Taxation Law Assignment: Fringe Benefits, Capital Gains Analysis

VerifiedAdded on 2023/03/17

|12

|2703

|90

Homework Assignment

AI Summary

This assignment solution addresses key aspects of Australian taxation law, specifically focusing on fringe benefits tax (FBT) and capital gains tax (CGT). The first part of the assignment explores FBT, defining fringe benefits and detailing the calculation methods for car fringe benefits, including the statutory formula and operating cost methods, with a case study involving an employee, Lucinda, and the company Spiceco Pty Ltd. Detailed calculations are provided to determine the taxable value of fringe benefits using both methods, along with the calculation of FBT liability and deemed depreciation and interest. The second part of the assignment addresses CGT, examining the tax implications of capital gains and losses. It analyzes the CGT treatment of various assets sold by Daniel, including his main residence (eligible for exemption), a painting (a collectible), a luxury yacht (personal use asset), and shares, calculating net capital gains and losses. The solution highlights relevant sections of the ITAA 1997 and provides a comprehensive breakdown of CGT events and exemptions.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Table of Contents

Answer to question 1:.................................................................................................................2

Answer to question 2:.................................................................................................................6

Answer to A:..........................................................................................................................6

Answer to question B:............................................................................................................8

Answer to question C:............................................................................................................9

References:...............................................................................................................................10

Table of Contents

Answer to question 1:.................................................................................................................2

Answer to question 2:.................................................................................................................6

Answer to A:..........................................................................................................................6

Answer to question B:............................................................................................................8

Answer to question C:............................................................................................................9

References:...............................................................................................................................10

2TAXATION LAW

Answer to question 1:

A fringe can be better known as the payment which the employer makes to the

employee but it is different from the usual salaries or wages (Cooper, 2018). As stated under

the fringe benefit tax legislation, a fringe cam be defined as the benefit that is given to the

employee in relation to the employment. This effectively implies that the benefit that is

provided to someone because they are treated as employee.

As defined under the “section 7 of the Fringe Benefit Tax Assessment Act 1986” a

car fringe benefit generally happens when the employer makes the car for the private usage of

the employee (Hodgson and Pearce 2015). The car is being treated as being available for the

private use of the employee. It is noteworthy to denote that the car one usually holds the car

one generally lease. An employer makes the available for the employee’s private use during

any day either;

a. The car is usually used for the private purpose of the employee

b. The car is available to the employee for making private use

Furthermore, a car is treated to be available for the private use of the employee when

the car is garaged at the employee’s home. Correspondingly, where the place of employment

and the residence are treated as same then the care is considered to be available for the

employee’s private use.

According to the “section 9, of the FBTAA 1986” the methods for computing the

taxable value of the car fringe benefit has been explained under this legislation (Briegel

2019). In order to calculate the taxable value of the fringe benefit of the car either the

statutory formula method or the operational cost method is used. By using the statutory

method, the taxpayers can compute the taxable value of the car fringe benefit by considering

the cost base of the car provided to employee for his private use.

Answer to question 1:

A fringe can be better known as the payment which the employer makes to the

employee but it is different from the usual salaries or wages (Cooper, 2018). As stated under

the fringe benefit tax legislation, a fringe cam be defined as the benefit that is given to the

employee in relation to the employment. This effectively implies that the benefit that is

provided to someone because they are treated as employee.

As defined under the “section 7 of the Fringe Benefit Tax Assessment Act 1986” a

car fringe benefit generally happens when the employer makes the car for the private usage of

the employee (Hodgson and Pearce 2015). The car is being treated as being available for the

private use of the employee. It is noteworthy to denote that the car one usually holds the car

one generally lease. An employer makes the available for the employee’s private use during

any day either;

a. The car is usually used for the private purpose of the employee

b. The car is available to the employee for making private use

Furthermore, a car is treated to be available for the private use of the employee when

the car is garaged at the employee’s home. Correspondingly, where the place of employment

and the residence are treated as same then the care is considered to be available for the

employee’s private use.

According to the “section 9, of the FBTAA 1986” the methods for computing the

taxable value of the car fringe benefit has been explained under this legislation (Briegel

2019). In order to calculate the taxable value of the fringe benefit of the car either the

statutory formula method or the operational cost method is used. By using the statutory

method, the taxpayers can compute the taxable value of the car fringe benefit by considering

the cost base of the car provided to employee for his private use.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

On the other hand, “section 10A and section 10 B of the FBTAA 1986” is largely

associated with the determination of the taxable value of the car fringe benefit under the

operating cost method (Barrett and Veal 2016). While computing the taxable benefit of the

car fringe benefit under the operating cost method the total operating cost incurred is taken

into the consideration to compute the taxable value of the car fringe benefit.

Case facts:

In the current it is noticed that Lucinda is the employee of Spiceco Pty Ltd. Lucinda is

provided with the car on 1st April to make the private use of it. The evidences from the case

study suggest that the total kilometres travelled by Lucinda stood 20,000 km while 70% of

the total kilometres were attributed for business purpose while remaining 30% of the total

distance was related to the private purpose. Providing of car to Lucinda by Spiceco Pty Ltd

constitute a car fringe benefit under “section 9, of the FBTAA 1986” (Braverman, Marsden

and Sadiq 2015).

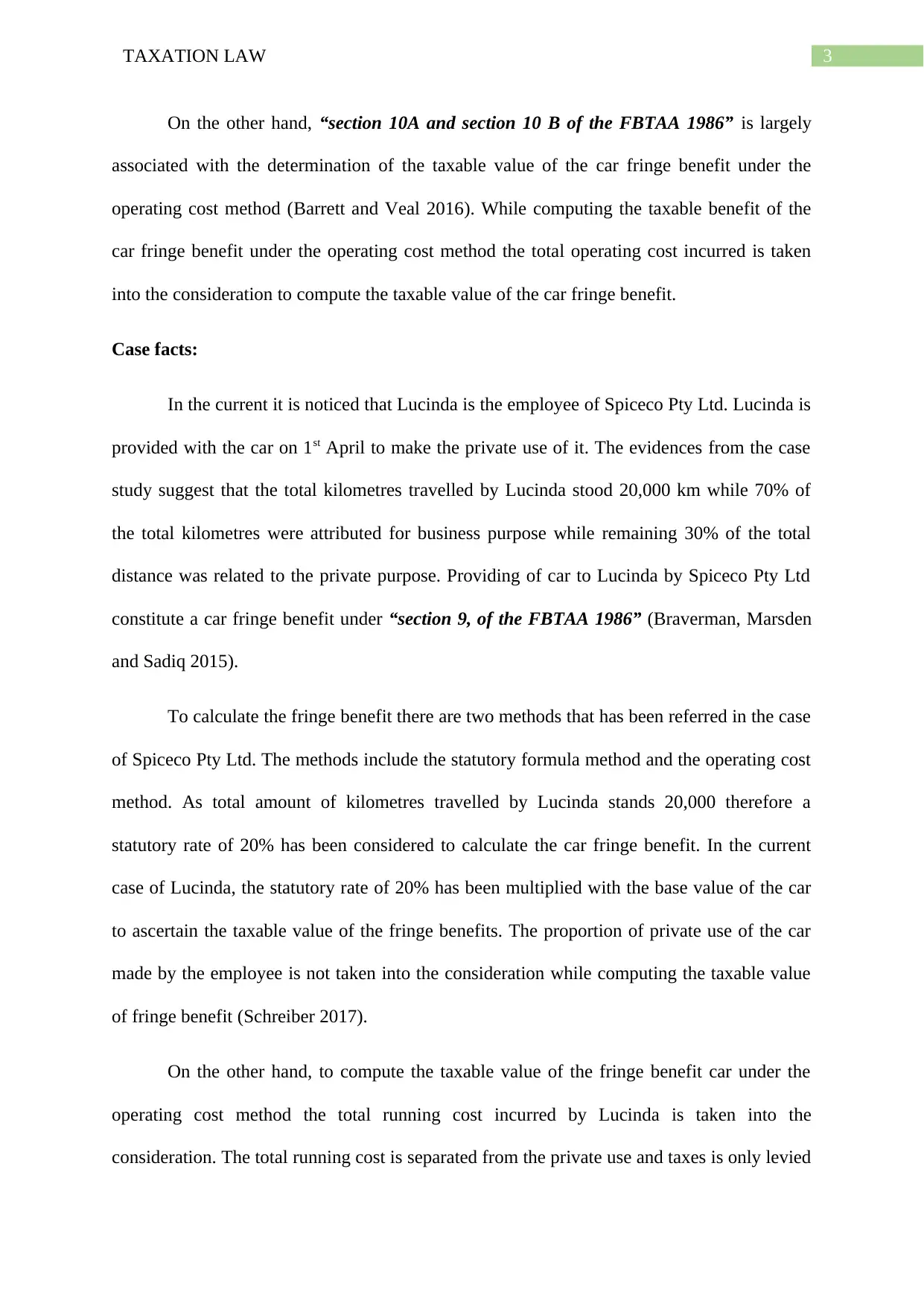

To calculate the fringe benefit there are two methods that has been referred in the case

of Spiceco Pty Ltd. The methods include the statutory formula method and the operating cost

method. As total amount of kilometres travelled by Lucinda stands 20,000 therefore a

statutory rate of 20% has been considered to calculate the car fringe benefit. In the current

case of Lucinda, the statutory rate of 20% has been multiplied with the base value of the car

to ascertain the taxable value of the fringe benefits. The proportion of private use of the car

made by the employee is not taken into the consideration while computing the taxable value

of fringe benefit (Schreiber 2017).

On the other hand, to compute the taxable value of the fringe benefit car under the

operating cost method the total running cost incurred by Lucinda is taken into the

consideration. The total running cost is separated from the private use and taxes is only levied

On the other hand, “section 10A and section 10 B of the FBTAA 1986” is largely

associated with the determination of the taxable value of the car fringe benefit under the

operating cost method (Barrett and Veal 2016). While computing the taxable benefit of the

car fringe benefit under the operating cost method the total operating cost incurred is taken

into the consideration to compute the taxable value of the car fringe benefit.

Case facts:

In the current it is noticed that Lucinda is the employee of Spiceco Pty Ltd. Lucinda is

provided with the car on 1st April to make the private use of it. The evidences from the case

study suggest that the total kilometres travelled by Lucinda stood 20,000 km while 70% of

the total kilometres were attributed for business purpose while remaining 30% of the total

distance was related to the private purpose. Providing of car to Lucinda by Spiceco Pty Ltd

constitute a car fringe benefit under “section 9, of the FBTAA 1986” (Braverman, Marsden

and Sadiq 2015).

To calculate the fringe benefit there are two methods that has been referred in the case

of Spiceco Pty Ltd. The methods include the statutory formula method and the operating cost

method. As total amount of kilometres travelled by Lucinda stands 20,000 therefore a

statutory rate of 20% has been considered to calculate the car fringe benefit. In the current

case of Lucinda, the statutory rate of 20% has been multiplied with the base value of the car

to ascertain the taxable value of the fringe benefits. The proportion of private use of the car

made by the employee is not taken into the consideration while computing the taxable value

of fringe benefit (Schreiber 2017).

On the other hand, to compute the taxable value of the fringe benefit car under the

operating cost method the total running cost incurred by Lucinda is taken into the

consideration. The total running cost is separated from the private use and taxes is only levied

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

on the total business kilometre used or travelled by Lucinda to determine the taxable value of

the fringe benefit.

Calculation of Fringe benefit using statutory method:

Statutory method

Taxable value of fringe benefits

Particulars Amount ($) Amount ($)

Base value of the car 18000

Statutory rate 20%

Car Available for Private use (Days) 365

Number of days in the FBT year 365

Gross Taxable Value of the Car Fringe benefit 3600.00

Less: Employee Contribution 1000

Net Taxable Value of fringe benefits 2600.00

Calculation of Taxable value of car fringe benefit under operating cost method

Operating cost method:

Taxable value of fringe benefits

Particular Amount ($) Amount ($)

Repairs 3300

Deemed Depreciation 4500

Deemed Interest 945

Fuel 990

Insurance 2200

Total operating cost 11935

Proportion of use for private purpose:

Total kilometre run 20000

Work related 14000

Private purpose related 6000

Percentage of private use 30%

Gross Taxable value of fringe benefits 3580.5

Less: Employee Contribution 1000

Net Taxable Value of fringe benefits 2580.5

on the total business kilometre used or travelled by Lucinda to determine the taxable value of

the fringe benefit.

Calculation of Fringe benefit using statutory method:

Statutory method

Taxable value of fringe benefits

Particulars Amount ($) Amount ($)

Base value of the car 18000

Statutory rate 20%

Car Available for Private use (Days) 365

Number of days in the FBT year 365

Gross Taxable Value of the Car Fringe benefit 3600.00

Less: Employee Contribution 1000

Net Taxable Value of fringe benefits 2600.00

Calculation of Taxable value of car fringe benefit under operating cost method

Operating cost method:

Taxable value of fringe benefits

Particular Amount ($) Amount ($)

Repairs 3300

Deemed Depreciation 4500

Deemed Interest 945

Fuel 990

Insurance 2200

Total operating cost 11935

Proportion of use for private purpose:

Total kilometre run 20000

Work related 14000

Private purpose related 6000

Percentage of private use 30%

Gross Taxable value of fringe benefits 3580.5

Less: Employee Contribution 1000

Net Taxable Value of fringe benefits 2580.5

5TAXATION LAW

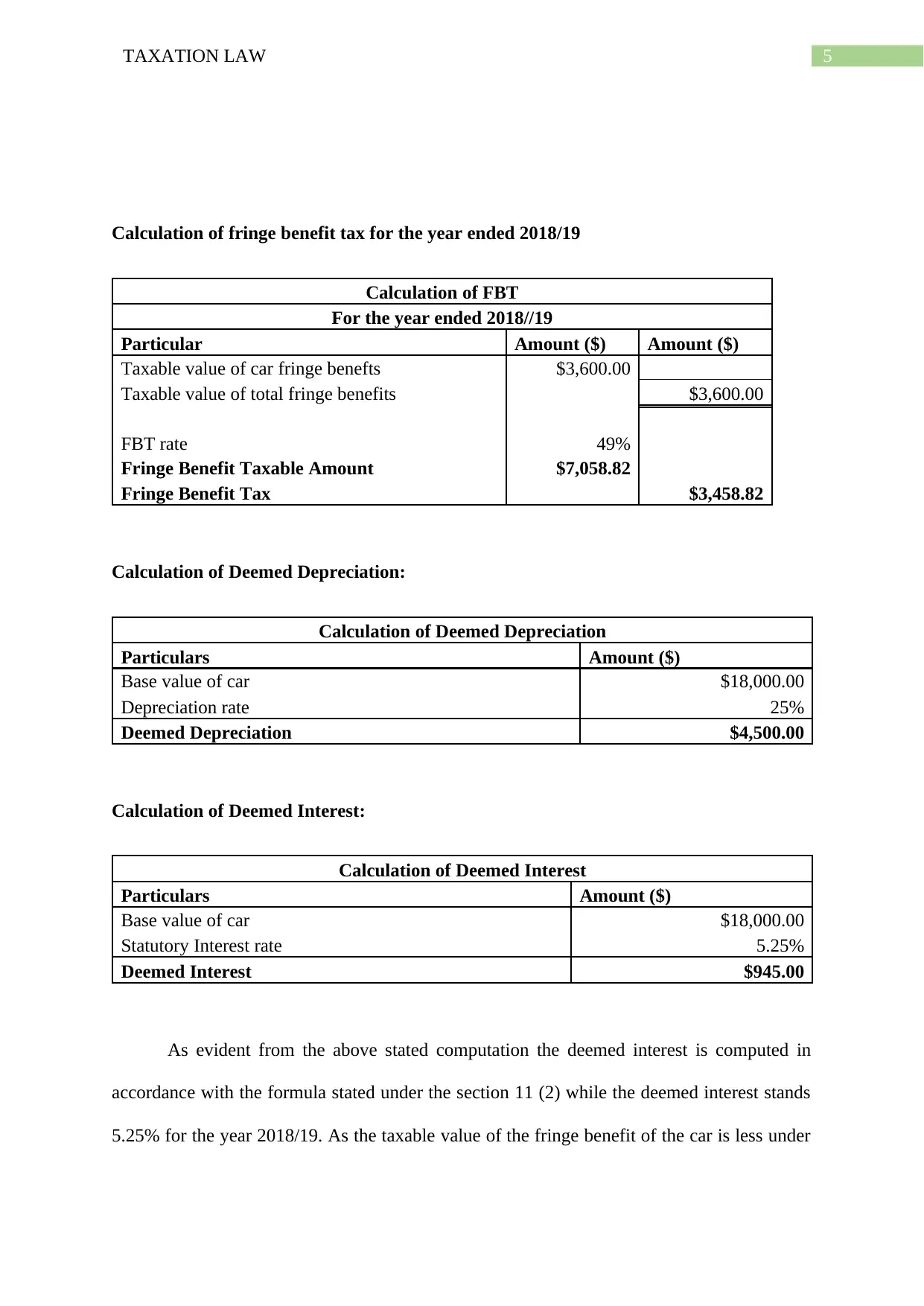

Calculation of fringe benefit tax for the year ended 2018/19

Calculation of FBT

For the year ended 2018//19

Particular Amount ($) Amount ($)

Taxable value of car fringe benefts $3,600.00

Taxable value of total fringe benefits $3,600.00

FBT rate 49%

Fringe Benefit Taxable Amount $7,058.82

Fringe Benefit Tax $3,458.82

Calculation of Deemed Depreciation:

Calculation of Deemed Depreciation

Particulars Amount ($)

Base value of car $18,000.00

Depreciation rate 25%

Deemed Depreciation $4,500.00

Calculation of Deemed Interest:

Calculation of Deemed Interest

Particulars Amount ($)

Base value of car $18,000.00

Statutory Interest rate 5.25%

Deemed Interest $945.00

As evident from the above stated computation the deemed interest is computed in

accordance with the formula stated under the section 11 (2) while the deemed interest stands

5.25% for the year 2018/19. As the taxable value of the fringe benefit of the car is less under

Calculation of fringe benefit tax for the year ended 2018/19

Calculation of FBT

For the year ended 2018//19

Particular Amount ($) Amount ($)

Taxable value of car fringe benefts $3,600.00

Taxable value of total fringe benefits $3,600.00

FBT rate 49%

Fringe Benefit Taxable Amount $7,058.82

Fringe Benefit Tax $3,458.82

Calculation of Deemed Depreciation:

Calculation of Deemed Depreciation

Particulars Amount ($)

Base value of car $18,000.00

Depreciation rate 25%

Deemed Depreciation $4,500.00

Calculation of Deemed Interest:

Calculation of Deemed Interest

Particulars Amount ($)

Base value of car $18,000.00

Statutory Interest rate 5.25%

Deemed Interest $945.00

As evident from the above stated computation the deemed interest is computed in

accordance with the formula stated under the section 11 (2) while the deemed interest stands

5.25% for the year 2018/19. As the taxable value of the fringe benefit of the car is less under

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

the operating cost method, it is advisable that Spiceco Pty Ltd should use the operating cost

method as this will help in minimising the fringe benefit tax liability.

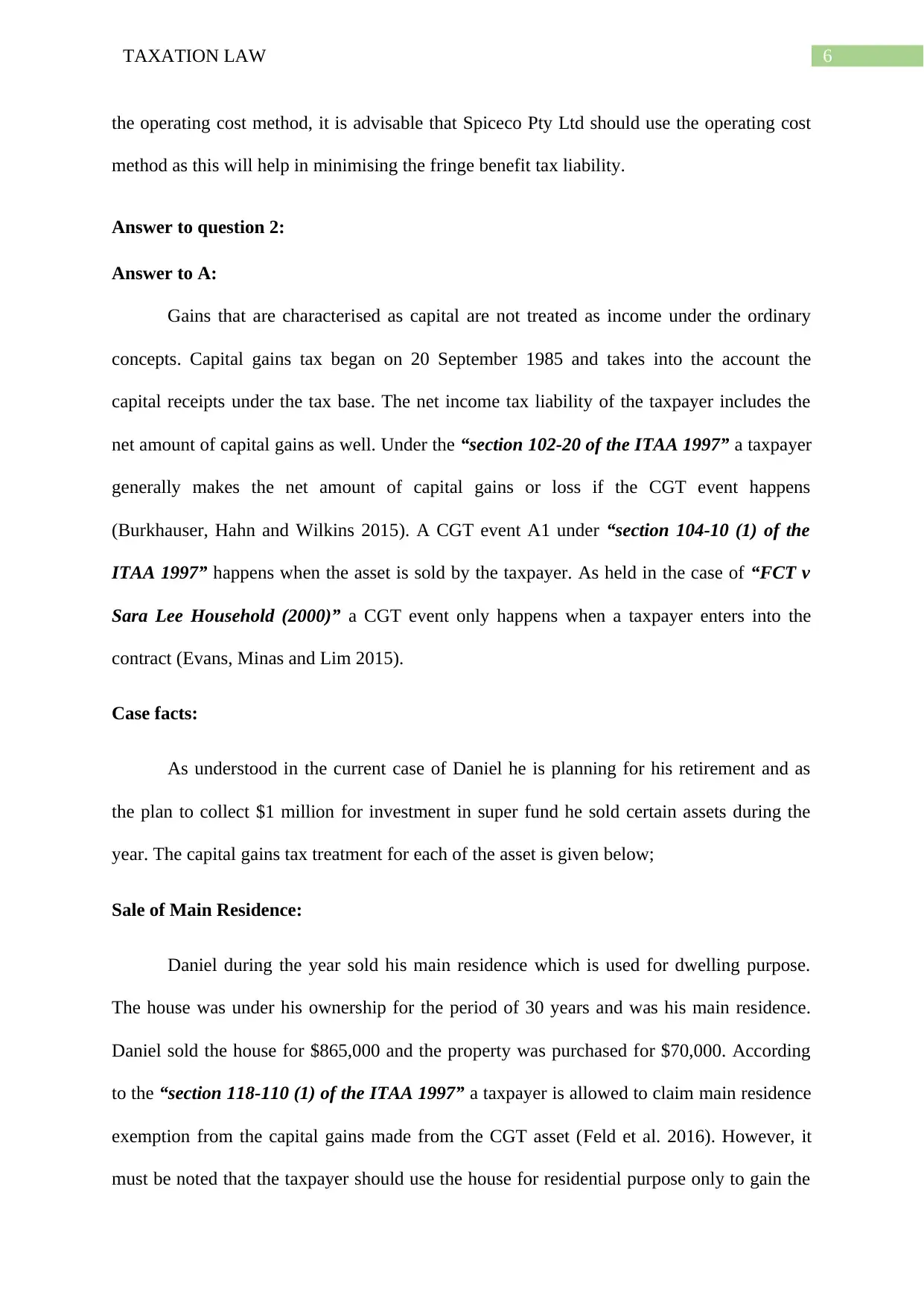

Answer to question 2:

Answer to A:

Gains that are characterised as capital are not treated as income under the ordinary

concepts. Capital gains tax began on 20 September 1985 and takes into the account the

capital receipts under the tax base. The net income tax liability of the taxpayer includes the

net amount of capital gains as well. Under the “section 102-20 of the ITAA 1997” a taxpayer

generally makes the net amount of capital gains or loss if the CGT event happens

(Burkhauser, Hahn and Wilkins 2015). A CGT event A1 under “section 104-10 (1) of the

ITAA 1997” happens when the asset is sold by the taxpayer. As held in the case of “FCT v

Sara Lee Household (2000)” a CGT event only happens when a taxpayer enters into the

contract (Evans, Minas and Lim 2015).

Case facts:

As understood in the current case of Daniel he is planning for his retirement and as

the plan to collect $1 million for investment in super fund he sold certain assets during the

year. The capital gains tax treatment for each of the asset is given below;

Sale of Main Residence:

Daniel during the year sold his main residence which is used for dwelling purpose.

The house was under his ownership for the period of 30 years and was his main residence.

Daniel sold the house for $865,000 and the property was purchased for $70,000. According

to the “section 118-110 (1) of the ITAA 1997” a taxpayer is allowed to claim main residence

exemption from the capital gains made from the CGT asset (Feld et al. 2016). However, it

must be noted that the taxpayer should use the house for residential purpose only to gain the

the operating cost method, it is advisable that Spiceco Pty Ltd should use the operating cost

method as this will help in minimising the fringe benefit tax liability.

Answer to question 2:

Answer to A:

Gains that are characterised as capital are not treated as income under the ordinary

concepts. Capital gains tax began on 20 September 1985 and takes into the account the

capital receipts under the tax base. The net income tax liability of the taxpayer includes the

net amount of capital gains as well. Under the “section 102-20 of the ITAA 1997” a taxpayer

generally makes the net amount of capital gains or loss if the CGT event happens

(Burkhauser, Hahn and Wilkins 2015). A CGT event A1 under “section 104-10 (1) of the

ITAA 1997” happens when the asset is sold by the taxpayer. As held in the case of “FCT v

Sara Lee Household (2000)” a CGT event only happens when a taxpayer enters into the

contract (Evans, Minas and Lim 2015).

Case facts:

As understood in the current case of Daniel he is planning for his retirement and as

the plan to collect $1 million for investment in super fund he sold certain assets during the

year. The capital gains tax treatment for each of the asset is given below;

Sale of Main Residence:

Daniel during the year sold his main residence which is used for dwelling purpose.

The house was under his ownership for the period of 30 years and was his main residence.

Daniel sold the house for $865,000 and the property was purchased for $70,000. According

to the “section 118-110 (1) of the ITAA 1997” a taxpayer is allowed to claim main residence

exemption from the capital gains made from the CGT asset (Feld et al. 2016). However, it

must be noted that the taxpayer should use the house for residential purpose only to gain the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

main residence exemption and should not use the house for producing income. As evident in

the current case of Daniel, the house was used as his main residence all through the period of

his ownership. The capital gains that would be made from the sale of house by Daniel will be

considered as the exempted capital gains.

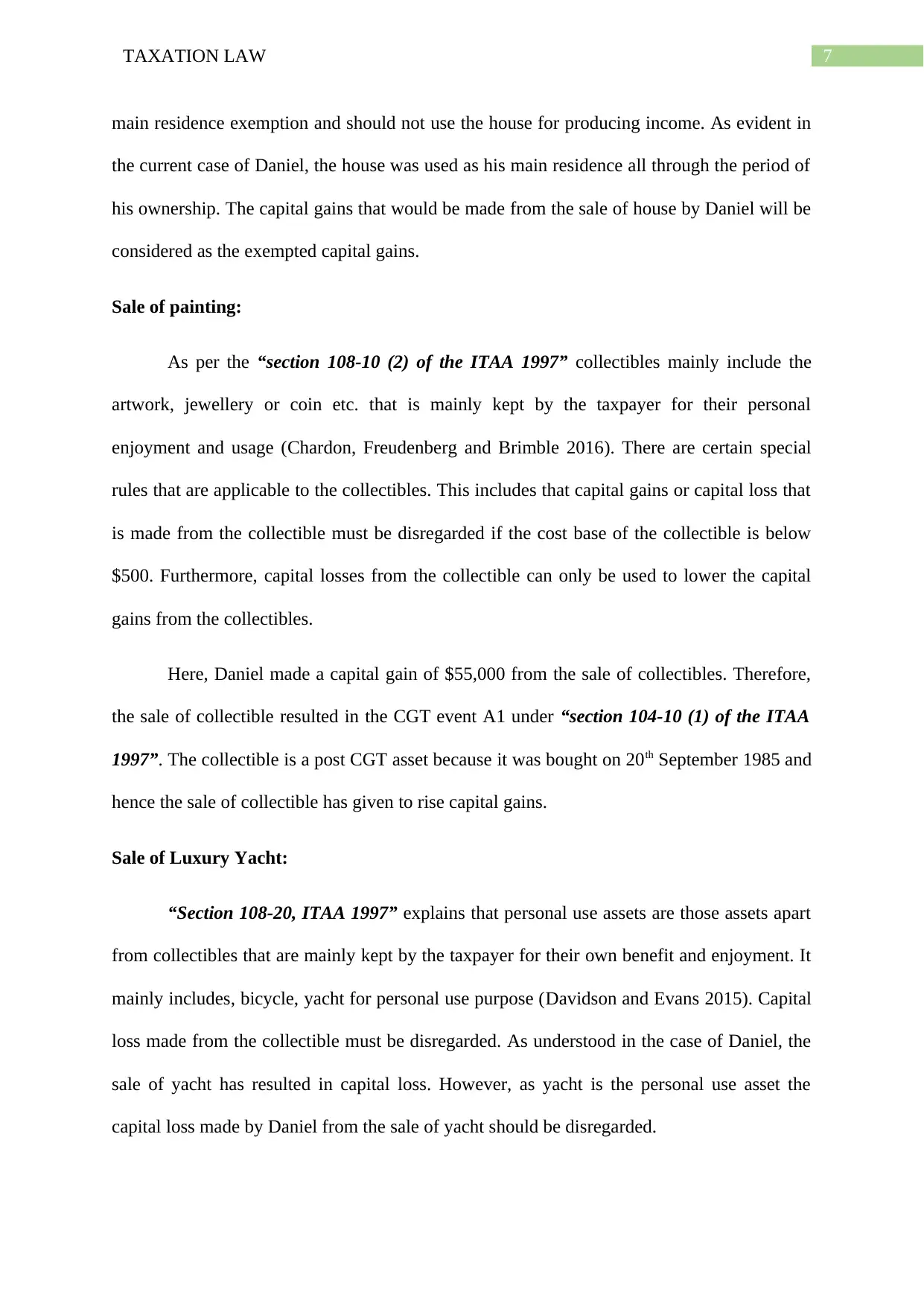

Sale of painting:

As per the “section 108-10 (2) of the ITAA 1997” collectibles mainly include the

artwork, jewellery or coin etc. that is mainly kept by the taxpayer for their personal

enjoyment and usage (Chardon, Freudenberg and Brimble 2016). There are certain special

rules that are applicable to the collectibles. This includes that capital gains or capital loss that

is made from the collectible must be disregarded if the cost base of the collectible is below

$500. Furthermore, capital losses from the collectible can only be used to lower the capital

gains from the collectibles.

Here, Daniel made a capital gain of $55,000 from the sale of collectibles. Therefore,

the sale of collectible resulted in the CGT event A1 under “section 104-10 (1) of the ITAA

1997”. The collectible is a post CGT asset because it was bought on 20th September 1985 and

hence the sale of collectible has given to rise capital gains.

Sale of Luxury Yacht:

“Section 108-20, ITAA 1997” explains that personal use assets are those assets apart

from collectibles that are mainly kept by the taxpayer for their own benefit and enjoyment. It

mainly includes, bicycle, yacht for personal use purpose (Davidson and Evans 2015). Capital

loss made from the collectible must be disregarded. As understood in the case of Daniel, the

sale of yacht has resulted in capital loss. However, as yacht is the personal use asset the

capital loss made by Daniel from the sale of yacht should be disregarded.

main residence exemption and should not use the house for producing income. As evident in

the current case of Daniel, the house was used as his main residence all through the period of

his ownership. The capital gains that would be made from the sale of house by Daniel will be

considered as the exempted capital gains.

Sale of painting:

As per the “section 108-10 (2) of the ITAA 1997” collectibles mainly include the

artwork, jewellery or coin etc. that is mainly kept by the taxpayer for their personal

enjoyment and usage (Chardon, Freudenberg and Brimble 2016). There are certain special

rules that are applicable to the collectibles. This includes that capital gains or capital loss that

is made from the collectible must be disregarded if the cost base of the collectible is below

$500. Furthermore, capital losses from the collectible can only be used to lower the capital

gains from the collectibles.

Here, Daniel made a capital gain of $55,000 from the sale of collectibles. Therefore,

the sale of collectible resulted in the CGT event A1 under “section 104-10 (1) of the ITAA

1997”. The collectible is a post CGT asset because it was bought on 20th September 1985 and

hence the sale of collectible has given to rise capital gains.

Sale of Luxury Yacht:

“Section 108-20, ITAA 1997” explains that personal use assets are those assets apart

from collectibles that are mainly kept by the taxpayer for their own benefit and enjoyment. It

mainly includes, bicycle, yacht for personal use purpose (Davidson and Evans 2015). Capital

loss made from the collectible must be disregarded. As understood in the case of Daniel, the

sale of yacht has resulted in capital loss. However, as yacht is the personal use asset the

capital loss made by Daniel from the sale of yacht should be disregarded.

8TAXATION LAW

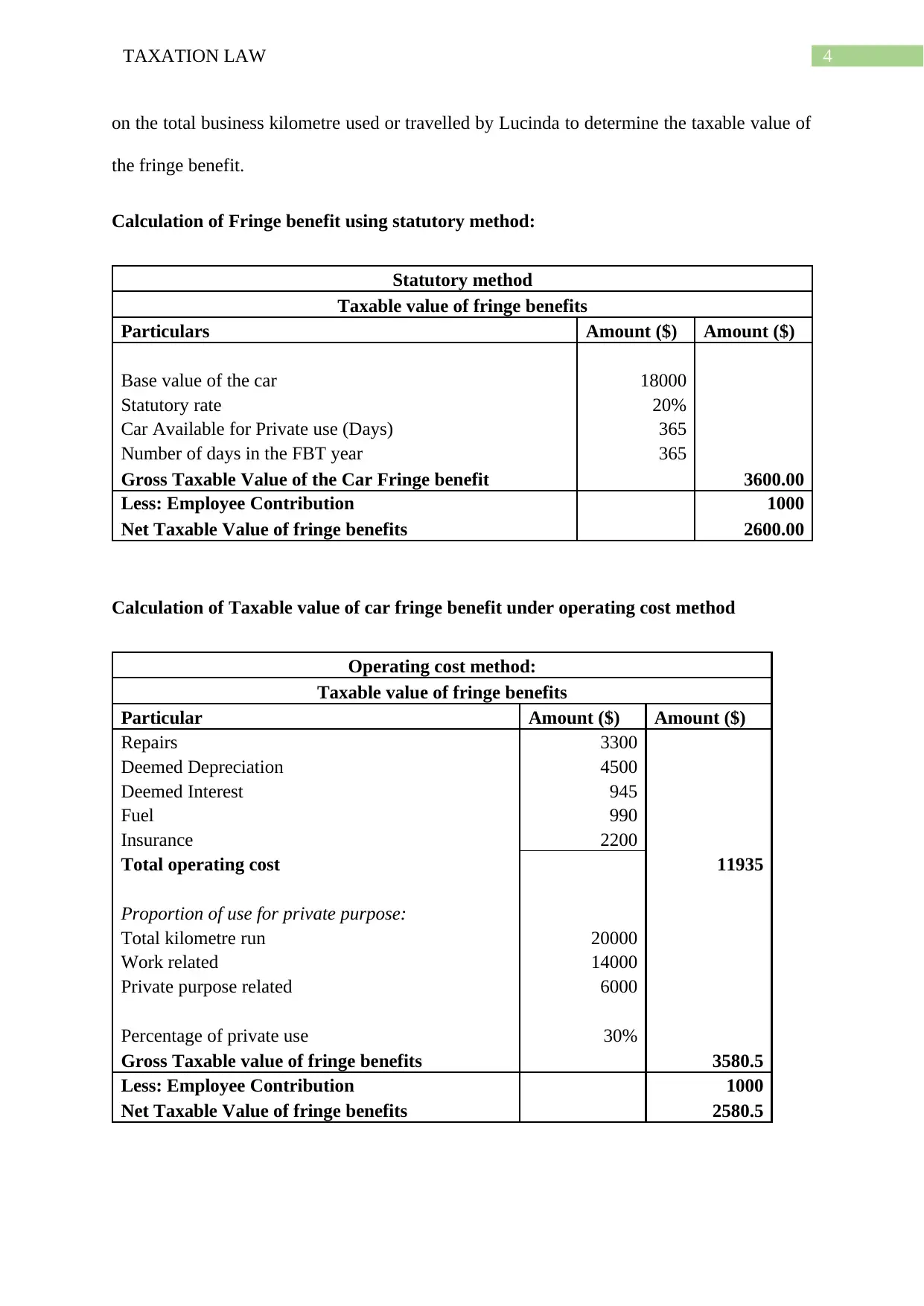

Sale of shares: Daniel during the year reported capital loss from the sale of shares that were

held in the BHP. The sale of shares resulted Daniel a capital loss of $1,000 for the current

year of 2018/19. Furthermore, Daniel also reports the loss of $10,000 from the sale of AZJ

shares. As the sale of BHP shares has resulted in capital loss therefore the previous year

capital loss cannot offset in this case because both shares resulted a capital loss (Jacob 2018).

Computation of net capital gains of Daniel Ray for the year 30 June 2019:

Calculations of Capital Gains Tax

For the year ended June 2019

Particulars Amount ($) Amount ($)

Net Capital Gains on Sale of Painting

Proceeds from sell of Painting 125000

Cost base 15000

Gross Capital Gains (proceeds less cost base) 110000

50% CGT Discount 55000

Taxable Capital Gains 55000

Capital gains on sale of shares

Gross Proceeds from Shares in BHP 80000

Less: Brokerage Fees 750

Net Proceeds 79250

Cost base

Less: Acquisition Cost 75000

Add: Stamp Duty on Purchase 250

Add: Interest on Loan 5000

Total Cost Base 80250

Capital Loss -1000

Net Capital gains 55,000

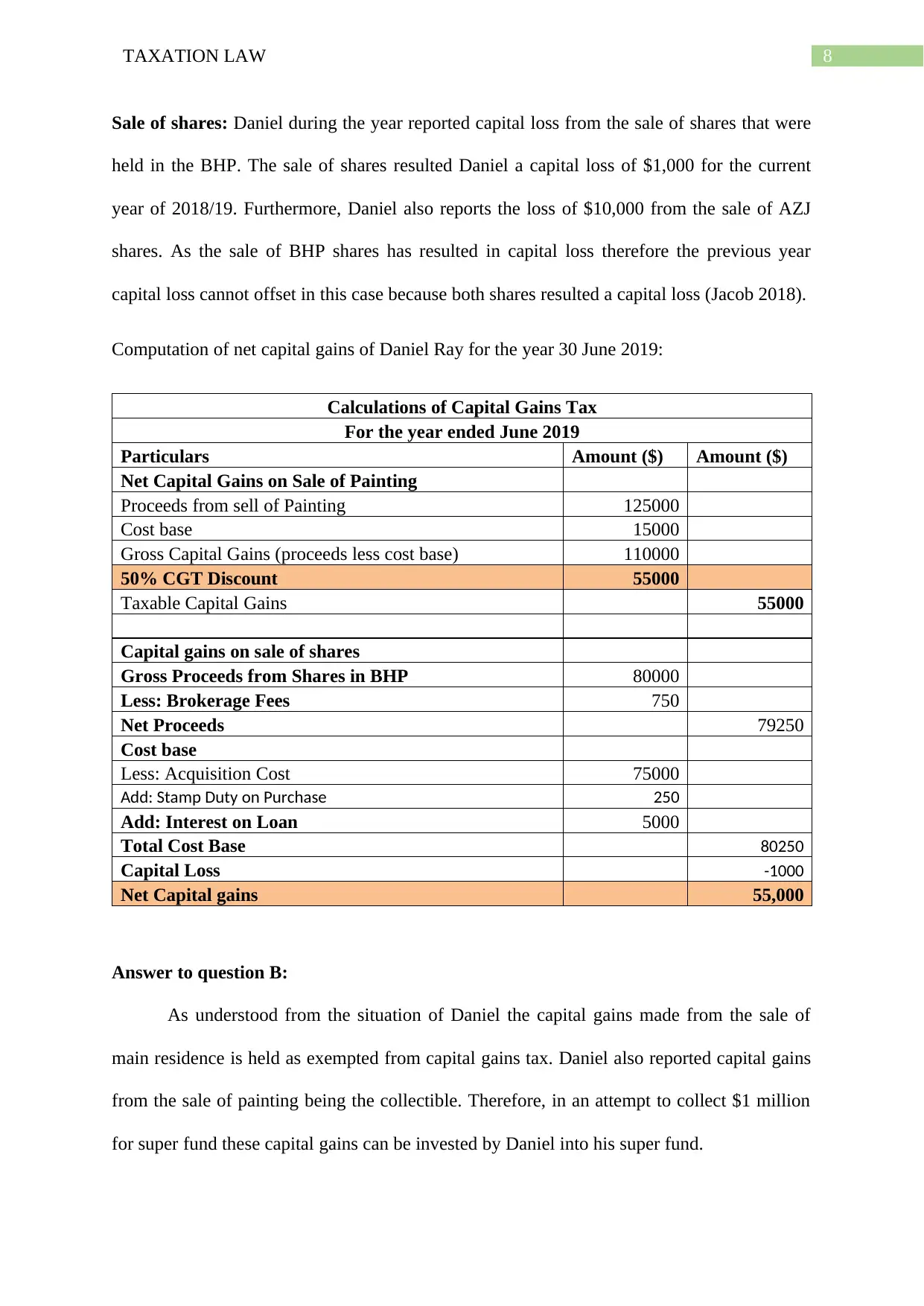

Answer to question B:

As understood from the situation of Daniel the capital gains made from the sale of

main residence is held as exempted from capital gains tax. Daniel also reported capital gains

from the sale of painting being the collectible. Therefore, in an attempt to collect $1 million

for super fund these capital gains can be invested by Daniel into his super fund.

Sale of shares: Daniel during the year reported capital loss from the sale of shares that were

held in the BHP. The sale of shares resulted Daniel a capital loss of $1,000 for the current

year of 2018/19. Furthermore, Daniel also reports the loss of $10,000 from the sale of AZJ

shares. As the sale of BHP shares has resulted in capital loss therefore the previous year

capital loss cannot offset in this case because both shares resulted a capital loss (Jacob 2018).

Computation of net capital gains of Daniel Ray for the year 30 June 2019:

Calculations of Capital Gains Tax

For the year ended June 2019

Particulars Amount ($) Amount ($)

Net Capital Gains on Sale of Painting

Proceeds from sell of Painting 125000

Cost base 15000

Gross Capital Gains (proceeds less cost base) 110000

50% CGT Discount 55000

Taxable Capital Gains 55000

Capital gains on sale of shares

Gross Proceeds from Shares in BHP 80000

Less: Brokerage Fees 750

Net Proceeds 79250

Cost base

Less: Acquisition Cost 75000

Add: Stamp Duty on Purchase 250

Add: Interest on Loan 5000

Total Cost Base 80250

Capital Loss -1000

Net Capital gains 55,000

Answer to question B:

As understood from the situation of Daniel the capital gains made from the sale of

main residence is held as exempted from capital gains tax. Daniel also reported capital gains

from the sale of painting being the collectible. Therefore, in an attempt to collect $1 million

for super fund these capital gains can be invested by Daniel into his super fund.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW

Answer to question C:

During the year Daniel reported a capital loss from the sale of yacht being the

personal use assets and he also reported the capital loss from the sale of BHP shares. Daniel

also has the previous year capital loss of $10,000 from the AZJ shares. It is advised that as

Daniel has not reported any capital gains from the personal use asset neither has he reported

capital gain from the sale shares. The capital loss should be carried forward by Daniel as the

same cannot be offset against the capital gains that is made by Daniel from the sale of main

residence and paintings.

Answer to question C:

During the year Daniel reported a capital loss from the sale of yacht being the

personal use assets and he also reported the capital loss from the sale of BHP shares. Daniel

also has the previous year capital loss of $10,000 from the AZJ shares. It is advised that as

Daniel has not reported any capital gains from the personal use asset neither has he reported

capital gain from the sale shares. The capital loss should be carried forward by Daniel as the

same cannot be offset against the capital gains that is made by Daniel from the sale of main

residence and paintings.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

References:

Barrett, J.M. and Veal, J.A., 2016. Tax Rationality, Politics, and Media Spin: A Case Study

of the Failed ‘Car Park Tax’Proposal. Centre for Accounting, Governance and Taxation

Research Working Paper, (102).

Braverman, D., Marsden, S. and Sadiq, K., 2015. Assessing Taxpayer Response to

Legislative Changes: A Case Study of In-House Fringe Benefits Rules. J. Austl. Tax'n, 17,

p.1.

Briegel, J., 2019. The Effects of the Tax Cuts and Jobs Act on Small Businesses. Journal of

Financial Service Professionals, 73(1).

Burkhauser, R.V., Hahn, M.H. and Wilkins, R., 2015. Measuring top incomes using tax

record data: A cautionary tale from Australia. The Journal of Economic Inequality, 13(2),

pp.181-205.

Chardon, T., Freudenberg, B. and Brimble, M., 2016. Tax literacy in Australia: not knowing

your deduction from your offset. Austl. Tax F., 31, p.321.

Cooper, R., 2018. Recent changes to fringe benefits. TAXtalk, 2018(71), pp.52-55.

Davidson, P. and Evans, R., 2015. Fuel on the fire: Negative gearing, capital gains tax &

housing affordability. ACOSS Papers, p.29.

Evans, C., Minas, J. and Lim, Y., 2015. Taxing personal capital gains in Australia: an

alternative way forward. Austl. Tax F., 30, p.735.

Feld, L.P., Ruf, M., Schreiber, U., Todtenhaupt, M. and Voget, J., 2016. Taxing away M&A:

The effect of corporate capital gains taxes on acquisition activity.

References:

Barrett, J.M. and Veal, J.A., 2016. Tax Rationality, Politics, and Media Spin: A Case Study

of the Failed ‘Car Park Tax’Proposal. Centre for Accounting, Governance and Taxation

Research Working Paper, (102).

Braverman, D., Marsden, S. and Sadiq, K., 2015. Assessing Taxpayer Response to

Legislative Changes: A Case Study of In-House Fringe Benefits Rules. J. Austl. Tax'n, 17,

p.1.

Briegel, J., 2019. The Effects of the Tax Cuts and Jobs Act on Small Businesses. Journal of

Financial Service Professionals, 73(1).

Burkhauser, R.V., Hahn, M.H. and Wilkins, R., 2015. Measuring top incomes using tax

record data: A cautionary tale from Australia. The Journal of Economic Inequality, 13(2),

pp.181-205.

Chardon, T., Freudenberg, B. and Brimble, M., 2016. Tax literacy in Australia: not knowing

your deduction from your offset. Austl. Tax F., 31, p.321.

Cooper, R., 2018. Recent changes to fringe benefits. TAXtalk, 2018(71), pp.52-55.

Davidson, P. and Evans, R., 2015. Fuel on the fire: Negative gearing, capital gains tax &

housing affordability. ACOSS Papers, p.29.

Evans, C., Minas, J. and Lim, Y., 2015. Taxing personal capital gains in Australia: an

alternative way forward. Austl. Tax F., 30, p.735.

Feld, L.P., Ruf, M., Schreiber, U., Todtenhaupt, M. and Voget, J., 2016. Taxing away M&A:

The effect of corporate capital gains taxes on acquisition activity.

11TAXATION LAW

Hodgson, H. and Pearce, P., 2015. TravelSmart of Travel Tax Breaks: Is the Fringe Benefits

Tax a Barrier to Active Commuting in Australia. eJTR, 13, p.819.

Jacob, M., 2018. Tax regimes and capital gains realizations. European Accounting

Review, 27(1), pp.1-21.

Schreiber, S., 2017. Boston Bruins Can Deduct Full Cost of Meals for Team's Away Games:

The Meals Were Provided by the Employer for Its Convenience, the Tax Court

Holds. Journal of Accountancy, 224(4), p.61.

Hodgson, H. and Pearce, P., 2015. TravelSmart of Travel Tax Breaks: Is the Fringe Benefits

Tax a Barrier to Active Commuting in Australia. eJTR, 13, p.819.

Jacob, M., 2018. Tax regimes and capital gains realizations. European Accounting

Review, 27(1), pp.1-21.

Schreiber, S., 2017. Boston Bruins Can Deduct Full Cost of Meals for Team's Away Games:

The Meals Were Provided by the Employer for Its Convenience, the Tax Court

Holds. Journal of Accountancy, 224(4), p.61.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.