Taxation Law: Determining Taxable Income and Allowable Deductions

VerifiedAdded on 2023/06/13

|9

|1928

|191

AI Summary

This article discusses the determination of taxable income and allowable deductions under section 6-5 and section 8-1 of the ITAA 1997. It also covers the taxation ruling of TR 98/9 and TR 97/23. The case laws of Scott v Commissioner of Taxation (1935), Ronpibon Tin NL v Federal Commissioner of Taxation (1949), Mansfield v Federal Commissioner of Taxation, and Western Suburbs Cinemas v Federal Commissioner of Taxation (1952) are also discussed. The article concludes with the computation of taxable income and tax payable for the year 2017/18.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1TAXATION LAW

Table of Contents

Issues:.........................................................................................................................................2

Rule:...........................................................................................................................................2

Application:................................................................................................................................3

Conclusion:................................................................................................................................5

Reference List:...........................................................................................................................6

Appendix:...................................................................................................................................7

Table of Contents

Issues:.........................................................................................................................................2

Rule:...........................................................................................................................................2

Application:................................................................................................................................3

Conclusion:................................................................................................................................5

Reference List:...........................................................................................................................6

Appendix:...................................................................................................................................7

2TAXATION LAW

Issues:

The issue here revolves around determining the taxable income for Joan and

considering the transactions that are considered as the allowable deductions under section 6-5

and section 8-1 of the ITAA 1997.

Rule:

As defined under section 6-5 of the ITAA 1997 income that are derived from the

personal exertion includes salaries, allowance, wages, commission, fees, superannuation,

allowance and proceeds from business (Woellner et al. 2016). As held in “Scott v

Commissioner of Taxation (1935)” receipts are treated as income and should be ascertained

in compliance with the ordinary concepts.

Section 8-1 defines that there are two positive limbs for deductions from their

assessable income. An individual can claim allowable deductions if the expenses are incurred

in gaining taxable income or the expenditure is occurred in producing the taxable income

(Robin and Barkoczy 2018). However, under the negative limbs of section 8-1 an individual

is barred from claiming deductions if the expenses are capital in nature or the loss and

outgoing are private or domestic in nature. As held in “Ronpibon Tin NL v Federal

Commissioner of Taxation (1949)” an expenses can be allowed as allowable deductions if it

is occurred in gaining the taxable income (Barkoczy 2016).

Cost that are incurred in general clothing expenses are not considered for deductions

however if the incurs expenses on compulsory uniforms and protective clothing which is

occupation specific can claim allowable deductions (Blakelock and King 2017). As held in

“Mansfield v Federal Commissioner of Taxation” the court allowed the flight attendant to

claim allowable deductions for occupation specific clothing.

Issues:

The issue here revolves around determining the taxable income for Joan and

considering the transactions that are considered as the allowable deductions under section 6-5

and section 8-1 of the ITAA 1997.

Rule:

As defined under section 6-5 of the ITAA 1997 income that are derived from the

personal exertion includes salaries, allowance, wages, commission, fees, superannuation,

allowance and proceeds from business (Woellner et al. 2016). As held in “Scott v

Commissioner of Taxation (1935)” receipts are treated as income and should be ascertained

in compliance with the ordinary concepts.

Section 8-1 defines that there are two positive limbs for deductions from their

assessable income. An individual can claim allowable deductions if the expenses are incurred

in gaining taxable income or the expenditure is occurred in producing the taxable income

(Robin and Barkoczy 2018). However, under the negative limbs of section 8-1 an individual

is barred from claiming deductions if the expenses are capital in nature or the loss and

outgoing are private or domestic in nature. As held in “Ronpibon Tin NL v Federal

Commissioner of Taxation (1949)” an expenses can be allowed as allowable deductions if it

is occurred in gaining the taxable income (Barkoczy 2016).

Cost that are incurred in general clothing expenses are not considered for deductions

however if the incurs expenses on compulsory uniforms and protective clothing which is

occupation specific can claim allowable deductions (Blakelock and King 2017). As held in

“Mansfield v Federal Commissioner of Taxation” the court allowed the flight attendant to

claim allowable deductions for occupation specific clothing.

3TAXATION LAW

The taxation ruling of TR 98/9 allows a person to claim allowable deductions for

self-education expenses (Barkoczy et al. 2016). As held in “Finn v Federal Commissioner

of Taxation” the commissioner allowed the self-education expenses that are occupation

specific.

The Australian taxation office allows a taxpayer to claim allowable deductions for the

home furniture, fittings along with the proportion of heating, cooling, lightning and cleaning

for the period that are used for self-education activities (Braithwaite 2017). The ATO states

that a taxpayer can claim work-related self-education expenses for the cost of travel that

requires a person to be temporarily away from home for a fortnight or more.

“Section 25-10 of the ITAA 1997” states that a person can deduct expenditure that is

occurred on the premises that is completely used for the gaining taxable income (Miller and

Oats 2016). “Section 25-10” also prohibits an individual to claim allowable deductions for

capital expenses.

The “taxation ruling of TR 97/23” provides whether a person can claim deductions

for repairs or the expenses alternatively represents the reconstruction or improvement (Cao et

al. 2015). As held in “Western Suburbs Cinemas v Federal Commissioner of Taxation

(1952)”. An individual taxpayer is not allowed to claim allowable deductions for repairs that

constitute as capital expenditure.

Application:

Under “section 6-5 of the ITAA 1997” income from salaries and interest income

derived by Joan represents income person exertion which will be considered assessable.

Referring to “Scott v Commissioner of Taxation (1935)” receipts from salaries and interest

from bank by Joan are treated as income with the ordinary concepts (Miller and Oats 2016).

It is noticed that Joan also received income from rental property. Referring to “Dixon v

The taxation ruling of TR 98/9 allows a person to claim allowable deductions for

self-education expenses (Barkoczy et al. 2016). As held in “Finn v Federal Commissioner

of Taxation” the commissioner allowed the self-education expenses that are occupation

specific.

The Australian taxation office allows a taxpayer to claim allowable deductions for the

home furniture, fittings along with the proportion of heating, cooling, lightning and cleaning

for the period that are used for self-education activities (Braithwaite 2017). The ATO states

that a taxpayer can claim work-related self-education expenses for the cost of travel that

requires a person to be temporarily away from home for a fortnight or more.

“Section 25-10 of the ITAA 1997” states that a person can deduct expenditure that is

occurred on the premises that is completely used for the gaining taxable income (Miller and

Oats 2016). “Section 25-10” also prohibits an individual to claim allowable deductions for

capital expenses.

The “taxation ruling of TR 97/23” provides whether a person can claim deductions

for repairs or the expenses alternatively represents the reconstruction or improvement (Cao et

al. 2015). As held in “Western Suburbs Cinemas v Federal Commissioner of Taxation

(1952)”. An individual taxpayer is not allowed to claim allowable deductions for repairs that

constitute as capital expenditure.

Application:

Under “section 6-5 of the ITAA 1997” income from salaries and interest income

derived by Joan represents income person exertion which will be considered assessable.

Referring to “Scott v Commissioner of Taxation (1935)” receipts from salaries and interest

from bank by Joan are treated as income with the ordinary concepts (Miller and Oats 2016).

It is noticed that Joan also received income from rental property. Referring to “Dixon v

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4TAXATION LAW

Federal Commissioner of Taxation (1952)” the income generated from the rental property

constitutes periodic receipts for Joan which will be held assessable.

Section 8-1 of the ITAA 1997 allows Joan to claim allowable deductions for

expenditure that are relevant and incidental in gaining taxable income. As evident Joan

incurred work related deductions on compulsory clothing such as pair of pants, new shirts

and shoes that formed the part of occupation specific clothing (Barkoczy et al. 2016).

Referring to “Mansfield v Federal Commissioner of Taxation” Joan can claim allowable

deductions for protective clothing.

Joan has incurred expenses on registration fees and also paid trade union membership

fees. Under section 8-1 of the ITAA 1997 Joan can claim allowable deductions for the

expenses incurred on nurse’s registration and membership since it is incurred in producing

the taxable income.

Joan also incurs expenses on new glass and was required to incur costs on vaccination

protection. The expenses occurred by Joan satisfies the positive test of “section 8-1 of the

ITAA 1997” since the expenses were relevant and incidental in gaining or producing taxable

income for Joan (Blakelock and King 2017). Referring to “Ronpibon Tin NL v Federal

Commissioner of Taxation (1949)” Joan can claim allowable deductions for these expenses.

The Australian taxation office provides that a person can claim allowable deductions

for expenses that are occurred in managing their tax affairs. Similarly, the cost incurred on

filing tax return can be claimed as allowable deductions by Joan.

Joan has incurred expenses on self-education for the cost of books and stationary.

Therefore, referring to “Finn v Federal Commissioner of Taxation” the self-education

expenses occurred will be allowed as deductions for Joan since the expenses are incurred in

enhancing the income producing activates. Joan reports expenses on home study purpose. As

Federal Commissioner of Taxation (1952)” the income generated from the rental property

constitutes periodic receipts for Joan which will be held assessable.

Section 8-1 of the ITAA 1997 allows Joan to claim allowable deductions for

expenditure that are relevant and incidental in gaining taxable income. As evident Joan

incurred work related deductions on compulsory clothing such as pair of pants, new shirts

and shoes that formed the part of occupation specific clothing (Barkoczy et al. 2016).

Referring to “Mansfield v Federal Commissioner of Taxation” Joan can claim allowable

deductions for protective clothing.

Joan has incurred expenses on registration fees and also paid trade union membership

fees. Under section 8-1 of the ITAA 1997 Joan can claim allowable deductions for the

expenses incurred on nurse’s registration and membership since it is incurred in producing

the taxable income.

Joan also incurs expenses on new glass and was required to incur costs on vaccination

protection. The expenses occurred by Joan satisfies the positive test of “section 8-1 of the

ITAA 1997” since the expenses were relevant and incidental in gaining or producing taxable

income for Joan (Blakelock and King 2017). Referring to “Ronpibon Tin NL v Federal

Commissioner of Taxation (1949)” Joan can claim allowable deductions for these expenses.

The Australian taxation office provides that a person can claim allowable deductions

for expenses that are occurred in managing their tax affairs. Similarly, the cost incurred on

filing tax return can be claimed as allowable deductions by Joan.

Joan has incurred expenses on self-education for the cost of books and stationary.

Therefore, referring to “Finn v Federal Commissioner of Taxation” the self-education

expenses occurred will be allowed as deductions for Joan since the expenses are incurred in

enhancing the income producing activates. Joan reports expenses on home study purpose. As

5TAXATION LAW

evident Joan uses 10% of the area of home for self-education purpose and will be able to

claim allowable deductions for these expenses.

Expenses incurred on attending aged conference is related to education purpose as it

required to the taxpayer to stay temporarily away from home and would be able to claim

allowable deductions (Miller and Oats 2016). However, expenses such as dinner, breakfast

and style magazine represents private expenditure. Joan would not be allowed to claim

deductions on private expenses under section 8-1 of the ITAA 1997.

There were rental property expenses such as repairs on broken window and

renovation of bathroom constituted repairs under section 25-10 as the property was held by

Joan entirely for production income (Robin and Barkoczy 2018). Cost such as stamp duty,

loan establishment represents cost acquisition of property by Joan therefore it cannot be

considered as allowable expenses.

Other costs such as installation of heater laying of concrete and wood heater costs

represents capital expenses. Referring to “Western Suburbs Cinemas v Federal

Commissioner of Taxation (1952)” Joan is not allowed to claim allowable deductions for

repairs that constitute as capital expenditure.

Conclusion:

Conclusively it can be stated that following the considerations of the transactions

reported by Joan, the net amount of tax refundable for the year 2017/18 stands $1546.

evident Joan uses 10% of the area of home for self-education purpose and will be able to

claim allowable deductions for these expenses.

Expenses incurred on attending aged conference is related to education purpose as it

required to the taxpayer to stay temporarily away from home and would be able to claim

allowable deductions (Miller and Oats 2016). However, expenses such as dinner, breakfast

and style magazine represents private expenditure. Joan would not be allowed to claim

deductions on private expenses under section 8-1 of the ITAA 1997.

There were rental property expenses such as repairs on broken window and

renovation of bathroom constituted repairs under section 25-10 as the property was held by

Joan entirely for production income (Robin and Barkoczy 2018). Cost such as stamp duty,

loan establishment represents cost acquisition of property by Joan therefore it cannot be

considered as allowable expenses.

Other costs such as installation of heater laying of concrete and wood heater costs

represents capital expenses. Referring to “Western Suburbs Cinemas v Federal

Commissioner of Taxation (1952)” Joan is not allowed to claim allowable deductions for

repairs that constitute as capital expenditure.

Conclusion:

Conclusively it can be stated that following the considerations of the transactions

reported by Joan, the net amount of tax refundable for the year 2017/18 stands $1546.

6TAXATION LAW

Reference List:

Barkoczy, S., 2016. Foundations of taxation law 2016. OUP Catalogue.

Barkoczy, S., Nethercott, L., Devos, K. and Richardson, G., 2016. Foundations Student Tax

Pack 3 2016. Oxford University Press Australia & New Zealand.

Blakelock, S. and King, P., 2017. Taxation law: The advance of ATO data

matching. Proctor, The, 37(6), p.18.

Braithwaite, V. ed., 2017. Taxing democracy: Understanding tax avoidance and evasion.

Routledge.

Cao, L., Hosking, A., Kouparitsas, M., Mullaly, D., Rimmer, X., Shi, Q., Stark, W. and

Wende, S., 2015. Understanding the economy-wide efficiency and incidence of major

Australian taxes. Canberra: Treasury working paper, 2001.

Miller, A. and Oats, L., 2016. Principles of international taxation. Bloomsbury Publishing.

ROBIN & BARKOCZY WOELLNER (STEPHEN & MURPHY, SHIRLEY ET AL.),

2018. AUSTRALIAN TAXATION LAW 2018. OXFORD University Press.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2016. Australian Taxation

Law 2016. OUP Catalogue.

Reference List:

Barkoczy, S., 2016. Foundations of taxation law 2016. OUP Catalogue.

Barkoczy, S., Nethercott, L., Devos, K. and Richardson, G., 2016. Foundations Student Tax

Pack 3 2016. Oxford University Press Australia & New Zealand.

Blakelock, S. and King, P., 2017. Taxation law: The advance of ATO data

matching. Proctor, The, 37(6), p.18.

Braithwaite, V. ed., 2017. Taxing democracy: Understanding tax avoidance and evasion.

Routledge.

Cao, L., Hosking, A., Kouparitsas, M., Mullaly, D., Rimmer, X., Shi, Q., Stark, W. and

Wende, S., 2015. Understanding the economy-wide efficiency and incidence of major

Australian taxes. Canberra: Treasury working paper, 2001.

Miller, A. and Oats, L., 2016. Principles of international taxation. Bloomsbury Publishing.

ROBIN & BARKOCZY WOELLNER (STEPHEN & MURPHY, SHIRLEY ET AL.),

2018. AUSTRALIAN TAXATION LAW 2018. OXFORD University Press.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2016. Australian Taxation

Law 2016. OUP Catalogue.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

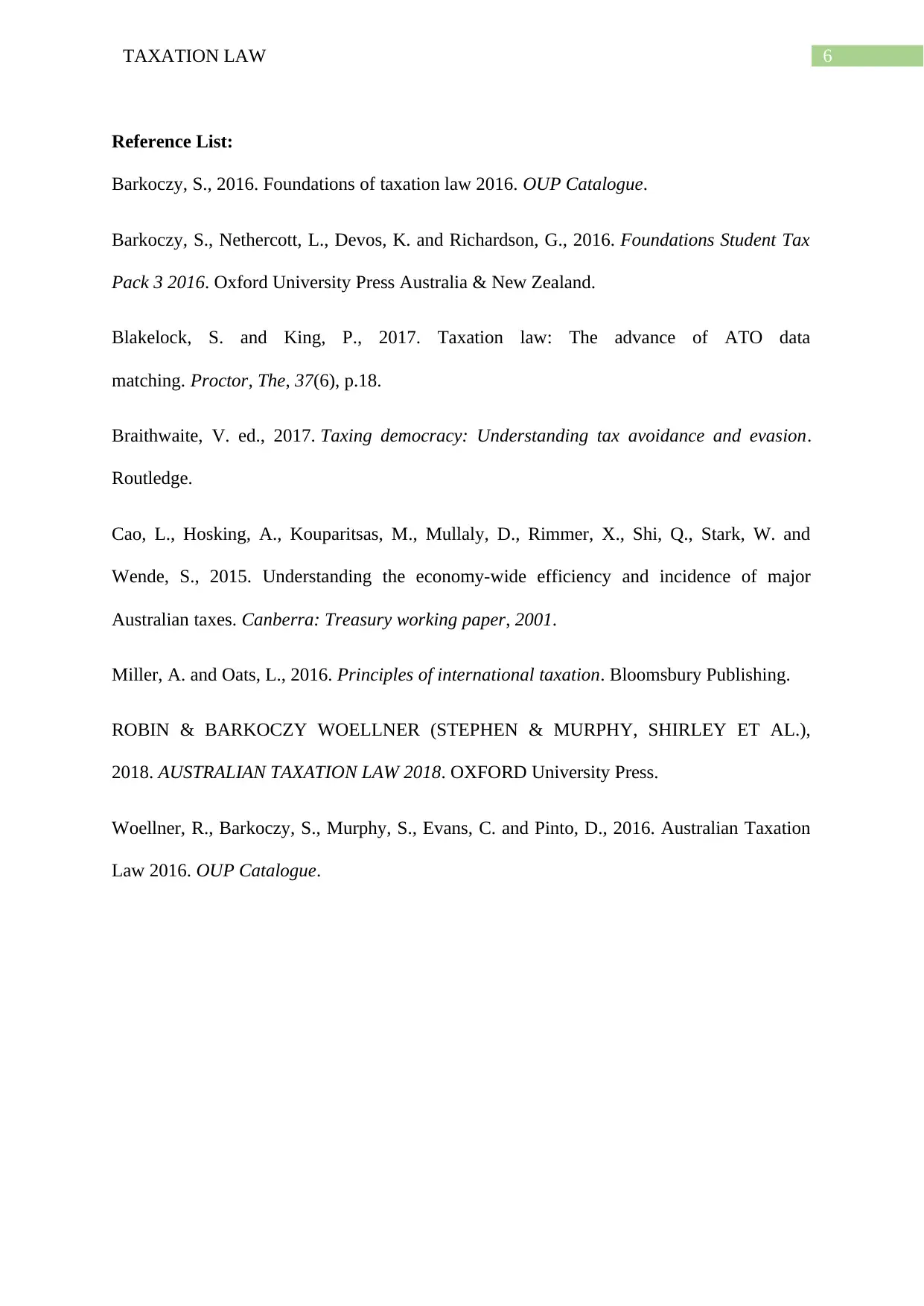

Appendix:

Computation of Taxable Income

In the Books of Joan

For the year ended 2017/18

Particulars Reference Section

Amount

($)

Amount

($)

Assessable Income

Gross Salary

Section 6-5 of ITAA

1997 76712

Australian sourced interest income

Section 6-5 of ITAA

1997 474

Receipts from Rental Bond

Section 6-5 of ITAA

1997 1500

Rental Property Income

Section 6-5 of ITAA

1997 18000

Total Assessable Income (A) 96686

Allowable Deductions

Work related Deductions (B)

Section 8-1 of the ITAA

1997

Compulsory Clothing

Section 8-1 of the ITAA

1997 206

Shoe Expenses

Section 8-1 of the ITAA

1997 140

Registration Fees

Section 8-1 of the ITAA

1997 465

Travel Allowance

Section 8-1 of the ITAA

1997 382

Trade Union Membership Fees

Section 8-1 of the ITAA

1997 826

Purchase of Glass

Section 8-1 of the ITAA

1997 265

Vaccination expenses

Section 8-1 of the ITAA

1997 94

Tax filing expenses

Section 8-1 of the ITAA

1997 150 2528

Self-education expenses ( C)

For Books

Section 8-1 of the ITAA

1997 413

For Stationary

Section 8-1 of the ITAA

1997 67

Computer Expenses

Section 8-1 of the ITAA

1997 765

Internet Expenses

Section 8-1 of the ITAA

1997 331.2

Home Study Expenses 510.6 2086.8

Appendix:

Computation of Taxable Income

In the Books of Joan

For the year ended 2017/18

Particulars Reference Section

Amount

($)

Amount

($)

Assessable Income

Gross Salary

Section 6-5 of ITAA

1997 76712

Australian sourced interest income

Section 6-5 of ITAA

1997 474

Receipts from Rental Bond

Section 6-5 of ITAA

1997 1500

Rental Property Income

Section 6-5 of ITAA

1997 18000

Total Assessable Income (A) 96686

Allowable Deductions

Work related Deductions (B)

Section 8-1 of the ITAA

1997

Compulsory Clothing

Section 8-1 of the ITAA

1997 206

Shoe Expenses

Section 8-1 of the ITAA

1997 140

Registration Fees

Section 8-1 of the ITAA

1997 465

Travel Allowance

Section 8-1 of the ITAA

1997 382

Trade Union Membership Fees

Section 8-1 of the ITAA

1997 826

Purchase of Glass

Section 8-1 of the ITAA

1997 265

Vaccination expenses

Section 8-1 of the ITAA

1997 94

Tax filing expenses

Section 8-1 of the ITAA

1997 150 2528

Self-education expenses ( C)

For Books

Section 8-1 of the ITAA

1997 413

For Stationary

Section 8-1 of the ITAA

1997 67

Computer Expenses

Section 8-1 of the ITAA

1997 765

Internet Expenses

Section 8-1 of the ITAA

1997 331.2

Home Study Expenses 510.6 2086.8

8TAXATION LAW

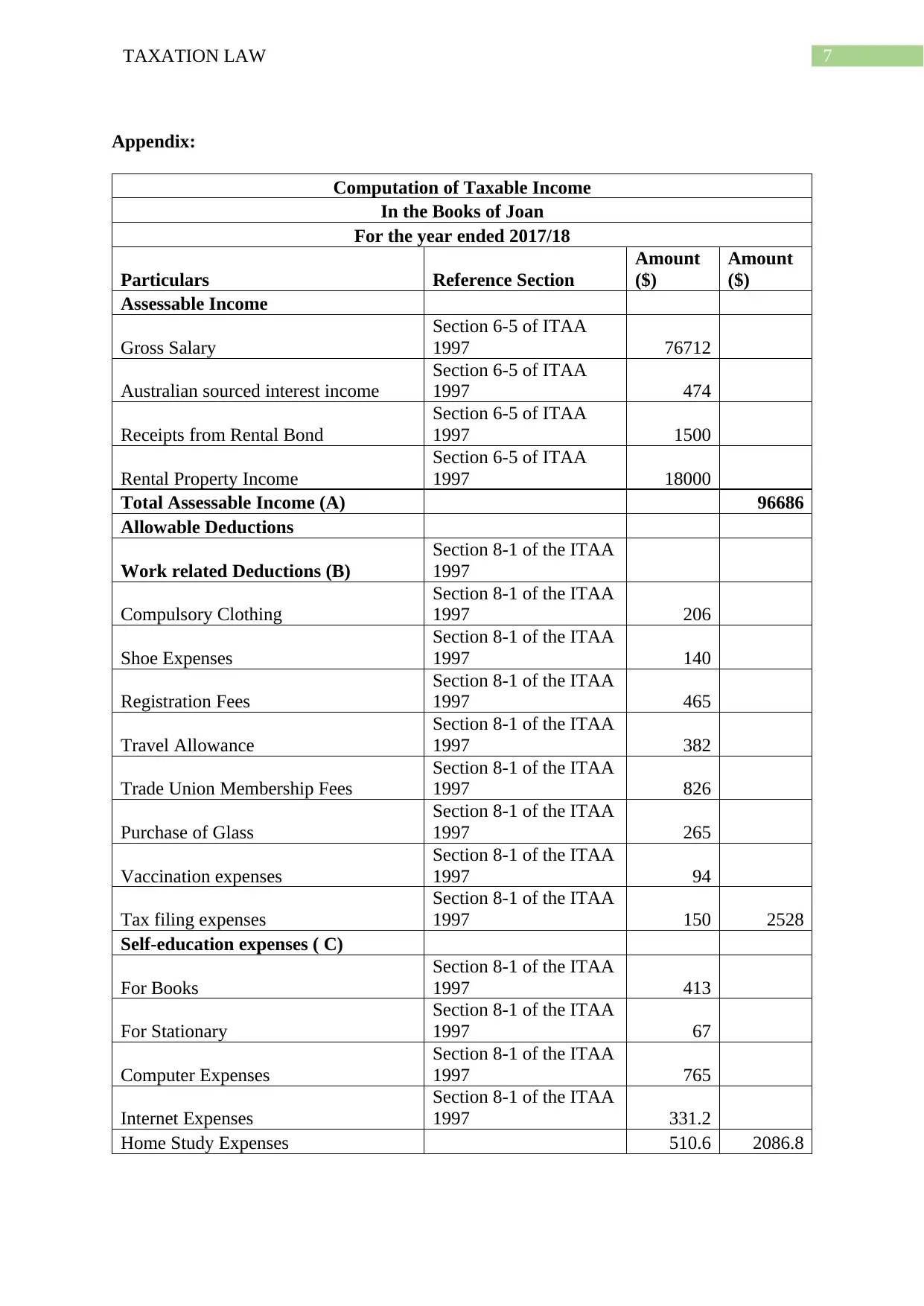

Accommodation and Meals

Expenses (D)

Conference Cost

Section 8-1 of the ITAA

1997 146

Conference Fees

Section 8-1 of the ITAA

1997 470

Dinner and Breakfast Expenses

Section 8-1 of the ITAA

1997 53

Accommodation for one night

Section 8-1 of the ITAA

1997 175 844

Donation Expenses

Donation to Army

Section 8-1 of the ITAA

1997 25

Donation to local family

Section 8-1 of the ITAA

1997 50 75

Rental Property Expenses (E)

Interest on Loan

Section 8-1 of the ITAA

1997 10970

Replacement of Broken Window

Section 8-1 of the ITAA

1997 380

Repairs cost on Bathroom

Section 8-1 of the ITAA

1997 2890

Legal expenses

Section 8-1 of the ITAA

1997 1420

Garage Expenses

Section 8-1 of the ITAA

1997 930

Solicitor Fees

Section 8-1 of the ITAA

1997 825

Council Rates

Section 8-1 of the ITAA

1997 1925

Insurance

Section 8-1 of the ITAA

1997 980

Land tax

Section 8-1 of the ITAA

1997 319

Painting Expenses

Section 8-1 of the ITAA

1997 420 21059

Total Allowable deductions (A-B-C-

D-E) = F 26593

Total Taxable Income (F) 70093

Tax on Taxable Income (G) 14327

Add: Medicare Levy (H) 1402

Less: PayG (I) 17275

Total Tax Payable/(Refundable)

(G+H-I) = J -1546

Accommodation and Meals

Expenses (D)

Conference Cost

Section 8-1 of the ITAA

1997 146

Conference Fees

Section 8-1 of the ITAA

1997 470

Dinner and Breakfast Expenses

Section 8-1 of the ITAA

1997 53

Accommodation for one night

Section 8-1 of the ITAA

1997 175 844

Donation Expenses

Donation to Army

Section 8-1 of the ITAA

1997 25

Donation to local family

Section 8-1 of the ITAA

1997 50 75

Rental Property Expenses (E)

Interest on Loan

Section 8-1 of the ITAA

1997 10970

Replacement of Broken Window

Section 8-1 of the ITAA

1997 380

Repairs cost on Bathroom

Section 8-1 of the ITAA

1997 2890

Legal expenses

Section 8-1 of the ITAA

1997 1420

Garage Expenses

Section 8-1 of the ITAA

1997 930

Solicitor Fees

Section 8-1 of the ITAA

1997 825

Council Rates

Section 8-1 of the ITAA

1997 1925

Insurance

Section 8-1 of the ITAA

1997 980

Land tax

Section 8-1 of the ITAA

1997 319

Painting Expenses

Section 8-1 of the ITAA

1997 420 21059

Total Allowable deductions (A-B-C-

D-E) = F 26593

Total Taxable Income (F) 70093

Tax on Taxable Income (G) 14327

Add: Medicare Levy (H) 1402

Less: PayG (I) 17275

Total Tax Payable/(Refundable)

(G+H-I) = J -1546

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.

![Taxation Law: Spriggs v Federal Commissioner of Taxation [2007]](/_next/image/?url=https%3A%2F%2Fdesklib.com%2Fmedia%2Fdocument%2Fpages%2Fspriggs-taxation-law-case-page-2.jpg&w=256&q=75)

![Academy Cleaning & Security Pty Ltd v Deputy Commissioner of Taxation [2017]: Taxation Law](/_next/image/?url=https%3A%2F%2Fdesklib.com%2Fmedia%2Facademy-cleaning-security-taxation_page_2.jpg&w=256&q=75)