Taxation Law Report: GST, Capital Gains, and Tax Implications

VerifiedAdded on 2021/02/22

|10

|2689

|56

Report

AI Summary

This report provides an analysis of Australian taxation law, specifically focusing on the Goods and Services Tax (GST) and Capital Gains Tax (CGT). The report examines two case studies. The first case study involves a property development company, City Sky Co., and its GST obligations, including registration requirements, input tax credits, and the GST implications of legal fees. The second case study analyzes the capital gains tax implications for an individual, Emma, detailing calculations for capital gains and losses from various asset transactions, including land, shares, and collectibles. The report identifies relevant taxation laws, applies them to the provided material facts, and presents detailed conclusions regarding the tax liabilities and credits in each scenario, offering a comprehensive overview of the tax implications for businesses and individuals in Australia. The report provides a clear understanding of GST and CGT principles, including calculations, and provides a good reference for students.

Taxation law

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

Question 1........................................................................................................................................1

Question 2........................................................................................................................................4

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION...........................................................................................................................1

Question 1........................................................................................................................................1

Question 2........................................................................................................................................4

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION

Australian tax law is created by statute and this becomes one of the primary

source lies in legislation. Legislations are the act of parliament that governs all the

country to provided basis of implication of taxes. Legislations in Australia are interpret

by decisions of various cases provided by courts and tribunals and they become second

source for tax law in the country. The Australian Tax Office is responsible for ensuring

individuals, companies, trust and other entities lodge their returns appropriately. In this

project report GST consequences of two cases will be discussed with relevant taxation

law. Together with this material facts regarding Capital Gain Tax with all the material

facts will be elaborated in this project report (Avi-Yonah, 2012).

Question 1

Identification of material facts:

In the present case The City Sky Company made an investment in a vacant land

for business purpose. The company plans to build 15 apartments on that land and sell

them. To initiate all the activities in legal manner, services of a local lawyer are

consulted by the company that cost $33000. The company was registered under GST

and lawyer was a sole trader with annual revenue of $300000.

Application of Tax legislations relating to GST:

As per taxation law in Australia registration under GST Act 1999 as per section 17(5)

(Goods and Service Tax) is required within 21 days. When GST turnover of businesses

or enterprises exceeding the turnover (gross income minus GST) is of $75000 or more.

In the present case scenario City Sky Co is a property investment and development

company (Goods and Service Tax, 2019). Vendors are required to registered for GST

purpose when they fall under any of the following situations-

the turnover from any of the property transactions and other transactions are

more than the GST registration threshold

activities are registered as enterprise for buying a land with an intention of

developing it for immediate resale at certain amount of profit.

Application of tax law to material facts:

1

Australian tax law is created by statute and this becomes one of the primary

source lies in legislation. Legislations are the act of parliament that governs all the

country to provided basis of implication of taxes. Legislations in Australia are interpret

by decisions of various cases provided by courts and tribunals and they become second

source for tax law in the country. The Australian Tax Office is responsible for ensuring

individuals, companies, trust and other entities lodge their returns appropriately. In this

project report GST consequences of two cases will be discussed with relevant taxation

law. Together with this material facts regarding Capital Gain Tax with all the material

facts will be elaborated in this project report (Avi-Yonah, 2012).

Question 1

Identification of material facts:

In the present case The City Sky Company made an investment in a vacant land

for business purpose. The company plans to build 15 apartments on that land and sell

them. To initiate all the activities in legal manner, services of a local lawyer are

consulted by the company that cost $33000. The company was registered under GST

and lawyer was a sole trader with annual revenue of $300000.

Application of Tax legislations relating to GST:

As per taxation law in Australia registration under GST Act 1999 as per section 17(5)

(Goods and Service Tax) is required within 21 days. When GST turnover of businesses

or enterprises exceeding the turnover (gross income minus GST) is of $75000 or more.

In the present case scenario City Sky Co is a property investment and development

company (Goods and Service Tax, 2019). Vendors are required to registered for GST

purpose when they fall under any of the following situations-

the turnover from any of the property transactions and other transactions are

more than the GST registration threshold

activities are registered as enterprise for buying a land with an intention of

developing it for immediate resale at certain amount of profit.

Application of tax law to material facts:

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The City Sky Co is already registered for GST purpose that reflects that company

has already crossed threshold limit required for registration under GST. An Australian

Business Number is required by City Sky Company to get registered under GST in

Australia. When an organisation or individual who is required to get registered under

GST and do not get registered. This leads to imposition of amount of GST on the sales

made since the date business become liable to pay GST. This amount of GST will be

paid even the amount of GST is not charged by seller from buyers (Jördens, 2012).

There are certain types of property whose purchase and sale will not be included

in calculating turnover for registration. Such as-

the sale of a residence that is old one but not a new premise to reside

sales are made and no payments is received unless it is given for some

settlement

sales made of some private property that do not belongs to enterprise through

which business operations are performed

when residential home is given on rent and income earned as rent from that

property

City Sky Company is registered under GST and possess an Australian Business

Number that provides business following benefits as per taxation law-

amount of GST will be included in the price charged by City Sky company in

taxable supply of goods and services in certain property transactions

claim of GST credit for the amount of GST that is included in goods and services

purchased for providing property development by City Sky company. The cost of

developing property includes architect's fees, consultant’s fees and construction

fees. All these cost must be incurred for the purpose of making taxable supplies

in the future.

Input tax credit means that amount of tax that is paid in the process of

manufacturing goods or providing services is reduced at the time of output tax

payments. The input tax credit mechanism allows GST registered businesses to receive

refunds on GST paid for the purpose of such inputs this helps in preventing the

cascading effects of tax on general public (Kopczuk, 2013). When amount of tax is

2

has already crossed threshold limit required for registration under GST. An Australian

Business Number is required by City Sky Company to get registered under GST in

Australia. When an organisation or individual who is required to get registered under

GST and do not get registered. This leads to imposition of amount of GST on the sales

made since the date business become liable to pay GST. This amount of GST will be

paid even the amount of GST is not charged by seller from buyers (Jördens, 2012).

There are certain types of property whose purchase and sale will not be included

in calculating turnover for registration. Such as-

the sale of a residence that is old one but not a new premise to reside

sales are made and no payments is received unless it is given for some

settlement

sales made of some private property that do not belongs to enterprise through

which business operations are performed

when residential home is given on rent and income earned as rent from that

property

City Sky Company is registered under GST and possess an Australian Business

Number that provides business following benefits as per taxation law-

amount of GST will be included in the price charged by City Sky company in

taxable supply of goods and services in certain property transactions

claim of GST credit for the amount of GST that is included in goods and services

purchased for providing property development by City Sky company. The cost of

developing property includes architect's fees, consultant’s fees and construction

fees. All these cost must be incurred for the purpose of making taxable supplies

in the future.

Input tax credit means that amount of tax that is paid in the process of

manufacturing goods or providing services is reduced at the time of output tax

payments. The input tax credit mechanism allows GST registered businesses to receive

refunds on GST paid for the purpose of such inputs this helps in preventing the

cascading effects of tax on general public (Kopczuk, 2013). When amount of tax is

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

imposed at each level of sales made and no reduction is provided on the tax that is

already paid on initial stage. This act will create a negative impact on ultimate

consumers as at last tax burden is imposed on them by charging high prices for the

goods and services offered.

There are certain restrictions to claim GST credit which are as follows-

businesses that are not registered under GST

when purchase of goods do not include GST price

amount of wages paid to employees as wages are GST free

no valid invoice is present for payment made in relation to GST

to the extent purchase are made for private or domestic use

real state property is purchased under margin scheme

time limit for claiming GST credit for the purchase has ended.

From the above implication provisions of GST and certain restrictions for

enterprises to claim credit. It is seen that City Sky company is registered and taking

services of lawyer for its business only. This entitles City Sky organisation to claim

amount of $3000 paid as GST in the process of development of property as credit

(Lang, 2014). This credit will be used at the time when any liability of GST will be

created when sales of the property developed will be made in future.

Detailed and accurate conclusion:

The City Sky organisation for dealing the legal issues appointed Maurice

Blackburn, to guide them in property development issues. Amount of $33000 is paid to

Maurice Blackburn for his services. Business run by Maurice is a sole trader business

with revenue of $300000 per year. As the amount of revenue earned from business

operations is much more than the minimum amount required for registration under GST.

This creates legal obligation on business of Maurice Blackburn to be registered under

GST provisions in Australia. When business of Maurice Blackburn will be registered

under GST provisions then amount charged from The City Sky company for lawyer

services will be included with GST. In Australia rate of GST charged on most of the

goods and services is 10% except some (Kemmeren, 2014).

The amount of $33000 is including GST amount that means it is 110% of the

base amount. Calculation of the amount of only GST is as follows-

3

already paid on initial stage. This act will create a negative impact on ultimate

consumers as at last tax burden is imposed on them by charging high prices for the

goods and services offered.

There are certain restrictions to claim GST credit which are as follows-

businesses that are not registered under GST

when purchase of goods do not include GST price

amount of wages paid to employees as wages are GST free

no valid invoice is present for payment made in relation to GST

to the extent purchase are made for private or domestic use

real state property is purchased under margin scheme

time limit for claiming GST credit for the purchase has ended.

From the above implication provisions of GST and certain restrictions for

enterprises to claim credit. It is seen that City Sky company is registered and taking

services of lawyer for its business only. This entitles City Sky organisation to claim

amount of $3000 paid as GST in the process of development of property as credit

(Lang, 2014). This credit will be used at the time when any liability of GST will be

created when sales of the property developed will be made in future.

Detailed and accurate conclusion:

The City Sky organisation for dealing the legal issues appointed Maurice

Blackburn, to guide them in property development issues. Amount of $33000 is paid to

Maurice Blackburn for his services. Business run by Maurice is a sole trader business

with revenue of $300000 per year. As the amount of revenue earned from business

operations is much more than the minimum amount required for registration under GST.

This creates legal obligation on business of Maurice Blackburn to be registered under

GST provisions in Australia. When business of Maurice Blackburn will be registered

under GST provisions then amount charged from The City Sky company for lawyer

services will be included with GST. In Australia rate of GST charged on most of the

goods and services is 10% except some (Kemmeren, 2014).

The amount of $33000 is including GST amount that means it is 110% of the

base amount. Calculation of the amount of only GST is as follows-

3

33000*100/110 = $30000

Amount of GST= $33000 - $30000 = $3000

This $3000 will be used as GST credit for City Sky company and can be used to

settle the tax liability under GST.

Question 2

Identification of material facts:

In the given case Emma is an individual undertaking various capital transactions

in an accounting year. All the assets used in the transactions are different and can be or

cannot be termed as a capital asset as per Capital Cain Taxation Act.

Identification of the relevant taxation law:

As per Income Tax Assessment Act, 1997 capital assets are termed as some

significant pieces of property such as house, cars, properties investments, stocks,

bonds and collectibles or art. When capital assets are considered in terms of

businesses these are those tangible assets having a useful longer life more than a year

and are not intended for sales in the regular course of business. Taxation in relation to

sale and purchase of capital assets are governed as per capital gain taxation. When

any capital asset is sold it gives rise to capital gain or capital loss. Capital gain or loss is

the difference between cost of acquisition of the asset and the amount received at the

time of disposal of the asset. Tax paid on amount of capital gain is part of income tax

and it is not a separate tax (Mason, 2015).

Application of tax law and material facts:

When capital gain earned in a financial year will be added to other incomes

earned in that financial year for taxation purpose. Amount of capital loss can be settled

against income earned through capital gain only and cannot be reduced for any other

income. Income earned on asset held for less than one year then it will be taxable as

normal income. Gain on some type of sales such as real estate and collectibles may be

taxed at different rates.

To calculate the amount of purchase of an asset purchase price plus any

commission paid and legal expenses incurred on the asset will be added to

purchase price.

4

Amount of GST= $33000 - $30000 = $3000

This $3000 will be used as GST credit for City Sky company and can be used to

settle the tax liability under GST.

Question 2

Identification of material facts:

In the given case Emma is an individual undertaking various capital transactions

in an accounting year. All the assets used in the transactions are different and can be or

cannot be termed as a capital asset as per Capital Cain Taxation Act.

Identification of the relevant taxation law:

As per Income Tax Assessment Act, 1997 capital assets are termed as some

significant pieces of property such as house, cars, properties investments, stocks,

bonds and collectibles or art. When capital assets are considered in terms of

businesses these are those tangible assets having a useful longer life more than a year

and are not intended for sales in the regular course of business. Taxation in relation to

sale and purchase of capital assets are governed as per capital gain taxation. When

any capital asset is sold it gives rise to capital gain or capital loss. Capital gain or loss is

the difference between cost of acquisition of the asset and the amount received at the

time of disposal of the asset. Tax paid on amount of capital gain is part of income tax

and it is not a separate tax (Mason, 2015).

Application of tax law and material facts:

When capital gain earned in a financial year will be added to other incomes

earned in that financial year for taxation purpose. Amount of capital loss can be settled

against income earned through capital gain only and cannot be reduced for any other

income. Income earned on asset held for less than one year then it will be taxable as

normal income. Gain on some type of sales such as real estate and collectibles may be

taxed at different rates.

To calculate the amount of purchase of an asset purchase price plus any

commission paid and legal expenses incurred on the asset will be added to

purchase price.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Sales price will be determined by sales amount deducted with any commission

paid for sales.

The amount spends in purchase of a capital asset is lees then amount earned as

sales price, this leads to generation of capital gain. when sales price is less then

purchase amount then it will be termed as capital loss.

As per Australian taxation law rate of tax applied on Long term capital gain is as

follows-

0% when income earned is below $38700 and income tax return is filled as

single and if married person fills return then income must be below $77400

(Radu, 2012).

15% rate of tax will be applicable on the amount earned as capital gain when

income earned is between $38701 and $500000 for single. When married person

fills return jointly then limit varies from $77401 and $600000.

20% rate of tax will be applicable if the income earned is more than $500000 for

single and $600000 when married filling the return together.

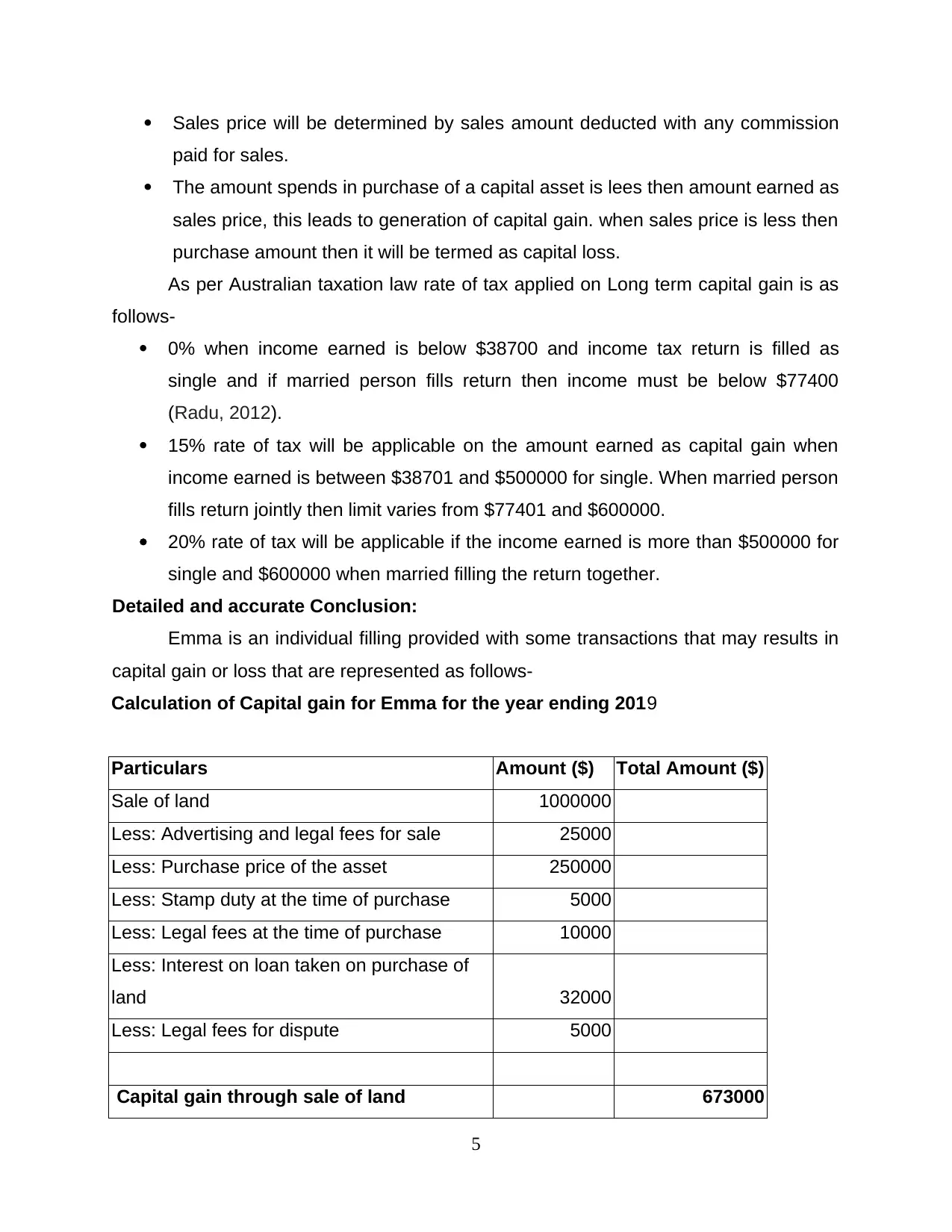

Detailed and accurate Conclusion:

Emma is an individual filling provided with some transactions that may results in

capital gain or loss that are represented as follows-

Calculation of Capital gain for Emma for the year ending 2019

Particulars Amount ($) Total Amount ($)

Sale of land 1000000

Less: Advertising and legal fees for sale 25000

Less: Purchase price of the asset 250000

Less: Stamp duty at the time of purchase 5000

Less: Legal fees at the time of purchase 10000

Less: Interest on loan taken on purchase of

land 32000

Less: Legal fees for dispute 5000

Capital gain through sale of land 673000

5

paid for sales.

The amount spends in purchase of a capital asset is lees then amount earned as

sales price, this leads to generation of capital gain. when sales price is less then

purchase amount then it will be termed as capital loss.

As per Australian taxation law rate of tax applied on Long term capital gain is as

follows-

0% when income earned is below $38700 and income tax return is filled as

single and if married person fills return then income must be below $77400

(Radu, 2012).

15% rate of tax will be applicable on the amount earned as capital gain when

income earned is between $38701 and $500000 for single. When married person

fills return jointly then limit varies from $77401 and $600000.

20% rate of tax will be applicable if the income earned is more than $500000 for

single and $600000 when married filling the return together.

Detailed and accurate Conclusion:

Emma is an individual filling provided with some transactions that may results in

capital gain or loss that are represented as follows-

Calculation of Capital gain for Emma for the year ending 2019

Particulars Amount ($) Total Amount ($)

Sale of land 1000000

Less: Advertising and legal fees for sale 25000

Less: Purchase price of the asset 250000

Less: Stamp duty at the time of purchase 5000

Less: Legal fees at the time of purchase 10000

Less: Interest on loan taken on purchase of

land 32000

Less: Legal fees for dispute 5000

Capital gain through sale of land 673000

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

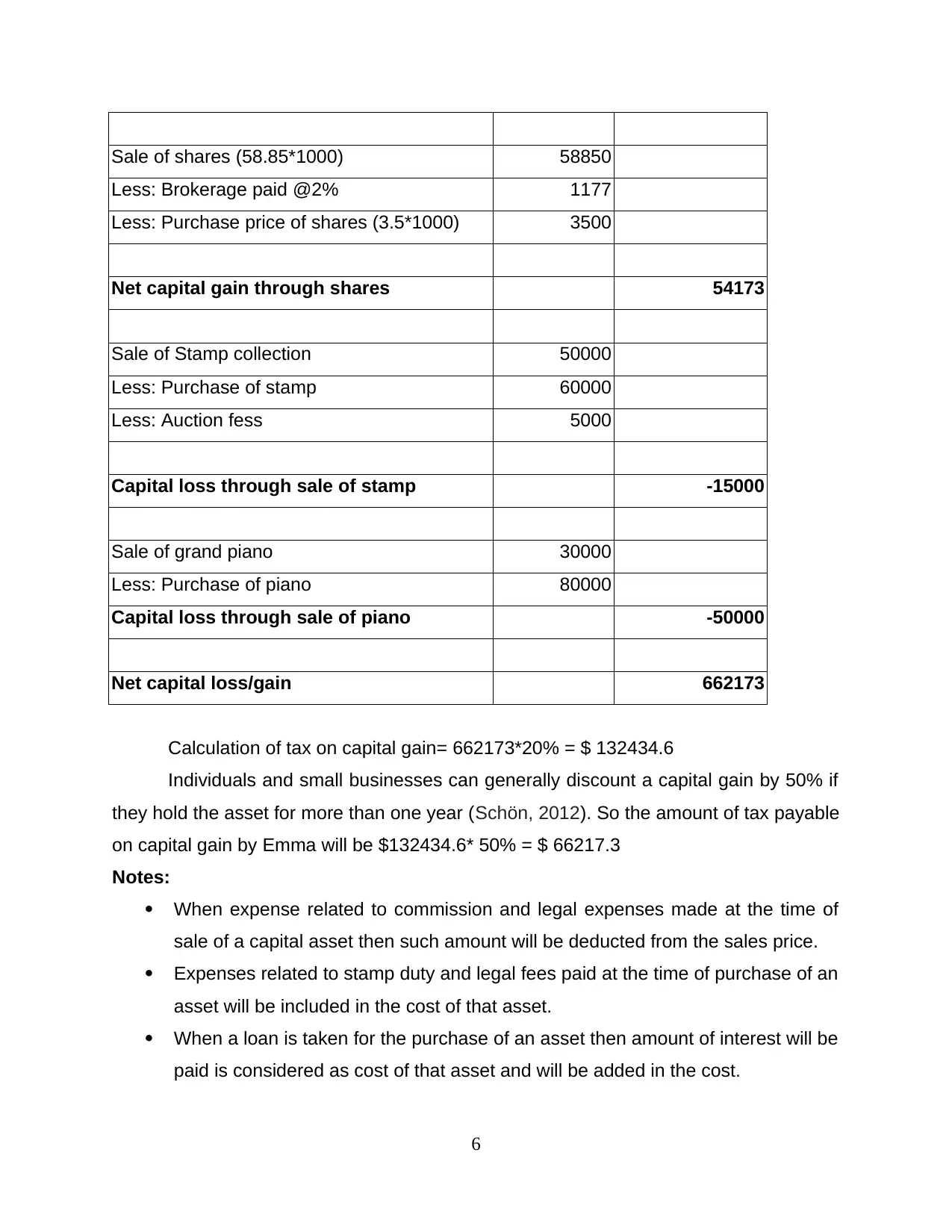

Sale of shares (58.85*1000) 58850

Less: Brokerage paid @2% 1177

Less: Purchase price of shares (3.5*1000) 3500

Net capital gain through shares 54173

Sale of Stamp collection 50000

Less: Purchase of stamp 60000

Less: Auction fess 5000

Capital loss through sale of stamp -15000

Sale of grand piano 30000

Less: Purchase of piano 80000

Capital loss through sale of piano -50000

Net capital loss/gain 662173

Calculation of tax on capital gain= 662173*20% = $ 132434.6

Individuals and small businesses can generally discount a capital gain by 50% if

they hold the asset for more than one year (Schön, 2012). So the amount of tax payable

on capital gain by Emma will be $132434.6* 50% = $ 66217.3

Notes:

When expense related to commission and legal expenses made at the time of

sale of a capital asset then such amount will be deducted from the sales price.

Expenses related to stamp duty and legal fees paid at the time of purchase of an

asset will be included in the cost of that asset.

When a loan is taken for the purchase of an asset then amount of interest will be

paid is considered as cost of that asset and will be added in the cost.

6

Less: Brokerage paid @2% 1177

Less: Purchase price of shares (3.5*1000) 3500

Net capital gain through shares 54173

Sale of Stamp collection 50000

Less: Purchase of stamp 60000

Less: Auction fess 5000

Capital loss through sale of stamp -15000

Sale of grand piano 30000

Less: Purchase of piano 80000

Capital loss through sale of piano -50000

Net capital loss/gain 662173

Calculation of tax on capital gain= 662173*20% = $ 132434.6

Individuals and small businesses can generally discount a capital gain by 50% if

they hold the asset for more than one year (Schön, 2012). So the amount of tax payable

on capital gain by Emma will be $132434.6* 50% = $ 66217.3

Notes:

When expense related to commission and legal expenses made at the time of

sale of a capital asset then such amount will be deducted from the sales price.

Expenses related to stamp duty and legal fees paid at the time of purchase of an

asset will be included in the cost of that asset.

When a loan is taken for the purchase of an asset then amount of interest will be

paid is considered as cost of that asset and will be added in the cost.

6

Expenses that are recurring in nature incurred on the land such as water and

insurance will not form part of the total cost of that asset.

When any legal fees are paid to resolve the dispute of the related asset then it

will form part of cost of that asset and amount will be added after indexation.

Calculation of capital gain on shares will be done by multiplying the amount of

sales price to number of shares and amount of brokerage for sale will be

deducted from sales price (Computing Capital Gain, 2019).

Stamps will be assumed as precious and considered as capital goods and profit

or loss on sale of which will be treated as capital gain or loss.

Piano will be assumed to be an antique asset to Emma and sales of which will

bring capital gain or loss as per Australian accounting standard 138 in

subheading 8.

CONCLUSION

From the above project report it has been concluded that taxation plays important

role in guiding individuals and business organisations to file their returns specifying

income earned in the year with amount of tax to be paid. Taxation is segregated into

various headings that helps in guiding and calculating amount of tax generated from

different types of income such as GST, CGT etc.

7

insurance will not form part of the total cost of that asset.

When any legal fees are paid to resolve the dispute of the related asset then it

will form part of cost of that asset and amount will be added after indexation.

Calculation of capital gain on shares will be done by multiplying the amount of

sales price to number of shares and amount of brokerage for sale will be

deducted from sales price (Computing Capital Gain, 2019).

Stamps will be assumed as precious and considered as capital goods and profit

or loss on sale of which will be treated as capital gain or loss.

Piano will be assumed to be an antique asset to Emma and sales of which will

bring capital gain or loss as per Australian accounting standard 138 in

subheading 8.

CONCLUSION

From the above project report it has been concluded that taxation plays important

role in guiding individuals and business organisations to file their returns specifying

income earned in the year with amount of tax to be paid. Taxation is segregated into

various headings that helps in guiding and calculating amount of tax generated from

different types of income such as GST, CGT etc.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals

Avi-Yonah, R. S., 2012. Slicing the shadow: A proposal for updating US international

taxation.

Jördens, A., 2012. Government, taxation, and law. In The Oxford Handbook of Roman

Egypt.

Kemmeren, E. C., 2014. Where is EU Law in the OECD BEPS Discussion?. EC Tax

Review. 23(4). pp.190-193.

Kopczuk, W., 2013. Taxation of intergenerational transfers and wealth. In Handbook of

public economics (Vol. 5, pp. 329-390). Elsevier.

Lang, M., 2014. Introduction to the law of double taxation conventions. Linde Verlag

GmbH.

Mason, R., 2015. Citizenship Taxation. S. Cal. L. Rev. 89. p.169.

Radu, M. E., 2012. International double taxation. Procedia-Social and Behavioral

Sciences. 62. pp.403-407.

Schön, W., 2012. Transfer Pricing–Business Incentives, International Taxation and

Corporate Law. In Fundamentals of International Transfer Pricing in Law and

Economics (pp. 47-67). Springer, Berlin, Heidelberg.

Online

Goods and Service Tax. 2019. [Online]. Available through:

<https://www.ato.gov.au/Business/GST/>

Computing Capital Gain. 2019. [Online]. Available Through:

<https://www.ato.gov.au/General/Property/Land---vacant-land-and-

subdividing/Vacant-land/#Land_as_a_capital_asset>

8

Books and Journals

Avi-Yonah, R. S., 2012. Slicing the shadow: A proposal for updating US international

taxation.

Jördens, A., 2012. Government, taxation, and law. In The Oxford Handbook of Roman

Egypt.

Kemmeren, E. C., 2014. Where is EU Law in the OECD BEPS Discussion?. EC Tax

Review. 23(4). pp.190-193.

Kopczuk, W., 2013. Taxation of intergenerational transfers and wealth. In Handbook of

public economics (Vol. 5, pp. 329-390). Elsevier.

Lang, M., 2014. Introduction to the law of double taxation conventions. Linde Verlag

GmbH.

Mason, R., 2015. Citizenship Taxation. S. Cal. L. Rev. 89. p.169.

Radu, M. E., 2012. International double taxation. Procedia-Social and Behavioral

Sciences. 62. pp.403-407.

Schön, W., 2012. Transfer Pricing–Business Incentives, International Taxation and

Corporate Law. In Fundamentals of International Transfer Pricing in Law and

Economics (pp. 47-67). Springer, Berlin, Heidelberg.

Online

Goods and Service Tax. 2019. [Online]. Available through:

<https://www.ato.gov.au/Business/GST/>

Computing Capital Gain. 2019. [Online]. Available Through:

<https://www.ato.gov.au/General/Property/Land---vacant-land-and-

subdividing/Vacant-land/#Land_as_a_capital_asset>

8

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.