BUSL320: Taxation Law and Practice Report on Anna McCartney's Case

VerifiedAdded on 2023/01/11

|9

|2062

|29

Report

AI Summary

This report provides a comprehensive analysis of taxation law, specifically addressing the tax consequences of employment-related receipts for Anna McCartney, a financial analyst. It examines key issues such as assessable income, including sign-on bonuses, salaries, and allowances, and delves into the relevant rules and applications of the Income Tax Assessment Act 1936 and 1997. The report explores allowable deductions for expenses like work-related travel and superannuation contributions. It also covers the treatment of non-cash benefits, frequent flyer points, and compensation payments. The analysis draws upon relevant case law, including FCT v Pickford (1998) and Payne v FCT (1996), to determine the tax implications of various financial transactions. The report concludes with a summary of Anna's taxable income and allowable deductions, offering a clear understanding of the tax outcomes based on the provided scenario. The report also includes a detailed table summarizing Anna's assessable income and allowable deductions for the year ended 30th June 2018.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Table of Contents

Answer to question 1:.................................................................................................................2

Issues:.........................................................................................................................................2

Rule:...........................................................................................................................................2

Application:................................................................................................................................4

Conclusion:................................................................................................................................6

References:.................................................................................................................................7

Table of Contents

Answer to question 1:.................................................................................................................2

Issues:.........................................................................................................................................2

Rule:...........................................................................................................................................2

Application:................................................................................................................................4

Conclusion:................................................................................................................................6

References:.................................................................................................................................7

2TAXATION LAW

Answer to question 1:

Issues:

The report will take into the account the tax consequences of the several employment

related receipts that are reported by the taxpayer in discharge of the employment. The issue

involves whether the taxpayer will be able to obtain allowable deduction for expenses that are

occurred in obtaining taxable income.

Rule:

As defined in “section 6, ITAA 1936”, income that are obtained from the personal

exertion generally comprises of the salaries, wages, bonuses etc. that are held assessable for

the recipient (Woellner et al. 2016). Provided that the receipts has adequate relation with the

income earning capacities of the taxpayer then it is held as the assessable receipts within

ordinary concepts of “section 6-5, ITAA 1997”. A large part of the income that is received by

the taxpayer is held as the ordinary income. The judgement in “Scott v CT (1935)” held that

income should not be viewed as a expression of art and there is an application of appropriate

principles to consider the receipts in accordance with the ordinary concepts (Braithwaite and

Reinhart 2019).

There are situations where the employers attract the candidates for employment

purpose by offering with the sign-on-fees. As stated by court in “FCT v Pickford (1998)” the

receipt of sign on fees by the fellow employee upon the joining of a new job was treated as

the payment for the future services and was income in accordance with the ordinary concept

of “section 6-5, ITAA 1997” (Barkoczy 2016).

Where a taxpayer obtains income from the personal services are regarded as the

employment payment and are treated assessable in the recipients hand. Similarly, in “Dean

Answer to question 1:

Issues:

The report will take into the account the tax consequences of the several employment

related receipts that are reported by the taxpayer in discharge of the employment. The issue

involves whether the taxpayer will be able to obtain allowable deduction for expenses that are

occurred in obtaining taxable income.

Rule:

As defined in “section 6, ITAA 1936”, income that are obtained from the personal

exertion generally comprises of the salaries, wages, bonuses etc. that are held assessable for

the recipient (Woellner et al. 2016). Provided that the receipts has adequate relation with the

income earning capacities of the taxpayer then it is held as the assessable receipts within

ordinary concepts of “section 6-5, ITAA 1997”. A large part of the income that is received by

the taxpayer is held as the ordinary income. The judgement in “Scott v CT (1935)” held that

income should not be viewed as a expression of art and there is an application of appropriate

principles to consider the receipts in accordance with the ordinary concepts (Braithwaite and

Reinhart 2019).

There are situations where the employers attract the candidates for employment

purpose by offering with the sign-on-fees. As stated by court in “FCT v Pickford (1998)” the

receipt of sign on fees by the fellow employee upon the joining of a new job was treated as

the payment for the future services and was income in accordance with the ordinary concept

of “section 6-5, ITAA 1997” (Barkoczy 2016).

Where a taxpayer obtains income from the personal services are regarded as the

employment payment and are treated assessable in the recipients hand. Similarly, in “Dean

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

& Anor v FCT (1997)” the remuneration that was paid to remain employed with the

company was considered as income in accordance with the ordinary concept of “section 6-5,

ITAA 1997” (Burton and Karlinsky 2016).

As defined in the “section 23L, ITAA 1936”, if the employer pays the expenses or

provides benefit to the employee then the benefit is not considered assessable as income for

the employee. Similarly, if the employer on behalf of the employee pays the superannuation

benefit then it is treated as non-taxable benefit for the employee (Sadiq 2019). The ATO

additionally explains that when the employee makes the salary sacrifice to pay the amount in

to the superannuation fund then these amounts are allowed for claiming income tax

deduction.

According to the explanation of ATO where the employee occurs any kind of cost for

attending the seminars or conference that are associated to the work and employment of the

employee then the cost that is occurred by the employee for attending the conferences or

seminars are allowed for deduction under “section 8-1, ITAA 1997” (Butler 2019). As per

“section 15-2” the employee may get some benefits in discharge of his employment services.

The benefits may be treted as taxable earnings. This includes the bonus, allowances or

premium.

As defined in the “Taxation Ruling of TR 1999/6” the taxpayer are not under

obligation of including in their taxable income the amount of frequent flyer points that is

earned by them upon taking up regular employment purpose trip (Hum et al. 2019).

Accordingly under the “section 21A, 1936” the non-cash benefits even though it has the

relation with the income earning activities of the taxpayer will not be held as income if the

benefit is non cash convertible. If the benefits cannot be converted into cash then it is not held

as income. The court in “Payne v FCT (1996)” explained that the redeeming the frequent

& Anor v FCT (1997)” the remuneration that was paid to remain employed with the

company was considered as income in accordance with the ordinary concept of “section 6-5,

ITAA 1997” (Burton and Karlinsky 2016).

As defined in the “section 23L, ITAA 1936”, if the employer pays the expenses or

provides benefit to the employee then the benefit is not considered assessable as income for

the employee. Similarly, if the employer on behalf of the employee pays the superannuation

benefit then it is treated as non-taxable benefit for the employee (Sadiq 2019). The ATO

additionally explains that when the employee makes the salary sacrifice to pay the amount in

to the superannuation fund then these amounts are allowed for claiming income tax

deduction.

According to the explanation of ATO where the employee occurs any kind of cost for

attending the seminars or conference that are associated to the work and employment of the

employee then the cost that is occurred by the employee for attending the conferences or

seminars are allowed for deduction under “section 8-1, ITAA 1997” (Butler 2019). As per

“section 15-2” the employee may get some benefits in discharge of his employment services.

The benefits may be treted as taxable earnings. This includes the bonus, allowances or

premium.

As defined in the “Taxation Ruling of TR 1999/6” the taxpayer are not under

obligation of including in their taxable income the amount of frequent flyer points that is

earned by them upon taking up regular employment purpose trip (Hum et al. 2019).

Accordingly under the “section 21A, 1936” the non-cash benefits even though it has the

relation with the income earning activities of the taxpayer will not be held as income if the

benefit is non cash convertible. If the benefits cannot be converted into cash then it is not held

as income. The court in “Payne v FCT (1996)” explained that the redeeming the frequent

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

flyer points was not held as income because it is non-convertible to cash (Morgan, Mortimer

and Pinto 2018).

Compensation usually has the character of replacing something. If a person is

compensated for any kind of loss to the capital asset then the compensation amount is held as

capital receipts and non-taxable (Barrett 2018). Where a taxpayer receives compensation for

the lost earnings then it is not considered taxable for the recipients. Compensation received

for the work place injuries are not held as income under “section 6-5, ITAA 1997”.

Application:

Anna upon joining was given the sign on fees that amounted to a bonus of $5,000.

Citing the example of in “FCT v Pickford (1998)” the receipt of sign on fees by Anna upon

the joining of a new job was treated as the payment for the future services and was income in

accordance with the ordinary concept of “section 6-5, ITAA 1997” (Morgan and Castelyn

2018).

She was given remuneration from the employment and she was paid with the

additional amount of bonus that were subjected to the market conditions. With reference to

the court decision in “Dean & Anor v FCT (1997)” the employment salary and bonus is

considered as income in accordance with the ordinary concept of “section 6-5, ITAA 1997”.

However, the bonus of $15,000 will not be considered taxable in the current year because it is

received in the next income year of 2019 (Cavenagh et al. 2018).

In the later part it is noticed that the employer has paid the superannuation for Anna.

Referring to “section 23L, ITAA 1936”, the employer pays the expenses or provides benefit

to the Anna in the form of superannuation benefit. Therefore, the benefit is not considered

assessable as income for the Anna (Robin and Barkoczy 2019). Later Anna made a salary

flyer points was not held as income because it is non-convertible to cash (Morgan, Mortimer

and Pinto 2018).

Compensation usually has the character of replacing something. If a person is

compensated for any kind of loss to the capital asset then the compensation amount is held as

capital receipts and non-taxable (Barrett 2018). Where a taxpayer receives compensation for

the lost earnings then it is not considered taxable for the recipients. Compensation received

for the work place injuries are not held as income under “section 6-5, ITAA 1997”.

Application:

Anna upon joining was given the sign on fees that amounted to a bonus of $5,000.

Citing the example of in “FCT v Pickford (1998)” the receipt of sign on fees by Anna upon

the joining of a new job was treated as the payment for the future services and was income in

accordance with the ordinary concept of “section 6-5, ITAA 1997” (Morgan and Castelyn

2018).

She was given remuneration from the employment and she was paid with the

additional amount of bonus that were subjected to the market conditions. With reference to

the court decision in “Dean & Anor v FCT (1997)” the employment salary and bonus is

considered as income in accordance with the ordinary concept of “section 6-5, ITAA 1997”.

However, the bonus of $15,000 will not be considered taxable in the current year because it is

received in the next income year of 2019 (Cavenagh et al. 2018).

In the later part it is noticed that the employer has paid the superannuation for Anna.

Referring to “section 23L, ITAA 1936”, the employer pays the expenses or provides benefit

to the Anna in the form of superannuation benefit. Therefore, the benefit is not considered

assessable as income for the Anna (Robin and Barkoczy 2019). Later Anna made a salary

5TAXATION LAW

sacrifice of $5,000 to contribute on her own superannuation fund. The amount of $5,000 can

be claimed as tax deduction for Anna.

She also reports the travelling expenditure to attend the conference of finance. With

respect to the “section 8-1, ITAA 1997” cost for attending the seminars or conference is

allowed for deduction (Cavenagh et al. 2018). This is because the cost were incurred by the

employee in course of the employment and allowed for deduction under “section 8-1, ITAA

1997”. She also received an allowance of $2,000 to defray the incidental cost (Barrett 2018).

The allowance will be considered as assessable statutory income under “section 15-2” for

Anna because it holds sufficient nexus with her employment and personal services.

She later redeemed the frequent flyer that she had with Qantas Airways. Citing the

example given in the case of “Payne v FCT (1996)” the redeeming the frequent flyer points

by Anna is not held as income because it is non-convertible to cash (Morgan and Castelyn

2018). In other words, under “section 21A, 1936” it amounts to non-cash benefits even

though it has the relation with the income earning activities of the taxpayer and will not be

held as income since the benefit is non cash convertible.

Anna also reports the receipts of the compensation payment from the previous

employer that she has sustained in discharge of her employment duties. The amount will be

considered as capital receipt because it was given to Anna as the loss of income earning

capacity. As the amount of $130,000 is a capital receipt, it will not be considered as income

in accordance with the ordinary concept of “section 6-5, ITAA 1997”. If as the alternative

Anna decides to take the lesser amount of $75,000 then it will be treated as compensation

payment only because the amount that is received by Anna is for the work place injury that is

suffered while carrying out her employment duties. Hence it is not an income.

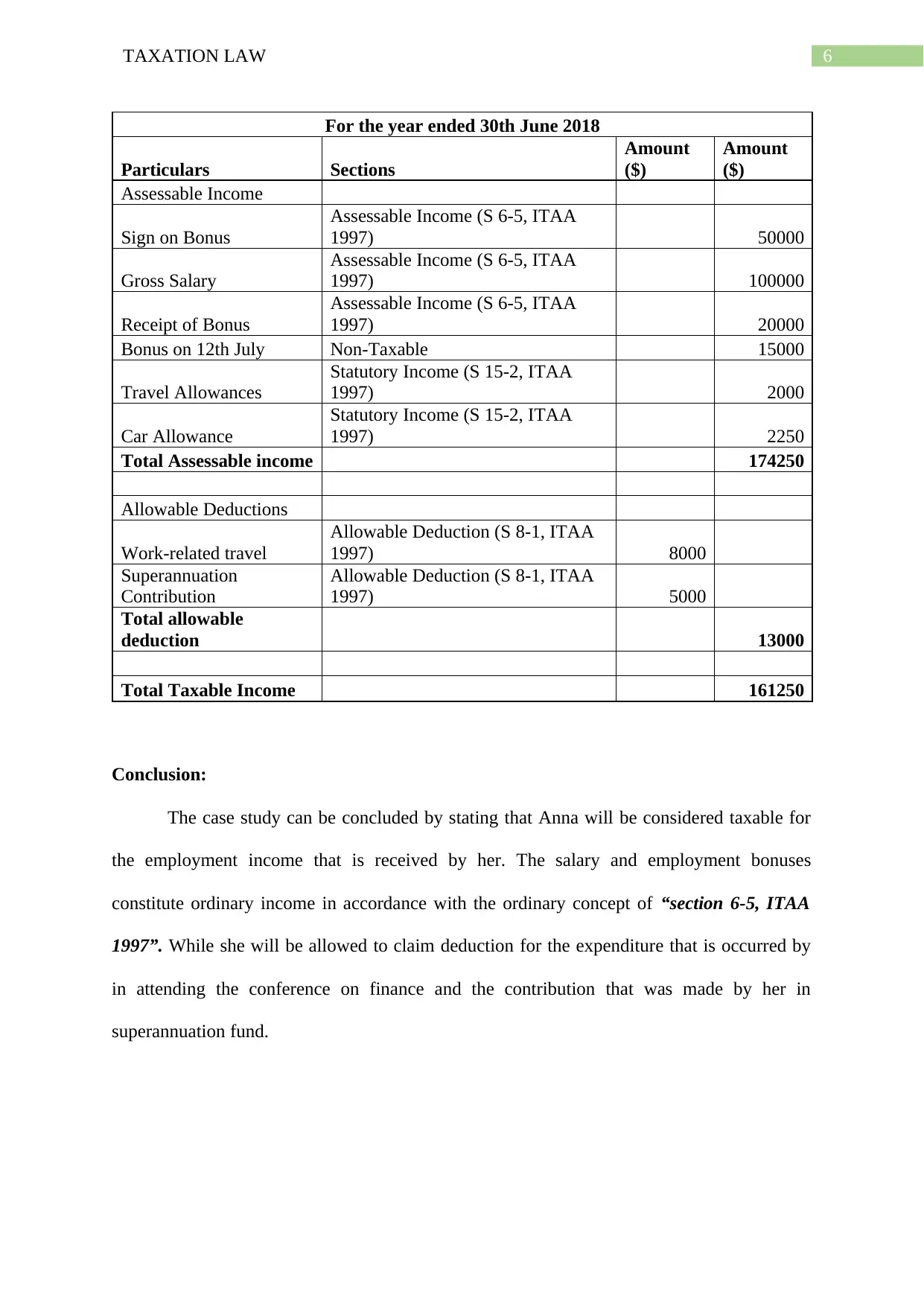

In the Books of Anna

sacrifice of $5,000 to contribute on her own superannuation fund. The amount of $5,000 can

be claimed as tax deduction for Anna.

She also reports the travelling expenditure to attend the conference of finance. With

respect to the “section 8-1, ITAA 1997” cost for attending the seminars or conference is

allowed for deduction (Cavenagh et al. 2018). This is because the cost were incurred by the

employee in course of the employment and allowed for deduction under “section 8-1, ITAA

1997”. She also received an allowance of $2,000 to defray the incidental cost (Barrett 2018).

The allowance will be considered as assessable statutory income under “section 15-2” for

Anna because it holds sufficient nexus with her employment and personal services.

She later redeemed the frequent flyer that she had with Qantas Airways. Citing the

example given in the case of “Payne v FCT (1996)” the redeeming the frequent flyer points

by Anna is not held as income because it is non-convertible to cash (Morgan and Castelyn

2018). In other words, under “section 21A, 1936” it amounts to non-cash benefits even

though it has the relation with the income earning activities of the taxpayer and will not be

held as income since the benefit is non cash convertible.

Anna also reports the receipts of the compensation payment from the previous

employer that she has sustained in discharge of her employment duties. The amount will be

considered as capital receipt because it was given to Anna as the loss of income earning

capacity. As the amount of $130,000 is a capital receipt, it will not be considered as income

in accordance with the ordinary concept of “section 6-5, ITAA 1997”. If as the alternative

Anna decides to take the lesser amount of $75,000 then it will be treated as compensation

payment only because the amount that is received by Anna is for the work place injury that is

suffered while carrying out her employment duties. Hence it is not an income.

In the Books of Anna

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

For the year ended 30th June 2018

Particulars Sections

Amount

($)

Amount

($)

Assessable Income

Sign on Bonus

Assessable Income (S 6-5, ITAA

1997) 50000

Gross Salary

Assessable Income (S 6-5, ITAA

1997) 100000

Receipt of Bonus

Assessable Income (S 6-5, ITAA

1997) 20000

Bonus on 12th July Non-Taxable 15000

Travel Allowances

Statutory Income (S 15-2, ITAA

1997) 2000

Car Allowance

Statutory Income (S 15-2, ITAA

1997) 2250

Total Assessable income 174250

Allowable Deductions

Work-related travel

Allowable Deduction (S 8-1, ITAA

1997) 8000

Superannuation

Contribution

Allowable Deduction (S 8-1, ITAA

1997) 5000

Total allowable

deduction 13000

Total Taxable Income 161250

Conclusion:

The case study can be concluded by stating that Anna will be considered taxable for

the employment income that is received by her. The salary and employment bonuses

constitute ordinary income in accordance with the ordinary concept of “section 6-5, ITAA

1997”. While she will be allowed to claim deduction for the expenditure that is occurred by

in attending the conference on finance and the contribution that was made by her in

superannuation fund.

For the year ended 30th June 2018

Particulars Sections

Amount

($)

Amount

($)

Assessable Income

Sign on Bonus

Assessable Income (S 6-5, ITAA

1997) 50000

Gross Salary

Assessable Income (S 6-5, ITAA

1997) 100000

Receipt of Bonus

Assessable Income (S 6-5, ITAA

1997) 20000

Bonus on 12th July Non-Taxable 15000

Travel Allowances

Statutory Income (S 15-2, ITAA

1997) 2000

Car Allowance

Statutory Income (S 15-2, ITAA

1997) 2250

Total Assessable income 174250

Allowable Deductions

Work-related travel

Allowable Deduction (S 8-1, ITAA

1997) 8000

Superannuation

Contribution

Allowable Deduction (S 8-1, ITAA

1997) 5000

Total allowable

deduction 13000

Total Taxable Income 161250

Conclusion:

The case study can be concluded by stating that Anna will be considered taxable for

the employment income that is received by her. The salary and employment bonuses

constitute ordinary income in accordance with the ordinary concept of “section 6-5, ITAA

1997”. While she will be allowed to claim deduction for the expenditure that is occurred by

in attending the conference on finance and the contribution that was made by her in

superannuation fund.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

References:

Barkoczy, S., 2016. Foundations of taxation law 2016. OUP Catalogue.

Barrett, J., 2018. Vacant Property Taxes and the Human Right to Adequate Housing. J. Austl.

Tax'n, 20, p.123.

Braithwaite, V. and Reinhart, M., 2019. The Taxpayers' Charter: Does the Australian Tax

Office comply and who benefits?. Centre for Tax System Integrity (CTSI), Research School

of Social Sciences, The Australian National University.

Burton, H.A. and Karlinsky, S., 2016. Tax professionals' perception of large and mid-size

business US tax law complexity. eJTR, 14, p.61.

Butler, D., 2019. Who can provide taxation advice?. Taxation in Australia, 53(7), p.381.

Cavenagh, J., Matley, H., Burke, L., Castles, S., Chesterfield, T., Clare, G., Fitzgerald, C.,

Grant, S., Kluckow, T., Lewis, A. and Norris, A., 2018. Australian legislation concerning

matters of international law 2016. Australian Year Book of International Law, 35, p.353.

Hum, F., Jackman, B., Quirico, O., Urbas, G. and Werren, K., 2019. Australian Uniform

Evidence Law. Cambridge University Press.

Morgan, A. and Castelyn, D., 2018. Taxation Education in Secondary Schools. J.

Australasian Tax Tchrs. Ass'n, 13, p.307.

Morgan, A., Mortimer, C. and Pinto, D., 2018. A practical introduction to Australian

taxation law 2018. Oxford University Press.

Robin and Barkoczy Woellner (Stephen & Murphy, Shirley Et Al.), 2019. Australian

Taxation Law Select 2019: Legislation And Commentary. Oxford University Press.

Sadiq, K., 2019. Australian Taxation Law Cases 2019. Thomson Reuters.

References:

Barkoczy, S., 2016. Foundations of taxation law 2016. OUP Catalogue.

Barrett, J., 2018. Vacant Property Taxes and the Human Right to Adequate Housing. J. Austl.

Tax'n, 20, p.123.

Braithwaite, V. and Reinhart, M., 2019. The Taxpayers' Charter: Does the Australian Tax

Office comply and who benefits?. Centre for Tax System Integrity (CTSI), Research School

of Social Sciences, The Australian National University.

Burton, H.A. and Karlinsky, S., 2016. Tax professionals' perception of large and mid-size

business US tax law complexity. eJTR, 14, p.61.

Butler, D., 2019. Who can provide taxation advice?. Taxation in Australia, 53(7), p.381.

Cavenagh, J., Matley, H., Burke, L., Castles, S., Chesterfield, T., Clare, G., Fitzgerald, C.,

Grant, S., Kluckow, T., Lewis, A. and Norris, A., 2018. Australian legislation concerning

matters of international law 2016. Australian Year Book of International Law, 35, p.353.

Hum, F., Jackman, B., Quirico, O., Urbas, G. and Werren, K., 2019. Australian Uniform

Evidence Law. Cambridge University Press.

Morgan, A. and Castelyn, D., 2018. Taxation Education in Secondary Schools. J.

Australasian Tax Tchrs. Ass'n, 13, p.307.

Morgan, A., Mortimer, C. and Pinto, D., 2018. A practical introduction to Australian

taxation law 2018. Oxford University Press.

Robin and Barkoczy Woellner (Stephen & Murphy, Shirley Et Al.), 2019. Australian

Taxation Law Select 2019: Legislation And Commentary. Oxford University Press.

Sadiq, K., 2019. Australian Taxation Law Cases 2019. Thomson Reuters.

8TAXATION LAW

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2016. Australian Taxation

Law 2016. OUP Catalogue.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2016. Australian Taxation

Law 2016. OUP Catalogue.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.