HI6028 Taxation Law T1 2019: CGT, Personal Exertion, & Loan Interest

VerifiedAdded on 2023/03/31

|8

|2376

|202

Homework Assignment

AI Summary

This assignment solution delves into various aspects of taxation law, addressing questions related to Capital Gains Tax (CGT), personal exertion income, and the tax implications of loan interest. It examines the differences between pre-CGT and post-CGT assets, the treatment of collectible and personal use assets, and the adjustability of capital losses. Furthermore, it analyzes scenarios involving personal exertion income, referencing relevant case law to determine the taxability of income derived from writing a book and assigning its copyright. Finally, the assignment discusses the tax consequences of one-off interest received under a loan agreement, distinguishing between ordinary and statutory income. The solution provides a comprehensive overview of the legal principles and their application to specific factual situations.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TAXATION LAW

Answer to question 1:

Answer to 1:

Assets created or purchases made after 20th September 2018 are taxed with

Capital Gains Tax (CGT). Consequently, the term Pre-CGT is associated with the

purchase of assets occurred before CGT regime came into effect, conversely, Post-

CGT is associated with purchase of assets conducted after the introduction of the

said tax regime (Dixon and Nassios 2016). Under income tax law, a capital gain is

not treated as an ordinary income. From the “s102-20, ITAA 1997” it can be stated

that without occurrence of any CGT transaction there is no possibility for a taxpayer

to make any gain or loss of capital. The A1 CGT event occurs only when selling of

CGT asset is conducted by the taxpayer and its explanation is found in “S-104-10

(1)”

The antique painting that Helen’s father bought in the month of February 1985

at $4000 cannot be taxed under CGT regime as the date of purchase is before the

date of introduction of the CGT. Thus, the painting should be accounted as a Pre-

CGT asset.

Answer to 2:

The antiques, paintings and famous sculpture come under the category of

collectible assets. These are usually used by taxpayers as own possession. Postage

stamp, books and old manuscripts are also considered as collectibles. This

explanation of collectible is given in “s108-10 (2), ITAA 1997” (Herault and Azpitarte

2015). Price of collectibles can range from low to high depending on its art or

historical value; however, there is exemption of CGT for collectibles priced at $500 or

below as stated in “s118-10(1), ITAA 1997”. In “s108-10 (1)”, there is a significant

explanation regarding occurrence of capital loss generated from collectible assets.

The explanation clarifies that capital loss generated from collectibles can only be

adjusted with capital gains that are generated from collectibles.

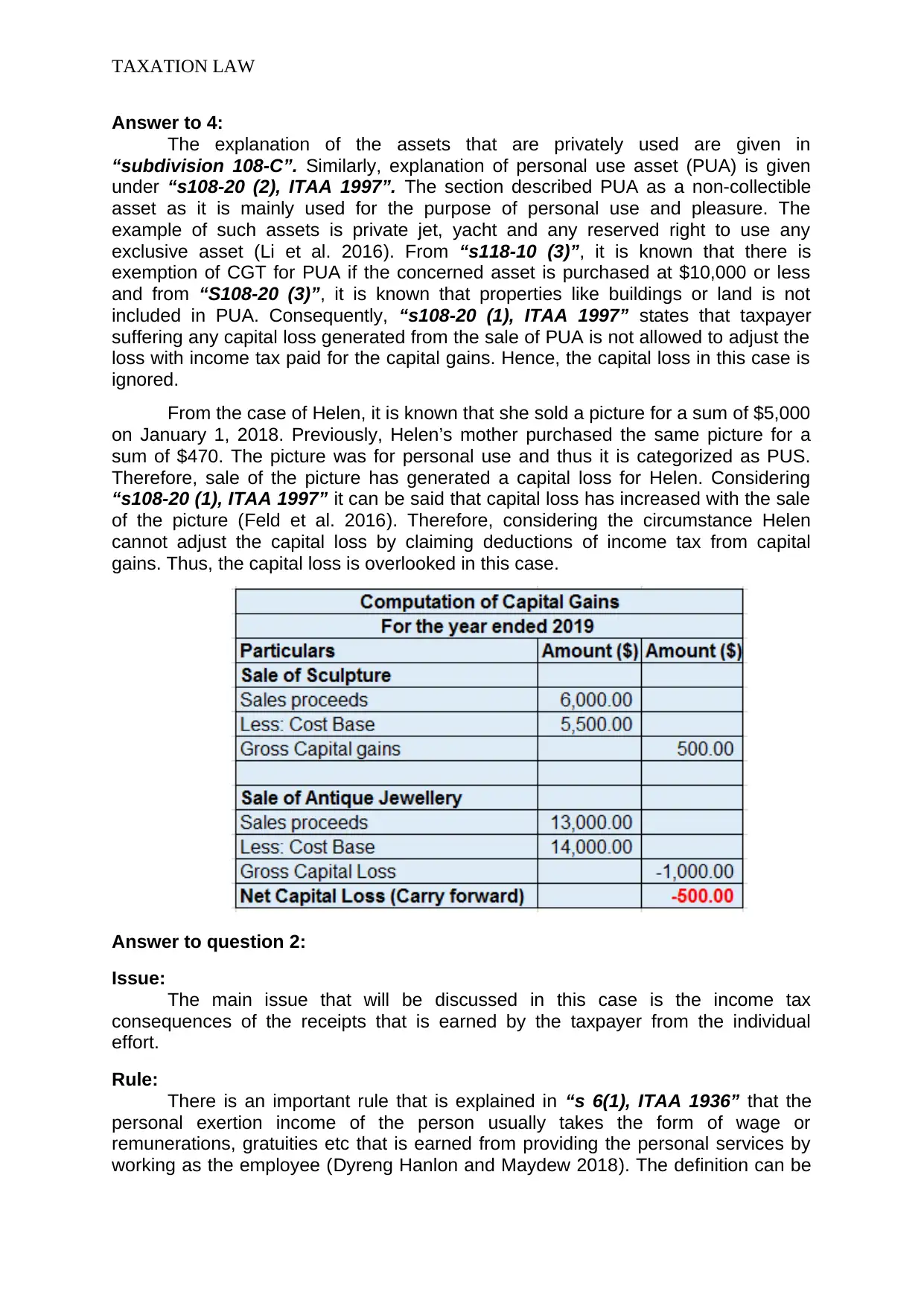

It is evident from the case study that the sculpture purchased in 1993 by

Helen costs $5,500. Helen made a capital gain of $500 by selling the sculpture on

January 1, 2018 for $6000. Given the date of purchase and resale, the capital gains

accrued from the collectible is eligible for CGT imposition.

Answer to 3:

Later in 2018, on March 20 Helen faced capital loss by selling an antique

jewellery. Helen purchased the antique jewellery in October 1987 by paying a price

of $14,000. On the other hand, it was sold for $13,000, $1000 less than the

purchased price. Hence, the capital loss occurred to Helen. It is already explained in

“s108-10 (1), ITAA 1997” that any capital loss generated from collectibles can only

be adjusted with the capital gains accrued from the collectibles (Blunden 2016).

Helen has made both capital gain and loss, which is evident from her transactions.

Putting it once again here, for reference that Helen made capital gains by selling

sculpture. Hence, applying “s108-10 (1), ITAA 1997”. Helen can adjust her capital

loss generated from sale of jewellery with the capital gains generated from sale of

sculpture.

Answer to question 1:

Answer to 1:

Assets created or purchases made after 20th September 2018 are taxed with

Capital Gains Tax (CGT). Consequently, the term Pre-CGT is associated with the

purchase of assets occurred before CGT regime came into effect, conversely, Post-

CGT is associated with purchase of assets conducted after the introduction of the

said tax regime (Dixon and Nassios 2016). Under income tax law, a capital gain is

not treated as an ordinary income. From the “s102-20, ITAA 1997” it can be stated

that without occurrence of any CGT transaction there is no possibility for a taxpayer

to make any gain or loss of capital. The A1 CGT event occurs only when selling of

CGT asset is conducted by the taxpayer and its explanation is found in “S-104-10

(1)”

The antique painting that Helen’s father bought in the month of February 1985

at $4000 cannot be taxed under CGT regime as the date of purchase is before the

date of introduction of the CGT. Thus, the painting should be accounted as a Pre-

CGT asset.

Answer to 2:

The antiques, paintings and famous sculpture come under the category of

collectible assets. These are usually used by taxpayers as own possession. Postage

stamp, books and old manuscripts are also considered as collectibles. This

explanation of collectible is given in “s108-10 (2), ITAA 1997” (Herault and Azpitarte

2015). Price of collectibles can range from low to high depending on its art or

historical value; however, there is exemption of CGT for collectibles priced at $500 or

below as stated in “s118-10(1), ITAA 1997”. In “s108-10 (1)”, there is a significant

explanation regarding occurrence of capital loss generated from collectible assets.

The explanation clarifies that capital loss generated from collectibles can only be

adjusted with capital gains that are generated from collectibles.

It is evident from the case study that the sculpture purchased in 1993 by

Helen costs $5,500. Helen made a capital gain of $500 by selling the sculpture on

January 1, 2018 for $6000. Given the date of purchase and resale, the capital gains

accrued from the collectible is eligible for CGT imposition.

Answer to 3:

Later in 2018, on March 20 Helen faced capital loss by selling an antique

jewellery. Helen purchased the antique jewellery in October 1987 by paying a price

of $14,000. On the other hand, it was sold for $13,000, $1000 less than the

purchased price. Hence, the capital loss occurred to Helen. It is already explained in

“s108-10 (1), ITAA 1997” that any capital loss generated from collectibles can only

be adjusted with the capital gains accrued from the collectibles (Blunden 2016).

Helen has made both capital gain and loss, which is evident from her transactions.

Putting it once again here, for reference that Helen made capital gains by selling

sculpture. Hence, applying “s108-10 (1), ITAA 1997”. Helen can adjust her capital

loss generated from sale of jewellery with the capital gains generated from sale of

sculpture.

TAXATION LAW

Answer to 4:

The explanation of the assets that are privately used are given in

“subdivision 108-C”. Similarly, explanation of personal use asset (PUA) is given

under “s108-20 (2), ITAA 1997”. The section described PUA as a non-collectible

asset as it is mainly used for the purpose of personal use and pleasure. The

example of such assets is private jet, yacht and any reserved right to use any

exclusive asset (Li et al. 2016). From “s118-10 (3)”, it is known that there is

exemption of CGT for PUA if the concerned asset is purchased at $10,000 or less

and from “S108-20 (3)”, it is known that properties like buildings or land is not

included in PUA. Consequently, “s108-20 (1), ITAA 1997” states that taxpayer

suffering any capital loss generated from the sale of PUA is not allowed to adjust the

loss with income tax paid for the capital gains. Hence, the capital loss in this case is

ignored.

From the case of Helen, it is known that she sold a picture for a sum of $5,000

on January 1, 2018. Previously, Helen’s mother purchased the same picture for a

sum of $470. The picture was for personal use and thus it is categorized as PUS.

Therefore, sale of the picture has generated a capital loss for Helen. Considering

“s108-20 (1), ITAA 1997” it can be said that capital loss has increased with the sale

of the picture (Feld et al. 2016). Therefore, considering the circumstance Helen

cannot adjust the capital loss by claiming deductions of income tax from capital

gains. Thus, the capital loss is overlooked in this case.

Answer to question 2:

Issue:

The main issue that will be discussed in this case is the income tax

consequences of the receipts that is earned by the taxpayer from the individual

effort.

Rule:

There is an important rule that is explained in “s 6(1), ITAA 1936” that the

personal exertion income of the person usually takes the form of wage or

remunerations, gratuities etc that is earned from providing the personal services by

working as the employee (Dyreng Hanlon and Maydew 2018). The definition can be

Answer to 4:

The explanation of the assets that are privately used are given in

“subdivision 108-C”. Similarly, explanation of personal use asset (PUA) is given

under “s108-20 (2), ITAA 1997”. The section described PUA as a non-collectible

asset as it is mainly used for the purpose of personal use and pleasure. The

example of such assets is private jet, yacht and any reserved right to use any

exclusive asset (Li et al. 2016). From “s118-10 (3)”, it is known that there is

exemption of CGT for PUA if the concerned asset is purchased at $10,000 or less

and from “S108-20 (3)”, it is known that properties like buildings or land is not

included in PUA. Consequently, “s108-20 (1), ITAA 1997” states that taxpayer

suffering any capital loss generated from the sale of PUA is not allowed to adjust the

loss with income tax paid for the capital gains. Hence, the capital loss in this case is

ignored.

From the case of Helen, it is known that she sold a picture for a sum of $5,000

on January 1, 2018. Previously, Helen’s mother purchased the same picture for a

sum of $470. The picture was for personal use and thus it is categorized as PUS.

Therefore, sale of the picture has generated a capital loss for Helen. Considering

“s108-20 (1), ITAA 1997” it can be said that capital loss has increased with the sale

of the picture (Feld et al. 2016). Therefore, considering the circumstance Helen

cannot adjust the capital loss by claiming deductions of income tax from capital

gains. Thus, the capital loss is overlooked in this case.

Answer to question 2:

Issue:

The main issue that will be discussed in this case is the income tax

consequences of the receipts that is earned by the taxpayer from the individual

effort.

Rule:

There is an important rule that is explained in “s 6(1), ITAA 1936” that the

personal exertion income of the person usually takes the form of wage or

remunerations, gratuities etc that is earned from providing the personal services by

working as the employee (Dyreng Hanlon and Maydew 2018). The definition can be

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TAXATION LAW

considered comprehensive and simply lay down the example of personal earnings

from the private efforts. The definition also requires appropriate attention towards the

common principles from the case law.

The general principle that explains that the suitable link must be existent

among the benefit and the money that is earned from the personal exertion. The

money that is earned through the personal exertion is the reward of the product

personal efforts (Mertens and Montiel Olea 2018). The taxpayer does not need to

satisfy the business or the employment relation. Receipts such as salary or wage is

held as the earnings that is made from the personal efforts.

To further support the analysis there are some noteworthy examples of the

income earned from the personal exertion. The case includes the federal court

judgement in “Brent v FC of T (1971)” the wife of the train robber provided a media

company with the permission of exclusively publishing her story related to her life

(Cvrlje 2015). The law court also considered that the amount that she has received

for enabling herself available for the interview and in return getting rewarded for the

same must be held as the reward for the services rendered. In other words it

amounts to the income that is earned from the personal exertion.

There are also some other examples where the payments that is derived from

the identical sources were treated as the reward for service that is rendered by the

taxpayer and therefore it constituted the taxable earnings under the ordinary

meaning of the “s6-5 ITAA 1997”. This involves the case of “Hobbs v Hussey

(1942)” where the taxpayer was considered as the criminal (Artavanis, Morse and

Tsoutsoura 2016). The federal court has assessed the taxpayer for the amount that

was received as the money for granting the rights of the autobiography that was

about to be published in the newspaper article as the assessable income with

respect to the ordinary meaning.

To further support the personal exertion income another instances of

“Housden (Inspecter of Taxes) v Marshall (1958)” can be raised (Kasper, Kogler

and Kirchler 2015). In this case the taxpayer has agreed to sell the experience as the

jockey and the photographs together with newspaper cuttings as the earnings from

the personal exertion which was assessable under“s6-5 ITAA 1997”.

Application:

To support the above explained laws, it is applied in Barbara’s situation. The

case throws light on the situation that Barbara being an economist researcher was

approached by the Eco Books Ltd who persuaded her to write book on economic

principles. She was given the offer of $13,000 to write the book. As a result the book

was written by Barbara and she was duly rewarded with the amount of $13,000. To

treat the payment as income for Barbara it is necessary to refer to the example of

“Brent v FCT (1971)”. The money received by Barbara is the income earned from

the personal exertion because it is having adequate nexus among the benefit as well

as Barbara’s personal exertion (Merz and Overesch 2016). The amount of $13,000

is duly received by Barbara as the reward for the product of private efforts. Though

there was no kind of business or employment relation but it had the element of

personal efforts such as providing of service. The amount is taxable as the ordinary

income under “s6-5 ITAA 1997”.

considered comprehensive and simply lay down the example of personal earnings

from the private efforts. The definition also requires appropriate attention towards the

common principles from the case law.

The general principle that explains that the suitable link must be existent

among the benefit and the money that is earned from the personal exertion. The

money that is earned through the personal exertion is the reward of the product

personal efforts (Mertens and Montiel Olea 2018). The taxpayer does not need to

satisfy the business or the employment relation. Receipts such as salary or wage is

held as the earnings that is made from the personal efforts.

To further support the analysis there are some noteworthy examples of the

income earned from the personal exertion. The case includes the federal court

judgement in “Brent v FC of T (1971)” the wife of the train robber provided a media

company with the permission of exclusively publishing her story related to her life

(Cvrlje 2015). The law court also considered that the amount that she has received

for enabling herself available for the interview and in return getting rewarded for the

same must be held as the reward for the services rendered. In other words it

amounts to the income that is earned from the personal exertion.

There are also some other examples where the payments that is derived from

the identical sources were treated as the reward for service that is rendered by the

taxpayer and therefore it constituted the taxable earnings under the ordinary

meaning of the “s6-5 ITAA 1997”. This involves the case of “Hobbs v Hussey

(1942)” where the taxpayer was considered as the criminal (Artavanis, Morse and

Tsoutsoura 2016). The federal court has assessed the taxpayer for the amount that

was received as the money for granting the rights of the autobiography that was

about to be published in the newspaper article as the assessable income with

respect to the ordinary meaning.

To further support the personal exertion income another instances of

“Housden (Inspecter of Taxes) v Marshall (1958)” can be raised (Kasper, Kogler

and Kirchler 2015). In this case the taxpayer has agreed to sell the experience as the

jockey and the photographs together with newspaper cuttings as the earnings from

the personal exertion which was assessable under“s6-5 ITAA 1997”.

Application:

To support the above explained laws, it is applied in Barbara’s situation. The

case throws light on the situation that Barbara being an economist researcher was

approached by the Eco Books Ltd who persuaded her to write book on economic

principles. She was given the offer of $13,000 to write the book. As a result the book

was written by Barbara and she was duly rewarded with the amount of $13,000. To

treat the payment as income for Barbara it is necessary to refer to the example of

“Brent v FCT (1971)”. The money received by Barbara is the income earned from

the personal exertion because it is having adequate nexus among the benefit as well

as Barbara’s personal exertion (Merz and Overesch 2016). The amount of $13,000

is duly received by Barbara as the reward for the product of private efforts. Though

there was no kind of business or employment relation but it had the element of

personal efforts such as providing of service. The amount is taxable as the ordinary

income under “s6-5 ITAA 1997”.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TAXATION LAW

After writing the book Barbara decides to assign the copyright of her written

book to the Eco Books Ltd. The publisher paid her with $13,400. This can be stated

that the amount of payment is an assessable income under “s6-5 ITAA 1997”. This

is because reference to “Hobbs v Hussey (1942)” should be made to treat the

money as taxable income (Goldin 2015). Barbara was motivated to provide the

service in return of earning payment. So assigning the copyright and receiving

payment in return is a taxable earnings under “s6-5 ITAA 1997”.

Barbara sells the manuscripts of the book and interview scripts to the library

and she was paid money for making her manuscripts and interview scripts available.

The judgement of “Housden v Marshall (1958)” can be referred in the situation of

Barbara and can be explained that the money that is received is a taxable earnings

from personal efforts under “s6-5 ITAA 1997”.

If in another situation Barbara simply writes the book during her free time and

later selling it in the market then the money that might be received will be considered

as the income from the personal exertion and it will be taxable under the ordinary

concepts of the “s6-5 ITAA 1997”.

Conclusion:

The case can be concluded that the payment for writing the book and

assigning the copyright of the book thereon can be characterised as the income from

personal exertion. The amount will be taxable under “s6-5 ITAA 1997”.

Answer to question 3:

Issues:

The main issue that will be discussed in this case is the income tax

consequences of the receipts that is from the one-off interest received under

agreement of loan.

Rule:

The central issue to the application of tax is the characterisation of the gain as

the ordinary income or the statutory income. No receipts is treated as the ordinary

income until it meets the both the prerequisites such as the amount should be cash

or may be easily converted into cash. The amount should also be the actual gain for

the taxpayer. As a result of this the prerequisite of the ordinary income is satisfied. A

gain that is received by the taxpayer in the regular or the periodical manner is most

likely to have the characteristics of the ordinary income than those gains that are

paid to the taxpayer as the lump sum. In “Hochstrasser v Mayes (1960)” if the

receipt is not held as the genuine gain then it is not the income (Alstadsæter and

Jacob 2016). Likewise, lump sum amount of gain might also be treated as the

ordinary earnings such as the one-off receipt of the interest under the agreement of

loan should be viewed as the income under “s6-5 ITAA 1997”.

Application:

The case provides that Patrick made the loan of $52,000 to his son. The main

purpose of giving the loan was to help the Son in his new start up. The agreement

was to pay the loan with $6000 as the interest inside five years. The loan was paid

within two years by Son with 5% as the additional amount of interest on the

borrowing. The interest payment was made as the one-off receipt of loan interest

under the agreement of the loan. Raising the example of “Hochstrasser v Mayes

After writing the book Barbara decides to assign the copyright of her written

book to the Eco Books Ltd. The publisher paid her with $13,400. This can be stated

that the amount of payment is an assessable income under “s6-5 ITAA 1997”. This

is because reference to “Hobbs v Hussey (1942)” should be made to treat the

money as taxable income (Goldin 2015). Barbara was motivated to provide the

service in return of earning payment. So assigning the copyright and receiving

payment in return is a taxable earnings under “s6-5 ITAA 1997”.

Barbara sells the manuscripts of the book and interview scripts to the library

and she was paid money for making her manuscripts and interview scripts available.

The judgement of “Housden v Marshall (1958)” can be referred in the situation of

Barbara and can be explained that the money that is received is a taxable earnings

from personal efforts under “s6-5 ITAA 1997”.

If in another situation Barbara simply writes the book during her free time and

later selling it in the market then the money that might be received will be considered

as the income from the personal exertion and it will be taxable under the ordinary

concepts of the “s6-5 ITAA 1997”.

Conclusion:

The case can be concluded that the payment for writing the book and

assigning the copyright of the book thereon can be characterised as the income from

personal exertion. The amount will be taxable under “s6-5 ITAA 1997”.

Answer to question 3:

Issues:

The main issue that will be discussed in this case is the income tax

consequences of the receipts that is from the one-off interest received under

agreement of loan.

Rule:

The central issue to the application of tax is the characterisation of the gain as

the ordinary income or the statutory income. No receipts is treated as the ordinary

income until it meets the both the prerequisites such as the amount should be cash

or may be easily converted into cash. The amount should also be the actual gain for

the taxpayer. As a result of this the prerequisite of the ordinary income is satisfied. A

gain that is received by the taxpayer in the regular or the periodical manner is most

likely to have the characteristics of the ordinary income than those gains that are

paid to the taxpayer as the lump sum. In “Hochstrasser v Mayes (1960)” if the

receipt is not held as the genuine gain then it is not the income (Alstadsæter and

Jacob 2016). Likewise, lump sum amount of gain might also be treated as the

ordinary earnings such as the one-off receipt of the interest under the agreement of

loan should be viewed as the income under “s6-5 ITAA 1997”.

Application:

The case provides that Patrick made the loan of $52,000 to his son. The main

purpose of giving the loan was to help the Son in his new start up. The agreement

was to pay the loan with $6000 as the interest inside five years. The loan was paid

within two years by Son with 5% as the additional amount of interest on the

borrowing. The interest payment was made as the one-off receipt of loan interest

under the agreement of the loan. Raising the example of “Hochstrasser v Mayes

TAXATION LAW

(1960)” the one-off money that is earned will be considered as the income for the

Patrick. The amount will be considered taxable under the ordinary meaning of “s6-5

ITAA 1997”.

Conclusion:

The issue to the can be concluded by stating that the one-off interest on loan

is a real gain for Patrick and it is taxable under the ordinary meaning of “s6-5 ITAA

1997”.

(1960)” the one-off money that is earned will be considered as the income for the

Patrick. The amount will be considered taxable under the ordinary meaning of “s6-5

ITAA 1997”.

Conclusion:

The issue to the can be concluded by stating that the one-off interest on loan

is a real gain for Patrick and it is taxable under the ordinary meaning of “s6-5 ITAA

1997”.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TAXATION LAW

References:

Alstadsæter, A. and Jacob, M., 2016. Dividend taxes and income shifting. The

Scandinavian Journal of Economics, 118(4), pp.693-717.

Artavanis, N., Morse, A. and Tsoutsoura, M., 2016. Measuring income tax evasion

using bank credit: Evidence from Greece. The Quarterly Journal of

Economics, 131(2), pp.739-798.

Blunden, H., 2016. Discourses around negative gearing of investment properties in

Australia. Housing Studies, 31(3), pp.340-357.

Cvrlje, D., 2015. Tax literacy as an instrument of combating and overcoming tax

system complexity, low tax morale and tax non-compliance. The Macrotheme

Review, 4(3), pp.156-167.

Dixon, J.M. and Nassios, J., 2016. Modelling the impacts of a cut to company tax in

Australia. Centre for Policy Studies, Victoria University.

Dyreng, S.D., Hanlon, M. and Maydew, E.L., 2018. When does tax avoidance result

in tax uncertainty?. The Accounting Review.

Dyreng, S.D., Hanlon, M. and Maydew, E.L., 2018. When does tax avoidance result

in tax uncertainty?. The Accounting Review.

Feld, L.P., Ruf, M., Schreiber, U., Todtenhaupt, M. and Voget, J., 2016. Taxing away

M&A: The effect of corporate capital gains taxes on acquisition activity.

Goldin, J., 2015. Optimal tax salience. Journal of Public Economics, 131, pp.115-

123.

Herault, N. and Azpitarte, F., 2015. Recent Trends in Income Redistribution in

Australia: Can Changes in the Tax‐Benefit System Account for the Decline in

Redistribution?. Economic Record, 91(292), pp.38-53.

Kasper, M., Kogler, C. and Kirchler, E., 2015. Tax policy and the news: An empirical

analysis of taxpayers’ perceptions of tax-related media coverage and its impact on

tax compliance. Journal of Behavioral and Experimental Economics, 54, pp.58-63.

Li, O.Z., Lin, Y. and Robinson, J.R., 2016. The effect of capital gains taxes on the

initial pricing and underpricing of IPOs. Journal of Accounting and Economics, 61(2-

3), pp.465-485.

Mertens, K. and Montiel Olea, J.L., 2018. Marginal tax rates and income: New time

series evidence. The Quarterly Journal of Economics, 133(4), pp.1803-1884.

Merz, J. and Overesch, M., 2016. Profit shifting and tax response of multinational

banks. Journal of Banking & Finance, 68, pp.57-68.

References:

Alstadsæter, A. and Jacob, M., 2016. Dividend taxes and income shifting. The

Scandinavian Journal of Economics, 118(4), pp.693-717.

Artavanis, N., Morse, A. and Tsoutsoura, M., 2016. Measuring income tax evasion

using bank credit: Evidence from Greece. The Quarterly Journal of

Economics, 131(2), pp.739-798.

Blunden, H., 2016. Discourses around negative gearing of investment properties in

Australia. Housing Studies, 31(3), pp.340-357.

Cvrlje, D., 2015. Tax literacy as an instrument of combating and overcoming tax

system complexity, low tax morale and tax non-compliance. The Macrotheme

Review, 4(3), pp.156-167.

Dixon, J.M. and Nassios, J., 2016. Modelling the impacts of a cut to company tax in

Australia. Centre for Policy Studies, Victoria University.

Dyreng, S.D., Hanlon, M. and Maydew, E.L., 2018. When does tax avoidance result

in tax uncertainty?. The Accounting Review.

Dyreng, S.D., Hanlon, M. and Maydew, E.L., 2018. When does tax avoidance result

in tax uncertainty?. The Accounting Review.

Feld, L.P., Ruf, M., Schreiber, U., Todtenhaupt, M. and Voget, J., 2016. Taxing away

M&A: The effect of corporate capital gains taxes on acquisition activity.

Goldin, J., 2015. Optimal tax salience. Journal of Public Economics, 131, pp.115-

123.

Herault, N. and Azpitarte, F., 2015. Recent Trends in Income Redistribution in

Australia: Can Changes in the Tax‐Benefit System Account for the Decline in

Redistribution?. Economic Record, 91(292), pp.38-53.

Kasper, M., Kogler, C. and Kirchler, E., 2015. Tax policy and the news: An empirical

analysis of taxpayers’ perceptions of tax-related media coverage and its impact on

tax compliance. Journal of Behavioral and Experimental Economics, 54, pp.58-63.

Li, O.Z., Lin, Y. and Robinson, J.R., 2016. The effect of capital gains taxes on the

initial pricing and underpricing of IPOs. Journal of Accounting and Economics, 61(2-

3), pp.465-485.

Mertens, K. and Montiel Olea, J.L., 2018. Marginal tax rates and income: New time

series evidence. The Quarterly Journal of Economics, 133(4), pp.1803-1884.

Merz, J. and Overesch, M., 2016. Profit shifting and tax response of multinational

banks. Journal of Banking & Finance, 68, pp.57-68.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TAXATION LAW

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.