................................................6

f) Food purchase for evening shifts ...............................................................................6

g) Speeding fine in emergency.....................................................................................7

h) Travelling expense.....................................................................................................7

CONCLUSION ..................................................................................................................7

REFERENCES..................................................................................................................8

INTRODUCTION...............................................................................................................1

QUESTION 1.....................................................................................................................1

a) Sale of land ...............................................................................................................1

b) Sale of Shares............................................................................................................3

c) Sale of stamp collection ............................................................................................3

d) Sale of Bob Marley Guitar..........................................................................................4

QUESTION 2.....................................................................................................................4

a) Travel Expenses. ......................................................................................................5

b) Moving expenses to relocate in Darwin. ...................................................................5

c) Payment of white uniform...........................................................................................6

d) Childcare expenses...................................................................................................6

e) Phone calls for attending patients. ............................................................................6

f) Food purchase for evening shifts ...............................................................................6

g) Speeding fine in emergency.....................................................................................7

h) Travelling expense.....................................................................................................7

CONCLUSION ..................................................................................................................7

REFERENCES..................................................................................................................8

INTRODUCTION

Most of the major business taxes of business like the income tax is collected by

Australian Government via Australian Taxation Office. Over some scenarios state taxes

are also applicable, generally for the payroll tax. There are number of tax treaties held

by Australia. It is holding number of tax treaties with many nations for preventing the

double taxation. An Australian resident individual are liable for income tax on worldwide

basis. Tax is collected every financial year from the working individuals (Woellner and

et.al., 2016). Australian income tax is based on progressive basis higher the income

higher is the tax liability. Present Report will provide understanding about the Australian

taxation system for income and the capital gains. It will provide about the incomes to be

reported and deductions and exemptions available to the individual in his tax return.

QUESTION 1

Capital gain refers to difference between acquisition price and the price received

on its sale. Tax over capital gains are levied when the gain is made on sale of asset.

Capital gain tax is applicable to shares, property, goodwill, foreign currency, licences,

contractual rights & the assets of personal use that are purchased above $ 10000.

main residence, cars, depreciating assets that are used for the taxable purpose. Assets

purchases before September 20, 1985 are tax exempt.

Capital gain tax is not separate tax it is the part of personal income tax. When the

property is owned for more than 12 months, on its sale capital gain tax becomes slight

complicated process. Capital gain is taxable as per the Income Tax Assessment Act,

1936 (Fry, 2017). The law provides for the provision and relevant rules regarding the

taxation of capital gains in the income tax return of individual. Section 104 of ITAA,

1997 provides the provisions of Capital gain event on disposal. Short term capital gain

arise if asset is hold for less than 12 months with tax rate upto 37%. When the assets

are hold for more than 12 months capital gains are taxed at lower rates of around 20%.

a) Sale of land

When the land is sold residents are atttract the CGT event and are liable to

capital gain tax on the profitable sale.

1

Most of the major business taxes of business like the income tax is collected by

Australian Government via Australian Taxation Office. Over some scenarios state taxes

are also applicable, generally for the payroll tax. There are number of tax treaties held

by Australia. It is holding number of tax treaties with many nations for preventing the

double taxation. An Australian resident individual are liable for income tax on worldwide

basis. Tax is collected every financial year from the working individuals (Woellner and

et.al., 2016). Australian income tax is based on progressive basis higher the income

higher is the tax liability. Present Report will provide understanding about the Australian

taxation system for income and the capital gains. It will provide about the incomes to be

reported and deductions and exemptions available to the individual in his tax return.

QUESTION 1

Capital gain refers to difference between acquisition price and the price received

on its sale. Tax over capital gains are levied when the gain is made on sale of asset.

Capital gain tax is applicable to shares, property, goodwill, foreign currency, licences,

contractual rights & the assets of personal use that are purchased above $ 10000.

main residence, cars, depreciating assets that are used for the taxable purpose. Assets

purchases before September 20, 1985 are tax exempt.

Capital gain tax is not separate tax it is the part of personal income tax. When the

property is owned for more than 12 months, on its sale capital gain tax becomes slight

complicated process. Capital gain is taxable as per the Income Tax Assessment Act,

1936 (Fry, 2017). The law provides for the provision and relevant rules regarding the

taxation of capital gains in the income tax return of individual. Section 104 of ITAA,

1997 provides the provisions of Capital gain event on disposal. Short term capital gain

arise if asset is hold for less than 12 months with tax rate upto 37%. When the assets

are hold for more than 12 months capital gains are taxed at lower rates of around 20%.

a) Sale of land

When the land is sold residents are atttract the CGT event and are liable to

capital gain tax on the profitable sale.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

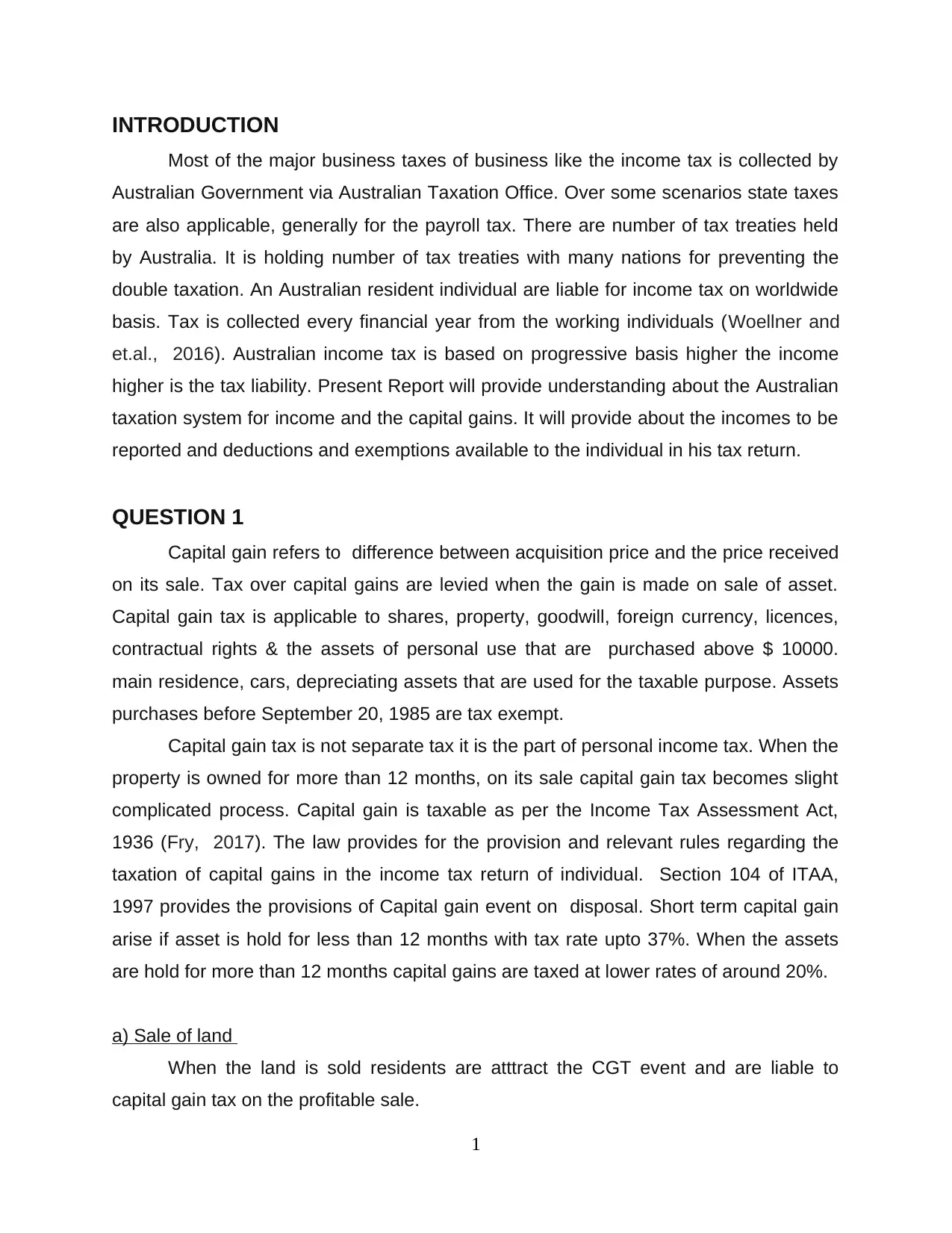

Sale Proceeds 800000

Cost Base

Cost of Purchase 130000

Stamp Duty 800

Legal Fees 1200

Removal of Pine trees 1500

Agent's fees & solicitor's Fees 25000

Cost Base Un-indexed 158500

Capital Gain on Sale

Proceeds on Sale 800000

Less : Un-indexed Cost base 158500

Capital Gain 641500

Tax on capital using discounting

method

Capital Gain 641500

Discount 50%

Net taxable capital gain 320750

Sophia sold the land acquired in 1991 for $ 800000 that was purchased for

$130000 in 1991. She incurred the expenditures on stamp duty and legal fees of $ 800

& $1200 respectively. Before the property was put for sale expenditure was incurred for

removal of pine trees for bringing the property to saleable condition. She also incurred

expenses on legal fees, advertising and fees of the agent on sale of land amounting

$25000 (Capital Gains Tax, 2019). Australian taxation guidelines provides that council

rates, insurance tax, and interest on borrowing for purchase of the property. These will

be forming part of cost base if property is acquired after August 20, 1991. In the present

case it is assumed that property is purchased before 20 August, therefore the above

expenditures are not included in the cost base (Brown, 2018). The deductions are not

available as it was not used for producing assessable income. She had capital gain of

$320750 using the discounting method.

2

Cost Base

Cost of Purchase 130000

Stamp Duty 800

Legal Fees 1200

Removal of Pine trees 1500

Agent's fees & solicitor's Fees 25000

Cost Base Un-indexed 158500

Capital Gain on Sale

Proceeds on Sale 800000

Less : Un-indexed Cost base 158500

Capital Gain 641500

Tax on capital using discounting

method

Capital Gain 641500

Discount 50%

Net taxable capital gain 320750

Sophia sold the land acquired in 1991 for $ 800000 that was purchased for

$130000 in 1991. She incurred the expenditures on stamp duty and legal fees of $ 800

& $1200 respectively. Before the property was put for sale expenditure was incurred for

removal of pine trees for bringing the property to saleable condition. She also incurred

expenses on legal fees, advertising and fees of the agent on sale of land amounting

$25000 (Capital Gains Tax, 2019). Australian taxation guidelines provides that council

rates, insurance tax, and interest on borrowing for purchase of the property. These will

be forming part of cost base if property is acquired after August 20, 1991. In the present

case it is assumed that property is purchased before 20 August, therefore the above

expenditures are not included in the cost base (Brown, 2018). The deductions are not

available as it was not used for producing assessable income. She had capital gain of

$320750 using the discounting method.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

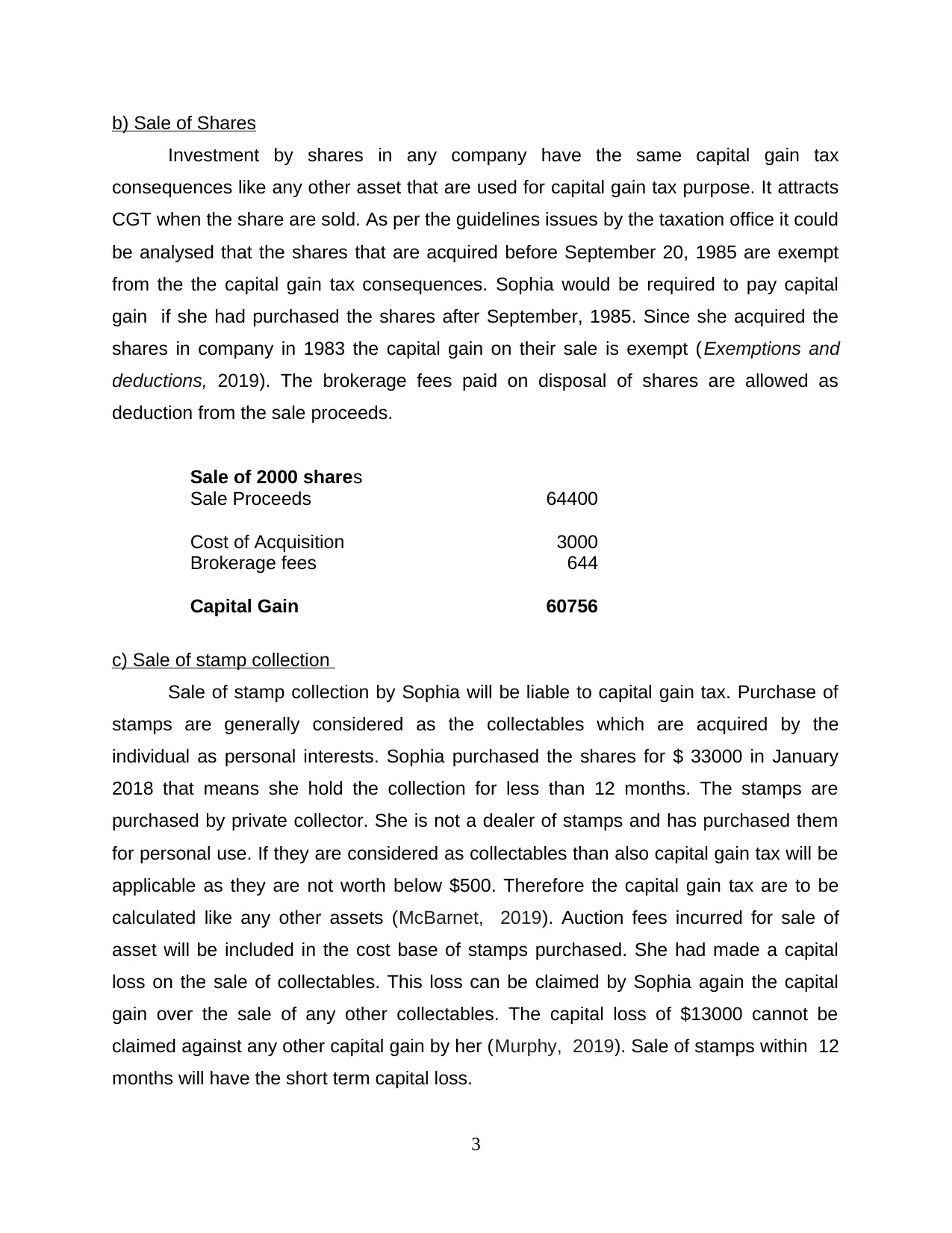

b) Sale of Shares

Investment by shares in any company have the same capital gain tax

consequences like any other asset that are used for capital gain tax purpose. It attracts

CGT when the share are sold. As per the guidelines issues by the taxation office it could

be analysed that the shares that are acquired before September 20, 1985 are exempt

from the the capital gain tax consequences. Sophia would be required to pay capital

gain if she had purchased the shares after September, 1985. Since she acquired the

shares in company in 1983 the capital gain on their sale is exempt (Exemptions and

deductions, 2019). The brokerage fees paid on disposal of shares are allowed as

deduction from the sale proceeds.

Sale of 2000 shares

Sale Proceeds 64400

Cost of Acquisition 3000

Brokerage fees 644

Capital Gain 60756

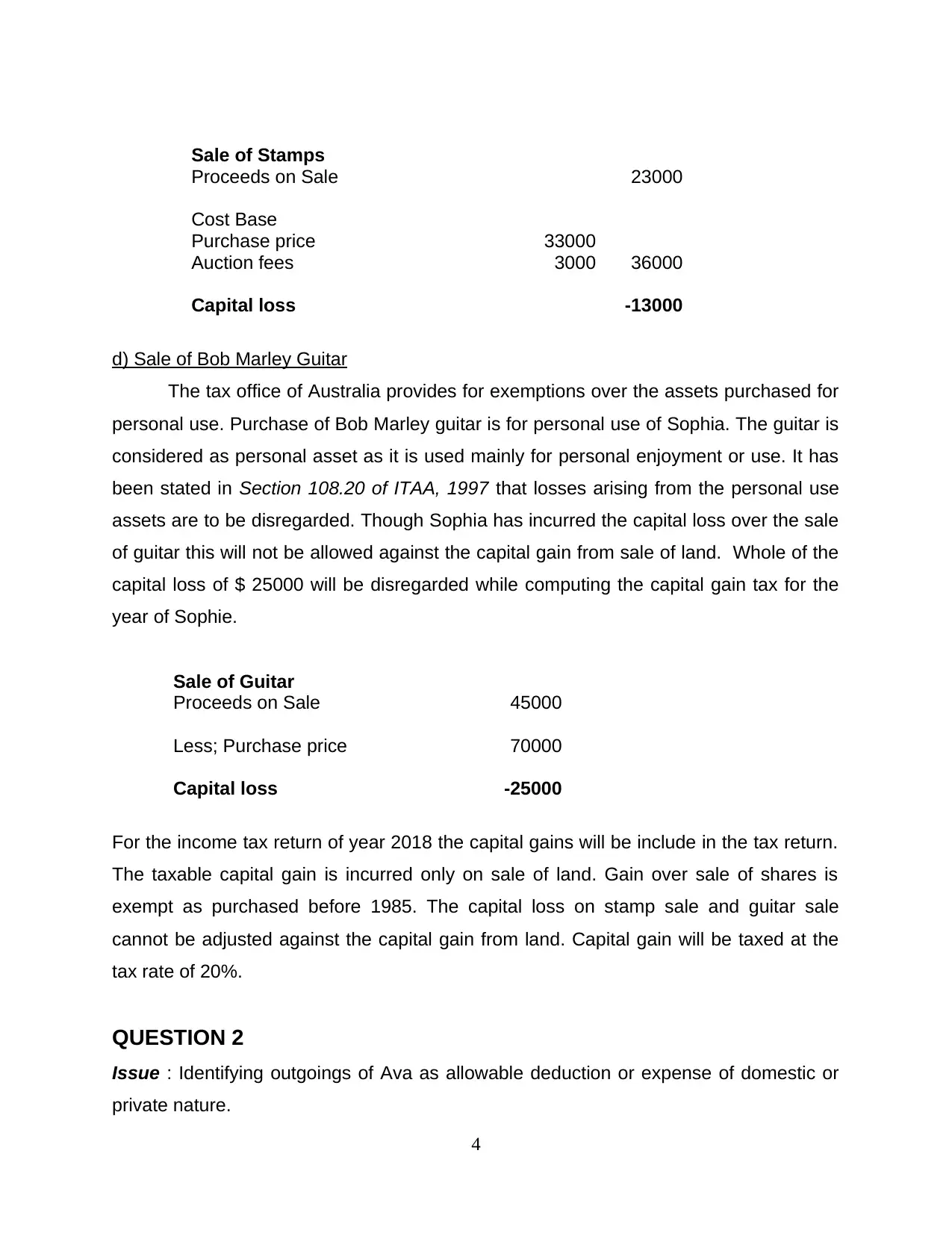

c) Sale of stamp collection

Sale of stamp collection by Sophia will be liable to capital gain tax. Purchase of

stamps are generally considered as the collectables which are acquired by the

individual as personal interests. Sophia purchased the shares for $ 33000 in January

2018 that means she hold the collection for less than 12 months. The stamps are

purchased by private collector. She is not a dealer of stamps and has purchased them

for personal use. If they are considered as collectables than also capital gain tax will be

applicable as they are not worth below $500. Therefore the capital gain tax are to be

calculated like any other assets (McBarnet, 2019). Auction fees incurred for sale of

asset will be included in the cost base of stamps purchased. She had made a capital

loss on the sale of collectables. This loss can be claimed by Sophia again the capital

gain over the sale of any other collectables. The capital loss of $13000 cannot be

claimed against any other capital gain by her (Murphy, 2019). Sale of stamps within 12

months will have the short term capital loss.

3

Investment by shares in any company have the same capital gain tax

consequences like any other asset that are used for capital gain tax purpose. It attracts

CGT when the share are sold. As per the guidelines issues by the taxation office it could

be analysed that the shares that are acquired before September 20, 1985 are exempt

from the the capital gain tax consequences. Sophia would be required to pay capital

gain if she had purchased the shares after September, 1985. Since she acquired the

shares in company in 1983 the capital gain on their sale is exempt (Exemptions and

deductions, 2019). The brokerage fees paid on disposal of shares are allowed as

deduction from the sale proceeds.

Sale of 2000 shares

Sale Proceeds 64400

Cost of Acquisition 3000

Brokerage fees 644

Capital Gain 60756

c) Sale of stamp collection

Sale of stamp collection by Sophia will be liable to capital gain tax. Purchase of

stamps are generally considered as the collectables which are acquired by the

individual as personal interests. Sophia purchased the shares for $ 33000 in January

2018 that means she hold the collection for less than 12 months. The stamps are

purchased by private collector. She is not a dealer of stamps and has purchased them

for personal use. If they are considered as collectables than also capital gain tax will be

applicable as they are not worth below $500. Therefore the capital gain tax are to be

calculated like any other assets (McBarnet, 2019). Auction fees incurred for sale of

asset will be included in the cost base of stamps purchased. She had made a capital

loss on the sale of collectables. This loss can be claimed by Sophia again the capital

gain over the sale of any other collectables. The capital loss of $13000 cannot be

claimed against any other capital gain by her (Murphy, 2019). Sale of stamps within 12

months will have the short term capital loss.

3

Sale of Stamps

Proceeds on Sale 23000

Cost Base

Purchase price 33000

Auction fees 3000 36000

Capital loss -13000

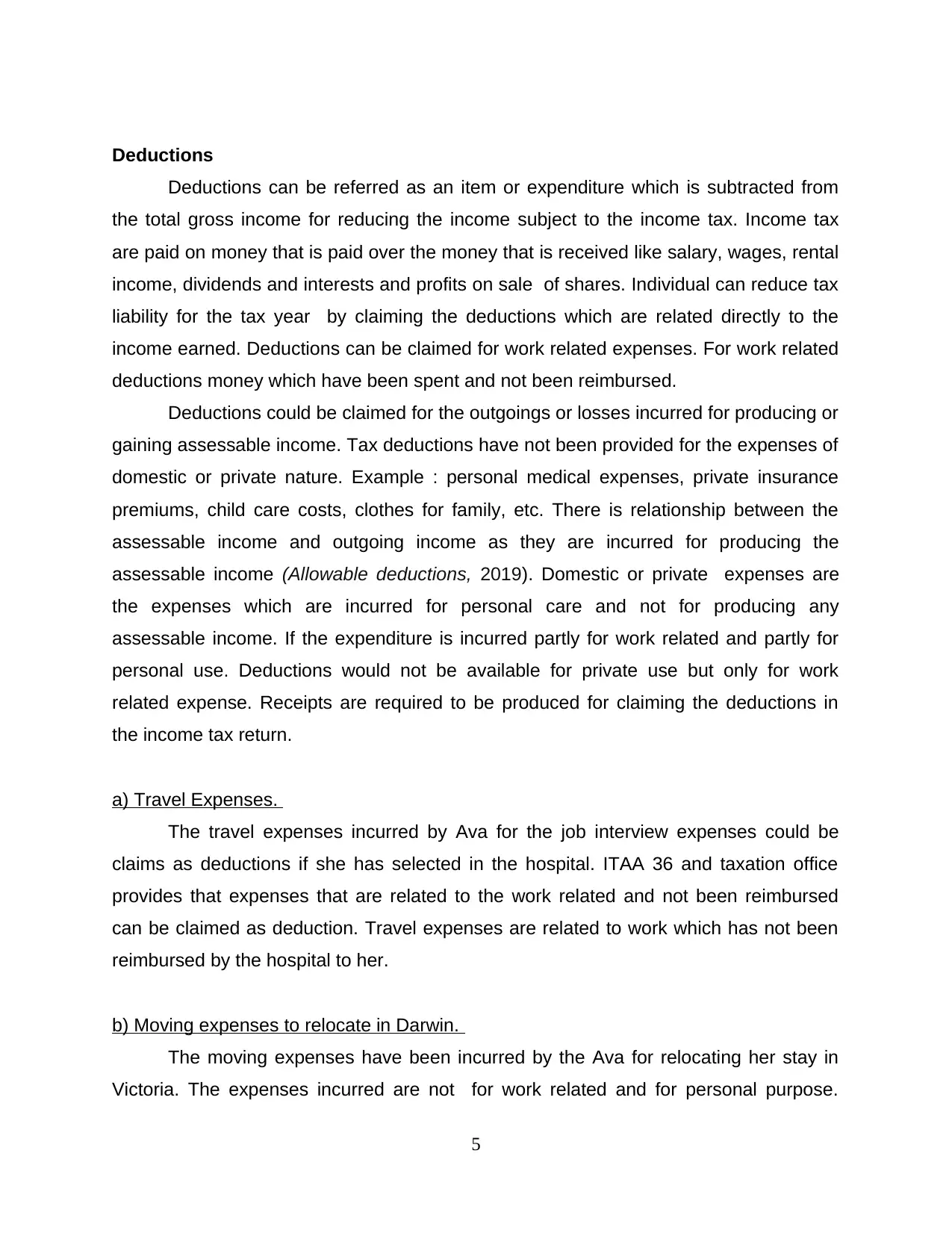

d) Sale of Bob Marley Guitar

The tax office of Australia provides for exemptions over the assets purchased for

personal use. Purchase of Bob Marley guitar is for personal use of Sophia. The guitar is

considered as personal asset as it is used mainly for personal enjoyment or use. It has

been stated in Section 108.20 of ITAA, 1997 that losses arising from the personal use

assets are to be disregarded. Though Sophia has incurred the capital loss over the sale

of guitar this will not be allowed against the capital gain from sale of land. Whole of the

capital loss of $ 25000 will be disregarded while computing the capital gain tax for the

year of Sophie.

Sale of Guitar

Proceeds on Sale 45000

Less; Purchase price 70000

Capital loss -25000

For the income tax return of year 2018 the capital gains will be include in the tax return.

The taxable capital gain is incurred only on sale of land. Gain over sale of shares is

exempt as purchased before 1985. The capital loss on stamp sale and guitar sale

cannot be adjusted against the capital gain from land. Capital gain will be taxed at the

tax rate of 20%.

QUESTION 2

Issue : Identifying outgoings of Ava as allowable deduction or expense of domestic or

private nature.

4

Proceeds on Sale 23000

Cost Base

Purchase price 33000

Auction fees 3000 36000

Capital loss -13000

d) Sale of Bob Marley Guitar

The tax office of Australia provides for exemptions over the assets purchased for

personal use. Purchase of Bob Marley guitar is for personal use of Sophia. The guitar is

considered as personal asset as it is used mainly for personal enjoyment or use. It has

been stated in Section 108.20 of ITAA, 1997 that losses arising from the personal use

assets are to be disregarded. Though Sophia has incurred the capital loss over the sale

of guitar this will not be allowed against the capital gain from sale of land. Whole of the

capital loss of $ 25000 will be disregarded while computing the capital gain tax for the

year of Sophie.

Sale of Guitar

Proceeds on Sale 45000

Less; Purchase price 70000

Capital loss -25000

For the income tax return of year 2018 the capital gains will be include in the tax return.

The taxable capital gain is incurred only on sale of land. Gain over sale of shares is

exempt as purchased before 1985. The capital loss on stamp sale and guitar sale

cannot be adjusted against the capital gain from land. Capital gain will be taxed at the

tax rate of 20%.

QUESTION 2

Issue : Identifying outgoings of Ava as allowable deduction or expense of domestic or

private nature.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

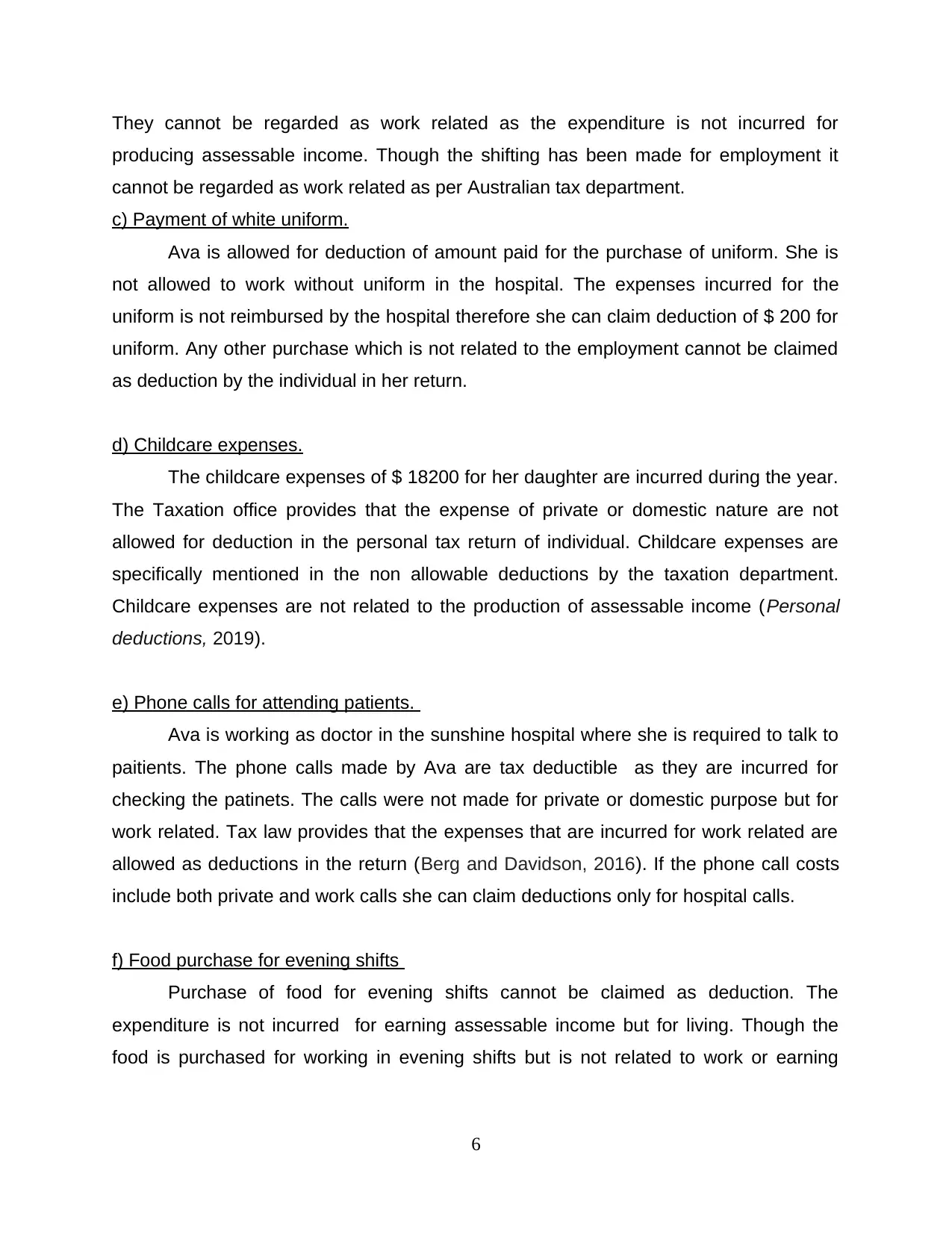

Deductions

Deductions can be referred as an item or expenditure which is subtracted from

the total gross income for reducing the income subject to the income tax. Income tax

are paid on money that is paid over the money that is received like salary, wages, rental

income, dividends and interests and profits on sale of shares. Individual can reduce tax

liability for the tax year by claiming the deductions which are related directly to the

income earned. Deductions can be claimed for work related expenses. For work related

deductions money which have been spent and not been reimbursed.

Deductions could be claimed for the outgoings or losses incurred for producing or

gaining assessable income. Tax deductions have not been provided for the expenses of

domestic or private nature. Example : personal medical expenses, private insurance

premiums, child care costs, clothes for family, etc. There is relationship between the

assessable income and outgoing income as they are incurred for producing the

assessable income (Allowable deductions, 2019). Domestic or private expenses are

the expenses which are incurred for personal care and not for producing any

assessable income. If the expenditure is incurred partly for work related and partly for

personal use. Deductions would not be available for private use but only for work

related expense. Receipts are required to be produced for claiming the deductions in

the income tax return.

a) Travel Expenses.

The travel expenses incurred by Ava for the job interview expenses could be

claims as deductions if she has selected in the hospital. ITAA 36 and taxation office

provides that expenses that are related to the work related and not been reimbursed

can be claimed as deduction. Travel expenses are related to work which has not been

reimbursed by the hospital to her.

b) Moving expenses to relocate in Darwin.

The moving expenses have been incurred by the Ava for relocating her stay in

Victoria. The expenses incurred are not for work related and for personal purpose.

5

Deductions can be referred as an item or expenditure which is subtracted from

the total gross income for reducing the income subject to the income tax. Income tax

are paid on money that is paid over the money that is received like salary, wages, rental

income, dividends and interests and profits on sale of shares. Individual can reduce tax

liability for the tax year by claiming the deductions which are related directly to the

income earned. Deductions can be claimed for work related expenses. For work related

deductions money which have been spent and not been reimbursed.

Deductions could be claimed for the outgoings or losses incurred for producing or

gaining assessable income. Tax deductions have not been provided for the expenses of

domestic or private nature. Example : personal medical expenses, private insurance

premiums, child care costs, clothes for family, etc. There is relationship between the

assessable income and outgoing income as they are incurred for producing the

assessable income (Allowable deductions, 2019). Domestic or private expenses are

the expenses which are incurred for personal care and not for producing any

assessable income. If the expenditure is incurred partly for work related and partly for

personal use. Deductions would not be available for private use but only for work

related expense. Receipts are required to be produced for claiming the deductions in

the income tax return.

a) Travel Expenses.

The travel expenses incurred by Ava for the job interview expenses could be

claims as deductions if she has selected in the hospital. ITAA 36 and taxation office

provides that expenses that are related to the work related and not been reimbursed

can be claimed as deduction. Travel expenses are related to work which has not been

reimbursed by the hospital to her.

b) Moving expenses to relocate in Darwin.

The moving expenses have been incurred by the Ava for relocating her stay in

Victoria. The expenses incurred are not for work related and for personal purpose.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

They cannot be regarded as work related as the expenditure is not incurred for

producing assessable income. Though the shifting has been made for employment it

cannot be regarded as work related as per Australian tax department.

c) Payment of white uniform.

Ava is allowed for deduction of amount paid for the purchase of uniform. She is

not allowed to work without uniform in the hospital. The expenses incurred for the

uniform is not reimbursed by the hospital therefore she can claim deduction of $ 200 for

uniform. Any other purchase which is not related to the employment cannot be claimed

as deduction by the individual in her return.

d) Childcare expenses.

The childcare expenses of $ 18200 for her daughter are incurred during the year.

The Taxation office provides that the expense of private or domestic nature are not

allowed for deduction in the personal tax return of individual. Childcare expenses are

specifically mentioned in the non allowable deductions by the taxation department.

Childcare expenses are not related to the production of assessable income (Personal

deductions, 2019).

e) Phone calls for attending patients.

Ava is working as doctor in the sunshine hospital where she is required to talk to

paitients. The phone calls made by Ava are tax deductible as they are incurred for

checking the patinets. The calls were not made for private or domestic purpose but for

work related. Tax law provides that the expenses that are incurred for work related are

allowed as deductions in the return (Berg and Davidson, 2016). If the phone call costs

include both private and work calls she can claim deductions only for hospital calls.

f) Food purchase for evening shifts

Purchase of food for evening shifts cannot be claimed as deduction. The

expenditure is not incurred for earning assessable income but for living. Though the

food is purchased for working in evening shifts but is not related to work or earning

6

producing assessable income. Though the shifting has been made for employment it

cannot be regarded as work related as per Australian tax department.

c) Payment of white uniform.

Ava is allowed for deduction of amount paid for the purchase of uniform. She is

not allowed to work without uniform in the hospital. The expenses incurred for the

uniform is not reimbursed by the hospital therefore she can claim deduction of $ 200 for

uniform. Any other purchase which is not related to the employment cannot be claimed

as deduction by the individual in her return.

d) Childcare expenses.

The childcare expenses of $ 18200 for her daughter are incurred during the year.

The Taxation office provides that the expense of private or domestic nature are not

allowed for deduction in the personal tax return of individual. Childcare expenses are

specifically mentioned in the non allowable deductions by the taxation department.

Childcare expenses are not related to the production of assessable income (Personal

deductions, 2019).

e) Phone calls for attending patients.

Ava is working as doctor in the sunshine hospital where she is required to talk to

paitients. The phone calls made by Ava are tax deductible as they are incurred for

checking the patinets. The calls were not made for private or domestic purpose but for

work related. Tax law provides that the expenses that are incurred for work related are

allowed as deductions in the return (Berg and Davidson, 2016). If the phone call costs

include both private and work calls she can claim deductions only for hospital calls.

f) Food purchase for evening shifts

Purchase of food for evening shifts cannot be claimed as deduction. The

expenditure is not incurred for earning assessable income but for living. Though the

food is purchased for working in evening shifts but is not related to work or earning

6

assessable income. Tax law provides deductions for food allowance paid by employer.

Expense is for private and domestic purpose.

g) Speeding fine in emergency

Speeding fine paid by Ava cannot be claimed as deductions as the tax office

specifically provides that fines and penalties are non allowable deductions (Allowable

deductions, 2019). The fine payment is not allowed as deduction under tax law.

h) Travelling expense

Travelling expense incurred by Ava are for earning the assessable income .

Travel expense to any place other than office are not allowed as deductions. If the

travelling expenses are been reimbursed by hospital than it will not be allowed as

deduction in the tax return of Ava for the year (Taylor and et.al., 2017).

CONCLUSION

The above study shows that all the incomes and expenses are guide by the ITAA

36 and the further guidelines provided by Australian Taxation Office. The project has

given understanding about the capital gain events and the exemptions allowed. An

individual can claim deduction for his work related expenses. They have to keep the

receipts of expenditure incurred for earning assessable income. They are not allowed

for deductions related with private or domestic purpose. The tax liability of an individual

is calculated after claiming all the deductions and exemptions where applicable.

7

Expense is for private and domestic purpose.

g) Speeding fine in emergency

Speeding fine paid by Ava cannot be claimed as deductions as the tax office

specifically provides that fines and penalties are non allowable deductions (Allowable

deductions, 2019). The fine payment is not allowed as deduction under tax law.

h) Travelling expense

Travelling expense incurred by Ava are for earning the assessable income .

Travel expense to any place other than office are not allowed as deductions. If the

travelling expenses are been reimbursed by hospital than it will not be allowed as

deduction in the tax return of Ava for the year (Taylor and et.al., 2017).

CONCLUSION

The above study shows that all the incomes and expenses are guide by the ITAA

36 and the further guidelines provided by Australian Taxation Office. The project has

given understanding about the capital gain events and the exemptions allowed. An

individual can claim deduction for his work related expenses. They have to keep the

receipts of expenditure incurred for earning assessable income. They are not allowed

for deductions related with private or domestic purpose. The tax liability of an individual

is calculated after claiming all the deductions and exemptions where applicable.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals

Woellner, R., and et.al., 2016. Australian Taxation Law 2016. OUP Catalogue.

Fry, M., 2017. Australian taxation of offshore hubs: an examination of the law on the

ability of Australia to tax economic activity in offshore hubs and the position of the

Australian Taxation Office. The APPEA Journal. 57(1). pp.49-63.

Brown, C., 2018. Submission to the Inspector-General of Taxation, Review into the

Australian Taxation Office’s use of Garnishee Notices.

McBarnet, D., 2019. When compliance is not the solution but the problem: From

changes in law to changes in attitude. Centre for Tax System Integrity (CTSI),

Research School of Social Sciences, The Australian National University.

Murphy, K., 2019. Moving towards a more effective model of regulatory enforcement in

the Australian Taxation Office. Centre for Tax System Integrity (CTSI), Research

School of Social Sciences, The Australian National University.

Berg, C. and Davidson, S., 2016. Submission to the House of Representatives Standing

Committee on Tax and Revenue Inquiry into the External Scrutiny of the

Australian Taxation Office.

Taylor, J., and et.al., 2017. Understanding Taxation Law 2018. LexisNexis Butterworths.

Online

Capital Gains Tax. 2019. [Online]. Available through :

<https://www.ato.gov.au/General/Capital-gains-tax/Your-home-and-other-real-

estate/Calculating-the-cost-base-for-real-estate/>.

Exemptions and deductions. 2019. [Online]. Available through :

<https://www.ato.gov.au/general/capital-gains-tax/cgt-assets-and-exemptions/>.

Allowable deductions. 2019. [Online]. Available through :

<https://www.ato.gov.au/Business/Income-and-deductions-for-business/

Deductions/>.

Personal deductions. 2019. [Online]. Available through :

<http://taxsummaries.pwc.com/ID/Australia-Individual-Deductions>.

8

Books and Journals

Woellner, R., and et.al., 2016. Australian Taxation Law 2016. OUP Catalogue.

Fry, M., 2017. Australian taxation of offshore hubs: an examination of the law on the

ability of Australia to tax economic activity in offshore hubs and the position of the

Australian Taxation Office. The APPEA Journal. 57(1). pp.49-63.

Brown, C., 2018. Submission to the Inspector-General of Taxation, Review into the

Australian Taxation Office’s use of Garnishee Notices.

McBarnet, D., 2019. When compliance is not the solution but the problem: From

changes in law to changes in attitude. Centre for Tax System Integrity (CTSI),

Research School of Social Sciences, The Australian National University.

Murphy, K., 2019. Moving towards a more effective model of regulatory enforcement in

the Australian Taxation Office. Centre for Tax System Integrity (CTSI), Research

School of Social Sciences, The Australian National University.

Berg, C. and Davidson, S., 2016. Submission to the House of Representatives Standing

Committee on Tax and Revenue Inquiry into the External Scrutiny of the

Australian Taxation Office.

Taylor, J., and et.al., 2017. Understanding Taxation Law 2018. LexisNexis Butterworths.

Online

Capital Gains Tax. 2019. [Online]. Available through :

<https://www.ato.gov.au/General/Capital-gains-tax/Your-home-and-other-real-

estate/Calculating-the-cost-base-for-real-estate/>.

Exemptions and deductions. 2019. [Online]. Available through :

<https://www.ato.gov.au/general/capital-gains-tax/cgt-assets-and-exemptions/>.

Allowable deductions. 2019. [Online]. Available through :

<https://www.ato.gov.au/Business/Income-and-deductions-for-business/

Deductions/>.

Personal deductions. 2019. [Online]. Available through :

<http://taxsummaries.pwc.com/ID/Australia-Individual-Deductions>.

8

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.