Holmes Institute HI6028 Taxation Law Assignment: Tax Issues

VerifiedAdded on 2023/03/20

|9

|2684

|84

Homework Assignment

AI Summary

This assignment solution addresses several key aspects of Australian taxation law, including the application of Capital Gains Tax (CGT) and income tax principles to various scenarios. The solution analyzes different types of assets, such as pre-CGT assets, collectables, and personal use assets, determining their tax implications based on the Income Tax Assessment Act 1997 (ITAA 1997). It also explores the treatment of income from personal exertion, copyright sales, and interest earned on loans. The assignment provides detailed explanations and references to relevant sections of the ITAA 1997 and case law, offering a comprehensive understanding of the tax liabilities in each situation. Furthermore, the solution delves into the tax treatment of loans, interest income, and the impact of repayments, providing a practical guide to navigating complex tax issues.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Answer to 1:

Requirement 1:

The regime of CGT is applicable from 20/09/1985. Correspondingly, the word pre-

CGT and post-CGT is frequently imposed on the assets that are purchased or dealings that is

taking place before or subsequent the date of introduction of CGT regimes (Dietsch and

Rixen 2017). A gain that is held as the capital is not held as ordinary income within the

legislation of income tax. Accordingly, under the “section 102-20, ITAA 1997” a capital gain

or loss happens when transaction associated to the CGT originates. Upon disposing the asset

CGT event A1 takes place within the legislation of “Sec104.10(1)”.

Helen disposed the painting having the sales of $4,000. It can be stated that the

antique impression is a Pre-CGT asset because it was purchased before the introduction of the

CGT system (Stoilova 2017). Therefore, Helen is required to exclude it from the capital gains

regimes and hence no tax is applicable.

Requirement 2:

As clarified in the “section 108-10 (2), ITAA 1997” collectable is a type of asset that

is largely used by taxpayer or kept for own enjoyment purpose. The assets generally comprise

of the artwork, antique coin or the medallion. It also includes the manuscript or book or the

postage stamp (Spiro 2018). When the collectables are bought for below $500 then capital

gains or loss is excluded within “s118.10(1), ITA Act 1997”. While an important explanation

has been made under the “section 108-10 (1)”, capital loss that is obtained from the

collectables is only permissible to be subtraction against the capital gains from the

collectables (Belitski, Chowdhury and Desai 2016).

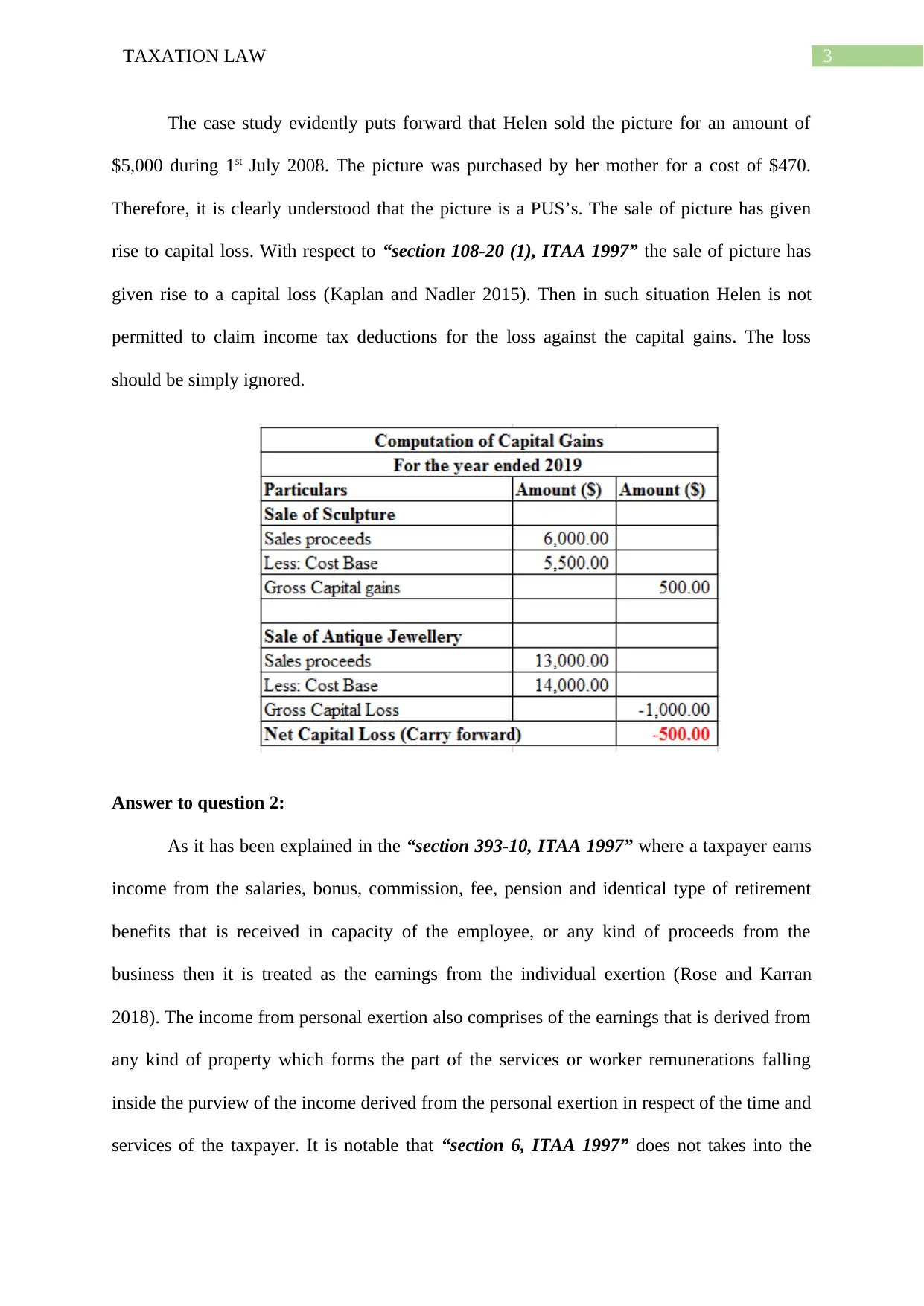

The case study evidently puts forward that Helen purchased a sculpture for a sum of

$5,500 during 1993. The collectables were sold for $6,000 on 1st January 2018.

Answer to 1:

Requirement 1:

The regime of CGT is applicable from 20/09/1985. Correspondingly, the word pre-

CGT and post-CGT is frequently imposed on the assets that are purchased or dealings that is

taking place before or subsequent the date of introduction of CGT regimes (Dietsch and

Rixen 2017). A gain that is held as the capital is not held as ordinary income within the

legislation of income tax. Accordingly, under the “section 102-20, ITAA 1997” a capital gain

or loss happens when transaction associated to the CGT originates. Upon disposing the asset

CGT event A1 takes place within the legislation of “Sec104.10(1)”.

Helen disposed the painting having the sales of $4,000. It can be stated that the

antique impression is a Pre-CGT asset because it was purchased before the introduction of the

CGT system (Stoilova 2017). Therefore, Helen is required to exclude it from the capital gains

regimes and hence no tax is applicable.

Requirement 2:

As clarified in the “section 108-10 (2), ITAA 1997” collectable is a type of asset that

is largely used by taxpayer or kept for own enjoyment purpose. The assets generally comprise

of the artwork, antique coin or the medallion. It also includes the manuscript or book or the

postage stamp (Spiro 2018). When the collectables are bought for below $500 then capital

gains or loss is excluded within “s118.10(1), ITA Act 1997”. While an important explanation

has been made under the “section 108-10 (1)”, capital loss that is obtained from the

collectables is only permissible to be subtraction against the capital gains from the

collectables (Belitski, Chowdhury and Desai 2016).

The case study evidently puts forward that Helen purchased a sculpture for a sum of

$5,500 during 1993. The collectables were sold for $6,000 on 1st January 2018.

2TAXATION LAW

Consequently, the sale of collectables has given rise to capital gains. The gains from the

collectables will attract capital gains tax liability.

Answer to 3:

The antique jewellery was purchased for a sum of $14,000 during October 1987 and

was sold for $13,000 in present tax year. As a result, the sale of antique jewellery for Helen

has given rise to capital loss. As explained in the “section 108-10 (1), ITAA 1997” the capital

loss that is suffered from the collectables is only permitted for deduction against the capital

gains that is obtained from the collectables (Everaert, Heylen and Schoonackers 2015). As

understood in the current situation of Helen, she has made the capital gains from the sale of

historical sculpture. With respect to the “section 108-10 (1), ITAA 1997” similarly, the

capital loss that is suffered from the sale of antique jewellery by Helen can be deducted from

the capital gains from the sculpture.

Answer to 4:

The “subdivision 108-C of the ITAA 1997” is related with the private use asset.

Accordingly, under the “section 108-20 (2), ITAA 1997” a personal use asset (PUA’s)is

generally defined as the non-collectable assets that is majorly kept or used by an individual

for their own use in the form of boats or right of purchasing the asset that is primary used or

kept by the taxpayer for their private usage and enjoyment (Black 2017). “Section 108-20

(3)”, explains that the PUA’s do not includes of the land or buildings. Furthermore, “section

118-10 (3)”, explains that the where the capital gains are made from the private use assets

that is purchased for $10,000 or less then capital gains is exempted in this situation.

Accordingly, “section 108-20 (1), ITAA 1997” explains that if the sale of personal use asset

has given rise to a capital loss then the taxpayer will not be permitted to claim income tax

offset for the loss against the capital gains (Van den Berg 2016). They are simply ignored.

Consequently, the sale of collectables has given rise to capital gains. The gains from the

collectables will attract capital gains tax liability.

Answer to 3:

The antique jewellery was purchased for a sum of $14,000 during October 1987 and

was sold for $13,000 in present tax year. As a result, the sale of antique jewellery for Helen

has given rise to capital loss. As explained in the “section 108-10 (1), ITAA 1997” the capital

loss that is suffered from the collectables is only permitted for deduction against the capital

gains that is obtained from the collectables (Everaert, Heylen and Schoonackers 2015). As

understood in the current situation of Helen, she has made the capital gains from the sale of

historical sculpture. With respect to the “section 108-10 (1), ITAA 1997” similarly, the

capital loss that is suffered from the sale of antique jewellery by Helen can be deducted from

the capital gains from the sculpture.

Answer to 4:

The “subdivision 108-C of the ITAA 1997” is related with the private use asset.

Accordingly, under the “section 108-20 (2), ITAA 1997” a personal use asset (PUA’s)is

generally defined as the non-collectable assets that is majorly kept or used by an individual

for their own use in the form of boats or right of purchasing the asset that is primary used or

kept by the taxpayer for their private usage and enjoyment (Black 2017). “Section 108-20

(3)”, explains that the PUA’s do not includes of the land or buildings. Furthermore, “section

118-10 (3)”, explains that the where the capital gains are made from the private use assets

that is purchased for $10,000 or less then capital gains is exempted in this situation.

Accordingly, “section 108-20 (1), ITAA 1997” explains that if the sale of personal use asset

has given rise to a capital loss then the taxpayer will not be permitted to claim income tax

offset for the loss against the capital gains (Van den Berg 2016). They are simply ignored.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

The case study evidently puts forward that Helen sold the picture for an amount of

$5,000 during 1st July 2008. The picture was purchased by her mother for a cost of $470.

Therefore, it is clearly understood that the picture is a PUS’s. The sale of picture has given

rise to capital loss. With respect to “section 108-20 (1), ITAA 1997” the sale of picture has

given rise to a capital loss (Kaplan and Nadler 2015). Then in such situation Helen is not

permitted to claim income tax deductions for the loss against the capital gains. The loss

should be simply ignored.

Answer to question 2:

As it has been explained in the “section 393-10, ITAA 1997” where a taxpayer earns

income from the salaries, bonus, commission, fee, pension and identical type of retirement

benefits that is received in capacity of the employee, or any kind of proceeds from the

business then it is treated as the earnings from the individual exertion (Rose and Karran

2018). The income from personal exertion also comprises of the earnings that is derived from

any kind of property which forms the part of the services or worker remunerations falling

inside the purview of the income derived from the personal exertion in respect of the time and

services of the taxpayer. It is notable that “section 6, ITAA 1997” does not takes into the

The case study evidently puts forward that Helen sold the picture for an amount of

$5,000 during 1st July 2008. The picture was purchased by her mother for a cost of $470.

Therefore, it is clearly understood that the picture is a PUS’s. The sale of picture has given

rise to capital loss. With respect to “section 108-20 (1), ITAA 1997” the sale of picture has

given rise to a capital loss (Kaplan and Nadler 2015). Then in such situation Helen is not

permitted to claim income tax deductions for the loss against the capital gains. The loss

should be simply ignored.

Answer to question 2:

As it has been explained in the “section 393-10, ITAA 1997” where a taxpayer earns

income from the salaries, bonus, commission, fee, pension and identical type of retirement

benefits that is received in capacity of the employee, or any kind of proceeds from the

business then it is treated as the earnings from the individual exertion (Rose and Karran

2018). The income from personal exertion also comprises of the earnings that is derived from

any kind of property which forms the part of the services or worker remunerations falling

inside the purview of the income derived from the personal exertion in respect of the time and

services of the taxpayer. It is notable that “section 6, ITAA 1997” does not takes into the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

account the interest income and excludes the receipts of business lending, rents and dividends

from the purview of the definition (McLaren 2015).

The receipts that is related to performance of contracts or the service provision then it

is held as the character of payment to the recipient. There must be adequate amount of nexus

among the amount and earning capacity of the taxpayer. According to the “section 6-5 (1),

ITAA 1997” the taxpayers is assessed for tax on the basis of the ordinary income (Whitehead

et al. 2018). As held in “FCT v Dixon (1952)” receipts earned from the income generating

activity will be held as ordinary proceeds. There should be a link among the receipt and the

earnings creating act. Similarly, in the case of “FCT v Brent (1971)” the reward for services

was held taxable by the taxpayer for coming in the media interview. The taxpayer received

the exclusive right of publishing her life story and as a result the taxpayer was considered

taxable for the receipts.

As per the “Copyright Act 1968” a copyright is regarded as the type of personal

property. The copyright act explains that the payments that amounts to sale of rights must be

viewed as royalties because it does not amount to payment for the use of the item of property.

Upon assigning the copyright that amounts to significant sterilisation of the rights of actual

copyright owner, it must be treated as the disposal of asset and not the receipt of royalty. The

court of law in “FCT v McCauley (1944)” explained that payment that is received from the

part or full assignment of copyright cannot be held royalty within the ordinary definition

(Black 2018). This is because the payer will be owner of property and that amount that is

received by the recipient would will cease to be property owner.

The current case study highlights that Barbara received a payment that amounted to

$13,000 to write a book. With respect to the “section 6, ITAA 1997”, the amount will be

treated as the income from the individual effort (Brown 2017). The receipt by Barbara forms

account the interest income and excludes the receipts of business lending, rents and dividends

from the purview of the definition (McLaren 2015).

The receipts that is related to performance of contracts or the service provision then it

is held as the character of payment to the recipient. There must be adequate amount of nexus

among the amount and earning capacity of the taxpayer. According to the “section 6-5 (1),

ITAA 1997” the taxpayers is assessed for tax on the basis of the ordinary income (Whitehead

et al. 2018). As held in “FCT v Dixon (1952)” receipts earned from the income generating

activity will be held as ordinary proceeds. There should be a link among the receipt and the

earnings creating act. Similarly, in the case of “FCT v Brent (1971)” the reward for services

was held taxable by the taxpayer for coming in the media interview. The taxpayer received

the exclusive right of publishing her life story and as a result the taxpayer was considered

taxable for the receipts.

As per the “Copyright Act 1968” a copyright is regarded as the type of personal

property. The copyright act explains that the payments that amounts to sale of rights must be

viewed as royalties because it does not amount to payment for the use of the item of property.

Upon assigning the copyright that amounts to significant sterilisation of the rights of actual

copyright owner, it must be treated as the disposal of asset and not the receipt of royalty. The

court of law in “FCT v McCauley (1944)” explained that payment that is received from the

part or full assignment of copyright cannot be held royalty within the ordinary definition

(Black 2018). This is because the payer will be owner of property and that amount that is

received by the recipient would will cease to be property owner.

The current case study highlights that Barbara received a payment that amounted to

$13,000 to write a book. With respect to the “section 6, ITAA 1997”, the amount will be

treated as the income from the individual effort (Brown 2017). The receipt by Barbara forms

5TAXATION LAW

the part of the services or remunerations falling inside the purview of the income derived

from the personal exertion in respect of the time and services of Barbara.

In the later part the copyright of the book that was written by Barbara was sold for a

sum of $13,400. Citing the case of “FCT v McCauley (1944)” it can be stated that the money

received from the sale of copyright of book will be considered as chargeable proceeds. The

fact that the taxpayer here sold the copyright of book will be treated taxable for the income

rather than being held for capital gains tax purpose. This is because the payment was made to

Barbara in exchange of her time and services rendered. Barbara will accordingly be treated

taxable on the income under the ordinary concepts of “section 6-5, ITAA 1997” for selling

the right, interest and title that ultimately got published.

She also sold the manuscript of her eco book to library for a sum of $4,350 and

interview manuscript that was collected at the time of writing of economic book. Quoting the

case of “FCT v Brent (1971)” the receipts mainly constitute income from the personal

exertion because it involved Barbara own use of skill and exertion. Therefore, the amount

will be held as proceeds under the ordinary conception of “section 6-5, ITAA 1997” and will

be counted in the taxable earnings of Barbara.

If in the alternative case, Barbara decides to write the economic book in the free time

and later takes the decision of selling the value that would be received would be held as

ordinary income from personal exertion. This is because it would involve personal efforts of

Barbara and consequently the amount will be considered for taxable purpose within the

ordinary sense of “section 6-5, ITAA 1997”.

Answer to question 3:

Patrick lent his son $52,000 for the setting up new business and also involved the

interest of $6000 at the end of five-year period. The excess amount of $6000 will be included

the part of the services or remunerations falling inside the purview of the income derived

from the personal exertion in respect of the time and services of Barbara.

In the later part the copyright of the book that was written by Barbara was sold for a

sum of $13,400. Citing the case of “FCT v McCauley (1944)” it can be stated that the money

received from the sale of copyright of book will be considered as chargeable proceeds. The

fact that the taxpayer here sold the copyright of book will be treated taxable for the income

rather than being held for capital gains tax purpose. This is because the payment was made to

Barbara in exchange of her time and services rendered. Barbara will accordingly be treated

taxable on the income under the ordinary concepts of “section 6-5, ITAA 1997” for selling

the right, interest and title that ultimately got published.

She also sold the manuscript of her eco book to library for a sum of $4,350 and

interview manuscript that was collected at the time of writing of economic book. Quoting the

case of “FCT v Brent (1971)” the receipts mainly constitute income from the personal

exertion because it involved Barbara own use of skill and exertion. Therefore, the amount

will be held as proceeds under the ordinary conception of “section 6-5, ITAA 1997” and will

be counted in the taxable earnings of Barbara.

If in the alternative case, Barbara decides to write the economic book in the free time

and later takes the decision of selling the value that would be received would be held as

ordinary income from personal exertion. This is because it would involve personal efforts of

Barbara and consequently the amount will be considered for taxable purpose within the

ordinary sense of “section 6-5, ITAA 1997”.

Answer to question 3:

Patrick lent his son $52,000 for the setting up new business and also involved the

interest of $6000 at the end of five-year period. The excess amount of $6000 will be included

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

for taxable purpose because the loan was not given as the part of gift to the son and required

to be repaid. However, the capital amount of $52,000 will not be included for assessment

purpose for Patrick. The interest that is projected to receive by Patrick by the end of five

years will attract tax liability and must be show in the taxable income of the taxpayer.

However, there is a change in facts where the loan was subsequently repaid by the son

within the time of two years and included the additional amount of 5% as loan interest. As

held in “Hochestrasser v Mayes (1960)” in order to have the nature of income the item of

income character should be a gain for the one that derives it (Black 2018). An item of income

is derived by the taxpayer will be having the character of income when it comes home.

Similarly, the receipt of interest by Patrick will be considered as a rea gain which will attract

tax liability. Patrick will be required to show the amount in to include the income into the

assessable income under the ordinary concept of “section 6-5, ITAA 1997”.

A noteworthy explanation can be made by stating that the mode of payment that is

adopted by the son either a single cheque or any other method payment will not bear any

effect on the tax liability position of the income (Whitehead et al. 2018). The most important

aspect is that the intention of the parties holds important in determining the tax situation. It is

noteworthy to denote that in the context of the Son the power of treating the receipt remains

within the jurisdiction of ATO. The ATO has the power of treating payment made to the

relatives, acquaintance and friends where the situation of case warrants as gift.

The taxation rulings associated in the case of Patrick may result an impact on interest

which is received by the taxpayer and the same will attract tax. Patrick is allowed with the

gift tax limit of $52,000 since it is a capital amount. While the interest that is received by

Patrick is a having the nature of income and it will form the part of the taxpayer’s total

taxable earnings where appropriate taxes will be levied.

for taxable purpose because the loan was not given as the part of gift to the son and required

to be repaid. However, the capital amount of $52,000 will not be included for assessment

purpose for Patrick. The interest that is projected to receive by Patrick by the end of five

years will attract tax liability and must be show in the taxable income of the taxpayer.

However, there is a change in facts where the loan was subsequently repaid by the son

within the time of two years and included the additional amount of 5% as loan interest. As

held in “Hochestrasser v Mayes (1960)” in order to have the nature of income the item of

income character should be a gain for the one that derives it (Black 2018). An item of income

is derived by the taxpayer will be having the character of income when it comes home.

Similarly, the receipt of interest by Patrick will be considered as a rea gain which will attract

tax liability. Patrick will be required to show the amount in to include the income into the

assessable income under the ordinary concept of “section 6-5, ITAA 1997”.

A noteworthy explanation can be made by stating that the mode of payment that is

adopted by the son either a single cheque or any other method payment will not bear any

effect on the tax liability position of the income (Whitehead et al. 2018). The most important

aspect is that the intention of the parties holds important in determining the tax situation. It is

noteworthy to denote that in the context of the Son the power of treating the receipt remains

within the jurisdiction of ATO. The ATO has the power of treating payment made to the

relatives, acquaintance and friends where the situation of case warrants as gift.

The taxation rulings associated in the case of Patrick may result an impact on interest

which is received by the taxpayer and the same will attract tax. Patrick is allowed with the

gift tax limit of $52,000 since it is a capital amount. While the interest that is received by

Patrick is a having the nature of income and it will form the part of the taxpayer’s total

taxable earnings where appropriate taxes will be levied.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

References:

Belitski, M., Chowdhury, F. and Desai, S., 2016. Taxes, corruption, and entry. Small

Business Economics, 47(1), pp.201-216.

Black, C., 2017. The Attribution of Profits to Permanent Establishments: Testing the

Interaction of Domestic Taxation Laws and Tax Treaties in Practice.

Black, C., 2018. Taxation of Intellectual Property Under Domestic Law and Tax Treaties:

Australia. Taxation of Intellectual Property under Domestic Law, EU Law and Tax Treaties",

IBFD: Amsterdam.

Brown, K.B., 2017. Taxation and Development: Overview. In Taxation and Development-A

Comparative Study (pp. 3-14). Springer, Cham.

Dietsch, P. and Rixen, T., 2017. Global Tax Governance. ECPR press.

Everaert, G., Heylen, F. and Schoonackers, R., 2015. Fiscal policy and TFP in the OECD:

measuring direct and indirect effects. Empirical Economics, 49(2), pp.605-640.

Kaplan, R.A. and Nadler, M.L., 2015. Airbnb: A case study in occupancy regulation and

taxation. U. Chi. L. Rev. Dialogue, 82, p.103.

McLaren, J., 2015. The Taxation of Foreign Investment in Australia by Sovereign Wealth

Funds: Why Has Australia Not Passed Laws Enshrining the Doctrine of Sovereign

Immunity. J. Austl. Tax'n, 17, p.53.

Rose, R. and Karran, T., 2018. Taxation by political inertia: Financing the growth of

government in Britain. Routledge.

Spiro, P.S., 2018. Tax policy and the underground economy. In Size, causes and

consequences of the underground economy(pp. 179-201). Routledge.

References:

Belitski, M., Chowdhury, F. and Desai, S., 2016. Taxes, corruption, and entry. Small

Business Economics, 47(1), pp.201-216.

Black, C., 2017. The Attribution of Profits to Permanent Establishments: Testing the

Interaction of Domestic Taxation Laws and Tax Treaties in Practice.

Black, C., 2018. Taxation of Intellectual Property Under Domestic Law and Tax Treaties:

Australia. Taxation of Intellectual Property under Domestic Law, EU Law and Tax Treaties",

IBFD: Amsterdam.

Brown, K.B., 2017. Taxation and Development: Overview. In Taxation and Development-A

Comparative Study (pp. 3-14). Springer, Cham.

Dietsch, P. and Rixen, T., 2017. Global Tax Governance. ECPR press.

Everaert, G., Heylen, F. and Schoonackers, R., 2015. Fiscal policy and TFP in the OECD:

measuring direct and indirect effects. Empirical Economics, 49(2), pp.605-640.

Kaplan, R.A. and Nadler, M.L., 2015. Airbnb: A case study in occupancy regulation and

taxation. U. Chi. L. Rev. Dialogue, 82, p.103.

McLaren, J., 2015. The Taxation of Foreign Investment in Australia by Sovereign Wealth

Funds: Why Has Australia Not Passed Laws Enshrining the Doctrine of Sovereign

Immunity. J. Austl. Tax'n, 17, p.53.

Rose, R. and Karran, T., 2018. Taxation by political inertia: Financing the growth of

government in Britain. Routledge.

Spiro, P.S., 2018. Tax policy and the underground economy. In Size, causes and

consequences of the underground economy(pp. 179-201). Routledge.

8TAXATION LAW

Stoilova, D., 2017. Tax structure and economic growth: Evidence from the European

Union. Contaduría y Administración, 62(3), pp.1041-1057.

Van den Berg, A., 2016. The effect of the Taxation Laws Amendment Act 25 of 2016 on

retirement planning (Doctoral dissertation, North-West University (South Africa),

Potchefstroom Campus).

Whitehead, R., Brown, L., Riches, E., Rennick, L., Armour, G., McAteer, J., Laird, Y. and

Reid, G., 2018. Rapid evidence review: Strengths and limitations of tobacco taxation and

pricing strategies.

Stoilova, D., 2017. Tax structure and economic growth: Evidence from the European

Union. Contaduría y Administración, 62(3), pp.1041-1057.

Van den Berg, A., 2016. The effect of the Taxation Laws Amendment Act 25 of 2016 on

retirement planning (Doctoral dissertation, North-West University (South Africa),

Potchefstroom Campus).

Whitehead, R., Brown, L., Riches, E., Rennick, L., Armour, G., McAteer, J., Laird, Y. and

Reid, G., 2018. Rapid evidence review: Strengths and limitations of tobacco taxation and

pricing strategies.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.