Taxation Law of Australia Individual Assignment - Term 1 2019

VerifiedAdded on 2023/03/17

|19

|4240

|68

Homework Assignment

AI Summary

This document provides a comprehensive solution to a Taxation Law of Australia assignment. The assignment covers various aspects of Australian taxation law, addressing questions on topics such as the effective life of assets for depreciation, tax offsets, top tax rates, capital gains tax (CGT) exemptions, CGT events, and the formula for income tax calculation. The solution further explores allowable deductions, including interest on borrowings, and discusses the deductibility of expenses related to work, child care, theft, and job seeking. Moreover, the assignment delves into CGT events, long-term leases, the use of land by new owners, partial exemptions for property used for income and residence, and the implications of capital gains and losses from share transactions. The solution provides detailed answers, references relevant legislation, and includes case law to support its arguments, offering a thorough analysis of the tax law principles.

Running head: TAXATION LAW OF AUSTRALIA

Taxation Law of Australia

Name of Student:

Name of University:

Author’s Note:

Taxation Law of Australia

Name of Student:

Name of University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW OF AUSTRALIA

Table of Contents

Question 1:.......................................................................................................................................3

Answer to Part a:.........................................................................................................................3

Answer to Part b:.........................................................................................................................3

Answer to Part c:.........................................................................................................................3

Answer to Part d:.........................................................................................................................3

Answer to Part e:.........................................................................................................................4

Answer to Part f:.........................................................................................................................4

Answer to Part g:.........................................................................................................................4

Answer to Part h:.........................................................................................................................5

Answer to Part i:..........................................................................................................................6

Question 2:.......................................................................................................................................6

Answer to Part a:.........................................................................................................................6

Answer to Part b:.........................................................................................................................7

Answer to Part c:.........................................................................................................................7

Answer to Part d:.........................................................................................................................8

Answer to Part e:.........................................................................................................................8

Question 3:.......................................................................................................................................9

Answer to Part a:.........................................................................................................................9

Table of Contents

Question 1:.......................................................................................................................................3

Answer to Part a:.........................................................................................................................3

Answer to Part b:.........................................................................................................................3

Answer to Part c:.........................................................................................................................3

Answer to Part d:.........................................................................................................................3

Answer to Part e:.........................................................................................................................4

Answer to Part f:.........................................................................................................................4

Answer to Part g:.........................................................................................................................4

Answer to Part h:.........................................................................................................................5

Answer to Part i:..........................................................................................................................6

Question 2:.......................................................................................................................................6

Answer to Part a:.........................................................................................................................6

Answer to Part b:.........................................................................................................................7

Answer to Part c:.........................................................................................................................7

Answer to Part d:.........................................................................................................................8

Answer to Part e:.........................................................................................................................8

Question 3:.......................................................................................................................................9

Answer to Part a:.........................................................................................................................9

2TAXATION LAW OF AUSTRALIA

Answer to Part b:.......................................................................................................................10

Answer to Part c:.......................................................................................................................10

Answer to Part d:.......................................................................................................................11

Question 4:.....................................................................................................................................12

Answer to Part a:.......................................................................................................................12

Answer to Part b:.......................................................................................................................12

Answer to Part c:.......................................................................................................................13

Answer to Part d:.......................................................................................................................13

Answer to Part e:.......................................................................................................................14

Question 5:.....................................................................................................................................14

Issues:........................................................................................................................................14

Laws:.........................................................................................................................................14

Application:...............................................................................................................................15

Conclusion:....................................................................................................................................17

Answer to Part b:.......................................................................................................................10

Answer to Part c:.......................................................................................................................10

Answer to Part d:.......................................................................................................................11

Question 4:.....................................................................................................................................12

Answer to Part a:.......................................................................................................................12

Answer to Part b:.......................................................................................................................12

Answer to Part c:.......................................................................................................................13

Answer to Part d:.......................................................................................................................13

Answer to Part e:.......................................................................................................................14

Question 5:.....................................................................................................................................14

Issues:........................................................................................................................................14

Laws:.........................................................................................................................................14

Application:...............................................................................................................................15

Conclusion:....................................................................................................................................17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW OF AUSTRALIA

Question 1:

Answer to Part a:

As per stated in “Taxation Ruling of TR 2018/4” Tax Commission has provided the

clarification in order to determine the effective life of assets for the purpose of depreciation

according to the “Section 40 (100) of ITAA 1997”.

Answer to Part b:

According to “Division 13 of ITAA 1997” could be obtained from the details of available tax

offsets1.

Answer to Part c:

During the 2018/19 tax year the Australian resident taxpayer is applicable for the top tax rate,

which amount to $54,907 with 45 cents for each $1 and above $180,000 for income which is

similar to $180,001 and above.

Answer to Part d:

Australian tax system has provided some exemption for the Australian taxpayer which

includes minimization, deferral or disregard of capital gains and loss. According to the provision

of “Section 118 (10-1) of ITAA 1997”, collectible assets or similar to its kind worth $500 or

below are exempted from CGT.

1 Robert N, Gordon, "REIT and MLP Taxation Under the New Tax Law." Journal of Taxation of

Investments 35.4 (2018).

Question 1:

Answer to Part a:

As per stated in “Taxation Ruling of TR 2018/4” Tax Commission has provided the

clarification in order to determine the effective life of assets for the purpose of depreciation

according to the “Section 40 (100) of ITAA 1997”.

Answer to Part b:

According to “Division 13 of ITAA 1997” could be obtained from the details of available tax

offsets1.

Answer to Part c:

During the 2018/19 tax year the Australian resident taxpayer is applicable for the top tax rate,

which amount to $54,907 with 45 cents for each $1 and above $180,000 for income which is

similar to $180,001 and above.

Answer to Part d:

Australian tax system has provided some exemption for the Australian taxpayer which

includes minimization, deferral or disregard of capital gains and loss. According to the provision

of “Section 118 (10-1) of ITAA 1997”, collectible assets or similar to its kind worth $500 or

below are exempted from CGT.

1 Robert N, Gordon, "REIT and MLP Taxation Under the New Tax Law." Journal of Taxation of

Investments 35.4 (2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW OF AUSTRALIA

Answer to Part e:

According to “CGT event B1 Section 104 (15) of ITAA 1997”, deals with the use and

enjoyment before the title being passed. This situation arises when an individual enters into any

kind of contract with any organisation in which the individual gained the right to use or do

enjoyment of CGT assets, which belonged to the individual passed to the organisation to whom

the contract is made. The assets title must be transferred in the name of organisation from the

individual on or before the contract ends.

Answer to Part f:

The formula contains Income Tax = (Taxable Income * Rate) – Tax Offsets

The above mentioned formula is associated with the “Section 4-10 (3) of ITAA 1997.

Answer to Part g:

According to the case of “FC of T v Day 2008 ATC 20-064,” which occurred in High

Court, legal expenses incurred by the taxpayer in order to create chargeable earnings and

simultaneously in net conditions highlighted in “Paragraph 8-1(1)(a) of ITAA 1997”. The case

discussed above the case carries immense importance in terms tax deduction associated with the

legal expenses of a public servant who pays charges in order to meet day-to-day expense2.

Taxpayer enjoys the legal expenses deduction according to the provision mentioned under

“Section 8-1 of ITAA 1997” incurred in the year 2002 which will help the taxpayer to defend

himself which is imposed by the employer on the taxpayer.

2 Alfred, Tran, "Can taxable income be estimated from financial reports of listed companies in

Australia." Austl. Tax F. 30 (2015): 569.

Answer to Part e:

According to “CGT event B1 Section 104 (15) of ITAA 1997”, deals with the use and

enjoyment before the title being passed. This situation arises when an individual enters into any

kind of contract with any organisation in which the individual gained the right to use or do

enjoyment of CGT assets, which belonged to the individual passed to the organisation to whom

the contract is made. The assets title must be transferred in the name of organisation from the

individual on or before the contract ends.

Answer to Part f:

The formula contains Income Tax = (Taxable Income * Rate) – Tax Offsets

The above mentioned formula is associated with the “Section 4-10 (3) of ITAA 1997.

Answer to Part g:

According to the case of “FC of T v Day 2008 ATC 20-064,” which occurred in High

Court, legal expenses incurred by the taxpayer in order to create chargeable earnings and

simultaneously in net conditions highlighted in “Paragraph 8-1(1)(a) of ITAA 1997”. The case

discussed above the case carries immense importance in terms tax deduction associated with the

legal expenses of a public servant who pays charges in order to meet day-to-day expense2.

Taxpayer enjoys the legal expenses deduction according to the provision mentioned under

“Section 8-1 of ITAA 1997” incurred in the year 2002 which will help the taxpayer to defend

himself which is imposed by the employer on the taxpayer.

2 Alfred, Tran, "Can taxable income be estimated from financial reports of listed companies in

Australia." Austl. Tax F. 30 (2015): 569.

5TAXATION LAW OF AUSTRALIA

Answer to Part h:

The tax burden and the marginal tax rate analyzed by the average tax rate which

evaluates the impact of tax on incentive earnings, savings, investment or spending. Total tax

divided by the overall income is mentioned by the average tax rate. The marginal tax rate deals

with the incremental tax incurred on increased income.

Answer to Part h:

The tax burden and the marginal tax rate analyzed by the average tax rate which

evaluates the impact of tax on incentive earnings, savings, investment or spending. Total tax

divided by the overall income is mentioned by the average tax rate. The marginal tax rate deals

with the incremental tax incurred on increased income.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW OF AUSTRALIA

Answer to Part i:

The expenditure tax imposed on the purchase of the goods and services is known as

Consumption Tax. The taxation system of Australia includes the tax imposed by the individual

are on the basis of consumption rather than the amount contributed by them to the economy3.

Question 2:

Answer to Part a:

According to the Australian Taxation Office (ATO) at the time of producing accessible

income the taxpayer of Australia are allowed to enjoy the deduction, which is made by the

taxpayer in relation to interest on borrowings. As per stated in “Section 8 (1) of ITAA 1997”, the

interest on loan which is made for business purpose are taken in the form of allowable

deduction4.

According to the case of “Amalgamated Zinc Limited v FC of T (1935)”, in order to settle

the wages of the staffs Brent has incurred interest on loan. The Brent took this decision because

the interest on loan will be considered as taxable earning which could be generated or gained.

According to the positive part mentioned in the “Section 8 (1) of ITAA 1997”, there will

allowable deduction for taking interest on loan by Brent.

3 P. T, Wanless, Taxation in centrally planned economies. Routledge, 2018.

4 Roger H, Gordon, "The Rise of the Value-Added Tax. Cambridge Tax Law series." (2016):

243-246.

Answer to Part i:

The expenditure tax imposed on the purchase of the goods and services is known as

Consumption Tax. The taxation system of Australia includes the tax imposed by the individual

are on the basis of consumption rather than the amount contributed by them to the economy3.

Question 2:

Answer to Part a:

According to the Australian Taxation Office (ATO) at the time of producing accessible

income the taxpayer of Australia are allowed to enjoy the deduction, which is made by the

taxpayer in relation to interest on borrowings. As per stated in “Section 8 (1) of ITAA 1997”, the

interest on loan which is made for business purpose are taken in the form of allowable

deduction4.

According to the case of “Amalgamated Zinc Limited v FC of T (1935)”, in order to settle

the wages of the staffs Brent has incurred interest on loan. The Brent took this decision because

the interest on loan will be considered as taxable earning which could be generated or gained.

According to the positive part mentioned in the “Section 8 (1) of ITAA 1997”, there will

allowable deduction for taking interest on loan by Brent.

3 P. T, Wanless, Taxation in centrally planned economies. Routledge, 2018.

4 Roger H, Gordon, "The Rise of the Value-Added Tax. Cambridge Tax Law series." (2016):

243-246.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW OF AUSTRALIA

Answer to Part b:

Sometimes it is important to assign expenses or losses, which are partially deductible. As per

the case of “Ronpiban Tin FL v FC of T (1949)”, in accordance with the commissioner

ascertain the part of expenses incurred to create accessible income. As the expenses is made on

work and private purposes only the deduction will be made on work purpose of the taxpayer5.

Julie has incurred $500 on mobile phones in which 60% of the phone call made for work

purpose and other 40% used for private purpose. According to the case of “Ronpiban Tin FL v

FC of T (1949)”, deduction claimed by Julie is on 60% because it is used by Julie for work

purpose this done in accordance to the “Section 8 (1) of ITAA 1997”. On the other hand other

40% is not deductible because it is used by the Julie for the private purpose, this is done in

accordance with the “Section 8-1 (2) of ITAA 1997”, which is also the negative limbs of this

Section.

Answer to Part c:

According to the “Section 8 (1) of ITAA 1997”, the child care expense is not allowed for

deduction. According to the case of “Ledge v FC of T (1972)”, the taxpayer was not allowed for

any deduction in the case of childcare expense during the time when the taxpayer is going for

work. This is taken because the expenses are not incidental or in any target to produce income.

Sally has incurred babysitting expenses for the childcare. This expense is non-deductible

because it is used for personal benefits and not for producing any kind of income. This type of

income failed to meet the positive or negative part of the “Section 8-1 (2)(b) of ITAA 1997”.

5 Janet, Grange, Geralyn A Jover-Ledesma and Gary L Maydew, 2014 Principles Of Business

Taxation

Answer to Part b:

Sometimes it is important to assign expenses or losses, which are partially deductible. As per

the case of “Ronpiban Tin FL v FC of T (1949)”, in accordance with the commissioner

ascertain the part of expenses incurred to create accessible income. As the expenses is made on

work and private purposes only the deduction will be made on work purpose of the taxpayer5.

Julie has incurred $500 on mobile phones in which 60% of the phone call made for work

purpose and other 40% used for private purpose. According to the case of “Ronpiban Tin FL v

FC of T (1949)”, deduction claimed by Julie is on 60% because it is used by Julie for work

purpose this done in accordance to the “Section 8 (1) of ITAA 1997”. On the other hand other

40% is not deductible because it is used by the Julie for the private purpose, this is done in

accordance with the “Section 8-1 (2) of ITAA 1997”, which is also the negative limbs of this

Section.

Answer to Part c:

According to the “Section 8 (1) of ITAA 1997”, the child care expense is not allowed for

deduction. According to the case of “Ledge v FC of T (1972)”, the taxpayer was not allowed for

any deduction in the case of childcare expense during the time when the taxpayer is going for

work. This is taken because the expenses are not incidental or in any target to produce income.

Sally has incurred babysitting expenses for the childcare. This expense is non-deductible

because it is used for personal benefits and not for producing any kind of income. This type of

income failed to meet the positive or negative part of the “Section 8-1 (2)(b) of ITAA 1997”.

5 Janet, Grange, Geralyn A Jover-Ledesma and Gary L Maydew, 2014 Principles Of Business

Taxation

8TAXATION LAW OF AUSTRALIA

Answer to Part d:

The application is possible for both expenses and losses bared by the taxpayer in accordance

with the “Section 8 (1) of ITAA 1997”. From the case of “Charles Moore & Co (WA) Private

Limited v FC of T (1956)”, it is evident that the court gave permission on the taxpayer for

providing deduction if it is occurred during theft of the earnings during going to the bank6.

As per stated that “Section 8 (1) of ITAA 1997” for Jerry it is evident to claim deduction for

the goods stolen which was done by the long-term staff. The loss was incurred by Jerry during

the time of conduction of business operations because the goods were supposed to generate

earnings for Jerry7.

Answer to Part e:

According to the “Section 8 (1) of ITAA 1997”, the expenses incurred or losses incurred

during the time of revenue generation are treated as they did not happened during the course of

activity and general deduction is allowed. According to the case of “Maddalena v FCT (1971)”,

in getting new job the expenses made are not falls under the taxable income because it is not

generating any kind of income and also the expenses before getting the job so it is not deductible

in accordance with the “Section 8 (1) of ITAA 1997”8.

6 Geralyn, Jover-Ledesma, Principles Of Business Taxation 2015 (Cch Incorporated, 2014)

7 Helena, Yuan, "Mid market focus: The sharing economy and taxation." Taxation in

Australia 51.6 (2016): 293.

8 Dale, Pinto, and Michelle Evans. "Returning income taxation revenue to the states: back to the

future." (2018).

Answer to Part d:

The application is possible for both expenses and losses bared by the taxpayer in accordance

with the “Section 8 (1) of ITAA 1997”. From the case of “Charles Moore & Co (WA) Private

Limited v FC of T (1956)”, it is evident that the court gave permission on the taxpayer for

providing deduction if it is occurred during theft of the earnings during going to the bank6.

As per stated that “Section 8 (1) of ITAA 1997” for Jerry it is evident to claim deduction for

the goods stolen which was done by the long-term staff. The loss was incurred by Jerry during

the time of conduction of business operations because the goods were supposed to generate

earnings for Jerry7.

Answer to Part e:

According to the “Section 8 (1) of ITAA 1997”, the expenses incurred or losses incurred

during the time of revenue generation are treated as they did not happened during the course of

activity and general deduction is allowed. According to the case of “Maddalena v FCT (1971)”,

in getting new job the expenses made are not falls under the taxable income because it is not

generating any kind of income and also the expenses before getting the job so it is not deductible

in accordance with the “Section 8 (1) of ITAA 1997”8.

6 Geralyn, Jover-Ledesma, Principles Of Business Taxation 2015 (Cch Incorporated, 2014)

7 Helena, Yuan, "Mid market focus: The sharing economy and taxation." Taxation in

Australia 51.6 (2016): 293.

8 Dale, Pinto, and Michelle Evans. "Returning income taxation revenue to the states: back to the

future." (2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW OF AUSTRALIA

The expenses made during the contest of general election of the local government do not

fetch any kind of income and moreover it is made before the income is generated and thus it does

not falls under the purview of deduction in accordance with the provision mentioned in the

“Section 8 (1) of ITAA 1997”9.

Question 3:

Answer to Part a:

According to “CGT event F2”, is applicable for the individual taxpayer in renewing or

granting or generating long-term lease. The elemental landowner or the taxpayer that grant with

sub-lease are applicable for “CGT event F2”. Andy who is a landowner and the individual has

granted lease term for five years to Brian at $5000 premium. From the above mentioned example

it is evident that “CGT event F2” has taken place. In the case of Andy it is not possible for Andy

to enjoy the CGT discount of 50% because the case has direct relevance of “CGT event F210”.

Answer to Part b:

As per Australian Taxation Office, there is a possibility of occurrence of “CGT event F2”

which includes the new owner gets the use of land. From the above mentioned perspective it is

evident that the rise of land and enjoyment happens during the time of land ownership which

acquired by the new owner of the land and the date at which the new owner has acquired the land

are applicable for rent and taxes. Instead of $40,000, Farm Limited has alternative to go for

9 Paul, Kenny, Australian Tax 2013 (LexisNexis Butterworths, 2013)

10 Marcel, Olbert, and Christoph Spengel. "International taxation in the digital economy:

challenge accepted." World tax journal9.1 (2017): 3-46.

The expenses made during the contest of general election of the local government do not

fetch any kind of income and moreover it is made before the income is generated and thus it does

not falls under the purview of deduction in accordance with the provision mentioned in the

“Section 8 (1) of ITAA 1997”9.

Question 3:

Answer to Part a:

According to “CGT event F2”, is applicable for the individual taxpayer in renewing or

granting or generating long-term lease. The elemental landowner or the taxpayer that grant with

sub-lease are applicable for “CGT event F2”. Andy who is a landowner and the individual has

granted lease term for five years to Brian at $5000 premium. From the above mentioned example

it is evident that “CGT event F2” has taken place. In the case of Andy it is not possible for Andy

to enjoy the CGT discount of 50% because the case has direct relevance of “CGT event F210”.

Answer to Part b:

As per Australian Taxation Office, there is a possibility of occurrence of “CGT event F2”

which includes the new owner gets the use of land. From the above mentioned perspective it is

evident that the rise of land and enjoyment happens during the time of land ownership which

acquired by the new owner of the land and the date at which the new owner has acquired the land

are applicable for rent and taxes. Instead of $40,000, Farm Limited has alternative to go for

9 Paul, Kenny, Australian Tax 2013 (LexisNexis Butterworths, 2013)

10 Marcel, Olbert, and Christoph Spengel. "International taxation in the digital economy:

challenge accepted." World tax journal9.1 (2017): 3-46.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW OF AUSTRALIA

buying 100-acre firm for $800,000. This will lead to the cause of “CGT event B1” for John. In

the case of John, it is possible to implicate CGT discount of 50% on the transaction made by

John.

Answer to Part c:

As per Australian Taxation Office, if the taxpayer is not residing for the ownership period

and at the same time the place is used to produce income then a certain exemption is allowed for

taxpayer. Olivia and Jamie have purchased a property and they have rented for the two years.

After, the property is used for income purpose and then it is utilized for residence purpose before

sale in 2018. Due to above mentioned situations Olivia and Jamie is are entitled for partial

exemption of the property after it is being sold in 201811. Therefore, Olivia and Jamie is liable to

enjoy the CGT 50 % discount so that there net capital gains could ascertain effectively12.

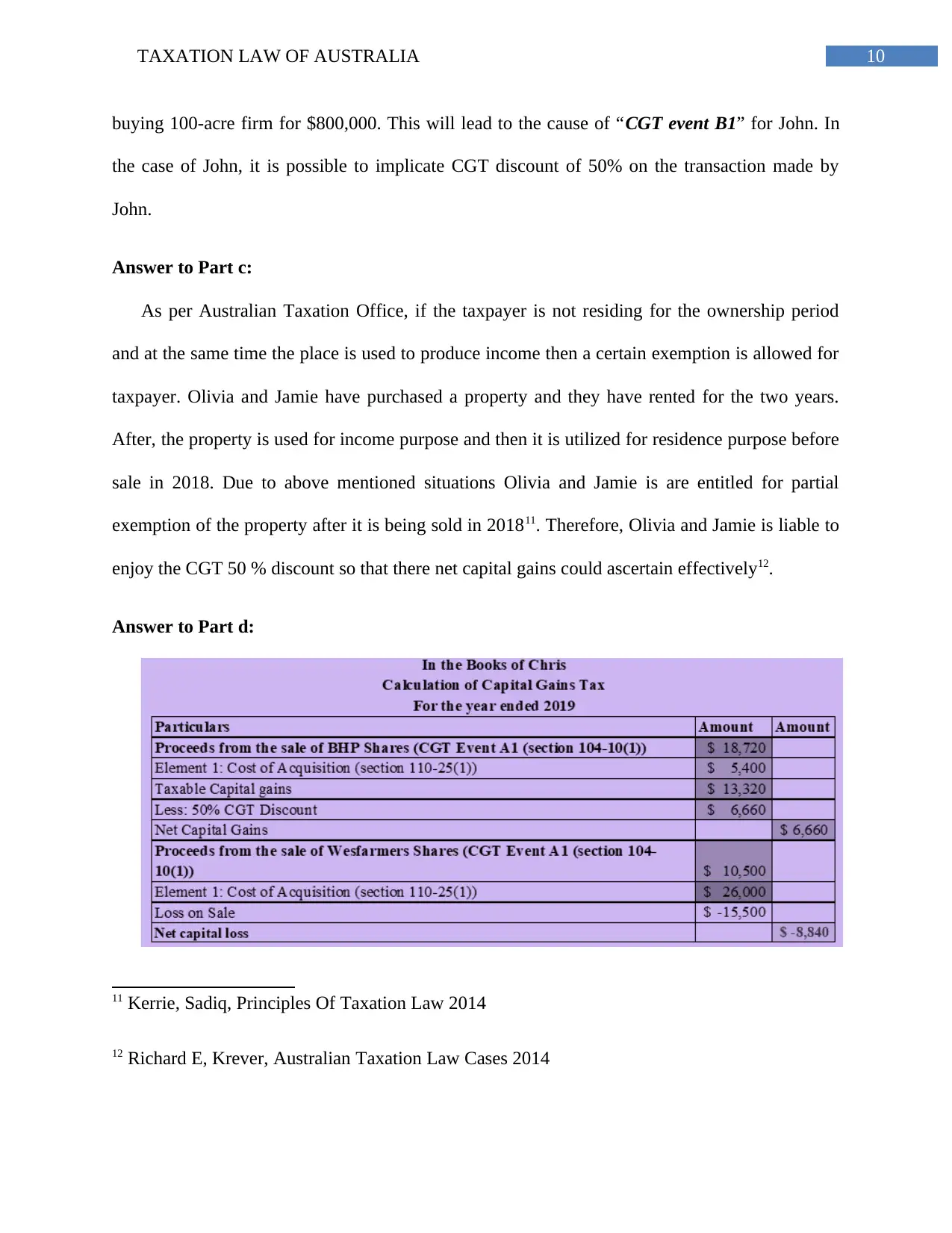

Answer to Part d:

11 Kerrie, Sadiq, Principles Of Taxation Law 2014

12 Richard E, Krever, Australian Taxation Law Cases 2014

buying 100-acre firm for $800,000. This will lead to the cause of “CGT event B1” for John. In

the case of John, it is possible to implicate CGT discount of 50% on the transaction made by

John.

Answer to Part c:

As per Australian Taxation Office, if the taxpayer is not residing for the ownership period

and at the same time the place is used to produce income then a certain exemption is allowed for

taxpayer. Olivia and Jamie have purchased a property and they have rented for the two years.

After, the property is used for income purpose and then it is utilized for residence purpose before

sale in 2018. Due to above mentioned situations Olivia and Jamie is are entitled for partial

exemption of the property after it is being sold in 201811. Therefore, Olivia and Jamie is liable to

enjoy the CGT 50 % discount so that there net capital gains could ascertain effectively12.

Answer to Part d:

11 Kerrie, Sadiq, Principles Of Taxation Law 2014

12 Richard E, Krever, Australian Taxation Law Cases 2014

11TAXATION LAW OF AUSTRALIA

According to the above table it can be seen that the shares of BHP can be sold and receive

the capital gains of $6,600 can be generated and on the other hand the shares of Wesfarmers are

sold and the capital loss of $15,500. From the deduction, process the capital loss of taxable

income however, on the other hand the capital gain made during the future period will be offset

under the taxable income13. It is possible for Chris to balance the capital gains made from the

share of BHP against the capital loss of incurred from the shares of Wesfarmers. Hence,

altogether Chris has caused net capital loss of $8,840 will be brought forward in next year.

Question 4:

Answer to Part a:

In case of simple prize winnings it is not possible for taxpayers for assessment. On the other

hand the prize winning money can be treated as accessible income if there is any sufficient

relationship with income generation of taxpayer. According to the case of FCT v Kelly (1985)”,

the football player who was awarded by the Channel 7 for the best player and fairest player will

be treated as ordinary income because it will be related with income of the player as the prize

money gained after utilising the skills of the player. Hence, it falls under the employment of the

player14.

13 Michael, Lang, et al., eds. Introduction to European tax law on direct taxation. Linde Verlag

GmbH, 2018.

14 Andrew, Shaw, "Tax files: Why small really is better: Accessing the lower corporate tax rate

for small business entities." Bulletin (Law Society of South Australia) 39.10 (2017): 39.

According to the above table it can be seen that the shares of BHP can be sold and receive

the capital gains of $6,600 can be generated and on the other hand the shares of Wesfarmers are

sold and the capital loss of $15,500. From the deduction, process the capital loss of taxable

income however, on the other hand the capital gain made during the future period will be offset

under the taxable income13. It is possible for Chris to balance the capital gains made from the

share of BHP against the capital loss of incurred from the shares of Wesfarmers. Hence,

altogether Chris has caused net capital loss of $8,840 will be brought forward in next year.

Question 4:

Answer to Part a:

In case of simple prize winnings it is not possible for taxpayers for assessment. On the other

hand the prize winning money can be treated as accessible income if there is any sufficient

relationship with income generation of taxpayer. According to the case of FCT v Kelly (1985)”,

the football player who was awarded by the Channel 7 for the best player and fairest player will

be treated as ordinary income because it will be related with income of the player as the prize

money gained after utilising the skills of the player. Hence, it falls under the employment of the

player14.

13 Michael, Lang, et al., eds. Introduction to European tax law on direct taxation. Linde Verlag

GmbH, 2018.

14 Andrew, Shaw, "Tax files: Why small really is better: Accessing the lower corporate tax rate

for small business entities." Bulletin (Law Society of South Australia) 39.10 (2017): 39.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.